North America News

US Stock Market Closing Levels: Mega-Caps Power Fresh Highs, Small Caps Lag

Indices hit new records despite weak breadth

- Dow +172.85 at 46,315.06

- Nasdaq +160.75 at 22,631.48

- S&P 500 +32.40 at 6,664.35

The major US indices notched new record intraday and closing highs on Friday, with mega-cap tech leading the way. The S&P 500 rose 0.5%, the Nasdaq 0.7%, and the Dow 0.4%.

Breadth was negative, however, with the Russell 2000 and S&P Mid Cap 400 each down 0.8%. Decliners outpaced advancers 2-to-1 on the NYSE and 3-to-2 on the Nasdaq, underscoring that big-cap strength masked broader weakness.

Leaders and laggards:

- Apple (+3.2%) extended gains on strong demand for its iPhone 17 lineup.

- Oracle (+4.1%) rebounded after President Trump described his call with China’s Xi as “productive” and referenced progress on TikTok.

- Alphabet (+1.2%) and Tesla (+2.2%) added to the upside.

- Energy (-1.3%) was the only S&P sector to drop more than 0.5%.

Earnings movers included FedEx (+2.4%) after an earnings beat and upbeat guidance, while Lennar (-4.2%) fell short on revenue.

Policy backdrop: Fed Governor Stephen Miran called for five rate cuts this year, while Minneapolis Fed President Neel Kashkari suggested two. Treasuries sold off again, with the 10-yr yield up 4 bps to 4.14%.

YTD performance:

- Nasdaq Composite: +17.2%

- S&P 500: +13.3%

- Russell 2000: +9.8%

- Dow: +8.9%

- S&P Mid Cap 400: +5.2%

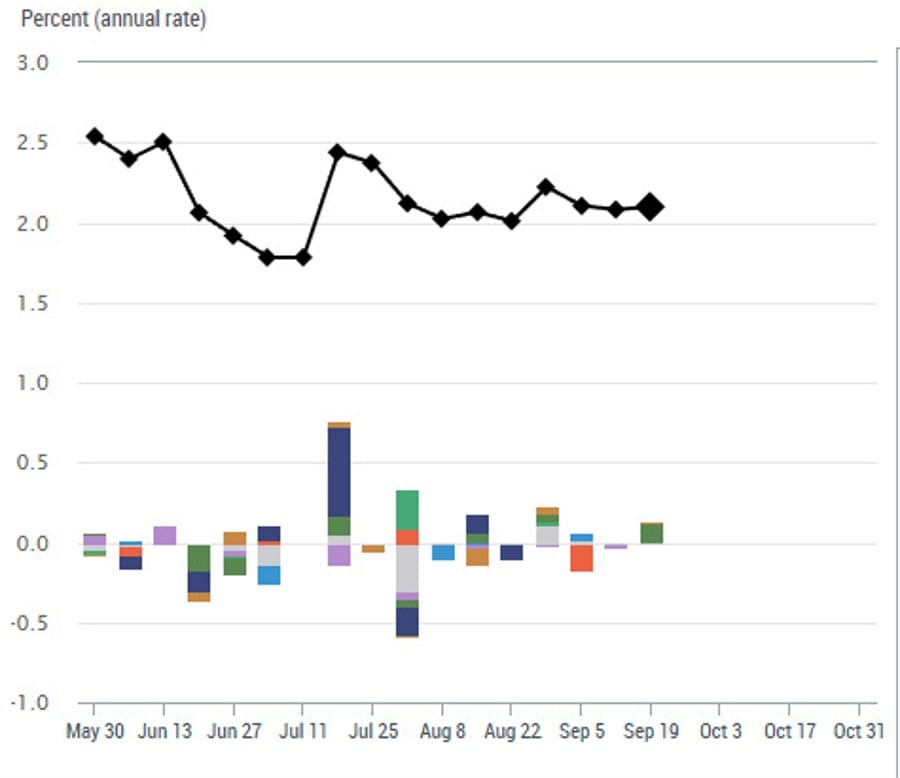

NY Fed GDP Nowcast Inches Up to 2.1%

The New York Fed’s Q3 2025 GDP Nowcast edged up to 2.10% from 2.08% last week.

The Empire State and Philly Fed surveys offset each other, while stronger retail sales provided a small lift. The advance Q3 GDP print is due October 30, leaving plenty of data ahead.

Trump Reports “Progress” in Call With Xi

President Trump said he had a “very productive” call with China’s Xi Jinping, highlighting progress on trade, fentanyl, Ukraine, and the TikTok deal.

Trump added that he and Xi agreed to meet at the APEC Summit in South Korea and plan reciprocal visits next year. He described the call as “very good” and confirmed more talks are scheduled.

Fed’s Daly: Rate cut was to try to support the labor market

- Comment from the SF Fed President

- Jobs market has softened quite a bit of the last year

Fed’s Miran: Falling Housing Costs to Ease Inflation

Fed Governor Stephen Miran said declining home prices will likely drive disinflation, offsetting stronger economic growth.

Miran argued that past border policy had fueled shelter costs, but with net migration now negative, he expects downward pressure. He acknowledged being at the low end of the Fed’s dot plot and will give a full account of his dissenting vote Monday.

Miran rejected claims he is following White House orders, saying his views differ mainly in emphasis. He warned that prolonged restrictive policy raises risks for jobs but downplayed tariff-driven inflation concerns.

Fed’s Kashkari Supports Two More Cuts, Warns on Risks

Minneapolis Fed President Neel Kashkari said he sees two more quarter-point rate cuts this year as appropriate, citing the risk of a sharp increase in unemployment.

Kashkari backed the rate cut delivered this week, noting that the neutral rate has likely risen to around 3.1% and that monetary policy may not have been as restrictive as previously thought.

He stressed the Fed could cut more aggressively if the labor market deteriorates further but also said the central bank should pause if inflation picks up or employment remains resilient. He added he would support raising rates again if conditions warranted.

On inflation, Kashkari noted tariffs are unlikely to push consumer prices much above 3%. He highlighted declines in both housing and non-housing services inflation, saying underlying pressures are easing.

He praised Fed Chair Powell for building strong consensus within the FOMC and insisted politics had not influenced the decision-making process.

Former Fed’s President Bullard: All people on list for Fed Chair are good

- Comments from the former Fed President, James Bullard

- Fed decision is good, looks like a sequence of three to year-end

- 75 bps of cuts by year-end would be significant

- Neutral rate is still fairly low, maybe 3.25%

- I would not have voted for 50 bps this week

- For doves, 25 this week and 25 in October is almost as good

Trump Administration Weighs $550bn Industrial Investment Plan

President Trump’s administration is considering a massive $550 billion program to boost U.S. manufacturing and strategic sectors, the Wall Street Journal reported.

The plan would channel funds into semiconductors, pharmaceuticals, minerals, energy, shipbuilding, and quantum computing. Potential perks for selected projects could include faster regulatory approvals and preferential access to federal land or water.

The initiative would expand Trump’s direct influence over industry, following earlier moves such as taking a stake in Intel, acquiring a “golden share” in U.S. Steel, and securing a cut of chip sales to China. Discussions are ongoing, and details remain fluid.

UBS Predicts 75bp More Fed Cuts as Powell Notes Weak Labor Market

UBS forecasts the Federal Reserve will lower interest rates by an additional 75 basis points between now and Q1 2026. The bank said the Fed is prioritizing signs of labor market weakness over what it sees as a temporary uptick in inflation.

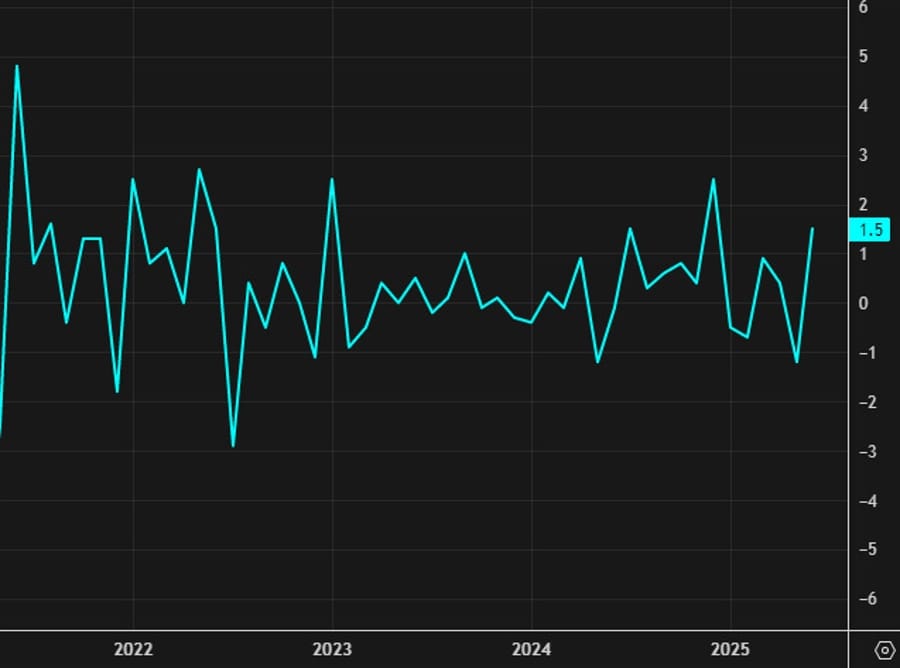

Fed Chair Jerome Powell emphasized that labor demand has softened, noting the pace of job creation is now below the level needed to keep unemployment steady. Nonfarm payrolls have averaged just 27,000 a month since May, with total payrolls revised down by 911,000. Initial jobless claims are at their highest since late 2021.

Inflation remains elevated, with core CPI at 3.1% y/y in August. Price pressures linked to tariffs could persist, though Powell argued these would amount to a one-off increase. The Fed projects inflation returning close to target by 2027, with long-term expectations anchored near 2%.

Market implications:

- Dollar: Additional cuts could weaken the currency if other central banks hold steady.

- Bonds: Front-end yields likely to fall; long-term yields capped by anchored expectations.

- Equities: Easier policy supports risk assets, though weak labor signals may limit gains.

- Commodities: Tariff-driven price effects are seen as temporary, limiting upside risks for Fed tightening.

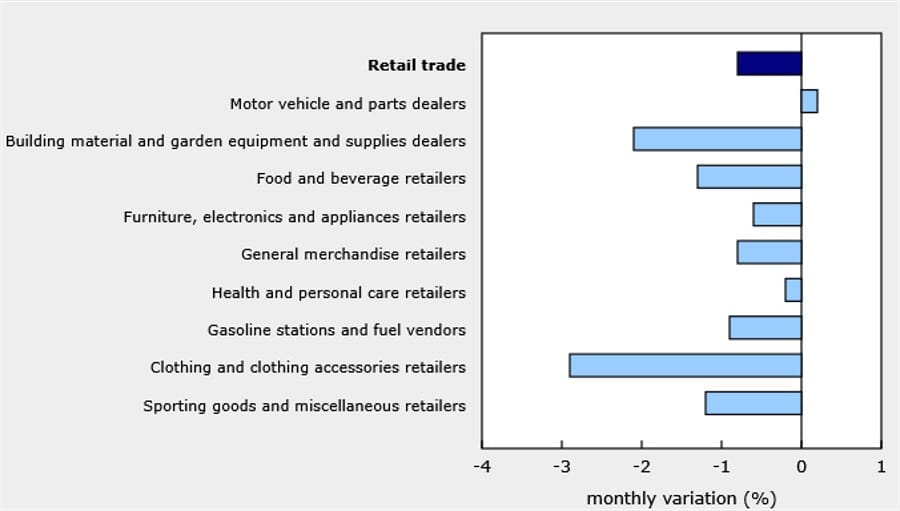

Canada Retail Sales Fall in July, Advance Data Signals August Rebound

Statistics Canada reported that July retail sales fell 0.8% m/m, well below expectations for a 1.5% gain. June’s advance report had pointed to a +0.7% increase, while the final figure was +1.5%.

Excluding autos, sales dropped 1.2% versus forecasts of -0.7%, after a 1.9% increase in June.

Eight out of nine subsectors saw declines, including a 1.3% fall in food and beverage retailers, with supermarkets down 2.5%. Clothing sales were off 3.2%. The lone positive came from motor vehicle and parts dealers, which rose 0.2%.

Advance estimates for August suggest a rebound, with sales expected to rise 1.0%. RBC’s credit card data earlier this week also showed mixed signals, with headline spending down 2.2% but core categories up 0.4%. Some retailers have reported that Canadian consumers are holding up better than their U.S. counterparts.

Canada and Mexico Launch New Security Dialogue

Canada’s Prime Minister Carney announced a new bilateral security dialogue with Mexico, aimed at boosting cooperation on cross-border threats, law enforcement, and regional stability. The initiative will complement existing frameworks with Washington and strengthen trilateral ties across North America.

Mexico’s President Sheinbaum said both countries also agreed to work on strengthening the USMCA trade agreement. Carney noted that adjustments can be found to improve competitiveness within the region.

Commodities News

Gold Pulls Back From Highs as Market Refocuses on Data

Gold prices gave up pre-FOMC gains after the Federal Reserve’s latest decision failed to meet the market’s dovish expectations. Traders are now refocusing on incoming U.S. economic data, with stronger releases likely to prompt a hawkish repricing in rate expectations.

Fundamental backdrop:

Gold had touched new record highs before the Fed’s announcement but retraced after the central bank projected only two more rate cuts in 2025, with some officials expecting just one or none. For 2026, the Fed penciled in a single cut, far below the three moves markets had priced in.

Fed Chair Jerome Powell described the September cut as a “risk management” step amid soft labor market data, but his tone was broadly neutral. The focus now shifts to whether upcoming data strengthens or weakens the case for further easing.

Bigger picture:

Gold remains in an uptrend as real yields continue to decline, but in the short term, stronger U.S. data could fuel corrections.

Technical levels:

1-hour chart: The key swing level at 3,672 remains pivotal. A break above could open the path to new highs, while rejection could see a retest of 3,615.

Daily chart: Gold’s push to new highs before FOMC was fully reversed. Buyers may find better entries near the main trendline, while sellers could target a drop toward 3,120 if strong U.S. data emerges.

4-hour chart: An upward trendline and minor support around 3,615 are in play. Buyers may defend these levels for another attempt higher, while sellers will watch for a breakdown to extend losses.

Baker Hughes Rig Count Rises in US and Canada

The US rig count rose by 3 to 542 this week, Baker Hughes reported. Oil rigs increased by 2 to 418, gas rigs were flat at 118, and miscellaneous rigs rose by 1 to 6.

Year-on-year, US rigs are down 46, with oil rigs 70 lower, partially offset by 22 more gas rigs. Offshore rigs held steady at 13, down 7 from last year.

Canada’s rig count also rose by 3 to 189, with oil rigs up 2 and gas rigs up 1. Compared to last year, Canada’s total is down 22.

Ivanhoe Cuts Kamoa-Kakula Outlook After Flooding – ING

Ivanhoe Mines has reduced its medium-term production target for the Kamoa-Kakula copper mine to 550 kt, down from more than 600 kt previously, ING analysts Ewa Manthey and Warren Patterson wrote.

The revision follows May’s flooding caused by seismic activity, which forced the company to reassess its long-term development plan. Ivanhoe plans to issue fresh output guidance for 2026 and 2027 once recovery efforts progress.

As one of the world’s largest copper mines, Kamoa-Kakula’s lower output adds pressure to global supply, with other major projects already struggling to maintain volumes.

Gold Pulls Back After Fed Decision – Commerzbank

Gold briefly hit a fresh record above $3,700/oz following the Fed’s latest meeting but then slid around $70, Commerzbank’s Carsten Fritsch reported.

The move mirrored the US dollar, which weakened immediately after the rate cut but strengthened sharply afterward. The Fed reduced its key rate by 25 bps, with Governor Stephen Miran alone pushing for a 50 bps cut.

The Fed’s dot plot signaled two more cuts this year, though the committee is split. For 2026, most officials see higher rates than markets currently price.

Fritsch noted Miran’s vote for aggressive easing offers a preview of policy risks after Powell’s term ends in May 2026, when a Trump-appointed successor could favor faster cuts despite inflation risks — a scenario that could propel gold even higher.

Russian Oil Production Faces Risk of Cuts – Commerzbank

Russia’s pipeline operator has warned that drone attacks from Ukraine may force a reduction in crude output, according to industry sources cited by Commerzbank analyst Carsten Fritsch.

Bloomberg data showed Russian seaborne exports rose to 4.1 mb/d in the week ending September 7, the highest since April 2023. But the following week saw exports drop by nearly 1 mb/d, mainly due to reduced shipments from Baltic ports after an attack on Primorsk.

Reuters sources indicated Russia plans to reroute flows through Ust-Luga and Novorossiysk to offset losses. Still, exports to China and India have declined for two consecutive weeks, reflecting the impact of new or threatened sanctions. Fritsch warned that if demand from Asia falters further, Moscow may be forced to cut production.

US Gas Storage Build Tops Forecasts, EU Prices Hold Firm – ING

Oil prices slipped for a third day after President Trump renewed calls for lower crude prices to pressure Moscow, ING analysts Ewa Manthey and Warren Patterson said. Upside risks remain from recent Ukrainian strikes on Russian energy assets.

ARA refined product stocks fell 239 kt last week to 5.92 mt, led by declines in naphtha (-120 kt) and fuel oil (-52 kt). Gasoline and gasoil stocks also eased modestly.

In the US, gas storage rose by 90 bcf, above forecasts for 80 bcf and the five-year average of 74 bcf, bringing inventories to 3.43 tcf, 6.3% above average. Henry Hub traded around $2.90/MMBtu.

In Europe, TTF futures gained 1.7% to just under €33/MWh, extending a three-day rally. Prices remain supported by concerns that the EU may accelerate its plan to phase out Russian LNG imports. EU storage is 81% full, down from 93.4% last year and below the five-year norm of 87.6%. Cooler weather could slow injections as the heating season approaches.

Swiss Gold Exports to US Collapse in August – Commerzbank

Swiss customs data show almost no gold shipments to the US in August, Commerzbank analyst Carsten Fritsch said.

Exports to China jumped to 35 tons, the highest in 15 months, while sales to India rose to 15 tons, the strongest this year. Fritsch noted this reflects renewed demand in Asia, where buyers have adjusted to higher price levels.

Deliveries to the US, however, fell to nearly zero, likely tied to tariff uncertainty. Although President Trump later confirmed gold would remain exempt, Fritsch said the initial confusion was enough to halt exports.

US Crude Stocks Post Sharp Draw – Commerzbank

US crude inventories fell by 9.3 million barrels last week, far more than expected, according to EIA data highlighted by Commerzbank’s Carsten Fritsch.

The draw, nearly triple the decline reported by API, contrasted with Bloomberg survey forecasts for a small build. It was driven by a steep fall in net imports to just 415,000 b/d, the lowest since records began, as exports surged.

Gasoline stocks dropped 2.35 million barrels, while distillates rose by 4 million barrels. Distillate inventories have now climbed more than 20 million barrels since July, narrowing their deficit to the five-year average to 7% from over 20%. Fritsch said this marks a clear easing in middle distillate market tightness.

Europe News

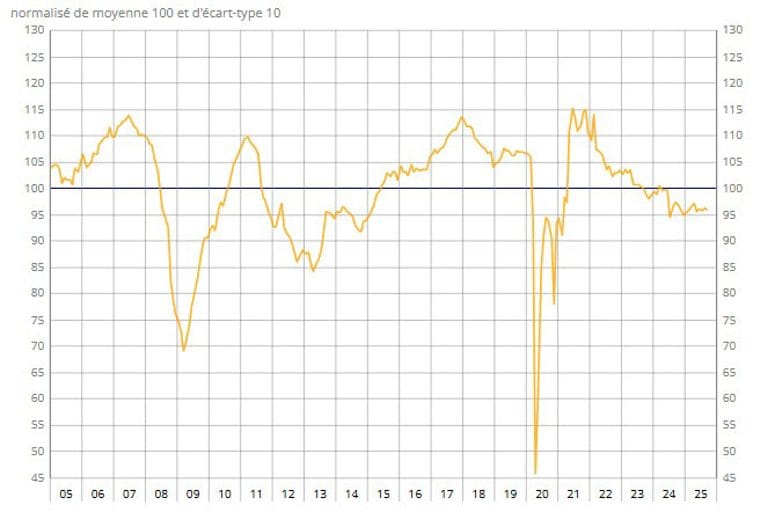

France September Business Confidence Holds Steady

INSEE reported that French business confidence held unchanged in September at 96, the same as in August.

Breaking down the details:

- Services confidence: Rose to 98 from 96 prior.

- Industrial confidence: Dipped slightly to 96 from 97.

Spain Revises 2024 GDP Growth Upward, Confirms Resilience

Spain’s national statistics agency (INE) revised the country’s 2024 GDP growth rate to 3.5%, up from its earlier estimate of 3.2%.

At the same time, the 2023 growth figure was adjusted lower to 2.5% from 2.7%, while the 2022 rate was nudged up to 6.4% from 6.2%.

The revisions underscore Spain’s relative strength in the euro area last year, in contrast to Germany and France. Germany struggled with a prolonged industrial slump, while France’s economy relied heavily on temporary boosts from the Olympic Games as domestic demand faltered.

UK Retail Sales Edge Higher in August, but Consumer Struggles Remain

The Office for National Statistics reported that UK retail sales rose 0.5% month-on-month in August, a touch stronger than the 0.3% expected. July’s figure was revised down from +0.6% to +0.5%.

On an annual basis, sales were up 0.7%, slightly above forecasts of 0.6%. The prior figure was revised down to +0.8% from +1.1%.

Excluding autos and fuel, sales gained 0.8% m/m (vs 0.7% expected), after a downwardly revised +0.4% in July. Year-on-year, the same measure rose 1.2% against a 1.0% estimate, though still weaker than July’s +1.3% (revised to +1.0%).

While the August numbers came in above expectations, the upward surprise was tempered by July’s negative revisions. Over the three months to August, sales volumes were down 0.1%, an improvement from the 0.6% drop recorded in the prior three months. Compared with pre-pandemic February 2020 levels, however, retail sales remain 2.1% lower.

Across categories, modest gains were recorded in food stores, department stores, non-food shops, and clothing retailers, offset by weaker sales of automotive fuel.

Overall, the data show a modest monthly lift but underscore the persistent challenges facing UK households, with high prices continuing to squeeze consumer spending power.

UK Consumer Confidence Falls on Tax Concerns

UK consumer sentiment weakened in September, with GfK’s confidence index dropping to -19 from -17 in August, missing expectations of -18. All five components of the index fell, and a separate gauge of savings intentions dropped sharply.

Economic outlook sentiment remained deeply negative at -32. GfK warned that expectations of higher taxes in Finance Minister Rachel Reeves’ November budget could drag confidence even lower. Reeves is due to unveil her fiscal plan on November 26, which will include tax hikes to meet budget goals after last year’s rise in employer social security contributions.

Market takeaways:

- Currency: Weak sentiment adds downside pressure to GBP.

- Bonds: Softer outlook supports gilts modestly.

- Equities: Consumer-facing industries may face pressure if tax hikes reduce household spending.

Morgan Stanley Scraps 2025 BoE Cut Forecasts

Morgan Stanley no longer expects the Bank of England to cut rates this year, following the central bank’s latest policy decision.

Previously, the bank’s base case had assumed sequential cuts starting in November and running through December, with a terminal rate of 2.75%. The shift marks a notable departure from that view.

Other institutions have made similar adjustments: UBS Global Wealth Management and Peel Hunt now also expect no further cuts in 2025. BNP Paribas has delayed its expected November cut to December.

Bank of America Joins Shift: No BoE Cuts Until 2026

Bank of America has revised its outlook on UK monetary policy, now seeing no rate cuts from the Bank of England in 2025. The bank expects the first reductions to come in February and April 2026.

The move aligns BofA with other banks that have pushed back expectations following the BoE’s latest decision.

Analysts at the bank stressed that inflation expectations remain stubbornly elevated, with wage growth still running hot. They argued that the BoE should focus less on rate cuts and more on guiding expectations lower—even by signaling that rate hikes are possible if necessary.

The note warned that while such a stance could risk slowing the economy or even triggering a recession, the central bank has few alternatives after mismanaging inflation earlier in the cycle.

ECB’s Muller: No need for further rate cuts

- Comments from the ECB policymaker to Bloomberg

- The ECB is running a slightly accomodative policy

- The economy is set to benefit from a pickup in domestic demand

ECB’s Centeno: Can’t tolerate inflation below 2% for too long

- Comments from the ECB policymaker, Mario Centeno

- 2028 inflation forecast likely to be below 2%

- Still see inflation risks to downside

- Next move is still likely to be a cut

Goldman Sachs Delays BoE Rate Cut Forecast to 2026

Goldman Sachs no longer expects the Bank of England to cut rates in 2025, revising its previous projection of a November move. The bank now sees the next cut coming in February 2026, with subsequent quarterly reductions bringing the terminal rate to 3% by the end of that year.

Hunt Warns Reeves Faces £50bn Budget Gap

Former UK Chancellor Jeremy Hunt warned that Chancellor Rachel Reeves faces a fiscal shortfall of up to £50 billion ahead of the Autumn Budget due November 26.

Speaking at the Guinness Global Investors Conference in London, Hunt said the government must prevent Britain from sliding into an unsustainable debt trajectory. “To spend more, taxes must rise; to cut spending, taxes can fall,” he said, stressing that Reeves faces an especially tough challenge given the high level of debt.

He compared the UK’s position with France, which he said was in a “catastrophic” debt situation, and Germany, which can afford more borrowing. The U.S., he added, also carries high debt burdens.

Market outlook:

- Gilts: Fiscal tightening could weigh on demand if growth slows.

- GBP: Higher taxes may cap sterling’s gains but credibility on debt supports stability.

- Equities: Consumer-facing firms vulnerable if household spending shrinks.

Asia-Pacific & World News

Xi Describes Talks With Trump as “Constructive”

President Xi Jinping said his talks with President Trump were “positive and constructive,” stressing that China-US ties remain critical.

Xi urged Washington to avoid unilateral trade restrictions and called for a fair, open environment for Chinese firms. He added that China will not forget US support during World War II.

China Sets 2030 Goal: 10,000 Convenience Hubs in 100 Cities

China’s Ministry of Commerce, together with eight other agencies, announced a plan to expand “15-minute living circles,” local hubs offering essential services within walking distance.

By 2030, Beijing aims to establish 10,000 of these centers across 100 pilot cities, covering all prefecture-level cities and qualifying county-level communities. Plans also include creating 500 “Silver Hair Golden Streets” for seniors and 500 “Children’s Fun Parks.”

Targets include raising resident satisfaction above 90% and boosting the share of chain stores to 30%, while improving digital integration and service quality.

China State Media Says Fed Cuts Open Space for PBoC

Shanghai Securities News reported that the Federal Reserve’s recent rate cut eases pressure on China and gives the People’s Bank of China more room to maneuver. Analysts say the PBoC could adjust interest rates or reserve requirements, though timing will remain deliberate.

China Cuts U.S. Treasury Holdings to Lowest Since 2008

Foreign ownership of U.S. Treasuries rose to a record $9.16 trillion in July, with strong buying from Japan and the United Kingdom. Japan increased its holdings to $1.15 trillion, while the UK’s position approached $900 billion.

China, however, reduced its holdings to $731 billion, the lowest level since 2008. The move reflects Beijing’s effort to diversify away from the dollar while supporting the yuan.

Trump and Xi Set for First Call Since June, Will Discuss Trade and Tech

U.S. President Donald Trump and Chinese President Xi Jinping are scheduled to speak by phone on Friday at 9 a.m. Washington time (9 p.m. Beijing), marking their first direct conversation since June.

The call is expected to cover trade tensions, TikTok’s U.S. operations, and wider technology issues. TikTok’s American unit is currently in negotiations with a consortium including Oracle, Andreessen Horowitz, and Silver Lake, with valuations running into the tens of billions of dollars.

The call comes during a temporary 90-day truce on trade, though disputes over high-tech exports and rare-earth supply chains remain unresolved. China continues to invest heavily in AI and semiconductor development to reduce reliance on U.S. technology.

Analysts expect limited progress from the discussion, likely confined to tariffs, tech access, and TikTok’s ownership structure. Broader disputes tied to industrial policy and national security are not expected to see resolution.

Tensions surrounding rare-earth supply chains are likely to persist, posing longer-term risks to global markets.

PBOC sets USD/ CNY reference rate for today at 7.1128 (vs. estimate at 7.1174)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 354bn yuan via 7-day reverse repos at 1.40%

- net 124.3bn yuan injection

NAB Forecasts RBA Rate Cuts in November and February

National Australia Bank expects the Reserve Bank of Australia will cut its cash rate in November and again in February, bringing it down to 3.1% by early 2026.

NAB anticipates the easing will be gradual rather than aggressive, as policymakers balance inflation control with economic growth. The bank cites moderating inflation, a softening labor market, and sluggish growth as drivers of policy adjustment.

Risks remain on both sides. Stronger wage growth or sticky services inflation could slow the RBA’s pace of cuts, while weaker global demand or trade disruptions could accelerate the easing cycle.

New Zealand Credit Card Spending Rises in August

The Reserve Bank of New Zealand reported that credit card spending in August totaled NZ$4.5 billion. Annual growth accelerated to 3.5%, up from 1.4% in August 2024.

New Zealand Trade Deficit Widens in August

New Zealand reported a wider trade deficit in August, with the monthly shortfall reaching NZ$1.19 billion, compared to NZ$578 million in July.

Exports fell to NZ$5.94 billion from NZ$6.71 billion in the prior month, while imports eased slightly to NZ$7.12 billion from NZ$7.28 billion.

The 12-month rolling deficit improved, narrowing to NZ$2.99 billion from NZ$3.94 billion previously.

BOJ Governor Ueda Signals Further Rate Hikes Possible if Outlook Holds

Speaking at a press conference, Bank of Japan Governor Kazuo Ueda said the central bank would continue raising interest rates if the economy and inflation evolve broadly in line with forecasts.

Ueda described Japan’s economy as “recovering moderately,” although some areas remain weak. He noted that growth may slow due to trade policy impacts on overseas economies but should rebound once external demand stabilizes. He added that the impact of rising food prices is likely to fade over time.

On inflation, Ueda said underlying price growth is still below the 2% target but moving closer. He emphasized the need to carefully monitor risks from U.S. tariffs, which could pressure exports, while highlighting that food price increases are unlikely to have a lasting effect on core inflation.

He dismissed the idea of revising the July outlook, saying there has been no material impact yet on capital investment, wages, or jobs. Uncertainty remains, however, over how tariffs will affect the yen and trade flows.

On asset disposals, Ueda reaffirmed that the BoJ will proceed with ETF and J-REIT sales until completed, stressing that the pace of disposals is not being used to adjust monetary policy.

Asked about whether the bank is “behind the curve,” Ueda declined to comment directly, stressing instead the importance of responding to actual data.

Bank of Japan Holds Main Policy Rate at 0.5%, Dissenters Push for Hike

The Bank of Japan left its benchmark policy rate steady at 0.5%, a move widely anticipated by markets. The decision came by a 7–2 majority, with two board members calling for an increase instead.

Board members Naoki Tamura and Hajime Takata opposed the decision. Takata said Japan had moved beyond its long-standing deflationary environment and argued that the 2% price stability goal was essentially “achieved.” Tamura stressed that with risks tilted toward stronger inflation, interest rates should be raised toward a neutral setting.

The BoJ described the economy as recovering moderately, though weakness remains in some areas. Exports and production have been mostly flat, while business investment is trending higher. Private consumption has shown resilience, and inflation expectations have risen somewhat. Growth may slow on the back of global trade frictions before re-accelerating later. Core inflation is projected to stagnate with weaker growth but should pick up again over time.

Separately, the central bank confirmed it will begin reducing its holdings of exchange-traded funds (ETFs) and real estate investment trusts (J-REITs). The decision to start selling these assets was unanimous, with the BoJ saying sales will proceed under its established disposal principles.

Japan Inflation Slows in August

Japan’s August consumer price index showed headline inflation at 2.7% year-on-year, slightly below the expected 2.8% and down from July’s 3.1%.

Core CPI, which excludes fresh food, rose 2.7% y/y, in line with forecasts but slower than the prior 3.1%, marking the weakest pace in nine months.

Core-core CPI, which strips out both fresh food and energy, came in at 3.3% y/y, matching expectations but a touch lower than July’s 3.4%.

Takaichi Pledges Tax Cuts, Cash Handouts in LDP Leadership Bid

Sanae Takaichi, a senior lawmaker competing for the Liberal Democratic Party leadership, will propose both income tax cuts and direct cash handouts to households as part of her campaign platform, according to the Nikkei.

The proposals target relief for households squeezed by persistent inflation and are designed to strengthen voter support ahead of the October 4 leadership election to replace outgoing Prime Minister Shigeru Ishiba. The combination of tax relief and household transfers represents one of the boldest fiscal stimulus pledges so far in the contest.

Her campaign underscores how cost-of-living issues and economic policy have become central to the leadership race, which will decide the next LDP president and the next prime minister.

Market implications:

- Equities: Consumer-oriented sectors could benefit from stronger domestic demand.

- Bonds: Questions about fiscal discipline may weigh on Japanese Government Bonds.

- Politics: The winner of the LDP race will shape Japan’s fiscal direction in the coming years.

Crypto Market Pulse

Crypto Today: Bitcoin, Ethereum, XRP Slip as Coinbase Reserves Hit $112B

Bitcoin, Ethereum, and XRP eased Friday, consolidating recent Fed-driven gains.

- Bitcoin (BTC): fell below $117,000 but held firm near support. A break above $120,000 could target August’s $124,474 peak.

- Ethereum (ETH): down more than 1%, testing $4,500 as support. US spot ETFs recorded $163M inflows Thursday, reversing Wednesday’s $57M outflow.

- XRP (XRP): slipped back to $3.00, reflecting softer retail demand but steady derivatives positioning.

Coinbase reserves at cycle high:

Exchange reserves across BTC, ETH, and stablecoins climbed to $112B, the highest since November 2021. Analysts see the buildup as a bullish signal of accumulation and potential liquidity expansion.

CryptoOnchain noted: “In past cycles, rising reserves on major exchanges like Coinbase have often coincided with higher market liquidity and bullish price momentum.”

Kraken, Trust Wallet Team Up to Expand xStocks Adoption

Kraken has partnered with Trust Wallet to broaden access to tokenized equities, or xStocks, developed in collaboration with Backed.

Key points:

- Trust Wallet’s 200M+ users can now buy, withdraw, and hold xStocks directly in-app.

- The product offers 60 tokenized equities, including Tesla (TSLAx), Apple (AAPLx), and GameStop (GMEx).

- Trading is supported across Ethereum, Solana, BNB Chain, and TRON.

Kraken launched xStocks in June, with combined CEX and DEX trading volumes exceeding $4B since launch.

Kraken co-CEO Arjun Sethi said the goal is to “accelerate the move to a future where global markets operate without borders, without barriers, and with the same openness and accessibility as the internet itself.”

The partnership underscores growing institutional and retail appetite for real-world asset (RWA) tokenization, with Nasdaq and Coinbase also pursuing SEC approval for tokenized securities trading.

NEAR Extends Rally as AI Integration Gains Traction

NEAR Protocol pushed above $3.00, extending its rebound with bulls eyeing resistance near $3.80.

The project has positioned itself as a blockchain for AI, building tools such as Shade Agents to enable autonomous AI bots to interact with blockchains securely.

Alex Shevchenko of Aurora Labs said traditional finance is ill-suited for AI agents, making crypto a natural enabler of the AI economy.

Ethereum has also stepped up efforts, with a new foundation team working on decentralized AI stacks. “Ethereum makes AI more trustworthy, and AI makes Ethereum more useful,” said Ethereum Foundation’s Davide Crapis.

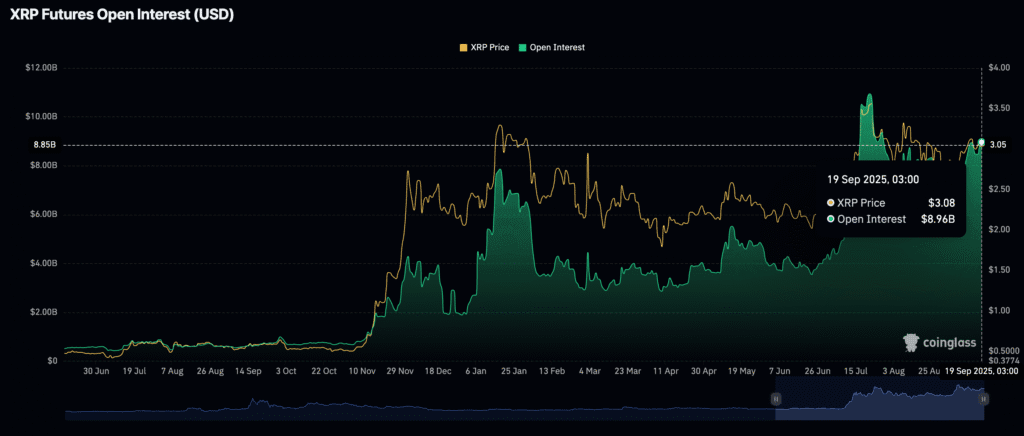

XRP Slips as Futures Open Interest Climbs

XRP fell to $3.00 Friday, retreating from a midweek high of $3.14, as crypto markets gave back gains sparked by the Fed’s dovish signals.

The Fed cut rates by 25 bps and projected two more moves this year, temporarily reviving risk appetite. But rising volatility weighed on crypto prices heading into the weekend.

CoinGlass data show XRP futures open interest climbed to $8.96b on Friday from $7.37b earlier this month. Analysts said the buildup points to fresh short positioning, amplifying downside risks despite bullish signals from MACD and Ichimoku indicators.

Ethena Weakens Despite Binance’s YZi Labs Boost

Ethena (ENA) slid 24% from its recent high, testing the 50-day EMA, even as Binance’s YZi Labs increased its stake in the project.

YZi Labs, formerly Binance Labs, said the move reflects its mission to back scalable digital dollar infrastructure. It pledged to help drive adoption of Ethena’s USDe stablecoin across CEXs and DeFi platforms while expanding stablecoin utilities.

USDe is currently the third-largest USD stablecoin, with a market cap of $14b. ENA ranks as the 42nd largest cryptocurrency at $4.6b.

What It Would Take for Bitcoin to Hit $1 Million

Bitcoin has surged to record highs in 2025, sparking renewed predictions it could eventually reach $1 million per coin. The launch of spot ETFs in 2024, including BlackRock’s iShares Bitcoin Trust—which drew $1.3 billion in its first two days—and the creation of a 200,000-BTC U.S. Strategic Reserve under President Trump in March 2025, have fueled optimism. Bitcoin touched $123,166 during “Crypto Week” in July.

Bulls like Cathie Wood, Michael Saylor, and Robert Kiyosaki have projected $1 million Bitcoin by 2030, citing scarcity, adoption, and institutional inflows. Analysts point to several conditions needed for such a rally:

- Institutional investment: Market cap must exceed $21 trillion, surpassing gold.

- Global adoption: At least 20–40% of the world’s population would need to use Bitcoin.

- Regulatory clarity: 2025 laws like the GENIUS and Clarity Acts help reduce uncertainty.

- Technology: Scaling solutions such as the Lightning Network are crucial.

The Day’s Takeaway

North America

- Equities: Major indices set fresh records Friday — Dow +0.4%, S&P 500 +0.5%, Nasdaq +0.7% — though breadth was weak, with small- and mid-caps down ~0.8%. Apple (+3.2%), Oracle (+4.1%), Tesla (+2.2%) and Alphabet (+1.2%) led gains; energy was the main drag (-1.3%).

- Policy & Fed: Fed Governor Miran urged five cuts this year, citing disinflation from falling housing costs, while Kashkari supported two. UBS forecast 75 bps of further easing through Q1 2026. The NY Fed GDP Nowcast ticked up to 2.1% for Q3.

- Politics & Trade: Trump and Xi held their first call since June, describing it as “productive” and “constructive,” covering trade, TikTok, and fentanyl. Trump flagged a possible $550B US industrial investment plan targeting chips, energy, and quantum.

- Treasuries: China cut holdings to $731B (lowest since 2008), while Japan and the UK added.

- Energy: US crude inventories plunged 9.3 mb, gasoline stocks fell, while distillates built sharply. Baker Hughes rig counts rose by 3 in both the US and Canada.

- Canada/Mexico: Canada retail sales fell 0.8% in July but August advance data point to a rebound. Canada and Mexico launched a new bilateral security dialogue with a pledge to reinforce USMCA.

Europe

- Monetary Policy: Goldman Sachs, Morgan Stanley, and Bank of America all delayed BoE cuts to 2026, citing sticky inflation.

- UK Economy: Consumer confidence dropped to -19, pressured by looming tax hikes; retail sales rose 0.5% in August, but revisions trimmed prior gains. Ex-Chancellor Hunt warned Reeves faces a £50B budget gap.

- France & Spain: French business confidence held at 96 in September; Spain revised 2024 GDP growth up to 3.5%, confirming resilience relative to peers.

Asia

- Japan: BoJ held rates at 0.5% (7–2 vote), with dissenters pushing for hikes. Gov. Ueda signaled hikes remain possible if conditions hold. CPI slowed in August to 2.7% y/y, its weakest in nine months. BoJ also confirmed ETF and J-REIT disposals.

- China: Xi called the Trump talks “constructive,” urged fewer restrictions, and set a 2030 goal for 10,000 “convenience hubs” across 100 cities. State media said Fed cuts give the PBoC policy room.

- Australia / New Zealand: NAB forecast two RBA cuts (Nov, Feb) to 3.1% by early 2026. NZ posted a wider August trade deficit (NZ$1.19B) but improving 12-month balance; credit card spending rose 3.5% y/y.

- Geopolitics: New Zealand deficit widened; Canada-Mexico security pact launched.

Commodities

- Gold: Prices spiked above $3,700/oz post-Fed before sliding $70. Commerzbank noted US imports from Switzerland collapsed in August, while exports to China (35t) and India (15t) surged.

- Oil & Gas: US crude drawdown of 9.3 mb underscored tightness, though distillates eased. Trump renewed pressure for lower prices. EU gas (TTF) rose 1.7% to ~€33/MWh on LNG phase-out risks; US storage rose 90 bcf (above forecast).

- Metals: Copper outlook darkened with Ivanhoe’s Kamoa-Kakula downgrade.

- Commodities Supply: Ivanhoe cut Kamoa-Kakula copper mine outlook due to flooding, lowering targets to 550 kt. Russia warned drone attacks may force oil output cuts after export disruptions.

Crypto

- Bitcoin & Ethereum: BTC slipped below $117K, ETH tested $4,500, consolidating after Fed cuts. Spot ETH ETFs drew $163M inflows. Coinbase reserves hit $112B, the highest since 2021.

- XRP: Fell back to $3.00, with futures open interest climbing to $8.96B, suggesting short build-up.

- Altcoins: ENA dropped 24% despite Binance’s YZi Labs support; NEAR extended gains above $3.00 on AI integration narratives.

- Tokenization: Kraken partnered with Trust Wallet to expand xStocks, offering 60 tokenized equities across Ethereum, Solana, BNB Chain, and TRON; trading volumes have topped $4B since June.