North America News

US Stocks Plummet, Marking Worst Week Since Early January

The major US indices suffered a steep decline, with the Nasdaq and Russell 2000 posting their worst weeks since January 6.

Weekly Performance:

- Dow Jones: -748.63 pts (-1.69%) (worst week since October 2024)

- S&P 500: -104.39 pts (-1.71%) (worst week since January 6)

- Nasdaq: -438.36 pts (-2.20%) (worst week since November 11)

- Russell 2000: -66.39 pts (-2.94%) (worst week since December 16)

Big Tech Weekly Performance:

- Nvidia: -3.21%

- Microsoft: -0.34%

- Amazon: -5.29%

- Alphabet (Google): -3.01%

- Apple: +0.38%

- Tesla: -5.07%

- Palantir: -14.91%

- Broadcom: -6.17%

- Adobe: -3.44%

- Costco: -3.44%

- Applovin: -18.59%

Key Takeaways:

- Meta (Facebook) fell for the fourth straight day, dropping -7.21% for the week.

- Chipmakers saw heavy selling, as Broadcom (-6.17%) and Nvidia (-3.21%) declined.

- Palantir tumbled (-14.91%) following weaker-than-expected guidance.

Markets remain volatile, with concerns over inflation, tariffs, and Fed policy weighing on investor sentiment.

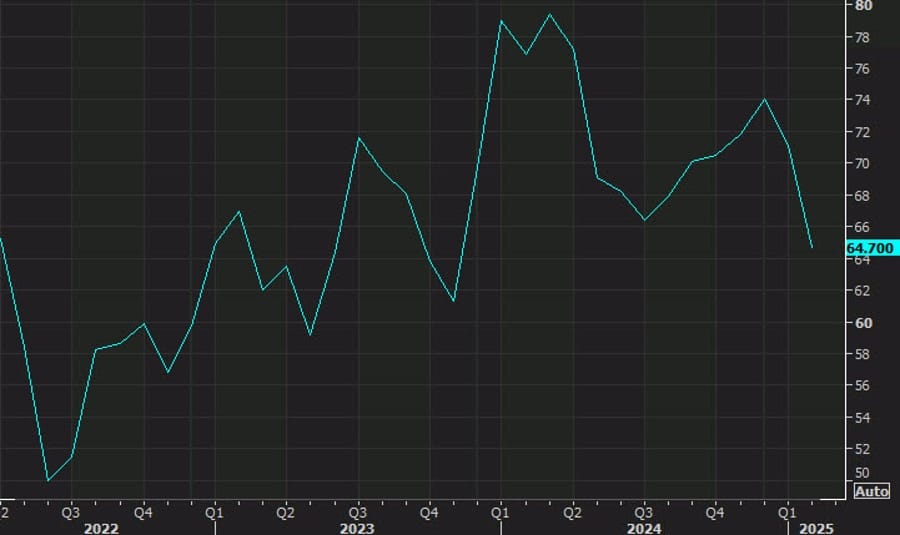

US Consumer Sentiment Drops Sharply, Long-Term Inflation Expectations Hit 30-Year High

The University of Michigan’s final consumer sentiment index for February showed a steep decline, missing expectations by a wide margin.

- Headline Sentiment: 64.7 (expected: 67.8, prior: 71.1)

- Current Conditions: 65.7 (expected: 68.7, prior: 74.0)

- Expectations Index: 64.0 (expected: 67.3, prior: 69.3)

- 1-Year Inflation Expectation: 4.3% (unchanged from prelim)

- 5-Year Inflation Expectation: 3.5% (previously 3.3%, highest in 30 years)

The sharp drop in sentiment suggests that consumers are growing increasingly pessimistic about economic conditions. More significantly, long-term inflation expectations hit a 30-year high, which is a key concern for the Federal Reserve. Historically, elevated inflation expectations have pressured the Fed into rate hikes, and this data could further complicate the central bank’s policy path.

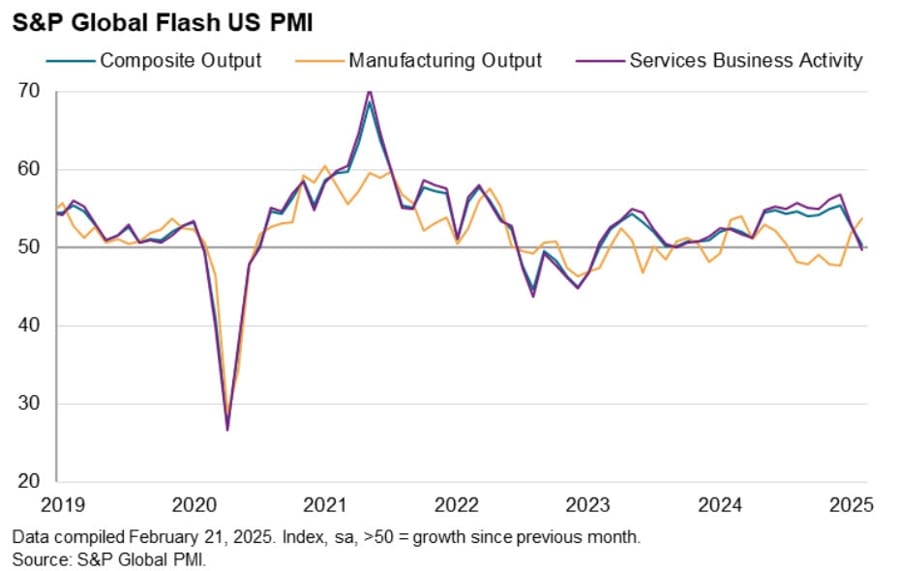

US Flash PMI Data Reveals Sharp Slowdown in Services Sector

The S&P Global US Flash PMI for February indicated a sharp slowdown in business activity, with services sector growth contracting unexpectedly while manufacturing held steady.

- Services PMI: 49.7 (expected: 53.0, prior: 52.9)

- Manufacturing PMI: 51.6 (expected: 51.5, prior: 51.2)

- Composite PMI: 50.4 (prior: 52.7)

Key findings:

- New order growth weakened sharply, with business expectations plunging on concerns over federal government policies, tariffs, and geopolitical risks.

- Manufacturing input costs spiked due to tariff-related price hikes, raising inflation risks.

- GDP growth is now tracking at just 0.6% (annualized), a significant slowdown from the 2%+ pace seen late last year.

This data suggests the US economy is losing momentum, and inflation risks from tariffs are rising.

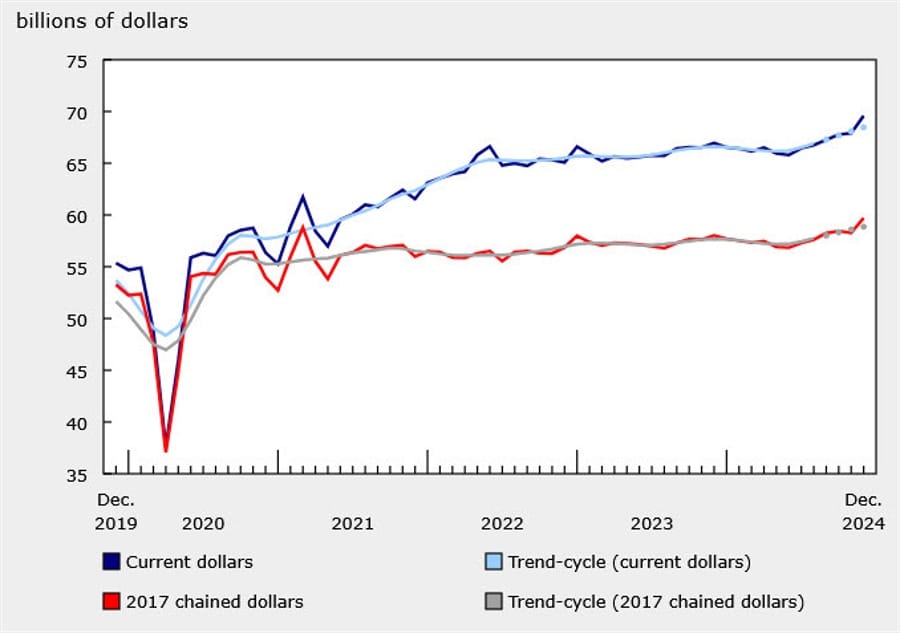

US Existing Home Sales Drop More Than Expected in January

US existing home sales for January declined 4.9% month-over-month, falling below expectations as high mortgage rates and affordability concerns continued to weigh on the housing market.

- Existing Home Sales: 4.08M (expected: 4.12M, prior: 4.29M)

- Home Supply: 3.5 months (prior: 3.3 months)

- Median Sales Price: $396,900 (+4.8% YoY, 19th consecutive month of price increases)

- Cash Sales: 29% (prior: 32%)

- First-Time Buyers: 28% (prior: 31%)

- 30-Year Mortgage Rate: 6.85% (prior: 6.87%)

Regional Breakdown:

- Northeast: Sales down -5.7% MoM, up +4.2% YoY (Median Price: $475,400, +9.5% YoY)

- Midwest: Sales flat MoM, up +5.3% YoY (Median Price: $290,400, +7.2% YoY)

- South: Sales down -6.2% MoM, unchanged YoY (Median Price: $356,300, +3.5% YoY)

- West: Sales down -7.4% MoM, up +1.4% YoY (Median Price: $614,200, +7.4% YoY)

Despite falling sales, home prices continue to rise, reflecting limited inventory and persistent demand.

Fed’s Goolsbee: Steel Tariffs Will Raise Production Costs

Federal Reserve Bank of Chicago President Austan Goolsbee stated that new steel tariffs will increase production costs, potentially impacting US manufacturing and economic growth.

- Steel prices are expected to rise, which could fuel inflation.

- Higher costs may force businesses to raise prices, further complicating the Fed’s inflation fight.

- This adds to concerns over Trump’s broader tariff agenda, including levies on automobiles, semiconductors, and pharmaceuticals.

Trump to Sign Memorandum to Retaliate Against Digital Taxes

President Donald Trump is set to sign a memorandum today that could open the door for retaliatory measures against digital services taxes imposed on US tech companies.

- The memo does not impose immediate tariffs but signals the administration’s willingness to act against countries targeting Silicon Valley firms.

- Tech investors view this as a positive development, reinforcing US dominance in digital markets.

This move aligns with Trump’s pro-business stance and may escalate trade tensions with the EU and other nations implementing digital taxes.

Federal Reserve’s Kugler: Watching Labor Market Closely Amid Tariff Uncertainty

Federal Reserve Board Governor Adriana Kugler stated that the Fed is closely monitoring layoffs and tariff impacts before considering further policy adjustments.

- Key Highlights:

- Fed should hold rates steady for now.

- Tariffs could drive inflation, but the extent remains unclear.

- Path to 2% inflation remains “bumpy”, but labor market stability supports a wait-and-see approach.

Kugler added that mass federal government layoffs could impact employment, but it’s too early to assess the long-term effects.

Bank of Canada’s Macklem Warns of Tariff Impact on Growth

BoC Governor Tiff Macklem warned that prolonged US tariffs could shave nearly 3% off Canadian GDP over two years, with exports falling 8.5% in the first year alone.

- Tariffs would cause an initial spike in inflation, requiring the BoC to prevent inflation from becoming entrenched.

- The 2026 monetary policy framework renewal is expected to keep the 2% inflation target unchanged.

Macklem emphasized that monetary policy must remain flexible to deal with shifting trade and economic conditions.

Canada’s Retail Sales Beat Expectations in December, But January Weakens

Canada’s December retail sales surged past expectations, rising 2.5% MoM (expected: +1.6%) but the January advance estimate showed a -0.4% decline.

- Retail Sales (MoM): +2.5% (expected: +1.6%, prior: 0.0%)

- Retail Sales Ex-Autos (MoM): +2.7% (expected: +1.8%, prior: -0.7%)

- Core Retail Sales (MoM): +2.5% (prior: -1.0%)

- Retail Sales (2024 full year): +1.3%

While December was strong, the January pullback suggests demand may be fading, potentially influencing the Bank of Canada’s rate decisions.

Commodities News

Gold Holds Near Record Highs, Poised for 8-Week Winning Streak

Gold prices touched an all-time high of $2,954 this week, driven by:

- Trump’s expansion of tariffs on soft commodities, fueling trade concerns.

- US economic data showing mixed results (Manufacturing PMI up, Services PMI down).

- Central bank gold purchases rose +54% YoY to 333 tonnes in January.

Gold Market Overview:

- Current Price: $2,940 (-0.15% on Friday)

- Resistance: $2,955 (ATH level)

- Support: $2,900 (psychological level)

Gold remains bullish in the long term, but short-term corrections are possible.

Baker Hughes Rig Count: US Rigs Increase, Canada Sees Slight Decline

The Baker Hughes Rig Count for the past week showed:

United States:

- Total rigs: 592 (+4 from last week, down -34 YoY)

- Oil rigs: 488 (+7 from last week, -15 YoY)

- Gas rigs: 99 (-2 from last week, -21 YoY)

- Offshore rigs: 14 (unchanged from last week, down -6 YoY)

Canada:

- Total rigs: 244 (-1 from last week, up +13 YoY)

- Oil rigs: 174 (unchanged from last week, +33 YoY)

- Gas rigs: 70 (-1 from last week, -20 YoY)

This report indicates a recovery in US drilling activity, while Canada sees a slight pullback.

Silver Struggles as Fed Signals Restrictive Policy to Stay

Silver prices are pressured around $33.00 as Fed officials reinforce a restrictive policy stance.

- Fed Governor Adriana Kugler stated that rates will stay high for some time as Trump’s tariff impacts remain uncertain.

- Fears of Trump’s tariff policies continue to support safe-haven demand for silver.

- Resistance: $34.87 (October 22 high)

- Support: $30.00 (trendline from August low)

European Natural Gas and Power Prices Drop Despite Cold Spell

Danske Bank reports that European natural gas and power prices have declined despite increased demand.

- Wind power production helped balance the market.

- Gas storage is now only 43% full, 20 percentage points lower than last year, which could keep prices elevated throughout 2025.

While prices are low now, the risk of a spike later this year remains high due to limited reserves.

OPEC+ Expected to Delay Production Hike Again Amid Market Uncertainty

OPEC+ is likely to postpone its planned 120,000 bpd production increase for the fourth time, citing economic and geopolitical concerns.

- Key Takeaways:

- OPEC faces challenges phasing out production cuts without disrupting oil markets.

- ANZ analysts: OPEC+ must carefully balance supply and price stability.

- The group’s ultimate goal is to restore 2.2 million barrels per day of production, but the timeline remains uncertain.

Europe News

Eurozone PMI: Marginal Growth Amid Stagnant Demand and Inflation Concerns

The Eurozone’s February flash PMI data showed marginal economic growth, as the manufacturing sector improved but services activity weakened.

- Services PMI: 50.7 (expected: 51.5, prior: 51.3)

- Manufacturing PMI: 47.3 (expected: 47.0, prior: 46.6)

- Composite PMI: 50.2 (expected: 50.5, prior: 50.2)

Key concerns:

- New orders continued to decline, raising concerns over demand weakness.

- Business confidence fell to a three-month low as firms cut jobs.

- Input costs and output prices rose, complicating the ECB’s inflation fight.

HCOB analysts warned that inflationary pressures remain persistent, particularly in services, suggesting that the ECB may delay interest rate cuts.

Germany’s February PMI Data Shows Signs of Recovery

Germany’s manufacturing sector showed signs of improvement in February, though services growth slowed slightly.

- Manufacturing PMI: 46.1 (expected: 45.5, prior: 45.0)

- Services PMI: 52.2 (expected: 52.5, prior: 52.5)

- Composite PMI: 51.0 (expected: 50.8, prior: 50.5)

Key takeaways:

- The manufacturing PMI hit a 24-month high, showing signs of stabilizing.

- Services sector remains resilient, supported by strong consumer demand.

- However, business confidence is fragile, with concerns over Trump tariffs on German exports weighing on sentiment.

HCOB analysts noted that the manufacturing sector is still contracting, but the recession appears to be easing, with new orders falling at a slower pace.

France’s Economic Struggles Deepen as February PMIs Hit 17-Month Lows

France’s February flash PMI data signaled a sharp economic downturn, with both the services and composite readings falling to their lowest levels since September 2023.

- Services PMI: 44.5 (expected: 48.9, prior: 48.2)

- Manufacturing PMI: 45.5 (expected: 45.5, prior: 45.0)

- Composite PMI: 44.5 (expected: 48.0, prior: 47.6)

Key takeaways:

- Demand conditions continue to weaken, dragging the economy further into contraction.

- Employment conditions worsened, with workforce reductions at the highest rate since August 2020.

- Services sector was the main drag, experiencing a sharp drop in new orders and activity.

HCOB analysts noted that France’s ongoing political instability and concerns over weak demand are eroding business confidence.

French Business Confidence Improves Slightly, but Employment Outlook Worsens

Despite weak PMI figures, France’s business confidence index ticked up to 96 in February from 95, driven by gains in manufacturing and services confidence.

- Manufacturing confidence: 97 (prior: 95, revised to 96)

- Services confidence: 98 (prior: 96)

- Employment confidence: 94 (prior: 98), lowest since April 2021 (excluding COVID-related anomalies).

The employment outlook remains a major concern, as businesses cut jobs at the fastest rate in nearly a decade.

Italy’s January Final CPI Confirms 1.5% YoY Inflation Rate

Italy’s final consumer price index (CPI) for January confirmed inflation at 1.5% YoY, in line with preliminary estimates.

- HICP inflation: 1.7% YoY (prelim: 1.7%, prior: 1.4%)

The report indicates that inflationary pressures remain moderate but are increasing slightly, aligning with broader Eurozone inflation trends.

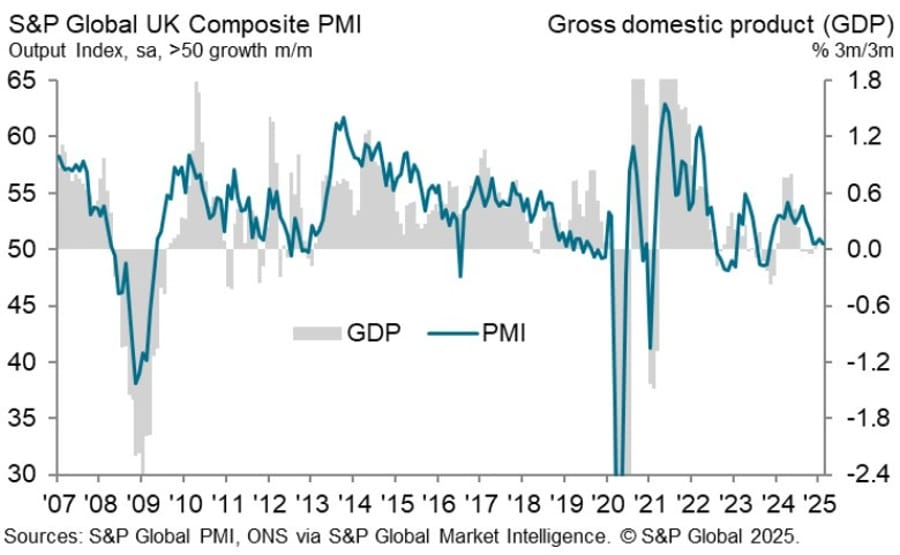

UK Flash PMIs Signal Stagnation Amid Rising Inflation Pressures

The UK’s February PMI data showed stagnant business activity for the fourth straight month, with job losses accelerating.

- Services PMI: 51.1 (expected: 50.8, prior: 50.8)

- Manufacturing PMI: 46.4 (expected: 48.4, prior: 48.3)

- Composite PMI: 50.5 (expected: 50.5, prior: 50.6)

Key takeaways:

- New orders fell at the fastest pace since August 2023, signaling weak demand.

- Firms face rising costs, with inflation pressures accelerating for the fourth consecutive month.

- Employment declined sharply, with job cuts at their highest level since the 2008 financial crisis (excluding COVID months).

S&P Global noted that the UK is experiencing a stagflationary environment, creating dilemmas for the Bank of England as it weighs inflation risks against a slowing economy.

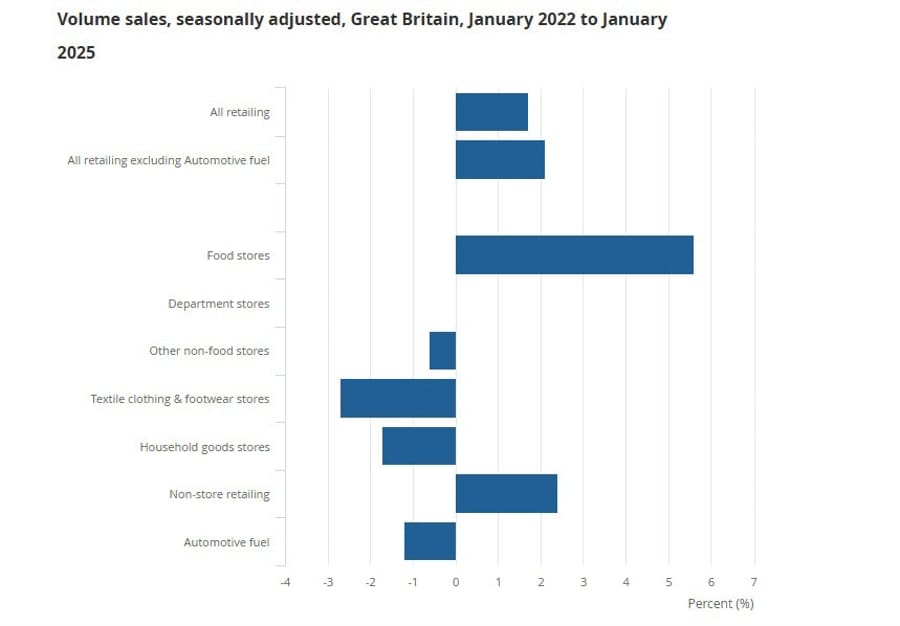

UK Retail Sales Surprise to the Upside in January

UK January retail sales jumped more than expected, driven by a surge in food sales.

- Retail sales (MoM): +1.7% (expected: +0.3%, prior: -0.6%)

- Retail sales (YoY): +1.0% (expected: +0.6%, prior: +2.8%)

- Retail sales ex-autos/fuel (MoM): +2.1% (expected: +0.9%, prior: -0.9%)

However, analysts cautioned that the gains were largely a rebound from four straight months of declines, suggesting that underlying demand remains weak.

Asia-Pacific & World News

Russia Says No Interim Contact Before Trump-Putin Meeting

The Kremlin confirmed that a Trump-Putin meeting is in the works, but no interim contact is expected before the event.

- Russia stated that details of the meeting are still being finalized.

- Both leaders are reportedly eager for face-to-face discussions.

With tensions over Ukraine and U.S. tariffs on Russian goods, the meeting could have major geopolitical implications.

China’s Financial Media Hints at Future Rate Cuts

Chinese financial media suggested that Loan Prime Rates (LPRs) could decline further, despite remaining unchanged at 3.1% (1-year) and 3.6% (5-year) in the latest policy decision.

- Key Context:

- The PBOC is focusing on stabilizing financial conditions and supporting real estate markets.

- Policymakers may be waiting for stronger economic signals before making another move.

Meanwhile, UK asset manager ABRDN is in talks with China’s Citic Bank to form a joint venture in China’s asset management sector, aiming to expand foreign participation in Chinese financial markets.

PBOC sets USD/ CNY reference rate for today at 7.1696

- PBOC CNY reference rate setting for the trading session ahead.

PBoC injects CNY 182.5bln yuan in open market operations (OMOs)

- via 7-day reverse repos

- rate unchanged at 1.50%

- net injection is 84bn yuan given 98.5bn yuan mature today

PIMCO and Yarra Capital Sound Caution on Australian State Bonds

Global asset manager PIMCO and Yarra Capital are avoiding Australian semi-government debt due to worsening fiscal conditions in multiple states.

- Queensland’s credit outlook was cut to negative, following similar actions for NSW and others.

- State debt is projected to triple to AUD 850 billion by 2028 as expenses outpace tax revenue.

- PIMCO prefers sovereign bonds over state bonds until fiscal discipline improves.

RBA Governor Bullock: “Board Didn’t Want to Be Late in Easing”

Reserve Bank of Australia (RBA) Governor Michele Bullock defended the recent rate cut, stating that the central bank acted cautiously and remains data-driven in future decisions.

- Key Comments:

- The labor market is still strong but showing signs of cooling.

- The inflation target of 2-3% remains a priority.

- “We might have more cuts, but we must be cautious.”

Australian PMIs for February showed signs of economic stabilization:

- Manufacturing PMI: 50.6 (27-month high).

- Services PMI: 51.4 (6-month high).

- Composite PMI: 51.2 (6-month high).

RBNZ Signals Additional 75 Basis Points of Rate Cuts in 2025

The Reserve Bank of New Zealand (RBNZ) Chief Economist Paul Conway outlined a dovish outlook, indicating another 75 basis points of cuts could be on the horizon.

- Key Points:

- A weaker NZD will support exports.

- Inflation pressures are expected to ease.

- The Official Cash Rate (OCR) will likely move below neutral but not in the immediate term.

New Zealand’s January trade balance recorded a 486 million NZD deficit, reversing a 94 million NZD surplus from December. Exports fell to 6.19 billion NZD, while imports rose to 6.68 billion NZD, signaling trade challenges ahead.

Japan’s Core Inflation Hits 19-Month High, Strengthening BOJ Rate Hike Expectations

Japan’s core consumer price index (CPI) climbed to 3.2% YoY in January—its fastest pace since mid-2023—reinforcing speculation that the BOJ could continue tightening monetary policy.

- Headline inflation: 4.0% (prior: 3.6%).

- Core CPI (ex-food): 3.2% (expected: 3.1%, prior: 3.0%).

- Core-core CPI (ex-food & energy): 2.5% (expected: 2.5%, prior: 2.4%).

Despite signs of price pressures, services inflation actually slowed to 1.4% from 1.6%. However, persistent inflationary trends could push the BOJ toward another rate hike later in 2025.

BOJ Governor Ueda Reaffirms Accommodative Policy, Signals Potential Rate Adjustments

Bank of Japan (BOJ) Governor Kazuo Ueda emphasized that Japan’s monetary policy remains accommodative, but adjustments could be made if underlying inflationary pressures continue to rise.

- Key Takeaways:

- BOJ will adjust policy if inflation strengthens.

- Underlying inflation is still slightly below the 2% target.

- A hike to 0.50% interest rates would increase interest payments on reserves by 1 trillion yen.

- The BOJ remains cautious about unintended economic consequences from further rate hikes.

Ueda also warned that loss of market confidence in Japan’s fiscal health could lead to rising bond yields, adding that the BOJ is prepared to intervene in markets if necessary.

Japan’s Prime Minister and Finance Officials Warn of Risks from Rising Yields

Japanese Prime Minister Shigeru Ishiba and Finance Minister Katsunobu Kato expressed concerns over rising Japanese Government Bond (JGB) yields, which reached 1.455%—the highest level since 2009.

- Japan’s public debt-to-GDP ratio is projected to hit 232.7% this year, raising concerns over borrowing costs.

- Industry and Trade Minister Yoji Muto is set to travel to the U.S. to discuss Japan’s exemption from upcoming Trump tariffs on steel and automobiles.

- Rising bond yields could pressure Japan’s fiscal situation, leading to potential cuts in government spending.

Crypto Market Pulse

Bybit Suffers $1.4 Billion Crypto Hack, Market Reacts

Crypto exchange Bybit confirmed a major security breach, with $1.4 billion worth of ETH and staked ETH stolen.

- The hack represents 16% of all major crypto hacks in history.

- Bybit CEO Ben Zhou stated the exchange remains solvent and can cover the losses.

- The stolen funds represent 75% of Bybit users’ ETH deposits.

- $200 million of stolen ETH has already been sold, raising concerns about further market instability.

Following the hack, Bitcoin, Ethereum, XRP, and Solana saw mild corrections, but Bybit’s reserve remains strong at $16.2 billion.

Dogecoin Adoption Surges as 160,000 New Wallets Created

Dogecoin (DOGE) saw a surge in network activity, with 160,000 new wallets created in the past 30 days, following Trump’s appointment of Elon Musk as DOGE Advisor.

- DOGE price: $0.24 (-3% on Friday, down from a peak of $0.26)

- New user growth: 160,000 wallets added since January 20

- DOGE ETFs speculated after Grayscale & Bitwise filed applications with the SEC

However, DOGE ETF hype was weakened after Argentina’s President Javier Milei was linked to a meme coin scam, dampening sentiment across the sector.

Dogecoin Price Forecast:

- Resistance: $0.26 (major barrier for bullish continuation)

- Support: $0.24 (lower Bollinger Band, short-term floor)

- Breakout potential: DOGE needs stronger momentum to surpass $0.30.

Shiba Inu Sees Recovery Potential as Meme Coins Struggle

Shiba Inu (SHIB) is gearing for a recovery, announcing new liquidity pools that could improve trading conditions.

- SHIB Price: $0.00001527 (-6% in past week)

- Target Resistance: $0.00001709 (+11% from current levels)

- DOGE, PEPE, and BONK continue to struggle, showing no signs of recovery.

Shiba Inu’s liquidity pool upgrade could boost adoption, while other meme coins face downward pressure.

SEC Set to Drop Case Against Coinbase, Eyes on Ripple

The US Securities & Exchange Commission (SEC) has agreed in principle to drop its lawsuit against Coinbase, marking a major shift in its approach toward cryptocurrency regulation.

- SEC staff approved the decision, but an official Commissioner vote is expected next week.

- Coinbase will not pay any fines or change its business practices.

- Crypto community expects Ripple may also see a similar resolution.

Implications for Ripple:

- Ripple has been locked in a five-year-long legal battle with the SEC since December 2020 over whether XRP constitutes a security.

- A July 2023 ruling partially favored Ripple, stating XRP’s sales on public exchanges were not securities transactions, but institutional sales violated securities laws.

- The SEC appealed the ruling and fined Ripple $125 million in late 2024.

- Judge Torres retains jurisdiction until August 7, 2025, meaning the SEC must wait before negotiating a settlement.

Crypto markets reacted positively, with Coinbase (COIN) shares rising 5%, and XRP gaining 3.2% on speculation that Ripple’s case may also be resolved soon.

Elon Musk’s “Dogefather” Post Sparks Meme Coin Surge

Elon Musk’s latest X (formerly Twitter) post triggered a sharp rally in Dogecoin-themed tokens, with some doubling in value.

- Musk posted an edited image of himself holding a chainsaw with the words “The Dogefather.”

- Investors rushed to buy Dogefather-branded tokens, leading to rapid price spikes.

- Similar trends have occurred in the past, with Musk’s tweets influencing Dogecoin and other meme coins.

The post follows Musk’s ongoing involvement with the Trump administration, where he has been advising on government efficiency and deregulation efforts.

Market analysts remain divided on whether this rally is sustainable or just another short-term speculation fueled by Musk’s influence.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments