North America News

U.S. Stocks End Mixed as Nasdaq Hits New Record, Small Caps Slide

U.S. equities finished the day on a mixed note Tuesday, with the Dow Jones Industrial Average and S&P 500 slipping, while the Nasdaq Composite notched another all-time closing high thanks to a chip stock rally. Meanwhile, the small-cap Russell 2000 underperformed sharply, logging its biggest one-day drop since May 21.

Semiconductor shares led the Nasdaq higher after reports suggested Washington might approve certain chip sales to China. Nvidia jumped 4.04%, AMD soared 6.41%, and Broadcom advanced 1.94%.

In the Dow, just four out of 30 names finished higher:

- Nvidia: +4.01%

- Microsoft: +0.53%

- Apple: +0.27%

- Amazon: +0.19%

On the flip side, American Express and Home Depot led losses, each falling over 3%. Other notable Dow laggards included:

- American Express (AXP): -3.19%

- Home Depot (HD): -3.16%

- UnitedHealth (UNH): -2.99%

- Merck & Co (MRK): -2.54%

- Travelers (TRV): -1.99%

- Goldman Sachs (GS): -1.65%

- Sherwin-Williams (SHW): -1.62%

- Amgen (AMGN): -1.53%

- Honeywell (HON): -1.18%

- Visa (V): -1.07%

Final index closes:

- Dow Jones: -436.36 points or -0.98% at 44,023.29 (session high: +44.62 points)

- S&P 500: -24.80 points or -0.40% at 6,243.76 (session high: +33.48 points)

- Nasdaq Composite: +37.47 points or +0.18% at 20,677.80 (session high: +195.71 points)

- Russell 2000: -44.67 points or -1.99% at 2,305.05 (session high: +7.84 points)

Top gainers outside the Dow included:

- Alibaba (BABA): +8.09%

- Super Micro Computer (SMCI): +6.92%

- First Solar (FSLR): +6.89%

- AMD (AMD): +6.41%

- Nvidia (NVDA): +4.01%

- Tencent ADR (TCEHY): +3.68%

- Citigroup (C): +3.61%

- Synopsys (SNPS): +3.55%

- Taiwan Semiconductor (TSM): +3.52%

- Fortinet (FTNT): +1.90%

Notable losers included:

- Papa John’s (PZZA): -6.12%

- Wells Fargo (WFC): -5.49%

- Occidental Petroleum (OXY): -5.28%

- Whirlpool (WHR): -5.21%

- Lennar (LEN): -4.57%

- Biogen (BIIB): -4.21%

- Delta Air Lines (DAL): -4.13%

- Block (XYZ): -3.93%

- Moderna (MRNA): -3.92%

- ARK Genomic Revolution ETF (ARKG): -3.68%

The latest batch of earnings kicked off with major banks. Citigroup bucked the trend, rising 3.61%, while others slipped despite beating estimates:

- BlackRock: -5.88%

- Wells Fargo: -5.49%

- J.P. Morgan: -0.85%

U.S. June CPI Data Shows Modest Core Inflation Uptick

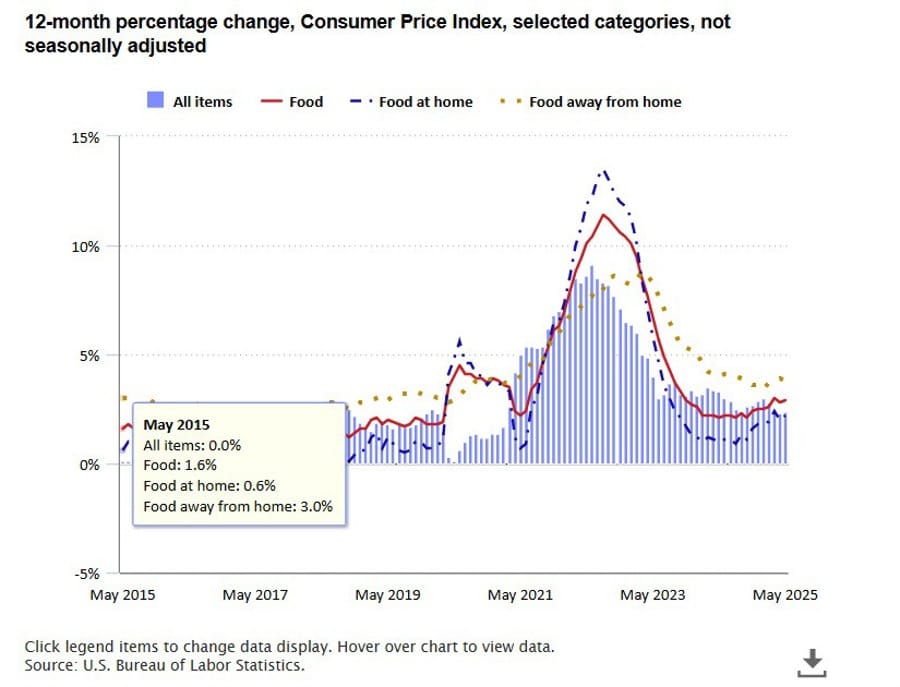

U.S. consumer price index data for June showed headline inflation rising 0.3% month-on-month, in line with expectations.

On an annual basis, headline CPI rose 2.7%, up from May’s 2.4%.

Core CPI (excluding food and energy) rose 0.2% month-on-month, slightly below the 0.3% estimate but above May’s 0.1%.

Annual core inflation came in at 2.9%, compared to 2.8% in May.

Detailed breakdown:

- Shelter costs rose 0.2%, the main contributor to the monthly gain.

- Energy prices climbed 0.9%, with gasoline up 1.0%.

- Food prices increased 0.3% overall, split between food at home (+0.3%) and food away from home (+0.4%).

- Price increases were also seen in household furnishings, medical care, recreation, apparel, and personal care.

- Declines appeared in used cars and trucks, new vehicles, and airline fares.

The headline CPI unrounded figure was 0.287% (just below the rounded 0.3%), while core CPI unrounded was 0.228% (close to the top end of the 0.2% range).

Despite tariff-driven inflation fears, the data suggests manageable price pressures for now, but it may keep the focus on Fed policy and Chair Powell in the coming months.

Feds Collins: solid economy gives Fed time to decide its next interest rate move

- Fed’s Collins speaking

- Solid economy gives Fed time to decide its next interest rate move

- It is challenging to set monetary policy right now amid uncertainty

- It’s time for Fed to be ‘actively patient’ with monetary policy

- Tariffs to boost inflation over second half of 2025, core inflation around 3% by year’s end

- Tariffs will slow hiring but ‘not necessarily by a large amount’

- Strong business, household balance sheets may blunt tariff pain

- Good profit margins may limit tariff pass-through

- Tariffs will weigh for a time on what is now strong economy

- Economy is currently in a ‘good place’ overall

- Core goods inflation showing some signs of tariff impact

Lutnick: China Chip Sales Linked to Rare Earth Agreement

Speaking on CNBC, Commerce Secretary Lutnick revealed that U.S. chip sales to China were part of a broader rare earth magnets deal.

The strategy is to ensure China relies on U.S. chips while limiting its domestic chip-building capabilities.

Lutnick emphasized efforts to establish American standards globally in AI and highlighted that tariffs target finished steel products rather than raw materials.

He argued that tariffs under Trump’s leadership are reversing decades of outsourcing, bringing jobs back and creating what he called “the best deals for the American people.”

Fed’s Barkin Warns Tariffs Will Add to Price Pressures

Richmond Fed President Thomas Barkin cautioned that upcoming U.S. tariff hikes will contribute to higher price pressures.

Speaking Tuesday, Barkin noted that tariffs risk amplifying inflationary trends that the Fed has been working to control.

His comments align with broader market concerns that new tariffs could derail plans for potential rate cuts and complicate the inflation outlook heading into late 2025.

US Bessent: I wouldn’t put too much emphasis on one inflation number

- Comments from the US Treasury Secretary, Scott Bessent

- It is important to look at trend, inflation not accelerating

- I haven’t seen today’s CPI figures yet.

- Trump said many times he’s not going to fire Powell.

- The Fed had big forecasting errors and there may be one now.

- Independent central bank very important for policy.

- The formal process for Powell successor already started.

- There are a lot of good candidates in and outside of the Fed.

- Successor pick will happen at Trump’s speed.

- We’re in a good place on China now.

- I expect to meet Chinese counterpart in next few weeks.

- I am not going to rush deals because of some market deadline.

Trump says ‘disappointed but not done’ with Putin

- Remarks by US president Trump in an interview with the BBC

- I’m disappointed in him but I’m not done with him

- Thought a deal with Russia was on the cards four different times

- We’ll have a great conversation and I think we’re close to getting it done, then he’ll go knock down a building in Kyiv

BofA: Trump Tariffs Reinforce “No Fed Rate Cut” Outlook for 2025

Bank of America economists say President Trump’s proposed 30% tariffs on EU and Mexican imports could delay any Federal Reserve rate cuts this year.

The measures could lift the effective U.S. tariff rate by about 4 percentage points, potentially rising further if additional global tariffs are introduced.

BofA estimates the tariffs could add roughly 30 basis points of stagflationary risk.

As a result, the Fed may prefer to hold rates steady rather than cut, aligning with BofA’s call for no rate reductions in 2025.

Moody’s Zandi Warns U.S. Housing Slump Entering “Red Flare” Stage

Moody’s chief economist Mark Zandi has escalated his warning on the U.S. housing market, describing the situation as moving from a “yellow flare” to a “red flare” due to persistently high mortgage rates.

Rates hovering near 7% are squeezing affordability, weakening demand, and hurting homebuilders’ margins.

Builders are backing away from costly mortgage rate buydowns, delaying land acquisitions, and pulling back on new starts and completions.

Zandi expects price growth to fade further, with more supply coming online and demographic shifts adding pressure.

He warned that the housing sector, once a key driver of the post-pandemic recovery, is now turning into a significant economic headwind that could drag into 2026.

Canada’s PM Carney: U.S. Tariffs Likely to Persist

Canadian Prime Minister Mark Carney told The Wall Street Journal that U.S. tariffs look set to stay in place for the foreseeable future.

Carney noted there is “lots of evidence” that no country is likely to escape the U.S. tariff net anytime soon. Starting August 1, Canada will face a 35% tariff on its exports to the U.S.

While there may be room for adjustment, Carney anticipates final rates to settle between 10% and 20% on average.

President Trump hopes domestic firms will absorb most of these cost increases, describing the tariffs as a tax for access to the U.S. market and as a counter to “unfair trade practices.”

Carney added that to lower these tariffs, the U.S. will likely demand full elimination of foreign tariffs on American goods in return.

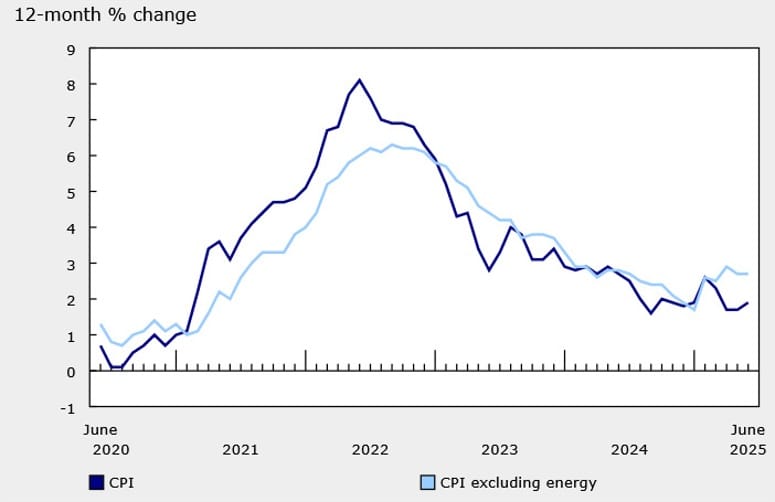

Canada’s June Inflation Matches Forecast, Core Measures Edge Up

Canada’s consumer price index (CPI) increased 1.9% year-on-year in June, matching expectations and up from May’s +1.7%.

On a monthly basis, CPI rose 0.1%, in line with the estimate and slowing from May’s +0.6%.

Core CPI (excluding volatile items) advanced 0.1% month-on-month, decelerating sharply from +0.6% in May.

Annual core CPI stood at 2.7%, higher than May’s 2.5%. The CPI median came in at 3.1% (vs 3.0% expected), while CPI trim remained at 3.0%, and CPI common was steady at 2.6%.

Durable goods prices accelerated, rising 2.7% year-on-year in June after a 2.0% gain in May, echoing patterns seen in the U.S. amid tariff pressures. Despite these figures, markets do not expect an immediate policy shift from the Bank of Canada.

Mexico Sheinbaum: Mexico will announce other measures if an agreement with the US is not reached

The Mexican president Sheinbaum:

- Mexico will announce other measures if an agreement with the US on new tariffs is not reached by August 1.

- She disagrees with US duties imposed on tomatoes

U.S. Slaps 17% Tariff on Mexican Tomato Imports

The U.S. Department of Commerce announced it will terminate the 2019 suspension agreement on Mexican tomato imports.

The decision reactivates an antidumping duty order, imposing a 17.09% tariff on most fresh tomatoes coming from Mexico.

The move marks a significant escalation in trade tensions with Mexico and ends a temporary truce that had lasted for nearly five years.

Commodities News

Gold Sinks as Inflation Data Lifts Dollar, Dampens Fed Cut Hopes

Gold prices retreated on Tuesday, shedding more than 0.40%, as hotter-than-expected U.S. inflation data bolstered the U.S. dollar and curbed speculation of near-term rate cuts from the Federal Reserve.

Spot gold last traded at $3,329, down from a daily peak of $3,366.

The June Consumer Price Index (CPI) report showed headline inflation rising 2.7% year-over-year, in line with forecasts and up from 2.4% in May. Core CPI (excluding food and energy) edged up to 2.9%, slightly below expectations of 3%, but still well above the Fed’s 2% target.

The data firmed up the view that the Fed is unlikely to cut rates soon, a sentiment reinforced ahead of the upcoming Jackson Hole Symposium and September policy meeting.

Meanwhile, President Trump stirred the policy pot by announcing a trade deal with Indonesia. Under this agreement, Indonesia will pay 19% duties on exports to the U.S., while U.S. goods are exempt from Indonesian tariffs. Trump revealed that Indonesia committed to purchasing $15 billion in American energy, $4.5 billion in agricultural goods, and 50 Boeing jets — many being 777 models.

Trump also reiterated calls for the Fed to slash interest rates despite inflationary pressures, while hinting that more trade deals are in the pipeline.

The U.S. dollar index (DXY) rallied 0.55% to 98.64, putting further pressure on bullion.

Looking ahead, traders will focus on U.S. Producer Price Index (PPI), retail sales data, jobless claims, and the University of Michigan consumer sentiment survey later this week.

Boston Fed President Susan Collins remarked Tuesday that achieving the Fed’s dual mandate is a longer-term goal, highlighting cooling signs in the labor market but cautioning against premature rate adjustments.

Crude Oil Settles Slightly Lower, Eyes Key Support Levels

Crude oil futures closed Tuesday down $0.46, or 0.69%, at $66.52. The session high touched $67.10, while the low hit $66.25.

On the technical front, prices stalled near the underside of a broken trendline, signaling bearish control.

Looking ahead, the next downside target lies at $66.13 — the 61.8% retracement of the rally from June’s low to July’s high. A break below that would open the door toward the July 7 swing low of $65.51.

U.S. Delays New Sanctions on Russia, Oil Markets Breathe — Commerzbank

Brent crude briefly topped $71 per barrel Monday — the first time since the Israel-Iran tensions — before easing, notes Commerzbank’s Barbara Lambrecht.

The price spike was fueled by strong Chinese crude imports and anticipation of U.S. sanctions on Russia.

President Trump ultimately gave Russia a 50-day window to end the war, threatening 100% tariffs on allies if not. While secondary sanctions on Russian oil buyers (mainly China and India) were feared, these were avoided for now, calming markets.

Meanwhile, Russia’s June oil exports fell to 7.23 million barrels per day, the lowest since 2021, raising doubts about its production resilience.

China’s Aluminum Output High Despite Slight June Dip — Commerzbank

China’s aluminum production dipped slightly in June versus May, according to data cited by Commerzbank’s Head of FX and Commodity Research, Thu Lan Nguyen.

Nguyen noted that this isn’t surprising, as production had hit a record in May. China has a government-mandated annual cap of 45 million tons for aluminum, forcing smelters to pull back to avoid surpassing this limit.

In the first half of 2025, output averaged 3.78 million tons per month, which would total 45.4 million tons if maintained for the year. Thus, a moderate reduction in the second half is likely.

However, with alumina prices dropping and profitability for smelters improving, it remains uncertain whether cuts will happen. For now, China’s high output continues to weigh on global aluminum prices.

Silver Rally Outpaces Gold in Catch-Up Move — Commerzbank

Silver prices surged roughly 5% since Friday, briefly crossing $39 per troy ounce, noted Commerzbank’s Thu Lan Nguyen.

This sharp move saw silver outpacing gold, which only rose about 1.5%. The rally appears driven by investor anxiety over new U.S. tariffs rather than fundamental demand shifts.

While gold is a classic safe haven, silver’s heavy industrial use makes it less reliable during economic downturns. The strong outperformance is viewed as a “catch-up” pattern similar to platinum’s earlier move.

Many investors, after gold’s 30% gain this year, are turning to lower-priced metals like silver, platinum, and palladium. Still, Commerzbank does not believe further sustained gains are justified, as physical demand will likely weaken under tariff-related economic pressure.

China’s Copper Ore Imports Dip, but Remain Strong — Commerzbank

Copper prices held firm above $9,600 per ton to start the week, though Commerzbank’s Thu Lan Nguyen warns of ongoing downward pressures.

London Metal Exchange (LME) inventories have grown since early July, signaling reduced U.S. demand.

Despite this, China — the world’s top copper producer — has maintained high import levels, though down from April’s record. For the first half of 2025, imports were up about 6% year-over-year.

Chinese smelters have managed so far despite low treatment and refining charges, helped by the copper price’s roughly 10% rise since January.

However, looming U.S. tariffs may further dampen prices internationally, raising questions about the profitability of China’s high production pace. Nonetheless, signs continue to favor expansion for now.

China’s Crude Oil Imports Surge, but Stockpiles Raise Caution — Commerzbank

China’s crude oil imports rose to 49.9 million tons in June, up 7% from May, according to customs data cited by Commerzbank’s Barbara Lambrecht.

This translates to nearly 12.2 million barrels per day, the highest daily volume since summer 2023.

Refinery throughput climbed to 15.2 million barrels per day, its strongest since September. High margins, especially in diesel, have made both processing and exports attractive.

Despite this, domestic demand remains soft, a trend reinforced by recent GDP data. The International Energy Agency (IEA) estimated China’s crude stocks grew by 82 million barrels in Q2 — nearly 900,000 barrels per day.

With state reserves already about 80% full and commercial facilities only half utilized, further build-up could slow sharply, posing a risk to oil market support.

Goldman Sachs Sees Gold Hitting $4,000 by Mid-2026

Goldman Sachs forecasts gold prices will rise to $3,700 per ounce by end-2025, then push further to $4,000 by mid-2026.

Key drivers include robust central bank and institutional buying — averaging 77 tonnes per month between January and May 2025 — and sustained ETF demand.

In May alone, central banks (excluding the U.S.) bought 31 tonnes, with China contributing 15 tonnes.

Goldman notes that speculative fund positions have moderated since April highs, leaving room for renewed upward momentum in coming quarters.

IEA Reports Surprising Saudi Oil Output Jump — Commerzbank

The International Energy Agency (IEA) slightly lowered its oil demand growth forecast to 700,000 barrels per day for this year and next — the smallest rise since the 2020 pandemic slump.

Unexpectedly, Saudi Arabia’s oil output surged by 700,000 barrels per day in June to 9.8 million, 430,000 above its agreed limit, noted Commerzbank’s Carsten Fritsch.

Bloomberg and Reuters surveys had shown lower figures. The IEA attributes the higher data to a 500,000 barrels-per-day export increase and 300,000 barrels-per-day higher crude processing.

Saudi Arabia reportedly requested OPEC to report lower figures for June to align with quotas. If this discrepancy persists, it could strain OPEC+ unity, potentially prompting other producers to boost supply unilaterally.

UBS Sees Trump Tariff Rhetoric as Bluff, Suggests Gold Hedge

UBS analysts believe President Trump is unlikely to fully implement his proposed 30% tariffs on EU goods, viewing it as a negotiation tactic.

Their base case assumes a final effective tariff rate around 15%, allowing U.S. equities to keep climbing.

UBS expects a trade deal or a deadline extension before August 1. On Mexico, they see no severe retaliatory measures despite ongoing tensions.

The bank recommends gradually increasing equity exposure during volatility, with a focus on U.S. tech, healthcare, and financials; Asian tech; and high-quality European stocks.

UBS also advises using gold as a hedge against policy uncertainty and geopolitical risks.

Europe News

European Stock Indices Close Lower, Led by Spain

Major European benchmarks closed in the red Tuesday, with Spain’s Ibex 35 lagging most:

- Spain’s Ibex: -1.15%

- Germany’s DAX: -0.35%

- France’s CAC 40: -0.54%

- UK’s FTSE 100: -0.66%

- Italy’s FTSE MIB: -0.66%

Eurozone Industrial Production Surges in May on Energy and Capital Goods

Eurostat data for May showed eurozone industrial production rose 1.7% month-on-month, beating the forecast of +0.9%.

April’s decline was revised from -2.4% to -2.2%.

The strong May figure was driven by a 3.7% jump in energy production. Even excluding energy, gains were solid: capital goods output climbed 2.7%, and non-durable consumer goods spiked 8.5%.

These increases were partly offset by drops in intermediate goods (-1.7%) and durable consumer goods (-1.9%).

German Economic Sentiment Rises Sharply, Current Conditions Improve

Germany’s July ZEW survey revealed a notable improvement in sentiment:

- Current conditions index rose to -59.5, stronger than the -66.0 expected and a big jump from June’s -72.0.

- Economic sentiment index climbed to 52.7, surpassing the 50.3 estimate and up from 47.5 previously.

ZEW highlighted that nearly two-thirds of respondents foresee economic improvements ahead, supported by hopes of a quick resolution to the U.S.-EU trade conflict and new domestic fiscal stimulus measures. The data signals growing confidence as Germany enters the third quarter.

Spain’s June Inflation Edges Higher, Core Rate Holds Steady

Spain’s final consumer price index (CPI) for June came in at +2.3% year-on-year, slightly above the initial estimate of +2.2%, and up from May’s +2.0%.

The harmonized index of consumer prices (HICP) also matched at +2.3% versus the preliminary +2.2%, and up from +2.0% previously.

Core inflation — a key focus for policymakers — remained at +2.2%, unchanged from May. The stable core reading supports expectations that the European Central Bank will hold rates steady throughout the summer.

UK Retail Sales Rebound in June, But Shoppers Remain Cautious

UK retail sales jumped in June, thanks to warmer weather and seasonal events like Wimbledon, according to the British Retail Consortium:

- Total sales climbed 3.1% year-on-year, up from 1.0% in May.

- Like-for-like sales rose 2.7%, compared to 0.6% the prior month.

Higher food prices and strong demand for summer goods like fans and clothing drove the boost.

However, Barclays data showed overall consumer spending slipped 0.1% year-on-year in June (down from +1.0% in May), suggesting households are still wary. Analysts pointed to inflation-driven growth rather than genuine volume increases, signaling restrained momentum for the broader economy.

BOE Mann: inflation is still a challenge

- BOE Mann speaking

- Inflation is still a challenge

- It is important for us to continue to use monetary policy in order to get us to that 2% inflation objective

EU Spokesperson: EU has no intention to retaliate before August 1

- Comments from an EU spokesperson on trade matters

- EU Trade Commissioner Sefcovic will talk with US Trade Representative Greer this early evening

- The EU has no intention to move forward with any trade countermeasures before August 1

Also comments from German Chancellor Merz:

- The goal is a quick solution, I am in close contact with Trump and Von Der Leyen

- The EU is refraining from counter measures for now, but US should not underestimate willingness to respond

ECB’s Radev: I value prudence, data-dependence and a strong anti-inflationary bias

- Remarks from the soon to be ECB policymaker, Dimitar Radev

- In policymaking I value prudence, data-dependence, and a strong anti-inflationary bias

- June ECB cut has clearly shifted the stance

- Temporary inflation undershoot possible, but wage and services pressures are evident

BofA FMS: Investors most overweight Euro since January 2005

- The Bank of American Fund Manager Survey for July

- Investor sentiment most bullish since February 2025

- Record surge in risk appetite past 3 months

- Cash levels fall to 3.9%, ‘triggering sell signal’

- Sentiment getting ‘toppy’, ‘greed always much harder to reverse than fear’

- Trade war remains biggest ‘tail risk’ for investors

EU Readies €72 Billion in Tariffs on U.S. Goods if Talks Fail

The European Union has prepared a new list of retaliatory tariffs on U.S. imports valued at €72 billion (US$84 billion) in case no trade deal is finalized by August 1, according to the Wall Street Journal.

The draft list includes items like aircraft, bourbon, cars, machinery, medical devices, chemicals, plastics, and agricultural products.

Originally targeting €95 billion in goods, the list was refined after consultations with industry stakeholders and EU member states. Approval from EU governments is still required, and no official statement has been issued yet.

Asia-Pacific & World News

PBOC to Inject ¥1.4 Trillion Into Banking System

The People’s Bank of China will inject ¥1.4 trillion (about US$195 billion) into the financial system on Tuesday via reverse repurchase agreements.

The liquidity injection, split between three-month and six-month tenors, aims to keep banking system liquidity “reasonably ample,” according to the central bank.

The move signals Beijing’s continued commitment to supporting credit conditions as economic headwinds persist.

China’s June Retail Sales Miss Forecast, Industrial Output Surges

China’s June data revealed a mixed picture:

- Retail sales rose 4.8% year-on-year, falling short of the 5.6% forecast and slowing from May’s 6.4%.

- Industrial production jumped 6.8% year-on-year, beating expectations of 5.6% and up from May’s 5.8%.

- Fixed asset investment increased 2.8% year-to-date, below the expected 3.7% and down from the previous 3.7%.

- Urban unemployment held steady at 5.0%.

China’s Q2 GDP Beats Expectations Despite Slightly Slower Growth

China’s economy expanded 1.1% quarter-on-quarter in Q2, slightly below Q1’s 1.2% but above the 0.9% forecast.

On a yearly basis, GDP rose 5.2%, beating the 5.1% consensus estimate though easing from Q1’s 5.4%.

The data underscores solid economic momentum heading into the second half of 2025, even as challenges linger.

China House Prices Continue Slide, But Yearly Declines Narrow

China’s property market remained under pressure in June:

- New home prices dropped 0.27% month-on-month, compared to May’s 0.22% decline.

- Year-on-year, new home prices fell 3.2%, slightly less than May’s 3.5% drop.

- Used home prices decreased 0.61% month-on-month, after a 0.50% fall in May.

China’s National Bureau of Statistics highlighted that new home prices fell in 70 cities month-over-month but noted that annual price declines are starting to narrow.

Nvidia to Restart H20 GPU Shipments to China With U.S. Green Light

Nvidia is set to resume sales of its H20 graphics processing units (GPUs) to China, using a modified design that aligns with U.S. export controls, according to sources familiar with the plan.

CEO Jensen Huang reportedly met with President Trump and other U.S. officials recently, emphasizing the company’s support for domestic job growth and technological leadership. During those talks, the administration is said to have assured Nvidia it would approve necessary export licenses.

With final regulatory clearance expected soon, deliveries of the updated H20 GPUs could begin in the near term.

PBOC sets USD/ CNY central rate at 7.1498 (vs. estimate at 7.1758)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 342.5bn yuan via 7-day reverse repos at 1.40%

- 69bn yuan mature today

- net 273.5bn yuan injection

Australian Consumer Confidence Ticks Up, But Mood Still Cautious

Australia’s Westpac-Melbourne Institute Consumer Confidence index rose 0.6% in July to 93.1, up from June’s 92.6.

Westpac noted that optimism was higher before the Reserve Bank unexpectedly kept rates steady at 3.85%. Confidence dipped after that decision, highlighting underlying caution.

While households felt slightly better about their own finances, sentiment about the broader economy weakened. Willingness to make large purchases also slipped, underscoring continued consumer restraint.

Japan Bond Yields Jump as Election Worries Stir Fiscal Jitters

Japanese government bond markets are under pressure ahead of this weekend’s upper house election.

Investors fear a potential shift toward more aggressive fiscal spending if Prime Minister Shigeru Ishiba’s coalition suffers setbacks.

- Japan’s 10-year yields rose above 1.59%, the highest since 2008.

- The 30-year yield surged 13 basis points on Monday to 3.17%, nearing May’s highs.

Barclays analysts believe current yields already reflect expectations of a major cut to the 10% consumption tax. A win for opposition parties campaigning on tax cuts could drive yields even higher and steepen the curve further.

Japan and EU to Issue Joint Statement to Deepen Economic Ties

Japan and the European Union plan to release a joint statement reinforcing their economic cooperation, according to the Yomiuri newspaper.

The new framework will emphasize trade expansion, advanced technology collaboration, and stronger supply chain integration.

Both sides aim to strengthen economic resilience amid rising geopolitical tensions and supply chain disruptions.

Japan trade negotiator says will continue negotiations to seek tariffs agreement with US

- Akazawa and Bessent will be meeting at the end of this week

The pair will be meeting on 18 July in Tokyo, just ahead of Bessent’s visit to the Expo 2025 Osaka’s US National Day celebration on 19 July. For now, negotiations are still stalling as Japan continues to hold a tough stance. The key deadline now is 1 August, as Trump threatens 25% tariffs against Japan.

Crypto Market Pulse

Bitcoin, Ethereum, XRP Pull Back as ETF Inflows Slow and Traders Lock Profits

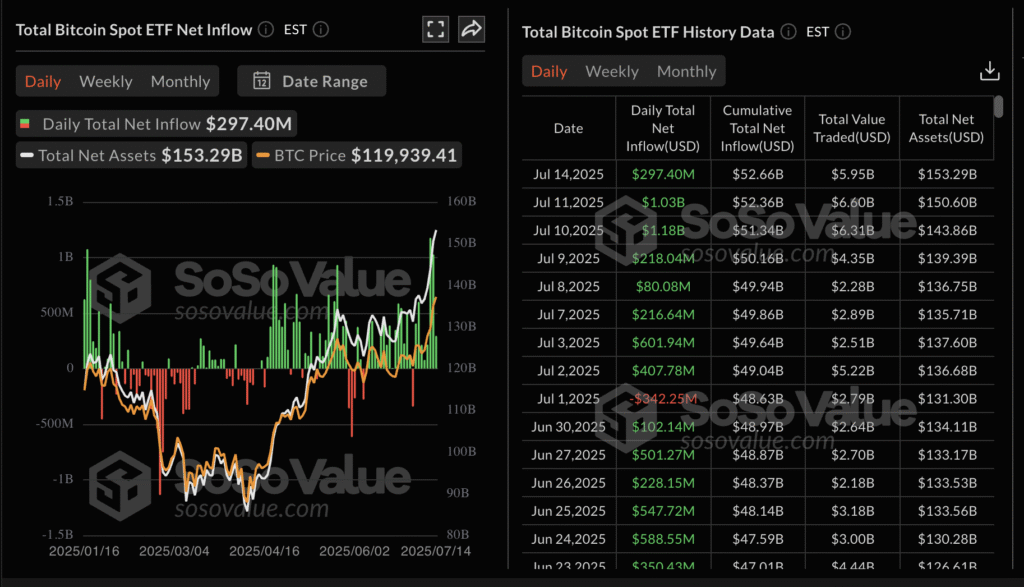

Tuesday saw a sharp shift in crypto sentiment after a big rally on Monday. Bitcoin (BTC) dropped to $116,918, losing more than 2% on the day as traders moved to secure gains before the U.S. CPI release.

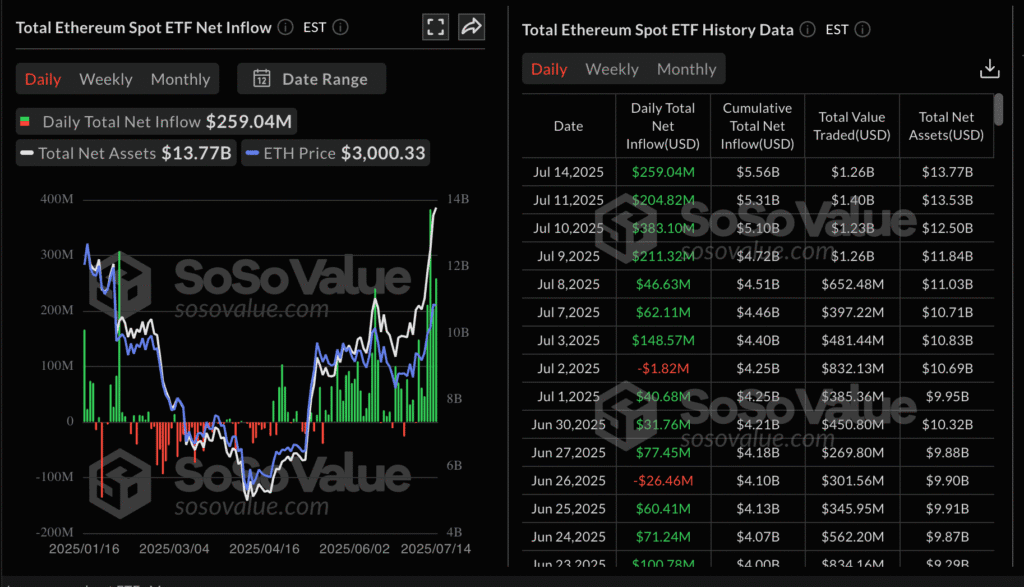

Ethereum (ETH) also dipped below $3,000, while XRP fell back under $3.02 after flirting with Monday highs.

Bitcoin had surged 16% since July 1 to a new record of $123,218, driven by strong institutional buying and technical momentum. However, attention shifted to U.S. inflation data, expected at 2.7% annual and 3% core for June.

Recent ETF inflows helped fuel Bitcoin’s breakout: spot ETFs saw over $1 billion in inflows on both Thursday ($1.18 billion) and Friday ($1.03 billion). But inflows fell to $297 million on Monday as caution returned.

Ethereum ETFs bucked the trend slightly, with Monday inflows rising to $259 million, marking a seventh straight day of gains.

Ethereum is now around $2,976 after facing rejection at $3,084. If volatility persists, traders may look to support at $2,880 and $2,664.

As inflation and tariff uncertainty swirl, volatility is expected to continue dominating the crypto landscape.

XRP Retreats as Crypto Week and U.S. Inflation Drive Volatility

Ripple’s XRP pulled back to $2.87 on Tuesday after slipping below the $3.00 mark. Earlier in the week, XRP hit a high of $3.03 before sellers took control amid heightened crypto market volatility.

Bulls stepped in to defend the $2.80 support level as investors digested fresh U.S. inflation data.

According to the U.S. Bureau of Labor Statistics, headline CPI rose 2.7% year-on-year in June, up from 2.4% in May, matching forecasts. Core CPI (excluding food and energy) climbed to 2.9% from 2.8% previously. Month-over-month, headline CPI rose 0.3%, and core increased 0.2%.

Crypto markets showed resilience after the release, suggesting the inflation shock had already been priced in. XRP is eyeing a rebound from $2.80 if market sentiment improves.

Meanwhile, “Crypto Week” in the U.S. House of Representatives is underway, with votes on major bills including the GENIUS Act and CLARITY Act. These proposals aim to create a solid regulatory foundation for digital assets, permanently block a CBDC, and protect financial privacy.

Ripple stands to benefit from clearer regulation, especially with its USD-backed stablecoin RLUSD and Ripple Payments platform potentially seeing wider adoption.

PEPE Pauses After Breakout, Derivatives Interest Soars

Pepe (PEPE) fell to $0.00001241 Tuesday after nearly hitting its 35% wedge breakout target at $0.00001355.

Despite the retreat, market interest remains strong. Futures open interest (OI) has surged 33.5% to $685 million since July 2, signaling robust trader engagement.

Volume in futures contracts has jumped to an average of $3.73 billion, up from $1.39 billion earlier this month, highlighting continued speculative appetite.

Technically, PEPE is supported around $0.00001169. A potential golden cross between the 50-day and 200-day EMAs could reinforce bullish momentum.

Key risk factors include possible profit-taking, U.S. inflation fears, and uncertainty around August 1 tariff implementations. If sentiment stabilizes, PEPE could aim for a push toward $0.00002000.

Dogecoin, Shiba Inu Face Sell Pressure as Bitcoin Rally Pauses

Dogecoin fell below $0.2000 Tuesday, down about 3% to $0.1912, as Shiba Inu also retraced from Monday’s $0.00001416 high.

Both meme coins surged after Bitcoin hit a record $123,218 but are now seeing profit-taking.

Traders are watching Tuesday’s U.S. CPI release closely. June’s CPI is expected to rise 2.7% year-on-year, with core CPI projected at 3%.

A higher-than-expected CPI could weaken risk appetite, hurting cryptos. Meanwhile, May’s CPI rose 2.4%, while core inflation was 2.8%.

If inflation data disappoints, risk-off sentiment may deepen, pressuring meme coins further.

Whale Snaps Up $2 Million in PI Tokens Despite Price Dip

Pi Network (PI) slipped 2% Tuesday, retesting support at $0.4460 amid increasing token unlocks and higher exchange balances.

A whale investor accumulated 5.3 million PI tokens worth over $2 million over three days, signaling strategic confidence despite the downturn.

PiScan data shows a net increase of 737,326 PI on centralized exchanges in 24 hours, bringing total listed exchange supply to 385.21 million PI.

Technical indicators show bullish RSI divergence, hinting at possible stabilization if selling pressure eases. However, higher exchange balances suggest continued downside risk.

BONK, PENGU, WIF Lead Solana Meme Coin Surge

Solana-based meme coins Bonk (BONK), Pudgy Penguins (PENGU), and Dogwifhat (WIF) are outperforming amid renewed crypto optimism.

BONK:

BONK is up over 6% today, continuing a 20% rally from last week. The coin aims to breach the $0.00002958 level (61.8% Fibonacci retracement) and potentially target $0.00004105. A golden cross between the 50-day and 200-day EMAs could act as a bullish catalyst.

PENGU:

PENGU rose 88% last week, now consolidating near $0.030. If it breaks this resistance, $0.037 (78.6% Fibonacci) is the next target. The upcoming multiplayer game launch and giveaways add momentum, though the RSI at 84 signals overbought conditions.

WIF:

WIF dipped 3% Tuesday to trade below $1.00, struggling to surpass the 200-day EMA at $1.06. A break above could push prices toward $1.21 or even $1.67. Momentum remains flat, with RSI at 56 and MACD flattening.

The Day’s Takeaway

United States

- Stock Market Mixed, Nasdaq Shines:

U.S. equities ended mixed, with the Dow dropping 0.98% and the S&P 500 slipping 0.40%. Meanwhile, the Nasdaq gained 0.18%, closing at a record high thanks to strong chip stock momentum (Nvidia +4.01%, AMD +6.41%, Broadcom +1.94%). The Russell 2000 underperformed, falling nearly 2%. - Earnings Kick Off:

Big banks started earnings season. Citigroup rose 3.61% despite general weakness among financials. BlackRock dropped 5.88%, Wells Fargo lost 5.49%, and J.P. Morgan fell 0.85%. - Inflation Watch:

June CPI rose 2.7% YoY, up from 2.4% in May and matching expectations. Core CPI increased to 2.9%, reinforcing market belief that the Fed will keep rates steady in the near term. - Fed Commentary:

Richmond Fed’s Barkin warned tariffs could stoke further price pressures. Boston Fed’s Collins signaled patience, highlighting ongoing labor market cooling. - Tariff Updates:

President Trump announced a trade deal with Indonesia, waiving U.S. tariffs while Indonesia pays 19% duties. The country committed to buying $15 billion in U.S. energy, $4.5 billion in agriculture, and 50 Boeing jets. - Housing Concerns:

Moody’s Mark Zandi raised a “red flare” over the U.S. housing market, citing 7% mortgage rates dampening sales and new construction. Price growth is stalling, and he warned the sector may shift from a post-COVID growth driver to an economic drag. - Tariff Outlook:

Prime Minister Carney of Canada suggested U.S. tariffs are likely to remain, with rates on Canadian exports set at 35% starting August 1. Trump views these as a tax on market access and a counter to “unfair trade practices.”

Canada

- Inflation Holds Steady:

June CPI came in at 1.9% YoY, matching expectations and up from 1.7% in May. Core inflation ticked up to 2.7% YoY from 2.5%. Durable goods prices accelerated, echoing tariff effects seen in the U.S.

Commodities

- Gold Weakens on Strong Dollar:

Gold fell over 0.40%, closing at $3,329 after peaking at $3,366. The U.S. dollar strengthened on hotter inflation data, and traders now expect fewer Fed rate cuts. - Oil Slips:

Crude futures settled at $66.52, down 0.69%. Prices found resistance at a broken trendline and now eye $66.13 support. - China Oil Imports and Stockpiling:

China imported 49.9 million tons of crude in June (+7% MoM), the highest daily level since last summer. However, rising inventories (82 million barrels added in Q2) suggest stockpiling may slow soon. - Saudi Production Surprise:

IEA data revealed Saudi oil output jumped by 700,000 bpd in June to 9.8 million bpd, surpassing agreed levels and raising questions over OPEC+ unity. - Aluminum and Copper in China:

Chinese aluminum production slightly dipped in June but remains high, pressuring prices. Copper ore imports fell from April peaks but are still up 6% YoY; strong local smelting activity persists despite tariff risks. - Silver Outpaces Gold:

Silver surged about 5% to over $39 per ounce, briefly outperforming gold. Commerzbank suggests the rally was driven by catch-up buying rather than fundamentals. - Russia Sanctions Delayed:

U.S. held off on immediate new sanctions against Russia, easing fears of near-term oil supply disruption.

Europe

- Spanish Inflation Ticks Up:

June final CPI confirmed at 2.3% YoY, slightly above preliminary estimates. Core inflation remained steady at 2.2%. - Eurozone Industrial Rebound:

May industrial production jumped 1.7% MoM (expected +0.9%), driven by energy (+3.7%) and non-durable consumer goods (+8.5%). - Germany Sentiment Improves:

July ZEW current conditions rose to -59.5 (vs. -66 expected), while economic sentiment climbed to 52.7, boosted by hopes of resolving U.S.-EU trade tensions. - Equity Indices Lower:

Major indices ended in the red: Spain’s Ibex (-1.15%), Germany’s DAX (-0.35%), France’s CAC (-0.54%), Italy’s FTSE MIB (-0.66%), UK’s FTSE 100 (-0.66%). - EU Tariff Threat:

The EU drafted €72 billion in potential counter-tariffs on U.S. goods if no deal is reached by August 1.

Asia

- GDP and Activity Data:

China Q2 GDP rose 1.1% QoQ (+5.2% YoY), slightly beating expectations. June retail sales disappointed (+4.8% YoY vs. +5.6% expected), while industrial production surprised to the upside (+6.8% YoY). - Housing Pressures Continue:

June new home prices dropped 3.2% YoY, marking ongoing strain in the property sector. - PBOC Injects Liquidity:

China’s central bank added 1.4 trillion yuan (~$195 billion) via reverse repos to keep liquidity ample. - Trade and Tech Moves:

Nvidia will restart H20 GPU sales to China with U.S. government approval, supporting local chip supply chains. - Japan Election Jitters:

Investors eye Japan’s upcoming upper house elections; 10-year JGB yields hit 1.59%, the highest since 2008, amid fiscal policy uncertainty. - Australia Confidence:

July consumer sentiment rose slightly to 93.1, up from 92.6, though overall optimism remains fragile.

Crypto

- Bitcoin and Ethereum Pull Back:

Bitcoin fell below $117,000 after peaking at $123,218, as profit-taking kicked in ahead of U.S. inflation data. Ethereum dropped under $3,000 after stalling near $3,084. - XRP Volatility:

XRP dipped to $2.87, holding above $2.80 support, after hitting $3.03 Monday. Regulatory optimism from U.S. “Crypto Week” is providing a potential tailwind. - Meme Coins Mixed:

Dogecoin and Shiba Inu slid as traders booked profits. Meanwhile, Solana-based coins like BONK, PENGU, and WIF saw strong technical setups, eyeing further gains despite temporary resistance. - PEPE Activity:

PEPE cooled at $0.00001241 after nearly hitting its wedge breakout target. Futures open interest rose 33.5% to $685 million, signaling solid speculative appetite. - PI Token Whale Move:

A whale acquired 5.3 million PI tokens (~$2 million) despite the broader price decline. Exchange balances increased, suggesting potential further supply pressure.