North America News

US Stocks Reverse Midday Slump to Close Higher as Traders Weigh Fed and China Developments

US equities experienced a volatile session on Wednesday, with major indexes swinging from strong early gains to midday losses before recovering into the close. The S&P 500 opened sharply higher, rising 1%, but erased those gains by the European close as traders reacted to renewed trade war headlines. However, dip buyers returned late in the session, lifting the benchmarks back into positive territory.

Closing levels:

- S&P 500 ↑ 0.40% to 6,671.05

- Nasdaq Composite ↑ 0.66% to 22,670.08

- Russell 2000 ↑ 0.80%, notching another record high

- Dow Jones Industrial Average ↓ 0.04% to 46,253.31

The early weakness followed a Wall Street Journal report suggesting that China may call President Trump’s bluff on new tariffs — a development that briefly reignited trade war fears. Still, investors found reasons to buy the dip, particularly in small caps and financials, which continued to benefit from strong early Q3 earnings.

In FX, the US dollar extended declines after dovish remarks from Fed Chair Powell, who emphasized labor market risks and hinted at a possible end to balance sheet runoff. Markets are now fully pricing in rate cuts in both November and December.

Treasury yields:

- 2-year: 3.499% (+2.0 bps)

- 5-year: 3.623% (+2.3 bps)

- 10-year: 4.035% (+1.4 bps)

- 30-year: 4.632% (unchanged)

Policy backdrop:

Treasury Secretary Bessent reaffirmed that the US aims to “help China, not hurt it,” but warned that Beijing’s economic coercion and Russian oil purchases could backfire. He noted that tariffs would remain in place unless China shows progress on fentanyl and trade practices, though Washington is open to lifting certain levies if improvements are sustained.

Separately, Fed Governor Miran struck a dovish tone, saying “two more rate cuts this year sound realistic.” He argued that policy remains more restrictive than perceived due to a lower neutral rate, and highlighted cooling inflation trends — particularly in housing — while cautioning that renewed US-China tensions pose fresh downside risks.

Meanwhile, the Federal Reserve’s Beige Book described national economic activity as little changed, with most districts citing modest or flat growth. Hiring remains stable but with growing signs of layoffs and hiring freezes, while inflation pressures persist unevenly across regions.

Bank of America Shares Jump 4.2% After Earnings Beat

Bank of America (BAC) shares rose 4.2% in premarket trading after the bank beat estimates on earnings, revenue, and margins, and signaled strong profitability into year-end.

Q3 results:

- Adjusted EPS: $1.06

- Revenue: $28.1 billion

- Net income: $8.5 billion

The gains were driven by consumer banking and global markets, with management citing a healthy environment for mergers and acquisitions and guiding for robust net interest margins in Q4.

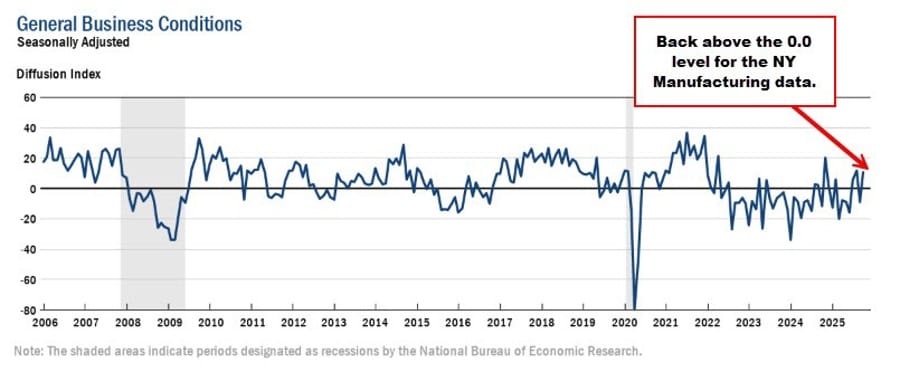

NY Manufacturing Index Surges to 10.7, Beats Forecasts

New York manufacturing activity rebounded sharply in October, with the Empire State index jumping to 10.7 from -8.7 the prior month, far above expectations for -1.4, the New York Fed reported.

New orders rose to 3.7 from -19.6, and shipments climbed to 14.4 from -17.3. Employment improved modestly to 6.2 while the average workweek shortened slightly to -4.1.

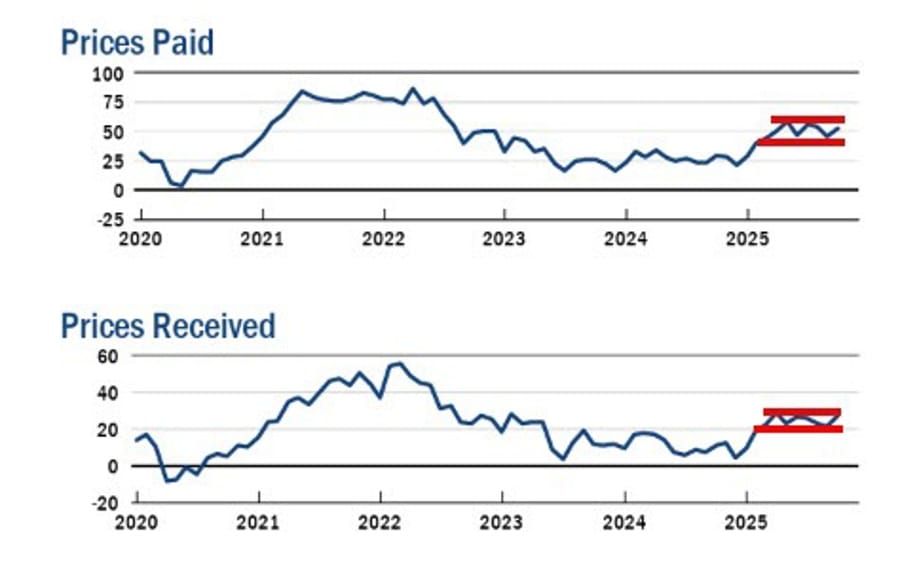

Prices paid accelerated to 52.4 and prices received to 27.2, indicating ongoing cost pressures.

Delivery times lengthened (3.9 vs. 0.0), while inventories were little changed (-1.0).

Firms grew more optimistic about the outlook, with nearly half expecting better conditions in coming months. Analysts said the upbeat data suggest modest manufacturing expansion despite persistent inflation concerns.

BofA, Morgan Stanley Deliver Strong Q3 Earnings, Lifting Market Sentiment

Bank of America and Morgan Stanley posted strong third-quarter results, fueling optimism across financials and equity futures.

BofA reported EPS of $1.06, topping estimates of $0.94, with net income rising to $8.5 billion from $6.9 billion a year ago. Net interest income climbed to $15.2 billion, up 9% y/y.

Morgan Stanley beat across the board, posting EPS of $2.80 versus $2.10 expected. Revenue came in at $18.22 billion, well above forecasts of $16.34 billion.

- Equities trading: $4.12B vs $3.41B est.

- FICC trading: $2.11B vs $2.07B est.

- Wealth management: $8.23B vs $7.78B est.

Futures responded positively, with S&P 500 up 0.6%, Dow up 0.5%, Nasdaq up 0.8%, and Russell 2000 extending prior gains.

U.S. Mortgage Applications Fall Again as Rates Hold Steady

U.S. mortgage applications fell 1.8% in the week ending October 10, following a 4.7% drop the week before, according to the Mortgage Bankers Association.

The market index slipped to 317.2, while the purchase index fell to 166.0 and refinancing eased to 1,168.0.

The 30-year fixed rate was largely unchanged at 6.42%, versus 6.43% a week earlier. The data had no significant market impact.

Fed’s Beige Book Shows No Signs of US Growth Acceleration

The Federal Reserve’s October Beige Book indicated that US economic activity was little changed since the prior report, suggesting that recent optimism over a possible reacceleration has yet to materialize in the data.

Key details:

- 3 districts reported slight to modest growth

- 5 districts reported no change

- 4 districts noted a slight softening in activity

- Wages continued to rise across all reporting districts

While markets have embraced a narrative of renewed momentum fueled by rate cuts, fiscal spending, and record equity levels, the Beige Book paints a more subdued picture. Business contacts across several regions highlighted softening demand, ongoing input cost pressures, and selective layoffs, particularly in sectors tied to manufacturing and trade.

In short, the report suggests that while the economy remains resilient, there is little evidence yet of an acceleration — aligning with the Fed’s cautious approach to policy easing in the coming months.

USTR’s Greer: China’s Moves “Repudiate” U.S.-China Trade Agreements

U.S. Trade Representative official Greer said China’s recent economic actions amount to a “complete repudiation” of prior trade agreements, accusing Beijing of economic coercion.

Greer’s comments come amid renewed trade tensions. He added pointedly that the U.S., “a country that’s imposed tariffs on nearly everyone,” faces growing scrutiny over its own protectionist policies.

Bessent: U.S. Will Need to Decouple If China Remains Unreliable

Investor Scott Bessent said the U.S. may need to decouple from China if Beijing continues acting as “an unreliable partner,” while noting progress in bilateral communication.

Bessent said U.S. and Chinese officials have held substantial talks in recent days and more are planned this week. Washington has offered to lift IEEPA fentanyl tariffs if China demonstrates compliance on fentanyl control for six months.

Fed’s Miran: Two Rate Cuts “Sound Realistic” This Year

Federal Reserve Governor Miran said two more rate cuts this year are realistic, citing the government shutdown and renewed U.S.-China tensions as increasing the urgency for easing.

He argued that current policy remains more restrictive than widely assumed, as the neutral rate may have fallen.

Other key remarks:

- AI investment could push the neutral rate higher over time.

- Housing inflation remains key to the Fed’s inflation outlook.

- Sees little evidence tariffs are driving prices higher.

- Warns against politicizing the Fed’s stance on climate or social issues.

Miran said the recent drop in long-term yields reflects market confidence that the Fed was right to begin cutting rates.

Fed’s Waller: AI Disruption Will Hit Jobs Before New Roles Emerge

Fed Governor Christopher Waller warned that AI-driven disruption will lead to job losses before replacement roles appear, saying the adjustment period could last several years.

Waller, speaking on the pace of automation, joked that “we could replace most central bankers with AI” and noted that the Fed employs 23,000 people, including 3,200 at its Washington headquarters.

His comments highlight growing concerns that AI’s rapid expansion could temporarily raise unemployment before productivity gains materialize.

Canada Wholesale Trade Falls 1.2% in August, Slightly Better Than Expected

Canadian wholesale trade slipped 1.2% in August, beating estimates for a 1.3% decline, following a strong +2.5% gain in July, according to Statistics Canada.

The data reflect a cooling trend in distribution activity, as manufacturing sales also softened compared to expectations for a 1.5% drop. The pullback underscores uneven momentum in Canada’s industrial sector amid higher borrowing costs.

Commodities News

Gold Rally Extends to Record Highs as Safe-Haven Momentum Builds

Gold hit another all-time high as investors sought safety amid renewed U.S.-China trade tensions and the absence of bearish catalysts.

Fundamental View

With inflation fears easing and the Fed signaling a dovish bias, falling real yields continue to support the metal. Analysts say only a major escalation in the trade dispute could trigger a meaningful pullback.

Technical Outlook

On the daily chart, gold’s parabolic rise has left limited near-term resistance. The 4-hour trendline remains the key support; buyers are expected to defend dips above $4,089, while a break lower could invite short-term selling before buyers re-emerge.

Crude Oil Settles Lower as Trade Tensions and Surplus Risks Weigh

WTI crude oil futures slipped on Wednesday, settling $0.43 lower (-0.73%) at $58.27 per barrel. Prices traded between $59.42 (high) and $58.20 (low), holding within Tuesday’s range.

The market continues to face downward pressure amid renewed US–China trade tensions and mounting concerns over future supply surpluses. The International Energy Agency (IEA) warned that global oil markets could face an oversupply of up to 4 million barrels per day by 2026, stoking fears of persistent price weakness.

From a technical perspective, WTI remains capped below a key resistance zone between $58.78 and $60.10, keeping sellers in control. The year-to-date low remains at $55.15.

Overall, crude remains range-bound but vulnerable to downside moves unless trade negotiations improve or evidence of tightening supply emerges.

Silver Holds Above $52 as Overbought Momentum Persists

Silver traded around $52.30 per ounce during Asian hours on Wednesday, recovering earlier losses within an ongoing bullish channel pattern.

The metal remains above its nine-day exponential moving average of $50.01, signaling strong near-term momentum. The 14-day RSI stays above 70, indicating overbought conditions that could prompt a short-term pullback.

Upside targets include the record $53.77 high set on Oct. 14 and the upper boundary of the channel near $54.30. A breakout above that could extend gains toward the psychological $55.00 level.

On the downside, support lies near the lower boundary of the channel and the nine-day EMA at $50.01. A break below that zone would expose the 50-day EMA around $43.93.

Fund Managers Pile Into Gold as Risk Appetite Surges — BofA Survey

Global investors have turned decisively risk-on, with equity allocations at an eight-month high and cash levels at multi-year lows, according to Bank of America’s October Global Fund Manager Survey.

The poll found “long gold” is now the most crowded trade, cited by 43% of respondents, surpassing “long Magnificent Seven” tech stocks at 39%. “Short U.S. dollar” ranked third at 8%.

BofA strategist Michael Hartnett said investors are positioning for renewed inflation and a weaker dollar, while concern over Fed independence and U.S. fiscal credibility grows.

Bond allocations have fallen to their lowest since 2022, while exposure to commodities and emerging-market equities has climbed to multi-year highs. Over half of respondents expect a soft landing, marking the largest six-month rise in optimism since 2020.

Still, valuation fears persist — 60% now view global equities as overvalued, and more than half see AI-related assets in bubble territory. “AI mania” topped the list of market risks, followed by a second inflation wave and dollar debasement.

JPMorgan’s Dimon: Gold Ownership ‘Semi-Rational’ as Valuations Look Stretched

JPMorgan Chase CEO Jamie Dimon said it’s now “semi-rational” for investors to own gold amid elevated global uncertainty, noting that the metal could rise sharply in volatile conditions.

Speaking at Fortune’s Most Powerful Women conference in Washington, Dimon said he’s “not a gold buyer — it costs 4% to own it,” but added that “it could easily go to $5,000 or $10,000 in environments like this.”

Dimon warned that valuations across most assets “are kind of high,” reflecting his broader caution toward risk-taking despite resilient markets.

ConocoPhillips Sees Disconnect Between Bearish Oil Sentiment and Tight Physical Supply

ConocoPhillips CEO warned that bearish sentiment in oil markets isn’t supported by physical data, pointing to stable inventories and tight Gulf Coast crude inflows.

He said global flows don’t indicate any buildup in floating storage or significant increases in medium-sour crude deliveries — both typical signs of excess supply. “You look at the physical market, and you don’t see that playing itself out,” he noted, warning that bearish futures positioning could soon collide with tighter real-world supply.

The CEO added that “many of the OPEC+ increases were paper barrels — they were already in the market,” suggesting investors may be overstating the risk of oversupply.

The comments highlight that underlying fundamentals may support higher prices than current futures reflect, and a continued absence of inventory builds could force short-covering if sentiment shifts.

Europe News

European Stocks End Mixed; France Outperforms

European equities closed mixed Wednesday, with French shares leading gains while other major indexes edged lower.

| Index | Move | % Change | Close |

|---|---|---|---|

| CAC 40 | +157.38 | +1.99% | 8,077.01 |

| STOXX 50 | +2.70 | +0.05% | 5,596.50 |

| DAX | -56.96 | -0.24% | 24,179.99 |

| FTSE 100 | -28.00 | -0.30% | 9,424.76 |

| IBEX 35 | -16.09 | -0.10% | 15,570.30 |

| FTSE MIB | -168.76 | -0.40% | 41,906.89 |

Gains in French industrial and luxury stocks offset weakness in German autos and U.K. energy names. Traders cited cautious sentiment and light volumes, with attention focused on U.S. rate policy and global trade developments.

Eurozone Industrial Output Falls 1.2% in August, Slightly Better Than Feared

Industrial production in the euro area fell 1.2% m/m in August, outperforming expectations for a 1.6% decline, Eurostat reported.

Output dropped across key categories: intermediate goods (-0.2%), energy (-0.6%), capital goods (-2.2%), and durable consumer goods (-1.6%). Only non-durable goods (+0.1%) saw a slight gain.

Production now stands at its lowest since January, though still 1.1% higher year-on-year.

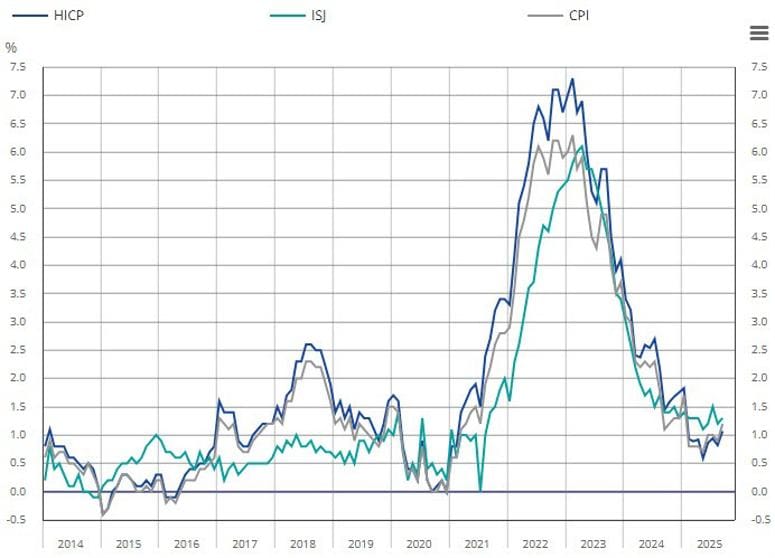

France Inflation Edges Up in September, Services Lead Gains

France’s annual inflation rate rose to 1.2% in September, matching preliminary estimates and accelerating from 0.9% in August, according to data from INSEE.

The EU-harmonized HICP also confirmed at +1.1% y/y, up from +0.8% previously. Services inflation increased to 2.4% from 2.1%, while core inflation ticked up to 1.3% from 1.2%.

Broad-based price gains underline steady, if modest, price pressure in the euro area’s second-largest economy.

Overall chart:

Spain Inflation Rises to 3.0% in September, Core Rate Steady

Spain’s final CPI came in at +3.0% y/y for September, slightly above the preliminary +2.9% and higher than August’s +2.7%, data from INE showed.

The harmonized HICP confirmed at +3.0%, with core inflation unchanged at 2.4%.

While headline prices accelerated, the stable core measure supports expectations that the ECB will maintain its current policy stance for now.

ECB’s Nagel: German economy is improving

- Comments from the Bundesbank leader

- It’s too early to give indications about the next rate move

- France recognizes the need to agree on a budget

- Current information doesn’t argue for moving rates

- Persistent services inflation demands vigilance

ECB’s Dolenc Sees No Need for Near-Term Rate Changes

ECB policymaker Primoz Dolenc said there is no reason to adjust rates in the coming months, suggesting policy is “in a good place.”

Dolenc, Slovenia’s acting central bank governor, maintained a neutral stance, reiterating that the next move could be “either a hike or a cut,” depending on incoming data.

EU Trade Chief to Meet China’s Commerce Minister Over Rare Earth Curbs

EU Trade Commissioner Maros Sefcovic will meet China’s Commerce Minister Wang Wentao next week to discuss Beijing’s new export controls on rare earth minerals.

Brussels is pressing for relief on restrictions that threaten European industries, though officials see little chance of a breakthrough.

Analysts say China’s move is part of a broader strategy to leverage rare earths as a bargaining chip ahead of potential talks between Xi Jinping and Donald Trump later this month.

Deutsche Bank Turns Bullish on Europe, Sees Up to 16% Upside Through 2026

Deutsche Bank upgraded its outlook on European equities, forecasting a 12–16% gain through 2026 as earnings recover, fiscal stimulus ramps up, and valuations remain attractive relative to the U.S.

Strategists cited Germany’s 2025 budget as a key turning point, marking a shift from promises to fiscal execution expected to revive manufacturing and lift company guidance.

The bank sees earnings growth of 10–12% next year, with sectors such as Autos, Energy, and Materials stabilizing after dragging in 2025. Strength in Health Care, Financials, and Industrials is expected to drive further upside.

Small- and mid-cap German firms are viewed as especially compelling given their discount and leverage to manufacturing recovery. Deutsche Bank argues Europe’s 15-year underperformance versus U.S. stocks may finally be ending, though it still sees risks tied to U.S. concentration and stretched valuations.

Asia-Pacific & World News

China Credit Growth Misses Again as Loan Demand Stays Weak

China’s M2 money supply rose 8.4% y/y in September, just below expectations of 8.5% and slowing from August’s 8.8%.

New yuan loans totaled ¥1.29 trillion, missing forecasts of ¥1.47 trillion but improving from ¥590 billion in August.

Despite repeated efforts to boost credit expansion, analysts warn that weak private-sector demand remains a structural challenge Beijing must address through broader policy measures.

Beijing Urges U.S. to Resume Dialogue, Calls for “Correction of Wrongdoing”

China’s Foreign Ministry reiterated its call for renewed dialogue with the United States, urging Washington to “correct its wrongdoing” and resolve differences through talks.

The comments highlight Beijing’s continued push for engagement amid heightened tensions over trade and technology restrictions.

China’s September CPI Falls 0.3% Year-on-Year, Deflation Pressures Persist

China’s September consumer prices fell 0.3% year-on-year, compared with expectations of a 0.2% decline and August’s 0.4% drop, highlighting persistent deflationary pressures.

Food prices fell 4.4% from a year earlier, while non-food prices rose 0.7%. Consumer goods prices dropped 0.8%, and service prices increased 0.6%.

On a monthly basis, CPI rose 0.1%, missing forecasts of +0.2%. Food prices climbed 0.7% month-on-month, while non-food prices slipped 0.1%. Goods prices rose 0.3%, but service prices fell 0.3%.

Producer prices (PPI) fell 2.3% year-on-year, matching expectations and improving from the previous -2.9%. Month-on-month, PPI was unchanged.

For the first nine months of 2025, average CPI declined 0.1% from a year earlier.

Beijing Sees Trump’s Market Obsession as Leverage in Trade Standoff

Beijing officials view U.S. President Donald Trump’s fixation on stock market performance as a key point of leverage in the ongoing trade conflict, according to a Wall Street Journal report.

Chinese policymakers, including President Xi Jinping, reportedly believe that sustained U.S. market weakness could pressure Trump into concessions, seeing his focus on equity gains as a political vulnerability.

Since the April selloff following Trump’s “Liberation Day” tariffs, Chinese negotiators have maintained a hard line, betting that additional U.S. market losses could push Washington toward compromise. Sources briefed on the strategy say Xi expects Trump to seek a truce at an upcoming Xi–Trump summit later this month.

The report underscores China’s confidence in its stance and suggests further tariff escalations could unsettle U.S. equities if rhetoric intensifies ahead of the summit.

China Imposes $1.7 Million Port Fee on First U.S.-Linked Vessel

China has imposed a “special port fee” on U.S.-linked vessels for the first time, expanding its trade retaliation against Washington.

According to Caixin, the Matson Waikiki — a U.S.-flagged container ship carrying 4,870 TEUs — was charged roughly 12.09 million yuan (US$1.7 million) after docking in Shanghai on Tuesday evening. The ship’s net tonnage is 30,224.

Chinese transport officials confirmed the levy applies under the new schedule announced earlier this month, though it’s unclear whether payment has been made. Analysts say the measure signals Beijing’s willingness to extend countermeasures into the logistics sector, raising costs for U.S.-related trade through Chinese ports.

PBOC sets USD/ CNY mid-point today at 7.0995 (vs. estimate at 7.1281)

- PBOC CNY reference rate setting for the trading session ahead. Cracking the 7.1 round number

In Open market operations (OMOs) the PBOC inject 43.5n yuan at an unchanged rate of 1.4%

Australia’s Leading Index Edges Just Above Trend in September

The Westpac–Melbourne Institute Leading Index nudged slightly above trend in September, rising to +0.04% from -0.16% in August.

The index, which tracks the likely pace of economic activity three to nine months ahead, showed mixed signals across components, with subdued momentum compared to earlier in the year.

The release had little immediate impact on the currency, with AUD/USD steady around 0.6490.

RBA’s Hunter Says Inflation Likely to Exceed Forecasts in Q3

Reserve Bank of Australia Assistant Governor Sarah Hunter said recent data suggest inflation in the third quarter will likely come in stronger than expected, with labour market conditions tighter than previously assumed.

Hunter noted that while employment growth has slowed, overall demand remains firm, and the Board will adjust policy as new information arrives.

She added that productivity weakness — tied to limited competition and reduced capital investment — has lowered the economy’s potential growth rate and constrained wage growth capacity.

Hunter emphasized that policy remains forward-looking over a one- to two-year horizon, with estimates for neutral rates “incredibly wide.” The RBA expects consumption to soften modestly in Q3 while the housing market continues to respond to earlier rate adjustments.

RBNZ’s Conway: Inflation Near Top of Band, Open to Further Rate Cuts

Reserve Bank of New Zealand Chief Economist Paul Conway said it remains “a bit nerve-wracking” with inflation at the top of the target range, but that the central bank remains open to further rate cuts if needed.

He said the recent 50-basis-point cut was “a finely balanced decision,” supported by excess capacity and confidence that inflation will ease.

Speaking at Citi’s Australia & New Zealand Investment Conference, Conway added that the Official Cash Rate remains the RBNZ’s primary policy tool, and the bank does not expect to use alternative monetary policy instruments soon.

He said while large-scale asset purchases helped during the pandemic, they also contributed to inflation pressures, emphasizing that operational independence and a medium-term inflation focus remain critical.

Conway added that structural factors — such as AI investment and climate-related spending — could push the neutral rate higher, but lower rates should still support residential investment.

S&P Reaffirms New Zealand’s Sovereign Ratings

S&P Global Ratings has affirmed New Zealand’s long-term foreign currency rating at ‘AA+/A-1+’ and its local currency rating at ‘AAA/A-1+’.

The agency noted that the economy contracted by 1.1% over the 12 months to June 2025 and has shrunk in three of the past five quarters. Despite this, S&P said the ratings remain supported by strong institutions and fiscal discipline.

Japan Markets Unwind Abenomics Trades as Coalition Fractures

Japan’s markets are reversing key “Abenomics 2” trades after Komeito’s exit from the ruling coalition triggered a surge in political uncertainty. The yen strengthened and equities slid as traders unwound bets linked to a weak currency and aggressive stimulus policies.

USD/JPY has dropped from 153.29 on Oct. 10 — its highest since February — to below 152. EUR/JPY retreated from a record 177.92, and other yen pairs followed. Demand for JPY call options has jumped as investors hedge against the possibility of a non-LDP government.

Japanese equities also reversed sharply. The Nikkei 225 fell from its Oct. 9 record of 48,597 to 46,544 earlier this week, shedding more than 2,000 points before finding support midweek.

Bond yields moved in tandem. The two-year JGB yield eased from an Oct. 1 high of 0.965% to around 0.903%, while the 10-year held near 1.65%, just below recent peaks. Analysts say yields could rise again if traders abandon expectations for fiscal stimulus and refocus on Bank of Japan tightening.

The trigger was Komeito’s departure from its long-standing coalition with the LDP, raising the likelihood that opposition blocs and independents could muster enough seats to form an alternative government.

Crypto Market Pulse

XRP Slips Below $2.50 as Selling Pressure Mounts

Ripple’s XRP extended losses below $2.50, with sentiment deteriorating amid weak crypto market momentum and declining futures interest.

The token’s rebound attempt at $2.63 on Monday failed, reinforcing short-term bearish signals. Support lies at $2.40, with further downside risk toward $2.20 if selling persists.

Ripple Expands Into Africa via Absa Partnership

Ripple announced a partnership with South Africa’s Absa Bank to provide institutional-grade digital asset custody services using Ripple’s blockchain infrastructure.

Absa becomes the first African bank to adopt Ripple’s custody platform, a move Ripple says will help meet rising demand for secure, compliant crypto storage in emerging markets.

Retail interest remains muted, with XRP futures open interest slipping further below pre-crash levels. Average daily volumes fell to $4.19 billion, signaling reduced participation.

Crypto Market Struggles as Bitcoin, Ethereum, XRP Lose Momentum

Major cryptocurrencies traded lower Wednesday, with Bitcoin, Ethereum, and XRP unable to sustain recent recoveries amid renewed macroeconomic headwinds.

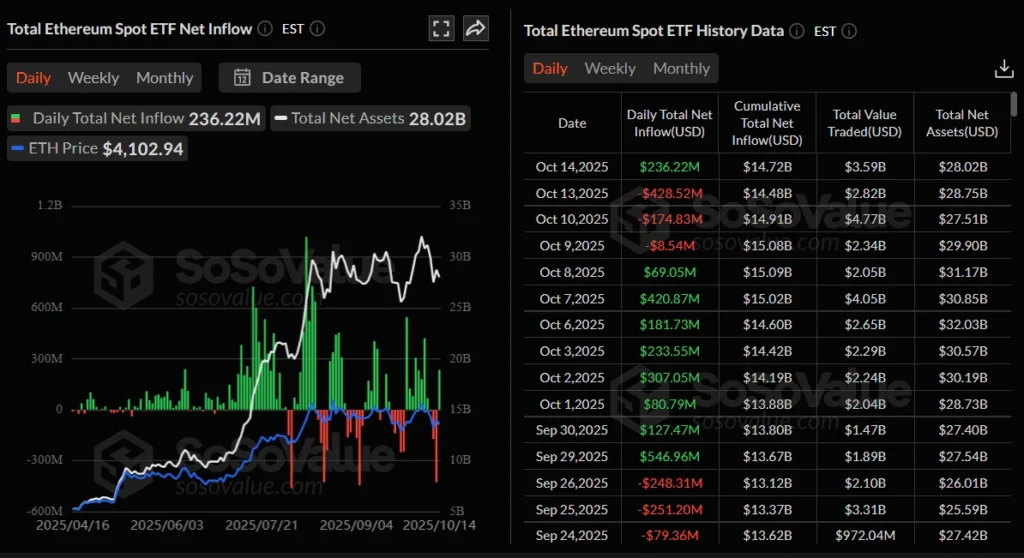

Bitcoin (BTC) fell below $113,000, while Ethereum (ETH) retreated from resistance despite mild spot ETF inflows. XRP weakened further, with open interest hitting its lowest level since November 2024.

ETF Flows Show Tepid Demand

According to SoSoValue, Bitcoin ETFs recorded $102.6 million in inflows Tuesday, ending a two-day outflow streak but below early-October highs when BTC hit $126,199.

Ethereum ETFs also saw inflows of $236.2 million, breaking a three-day outflow streak.

Analysts said U.S.-China trade tensions and the ongoing U.S. government shutdown are dampening crypto sentiment as investors remain risk-averse.

Bittensor (TAO) Rally Extends as Retail Traders Return

AI-linked cryptocurrency Bittensor (TAO) continued its four-day winning streak, trading near $460 Wednesday after gaining 3% in the previous session.

Rising retail participation and surging derivatives activity have fueled momentum. CoinGlass data show open interest up 28% in 24 hours to $338.6 million, while trading volume jumped 59% to $2.34 billion.

Technical analysts see TAO at a critical juncture, with buyers eyeing a breakout above recent highs if momentum persists.

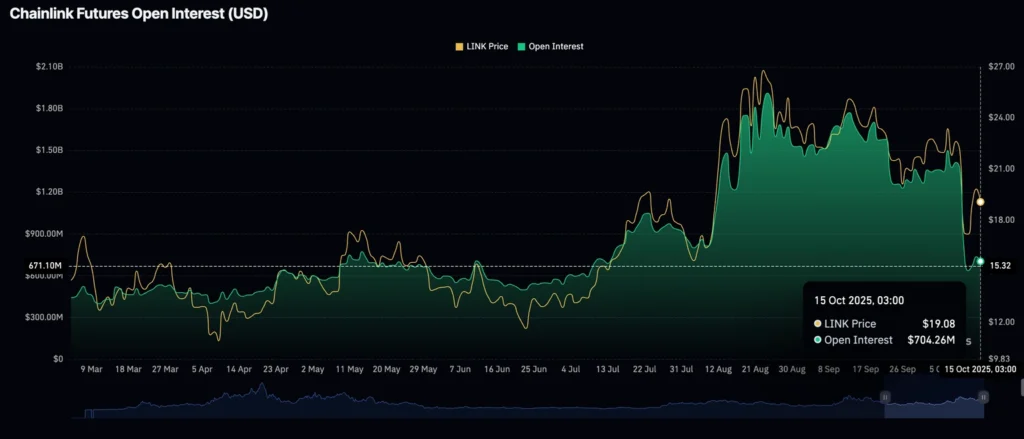

Chainlink Faces 15% Downside Risk as Deleveraging Continues

Chainlink (LINK) traded just above $18.00 on Wednesday, extending its decline alongside broader crypto weakness. The token has lost about 10% since Monday and could fall another 15% toward $15.00 if selling persists.

Friday’s market rout triggered Chainlink’s largest-ever deleveraging event, wiping out $167 million in long positions and $16 million in shorts. Open interest in futures briefly rebounded to about $737 million before slipping again to $704 million.

Analysts say the drop in open interest and weak retail participation reflect ongoing caution after the selloff. If risk aversion deepens and OI falls further, LINK could see additional downside pressure.

Backpack to Offer SEC-Registered Tokenized U.S. Stocks via Superstate Deal

Crypto exchange Backpack is expanding into tokenized U.S. equities through a partnership with Superstate, the blockchain finance firm founded by Compound creator Robert Leshner.

The integration will embed Superstate’s Opening Bell platform into Backpack, allowing non-U.S. users to trade SEC-registered, onchain shares of publicly listed companies.

The firms said these are not synthetic or derivative products but real equities issued under U.S. securities law, with identical CUSIPs to traditional listings on the NYSE or Nasdaq.

“For traders, it means more assets and better margin flexibility; for issuers, it opens access to millions of crypto-native investors,” Leshner said.

Backpack, originally part of the Solana ecosystem and now a licensed exchange in Dubai and Cyprus, becomes the first centralized platform to offer fully SEC-registered equities natively onchain. The rollout and supported tickers will be announced in the coming weeks.

U.S. Seizes $12 Billion in Bitcoin Linked to Cambodia-Based Fraud Network

The U.S. Treasury has moved to seize 127,271 bitcoin — valued at roughly US$12 billion — from Chinese national Chen Zhi and his Cambodia-based Prince Group, marking one of the largest crypto confiscations in history.

Authorities accuse the Prince Group of orchestrating large-scale “pig-butchering” scams, in which victims are lured into fake investments before their funds are stolen. The network allegedly engaged in human trafficking and forced labour in Cambodian “scam compounds.”

Investigators say Chen laundered proceeds through property, banking, and bitcoin-mining ventures, including Laos-based Warp Data Technology Lao Sole Co.

The action underscores that while bitcoin’s blockchain is decentralized and theoretically seizure-resistant, enforcement remains possible when authorities obtain private keys or custodial access.

The move highlights intensifying U.S. scrutiny of crypto assets tied to human trafficking and online fraud, raising compliance risks for Asian exchanges handling high-risk flows.

The Day’s Takeaway

North America

U.S. markets closed higher after a choppy session, with the S&P 500 up 0.4%, Nasdaq +0.66%, and Russell 2000 hitting another record high, as traders weighed dovish Fed signals against renewed U.S.–China trade tensions. The Dow slipped 0.04% amid rotation into small caps and financials following strong earnings from Bank of America and Morgan Stanley.

Bank of America surged 4.2% after posting EPS of $1.06 and revenue of $28.1B, topping expectations, while Morgan Stanley beat across all segments, signaling resilience in capital markets and wealth management. Futures pointed higher as dip-buyers returned late in the day.

Fed Chair Powell struck a dovish tone, hinting at an end to balance sheet runoff, while Governor Miran said “two rate cuts this year sound realistic,” citing the government shutdown and U.S.–China tensions. The Beige Book described economic activity as “little changed,” with modest wage gains and growing signs of hiring freezes, tempering optimism for acceleration.

Yields edged up slightly: 10-year at 4.04%, 2-year at 3.50%, suggesting confidence that policy easing will continue.

In manufacturing, the New York Fed’s Empire State Index rebounded sharply to 10.7 from –8.7, signaling renewed momentum. New orders and shipments turned positive, while prices paid rose to 52.4, underscoring persistent cost pressures.

In trade policy, USTR official Greer accused China of “repudiating” existing trade agreements, while investor Scott Bessent said the U.S. may need to “decouple” if Beijing remains unreliable — though backchannel talks continue.

In Canada, wholesale trade slipped 1.2% in August, slightly better than forecast, signaling cooling industrial activity after July’s sharp rebound.

Technically, U.S. equities continue to hold above key support zones with breadth improving, though momentum indicators suggest near-term consolidation if earnings optimism fades.

Europe

European markets ended mixed as traders balanced optimism from French equities against broader caution. The CAC 40 rose 1.99%, driven by luxury and industrials, while the DAX (-0.24%) and FTSE 100 (-0.30%) lagged.

Macro data remained stable. France’s inflation rose to 1.2% in September, led by services, while Spain’s CPI hit 3.0%, slightly above estimates but with core inflation steady at 2.4%. Eurozone industrial output fell 1.2% m/m, beating expectations but showing persistent weakness across capital goods and energy sectors.

The ECB’s Dolenc reiterated no immediate need to adjust rates, calling policy “in a good place,” while Deutsche Bank turned bullish on Europe, forecasting a 12–16% upside through 2026 as earnings recover and fiscal spending gains traction.

Technically, European equities remain range-bound but are showing early signs of leadership rotation toward cyclicals. German small caps and industrials are attracting value interest amid stable yields.

Asia

Markets across Asia were volatile, led by Japan’s sharp unwinding of “Abenomics 2” trades after Komeito’s exit from the LDP coalition triggered political uncertainty. The Nikkei 225 plunged more than 2,000 points from record highs before stabilizing near 46,500, while the yen strengthened below 152 per USD. Bond yields eased modestly as traders reassessed stimulus bets.

In China, deflation concerns deepened as CPI fell 0.3% y/y in September and PPI contracted 2.3%, reflecting weak domestic demand. M2 money supply growth slowed to 8.4%, while new loans missed forecasts, reinforcing signs of muted credit appetite.

Beijing’s rhetoric hardened: the Foreign Ministry urged Washington to “correct its wrongdoing,” while new $1.7M port fees on U.S.-linked vessels marked the first direct maritime retaliation. Officials reportedly see Trump’s focus on markets as leverage in ongoing negotiations.

Elsewhere, Australia’s RBA officials flagged stronger-than-expected Q3 inflation, and the Leading Index barely rose, signaling modest momentum. In New Zealand, the RBNZ’s Conway remained open to more rate cuts, citing confidence that inflation is easing toward target.

S&P Global reaffirmed New Zealand’s ‘AA+/AAA’ sovereign ratings, citing institutional strength despite a mild recession. The economy has contracted in three of the past five quarters but remains fiscally disciplined.

Fundamentally, Asia faces diverging forces — political uncertainty in Japan, deflation in China, and cautious optimism in Oceania. Technically, the Nikkei remains in corrective mode, with key support near 45,800, while the offshore yuan holds steady around 7.29 despite trade tensions.

Commodities

Crude oil slipped 0.73% to $58.27, weighed by renewed U.S.–China trade tensions and IEA warnings of a potential 4 million bpd surplus by 2026. Futures remain capped below the $60 resistance zone, with downside risk toward $55.15 unless physical tightness emerges.

ConocoPhillips’ CEO said bearish futures sentiment is “disconnected from physical markets,” noting that inventories remain tight and most OPEC+ increases were “paper barrels.” That disconnect may force short-covering if fundamentals hold.

Gold extended record highs, supported by lower real yields and safe-haven inflows. Jamie Dimon called owning gold “semi-rational” in this macro backdrop, warning valuations across other assets look stretched.

Silver hovered around $52.30, above its 9-day EMA at $50, with momentum still strong but overbought (RSI >70). Bulls target $53.77–$55, while initial support sits near $50.00.

Technically, both gold and silver maintain strong bullish structures, but stretched positioning may prompt brief consolidation before new highs.

Crypto

The U.S. Treasury’s $12B bitcoin seizure from Cambodia-based Prince Group sent shockwaves across the sector, reinforcing regulatory risks tied to cross-border fraud and money laundering.

Crypto markets traded lower, with Bitcoin below $113,000, Ethereum retreating, and XRP slipping under $2.50 as open interest hit its lowest since 2024. ETF inflows resumed modestly — $102.6M for BTC and $236.2M for ETH — but risk appetite remains fragile amid U.S.–China tensions and the government shutdown.

Chainlink (LINK) slid toward $18, facing potential downside to $15 if deleveraging persists. Meanwhile, Bittensor (TAO) extended its rally near $460, driven by AI-related optimism and surging derivatives activity.

Ripple expanded into Africa through a partnership with Absa Bank, offering institutional custody — a key step toward compliant digital infrastructure in emerging markets.

Technically, the crypto complex remains under pressure but selectively strong in AI and real-world asset narratives. Volatility remains elevated with sentiment skewed defensive.