North America News

Tech Rout Drags NASDAQ Down Nearly 1.5% as Intel Defies the Trend

U.S. equities ended mixed Tuesday, with tech weakness pulling the NASDAQ lower while defensive sectors propped up the broader market. The Dow Jones Industrial Average eked out a gain, but the NASDAQ and S&P 500 both slipped as chipmakers bore the brunt of selling pressure.

Closing snapshot:

- Dow Jones Industrial Average: +10.57 points (+0.02%) at 44,922.39

- S&P 500: -37.70 points (-0.58%) at 6,411.45

- NASDAQ Composite: -314 points (-1.46%) at 21,314.95

The NASDAQ closed just under its 100-hour moving average at 21,333.30, a short-term bearish signal. Traders are eyeing the 200-hour moving average at 21,123.54 as the next key support.

Chips under fire, except Intel

Semiconductors were the epicenter of the selloff. Nvidia (-3.55%), AMD (-5.44%), and Broadcom (-3.55%) all slumped, alongside Taiwan Semiconductor (-3.16%) and Micron (-1.51%). ASML was more resilient, easing just 0.53%.

The lone standout was Intel, which surged 6.97% after news it sold $2 billion in stock to SoftBank and advanced a deal with Washington that would allow swapping Chips Act funds for equity. Despite the dilution, investors cheered the show of confidence in Intel’s prospects.

Sectors split as defensives shine

Seven of the S&P’s eleven sectors advanced, led by Real Estate (+1.80%), Consumer Staples (+1.00%), Utilities (+0.83%), and Health Care (+0.62%). Cyclicals lagged, with Information Technology (-1.88%) and Communication Services (-1.16%) weighing most heavily.

S&P sector performance:

- Information Technology: -1.88%

- Communication Services: -1.16%

- Consumer Discretionary: -0.38%

- Energy: -0.19%

- Industrials: +0.19%

- Financials: +0.17%

- Materials: +0.53%

- Health Care: +0.62%

- Utilities: +0.83%

- Consumer Staples: +1.00%

- Real Estate: +1.80%

With growth sectors losing steam and defensives finding buyers, markets are tilting into a more cautious stance as investors assess the outlook for rates, tech demand, and government intervention in the semiconductor space.

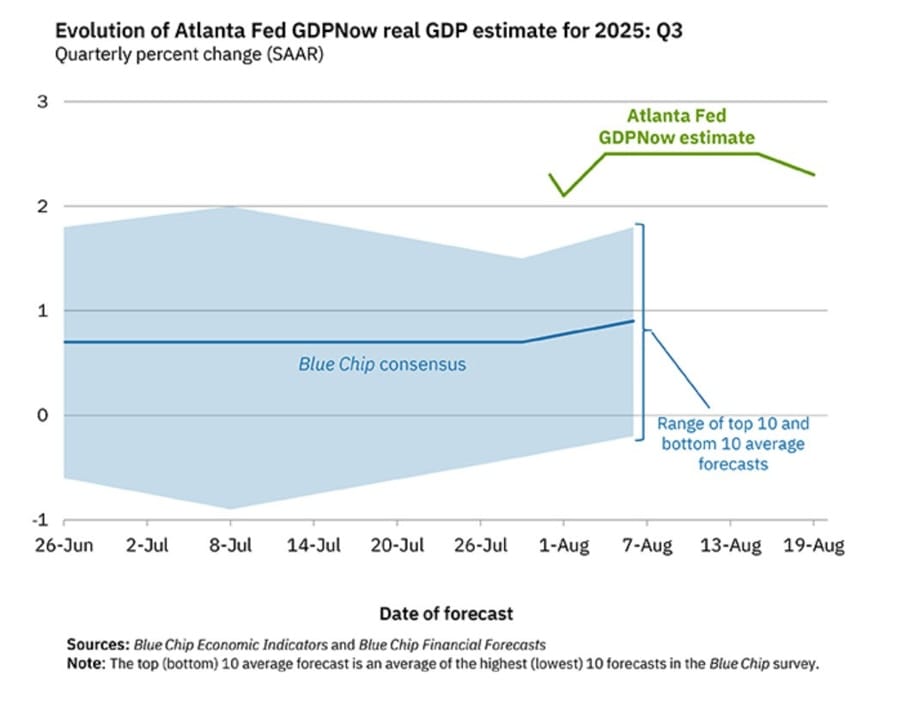

Atlanta Fed GDPNow Estimate Eases to 2.3% for Q3

The Atlanta Fed’s GDPNow model trimmed its projection for third-quarter US growth to 2.3%, down from the 2.5% forecast issued previously.

The revision reflects softer data momentum as the economy transitions into the second half of the year. Markets remain attentive to whether the downgrade signals early cracks in domestic demand, especially ahead of next week’s Fed symposium.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 2.3 percent on August 19, down from 2.5 percent on August 15. After this morning’s housing starts release from the US Census Bureau, the nowcast of third-quarter real residential investment growth decreased from 1.1 percent to -5.9 percent.

US Housing Starts Exceed Expectations in July

US housing starts rose to 1.428 million in July, comfortably above the 1.290 million forecast. June’s figure was revised up from 1.321 million to 1.358 million.

Building permits slipped slightly to 1.354 million, below the 1.386 million expected and down from June’s 1.393 million.

While the release won’t outweigh market focus on NFP and CPI, the stronger-than-expected starts show that a Fed rate cut could risk overstimulating the economy and reinforcing inflationary pressures.

White House: Putin Agrees to Next Step in Peace Process

The White House confirmed that Vladimir Putin has agreed to the next step in a peace initiative involving Ukraine, following earlier reports of bilateral talks with President Volodymyr Zelenskyy.

According to the administration:

- The process envisions a Putin-Zelenskyy meeting, followed by a trilateral session with the US.

- Secretary of State Rubio, Vice President Vance, and US envoy Witkoff would coordinate directly with Ukraine.

- President Trump has instructed the national security team to work with Europe on security guarantees.

- The US reiterated that no American troops will be deployed in Ukraine.

Putin suggested Moscow as a venue, but the White House is reportedly favoring Budapest, Hungary for the talks.

MUFG: Powell to Play It Safe at Jackson Hole

MUFG expects Fed Chair Powell to strike a cautious tone at Jackson Hole, avoiding explicit signals about a September move.

Key points:

- A repeat of last year’s dovish guidance is unlikely.

- Markets currently expect policy easing to resume, but Powell may buy time by not confirming timing.

- A cautious stance would limit downside pressure on the US dollar, forcing markets to reassess rate cut pricing.

Fed’s Bowman: Stance on Monetary Policy Unchanged

Federal Reserve Governor Michelle Bowman said Tuesday that her monetary policy outlook remains unchanged.

- Bowman, a Trump appointee, voted in favor of a rate cut at the July FOMC meeting.

- Speaking with Bloomberg, she reiterated her position but declined to offer new policy guidance.

- Most of her additional remarks focused on regulatory issues, not interest rates.

Her comments underscore the ongoing split within the Fed as markets weigh the timing and scale of future easing.

Trump: “Hope Putin Will Be Good, If Not, a Rough Situation”

In a Fox News interview, President Donald Trump offered blunt remarks on Ukraine and his relationship with Vladimir Putin:

- Said Europeans are pushing for an end to the war.

- Confirmed plans to arrange a Putin-Zelensky meeting but stressed “we’ll let them meet first.”

- Argued Zelensky must show flexibility, including on territorial concessions.

- Stated Ukraine should not have applied to NATO and reaffirmed that Ukraine will not become a NATO member.

- Claimed France, Germany, and the UK want boots on the ground in Ukraine, though ruled out US troop involvement.

- Suggested Ukraine “is going to lose a lot of land.”

- Described Russia as a powerful military nation.

- Emphasized that while Putin may not want a deal, “we’ll find out in the coming weeks.”

- Added that a warm relationship with Putin is a good thing, but only if it delivers results.

US and European Officials Draft Security Guarantees for Ukraine

According to Bloomberg, US and European officials are moving immediately to establish security guarantees for Ukraine aimed at strengthening Kyiv’s military.

The plan is designed to avoid restrictions that Russia might demand in future peace talks, such as limiting Ukraine’s armed forces.

The framework is expected to expand on the work of the European “coalition of the willing,” although the exact format and scope remain undecided.

US Bessent: I believe there will be meeting between Putin and Zelensky

- Comments from the US Treasury Secretary, Scott Bessent to CNBC

- I sense that both sides are ready for this conflict to end.

- Monday was optimistic, a great day.

- Plan to up tariffs on India over Russian oil buying.

- We’re pushing back on countries around the world on digital services taxes.

- Nvidia will require licence for any new China chip.

- We will be meeting with Fed candidates right before, right after Labor Day.

- Much of PPI inflation was investment services.

S&P Holds US Credit Rating at AA+ with Stable Outlook Despite Deficit Concerns

S&P Global Ratings has reaffirmed the US sovereign credit score at AA+/A-1+ with a stable outlook, citing rising debt and persistent deficits but ruling out prolonged deterioration in fiscal conditions.

The agency projects US net general government debt climbing to about 100% of GDP, driven by higher interest costs and aging-related expenditures. While fiscal deficits are unlikely to shrink materially, S&P does not foresee structural weakening in the near term.

Economic growth is forecast at around 2%, with slower expansion expected: 1.7% in 2025 and 1.6% in 2026.

Rubio Endorses Ukraine Security Guarantees, Confirms Trump Pressed Putin

Senator Marco Rubio said he is committed to working with European allies and other partners to build a framework of security guarantees for Ukraine.

In a Fox News interview, Rubio confirmed he was present when Donald Trump urged Vladimir Putin to meet with Volodymyr Zelenskiy. He said the discussion underscored the US push to involve multiple countries in bolstering Ukraine’s security.

Morgan Stanley Expects Powell to Lean Hawkish at Jackson Hole

Morgan Stanley believes Fed Chair Jerome Powell will strike a hawkish tone at this week’s Jackson Hole meeting, citing sticky inflation and the need for flexibility.

- Inflation: July CPI matched expectations, but core CPI climbed 3.1% y/y, driven by services. Goods inflation was muted, tariffs having a slower effect.

- Outlook: PCE inflation seen peaking around 4.5% annualized, with year-end projections of 3% headline and 3.2% core. Risks tilt toward inflation persisting above target into 2026.

- Fed vs. markets: Markets price a near-certain September rate cut (~93%). Some Fed officials remain concerned about inflation risks.

- Trade/tariffs: Effective tariff rate is 16%, with receipts rising but shipping volumes softening.

- Scenarios: Baseline (40%) is slow growth with ~1% GDP in 2025–26; mild recession also 40%; upside demand or supply shocks at 10% each.

The bank suggests Powell’s remarks will prioritize inflation risks over labor concerns.

NATO Chief Hails Breakthrough in Washington Talks on Ukraine

NATO Secretary General Mark Rutte said discussions in Washington marked a “breakthrough” for Ukraine’s security guarantees.

He confirmed that the US will play a role in shaping these commitments, though NATO membership remains off the table for now. Talks are exploring arrangements that mirror aspects of Article 5, but without troop deployments.

Details are expected to be fleshed out in the coming days.

Arm Recruits Amazon AI Chip Director to Lead New Effort

Arm has appointed Rami Sinno, former director of Amazon’s AI chip program, to spearhead its push into building in-house processors.

Sinno was instrumental in developing Amazon’s Tranium and Inferentia chips, designed for AI training and inference workloads.

The hire underscores Arm’s strategic shift from primarily licensing architectures to producing complete chip designs. Reuters had previously reported on this transition and Arm’s executive hiring drive earlier in the year.

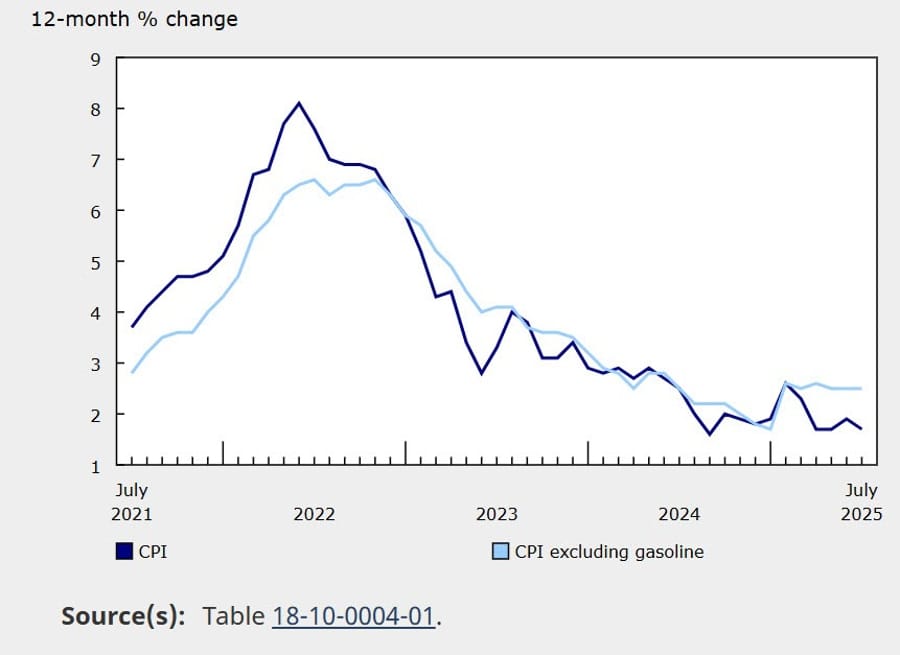

Canada July CPI: Inflation Holds in Line With Forecasts

Canada’s consumer prices rose 0.3% in July, exactly matching expectations, following a 0.1% increase in June. On a yearly basis, CPI was up 1.7%, just shy of the 1.8% forecast, compared with 1.9% in June.

The Bank of Canada’s core measures came in mixed:

- CPI Median: 3.1%, unchanged from estimates, but down sharply from June’s 13.1%.

- CPI Trim: 3.0% vs 3.1% forecast (prior 3.0%).

- CPI Common: steady at 2.6%.

- BoC core YoY: 2.6% vs 2.7% in June.

- BoC core MoM: 0.1%, unchanged from last month.

Breakdown:

- Gasoline prices fell 16.1% YoY due to the carbon levy removal; MoM down 0.7% on weaker crude and higher OPEC+ output.

- Shelter costs climbed 3.0% YoY, driven by rent (+5.1%) and natural gas (-7.3%, less negative). Mortgage interest growth slowed to +4.8%.

- Food inflation picked up: grocery prices up 3.4% YoY vs 2.8% in June. Coffee prices spiked 28.6%, confectionery +11.8%, and fruit led by grapes +29.7%.

- Regionally, Newfoundland & Labrador recorded the sharpest rise, led by electricity prices surging 13.9%.

Commodities News

Gold Analysis: Traders Await Powell and September NFP

Gold prices remain rangebound as markets await Fed Chair Powell’s Jackson Hole speech and the September NFP report.

Fundamentals:

- Gold has consolidated after mixed US data: CPI in line, but PPI beat expectations, jobless claims fell further, and UMich inflation expectations rose.

- Traders pared back Fed cut bets from 64 bps after CPI to 53 bps following the stronger data.

- Powell is expected to avoid commitments and keep policy data-dependent.

Technical Levels:

- Daily chart: Trading between 3,245 support and 3,438 resistance.

- 4H chart: Support near 3,330; buyers defending this level to target 3,438, while sellers eye a break lower toward 3,245.

- 1H chart: Range play continues, with buyers leaning on support and sellers waiting for breakdown signals.

Big picture: Gold’s long-term bias stays bullish given expected Fed easing, but short-term corrections are likely if markets reprice hawkishly.

China Copper Output Hits Near-Record Levels

China’s refined copper production continued to surge in July, producing 1.27 million tons, the second-highest ever monthly figure.

From August 2024 to July 2025, output totaled 14.38 million tons, the highest 12-month figure on record.

Imports have also risen sharply, with copper ore imports up 18% year-on-year in July. Chile’s copper exports to China rose by the same percentage.

China now accounts for over 50% of global refined copper output—a share that has likely increased further with record production in recent months.

Gold Market Balances Ukraine Developments and Jackson Hole Expectations

Gold prices reacted cautiously to last week’s Trump-Putin summit in Alaska, as the vague outcomes left markets uncertain.

While the lack of escalation helped reduce geopolitical risk, hopes for a Zelenskiy-Putin meeting tempered safe-haven demand.

Attention now shifts to Jackson Hole, where Powell’s tone could determine gold’s next move. With markets already pricing two 25bps cuts this year and three in 2026, Powell would need to sound distinctly dovish for gold to benefit further.

China’s Oil Product Exports Surge in July

China’s customs data showed significant increases in diesel, gasoline, and jet fuel exports last month.

- Diesel exports: 820,000 tons, the largest in 11 months.

- Gasoline exports: 930,000 tons, the biggest this year alongside March.

- Jet fuel exports: nearly 2 million tons, the highest since March 2024.

The jump in jet fuel points to rising international travel. However, higher exports pulled implied domestic oil demand back under 14 million bpd. Still, demand remained 6% higher year-on-year.

US Criticizes India Over Russian Oil Imports, Tariffs Incoming

The White House’s trade adviser, Navarro, sharply criticized India’s role in channeling Russian oil into global markets, accusing New Delhi of acting as a clearinghouse for embargoed crude.

He argued that India’s re-exports provide Moscow with critical revenue to fund the war in Ukraine.

While China imports even larger volumes of Russian oil, Washington’s rhetoric has been more restrained toward Beijing.

India imported 1.4 million bpd from Russia in July (China: 1.8 million bpd), according to IEA data. Both were slightly down from June.

A 25% US tariff on Indian goods is set to take effect next week, with little chance of suspension after Navarro’s remarks.

Oil Prices Decline on Optimism Over Ukraine Negotiations

Oil markets slipped following Friday’s Trump-Putin meeting, despite no concrete ceasefire announcement.

The absence of Trump’s threatened punitive measures helped ease fears, while subsequent talks involving Trump, Zelenskiy, and European leaders raised hopes for progress.

As a result, oil prices are falling again today, Commerzbank noted.

China Steel Output Drops for Third Month

China’s steel production fell 4% y/y in July to under 80 million tonnes, marking its lowest level of the year.

Over the first seven months of 2025, output dropped 3.1% y/y, the weakest since 2020. Authorities are curbing supply to prevent excessive competition and reduce pollution ahead of September’s military parade in Beijing.

Demand remains sluggish, weighed down by a struggling property sector and disappointing macroeconomic data.

Meanwhile, aluminium imports jumped 38.2% y/y in July to 360kt, while alumina exports surged 56.4% y/y to 230kt.

Europe News

European Stocks Push Higher as Funds Rotate Out of US

European equities advanced on Tuesday as capital flowed out of US markets, boosting major indices across the region.

- German DAX climbed 0.45%, closing at 24,423.08, just shy of its all-time peak of 24,549.57.

- France’s CAC 40 added 1.21%, reaching its strongest level since March 2025.

- UK’s FTSE 100 rose 0.34% to a record close of 9,189.23.

- Spain’s Ibex gained 0.34%, marking a 17½-year high.

- Italy’s FTSE MIB advanced 0.89%, securing an 18-year closing high.

While most benchmarks set fresh milestones, the DAX remains just short of its historical record, highlighting the uneven nature of the rally.

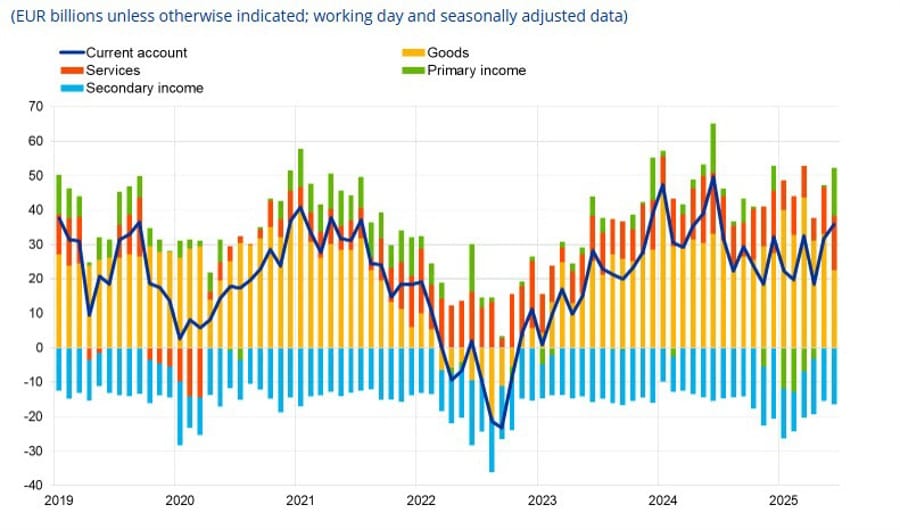

Eurozone Current Account Surplus Widens in June

The Eurozone’s current account surplus climbed to €35.8 billion in June, compared with €32.3 billion in May.

Details:

- Goods surplus: €23 billion.

- Services surplus: €16 billion.

- Primary income surplus: €14 billion.

- Secondary income deficit: €17 billion.

UK Delays July Retail Sales Data to September 5

The UK Office for National Statistics (ONS) announced a delay in publishing July retail sales data, moving the release from 22 August to 5 September.

The ONS cited the need for “further quality assurance” as the reason for the two-week postponement. The credibility of UK data has been questioned recently, particularly regarding labor market figures, and this delay adds to concerns.

German Chancellor Merz Calls Ukraine Talks Decisive, Endorses Security Guarantees

German Chancellor Friedrich Merz described the ongoing discussions over Ukraine as “decisive days”, while expressing support for security guarantees.

He welcomed Trump’s announcement of commitments for Ukraine and confirmed that Trump had spoken with Putin about a possible meeting with Zelenskiy.

Merz said expectations for the talks were not just met but exceeded. He also emphasized that all European nations should take part in providing security guarantees.

Plans are underway for a Putin-Zelenskiy meeting within two weeks, followed by a trilateral summit involving Trump.

Asia-Pacific & World News

Kremlin Confirms Trump-Putin Call Focused on Ukraine

The Kremlin confirmed a 40-minute phone call between Donald Trump and Vladimir Putin, centering on the Ukraine conflict and bilateral cooperation.

Discussions included potentially raising the level of Russian and Ukrainian negotiators, according to Kremlin aides. Putin expressed gratitude for Trump’s hospitality at the Alaska summit.

Both leaders voiced support for continuing direct Russia-Ukraine dialogue and agreed to maintain close contact on the issue.

PBOC sets USD/ CNY reference rate for today at 7.1359 (vs. estimate at 7.1846)

- PBOC CNY reference rate setting for the trading session ahead.

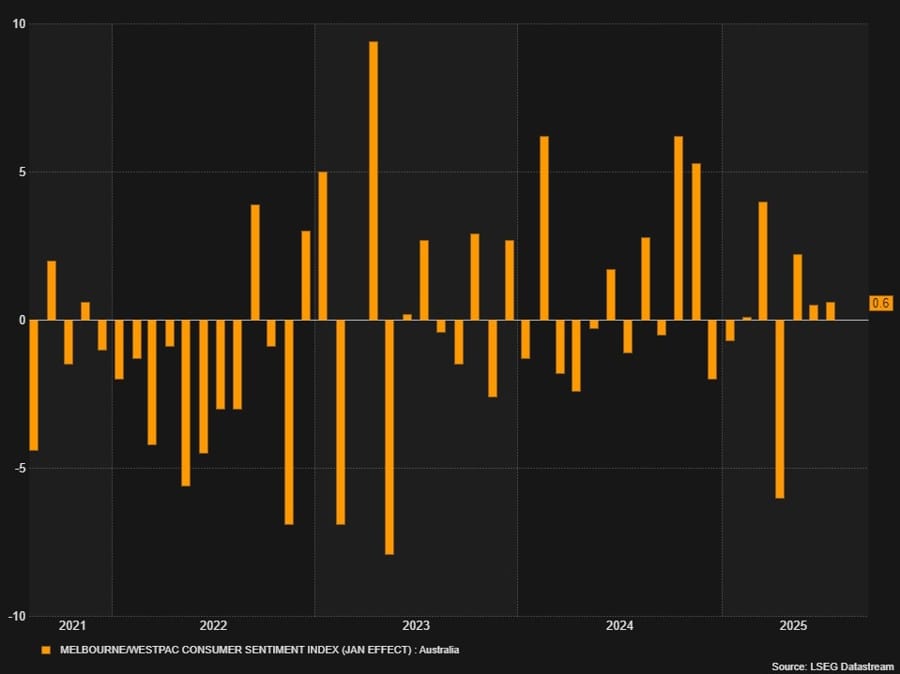

Australia Consumer Sentiment Jumps to 3½-Year High

Australia’s Consumer Sentiment Index rose 5.7% in August 2025 to 98.5, the strongest since early 2022 and nearly back into positive territory.

The improvement was largely fueled by the RBA’s third rate cut of the year, which lowered the cash rate to 3.6%.

- Household financial outlook improved, with the 12-month index at 106.8, comfortably above its long-run average.

- Economic expectations strengthened: 101.2 for the next year and 98.4 for the next five years, both above norms.

- Housing sentiment surged: the “time to buy a dwelling” sub-index jumped 10.5% to 97.8, a four-year high, while house price expectations climbed further to 164.2.

- Labor market confidence was stable, with the unemployment expectations index easing to 125.6, consistent with steady employment.

The rebound was broad-based, with renters as well as homeowners sharing in the improved mood.

RBC’s Short-Term Currency Outlook: JPY Favored, USD Rangebound

US Dollar (USD): Expected to remain rangebound as opposing forces balance out—Federal Reserve cuts point to weakness, but strong US equities continue to attract flows. Downside risk could emerge later in Q4.

Euro (EUR): Weak investment appeal so far with equities and yields lagging the US. German stimulus and Fed cuts versus ECB’s pause could support EUR/USD. Risks remain two-sided, though bias leans slightly higher.

Japanese Yen (JPY): RBC stays bullish, expecting USD/JPY to drop below 140 by year-end. The bank attributes recent weakness to temporary July factors such as elections and tariff headlines. Interest rate spreads are turning in favor of the yen, with the BoJ steady while the Fed eases.

British Pound (GBP): Viewed as undervalued compared with EUR, SEK, and CHF. Strongest near-term upside in GBP/CHF. With the BoE cautious on rate cuts—only one more expected this year—sterling remains attractive for carry trades.

Swiss Franc (CHF): Weakness delayed as the SNB remains wary of overly negative rates. Inflation is subdued but edging up. Heavy US tariffs pose risks given that 39% of Swiss exports head to the US. Vulnerable to bouts of selling.

Canadian Dollar (CAD): USD/CAD trapped between 1.3550 and 1.3900. RBC maintains a 1.38 target for Q3. Moves above 1.38 seen as selling opportunities unless major Fed or BoC surprises occur.

Australian Dollar (AUD): Forecasts revised upward, with AUD/USD expected at 0.64 by end-2025. Gains supported by USD weakness, improving US-China trade relations, and firm commodity demand.

New Zealand Dollar (NZD): Revised lower to 0.58 by end-2025. Economy under strain from rising unemployment and weak activity, despite elevated interest rates. Agriculture sector, however, benefits from currency weakness.

UBS Weekly FX Views: USD Weakness in Focus

US Dollar (USD): Continuing its decline after a July bounce. Softer data and dovish Fed positioning raise odds of a September cut. Powell may outline an easing cycle restart at Jackson Hole. Target: EUR/USD 1.21 by year-end.

Euro (EUR): Driven by USD moves. June trade data and flash PMIs in focus. Manufacturing recovery could support sentiment. EUR/CHF expected in 0.94–0.95 range.

British Pound (GBP): Awaiting UK CPI. Hawkish BoE stance provides support, though fiscal risks remain. Resistance near 1.38 unlikely to break soon. Carry advantage remains attractive.

Australian Dollar (AUD): Following the August RBA cut to 3.6%, labor market strength persists. Inflation and wages still elevated. Forecast: AUD/USD between 0.68–0.70 by mid-2026, with buying interest below 0.64.

Japanese Yen (JPY): USD/JPY easing into 146–147 as Fed cuts priced. Reports suggest BoJ faces pressure to tighten, with CPI expected at 3.3%. A December rate hike is possible. Strategy: sell USD/JPY rallies.

Veteran LDP Lawmaker Urges BOJ to Begin Rate Hikes Early

Taro Kono, a senior LDP politician and former minister for digital transformation, called on the Bank of Japan to begin raising rates sooner rather than later.

Kono argued:

- Japan needs a new framework with higher rates and stronger fiscal discipline.

- A stronger yen is necessary, as the prolonged weak currency is undesirable.

- Real borrowing costs should not remain negative for an extended period.

The BOJ has been patient under Governor Ueda, waiting until March 2024 to act after the wage negotiations. That cautious approach suggests any future tightening could still be gradual, but political pressure is now rising.

Japan PM Pushes for Ceasefire, Questions Role in Ukraine’s Security

Japan’s Prime Minister Ishiba emphasized that halting the fighting and securing what he called a “fair peace” should be the immediate priority when asked about the outcome of the US-Ukraine meeting.

He explained that Japan will examine how it could contribute to Ukraine’s security, but stressed that this will be considered strictly within Japan’s existing legal framework and national capabilities. In other words, Tokyo is signaling support in principle, but the language suggests its direct security role may remain limited.

Crypto Market Pulse

Crypto Market Update: Bitcoin, Ethereum, XRP Face Mounting Pressure

Risk-off sentiment gripped crypto markets as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) extended declines.

Macro backdrop:

- The selloff follows last week’s US PPI surprise (+0.9% vs +0.2% forecast), dampening Fed cut hopes.

- Markets have priced out a 50 bps cut in September; CME FedWatch shows an 83% probability of a 25 bps reduction.

Derivatives flows:

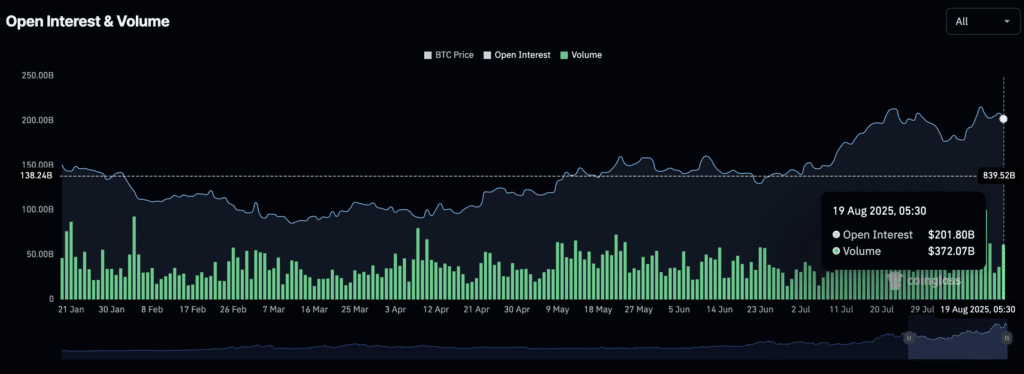

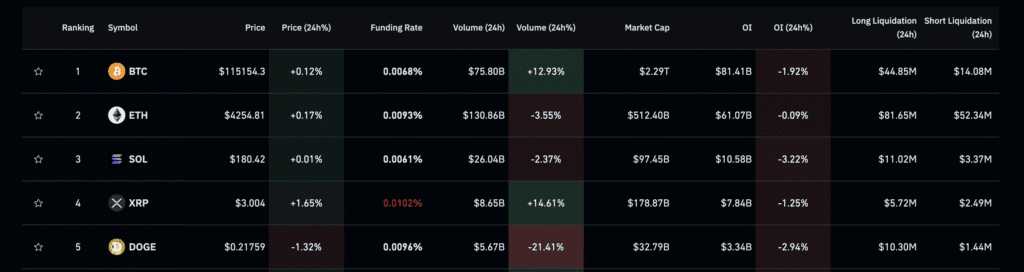

- Total crypto Open Interest fell to $201.8B, down from $208.3B.

- Trading volumes surged to $372.1B from $221.4B, suggesting long liquidations and reduced market exposure.

- Bitcoin and XRP OI each dropped over 1%; ETH OI remained stable near $61.1B.

Bitcoin (BTC):

- Briefly dipped under $115,000, holding just above the 50-day EMA at $115,063.

- Key downside: $111,980 support.

- Indicators show fading bullish momentum: RSI at 45, MACD in decline with red histogram expansion.

- Upside potential: rebound toward $120,000 supply zone.

Ethereum (ETH):

- Down 0.5% Tuesday, extending Monday’s 3.6% loss.

- Testing lower boundary of a rising channel, with critical support near $4,000.

- MACD bearish crossover confirmed; RSI slipped below 70, signaling momentum loss.

- A bullish reversal would require reclaiming $4,472.

Ripple (XRP):

- Trading at a support confluence: 50-day EMA, uptrend line, and 38.2% Fib retracement at $2.99.

- Breakdown risks extend to $2.78 (50% retracement) and 100-day EMA at $2.72.

- MACD near zero with red histogram growth; RSI at 46 points to mounting bearish momentum.

- Upside recovery could retest $3.34 resistance.

Fed’s Bowman: Staff Should Be Allowed Limited Crypto Exposure

Fed Governor Michelle Bowman argued Tuesday that Federal Reserve staff should be permitted to hold “de minimis” amounts of cryptocurrency.

- She said small personal exposure would help examiners better understand digital products.

- Restrictions on staff investments could hinder the Fed’s ability to recruit and retain specialists.

Bowman’s remarks reflect the ongoing debate about how much exposure regulators themselves should have to the crypto industry they oversee.

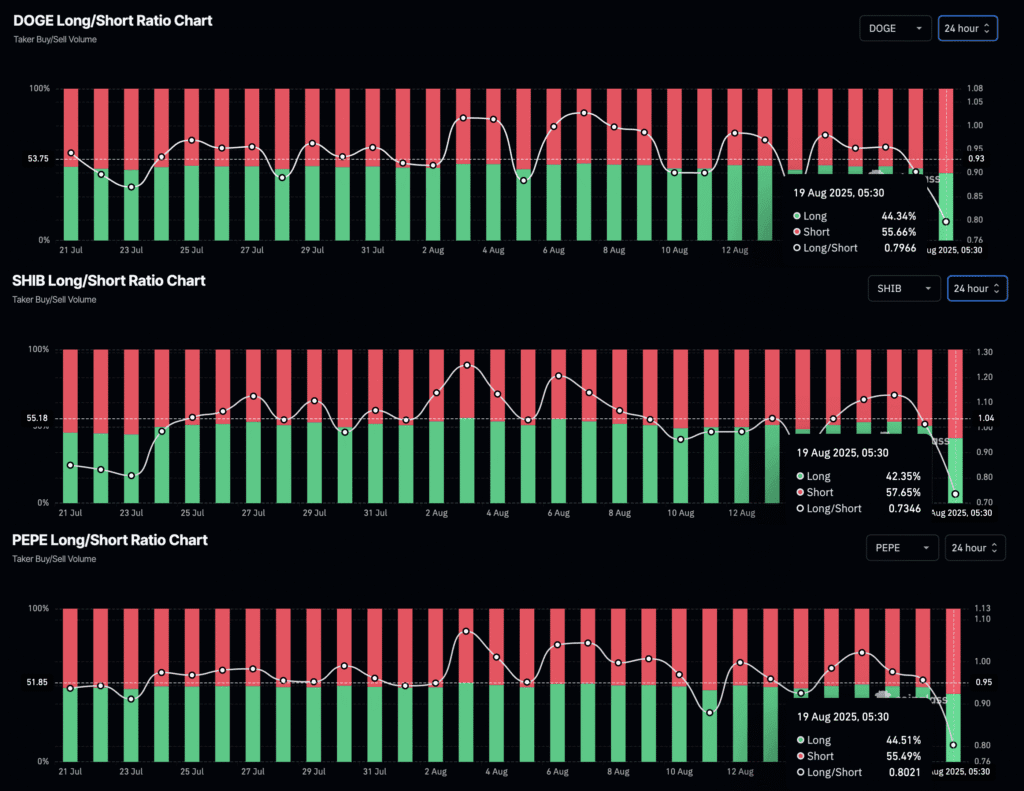

Meme Coins Flash Bearish Signals: DOGE, SHIB, PEPE Under Pressure

The meme coin sector remains under heavy selling pressure as Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) struggle to hold key technical levels.

Market positioning:

- CoinGlass data shows short positions dominate, with 55% of trades skewed bearish across DOGE, SHIB, and PEPE derivatives.

- SHIB in particular faces stronger pessimism, with 57% short positioning.

Dogecoin (DOGE):

- Down another 2% Tuesday, extending Monday’s 5% drop.

- Trading near the 50-day EMA at $0.2163; a break could expose the 200-day EMA at $0.2100.

- The MACD issued a sell signal Monday, while RSI at 47 continues to decline.

- A rebound could allow a retest of $0.2407 resistance.

Shiba Inu (SHIB):

- Lost 2.46% Monday and another 2% Tuesday, threatening a triangle breakdown.

- Support trendline: $0.00001244. A close beneath this risks a slide to $0.00001166.

- Momentum indicators confirm weakening demand: MACD sell signal, RSI at 43.

- A bullish bounce could retest the 50-day EMA at $0.00001304.

Pepe (PEPE):

- Down over 1% Tuesday, adding to Monday’s 3.96% fall.

- Faces risk of losing the $0.00001000 psychological floor, with next support at $0.00000986.

- MACD bearish crossover and RSI at 42 confirm building downside pressure.

- Looming Death Cross between 50- and 200-day EMAs could accelerate losses.

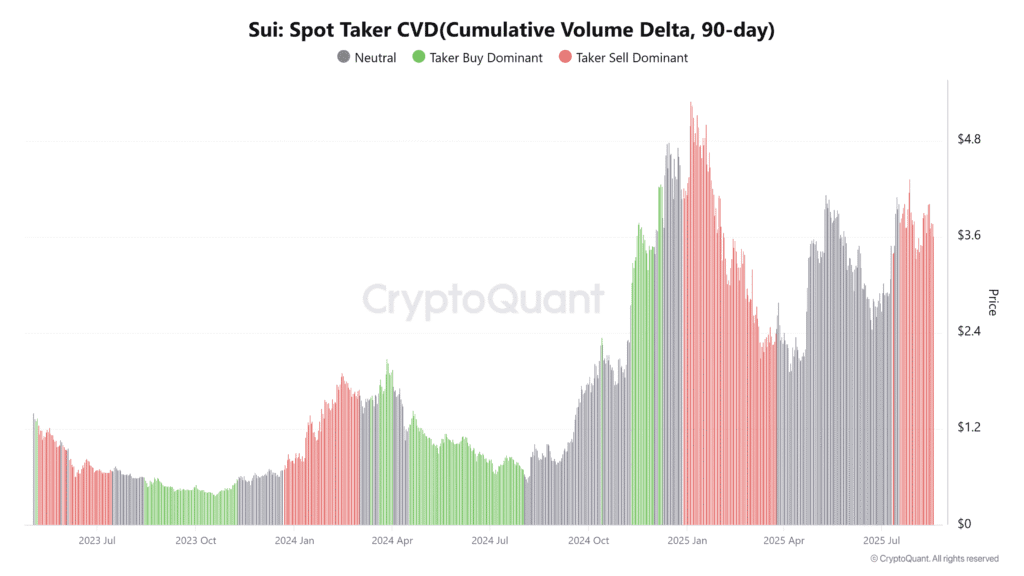

SUI Breaks Support, Signals Deeper Correction Ahead

Sui (SUI) fell below $3.60 on Tuesday, breaking a key ascending trendline support and extending losses.

On-chain metrics confirm the bearish shift:

- CryptoQuant’s Spot Taker CVD is in negative territory, showing sellers in control since mid-July.

- A falling CVD points to a Taker Sell Dominant Phase, where sell orders outweigh buys.

Technical indicators also lean bearish, suggesting the correction could deepen if selling persists.

Bitcoin Shows Signs of Exhaustion on Higher Timeframes

Bitcoin’s latest rally is flashing potential exhaustion signals on the weekly timeframe, raising the risk of near-term corrections.

Analysts caution this does not necessarily imply a full reversal. In strong momentum markets, even modest pullbacks can quickly reset.

For long-term holders, the trend remains intact, but short-term traders may want to take note of the bearish divergence patterns.

- Key support sits at 112K.

- A break below that could open the door to the next major support zone near 101K.

Profit-taking after the run-up seems inevitable, though whether this results in a mild shakeout or deeper retracement is yet to be seen.

Stellar Holds at 50-Day EMA as Positive Fundamentals Build

Stellar (XLM) continued its decline for a fourth day on Tuesday, testing support at the 50-day EMA ($0.3936).

Positive Developments:

- Paxos received a non-objection certification from New York regulators to issue PayPalUSD (PYUSD) on Stellar.

- Stellar partnered with Archax, a UK-regulated exchange, to expand tokenization of real-world assets. The Stellar Development Foundation will invest directly in Archax.

Technical Picture:

- XLM trades at $0.4057, down 2%. A break below the 50-day EMA risks a slide to the 100-day EMA at $0.3568, a 12% drop.

- MACD momentum is weakening toward the zero line.

- RSI is at 46, sloping down, signaling fading demand and room for further correction.

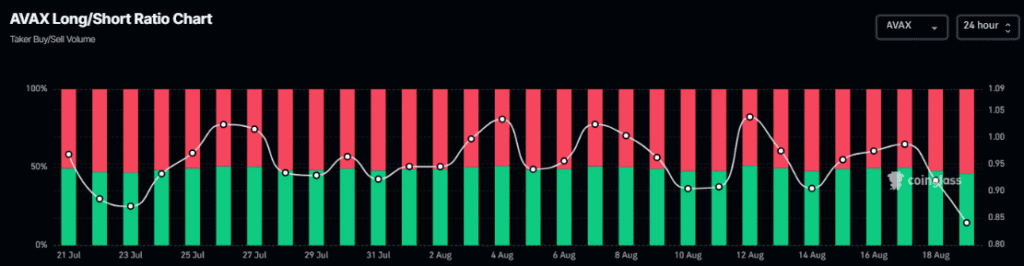

AVAX Slips Below $24 as Bears Take Control

Avalanche (AVAX) dropped over 2% Tuesday, extending Monday’s 6% loss.

Derivatives Data:

- Coinglass OI-Weighted Funding Rate flipped negative Monday, meaning shorts are paying longs. Historically, this shift has coincided with sharp AVAX sell-offs.

- Long-to-short ratio dropped to 0.84, the lowest in a month, reflecting bearish sentiment as more traders bet against the asset.

Technical Outlook: Momentum continues to weaken, with price action suggesting the potential for a deeper pullback ahead.

The Day’s Takeaway

North America

- Equities: Mixed close as tech drags. Dow +0.02% (44,922.39), S&P 500 -0.58% (6,411.45), NASDAQ -1.46% (21,314.95). NASDAQ finished below its 100‑hour MA (21,333.30); 200‑hour MA sits at 21,123.54.

- Semis: Broad selloff—NVDA -3.55%, AMD -5.44%, AVGO -3.55%, TSMC -3.16%, MU -1.51%, ASML -0.53%. Intel +6.97% on SoftBank’s $2B equity purchase and a prospective Chips Act-for-equity structure; investors framed it as a vote of confidence.

- Macro nowcast: Atlanta Fed GDPNow cut Q3 growth tracking to 2.3% (from 2.5%).

- Ratings: S&P affirmed US AA+/A‑1+, stable outlook. Sees net general gov’t debt ~100% of GDP, deficits staying wide but no persistent deterioration; growth around 2%, easing to 1.7% (2025) and 1.6% (2026).

- Housing: Starts 1.428m (vs 1.290m exp); permits 1.354m (vs 1.386m exp). Stronger starts underscore risk a Fed cut could re‑ignite demand.

- Fed watch:

- Powell @ Jackson Hole—Morgan Stanley expects a hawkish lean (sticky services inflation; wants flexibility).

- MUFG expects caution/no explicit Sept signal, which could temper USD downside near term.

- Gov. Bowman: policy stance unchanged (she backed the July cut).

- Politics/Geopolitics (US angle):

- Trump (Fox News): wants Putin–Zelensky meeting; says no US boots; argues Ukraine won’t join NATO and must show flexibility (territories); warns it’ll be a “rough situation” if Putin’s not “good.”

- Sen. Rubio: backs security guarantees for Ukraine; says he witnessed Trump urging Putin to meet Zelenskiy.

- Canada CPI (July):MoM 0.3% (exp 0.3%), YoY 1.7% (exp 1.8%); prior 0.1% MoM, 1.9% YoY.

- BoC core: YoY 2.6% (prev 2.7%), MoM 0.1% (unch).

- Median 3.1% (in line), Trim 3.0% (vs 3.1% exp), Common 2.6% (unch).

- Drivers: Gasoline -16.1% YoY (carbon levy removal; -0.7% MoM on crude/OPEC+). Shelter +3.0% (rent +5.1%, natgas -7.3%; mortgage interest +4.8% slowing). Groceries +3.4% (coffee +28.6%, confectionery +11.8%, grapes +29.7%). NL & Labrador led acceleration (electricity +13.9%).

Commodities

- Gold: Geopolitics mixed—Alaska summit outcomes vague; prospect of Putin–Zelensky meeting trims risk premium. Focus on Jackson Hole; with markets already pricing 2 cuts in ’25 and 3 in ’26, gold likely needs a very dovish Powell to pop.

- Technical map: Range 3,245–3,438 (daily). 4h support ~3,330; sellers eye a break to 3,245; buyers fading dips toward 3,438 top.

- Oil: Prices eased on hopes of Ukraine progress.

- China products (July): Diesel 820kt (11‑mo high), Gasoline 930kt (year’s high with March), Jet ~2mt (highest since Mar ’24). Higher exports pulled implied demand <14 mb/d, yet +6% YoY.

- US→India pressure: White House trade adviser Navarro blasted India for acting as a clearinghouse for Russian oil; 25% US tariffs on India set to kick in next week.

- Base metals / bulk:

- Copper (China): 1.27mt refined in July (2nd‑highest ever). Aug ’24–Jul ’25: 14.38mt—record 12‑mo output; China now >50% of global refined copper. Ore imports +18% YoY; Chile exports to China +18%.

- Steel (China): July -4% YoY to <80mt (3rd monthly drop; YTD -3.1% YoY, weakest since 2020). Policy curbs + parade‑related pollution controls weigh; demand soft on property weakness.

- Aluminium/alumina flows (China): Aluminium imports +38.2% YoY (360kt); YTD imports +1.5% to 2.33mt. Alumina exports +56.4% YoY (230kt); YTD +64.3% to 1.6mt.

Europe

- Equities: Rotation out of US lifts bourses—CAC +1.21% (highest since Mar ’25), FTSE 100 +0.34% to a record 9,189.23, Ibex +0.34% (17½‑yr high), FTSE MIB +0.89% (18‑yr high), DAX +0.45% to 24,423.08 (just shy of 24,549.57 ATH).

- Data: Eurozone current account €35.8bn (prior €32.3bn): goods €23bn, services €16bn, primary income €14bn, secondary income -€17bn.

- UK: ONS delays July retail sales to 5 Sep (“further quality assurance”).

- Corporate/Tech: Arm hires Amazon AI chips lead Rami Sinno to drive in‑house chip program (shift from pure IP licensing to full designs).

- Security/Ukraine:

- NATO’s Rutte: Washington talks a “breakthrough”—US will be involved in security guarantees; exploring Article 5‑type constructs without troop deployments.

- Germany’s Merz: Calls this a decisive period; welcomes US security commitments; says expectations were exceeded; all of Europe should contribute; flags Putin–Zelensky meeting within ~two weeks, followed by a trilateral with Trump.

- Kremlin readout: 40‑minute Trump–Putin call—discussed raising negotiation levels and continuing direct Russia–Ukraine talks; agreed to keep close contact.

Asia

- Japan (policy & geopolitics):

- PM Ishiba: Priority is immediate ceasefire and a “fair peace.” Japan will assess contributions to Ukraine within its legal framework and capabilities—signaling a limited direct security role.

- Taro Kono (LDP): Urges the BoJ to start hikes early; wants a stronger yen; warns against prolonged negative real borrowing costs.

- Australia:Consumer Sentiment Index +5.7% to 98.5 (3½‑yr high). Boosted by the RBA’s third cut of 2025 (cash rate 3.6%).

- Households: Finances next 12m = 106.8 (above long‑run avg).

- Outlook: Next 12m 101.2, next 5y 98.4 (above norms).

- Housing: “Time to buy” +10.5% to 97.8 (4‑yr high); price expectations 164.2 (very bullish).

- Labor: Unemployment expectations 125.6 (stable jobs).

- Gains broad‑based—renters and homeowners.

Rest of World

- US & Europe to draft Ukraine security guarantees (Bloomberg): Package to bolster Ukraine’s forces without limits that Russia might demand; builds on Europe’s “coalition of the willing”—format TBD.

- White House brief: Putin agreed to the next step; a Putin–Zelensky bilateral to precede a trilateral with the US. Coordination by Sec. Rubio, VP Vance, envoy Witkoff. No US boots. Venue: Moscow proposed by Putin; Budapest reportedly favored by Washington.

- Global FX strategy:

- RBC (1–3m): USD rangebound near term (Fed cuts vs US equity inflows). EUR mildly positive bias; JPY bullish (sees USD/JPY <140 by year‑end as spreads shift); GBP undervalued (carry appeal; GBP/CHF best near‑term); CHF vulnerable to bouts of weakness (US tariffs risk; 39% exports to US); CAD stuck 1.3550–1.3900 (sell >1.38 unless big Fed/BoC surprises); AUD lifted by softer USD/commodities (sees 0.64 end‑2025); NZD cut to 0.58 end‑2025 (weak economy; agri benefits from softer FX).

- UBS (week ahead): USD downtrend resuming; markets price >25 bps Sept cut; Powell could tee up easing cycle restart. EUR anchored by USD path (EUR/CHF 0.94–0.95); GBP supported but capped near 1.38; AUD: two more RBA cuts to 3.1% by Feb, prefer longs ≤0.64; JPY: sell USD/JPY rallies (BoJ Dec hike possible).

Crypto

- Market tone: Risk‑off after US PPI +0.9% surprise; 50 bps cut priced out; ~83% odds of 25 bps in Sept (CME). Open Interest $201.8B (from $208.3B) while volumes $372B (from $221B) → long liquidations / de‑risking.

- Majors:

- Bitcoin (BTC): Whipsawed around $115k; holding 50‑day EMA $115,063. Key support $111,980. Weekly bearish divergence flags exhaustion; supports at $112k, then $101k.

- Ethereum (ETH): Extends slide; targeting $4,000 (lower bound of rising channel). Needs $4,472 reclaim to flip bias.

- XRP: At $2.99 support confluence (50‑day EMA + trendline + 38.2% Fib); risks $2.78 (50% Fib) / 100‑day EMA $2.72 on break.

- Meme coins:

- DOGE: -5% Mon, -2% Tue; flirting with 50‑day EMA $0.2163; break risks 200‑day EMA $0.2100.

- SHIB: Threatens triangle breakdown below $0.00001244 → $0.00001166 next; MACD sell, RSI 43.

- PEPE: Near $0.00001000 psych; Death Cross risk as 50/200‑day EMAs converge; support $0.00000986.

- Altcoins:

- SUI: Lost $3.60 and broke ascending trendline; Taker CVD negative since mid‑July → sell‑dominant flow.

- Stellar (XLM): Testing 50‑day EMA $0.3936; PYUSD issuance on Stellar got NYDFS NOC via Paxos; SDF–Archax partnership (tokenization; SDF investing). Risks 100‑day EMA $0.3568 if 50‑day fails; MACD soft, RSI 46.

- AVAX: Below $24; funding negative, L/S ratio 0.84 (1‑mo low) → shorts dominant; momentum weakening.

- Policy: Fed’s Bowman supports allowing “de minimis” crypto holdings for Fed staff to better understand products; warns strict limits could hamper recruiting/retention of expert examiners.