North America News

S&P 500 Marks Fresh Record Before Stalling, Russell 2000 Leads with Big Breakout

U.S. equities finished higher on Thursday, with the S&P 500 opening at a new record before drifting sideways. By the close, all three major indexes notched fresh records again. The Russell 2000, however, stole the spotlight with a sharp surge.

Closing levels:

- S&P 500: +0.5%

- Nasdaq Composite: +1.0%

- Dow Jones Industrial Average: +0.3%

- Russell 2000: +2.4%

The Russell 2000 pushed through its 2024 peak and is now pressing against its 2021 all-time high, highlighting renewed appetite for small-cap names amid the broader market rally.

U.S. 10-Year TIPS Auction Shows Weak Demand

The U.S. Treasury sold $19 billion of 10-year TIPS at a high yield of 1.734%, well above the when-issued yield of 1.684%, producing a 5bp tail.

The bid-to-cover ratio came in at 2.2. Allocation details:

- Primary dealers: 17.79%

- Direct bidders: 26.12%

- Indirect bidders: 56.08%

Overall, it was a poor auction outcome with a larger-than-usual tail.

U.S. Jobless Claims Fall to 231K

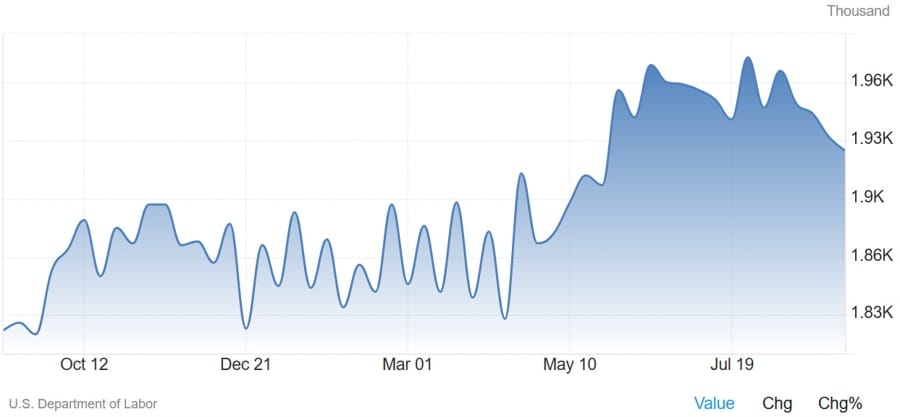

Initial jobless claims in the U.S. came in at 231,000, below the 240,000 consensus forecast. The prior week’s figure was revised slightly higher to 264,000.

Continuing claims also beat expectations at 1.92 million, compared with forecasts for 1.95 million, and lower than the revised 1.927 million the week before.

The data show improvement after a spike in Texas filings had distorted earlier reports — later revealed to be fraudulent. Overall, claims remain steady, with continuing claims trending downward.

Philly Fed Index Surges to 23.2 in September

The Philadelphia Fed’s September manufacturing index jumped to +23.2, far above expectations of +2.5 and up from -0.3 in August.

Details:

- Employment: 5.6 (vs. 5.9 prior)

- Prices paid: 46.8 (vs. 66.8 prior, a sharp drop from multi-year highs)

- New orders: +12.4 (vs. -1.9 prior)

- Shipments: 26.1 (vs. 4.5 prior)

- Unfilled orders: -6.6 (vs. -16.8 prior)

- Delivery times: -3.4 (vs. -5.4 prior)

- Inventories: 15.0 (vs. -6.2 prior)

- Average workweek: 14.9 (vs. 4.7 prior)

Six-month outlook:

- General activity index: 31.5 (vs. 25.0 prior)

- Capex expectations: 12.5 (vs. 38.4 prior)

U.S. Mortgage Rates Drop to Lowest Since October 2024

Freddie Mac data showed the average 30-year fixed mortgage rate fell to 6.26% in the week of September 18, down from 6.35% the prior week. This marks the lowest level since October 2024.

US Hassett: Fed rate decision good first step

- The Whiter House Senior Adviser Hassett speaking to CNBC

- Economic growth is coming without inflation

- Miran’s analysis is ‘heartfelt’ and not affected by politics

- No knowledge of Nvidia stake deal similar to Intel arrangement

- Rare earths were a potential bottleneck for the US economy

- Focused this week on American farmers

Goldman Sachs AM Forecasts Two More Fed Cuts in 2025

Goldman Sachs Asset Management expects the Federal Reserve to deliver additional 25 basis point cuts in both October and December, extending the easing cycle after September’s move.

The firm said the Fed’s dot plot leans toward a gradual loosening path, reflecting confidence inflation is easing while growth risks build. Goldman noted only a sharp rebound in inflation or the labour market would derail this plan.

The asset manager also expects two more FOMC cuts in 2026.

Nomura Revises Fed Outlook: Cuts Now Expected in October and December

Nomura has shifted its forecast for Federal Reserve policy, now projecting two additional cuts this year — one in October and another in December. Previously, the bank had only penciled in a December move.

Looking ahead to 2026, Nomura anticipates a series of 25bp reductions in March, June, and September.

Markets had hoped Chair Jerome Powell would signal something bolder, but he described Wednesday’s decision as a “risk management” cut, stressing labour market concerns. While Powell acknowledged inflation risks have eased, he said they are not yet fully behind us. Market pricing currently reflects around 44bp of easing before year-end, largely consistent with Nomura’s updated call.

Mercer: Trump Policies Prompt Investor Shift Away from U.S.

Mercer LLC says Trump’s trade policies and pressure on the Federal Reserve are driving investors to reduce exposure to U.S. markets. The firm, advising 3,900 clients managing $17 trillion, reports increased allocations to Europe, Japan, and private markets.

Chief Investment Officer Hooman Kaveh told Bloomberg that Trump’s tariffs, Fed politicisation, deficit concerns, and a weaker dollar have triggered diversification. U.S. equities have underperformed global peers this year, and tariffs could further squeeze margins or lift inflation.

Clients are also turning to European and Japanese stocks with more attractive valuations, as well as private markets such as AI-related ventures.

Meta Unveils $799 Ray-Ban Display AR Glasses

At its Meta Connect 2025 event, CEO Mark Zuckerberg introduced the Meta Ray-Ban Display smart glasses, priced at $799 and launching September 30. The wearable combines cameras with in-lens displays for augmented reality, paired with a neural wristband that translates muscle movements into controls.

Users can rotate their wrist to adjust music or tap fingers to send a text. While demonstrations highlighted the technology’s potential, not all features worked smoothly — including a failed WhatsApp call command.

Fed Moving Toward Neutral Stance, Inflation Still a Concern

At its September meeting, the Federal Reserve cut rates by 25 basis points to a midpoint of 4.125%, emphasizing risk management as a guiding principle. Updated projections showed stronger growth, a more resilient labour market, and inflation gradually easing toward the 2% target by 2027.

Westpac said the Fed is inching toward a neutral policy stance, but sticky inflation could slow the path to further easing. Its economists noted the wide split in the Fed’s “dot plot,” with some officials backing more cuts this year and others seeing little need. By 2027, expectations largely converge.

Westpac remains more cautious than the Fed’s central forecast, warning that U.S. growth could undershoot and inflation may linger, forcing policy to stay moderately restrictive longer than markets anticipate.

Treasury Secretary Bessent Faces Questions Over 2007 Mortgage Filings

Bloomberg reported that U.S. Treasury Secretary Scott Bessent listed two different homes — one in New York and one in Massachusetts — as his “primary residence” when applying for mortgages in 2007. The disclosures came from Bank of America filings and mirror arrangements that Donald Trump has previously criticized as “mortgage fraud.”

Mortgage experts told Bloomberg that no wrongdoing appeared in Bessent’s paperwork, saying such discrepancies are not unusual. Bank of America reportedly didn’t rely on Bessent’s declarations when approving the loans.

Bessent’s attorney, Alex Spiro, dismissed the report, insisting the paperwork was handled correctly nearly two decades ago and that Bloomberg’s own reporting confirmed as much.

Commodities News

Gold Retreats After Strong U.S. Data Tempers Fed Cut

Gold prices slipped on Thursday as stronger U.S. labor and manufacturing data offset the bullish impact of the Federal Reserve’s rate cut. Spot gold fell 0.39% to $3,643 after reaching an intraday high of $3,673.

Profit-Taking Emerges Post-Fed Decision

The pullback followed the release of Initial Jobless Claims, which came in better than expected, and a robust September Philadelphia Fed survey. The upbeat data stood in contrast to Fed Chair Jerome Powell’s cautious tone on labor market risks.

On Wednesday, the Fed reduced its policy rate by 25 basis points, bringing it into a 4.00–4.25% range. The decision wasn’t unanimous: Stephen Miran dissented, backing a larger 50bp cut. Powell emphasized that future decisions remain data-dependent, with each meeting “live” as the central bank weighs risks to employment and inflation.

Long-Term Outlook Remains Constructive

Despite Thursday’s dip, gold’s outlook remains supported by the broader Fed easing cycle, which typically favors non-yielding assets. On the demand side, Reuters reported that Swiss gold exports to China surged 254% in August, signaling continued appetite from Asia.

Silver Holds $41.50 After Fed-Driven Drop

Silver steadied on Thursday after sliding to $41.20 on Wednesday, its lowest in five sessions. At the time of writing, prices trade near $41.81, supported by dip-buying at the $41.50 level.

Key Technical Levels

The $41.50 area has become a key floor, reinforced by the 50-SMA at $41.78. Failure to hold this zone would expose $40.50 as the next support.

On the upside, resistance lies at $42.16 (21-SMA), followed by $42.50 and the recent high of $42.97. A sustained break higher could target the psychological $43.50 mark.

The RSI sits near 47, neutral after cooling from overbought conditions. A move above 50 would hint at renewed buying strength, while a drop under 45 could signal more downside. For now, silver remains rangebound between $41.50 support and the $42.00–42.20 resistance zone.

LME Copper Stocks Edge Higher in U.S. Warehouses

LME data showed copper inventories in U.S. warehouses increased by 175 tonnes — the first rise since December 2023, according to ING analysts Ewa Manthey and Warren Patterson.

China’s refined copper output rose 15% year-on-year in August to 1.3 million tonnes, supported by higher ore imports. Among other metals, zinc production surged 23% YoY to 651kt (a high since March 2024), while lead output grew 3.7% YoY to 667kt.

ING noted that U.S. copper prices have been trading above LME benchmarks since Washington announced a 50% tariff on imports. Though refined and concentrate imports were later exempted, price spreads still encouraged traders to move metal into Comex depots.

EIA Reports Large U.S. Crude Draw, Exports Jump

EIA data showed U.S. commercial crude inventories fell by 9.3 million barrels last week, far exceeding the 3.4 million barrel draw reported by the API. Stocks now stand at just above 415 million barrels, around 5% below the five-year average.

Exports nearly doubled, climbing 2.5m b/d to 5.3m b/d, while imports slipped by 579k b/d to 5.7m b/d. Cushing stocks declined 296k barrels to 23.6m barrels.

Refined products:

- Gasoline inventories fell by 2.3m barrels to 217.6m, 1% below the five-year average. Demand rose by 302k b/d to 8.8m b/d. Markets had expected a small build.

- Distillate inventories rose sharply by 4m barrels to 124.7m, compared with forecasts for a 1.24m increase. This is the highest level since January, helped by lower exports, and should ease pressure on diesel supplies heading into harvest and winter demand peaks.

Trump: Falling Oil Prices Would Force Putin’s Hand

Donald Trump suggested that if global crude prices drop significantly, Russian President Vladimir Putin would be left with no choice but to end the war in Ukraine.

Trump has recently pressed Europe and India to cut their purchases of Russian crude. His latest comments leave it unclear whether he was referring to global benchmark prices or specifically Russian oil, though the two are closely linked. The existing oil price cap has not proven effective.

EU to Accelerate Russian LNG Phaseout After Trump Pressure

Bloomberg reported that the European Commission is considering a faster timeline to end Russian LNG imports. Sources said the bloc may bring forward its planned phaseout — previously set for the end of 2027 — after lobbying by Trump.

This move suggests Trump is preparing for a protracted conflict with Russia, with energy sanctions forming a key part of the strategy to undermine Moscow’s economy.

Deutsche Bank Boosts 2026 Gold and Silver Price Forecasts

Deutsche Bank raised its 2026 gold price projection to an average of $4,000 per ounce, up from $3,700, citing robust central bank demand — particularly from China — and the effects of U.S. Federal Reserve rate cuts.

Analyst Michael Hsueh said central bank purchases could hit 900 tons next year, supporting further gains. He also noted risks lean bullish for gold if the Fed’s independence comes under pressure, though that scenario wasn’t factored into the bank’s base forecast.

For silver, Deutsche lifted its 2026 forecast to $45 an ounce from $40, expecting a fifth consecutive year of physical market deficits.

Europe News

Eurozone Current Account Surplus Narrows in July

The euro area logged a current account surplus of €27.7 billion in July, down from June’s €35.8 billion, according to the European Central Bank.

The decline was mainly due to a smaller primary income surplus. Breaking it down: goods recorded a €25 billion surplus, services added €12 billion, and primary income contributed €7 billion. These were partially offset by a €16 billion deficit in secondary income.

Bank of England Holds Rates at 4% in September Decision

The Bank of England kept its policy rate unchanged at 4.00% during its September meeting. The vote split was 2–7–0, with Swati Dhingra and Silvana Tenreyro backing a 25bp cut, matching expectations.

The BoE noted that disinflationary forces remain, with wage pressures easing faster than price pressures. Pay growth, while still high, is cooling and projected to slow sharply through year-end.

The statement also highlighted that upside risks to medium-term inflation are still significant, while downside risks to economic growth persist. Policymakers reiterated that monetary policy is not on a preset path and further adjustments will depend on how underlying disinflation evolves.

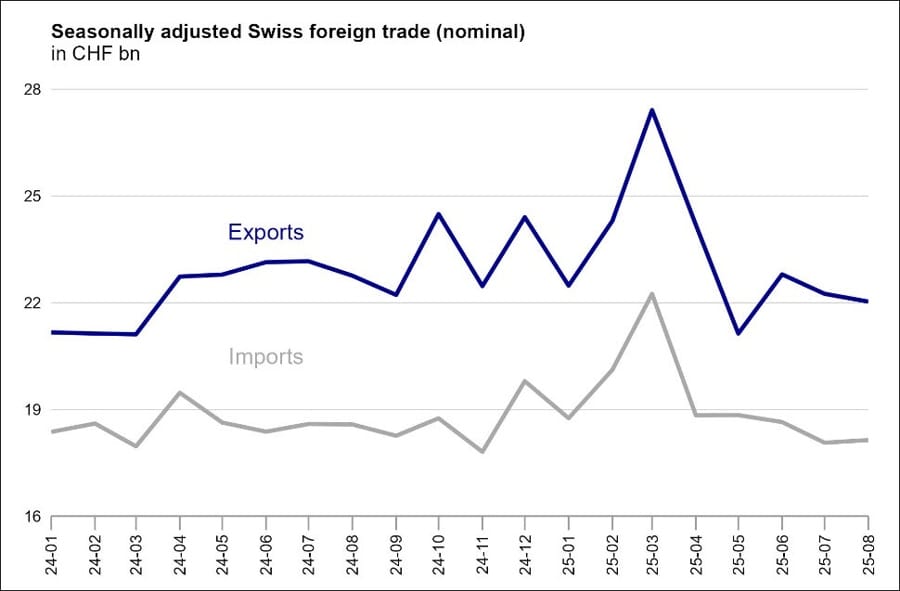

Switzerland’s Trade Surplus Slips in August

Fresh data from the Swiss Federal Statistical Office showed the country posted a trade surplus of CHF 4.01 billion in August, down from a revised CHF 4.62 billion in July.

The Swiss trade surplus narrowed slightly in August, with the trend in exports and imports as per the following:

BoE’s Bailey Signals More Cuts Ahead

Bank of England Governor Andrew Bailey said further reductions in the policy rate are likely, though the timing and magnitude remain uncertain. He emphasized that gilt markets are not under strain and that global conditions are driving long-term gilt yields higher.

ECB’s de Guindos: Present policy stance is appropriate

- Comments from the ECB Vice President, Luis de Guindos from MNI

- We must continue having a very prudent approach

- Environment is quite uncertain

- Growth in H2 won’t be very different from Q2

- Risks from fiscal policy are becoming more tangible

- Growth risks are now much more balanced

- Valuation of markets are very elevated

- We have to accept small deviations from the inflation goal

Bank of England Expected to Slow Bond Sales, Keep Rates Steady

At its upcoming meeting, the Bank of England is expected to keep rates unchanged at 4% while scaling back its quantitative tightening program. Markets anticipate a reduction in annual gilt sales from £100 billion to about £67.5 billion, with some analysts predicting a deeper cut.

The likely vote is 7–2 to hold steady, after last month’s narrow 5–4 decision to reduce rates.

While the BoE insists QT has only a marginal effect on borrowing costs, critics say it has amplified market volatility, especially in long-dated gilts. Inflation remains stubborn at 3.8% in August, nearly double the target, with expectations it will peak at 4% before easing toward 2% by mid-2027.

Markets now assign just a 30% chance of another cut this year, though economists still see scope for easing in late 2025 or early 2026.

Asia-Pacific & World News

China Keeps Rates Steady Despite Fed Cut

The People’s Bank of China left its seven-day reverse repo rate unchanged at 1.40%, choosing not to mirror the U.S. Federal Reserve’s cut.

Analysts said resilient exports and a surging stock market gave Beijing room to pause, even as growth slows. August data showed the downturn was milder than expected, with some stimulus potentially deferred until next year.

Nomura’s Ting Lu warned that aggressive easing could inflate a stock bubble, while ANZ’s Xing Zhaopeng said further measures could still arrive in Q4. Long-term reforms remain a key agenda item ahead of October’s plenum.

Hong Kong Cuts Base Rate After Fed Decision

The Hong Kong Monetary Authority (HKMA) lowered its base rate by 25 basis points to 4.5%, following the U.S. Federal Reserve’s latest move.

Because the Hong Kong dollar is pegged to the U.S. dollar within a tight band of about 7.8 HKD per USD, the HKMA closely shadows Fed policy. Without alignment, capital inflows or outflows could destabilize the peg.

The HKMA generally keeps its base rate about 50 basis points above the Fed’s as a buffer to maintain currency stability and ensure investors don’t automatically prefer USD over HKD.

China’s Auto Industry Grapples with Oversupply and Discounts

China’s car sector is under strain as years of government-driven production targets have created a massive vehicle surplus. The glut has triggered deep discounts, unconventional sales methods, and mounting losses across dealerships.

Some unsold vehicles are registered as “sold,” exported as zero-mileage “used” cars, or dumped on gray-market platforms like Zcar. Others are abandoned in lots or auctioned online at steep discounts. Analysts say destructive competition has created a vicious cycle, leaving many automakers unprofitable.

Local government subsidies and cheap land have worsened overcapacity. While major brands like BYD and Geely may endure, analysts predict only about 15 of China’s 129 EV and hybrid makers will survive by 2030.

The oversupply problem carries broader risks, as autos and related industries make up around 10% of China’s GDP. Meanwhile, U.S. and European officials fear cheap Chinese cars flooding their markets.

Brazil’s Central Bank Holds Selic Rate at 15%

The Central Bank of Brazil kept its benchmark Selic rate unchanged at 15.0% in a unanimous decision, aligning with forecasts from a Reuters poll.

In its statement, the bank removed language referencing the “interruption” of hikes, but stressed vigilance in assessing whether rates need to stay high for an extended period to return inflation to target. Policymakers underscored they remain ready to raise rates again if necessary.

The bank highlighted de-anchored inflation expectations, persistent price pressures from a tight labour market, and risks tied to U.S. tariff moves and Brazil’s fiscal stance. While growth indicators show moderation, activity remains stronger than anticipated. Headline and core inflation both remain above target, keeping risks tilted in both directions.

PBOC sets USD/ CNY reference rate for today at 7.1085 (vs. estimate at 7.1113)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 487bn yuan via 7-day reverse repos at 1.40%

- net 195bn yuan injection

Australia’s Job Report Shows Weakness in August

Australia’s unemployment rate held at 4.2% in August, matching expectations, but underlying details showed weakness.

Employment fell by 5,400 jobs, compared with forecasts for a 22,000 gain. Full-time positions plunged by 40,900 after a strong July, while part-time jobs rose by 35,500. The participation rate slipped to 66.8% from 67%, preventing the jobless rate from rising.

The combination of job losses and weaker participation points to a softer labour market.

Westpac Sees Two RBNZ Cuts in October and November

Westpac now expects the Reserve Bank of New Zealand to accelerate its easing cycle, projecting a 50 basis point cut in October to bring the Official Cash Rate to 2.5%, followed by another 25 basis point cut in November to 2.25%.

The bank cited slowing growth and easing inflation pressures, arguing the central bank has scope for back-to-back moves before year-end.

New Zealand GDP Shrinks More Than Expected in Q2

New Zealand’s economy contracted sharply in the second quarter of 2025, with GDP down 0.9% quarter-on-quarter, far worse than the expected 0.3% decline and following a 0.8% gain in Q1. On an annual basis, GDP fell 0.6%, compared to forecasts for flat growth.

Statistics New Zealand said the decline was broad-based, with activity down in 10 of 16 industries. The Reserve Bank of New Zealand had projected only a 0.3% drop.

Weaker housing demand and uncertainty linked to U.S. tariffs weighed heavily. GDP has now fallen in three of the past five quarters, underscoring a fragile recovery.

Japan Machinery Orders Fall Sharply in July

Japan’s core machinery orders — a key forward-looking gauge of capital spending — posted mixed results in July 2025. Orders fell 4.6% month-on-month, far worse than expectations for a 1.7% decline.

Year-on-year, orders were up 4.9%, slightly below the expected 5.4% gain. The weak monthly data overshadowed the annual increase, highlighting volatility in the series and raising concerns about near-term investment momentum.

Bank of Japan Set to Hold Rates Steady at September Policy Meeting

The Bank of Japan (BOJ) kicked off its September 18–19 meeting, with expectations pointing to no change in policy. According to Nikkei, the central bank will likely leave its overnight call rate fixed at 0.5%, a level held since January’s quarter-point increase. That would mark the fifth straight meeting without an adjustment.

Board members broadly agree it’s too early to tighten further. Markets share that outlook, with attention focused on how U.S. tariffs may hit exporters, wages, and investment. BOJ Deputy Governor Ryozo Himino recently cautioned that tariff risks could be more serious than previously assumed, suggesting the issue deserves closer monitoring.

Market reaction is expected to be muted unless the BOJ signals concern that tariffs could weigh heavily on growth. For Japanese equities, exporters may remain cautious as automakers reassess guidance under tariff pressures.

Crypto Market Pulse

Crypto Market Today: Bitcoin, Ethereum, XRP Push Higher on Fed Easing

Bitcoin (BTC) climbed above $117,000 on Thursday, extending gains after the U.S. Federal Reserve’s rate cut decision and dovish dot plot. Ethereum (ETH) held steady near $4,600, while Ripple’s XRP continued its upward push, aiming at the $3.66 peak.

Fed Policy Fuels Risk Appetite

The Fed trimmed rates by 25 basis points on Wednesday, lowering the benchmark to 4.00–4.25%. The decision, supported by 11 out of 12 FOMC members, came amid signs of a softer labour market and higher unemployment.

Markets reacted positively to the prospect of further cuts, as the dot plot showed expectations of easing at each remaining meeting in 2025. The shift has revived demand for risk assets, with crypto leading the charge.

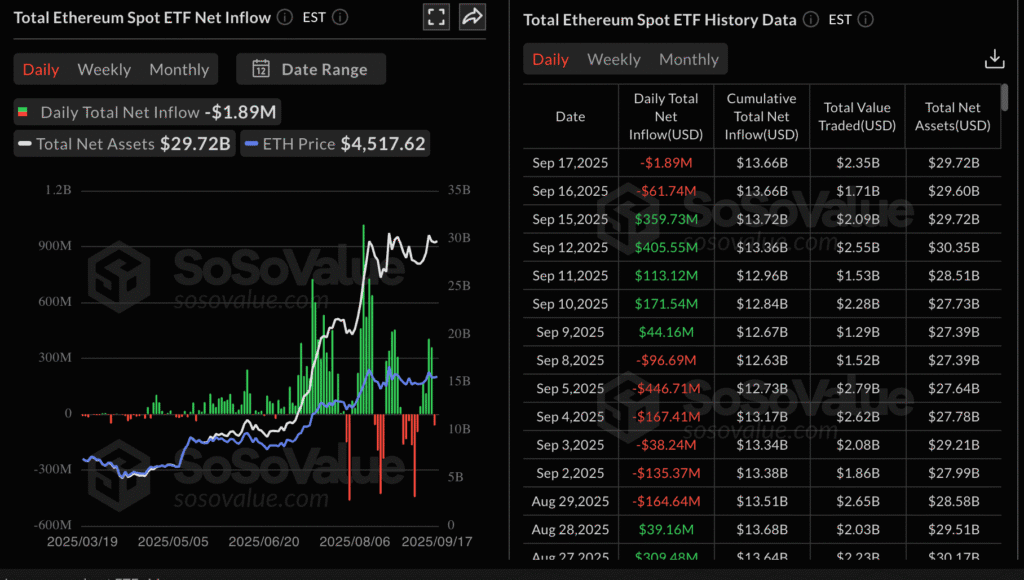

Ethereum Eyes $5K Level

ETH is pressing against a long-standing trendline resistance dating back to August 24, when it reached its $4,956 record high. Key moving averages back the move:

- 50-day EMA: $4,229

- 100-day EMA: $3,786

- 200-day EMA: $3,327

The RSI sits at 57, signaling room for further upside before overbought conditions set in. A break above $4,800–$4,956 would set the stage for a push beyond the $5,000 psychological barrier.

ETF flows remain a concern, however. Ethereum spot ETFs saw $1.89 million in outflows on Wednesday, extending the previous day’s decline. If institutions continue to cut exposure, ETH could dip back below $4,229 before regaining momentum.

Pi Network Holds Steady in Consolidation as Upgrade Progresses

Pi Network’s recent downtrend has shifted into sideways action, with the price holding in a narrow range above $0.3500 on Thursday. The consolidation comes after a descending channel breakout that failed to deliver momentum, leaving traders waiting for the next directional move.

Meanwhile, the network continues its migration to Stellar protocol version 23.

Testnet 1 Migrates to Version 23

Pi Network confirmed that Testnet 1 has successfully transitioned from Stellar protocol version 19 to version 23. The focus now turns to upgrading Testnet 2, a step that will precede the Mainnet rollout of smart contracts.

The upgrade is expected to introduce new functionality, but communication from the core team has been limited, leaving the community uncertain. Developers also warned that planned outages could occur during the process.

Despite the progress, sentiment has not shifted significantly, with PI still trading flat near $0.3500. The Testnet 2 upgrade, however, could serve as a catalyst, bringing the Mainnet closer to unlocking smart contract capabilities.

Meme Coins Bounce: Dogecoin, Shiba Inu, Pepe Regain Traction

Speculative favourites Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) staged a recovery on Thursday, buoyed by fresh inflows into derivatives markets. The Fed’s rate cut has sparked renewed risk appetite, with meme coins drawing traders back in.

Derivatives Flow Signals Shift

CoinGlass data shows open interest rose across the three tokens:

- DOGE: +3% to $5.55B

- SHIB: +5% to $246M

- PEPE: +7% to $784M

The uptick points to a revival of bullish sentiment, often a precursor to sharp rallies in speculative corners of the market.

Dogecoin Targets $0.30

DOGE rose 4.67% on Wednesday and held gains on Thursday, bouncing off a trendline support connecting September 9 and 17 lows. Resistance sits near $0.3146, with RSI at 63 and MACD signaling renewed upside momentum. A drop below the 50-EMA at $0.2647 could drag the token toward the 100-EMA at $0.2517.

Shiba Inu Tests Pivot Resistance

SHIB has extended its uptrend for a third day, trading near $0.00001364. A decisive close above this pivot would open the door to $0.00001488. RSI at 58 and a bullish MACD cross strengthen the outlook, though a pullback to the 200-EMA at $0.00001293 remains possible if resistance holds.

Pepe Holds Above $0.00001000

PEPE gained over 1%, holding above the $0.00001000 level and eyeing $0.00001266, last tested Saturday. RSI at 63 and positive MACD momentum suggest further upside, though overbought conditions are approaching.

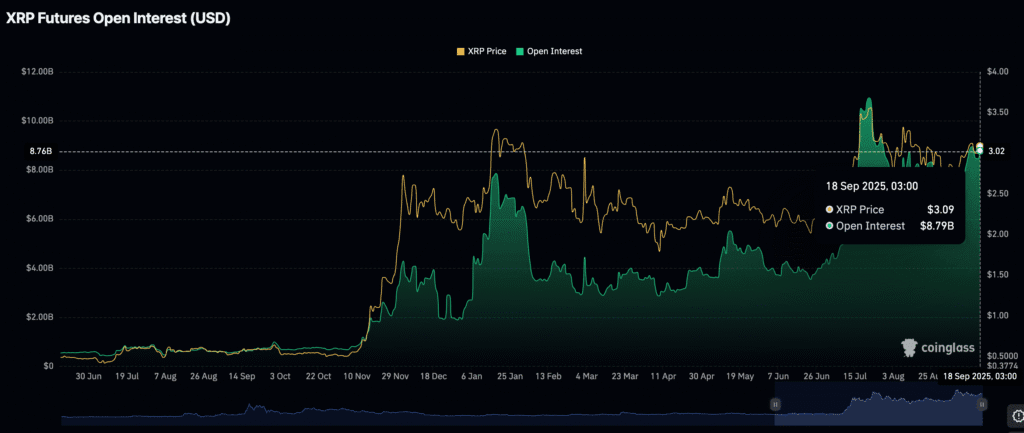

XRP Gains Above $3.12 as Ripple Strikes New Partnerships

XRP traded higher on Thursday, climbing past $3.12 and targeting its $3.66 all-time high. The move follows the Fed’s 25bp rate cut, which has boosted risk sentiment across markets.

Ripple Teams with DBS and Franklin Templeton

Ripple has announced a partnership with DBS Bank and Franklin Templeton to launch tokenized money market fund (MMF) trading. Under the plan, DBS Digital Exchange will list Ripple’s RLUSD stablecoin alongside Franklin Templeton’s sgBENJI token, representing its Onchain US Dollar Short-Term MMF.

The setup allows clients to swap RLUSD for sgBENJI quickly, enabling portfolio rebalancing while preserving yield. Franklin Templeton’s Roger Bayston highlighted the initiative as a step toward broader digital asset adoption.

Ripple noted that 87% of institutional investors plan to allocate to digital assets in 2025, underscoring the growing appeal of tokenized finance.

Futures Data Supports Bullish Case

XRP open interest in futures markets rose to $8.79 billion on Thursday, up from $7.37 billion earlier this month. Rising OI signals increasing trader participation and confidence in further gains.

As long as sentiment remains risk-on, the path of least resistance for XRP remains higher.

SEC Approves New Rules for Spot Crypto ETFs

The U.S. Securities and Exchange Commission voted to allow exchanges including NYSE, Nasdaq, and Cboe to list spot cryptocurrency ETFs under generic standards, slashing approval times from more than 240 days to about 75.

The rule change ends a decade-long case-by-case review process since the first Bitcoin ETF application in 2013. Dozens of new ETFs could launch, potentially covering tokens such as Solana, XRP, and Dogecoin. The first listings may appear as early as October.

The move comes amid Trump administration efforts to create a more crypto-friendly regulatory framework, contrasting with the slower approach under President Biden. Industry participants welcomed the decision but stressed that firms still need to finalize legal, marketing, and infrastructure work.

Golden Trump Statue with Bitcoin Appears Outside Capitol

On Tuesday, a 12-foot golden statue of former President Donald Trump holding a Bitcoin was erected outside the U.S. Capitol, just ahead of the Federal Reserve’s policy announcement. The temporary installation, located on 3rd Street, was backed by a group of crypto investors.

Organizers said the artwork was designed to provoke debate over the role of digital currencies and U.S. monetary policy. Spokesperson Hichem Zaghdoudi said the piece symbolizes the intersection of politics and financial innovation. With the Fed shaping the policy landscape, he added, the statue is intended to prompt reflection on cryptocurrency’s growing influence.

The Day’s Takeaway

North America

S&P 500 Marks Record Close, Russell 2000 Leads

US equities finished higher on Thursday, with the S&P 500 hitting a fresh record shortly after the open before fading slightly. By the close, all three major benchmarks had logged new record highs.

- S&P 500: +0.5%

- Nasdaq Composite: +1.0%

- Dow Jones Industrial Average: +0.3%

- Russell 2000: +2.4%

The Russell 2000 broke through its 2024 peak and is now pressing against its 2021 all-time high, underscoring renewed appetite for small-cap stocks amid the broader rally.

US Initial Jobless Claims Beat Forecasts

Initial claims came in at 231K, below the 240K expected. Continuing claims also surprised to the downside at 1.92M versus 1.95M expected. Although the prior week’s data was revised slightly higher, fraudulent filings in Texas had distorted that spike, leaving the broader labor market picture resilient.

Philadelphia Fed Index Surges in September

The Philadelphia Fed manufacturing index jumped to +23.2, far stronger than the +2.5 expected and the -0.3 prior.

Key components:

- Employment: 5.6 (vs 5.9 prior)

- Prices paid: 46.8 (vs 66.8 prior)

- New orders: 12.4 (vs -1.9 prior)

- Shipments: 26.1 (vs 4.5 prior)

- Unfilled orders: -6.6 (vs -16.8 prior)

- Inventories: 15.0 (vs -6.2 prior)

Forward outlook climbed to 31.5 (vs 25.0 prior), though capex expectations dropped to 12.5 from 38.4.

Nomura Revises Fed Rate Cut Outlook

Nomura now expects two additional Fed rate cuts this year — in October and December — compared to its prior forecast of just one in December. For 2026, the firm projects three more 25 bps reductions (March, June, September). Chair Powell called the recent move a “risk management” cut, highlighting labor market risks while noting inflationary pressures have eased. Markets are pricing in ~44 bps of cuts by year-end.

US 30-Year Mortgage Rate Falls to One-Year Low

The average 30-year fixed mortgage rate slipped to 6.26% for the week ending September 18, down from 6.35% the prior week. According to Freddie Mac, this marks the lowest level since October 2024.

US 10-Year TIPS Auction Disappoints

The Treasury auctioned $19B in 10-year TIPS at a high yield of 1.734%, well above the 1.684% when-issued level, creating a 5 bps tail. Bid-to-cover came in at 2.2, with indirect bidders taking 56.08%, directs 26.12%, and dealers 17.79%. The auction was viewed as soft.

Commodities

Gold Slips After Upbeat US Data

Gold fell 0.39% to $3,643 after touching $3,673, as upbeat labor and manufacturing reports offset the bullish impact of the Fed’s 25 bps cut. Profit-taking also weighed. The Fed decision was not unanimous, with Stephen Miran backing a larger 50 bps reduction. Despite the dip, easing expectations and a 254% YoY surge in Swiss gold exports to China support the long-term bullish case.

Silver Holds Steady After Fed-Driven Dip

Silver recovered modestly, trading at $41.81 after falling to $41.20 on Wednesday, its lowest in five sessions. Support sits at $41.50 (reinforced by the 50-SMA), with resistance at $42.16–42.50. A retest of $42.97 or the psychological $43.50 remains possible. RSI stands at 47, reflecting neutral momentum.

Crude Oil Stocks Show Sharp Draw

EIA reported a 9.3M barrel decline in US crude inventories, far steeper than API’s 3.4M estimate. Exports surged by 2.5M bpd to 5.3M bpd, while imports slipped 579K bpd to 5.7M bpd. Cushing stocks fell by 296K barrels. Gasoline supplies dropped 2.3M barrels, while distillates jumped 4M barrels, the highest since January, alleviating diesel shortage concerns.

Copper Inventories Rise in US Warehouses

LME data revealed a 175-tonne increase in US copper stockpiles, the first since December 2023. Commerzbank attributed this to pricing distortions from tariff announcements, later clarified to target only semi-finished goods. China’s refined copper output rose 15% YoY to 1.3Mt in August, with zinc output up 23% YoY (651kt) and lead up 3.7% YoY (667kt).

Europe

Swiss Trade Surplus Narrows in August

Switzerland’s trade surplus fell to CHF 4.01B in August, down from CHF 4.62B in July (revised), per the Federal Statistical Office.

Eurozone Current Account Surplus Declines

The Eurozone’s July current account surplus dropped to €27.7B from €35.8B. Goods (€25B), services (€12B), and primary income (€7B) posted surpluses, offset by a €16B deficit in secondary income.

Bank of England Holds Rates at 4.00%

The BOE left its policy rate unchanged at 4.00%, with a 2–7–0 vote. Dhingra and Taylor supported a cut. Officials flagged progress in disinflation, though wage growth remains stronger than price declines. Risks are tilted toward higher inflation but also include downside growth risks. Governor Bailey added that more cuts are likely, though the timing is uncertain.

Rest of the World

Trump Suggests Oil Pressure Could End Russia’s War

Donald Trump argued that if crude prices fall significantly, President Putin “will have no choice but to end the war,” framing oil revenue as a key lever. His comments highlight ongoing pressure on Russian energy flows, though benchmarks are difficult to disentangle from global markets.

EU Mulls Faster Phase-Out of Russian LNG

The European Commission is considering accelerating its phase-out of Russian LNG imports, potentially before 2027. The measure could be included in the next sanctions package, according to Bloomberg, and reflects both Trump’s lobbying efforts and Europe’s long-term strategy to curb reliance on Russian energy.

Crypto

Pi Network Consolidates as Upgrade Advances

Pi held steady near $0.3500 on Thursday, moving sideways after failing to build momentum from a channel breakout. Testnet 1 has successfully migrated to Stellar protocol v23, with Testnet 2 next in line before Mainnet smart contract rollout. Developers warned of potential outages during the process, while community sentiment remains cautious.

Bitcoin, Ethereum, and XRP Extend Gains Post-Fed

- Bitcoin (BTC): Broke above $117,000 on dovish Fed momentum.

- Ethereum (ETH): Consolidated near $4,600, pressing $4,800–$4,956 resistance. Supportive EMAs remain intact, though ETFs saw $1.89M in outflows.

- XRP: Pushed above $3.12, targeting its $3.66 ATH. Ripple announced a partnership with DBS Bank and Franklin Templeton to offer tokenized MMF trading, listing RLUSD alongside Franklin’s sgBENJI token on DBS Digital Exchange. XRP futures open interest rose to $8.79B, reinforcing bullish sentiment.

Meme Coins Bounce With Derivatives Boost

- Dogecoin (DOGE): +4.67%, bouncing off trendline support, targeting $0.3146. RSI at 63, MACD bullish.

- Shiba Inu (SHIB): Hovering near $0.00001364, eyeing $0.00001488 pivot resistance. RSI at 58, MACD supportive.

- Pepe (PEPE): +1%, holding above $0.00001000 and aiming for $0.00001266. RSI at 63, momentum positive.

CoinGlass OI data showed DOGE +3%, SHIB +5%, and PEPE +7%, reflecting revived speculative appetite.