North America News

Wall Street Ends Mixed Post-Fed: Dow Slips, Tech Holds Firm, Small Caps Rally

U.S. stocks closed with mixed results on Wednesday following the Fed’s decision to hold rates steady and Powell’s balanced-but-cautious comments in the press conference. The Dow pulled back slightly, the S&P 500 ended flat, and the NASDAQ inched higher. Small caps, led by the Russell 2000, posted a stronger move to the upside.

Fed Wrap-Up:

- Powell reaffirmed confidence in the economy and the labor market.

- Tariffs were flagged as a top risk to near-term inflation.

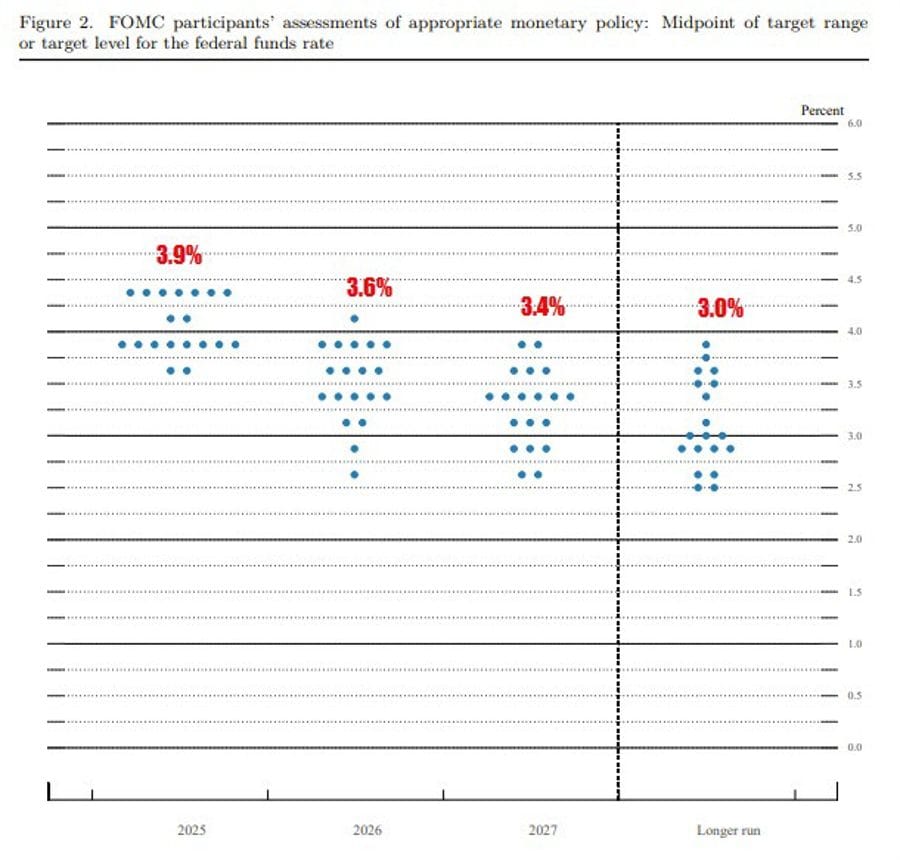

- While the dot plot still points to two cuts in 2025, more policymakers now forecast no cuts at all—7 versus 4 in March—underscoring divisions inside the Fed.

Closing Stats:

- Dow Jones: -44.14 points (-0.10%) to 42,171.66

- S&P 500: -1.85 points (-0.03%) to 5,980.87

- NASDAQ Composite: +25.18 points (+0.13%) to 19,546.27

- Russell 2000: +11.00 points (+0.52%) to 1,112.96

Top Gainers:

- SoFi Technologies +6.51%

- Robinhood +4.54%

- ARK Innovation ETF +4.47%

- Intel +3.32%

- Super Micro Computer +3.15%

- Rivian +2.84%

- Tesla +1.84%

- JPMorgan +1.66%

- NVIDIA +0.94%

- Apple +0.48%

Notable Decliners:

- Mastercard -5.38%

- Visa -4.89%

- PayPal -2.97%

- Lockheed Martin -2.24%

- Alphabet -1.50%

- Amazon -1.06%

- Salesforce -1.08%

- Bitcoin Futures -0.71%

- Ethereum (ETH/USD) -0.87%

Key Theme:

While tech and financials helped buoy broader indexes, the heaviest pressure was on payment processors, with both Mastercard and Visa tumbling sharply. Ongoing concerns about global rates and potential regulation may be driving the retreat in fintech.

With Powell signaling a steady hand and emphasizing caution over conviction, traders may continue to recalibrate expectations through the summer.

Fed’s June Dot Plot Reveals Shift: Fewer Cuts, Higher Inflation Expectations

The Federal Open Market Committee’s updated dot plot and economic projections show that two rate cuts remain the median outlook for 2025, but the path forward is now cloudier as inflation pressures prove stickier than expected.

Here’s how the forecast has shifted:

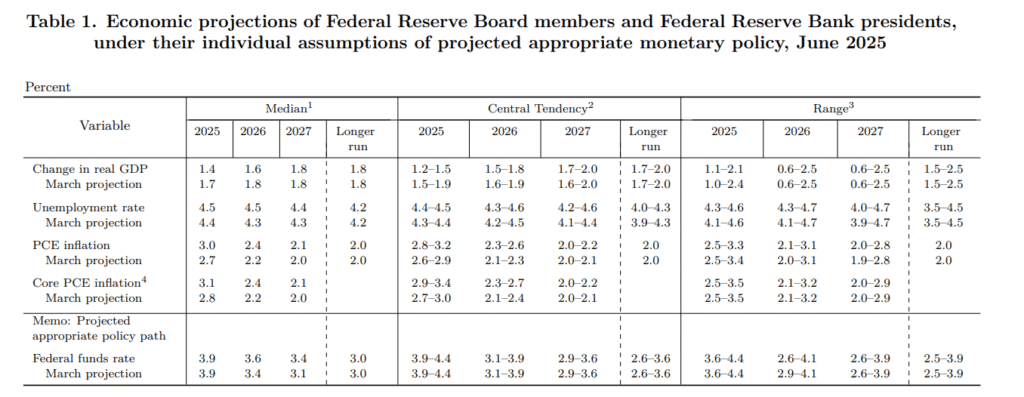

GDP

- March 2025 forecast: 1.7%

- June update: 1.4%

→ Indicates a 0.3 percentage point downgrade, signaling slower-than-expected momentum.

PCE Inflation

- March projection: 2.7% headline / 2.8% core

- June update: 3.0% headline / 3.1% core

→ A 0.3% increase across both measures, largely driven by tariff effects and stubborn service sector prices.

Unemployment

- March 2025: 4.4%

- June update: 4.5%

The Fed kept its year-end 2025 policy rate target at 3.9%, but raised projections for the following years:

- 2026 rate: now 3.6%, up 0.2% from March

- 2027 rate: now 3.4%, up from 3.1%

Further out, the Fed sees 2026 GDP also taking a hit, revised down to 1.6% from 1.8%. Unemployment in 2026 is now expected to remain at 4.5%, compared to the 4.3% forecast in March.

Inflation in 2026 is projected at 2.4% for both the headline and core measures—up 0.2%—and slightly above the 2% target in 2027 at 2.1%.

This new trajectory makes clear that the Fed is bracing for persistent inflation and a slower glide path back to price stability. Rate cuts remain on the table, but the bar has been raised.

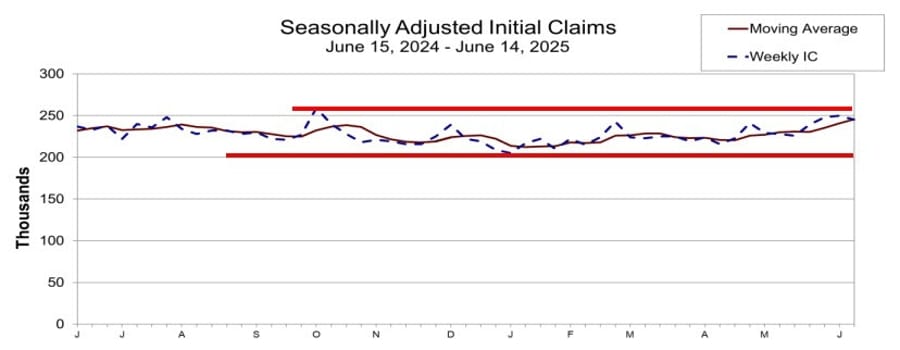

US Jobless Claims Hold at 245K, But Continuing Claims Stay Elevated

The latest U.S. initial jobless claims data came in at 245,000, matching estimates, while the prior week was revised upward to 250,000—the highest since October 2024.

- 4-week average for initial claims: 245.5K (up from 240.25K)

- Continuing claims: 1.945M vs. 1.932M expected (prior revised to 1.951M)

- 4-week average for continuing claims: 1.926M

This marks the fourth consecutive week with continuing claims above 1.9 million. The data was released one day early due to the Juneteenth holiday, during which U.S. markets and federal offices will be closed.

Despite the increase, initial claims remain within the familiar volatility range observed over the past year.

US Housing Starts Tumble to Lowest Since 2020

Housing starts in the U.S. fell to 1.256 million in May, missing forecasts for 1.357 million and marking a 9.8% monthly drop—the lowest since the early pandemic slump.

Building permits also declined to 1.393 million, compared to expectations of 1.428 million.

The pullback comes even as mortgage rates fell to their lowest levels since April. Yet mortgage applications remain weak, and homebuilder sentiment is near crisis-era lows.

Lennar shares have nearly halved since peaking in July, and with NAHB sentiment readings scraping bottom, the outlook for U.S. housing looks bleak despite broader optimism in equities.

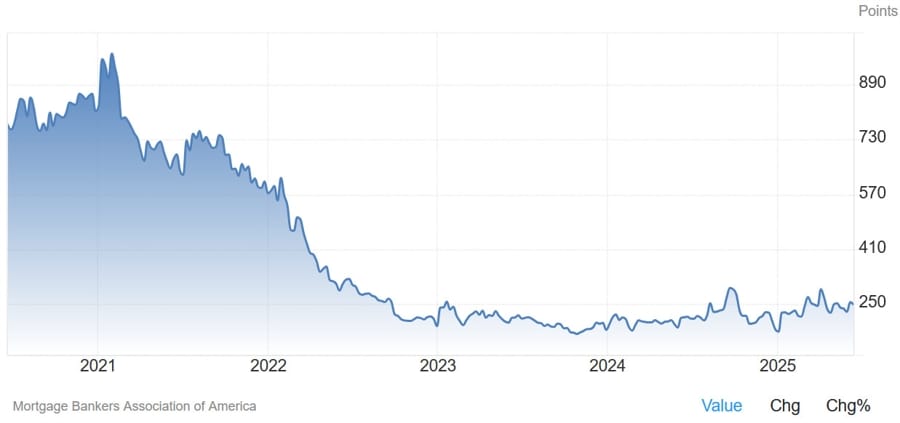

US Mortgage Activity Slides as Applications Drop 2.6%

Mortgage demand in the U.S. fell during the week ending June 13, with the MBA market index dropping to 248.1 from 254.6 a week earlier.

Breakdown of the week’s figures:

- Purchase Index: 165.8 (down from 170.9)

- Refinance Index: 692.4 (down from 707.4)

- 30-Year Fixed Rate: 6.84%, easing slightly from 6.93%

Despite lower mortgage rates, demand is still struggling—mirroring broader weakness in the housing market.

U.S. Treasury Unveils $183B in Note Auctions Next Week

The U.S. Treasury has scheduled three coupon auctions for next week:

- $69B in 2-year notes on June 24

- $70B in 5-year notes on June 25

- $44B in 7-year notes on June 26

All securities will settle on June 30.

These sales come amid ongoing scrutiny over rising debt servicing costs and shifting demand for short- to mid-term U.S. government paper.

Fed Holds Rates Steady, Keeps Options Open Amid Sticky Inflation and Growth Risks

The Federal Reserve opted to leave its benchmark interest rate unchanged on June 18, maintaining the federal funds target range at 4.25%–4.50%, a decision that was fully anticipated by markets. The central bank’s accompanying statement reaffirmed its assessment that the economy is still growing at a “solid pace,” and that the labor market remains tight with unemployment low.

What’s changed?

The Fed’s language on economic outlook saw a slight but notable adjustment: it now says uncertainty around the economy has diminished, though it “remains elevated.” This contrasts with its previous stance that risks had increased. In another subtle shift, the Fed added that it now “judges the risks of higher unemployment and higher inflation have risen,” hinting at a growing concern about the dual-mandate trade-offs.

No dissents were recorded in the vote, indicating strong consensus around the hold decision.

Updated Dot Plot & Economic Forecasts:

- Year-end 2025 rate projection: 3.9% (unchanged, though supported by just a slim majority)

- Year-end 2026: revised up to 3.6% from 3.4%

- Year-end 2027: now 3.0%, a slight drop from 3.1%

On the macro side, the Fed has lifted its inflation projections across the board:

- 2025 PCE inflation: now seen at 3.0% (up from 2.7%)

- 2025 Core PCE: forecast at 3.1% (up from 2.8%)

- 2025 GDP: downgraded to 1.4% from 1.7%

- 2025 unemployment: nudged up to 4.5% from 4.4%

The Fed’s own projections suggest they don’t expect to hit the 2% inflation target even by 2026 or 2027, reflecting a more cautious outlook than before. Growth is seen slowing next year as well, while inflation remains above target—a combination that will likely make future rate decisions increasingly data-sensitive.

Powell Cautious in Presser: Tariffs, Inflation, and Employment Keep Fed in Wait-and-See Mode

In his post-decision press conference, Fed Chair Jerome Powell presented a nuanced, cautious message. While he noted recent progress on inflation and acknowledged a resilient economy, Powell emphasized the risks that remain—particularly tariff-driven inflation and pockets of labor market softness.

Here’s a breakdown of Powell’s comments by topic:

Inflation

- “We’ve seen three encouraging inflation prints—but that’s just a start.”

- Goods inflation is on the rise again; core services are improving slowly.

- Tariffs are expected to add pressure in the coming months.

- Powell stressed that confidence in disinflation is not yet sufficient.

- “We are committed to restoring 2% inflation on a sustained basis.”

Tariffs

- “Tariffs don’t hit instantly, but the impact is starting to surface.”

- Businesses plan to pass costs on to consumers—adding to near-term price pressures.

- Powell admitted the Fed is adapting “in real time” to tariff changes, noting that forecasting the impact remains highly uncertain.

Employment

- Labor market is “cooling at the margin,” but no sign of widespread weakness.

- Layoffs remain low, but job seekers re-entering the market are struggling more.

- “No compelling reason” to cut rates based solely on labor data.

Policy Path

- “We’re in a good spot. It’s not overly tight, but modestly restrictive.”

- Diverging views on the dot plot reflect economic uncertainty, not policy disunity.

- Powell emphasized that the Fed is “patient,” and future decisions will depend on incoming data, particularly inflation.

Economic Resilience

- “The economy continues to surprise to the upside.”

- He feels more optimistic than he did three months ago, crediting business and household strength.

Sentiment and Uncertainty

- Sentiment is recovering from April’s lows; uncertainty has eased but not disappeared.

- “We’ve improved our confidence level—but we’re not there yet.”

Data Quality

- Powell made a rare appeal for reliable economic data, calling it “a huge public good.”

- While the Fed can work with what it has, data integrity is essential to long-term policy success.

Other Issues

- Powell downplayed any direct policy discussion about Trump’s proposed tariff plan, calling it “still evolving.”

- He acknowledged that the housing market remains structurally tight, calling it a long-term challenge.

Overall, Powell struck a tone of measured optimism, balancing progress with caution. His message: The Fed isn’t ready to pivot yet—but it’s closer than it was.

U.S. Regulators Eye Changes to Capital Rules to Ease Treasury Market Pressure

U.S. financial regulators are reviewing possible adjustments to the enhanced supplementary leverage ratio (eSLR) to improve liquidity in the $29 trillion Treasury market. The change would allow banks to hold more Treasuries without additional capital charges.

Sources indicate regulators are considering reducing the capital requirement for bank holding companies to between 3.5% and 4.5%, down from 5%. Operating subsidiaries could see a drop from the current 6% to the same range.

The Fed, FDIC, and OCC are leading the review, aiming to boost government debt market efficiency while maintaining banking system safety.

BlackRock CIO Reider says on the FOMC: “There is no reason why you wouldn’t just end QT”

- Federal Open Market Committee (FOMC) statement due Wednesday

- Trump tariffs so far haven’t flowed into U.S. inflation data in a big way

- Federal Reserve will maintain its wait-and-see approach on interest rates

- Over the next two months, the Fed may get a “very good reading” on the impact of tariffs on inflation

- companies have been absorbing the levies, may soon face a decision on whether to start passing them through to consumers

- along with some further “softening” in the labor market, could set the Fed up to potentially cut its benchmark rate at its policy meeting in September

- said the Fed could be thinking about when to stop its quantitative-tightening program, or the shrinking of its balance sheet, after deciding in March to slow the pace of QT

- “There is no reason why you wouldn’t just end QT”

BoC’s Macklem: Trade Deal Could Pave Way for Tariff Rollback

Bank of Canada Governor Tiff Macklem struck an optimistic tone, stating that a new U.S.–Canada trade deal may lead to tariff removal, but added that underlying inflation could complicate any monetary easing.

Key points from Macklem:

- A finalized deal could soften inflation pressures from cross-border tariffs

- Still too early to commit to cuts if core inflation remains firm

- Rate cuts remain an option if trade uncertainty escalates and cost pressure eases

- Final domestic demand has held up, but businesses and households remain cautious

The BoC remains in “wait-and-see” mode, with trade talks and U.S. job data driving the next moves.

LNG Canada May Deliver First Output This Week at 25% Capacity

Canada’s Kitimat-based LNG Canada project may begin production this week, Reuters reports. Initial operations are expected to run at around 25% capacity, marking Canada’s entry into global LNG exports.

Key project details:

- Located in Kitimat, BC; led by Shell with backing from PetroChina, Petronas, Mitsubishi, and KOGAS

- Total investment: $40 billion

- Capacity: 14M tonnes/year (2 trains), with room for expansion

- Power: Low-carbon hydroelectric

- Delivery pipeline: Coastal GasLink

The facility’s west coast location offers a shorter shipping route to Asia than U.S. Gulf Coast terminals. With construction started in 2019, LNG Canada positions itself as a cleaner, more stable LNG source amid heightened energy security concerns.

Commodities News

Gold Stays Near $3,390 as Fed Keeps Rates Steady, Eyes Two Cuts in 2025

Gold prices hovered just under $3,390 following the Federal Reserve’s June 18 decision to leave interest rates unchanged at 5.25%–5.50%, as anticipated. While the central bank offered no immediate policy shifts, the updated Summary of Economic Projections (SEP) signaled that Fed officials still expect two rate cuts in 2025—50 basis points in total.

At the time of writing, spot gold was little changed, trading down just 0.08% as markets absorbed the Fed’s slightly dovish stance despite upward revisions in inflation estimates.

The FOMC statement reiterated familiar language, describing the U.S. economy as growing at a “solid” pace, with the unemployment rate still low and labor market conditions stable. The Committee confirmed it would continue shrinking its balance sheet by allowing Treasuries to roll off, while remaining vigilant about risks to both sides of its dual mandate.

SEP Highlights:

- 2025 GDP forecast trimmed from 1.7% to 1.4%

- Unemployment ticked up slightly to 4.5%

- Core PCE inflation revised up from 2.8% to 3.1%

- Fed funds rate for 2025 held steady at 3.9%

These adjustments reflect the Fed’s cautious view on inflation persistence, especially given the impact of tariffs. But for gold, the tone wasn’t enough to push the metal meaningfully higher or lower. Traders appeared to be holding their positions ahead of Fed Chair Powell’s press conference for more clarity.

Key levels to watch:

- Immediate resistance sits at $3,400, followed by the June 16 high of $3,452

- A further break could challenge the $3,500 psychological level

- Support rests at $3,350, with deeper floors at the 50-day SMA ($3,301) and the May 29 low of $3,245

For now, gold remains rangebound, with macro themes—including Fed policy expectations and inflation outlook—likely to dictate the next directional move.

Standard Chartered Warns Oil Shock Would Cut Global Growth

A fresh report from Standard Chartered warns that oil price spikes—especially past $90/barrel Brent—pose a greater risk to global GDP than price drops do.

Key points:

- A 10% increase in oil prices could shave 0.1–0.2 percentage points off global growth

- Inflation impact felt within one quarter via headline CPI

- Vulnerable economies include Jordan, South Africa, Thailand

- More resilient: UAE, Switzerland, Peru

The bank stresses that headline inflation is more reactive than core inflation due to the energy weighting in CPI baskets, but central bank credibility helps anchor expectations.

Crude Stocks Plunge by Over 11M Barrels, But Oil Prices Stay Soft

The latest EIA report revealed a massive drawdown of -11.473 million barrels in U.S. crude oil inventories—well beyond the expected -1.794 million.

Other figures:

- Gasoline: +0.209M vs. +0.627M expected

- Distillates: +0.514M vs. +0.440M expected

- Cushing: -0.995M (last week: -0.403M)

Despite the bullish inventory draw, WTI crude slipped to $72.23, with intraday lows hitting $71.48, suggesting broader market caution is keeping oil bulls in check.

Iron Ore Dips Below $93 as China’s Property Market Slows

Iron ore prices slid below $93/ton, with ING analysts citing persistent weakness in China’s real estate sector—the largest driver of steel demand.

- New home prices in 70 Chinese cities declined 0.2% in April, the steepest fall in 7 months

- New housing starts remain in decline

- Steel production in May fell nearly 7% y/y

Government efforts are focused on clearing unsold inventory rather than stimulating new construction, which continues to weigh on raw material demand.

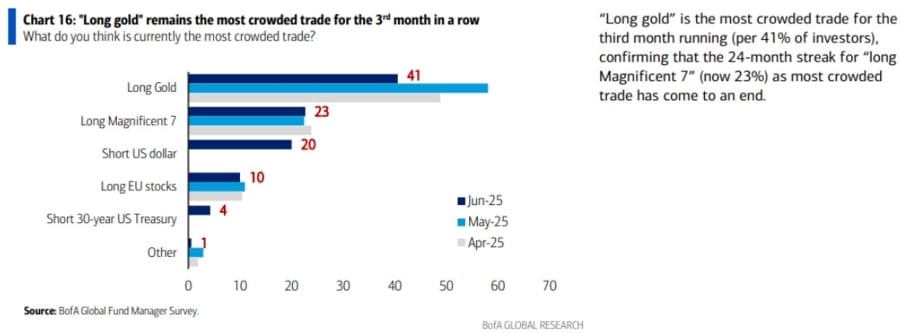

Gold Remains Top Pick Among Fund Managers for Third Straight Month

According to the latest Bank of America Global Fund Manager Survey, being “long gold” is still the most crowded trade—for the third consecutive month.

Other crowded positions:

- Long “Mag 7” tech stocks

- Short U.S. Dollar

The sustained bullish tilt toward gold reflects persistent stagflation fears and geopolitical uncertainty, while the bearish stance on the dollar is increasingly precarious, especially since the greenback has held its ground since April.

The survey suggests that investors remain defensively positioned as macro risks linger into the second half of the year.

Qatar Delays LNG Shipments Amid Strait of Hormuz Tensions

Qatar has told LNG carriers to wait before entering the Strait of Hormuz, adding a fresh layer of uncertainty to global gas markets, ING reports.

- Qatar accounts for ~20% of global LNG exports

- Any bottleneck at the Strait, which handles nearly all of Qatar’s outbound LNG, would immediately strain the market

So far, supply remains balanced, but a prolonged disruption would force Asian and European buyers into direct competition, driving up prices.

Former Iranian Minister Suggests Hormuz Shutdown to Block U.S. Involvement

Ehsan Khandozi, Iran’s former Economy Minister, floated a bold strategy on X: impose Iranian control over the Strait of Hormuz for 100 days to prevent further U.S. engagement in the conflict.

In his words: “Starting tomorrow, no oil or LNG tankers should pass through without Iran’s approval.”

The Strait, which channels 20% of global oil exports, is the world’s most critical energy chokepoint. A move to restrict access would likely ignite a spike in crude prices, hammer global growth, and trigger a broad market selloff. While Khandozi is no longer in government, the post signals a potentially serious option under review.

Oil Markets Brace for Iranian Retaliation If U.S. Joins Conflict

Oil prices are being supported by growing fears that Iran could retaliate against U.S. involvement in regional strikes. Sources indicate that Tehran’s response could involve:

- Deploying sea mines in the Strait of Hormuz

- Targeting U.S. military bases in the Gulf

Such actions would pose a serious threat to global oil flows through one of the world’s most critical maritime chokepoints, adding geopolitical risk premiums to energy markets.

Europe News

European Markets End Mixed: DAX and CAC Slip, FTSE Gains

European equity markets wrapped up the session with mixed results:

- German DAX: -0.39%

- France’s CAC 40: -0.36%

- UK FTSE 100: +0.11%

- Spain’s Ibex: +0.08%

- Italy’s FTSE MIB: +0.08%

Sectors like industrials and consumer discretionary underperformed, while defensive names helped keep the broader indices stable.

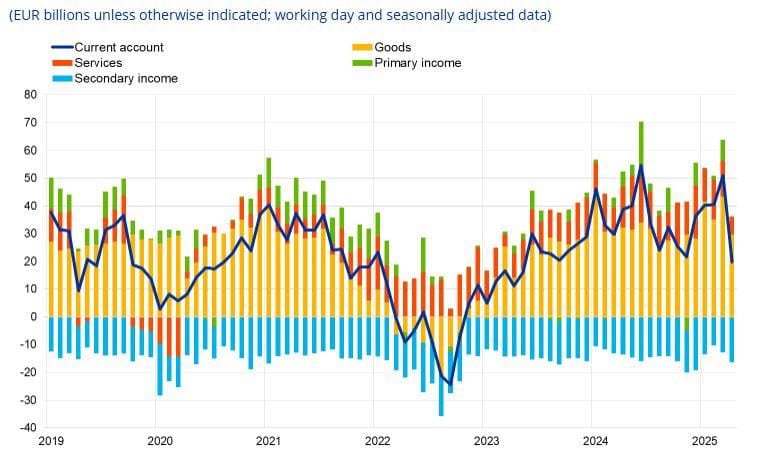

Eurozone Current Account Narrows Sharply in April Amid Export Pullback

The Eurozone posted a €19.3 billion surplus in April, according to ECB data released June 18, marking a steep decline from the €60.1 billion reported in March.

The seasonally adjusted figure came in at €50.9 billion for March. April’s slide is largely attributed to weaker goods exports, which had surged in March as exporters front-loaded shipments ahead of potential U.S. tariff changes.

Breakdown of April components:

- Goods surplus: €30 billion

- Services surplus: €7 billion

- Primary income: Flat

- Secondary income: Deficit of €16 billion

The drop underscores trade fragility amid global uncertainty and shifting geopolitical pressures.

Eurozone Inflation Confirmed at 1.9% in May as Core Price Growth Cools

Final Eurostat data for May confirms headline inflation at 1.9% year-over-year, matching the preliminary print and down from 2.2% in April.

Core inflation also held steady at 2.4% y/y, a decline from 2.7% in the prior month.

The continued cooling in inflation gives the European Central Bank some breathing room heading into the summer. However, the market response has been cautious: current pricing reflects only ~21 basis points of rate cuts by the end of 2025.

UK Confirms Auto Tariff Deal With U.S. to Kick In by Month-End

British officials say a 10% auto tariff agreement with the United States will take effect by the end of June. The deal avoids the previously floated 25% rate and represents partial progress in broader U.S.-UK trade talks.

However, negotiations remain stalled on the steel and aluminum front. Trump has delayed a potential doubling of current 25% tariffs on those goods until July 9, buying negotiators a few more weeks to reach a resolution.

German Chancellor Expects US-EU Tariff Breakthrough Soon

German Chancellor Friedrich Merz expressed optimism that a resolution to the U.S.-EU tariff dispute could be reached “in the coming days,” though no official deal has been announced yet.

The statement adds momentum to ongoing negotiations amid rising pressure from both European exporters and U.S. importers facing steep duties on industrial goods.

ECB’s Panetta: ECB to Stay Flexible, Decide Meeting by Meeting

- Comments from the ECB policymaker

- ECB Outlook Faces Substantial, Difficult-to-Quantify Risks.

- Risks include US tariffs, Israel-Iran conflict.

- ECB not pre-committing to a defined course on monetary policy

- Macroeconomic risks arise from conflicting signals in US trade policy, recent Iran-Israel conflict

Asia-Pacific & World News

PBOC’s Pan Gongsheng: China to Expand Monetary Tools, Launch e-CNY Center

People’s Bank of China Governor Pan Gongsheng announced several steps to expand the country’s financial infrastructure, including plans for a new e-CNY international operations center in Shanghai.

Key initiatives:

- Accelerating yuan FX futures in coordination with securities regulators

- Building a national transaction reporting system for interbank markets

- Promoting the issuance of offshore bonds and upgrading free trade accounts

- Exploring increased regular SDR issuance and broader allocation

Pan also pointed to progress in tackling shadow banking risk, stating it has been “greatly reduced.” The yuan, now the third most-used currency for payments globally, is positioned for broader international use.

Top Chinese Official: Domestic Consumption Now Leading China’s Growth

A senior Chinese financial regulator emphasized that consumer spending has overtaken other sectors as the primary engine of China’s economic growth. The official underscored China’s position as the world’s top buyer of mobile phones, cars, and home appliances.

Speaking on financial liberalization, the regulator highlighted the benefits of China’s open market for global investors, citing that foreign banks and insurers now hold over 7 trillion yuan in assets within the country.

These upbeat assessments are likely to temper expectations for large-scale stimulus, as policymakers point to underlying economic strength.

China Pledges Stability in Currency and FX Markets, Expands Foreign Investment Measures

China’s State Administration of Foreign Exchange (SAFE) reaffirmed its commitment to keeping the yuan stable at “reasonable and balanced levels.” Officials said they are confident in maintaining orderly foreign exchange operations, even in the face of external volatility.

SAFE noted resilience in exports and highlighted a recent uptick in onshore stock buying. It pledged continued macro-level support, including reforms aimed at improving foreign debt management, refining investor access rules, and enhancing FX business oversight.

Among upcoming initiatives:

- Launching a new FX management policy evaluation mechanism

- Adjusting quotas for qualified domestic institutional investors (QDII)

- Expanding support for foreign trade firms and deepening FX reform

- Enhancing fund supervision for domestically listed companies operating abroad

SAFE also stressed that its ability to manage currency market shocks has improved and that the global balance of payments remains on steady footing.

PBOC sets USD/ CNY mid-point today at 7.1761 (vs. estimate at 7.2027)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 156.3bn yuan via 7-day reverse repos at 1.40%

- 164bn yuan mature today

- net drain 7.7bn yuan

New Zealand Current Account Narrows But Remains in Deficit

New Zealand’s Q1 current account deficit narrowed to NZD -2.324 billion, slightly above forecasts. This is a marked improvement from the previous quarter’s NZD -7.037 billion shortfall.

Key figures:

- Current account-to-GDP: -5.7% (vs. -5.8% expected)

- Annual deficit: NZD -24.662 billion, down from NZD -26.401 billion

While the quarterly gap improved, the overall current account remains in substantial deficit territory.

NZ Consumer Confidence Picks Up Slightly, Remains Fragile

Consumer sentiment in New Zealand improved modestly in Q2, with the Westpac-McDermott Miller index rising to 91.2, up from 89.2 in Q1. However, the reading remains well below the 100 threshold that separates optimism from pessimism.

Analysts described the gain as modest, noting ongoing household uncertainty amid economic headwinds. The mood remains cautious despite a stabilization in confidence levels.

Japanese Manufacturers Turn Cautious Amid Trade Tensions

The June Reuters Tankan survey showed weakening sentiment among Japanese manufacturers. The index slipped to +6, down from May’s +8, with projections for a further drop to +2 in the coming quarter.

Key concerns:

- U.S. auto tariffs and trade uncertainty

- Sluggish demand from China

- Disruptions from rare earth export controls

Non-manufacturing sentiment held steady at +30, supported by strong tourism and IT investment, but is expected to ease to +24 amid rising labor costs and staffing shortages.

Japan’s Exports Decline in May, Machine Orders Fall Sharply

Japan’s export sector shrank for the first time in eight months, with May exports down 1.7% year-over-year, though beating expectations for a steeper 3.7% decline. Imports dropped more sharply by 7.7% y/y.

Regional breakdown:

- Exports to Asia: +0.4%

- To China: -8.8%

- To EU: +4.9%

- To U.S.: -11.1%

The trade deficit came in at -637.6 billion yen, smaller than expected. Adjusted figures showed a deficit of -305.5 billion yen.

Separately, April’s core machine orders—a forward indicator of corporate investment—fell 9.1% MoM but rose 6.6% from a year earlier.

Japan’s Ishiba Backs Cash Aid for Households, Signals Policy Focus at G7

Japanese Prime Minister Ishiba described direct cash payments as the fastest and most effective method to help low-income households deal with rising living costs. He stressed that such aid would directly support consumption, particularly essentials like food and utilities.

During the G7 summit, Ishiba:

- Warned against allowing Iran to develop nuclear weapons

- Reaffirmed cooperation with the U.S. and South Korea on North Korea’s missile program and cyber activities

- Highlighted ongoing but unresolved trade negotiations with the U.S., emphasizing Japan’s intent to defend national interests

- Announced plans to attend the upcoming NATO summit in the Netherlands

Despite the push for a trade breakthrough, differences remain on tariff terms.

Crypto Market Pulse

XRP Eyes $2.65 as Legal Momentum Builds and Fed Risks Subside

Ripple’s XRP token has begun showing signs of life after falling nearly 9% from its local high of $2.34. Trading just above $2.15, XRP is now attempting to establish a new technical base as the broader crypto market absorbs macroeconomic developments and legal headlines.

The broader market has pivoted focus away from Middle East tensions to the Federal Reserve’s rate policy, with most expecting the Fed to keep rates on hold in the 4.25%–4.50% range. That expectation proved accurate, helping risk assets—including crypto—find some footing.

Ripple Makes Legal Headway

Ripple has submitted a supplemental letter to the U.S. Securities and Exchange Commission (SEC) in support of a joint motion seeking an indicative ruling. The filing clarified that neither party is asking Judge Analisa Torres to revisit the original Summary Judgment Order, but rather to acknowledge a mutual agreement on a revised $50 million penalty—down from the $125 million civil fine ordered, and drastically lower than the SEC’s initial $2 billion demand.

Ripple stressed that the agreement doesn’t exempt the firm from securities obligations, but instead reflects a practical resolution aligned with how the SEC has handled similar crypto cases involving Binance and Coinbase.

Ripple concluded that finalizing this indicative ruling would put it “on more even footing” with firms whose cases were dismissed earlier and allow for greater regulatory clarity.

Technical Setup for XRP

XRP is showing signs of a bullish fractal breakout, contingent on support at $2.00 holding firm. If the current support structure holds, bulls may eye a move toward $2.65 as the next target level.

The sentiment has cooled from its recent highs, but traders are watching closely for signals of a shift in momentum. A break below $2.00 would invalidate the current bullish structure, opening the door to deeper downside, but as long as XRP stays above that level, the technical bias is cautiously constructive.

Bitcoin, Ethereum, and XRP Maintain Support Despite Middle East Conflict

Bitcoin (BTC), Ethereum (ETH), and XRP remained steady on Wednesday, as traders showed remarkable composure despite the ongoing Israel–Iran conflict, which entered its sixth day. Each of the top cryptocurrencies continued to defend key technical support levels, defying geopolitical fears and macroeconomic uncertainty.

Bitcoin Finds Stability at $103K Zone

Bitcoin has been trading in a tight band above $102,600 since last Friday, when it tested that level during heightened geopolitical stress. As of now, BTC is consolidating just under $103,000, about 10% off its all-time high.

The On-Balance Volume (OBV) indicator on the daily chart is diverging positively from price, suggesting that buyer interest may be accumulating beneath the surface. Meanwhile, the RSI is neutral at 48, and MACD remains in bearish territory with red histogram bars beneath the midline—indicating soft downside pressure for now.

Upside targets:

- $106,179 and $108,046 (Fair Value Gap resistance)

- $111,980 (All-time high)

Downside watch:

- $102,664 remains the key liquidity zone to monitor if selling resumes.

Ethereum Consolidates, Eyes $3,000 Psychological Barrier

Ethereum has stayed anchored just above $2,400, holding a strong support level while showing signs of softening momentum. On the three-day chart, the MACD is printing smaller green bars, pointing to reduced bullish energy, while the RSI is at 55—indicating neutral-to-bullish sentiment.

Despite the slowdown, a close above $2,700 could open a test of $3,000, provided ETH can clear the June 9 peak at $2,879. On the daily chart, however, the RSI has dipped to 48, showing a loss of short-term momentum after being overbought earlier this month.

Overall, ETH is in a neutral range, with a tilt toward upside if bulls can reclaim higher ground.

XRP Remains Rangebound, Despite Ripple Progress

XRP, meanwhile, has continued to trade sideways in the $2.00–$2.30 range, showing little volatility despite Ripple’s ongoing legal developments. XRP has held up amid the broader market’s cautious mood, with no major breakouts or breakdowns over the past three weeks.

The price pattern suggests that a catalyst—either a court decision or stronger market momentum—will be needed to trigger the next move. Until then, XRP remains locked in a consolidation phase.

AVAX Under Pressure as Open Interest Drops to 30-Day Low

Avalanche (AVAX) is flashing signs of weakness, despite a modest rebound of nearly 1% on Wednesday. Open Interest in AVAX derivatives has slumped to a 30-day low of $441 million, according to Coinglass.

- Long liquidations: $1.4 million

- Shorts: $86K

- Long/short ratio: 0.9451

- Funding rate: ~0.0022%

With bulls backing off and Open Interest slipping, a break below current support could push AVAX toward year-to-date lows if sentiment fails to recover.

HYPE Slides 6% Despite Eyenovia’s $50M Treasury Initiative

HYPE dropped 6% over the last 24 hours, despite Eyenovia’s announcement of a $50 million PIPE offering to create a Hyperliquid treasury.

Highlights:

- Plan to acquire up to 1M HYPE

- Eyenovia to rebrand as Hyperion DeFi, ticker HYPD

- Staking partnership with Anchorage Digital

- Appointment of Hyunsu Jung as CEO

The offering aims to position the company as one of HYPE’s top validators. Despite the bullish narrative, the token fell to the lower edge of its support channel and risks breaking below $30.50 if weakness continues.

The Day’s Takeaway

United States

- Federal Reserve Holds Rates Steady

The Fed kept the federal funds rate unchanged at 5.25%–5.50%, as expected. The updated dot plot still projects two 25 bps cuts in 2025, though more officials now expect no change this year (7 vs. 4 in March).

GDP for 2025 was revised down to 1.4%, and core PCE inflation was bumped to 3.1% from 2.8%, suggesting the Fed remains cautious about underlying price pressures. - Powell Stresses Patience and Tariff Uncertainty

In his press conference, Chair Powell said the Fed is in a “good place” and emphasized uncertainty around tariffs as a key variable. Inflation has improved over the past three months but is not yet on a clearly sustainable path toward 2%. He also noted that while labor market cooling is visible, it’s not severe enough to justify cuts yet. - Jobless Claims Stay Elevated

Initial claims were in line at 245K, but continuing claims remain above 1.9 million for a fourth week. The four-week averages for both initial and continuing claims have risen. - Housing Starts Miss Big

May housing starts dropped to 1.256 million, below expectations and marking the lowest level since 2020. Building permits also missed. NAHB sentiment earlier this week was the third-worst since the GFC, showing deep weakness in housing despite lower mortgage rates. - Stocks Close Mixed Post-Fed

- Dow: -0.10%

- S&P 500: -0.03%

- NASDAQ: +0.13%

- Russell 2000: +0.52%

Market leaders included SoFi, Robinhood, and Intel, while Mastercard and Visa posted heavy losses.

- Treasury Auctions Announced

The U.S. Treasury will auction $183B in coupons next week across 2-year, 5-year, and 7-year maturities. - Mortgage Demand Slides

MBA mortgage applications fell 2.6% last week, with both purchase and refinance indexes declining despite a slight dip in the 30-year rate to 6.84%.

Canada

- BoC Cautious as Trade Deal Progresses

Governor Tiff Macklem said a new Canada–U.S. trade deal could help reduce inflation pressure by leading to tariff removal. However, he warned that persistent inflation could delay rate cuts, especially if tariffs and uncertainty continue to spread through the economy. - LNG Canada Nears First Export

Canada’s $40 billion Kitimat LNG terminal is expected to produce its first cargo this week, operating at 25% capacity. This could make Canada a significant LNG supplier to Asia and add new flexibility to global gas flows.

Commodities

- Oil Draws Heavily, Prices Unmoved

Crude inventories fell 11.473 million barrels, far surpassing expectations. Yet WTI crude traded lower near $72, suggesting that macro concerns and risk-off flows are outweighing bullish supply data. - Iron Ore Dips Below $93/t

Prices fell on signs of persistent weakness in China’s property market and a slowdown in steel demand. Authorities are pushing mills to curb output amid a supply glut. - Qatar Pauses LNG Shipments Through Hormuz

Tensions in the Middle East prompted Qatar to delay LNG vessels from entering the Strait of Hormuz, raising risks for global LNG supply. Qatar supplies roughly 20% of global LNG. - Standard Chartered Flags Oil Shock Risk

The bank warns that a move above $90/barrel Brent would be an inflationary shock, likely shaving 0.1–0.2 percentage points off global GDP. Countries with high fuel import ratios and low fiscal space are most at risk (e.g., Jordan, Thailand, South Africa). - Gold Steady at $3,390 Post-Fed

Gold held near $3,390 despite the Fed’s cautious tone and higher inflation forecasts. Traders are eyeing resistance at $3,400, $3,452, and $3,500. Support levels include $3,350 and $3,301 (50-day SMA).

Europe

- DAX and CAC Lower, FTSE Edges Up

European indices closed mixed.- DAX: -0.39%

- CAC 40: -0.36%

- FTSE 100: +0.11%

- Eurozone Current Account Slumps

The April current account surplus dropped to €19.3B from €60.1B in March due to a sharp drop in goods exports—likely front-loaded ahead of U.S. tariffs. - Final CPI Holds at 1.9% in May

Core inflation remained at 2.4%, unchanged from preliminary estimates. Markets now price in just ~21bps of ECB cuts for the rest of the year. - Chancellor Merz Expects Tariff Agreement with U.S.

Germany’s Merz said he expects a resolution in the US-EU tariff dispute in the coming days.

Asia

- Japan Exports Fall Less Than Feared

May exports dropped 1.7% y/y, better than the expected -3.8%. Imports fell 7.7%, deepening the trade deficit. Core machine orders also slipped 9.1% m/m, hinting at weakening capex ahead. - BOJ Holds Policy Steady, Adjusts Taper Pace

The Bank of Japan left rates at 0.50% and confirmed a gradual tapering of bond purchases into 2027. One dissenting vote (Tamura) called for allowing long-term yields to float more freely. - Japan Manufacturing Sentiment Dips

The Reuters Tankan showed a decline in manufacturing sentiment to +6 in June from +8, as uncertainty over U.S. tariffs and weak Chinese demand weighed. Non-manufacturing sentiment held steady but is expected to decline. - China’s SAFE Signals FX Stability Push

China’s FX regulator pledged to keep the yuan stable and boost the resilience of FX markets. Measures include reforms to foreign debt management, foreign trade policy, and new QDII quotas. - Consumption Becomes China’s Top Growth Driver

Chinese officials emphasized that consumption now leads GDP growth, with China now the largest buyer of autos, smartphones, and home appliances. - PBOC to Expand FX Toolbox, Push e-CNY

Governor Pan Gongsheng announced plans for an international e-CNY hub in Shanghai, reforms to cross-border FX trading, and support for offshore bond development.

Rest of the World

- New Zealand Consumer Confidence Rebounds Slightly

Consumer sentiment inched up to 91.2 in Q2 from 89.2, still deeply pessimistic. Westpac described the move as modest, with households still anxious about the economy. - NZ Current Account Deficit Narrows Sharply

Q1 current account deficit narrowed to NZD -2.32B, a sharp improvement from the previous NZD -7.04B, bringing the GDP ratio to -5.7%.

Crypto

- Bitcoin, Ethereum, and XRP Hold Key Support Amid Conflict and Fed Uncertainty

- BTC: Holds above $103,000, OBV divergence suggests potential for reversal

- ETH: Trading near $2,400, looking to break above $2,700 toward $3,000

- XRP: Remains rangebound near $2.15, eyeing $2.65 on bullish breakout

- Ripple Moves Closer to $50M SEC Settlement

Ripple filed a supplemental letter supporting a joint motion with the SEC for a reduced penalty. Judge Torres had previously ordered a $125M fine, but both parties have agreed to settle for $50M, citing consistency with recent SEC settlements.