North America News

U.S. Stocks Post Sharpest One-Day Drop Since October

U.S. equity markets saw their biggest daily decline in more than a month on Thursday, as a broad-based selloff hit Wall Street with little apparent catalyst.

Closing levels:

- S&P 500: -1.6%

- Nasdaq Composite: -2.3%

- Dow Jones Industrial Average: -1.6%

- Russell 2000: -2.9%

The reversal came just a day after a strong rally, leaving traders puzzled by the abrupt shift in sentiment. While investors continue to debate AI spending risks and uncertainty over a December Fed rate cut, neither factor represented new information compared with yesterday’s bullish session. The move reflects growing market sensitivity to positioning and valuation levels after recent record runs in large-cap tech.

U.S. Treasury 30-Year Bond Auction Draws Weak Demand

The U.S. Treasury sold $25 billion in 30-year bonds on Thursday at a high yield of 4.694%, coming in 1 basis point above the when-issued level of 4.684%, signaling softer demand.

Auction results:

- High yield: 4.694%

- WI level: 4.684%

- Tail: +1.0 bps (vs. 6-month avg 0.3 bps)

- Bid-to-cover: 2.29x (vs. 6-month avg 2.36x)

- Directs: 14.50% (vs. 26.0% avg)

- Indirects: 70.99% (vs. 61.6% avg)

- Dealers: 14.51% (vs. 12.4% avg)

The higher tail and weaker bid-to-cover ratio point to below-average investor appetite. Domestic demand lagged recent norms, while foreign participation rose, leaving dealers with a larger-than-usual allocation. Overall, the auction outcome was viewed as soft, continuing a recent streak of tepid long-end demand.

Disney Shares Slide 8% After Mixed Earnings

Walt Disney Co. shares plunged nearly 9% to their lowest since May after the company reported flat revenue and mixed results across divisions in its fiscal fourth-quarter earnings.

Earnings per share: $1.11 (vs. $1.05 expected)

Revenue: $22.5 billion (flat year-on-year, below $22.75 billion estimate)

Streaming remains a bright spot, with direct-to-consumer profits up 39% to $352 million and Disney+ and Hulu adding 12.5 million subscribers, bringing the total to around 196 million.

Parks & Experiences operating income rose 13% to $1.88 billion, supported by strong cruise and Disneyland Paris activity.

The weakness came from the Entertainment and TV divisions, where operating income fell more than one-third to $691 million. Traditional TV profits declined 21% to $391 million, while ESPN earnings also slipped.

Despite the hit, Disney raised its dividend by 50% to $1.50 and expanded share buybacks. CEO Bob Iger said the company is “positioned to continue growing streaming” into fiscal 2026 as it leans harder into its direct-to-consumer transition — a shift that remains central to Disney’s long-term strategy.

Fed’s Musalem: Outside of data centers, business investment has been tepid

- Fed’s Musalem speaking now

- Outside of data centers, business investment has been tepid

- Business learning how to run their firms in uncertain environment

- Critical to return to having readily available official data that has integrity.

- We are not flying blind though.

- Have a reasonable picture of what the economy is doing

- Expected 4th-quarter weakness, rebound 1st quarter with next year at or above potential.

- Very accommodative financial conditions and deregulation are tailwinds.

- Expect labor market to stay around full employment, likely to soften a little, get the 4.5% unemployment.

- Expects impact of tariffs to fade by 2nd half of next year

- Expects inflation the ball starting 2nd half of next year, provided we have appropriate monetary policy.

- Supported rate cuts so far to protect labor market.

- Limited room to ease without becoming overly accommodative

- Closer to neutral than modestly restrictive.

- Need to continue to lean against inflation.

Fed’s Kashkari: Inflation Still Too High at 3%

Minneapolis Federal Reserve President Neel Kashkari said on Thursday that inflation remains too high at around 3%, and the central bank continues to receive mixed signals from the economy.

Kashkari noted that some parts of the labor market are showing stress, even as others remain strong, suggesting policy decisions will require careful calibration. His remarks reinforce the Fed’s cautious tone as officials assess whether inflation progress is sufficient to justify rate cuts in the coming months.

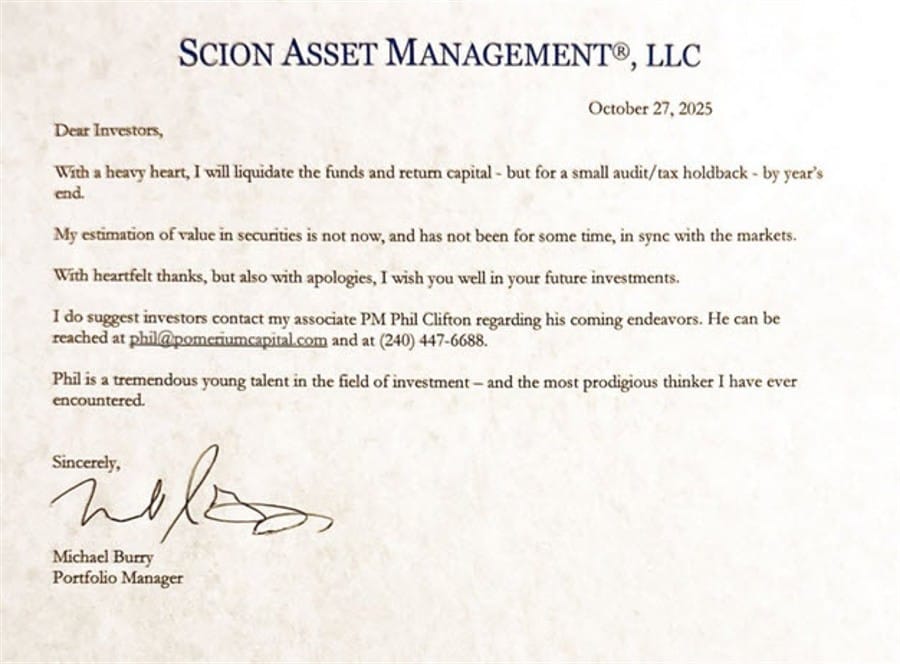

Michael Burry to Shut Hedge Fund, Transition to Family Office

Famed short-seller Michael Burry is closing his hedge fund and converting it into a family office, ending an era that drew outsized attention from markets and media alike.

Burry’s recent regulatory filings showed heavy put positions in Palantir and Nvidia, but those options were tied to third-quarter holdings that ended September 30, leaving him deep in the red despite subsequent declines in both stocks. The investor — best known for his bet against subprime mortgages before the 2008 crisis — now appears to be stepping back from professional fund management altogether.

Fed’s Daly: Too Early to Call December Decision; Hammack Warns on Sticky Inflation

San Francisco Fed President Mary Daly said it’s premature to determine whether the central bank will cut rates in December, emphasizing the need for more data before making a decision. Daly said the economy retains “cautious optimism” but noted inflation remains stubborn and the labor market has slowed.

Separately, Fed Governor Adriana Kugler Hammack told MarketWatch that inflation pressures are persisting, driven mainly by services rather than imported goods. She highlighted that many contracts will be renegotiated early next year, potentially reigniting pricing pressures.

Hammack dismissed suggestions that the Fed might tolerate inflation just below 3%, saying “getting it back to 2% is critical for our credibility.” She added that while she doesn’t foresee a labor-market downturn, monetary policy may have limited room to do more for employment.

Microsoft to Integrate OpenAI Chip Designs Into Its Hardware Plans

Microsoft is set to incorporate OpenAI’s custom chip designs into its own AI hardware development, CEO Satya Nadella said in a podcast released Wednesday. The company will leverage OpenAI’s semiconductor and system innovations through 2030, with extended access to OpenAI’s models until 2032 under their renewed partnership. OpenAI, working with Broadcom on AI processors, is helping Microsoft industrialize these designs for broader use across its cloud and AI operations. The deeper integration underscores Microsoft’s strategy to tighten control over its AI stack and reduce reliance on third-party chip suppliers.

Trump Signs Bill to End Record U.S. Government Shutdown

President Donald Trump has signed a funding bill reopening the U.S. government after a record 43-day shutdown. The measure funds operations through the end of January. Trump acknowledged the shutdown caused significant damage — estimated at $1.5 trillion — and said recovery could take weeks. He called for an end to government shutdowns, adding that Americans “should have money for health care and direct payments.”

Fed’s Collins: Inflation Still Too High to Ease Restrictive Policy

Boston Fed President Susan Collins said the recent two-step reduction in interest rates was the right move given current risks but warned inflation remains too high for the central bank to ease up entirely. Speaking in a Q&A after her earlier address, Collins said policy must stay “mildly restrictive” to ensure continued disinflation. She also underscored the importance of Fed independence, noting that a data-driven approach allows policymakers to focus on long-term stability rather than short-term political or market pressures.

USDA: Full SNAP Benefits to Resume Within 24 Hours After Shutdown Ends

The USDA said full Supplemental Nutrition Assistance Program (SNAP) payments will restart within 24 hours once the U.S. government reopens, providing relief to 42 million Americans impacted by the prolonged shutdown. Spokesperson Alec Varsamis said funds will be distributed to states immediately after President Trump signs the funding bill expected Wednesday night. The shutdown, which disrupted benefits since November 1, forced food banks and local agencies to manage surging demand. Although contingency funds covered about 65% of payments, legal disputes over full benefits created delays. Politico reported some states may still face administrative backlogs as systems restart.

Commodities News

Gold Technical Analysis: Focus Turns to U.S. Data After Shutdown Ends

Gold prices extended their rally beyond the $4,200 mark, breaking another resistance level despite little change in underlying fundamentals. The move appears driven by a short squeeze rather than any clear macro catalyst.

Soft ADP employment data earlier in the week offered limited reaction at the time, suggesting traders are now positioning ahead of the return of key U.S. economic releases following the government’s reopening. Upcoming CPI and nonfarm payrolls data are set to define the next leg for gold.

Stronger labor market readings would likely weigh on the metal by reinforcing expectations that the Fed could pause rate cuts. Conversely, weaker data should bolster gold as it would give policymakers more leeway to ease policy.

In the broader outlook, gold remains in an uptrend, supported by falling real yields and the Fed’s dovish bias. Short-term headwinds may persist, however, if markets price in renewed hawkishness around rates.

Technical Picture – Daily Chart

Gold has cleared its prior swing high near $4,150, extending gains above $4,200 and setting new record highs. Sellers have little room to maneuver unless the price drops back below $4,150, which could signal a potential reversal.

Technical Picture – 4-Hour Chart

A firm support zone has formed near $4,150, reinforced by an ascending trendline. Any pullback into that level may attract fresh buying interest with stops below support, while a clean break lower would give sellers an opening toward $4,000.

Technical Picture – 1-Hour Chart

Momentum remains bullish as long as the trendline holds. Buyers are expected to defend support, while sellers will look for a decisive break below to initiate downside positions.

EIA: U.S. Crude Inventories Surge by 6.4 Million Barrels

U.S. crude oil stockpiles rose sharply last week, according to Energy Information Administration (EIA) data released Thursday.

Weekly petroleum inventories:

- Crude: +6.41 million barrels (vs. +1.96 million expected)

- Gasoline: -0.95 million (vs. -1.89 million expected)

- Distillates: -0.64 million (vs. -2.03 million expected)

The build in crude inventories far exceeded expectations, reversing last week’s 5.20 million-barrel drawdown. Product inventories for gasoline and distillates both declined but by smaller margins than anticipated. The data suggest refiners scaled back runs while imports likely increased, putting short-term pressure on crude prices.

IEA Lifts Oil Demand Forecasts but Warns of Looming Supply Surplus

The International Energy Agency raised its forecasts for global oil demand growth but maintained that supply will continue to outstrip consumption into 2026.

The agency now expects demand to rise by 790,000 barrels per day (bpd) in 2025, up from 710,000 bpd, and by 770,000 bpd in 2026, compared with 700,000 bpd previously. Supply is projected to climb by 3.1 million bpd in 2025 and 2.5 million bpd in 2026, both slightly higher than earlier estimates.

By 2026, global oil supply is expected to exceed demand by 4.09 million bpd, versus a previously projected surplus of 3.97 million bpd — reinforcing the IEA’s view that the market will remain oversupplied despite steady demand growth.

Silver Technical Analysis: At the Brink of a Double Top or Breakout

Silver prices have climbed back toward record highs, mirroring gold’s recent surge, in what could mark either a major double-top pattern or a fresh leg higher. The rally appears technically driven, with limited fundamental justification and signs of short covering.

The reopening of the U.S. government brings key risk events back into focus — particularly CPI and jobs data. Strong U.S. data could cap silver’s momentum by delaying rate cuts, while weaker readings would likely underpin further gains.

Longer term, silver’s uptrend remains supported by falling real yields and an accommodative Fed stance. However, near-term trading may turn volatile if markets price in another hawkish repricing of rates.

Technical Picture – Daily Chart

Silver is hovering near its record high. Sellers may look to fade the move with tight stops above the peak, targeting a correction toward the major trendline near $45.00. Bulls, meanwhile, will want to see a clean breakout to extend the rally.

Technical Picture – 4-Hour Chart

Support is forming near $49.50, aligning with a short-term ascending trendline. Buyers are likely to defend that area, while a breakdown could trigger a move lower toward the broader trendline base.

Technical Picture – 1-Hour Chart

Momentum remains firmly upward, with an intraday trendline continuing to define short-term bullish structure.

Aluminium Extends Rally on Supply Constraints – ING

Aluminium prices continued to climb this week, with three-month LME contracts trading above $2,900 per tonne on Thursday morning. The metal has gained more than 13% year-to-date, making it the third-best performer on the LME after copper and tin, according to ING strategists Ewa Manthey and Warren Patterson.

Tight Supply and China’s Capacity Cap Support Prices

“The market is being driven by tightening supply expectations in China and a broader risk-on sentiment following the easing of U.S.-China tensions,” ING said. “The recent trade truce has removed a key downside risk for industrial metals.”

China’s aluminium production is now close to its self-imposed 45 million tonne capacity cap, introduced in 2017 to curb overcapacity and emissions. Assuming the cap holds, ING sees the global aluminium market largely balanced next year — a factor that is also restraining exports and tightening supply outside China.

Limited Western Restart Plans, Indonesian Output Rising

Few new restarts have been announced in Europe or the U.S., mainly due to high power costs and the lack of competitive long-term energy contracts. However, Indonesian exports are rising rapidly, which could pressure prices in 2026.

Aluminium has also tracked the broader rally in copper, which recently hit a record high. The copper-to-aluminium price ratio is nearing record levels, hinting at potential substitution demand from copper to aluminium as prices diverge.

U.S. Oil Inventories Show Smaller-Than-Expected Build

Private API data showed U.S. crude inventories rose by 1.3 million barrels last week, below expectations for a 1.7 million-barrel increase. Gasoline stocks fell by 1.4 million barrels, while distillates climbed by 944,000. Inventories at Cushing, Oklahoma, slipped by 43,000 barrels. The release was delayed by a day due to the U.S. holiday earlier in the week.

Europe News

European Stocks Retreat After Recent Record Highs

European equity benchmarks slipped on Thursday, easing from recent record levels set earlier in the week as investors took profits following strong gains.

Closing levels:

- Germany’s DAX: -1.45%

- France’s CAC 40: -0.11%

- UK’s FTSE 100: -1.05%

- Spain’s Ibex 35: -0.23%

- Italy’s FTSE MIB: -0.08%

The pullback followed new all-time highs earlier in the week for the FTSE 100 and Ibex 35. Analysts described the session as a “natural consolidation” after extended rallies, with sentiment dampened by weakness in global equities and renewed uncertainty around central bank policy paths.

Eurozone Industrial Output Rebounds Slightly, Misses Forecast

Euro area industrial production rose 0.2% month-on-month in September, undershooting expectations for a 0.7% increase, Eurostat reported. August output was revised to a 1.1% decline from the initially reported 1.2% fall.

Production increased for intermediate goods (+0.3%), energy (+1.2%), and capital goods (+0.3%), but declined for durable consumer goods (-0.5%) and non-durable consumer goods (-2.6%). The figures suggest a partial recovery at the end of the third quarter, though momentum remains subdued.

UK GDP Shrinks 0.1% in September as Industry Drags

UK GDP slipped 0.1% in September, missing expectations for flat growth, according to the Office for National Statistics. Services output rose 0.2%, while industrial production dropped 2% and manufacturing output fell 1.7%. Construction grew 0.2%. The weakness in industry offset modest services gains, leaving growth momentum subdued heading into Q4.

UK Q3 GDP Grows Just 0.1%, Adding Pressure on BOE

Preliminary data showed the UK economy expanded 0.1% in the third quarter, below forecasts of 0.2%, with annual growth slowing to 1.3%. Softer activity across August and September has reinforced expectations for a December rate cut, with market-implied odds now exceeding 80%. Weak growth and deteriorating labor data are intensifying pressure on the Bank of England to ease policy before year-end.

BOE’s Greene Reappointed for Second Term on MPC

The Bank of England has reappointed Megan Greene for a second and final three-year term as an external member of the Monetary Policy Committee (MPC).

The decision comes amid a finely balanced MPC split — the most recent vote was 5–4 to hold rates steady. Greene was among the majority favoring no change.

“I am not convinced the monetary stance is meaningfully restrictive,” Greene said. “There is huge uncertainty around the neutral rate, but as we approach it, the risk of cutting too far or too fast rises.”

Under current rules, external members can serve a maximum of two terms. Greene’s reappointment ensures continuity on the committee during a period of heightened inflation and policy uncertainty.

EU Readies Implementation Plan for Expanded U.S. Trade Deal

The EU is preparing an “implementation action plan” to deepen trade ties with the U.S., focusing on five areas: tariffs, market access, digital trade, standards, and cooperation on steel and aluminum, according to Bloomberg. The plan, not yet shared with Washington, seeks lower U.S. tariffs on European goods including wine and spirits, while maintaining a 15% cap across sectors. It also proposes a joint economic security group to coordinate on investment screening, export controls, and raw materials. The proposal could ease regulatory frictions and lower costs for exporters if accepted by the U.S.

EU to Fast-Track Fee on Cheap Chinese Parcels — FT

The European Union plans to bring forward a handling fee on small parcels from online platforms such as Shein, Temu, and Alibaba to early 2026, two years earlier than initially planned, the Financial Times reported. Trade commissioner Maros Šefčovič urged finance ministers to approve the accelerated rollout, arguing it would help curb the inflow of low-cost Chinese imports and protect domestic retailers from unfair price competition.

Asia-Pacific & World News

China October Credit Data Misses as Loan Growth Slows Again

China’s latest credit data showed continued weakness in lending activity despite signs of market optimism elsewhere.

M2 money supply grew 8.2% year-on-year in October, slightly above the 8.1% forecast but slower than the 8.4% in September. New yuan loans came in sharply below expectations at ¥220 billion, versus estimates of ¥500 billion and down from ¥1.29 trillion previously.

The soft lending figures highlight persistent weakness in private-sector credit demand and suggest Beijing still faces challenges in stimulating borrowing to support growth. Year-to-date new bank loans total ¥14.97 trillion, well below last year’s full-year figure of ¥18.1 trillion, signaling the government’s policy push has yet to gain traction.

Macquarie: China Likely to Maintain 5% Growth in 2026 on Strong Exports

Macquarie economists project China’s economy will grow around 5% in 2026, powered by resilient export demand. Exports have risen 5% year-to-date through October, just shy of last year’s 6% pace, despite ongoing tariffs. The bank expects exports to expand 6% next year, far above market consensus. Stronger trade could reduce Beijing’s need for major stimulus, though deflationary pressures remain a concern.

PBOC sets USD/ CNY reference rate for today at 7.0865 (vs. estimate at 7.1156)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 190bn yuan via 7-day reverse repos at an unchanged rate of 1.40%.

- after maturities today the net injection is 97.2bn yuan

Westpac: October Jobs Rebound Keeps RBA Focused on Inflation

Westpac said Australia’s stronger October labor report offsets September’s weakness and confirms a gradual easing in labor market tightness rather than a shift in momentum. The bank expects the RBA to stay focused on inflation trends, viewing recent volatility in employment as noise. With the jobs market still steady and inflation elevated, Westpac sees the central bank holding rates while watching upcoming CPI data closely.

Australia’s Inflation Expectations Ease to 4.5%

The Melbourne Institute reported Australian inflation expectations at 4.5% for November 2025, down from 4.8% in the previous month. The reading suggests inflation expectations are edging lower but remain well above the Reserve Bank of Australia’s 2–3% target range.

Australia Jobless Rate Falls to 4.3% in October

Australia’s unemployment rate dropped to 4.3% in October, better than expectations of 4.4% and down from 4.5% previously, data showed. Employment surged by 42,200, double the forecast, with a sharp 55,300 rise in full-time jobs offsetting a 13,100 decline in part-time positions. The participation rate held steady at 67%. The stronger data ease pressure on the Reserve Bank of Australia to cut rates as inflation remains elevated.

NZ Retail Spending Posts Slight Uptick in October

New Zealand’s retail spending edged 0.2% higher in October, a modest rebound following a 0.5% decline the prior month, according to Statistics New Zealand data on electronic card transactions. Annual growth came in at 0.8%, down from 1.0% previously. Analysts said the results point to cautious but stabilizing household demand as elevated borrowing costs and tighter budgets continue to weigh on spending.

Japan PPI Rises Above Forecast in October

Japan’s Corporate Goods Price Index rose 0.4% in October from the prior month, exceeding forecasts for a 0.3% increase, Bank of Japan data showed. Year-on-year, producer prices climbed 2.7%, slightly above expectations of 2.5% and matching September’s pace. The data suggest persistent upstream price pressure despite subdued domestic demand.

Japan Finance Minister: Default Risk ‘Hard to Foresee’

Finance Minister Katayama said Japan’s default risk remains minimal given that government bonds are largely held by domestic investors. He reiterated the government’s support for the BOJ’s efforts to achieve stable 2% inflation. Katayama added that while a sharp yen decline could fuel import-driven inflation, fiscal policy will remain “responsible.” He also noted that future tax cuts are not off the table.

BOJ’s Ueda: Steady Wage Gains Key to Sustainable Inflation

Bank of Japan Governor Kazuo Ueda said the central bank continues to pursue a moderate, wage-driven inflation cycle to underpin stable economic growth. Ueda noted consumption remains resilient amid improving labor conditions, while inflation is gradually converging toward the 2% target. He said recent food price increases are mostly one-offs tied to raw material costs, but companies are increasingly passing on higher wages. Ueda also emphasized that long-term rates reflect expectations for short-term policy moves and term premiums, adding the BOJ will act if yields move “out of step” with fundamentals.

PM Takaichi Pledges Growth Without Raising Taxes

Prime Minister Sanae Takaichi vowed to strengthen Japan’s economy to boost tax revenues without increasing tax rates. Economists say while fiscal stimulus could lift growth, it may also add to government debt. Takaichi’s administration is promoting investment in advanced technology and defense amid ongoing budget pressures.

Japan Firms Positive on Takaichi Leadership, But Cautious on Risks

Japanese companies are showing renewed confidence under new Prime Minister Sanae Takaichi, though concerns persist over her minority government and tensions with China, a Reuters corporate survey found. About 43% of firms expect business conditions to improve, compared with just 3% expecting deterioration. Nearly half cited political instability as a key risk, and 42% pointed to China-related tensions. On wages, 72% of firms plan similar pay hikes next year as in 2024, when increases hit a 34-year high. The data suggest steady domestic demand, even as geopolitical uncertainty clouds the outlook.

Crypto Market Pulse

Bitcoin Slides Below $100,000, Hits Lowest Since May

Bitcoin (BTC) fell more than 3% on Thursday, breaking below the key psychological $100,000 mark and hitting its lowest level since May 8.

The cryptocurrency traded as low as $98,081, down roughly $3,000 or -3.1% on the day. The move also pushed the price below the prior June 22 low of $98,240, signaling a deeper technical correction.

From a chart perspective, the next major support target sits near $96,975, aligning with the 38.2% Fibonacci retracement of the rally from the August 2024 low to the October 2025 high.

Traders say the break of $100,000 — a natural support zone — could trigger additional liquidation if risk sentiment across global markets continues to weaken.

Grayscale Files for U.S. IPO, Eyes NYSE Listing Under ‘GRAY’

Digital asset manager Grayscale Investments has filed for an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC), becoming the latest crypto firm to seek a public listing in the United States.

Filing Details

The S-1 registration, submitted Thursday, outlines plans to list on the New York Stock Exchange (NYSE) under the ticker GRAY. The offering will include two share classes:

- Class A: one vote per share with full economic rights.

- Class B: multiple votes per share, carrying majority control.

The number of shares and price range have not yet been disclosed. The IPO will proceed after SEC review and favorable market conditions. Morgan Stanley, BofA Securities, Jefferies, and Cantor are joint lead underwriters.

Grayscale’s Market Position

Grayscale manages roughly $35 billion in assets across more than 40 products, including Bitcoin and Ethereum ETFs, and estimates its total addressable market at $365 billion.

The filing follows the reopening of U.S. government agencies after the shutdown, which had slowed SEC operations. The move reflects growing industry confidence as the Trump administration pushes for clearer crypto regulation and agencies like the SEC and CFTC work toward balanced oversight frameworks.

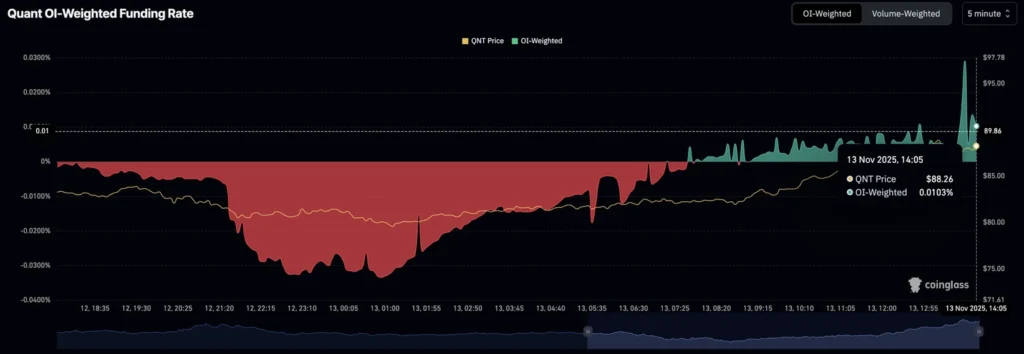

Quant (QNT) Eyes Breakout as Whale Demand Climbs

Quant (QNT) surged 11% on Thursday, approaching resistance at the top of its consolidation range amid a clear uptick in whale accumulation and bullish derivatives positioning.

Technical and On-Chain Signals Turn Positive

Momentum indicators, including the MACD, have flipped to a buy signal, suggesting renewed upside potential.

According to Santiment, wallets holding 10,000 to 1 million QNT now control 57.83% of supply, up from 56.98% in early October — an increase of about 130,000 QNT (8.48M → 8.61M). This accumulation implies institutional and whale confidence ahead of a potential breakout.

Derivatives Data Reinforce Bullish Bias

CoinGlass data show the Open Interest–weighted funding rate at 0.0103%, slightly below earlier highs of 0.0291% but still positive, indicating bulls are paying to maintain long exposure. Combined with rising long positions and reduced short interest, QNT’s technical outlook suggests growing demand from both large holders and retail traders.

Crypto Market Update: Bitcoin, Ethereum, XRP Extend Recovery Despite ETF Outflows

The crypto market continued to recover on Thursday, led by gains in Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), even as ETF flows turned negative and retail interest stayed muted.

Bitcoin traded above $103,000, while Ethereum reclaimed the $3,500 level and XRP rose beyond $2.50, shrugging off thin demand.

Market Sentiment Improves After U.S. Shutdown Ends

Positive sentiment followed President Donald Trump’s signing of legislation ending the U.S. government shutdown, the longest in history. “This is no way to run a country,” Trump said, adding that such disruptions “can never happen again.” Risk assets, including crypto, edged higher in response.

ETF Outflows Reflect Weak Institutional Demand

According to SoSoValue, U.S.-listed Bitcoin ETFs recorded $278 million in outflows on Wednesday, snapping a two-day streak of inflows ($524 million Tuesday, $1.15 million Monday).

Ethereum ETFs saw $184 million in outflows, extending a three-day losing streak.

ETF data continue to act as a gauge of institutional sentiment. Persistent outflows signal ongoing caution despite the market’s technical rebound.

Crypto Market Stagnates as Risk Appetite Fades

The global cryptocurrency market remains rangebound, with total capitalization steady near $3.5 trillion and the fear index dropping to 15, its lowest since March 4.

Despite rallies in equities and precious metals, digital assets have failed to participate, raising concerns of a potential broader shift in sentiment. Analysts warn that if this stagnation isn’t simple profit-taking by whales after gains since April, it could reflect a deeper phase of risk aversion.

Bitcoin Losing Momentum

Bitcoin continues to hover near its 50-week moving average, struggling to maintain its bull-market structure. The pattern mirrors conditions last seen in late 2021, aligning with the four-year halving cycle that historically dictates market rhythm.

Correlation Breakdown

Over the past three months, Bitcoin has fallen 15%, while the S&P 500 has risen 7%, marking a sharp divergence after four years of close correlation. Santiment analysts suggest BTC may now be undervalued relative to equities.

Jan3 CEO Samson Mow attributes the decline to profit-taking by investors from the previous 12–18 months, while Morgan Stanley advises clients to reduce crypto exposure as the current cycle nears its end.

Mining and Institutional Developments

Marathon Digital CEO Fred Thiel warned that only miners with cheap energy access or new business models will survive the current margin squeeze.

Meanwhile, SoSoValue reports $350 million in inflows to U.S. Solana ETFs over 11 trading sessions — far exceeding expectations.

Visa also launched a USDC-based cross-border payments pilot, while Coinbase announced plans to debut an ICO platform to support verified token launches, marking a new stage in crypto capital formation.

Tokyo Exchange Weighs Crypto-Asset Limits for Listed Firms

The Japan Exchange Group is considering tighter oversight of listed firms accumulating large cryptocurrency holdings, amid growing governance and investor-protection concerns. Sources say the Tokyo Stock Exchange may apply stricter rules to prevent backdoor listings and could require new audits for some firms. Several companies have already paused crypto purchases after JPX warnings. The move follows steep share declines in firms heavily invested in digital assets and reflects regulators’ intent to safeguard retail investors.

The Day’s Takeaway

North America

- Equities: US markets posted their largest one-day drop since Oct. 10 as a broad selloff hit risk assets. Major closing moves: S&P 500 -1.6%, Nasdaq -2.3%, Dow -1.6%, Russell 2000 -2.9%. Traders cited positioning and valuation sensitivity after recent rallies; worries over tech/AI spending and uncertainty about a December Fed cut amplified the move.

- Treasuries: The Treasury sold $25bn of 30-year bonds at a 4.694% high yield, 1 bp above the when-issued level. Demand looked soft: bid-to-cover 2.29x, directs down to 14.5%, indirects elevated at 71.0% and dealers took a larger allotment than typical — a sign of weaker domestic appetite and stronger foreign participation.

- Policy & Fed speak: Boston Fed’s Susan Collins and other Fed officials reiterated that inflation is still too high and that a “mildly restrictive” stance remains appropriate; San Francisco Fed’s Mary Daly said it’s too early to decide on a December cut and urged waiting for more data. Minneapolis Fed’s Neel Kashkari flagged that inflation near 3% is still unacceptable and that the economy is sending mixed signals. Fed Governor comments stressed sticky services inflation and the importance of wage dynamics.

- Corporate / Tech: Microsoft confirmed plans to incorporate OpenAI’s custom chip designs into its hardware roadmap under the companies’ extended partnership, strengthening its vertical AI strategy. Disney shares plunged after mixed results: Q4 adjusted EPS $1.11 vs $1.05 est, revenue $22.5bn vs $22.75bn est; streaming profit rose 39% to $352m and combined subs grew by 12.5m to about 196m, but entertainment/linear TV weakness pulled overall revenue below expectations.

- Policy fallout: President Trump signed the funding bill to reopen the government after a 43-day shutdown; USDA said full SNAP benefits would restart within 24 hours of reopening, easing pressure on households and foodbanks.

- Market players: Michael Burry is closing his hedge fund and moving to a family-office structure after Q3 option positions underperformed.

Commodities

- Aluminium: LME three-month contracts traded above $2,900/t, up 13% YTD, supported by tightening supply expectations in China and limited western restarts. ING said China is near a 45mt capacity cap, keeping ex-China markets tight; rising Indonesian exports are a potential future headwind. Copper-to-aluminium ratios near record levels may prompt substitution flows.

- Oil: IEA raised demand growth forecasts to 790k bpd (2025) and 770k bpd (2026); supply is expected to rise by 3.1m bpd (2025) and 2.5m bpd (2026), leaving a projected 2026 surplus of ~4.09m bpd. Separately, EIA weekly US data showed a large crude build of +6.41m barrels (vs +1.96m expected), gasoline draw -0.95m, distillates -0.64m — a mix suggesting refinery runs/import swings pressured crude. Private API figures earlier showed a smaller-than-expected crude build (+1.3m).

- Precious metals: Gold ripped above the $4,200 level on what looks like short covering; with the US data flow resuming post-shutdown, CPI and NFP will be key near-term drivers — strong prints could weigh on the metal, weak prints would support it. Silver is trading near record highs and faces a potential double-top or breakout; key technical supports noted around $49.50 (4-hr) and a larger trendline near $45.00.

Europe

- Equities: European indices pulled back from earlier weekly highs: DAX -1.45%, CAC -0.11%, FTSE 100 -1.05%, Ibex -0.23%, FTSE MIB -0.08%. Profit-taking followed record runs in UK and Spanish markets earlier in the week.

- Policy / Trade: The EU is accelerating a handling fee on small parcels from low-cost Chinese platforms to early 2026 to protect domestic retailers, per FT reporting. Brussels is also drafting an implementation action plan for the recent US-EU trade agreement covering tariffs, market access, digital trade, standards, and cooperation on steel and aluminium — seeking broader tariff limits and coordination mechanisms.

- Macro: Eurozone industrial production rose 0.2% m/m in September (below +0.7% expected), with gains in intermediate, energy and capital goods offset by declines in consumer goods — signalling only a modest end-Q3 rebound.

- Central bank: The Bank of England reappointed external MPC member Megan Greene for a second three-year term; she has been among those voting to hold rates, warning that the stance may not be meaningfully restrictive and urging caution on cuts.

Asia

- Japan: Corporate sentiment shows cautious optimism under PM Sanae Takaichi, but nearly half of firms flagged political instability and 42% cited China tensions as risks. Japan PPI (Corporate Goods Price Index) rose 0.4% m/m in October and 2.7% y/y, above forecasts — signalling upstream price pressure. BOJ Governor Kazuo Ueda reiterated the drive for a wage-led, sustainable inflation cycle and said the BOJ will act if long-term yields deviate “out of step.” The Japan Exchange Group is reviewing tighter rules for listed firms accumulating crypto amid governance concerns. Finance Minister Katayama said default risk is “hard to foresee” given domestic JGB holdings. PM Takaichi pledged growth to raise revenues without tax hikes.

- China: October credit data disappointed: M2 +8.2% y/y (vs 8.1% exp), but new yuan loans only ¥220bn (vs ¥500bn est; prior ¥1.29tn). Year-to-date new loans stand at ¥14.97tn, well short of 2024’s pace — underscoring fragile private demand and challenges for Beijing’s credit restart. Macquarie sees China growing ~5% in 2026, driven by stronger exports, but persistent deflationary pressures remain a caveat.

- Australia / Oceania: Australia unemployment fell to 4.3% in October (vs 4.4% exp), employment +42.2k with full-time hires up 55.3k; the stronger jobs print keeps RBA focused on inflation rather than cuts. Melbourne Institute inflation expectations eased to 4.5% in November from 4.8% prior. Westpac noted the October rebound lets the RBA look past September weakness and remain inflation-focused.

- New Zealand: Retail spending (electronic card transactions) edged +0.2% m/m in October with annual card spending +0.8% y/y, pointing to tentative stabilisation in household demand amid high borrowing costs.

Crypto Markets

- Price action & flows: Bitcoin slipped below $100,000, trading near $98,081 at session lows and breaching the June 22 low; technical support lies near $96,975 (38.2% retracement). Market cap hovered ~$3.5tn, with the crypto fear index down to 15.

- ETF flows & institutional demand: US-listed Bitcoin ETFs saw $278m outflows on Wednesday after prior inflows; Ethereum ETFs recorded $184m outflows — a sign of cautious institutional positioning despite price rebounds.

- Corporate moves & IPOs: Grayscale filed an S-1 for a US IPO aiming to list as GRAY on the NYSE; it manages roughly $35bn AUM and named Morgan Stanley, BofA, Jefferies and Cantor as lead underwriters. Visa piloted USDC cross-border payments; Coinbase plans an ICO platform.

- Tokens & flows: Quant (QNT) jumped ~11%, buoyed by whale accumulation — wallets holding 10k–1m QNT now control 57.83% of supply — and positive derivatives signals (OI-weighted funding ~0.0103%). Solana-linked spot ETFs drew roughly $350m in 11 sessions.

- Industry health: Analysts flagged a divergence between BTC and equities (BTC -15% vs S&P +7% over 3 months), miner margin pressures, and a possible period of profit-taking; institutional and retail rotations into tokenized ETFs and payments pilots show ongoing structural change.