North America News

U.S. Markets Slip as Tariff Uncertainty, Lack of EU Progress Weigh

U.S. equity markets gave up early gains and ended the session mixed, as fresh concerns emerged over stalled tariff talks between the U.S. and EU.

Closing snapshot:

- S&P 500: -0.2%

- Nasdaq Composite: flat

- Dow Jones Industrial Average: -0.4%

- Russell 2000: +0.1%

Sentiment was also shaken by United Airlines’ earnings guidance, which forecast 2025 EPS of $11.50–$13.50 in a stable environment, but only $7.00–$9.00 if a recession hits. The airline also projects Q2 EPS between $3.25 and $4.25, citing a potential 5-point revenue hit in a downturn.

With no major developments on the tariff front and negotiations with European counterparts making little headway, investors appear hesitant to make directional bets, keeping volatility contained for now.

Amazon Flags Tariff Pressure on Third-Party Sellers

Amazon is sounding the alarm about the impact of U.S. tariffs on Chinese imports, especially on its vast network of third-party sellers, who make up over 60% of its total sales.

Key developments:

- Amazon is actively collecting feedback from sellers

- Some are considering halting operations or delaying restocking

- Others are stockpiling inventory ahead of potential tariff hikes

- Despite tech product exemptions, the 145% tariffs are still squeezing margins

Amazon stock dipped 1.05% on the day, closing at $180.20.

Empire State Manufacturing Index Improves Slightly, but Outlook Tanks

The New York Fed’s April Empire State Manufacturing Index came in at -8.1, better than the -14.5 forecast and up from -20.0 in March. Still negative, but less bleak.

Breakdown:

- New orders: -8.8 (from -14.9)

- Shipments: -2.9 (from -8.5)

- Employment: -2.6 (from -4.1)

- Workweek: -9.1 (vs -2.5)

- Prices paid: 50.8 (vs 44.9)

- Prices received: 28.7 (vs 22.4)

Some areas improved—unfilled orders rose to 4.1 (from -2.1)—but work hours shrank, and inventories slipped to 7.4 (from 13.3).

Six-month forward :

The bigger concern lies ahead. The index for six-month expectations dropped from +12.7 to -7.4, the worst outlook since early 2020. Future orders and shipments are seen contracting, capital spending plans were basically flat, and price pressures are expected to worsen. Labor demand may hold up, but pessimism is clearly deepening across the board.

U.S. Import Prices Dip in March as Export Prices Hold Steady

March data from the U.S. showed import prices declining 0.1% month-over-month, missing the expected flat reading. February’s increase was revised down from +0.4% to +0.2%.

Meanwhile:

- Export prices were unchanged m/m, as forecast.

- Year-over-year, import prices rose 0.9%, down from 2.0% in February.

- Export prices rose 2.4% y/y, slightly above the prior 2.1%.

The data suggests trade-related inflation pressures are cooling, particularly on the import side, even as global price shifts and tariffs continue to reshape cross-border cost structures.

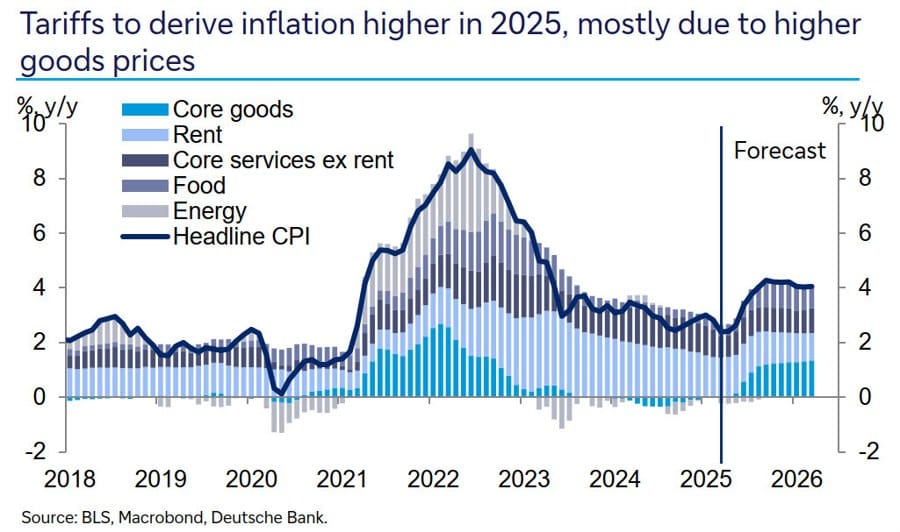

Deutsche Bank Slashes U.S. Growth Outlook, Sees Stagflation Risks Rising

Deutsche Bank has significantly lowered its U.S. GDP growth forecast for 2025, now projecting just +0.9% (Q4/Q4), down from earlier expectations.

Key drivers:

- Trade war fallout, financial tightening, and policy uncertainty

- Unemployment expected to rise to 4.6% (from current 4.1%)

- Core PCE inflation seen hitting ~3.75% by end-2025, about 1 percentage point above previous projections

- U.S. CPI forecast for 2026 raised to 3.2%, potentially delaying interest rate cuts

- The bank now sees a December rate cut, followed by two more in Q1 2026

Global implications:

- China’s 2025 GDP forecast lowered to 4.5%, assumes tariffs at 145%

- Xi is expected to announce a major fiscal stimulus before mid-year

- Eurozone growth forecast cut to 0.5%

- UK GDP revised to 0.8%, down from 1.0%

- Global GDP now seen at 2.9% in 2025, down from 3.2%

Deutsche Bank writes:

This potentially marks the largest shock to the world’s financial and trading system since the collapse of Bretton Woods in 1971. Although Trump’s 90-day tariff reprieve and subsequent exceptions have lessened the impact, much damage has already been done thanks to extreme levels of uncertainty around the credibility and direction of policymaking. The US’s exorbitant privilege of being able to comfortably fund its twin deficits is perhaps the largest consequence of recent events, and may ultimately determine how far the US administration is able to continue this policy.

Morgan Stanley and Citi Cut 2025 EPS Forecasts Amid Trade Risks

Wall Street giants Morgan Stanley and Citigroup have revised their 2025 earnings forecasts downward in response to the escalating tariff environment.

- Citi slashed its S&P 500 target to 5,800, down from 6,500, assuming earnings of $255/share (vs. $270 previously).

- Morgan Stanley now expects EPS of $257, a reduction from $271.

Both banks cited concerns that tariffs will undercut profit margins and weigh heavily on corporate earnings growth.

Goldman Sachs Estimates 500K U.S. Job Losses from Tariffs

Goldman Sachs has flagged a potential loss of 500,000 U.S. jobs tied to the broader impact of Trump’s trade tariffs. Their analysis, informed by academic research, found that while protected sectors might see modest job gains, the net employment effect is negative.

For every 1 percentage point increase in tariffs, employment in protected industries could rise 0.2% to 0.4%, but job losses in downstream sectors could amount to 0.3% to 0.6%.

Scaling that to the U.S. economy, Goldman predicts a gain of just under 100,000 jobs in manufacturing, but a loss of around 500,000 in downstream roles due to increased input costs.

BofA CEO: Consumer Spending Still Holding Up — For Now

Bank of America CEO Brian Moynihan told CNBC that U.S. consumer spending hasn’t slowed yet, but he emphasized the word “yet,” warning that job losses could change that dynamic quickly.

Key points:

- Spending patterns are consistent with around 2% economic growth

- Moynihan is concerned that the trade war could escalate into services, which would be far more damaging

- He stressed the importance of supporting U.S. service exports

- Despite macro uncertainty, deposit performance has exceeded expectations

- The bank is “prepared for stress scenarios” if conditions worsen

BofA Survey: Fund Managers Bet Against the Dollar, Shift Out of U.S. Equities

Bank of America’s latest Fund Manager Survey (FMS) shows a growing consensus that:

- 61% expect the U.S. dollar to weaken in the next 12 months

- U.S. equity allocations fell 53 percentage points in two months (record drop)

- U.S. equities now sit at net 36% underweight, the lowest since May 2023

- Global equities also underweight at net 17%

Additional findings:

- Cash holdings rose to 4.8%, the biggest two-month increase since April 2020

- 73% say “U.S. exceptionalism” has peaked

- “Long gold” cited as the most crowded trade by 49%

- 82% believe the global economy will weaken, a 30-year high

- 42% anticipate a recession

- A record number of fund managers plan to cut U.S. equity exposure

Nissan to Slash Rogue SUV Output in Japan Due to U.S. Tariffs – Report

Nissan is reportedly planning a significant cut to domestic production of its top-selling U.S. model, the Rogue SUV, due to the impact of American trade tariffs. According to a source cited by Reuters, the automaker will reduce output at its Kyushu plant by 13,000 units from May through July.

The reduction amounts to about 20% of the 62,000 Rogue units sold in the U.S. during Q1 of this year. Production halts are expected on some days. In 2024, the Rogue was Nissan’s best-selling model in the U.S., accounting for over 246,000 units, or more than a quarter of its U.S. total.

G7 finance ministers, central bank governors to hold meeting in the US – report

- The meeting is said to take place as early as 23 April

This according to Kyodo News. This will definitely be an interesting one to watch out for when it happens. But unless Trump is also involved in the meeting, I reckon it might not lead to much. The meeting is expected to take place in Washington.

Deutsche Bank Now Expects Fed Rate Cut in December

Deutsche Bank has shifted its outlook on U.S. monetary policy, now predicting a 25 bps Fed rate cut in December, reversing its prior call for no cuts in 2025.

The bank also expects:

- Two additional 25 bps cuts in Q1 2026

- A terminal rate of 3.5%–3.75%

Deutsche Bank said upcoming speeches from Fed Chair Powell (April 16) and key regional surveys like Empire State and Philadelphia Fed will be crucial. They expect both data points to reflect worsening sentiment due to recent policy shifts from the Trump administration.

Goldman Sachs CEO: Recession Risk Is Rising

Goldman Sachs CEO David Solomon warned that the odds of a recession have increased, citing mounting uncertainty from trade policies and global economic slowdown.

Speaking after the bank’s Q1 results, Solomon said:

- Firms are struggling to make long-term decisions.

- New tariffs have reset the global growth outlook.

- There’s a growing disconnect between expected demand and actual planning.

- Clients are particularly wary of making large investments in the current environment.

Solomon called the current outlook a “material risk” to both the U.S. and global economy.

Fed’s Bostic: Inflation Above Target, Policy Path Still Unclear

Atlanta Fed President Raphael Bostic offered a blunt assessment of the current economic landscape, saying inflation remains too high, and the outlook is clouded by significant uncertainty.

Highlights from his remarks:

- The “range of possible outcomes has exploded.”

- The U.S. economy is in a pause, with businesses hesitant to invest.

- Tariffs are expected to push inflation timelines further out.

- Bostic expects GDP growth to top 1%, but says more clarity is needed before acting.

- He cautioned against “moving boldly” without a clearer view and noted immigration constraints affecting some labor markets.

CNBC Survey: Tariffs May Undermine U.S. Manufacturing Reshoring

A CNBC Supply Chain survey reveals that Trump’s tariffs could backfire on efforts to bring manufacturing back to the U.S.. Most firms surveyed said reshoring would double their costs, leading them to seek low-tariff regions instead.

Key findings:

- 81% of firms open to reshoring would automate rather than hire U.S. workers.

- 61% expect consumer prices to rise, with weaker demand ahead.

- 63% now see a recession as their base case.

The report underscores the disconnect between political reshoring goals and business realities in a globalized economy.

Link here to the CNBC piece for more.

Canadian Inflation Slows Sharply in March, Opening Door for Rate Cut

Canada’s March CPI report came in softer than expected, adding pressure on the Bank of Canada ahead of its rate decision this Wednesday.

Key figures:

- Headline CPI: +2.3% y/y (vs 2.6% expected)

- Monthly CPI: +0.3% (vs +0.6%)

- Core CPI m/m: +0.1% (down from +0.7%)

- Core CPI y/y: +2.2% (vs 2.7%)

- CPI Median: 2.9%

- CPI Trim: 2.8%

- CPI Common: 2.3%

Price drops were notable in airfare (-12%), travel tours (-4.7%), and cell phone services (-8.8%), thanks to ongoing telecom competition. The expiration of the GST tax holiday on February 15 softened the disinflation trend, but overall, the deceleration in inflation gives the BoC the flexibility to signal or implement a cut as early as June.

Canadian Housing Starts Continue Slide as Urban Slowdown Deepens

Canada’s housing market cooled further in March, with housing starts falling to 214,200 units, well below the 242,500 expected. This marks another leg down from 267,300 units in November, pointing to a broader slowdown—particularly in key urban centers.

Compared to a year ago:

- Starts fell 11.6% nationally

- Toronto: -65%

- Vancouver: -59%

- Montreal: +138% (a rare outlier)

The numbers reflect the ongoing unraveling of the Toronto condo boom and tighter credit conditions across the board. With activity declining sharply in major metro areas, the national trend is likely to stay weak into mid-year unless financing conditions ease.

Commodities News

Gold Holds Above $3,200 as Trade Risks Drive Safe-Haven Demand

Gold prices remain firm above $3,200, buoyed by growing recession fears and lingering uncertainty around U.S. tariff policy. Spot gold was last seen trading near $3,230, just below Monday’s high of $3,245, which marked a new all-time record.

The risk environment remains tense after President Trump’s 125% tariff hike on Chinese goods, which is expected to strain global trade. Investors are flocking to safe-haven assets like gold as fears grow that China will redirect exports to other markets, intensifying competition and supply shocks.

Adding to gold’s momentum is the rising expectation that the Federal Reserve will cut rates in June. Fed Governor Christopher Waller acknowledged that the tariff shift represents one of the most significant economic shocks in decades and backed rate cuts to cushion the impact.

Technical outlook: Gold remains supported above its 20-day EMA ($3,090) with the RSI above 60, indicating strong bullish momentum. Immediate resistance is seen at the $3,300 round level, with support anchored at the EMA zone.

Crude Oil Stalls Again as Market Awaits Breakout Signal

WTI crude oil was little changed on Tuesday, trading around $61.44, as prices remain rangebound for a second straight session.

The day’s high touched $62.06, where the price again ran into resistance at the 200-hour moving average ($61.54)—a level that sellers have defended two days in a row. On the downside, the 100-hour moving average ($60.92) has acted as support.

With the 100- and 200-hour MAs now converging, traders are closely watching for a decisive breakout in either direction. A move above the 200-hour MA would suggest bullish continuation, while a break below the 100-hour MA would shift sentiment bearish.

Until then, momentum remains neutral as the market digests global growth risks and ongoing trade tensions.

China’s Copper Imports Fall, While Steel Exports Rise – ING

ING analysts report that China’s copper imports declined 1.4% YoY in March to 467,000 tonnes, while cumulative Q1 imports fell 5.2%.

Contributing factors:

- U.S. arbitrage drew more copper to COMEX, away from China

- Copper concentrate imports rose 2.7% YoY in March

- Steel exports increased 5.7% YoY in March, continuing a positive trend (+6.3% YTD)

On the precious metals side, China’s central bank reportedly issued new gold import quotas amid strong haven demand. COMEX gold inventories, which had surged earlier, are now falling as gold was excluded from recent tariffs.

Gold Hits Record High Amid Tariff Uncertainty and Dollar Weakness

Gold prices surged to a new record $3,245/oz this week, driven by rising demand for safe-haven assets, a weakening dollar, and tariff-related market stress.

Commerzbank highlights:

- Initial optimism from tariff exemptions on electronics faded quickly as new sectoral tariffs loom

- The U.S. dollar’s declining status is pushing investors toward gold

- Inflows into major gold ETFs suggest strong institutional interest

Rate policy divergence is also in play:

- The ECB is expected to cut rates soon and signal more easing

- The Fed’s path remains unclear, though the market still anticipates a June cut

- Fed officials like Neel Kashkari have recently downplayed the urgency of cutting rates, potentially capping gold’s upside in the near term

IC Markets: A Top-Tier Broker for Serious Gold Traders

When it comes to trading Gold, not all brokers are created equal. For traders who demand tight spreads, rapid execution, and institutional-grade reliability, IC Markets stands out as one of the best in the business.

With spreads starting from just 0.1 pips and leverage of up to 1:500, IC Markets offers one of the most cost-effective trading environments available today. These ultra-low costs, combined with lightning-fast order execution, make it a top choice for scalpers, day traders, and anyone operating in fast-moving Gold markets. Even in high-volatility conditions, IC Markets delivers minimal slippage, thanks to its deep liquidity pool sourced from top-tier financial institutions.

Traders can choose from MetaTrader 4, MetaTrader 5, or cTrader, each offering robust charting tools, support for algorithmic trading, and customizable indicators. Whether you’re manually trading breakouts or running a fully automated Gold strategy, the platform flexibility ensures you’re covered.

New to the game? IC Markets also offers demo accounts, so you can test strategies risk-free before going live.

Security and regulation are also on point. IC Markets is fully licensed by ASIC (Australia), CySEC (Cyprus), and the FSA (Seychelles). And with 24/7 multilingual support, help is always just a message away.

Bottom line: If you’re serious about trading Gold—whether you’re hedging against inflation, speculating on price swings, or executing high-frequency strategies—IC Markets delivers the speed, cost-efficiency, and reliability you need in 2025.

More info here.

China’s Crude Imports Jump to 18-Month High in March

China’s crude oil imports surged to 12.1 million barrels per day in March, the highest level in over 18 months, according to Commerzbank.

Key sources:

- Iran and Russia led the gains, with Iranian barrels flowing heavily into Shandong province

- Vortexa data showed a spike in seaborne imports

- Some refineries stocked up ahead of U.S. sanctions tightening

However, the jump is likely temporary:

- China’s oil product exports fell in Q1

- Export quotas have been lowered, capping refinery output

- Crude intake may drop back in the coming months

IEA Cuts Oil Demand Growth Outlook for 2025, 2026

The International Energy Agency (IEA) has lowered its forecast for global oil demand growth:

- 2025: revised down to 730K barrels/day, from 1.03M

- 2026: expected at 690K barrels/day

On the supply side, 2025 output is seen at 1.2M barrels/day, a 260K drop due to lower production in the U.S. and Venezuela.

IEA’s report reflects the dampening effects of trade friction on global energy demand.

Europe News

European Stocks Rise Despite Slump in German Confidence

European markets closed higher on Tuesday, brushing off disappointing data from Germany. The ZEW Economic Sentiment Index for Germany fell sharply to -14.0 in April (from 51.6), undershooting expectations of 9.5.

Still, investors bought the dip:

- German DAX: +1.43% to 21,253.71 (above its 100-hour MA of 20,947.96)

- France’s CAC: +0.86% to 7,138.41

- UK FTSE 100: +1.41% to 8,349.11

- Spain’s Ibex: +2.14% to 12,879.30

- Italy’s FTSE MIB: +2.39% to 35,843.81

Despite worsening sentiment, EU officials indicated that tariffs are likely to stay in place as talks with the U.S. stall.

Eurozone Industrial Production Beats Forecasts in February

Eurostat reported that Eurozone industrial output rose 1.1% m/m in February—sharply above the 0.3% expected.

Breakdown:

- Capital goods: +0.8%

- Non-durable consumer goods: +2.8%

- Intermediate goods: +0.3%

- Offsets: Energy (-0.2%), durable consumer goods (-0.3%)

The upward surprise suggests the sector had momentum early in Q1 despite trade headwinds.

Germany’s ZEW Economic Outlook Crashes as Tariffs Cloud Sentiment

Germany’s ZEW survey for April revealed a dramatic collapse in economic expectations:

- Economic sentiment: -14.0 (vs. +9.5 expected; prior 51.6)

- Current conditions: -81.2 (vs. -86.8 expected)

ZEW attributed the plunge to “erratic U.S. trade policy”, stating that reciprocal tariffs are fueling global uncertainty and undermining growth expectations.

Germany Wholesale Prices Decline in March

Germany’s wholesale price index fell 0.2% in March, missing expectations for a 0.6% gain, according to Destatis. Year-on-year, wholesale prices rose 1.3%, down from 1.6%.

Despite the monthly dip, the index level remains elevated at 117.9, above the 2023 average of 116.4. The pullback comes after a surge in February, reflecting some cooling in price pressures.

France Inflation Steady at 0.8% in March Final Reading

Final data from INSEE confirmed France’s CPI held steady at +0.8% year-on-year in March, in line with preliminary figures. The harmonized index (HICP) also remained unchanged at +0.9%.

Core inflation stayed at 1.3%, matching February’s level—offering the ECB some comfort, especially as France looks less exposed to U.S. tariffs compared to peers like Germany.

UK Jobless Rate Steady at 4.4%, But Payrolls Shrink

UK labor market data for February showed the ILO unemployment rate unchanged at 4.4%, matching expectations. However, underlying job growth slowed, and wages edged down slightly:

- Employment change: +206K vs. +170K expected

- Average weekly earnings (inc. bonus): +5.6% y/y

- Ex-bonus: +5.0% y/y vs. +6.0% expected

- March payrolls: -78K (previous revised from +21K to -8K)

Though the jobless rate held, payrolls declined by 0.1% in Q1, and pay growth flattened—signaling emerging cracks beneath headline stability.

UK Consumer Spending Holds Steady in March Amid Tariff Worries

British consumer spending in March was modestly resilient, though early signs of stress are emerging, especially in broader consumption patterns.

- BRC retail sales: +1.1% y/y (unchanged from February)

- Like-for-like sales: steady at +0.9%

BRC CEO Helen Dickinson noted surprising strength in both food and non-food categories, suggesting underlying demand remains firm.

In contrast, Barclays’ broader spending data (debit/credit cards) showed:

- +0.5% y/y growth, down from 1.0% in February

- Supermarket spending fell 2.6%

- Warmer weather lifted sales at garden centres and specialty retailers

Barclays Chief UK Economist Jack Meaning expects spending to remain subdued through mid-2025, with a gradual recovery anticipated in 2026 as rate cuts and economic stabilization take hold.

EU expects tariffs to remain as talks make little progress

- Report from Bloomberg

The report said:

- After a two-hour meeting, EU trade chief Maros Sefcovic left unclear on US goals.

- The US officials indicated that the 20% “reciprocal” tariffs — which have been reduced to 10% for 90 days — as well as other tariffs targeting sectors including cars and metals would not be removed outright

- The US would like to see European chemical firms produce more precursors used in the pharmaceutical industry in the US, integrate supply chains, have preferential procurement and suggested the bloc should increase the price of its medicines

- Trump officials have so far shown little appetite in exploring more LNG purchases to avoid tariffs

- US said has insisted on discussing what the US perceives as non-tariff barriers such as digital and artificial intelligence regulations as well as food standards

Asia-Pacific & World News

China’s Premier Li Acknowledges External Shocks, Calls for Trade Diversification

Chinese Premier Li Qiang addressed mounting external pressures, urging companies to diversify foreign trade markets and stabilize export activity amid shifting global dynamics.

Speaking via state media, Li also emphasized:

- Greater efforts to boost domestic consumption

- Expanded focus on employment stability and income growth

- Recognition that China’s property market still has considerable room to develop

- A pledge to calmly manage economic challenges stemming from external shocks

China: “We’ll Extend a Hand, Not Throw a Punch” Amid Trade Tensions

China’s Foreign Ministry issued a measured response to trade escalation, saying it remains committed to cooperation, not confrontation.

A spokesperson said China will:

- Trade with more partners globally

- Position itself as a magnet for foreign investment

- Remain resilient in the face of external uncertainties

While the tone was less combative, the message signaled no intent to concede—only to diversify relationships beyond the U.S.. No signs of a formal negotiation path were offered.

China Suspends Boeing Jet Deliveries Amid Trade Dispute – Report

In a fresh blow to U.S. aerospace, China has reportedly directed its airlines to halt deliveries of Boeing aircraft, according to a Bloomberg report citing sources familiar with the decision.

The order also includes a freeze on purchases of aircraft-related equipment and parts from American firms. With Airbus already holding a dominant position in the Chinese aviation market, the move further dims Boeing’s hopes of regaining share—especially as China is projected to account for 20% of global aircraft demand over the next two decades.

UBS Slashes China GDP Outlook for 2025 to 3.4% Amid Tariff Pressure

UBS has downgraded its forecast for China’s economic growth in 2025, citing persistent trade tensions and the expectation of continued tariff enforcement. The bank now sees China’s GDP expanding just 3.4%, down from its earlier projection.

The revision assumes current tariffs remain in place and that Beijing will launch additional stimulus measures to support the economy. UBS acknowledged significant uncertainty around the estimate, noting a “high margin of error” given evolving global dynamics and internal policy responses.

Chinese police put 3 U.S. operatives on wanted list over cyberattacks

- Chinese state media, Xinhua, report

Police in Harbin, northeastern China, announced on Tuesday that they are seeking three U.S. National Security Agency operatives suspected of conducting cyberattacks on the city during February’s Asian Winter Games.

According to the Harbin public security bureau, the individuals were linked to the NSA’s Office of Tailored Access Operations, which allegedly targeted critical IT infrastructure for the event, including systems handling registration, travel logistics, and competition entries.

Chinese investigators said the attacks aimed to access sensitive personal data and were disguised through front companies that procured global IP addresses and rented overseas servers to mask the source. Authorities say the investigation is ongoing.

Info comes via Xinhua, link for more.

PBOC sets USD/ CNY central rate at 7.2096 (vs. estimate at 7.3094)

- PBOC CNY reference rate setting for the trading session ahead.

RBA Minutes: May Meeting Seen as Crucial Juncture

Minutes from the Reserve Bank of Australia’s March 31–April 1 meeting show the central bank holding off on immediate action, but identifying the May meeting as a potential turning point.

Key takeaways:

- The board said it’s too early to adjust rates in response to risks.

- Acknowledged global uncertainties, including U.S. tariffs, could affect Australia’s outlook.

- Trimmed mean inflation likely fell below 3% in Q1.

- The labor market remains tight, though there’s a chance it’s not as constrained as previously thought.

- Wage growth may be easing; productivity remains weak.

- Consumer demand appears to be strengthening, not just due to seasonal promotions.

- No changes planned to the pace of winding down government bond holdings.

New Zealand Food Prices Rebound in March

New Zealand’s food prices rose 0.5% month-over-month in March, reversing February’s 0.5% decline. On an annual basis, the Food Price Index increased 3.5%, up from 2.4% in the previous reading.

The index tracks the average price changes of grocery and food items across New Zealand, making it a key inflation component in consumer budgets.

RBNZ’s Conway Flags Weaker Global Outlook as Risks Shift

Reserve Bank of New Zealand Chief Economist Paul Conway warned that higher tariffs and ongoing global trade uncertainty are tilting economic risks to the downside.

Conway said global economic activity—and that of New Zealand—will likely underperform earlier projections. While the inflation impact remains less clear, the broader risk balance has shifted negatively.

He expressed hope that pre-pause U.S. tariff levels represent a worst-case scenario but acknowledged the path forward is highly uncertain.

Senior BOJ official cites Trump tariffs as a cause of volatile market moves

- “Due in part”

Senior BOJ official:

- Markets, particularly U.S. stocks, long-term interest rates, making volatile moves due in part to U.S. tariff policy

- Unlike during global financial crisis, we are not seeing sharp shrinkage of liquidity

- BOJ will continue to scrutinise market developments and their impact on Japan, overseas economies

Japan finance minister Kato says negative impacts of excessive FX volatility

- Kato says Have agreed with Bessent to closely communicate on forex

- Planning to attend spring meetings of IMF, World Bank in Washington

- Forex rates should be determined by markets

- Excessive volatility would negatively affect economic and financial stability

- Have agreed with Bessent to closely communicate on forex

- Closely monitoring financial markets as they have been unstable recently

Ex BOJ official says Bank to hold, not hike: “will be in a wait-and-see mode for a while”

- Bank of Japan forecast

Bloomberg with a piece citing an ex-BOJ official. The Bank of Japan is likely to hold off on further rate hikes for now amid growing uncertainty from U.S. trade policy, according to former BOJ executive director Kenzo Yamamoto.

Speaking ahead of U.S.-Japan trade talks, Yamamoto said, “They will be in a wait-and-see mode for a while,” pointing to the unclear scope of a 90-day tariff reprieve and the need to observe how negotiations unfold.

With Japan’s economy vulnerable to shocks from rising U.S. tariffs and a strengthening yen, the BOJ is seen as reluctant to tighten further in the near term. Yamamoto warned that the recent 10% rise in the yen could squeeze export profits and weigh on business investment and wages.

While inflation has exceeded 2% since 2022, the BOJ continues to defend its slow pace of policy normalisation, insisting the inflation trend remains uncertain. “The BOJ seems too focused on having the 2% inflation target achieved for such an extended period of time,” Yamamoto said, cautioning that this approach risks delaying much-needed rate adjustments in an increasingly volatile global environment.

Bank of Korea seen holding rates this week, but cuts expected soon

- April 17 meeting

The Bank of Korea is expected to keep its benchmark interest rate steady at 2.75% at its April 17 meeting, according to a Reuters poll of economists.

- Of the 37 surveyed, 24 anticipate no change, while 13 foresee a 25 basis point cut.

This would mark the second pause since the central bank began easing rates in October, with policymakers now assessing the economic fallout from U.S. President Trump’s tariff actions and recent currency market volatility. Exports make up nearly half of South Korea’s GDP, leaving the economy especially sensitive to trade disruptions.

Despite the likely hold, most economists still expect the BOK to resume cutting rates from May, with 27 of 30 predicting a reduction to 2.50% next month and further easing to 2.25% by the end of Q3 — unchanged from the February poll.

Morgan Stanley:

- a “dovish hold” is expected this week as the BOK navigates tariff uncertainty and sharp FX swings

- downward revision to the bank’s growth outlook in May is now likely.

Crypto Market Pulse

Ethereum Staking Balance Falls as Whales Begin Accumulating Again

Ethereum (ETH) dropped 2% on Tuesday as data showed a decline of 120,000 ETH in total staked value over the past five days, signaling potential selling pressure. However, that bearish signal is being counterbalanced by a return of whale accumulation.

Whales holding between 10,000 and 100,000 ETH have bought back 320,000 ETH in the past 24 hours, reversing a two-week stretch in which they sold over 570,000 ETH. The renewed buying comes as exchange supply increased by nearly 400,000 ETH since the start of April, adding to concerns about short-term selloffs.

From a technical view, ETH is hovering near support of an ascending triangle at the $1,600 level. If that floor holds, bulls may push toward resistance at $1,688 and potentially test $1,800.

Liquidation data from Coinglass shows over $34.3 million in futures positions were wiped out in the last 24 hours, mostly from longs. If whale buying sustains and staking outflows slow, Ethereum could stabilize and resume upward momentum.

Tether Backs Fizen to Expand USDT Utility and Target $8.9 Trillion Payments Market

Tether has made a strategic investment in Fizen Limited, a fintech firm focused on crypto payments and self-custody wallets, marking a major move to advance the adoption of USDT in real-world transactions.

Fizen bridges the gap between blockchain and everyday commerce, offering merchants seamless fiat settlement for crypto transactions using familiar methods like QR codes and card terminals. This infrastructure enables users to pay with stablecoins while merchants receive local currency, removing volatility and onboarding hurdles.

Tether CEO Paolo Ardoino said the deal reflects the company’s commitment to expanding global access to digital finance and promoting the informed use of stablecoins in everyday life.

The partnership aims to push financial inclusion, particularly in underserved regions where banking access is limited. Fizen’s smartphone-based wallet and intuitive interface allow users to engage with crypto without needing advanced technical knowledge.

The global potential is vast. According to Juniper Research, QR code payments are expected to hit $5.4 trillion in 2025 and exceed $8 trillion by 2029, with over 2.2 billion users globally. By tapping into this trend, Tether is positioning USDT to compete in a market worth nearly $9 trillion in annual transaction volume.

Altcoin Traders Hit by Liquidations as Bitcoin Dominance Grows

Traders betting on XRP, Dogecoin (DOGE), and Mantra (OM) faced heavy losses in the last 24 hours due to long liquidations—even as prices showed mild recovery.

Liquidation data:

- XRP: $2.24M in long liquidations; trades at $2.15

- DOGE: $3.39M in longs wiped out; trading at $0.159

- Mantra (OM): $8.85M in long liquidations; OI collapsed from $345M to $136M

Key trend: The altcoin season index remains weak, as Bitcoin dominance climbs to 63.85%, nearing a 4-year high. Traders are pivoting away from altcoins, delaying hopes of a broader crypto rotation.

Canada Approves First Solana ETFs with Staking

Canada just greenlit the world’s first spot Solana ETFs, including staking functionality, making a big leap ahead of U.S. regulators.

Details:

- Launch date: April 16, 2025

- Issuers: Purpose, Evolve, CI Global AM, and 3iQ

- ETFs will hold actual SOL tokens and allow on-chain staking

- Staking yields could exceed those of Ethereum, according to TD Bank

Meanwhile, U.S. Solana ETF proposals from Bitwise, Grayscale, and others remain under SEC review, with VanEck’s decision due May 19.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States: Tariff Fog Hangs Over Economy, Market Cautious

Empire State Manufacturing Index improved to -8.1 (from -20.0), but forward-looking sentiment collapsed, with the six-month outlook dropping to -7.4, signaling rising pessimism.

Import prices declined -0.1% in March, while export prices remained flat. Year-over-year, price growth is easing, pointing to cooling trade inflation.

Consumer spending still resilient, per Bank of America’s CEO, though he warned a downturn could follow job losses.

Goldman Sachs and Morgan Stanley revised down 2025 earnings expectations for S&P 500 firms due to tariffs.

Deutsche Bank now sees U.S. GDP at 0.9% in 2025, with core PCE inflation at 3.75%, citing stagflation risks.

Markets closed slightly lower, with the S&P 500 down 0.2%, Dow -0.4%, Nasdaq flat. Lack of tariff resolution with the EU kept sentiment subdued.

Canada: CPI Drop Clears Path for Rate Cut

March CPI came in softer than expected at +2.3% y/y, down from 2.6%. Core inflation also slowed, reinforcing expectations for a June Bank of Canada rate cut.

Housing starts fell sharply, dropping to an annualized 214.2K vs. 242.5K expected. Toronto and Vancouver saw steep declines in activity.

This data gives the BoC room to act as domestic growth cools alongside softer inflation.

Commodities: Gold Steady, Oil Awaits Direction

Gold remains elevated, holding near $3,230–$3,245, supported by Fed rate cut expectations and safe-haven demand driven by tariff fears. Fed’s Waller called new trade policy “one of the biggest shocks in decades.”

WTI crude oil is directionless for now, trading in a tight range between support at $60.92 and resistance at $61.54. Traders are waiting for a breakout.

IEA cut global oil demand forecasts, projecting just 730K bpd growth in 2025 amid rising trade frictions and weak global activity.

Europe: Equities Up Despite Confidence Collapse

ZEW economic sentiment in Germany fell off a cliff to -14.0 from 51.6 as tariffs dampen outlook. Current conditions improved slightly.

France’s CPI held steady at +0.8% y/y, while Germany’s wholesale prices slipped -0.2%, easing some inflationary pressure.

European indices rose, with the DAX up 1.43%, and all major indices finishing above their 100-hour moving averages despite macro uncertainty.

Asia & Rest of the World: China’s Trade Pivot Deepens

China’s Premier Li acknowledged drastic external changes, urging exporters to diversify markets and focus on domestic demand.

Boeing setback: China reportedly told its airlines to halt Boeing jet deliveries and parts purchases, escalating trade retaliation.

Nissan to cut Rogue SUV production in Japan by 13,000 units from May to July due to U.S. tariffs, a direct impact on auto supply chains.

Crypto: Mixed Momentum as Stablecoins Advance and Altcoins Struggle

Tether’s investment in Fizen could reshape real-world stablecoin use. The goal: make USDT a go-to payment option, especially in unbanked and emerging markets. With QR code payments forecast to exceed $8.9 trillion globally by 2029, this move is about real-world traction—not just speculation.

Ethereum (ETH) is under pressure. Total value staked has dropped by 120K ETH in five days, signaling a possible shift to distribution. At the same time, whales have resumed buying, scooping up 320K ETH in 24 hours after dumping over 570K ETH this month. ETH is trying to hold $1,600 support.

Altcoins underperform: Traders betting long on XRP, DOGE, and OM (Mantra) took heavy hits with millions in liquidations. OM’s open interest dropped sharply, and its long/short ratio slipped below 1—pointing to possible more downside.

Canada approved the world’s first spot Solana ETFs with staking. Unlike U.S. proposals, these funds will hold actual SOL and allow staking rewards. Launch is set for April 16, giving SOL a unique edge in the ETF race.