North America News

US Stocks Slide on Iran Strike Fears as Trump Ramps Up War Rhetoric

U.S. equity markets sold off on Tuesday as geopolitical tension surged following President Donald Trump’s call for “unconditional surrender” from Iran, posted on his Truth Social platform. Investors grew anxious over the prospect of a U.S. military strike, with the President reportedly weighing joint action with Israel.

Major U.S. indexes finished in the red:

- S&P 500: down 50 points, or -0.8%

- Nasdaq: -0.9%

- Russell 2000: -1.0%

- Dow Jones Industrial Average: -0.7%

The losses effectively erased Monday’s gains as traders braced for escalation in the Middle East. While no official strike decision has been made, reports indicate a high-level strategy meeting is underway within the Trump administration.

Market risk appetite deteriorated throughout the session, with safe-haven assets seeing mixed results and investor focus shifting toward the Federal Reserve’s upcoming policy announcement.

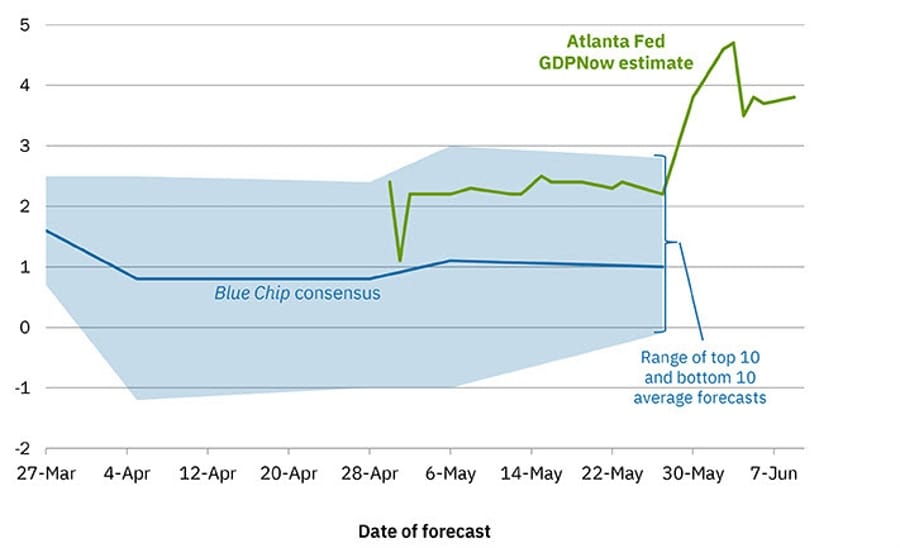

Atlanta Fed Trims Q2 GDPNow Forecast to 3.5%

The Atlanta Fed’s GDPNow model has lowered its estimate for second-quarter U.S. GDP growth to 3.5%, down slightly from 3.8%.

While it’s still early in the forecast window, this dip reflects accumulating softness in data like retail sales and industrial output. Despite these signs, there’s no immediate panic—core economic momentum remains intact, but uncertainty continues to weigh on sentiment.

In their own words:

After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, the Federal Reserve Board of Governors, and the Treasury’s Bureau of the Fiscal Service, the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real government expenditures growth decreased from 2.5 percent and 2.3 percent, respectively, to 1.9 percent and 2.1 percent, while the nowcast of second-quarter real gross private domestic investment growth increased from -1.9 percent to -1.4 percent.

U.S. Retail Sales Fall Sharply in May, But Control Group Offers Some Relief

Retail sales in the U.S. declined by 0.9% in May 2025, a sharper drop than the expected -0.7%. April’s figure was also revised lower—from a slight +0.1% gain to a -0.1% decline.

Breaking down the report:

- Sales excluding autos dropped 0.3% (forecast was +0.1%).

- Ex-autos and gas slipped 0.1%.

- The control group, which strips out the most volatile components and feeds into GDP calculations, rose 0.4%, slightly above the 0.3% consensus. April’s figure for this category was revised up to -0.1% from -0.2%.

On a year-over-year basis, retail sales growth eased from +5.16%, though the new annual figure was not specified.

Category highlights:

- Electronics and appliances: -0.6%

- Building materials: -2.7%

- Food and beverages: -0.7%

- Restaurants and bars: -0.9%

- Clothing: +0.8%

- Sporting goods, hobby, and music stores: +0.8%

The drop in dining-out spending raises concerns about consumer sentiment, while gains in discretionary areas like clothing and sports gear are a modest counterpoint. The weakest sector remains housing-related goods, with building materials down 1.1% year-over-year before adjusting for inflation.

Markets slightly adjusted Fed rate cut expectations after the report, shifting from 49 to 48.5 basis points of easing priced in. The Fed’s two-day meeting begins today.

U.S. Industrial Production Drops in May; Capacity Use Slips

U.S. industrial production shrank by 0.2% in May 2025, underperforming the +0.1% rise that had been expected. April’s figure was revised up from flat to a modest +0.1%.

Other key numbers:

- Capacity utilization fell to 77.4%, below the 77.7% forecast.

- Manufacturing output ticked up 0.1%, just shy of the expected +0.2%.

- April’s manufacturing output was revised to -0.5% from -0.4%.

The data points to sluggish momentum in U.S. industrial activity as manufacturers face softer demand and possible inventory overhangs.

Homebuilder Sentiment Falls Further in June, NAHB Index Misses Forecast

The National Association of Home Builders (NAHB) housing market index fell to 32 in June, missing the forecast of 36 and declining from May’s reading of 34.

Breakdown by sub-index:

- Single-family sales: 35 (down from 37)

- Buyer traffic: 21 (down from 23)

- Sales expectations: 40 (down from 42)

This marks another weak reading in homebuilder sentiment, highlighting the ongoing drag from high interest rates, limited affordability, and softening demand from prospective buyers.

Business Inventories Flat in April; Retail Stockpiles Rise Steadily

Total U.S. business inventories held steady in April 2025, in line with expectations. March saw a small 0.1% increase.

Other details:

- Total business inventories: $2.6565 trillion, up marginally from $2.6557 trillion in March

- Retail inventories excluding autos: +0.3%, matching the prior month

The inventory-to-sales ratio came in at 1.38, slightly lower than April 2024’s 1.40. The flat readings suggest businesses are managing stock levels cautiously amid uncertainty about future demand.

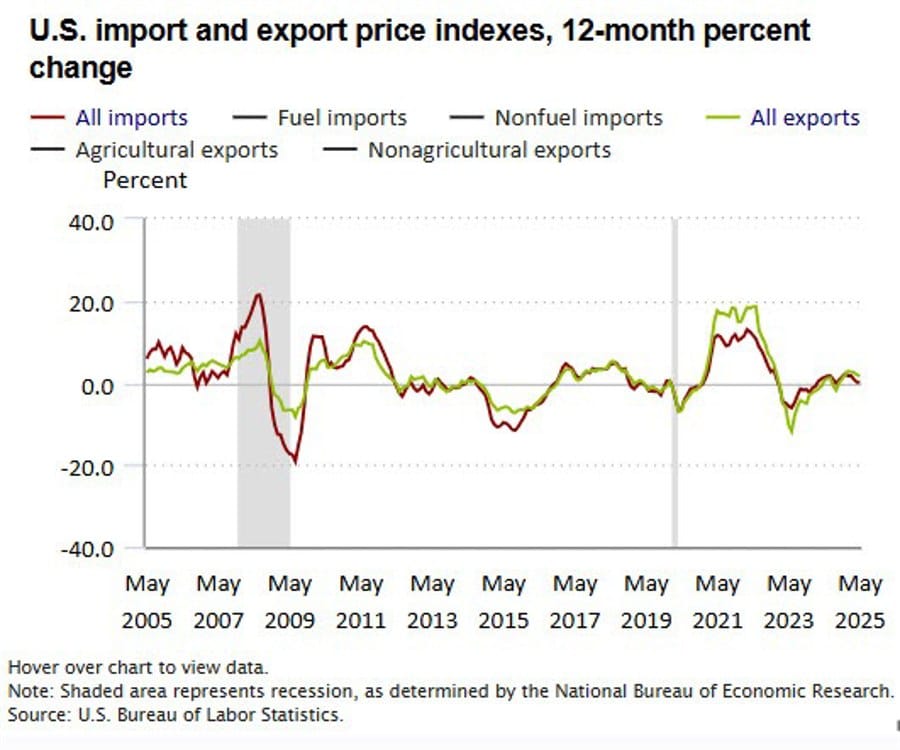

Import Prices Flat in May; Export Prices See Steepest Drop in Two Years

U.S. import prices were unchanged in May, beating forecasts of a 0.2% decline. April’s figure was revised up slightly to a 0.1% gain.

Key details:

- Import prices MoM: 0.0% vs -0.2% expected

- Y/Y import prices: +0.2% (up from +0.1% last month)

- Export prices MoM: -0.9%, far below the -0.2% forecast — the largest monthly drop since May 2023

- Y/Y export prices: +1.7%

The lack of momentum in import costs is a positive sign for inflation. However, the plunge in export prices signals weakening demand abroad or falling prices for key U.S. goods overseas.

Some details:

- Import fuel prices declined 4.0 percent in May following decreases of 2.6 percent in April and 3.4 percent in March. The May decrease was the largest monthly decline since the index fell 7.2 percent in September 2024.

- Foods, Feeds, and Beverages: Foods, feeds, and beverages prices fell 0.3 percent in May following decreases of 0.1 percent in each of the 2 previous months.

- Import prices for nonfuel industrial supplies and materials rose 1.3 percent in May, after a 0.4-percent increase in April.

- Prices for each of the major finished goods import categories rose in May. Import capitalgoods prices advanced 0.2 percent in May following a 0.7-percent rise in April.

- The price index for agricultural exports increased 0.2 percent in May following a 0.4-percent rise in April.

- Nonagricultural export prices decreased 1.0 percent in May, after rising 0.1 percent in April.

- Nonagricultural Industrial Supplies and Materials: Nonagricultural industrial supplies and materials prices declined 3.0 percent in May, after a 0.5-percent drop the previous month.

- Prices for each of the major finished goods export categories rose in May. The price index for export capital goods increased 0.4 percent in May, the largest monthly advance since October 2024.

U.S. Considered Tougher Tech Export Limits on China If London Talks Had Collapsed

According to the Wall Street Journal, U.S. officials were prepared to expand restrictions on tech exports to China had recent negotiations in London gone badly. Insiders say the Commerce Department had contingency plans to widen the ban on semiconductor-related exports, potentially targeting more chip-making equipment.

Although the talks were ultimately described as constructive, the behind-the-scenes preparation signals just how quickly U.S.–China tensions could escalate again over tech dominance and national security concerns.

Trump: EU not yet offering a fair deal

- Comments from the US President

- EU not yet offering a fair deal.

- Bessent stayed at G7.

- Chance of Japan deal, but they’re “tough”.

- Reiterates threat to send letters with what tariffs he’ll charge.

- Pharma tariffs coming very soon.

- Might do separate Canada deal for Golden Dome.

- Canada will pay to join Golden Dome project.

- Will probably extend TikTok deadline again.

- Not too much in mood to negotiate with Iran.

Senate Republicans Move to Kill $7,500 EV Tax Credit

Details emerging from the U.S. Senate’s tax and budget legislation reveal plans to end the federal $7,500 electric vehicle tax credit. If passed, the credit would expire 180 days after the bill is signed into law. This development is likely to impact automakers like Tesla and could shift dynamics in the EV market. The amendment is part of a larger Republican-led effort to reshape energy and vehicle policy.

Trump Expected to Make ‘Last-Chance’ Offer to Iran

According to U.S. and European officials cited by The Jerusalem Post, President Trump is set to present Iran with what’s being described as a final proposal on nuclear negotiations. Sources suggest the new offer could be slightly more favorable than the one floated nearly two weeks ago. However, the core U.S. position remains unchanged—demanding zero uranium enrichment from Tehran.

Trump Seeks Iran Nuclear Talks and Ceasefire Discussions This Week

U.S. President Donald Trump is pushing for direct talks with Iran this week, aiming to revive nuclear negotiations and push for a ceasefire. According to sources cited by Axios, the U.S. has tapped envoy Brian Witkoff to meet with Iranian Foreign Minister Abbas Araghchi. Four insiders briefed on the situation confirmed the initiative is in motion.

U.S. Plans 100K Vehicle Quota for UK Auto Imports at 10% Tariff

The U.S. is drafting trade terms that would allow the import of 100,000 UK-made vehicles annually under a 10% tariff. Normally subject to a 25% rate, the proposed cap reflects efforts to ease trade restrictions. Further plans include preferential agreements on pharmaceuticals and aerospace components, along with tariff rollbacks targeting UK steel, aluminum, and aviation products. This forms part of a broader U.S.-UK trade framework currently being revealed in stages.

Bank of Canada: Inflation May Persist as Trade Uncertainty Lingers

At its June 4 meeting, the Bank of Canada opted to hold the policy rate steady at 2.75%. While markets currently assign only a 20% chance of a rate cut on July 30, the central bank remains alert to evolving economic pressures—especially inflation and global trade dynamics.

Key insights from the meeting summary:

- Policymakers are concerned that inflationary pressures could prove persistent as businesses and consumers adjust to global supply chain shifts.

- Officials emphasized the difficulty of tracking how input cost increases pass through to consumers.

- While Q1 business investment showed promise, it was viewed as potentially temporary.

- The Council acknowledged that short-term inflation expectations among consumers and businesses had risen.

- A reduction in rates remains on the table, particularly if trade tensions expand and price pressures stay under control.

- Encouragingly, the likelihood of a severe global trade war was seen as lower.

Officials also noted that Canadian export momentum could quickly reverse if tariffs and uncertainty continue to weigh on global demand.

Trump and Carney Push for Trade Deal Within 30 Days

President Donald Trump and Canadian Prime Minister Mark Carney have agreed to finalize a bilateral trade deal within 30 days. Meeting on the sidelines of the G7 summit, both leaders committed to resolving existing trade tensions quickly. This is the first time a hard timeline has been set for wrapping up negotiations on tariffs and other sticking points.

Canadian media (CBC) with the info

Commodities News

Gold Slips Below $3,400 Despite Rising Global Tensions as Dollar Strengthens

Gold prices edged lower Tuesday, dipping to $3,380 as a stronger U.S. Dollar overshadowed rising geopolitical stress. Although conflict between Israel and Iran threatens to intensify—with Trump reportedly considering military action—the safe-haven metal failed to attract strong inflows.

Key market drivers:

- Gold: down 0.05%, trading at $3,380

- US Dollar Index (DXY): up 0.46% to 98.58

- 10-year Treasury yield: down 5.5 basis points to 4.403%

- Real yields: fell to 2.103%

Despite heightened geopolitical risk, the Dollar gained ground, limiting gold’s upside. Trump’s unexpected departure from the G7 meeting and his call for Tehran’s evacuation added urgency to the situation, yet bullion remained subdued.

Meanwhile, economic signals were mixed:

- Retail sales in May fell 0.9% month-over-month, missing forecasts, although annual growth reached 3.3%.

- Industrial production contracted 0.2%, missing expectations of a slight uptick.

Investors are now squarely focused on the Federal Reserve’s rate decision, due Wednesday. The Fed is expected to keep rates steady but will release new economic projections. A dovish signal could support gold prices in the near term, especially as money markets now price in 44 basis points of easing by year-end.

According to BBH strategist Win Thin, a hawkish shift in the Dot Plot could occur if just two Fed officials move their projections from two rate cuts to one.

On the longer-term horizon, central bank demand remains robust. The World Gold Council’s latest survey shows 95% of central banks expect to increase their gold holdings over the next 12 months—a strong backdrop for demand even amid short-term price pressure.

Oil Surges Over $3 as Markets Brace for Iran Escalation

WTI crude jumped $3.07 on Tuesday to settle at $74.84 per barrel, fueled by concerns that the Israel-Iran conflict could disrupt supply routes. Traders are especially focused on the Strait of Hormuz, where traffic has already reportedly slowed.

While prices haven’t returned to the recent highs from Friday or early Monday, the potential for further escalation keeps the market on edge. A confirmed loss of barrels would likely trigger another sharp spike.

IEA Says Oil Market Well Supplied Through 2025, Cuts Demand Outlook

The International Energy Agency’s latest monthly report projects the global oil market will remain adequately supplied in 2025, barring major disruptions. It lowered its global oil demand growth forecast to 720,000 barrels per day for 2025 (from 740,000 bpd), and to 740,000 bpd in 2026 (from 760,000 bpd).

The IEA attributes the slower growth to cleaner energy adoption and weaker economic conditions. Supply is expected to rise by 1.8 million bpd in 2025, more than meeting demand.

By 2030, oil production capacity is forecast to hit 114.7 million bpd, compared to projected demand of 105.5 million bpd. In the U.S., oil demand is expected to be 1.1 million bpd higher than previously forecast, due to slowing EV adoption and cheaper fuel prices.

Natural Gas Prices Spike on LNG Supply Risk Through Hormuz

European natural gas prices continued their rally, surging to their highest levels since April. ING analysts Ewa Manthey and Warren Patterson report a 4.8% increase on Friday, citing fears that a regional conflict could disrupt LNG transit through the Strait of Hormuz.

Qatar, which supplies roughly 20% of the world’s LNG, ships via this critical chokepoint—and no alternative route exists. ING warns that any blockage would significantly tighten global LNG supplies, sending prices even higher.

Meanwhile, the European Commission is expected to propose a phased ban on Russian gas starting January, aiming to fully eliminate dependence by the end of 2027.

Oil Prices Hover as Traders Await New Signals on Israel-Iran Tensions

After last week’s sharp moves, oil markets are entering a holding pattern. Prices surged early in the conflict but later reversed most gains as no actual supply disruption occurred.

With the price now consolidating below $72 per barrel, traders are watching for further developments. Technically, sellers could look to drive the price toward $65 if resistance at $72 holds. Bulls, however, are waiting for a breakout to push toward new highs.

Fundamentally, oil is expected to remain supported by global central bank easing and increased fiscal spending—unless geopolitical risks flare up again.

Gold Climbs Above $3,400/oz as Tensions Boost Safe-Haven Demand

Gold prices jumped above $3,400 per ounce in early Tuesday trading, rebounding from Monday’s 1.4% dip—the steepest one-day drop in a month. The move comes as investors react to rising geopolitical risk in the Middle East.

ING analysts report strong inflows into gold ETFs, with 136,032 troy ounces added in the latest session. SPDR Gold Shares saw a $285 million inflow on Friday alone.

Markets now turn their attention to Wednesday’s Federal Reserve meeting, where rates are expected to be held steady. Geopolitical jitters and central bank policy remain key drivers of the gold market outlook.

Oil Tanker Fire Near Hormuz Not Linked to Regional Conflict, Says Frontline

Tanker operator Frontline has clarified that the incident involving three ships on fire in the Gulf of Oman was unrelated to the Israel-Iran conflict. The fire stemmed from a collision, not a military strike.

The vessels involved, Adalynn and Front Eagle, were operating near—but outside—the Strait of Hormuz when the incident occurred. No ties to geopolitical tensions have been identified.

Oil Prices Surge After Trump Urges Tehran Evacuation

Oil markets jumped again after President Trump called for U.S. nationals to leave Tehran, signaling heightened risk of U.S. involvement in the Middle East conflict.

ING analysts say Trump’s remarks contrasted sharply with earlier optimism about de-escalation between Israel and Iran. Iran has reportedly shown interest in resuming nuclear talks—provided the U.S. stays out of Israeli operations.

Roughly one-third of global seaborne oil passes through the Strait of Hormuz. While infrastructure remains untouched so far, the fear of disruption is driving market volatility. Trump also left the G7 early, fueling speculation about a more hands-on U.S. role in the region.

UBS Forecasts $3,500 Gold; Says Oil Risk Premium Overstated

UBS is bullish on gold, forecasting a rise to $3,500 per ounce by the end of 2025. The bank argues that recent market reactions to Middle East tensions have been exaggerated and that the geopolitical premium on oil is overstated—especially since Iran contributes only 1.6% of global output. UBS suggests the pullback in oil prices is an opportunity for investors and maintains a strong outlook for equities, particularly in defense and tech sectors.

Three Tankers Ablaze Near Strait of Hormuz; Oil Prices React

Oil prices climbed following reports of fires aboard three ships in the Gulf of Oman, close to the critical Strait of Hormuz. Early reports indicate two tankers collided Tuesday, catching fire. Fortunately, no injuries or oil spills have been reported. The fires are said to have broken out near Khor Fakkan anchorage, off Fujairah, UAE. The region has seen increased electronic warfare activity amid heightened Iran-Israel tensions. The White House is likely monitoring prices closely, as Trump has historically opposed oil spikes.

Europe News

Germany’s Economic Outlook Brightens as ZEW Survey Beats Forecasts

Germany’s ZEW survey for June 2025 showed a notable improvement in both current conditions and economic sentiment. The current conditions index rose to -72.0 from -82.0 last month, better than the expected -75.0.

More significantly, the economic sentiment index jumped to 47.5—well above the forecast of 35.0 and up from 25.2 in May. This marks the strongest reading since March and the second-highest since February 2022.

Analysts attribute the optimism to growing investment activity and stronger consumer demand, bolstered by new fiscal initiatives from Berlin’s recently elected government.

EU Snubs Key Economic Meeting With China Over Lack of Progress

The European Union has declined to participate in the EU–China High-Level Economic and Trade Dialogue, a move that signals continued strain in relations despite recent efforts at diplomacy.

The FT, citing multiple sources, reports that Brussels is frustrated by China’s failure to make meaningful concessions. The meeting was supposed to help pave the way for the upcoming EU–China leaders’ summit scheduled for July 24–25 in Beijing.

One EU official noted, “China wants the dialogue, but we’re not seeing results.” Trade disputes—including tariffs on EVs, rare earth export controls, and anti-dumping duties—remain unresolved, contributing to the growing deadlock.

ECB’s Stournaras: Any further rate cuts will depend on data

- Remarks by ECB policymaker, Yannis Stournaras

- ECB has reached “first point of equilibrium”

- Any further rate cuts will depend on data

Asia-Pacific & World News

China Urges Nationals to Exit Israel Immediately Amid Rising Danger

The Chinese embassy in Israel has issued a stark warning to its citizens, advising them to exit the country via land routes into Jordan as soon as possible. Citing a rapidly deteriorating security situation, officials are urging Chinese nationals to avoid delay in leaving Israel.

We have been consistently clear that Iran can never have a nuclear weapon – G7 statement

- G7 leaders issue a statement on recent developments between Iran and Israel

- We have been consistently clear that Iran can never have a nuclear weapon

- Urges that resolution of the crisis can lead to broader de-escalation of hostilities in the region

- Reaffirms that Israel has a right to defend itself

- We reiterate our support for the security of Israel

- Will remain vigilant on the implications for international energy markets and stand ready to coordinate

PBOC sets USD/ CNY central rate at 7.1746 (vs. estimate at 7.1820)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 197.3bn yuan via 7-day reverse repos at 1.40%

- 198.6bn yuan mature today

- net drain 1.3bn yuan

New Zealand Food Prices Increase Slows in May

New Zealand’s Food Price Index rose 0.5% month-over-month in May 2025, down from April’s 0.8% rise. The latest figures suggest a mild easing in food inflation, though prices are still climbing.

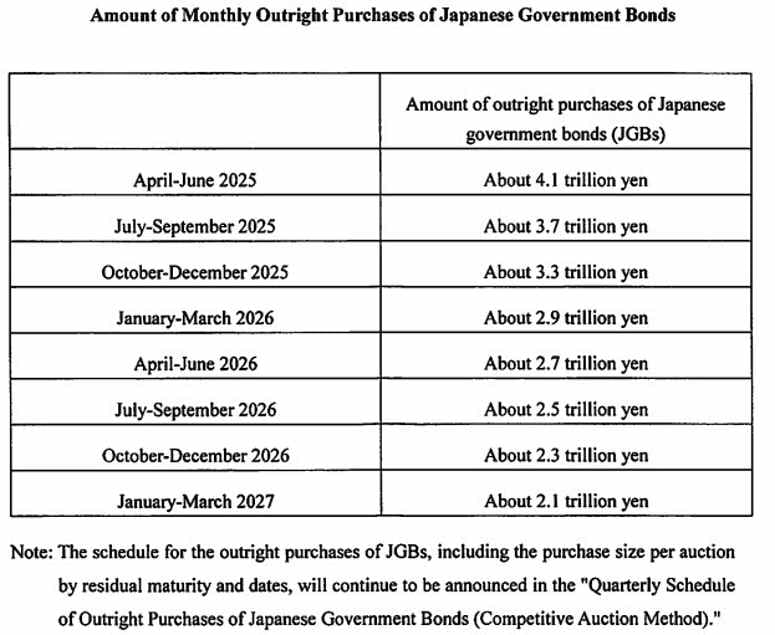

Bank of Japan Holds Rates Steady, Signals Continued Bond Tapering

The Bank of Japan kept its short-term policy rate unchanged at 0.50% during its June 2025 meeting, as markets anticipated. The decision on rates was unanimous.

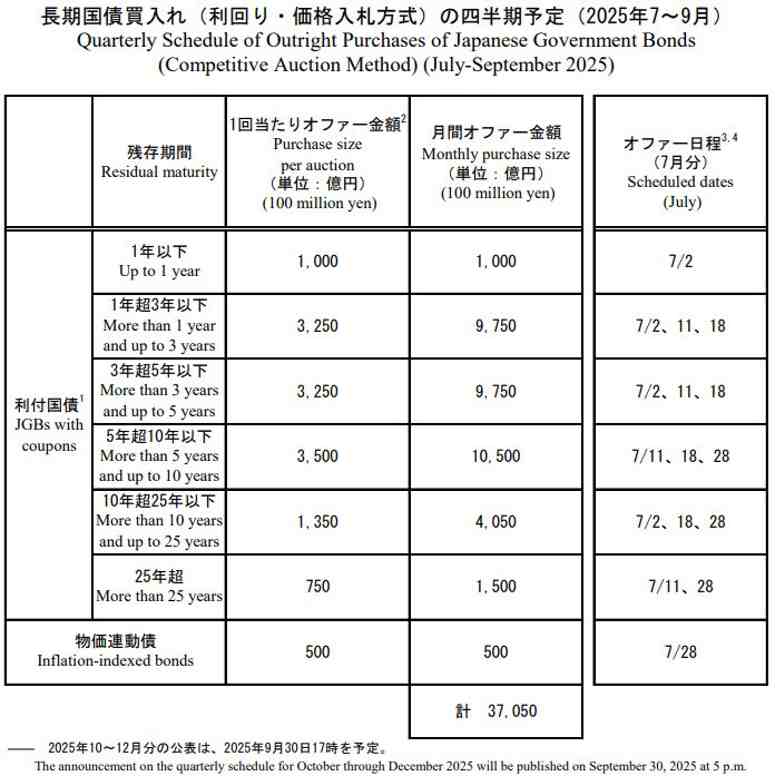

The central bank reaffirmed its bond purchase tapering path, outlining a gradual reduction in its monthly Japanese Government Bond (JGB) purchases. It plans to cut purchases by approximately ¥400 billion each quarter through Q1 2026. From Q2 2026, the pace of reduction will ease to about ¥200 billion per quarter, bringing monthly purchases to around ¥2 trillion by early 2027.

The taper plan was passed by an 8–1 majority, with board member Tamura dissenting. He argued for letting long-term interest rates be shaped more directly by market dynamics.

While the Bank acknowledged a moderate recovery in Japan’s economy, it also flagged weakening areas. Slowing global growth and declining corporate profits are likely to weigh on momentum. Inflation remains subdued for now, but is expected to edge higher as labor market tightness increases. However, risks remain high, especially around trade policy unpredictability and global market responses.

BOJ’s JGB Taper Plan: Quarterly Reduction Schedule Through Q1 2027

A summary released by the Bank of Japan shows a staged drawdown in JGB purchases:

- Through Q1 2026: Purchases decrease by ¥400 billion per quarter.

- From Q2 2026 to Q1 2027: Quarterly reductions slow to ¥200 billion.

- By January–March 2027: Monthly purchases will be trimmed to approximately ¥2 trillion.

The plan includes distribution across different maturity tenors, further indicating a managed approach to winding down central bank support without destabilizing the market.

BOJ governor Ueda: We considered market participants’ views for bond plan

- Remarks by BOJ governor, Kazuo Ueda, at his press conference

- Long-term rates should be formed by financial markets

- We showed bond buying plans through to Q1 2027 to allow flexibility, predictability

- Japan’s economy is recovering moderately, although some weak moves are seen

- Easy monetary conditions will support the economy

- Will keep raising rates if economy, prices improve

- Trade developments and their impact remain extremely uncertain

- Will guide policy from standpoint of sustainably ,stably achieving price target

- There are potential upside and downside risks to prices

- Will continue to carefully monitor data in deciding policy

- There is a growing view that pessimistic data would come out in the latter half of 2025

- There are more pessimistic data on sentiment globally

- More important than ever to analyse the variety of data amid high uncertainties

- It is not so much about fiscal considerations

- But mainly to avoid excessive volatility from negatively impacting the economy

- It is a preventive measure against uncertainties in the bond market

- The decision is based on market movements during April and May

- Uncertainties on impact on the economy are still high even if tariffs are lower

- Unable to ignore risks on trade policies reversing wage-setting behaviour among firms

- Expects effects of trade policies to appear more

- Tariffs could affect corporate earnings, winter bonus and wage negotiations

- Rate hike decision would have to be based on lots of data and considerations

Japan PM Ishiba says did not reach trade deal agreement with Trump

- Says will continue tariff talks

- US President Trump did not reach tariff agreement

- Japan, U.S. confirmed to continue tariff talks

Japan finance minister Kato says no plan for talks with Bessent at present

- In effect Kato helping the yen along lower

- No fixed plan right now to hold further talks with U.S. Treasury Secretary Bessent

- Closely monitor how attacks on oil facilities would affect oil supplies, market prices

Bank of Japan to Hold Rates, May Slightly Slow Bond Tapering

MUFG projects the Bank of Japan will keep its policy rate unchanged at 0.5% in the upcoming June meeting. Despite market uncertainty, the bank doesn’t expect changes to the current bond tapering roadmap. That said, slight tweaks could come—like trimming quarterly cuts in bond purchases to ¥300 billion starting FY2026. This move would aim to reassure bond markets and underscore the BOJ’s stability stance. The rate announcement is due between 0230–0330 GMT, with Governor Ueda scheduled to speak at 0630 GMT.

Singapore Export Figures Disappoint in May, Miss Forecasts

Singapore’s non-oil domestic exports dropped 3.5% year-over-year in May, sharply missing the +8.0% gain expected and down from April’s +12.4% growth. Shipments to Taiwan, South Korea, Indonesia, and Hong Kong rose, but exports to the U.S., Thailand, and Malaysia declined. The government has revised its GDP growth forecast for 2025 downward—from 1–3% to a tighter 0–2% range.

Crypto Market Pulse

Crypto Markets Drift as Conflict, Fed Meeting Keep Traders on Edge

Bitcoin, Ethereum, and XRP are all range-bound Tuesday as market participants weigh the impact of continued Middle East unrest and await Wednesday’s Fed meeting.

Market snapshot:

- BTC holding below $107K

- ETH steady at $2,561, supported by 200-day EMA at $2,476

- XRP down near $2.20, unable to break above resistance at $2.24

Trump calls for evacuation of Tehran, adding to the market’s sense of unease. Despite these tensions, ETF inflows remain positive:

- BTC ETFs: $412M net inflow Monday

- ETH ETFs: $21M net inflow, led by BlackRock and Fidelity

Investors are watching for:

- Fed interest rate decision (likely no change)

- Powell’s tone on inflation and economic strength

While crypto has shown resilience, traders remain cautious, especially with the July 9 tariff deadline approaching and global macro risks still in play.

Bitcoin Falls Below $106K Amid Geopolitical Fears and Cautious Trading

Bitcoin (BTC) dipped to around $106.2K, down from Monday’s high of $108.9K, as risk aversion takes hold due to the ongoing Israel-Iran conflict and investor caution ahead of the FOMC rate decision.

What’s weighing on BTC:

- Fifth day of Middle East tensions

- Trump’s call for Tehran evacuations sparks concern over U.S. involvement

- Global equities under pressure

But demand remains solid:

- BTC ETFs have posted 6 straight days of net inflows, totaling $1.8B

- Trump Media seeks SEC approval for Bitcoin-Ether ETFs

- Corporate buys surge: Strategy adds $1.05B in BTC, Metaplanet’s holdings hit 10,000 BTC

Investors await the Fed’s next move. The central bank is expected to hold rates steady, but dovish commentary could boost Bitcoin, especially if markets sense rate cuts are on the horizon.

Cardano (ADA) Risks Deeper Slide as Triangle Breakdown Accelerates

Cardano’s ADA is slipping again, down over 1% on Tuesday, and testing key levels following a triangle breakdown on its charts. Analysts now eye a possible move toward $0.51 unless sentiment shifts.

The announcement of a revised incentive scheme by Input/Output Global, aimed at supporting smaller stake pool operators, hasn’t been enough to turn market momentum. The update seeks to reduce centralization, but derivatives market sentiment remains weak.

Bearish momentum is expected to continue unless ADA can reclaim lost ground above trendline resistance.

XRP Faces Network Activity Collapse as Downtrend Deepens

Ripple’s XRP is under pressure, trading near $2.20, down 1.5% on the day, as network activity on the XRP Ledger plummets. Active addresses fell from 609,000 to just 100,000, an 84% collapse in three days—raising red flags about demand and engagement.

Key data:

- Futures Open Interest (OI) sits at $4B, up slightly but down from the $5.52B mid-May peak.

- Key resistance: $2.24 | Key support: $2.09

Despite the sharp activity drop, XRP is still above key support. However, sustained weakness could block attempts to retest $2.34 or reach toward $3.00, especially as broader crypto market sentiment stays cautious amid Middle East tensions.

Hyperliquid (HYPE) Drops Below $40 as Traders Take Profits

After touching an all-time high of $45.72, HYPE has pulled back to $40.13, down more than 3.5% amid rising market volatility and increased liquidations. Technical indicators, including the MACD, now show a bearish turn.

Market stats:

- Open Interest (OI): Down 8% to $1.91B in 24 hours

- Volume: Up 54% to $2.89B

- Liquidations: $1.77M total, with $1.23M in long positions

Unless the $40.00 support level holds, traders may see further declines. Rising geopolitical tension and a cooling derivatives market suggest the recent rally may be losing steam.

Ubyx Raises $10M to Build Unified Stablecoin Clearing Network

London-based fintech startup Ubyx has raised $10 million in a seed round led by Galaxy Ventures, with participation from Coinbase Ventures, Founders Fund, Paxos, and others. The company is building a unified stablecoin clearing infrastructure.

What Ubyx aims to solve:

- Today, each stablecoin issuer must build its own off-ramp infrastructure.

- Ubyx wants to create a common system for redeeming stablecoins from multiple issuers into banks or fintech platforms at face value.

- Backers and early adopters include Ripple, Paxos, Transfero, and Monerium.

The system will support redemptions through regulated institutions, offering compliance with KYC/AML standards. Ubyx is expected to go live later this year, supporting over a dozen blockchains, including Solana, Arbitrum, and XRPL.

The goal: to make stablecoins as easy to use and as widely accepted as Visa cards—without each issuer needing to build their own network.

The Day’s Takeaway

US

- Markets retreat on Iran strike fears: U.S. equities slid across the board Tuesday, with the S&P 500 dropping 0.8%, Nasdaq down 0.9%, Russell 2000 off 1.0%, and Dow shedding 0.7%. The selloff came as Trump floated the possibility of military action against Iran and demanded “unconditional surrender” via social media. Monday’s gains were nearly wiped out.

- Retail sales disappoint: May retail sales dropped 0.9% MoM (vs. -0.7% expected), marking a sharp reversal from earlier strength. Sales excluding autos and gas declined 0.1%. However, the control group—a better GDP proxy—rose 0.4%, slightly above estimates.

- Industrial production contracts: Output fell 0.2% in May, missing the forecast for a modest gain. Manufacturing saw only a slight 0.1% uptick, while capacity utilization fell to 77.4%.

- Housing market sentiment weakens: The NAHB index fell to 32 in June, below the expected 36. All key subcomponents declined, showing continued stress in U.S. homebuilder confidence.

- Fed policy decision incoming: Markets await the FOMC rate announcement Wednesday. The Fed is expected to hold rates steady but update its economic projections. Traders now price in roughly 44 bps of rate cuts by year-end.

- Import/export prices show no inflation spike: Import prices were flat MoM; export prices dropped 0.9%—the steepest decline since May 2023. Year-over-year, both remain tame, with import prices up 0.2% and exports +1.7%.

- GDPNow revised down: The Atlanta Fed trimmed its Q2 growth estimate to 3.5% from 3.8%, reflecting accumulating data softness.

Canada

- Bank of Canada holds firm, inflation risks persist: The BoC kept its rate steady at 2.75% and acknowledged that underlying inflation could linger due to shifting global trade dynamics. Officials are watching closely, with the possibility of a rate cut still alive if trade tensions continue and inflation stays controlled.

Commodities

- Oil surges on Iran tensions: WTI crude rose $3.07 to close at $74.84. Concerns over a potential U.S. strike on Iran and reports of reduced traffic through the Strait of Hormuz drove prices higher.

- Gold slips despite global unrest: Gold edged down to $3,380 as a stronger U.S. Dollar outshined safe-haven demand. While geopolitical risks remain high, gold failed to attract strong inflows ahead of the Fed decision.

- World Gold Council survey: 95% of central banks plan to increase gold reserves over the next 12 months, reinforcing long-term demand.

Europe

- Germany’s ZEW sentiment jumps: Economic expectations index rose to 47.5, well above forecasts and hitting its highest level since March. Investors were buoyed by improving demand and optimism tied to new fiscal policy.

- EU–China trade rift deepens: Brussels has refused to participate in a key economic dialogue with Beijing ahead of the July leaders’ summit, citing stalled progress on trade issues and previous disputes over tariffs and rare earths.

Asia

- Bank of Japan maintains 0.5% rate: The BOJ held its policy rate steady and confirmed its bond tapering plan through early 2027. Reductions will continue at ¥400B per quarter through Q1 2026, slowing to ¥200B thereafter.

- Japan’s economy shows mixed signals: BOJ flagged moderate recovery but cited headwinds from weak global demand and sluggish corporate earnings. Inflation is expected to rise slowly as labor shortages grow.

- Singapore exports surprise to the downside: Non-oil domestic exports fell 3.5% YoY in May vs. +8% expected. The GDP forecast was cut to 0–2% growth for 2025.

- China trade talks falter on global stage: The U.S. considered sweeping tech export bans if recent talks had failed, signaling ongoing tension despite the appearance of diplomacy.

Crypto

- Bitcoin drops to $106K amid risk-off mood: BTC slipped from Monday’s $108.9K high as geopolitical fears and the upcoming Fed decision weighed on sentiment. Institutional demand remains strong with $1.8B in ETF inflows since last week.

- Trump Media files for BTC and ETH ETFs: A second ETF application has been submitted by Trump Media, seeking SEC approval for crypto-focused products.

- XRP loses momentum: XRP slid to $2.20 after a dramatic 84% drop in active addresses. Network activity collapse and falling Open Interest paint a bearish picture near-term.

- HYPE hits $40 support: After peaking at $45.72, the Hyperliquid token pulled back sharply. Open Interest dropped 8% to $1.91B amid rising liquidations and technical selling pressure.

- Cardano risks deeper losses: ADA trades lower following a triangle breakdown, despite Input/Output’s new incentive scheme aimed at supporting smaller stake pool operators.

- Crypto markets on edge: Broader digital assets like ETH and XRP are in holding patterns, with ETH holding key EMAs and XRP testing support at $2.09. Investors are cautious ahead of the Fed meeting and Middle East headlines.