North America News

Stocks End Mixed After Fed Cut, Powell Signals Caution

The stock market closed with a split performance Wednesday as the Federal Reserve delivered a widely expected 25-basis-point cut, while signaling a measured path for easing.

- Dow Jones Industrial Average: +260.42 (0.6%) at 46,018.11

- S&P 500: -6.42 (-0.1%) at 6,600.34

- Nasdaq Composite: -72.63 (-0.3%) at 22,261.33

The Dow surged to a record intraday high of 46,261.95 immediately after the FOMC announcement, but the Nasdaq reversed gains late in the session, pulling the S&P slightly lower.

FOMC impact: The 25-bps cut was fully priced in, with investors more focused on the Fed’s updated projections. The dot plot showed officials split: 10 policymakers expect two more cuts this year, 9 expect fewer.

Rate expectations rose following the decision:

- October 29 meeting: 89.9% odds of at least one more cut (vs. 78.2% yesterday).

- December 10 meeting: 83.9% odds of another cut (vs. 72.8% yesterday).

While easing is expected through year-end, the Fed now projects only one cut in 2026, fewer than markets had previously priced in.

Sector moves:

- Tech (-0.7%), industrials (-0.5%), and consumer discretionary (-0.3%) lagged, dragged lower by mega-cap weakness.

- NVIDIA (NVDA) fell 2.6% after reports that China asked domestic firms to halt purchases of its products.

- Financials (+1.0%) and consumer staples (+0.9%) led gainers, with four other sectors posting modest advances.

Market breadth: The equal-weighted S&P 500 (+0.1%) outperformed the cap-weighted index (-0.1%), while small caps gave back early gains. The Russell 2000 added 0.2% and the S&P Mid Cap 400 slipped 0.2%.

IPO watch: StubHub (STUB) priced at $23.50, opened at $25.35, but closed down 6.4% at $22.00.

Bonds: Treasury yields climbed after the Fed decision. The 2-year yield rose 4 bps to 3.55%, and the 10-year yield added 5 bps to 4.08%.

Economic data:

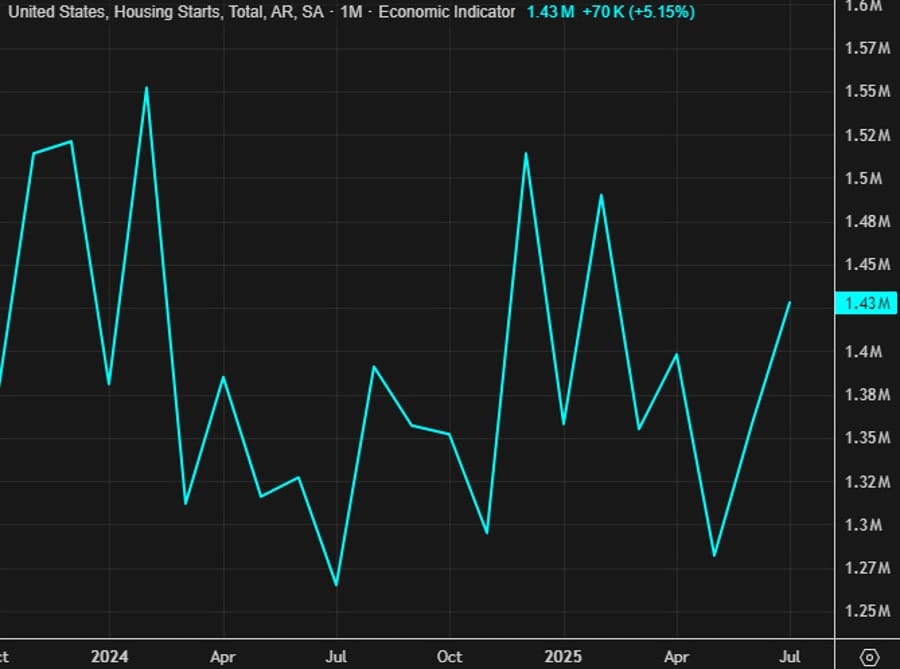

- Housing starts fell 8.5% in August to 1.307M; building permits declined 3.7% to 1.312M. Weakness was concentrated in single-family homes, especially in the South (-17%).

- MBA Mortgage Index jumped 29.7%, with refinancing up 57.7% and purchase applications up 2.9%.

YTD performance: Nasdaq +15.3%, S&P 500 +12.2%, Dow +8.2%, Russell 2000 +8.0%, S&P Mid Cap 400 +4.7%.

Fed Cuts Rates by 25 bps, Miran Dissents for 50 bps

The Federal Reserve lowered its target range by 25 basis points to 4.00–4.25% on September 17, 2025, in line with market expectations. Governor Miran dissented, preferring a 50 bps move, while all other members supported the smaller cut.

The statement noted that economic activity “moderated in the first half,” and that “job gains have slowed.” The earlier phrase that unemployment “remains low” was dropped in favor of saying it has “edged higher.”

On inflation, the language shifted slightly to say it has “moved up and remains somewhat elevated,” compared with “remains somewhat elevated” in the previous release.

The Fed’s median projections still show two additional cuts this year. Forecasts for end-2026 and beyond were left unchanged.

Fed Forecasts: Stronger Growth, Two More Cuts in 2025

The Fed’s updated projections showed a dovish tilt, with the 2025 year-end funds rate now expected at 3.675%, down from 3.875% previously. For 2026 and 2027, officials see rates at 3.375% and 3.125%, respectively, while 2028 was forecast at 3.125% for the first time. The longer-run rate was nudged up to 3.125% from 3.0%.

Markets now price in 47 bps of easing this year, compared with 41.9 bps before the decision. By July 2026, expectations stand at 108 bps in cuts, up from 100 bps previously.

Inflation: Headline PCE is forecast at 3.0% in 2025, 2.6% in 2026, 2.1% in 2027, and 2.0% in 2028. Core PCE is seen at 3.1% in 2025, 2.6% in 2026, 2.1% in 2027, and 2.0% in 2028.

Growth: GDP estimates improved to 1.6% for 2025 (from 1.4%), 1.8% for 2026 (from 1.6%), and 1.9% for 2027 (from 1.8%).

Jobs: The unemployment rate is projected at 4.5% in 2025, easing to 4.4% in 2026 and 4.3% in 2027, before reaching 4.2% in 2028.

The Fed emphasized resilience in consumer spending, but risks remain around the labor market’s ability to recover if layoffs accelerate.

Powell: Risks Tilt Toward Jobs, Policy Still Restrictive

Fed Chair Jerome Powell said recent data show GDP growth moderating, with the slowdown “largely reflecting weaker consumer spending,” even as business investment strengthens.

He highlighted:

- Disinflation in services is ongoing.

- Job gains are now below the breakeven pace.

- Labor demand has softened.

- Tariffs could prove more persistent than expected, with companies planning to pass costs to consumers.

Powell described the cut as a “risk-management move” given rising downside risks to employment. He stressed the Fed remains in a meeting-by-meeting stance, watching data closely, and pushed back on the idea that restrictive policy is no longer warranted.

On the dot plot, Powell noted forecasts reflect a range of views: 10 participants penciled in two more cuts this year, while 9 saw fewer.

He declined to comment on Fed Governor Lisa Cook’s court case and said benchmark payroll revisions matched expectations. Asked about his own plans for May, Powell said, “I have nothing new.”

Markets were unsettled by his lack of a stronger dovish signal, leaving rate expectations little changed beyond 2025.

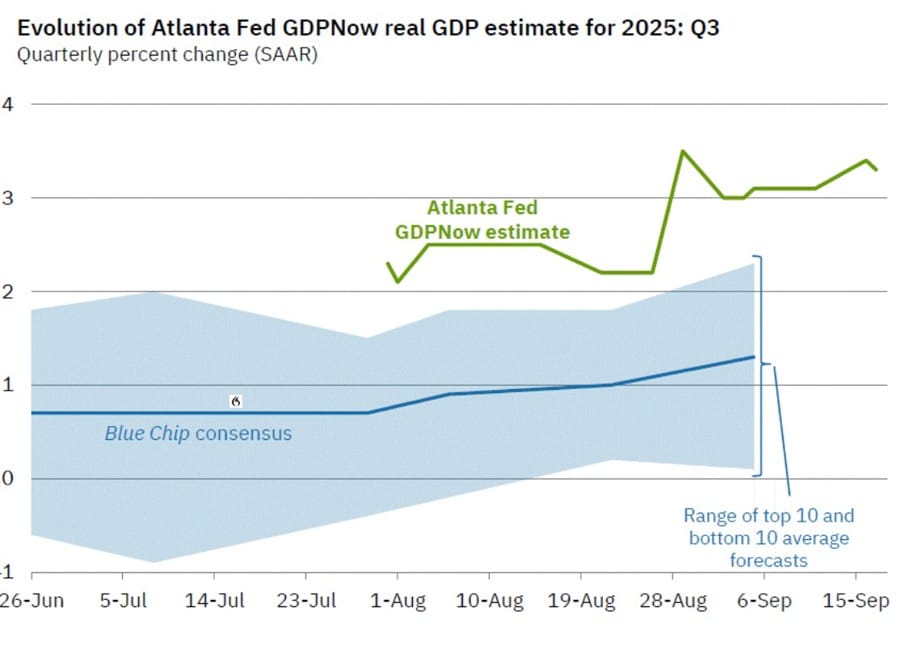

Atlanta Fed GDPNow Stays at 3.4%

The Atlanta Fed’s GDPNow model continues to project 3.4% growth for Q3 2025. The estimate was unchanged following the release of U.S. housing starts and building permits data, which failed to shift the growth outlook.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 3.3 percent on September 17, down from 3.4 percent on September 16. After this morning’s housing starts release from the US Census Bureau, the nowcast of third-quarter real residential investment growth decreased from -4.6 percent to -6.3 percent.

U.S. Housing Starts Fall Sharply in August

Housing starts in the U.S. dropped to an annualized 1.307 million in August, well below expectations of 1.365 million and down from July’s 1.428 million. That marks an 8.5% monthly decline, reversing July’s 5.2% increase.

Building permits also softened, falling to 1.312 million versus forecasts of 1.37 million. That represents a 3.7% monthly drop, following a 2.2% fall previously.

The readings put housing activity near the lower end of the post-COVID range. Analysts expect upcoming rate cuts to gradually support the sector.

U.S. Mortgage Applications Jump Nearly 30%

Mortgage applications in the U.S. surged 29.7% in the week ending September 12, data from the Mortgage Bankers Association shows. That compares with a 9.2% gain the previous week.

The market index climbed to 386.1 from 297.7. The purchase index edged up to 174.0 from 169.1, while refinancing demand soared to 1596.7 from 1012.4.

The average 30-year fixed mortgage rate slipped to 6.39% from 6.49%. While notable, the release typically does not move markets.

Lyft Shares Rally as Waymo Partnership Announced

Lyft shares jumped as much as 20% at the open and were last trading up 13% after news that Waymo will launch its self-driving taxi service in Nashville next year with Lyft as a partner.

The move marks the first time Waymo has teamed up with Lyft. In other markets, such as Atlanta and Austin, Waymo has chosen to work exclusively with Uber or its own Waymo One app. The mixed strategy suggests the company is testing different approaches across cities.

Treasury Secretary Bessent Under Scrutiny for Dual “Primary Residence” Claims

Bloomberg reports that U.S. Treasury Secretary Scott Bessent once declared two different homes as his “principal residence” simultaneously.

On September 20, 2007, Bessent pledged that both a seven-bedroom Georgian manor in Bedford Hills, New York, and a beachfront property in Provincetown, Massachusetts, would serve as his primary residence for mortgage purposes — both with the same lender on the same day.

The revelations echo claims made against Fed Governor Lisa Cook, whom the President has sought to remove. Cook has rejected the pressure, stating: “I have no intention of being bullied to step down from my position because of some questions raised in a tweet.” She remains in office while the matter proceeds through the courts.

Ex-Fed President Mester Warns Political Pressure Risks Fed Credibility

Loretta Mester, former Cleveland Fed president and now a Wharton professor, has warned that political attacks on the Fed could erode its credibility, even though they will not sway decisions.

Mester argued that skepticism among the public is a concern, noting: “They also have to contend with the fact that there may be some of the public that’s skeptical about how they’ve gone about making their decisions.”

She added that rate cuts, whether single or multiple, may not ease the political pressure, saying: “I’m not convinced one rate cut or many cuts will take pressure off the Fed.”

Fed Preview: Most Expect 25 bps Cut, Some Eye 50 bps Move

Markets are awaiting the Fed’s policy announcement on Wednesday, September 17, 2025, with consensus pointing to a 25 basis-point cut. Analysts say the smaller move is largely priced in and may not move markets much unless forward guidance shifts.

A more aggressive 50 basis-point cut, however, could weaken the U.S. dollar, push Treasury yields lower, and trigger a risk-on rally in equities and gold.

Banks expecting a 25 bps cut include BMO, Barclays, CIBC, Goldman Sachs, JPMorgan, Morgan Stanley, Nomura, RBC, Scotiabank, and Wells Fargo. Standard Chartered and Société Générale are among those forecasting a 50 bps move.

Société Générale Warns Stocks Could Retreat if Fed Turns Less Dovish

Société Générale’s Subadra Rajappa has cautioned that U.S. equities could sell off if the Federal Reserve does not meet market expectations for rate cuts. Speaking on CNBC, Rajappa said investors are positioned for a dovish stance, and any disappointment could cause “an unwind.”

If the Fed’s dot plot signals fewer rate cuts, the U.S. dollar could strengthen and Treasury yields rise, putting equities and gold under renewed pressure.

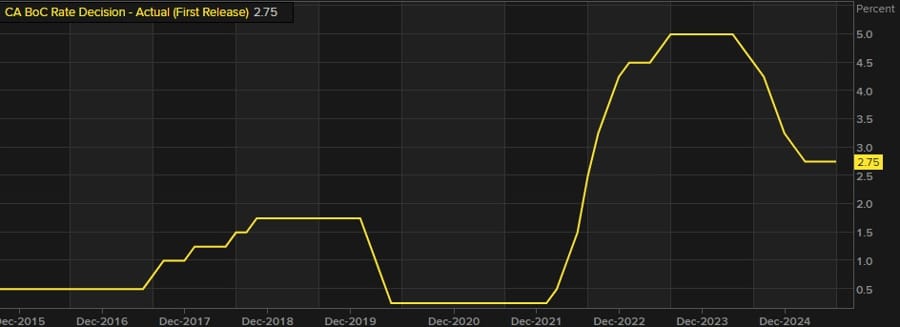

Bank of Canada Governor: Decision to Cut Was Unanimous

Bank of Canada Governor Tiff Macklem said there was “a clear consensus” to deliver a 25 bps rate cut this week, even as the inflation backdrop remains mixed.

He noted that while core inflation showed upward momentum earlier in the year, that pressure has now faded. “At this point, inflationary pressures look a bit more contained,” Macklem said. Still, tariffs are weighing on the Canadian economy, particularly in affected industries, and the central bank is watching exports and business investment closely.

The BoC expects growth of around 1% in the second half of 2025, ruling out recession. Markets have trimmed expectations for another October cut to 42%, down from 52% before the decision. Pricing for mid-2026 remains largely unchanged, with around 29 bps of easing expected.

Bank of Canada Delivers Expected 25 bps Rate Cut

The Bank of Canada cut its benchmark rate by 25 basis points to 2.50% on Wednesday, in line with expectations. The last cut came in March, and the easing cycle began in June 2024.

The central bank noted slowing global growth and said core inflation measures have hovered around 3%, though upward momentum has faded. Underlying inflation is running closer to 2.5%.

Officials pointed to reduced price pressure from the removal of Canadian retaliatory tariffs on U.S. goods. However, they highlighted ongoing risks from trade disruptions, shifting supply chains, and U.S. tariff impacts on Canadian exports and investment.

Markets were 95% priced for the cut and now see a 52% chance of another reduction in October. Futures imply 58 bps of easing by June 2026.

Commodities News

Gold Drops as Fed Signals Gradual Easing

Gold prices retreated Wednesday after the Fed’s 25-bps rate cut fell short of more aggressive easing hopes. At last check, spot gold was down 0.8% to $3,660.

Fed outcome: The FOMC delivered a quarter-point cut, with Governor Stephen Miran dissenting in favor of 50 bps. The statement acknowledged slower growth and a softer labor market while noting inflation has “moved up and remains somewhat elevated.”

SEP projections: The Fed’s Summary of Economic Projections pointed to another 50 bps of cuts by year-end, with the median year-end funds rate at 3.60%. Longer-term projections were unchanged.

Powell’s remarks:

- Labor demand “has softened.”

- Risks have “shifted,” with greater downside pressure on jobs.

- No broad support for a 50-bps cut this meeting.

- Policy remains restrictive but flexible, with the Fed prepared to adjust as needed.

The cautious tone dampened gold’s rally momentum, with investors trimming bets on an aggressive cutting cycle despite inflation remaining above target.

Gundlach: Gold Will “Almost Certainly” Top $4,000 in 2025

DoubleLine Capital CIO Jeff Gundlach said gold prices are headed higher after hitting $3,700 for the first time. Speaking on CNBC after the Fed decision, which he supported, Gundlach said, “I think almost certainly gold will close above $4,000 by the end of this year.”

Gold has doubled over the past two years and is up 45% year-to-date. Gundlach called the rally “ridiculous” and noted that rising participation by gold miners and retail investors signals broadening momentum.

He sees another $340 gain from current levels, a rise of around 9%.

Gundlach also attributed part of gold’s surge — and the dollar’s decline — to politics, saying that for Trump-era Fed chair candidates, “the job interview is: Will you do what I tell you to do?”

U.S. Oil Inventories Post Massive 9.3 Million Barrel Draw

The latest EIA data showed a huge crude oil stock draw of 9.285 million barrels, far exceeding expectations for a 0.857 million decline.

Gasoline inventories fell by 2.347 million barrels, compared with forecasts for a small build of 68,000. Distillate supplies rose 4.046 million, beating expectations for a 975,000 increase.

At Cushing, stockpiles were down 298,000 barrels, following a 365,000 decline the week before.

The figures confirm a much deeper crude draw than the API survey had indicated, which reported a 3.42 million barrel drop the previous day.

LME Aluminium Rally Extends; Tom-Next Spread at One-Year High

Aluminium prices on the LME climbed for the eighth straight session, closing above $2,700/t — the strongest since February 20, 2025. ING analysts Ewa Manthey and Warren Patterson attributed the move to expectations of a U.S. Federal Reserve rate cut this week and a weaker dollar index, which has slipped to its lowest since 2022.

The aluminium tom-next spread flipped to a premium of $13.25/t on Tuesday, the highest since August 2024, after weeks in contango. The shift signals rising physical demand and tighter exchange inventories.

LME data showed aluminium stocks fell by 1,500 tonnes to 483,375 tonnes. On-warrant inventories dropped to 375,025 tonnes, the lowest since July 7, 2025. Speculative positioning also strengthened, with COTR data showing net long bets rising 4,562 lots to 131,922 as of September 12 — the most bullish since June 2024.

In other base metals, money managers added 2,597 lots to their copper net long, bringing the total to 56,390. Zinc net longs were cut by 1,654 lots to 33,066.

Private Survey Shows Larger-Than-Expected U.S. Crude Draw

The latest API inventory report showed a larger-than-expected drawdown in crude oil stocks. Crude supplies fell by 3.420 million barrels, compared with forecasts for a 1.6 million decline.

Gasoline inventories decreased by 691,000 barrels, while distillates rose by 1.906 million. At Cushing, stockpiles dropped by 379,000 barrels.

Morgan Stanley CIO Pushes 60/20/20 Portfolio, Gold as Key Hedge

Morgan Stanley Chief Investment Officer Mike Wilson is advocating a 60/20/20 portfolio mix — 60% equities, 20% bonds, and 20% gold — as an upgrade to the traditional 60/40 strategy.

Wilson argues that with limited upside in U.S. stocks and higher bond yields, gold provides stronger inflation protection. He favors shorter-dated Treasuries such as five-year notes over 10-year bonds for better returns.

He describes equities and gold as complementary hedges: equities offering growth upside, and gold serving as a safe haven when real rates decline. His remarks come as U.S. equities have rebounded strongly, with the S&P 500 and Nasdaq posting fresh September highs despite seasonal weakness.

Bank of America Sees Gold Hitting $4,000 by 2026, Warns of Fed Risks

Bank of America remains committed to its $4,000 per ounce gold target for 2026 but warns of potential volatility in the near term. Analysts point to stretched speculative positions and the risk of a hawkish Federal Reserve as possible triggers for a pullback.

Investment demand for gold now exceeds central bank Treasury holdings, underscoring its appeal as a hedge. Still, sentiment appears crowded. BofA expects the Fed to cut rates this week, pause until December, and then reassess.

Inflation, measured by the PCE index, is expected to stay above 3% through mid-2026, keeping pressure on policymakers. If the Fed signals fewer cuts, analysts warn speculative positions could unwind, hitting gold in the short term. Longer-term, however, gold is still viewed as one of the strongest hedges against inflation and policy missteps.

Europe News

Eurozone Final August CPI Revised Slightly Lower

Eurostat confirmed on September 17 that eurozone consumer prices rose 2.0% year-on-year in August, a touch below the preliminary 2.1% reading and unchanged from July.

Core CPI held at 2.3%, in line with the flash estimate, but down from 2.4% in the prior month.

ECB Wage Tracker Points to Slower Growth in 2026

The ECB’s latest wage tracker shows that negotiated wage growth, including smoothed one-off payments, averaged 4.6% in 2024 and 3.2% in 2025. For the first half of 2026, the figure falls sharply to 1.7%, down from 2.1% in the latter half of 2025 and 4.3% in the first half of that year.

The slowdown indicates wage pressures are becoming more stable, a positive sign for the ECB as it looks to maintain inflation close to target in the absence of fresh shocks.

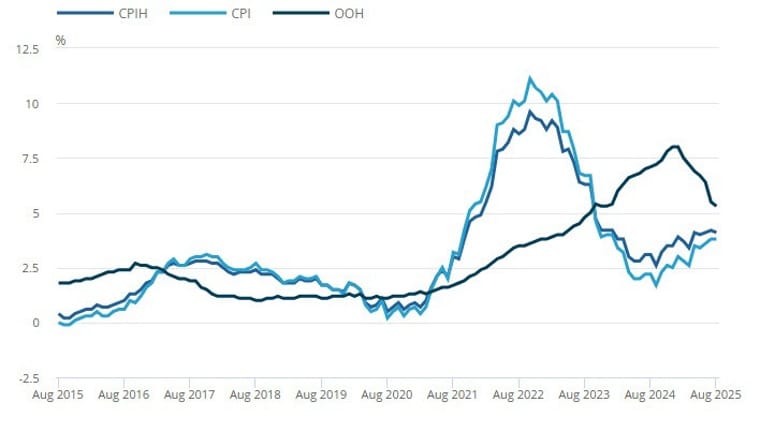

UK Inflation Holds at 3.8% in August, Core Slips on Airfare Prices

UK consumer prices rose 3.8% year-on-year in August, matching both expectations and July’s reading, according to the ONS. Core CPI eased to 3.6%, in line with forecasts and down from 3.8% previously.

The decline in core inflation was driven largely by airfare costs. Prices increased 2.1% between July and August this year, a sharp contrast to the 22.2% surge seen during the same period in 2024. The difference stems from holiday travel falling earlier in July this year, which inflated that month’s index.

Services inflation also moderated slightly, easing from 5.0% to 4.7% in August, while goods inflation ticked higher from 2.7% to 2.8%.

For the Bank of England, the picture remains broadly unchanged: core inflation is still elevated and services remain sticky, even if momentum is cooling.

ECB’s Stournaras: Soft landing achieved, but must remain flexible and ready to act

- Remarks from the ECB policymaker via Econostream

- Latest ECB decision driven by prudent, wait and see approach in a fluid and uncertain environment.

- Financing conditions had become easier in orderly fashion thanks to ECB policy.

- This should support a gradual economic recovery over the medium term.

- By keeping inflation expectations firmly anchored to our medium term target, monetary policy acts as a stabilising force.

- Looking ahead, favourable financing conditions are expected to support growth even though risks due to trade policy uncertainty and geopolitical tensions are tilted to the downside.

ECB’s Escriva: We need to be agile and ready to move in any direction on monetary policy

- Comments from the ECB policymaker

- Even if out central scenario is materialising, that doesn’t mean the uncertainty elements have been erased.

- Disinflation has been a success.

- The situation was complex two or three years ago.

- The current interest rate at 2% seem reasonable to us.

- Risks to inflation are balanced and slightly negative for growth.

ECB’s de Guindos: The current interest rate is appropriate

- Comments from the ECB Vice President, Luis de Guindos

- The current interest rate is appropriate based on inflation developments, our projections and the transmission of monetary policy.

- We are living in a very complex and uncertain world with numerous risks.

- Despite rising real incomes, consumption remains subdued. Maybe because households fear higher taxes in the future.

- Markets are not always wrong, but they are not always right either.

- Thursday decision was unanimous.

- We all agree we must keep all options open.

- If the situation changes, we will adjust out stance accordingly.

- An independent central bank is the best protection against high inflation.

- Inflation expectations only stay low if investors and consumers trust the central bank to keep prices stable.

- It’s particularly critical if monetary policy is constrained by fiscal policy – what we can fiscal dominance.

Asia-Pacific & World News

Beijing Orders Tech Firms to Halt Nvidia Chip Purchases

China’s internet regulator has told the country’s leading technology companies to stop buying Nvidia’s AI chips and cancel existing orders, the Financial Times reports.

The directive marks a step up from earlier restrictions focused only on Nvidia’s H20 processors. Beijing is intensifying pressure on its tech sector to reduce reliance on U.S. suppliers and support the growth of domestic semiconductor capabilities.

Full report here

Beijing Rolls Out Service-Sector Boost: Healthcare, Culture, Sports, and Tourism

China has unveiled new policies designed to stimulate services consumption as the economy slows. Announced by nine agencies, including the central bank and commerce ministry, the plan aims to open key industries such as healthcare, education, telecommunications, and culture to more private and foreign investment.

Healthcare and tourism feature heavily in the initiative, with authorities looking to attract capital into mid- to high-end services. The sports economy is also in focus, with support for professional leagues, international events, and large-scale activities.

Funding will flow from both central and local governments, with special bonds targeted at projects in culture, elderly care, childcare, tourism, and sports. Banks will be urged to extend more credit lines to service businesses.

The rollout comes as August factory output and retail sales delivered their weakest readings in a year. To prop up demand, Beijing has already deployed ¥231 billion ($32.5 billion) in special treasury bonds to back appliance and electronics trade-ins. Economists stress that a stronger services sector is vital as China battles U.S. tariffs and broad growth headwinds.

China’s Rare-Earth Export Curbs Hit European Companies, Losses in Millions

The European Chamber of Commerce in China has warned that at least one member company has lost “millions of euros” due to Beijing’s tighter controls on rare-earth exports. China holds nearly 70% of global rare-earth output and around half of reserves, giving it an outsized role in the supply chain.

European firms report increasing difficulty obtaining licenses, with requirements now including single-use permits and proof that materials won’t be used for military applications. Despite some approvals earlier in the year, uncertainty has grown.

The EU sources nearly half of its rare-earth imports from China, leaving it highly vulnerable to disruption. Businesses warn shortages could emerge by Q3, and the European Chamber plans to brief policymakers as Beijing finalizes its next five-year strategy.

China’s Golden Week Travel Bookings Surge, Railways to Handle 219 Million Trips

China is gearing up for an enormous travel wave during its upcoming “golden week” holiday from October 1 to October 10, expected to lift both mobility and spending across the country. The break, which combines the Mid-Autumn Festival and National Day, is already generating strong demand for both domestic and overseas trips.

The railway system anticipates carrying 219 million passengers between September 29 and October 10, a sharp increase from last year’s 177 million during the same period. October 1 alone set a record in 2022 with 21.4 million journeys, and this year’s figures may surpass that.

Demand isn’t limited to rail: domestic flight searches in early September climbed 30% year-on-year, with bookings for planes, trains, and car rentals all posting sharp gains. Multi-destination car rentals jumped 93% compared with last year, according to travel platform Fliggy.

PBOC sets USD/ CNY mid-point today at 7.1013 (vs. estimate at 7.1021)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 418.5bn yuan via 7-day reverse repos at 1.40%

- net 114.5bn yuan injection

Australia’s Westpac Leading Index Slips Below Trend

Australia’s Westpac-Melbourne Institute Leading Index showed its first below-trend reading since late 2024, signaling a loss of economic momentum. The six-month annualized growth rate fell to -0.16% in August, down from +0.11% in July.

Nearly all components contributed to the slowdown, underscoring weaker momentum even as overall recovery continues. Analysts note the Reserve Bank of Australia has been cautious about cutting rates given stubborn inflation and a resilient labor market, though signs of a softer outlook are emerging.

New Zealand Q2 Current Account Deficit Much Smaller Than Expected

New Zealand’s Q2 2025 current account deficit came in at NZD -0.970 billion, far better than expectations of -2.700 billion and significantly smaller than Q1’s NZD -2.324 billion.

The annual current account balance stood at -NZD 15.956 billion, compared with forecasts of -20.4 billion and an improvement from -24.662 billion previously. As a share of GDP, the deficit narrowed to -3.7% from -5.7%, beating expectations of -4.8%.

New Zealand Westpac Consumer Confidence Edges Lower in Q3

New Zealand’s Westpac Consumer Confidence index slipped slightly in Q3 2025, coming in at 90.9 versus 91.2 in the previous quarter.

Japan Trade Data August 2025: Exports Extend Decline, Imports Drop

Japan’s exports fell for the fourth straight month in August, down 0.1% year-on-year. While still negative, the figure beat expectations of a 1.9% drop and was better than July’s 2.6% decline.

Imports fell 5.2% year-on-year, a smaller decline than the 7.4% seen previously but larger than the forecast of -4.2%. The trade balance came in at a deficit of ¥242.5 billion, narrower than the expected ¥513.6 billion shortfall but wider than July’s ¥118.4 billion deficit.

Japan’s GPIF Makes First Direct Alternative Investments at Home with ¥50 Billion

Japan’s Government Pension Investment Fund (GPIF), the world’s largest pension fund, is taking its first steps into domestic alternative assets without external managers. The fund has earmarked ¥50 billion ($340 million), with ¥40 billion set aside for infrastructure projects such as data centers and ¥10 billion for real estate.

Though small compared with GPIF’s massive ¥260 trillion portfolio, the move gives the fund greater control while expanding into higher-yielding investments beyond stocks and bonds. Alternatives come with risks, including low liquidity and exposure to property and infrastructure cycles, but they have gained traction globally.

Currently, GPIF allows alternatives to make up to 5% of its holdings, but actual exposure remains just 1.6%. The shift could help fuel demand in Japan’s property and infrastructure sectors, while signaling that Japanese institutions are catching up with peers abroad.

Singapore’s Non-Oil Exports Post Steep August Drop

Singapore’s Non-Oil Domestic Exports (NODX) plunged 11.3% year-on-year in August, badly missing expectations for a 0.1% gain. Shipments also declined 8.9% month-on-month, following a 6% fall in July.

Both electronics and non-electronics exports slumped, with shipments to key partners such as the U.S., China, and Indonesia all down. Exports to the U.S. dropped 28.8% as tariffs of 10% added pressure despite Singapore’s free-trade agreement.

Officials caution that growth will slow in the second half of 2025 after stronger results earlier in the year. Enterprise Singapore still projects 1%–3% growth for non-oil exports across the full year.

Crypto Market Pulse

Crypto Market Pauses Ahead of Fed; BTC Near $117K

The global crypto market cap rose 1% in the past day to $4.06 trillion, fueled by Wall Street gains and expectations of a Fed rate cut. The weaker dollar also lifted valuations.

Bitcoin briefly traded above $117,000 Wednesday morning, maintaining its September uptrend. Resistance sits near $119,000, a level last seen in late July. A breakout there could open the way for new all-time highs.

Binance Coin has already been setting fresh records, climbing from $500 in spring to $860 in July before retracing. The current rally suggests a near-term target of $1,080 from Wednesday’s $955.

Investor focus is squarely on the Fed. Analysts expect BTC could dip after an anticipated 25 bps cut. Still, some see a bullish Q4: Fundstrat’s Tom Lee forecasts a “grand rally” in BTC and ETH on the back of looser global monetary policy and seasonal strength.

In corporate moves, PayPal rolled out a crypto payments feature called PayPal Links, while Michael Saylor’s Strategy added 525 BTC last week, bringing its holdings to 638,985 BTC worth $47.23 billion.

Elsewhere, China’s Next Technology Holding announced a $500 million share sale, partly to expand its bitcoin position. Pantera’s Dan Morehead also reiterated his bullish stance on Solana, noting its $1.1 billion exposure exceeds the firm’s Bitcoin and Ethereum holdings.

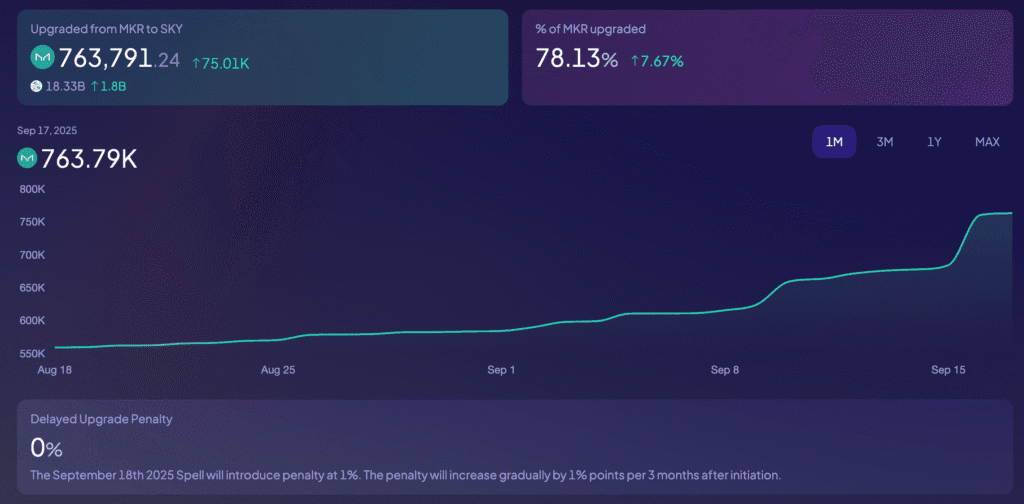

SKY Climbs as Revenue Hits Record and Upgrade Deadline Nears

Sky (SKY), the successor to MakerDAO’s MKR token, gained over 5% on Wednesday, extending its rebound from the 200-day EMA. The move came as quarterly revenue topped $100 million in Q3 — the highest on record — and ahead of Thursday’s deadline to upgrade MKR to SKY without penalty.

Analytics firm Token Terminal estimates Sky Protocol could generate nearly $470 million in revenue over the next 12 months, with Spark.Fi and Grove.Finance driving growth. As of Wednesday, 78.13% of MKR has been converted, up nearly 8% in 24 hours.

A community vote on Thursday could approve penalties for late conversion, starting at 1% on Monday and rising by 1% every three months until reaching 100% by 2050. The looming deadline has accelerated demand, adding bullish momentum.

Forward Industries Launches $4B Equity Program to Expand Solana Treasury

Solana (SOL) traded near $230 support on Wednesday, softening ahead of the Federal Reserve’s policy decision, even as Forward Industries unveiled a major new capital raise.

The NASDAQ-listed company filed an at-the-market equity offering of up to $4 billion with the SEC, with proceeds earmarked for corporate purposes and expansion of its Solana treasury. The move follows a record $1.65 billion raise earlier this month, which financed the purchase of 6.8 million SOL.

Chairman Kyle Samani called the ATM program a “flexible and efficient mechanism” to scale the firm’s Solana strategy. The company expects the new funds to strengthen its treasury positioning and support broader growth initiatives.

Forward joins around 10 other listed firms with active Solana holdings, including DeFi Development Corp, Upexi, Sharps Technology, Sol Strategies, and Exodus. Pantera Capital CEO Dan Morehead said this week that his firm holds $1.1 billion worth of Solana, its largest allocation in digital assets.

Stellar (XLM) Sees Intraday Surge, Then Rapid Reversal

Stellar’s XLM token traded in a volatile $0.38–$0.39 band over the past day, with a dramatic spike during early European hours. Between 08:00–09:00 UTC, prices jumped from $0.38 to $0.39 on trading volume above 70 million — more than triple the 24-hour average.

Momentum carried into the following hour with volume still above 60 million, supported by optimism around institutional adoption. A DTCC patent filing recently cited XLM and XRP as viable networks for liquidity tokenization in markets handling $4 quadrillion in securities annually. Meanwhile, Stellar’s total value locked has risen ninefold over the past year, with new payments and asset management firms preparing launches.

But momentum faded quickly in the afternoon session. Between 13:15–14:14 UTC, XLM dropped back toward $0.38, with the sharpest selling around 13:45 on heavy 3.6 million volume. The late fade pointed to institutional withdrawal and possible short-term consolidation.

The pattern highlights both surging institutional interest in Stellar’s ecosystem and the fragility of short-term sentiment.

BofA Survey Shows Fund Managers Keep Crypto Allocations Near Zero

Bank of America’s latest Global Fund Manager Survey reveals that institutional investors remain reluctant to allocate meaningfully to cryptocurrencies despite the sector’s growth.

The September survey found that 67% of managers reported zero allocation to crypto assets, including bitcoin, ether, ripple, and tether. Just 3% hold a 2% allocation, another 3% reported 4%, and only 1% have 8% or more exposure.

Across the full sample, average allocation to crypto is just 0.4% of assets under management. Even among those invested, weighted exposure averages only 3.7%.

The study highlights deep structural skepticism: 84% of respondents said they have not made structural allocations to crypto, with only 8% treating it as a long-term asset class. Concerns include volatility, unclear regulation, and uncertainty over crypto’s role in diversified portfolios.

Despite retail adoption and new regulated products such as spot bitcoin ETFs, institutional allocations remain negligible.

The Day’s Takeaway

North America

- Federal Reserve Cuts Rates: The Fed lowered its target range by 25 bps to 4.00–4.25%, with Governor Miran dissenting in favor of 50 bps. Updated projections signal two more cuts this year, but fewer in 2026. Powell emphasized risks are tilting toward jobs while policy remains restrictive.

- Market Reaction: U.S. equities ended mixed — Dow +0.6% at a record, S&P 500 -0.1%, Nasdaq -0.3%. Financials and staples outperformed, while tech lagged. Treasury yields rose, with the 10-year at 4.08%. Gold slipped 0.8% after the cut.

- Economic Data: August housing starts dropped 8.5% to 1.307M, while building permits fell 3.7%. MBA mortgage applications surged 29.7%, led by refinancing demand. Atlanta Fed GDPNow held steady at 3.4% for Q3.

- Treasury Controversy: Reports emerged that Treasury Secretary Scott Bessent once claimed two properties as “primary residences” on the same day for mortgage purposes, drawing scrutiny.

- Corporate Moves: Lyft shares rallied up to 20% after announcing a self-driving taxi partnership with Waymo in Nashville.

- Canada: The Bank of Canada cut rates by 25 bps to 2.50%, with Governor Macklem stressing the decision was unanimous. Inflationary pressures are easing, though tariffs weigh on growth. Markets now see reduced odds of another cut in October.

Europe

- UK Inflation: CPI held at 3.8% in August, with core easing to 3.6% on airfare declines. Services inflation slipped to 4.7%, but remains elevated.

- Eurozone Inflation: Final August CPI was revised to 2.0% y/y (vs. 2.1% prelim). Core CPI held at 2.3%.

- ECB Wage Tracker: Negotiated wage growth expected to slow sharply to 1.7% in early 2026, easing pressure on inflation.

- Rare-Earth Disruption: The European Chamber of Commerce in China reported members losing “millions” from Beijing’s stricter rare-earth export controls, highlighting Europe’s vulnerability.

Asia

- China Golden Week Travel: Railways expect 219M trips during the Oct. 1–10 holiday, up from 177M last year. Domestic flights and car rentals are also surging.

- China Services Push: Beijing rolled out new measures to boost healthcare, tourism, sports, and culture sectors, with funding from special bonds and bank credit.

- China Tech Restrictions: Authorities ordered local firms to halt purchases of Nvidia chips, escalating efforts to reduce U.S. reliance.

- Japan:

- GPIF invested ¥50B in domestic alternatives (infrastructure & real estate) without external managers, marking a first.

- Trade Data: August exports fell 0.1% y/y, the fourth straight decline, while imports dropped 5.2%. Trade deficit widened to ¥242.5B.

- Australia: Westpac Leading Index turned negative for the first time since 2024, pointing to slowing momentum.

- Singapore: Non-oil exports plunged 11.3% y/y in August, far worse than forecasts, with shipments to the U.S. down nearly 29% amid tariffs.

- New Zealand: Q2 current account deficit shrank to NZD -0.97B (vs. -2.7B expected), improving as a share of GDP to -3.7%. Consumer confidence edged lower in Q3.

Commodities

- Oil:

- EIA Data: U.S. crude stocks posted a massive 9.3M barrel draw, far deeper than expected. Gasoline inventories fell 2.3M, while distillates rose 4M.

- API Data: Private survey showed a smaller 3.4M draw the prior day.

- Gold:

- Prices dipped after the Fed’s cautious cut, last at $3,660.

- Bank of America reaffirmed its $4,000 target by 2026 but warned of near-term risks from speculative positioning and Fed policy shifts.

- Jeff Gundlach predicted gold will “almost certainly” top $4,000 this year, citing political risks and investor momentum.

- Morgan Stanley CIO Mike Wilson promoted a 60/20/20 portfolio with gold as a hedge.

- Base Metals: LME aluminum extended its rally above $2,700/t, with tom-next spreads flipping to a one-year high premium. Inventories fell, while speculative longs hit their most bullish since mid-2024. Copper net longs rose; zinc longs were cut.

Crypto

- Market Overview: Crypto market cap rose 1% to $4.06T as BTC held near $117K. Analysts see resistance at $119K. Binance Coin trades near $955 with upside to $1,080.

- Corporate Moves:

- Forward Industries launched a $4B equity program to expand its Solana treasury, following a $1.65B raise earlier this month.

- PayPal introduced “PayPal Links” for crypto payments.

- Michael Saylor’s Strategy added 525 BTC, bringing holdings to nearly 639K BTC.

- China’s Next Technology announced a $500M share sale, partly to expand bitcoin exposure.

- Solana: Pantera Capital revealed $1.1B in Solana holdings, its largest digital asset allocation.

- Stellar (XLM): Surged briefly on institutional adoption optimism, then retraced as volume faded. A DTCC filing cited XLM and XRP as viable tokenization networks.

- Sky (SKY): Gained over 5% as quarterly revenue hit $100M and MKR-to-SKY upgrade deadline approached. Conversion reached 78%.

- Institutional Flows: BofA’s Fund Manager Survey showed crypto allocations remain minimal, averaging just 0.4% of AUM, with 67% reporting zero exposure.