North America News

US Stocks Slip Ahead of Fed Decision After Intraday Highs

Major US indices closed slightly lower on Tuesday after late selling erased earlier gains, as investors positioned ahead of the Federal Reserve’s policy decision on Wednesday.

The S&P 500 and Nasdaq both hit fresh intraday highs at 6,626.99 and 22,397.50, respectively, before reversing into the red. The Nasdaq 100 ended -0.08%, snapping a nine-day winning streak, while the broader Nasdaq Composite also eased after rising in eight of the last nine sessions.

Closing levels:

- Dow Jones: -0.27%

- S&P 500: -0.13%

- Nasdaq: -0.07%

- Russell 2000: -0.09%

Sector breakdown (S&P 500):

- Energy +1.74% led gains, followed by Consumer Discretionary +0.82% and Telecom +0.27%.

- Utilities -1.81% lagged, with Real Estate -0.68% and Financials -0.57% also weaker.

- Overall, 5 of 11 sectors advanced, while 6 declined.

The cautious tone reflects positioning ahead of the Fed’s rate call, where markets largely expect a 25 bps cut but remain alert to forward guidance.

US Treasury Sells $13B in 20-Year Bonds at 4.613%

The Treasury sold $13B of 20-year bonds at a 4.613% high yield, nearly matching the 4.615% when-issued level.

- Bid-to-cover: 2.74x (vs. 6-month avg. 2.65x).

- Direct bidders: 27.9% (vs. avg. 19.5%).

- Indirects: 64.6% (slightly below 67.2%).

- Dealers: 7.6% (well below 13.3%).

Strong domestic demand and a negative tail signal healthy appetite for long-term Treasuries.

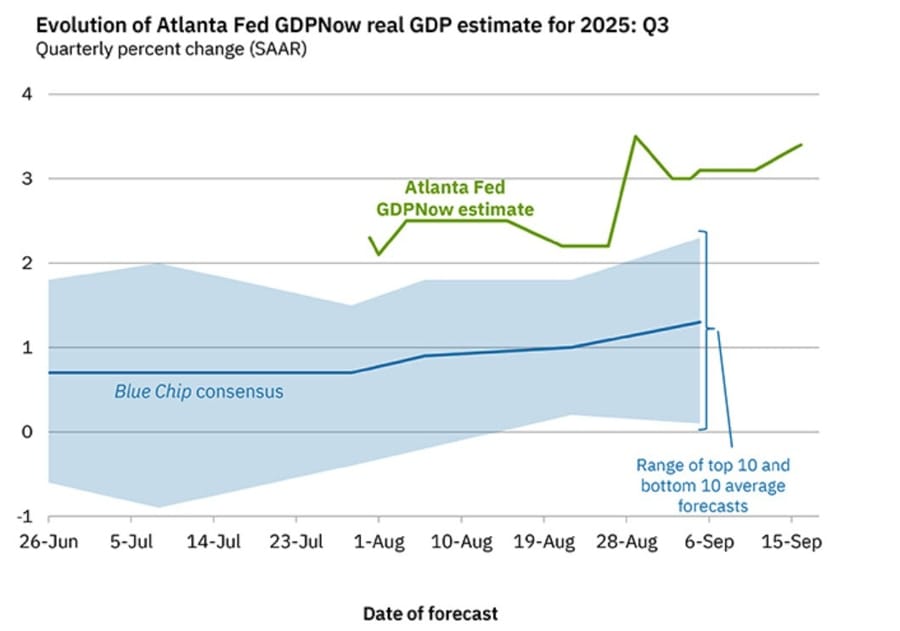

Atlanta Fed GDPNow Estimate Climbs to 3.4%

The Atlanta Fed GDPNow model raised its Q3 growth forecast to 3.4%, up from 3.1% on September 11.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 3.4 percent on September 16, up from 3.1 percent on September 10. After recent releases from the US Census Bureau, US Bureau of Labor Statistics, and Treasury’s Bureau of the Fiscal Service, the nowcasts of third-quarter real personal consumption expenditures growth and real gross private domestic investment growth increased from 2.3 percent and 6.2 percent, respectively, to 2.7 percent and 6.9 percent, while the nowcast of the contribution of net exports to third-quarter real GDP growth decreased from 0.23 percentage points to 0.08 percentage points.

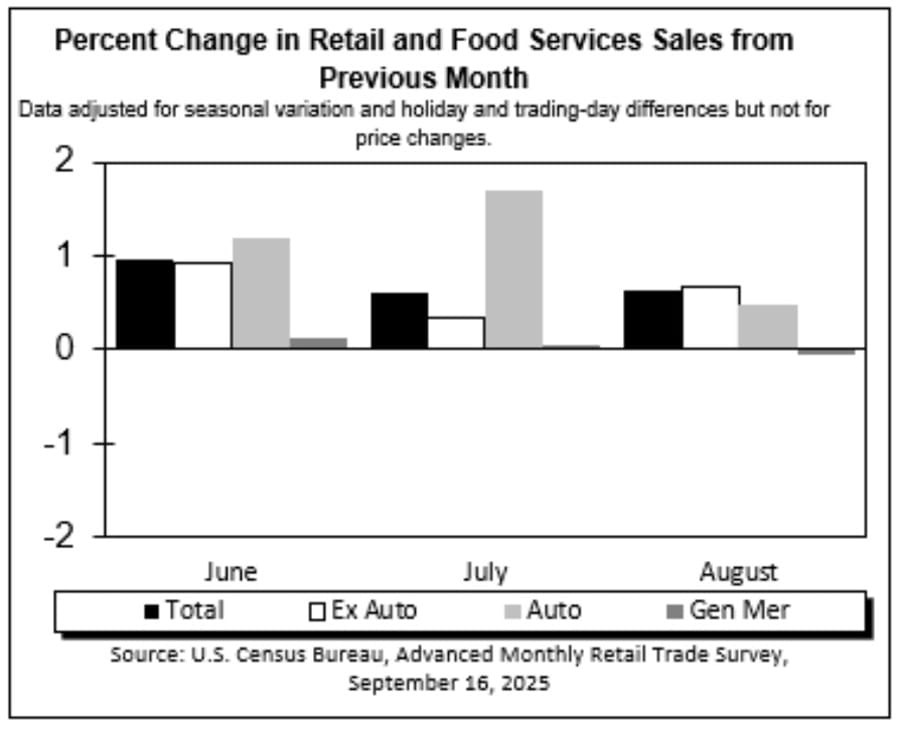

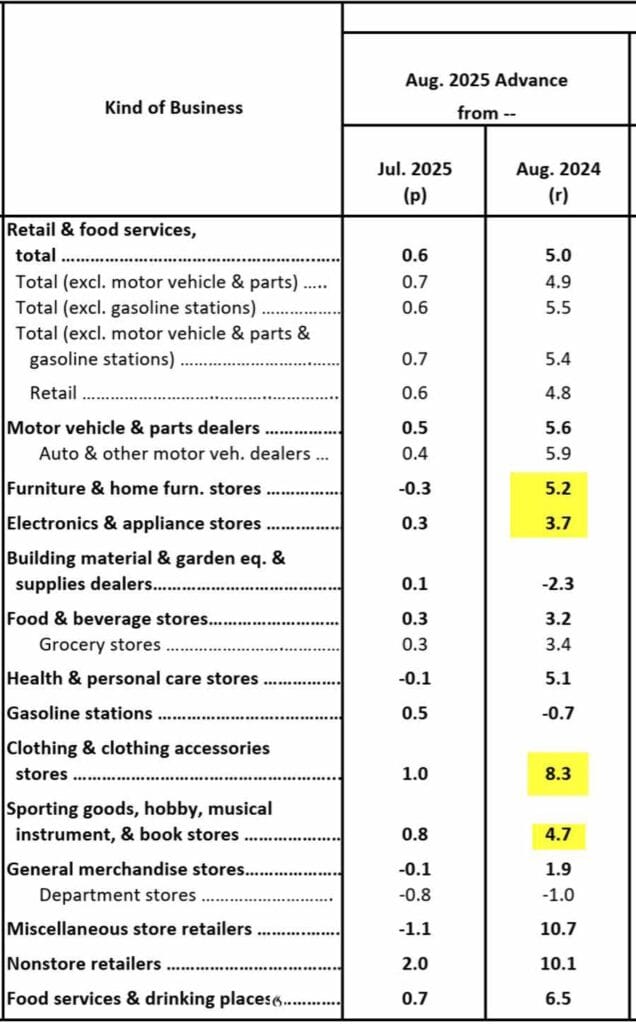

US Retail Sales Jump in August, Beating Expectations

US retail sales rose 0.6% in August, triple the forecast of 0.2%. July’s figures were revised up to 0.6%.

- Ex-autos: +0.7% (vs. 0.4% est., revised from +0.3% to +0.4% prior).

- Control group: +0.7% (vs. 0.4% est.), directly feeding into GDP.

- Ex-gas/autos: +0.7% (vs. 0.3% prior, revised from +0.2%).

The strength should lift GDP models, with the Atlanta Fed’s GDPNow last at 3.1% on Sept. 11, set for revision today.

Key driver: higher prices on imported goods boosted sales. Furniture (+5.2%), electronics/appliances (+3.7%), and clothing (+8.3%) all posted gains.

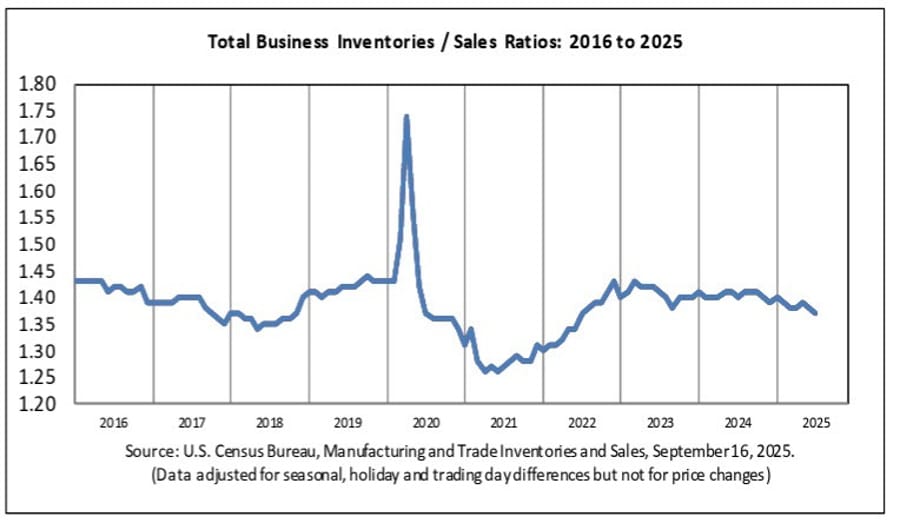

US Business Inventories Rise in July

Business inventories rose 0.2% in July, matching forecasts.

- Retail inventories ex-autos: +0.1%.

- Inventory-to-sales ratio: 1.37 vs. 1.40 a year earlier.

The stable ratio suggests businesses are keeping stock levels lean despite steady demand.

NAHB Housing Market Index Holds at Depressed Levels

The NAHB housing market index for September registered 32, in line with August but below the 33 estimate.

- Current sales: 34 (unchanged).

- Buyer traffic: 21 (down 1).

- Future sales expectations: 45 (up 2).

The index remains deeply below 50, showing builders still face weak demand.

US Industrial Production Edges Higher in August

Industrial production rose 0.1% in August, beating expectations of -0.1%.

- July revised lower from -0.1% to -0.4%.

- Manufacturing output: +0.2% (vs. -0.2% est.).

- Capacity utilization: steady at 77.4%.

- Y/Y: +0.87% (down from +1.27%).

The small rebound comes after weakness earlier in the summer.

US import prices rise 0.3% in August

US import prices rose 0.3% in August, against expectations for a 0.1% decline. Export prices also climbed 0.3%, beating forecasts for flat growth.

Year-over-year, import prices were unchanged while export prices rose 3.4%, the fastest pace since early 2023.

The data suggests US trade costs are firming despite a softer global growth backdrop.

WSJ: Framework for TikTok Deal Outlined

The Wall Street Journal outlined the proposed TikTok deal:

- New US Entity: TikTok’s US operations spun into a separate firm.

- Ownership: US investors (Oracle, Silver Lake, Andreessen Horowitz, others) to hold ~80%; Chinese shareholders below 20%.

- Board: US-dominated, one seat for the US government.

Technology & Data:

- Algorithms re-engineered in the US, licensed from ByteDance.

- Oracle to manage US user data in Texas.

- Beijing agreed to IP licensing.

Transition: US users will migrate to a new app under development.

Politics: Talks in Madrid produced the framework. Trump confirmed a deal, with plans to speak to Xi Friday. Beijing is pushing for a Trump visit later this year.

Investor Breakdown: US firms plus existing ByteDance investors like KKR and General Atlantic.

Outstanding Issues: Security risks around algorithms and final approval from both governments.

Morgan Stanley: Fed to Stick with 25 bps Cut Despite Miran’s Push for 50

Morgan Stanley expects the Federal Reserve to announce a 25 basis point cut at this week’s meeting, even with Trump’s new Fed board appointee, Miran, securing enough Senate votes to join as a policymaker. The firm sees Miran as the lone voice backing a 50 bps cut, while the majority will opt for a slower approach.

The bank forecasts the Fed’s dot plot to show two cuts in 2025 and two more in 2026. Its reasoning: when policy is only mildly restrictive, the Fed historically moves gradually, not with large emergency-style cuts. There isn’t yet enough proof of a labor market breakdown to warrant a 50 bps move.

On Powell’s press conference, Morgan Stanley expects a repeat of his Jackson Hole tone—highlighting downside risks in employment while maintaining a strictly data-dependent stance. Despite caution for now, the firm still projects the Fed will continue cutting rates each meeting through January.

RBC Projects S&P 500 at 7,100 in 2026, Warns of Volatility

RBC Capital Markets issued an early 2026 forecast for the S&P 500, targeting 7,100 in the second half alongside earnings of $297/share. The firm stressed that these figures are preliminary and subject to revision as the outlook evolves.

For 2025, RBC nudged its target higher to 6,350 from 6,250, underpinned by EPS expectations of $269. Strategists cautioned, however, that markets are still facing uneven conditions and heightened volatility. Policy uncertainty, sticky inflation, and shifting rate expectations remain key risks despite improving earnings forecasts.

TD Cowen: 60% Odds SEC Shifts to Semi-Annual Earnings Reporting

TD Cowen says there is a 60% chance the SEC will move to semi-annual earnings reports, replacing quarterly disclosures. The change, long debated, has gained traction with backing from President Trump and lobbying from the Long-Term Stock Exchange.

Analysts say SEC Chair Paul Atkins is well-positioned to push the move forward, with the formal rulemaking process likely taking six months or more. While companies would benefit from reduced compliance costs, investors could face less frequent transparency.

Powell Expected to Push Back Against Market’s Aggressive Rate-Cut Bets

Markets are focused on this week’s Fed meeting, where TD Securities expects Chair Jerome Powell to curb expectations of rapid easing. The firm sees the 2025 “dot plot” keeping two rate cuts in place, while the 2026 projection could be lowered by 25 bps.

Powell is likely to stress that decisions remain data-driven, disappointing traders who had been pricing in October and December cuts. This would leave the dollar supported in the near term, despite soft labor and inflation data.

HSBC: Dollar Could Briefly Spike After Fed Cut, Weak Jobs Still Key Risk

The Fed is expected to cut rates this week, but HSBC warns the U.S. dollar could temporarily rise following the decision. Traders already expect about 140 bps of easing through the end of 2026, leaving little room for the Fed to sound more dovish than markets.

HSBC says unless Powell signals a much faster pace of cuts, the greenback could see a knee-jerk rally. However, it expects gains to fade quickly, as weakening labor market data reinforces the likelihood of deeper easing ahead.

Bullard Open to Fed Chair Role if Core Principles Protected

James Bullard, former head of the St. Louis Fed and now dean at Purdue University, confirmed he has spoken with Treasury Secretary Scott Bessent about possibly becoming the next Federal Reserve chair. Bullard said he would only accept the job if three conditions are safeguarded: protecting the U.S. dollar’s reserve currency role, maintaining low and stable inflation, and ensuring the central bank’s independence.

The Trump administration is actively reviewing candidates to replace Jerome Powell, whose chairmanship ends in May, though he can stay on the Fed board until 2028. Trump and Bessent have been vocal critics of Powell, pressing for faster and deeper rate cuts. Markets widely expect a 25-basis-point reduction this week in response to slowing job creation and inflation uncertainty.

Bullard, known for favoring nimble policy during his time at the Fed, projects 75 bps of easing by year-end. He dismissed tariffs as only a temporary inflation risk and pointed to a cooling labor market, partly tied to immigration changes reducing employment needs. He underscored the need to shield Fed independence and also commented that Governor Lisa Cook should be given fair treatment amid ongoing fraud allegations.

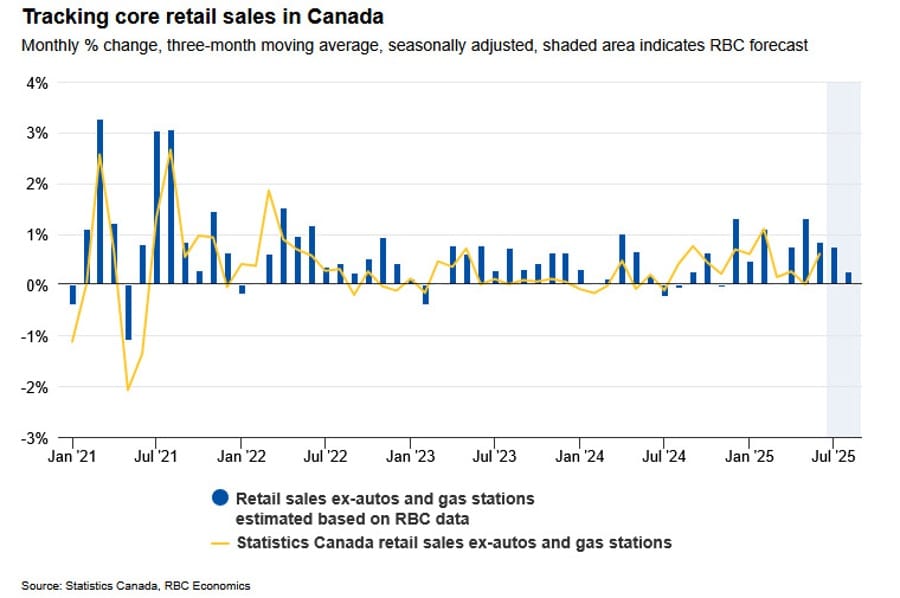

Canadian Consumer Spending Remains Resilient – RBC

RBC cardholder data shows core retail sales +0.4% in August, while the headline fell -2.2%, weighed by cheaper gasoline.

- Clothing, arts, and entertainment spending accelerated.

- Household and construction softened.

- Grocery store spending flat since May.

RBC economist Rachel Battaglia noted that resilient consumers should help Canada’s economy return to modest growth after a Q2 contraction, offsetting weakness in industry.

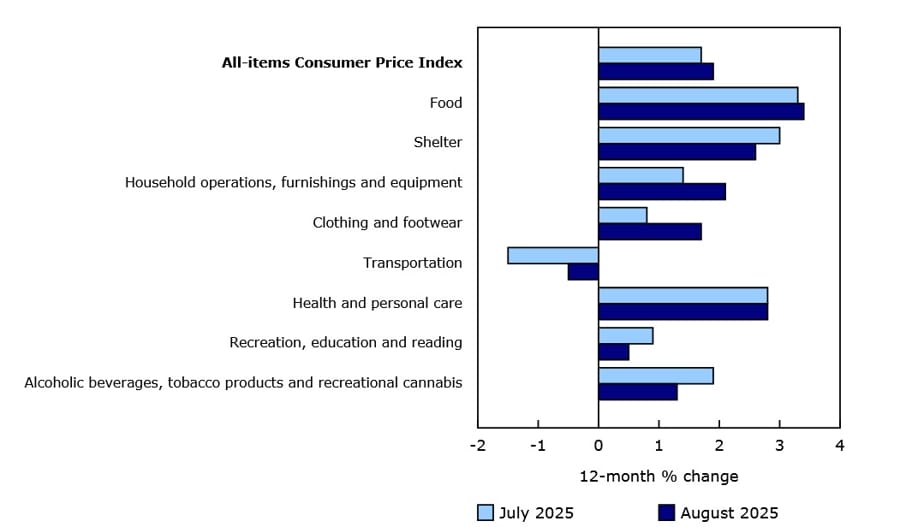

Canada August CPI slows to 1.9% y/y

Canada’s consumer price index rose 1.9% in August from a year earlier, slightly softer than the 2.0% forecast. Prices fell 0.1% on the month, versus expectations of a 0.1% increase.

Core inflation was mixed but stable: the Bank of Canada’s trim and median measures held at 3.0% and 3.1% respectively, while common CPI eased to 2.5% from 2.6%.

Travel was a major drag, with tour prices down 9.3% and airfares down 7.6% as Canadians cut back on US trips.

The weaker print clears the way for a rate cut at Wednesday’s BoC meeting, though markets are divided on whether easing will extend beyond one more move.

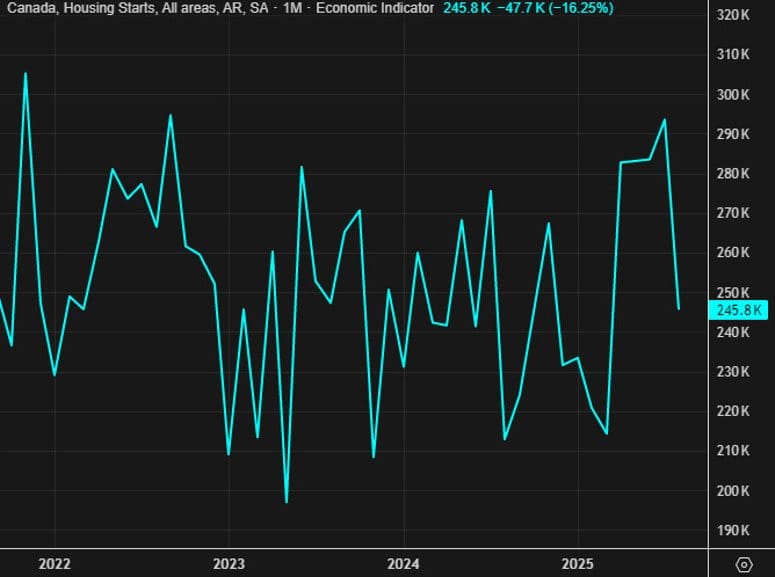

Canada housing starts dip to 245.8K in August

Canada recorded 245,800 housing starts in August, sharply below expectations of 277,500 and down 16% from July’s 294,100, according to CMHC data.

The drop follows several strong months of construction activity, suggesting a pause rather than a structural slowdown.

Commodities News

Gold Breaks Above $3,700 to New Record High Ahead of Fed Decision

Gold surged to an all-time high above $3,700, fueled by strong US data, dollar weakness, and Fed cut expectations.

- Drivers: retail sales and import prices topped forecasts, but labor softness has markets pricing a 25 bps Fed cut this week, the first since December.

- Technical backdrop: August lows held at the 100-day MA; the $3,452–$3,500 zone was retested and confirmed support earlier this month.

- The breakout carried momentum into this week, keeping bulls in firm control.

Crude Oil Rises to $64.52, Back Above 100-Day MA

Crude oil futures settled at $64.52, up $1.22 (+1.93%).

- Price reclaimed the 100-day MA at $64.32, shifting bias positive.

- Still below key resistance: 50% retracement at $66.36 and 200-day MA at $67.01.

- A break above those levels would strengthen the bullish case.

Russia may cut oil output after drone attacks – Reuters

Russian oil output could be curtailed after drone strikes on ports and refineries forced pipeline operator Transneft to restrict storage capacity, Reuters reported Tuesday.

Transneft, which handles more than 80% of Russia’s crude, warned producers they may need to reduce production after a wave of Ukrainian drone attacks.

The news pushed Brent crude to a two-week high, though exports from Baltic ports have so far continued.

U.S. NatGas Breaks Above $3 on Heatwave Demand

Henry Hub natural gas futures climbed 3.5% on Monday, closing above $3/MMBtu, as late-season heat is expected to boost cooling demand, ING reported.

Forecasts call for above-normal temperatures across the U.S. over the next two weeks, slowing the usual autumn storage builds. Typically, demand eases at this point in the year, but hotter weather is keeping injections below normal pace.

Japan JERA in advanced talks to buy USD $1.7B worth of US Natural gas production assets

Japan JERA is in advanced talks to buy USD $1.7B worth of Natural gas production from GeoSotuthern Energy and Williams Companies Joint Venture.

Oil Steady as Market Balances Risks and Fundamentals

Crude traded flat on Tuesday morning, with traders weighing geopolitical risks against oversupply concerns, ING analysts noted.

Reports suggest the EU may sanction Indian and Chinese firms accused of enabling Russia’s oil exports as part of a new package. Meanwhile, tanker loadings at Russia’s Primorsk terminal resumed after Ukraine’s drone attack last Friday, easing immediate disruption fears.

Gold Nears $3,700, Copper at Yearly High

Gold climbed toward $3,700/oz, marking another record, while copper prices jumped to their highest since June 2024, ING said.

Investor expectations for Fed easing—25 bps this week with at least one or two more cuts by year-end—have pulled Treasury yields to multi-month lows and weakened the dollar. Central bank buying and geopolitical risks have also fueled gold’s more than 40% surge YTD.

On copper, Chile expects output growth this year and next, aiming for a record 6 mt by 2027. Despite setbacks at Codelco and Teck mines, other operations are compensating:

- BHP’s Escondida boosted production +11% y/y in H1.

- Collahuasi is recovering from low-quality ore issues.

- El Salvador mine is ramping up.

This provides relief to a tight global market, though achieving Chile’s 5.6 mt annual target still faces operational risks.

Ukraine Drone Strike on Russian Port Temporarily Lifts Oil

Oil prices rebounded sharply on Friday after news broke that Ukraine launched a drone attack on Primorsk, Russia’s largest Baltic oil terminal. Brent spiked nearly $2 to $68/bbl before stabilizing, according to Commerzbank.

Primorsk exported close to 1 mbpd in August. Loadings were suspended briefly but have since resumed. Other Baltic facilities and pipelines have also been targeted, though supplies haven’t been seriously disrupted.

In fact, Russia’s seaborne oil exports rose to their highest since mid-July in early September, even hitting a 17-month high. Plans for September shipments from western ports were revised up 11% to 2.1 mbpd.

The attacks disrupted refinery operations, leaving more crude available for export, offsetting supply concerns.

China Refineries Boost Crude Processing in August

China’s refineries processed 63.46 million tons of crude oil in August, up 7.4% y/y, according to the NBS. This equals just under 15 million barrels/day, the second-highest in 17 months (after June).

For January–August, throughput totaled 488 million tons, averaging 14.7 mbpd—3.3% higher y/y. Oilchem data showed refinery utilization at 72%, up 2.6 points from last year.

Despite rising processing, inventories built by more than 1 million barrels/day in August, nearly double July’s pace. That’s because imports surged and domestic output also ticked higher.

Last year, both imports and processing had been falling. The rebound underscores stronger demand, helping offset global oversupply from OPEC+ hikes—though the sustainability is in question given stockpile builds outpacing actual consumption.

Commerzbank: Slim Odds of Tougher U.S. Sanctions on Russia

Commerzbank’s Carsten Fritsch said chances are low for harsher U.S. sanctions on Russian oil in the near term. To cut exports meaningfully, major buyers would need to be deterred, but that looks unlikely.

President Trump floated sweeping sanctions over the weekend, contingent on all NATO allies joining in. Yet EU Commission President Ursula von der Leyen dismissed secondary tariffs as a tool, and Turkey—still a major buyer—is unlikely to stop purchases voluntarily.

With EU leaders preparing their 19th sanctions package, Fritsch noted there is “little to suggest” the U.S. will move to tougher measures soon.

Europe News

European Stocks Retreat Sharply

Major European indices fell on Tuesday:

- DAX: -1.79% (worst since Sept. 2).

- CAC 40: -1.0% (snaps 6-day win streak).

- FTSE 100: -0.88%.

- Ibex: -1.51%.

- FTSE MIB: -1.28%.

The declines followed profit-taking after recent gains and caution ahead of the Fed’s decision.

Eurozone Industrial Production Rebounds in July

Eurostat reported eurozone industrial production rose 0.3% m/m in July (vs +0.4% expected). June’s figure was revised higher, from -1.3% to -0.6%.

By sector:

- Intermediate goods: +0.5%

- Capital goods: +1.3%

- Durable consumer goods: +1.1%

- Non-durable goods: +1.5%

- Energy: -2.9%

The bounce shows resilience in manufacturing, though energy output remains a drag.

Germany ZEW Survey: Conditions Slide Further, Sentiment Beats

The September ZEW survey painted a bleak picture of Germany’s current economic conditions, falling to -76.4 (worse than -75.0 expected, prior -68.6).

However, the outlook component surprised to the upside, rising to 37.3 vs 26.3 expected (prior 34.7).

The data shows that while the present environment is deteriorating, investor expectations for the future are holding up better than feared—supporting the ECB’s argument for leaving policy unchanged into year-end.

Italy August CPI Confirmed at 1.6%

Final August data from Istat confirmed Italian consumer prices rose 1.6% y/y, unchanged from the preliminary reading and slightly below July’s 1.7%.

- HICP: +1.6% y/y, revised down from +1.7% prelim

- Core inflation: +2.1% y/y, up from 2.0% in July

The uptick in core contrasts with the overall easing, though Italy remains one of the more stable economies on the ECB’s inflation watchlist. Germany, not Italy, continues to pose the bigger inflation challenge for the bloc.

UK Unemployment Holds at 4.7% in July, Real Wages Cooling

UK labor market data from the ONS showed the ILO unemployment rate steady at 4.7% in July, matching forecasts.

- Employment change: +232k vs +220k expected (prior +238k)

- Average weekly earnings: +4.7% y/y, in line with estimates (prior +4.6%)

- Earnings ex-bonus: +4.8% y/y, also in line (prior +5.0%)

- August payrolls: -8k, after a slight revision to -6k in July

The number of payrolled employees has been edging down since October 2024, now at nearly two-year lows, though still well above pre-pandemic levels. Wages are easing gradually, which should support the Bank of England’s hopes that softer pay growth will eventually filter into lower consumer price pressures.

ECB’s Scicluna: There is no cut already in a box and waiting to be unpacked

- Remarks from the ECB policymaker to Econostream

- Small inflation deviations are no reason to panic.

- Euro appreciation could undermine European competitiveness.

- Eurozone economy is a delicate balance as a result of countervailing forces.

- There are downside risks but no one is sure they will materialise, so we have to wait and see.

- If December comes and we remain in balance, then we won’t move.

- If something significant and obvious happens before October, then we don’t need a forecast to make a decision.

- We are not committed one way or the other.

EU’s von der Leyen: AI is reshaping global tech competition

- Remarks from the European Commission President, Ursula von der Leyen

- Will sign first AI gigafactory pilot projects today

- We need a massive boost to public and private investment

- Too often losing jobs to non-market economies

- Wish the same urgency for competitiveness as defense

ECB’s Kazaks: Reduction in ECB rates is already very significant

- Comment from the ECB policymaker to TV24

- There is no reason to cut rates at the moment

ECB’s Villeroy: French growth is not strong enough but remains positive

- Comments from the ECB policymaker

- We seriously have to tackle the debt problem

- We can do it

- There is no reason for France to become Europe’s laggard

- We must both reign in spending and raise taxes

BoE Expected to Keep Rates at 4% in September, Debate Turns to 2025 Path

The Bank of England is expected to hold its benchmark rate at 4% on September 18, according to a Reuters survey of 67 economists. All respondents predicted a hold, though their outlooks diverged beyond that.

- 42 economists forecast a quarter-point cut in Q4.

- 3 economists see a larger 50-bp cut.

- 22 economists expect no cuts this year at all.

Inflation, which spiked above 11% nearly three years ago and briefly returned to the 2% target last year, is forecast to hit 4% in September. A return to target is not expected until mid-2027. Wage growth remains high at 5%, while inflation is projected to average 3.8% in Q3 and 3.6% in Q4.

Some analysts argue inflation’s persistence makes easing too risky, warning of unanchored expectations. Others still see November as a viable point for the first cut if the upcoming September 16–17 inflation and jobs data softens. Meanwhile, UK growth is projected at just 0.2–0.4% q/q through 2026, averaging a little above 1% annually. The BoE is also continuing its balance sheet reduction, with forecasts for another £50–100 billion in bond sales over the next year.

Deutsche Bank: ECB Likely at Terminal Rate, Next Move a 2026 Hike

Deutsche Bank analysts believe the European Central Bank has settled at its terminal policy rate after the September meeting, with 2% now the long-term anchor. Markets came away from the meeting less worried about further cuts, as the ECB offered no explicit forward guidance but signaled greater comfort with current levels.

The firm shifted its forecast to a 2% terminal rate after the EU-U.S. trade deal and says that while more easing remains a possibility, the threshold for cuts has risen sharply. Inflation may dip below target in early 2026, but Deutsche Bank does not expect that to be enough to trigger action.

Its baseline scenario is that the ECB stays steady until late 2026, when it would likely raise rates rather than cut further. The bank summarized: “The hurdle to additional easing feels higher after this meeting.”

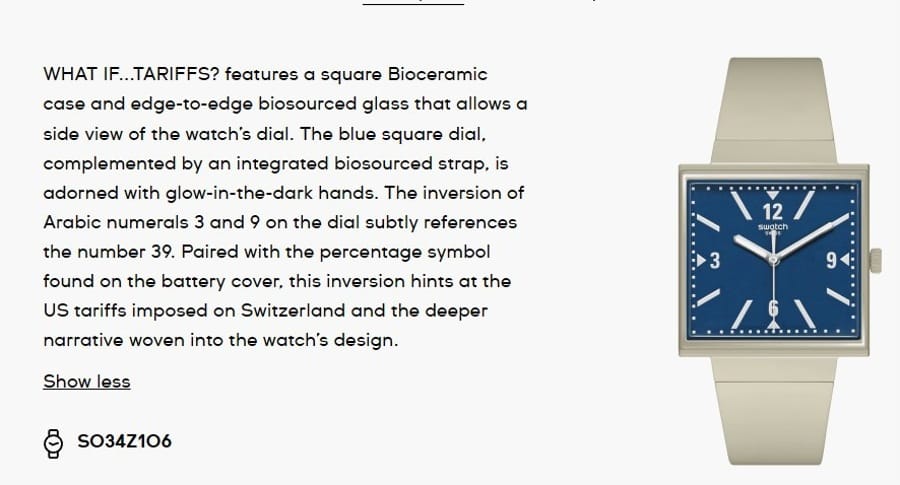

Swatch Pokes Fun at Trump’s Tariffs with “WTF Tariffs” Watch

Swatch has unveiled a new watch design mocking Trump’s 39% tariff on Swiss imports. The piece, called WHAT IF…TARIFFS?, features a square Bioceramic case, biosourced strap, glow-in-the-dark hands, and edge-to-edge glass.

The dial inverts the Arabic numerals 3 and 9, a reference to the 39% tariff. The back includes a percentage symbol, embedding the tariff controversy directly into the watch’s design.

Asia-Pacific & World News

China to Launch Policy Promoting “15-Minute Living Circles”

China announced it will introduce a new policy aimed at boosting consumption by promoting “15-minute convenience living circles.” Details remain limited, but the initiative is expected to support domestic demand by improving consumer access to goods and services within local neighborhoods.

BofA: China Stock Rally May Settle Into Grind After 12% Surge

Bank of America says Chinese equities may cool after rallying 12% since early August, pushing the CSI 300 near a three-year high. The bank noted that while policy support, liquidity, and AI enthusiasm have driven gains, positioning is already “quite bullish.”

Options data suggest investors expect continued upside, but more gradually than last year’s 30% stimulus-fueled surge. Lars Naeckter of BofA recommends selling out-of-the-money calls to fund positions closer to spot, anticipating a steady rather than explosive rally. With many global funds underexposed to China, options markets remain a relatively cheap entry point.

U.S. Urges Europe to Match Tougher Tariffs on China, India Over Russian Oil

Treasury Secretary Scott Bessent said the U.S. will not impose tariffs on Chinese goods tied to Russian oil unless Europe acts as well. He called on European governments to “do their share” in cutting Moscow’s energy revenues, criticizing both direct Russian imports and Indian refined product purchases.

The U.S. has already imposed 25% tariffs on Indian goods, while Trump is urging Europe to adopt 50–100% duties on both China and India. Bessent argued coordinated tariffs could collapse Russia’s revenues within “60 to 90 days.”

He added that Washington is weighing tighter sanctions on Russian oil majors and considering redirecting part of the $300 billion in frozen Russian assets into a vehicle for Ukraine financing.

PBOC sets USD/ CNY central rate at 7.1027 (vs. estimate at 7.1159)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 287bn yuan via 7-day reverse repos at 1.40%

- net 40bn yuan injection

RBA’s Hauser: AUD Acts as a “Natural” Hedge

RBA Deputy Governor Andrew Hauser said the Australian dollar has proven to be a well-functioning hedge for global investors, countering claims that both the USD and AUD’s hedge roles are eroding.

He noted that while uncertainty is still high, predictions of the U.S. dollar’s demise and the collapse of Australia’s hedging model are overstated. Superannuation and pension funds will likely need to expand their use of FX hedging as they diversify more into offshore assets, given limited domestic opportunities.

Hauser’s remarks were aimed more at boosting confidence in the AUD than signaling any monetary policy direction.

RBA’s Sarah Hunter: Inflation Target Within Reach

RBA Assistant Governor Sarah Hunter said the central bank is “close” to achieving its inflation goal during a fireside chat at the 2025 AFIA Conference.

Key points from her remarks:

- Risks to the outlook are balanced.

- Policy effects are lagging, requiring a forward-looking approach.

- Consumption has begun improving, with household spending turning up.

- Core inflation is tracking broadly in line with forecasts.

- The RBA aims to keep the economy near full employment.

Hunter added that July CPI data was affected by timing quirks related to rebates.

New Zealand Food Prices Up 0.3% in August

Statistics New Zealand reported that the country’s Food Price Index rose 0.3% m/m in August, after a 0.7% gain in July. On an annual basis, food prices increased 5.0%, unchanged from July’s pace. Food costs account for nearly 19% of the nation’s consumer price index.

Japan’s Hayashi: Pleased with U.S. Tariff Agreement Implementation

Chief Cabinet Secretary Yoshimasa Hayashi said Japan is satisfied with the way its tariff agreement with the U.S. has been implemented. He called the pact a stabilizing factor in bilateral ties, showing both governments are keeping commitments to smooth trade flows.

Hayashi’s remarks come amid ongoing global tariff tensions. He emphasized that the deal gives Japan and the U.S. a foundation for predictability and cooperation even as they continue navigating sensitive issues like agricultural trade and supply-chain security.

Crypto Market Pulse

Pi Network stalls at $0.35 as breakout momentum fades

Pi Network (PI) traded around $0.35 on Tuesday, struggling to hold gains from a recent breakout.

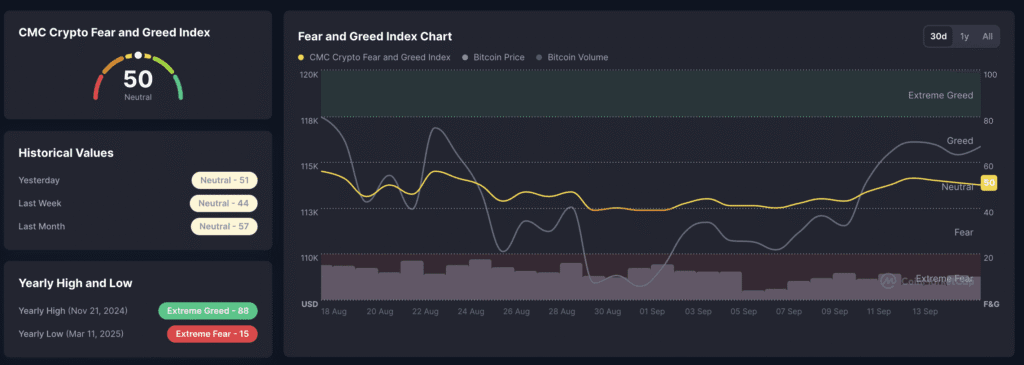

The Crypto Fear and Greed Index sits at 50, reflecting neutral sentiment ahead of the Fed’s expected rate cut. Analysts say this “wait-and-see” mood puts PI at a crossroads, with risks of losing bullish momentum if market catalysts don’t materialize.

Google launches AI payments protocol with stablecoin support

Google has rolled out an open-source payments protocol for AI applications, enabling transactions using both traditional rails and stablecoins.

The system builds on Google’s earlier communication standard for AI agents and was developed in collaboration with Coinbase, the Ethereum Foundation, and over 60 other firms including Salesforce, American Express, and Etsy.

James Tromans, Head of Web3 at Google Cloud, said the protocol was designed “from the ground up” to accommodate legacy systems while integrating new tools like stablecoins. Coinbase’s Erik Reppel added that the collaboration ensures interoperability, allowing AI systems to transfer value seamlessly.

The launch comes as stablecoin adoption rises in the US, following the passage of the GENIUS Act in July and the SEC’s clarification that fully backed, redeemable stablecoins are generally outside securities regulation.

Google is now one of the first major tech firms to formally integrate stablecoins, while rivals Apple and Meta continue to take a more cautious approach.

SharpLink repurchases 1M shares as ETH eyes rebound at $4,500

Ethereum (ETH) slipped below $4,500 on Tuesday, trading at $4,490, as treasury firm SharpLink Gaming stepped up its $1.5 billion share buyback program.

SharpLink disclosed it had repurchased 1 million shares of its stock (SBET) at an average price of $16.67, bringing total buybacks to 1.93 million shares since late August. The firm has spent about $32 million so far.

The move comes as SharpLink’s stock trades at a discount to its net asset value. “We continue to believe our common stock is significantly undervalued,” the company said, calling repurchases the best way to maximize shareholder value.

SharpLink holds 838,152 ETH, making it the second-largest Ethereum treasury behind BitMine Immersion’s 2.15 million ETH stash. Analysts at Standard Chartered say Ethereum-focused treasuries have the strongest long-term outlook among digital asset treasuries, despite short-term stock price weakness.

XRP steadies at $3.00 ahead of Fed decision, ETF launch looms

XRP traded near $3.03 on Tuesday, holding key support as traders await Wednesday’s Federal Reserve rate decision and the debut of a new spot ETF.

Markets widely expect the Fed to cut rates by 25 basis points, with some investors still hoping for a 50 bps move. A cut would support risk assets, including cryptocurrencies.

At the same time, Bloomberg’s James Seyffart confirmed that the REX-Osprey XRP ETF (XRPR) will launch this week, possibly on Thursday. The fund will provide US investors with direct exposure to XRP’s spot price for the first time.

XRP, which peaked at $3.66 in July, could see renewed momentum if ETF inflows mirror those of Bitcoin and Ethereum earlier this year. However, a break below $3.00 remains possible if macro conditions turn unfavorable.

Solana holds $235 as Pantera confirms $1.1B exposure

Solana (SOL) traded at $235 on Tuesday, down from last week’s $250 high, as investors brace for the Federal Reserve’s policy decision.

Pantera Capital CEO Dan Morehead confirmed the firm holds $1.1 billion in SOL, calling it the fastest blockchain and noting it has outperformed Bitcoin over the past four years.

Markets are pricing in a 96% chance of a 25 bps Fed rate cut on Wednesday. Lower borrowing costs tend to support risk assets, suggesting Solana’s institutional adoption could deepen into year-end.

Citi: Ether Could Reach $6,400 by 2025 End in Bull Case

Citigroup outlined wide-ranging scenarios for ether, setting a base case at $4,300, a bull case at $6,400, and a bear case at $2,200 by year-end 2025. ETH currently trades near $4,515.

Analysts highlighted network activity as the primary driver but cautioned that most recent growth is happening on layer-2 networks. Citi assumes only 30% of that value flows back to Ethereum’s base layer, meaning ETH prices are running ahead of activity-based models.

Supportive drivers include tokenization, stablecoin demand, and modest ETF flows. Macro conditions are seen as neutral, with equities already near Citi’s 6,600 target for the S&P 500.

The Day’s Takeaway

North America

- Fed Focus: Markets brace for the FOMC decision with expectations of a 25 bps rate cut. TD Securities expects Powell to push back on aggressive easing bets, while Morgan Stanley sees a gradual path of cuts into 2026. HSBC warns the dollar could briefly spike post-decision.

- Leadership Watch: Former St. Louis Fed President James Bullard confirmed he has spoken with Treasury Secretary Bessent about the Fed Chair role, but only if central bank independence and core principles are preserved.

- Economic Data:

- Retail sales: +0.6% in August (triple estimates), fueling GDP upgrades; Atlanta Fed’s GDPNow raised to 3.4%.

- Industrial production: +0.1% (vs. -0.1% est.), manufacturing output +0.2%.

- Import prices: +0.3% m/m; export prices also +0.3%.

- Business inventories: +0.2% in July.

- Housing:

- NAHB Index: Stuck at 32, signaling weak builder sentiment.

- Canada housing starts: Fell to 245.8K, well below forecasts.

- Inflation:

- Canada CPI: 1.9% y/y in August (softer than 2.0% est.); clears way for a BoC rate cut this week.

- Core measures: Mixed but stable.

- Spending & Growth: RBC card data shows Canadian consumer spending resilient despite headline weakness from cheaper gasoline.

- Markets:

- Equities: US indices slipped slightly after intraday highs (Dow -0.27%, S&P -0.13%, Nasdaq -0.07%). Energy led gains (+1.74%), Utilities lagged (-1.81%).

- Treasuries: Strong demand in a $13B 20-year bond auction (4.613% yield, bid-to-cover 2.74x).

- RBC Forecast: S&P 500 seen at 7,100 in 2026 with EPS of $297, but volatility risks flagged.

- Corporate & Policy Moves:

- TD Cowen: 60% odds the SEC shifts to semi-annual earnings reporting.

- TikTok Deal Framework: US investors to hold ~80%, algorithms re-engineered domestically, Oracle to manage data. Trump-Xi talks expected.

Europe

- ECB: Deutsche Bank says the ECB has reached terminal rate (2%), with next move likely a hike in 2026.

- BoE: Expected to hold at 4% on Sept. 18. Economists split on whether cuts start in November or 2025. Inflation persistence remains a key risk.

- Data & Markets:

- Germany ZEW: Current conditions worsened (-76.4), but expectations improved (37.3).

- Italy CPI: +1.6% y/y in August, core inflation ticking higher at 2.1%.

- Eurozone industrial production: +0.3% m/m in July, led by capital goods.

- UK jobs: Unemployment steady at 4.7%, wages cooling.

- Equities: European indices slumped (DAX -1.79%, CAC -1.0%, FTSE 100 -0.88%).

Asia

- China:

- Equities: BofA warns rally (CSI 300 +12% since August) may slow to a grind as positioning turns bullish.

- Policy: Government to roll out “15-minute living circles” to boost domestic consumption.

- Energy: Refineries processed 63.46M tons crude in August (+7.4% y/y), inventories building despite stronger throughput.

- Japan: Chief Cabinet Secretary Hayashi praised smooth implementation of US-Japan tariff deal, calling it a stabilizer for bilateral ties.

- Australia:

- RBA’s Hunter: Inflation target within reach, risks balanced.

- RBA’s Hauser: AUD remains a reliable global hedge.

- New Zealand: Food prices +0.3% m/m in August, annual pace steady at 5.0%.

Rest of the World

- Russia / Ukraine:

- Drone strikes on Russian ports and refineries pushed Brent crude to a two-week high.

- Reuters reports Russian output may be curtailed as Transneft restricts storage.

- Despite attacks, seaborne exports remain strong at 17-month highs.

- US/EU Tariffs: Treasury Secretary Bessent urged Europe to match US tariffs on China and India tied to Russian oil, warning unilateral action won’t be taken.

Commodities

- Gold: Broke above $3,700/oz, fresh all-time highs. Safe-haven demand, central bank buying, and rate cut bets keep momentum bullish.

- Copper: Hit 2024 highs as Chile boosts output (+11% at BHP’s Escondida). Risks remain around Codelco and Teck operations.

- Oil:

- Brent rebounded on Russia supply risks, settling at $64.52, reclaiming 100-day MA.

- Market balancing supply growth (OPEC+ hikes, Russian exports) with geopolitical risks.

- Natural Gas: Henry Hub broke above $3/MMBtu, lifted by late-season US heatwave.

Crypto

- Google Payments Protocol: Launched open-source system for AI + stablecoin transactions, developed with Coinbase, Ethereum Foundation, and others.

- Ethereum (ETH): Slipped to $4,490; SharpLink repurchased 1M shares, holding 838K ETH (2nd-largest treasury).

- XRP: Held at $3.03; first spot ETF (XRPR) expected to launch this week.

- Solana (SOL): $235; Pantera confirms $1.1B exposure.

- Pi Network (PI): $0.35; momentum fading as sentiment neutral (Fear & Greed Index = 50).

- Citi Forecast: ETH bull case $6,400 by 2025, base $4,300, bear $2,200.