North America News

U.S. Stocks Rebound Sharply to End Week Higher

U.S. stocks staged a strong turnaround Friday, erasing steep early losses to close higher across major indexes as investors reacted to upbeat remarks from President Donald Trump on trade with China.

Closing levels:

- S&P 500: +0.5%

- Nasdaq Composite: +0.6%

- Dow Jones Industrial Average: +0.6%

- Russell 2000: −0.6%

Weekly performance:

- S&P 500: +1.7%

- Nasdaq Composite: +2.1%

- Dow Jones Industrial Average: +1.6%

- Russell 2000: +2.5%

Stock futures had been deeply negative early in the session, but sentiment reversed after Trump and senior officials repeatedly signaled optimism about reaching a trade deal with China. Those comments helped stabilize risk appetite and triggered broad-based buying into the close.

“The President’s tone shift clearly changed the market mood,” said one trader. “Dip buyers were waiting for a signal, and they got one.”

Still, trading was volatile, with sharp intraday swings reflecting caution ahead of more concrete trade developments.

Financial shares led gains as concerns around the sector eased. Zions Bancorp’s $50 million loan writedown, initially viewed as a warning sign, was later seen as immaterial relative to its $89 billion loan book. Credit card stocks, which had slumped on Thursday, rebounded strongly.

Gold was the day’s major casualty, dropping as much as $120 at one point before paring losses to end down nearly 2% — its steepest retracement since hitting record highs. The move rattled parts of the market but underscored the shift in tone toward risk assets.

Despite the week’s gains, all major equity benchmarks remained confined within last Friday’s trading range as investors await greater clarity on trade policy.

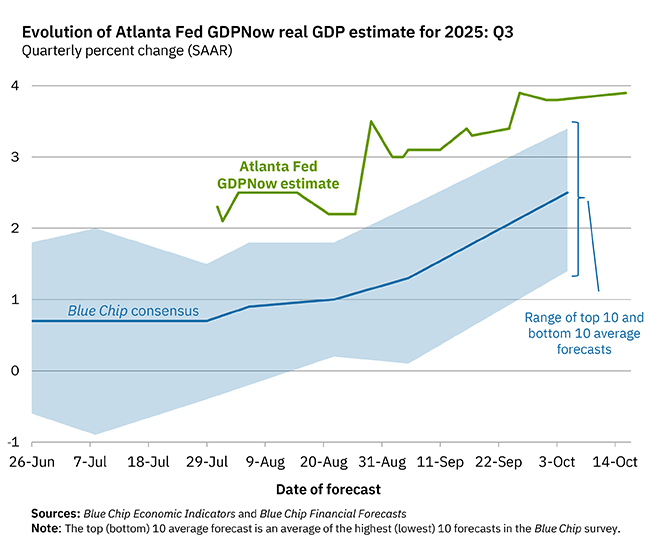

Atlanta Fed GDPNow Estimate Edges Up, Data Scarce Amid Shutdown

The Atlanta Fed’s GDPNow model nudged up its estimate for fourth-quarter growth to 3.9% from 3.8%, despite sparse economic data caused by the government shutdown.

“After yesterday’s monthly Treasury statement, nowcasts for personal consumption and private investment rose modestly, while government spending estimates declined,” the Atlanta Fed said.

The model now projects Q3 real personal consumption growth at 3.3%, up from 3.2%, and private investment at 4.4%, up from 4.0%. Real government spending is estimated at 1.5%, down from 1.8%.

Analysts caution that the model is increasingly difficult to interpret given limited incoming data, leaving policymakers “flying blind.”

Fed’s Musalem: Could Support Another Rate Cut if Job Risks Rise

Federal Reserve Governor Adriana Kugler Musalem said she could back another interest rate cut if risks to the labor market increase and inflation continues to cool, emphasizing the need for a cautious, data-driven approach.

“I could support a path with another cut if more risks to jobs emerge and inflation remains contained,” Musalem said Friday. “The Fed should not be on a preset course.”

She added that policy is “somewhere between restrictive and neutral,” noting that there is “limited space before rate cuts would make policy accommodative.”

Musalem said the central bank is navigating “a particularly uncertain moment” and should decide policy “meeting by meeting.” She said tariff effects are still filtering through the economy and could last into mid-2026, pressuring retailers and consumers.

“Purchasing power is still an issue for many Americans,” she said. “Inflation remains a big deal for households, and it’s important for the Fed to get back to 2%.”

Musalem added that services inflation remains elevated and will “require more work” to bring down. She expects inflation to return toward target in the second half of 2026.

On the labor market, she said job growth has slowed, partly due to immigration shifts, but the market remains near full employment. “We’re not seeing an increase in layoffs. We’re not in imminent trouble, but risks have risen.”

She placed the breakeven job growth rate between 30,000 and 80,000 and said payrolls could turn negative “without a major rise in unemployment.”

“Financial conditions are accommodative,” she said, though she cautioned that credit-market risks always merit attention. “Credit conditions are good now, but we must remain vigilant.”

Trump on China Trade: “We’ll See What Happens”

Former President Donald Trump said the U.S. will meet with China in two weeks but warned that trade negotiations remain uncertain.

Speaking on Fox Business, Trump said, “China is always looking for an edge. I don’t know what’s going to happen. We’re going to meet in a couple weeks.”

He added that current tariffs “aren’t sustainable” but justified them as a response to Chinese trade practices. “China forced me to do that,” he said. “We’re going to do fine with China — but we have to have a fair deal.”

Trump’s comments reinforced market expectations that no major escalation will occur before the APEC meeting, where both sides aim to de-escalate tensions.

White House Adviser Hassett: Confident on Reset With China

White House economic adviser Kevin Hassett said he remains confident the U.S. and China can return to a “good place” in trade relations, while acknowledging recent tensions.

“We’re not at war with China,” Hassett told Fox News, adding that while he’s been “disappointed” by some of Beijing’s actions, Washington seeks a constructive outcome.

He noted that China “has a little bit of leverage right now,” but said any escalation would ultimately hurt Beijing more. “I don’t think they’re really going to do it,” he said.

Risk assets jumped earlier Friday after an excerpt from a Fox interview showed former President Donald Trump saying the U.S. will “be fine with China.” Asked whether high tariffs would remain, Trump replied, “no, but they could stand,” repeating remarks made earlier in the week.

Both sides appear to be holding off on new trade actions ahead of the APEC summit in South Korea on Oct. 29–30, where Trump and President Xi Jinping are expected to meet.

S&P: Trump’s Tariffs to Cost $1.2 Trillion, Consumers Hit Hardest

S&P Global estimates that President Trump’s tariffs will cost global companies roughly US$1.2 trillion in 2025, with nearly two-thirds of the burden falling on consumers.

The analysis — based on data from 9,000 firms tracked by 15,000 analysts — found that businesses will absorb only about one-third of the cost. The remainder will be passed through as higher consumer prices and reduced output.

S&P said tariffs effectively act as taxes on global supply chains, diverting funds to governments and logistics costs while squeezing margins.

With 10% tariffs now applied to all U.S. imports — plus targeted duties on autos, timber, and cabinetry — S&P warned that households face “paying more for less” as real output shrinks. The report also said the $1.2 trillion figure likely understates the true cost given rising input inflation and weaker productivity.

Standard Chartered: Central Banks Trading the Dollar Countercyclically

Global reserve managers are taking a countercyclical approach to the U.S. dollar, buying on weakness and selling on strength, according to Standard Chartered.

Citing IMF data, the bank said official dollar reserves and the Bloomberg Dollar Index have moved in opposite directions in 17 of the past 20 quarters.

In Q2 2025, dollar reserves rose by US$50 billion as the greenback slid 6.6%, while in Q4 2024, reserves fell by US$154 billion as the dollar gained 7.1%.

Standard Chartered said the behaviour underscores “caution and opportunism” among central banks seeking to stabilise markets rather than chase trends. The pattern shows official institutions acting as balancing forces, smoothing global currency swings.

Kashkari Says Fed May Overstate Slowdown, Backs Two “Insurance” Cuts

Minneapolis Fed President Neel Kashkari said the U.S. economy may not be slowing as sharply as perceived and backed two additional rate cuts as “insurance” against downside risks.

Speaking in Rapid City, South Dakota, Kashkari said the greater risk lies in a surprise labour-market downturn, not runaway inflation. “If we’re making an error, it’s probably that we’re overestimating the slowdown,” he said.

He expects inflation to hover near 3% for an extended period — above target but unlikely to re-accelerate to 4–5%. The ongoing government shutdown, he warned, is distorting real-time data and complicating policy assessment.

Kashkari reiterated his support for a cautious easing path, noting that last year’s pre-emptive cuts helped sustain job growth. He also flagged housing affordability, private credit exposure, and lingering tariff impacts as risks to watch.

Westpac: Dollar Strength Tied to Yen Weakness, Not U.S. Growth

Westpac says the U.S. dollar’s rally reflects global policy divergence more than domestic economic strength, with yen weakness playing a key role.

The bank said the prolonged U.S. government shutdown could hurt consumption and investment, undermining the notion that dollar gains are growth-led.

Europe and Asia, excluding Japan, remain relatively resilient. However, Westpac said a leadership change in Tokyo — with Sanae Takaichi seen as favouring looser policy — could trigger further yen softness, supporting USD/JPY.

China’s renminbi, meanwhile, is viewed as Asia’s likely outperformer amid steady growth and expected stimulus. Westpac said the greenback’s upside may be limited elsewhere but that yen dynamics could keep it firm in the near term.

Trump Predicts “Fat-Loss” Drug Prices Will Drop

Former President Donald Trump said he expects prices for popular “fat-loss” drugs to fall, offering little detail but suggesting cost reductions are likely in coming months.

Trump made the comment while speaking broadly about healthcare and consumer pricing, without elaborating on policy measures or timelines.

Bank of Canada’s Macklem: Risks Central to Next Rate Decision

Bank of Canada Governor Tiff Macklem said policymakers will put greater emphasis on balancing risks in their next rate decision, as uncertainty clouds the economic outlook.

“We’re putting more emphasis on risk when it comes to the next rate decision,” Macklem said Friday. “We hope to be a bit more forward-looking, but there’s a lot of uncertainty, and we need to be humble about our forecasts.”

He said growth is expected to resume, but at a subdued pace. “Growth is likely to be soft and probably a little below potential,” Macklem said. “It’s not going to feel very good, and it’s certainly not going to be enough to close the output gap.”

The comments suggest the central bank remains cautious amid uneven data, with the focus shifting from inflation momentum to downside risks for growth and jobs.

Commodities News

Gold Sinks 2% From Record High as Trump Softens China Rhetoric

Gold prices retreated sharply Friday, dropping 2% from record levels as U.S. President Donald Trump’s softer tone on China boosted risk sentiment and the dollar, while Treasury yields climbed.

Spot gold fell below $4,250 per ounce, trading around $4,230–$4,240 after touching a record $4,379 earlier in the session. The pullback came as Trump said triple-digit tariffs on China were “unsustainable” and risked escalating tensions, signaling a willingness to ease trade pressure.

Trump added that he expects to meet Chinese President Xi Jinping “in a couple of weeks” in South Korea, remarks that fueled optimism for progress in negotiations and reduced haven demand.

The U.S. 10-year Treasury yield rose nearly three basis points, adding pressure to non-yielding assets such as bullion. The U.S. dollar also firmed modestly, further weighing on gold.

Federal Reserve officials reiterated their commitment to restoring inflation to the 2% target. St. Louis Fed President Alberto Musalem said he supports a rate cut at the October meeting but emphasized that policy should continue to lean against inflation risks. Fed Governor Christopher Waller and Minneapolis Fed President Neel Kashkari echoed those remarks, noting that economic momentum remains stronger than many expected.

Market focus now shifts to next week’s Consumer Price Index (CPI) report, due Friday at 8:30 a.m. ET, which could set the tone for the Fed’s next policy step.

Baker Hughes Rig Count: U.S. Rises by One, Canada Adds Five

U.S. drilling activity rose modestly this week, while Canada posted a stronger gain, according to Baker Hughes data released Friday.

The total U.S. rig count increased by one to 548, with oil rigs steady at 418, gas rigs up one to 121, and miscellaneous rigs unchanged at nine. The count is down 37 rigs from a year ago.

Offshore activity increased by two to 17 rigs but remains one lower than a year earlier.

In Canada, the rig count rose by five to 198, driven by a seven-rig increase in oil drilling to 136. Gas rigs fell by two to 61, with miscellaneous rigs unchanged at one.

Year-on-year, Canada’s total is down 19 rigs, with oil rigs down 17 and gas rigs down three.

Chile’s Copper Premium Soars on Supply Shortage, Says Commerzbank

Chile’s largest copper producer plans to sharply raise its premium for key European customers due to ongoing supply disruptions, Commerzbank said.

“Sources report a premium of $325 per ton, up from around $230 in recent years,” said Thu Lan Nguyen, head of FX and commodity research.

Output from the producer is roughly 10% below last year’s levels, with a 25% production drop in August alone following an accident at the El Teniente mine. Regulators say investigations may take months, delaying a full restart.

Commerzbank said the disruption “will likely support prices and limit downside potential for copper in the short term.”

U.S. Natural Gas Hits Three-Week Low as Storage Builds, Says ING

U.S. natural gas prices fell to a three-week low near $2.90 per MMBtu, pressured by robust storage levels, according to ING analysts Ewa Manthey and Warren Patterson.

“Prices declined for a fourth straight session as weekly storage builds offset expectations for cooler weather later in October,” they said.

EIA data showed inventories rose by 80 billion cubic feet last week, in line with the five-year average. Total gas stockpiles now stand at 3.721 trillion cubic feet, about 4.3% above the seasonal norm.

ING said ample inventories mean the U.S. will enter winter with a comfortable surplus.

Commerzbank: IEA Overstates 2026 Oil Surplus Forecast

The International Energy Agency’s forecast of a 4 million-barrel-per-day oil surplus next year is overly optimistic, Commerzbank’s Carsten Fritsch said.

The IEA projects supply growth of 1.2 million barrels per day from OPEC+ and another 1.2 million from non-OPEC producers, while demand rises by just 700,000 barrels.

Fritsch called the assumptions “extremely ambitious,” noting that OPEC and S&P Global data show current output roughly 1 million barrels lower than IEA estimates.

“The oversupply is unlikely to be as large as predicted,” he said, recalling that similar surpluses during the pandemic were quickly corrected by supply cuts.

Chinese Smelters Boost Copper Exports as Prices Stay Elevated

Chinese smelters are increasing metal exports to take advantage of high global prices, contributing to recent declines in copper and zinc prices, according to Commerzbank.

“This makes sense given strong domestic output and weakening local demand,” said Thu Lan Nguyen. “Exports of unwrought copper and products rose 13% in the first eight months of the year.”

By contrast, zinc concentrate exports fell almost 20% from last year’s levels. Significant zinc exports last occurred in 2022, when European smelters cut output amid surging energy costs.

HSBC Sees Gold Rally Extending Through 2026

HSBC expects gold’s rally to extend well into 2026, supported by central-bank accumulation, U.S. fiscal worries, and structural demand for diversification.

In its commodities outlook, the bank said strong buying from emerging-market central banks and persistent investor appetite are likely to sustain prices.

The report cited mounting concern over U.S. fiscal deficits as a key catalyst, driving gold’s role as a hedge against dollar weakness and debt risks.

However, HSBC cautioned that the metal’s trajectory could flatten temporarily if the Federal Reserve slows its pace of rate cuts, lifting yields and strengthening the dollar.

Still, it maintained a bullish medium-term view, saying dips should be viewed as buying opportunities given enduring macro uncertainty and institutional demand.

Oil Falls as U.S. Inventories Rise, ING Says

Oil prices extended losses, with WTI heading for a third weekly decline and hitting its lowest level since May amid rising U.S. inventories.

The EIA reported a third straight weekly build of 3.5 million barrels, bringing total crude stocks to 423.8 million barrels — the highest since September but still 4% below the five-year average.

Cushing storage fell 703,000 barrels to 22 million, while refinery utilization dropped to 85.7%.

ING analysts Ewa Manthey and Warren Patterson said discussions between Trump and Russian President Vladimir Putin over Ukraine have eased concerns about energy-supply disruptions.

Refined product inventories rose in Singapore and Europe, with middle distillate supplies remaining comfortable, they added.

China’s Canadian Crude Imports Hit Record as U.S. Oil Purchases Slide

China’s crude imports from Canada are on pace for a record October, topping 5 million barrels so far this month as Beijing shifts away from U.S. oil amid deepening trade tensions, according to Vortexa data.

Roughly 70% of Vancouver-loaded shipments are heading to Chinese ports, with the rest bound for the U.S. West Coast or trans-shipment points near Los Angeles.

Chinese refiners have been building inventories at a rate above 500,000 barrels a day, capitalising on discounts for Russian and Iranian barrels while diversifying supply. The move comes after Beijing imposed retaliatory port fees on U.S.-linked vessels, raising freight costs for American crude.

Strong Asian demand has pushed up prices for Western Canadian Select, which now trades at a US$10.20 discount to WTI — the narrowest since July — and even at a premium to Texas-loaded Canadian barrels for the first time since 2024.

Gold Retreats Sharply From Record Highs

Gold has fallen back under US$4,290 after briefly touching levels above US$4,360 in a volatile session that saw heavy profit-taking.

Traders described the pullback as a “washout” from its parabolic peak, warning that more turbulence could follow as markets recalibrate positions after the surge.

Volatility remains elevated across precious metals, with further swings likely as investors assess Fed policy signals and geopolitical flows.

Gold Gains as Fed Dovish Tilt Meets Renewed U.S.–China Tensions

Gold prices rose this week as dovish remarks from the Federal Reserve and renewed U.S.–China tensions lifted demand for safe havens, Commerzbank said.

Fed Chair Jerome Powell highlighted rising labor-market risks as a greater concern than inflation, echoed by New York Fed President John Williams and Governor Christopher Waller.

New FOMC member and Trump ally Stephen Miran advocated a 50-basis-point rate cut, adding that two more cuts this year remain “realistic.”

Markets are now pricing about five quarter-point cuts through 2026. Commerzbank said the shift reflects both policy uncertainty and concerns over U.S. regional banks.

Europe News

Eurozone Inflation Revised Up Slightly in September

Eurostat’s final data showed eurozone consumer prices rose 2.2% year-on-year in September, confirming the preliminary reading but with core inflation revised slightly higher to 2.4% from 2.3%.

The prior month saw headline inflation at 2.0% and core at 2.3%. The modest uptick reinforces expectations that the European Central Bank will keep rates on hold through year-end.

BOE Greene: Core and services inflation are going sideways

- BOEs Greene speaking

- Core and services inflation are going sideways.

- Indications are in disinflation process is slowing.

- Concerned about second-round effects of inflation

- Firms more sensitive to upside inflation surprises.

- Policy not meaningfully restrictive

- Should slow down rate cutting cycle

- Slack has opened up in the labor market making wage part of wage price spiral less likely.

- Latest rising UK unemployment is in line with what we were expecting.

- We should not cut rates every quarter, but rate cutting cycle not over.

MUFG: ECB Could Cut Again by Mid-2026, Euro May Still Strengthen

The European Central Bank may deliver another rate cut by mid-2026, but the euro could stay firm as the Federal Reserve eases policy faster, according to MUFG.

The bank’s analysts said markets are likely to price in a more aggressive U.S. easing cycle over the next year, narrowing yield spreads in favour of the euro. While the ECB has signalled a pause, MUFG said there is still room for further action if inflation drifts lower.

The bank pointed to falling energy prices following OPEC+’s production increase and China’s re-routing of exports away from the U.S. as potential disinflationary drivers for Europe.

A faster Fed easing path, MUFG added, could limit dollar strength and keep EUR/USD supported near medium-term highs even if eurozone rates edge down.

ECB’s Simkus: I like the idea of a risk management cut

- Comments from the ECB policymaker, Gediminas Simkus

- Inflation and growth risks are more tilted to the downside

- More euro appreciation is possible

- 2028 price forecast is important for the next ECB move

ECB’s Scicluna says the Bank must not rush into further rate cuts

- ECB mustn’t rush further interest-rate cuts, the effects of higher Trump trade tariffs on prices are not clear yet

- ECB mustn’t rush further interest-rate cuts

- the effects of higher Trump trade tariffs on prices are not clear yet

- “It’s not so straightforward whether higher trade tariffs will be disinflationary or inflationary,”

- “The jury is still out and we shouldn’t jump to conclusions as this is crucial.”

BoE’s Pill: A more cautious withdrawal of monetary policy restriction may be appropriate

- Comments from the BoE policymaker, Huw Pill

- There is a risk that self-sustaining inflationary dynamics embed in expectations

- Must guard against cutting too far or too fast

- Vote to maintain rates is a skip rather than a halt

- Continue to see rate cuts if the economy evolves as forecast

- Need to recognise CPI stubbornness as more pressing

- Shocks could prompt policy changes either way

Asia-Pacific & World News

WTO Chief Urges U.S. and China to De-Escalate Trade Dispute

World Trade Organization Director-General Ngozi Okonjo-Iweala said she has urged U.S. and Chinese officials to step back from intensifying tariff measures, warning that global trade remains under strain.

“The multilateral trading system has been undermined by tariffs and bilateral deals, but it’s still proving resilient,” she said.

Okonjo-Iweala called for the current crisis to be used as a catalyst for reform, saying the WTO must become “more flexible, faster and more efficient.”

She expressed “serious concern” about the recent spike in U.S.–China tensions and said the WTO hopes both sides “find an off-ramp soon.”

PBOC Signals No Change to Loose Policy Stance

People’s Bank of China Governor Pan Gongsheng said monetary policy will remain “appropriately loose,” indicating no shift ahead of Monday’s rate announcement.

Markets expect the PBOC to hold benchmark lending rates steady for a fifth straight month as officials balance growth support with financial stability amid ongoing U.S.–China trade tensions.

Beijing remains focused on maintaining liquidity while fiscal measures take the lead in stimulus efforts. Analysts said the central bank has “done its job” in ensuring monetary conditions stay supportive as external risks persist.

Nomura: China to Drop GDP Target in 15th Five-Year Plan

Nomura expects Beijing to forgo a specific GDP growth target in its upcoming 15th Five-Year Plan (2026–2030), focusing instead on resilience, security, and social inclusion.

The Communist Party’s Central Committee will meet from Oct. 20–23 to discuss the framework, which will later go to the National People’s Congress in March 2026 for approval.

Nomura said the new plan carries greater weight than its predecessor given China’s larger global role and continued property-market strain.

While the 14th plan met several goals, Nomura said China now faces structural challenges — slower population growth, weaker property investment, and the need to shift from quantitative to qualitative expansion. The focus, it said, will be on long-term stability and strategic sectors rather than short-term stimulus.

China Accuses U.S. of “Stoking Panic” Over Rare-Earth Curbs

Beijing accused Washington of deliberately fuelling global panic over China’s new rare-earth export licensing regime, rejecting U.S. calls to scrap the policy and condemning what it called “gross distortions” by American officials.

Commerce Ministry spokesperson He Yongqian said the new rules, effective Nov. 8, align with international standards and allow compliant civilian exports to continue.

The People’s Daily issued a seven-point rebuttal, calling the U.S. hypocritical for maintaining its own control list of more than 3,000 items.

Tensions escalated after Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer accused China of seeking “global supply-chain control.” Beijing denounced Bessent’s remarks and urged Washington to “correct its mistakes.”

The exchange comes as Presidents Trump and Xi prepare to meet in South Korea later this month, with the dispute threatening to overshadow broader trade negotiations.

PBOC sets USD/ CNY reference rate for today at 7.0949 (vs. estimate at 7.1154)

- PBOC CNY reference rate setting for the trading session ahead.

PBoC injects CNY 164.8bln via 7-day reverse repos, rate at unchanged 1.40%

- the net drain today is 244.2bn yuan

Westpac: RBA’s November Meeting Still “Live” After Jobless Uptick

Westpac says the Reserve Bank of Australia’s November policy meeting remains “well and truly live” following September’s rise in unemployment, with inflation data later this month likely to determine the next move.

The bank noted that stronger labour-force participation and softer hiring have added modest slack to the job market, pointing to a gradual cooling rather than a sharp downturn.

Westpac continues to flag a 25-basis-point rate cut as a live option but said the October 29 Q3 CPI print will be decisive. A subdued inflation reading would bolster confidence for the RBA to start easing, while a hotter result could push the first rate cut into early 2026.

BOJ’s Uchida: Japan economy recovering moderately, albeit with some weak signs

- Remarks by BOJ deputy governor, Shinichi Uchida

- Tankan survey showed business sentiment turns positive for some manufacturers

- That as uncertainty over US tariffs outlook recedes

- Business sentiment looks solid overall

- Underlying inflation likely to stagnate for some period before reaccelerating gradually

- Uncertainty surrounding overseas economic developments remain high

- To continue raising interest rates if economy, prices move in line with our forecasts

Singapore’s September Exports Surge, Defying Forecasts

Singapore’s non-oil domestic exports jumped 6.9% in September from a year earlier, beating expectations for a 2.1% decline, driven by stronger electronics shipments and robust demand from China, Hong Kong, and Taiwan, data from Enterprise Singapore showed.

On a monthly basis, exports surged 13.0%, exceeding forecasts for a 9.0% gain.

Exports to the U.S. dropped 9.9% after nearly a 30% fall in August, reflecting the drag from Washington’s 10% tariff on Singaporean goods. Shipments to the EU and Indonesia also slipped.

Officials said front-loading ahead of U.S. tariffs had supported trade earlier in the year but warned of slower momentum ahead. The government maintained its 2025 export growth forecast at 1–3%, with a possible drag from pending pharmaceutical tariff talks.

Seoul Warns of FX Risks Over Trump’s US$350 Billion Payment Demand

South Korea’s Finance Minister Koo Yun-cheol said it remains unclear whether President Donald Trump will accept Seoul’s opposition to a US$350 billion upfront investment tied to their July trade deal.

Speaking in Washington, Koo said a one-time payment of that size could destabilise Korea’s foreign-exchange market and potentially trigger financial stress similar to the 1997 Asian crisis.

He raised the issue with U.S. Treasury Secretary Scott Bessent, who acknowledged the concerns and promised to relay them to Commerce Secretary Howard Lutnick. “U.S. officials understand Korea’s position,” Koo said, though it remains uncertain if Trump will yield.

The trade deal, which would cut U.S. auto tariffs to 15% in exchange for Korean investment, remains stalled over funding structure and timing. Seoul’s warning underscores the delicate balance between economic diplomacy and currency-market stability.

Crypto Market Pulse

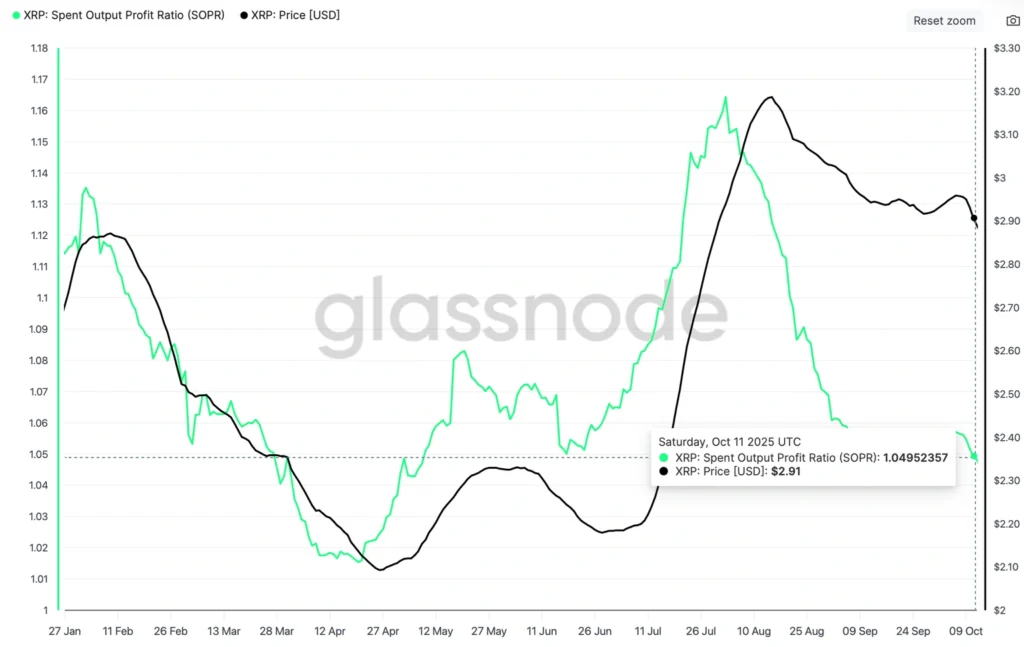

XRP Sell-Off Deepens as Token Targets $2 Support

Ripple’s XRP extended its decline Friday, dropping for a fourth straight day to around $2.26 as crypto markets remained under pressure.

The token has mirrored broader weakness across digital assets as traders react to macroeconomic uncertainty tied to U.S.–China trade tensions and the absence of near-term catalysts.

The October 10 liquidation wave marked one of the largest in XRP’s history, wiping out $611 million in long positions and $90 million in shorts, according to CoinGlass data.

Retail participation remains subdued, with XRP futures open interest sliding below $4 billion — the lowest since June — from a July peak near $11 billion. The decline signals shrinking speculative appetite and reduced bullish leverage.

XRP’s Spent Output Profit Ratio (SOPR), which tracks whether holders are selling at a profit or loss, has fallen to 1.04. A drop toward 1.00 typically signals capitulation, where weak holders exit at breakeven or losses.

“Capitulation events like these often clear excess selling pressure and pave the way for eventual stabilization,” CoinGlass noted.

Uniswap Integrates Solana to Tackle DeFi Fragmentation

Uniswap has added support for Solana on its web application, enabling users to connect their wallets and trade Solana-based tokens directly, the decentralized exchange said Thursday.

The move allows Uniswap users to access tokens across Solana, Ethereum, Base, Unichain and other supported networks through a single interface. “With Solana live, users will be able to access more liquidity and more tokens right from the Uniswap Web App,” the company said in a statement.

Uniswap said the integration is part of a broader plan to reduce fragmentation across decentralized finance platforms, where users have long been forced to manage multiple wallets and interfaces.

“We have users who want access to Solana tokens,” Uniswap founder Hayden Adams wrote on X. “Ignoring them loses us users — to absolutely no one’s benefit.”

The integration’s first phase focuses on direct swaps, with upcoming updates set to add bridging, cross-chain trading, and wallet-level Solana support. Solana swaps will be powered by the Jupiter API, giving users access to more than one million Solana-based tokens.

Uniswap remains Ethereum’s largest decentralized exchange, with $149.5 billion in trading volume over the past month, according to DeFiLlama. UNI and SOL declined 4% and 3%, respectively, over the past 24 hours amid broader crypto market weakness.

Japan’s Mega-Banks to Launch Dollar–Yen Stablecoin

Japan’s top three banking groups — MUFG, Sumitomo Mitsui, and Mizuho — plan to issue a fiat-backed stablecoin for cross-border payments, according to Nikkei.

The token, linked to both the U.S. dollar and Japanese yen, will be piloted by Mitsubishi Corporation before wider rollout to more than 300,000 partner firms.

Stablecoins, backed by fiat or commodities, aim to reduce volatility in digital transactions. Japan’s regulators are finalizing approvals for local yen-backed tokens, paving the way for widespread use in corporate settlements.

The move adds momentum to Japan’s digital-finance drive, following Post Bank’s planned DCJPY tokenized deposit in 2026 and Ripple partner SBI’s planned launch of the RLUSD stablecoin the same year.

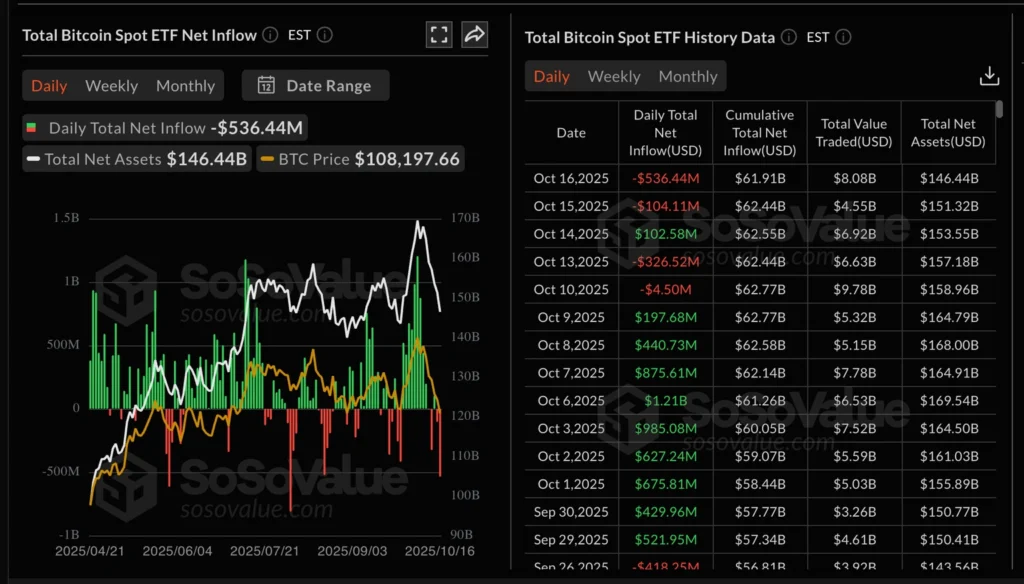

Crypto Market Sell-Off Deepens; Bitcoin Eyes October Lows

Bitcoin extended its slide below $105,000, while Ethereum and XRP hit key support levels as risk-off sentiment swept digital assets.

Ethereum traded near $3,700, and XRP fell below $2.22, with total crypto market capitalization down 6% in 24 hours to $3.76 trillion, according to CoinGecko.

ETF data suggest institutional interest remains weak. U.S. Bitcoin ETFs saw $536 million in outflows Thursday — the largest since August 19 — following $104 million the prior day.

Ethereum ETFs also saw $57 million in redemptions, with only BlackRock’s ETHA posting inflows. Analysts said sustained ETF outflows and leveraged deleveraging “leave the market vulnerable to further downside.”

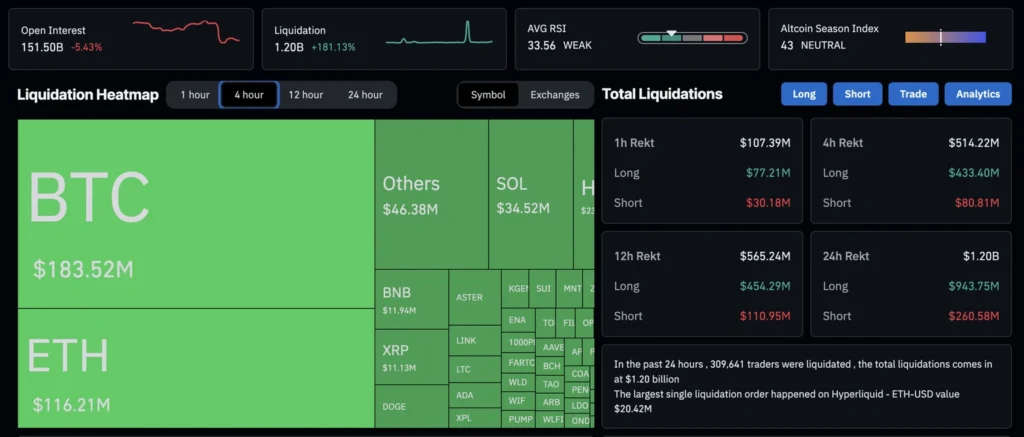

Altcoins Lead $1 Billion Crypto Liquidation Wave

BNB, Solana, and Cardano plunged over 10% in the past 24 hours, driving total crypto market liquidations above $1 billion as traders unwound leveraged positions.

The broader crypto market dropped 3% to $3.5 trillion, marking a fourth straight day of losses and reinforcing the week’s failed rebound as a “dead-cat bounce.”

CoinGlass data showed $1.2 billion in liquidations, with $944 million in long positions wiped out — signaling traders are cutting risk.

BNB is testing its 50-day EMA near $1,046; a close below that level could open the door to $1,000 support. Open interest in crypto futures fell 5.4%, underscoring fading conviction.

Bitcoin Slides to Four-Month Low as Technical Pressure Builds

Bitcoin extended its recent losses, falling 4% to just below US$104,000 and touching its lowest level in four months.

The cryptocurrency is now threatening a break below its 200-day moving average for the first time since April, signalling potential for deeper technical losses.

After surging 65% over the past six months, Bitcoin’s rally has stalled as risk sentiment deteriorates across global markets. The broader selloff in equities has amplified pressure on digital assets.

Analysts say a sustained move below both the 100- and 200-day averages could trigger a larger correction, making Bitcoin a key gauge of investor appetite for speculative risk heading into the weekend.

The Day’s Takeaway

North America

U.S. markets rebounded sharply Friday as President Donald Trump’s softer tone on China boosted risk appetite and reversed early-session losses. The S&P 500, Nasdaq, and Dow each rose around 0.6%, while the Russell 2000 lagged slightly. Traders said Trump’s comments signaling optimism for a trade deal “changed the market mood,” triggering a late-session rally led by financials and tech.

Federal Reserve officials maintained a cautious tone. Governor Adriana Kugler Musalem said she could back another rate cut if job risks rise and inflation cools, adding that policy remains between restrictive and neutral. Minneapolis Fed’s Neel Kashkari echoed support for two “insurance” cuts, while other Fed officials cited lingering tariff effects and data uncertainty from the ongoing government shutdown.

The Atlanta Fed’s GDPNow model nudged Q4 growth to 3.9% despite sparse data, underscoring the economy’s resilience amid fiscal disruption. Meanwhile, S&P Global estimated Trump’s tariffs could cost global companies $1.2 trillion this year, with two-thirds of that burden falling on consumers.

Bank of Canada Governor Tiff Macklem said policy decisions will weigh risks more heavily as growth stays soft and uneven. Canada’s rig count rose by five, while U.S. rigs inched up by one, according to Baker Hughes. In Mexico, no major data were released.

Europe

Eurozone inflation was revised slightly higher, with September’s core rate ticking up to 2.4%, reinforcing expectations that the ECB will hold rates steady through year-end. MUFG projected another ECB rate cut by mid-2026 but said the euro could still strengthen if the Fed eases faster, narrowing yield spreads.

Falling energy prices from OPEC+’s production increase and China’s export re-routing were cited as disinflationary factors, while Standard Chartered noted central banks are trading the dollar countercyclically — buying weakness and selling strength — smoothing volatility across currencies.

Asia

In China, the PBOC signaled no change to its loose monetary stance ahead of Monday’s rate announcement, prioritizing liquidity support amid trade tensions. Nomura expects Beijing to drop a formal GDP target in its next Five-Year Plan, shifting focus toward stability and security.

Beijing also accused Washington of “stoking panic” over its new rare-earth export rules, deepening trade friction ahead of the expected Trump-Xi meeting at the APEC summit. Meanwhile, Chinese crude imports from Canada hit record highs as purchases of U.S. oil fell, reflecting shifting supply chains amid escalating tariffs.

Elsewhere, Singapore’s September exports surprised with a 6.9% annual gain, beating forecasts on strong electronics demand. South Korea warned that Trump’s proposed $350 billion upfront investment could destabilize its FX market, raising the specter of 1997-style stress if implemented.

Japan’s three mega-banks announced plans for a dollar-yen stablecoin to streamline cross-border payments, part of Tokyo’s accelerating push into digital finance.

Rest of World

Westpac said the RBA’s November meeting remains “live” after an uptick in unemployment, with the next inflation print likely to determine a rate move. The bank sees a 25-bp cut as a live option if inflation softens.

Chile’s copper premium surged to $325 per ton due to supply shortages, with output down 10% year-on-year. The disruption may tighten global supply in coming months, according to Commerzbank.

Commodities

Gold tumbled 2% from record highs to around $4,230 as Trump’s softer China rhetoric and firmer Treasury yields triggered profit-taking and reduced haven demand. The pullback followed a parabolic rally earlier in the week that briefly topped $4,360. HSBC remains bullish long-term, citing central-bank buying and U.S. fiscal concerns as ongoing drivers.

Oil prices slid to multi-month lows as inventories rose and the IEA’s forecast for a 4 million bpd surplus drew skepticism. ING and Commerzbank both said the oversupply is overstated given current production levels. U.S. natural gas also dipped to a three-week low amid strong storage builds, leaving the market comfortably supplied ahead of winter.

Crypto

Crypto markets extended losses, with Bitcoin slipping below $105,000 and Ethereum and XRP testing key support levels. CoinGlass data showed over $1.2 billion in liquidations in 24 hours, mostly from long positions, underscoring leveraged unwinds. Altcoins led declines, dragging total crypto market capitalization down 6% to $3.76 trillion.

Ripple’s XRP continued its four-day slide toward $2 support, with open interest plunging to its lowest since June. Analysts see capitulation nearing as weaker holders exit. Uniswap’s integration of Solana marked a major step in DeFi unification, expanding token access across multiple chains despite concurrent market weakness.