North America News

US Stocks End Mixed as Inflation Concerns Cap Gains

U.S. stocks closed Friday with a split performance, as investors balanced optimism over potential rate cuts and peace talks with ongoing inflation worries. Import prices rose sharply, tempering sentiment even after a solid July Retail Sales report.

The Dow Jones Industrial Average eked out a small gain, buoyed by an 11.98% surge in UnitedHealth Group (UNH) following news that Berkshire Hathaway had taken a stake during the most recent quarter. UNH’s rally helped offset broader market weakness, preventing the Dow from joining the S&P 500 and Nasdaq in the red.

The Dow touched an intraday record high of 45,203.52, but profit-taking later trimmed gains, leaving it at 44,946.18, just shy of its record close from earlier in the week. The S&P 500 and Nasdaq Composite slipped as tech names faced pressure, while cyclical sectors showed pockets of resilience.

Closing Levels:

- Dow: +34.86 points (+0.08%) to 44,946.18

- S&P 500: –18.74 points (–0.29%) to 6,449.80

- Nasdaq: –87.69 points (–0.43%) to 21,622.98

- Russell 2000: –12.55 points (–0.55%) to 2,286.52

Weekly Performance:

- Dow: +1.74%

- S&P 500: +0.94%

- Nasdaq: +0.81%

U.S. Consumer Sentiment Falls to 58.6 in August

The University of Michigan’s preliminary August reading came in at 58.6 (forecast 62.0), down from 61.7 in July.

Breakdown:

- Current conditions: 60.9 (est. 67.9, prior 68.0)

- Expectations: 57.2 (est. 56.5, prior 57.7)

- 1-year inflation expectations: 4.9% (prior 4.5%)

- 5-year inflation expectations: 3.9% (prior 3.4%)

Survey director Joanne Hsu said sentiment dropped for the first time in four months, mainly due to inflation concerns. Buying conditions for durables fell 14% to the lowest level in a year. Consumers still expect inflation and unemployment to worsen over time, though both short- and long-term inflation expectations remain below April–May highs.

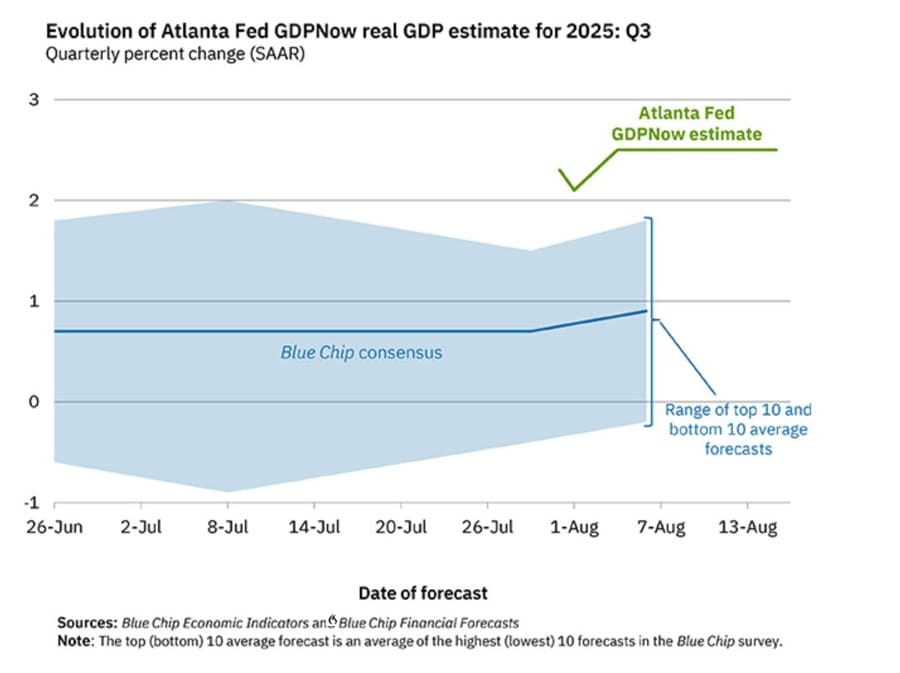

Atlanta Fed GDPNow Holds at 2.5%

The Atlanta Fed’s GDPNow model kept its Q3 2025 growth projection steady at 2.5%.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 2.5 percent on August 15, unchanged from August 7 after rounding. After recent releases from the US Census Bureau, US Bureau of Labor Statistics, Federal Reserve Board of Governors, and Treasury’s Bureau of the Fiscal Service, the nowcast of third-quarter real personal consumption expenditures growth increased from 2.0 percent to 2.2 percent, while the nowcast of third-quarter real gross private domestic investment growth decreased from 7.3 percent to 6.6 percent.

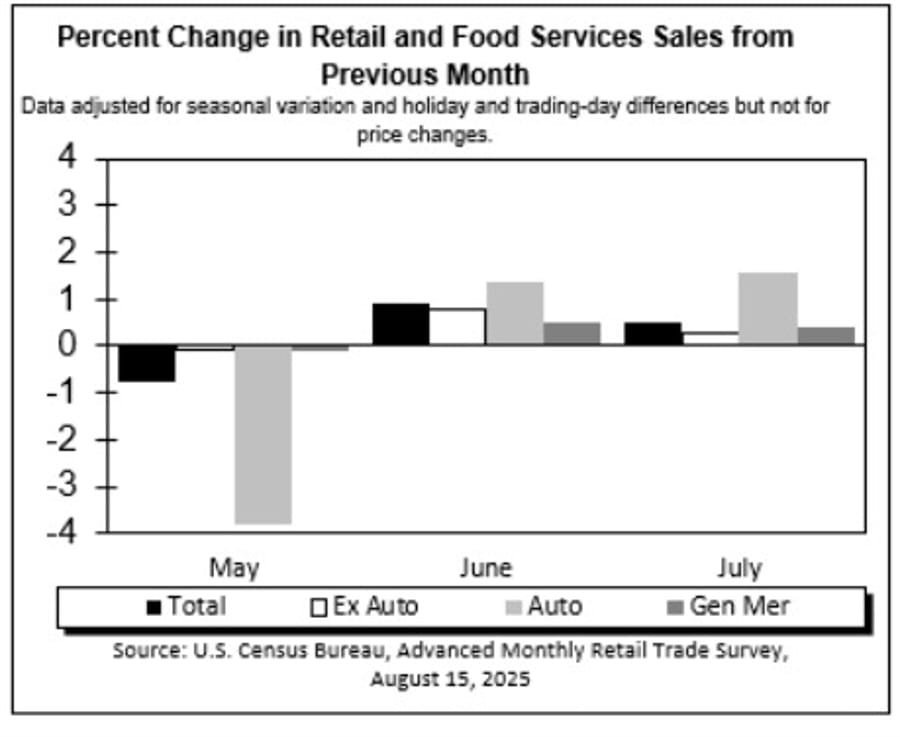

U.S. Retail Sales for July Match Forecasts

July 2025 retail sales results:

- Headline: +0.5% m/m (forecast +0.5%), prior revised to +0.9%

- Ex-autos: +0.3% m/m (forecast +0.3%), prior revised to +0.8%

- Ex-gas/autos: +0.2% m/m, vs +0.6% in June

- Control group: +0.5% m/m (forecast +0.4%), prior revised to +0.8%

- Retail sales y/y: +3.92% vs +4.35% in June (revised from 3.92%)

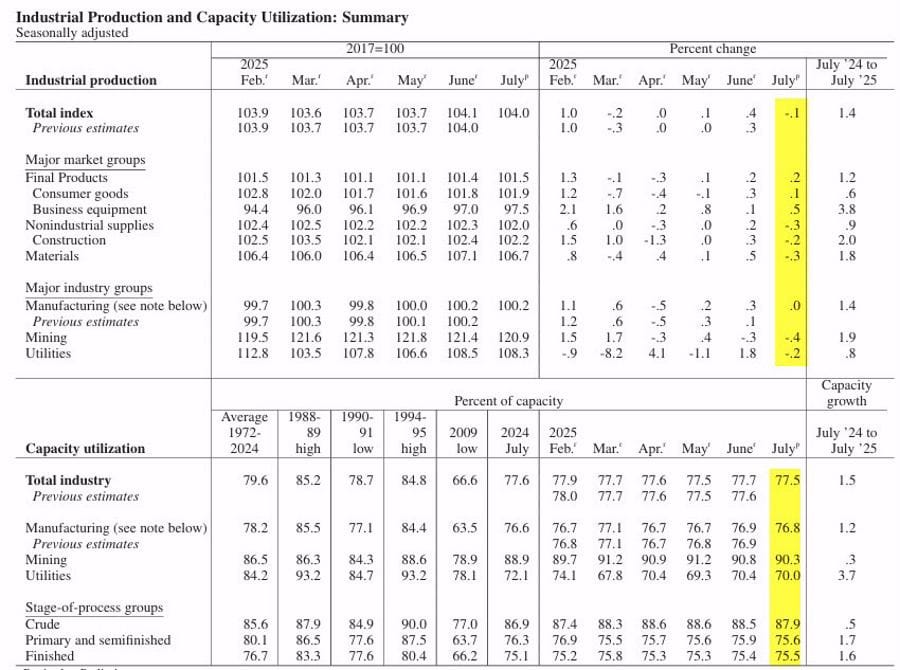

U.S. Industrial Production Dips in July

July industrial production fell 0.1% m/m (forecast 0.0%). June’s figure was revised up to +0.4% from +0.3%.

Capacity utilization was steady at 77.5%, in line with expectations, though June was revised to 77.7%.

- Industrial production y/y: +1.4%

- Capacity utilization y/y: +1.5%

New York Fed Manufacturing Index Hits Nine-Month High in August

The NY Fed’s general business conditions index rose to 11.9 in August (est. 0.0), its strongest since November 2024.

Key details:

- New orders: +13 points to 15.4

- Shipments: Steady at 12.2

- Inventories: Down 22 points to –6.4

- Employment: 4.4 (modest job growth)

- Prices paid: 54.1 (still high)

- Prices received: Down to 22.9

- Future outlook: 16.0 (8 points lower than last month)

Two-thirds of firms expect input costs to keep rising over the next six months, though capital spending plans remain subdued.

Wells Fargo Sees July U.S. Retail Sales Lift from Auto Rebound

Ahead of the July retail sales report, Wells Fargo projects a 0.6% m/m gain, with auto sales and higher prices driving the increase. Without autos, the bank expects sales to rise only 0.3%, citing consumer fatigue and more selective spending amid tariff-related price concerns.

Other forecasts:

- BofA: Retail sales control group +0.6% m/m, implying a 0.4% real gain based on core goods prices ex-transportation.

- Deutsche Bank: Headline sales +1.2% vs +0.6% ex-autos, with retail control steady at +0.5%. They expect strong non-store sales (+1.4%), boosted by an extended four-day Amazon Prime Day.

U.S. Import Prices Rise 0.4% in July

July 2025 data shows:

- Import Prices: +0.4% m/m (forecast 0.0%), prior revised to +0.1%

- Import Prices y/y: –0.2% (unchanged from prior)

- Export Prices: +0.1% m/m (in line with forecast), prior +0.5%

Fed’s Goolsbee Cautions on Inflation Risks from Tariffs

Chicago Fed President Austan Goolsbee told CNBC he sees “a note of unease” in the latest CPI and PPI readings. While urging against overreacting to one month of data, he warned tariffs have created lasting uncertainty and could trigger the “nightmare scenario” of rising prices and falling employment.

Goolsbee said the Fed must decide which tariff-related price increases to ignore and which to counteract. If inflation data stabilizes, rate cuts could come later this year. He expressed concern about recent services inflation, hoping it proves temporary.

Soros Fund and Appaloosa Dramatically Boost Nvidia Holdings

Soros Fund Management bought 932,539 Nvidia shares in Q2 2025, a more than 1,600% increase, bringing its total to 990,292 shares. Appaloosa Management raised its Nvidia stake by 483% to 1.75 million shares. Both moves highlight confidence in Nvidia’s leadership in AI hardware.

Buffett’s Berkshire Hathaway Adds UnitedHealth, Nucor, and Homebuilders, Cuts Apple and BofA

Berkshire Hathaway disclosed new stakes in UnitedHealth Group (~US$1.6B, 5M shares), Nucor, and homebuilders Lennar and DR Horton. Smaller positions were added in Lamar Advertising and Allegion.

Apple and Bank of America stakes were trimmed. The new positions triggered rallies in each stock after the filing. Buffett is set to step down as CEO at the end of 2025, with Greg Abel taking over capital allocation duties.

Canada Manufacturing Sales Edge Higher in June

Manufacturing sales rose 0.3% to C$68.5B in June 2025, ending a four-month slide. Gains were recorded in 13 of 21 subsectors, led by petroleum and coal (+11.8%) and food (+2.5%). Transportation equipment fell 5.0%, offsetting part of the increase. Sales remain 2.7% lower y/y.

Wholesale trade rose 0.7% m/m, matching forecasts, following a 0.1% gain in May.

Commodities News

US rig count flat, Canada adds three rigs

The US oil and gas rig count was unchanged at 539 this week, according to Baker Hughes. Oil rigs rose by one to 412, gas rigs fell by one to 122, and miscellaneous rigs held at five. The total is 47 rigs lower than a year ago.

The US offshore rig count stayed at 13, down six from last year.

In Canada, rigs rose by three to 183. Oil rigs increased by four to 126, gas rigs were flat at 57, and miscellaneous rigs fell by one to zero. Canada’s total is down 34 rigs year-on-year.

Gold Holds Steady Ahead of Trump–Putin Summit as Dollar Slips

Gold prices were steady on Friday, with traders awaiting the outcome of the high-profile meeting between U.S. President Donald Trump and Russian President Vladimir Putin in Alaska. The metal traded in a narrow range between $3,330 and $3,350, ending the session at $3,340, up 0.17%.

The U.S. Dollar weakened after July Retail Sales came in line with forecasts and June’s figures were revised higher. Still, the data failed to spark a rally in the greenback. Additional reports showed consumer sentiment dipping and inflation expectations rising, while industrial production fell in July.

The U.S. Dollar Index (DXY) dropped 0.37% to 97.83, supporting bullion. However, high U.S. Treasury yields continued to limit gold’s upside.

Looking ahead, markets will watch next week’s flash PMI data, minutes from the Federal Reserve’s last meeting, and Fed Chair Jerome Powell’s speech at Jackson Hole for fresh clues on the interest rate outlook.

Silver steady near $38 as traders eye Trump–Putin summit

Silver is trading around $38.00 Friday, recovering from a four-day low of $37.69 but still down nearly 1% for the week.

A softer US dollar has offered some support, but rising Treasury yields are capping gains.

Markets are watching the Trump–Putin summit in Alaska, set to begin later Friday. While no breakthrough is expected, the meeting adds geopolitical uncertainty that could boost safe-haven demand. So far, silver’s reaction has been muted, with prices still capped below key resistance.

OPEC Forecasts Tighter Oil Market in 2025–2026

OPEC raised its oil demand forecast slightly, projecting increases of 1.3 million barrels/day in 2025 and 1.4 million in 2026. Supply outside OPEC+ is expected to grow more slowly, which could increase demand for OPEC+ output.

July’s production among quota-bound members was 187,000 barrels/day below target, with Kazakhstan overproducing while Iraq and Russia cut output more than required.

Gold Drops After Strong U.S. Producer Price Data

Gold prices fell about $30 to $3,330/oz after July U.S. producer prices rose more than expected, dampening expectations for a 50-basis-point Fed rate cut in September. Silver slipped below $38/oz after hitting $38.7 earlier in the day.

Markets are awaiting confirmation that U.S. gold imports will remain tariff-free. The upcoming Trump–Putin summit could also affect safe-haven demand.

Oil Slips Below $66 on Bearish Data from IEA and EIA

Brent crude settled under US$66/bbl for the first time since early June as the IEA projected large inventory builds through late 2025 and into 2026.

- IEA sees global demand growing by 680k b/d in 2025 and 700k b/d in 2026.

- Supply is forecast to rise 2.5m b/d in 2025 and 1.9m in 2026, partly due to unwinding OPEC+ cuts.

- EIA data showed U.S. crude inventories up 3.04m barrels last week, above API estimates.

Despite tight distillate supplies, gasoline inventories remain near their five-year average.

Europe News

European Markets End Week Mixed

Major European indices closed Friday with mixed results:

- DAX: –0.07%

- CAC 40: +0.67%

- FTSE 100: –0.42%

- Ibex 35: +0.47%

- FTSE MIB: +1.1%

Weekly performance:

- DAX: +0.81%

- CAC 40: +2.33%

- FTSE 100: +0.47% — highest weekly close on record

- Ibex 35: +3.05% — highest since Dec 2007

- FTSE MIB: +2.47% — highest since Jun 2007

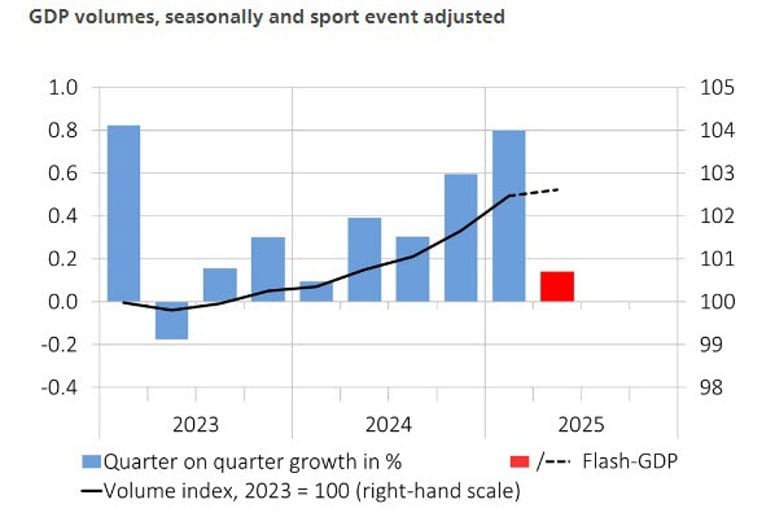

Switzerland Q2 GDP Growth Slows to 0.1%

SECO data shows Swiss GDP expanded just 0.1% in Q2 2025, following a stronger 0.8% gain in Q1. The services sector continued to post gains, but those were offset by weakness in industrial output.

Asia-Pacific & World News

PBOC Reaffirms “Moderately Loose” Monetary Policy Approach

China’s central bank, in its Q2 monetary policy implementation report, said the economy still faces “numerous risks and challenges.” The PBOC pledged to:

- Maintain policy continuity and stability

- Safeguard against systemic financial risks

- Adjust the pace and intensity of measures as conditions evolve

- Keep liquidity “ample” and prices “reasonable”

- Strengthen enforcement and oversight of interest rate policy

- Stabilize market expectations and address disruptions to market order

China Halts Auto Trade-In Subsidies in Some Regions, NEV Incentives Still Active

Reports indicate that China has paused its car trade-in subsidies in multiple regions, though programs for scrapping and replacing vehicles remain in place. The extent of the suspension is unclear.

The auto trade-in initiative — often compared to the U.S. “cash for clunkers” but broader and more geared toward new energy vehicles (NEVs) — offers subsidies of up to CNY 20,000 for NEVs and CNY 15,000 for traditional gasoline-powered cars.

Part of a larger consumer goods trade-in plan, the scheme has already attracted more than 10 million applications. Authorities expect it to drive an extra 3 million vehicle purchases this year, with NEVs anticipated to make up over 60% of new car sales thanks largely to these incentives.

July Sees Another Dip in China’s Home Prices Despite Looser Rules in Suburbs

China’s new home prices fell for a second month in July, dropping 0.3% from June, based on Reuters calculations from National Bureau of Statistics data. Sixty out of seventy tracked cities recorded month-on-month declines, matching June’s pace.

Year-on-year, prices were down 2.8%, an improvement from the 3.2% drop in June. Declines narrowed across all city categories. Given the property market’s former role in driving roughly a quarter of China’s GDP, policymakers are keen to stabilize it to help hit the “around 5%” growth goal.

Measures to revive demand have included increased access to housing provident funds, subsidies for purchases, and, in Beijing’s case, lifting suburban buying restrictions in August while keeping limits inside the fifth ring road.

Separate official data showed property investment for January–July fell 12.0% year-on-year, a steeper drop than the 11.2% fall in the first half of 2025.

China’s July Output and Retail Figures Disappoint, Growth Challenges Persist

China’s July economic data fell short of forecasts, underscoring weak domestic consumption and global headwinds.

- Industrial output grew 5.7% y/y, down from 6.8% in June — the slowest pace since November 2024.

- Retail sales rose 3.7% y/y, versus 4.8% in June.

- Fixed asset investment grew just 1.6% in January–July, far below the 2.7% forecast.

The producer price index declined 3.6% y/y for a second straight month, pointing to persistent factory-gate deflation. Beijing faces pressures from U.S. trade measures, soft consumer spending, and supply chain disruptions caused by extreme weather.

Although a recent U.S.–China trade truce helped prevent a sharper slowdown, analysts caution that weak demand and ongoing uncertainties will weigh on growth in the coming months.

July 2025: China Retail Sales and Industrial Output Miss Expectations

Fresh data from the National Bureau of Statistics shows July’s performance came in below projections:

- Retail Sales (y/y): +3.7% (forecast +4.6%, prior +4.8%)

- Industrial Production (y/y): +5.7% (forecast +6.0%, prior +6.8%)

- Fixed Asset Investment (y/y, Jan–Jul): +1.6% (forecast +2.7%, prior +2.8%)

The unemployment rate rose to 5.2% (from 5.1%), with the NBS attributing part of the increase to the influx of new college graduates.

Despite weaker-than-expected growth, the NBS maintained that the economy “remained steady” in July, citing resilience despite external challenges and extreme weather, including both heatwaves and flooding.

China’s July Home Prices Continue to Slide

The property sector remains under pressure from heavy debt burdens. National July new home prices posted:

- –2.8% y/y (June: –3.2%)

- –0.3% m/m (June: –0.3%)

China Warns Western Firms on Rare Earth Stockpiling

According to the Financial Times, Beijing has told foreign companies that building large reserves of rare earths could lead to supply shortages. The warning comes alongside deliberate export restrictions on the materials.

Unnamed sources say China plans to use rare earths as leverage in global trade disputes. These minerals are vital for high-tech manufacturing, and tighter controls could have far-reaching effects on industries worldwide.

PBOC sets USD/ CNY reference rate for today at 7.1371 (vs. estimate at 7.1852)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 238bn yuan via 7-day reverse repos at 1.40%

- 122bn yuan mature today

- net injection is 116bn yuan

New Zealand Food Prices Rise 0.7% in July

July’s Food Price Index in New Zealand rose 0.7% m/m, down from June’s 1.2% gain. On a year-on-year basis, prices were up 5.0%.

New Zealand Manufacturing Returns to Expansion in July

The BNZ–BusinessNZ Performance of Manufacturing Index jumped to 52.8 in July, from a revised 49.2 in June, signaling a return to expansion. The long-term average for the survey is 52.5.

While demand remains soft and costs elevated, BNZ’s senior economist noted that the rebound is encouraging, though it needs to be sustained to align with growth forecasts.

Japan finance minister Kato says monetary policy jurisdiction if BOJs

- Monetary policy falls under jurisdiction of BOJ

- Monetary policy falls under jurisdiction of BOJ

- Expect BOJ to conduct appropriate monetary policy to sustainably, stably hit its price target, working closely with govt

- No comment on Bessent’s comments on BOJ

Japan’s Q2 GDP Beats Forecasts on Business Spending and Exports

Preliminary data shows Japan’s economy expanded faster than expected in Q2 2025:

- GDP SA (q/q): +0.3% (est. +0.1%, prior 0.0%)

- GDP Annualized SA (q/q): +1.0% (est. +0.4%, prior –0.2%)

- GDP Nominal SA (q/q): +1.3% (est. +1.4%, prior +0.9%)

- GDP Deflator (y/y): +3.0% (est. +3.2%, prior +3.3%)

Private consumption rose 0.2% q/q, while business spending climbed 1.3%, both rising for a fifth consecutive quarter. Net exports contributed 0.3 percentage points to GDP, while inventories subtracted 0.3 points.

Japan economy minister Akazawa: Govt, BOJ both striving to achieve 2% inflation

- Latest data confirm the economy is recovering modestly

- Must remain mindful of risks from US trade policies that could weigh on growth.

- Rising prices could dampen consumer sentiment and hurt private consumption.

- No comment on BoJ rate level

- Treasury Secretary Bessent did not call on BOJ to raise interest rates, said only that BOJ likely to raise rates as it was behind the curve on inflation

- Govt, BOJ both striving to achieve 2% inflation, which will help achieve solid economic growth

- My understanding is that in latest US-Japan trade agreement chip-making equipment sector is included in chips

- But we have not specifically discussed this point with U.S yet

- U.S. tariff likely to push down Japan’s real GDP by 0.3–0.4%

Crypto Market Pulse

Bitcoin, Ethereum, XRP attempt recovery despite inflation worries

Bitcoin is holding above $119,000 Friday, aiming to retest the $120,000 mark after Thursday’s inflation-driven drop. Ethereum rebounded from $4,455 to above $4,600, while XRP traded near $3.10 with a slightly positive funding rate.

July’s hot PPI data raised concerns that inflation could delay the Fed’s expected September rate cut, though markets still price in a 92% chance of the cut.

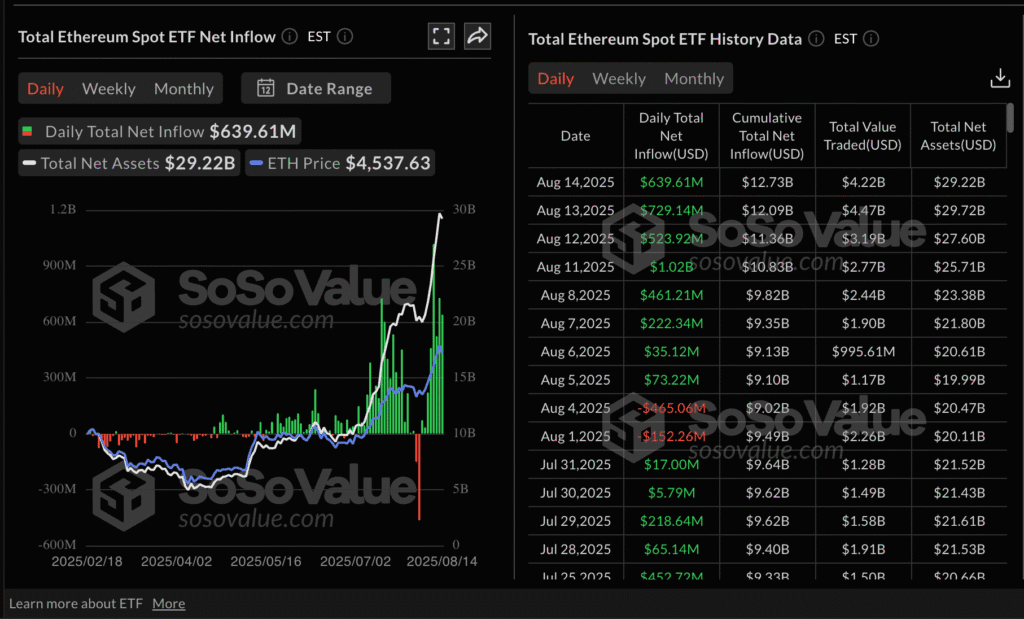

Institutional interest remains strong: US Ethereum spot ETFs saw $634 million in inflows Thursday, bringing cumulative inflows to $12.7 billion and net assets to $29.2 billion.

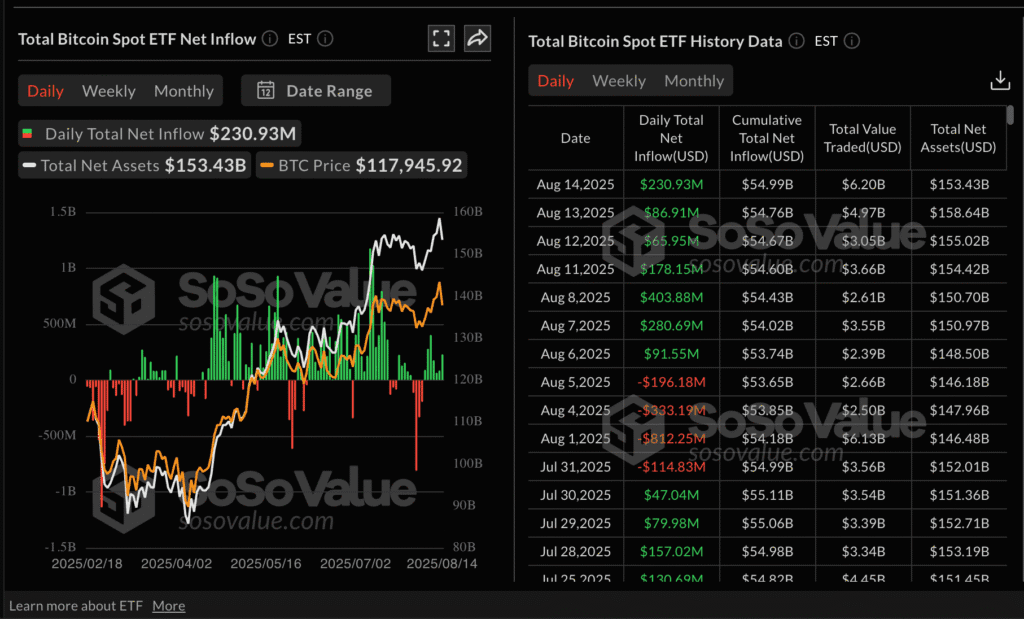

Bitcoin spot ETFs added $231 million, with total inflows nearing $55 billion and net assets at $153 billion.

Circle and Stripe move away from Ethereum to launch their own blockchains

Circle and Stripe are developing their own Layer-1 blockchain protocols, stepping away from Ethereum despite its long-standing dominance in smart contracts.

Circle’s Arc blockchain, revealed during its first earnings release since going public in June, is aimed at enterprise-grade payments, capital markets, and stablecoin services. It will be Ethereum Virtual Machine (EVM)-compatible and use USDC for gas fees. Launch is planned for this fall, with Arc integrated across Circle’s product suite.

Stripe’s Tempo blockchain, built with Paradigm, will target high-performance stablecoin payment infrastructure. Full details remain under wraps.

Industry analysts point to control as the main reason for bypassing Ethereum. Barry Plunkett of Interchain Labs said building a proprietary Layer-1 allows for real-time, deterministic settlement with fewer dependencies on third-party bridges and finality challenges. Both companies are also positioning themselves for compliance-focused financial services under incoming regulation.

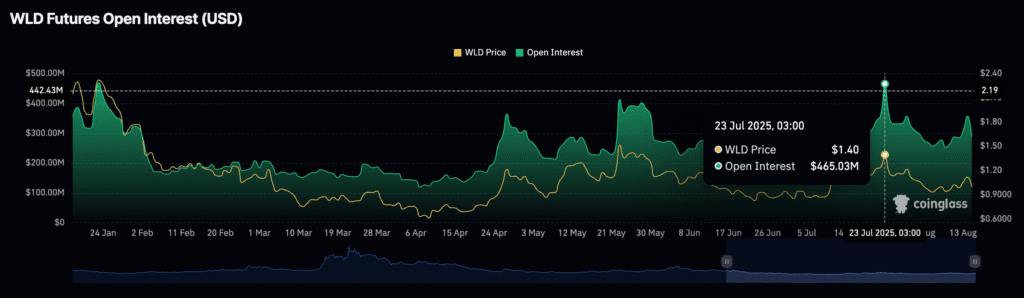

Worldcoin could drop 9% as open interest plunges

Worldcoin (WLD) is struggling to stay above $1.00 as weak sentiment sweeps through the crypto market. Thursday’s inflation-driven sell-off pushed the token toward key support near $0.90.

WLD’s futures open interest has fallen to $287 million — 38% below July’s peak of $465 million — showing a sharp drop in speculative positioning.

Bearish technical indicators, including the MACD and SuperTrend, suggest any short-term rebound could be limited, with downside risk still in play.

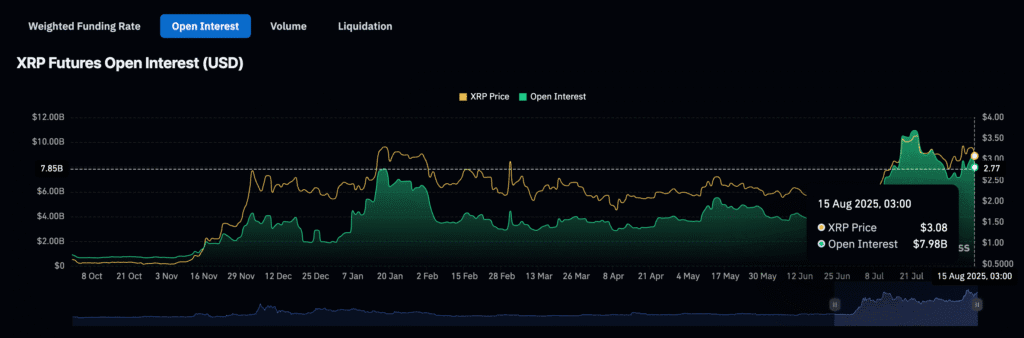

XRP price risks breaking below $3.00 as momentum fades

XRP is clinging to support above $3.00 on Friday after retreating from Thursday’s high of $3.35. Earlier in the week, the token abandoned its push toward the $3.66 record high, with inflation concerns in the US rattling risk assets.

Hotter-than-expected US Producer Price Index (PPI) data has investors worried the Federal Reserve may delay the September rate cut many had anticipated.

XRP’s futures open interest (OI) has dropped below $8 billion after peaking near $9 billion Thursday, well under the $10.94 billion seen in late July. This decline signals waning bullish sentiment, with fewer traders willing to bet on a short-term rally. Neutral retail activity suggests there’s room for upside without overheating, but without renewed interest, a return to the all-time high may be out of reach for now.

SEC prepares new crypto rules, awaits congressional action

SEC Chair Paul Atkins says the agency is “mobilizing” to update crypto regulations while awaiting new laws from Congress.

Speaking Friday, Atkins said the SEC is aligning its divisions to implement recommendations from Trump’s Crypto Working Group, which include revisiting decades-old rules. The agency’s work will be based on recent legislation, including the GENIUS Act, which regulates stablecoin issuance.

The House has also passed the CLARITY and Anti-CBDC bills, awaiting Senate review.

Atkins recently launched “Project Crypto” to modernize rules for asset classification, custody, and trading, with the aim of moving US financial markets on-chain. He also noted that a recent court decision striking down the debit interchange rule could accelerate adoption of alternative payment systems, including crypto.

Standard Chartered Raises Ethereum Target to $25K on Corporate Demand Surge

Standard Chartered has lifted its Ethereum forecast, setting a year-end 2025 target of US$7,500 (up from US$4,000) and a 2028 target of US$25,000.

The bank cites:

- Stronger market conditions

- Increased corporate treasury accumulation

- Growing institutional activity in staking, DeFi, and infrastructure

Corporate treasuries now hold a significant portion of ETH supply, a share that Standard Chartered believes could reach 10%, similar to early Bitcoin adoption patterns. Risks remain from regulation, competing blockchains, and network upgrades, but the bank sees stronger medium- to long-term fundamentals.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

North America

United States

- Equities: Mixed close. Dow +0.08% to 44,946.18 (intraday record 45,203.52), S&P 500 –0.29% to 6,449.80, Nasdaq –0.43% to 21,622.98, Russell 2000 –0.55% to 2,286.52. Weekly: Dow +1.74%, S&P +0.94%, Nasdaq +0.81%.

- Single-name driver: UnitedHealth (UNH) +11.98% on reports of a Berkshire stake, propping up the Dow.

- Macro data:

- Retail Sales (Jul): +0.5% m/m (in line); control group +0.5%; June revised to +0.9%.

- Import Prices (Jul): +0.4% m/m (vs 0.0% est); Export Prices +0.1%.

- Industrial Production (Jul): –0.1% m/m (vs 0.0% est); Capacity Utilization 77.5%.

- U. Michigan Sentiment (Aug prelim): 58.6 (vs 62.0 est); 1-yr inflation 4.9%, 5-yr 3.9%.

- NY Fed Mfg (Aug): 11.9 (highest since Nov 2024); new orders 15.4.

- GDPNow (Q3): 2.5% unchanged.

- Fed: Chicago Fed’s Goolsbee flagged unease over CPI/PPI and tariff effects; said cuts are possible later this year if inflation behaves; focus on distinguishing tariff-driven price spikes from broader pressures.

- Street previews (pre-release): Wells Fargo saw headline sales +0.6% (ex-auto +0.3%); BofA control group +0.6%; Deutsche Bank looked for headline +1.2% with strong non-store sales on an extended Prime Day.

Canada

- Manufacturing (Jun): +0.3% m/m to C$68.5B after four monthly declines; strength in petroleum/coal +11.8% and food +2.5%; transport equipment –5.0%. Sales –2.7% y/y.

- Wholesale Trade (Jun): +0.7% m/m.

Commodities

- Gold: $3,340 (+0.17%); stuck $3,330–$3,350 as softer USD (DXY –0.37% to 97.83) helps, but higher UST yields cap upside. Earlier in the week, hotter U.S. PPI knocked gold about $30 lower to $3,330. Watch next week’s flash PMIs, FOMC minutes, and Powell at Jackson Hole.

- Silver: Around $38.00, off a four-day low $37.69; weekly still ~–1%. Geopolitics in focus with the Trump–Putin Alaska summit.

- Oil: Bearish near term: Brent settled < $66/bbl on IEA/EIA signals of inventory builds (’25–’26) and a U.S. crude stock +3.04m bbl rise. Tighter medium-term risk: OPEC nudged demand forecasts up (’25 +1.3mb/d, ’26 +1.4mb/d); non-OPEC+ supply seen slower, implying more call on OPEC+. July quota-bound output ran 187kb/d below target.

- Rigs (Baker Hughes): U.S. 539 (unchanged; oil +1 to 412, gas –1 to 122; offshore 13). Canada 183 (+3) (oil +4 to 126; gas flat 57).

Europe

- Equities: Mixed close Friday: DAX –0.07%, CAC +0.67%, FTSE 100 –0.42%, Ibex +0.47%, FTSE MIB +1.1%.

- Week: DAX +0.81%, CAC +2.33%, FTSE 100 +0.47% (record weekly close), Ibex +3.05% (highest since Dec 2007), FTSE MIB +2.47% (highest since Jun 2007).

- Switzerland: Q2 GDP +0.1% q/q (from +0.8% in Q1); services up, industry down.

Asia

- China — Policy & Industry:

- PBOC (Q2 report): Will maintain moderately loose policy, keep liquidity ample, refine tools, defend against systemic risk, stabilize prices/expectations, and adjust pace as needed.

- Auto subsidies: Trade-in subsidies paused in multiple regions (scope unclear); scrap/renewal incentives continue. Program offers up to CNY 20k for NEVs and CNY 15k for ICE; 10M+ applications; expected to spur ~3M extra sales in ’25 with NEVs >60% of new sales.

- Rare earths: FT reports warnings to foreign firms against stockpiling; exports deliberately restricted; materials seen as leverage in disputes.

- China — Data:

- Home prices (Jul): –0.3% m/m (2nd straight month; 60/70 cities down), –2.8% y/y (from –3.2%). Beijing eased suburban curbs in Aug; intra-5th ring restrictions remain. Property investment (Jan–Jul): –12.0% y/y (worse than H1 –11.2%).

- Activity (Jul): Industrial output +5.7% y/y (Nov ’24 low), Retail sales +3.7% y/y, FAI (Jan–Jul) +1.6% (vs 2.7% est). PPI –3.6% y/y; jobless 5.2% (grad season effect). Authorities cite resilience amid extreme weather (heat, floods).

- Japan: Q2 GDP (prelim) beat: +0.3% q/q SA, +1.0% q/q annualized; private consumption +0.2%, capex +1.3% (both up for a 5th straight quarter). Net exports +0.3ppt, inventories –0.3ppt. GDP deflator +3.0% y/y.

Rest of the World

- New Zealand: Food Price Index (Jul) +0.7% m/m (+5.0% y/y). Manufacturing PMI (Jul) 52.8 (back to expansion; long-run avg 52.5).

Crypto

- Market snapshot:

- Bitcoin (BTC): Holding > $119,000, eyeing $120k retest after PPI-sparked sell-off.

- Ethereum (ETH): Rebounded from $4,455 to > $4,600; U.S. spot ETF inflows $634m Thursday ($12.7b cumulative; $29.2b AUM).

- XRP: Around $3.10 with slightly positive funding; risk of break below $3.00 as futures OI < $8b (near-$9b Thu peak; below $10.94b on Jul 22).

- BTC spot ETFs: +$231m Thursday (~$55b cumulative; $153b AUM).

- Tokens & flows:

- Worldcoin (WLD): Near $1.00; OI $287m, –38% from July peak $465m; sell signals (MACD, SuperTrend) keep recovery risks elevated; $0.90 support in view.

- Policy/Regulation:

- SEC: Chair Paul Atkins says the agency is “mobilizing” on updated crypto rules, awaiting further Congressional action (GENIUS Act enacted; CLARITY & Anti-CBDC bills through the House). Project Crypto launched to modernize classification, custody, and trading; push to move markets on-chain.

- Strategy/Infrastructure:

- Circle & Stripe: Building proprietary Layer-1s: Circle Arc (EVM-compatible; USDC as gas; public launch this fall; integrated across Circle suite), Stripe Tempo (payments-first with Paradigm). Rationale: control, deterministic settlement, compliance-first rails.

- Research/Outlook:

- Standard Chartered: ETH targets raised — $7,500 (end-’25) and $25,000 (’28) on stronger market conditions, corporate treasury accumulation (potential ~10% of supply), and institutional staking/DeFi/infrastructure demand.

(U.S. Equities — Ownership Moves)

- Berkshire Hathaway: New stakes in UnitedHealth (~$1.6B; 5M sh), Nucor, Lennar, DR Horton; trims Apple and Bank of America; added Lamar Advertising, Allegion. Buffett to step down as CEO end-2025; Greg Abel to lead capital allocation.

- Soros Fund & Appaloosa: Aggressively added Nvidia — Soros +1,600% to 990,292 (932,539 bought incl. options); Appaloosa +483% to 1.75m — underscoring conviction in AI hardware leadership.