North America News

Major U.S. Stock Indices Sink as Yields Spike and Growth Fears Resurface

Wall Street closed deep in the red on Wednesday, with rising bond yields and renewed concern over slowing economic growth weighing heavily on equities. The Dow led the retreat, dragged lower by a steep selloff in UnitedHealth shares.

🔻 Market Close Snapshot:

- Dow Jones: −816.80 points (−1.91%) to 41,860.44

- S&P 500: −95.85 points (−1.61%) to 5,844.61

- NASDAQ: −270.07 points (−1.41%) to 18,872.64

While the Nasdaq briefly turned positive midday, all three major indices reversed into losses late in the session, tracking the surge in Treasury yields.

UnitedHealth Headlines Dow Decliners

UnitedHealth Group (UNH) fell 5.78%, leading the Dow’s slide after fresh headlines fueled investor anxiety. A report accused the insurer of making secret payments to nursing homes to cut down hospital transfers—raising patient safety concerns. Although the company stated that the Justice Department deemed the claims “factually inaccurate,” the market didn’t shrug it off.

Worse, the company is now facing a criminal DOJ investigation over potential Medicare fraud. Coupled with the sudden resignation of CEO Andrew Witty and the scrapping of its 2025 financial outlook, the stock dropped to a five-year low.

Other top Dow decliners:

- Nike (NKE): −4.12%

- American Express (AXP): −3.43%

- Apple (AAPL): −2.31%

- Visa (V): −2.33%

- Salesforce (CRM): −2.01%

- IBM (IBM): −2.28%

- Goldman Sachs (GS): −2.15%

- Boeing (BA): −2.15%

- Caterpillar (CAT): −2.00%

S&P 500: Sector Pain Spreads

The S&P 500 saw broad weakness, with heavy losses in healthcare, financials, and tech.

Biggest S&P 500 losers included:

- Blackstone (BX): −4.65% – hit by rising rates pressuring alternative asset managers

- KKR (KKR): −4.60% – private equity names sold on macro fears

- T-Mobile (TMUS): −4.31% – weighed down by regulatory concerns

- Palantir (PLTR): −3.99% – profit-taking in high-beta tech

- Thermo Fisher (TMO): −3.74% – weak life sciences demand

- Bristol Myers (BMY): −3.84% – concerns over drug pipeline

- Wells Fargo (WFC): −3.09% – sluggish loan growth outlook

- Uber (UBER): −3.48% – tech/cyclicals broadly sold

- NextEra Energy (NEE): −3.86% – utilities fell as bond yields rose

Treasury Yields Surge to Multi-Month Highs

With no Fed speakers on deck, bond yields stole the spotlight. The 10-year Treasury yield jumped 10.3 basis points to 4.584%, its highest since February. The 30-year yield rose even more—up 11.1 basis points to 5.079%, peaking intraday at 5.098%.

Key drivers of the yield spike:

- A weak 20-year bond auction, which tailed by 1.2 bps and showed soft demand—especially from U.S. buyers

- Growing concerns over the federal deficit, fueled by the administration’s “Big Beautiful Tax Deal” that could sharply increase debt, relying heavily on ambitious 3% GDP growth projections instead of spending cuts

On technical charts, yields bounced off their 200-hour moving averages, maintaining upside momentum.

U.S. 20-Year Bond Auction Shows Weak Demand, High Yield at 5.047%

The U.S. Treasury auctioned $16 billion in 20-year bonds at a high yield of 5.047%, slightly above the when-issued level of 5.035%.

Auction metrics:

- Tail: 1.2 bps (vs. 6-month average of -0.4 bps)

- Bid-to-Cover: 2.46x (vs. 2.57x average)

- Directs: 14.1% (vs. 17.1%)

- Indirects: 70.7% (better than average)

- Dealers: 16.9%

The auction drew less domestic interest and had to clear at a higher yield, underscoring weakness in demand. A flatter curve isn’t helping either—the 20-year is yielding more than both the 10-year (4.55%) and 30-year (5.032%).

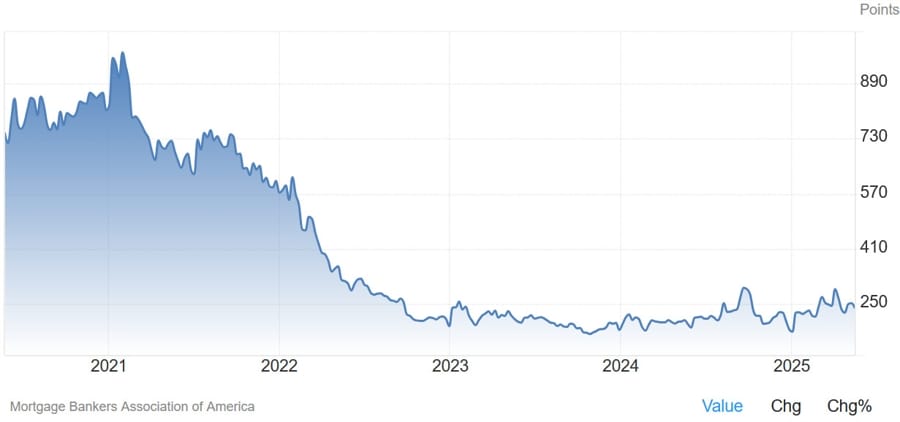

U.S. Mortgage Demand Sinks as Rates Climb

U.S. mortgage applications dropped 5.1% in the week ending May 16, according to the Mortgage Bankers Association. That’s a sharp reversal from the previous week’s 1.1% gain.

- Market Index: 238.5 (down from 251.2)

- Purchase Index: 157.8 (from 166.5)

- Refinance Index: 682.5 (from 718.1)

- 30-Year Mortgage Rate: 6.92% (up from 6.86%)

The spike in borrowing costs continues to chill activity across both the refinance and purchase markets.

SALT Deduction Deal Finalized, Says House Speaker Johnson

U.S. House Speaker Mike Johnson confirmed that lawmakers have struck a deal to lift the SALT deduction cap to $40,000. The agreement follows earlier reports of a tentative arrangement and marks a major milestone for the GOP’s comprehensive legislative package.

Johnson said they’re aiming for a House vote soon, though resistance remains among conservative members who oppose expanding the cap.

Musk Warns of Looming Power Crunch for AI

Elon Musk said Tuesday that artificial intelligence projects may run into power shortages by mid-2026. He revealed plans by his AI venture, xAI, to build a gigawatt-scale data center near Memphis, Tennessee—on par with a typical U.S. nuclear plant in capacity.

Tentative Deal Reached to Raise SALT Deduction Cap

A compromise is forming in the U.S. House of Representatives to raise the cap on state and local tax (SALT) deductions to $40,000. Speaker Mike Johnson and several Republicans from high-tax states are backing the increase as part of a broader GOP legislative package.

The deal isn’t final. Fiscal conservatives still need to approve it. But it marks a key step in advancing Republican priorities on taxes, energy, border policy, and defense.

Via Politico

Fed’s Hammack says sentiment data about the economy has been concerning

- Federal Reserve Bank of Cleveland President Beth Hammack

- Sentiment data about the economy concerning

- If the Fed faces challenges on inflation and unemployment it will be a difficult choice

- Will take more time to see how business decisions are influenced by trade policy

- Right now the best action for the Fed is to sit on its hands… “”The best action we can take is to sit on our hands and really carefully go through the data, engage with our communities, hear what they are thinking about, hear about the choices that they are making,””

- Inflation expectations have stayed reasonably well-anchored, if that changes it might be a signal the Fed needs to act

Federal Reserve Bank of San Francisco President Mary Daly is speaking at the same event:

- The net effect of Trump administration trade, immigration, other polices remains unknown

Federal Reserve Bank of Atlanta President Raphael Bostic is moderating the discussion:

- Do not expect a recession, but unclear when households and firms will feel comfortable making long run spending decisions

- On the most high profile questions, including trade policy, clarity seems to be moving further into the future

Apple CEO Tim Cook met with Trump on Tuesday at the White House

- Politico report

Apple CEO Tim Cook met with Trump on Tuesday at the White House.

Earlier this week Trump said he told Cook not to expand Apple’s manufacturing footprint in India.

Canada’s New Home Prices Dip in April

Canada’s New Housing Price Index fell 0.4% in April, signaling growing weakness in the housing sector. This follows a flat reading in March.

The correction in housing comes just as inflation data slashes the odds of a Bank of Canada rate cut in June—now down to 31%. Bond yields are climbing in tandem with global trends, tightening financial conditions even further.

Mexico Says U.S. Car Tariff Will Average 15%, Not 25%

Mexico’s Economy Minister Marcelo Ebrard said vehicles built in Mexico and sold to the U.S. will face a 15% average tariff instead of the feared 25%. He attributed the lower rate to preferential terms for regional products.

Commodities News

Gold Holds Firm Above $3,300 Amid U.S. Debt and Geopolitical Fears

Gold extended its gains to $3,307 on Wednesday as markets react to mounting U.S. fiscal concerns and geopolitical tensions. Moody’s recent downgrade of the U.S. credit rating and renewed unrest in the Middle East have boosted safe-haven demand.

- Gold’s daily low: $3,285

- U.S. Dollar Index: down 0.52% to 99.49

Moody’s dropped the U.S. rating to AA1, citing debt sustainability issues as Trump’s proposed tax cuts could add $3.8 trillion to the deficit. The weakening dollar is lifting gold further.

Meanwhile, CNN reported that Israel may be preparing to strike Iranian nuclear sites, compounding fears and supporting bullion.

Traders are now watching Fed speakers, PMIs, housing numbers, and jobless claims for clues on future policy moves.

Crude Futures Fall to $61.57, Test Key Support Levels

Oil futures closed lower at $61.57 per barrel, down $0.46 or 0.74% on the day. Prices hit a session low of $61.30 after briefly testing a high of $64.14.

Technically, the dip brought crude near its 200-bar moving average on the 4-hour chart ($61.18). A break below that could trigger deeper losses toward the 100-bar MA around $60.45. But as long as support holds, short-term bulls may stay in play.

Silver Nears $33.20 as Credit Downgrade Weighs on Dollar

Silver extended its rally to $33.20 on Wednesday, climbing in tandem with gold as Moody’s downgrade of the U.S. credit rating sparked more demand for safe-haven assets.

- DXY falls to 99.50, a two-week low

- Moody’s cut: U.S. rating lowered to Aa1

- National debt: Approaching $36 trillion

Silver’s appeal is growing amid uncertainty over Trump’s proposed tax legislation, which faces internal GOP resistance. Technicals are turning bullish after a breakout from a descending triangle pattern.

The 20-day EMA around $32.65 is acting as support. If momentum holds, silver could test the March 28 high of $34.60. On the downside, watch $30.90 as key support.

Meanwhile, investors are watching Vatican-hosted ceasefire talks between Russia and Ukraine. A breakthrough could dampen safe-haven demand, but for now, silver is thriving on global jitters.

U.S. Crude Stocks Climb Unexpectedly, Gasoline and Distillates Also Higher

U.S. oil inventories rose by 1.328 million barrels for the week ending May 16, defying expectations for a drawdown. Analysts had forecast a drop of 1.277 million.

Other key figures:

- Gasoline: +816K vs -524K expected

- Distillates: +579K vs -1,398K expected

The surprise build in stockpiles came after private data earlier in the week showed similar trends. The crude build was slightly less than the private estimate of +2.499 million, but gasoline and distillates surprised with gains instead of expected declines.

Gas Prices Spike as Norwegian Outages Rattle Supply

European natural gas prices jumped nearly 5% Tuesday, driven by unexpected outages in Norway—a key gas supplier to the EU.

An unplanned shutdown at the Kollsnes processing plant created supply worries, compounded by seasonal maintenance at several fields. According to ING, LNG send-outs in Europe have dropped to their lowest levels since February.

Meanwhile, Asian LNG continues to trade at a premium, limiting shipments to Europe and tightening local supply even further.

Oil Rises on Israel-Iran Strike Speculation

Crude prices climbed early Tuesday on media reports that Israel may be preparing to hit Iranian nuclear facilities. ING analysts say markets are beginning to price in a heightened geopolitical premium.

- WTI crude rose a modest 2%, suggesting traders are still cautious about the credibility of the reports.

- Iran produces ~3.35M b/d, and any military escalation could disrupt broader regional flows.

U.S. oil inventory data from the API showed:

- Crude stocks up 2.5M barrels

- Gasoline down 3.2M barrels

- Distillates down 1.4M barrels

Distillate inventories are at their lowest seasonal level in 20 years, according to EIA.

China’s Gold Imports Surge to 11-Month High on New Quotas

Chinese gold imports jumped 73% in April to 127.5 metric tons, the highest monthly total since May 2024, despite historically high prices. The increase coincided with new import quotas issued by the People’s Bank of China (PBOC) to select banks.

The PBOC controls access to physical gold imports and typically grants licenses to approved commercial banks. April’s rise suggests intensified investor interest and potential central bank strategy adjustments.

CNN: Israel Prepping for Potential Strike on Iran Nuclear Sites

CNN reports the U.S. has intelligence suggesting Israel is preparing to attack Iran’s nuclear facilities. No final decision has been made. Oil prices climbed on the news, reflecting market fears of escalation.

Europe News

European Markets Close Mixed as DAX Hits New Record

Europe’s major stock indices ended the session with mixed results after early losses during the U.S. trading open. Here’s the final scoreboard:

- Germany DAX: +0.34% (new all-time high)

- France CAC: -0.36%

- UK FTSE 100: +0.06% at 8,786.47 (just shy of Feb 28’s 8,809.75 high)

- Spain Ibex: -0.11% (but hits post-2008 high)

- Italy FTSE MIB: +0.07%

Germany’s DAX continues to lead the pack on strong corporate earnings and investor optimism, with tech, finance, and energy stocks fueling the rise. Meanwhile, Spain’s Ibex is seeing a long-awaited rebound, and the UK’s FTSE is within striking distance of its record.

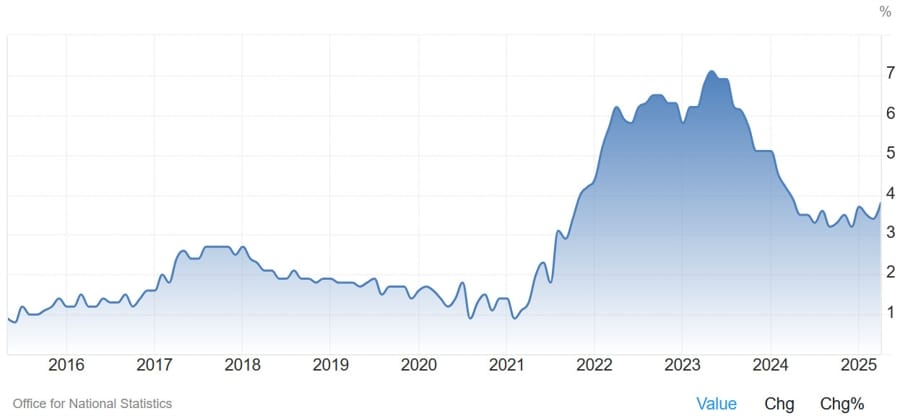

UK Inflation Surges Past Expectations in April

UK consumer inflation came in hot in April, rising 3.5% year-over-year—well above the 3.3% forecast and sharply higher than March’s 2.6%. Core CPI hit 3.8% (vs. 3.6% expected), while services inflation jumped to 5.4%, far above the 4.8% estimate.

The unexpected spike throws cold water on hopes for aggressive rate cuts by the Bank of England. Markets are now pricing in just 25–28 basis points of easing this year, effectively one rate cut. And even that could be optimistic.

The narrative has flipped: inflation, not growth, is now the central risk—just as it is for the ECB and the Fed.

German FM Klingbeil met with US Treasury Secretary Bessent: Agreed to meet again

- The G7 finance ministers meeting this week

Germany’s finance minister Klingbeil met with US Treasury Secretary Bessent for a bilateral conversation. The finance ministers of the G7 are meeting in Canada this week.

Both leaders agreed to meet again in Washington with Bessent inviting Klingbeil for the meeting.

ECB Escriva: EUR recent appreciation was a surprise

ECB Excriva says:

- Euro’s recent appreciation was a surprise.

- More difficult to predict how tariffs impact inflation

ECB’s Centeno: We made need rates below neutral rate to prevent inflation sub-2%

- Comment from Centeno

- Interest rate to prevent inflation from falling under 2% may have to come below the neutral rate between 1.50-2.00%

ECB’s de Guindos: Equity valuations are high, credit spreads out of sync with risk

- Remarks from the ECB policymaker, Luis de Guindos

- Equity valuations are high, credit spreads out of sync with risk.

- US downgrade was discounted by markets.

- Eurozone bond yields have decoupled from US, spread contained.

- Markets are complacent but that can change.

- 2% price goal to be reached sooner than later.

- We can’t be complacent on fiscal risks for markets.

- Energy costs and the Euro to push inflation down.

- Some one-offs boosted Q1 GDP in Eurozone.

- New projections to go in ‘same direction’ as EU’s.

- Many risks we’ve flagged have become reality.

ECB’s Kazaks: The ECB will soon reach terminal rate if baseline holds

- Remarks from the ECB policymaker, Martins Kazaks

- The ECB will soon reach terminal rate if baseline holds.

- Interest rate cuts are nearing an end assuming inflation stabilises at 2% over the coming months.

- It’s important to analise alternative scenarios amid the trade uncertainty.

- If either inflationary or deflationary risk scenario materialises, monetary policy will react accordingly.

Asia-Pacific & World News

China Slams U.S. Chip Curbs as ‘Bullying’

China’s Ministry of Commerce has denounced recent U.S. export controls on advanced chips, calling them “typical unilateral bullying” and accusing the U.S. of destabilizing the global semiconductor industry.

The ministry claims the measures breach international norms and discriminate against Chinese firms. It warned that anyone helping implement U.S. restrictions could face legal consequences and called on Washington to back off.

Hong Kong Pension Funds Flag Risks After Moody’s US Downgrade

Moody’s downgrade of U.S. sovereign debt has triggered concern among Hong Kong pension managers. Under local rules, U.S. Treasuries can only exceed a 10% fund allocation if rated AAA by approved agencies. With Moody’s no longer providing that rating, only Japan’s R&I still does.

The Hong Kong Investment Funds Association is urging flexibility, warning that HK$484 billion in assets could be affected. The Mandatory Provident Fund Authority said Treasuries still qualify for now but may reassess as needed.

There’s concern that other global funds with similar requirements might also have to reduce exposure, potentially pressuring U.S. bond markets further.

G7 Considers Coordinated Tariffs on Budget Chinese Imports

The G7 is exploring joint trade actions aimed at curbing the flood of low-cost Chinese goods. Canada’s Finance Minister François-Philippe Champagne confirmed ongoing talks among member nations to respond to China’s industrial overcapacity and trade practices.

The discussions follow U.S. efforts to remove duty-free treatment for sub-$800 e-commerce imports from China—targeting platforms like Shein and Temu. Europe may follow suit, with France, the UK, and the EU weighing fees or tariffs on similar imports.

The move signals a shift toward collective action against what G7 officials see as state-supported overproduction and market distortion across multiple sectors, including electronics and textiles.

Morgan Stanley Ups China Growth Forecast as Trade Pressures Ease

Morgan Stanley has lifted its 2025 GDP growth estimate for China to 4.5%, up from 4.2%, citing an improved external environment. Its 2026 projection has also been revised upward to 4.2% from 4.0%. The update reflects easing trade tensions and the assumption that U.S. tariffs will cap at 30%, giving China room for a slower, more measured policy response.

Q4 2025 GDP is now expected to grow 4.0% year-over-year, a slight upgrade from 3.7%. But structural headwinds in real estate and consumption remain. Nominal growth is projected to hover around 3.5%–3.6% through 2026, with continued deflationary pressure. The GDP deflator is forecast at -0.9% for 2025 and -0.7% for 2026 due to weak producer and consumer prices.

PBOC sets USD/ CNY central rate at 7.1937 (vs. estimate at 7.2133)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 157bn yuan via 7-day reverse repos at 1.40%

- 92bn yuan matured today

- net injection 65bn yuan

CBA Shifts RBA Rate Cut Timeline Forward

The Commonwealth Bank of Australia now expects the Reserve Bank to cut rates in both August and September, citing falling inflation and slower wage growth.

CBA still forecasts four total cuts in the easing cycle, which would lower the cash rate from 4.35% to 3.35%. It warned, however, that global risks could push the RBA to cut sooner or deeper, especially if data justifies more stimulus.

Australia’s Leading Index Flatlines in April

Westpac’s Leading Index for April 2025 showed zero growth month-on-month, essentially flat at -0.01% when rounded. The six-month annualized rate slowed from 0.5% to 0.2%, signaling a loss of momentum.

Westpac noted reduced tailwinds from commodity prices and ongoing uncertainty. The data points to below-trend growth for the rest of the year.

RBNZ Inflation Expectations Edge Higher in New Survey

The Reserve Bank of New Zealand’s latest data shows one-year inflation expectations have risen to 2.44%, up from 2.25%. The two-year outlook also nudged up, from 2.47% to 2.54%. These findings come from the RBNZ’s Business Expectations Survey (BES), which debuted this quarter.

The BES, now set for quarterly release ahead of each Monetary Policy Statement, surveys hundreds of firms across industries and sizes. Unlike the long-standing Survey of Expectations, which draws on forecasts from economists and analysts, BES taps into actual business sentiment.

New Zealand Exports Rise in April, Trade Surplus Widens

New Zealand’s April exports hit NZ$7.84 billion, up from NZ$7.41 billion in March. Imports dropped to NZ$6.42 billion, yielding a trade surplus of NZ$1.426 billion—beating expectations.

However, the 12-month trade balance remains negative at -NZ$4.81 billion.

Japanese Manufacturing Sentiment Slips in May

May’s Reuters Tankan survey shows Japan’s manufacturing sentiment index dipping to +8 from +9 in April, with the non-manufacturing index steady at +30.

Tariff uncertainty linked to Trump-era trade threats is weighing on business confidence. Firms also cited inflation, sluggish capital spending, and China’s economic fragility as ongoing concerns.

Japan’s April Trade Data Shows Sharp Deterioration

Japan’s trade balance swung to a -¥115.8 billion deficit in April 2025, missing expectations for a ¥227.1 billion surplus. Imports fell 2.2% year-over-year—less than forecast—while exports rose just 2.0%.

Breakdown of exports:

- To Asia: +6%

- To China: -0.6%

- To EU: -5.2%

- To U.S.: -1.8%

The overall data reveals weak global demand and sluggish trade performance.

Crypto Market Pulse

Bitcoin Smashes Past $109,800, Targets $120,000 Next

Bitcoin hit a record high on Wednesday, soaring past $109,800 and eclipsing its previous peak of $109,588 set in January. This marks the second time in 2025 that BTC has set a new all-time high, rallying more than 47% from its April low near $75,000.

The recovery came after a sharp dip earlier this year, when talk of new U.S. trade tariffs under President Trump sparked a selloff. But confidence returned as the U.S. struck trade deals, and spot Bitcoin ETFs recorded $7.4 billion in net inflows over the last five weeks—$329 million on Tuesday alone.

Institutional interest is growing, too. Strategy added to its BTC holdings last week, now controlling 576,230 BTC—about 2.74% of the total supply.

Technically, Bitcoin appears primed for another leg higher. Momentum indicators are flashing overbought signals, and a golden cross on the daily chart looks imminent. If $109,800 holds, BTC could test $120,000. But if it slips below $105,000, a drop toward $100,000 support is possible.

Cardano Stays Bullish as USDA Stablecoin Boosts Market Cap

Cardano (ADA) is holding strong at $0.78, riding a wave of momentum from ecosystem upgrades and rising stablecoin activity. Its stablecoin market cap has now topped $30 million—up 30% in Q1—fueled by the successful launch of the USDA token.

USDA, a native dollar-backed asset from Anzen Finance, attracted over $5.5 million in liquidity and more than 3,400 transactions in its first week. That’s just part of Cardano’s DeFi resurgence, which includes a 13% jump in DeFi diversity and a 5% boost in treasury reserves, per Messari data.

The network also enacted a new constitution that formalizes decentralized governance through its DRep model.

Other stablecoins are showing varied performance: USDM jumped 40% QoQ, iUSD dropped 20%, and DJED ticked up 2%. Still, USDA is driving most of the action, supporting Cardano’s push for reserve-backed stability in a tightening regulatory climate.

XRP at Risk of Breakdown as Network Activity Dives

XRP’s price has dropped to $2.33 from a recent high of $2.65, testing support at its 50-day EMA. A broader stall in the crypto market is forcing XRP into consolidation, with warning signs piling up.

- Network activity has cratered, with Daily Active Addresses falling 95% from a Q1 peak of 612,000 to just 33,400.

- Whale selling continues, with large holders (100k–1M XRP) cutting holdings from 11% to 10.32% of supply since November.

Bearish indicators are flashing:

- MACD has issued a sell signal.

- RSI is trending down at 52, nearing the bearish threshold of 50.

If bulls can’t defend $2.28, XRP risks a deeper correction.

‘Hawk Tuah Girl’ Claims She’s Been Cleared in HAWK Token Collapse

Haliey Welch, aka “Hawk Tuah Girl,” says she’s been cleared by both the SEC and FBI after the implosion of the HAWK memecoin, which she once promoted heavily.

Welch now distances herself from the token, which launched in December and crashed from a $491M market cap to just over $100K. Speaking on her podcast, she said, “They went through my phone. I was good to go,” while admitting she didn’t fully grasp crypto at the time.

She now estimates user losses at $180K—far below earlier $1.2M figures—but critics aren’t buying it. The token’s value is down 99%, and Welch is facing intense backlash for endorsing a project she didn’t understand.

Theta Capital Raises $175M to Fund Crypto Startups

Dutch firm Theta Capital has raised $175 million for its latest fund focused on early-stage blockchain ventures. The fund, Theta Blockchain Ventures IV, will deploy capital through top-tier crypto-native VCs.

Managing partner Ruud Smets said the fund targets firms with deep expertise in early crypto investments. Theta has backed major names like Polychain, CoinFund, and Castle Island Ventures.

The fund’s launch comes as crypto VC rebounds:

- Q1 2025 VC funding in digital assets hit $4.8B, up 54% QoQ.

- Total deal count was 405, down YoY, but funding levels doubled.

PitchBook noted that infrastructure, trading, and asset management firms led funding, with $2.55B going to just 16 deals. Circle’s rumored IPO could become the next defining moment in crypto equity markets.

The Day’s Takeaway

United States

- Stocks slump across the board: Major indices closed sharply lower amid a bond market selloff.

- Dow Jones: −1.91%

- S&P 500: −1.61%

- NASDAQ: −1.41%

- UnitedHealth (UNH) plunged 5.78% on DOJ-related investigations and leadership shake-up, pulling the Dow to its worst day in months. Other blue-chip names including Nike, American Express, and Apple also posted steep losses.

- Treasury yields spike:

- 10-year yield: +10.3 bps to 4.584%

- 30-year yield: +11.1 bps to 5.079%

Weak demand at a 20-year bond auction and renewed deficit fears drove rates higher.

- No Fed speakers on the calendar; rate hike expectations stayed muted, but bond volatility filled the void.

Canada

- New housing price index declined 0.4% in April, marking a notable slowdown in the housing sector.

- The drop comes amid rising bond yields and fading hopes of a near-term Bank of Canada rate cut.

- Odds of a June cut dropped to just 31%, with Canadian yields moving in lockstep with global markets.

Commodities

- Oil:

- WTI crude settled at $61.57, down $0.46 (-0.74%).

- Inventories rose unexpectedly:

- Crude: +1.328M (vs. -1.277M expected)

- Gasoline: +816K

- Distillates: +579K

- Technical support at $61.18 (200-bar MA) held for now, but bears are circling.

- Gold:

- Held above $3,300 at $3,307 as safe-haven demand surged.

- Boosted by U.S. credit downgrade, Middle East tensions, and tax-driven deficit fears.

- The dollar’s drop (DXY down 0.52%) added further lift.

- Silver:

- Rallied to $33.20, hitting a weekly high.

- Moody’s downgrade and fiscal fears sent the USD lower, sparking safe-haven interest in precious metals.

- Watch for potential resistance at $34.60.

Europe

- Indices finish mixed, recovering some losses from early U.S. market jitters:

- Germany DAX: +0.34% (new record high)

- France CAC: −0.36%

- UK FTSE 100: +0.06% (just shy of record)

- Spain Ibex: −0.11% (at highest level since 2008)

- Italy FTSE MIB: +0.07%

- The DAX continues to outperform, backed by strong earnings and economic data. The FTSE 100 is one strong session away from setting a new record close.

Asia

- No major session data releases today, but markets are bracing for fresh PMI figures and Fed-linked guidance.

- In Japan, earlier weakness in exports and manufacturing sentiment still weighs on equity sentiment.

- China remains in focus after Morgan Stanley raised its GDP forecast to 4.5% for 2025.

Rest of the World

- Middle East:

- CNN reported that Israel may be preparing to strike Iranian nuclear facilities, triggering a geopolitical risk premium across oil and gold markets

- Russia–Ukraine:

- Vatican City hosting new ceasefire talks. Trump claims a resolution is in sight but details remain vague.

- Safe-haven demand remains intact pending further developments.

Crypto

XRP, previously under pressure, is consolidating above support at $2.28. Whale exits and weak network activity are red flags, but bullish market momentum may keep it afloat.

Bitcoin hits a new all-time high above $109,800, gaining 47% since its April lows and eyeing $120,000.

ETF inflows and institutional buying (e.g., Strategy’s BTC holdings up to 576,230) are major tailwinds.

Overbought conditions (RSI, Stochastics) could trigger short-term pullbacks, but the golden cross setup remains bullish.

Cardano (ADA) trades near $0.78 with strong bullish structure.

Stablecoin market cap on Cardano jumped 30% QoQ, led by USDA’s $5.5M launch.

Full decentralized governance now in place; DeFi metrics also improved across the board.