North America News

NASDAQ, S&P Close at Record Highs as Netflix Beats Earnings Forecast

U.S. stocks closed higher across the board on Thursday, with both the NASDAQ and S&P 500 notching new all-time highs. The NASDAQ logged its 10th record close of 2025, while the S&P marked its ninth record finish this year.

Here’s where the major indexes ended:

- Dow Jones Industrial Average: +230.32 points (+0.52%) to 44,485.10

- S&P 500: +33.76 points (+0.54%) to 6,297.46

- NASDAQ Composite: +153.78 points (+0.74%) to 20,884.27

After the bell, Netflix reported stronger-than-expected results:

- EPS: $7.19 vs. $7.06 expected

- Revenue: $11.08 billion vs. $11.04 billion expected

- Forward Guidance: Netflix now expects full-year revenue between $44.80–$45.20 billion, above consensus forecasts of $44.43 billion.

Shares of Netflix were volatile in after-hours trading as the market parsed the earnings details and outlook.

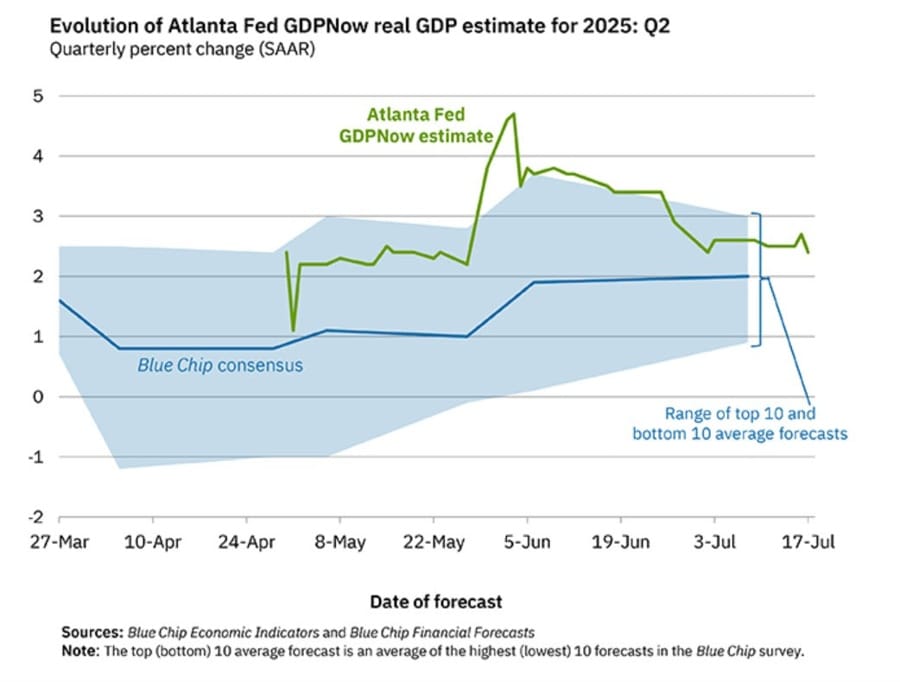

Atlanta Fed Lowers Q2 GDPNow Estimate to 2.4%

The Atlanta Fed’s GDPNow model has revised its forecast for Q2 2025 U.S. economic growth down to 2.4%, from 2.6% previously. While still pointing to a modestly expanding economy, the dip reflects slightly weaker-than-expected input data, including inventory and consumption components.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on July 17, down from 2.6 percent on July 9. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Federal Reserve Board of Governors, the nowcast of second-quarter real personal consumption expenditures growth declined from 1.6 percent to 1.5 percent.

30-Year U.S. Mortgage Rate Inches Up to 6.75%, Still Below January High

Freddie Mac reports the average 30-year fixed mortgage rate in the U.S. has climbed to 6.75% from 6.72% this week. While a modest rise, it puts rates back near the top of the recent trading range for 2025, which has hovered between 6.10% and 7.22%. The lowest point this year was 6.62% in early April, while the high was 7.04% in mid-January.

Last fall’s spike—between September and November—briefly pushed mortgage rates as high as 7.79%, marking the cycle peak so far. With inflation and Fed expectations shifting again, housing markets remain sensitive to these rate movements.

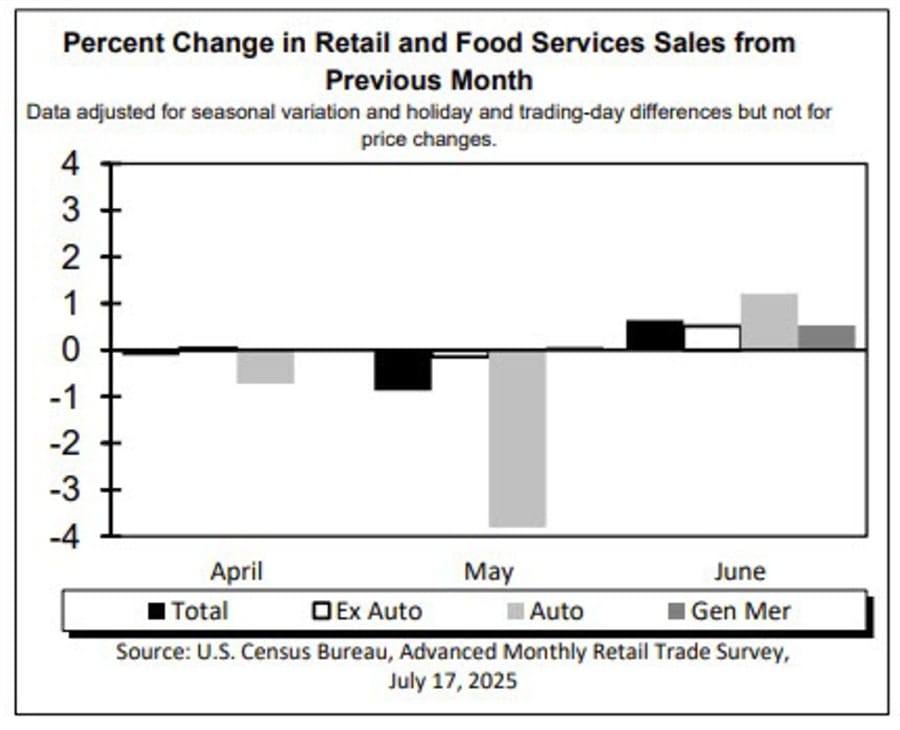

U.S. Retail Sales Rise 0.6% in June, Beating Expectations

Retail sales bounced back in June, climbing 0.6% month-over-month and topping the 0.1% consensus. The ex-auto and ex-gas numbers also beat, at 0.5% and 0.6%, respectively. The prior month was revised slightly lower.

The control group—a key input into GDP—rose 0.5%, indicating firm underlying consumption. Annual retail sales growth now stands at 3.5%, up from 3.29% in May. However, as the data is not inflation-adjusted, some of the gains likely reflect higher prices.

Notable category increases included:

- E-commerce: +1.2%

- Autos and parts: +0.9%

- Clothing: +0.9%

- Furniture: +0.7%

- Building materials: +0.9%

Declines were modest and focused on:

- Health/personal care: -0.5%

- Electronics: -0.3%

- Department stores: -0.8%

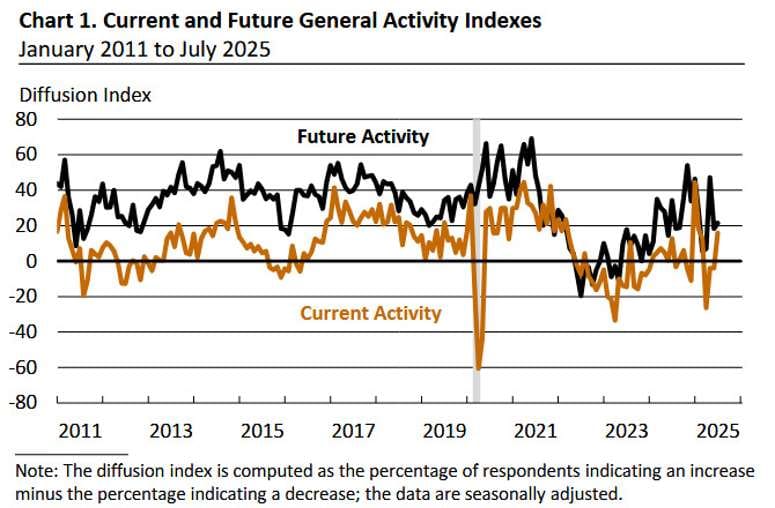

Philly Fed Index Surges to 15.9 in July, Employment Turns Positive

The Philadelphia Fed’s manufacturing index surprised to the upside in July, jumping to +15.9 from June’s -4.0 reading. Forecasts had pointed to a negative -1.0 result. All major components improved.

- New orders rose to 18.4 (from 2.3)

- Shipments jumped to 23.7 (from 8.3)

- Prices paid soared to 58.8 (from 41.4)

- Prices received hit 34.8 (from 29.5)

- Employment turned positive at 10.3 (from -9.8)

While this regional survey is volatile and rarely market-moving on its own, the July numbers suggest robust activity. Firms appear optimistic about the next six months, and hiring is back in expansion territory.

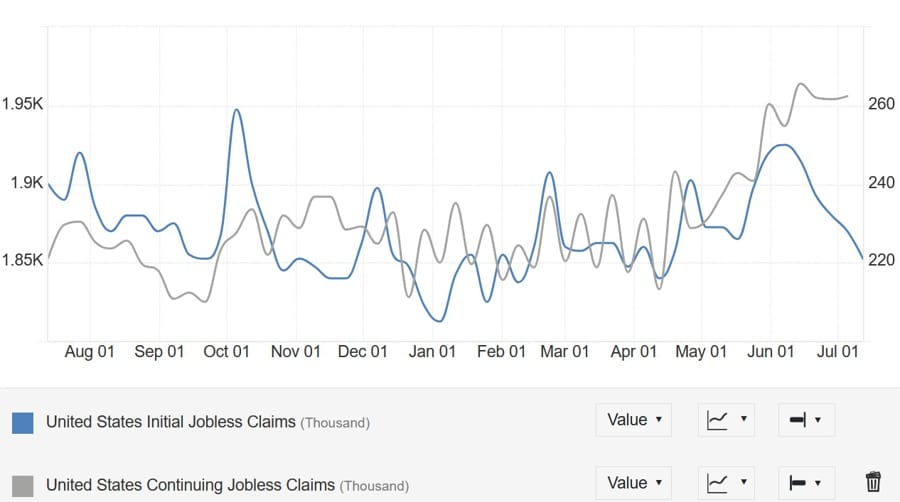

U.S. Jobless Claims Dip to 221K, Continuing Claims Also Lower

Initial claims for unemployment benefits totaled 221,000 last week, below the 235,000 estimate. The prior figure was revised slightly higher to 228,000. Continuing claims came in at 1.956 million, also under expectations.

The data suggests continued resilience in the labor market, even as other metrics hint at softening in hiring.

U.S. Business Inventories Flat in May; Sales Slide Slightly

Business inventories in the U.S. remained unchanged in May, according to the latest data. This aligns with analyst expectations for a 0.0% reading and matches April’s flat print. Retail inventories excluding autos rose 0.2%, consistent with the prior month.

Total business sales fell 0.4% from April but were up 3.1% from May last year. The inventories-to-sales ratio ticked down to 1.39 from 1.41 a year ago, suggesting companies are tightening their stock levels relative to demand—a possible sign of cautious optimism.

Homebuilder Sentiment Holds at 33; Price Cuts Hit Record High

The NAHB housing market index stayed unchanged at 33 in July, in line with expectations. While slightly above June’s 32, the overall mood among builders remains subdued.

Price cuts hit a new high, with 38% of builders reducing prices—up from 37% in June and the highest percentage since tracking began in 2022. Average reductions held at 5%. Sales incentives were offered by 62% of builders, unchanged from last month.

Housing starts for single-family homes are expected to decline further this year, with permits already down 6% year-to-date. Builder traffic remains at its lowest level in over two years.

U.S. Import Prices Soft in June, Export Prices Rebound

U.S. import prices rose just 0.1% in June, missing the 0.3% forecast, while May’s figure was revised even lower to -0.4%. On the export side, prices jumped 0.5%, above expectations, and posted a 2.8% year-over-year increase—the highest since January.

Food-related import prices fell 0.8% in June. Prices for consumer goods rose 0.4%, the sharpest increase since February 2024. Capital goods were flat. On the export front, agricultural goods rose 0.8%, driven by higher meat and soybean prices, while non-agricultural goods also climbed 0.5%.

Overall, the data shows limited import inflation but hints at renewed pricing strength in U.S. exports.

Fed’s Daly: We still have some work to do on inflation

- San Francisco Pres.Mary Daly speaking

- We still have some work to do on inflation

- We have solid growth, solid labor market.

- What’s bothersome still is we haven’t achieved price stability.

- Focus is on inflation, other things don’t distract us.

- Policy, economy is in a good place.

- Rates have been restrictive for a significant number of years.

- June CPI showed some of the effects of tariffs..

- Other parts of inflation are coming down.

- The want to lower rates preemptively

- Two rate cuts this year is a reasonable outlook

- Businesses are optimistic.

- Businesses not stalling out

- Don’t need to slow growth precipitously to get last mile on inflation.

- Wouldn’t want to see more weakness in the labor market.

- Fed policymakers to share people responsibility on setting up US interest rates

- On the possibility of a July rate cut, she answers that’s the wrong question

- the question is the direction of travel, which is rates will be cut consistent with falling inflation.

- Whether rate cut happens in July or September is most relevant.

- Where rates eventually settled will be 3% or higher.

- That rate is higher than neutral pre-pandemic.

- Not surprised that there is some inflation in the good sector, encouraged by disinflation in other sectors.

- Rates are modestly or moderately or a little restrictive

- in bond market as a volatility rather than a significant change in how investors are pricing the things.

- If financial positions got over loose, we’d have to take that into account but don’t see that happening.

- Financial conditions are slightly restrictive to growth

Citi Revises ECB Forecast: No Cut in July, But Two Later in 2025

Citi has shifted its rate outlook for the European Central Bank, dropping its forecast for a July cut and now expecting two moves—one in September and another in December.

This updated view is more aggressive than the current market pricing, which only anticipates about 25 basis points in total cuts through year-end. The ECB has hinted at a summer pause, but any further moves will depend heavily on incoming economic data and how U.S.-EU trade talks unfold.

Kevin Warsh: Fed Is Missing the Moment on AI and Needs a Shakeup

Speaking on CNBC, former Fed governor and potential chair pick Kevin Warsh slammed the current Federal Reserve for what he sees as outdated thinking and institutional drift. Warsh pointed to emerging AI trends that could slash costs and boost productivity—but warned that the Fed isn’t paying attention.

He argued that the central bank has lost its credibility, is entangled in politics, and continues to misread inflation and rate policy. “This is a transformational moment,” Warsh said, calling for a regime change and distancing the Fed from DEI, climate agendas, and fiscal interference. He sees the first rate cut as a signal of deeper change ahead.

Feds Kugler: Appropriate to keep policy rate of interest steady for some time

- Cites low unemployment and building price pressure from tariffs

- Appropriate to keep policy rate of interest steady for some time given low unemployment, and building price pressure from tariffs.

- Inflation remains above the 2% target.

- Labor market is stable and resilient.

- A restricted policy stance is important right now to keep inflation expectations anchored.

- Estimate of June PCE inflation is 2.5% versus 2% target. Core estimate at 2.8%. Both higher than in May.

- CPI shows inflation broadly across four goods.

- Many reasons to think quarter impact of tariffs on inflation is still to come.

JPMorgan’s Dimon Defends Fed Autonomy Amid Trump Tensions

JPMorgan Chase CEO Jamie Dimon is backing the Fed. Speaking during the company’s Q2 earnings call, Dimon described central bank independence as “absolutely critical” for market stability.

He warned that political interference—like threats to remove Fed Chair Jerome Powell—could undermine confidence. MUFG echoed this sentiment, warning that any attempt to fire Powell would likely face a legal fight and damage the Fed’s credibility long-term.

U.S. Treasury Secretary Bessent Heads to Japan for Talks

Treasury Secretary Marissa Bessent is set to arrive in Tokyo on Friday for a “courtesy visit” with Japanese Prime Minister Ishiba, according to the Japanese government. She will also meet with trade negotiator Akazawa, with both expected to travel to Osaka on Saturday.

While framed as a routine diplomatic stop, speculation is building that Bessent could be carrying messages from President Trump—or paving the way for formal negotiations with Japan on trade or tariffs.

US Trade Advisor Navarro: We have got several trade deals but many are unilateral

- Comments from the US Trade Advisor, Peter Navarro

- Non-tariff barriers is big challenge for the EU to solve.

- EU VAT tax is also a subsidy.

- We’d like to see VAT tax relief and lower tariffs.

Deutsche Bank Warns of High-Risk Window Around August 1

Deutsche Bank is flagging the early August window—specifically August 1—as a danger zone for markets. Analysts see three major risks converging: the next U.S. tariff deadline, the monthly jobs report, and already elevated long-term bond yields.

Each of these could independently spark volatility, but together, they create a “seriously problematic” setup for risk assets. Deutsche points to last year’s late July selloff as a warning and says a similar downturn is possible if economic surprises hit while investor nerves are frayed.

Goldman Sachs CEO Calls Fed Independence “Super Important”

Goldman Sachs CEO David Solomon weighed in on central bank independence, calling it “super important” during a CNBC interview. He said independent monetary policy is a bedrock of global economic stability and must be preserved, especially as political rhetoric heats up around the Fed’s decisions.

Fed’s John Williams Avoids Trump Comments, Reaffirms Central Bank’s Role

New York Fed President John Williams is steering clear of political battles. At a press briefing, Williams declined to weigh in on reports that Trump is considering firing Fed Chair Jerome Powell.

Instead, he reaffirmed the Fed’s focus on data-driven policy and defended the dollar’s status as the world’s top reserve currency, calling its foundation “unchanged.” Williams also noted that inflation remains above target due to tariffs, and absent those, it might be closer to 2%.

He pegged the neutral interest rate (R-star) at around 0.75%, and described the labor market as sluggish but stable—“low hiring, low firing.” The disinflation trend, he said, is intact, though uneven.

Trump Floats New Tariffs, Says EU Deal Is Possible

In a new interview, former President Trump hinted at the possibility of a trade deal with Europe but kept the door open for fresh tariffs. On Canada, he said it’s “too soon to say.”

Trump claimed the U.S. is “very close” to finalizing a tariff deal with India. He also floated the idea of imposing a flat 10–15% tariff on 150 smaller nations, saying a single rate might simplify enforcement.

Tesla’s New Model YL Targets Mid-Size SUV Market, Says Goldman Sachs

Goldman Sachs is holding steady with a Neutral rating on Tesla and a price target of $285. But there’s a new wildcard: the Model YL. Tesla’s latest release is a six-seat SUV aimed squarely at the mid-size, three-row category. It’s marginally larger than the original Model Y and expected to hit the Chinese market this fall, priced around $56,000.

According to Goldman, while some Model Y and Model X sales could shift toward the YL, the new variant opens doors in key SUV segments across the U.S., Europe, and China. The firm also expects a lower-cost Model 3 or Y in 2025. Their projection? Roughly 375,000 new-unit sales by 2027. That said, risks from tariffs, intensifying EV competition, and pricing headwinds remain.

BlackRock’s Rieder: Inflation Holds Steady Despite Tariffs

BlackRock’s Rick Rieder says the feared inflation surge from new tariffs hasn’t materialized—yet. After the June CPI report showed modest gains (core CPI up 0.23% month-on-month and 2.93% year-on-year), Rieder credited businesses for getting ahead of supply chain challenges earlier this year.

Companies, he noted, have been managing costs strategically, with many choosing not to pass price hikes on to consumers. Easing labor market pressure is also helping. Given these trends, Rieder expects the Fed could begin rate cuts by September. July, however, remains unlikely as policymakers assess incoming tariff effects.

Couche-Tard Walks Away from $47B Bid for Japan’s Seven & i

Alimentation Couche-Tard has officially pulled the plug on its $47 billion offer to acquire Seven & i Holdings, the Japanese parent company of 7-Eleven. After a year of negotiations and multiple revised bids, Couche-Tard cited delays and what it called a lack of engagement from Seven & i.

The deal’s collapse raises fresh doubts about Japan’s openness to foreign acquisitions. Seven & i countered the narrative, expressing disappointment and disputing Couche-Tard’s claims. The bid withdrawal ends one of the biggest cross-border acquisition efforts in recent years.

Commodities News

Gold Slips as Fed Rate Cut Hopes Fade on Strong U.S. Data

Gold prices softened Thursday as stronger U.S. retail sales and jobless claims data supported the case for the Federal Reserve to hold interest rates steady later this month. Spot gold was last trading near $3,340, down more than 0.26% on the session.

Several Fed officials struck a cautious tone:

- Governor Adriana Kugler said policy needs to stay tight for longer

- San Francisco Fed President Mary Daly noted inflation is still above target and not yet contained

This week’s economic data strengthened the Fed’s position:

- Initial Jobless Claims: fell to 221K, below the 235K estimate

- June Retail Sales: rose 0.6% MoM, crushing the 0.1% forecast

- 10-year Treasury yield: steady at 4.461%, helping cap gold upside

- U.S. Dollar Index (DXY): up 0.45% to 98.72

With CPI still elevated and tariffs adding to price pressure, the market is now assigning a 95% probability that the Fed will hold rates at the July 30 meeting, with just a 5% chance of a rate cut.

Unless inflation data softens significantly, gold may remain under pressure in the near term, especially with rising bond yields and a firmer dollar limiting demand for non-yielding assets like bullion.

Silver Pulls Back Below $38 as Dollar Strengthens After Hot Retail Sales

Silver prices edged lower Thursday after strong U.S. retail sales data boosted the dollar and weighed on commodities. Spot silver traded around $37.57, down modestly after a 0.56% gain the previous session.

The metal recently hit a 14-year high at $39.13 earlier in the week. While still in an uptrend, momentum has cooled:

- 21-day EMA remains solid support at $36.91

- RSI now at 63.42, easing from overbought levels

- ADX low at 17.85, suggesting trend strength is weakening

Key support stands at $37.00. A break below that could send silver toward $35.50 and $34.50. To the upside, bulls must clear the $39.13 high to push for a breakout toward the psychological $40.00 mark.

The catalyst for Thursday’s pullback was stronger-than-expected June retail sales, up 0.6% vs. 0.1% forecast, and improved jobless claims, both of which reinforced expectations that the Fed may keep rates steady in July.

Crude Oil Settles Higher; September Futures Close at $66.23

Crude oil futures rose on Thursday, with September WTI crude settling at $66.23, up $1.04 on the day. The session high reached $66.27, while the low dipped to $65.02.

Meanwhile, the front-month August contract ended the day at $67.54, up $1.16 or 1.75%. Price action reflects ongoing volatility in energy markets as traders weigh global demand concerns against supply constraints and geopolitical developments.

Europe News

European Markets Climb; DAX and CAC Lead with Over 1.25% Gains

Major European stock indices closed solidly higher on Thursday. Germany’s DAX posted a 1.49% gain, while France’s CAC rose 1.29%. London’s FTSE 100 also advanced, adding 0.52%, and Southern European markets joined in: Spain’s Ibex climbed 0.78%, and Italy’s FTSE MIB rose 0.92%.

The rally spilled into U.S. markets during the European close, with Wall Street indexes ticking higher as traders digested corporate earnings and a calmer geopolitical tone.

Eurozone CPI Finalized at 2.0% in June, Core at 2.4%

Eurostat confirmed that consumer prices in the euro area rose 2.0% year-on-year in June, matching the preliminary figure and marking a slight uptick from May’s 1.9%. Core inflation—stripping out energy and food—held steady at 2.4%.

The data aligns with the ECB’s expectations but doesn’t settle the debate on when (or if) rate cuts will resume later this year.

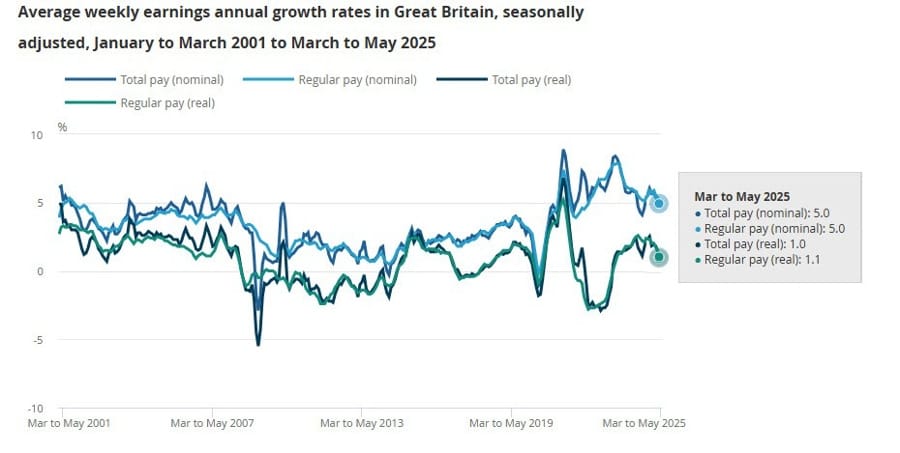

UK Unemployment Ticks Up to 4.7% in May, Payrolls Shrink Again

The UK’s jobless rate inched higher to 4.7% in May, missing forecasts for 4.6% and marking the highest level since 2021. This comes alongside continued weakness in payrolls, with June seeing a 41,000 decline. May’s initial -109,000 figure was revised to a less severe -25,000.

Despite that, total employment rose sharply by 134,000, well ahead of the 46,000 expected. Wages also held firm. Average weekly earnings including bonuses rose 5.0% year-on-year in the three months to May, matching estimates, though down from a revised 5.4%. Regular pay (excluding bonuses) also increased 5.0%, just above the 4.9% forecast.

Real wages, however, are slipping. Adjusted for inflation, total pay rose just 1.0% and regular pay 1.1%—the weakest real wage growth since mid-2023. The data adds weight to the Bank of England’s case for a rate cut, even with inflation still sticky.

Bundesbank’s Nagel says dangerous to play with central bank independence

- Remarks by Bundesbank president and ECB policymaker, Joachim Nagel

- Independence is the DNA of central banks

- It is dangerous to play with it

Asia-Pacific & World News

China Blames U.S. for Breakdown in Fentanyl Cooperation

Beijing is firing back at U.S. criticism over fentanyl trafficking, rejecting Trump’s recent comments and placing blame on Washington instead. According to Chinese officials, U.S.-imposed fentanyl-related tariffs have undermined cooperation on narcotics enforcement.

China’s stance echoes that of Mexico, arguing that the U.S. needs to engage on the issue based on facts, not politics. Trump, however, continues to link trade policy and fentanyl crackdowns—using one to justify the other as talks stall.

Nvidia Chip Sale to UAE Stalled by Trump Officials Over Security Fears

A major Nvidia chip deal is caught in limbo. Trump administration officials are holding up an agreement to sell billions of dollars’ worth of advanced AI chips to the United Arab Emirates, citing national security concerns.

Although Trump had voiced support during a May trip to the Middle East, negotiations have stalled. U.S. officials fear the chips could eventually reach China. Without additional safeguards, the deal may not move forward.

Wall Street Journal reporting (gated).

PBOC sets USD/ CNY reference rate for today at 7.1461 (vs. estimate at 7.1703)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 450.5bn yuan via 7-day reverse repos at 1.40%

- 90bn yuan mature today

- net 360.5bn injection yuan

Australia’s Job Market Wobbles: Unemployment Hits 4.3%

Australia’s labor market softened in June. The jobless rate climbed to 4.3%—the highest in three and a half years—missing expectations of 4.1%. Net employment barely budged, adding only 2,000 jobs versus the 20,000 forecast.

The details show a deeper shift: full-time roles plummeted by 38,200 while part-time jobs jumped 40,200. Hours worked fell 0.9% month-over-month. Participation ticked up to 67.1%, just below all-time highs. This report raises fresh concerns about underlying labor market strength heading into the second half of 2025.

New Zealand Food Prices Accelerate in June

Food inflation in New Zealand picked up steam in June. The Food Price Index climbed 1.2% month-over-month, more than doubling May’s 0.5% gain. On a yearly basis, food prices rose 4.6%, slightly up from the prior 4.4%.

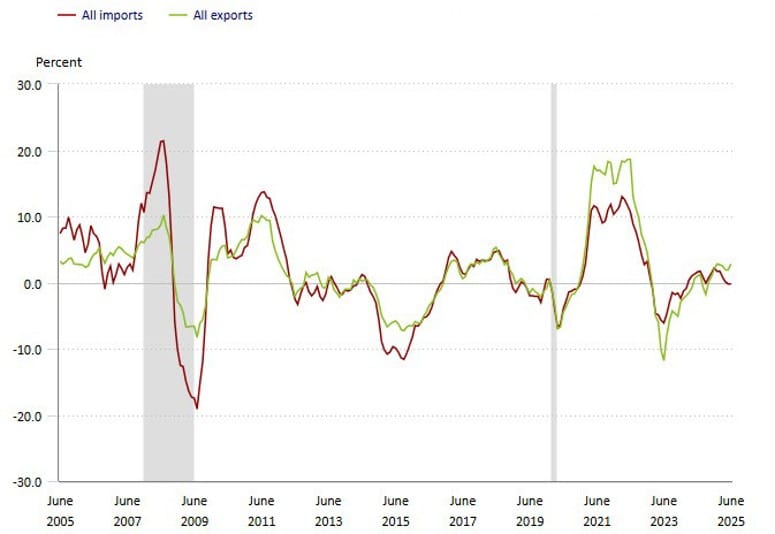

Japan’s Exports Dip Again in June, Trade Surplus Misses Forecast

Japan’s trade performance disappointed again in June. Exports dropped 0.5% year-on-year, missing expectations for a 0.5% gain and marking a second straight monthly decline.

Imports rose slightly by 0.2% year-on-year—better than the expected -1.6%. Japan logged a trade surplus of 153.1 billion yen, well below the forecasted 353.9 billion. Key export destinations like the U.S. and China saw declines of 11.4% and 4.7%, respectively. Only Asia (+1.7%) and the EU (+3.6%) registered gains.

Japan’s Akazawa and US’ Lutnick held multiple phone calls

- Akazawa will meet with Bessent this week

Japan’s chief tariff negotiator Ryosei Akazawa spoke multiple times with U.S. Commerce Secretary Howard Lutnick in recent weeks.

- Japan, US re-confirmed each side’s position on U.S. tariff measures, engaged in deep interaction

Akazawa will meet with Bessent this week also.

Japan Deputy Chief Cabinet Secretary Aoki: Concerned about speculative FX market movements

- Japanese authorities back to expressing concern about the weak yen

- Important for currencies to move in stable manner reflecting fundamentals

- Will closely monitor how interest rates affect livelihood

- Concerned about FX market movements, including speculative moves

- Will create market environment where JGBs would be issued stably

Singapore’s Export Surprise: Non-Oil Shipments Surge 13% in June

Singapore posted a major upside surprise in June, with non-oil domestic exports jumping 13% year-on-year—beating the 5% estimate and reversing a 3.9% drop in May.

The first-half 2025 trend now shows a 5.2% annual gain. Exports were powered by a 53.8% spike in PC shipments, 17.5% growth in integrated circuits, and a 211.9% surge in non-monetary gold. While shipments rose to Hong Kong, Taiwan, and South Korea, they fell to Japan, Indonesia, and the U.S.

Despite the strong quarter and a 4.3% Q2 GDP reading, Trade Minister Gan Kim Yong warned that U.S. tariffs and fading front-loading demand could stall future gains. Gan plans to lobby for exemptions on pharmaceutical exports during a trip to Washington.

Crypto Market Pulse

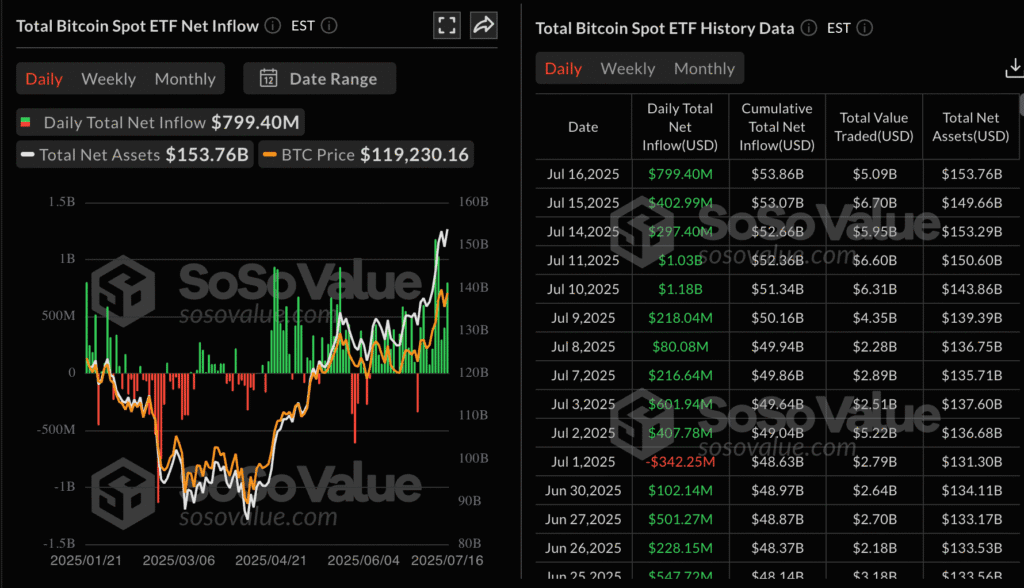

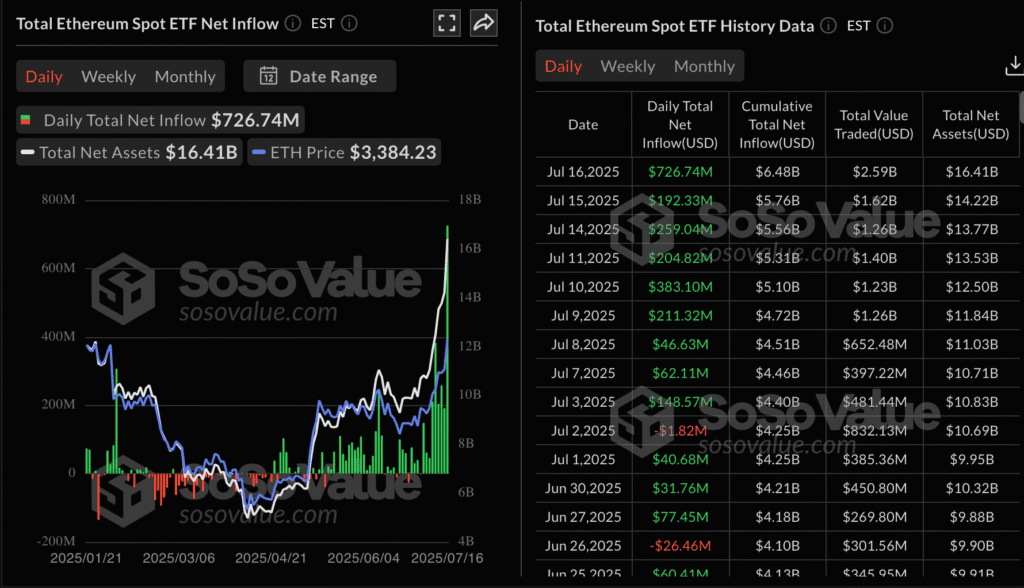

Crypto Market Watch: Ethereum, XRP Extend Rally as Congress Advances Bills

Bitcoin is consolidating around $118,000, but Ethereum and XRP are powering higher. ETH is approaching $3,500 with strong ETF inflows—Wednesday saw a record $726 million in new ETH ETF investment. XRP is also surging, just 5% shy of its $3.40 all-time high.

Meanwhile, the U.S. House of Representatives revived its stalled ‘Crypto Week’ legislation push. Votes are scheduled for the GENIUS Act today, with the CLARITY Act potentially advancing next week before the August recess.

Spot Bitcoin ETFs logged $799 million in inflows on Wednesday, with no outflows reported. BlackRock’s IBIT led with $764 million. Combined institutional inflows, favorable macro conditions, and weakening dollar trends are setting the stage for a broader altcoin rally.

Ethereum shows technical strength with two recent Golden Cross patterns, and key support remains at $3,217 and $2,880. For XRP, momentum indicators continue to point upward as it pushes toward price discovery territory.

Ether Climbs 8%, Leads Market as Traders Watch for New Highs

Ether (ETH) rose 8% to trade above $3,340, while Bitcoin (BTC) held steady near $118,400 after peaking at $123,218 earlier this week. Ethereum has gained over 20% in the past seven days and is nearing its 2021 record.

XRP also pushed higher, up 6.4% on the day and 27% for the week, reaching $3.09. Solana (SOL) rose 5% to $170, Dogecoin (DOGE) gained 6% to break 20 cents, and BNB added 3% to hit $708.

ETF flows are supporting the rally, with Bitcoin spot ETFs seeing net inflows of $799 million on Wednesday, led by BlackRock’s IBIT at $763 million.

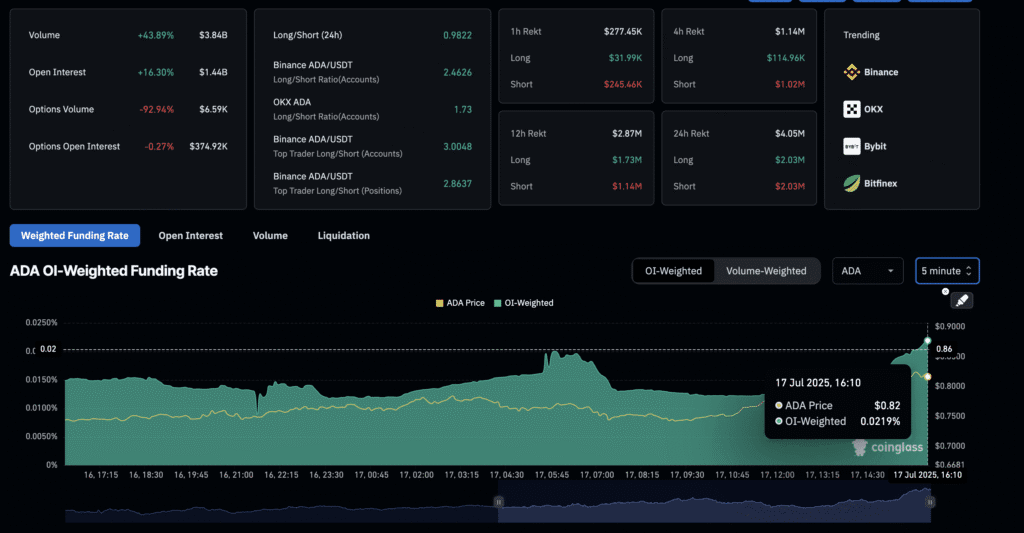

Cardano Surges as Derivatives Traders Boost Long Bets

Cardano (ADA) is up more than 40% over the past 10 days and 7% in the last 24 hours, reaching above $0.80 for the first time in over a month. Traders are positioning for further upside, with Open Interest now at $1.44 billion—just shy of the January record.

CoinGlass data shows ADA’s OI rose 16.3% in one day. The funding rate is positive at 0.0219%, and long positions now account for just over 50% of taker volume. The technical chart shows bullish momentum building, with $1.00 in sight if resistance levels break.

XRP Eyes All-Time High as Ripple Pushes into Tokenized Real Estate

XRP is fast approaching its all-time high of $3.40, trading around $3.24 Thursday after bouncing off support near $2.80 earlier this week. The rally briefly stalled at $3.29, but bullish momentum remains strong.

Ripple has partnered with Ctrl Alt to support Dubai’s Land Department in launching a blockchain-based real estate tokenization platform. Ripple’s XRPL ledger will serve as the infrastructure for managing title deeds, further solidifying XRPL’s use case in institutional finance.

Adoption of the XRPL EVM sidechain is also ramping up, with 1,300 smart contracts deployed and over 160 tokens launched. Ripple’s strategic expansion across the Middle East, Europe, and Latin America is driving both utility and price momentum.

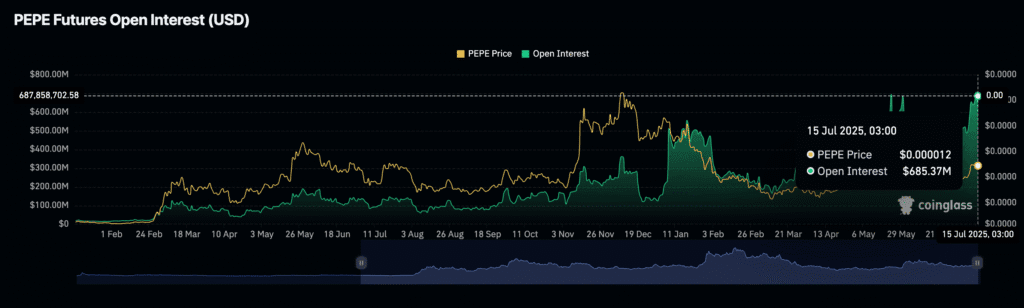

PEPE Gains Strength with Dual Golden Cross Patterns and Rising Volume

Pepe (PEPE) is riding a fresh wave of momentum, climbing toward the $0.00001400 level again after consolidating near $0.00001364. Two Golden Cross patterns have emerged on the daily chart, signaling sustained bullish sentiment.

The meme coin is up 22% over the past week and 5% in the last 24 hours. Open Interest surged from $455 million on July 2 to $685 million, while derivatives volume shot up 34% to nearly $5 billion. These trends suggest rising trader confidence and the potential for a breakout.

The Altcoin Season Index has climbed from 12 to 41 in recent weeks—still below the 75 threshold but indicating growing interest in alternative tokens amid Bitcoin’s breakout above $123,000.

Litecoin Aims Higher as Whales Accumulate and Price Breaks Resistance

Litecoin (LTC) traded above $98 on Thursday, building on a breakout past its weekly resistance at $96.30. On-chain data shows whales are accumulating: wallets with 1M–10M LTC added 360,000 tokens since early June.

Meanwhile, smaller holders have been shedding positions, creating a potential supply imbalance. Open Interest has risen 9.52% in the last 24 hours to $746.84 million. Funding rates also spiked to 0.022%, indicating long dominance in the derivatives market and the possibility of a push toward the $107.50 target.

The Day’s Takeaway

United States

- Major Indices Set Records: The NASDAQ closed at 20,884.27, up 0.74%, marking its 10th all-time high of the year. The S&P 500 also notched a new record close at 6,297.46, its ninth of 2025. The Dow gained 230.32 points to 44,485.10.

- Netflix Earnings Beat: Netflix posted Q2 EPS of $7.19, topping expectations of $7.06. Revenue came in at $11.08B, just above the $11.04B estimate. Forward guidance was lifted to $44.8B–$45.2B, above consensus. Shares traded mixed after hours.

- Retail Sales Rebound: June retail sales jumped 0.6% MoM, well above the 0.1% forecast, rebounding from May’s -0.9%. Core control group sales also exceeded expectations.

- Labor Market Still Firm: Initial jobless claims fell to 221K, beating the 235K estimate. Continuing claims also dropped slightly to 1.956M.

- NAHB Housing Index Steady: Builder sentiment remained weak but stable at 33, with price cuts hitting a record 38% of builders. Permits are down 6% YTD.

- Atlanta Fed GDPNow Revised Lower: Q2 growth forecast was lowered to 2.4% from 2.6%.

- Business Inventories Flat: May inventories came in at 0.0%, matching estimates. Sales dipped 0.4% MoM but rose 3.1% YoY.

- Mortgage Rates Rise: 30-year fixed mortgage rate climbed to 6.75%, up slightly from 6.72%, according to Freddie Mac.

- Philly Fed Index Surges: July index jumped to +15.9, beating expectations of -1.0. Employment, new orders, and shipments all improved.

- Federal Reserve Tone Steady: Fed officials, including Kugler and Daly, reinforced a cautious stance. Rate cut odds for July dropped to just 5%.

Canada

- Couche-Tard Withdraws Seven & i Bid: Alimentation Couche-Tard ended its $47B takeover effort of Japan’s Seven & i Holdings, citing unproductive talks and delays. The move raises concerns over Japan’s openness to foreign acquisitions.

Commodities

- Crude Oil Rises:

- September WTI settled at $66.23, up $1.04.

- August contract closed at $67.54, a gain of $1.16 or 1.75%.

- Silver Pulls Back: Spot silver eased to $37.57, down from a recent 14-year high of $39.13. Strong U.S. data lifted the dollar and pressured the metal. RSI signals momentum cooling; key support near $37.

- Gold Slips: Gold traded lower at $3,340, down 0.26% on the day. Strong U.S. jobless claims and retail sales dented rate cut hopes and weighed on bullion prices.

Europe

- Markets Rally:

- German DAX: +1.49%

- France’s CAC: +1.29%

- UK FTSE 100: +0.52%

- Spain’s IBEX: +0.78%

- Italy’s FTSE MIB: +0.92%

- Eurozone CPI Confirmed: June inflation held steady at +2.0% YoY, with core CPI at +2.4%, matching the flash estimate.

- Citi Revises ECB Rate Outlook: Citi now expects rate cuts in September and December, dropping the July cut call.

- UK Jobless Rate Rises: May ILO unemployment rose to 4.7%, above the 4.6% forecast, the highest since 2021. Payrolls fell by 41K in June.

Asia

- China Pushes Back on Fentanyl Accusations: Beijing blamed the U.S. for stalled cooperation, citing punitive tariffs.

- Japan Trade Data Mixed:

- Exports fell 0.5% YoY, marking the second monthly drop.

- Imports rose 0.2%, beating the -1.6% forecast.

- Trade surplus at 153.1 billion yen, below expectations.

- US-Japan Trade Talks: U.S. Treasury Secretary Marissa Bessent will meet with PM Ishiba and trade negotiator Akazawa in Tokyo and Osaka. A key focus is Japan’s effort to soften U.S. tariff threats.

- Singapore Exports Surge: Non-oil exports jumped 13.0% YoY in June, led by strong demand for PCs, chips, and gold.

Rest of the World

- Australia Job Market Weakens: June unemployment ticked up to 4.3%; full-time jobs dropped by 38.2K. Participation held at 67.1%.

- New Zealand Food Inflation Picks Up: June FPI rose 1.2% MoM, with YoY inflation at 4.6%, up from 4.4%.

Crypto

- Bitcoin Consolidates: BTC held near $118,000, up 6.6% for the week. Spot ETFs posted $799M in inflows, led by BlackRock’s IBIT with $763M.

- Ethereum Rallies: ETH climbed 8% to $3,340, up 20.5% on the week. ETF inflows hit a record $726M on Wednesday.

- XRP Eyes New High: XRP rallied to $3.24, closing in on its $3.40 all-time high. Ripple’s real estate tokenization deal in Dubai is boosting momentum.

- ADA Bullish Setup: Cardano surged over 40% in 10 days, with Open Interest near its all-time high at $1.44B.

- PEPE Pushes Higher: Meme coin PEPE trades near $0.00001400, riding momentum from two Golden Cross patterns and rising derivatives volume.

- Litecoin Breakout: LTC climbed above $98, driven by whale accumulation and rising Open Interest, now at $746.84M.

- Crypto Legislation in Motion: U.S. House advanced the GENIUS Act and CLARITY Act, part of the revived ‘Crypto Week’ legislative agenda, signaling regulatory momentum.