North America News

U.S. Stocks Close Lower; Russell 2000 Sinks Over 2%

U.S. equities finished broadly lower on Thursday, led by sharp losses in small-cap shares. The Russell 2000 tumbled 2.09%, underperforming the major averages as investors rotated out of economically sensitive stocks.

The S&P 500 and Dow Jones Industrial Average each lost around 0.6%, while the Nasdaq Composite slipped 0.47%, weighed by weakness in financial and energy shares.

Closing levels:

- Dow Jones Industrial Average: -301.07 points (-0.65%) at 45,952.24

- S&P 500: -41.99 points (-0.63%) at 6,629.07

- Nasdaq Composite: -107.54 points (-0.47%) at 22,562.54

- Russell 2000: -52.73 points (-2.09%) at 2,467.01

Sector performance was broadly negative, with financials (-2.75%) posting the steepest losses amid concerns over higher funding costs and narrowing margins. Energy (-1.12%) and utilities (-1.05%) also lagged. Information technology (+0.13%) was the only sector to finish higher, helped by modest gains in semiconductor and software names.

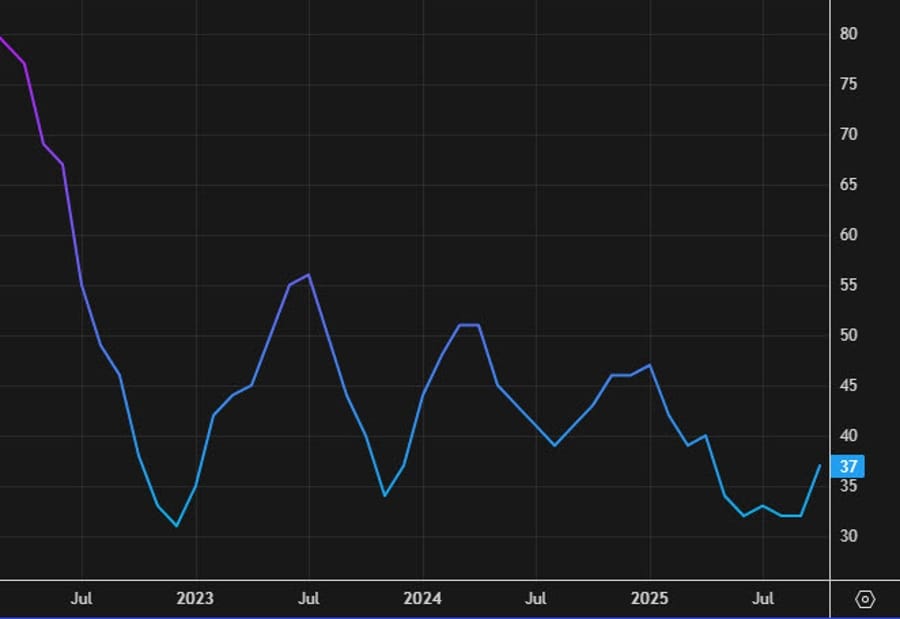

U.S. Homebuilder Sentiment Rises to 37 in October, Above Forecasts

The NAHB Housing Market Index rose to 37 in October, beating expectations of 33 and improving from 32 in September, data from the National Association of Home Builders showed Tuesday.

All major components gained modestly:

- Current single-family sales: 38 (prior 34)

- Prospective buyer traffic: 25 (prior 21)

While the increase marks the strongest reading since May, sentiment remains well below the 50 threshold that separates positive from negative conditions. Analysts noted that higher mortgage rates continue to constrain affordability, keeping builder confidence at “dismal” levels despite the improvement.

U.S. September Customs Receipts Surge to $29.6 Billion; Annual Deficit Shrinks Slightly

U.S. net customs receipts totaled $29.6 billion in September, up sharply from $7.25 billion a year earlier, according to Treasury data.

The increase comes amid higher tariff collections, though analysts noted the figure remains low relative to the administration’s $500 billion annual tariff target. The U.S. is currently on pace for roughly $269 billion in additional tariff revenue.

Despite a record monthly budget surplus in September, the improvement mainly reflects timing effects in outlays and receipts. The year-to-date federal deficit stood at $1.775 trillion, slightly below the $1.817 trillion gap recorded a year ago.

Philly Fed Index Slumps to -12.8, New Orders Stay Positive

The Philadelphia Fed’s manufacturing index plunged to -12.8 in October from 23.2 in September, sharply missing expectations for +8.5.

While new orders stayed positive at 18.2 for the second straight month, shipments dropped to 6.0 from 26.1. Employment slipped to 4.6 from 5.6, and unfilled orders remained negative at -2.2.

The six-month outlook index improved to 36.2 from 31.5, and the forward capex index rose to 25.2 from 12.5, suggesting firms remain cautiously optimistic.

Nearly half of surveyed companies expect prices to rise, with none anticipating declines — a sign inflation expectations remain firm despite falling oil prices.

Fed’s Miran Favors 50-Basis-Point Cut, But Expects a 25-Basis-Point Move

Federal Reserve Governor Stephen Miran said he favors a 50-basis-point rate cut but expects the central bank to opt for a more cautious 25-basis-point reduction amid renewed uncertainty from U.S.-China trade tensions.

Miran said disruptions in rare earth supplies could be “very damaging” for manufacturers, though he does not foresee a recession. He added that tariffs could eventually influence inflation but have not yet shown material impact.

Separately, Fed Governor Christopher Waller told Bloomberg TV that “little has changed” over the past six weeks, saying the Fed should “move carefully” in 25-basis-point steps to avoid policy mistakes.

Waller, a candidate for Fed chair, said inflation is near 2.5% and expected to trend lower, while labor markets show “clear warning signs” of weakness. He sees further cuts depending on upcoming data, noting that the neutral rate is roughly 100–125 basis points below the current level.

Richmond Fed President Thomas Barkin added that the jobs market has “noticeably shifted,” with consumers still spending but showing signs of strain compared with recent years.

White House Says Trump–Putin Talks Show “Progress”; Follow-Up Meeting Planned

The White House said President Donald Trump believes “progress was made” in his meeting with Vladimir Putin, as both sides prepare for another high-level round of talks next week.

Trump confirmed that his advisors will meet their Russian counterparts before a potential Trump–Putin summit in Budapest, adding that he and Putin spent “a great deal of time” discussing postwar trade opportunities between the U.S. and Russia.

Putin’s envoy described the call as “positive and productive,” saying next steps were “clearly defined.” Both leaders also reaffirmed the goal of eventually bringing Ukrainian President Volodymyr Zelensky into direct talks.

USTR Greer Says China Acting as if It Wants to Decouple

U.S. Trade Representative Alan Greer said China is “acting as if it wants to decouple,” as Washington ramps up efforts to strengthen control over strategic materials and rare earths.

Speaking to Fox News, Greer said the U.S. and its allies are considering new investments and equity stakes in rare earth companies, as well as reshoring key supply chains to reduce dependency on China.

Greer’s remarks follow renewed trade tensions and align with Treasury Secretary Bessent’s push for more government involvement in critical industries.

Goldman Says AI Investment Still Contained, Productivity Payoff Could Be Massive

Goldman Sachs said current U.S. investment in artificial intelligence remains manageable, accounting for less than 1% of GDP — well below prior tech booms — while potential productivity gains could be enormous.

The bank estimates AI-driven efficiency could deliver $8 trillion in present-value gains to the U.S. economy, with scenarios ranging from $5 trillion to $19 trillion.

Goldman said AI spending remains proportionate to long-term returns, unlike past bubbles, even as valuations climb. The note suggests AI-linked equities could see continued support from strong productivity tailwinds.

Barclays Sees U.S. Growth Averaging 2% Through 2026, Flags Risks from Jobs and Tariffs

Barclays expects U.S. GDP growth to average around 2% quarter-on-quarter through mid-2026, reflecting a soft-landing trajectory as fiscal stimulus fades and new tariffs take hold.

The bank said trade measures will likely weigh on activity gradually as companies pass on higher import costs over time. That could temper inflation near-term but compress margins.

Barclays warned that slower consumer spending and rising unemployment pose key downside risks. It said a cooling labor market could erode confidence and dampen demand into 2026.

Trump Administration Moves to Cut 10,000 Federal Jobs Amid Shutdown

The Trump administration plans to eliminate more than 10,000 federal positions during the ongoing government shutdown, budget director Russell Vought said, according to CNBC.

Vought said the aim is to “shutter the bureaucracy,” targeting agencies seen as redundant. Reduction-in-force notices have been issued to thousands of employees, with more expected.

He also said the Consumer Financial Protection Bureau will be closed within months, and other programs — including DOE climate initiatives and minority business programs — face review.

A federal judge has issued a temporary restraining order halting layoffs, saying they may violate federal law. The shutdown, in its third week, has left many workers unpaid, though the Defense Department continues paying active-duty troops.

Canada Housing Starts Jump 19% in September to 279,200 Units

Canadian housing starts surged to 279,200 in September, well above expectations for 255,000 and up 19% year-on-year, the Canada Mortgage and Housing Corp. reported.

Starts were particularly strong in Montreal and Toronto, driven by a rise in rental apartment construction. Year-to-date starts are up 5% compared with the same period last year.

CMHC Deputy Chief Economist Tania Bourassa-Ochoa said the data reflect “resilience” but cautioned that today’s activity levels “stem from decisions made months or years ago when investor confidence was higher.”

Commodities News

Crude Oil Futures Settle Lower at $57.46, Weakest Since Early May

Crude oil futures extended losses Thursday, settling down $0.81 (-1.39%) at $57.46 per barrel, pressured by another larger-than-expected inventory build reported by the U.S. Energy Information Administration (EIA).

The EIA said crude stocks rose 3.524 million barrels last week, following a 3.715 million-barrel increase the week before. Market consensus had expected a modest 288,000-barrel build.

Prices traded between a session low of $57.26 and a high of $59.11. The drop pushed crude to its weakest level since May 5, with technical analysts identifying $55.87 (May 5 low) and $55.15 (April 9 low) as the next downside targets.

On the upside, resistance is seen between $59.78 and $60.10, where a sustained breakout would be needed to relieve ongoing bearish pressure.

Gold Extends Rally to Record $4,316 as Yields Drop

Gold prices climbed to another record high on Thursday, hitting an intraday peak of $4,316/oz as falling bond yields and risk aversion drove fresh safe-haven demand. The metal last traded near $4,276.68, up more than 62.8% year-to-date.

Technical charts show near-term resistance around $4,340, with support forming near $4,231.

Analysts said the move higher was supported by a sharp decline in U.S. Treasury yields, while equities slipped as investors shifted toward defensive assets.

U.S. Crude Inventories Rise by 3.52 Million Barrels – EIA

U.S. commercial crude oil inventories rose 3.524 million barrels last week, the Energy Information Administration (EIA) reported, exceeding expectations for a 288,000-barrel build.

- Prior week: +3.715 million barrels

- Gasoline: -267,000 barrels (expected -75,000)

- Distillates: -4.259 million barrels (expected -294,000)

The larger-than-expected crude build marks the fourth consecutive weekly increase, though falling gasoline and distillate stocks point to steady demand. The data follow an earlier API report showing a similar build, keeping pressure on oil prices despite recent geopolitical headlines.

U.S. Rare Earth Firms Rally as Washington Pushes Strategic Independence

As rare earth supply concerns rise, several U.S.-linked producers are gaining attention amid Washington’s push for self-sufficiency in critical minerals.

USTR Alan Greer said the U.S. will “do more” to secure its rare earth position, including additional equity stakes and reshoring efforts.

Among key players:

MP Materials (NYSE: MP) trades at $92.88 premarket. The Defense Department has invested $400 million in preferred shares, making it the top shareholder. MP has multiple DoD contracts, including $58.5 million in support for a Texas magnet plant and a price floor guarantee for key elements under a long-term deal.

Ucore Rare Metals (TSXV: UCU / OTCQX: UURAF) trades at $7.49 after securing $18.4 million in DoD funding to build a commercial rare earth separation plant in Louisiana. Its project has priority defense status under DPAS.

Critical Metals (CRML) trades at $26.04 premarket and holds a 10-year supply deal with U.S.-funded processors, though it relies on offtake agreements rather than direct equity backing.

The rally has been sharp: MP up 475% in 2025, UURAF up 1,300%, CRML up 234%. Still, all remain loss-making — MP reported a -$0.18 EPS on $57.4 million revenue last quarter, Ucore posted -$0.03, and CRML -$0.16 with no revenue.

Other key names include Lynas Rare Earths (ASX: LYC) at $20.40, Energy Fuels (TSX: EFR) at C$35.05, and USA Rare Earth (USAR) at $34.10.

While volatile, the sector’s political backing under national security priorities has kept investor attention high as U.S.-China tensions escalate.

Gold Hits Record $4,242 as US-China Tensions Flare, Fed Cut Bets Rise – ING

Gold surged to another record high Thursday, with spot prices touching $4,242/oz, driven by escalating U.S.–China tensions and renewed expectations for two more Fed rate cuts this year, ING’s Ewa Manthey and Warren Patterson said.

Silver climbed over 3% to finish above $53/oz Wednesday amid tight supply in London. U.S. Treasury yields fell to multi-month lows after Fed Chair Powell signaled support for a quarter-point rate cut this month.

Tensions flared as President Trump threatened new 100% tariffs on Chinese goods, prompting Beijing to vow retaliation. Traders are also watching the Section 232 probe on critical minerals — including silver, platinum, and palladium — for possible new trade measures.

Gold and silver are up roughly 55% and 80% year-to-date, respectively, supported by strong central-bank buying, ETF inflows, and safe-haven demand amid Fed uncertainty and a protracted U.S. government shutdown.

Oil Prices Edge Higher After API Reports Large Crude Build – ING

Oil prices recovered some ground Thursday morning as President Trump said India plans to halt purchases of Russian crude “soon,” ING analysts Ewa Manthey and Warren Patterson noted.

The move came despite a bearish U.S. inventory report from the American Petroleum Institute (API), which showed crude stockpiles rising for a third straight week.

API data indicated a 7.36 million-barrel crude build last week, defying expectations for a 136,000-barrel draw. Gasoline inventories increased 3 million barrels, while distillate stocks fell 4.8 million barrels.

ING said the drop in distillates sends “mixed signals” about demand, as it hints at ongoing consumption but uneven refinery dynamics. The official EIA inventory data later today will offer a clearer picture.

India’s foreign ministry confirmed it will “diversify energy sourcing” while keeping supplies stable and affordable.

China Says Rare Earth Controls Are Not a Ban, Urges U.S. to “Correct Mistakes”

China’s Commerce Ministry said its recent export control measures on rare earths differ from an outright export ban, reiterating that the country remains committed to constructive trade engagement.

The ministry said it had taken a “positive and constructive stance” in recent discussions with U.S. officials and urged Washington to “appreciate the progress” achieved in prior talks while correcting “recent wrong actions.”

The statement follows heightened tensions after President Trump threatened to impose 100% tariffs on Chinese goods last week.

ANZ Sees Gold Hitting $4,600, Silver at $57.50 by Mid-2026

ANZ forecasts gold prices peaking at $4,600 and silver at $57.50 by June 2026, supported by geopolitical tensions, trade tariffs, and concerns over U.S. fiscal stability.

The bank expects gold to reach $4,400 by end-2025 before easing in the second half of 2026 as the Federal Reserve’s easing cycle concludes.

ANZ said political risks, ballooning debt, and doubts about Fed independence will sustain investor demand, though a stronger economy or hawkish Fed could weigh on prices.

Trump Says India to Halt Russian Oil Imports, Will Pressure China Next

U.S. President Donald Trump said Indian Prime Minister Narendra Modi has agreed to stop buying Russian crude, signaling a major shift in Moscow’s export landscape. Trump added he will push China to follow suit as Washington tightens efforts to cut Russia’s energy income.

Oil prices moved higher after Trump’s comments.

India and China are Russia’s largest oil buyers, benefiting from discounts since the 2022 Ukraine invasion. Trump recently imposed tariffs on Indian goods to pressure New Delhi to curb Russian imports.

The Indian government has yet to confirm Modi’s commitment. Analysts said the move, if confirmed, could tighten global supply and lift prices, while renewed pressure on China could unsettle regional energy trade.

Europe News

European Stocks Close Higher; CAC Leads Gains

European equities finished broadly higher on Thursday, with sentiment supported by resilient U.S. housing data and optimism over U.S.–Russia diplomatic progress.

- Germany’s DAX: +0.38%

- France’s CAC 40: +1.38%

- U.K. FTSE 100: +0.12%

- Spain’s IBEX 35: +0.48%

- Italy’s FTSE MIB: +1.12%

French shares outperformed, extending gains after the government survived two no-confidence votes earlier in the week.

Eurozone Trade Surplus Shrinks Sharply in August to €1.0 Billion

The euro area’s trade surplus narrowed to €1.0 billion in August from a revised €12.7 billion in July, Eurostat reported.

The decline was driven by a steep fall in the machinery and vehicles surplus, which dropped to €7.8 billion from €18 billion. Compared with a year earlier, the overall balance decreased by €2 billion.

The weaker showing reflects softer global demand and slower export growth across key industrial categories.

Here are the year-to-date comparisons, which still show growing conditions for the year:

Italy’s September Inflation Holds at 1.6%, Core Price Growth Slows

Italy’s final September CPI reading confirmed annual inflation at 1.6%, unchanged from the preliminary estimate, national statistics agency Istat said.

The EU-harmonized HICP measure also stood at 1.8%, matching the flash estimate. Core inflation eased slightly to 2.0% from 2.1% in August, reflecting cooling underlying pressures.

While the moderation offers some relief for policymakers, analysts noted that Germany’s still-sticky price dynamics remain a key concern for the ECB’s overall inflation outlook.

U.K. Economy Expands 0.1% in August, Industrial Output Beats Forecasts

U.K. GDP grew 0.1% in August, matching expectations and showing modest improvement after July’s revised 0.1% contraction, according to the Office for National Statistics.

Industrial output rose 0.4%, topping forecasts for a 0.1% gain, while manufacturing output advanced 0.7% after a 1.1% drop the prior month. Services activity was flat against expectations for a 0.1% increase, and construction output slipped 0.3%.

The mixed report points to continued stagnation in services but some stabilization in industrial production after a weak summer period.

ECB Lagarde: Growth inflation risks have become more balanced

- ECBs Lagarde

- Growth inflation risks have become more balanced

- ECB as well positioned to face future shocks

ECB Officials Signal End of Rate-Cut Cycle, See Balanced Inflation Risks

European Central Bank policymakers struck a broadly steady tone, signaling the end of the rate-cut phase while highlighting balanced inflation risks and steady growth momentum.

ECB’s Primoz Dolenc said inflation risks are now “balanced” and growth remains on a “solid path,” adding that rates should stay unchanged unless a fresh shock hits the economy.

Pierre Wunsch noted that the probability of another rate cut “has been receding,” citing balanced price risks and the need to monitor stubborn services inflation.

Martin Kocher said the ECB is “at or very near” the end of its rate-cut cycle, stressing the importance of keeping policy room in reserve for potential crises.

Georg Muller told Econostream there is a “good case” for holding rates steady, arguing that current levels are not restraining investment or growth. He added that another cut would only be warranted if conditions deteriorate significantly, saying the inflationary period “appears to be over.”

French Government Survives Two No-Confidence Votes

France’s government survived two no-confidence motions in parliament, ensuring Prime Minister Sébastien Lecornu’s administration stays in power for now.

The first motion drew 271 votes against the government — short of the 289 needed for removal — after Lecornu secured Socialist Party backing by agreeing to pause President Macron’s contested pension reform.

A second motion later in the day failed even more decisively, with only 144 lawmakers voting to oust the government. Lecornu’s survival allows him to press ahead with the upcoming budget negotiations.

The CAC 40 index gained 0.8% to 8,140 in afternoon trading, near session highs, as investors welcomed the renewed political stability.

Analysts See Sterling Under Pressure from BoE Cut Risks and Fiscal Strains

Analysts warned the pound may weaken further toward year-end as markets underestimate the risk of another Bank of England rate cut and as fiscal fragility clouds sentiment.

MUFG said softening inflation and sluggish wage growth could strengthen the case for a December cut. The U.K.’s Nov. 26 budget may reveal tighter fiscal conditions, adding to pressure.

Rabobank highlighted the U.K.’s large current account deficit and reliance on external financing as key vulnerabilities compared with the eurozone. It expects the euro to edge higher against sterling through 2026.

Both banks see rising fiscal risk and dovish BoE expectations eroding the pound’s late-2025 resilience.

Asia-Pacific & World News

Kremlin Says Putin–Trump Call “Substantive and Open”; Summit Preparations Underway

A senior Kremlin aide said Thursday that the Putin–Trump phone call earlier this week was “substantive and open,” lasting nearly 2.5 hours and laying the groundwork for a potential summit in Budapest.

According to Yuri Ushakov, the conversation covered the situation in Ukraine, with Putin emphasizing that Russian forces maintain “strategic initiative along the entire frontline.” Trump reportedly acknowledged the conflict as “the hardest of all to resolve” but said ending it would unlock “amazing opportunities for U.S.–Russia economic cooperation.”

Both leaders agreed to remain in close contact, and U.S. Senator Marco Rubio is expected to speak with Russian Foreign Minister Sergey Lavrov in the coming days as part of preparatory talks.

Putin also raised concerns over potential U.S. Tomahawk missile deliveries to Ukraine, warning they would not alter the battlefield but would “harm peace efforts and bilateral ties.”

BofA Sees China Deflation Easing Gradually, CPI Likely Negative in Q4

Bank of America said China’s September inflation data suggest deflationary pressures are starting to ease, though overall price momentum remains muted amid weak consumption.

Consumer prices fell 0.3% from a year earlier, and producer prices dropped 2.3%, both matching BofA’s estimates and narrowing from August’s deeper declines. The bank attributed the smaller contractions partly to base effects and a surge in gold prices offsetting weaker food costs.

BofA noted that selective policy support and targeted measures have softened deflationary forces, but supply continues to outpace sluggish demand. The lender expects producer price deflation to moderate further over coming months, helped by the base effect and steps to reduce industrial overcapacity. However, with household demand still soft, CPI is projected to stay below zero through year-end.

BofA’s outlook indicates that China’s deflation cycle may be stabilizing but not reversing, implying continued policy accommodation into 2026 as domestic demand and pricing power remain constrained.

U.S. Plans More Strategic Stakes to Counter China’s Industrial Policy, Bessent Says

U.S. Treasury Secretary Scott Bessent said the Trump administration will expand government equity stakes in critical industries to counter China’s state-led industrial strategy and export controls.

Speaking at a CNBC event, Bessent said tighter Chinese restrictions on rare earth minerals and magnets underscore the need for U.S. self-reliance in key materials. “When you’re competing with a non-market economy like China, you have to play industrial policy,” he said.

The administration plans to shift from subsidies toward direct ownership stakes in firms such as Intel, MP Materials, and Trilogy Metals. New investment targets include semiconductors, pharmaceuticals, steel, and rare earths, alongside potential price floors and stockpiles.

Bessent said seven industries have been identified for development, cautioning against overreach and urging strategic discipline. He also criticized U.S. defense contractors for lagging in innovation and focusing on buybacks, saying Washington could pressure them to boost R&D after setbacks such as Boeing’s.

BofA: China Loan Demand Remains Weak, Infrastructure May Lift Q4 Credit

Bank of America said China’s September credit figures highlight persistently weak loan demand, with property and private investment sluggish despite some infrastructure-driven gains.

New yuan loans totaled 1.29 trillion yuan, matching BofA’s forecast but below the 1.46 trillion yuan market estimate. Total social financing rose 3.53 trillion yuan, while M1 grew 7.2% and M2 slowed to 8.4%.

Household borrowing weakened to 389 billion yuan from 500 billion a year earlier, and corporate loans declined to 1.22 trillion yuan from 1.49 trillion. Corporate capex loans eased to 910 billion yuan.

BofA said despite supportive policy, credit appetite remains subdued. Infrastructure spending could provide a modest fourth-quarter lift, but overall credit growth is likely to remain constrained.

PBOC sets USD/ CNY reference rate for today at 7.0968 (vs. estimate at 7.1186)

- PBOC CNY reference rate setting for the trading session ahead.

PBoC injects CNY 236bln via 7-day reverse repos, rate at unchanged 1.40%

Australia’s Jobless Rate Jumps to 4.5%, Raising Pressure for RBA Cut

Australia’s unemployment rate rose to 4.5% in September, the highest in nearly four years and above expectations of 4.3%, fueling speculation of a rate cut at the Reserve Bank’s November 4 meeting.

Employment increased by 14,900 positions, missing forecasts of a 17,000 gain. Full-time jobs rose 8,700 after a 40,900 drop in August, while part-time roles climbed 6,200. The participation rate edged up to 67.0%, slightly above expectations.

The weaker labor data are expected to intensify debate over whether monetary easing should resume amid signs of cooling demand.

RBA’s Kent Says Neutral Rate Not Useful Near Term as Conditions Loosen

Reserve Bank of Australia Assistant Governor Christopher Kent said financial conditions have eased after recent rate cuts, but the “neutral rate” concept is too uncertain to guide short-term policy.

Speaking at the CFA Society Australia conference, Kent said credit is flowing more easily and policy now sits within a broad neutral range. He added the RBA will reassess the outlook based on incoming data as inflation and growth uncertainty persist.

New Zealand Food Prices Fall 0.4% in September After Revision

New Zealand’s Food Price Index fell 0.4% in September, a sharp revision from the previously reported 0.3% gain. Annual growth stood at 5.0%.

The correction marks a significant swing, suggesting easing food inflation pressures as supply conditions improve.

BOJ Shimizu: BOJ must proceed carefully with policy normalization

- BOJ Shimizu strikes a cautious tone on policy

- Inflation expectations in Japan are still below 2%, so the BOJ must lift expectations and continue to support economic activity.

- It is not known exactly how Japan’s economy will react to the new environment of higher interest rates, which is why the BOJ must proceed carefully with policy normalization.

- If the BOJ is sufficiently confident about the future path of the economy, it can proceed with policy normalization.

IMF Urges BOJ to Maintain Loose Policy, Hike Only Gradually

The International Monetary Fund has urged the Bank of Japan to keep policy accommodative and raise rates slowly, citing fragile trade conditions and uncertain wage momentum.

IMF Asia-Pacific deputy director Nada Choueiri said Japan’s economy has held up on solid exports and spending but faces downside risks. She added that the BOJ is not lagging inflation trends and should avoid tightening too quickly.

Choueiri said any new fiscal measures must remain temporary and targeted to avoid worsening Japan’s debt burden.

Japan Machinery Orders Miss Forecasts, Up 1.6% Y/Y

Japan’s core machinery orders rose 1.6% in August from a year earlier, missing expectations of a 4.8% increase, data from the Cabinet Office showed.

On a month-on-month basis, orders fell 0.9%, worse than forecasts for a 0.5% rise. July saw a 4.6% drop. The volatile indicator serves as a leading gauge for capital expenditure over the next six to nine months.

Japan’s Finance Minister Pledges to Monitor FX for Disorderly Moves

Japanese Finance Minister Shunichi Kato said Tokyo will closely monitor currency markets for “excessive fluctuations,” emphasizing the need for exchange rates to reflect economic fundamentals.

Kato confirmed discussions with G7 finance chiefs and U.S. Treasury Secretary Bessent, including coordination on foreign-exchange stability and concerns over China’s rare earth export limits.

He said political stability is critical for FX markets and warned that retaliatory trade measures among major economies could harm global growth.

BOJ’s Tamura Calls for Gradual Rate Hikes Toward Neutral Level

Bank of Japan board member Toyoaki Tamura said the BOJ should continue moving interest rates closer to neutral, warning that delaying normalization could force sharper hikes later.

Tamura, who supported a rate increase at the last meeting, said Japan’s economy is likely to grow moderately as overseas conditions stabilize. He noted upside risks to prices and said real rates remain negative, with inflation potentially deviating above the BOJ’s baseline scenario.

He estimated Japan’s neutral rate at “at least 1%” and said policy remains far below that level. Tamura added that many firms are maintaining strong investment plans and that food price pressures warrant close monitoring.

Japan, China, South Korea Central Bank Chiefs Meet to Discuss Economic Outlook

Central bank governors from Japan, China, and South Korea held a trilateral meeting chaired by BOJ Governor Kazuo Ueda to exchange views on regional economic and financial trends.

Officials discussed recent developments in growth and markets amid shared concerns over global uncertainty and inflation dynamics.

Crypto Market Pulse

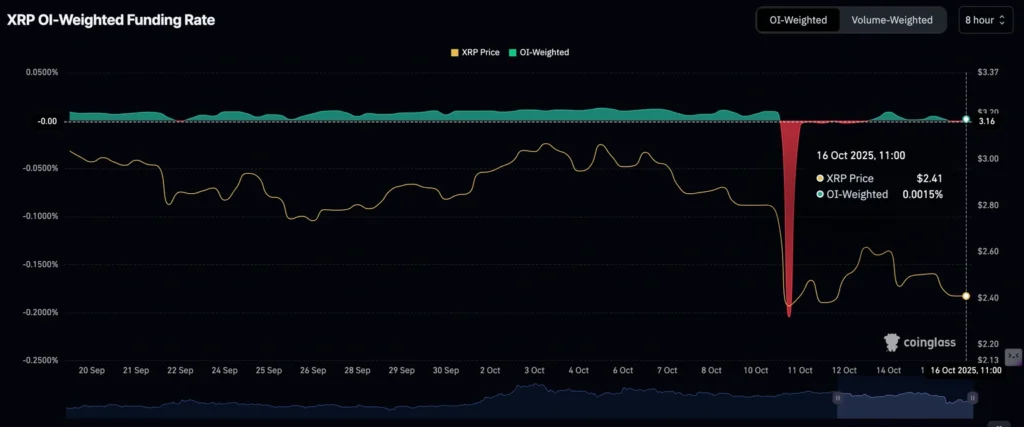

XRP Rebounds Above $2.40 as Exchange Inflows Drop, Traders Eye 10% Upside

Ripple’s XRP climbed back above $2.40 on Thursday, rising alongside other major cryptocurrencies after two days of declines. The rebound comes as inflows to the Binance exchange decline, suggesting easing selling pressure and potential bear fatigue.

Earlier in the day, XRP briefly dipped to $2.35 before recovering, supported by renewed buying interest in futures markets. The Open Interest (OI)-weighted funding rate has turned positive again at 0.0015%, up from a deeply negative -0.2045% over the weekend, according to CoinGlass data — a sign that traders are once again positioning for upside.

In the prior week, exchange inflows peaked at around 362 million XRP tokens, coinciding with a market-wide deleveraging event that sent XRP as low as $1.25. The sharp decline in inflows this week indicates waning sell-side pressure.

If bullish momentum holds, analysts see potential for XRP to retest $2.62, with a breakout above that level opening the door toward the $3.00 psychological mark.

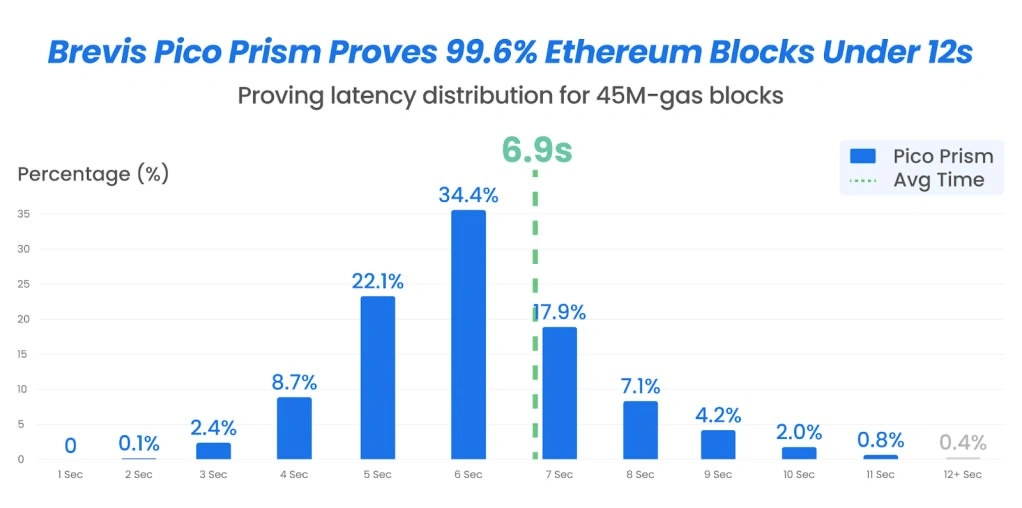

Ethereum Scaling Breakthrough: Pico Prism Achieves 99.6% Real-Time Proof

Ethereum’s scaling potential took a leap forward after Brevis unveiled its new zero-knowledge Ethereum Virtual Machine, Pico Prism, capable of proving mainnet blocks almost instantly using consumer-grade GPUs.

In a September test, Pico Prism achieved 99.6% real-time proving — generating cryptographic proofs faster than blocks are produced — using 64 Nvidia RTX 5090 cards. The company aims to reach the same performance with fewer than 16 GPUs “within months.”

Brevis said the breakthrough brings Ethereum closer to 10,000 transactions per second, potentially enabling lightweight validation on consumer devices.

“Real-time proving breaks the existing model where every validator re-executes every transaction,” the firm said. “Now one prover can generate a proof, and everyone else verifies it in milliseconds.”

The advance could scale Ethereum by 100x, slashing costs and expanding global participation through cheaper, faster verification.

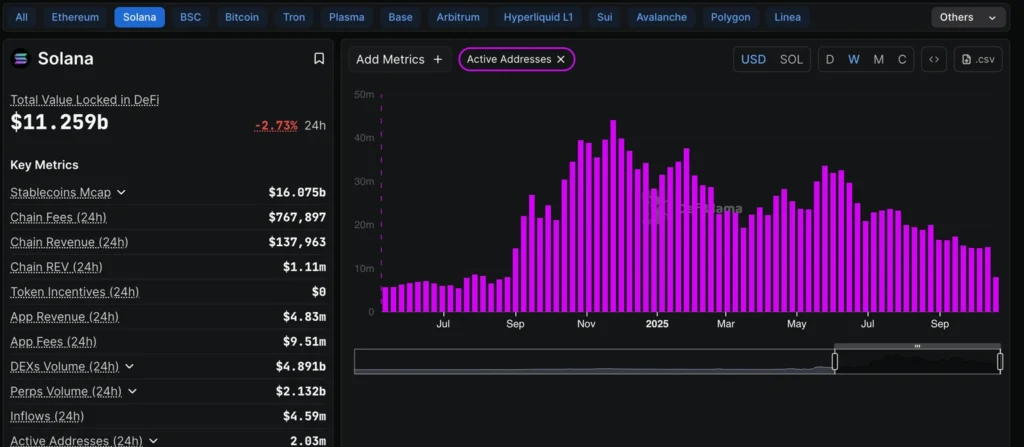

Solana Rebounds Toward $200 as Crypto Sentiment Improves

Solana (SOL) climbed above $195 Thursday, recovering from a brief flash dip as the broader crypto market regained some risk appetite. Bitcoin traded back above $111,000, and Ethereum tested resistance near $4,100.

SOL is attempting to retake the $200 mark, but analysts caution that on-chain activity remains weak. Data from DefiLlama show active Solana addresses dropped to 8.04 million in mid-October from 33.6 million in late May — a steep decline suggesting waning user engagement.

The fall in active users may cap upside momentum despite improving sentiment. A sustained base above $195 is needed to confirm bullish control and avoid another retest of $186 support.

Crypto Market Slides as Bitcoin, Ethereum, XRP Face Renewed Pressure

Bitcoin (BTC) fell for a third straight day Thursday, trading around $110,500, as traders continued to unwind positions following last week’s record deleveraging event.

BTC is now hovering near key support between $108,000–$110,000, while Ethereum (ETH) holds above the 100-day EMA but remains technically weak. XRP faces further downside toward $2.20 if bearish momentum persists.

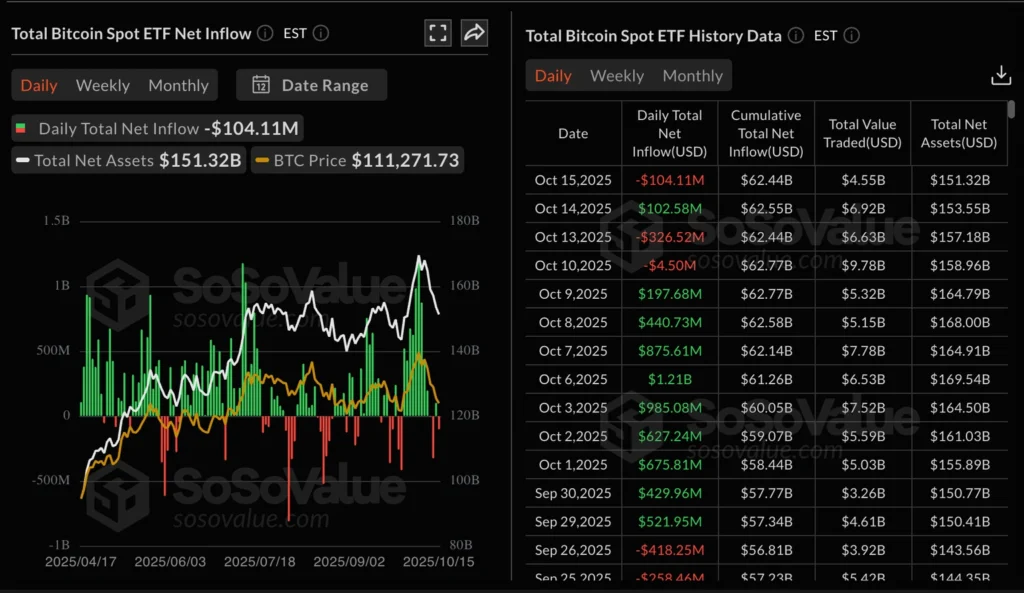

Altcoins remain subdued as institutional flows soften. SoSoValue data showed $104 million of Bitcoin ETF outflows on Wednesday, partially reversing a $103 million inflow the prior day. Total Bitcoin ETF assets stand at $151.3 billion, with cumulative net inflows of $62.4 billion.

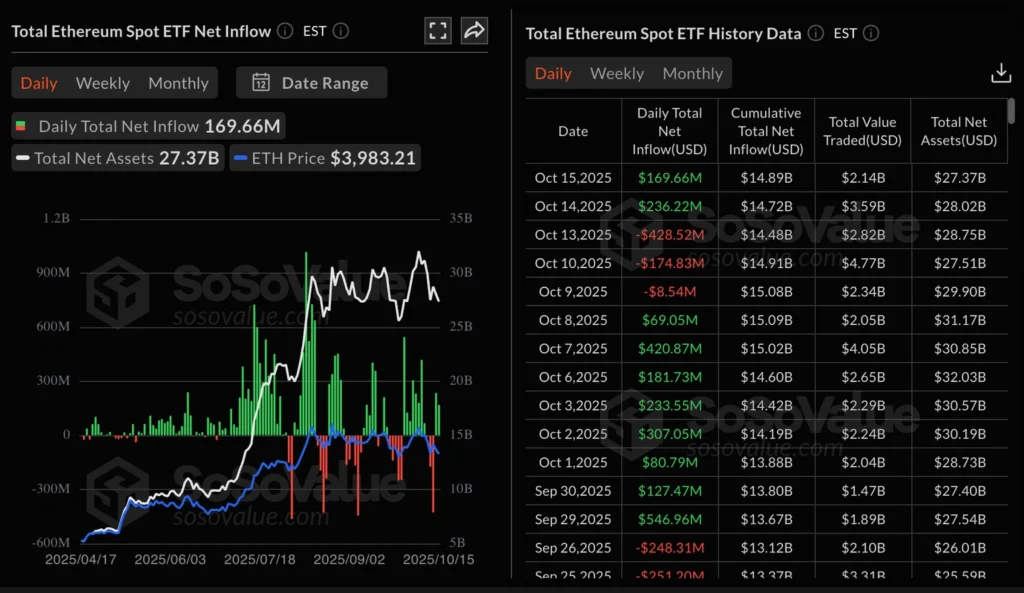

Ethereum ETFs saw $169 million in inflows Wednesday, down from $236 million on Tuesday, underscoring fading institutional appetite. Analysts say steady inflows are critical to sustain a short-term rebound toward BTC’s $126,199 record high.

Hyperliquid (HYPE) Extends Losses as Funding Turns Negative

Hyperliquid (HYPE) traded near $37.34 Thursday, down almost 6% for the week, as derivatives data point to mounting bearish sentiment.

Open interest has dropped to $163.3 million, its lowest since early September, while the OI-weighted funding rate slipped to -0.014%, according to Coinglass. That suggests traders are paying to maintain short positions, signaling expectations of further downside.

Technically, a close below the $36.51 support level could accelerate declines. Analysts say weakening participation and negative funding indicate fading investor conviction, increasing the risk of another leg lower if sentiment fails to improve.

Dogecoin Stabilizes as Whales Accumulate 280 Million Tokens

Dogecoin (DOGE) traded around $0.19 Thursday, down about 5% this week, but on-chain data point to growing whale accumulation that could support a rebound.

Santiment data show large wallets added 280 million DOGE between Monday and Thursday, signaling renewed confidence among top holders. The token’s near-term outlook improves if weekly support levels hold, with a potential recovery toward the 50-day EMA at $0.23.

Separately, the House of Doge, the corporate arm of the Dogecoin Foundation, signed a definitive merger agreement with Brag House Holdings (Nasdaq: BRAG) — a Gen-Z-focused gaming and digital media firm — to accelerate mainstream adoption and institutional use cases.

Analysts say the merger could boost Dogecoin’s ecosystem visibility, but near-term price momentum remains tied to broader crypto sentiment.

The Day’s Takeaway

North America

U.S. equities closed sharply lower Thursday, led by a steep selloff in small caps. The Russell 2000 plunged 2.09%, while the S&P 500 and Dow Jones each lost around 0.6%, and the Nasdaq Composite shed 0.47%. Financials (-2.75%) and Energy (-1.12%) dragged the market lower, while Information Technology (+0.13%) was the sole sector to finish in positive territory.

Treasury yields retreated as safe-haven flows lifted gold to record highs.

Federal Reserve officials struck a cautious tone ahead of next month’s meeting. Governor Stephen Miran reiterated his preference for a 50-basis-point rate cut but expects a smaller 25-basis-point move amid renewed trade tension with China. Governor Christopher Waller and Richmond Fed’s Thomas Barkin both emphasized patience as labor market softness deepens.

In Washington, the Trump administration announced plans to eliminate 10,000 federal jobs during the ongoing government shutdown, while Budget Director Russell Vought confirmed plans to shutter the Consumer Financial Protection Bureau and scale back several agency programs.

Trade policy also stayed in focus as Treasury Secretary Scott Bessent outlined a strategy to take direct government equity stakes in key U.S. industries — from semiconductors to rare earths — to counter China’s industrial policy.

U.S. macro data showed mixed readings. The Philadelphia Fed manufacturing index fell sharply to -12.8 in October, though forward expectations improved. Homebuilder sentiment rose to 37 in October (vs. 33 expected), its highest since May, while September customs receipts jumped to $29.6 billion, helping trim the annual deficit slightly.

In Canada, housing starts surged 19% in September to 279,200 units, led by strength in Toronto and Montreal, signaling still-robust construction activity despite tighter financing conditions.

Europe

European stocks extended gains, with the CAC 40 rising 1.38%, leading regional benchmarks higher. The DAX added 0.38%, FTSE 100 0.12%, and FTSE MIB 1.12%. Political stability in France boosted sentiment after Prime Minister Sébastien Lecornu’s government survived two no-confidence votes earlier in the week.

The ECB signaled it is near the end of its rate-cut cycle. Policymakers said inflation risks are now “balanced,” and growth remains steady. Officials including Primoz Dolenc and Pierre Wunsch emphasized holding rates steady unless conditions deteriorate.

In the U.K., August GDP rose 0.1%, while industrial output beat expectations at +0.4%. Analysts at MUFG and Rabobank warned that sterling faces renewed downside risks from potential BoE rate cuts and widening fiscal strains.

Italy’s inflation held at 1.6%, while the eurozone trade surplus narrowed sharply to €1.0 billion, reflecting weaker machinery exports.

Asia

China: Bank of America said deflationary pressures are easing gradually, with September CPI at -0.3% y/y and PPI at -2.3%, both improving from August. The bank expects CPI to stay negative through Q4 but sees producer price deflation moderating as overcapacity adjustments progress. Loan demand remains weak, though infrastructure spending could stabilize credit in Q4.

Beijing’s Commerce Ministry defended recent rare earth export controls, calling them “not a ban” and urging the U.S. to “correct recent wrong actions.”

Japan: BOJ board member Toyoaki Tamura called for gradual rate hikes toward a “neutral level” near 1%, warning against delaying normalization. The Finance Minister Shunichi Kato pledged to monitor FX markets for disorderly moves, while the IMF urged the BOJ to maintain an accommodative stance and tighten only gradually.

August machinery orders rose 1.6% y/y, missing forecasts, while the BOJ, PBOC, and BOK held a trilateral meeting to discuss regional stability.

Australia: The jobless rate climbed to 4.5% in September — a near four-year high — reinforcing bets for a potential RBA rate cut in November. RBA’s Christopher Kent said financial conditions have loosened but dismissed using the “neutral rate” as a short-term policy guide.

New Zealand: Food prices fell 0.4% in September after revision, suggesting easing inflation pressures.

Rest of World

U.S.–Russia diplomacy appeared to gain traction as both sides described this week’s Trump–Putin call as “substantive and open.” The White House said “progress was made,” and plans are underway for a follow-up summit in Budapest. Moscow confirmed preparations and said the leaders discussed Ukraine and postwar trade.

Separately, President Trump announced that India has agreed to halt imports of Russian crude, with Washington expected to pressure China next. Analysts said the move could tighten global oil supply if confirmed.

Commodities

Oil: Crude futures fell again, with WTI settling at $57.46 (-1.39%), the lowest since early May, after a larger-than-expected 3.524 million-barrel build in EIA inventories. Gasoline and distillate draws helped temper the bearish tone. Technical support sits near $55.15–$55.87, with resistance at $59.78–$60.10.

Separately, API data earlier in the week showed a 7.36 million-barrel build, adding to bearish pressure.

Gold: Prices surged to another record, hitting $4,316/oz, supported by falling bond yields and renewed risk aversion. Analysts see resistance near $4,340 and support around $4,231. ANZ reiterated its long-term forecast for gold to reach $4,600 by mid-2026, citing U.S. fiscal concerns and geopolitical tensions.

Crypto

The crypto market extended its pullback, with Bitcoin (BTC) sliding for a third day to around $110,500, pressured by ETF outflows totaling $104 million. Ethereum (ETH) held near support above its 100-day EMA, while XRP rebounded above $2.40 amid falling exchange inflows and recovering sentiment.

Solana (SOL) regained ground toward $200, though active addresses continue to fall, suggesting weaker network participation. Hyperliquid (HYPE) dropped near $37, with funding turning negative and open interest at multi-month lows.

In contrast, Dogecoin (DOGE) stabilized around $0.19 as whales accumulated 280 million tokens, while the Dogecoin Foundation’s corporate arm announced a merger with Brag House Holdings (Nasdaq: BRAG) to expand institutional use cases.

Separately, Brevis unveiled a major Ethereum scaling breakthrough — the Pico Prism ZK-EVM — achieving 99.6% real-time proof generation, a milestone that could boost Ethereum throughput to 10,000 transactions per second and lower verification costs dramatically.