North America News

Stocks Snap Six-Day Winning Streak as Wall Street Pauses for Breath

U.S. stocks pulled back Tuesday, breaking a six-day rally as investors digested the recent surge from April lows and awaited further clarity on policy and corporate developments.

- Dow Jones fell 114.83 points to 42,677.24

- Nasdaq slid 72.75 points to 19,142.71

- S&P 500 dropped 23.14 points to 5,940.46

Lack of major economic data left markets drifting, while headlines from Capitol Hill offered little to rally around. Former President Donald Trump met with House GOP leaders, reportedly urging them to hold the line on Medicaid funding and dismissing calls from the SALT Caucus to raise deduction limits.

Eight of 11 S&P sectors closed lower, with energy (-1.0%) leading declines. Defensive plays outperformed, as utilities, health care, and consumer staples all posted modest gains.

Market breadth was moderately negative, with decliners outpacing advancers by an 8-to-5 ratio on the NYSE. Tech underperformed, with Alphabet (GOOG) sliding 1.5% during its I/O event, while Tesla (TSLA) gained 0.5%, although well off session highs.

Home Depot also slipped 0.6% after a mixed Q1 report, where it reaffirmed full-year guidance but noted no plans to raise prices in response to tariffs.

Despite today’s pause, investors showed late-session buying interest, helping indexes rebound off their lows. The Vanguard Mega-Cap Growth ETF (MGK) ended the day down 0.5%, recovering from a steeper drop earlier.

Fed’s Bostic: More businesses say they can no longer delay tariff price hikes or job cuts

- Bostic on the economy

- Says he hears from an increasing number of businesses who say they can no longer delay responding through changes via prices or employment

- Fed needs to be more certain about the outlook to be comfortable with how policy should shift

- US economy is going to see a slowdown in activity but how it plays out is hard to say

- Businesses say demand still strong enough to justify current workforce, though they are developing contingency

- There is a lot unknown about how customers would respond to another round of inflation; could be more price-sensitive now

- US tariff level is still high enough that it is difficult to assess what will happen

- Further instability in Treasury market would add to uncertainty

Fed’s Musalem: Hearing that businesses and households are holding back from decisions

- Comments from the St Louis Fed chief

- If decisions have been somewhat paused I’d expect it to affect the economic outlook

- The impact of uncertainty on economic activity tends to be pretty meaningful

- Monetary policy is currently well-positioned

- Balanced response to higher inflation, unemployment feasible if inflation expectations stay anchored.

- If inflation expectations become unanchor, Fed policy should prioritize price stability.

- US economy has underlying strength, labor market stable, inflation east but above 2% goal.

- Economic policy uncertainty unusually high.

- Even after May 12 de-escalation, tariffs likely to lead to labor market softening, higher prices.

- Tariffs as likely to have temporary as persistent effect on inflation.

- If trade tensions are durably de-escalated, inflation could head back to target, labor market remain resilient, and current monetary policy would remain appropriate.

BIS Warns of Global Scramble for U.S. Dollars in FX Swap Market

The Bank for International Settlements (BIS) has issued a stark warning: rising financial instability in the U.S. could lead to a sudden and severe rush for U.S. dollars, particularly by non-bank institutions holding large FX swap positions off their balance sheets.

BIS economist Hyun-Song Shin highlighted that more than $80 trillion in FX swaps are sitting off traditional balance sheets—short-term dollar borrowings that could trigger liquidity stress if rolled over rapidly.

He cautioned that a synchronized drop in U.S. equities, bonds, and the dollar—seen recently—could signal eroding confidence in American financial assets. Shin’s comments came during a lecture at the London School of Economics, echoing concerns about market fallout from Trump’s tariff policy and the Moody’s downgrade of U.S. credit.

UBS Maintains Full Strategic Exposure to U.S. Equities Despite Downgrade

UBS continues to recommend full strategic exposure to U.S. equities, even after shifting its short-term view to “Neutral” from “Attractive.” In a note released Monday, the bank reiterated that its neutral stance is due to valuation caution, not a shift in long-term outlook.

UBS emphasized that resilient AI-related earnings and ongoing strength in sectors like information technology, communication services, healthcare, and utilities support their positive 12-month forecast. The recent Moody’s downgrade of U.S. credit has not altered their broader investment positioning.

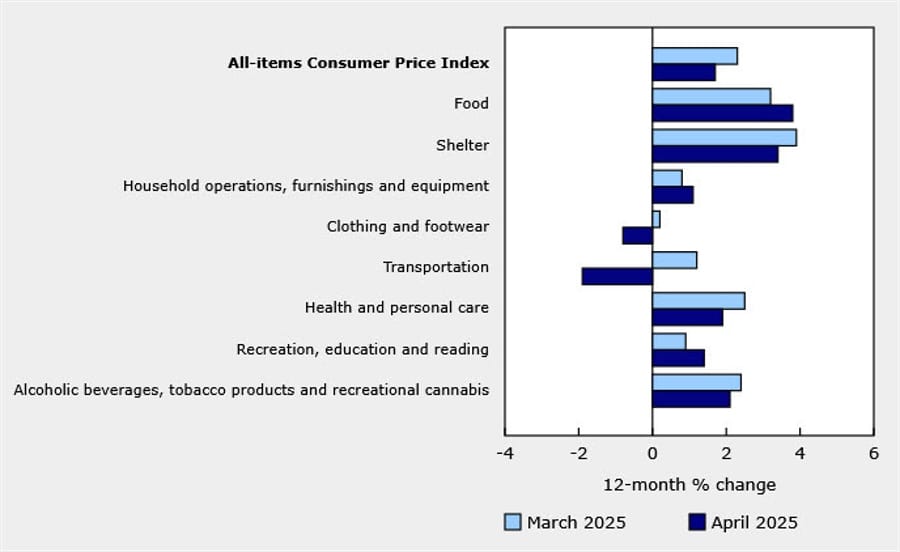

Canada CPI Hotter Than Expected in April, Core Metrics Raise Rate Cut Doubts

Canada’s April 2025 inflation data came in mixed, with headline CPI softening but core inflation metrics heating up, complicating rate cut expectations.

- Headline CPI y/y: +1.7% vs +1.6% expected (prior: 2.3%)

- CPI m/m: -0.1% vs -0.2% expected (prior: +0.3%)

- Core CPI m/m: +0.5% vs +0.1% last month

- Core CPI y/y: +2.5% vs +2.2% prior

- CPI Median y/y: 3.2% (vs 2.9% est)

- CPI Trim y/y: 3.1% (vs 2.9%)

- CPI Common y/y: 2.5% (vs 2.3%)

Gasoline prices dropped 18.1% y/y, helped by the removal of Canada’s carbon tax on April 1, while natural gas prices fell 14.1%. Still, food inflation persisted, with grocery prices up 3.8% and restaurant prices up 3.6%.

Markets had priced in a 65% chance of a June BoC rate cut before this data. That probability has now dropped to 51%, with sticky core inflation raising doubts.

Canadian Home Prices Slide for Fourth Month Straight in April

The Teranet–National Bank House Price Index dropped 1.5% in April on a seasonally adjusted basis—marking the fourth consecutive month of declines. While prices rose 0.2% year-over-year, this is down sharply from the 2.3% increase in March.

Toronto home values are under pressure, down 3.5% y/y, while Quebec continues to show strength. Rising core inflation is further complicating the picture, dimming odds of a Bank of Canada rate cut in June. Market pricing for a move is now down to 39%, and the 5-year bond yield has risen to 2.88%.

Commodities News

API Data Reveals Surprise Crude Build, Pressures Market Ahead of EIA Report

The American Petroleum Institute (API) reported a surprise crude oil inventory build ahead of Wednesday’s official Energy Information Administration (EIA) release.

Here’s the breakdown from the private inventory survey:

- Crude: +2.499 million barrels (expected: -1.85 million)

- Gasoline: -3.238 million barrels

- Distillates: -1.401 million barrels

- Cushing: -443,000 barrels

- Strategic Petroleum Reserve (SPR): +900,000 barrels

The headline build in crude contrasts sharply with expectations of a draw and could weigh on near-term price action if confirmed by the EIA data. Gasoline and distillates, however, saw larger-than-expected draws, suggesting robust end-user demand. Market participants are bracing for volatility into Wednesday’s official report.

Gold Surges Above $3,280 as Downgrade and Global Rate Cuts Stoke Demand

Gold prices ripped higher Tuesday, climbing more than 1.5% to $3,278 as safe-haven demand returned in force following Moody’s downgrade of U.S. sovereign credit, geopolitical risk, and fresh global interest rate cuts.

The downgrade from AAA to AA1, issued late last week, rattled investor sentiment and triggered a rotation out of risk and into non-yielding assets like gold. This move came despite elevated U.S. Treasury yields, which typically weigh on precious metals.

Adding fuel to the rally, central banks in China (PBoC) and Australia (RBA) both cut rates this week, supporting global liquidity conditions and stoking further interest in bullion. Meanwhile, U.S. equities turned red, and the Dollar Index (DXY) dropped 0.21% to 100.17, weakening the greenback’s appeal as a safe haven.

Federal Reserve officials, including Atlanta Fed’s Raphael Bostic and Cleveland Fed’s Beth Hammack, maintained a cautious tone, warning of potential stagflation and signaling limited rate cuts in 2025. This has reinforced gold’s status as a hedge against policy and fiscal uncertainty.

Goldman Sachs now projects gold to average $3,700 per ounce by the end of the year, with a further run to $4,000 by mid-2026.

Crude Oil Settles at $62.56, Testing Key Support Amid Sideways Trade

June crude oil futures finished Tuesday’s session down $0.13, or -0.21%, closing at $62.56 per barrel. The contract traded between a high of $63.17 and a low of $62.19 throughout the day.

From a technical standpoint, oil found strong support at its 100-hour moving average, which acted as a magnet for dip buyers during the session. That level has become the key battleground for bulls. However, a drop back below both the 100-hour ($61.82) and the 200-hour moving average would shift momentum to the downside and build a more bearish technical picture.

Traders now await official inventory data after API figures showed a surprise build in crude stocks.

China’s Crude Processing Slumps Despite High Imports – Commerzbank

Despite importing large volumes of crude oil in April, China’s refinery throughput fell to 58M tons (14.1 mbpd), 1.4% lower y/y and well below March’s levels, Commerzbank reports.

Refinery utilization dropped to 74%, its weakest since 2022. Domestic output rose slightly, adding to inventories, which increased by nearly 2M barrels/day.

Adjusted for product exports, China’s apparent oil demand was 5.5% lower than a year ago. The data points to continued sluggishness in the world’s second-largest oil market.

Palladium Deficit Shrinking on Weaker Demand – Commerzbank

Palladium’s supply gap is narrowing as demand from automakers declines. Commerzbank, citing Metals Focus, expects a 254,000-ounce deficit in 2025, down from 407,000 ounces last year.

Demand is projected to dip 3% to 9.42M ounces, while supply will fall 2% to 9.16M ounces. Low prices are discouraging production, with 16% of PGM output loss-making in 2024.

Inventory remains historically low at 11.3M ounces, but still sufficient to meet 14 months of demand. Commerzbank forecasts palladium prices at $950/oz in Q3 and $1,000 by mid-2026.

EU Eyes Lower Russian Oil Price Cap at $50 – Commerzbank

The EU is pushing for a reduction of the Russian oil price cap to $50 per barrel, down from the current $60, according to Reuters and Commerzbank’s Barbara Lambrecht.

The move would be discussed at the upcoming G7 finance ministers’ meeting. With crude prices dropping, the existing cap has become ineffective—allowing Russian shipments to proceed with regular freight and insurance rates. Tighter enforcement is expected in the upcoming 17th EU sanctions package, including measures against the shadow fleet.

EV Surge Slashes Oil Demand Outlook – Commerzbank

Electric vehicle (EV) sales continue their upward trajectory, reshaping global oil demand forecasts, according to the IEA’s Global EV Outlook and analysis from Commerzbank’s Barbara Lambrecht.

Key stats:

- 17M EVs sold in 2024, +25% y/y

- China leads with 11M EVs sold

- EVs make up nearly 25% of global car sales in 2025

- By 2030, EVs are expected to displace 5 million barrels/day of oil

The IEA estimates EVs will rise from 0.7% of global electricity usage in 2024 to 2.5% by 2030, underscoring the energy transition’s accelerating impact on fossil fuel markets.

Kazakhstan Boosts Oil Production, Pressures OPEC Agreement

Kazakhstan has quietly increased oil output by 2% so far this month, bringing daily production to 1.86 million barrels, far above its OPEC+ quota of 1.486 million, according to an industry source cited by Reuters. Despite promising to cut back to offset earlier overproduction, the country continues to pump above its target.

OPEC is responding by fast-tracking its phased return of withheld supply—an acceleration that now looks set to continue. Kazakhstan’s oil ministry claims it’s taking “all necessary steps” to comply, but the widening gap between words and barrels may test OPEC unity.

Iran’s Supreme Leader Khamenei: I don’t think nuclear talks with the US will be successful

- This headline from Mehr News gave crude oil prices a boost

- I don’t think nuclear talks with the US will be successful.

- US demand that Iran stops enrichment is outrageous.

- The US should avoid talking nonsense in talks.

Nippon Steel Ups U.S. Investment Offer to $14 Billion in U.S. Steel Takeover Bid

Nippon Steel has sweetened its proposed acquisition of U.S. Steel by pledging $14 billion in total U.S. investments, including $4 billion for a new steel mill.

The Japanese steelmaker is seeking to gain approval from U.S. regulators, especially after bipartisan opposition and a prior deal rejection by President Biden. A national security review is expected to conclude by May 21, with Trump to weigh in afterward.

Nippon initially offered $1.4 billion in U.S. investments, later increased to $2.7 billion, and now ballooned the offer to $11 billion through 2028, with $1 billion on a greenfield site that may grow to $4 billion. If the deal collapses, Nippon faces a $565 million breakup fee. The firm continues to navigate both political resistance and 25% U.S. steel tariffs.

Europe News

European Stocks Rally, Spain’s IBEX Hits Another Record

European equities closed higher across the board, with Spain’s IBEX rising 1.2%, notching another record high. The index has now gained 23% since the April lows.

Day-end results:

- DAX: +0.3%

- CAC 40: +0.8%

- FTSE 100: +0.9%

- FTSE MIB: +0.8%

Momentum across Europe was broad-based, with investors encouraged by strong earnings and easing macro concerns.

Eurozone Consumer Confidence Improves, Still Weak

Preliminary data for May consumer sentiment in the eurozone came in at -15.2, better than the forecasted -16.0 and April’s -16.6.

While the improvement is welcome, sentiment remains below all 2024 readings, indicating consumers still feel cautious despite recent economic stability.

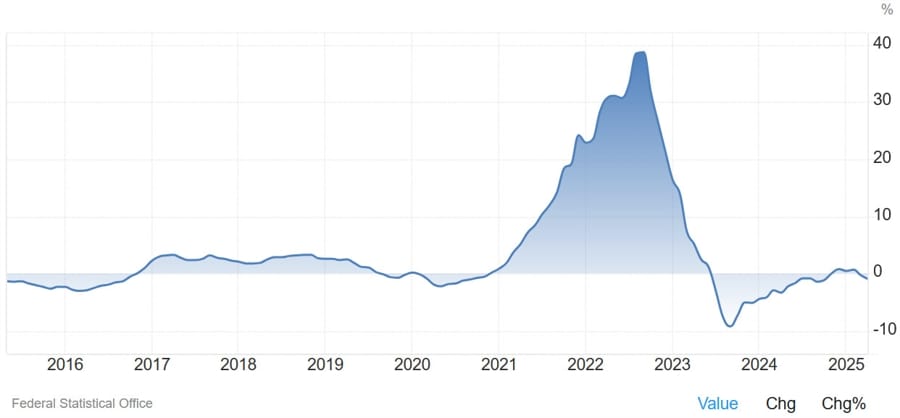

Germany’s Producer Prices Slide in April, Led by Cheaper Energy

Germany’s Producer Price Index (PPI) fell more than expected in April, according to Destatis data published on May 20.

- Monthly PPI: -0.6% vs -0.3% forecast; prior was -0.7%

- Annual PPI: -0.9% vs -0.6% expected; prior -0.2%

Falling energy prices led the decline. Excluding energy, prices were 1.5% higher year-over-year and up 0.4% from March. In contrast, capital goods, consumer goods, and intermediate goods saw year-over-year price increases, indicating ongoing cost pressures outside the energy sector.

BoE’s Pill: Vote against interest rate cut was a ‘skip’ within a continuing withdrawal

- Comments from the BoE policymaker, Huw Pill

- Vote against interest rate cut was a ‘skip’ within a continuing withdrawal of monetary policy restriction.

- Inflation pressure indicators give me cause for concern.

- Quarterly pace of 25 bps cuts seen since last summer is too rapid given the inflation outlook.

- My dissenting vote was favouring a ‘skip’ in the quarterly pattern of bank rate cuts.

- It should not be seen as favouring a halt to withdrawal of restriction.

- Structural changes in price and wage setting behaviour have increased the intrinsic persistence of the UK inflation process.

- Pace of quarterly cuts too rapid given the balance of risks to price stability we face.

- Believes that the underlying disinflation process remains intact.

- Prospective path of bank rate from here is downward.

- My dissent from that decision does not reflect a fundamental difference with the committee majority.

- We now need cautious cuts.

- We should not be dependent on how data turns out.

- We can’t assume that inflation pain of new economic shocks will go away.

- I agree with the MPC view that there is an easing in the labour market, question is about the pace.

- Some key pay indicators remain quite strong.

ECB’s Knot: Mid-term inflation outlook too uncertain to say whether we need a June cut

- Remarks from the ECB policymaker, Klaas Knot

- Mid-term inflation outlook too uncertain to say whether we need a June cut.

- ECB projections likely to show lower inflation this year and the next, but longer term is uncertain.

ECB’s Schnabel: Disinflation is on track, but new shocks are posing new challenges

- Comments from the ECB policymaker, Isabel Schnabel on her X account

- Disinflation is on track, but new shocks are posing new challenges.

- Tariffs may be disinflationary in the short run but pose upside risks over the medium term.

- Appreciation of the Euro is historical opportunity to foster the international role of the Euro.

Asia-Pacific & World News

PBoC Pledges Continued Policy Support for Real Economy

China’s central bank governor led a symposium reaffirming the People’s Bank of China’s (PBoC) ongoing commitment to loose monetary policy and proactive financial support for the real economy.

Key pledges include:

- Meeting the credit needs of households and businesses

- Supporting technology innovation and domestic consumption

- Strengthening policy transmission channels

- Promoting broader yuan internationalization

- Ensuring the security of the national financial system

The central bank emphasized that it will continue to use both existing tools and new policy levers to keep credit flowing, stabilize growth, and assist sectors under stress—including foreign trade and private enterprises.

GM to Halt Vehicle Exports to China from U.S.

General Motors has announced it will stop shipping U.S.-made vehicles to China, as revealed in an internal memo cited by Reuters. The decision was communicated to employees and dealers involved in the China export operation on Friday.

No further details have been made public regarding the rationale or implications of the move.

Chinese Banks Slash Yuan Deposit Rates Amid Economic Strain

Several major banks in China—including Agricultural Bank of China, Bank of Communications, and Postal Savings Bank of China—have cut yuan deposit rates on Tuesday, continuing a trend aimed at boosting economic activity.

- Time deposits across multiple durations saw cuts:

- 5 basis points off general time deposit rates

- 15 basis points off one-year deposits, now at 0.95%

- 25 basis points off three- and five-year terms

Earlier cuts were already confirmed from China Merchants Bank, ICBC, Bank of China, and China Construction Bank. The coordinated action reflects mounting pressure on banks to respond to a property sector crisis, low credit demand, and razor-thin net interest margins.

PBOC Cuts Loan Prime Rates by 10 Basis Points as Expected

The People’s Bank of China officially reduced its Loan Prime Rates (LPRs) by 10 basis points on Tuesday. The 1-year LPR now stands at 3.0%, down from 3.1%, and the 5-year LPR has been lowered to 3.5%, from the previous 3.6%.

This move was in line with market forecasts, especially after the PBOC cut its 7-day reverse repo rate to 1.4% earlier this month. Governor Pan Gongsheng had previously indicated that this would pave the way for a matching adjustment in LPRs.

China Approves 27 Major Investment Projects Worth Over 573 Billion Yuan

From January through April, China’s National Development and Reform Commission (NDRC) gave the green light to 27 fixed asset investment projects, totaling 573.7 billion yuan in value. The country’s top economic planning body also stated that it aims to finalize its “two major” infrastructure project list for 2025 by the end of June.

Officials further pledged greater openness to foreign capital, stating clearly that foreign investors and businesses will continue to be welcomed in China.

Beijing Accuses U.S. of Violating Geneva Agreement with Chip Export Rules

China has condemned recent U.S. changes to chip export regulations, saying they violate the consensus reached during Geneva trade talks. The criticism follows a move by the U.S. Commerce Department, which cited Huawei’s Ascend AI chips as breaching current U.S. export controls. The move has further strained bilateral relations between the two superpowers.

PBOC sets USD/ CNY mid-point today at 7.1931 (vs. estimate at 7.2112)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 357bn yuan via 7-day reverse repos at 1.40%

- 180bn yuan matured today

- net injection 177bn yuan

RBA Cuts Cash Rate to 3.85%, Signals Policy Shift Amid Global Uncertainty

The Reserve Bank of Australia (RBA) lowered its benchmark cash rate to 3.85% from 4.10% at its May 2025 policy meeting—an expected move as inflation trends lower and global risks intensify.

The RBA noted that inflation had eased through the March quarter, with underlying inflation now projected to stay near the 2–3% target midpoint through most of the forecast horizon. Meanwhile, headline inflation is forecast to briefly rise due to unwinding temporary factors.

Growth outlook has dimmed slightly, with the central bank now forecasting:

- Trimmed Mean Inflation: 2.6% in June of 2025, 2026, and 2027

- GDP Growth: 1.8% in June 2025; 2.2% in 2026 and 2027

- Unemployment: 4.2% in 2025; 4.3% in 2026 and 2027

- Cash Rate Assumption: 4.0% in 2025, falling to 3.2% by 2027

The RBA acknowledged tighter global trade dynamics—highlighting recent tariffs and the economic toll of geopolitical friction—as a source of elevated uncertainty.

While the labor market remains tight and domestic demand is improving, the board judged inflation risks have evened out. With inflation now inside the target band, the RBA opted to make policy “less restrictive” while remaining cautious. The board reaffirmed its commitment to data dependency and stressed its ability to act quickly in response to external shocks.

RBA Governor Bullock: Rate Cut Reflects Confidence, But Outlook Still Clouded

RBA Governor Michele Bullock described the latest rate cut as a “confidence move”, adding that the board is ready to adjust further if conditions warrant.

Speaking after the policy announcement, Bullock said inflation was trending in the right direction, and the rate cut is intended to support consumption and offset global risks. She acknowledged the growing uncertainty caused by U.S. tariffs, calling them broader than expected.

Highlights from Bullock’s remarks:

- The board debated both 25 and 50 bps cuts; the consensus landed on 25 bps.

- Consumption is expected to strengthen with easing inflation and lower rates.

- Businesses are reporting margin pressure.

- The RBA is monitoring for financial disruptions but doesn’t see any immediate crises.

- She emphasized that “market pricing does not reflect RBA guidance”, and more cuts are possible but not guaranteed.

Australian Coalition Fractures as Nationals Exit Alliance with Liberals

In a significant political realignment, Australia’s National Party has formally exited its longstanding coalition with the Liberal Party, following the opposition’s major election defeat.

Nationals leader David Littleproud said the party would now operate independently on a principled platform but would continue to cooperate with the Liberals when interests align. The breakup ends one of the country’s most enduring political alliances, as the center-right coalition had historically acted as a united front in Australian politics. Labor currently holds power, having secured an expanded mandate in the recent election.

BoJ Bond Market Dialogue Reveals Diverging Views on Taper Strategy

The Bank of Japan published notes from its bond market participant briefing, showing divergent views on the ongoing JGB taper and its impact on market functioning.

Some participants said JGB market performance had improved due to reduced central bank buying. Others flagged liquidity issues in the super-long end of the curve, citing a mismatch between supply and demand.

Market feedback varied:

- Some called for a faster taper beginning in fiscal 2026

- Others preferred a more gradual or steady pace

- Proposed taper end-points ranged from 0 to 3 trillion yen monthly

- One view supported pausing the taper if liquidity deteriorates sharply

Several participants noted that structural factors—such as a lack of investor interest—are partly to blame for the issues in the super-long JGB market, not just BoJ actions.

Bank of Japan to Consult Markets on JGB Purchase Plans

According to the Nikkei, the Bank of Japan will seek feedback from financial markets regarding the scale of its Japanese Government Bond (JGB) purchases.

Although the BOJ still intends to gradually reduce JGB buying after Spring 2026, the rising yield environment has prompted the central bank to consult stakeholders earlier. The sustained climb in Japanese bond yields has also helped bolster the yen, which has faced ongoing volatility this year.

Akazawa: Japan, U.S. conducted working-level talks on bilateral trade on Monday

- Japan economy minister Akazawa:

- Japan, U.S. conducted working-level talks on bilateral trade in Washington DC on Monday

- no change to Tokyo’s stance of demanding an elimination of U.S. tariffs in bilateral trade negotiations

- schedule for a third round of ministerial-level negotiations was yet to be fixed

Japan finance minister Kato hints at plans to speak with Bessent on FX this week

- Japan finance minister Kato:

- Will hold bilateral meetings with counterparts at G7 finance leaders’ meeting later this week

- Expect to discuss various topics, including FX, if I were to meet Bessent on sidelines of G7 gathering

- Will scrutinise impact of U.S. fiscal, monetary policy on Japan’s economy, when asked about Moody’s downgrade of US debt rating

- In previous bilateral meeting with Bessent, two sides confirmed FX rates should be set by markets and that excess volatility in FX market has adverse impact on economy

- Expect any talks with Bessent this week to be based on this understanding on FX

US and Japan are expected to hold talks on Friday, May 23

- US Treasury Secretary Bessent not expected to attend Japan, US talks on Friday

US Treasury Secretary Bessent is not expected to attend the talks between Japan and US coming up Friday this week.

Kyodo with the info.

South Korea Household Credit Posts Fastest Annual Growth Since June 2022

Data released by the Bank of Korea shows household credit grew 2.5% year-over-year by the end of March 2025, marking the quickest pace since June 2022. Quarter-on-quarter, household credit edged up 0.1%, slowing from the 0.6% increase recorded at the end of December 2024.

South Korea, U.S. will resume tariff talks on Tuesday, aiming for July trade deal

- This will be the second round of talks for the two

South Korea and the United States are holding a second round of technical discussions this week in Washington over the U.S.’s reciprocal tariff measures.

- The three-day session will begin Tuesday (local time)

- Both sides are working toward a “package” trade agreement, targeted for early July.

- Talks will cover six key issues — trade imbalances, non-tariff barriers, economic security, digital trade, product origin rules, and commercial factors.

- This follows the first round of working-level negotiations held on May 1.

Crypto Market Pulse

Bitcoin Targets All-Time High, Golden Cross Within Reach

BTC/USD is locked in a tight range near $105,000, after briefly peaking above $107,000. Analysts are watching for a breakout toward $109,500, the threshold to a new record high.

Moody’s downgrade and the proposed Trump tax bill—expected to add trillions to the deficit—have sparked fears about U.S. fiscal health, weakening the dollar index and giving Bitcoin a fresh hedge narrative.

The GENIUS Act, passed 66–32 in the Senate, adds regulatory momentum for stablecoins. At the same time, JP Morgan is opening Bitcoin purchases to clients, and its analysts see BTC outperforming gold in 2025.

Technicals show a golden cross forming as the 50-day SMA nears the 200-day, with support zones at 102K, 100K, and 97.5K. Resistance remains at 109.7K and, if broken, could target 115K.

Maker and Quant Rally on Robinhood’s RWA Proposal to SEC

Maker (MKR) and Quant (QNT) extended gains Tuesday following Robinhood’s formal submission to the SEC proposing a regulatory framework for real-world asset (RWA) tokens.

The 42-page proposal outlines a national framework that would treat RWA tokens like the underlying traditional assets (equities, bonds), not synthetic derivatives. Robinhood also proposed off-chain trade matching with on-chain settlement to reduce lag and improve transparency.

Maker is trading near $1,717, down from a recent high but still above key EMAs. The RSI at 54.6 and MACD crossover point to cooling momentum. Meanwhile, Quant, holding above $96, continues to benefit from growing adoption of its cross-chain infrastructure solutions.

Bitcoin Shrugs Off Downgrade, Hacks, and Keeps Climbing

Bitcoin has remained resilient despite headlines that would normally trigger sell-offs. Moody’s downgrade of U.S. sovereign debt, a $20 million Coinbase ransom demand, and past hacks at Binance, Kraken, and Bybit have done little to shake bulls.

Retail momentum is overriding concern about regulation or valuation. HSBC says the U.S.-China tariff pause has shifted global risk sentiment, giving crypto room to run. Even Trump’s promotion of the TRUMP token is fueling more retail buzz.

With Bitcoin trading firmly above $105K, the market appears more focused on trend continuation than macro headwinds.

CME’s XRP Futures Launch Draws Strong Volume But Fails to Lift Price

XRP traded lower for a second straight day, slipping to around $2.34, despite the debut of cash-settled futures contracts on CME Group’s derivatives platform.

- XRP futures posted $2.4 million in first-day volume

- Standard contracts (50,000 XRP each): ~$1M traded at ~$2.35 avg

- Micro contracts (2,500 XRP each): ~$1.38M volume across 236 contracts

Despite strong participation, XRP didn’t rally. Broader sentiment remains cautious, and the futures launch didn’t spark a breakout.

Technicals show XRP holding just above the 50-day EMA (~$2.28). If that level fails, support lies at the 100-day EMA ($2.26) and 200-day EMA (~$2.04). The MACD has flashed a sell signal, and the RSI around 51 reflects neutral-to-bearish momentum.

Investor sentiment is also being shaped by legal tensions: Judge Analisa Torres recently denied Ripple and the SEC’s joint request to reduce a $125 million penalty to $50 million.

India’s Supreme Court Urges Crypto Regulation Amid Growing Usage

India’s Supreme Court has pressed the government to introduce a regulatory framework for cryptocurrencies, criticizing the inconsistency of taxing crypto while leaving it largely unregulated.

Justice Surya Kant remarked that crypto represents a “parallel economy” and warned it poses systemic risks. He noted, “If you can tax it at 30%, then please regulate it.”

The Additional Solicitor General responded that the government would take the court’s concerns under advisement, hinting at a possible policy review.

The comments came during a May 5 hearing tied to an ongoing crypto investigation. Judge Kant also raised concerns about the potential for crypto misuse and illegal activities. Meanwhile, confusion remains around Bitcoin’s origin and pseudonymous creator, with some inaccurate claims made in court.

India currently imposes taxes on crypto gains and requires limited reporting but lacks a full legal framework, drawing criticism from both the public and crypto industry.

Aave Eyes $300 After Aptos Launch and Spike in Open Interest

Aave (AAVE) is on a bullish run, hovering near $264, following a 20% surge fueled by the launch of its v3 lending protocol on the Aptos blockchain. The expansion has reignited enthusiasm among traders.

Key metrics:

- Open Interest (OI) up 42% to $576M

- Trading volume spiked 90% to $1.84B

- Short liquidations: ~$4.05M vs long liquidations at ~$674K

The v3 rollout introduces enhanced collateral, liquidation, and incentive mechanisms for Aptos-based lending. Traders are eyeing $300 as the next target if resistance at $270 is cleared.

Support levels lie at:

- 50-day EMA: $194

- 100-day EMA: $197

- 200-day EMA: $200

A golden cross could form if the 50-day EMA crosses the 200-day EMA, adding momentum. However, with the RSI at 75.44, overbought signals suggest traders may need to tread carefully in the short term.

The Day’s Takeaway

United States

- Stocks Pause After Six-Day Rally: The S&P 500 ended a six-session winning streak, closing down 23 points at 5940.46. The Dow lost 114 points while the Nasdaq dropped 72. The pullback came as investors took profits and digested political headlines, including Trump’s Capitol Hill visit and mixed Q1 earnings from Home Depot.

- Gold Surges After Moody’s Downgrade: Investor risk appetite took a hit after Moody’s downgraded the US sovereign credit rating from AAA to AA1. Gold soared past $3,280 as traders rotated into safe havens.

- Fed Caution Continues: Fed officials including Bostic and Hammack maintained a cautious stance, with only one potential rate cut on the table in 2025 and increased concern over stagflation risks tied to fiscal instability and tariffs.

- Private Oil Inventory Data Surprises: The latest API data showed a crude inventory build of 2.5 million barrels, against expectations for a draw. This adds pressure ahead of the official EIA report.

Canada

- April Home Prices Drop Again: Teranet-National Bank reported a 1.5% monthly decline in Canadian home prices, the fourth straight monthly drop. Toronto remains weak (-3.5% y/y), while Quebec shows relative strength.

- Inflation Data Weighs on Rate Cut Odds: After hotter-than-expected CPI data, market odds for a June BoC rate cut fell to 39%, down from over 60%. Canadian 5-year yields rose to 2.88%, near February highs.

Commodities

- Crude Oil Settles Lower: June WTI crude futures closed at $62.56, down 0.21%. Buyers defended the 100-hour moving average, but bearish pressure could build if that level breaks.

- Gold Powers Ahead on Downgrade, Global Cuts: Gold rallied over 1.5%, hitting $3,278, as the Moody’s downgrade, cautious Fed tone, and global rate cuts (from PBoC and RBA) pushed traders toward non-yielding assets.

- Palladium Market Deficit Shrinks: Commerzbank noted a forecasted 254K oz. deficit in 2025, smaller than 2024 due to weaker demand, particularly from automakers. Prices are expected to stay capped below $1,000/oz.

Europe

- Eurozone Consumer Sentiment Edges Up: Flash consumer confidence improved to -15.2 in May, beating expectations but still below 2024 levels.

- European Equities Rally: Spain’s IBEX surged 1.2% to a record high, bringing its post-April gains to 23%. Broader indices also rose: FTSE 100 (+0.9%), CAC 40 (+0.8%), DAX (+0.3%).

- EU Targets Russian Oil Price Cap Cut: The bloc is considering lowering the Russian oil price cap from $60 to $50/barrel, with support expected from G7 finance ministers at their next meeting.

Asia

- China’s Oil Demand Weakens: Crude processing fell to 14.1 million bpd in April, down 1.4% y/y. Refinery utilization sank to 74%, the lowest since 2022.

- Rate Cuts Across Asia-Pacific: The PBoC and RBA both reduced key rates this week, boosting liquidity but also reflecting concern over global growth softness.

- Electric Vehicle Boom Cuts Oil Outlook: The IEA projects 20 million EV sales globally in 2025 and a long-term drop of 5 million barrels/day in oil demand by 2030, led by China.

Crypto

Altcoins See Real-World Token Rally: Maker and Quant outperformed following Robinhood’s proposal. Maker hovers near $1,717, and Quant is pushing back toward the $100 level, supported by strong technicals and real-world asset (RWA) infrastructure demand.

Bitcoin Holds at $105K Amid Credit Fears: BTC continues to consolidate near $105,000, shrugging off US credit downgrade and exchange hacks. JPMorgan has opened BTC purchases to clients, and institutional support remains strong.

Golden Cross in Sight: A bullish technical formation (50 SMA crossing above 200 SMA) could form soon, potentially triggering a new run toward $109.5K and $115K.

Regulatory Momentum Builds: The Senate passed the Genius Act, the first stablecoin bill to receive full chamber support. Robinhood’s RWA proposal to the SEC is also pushing the sector toward legal mainstream adoption.