North America News

U.S. Stock Indexes Set Fresh Closing and Intraday Records

U.S. equities finished Wednesday at new all-time highs after a volatile trading session that saw both sharp gains and brief dips into negative territory.

- Dow Jones Industrial Average: +463.66 points (+1.04%) to 44,922.27 — leading the day’s advance.

- S&P 500: +20.82 points (+0.32%) to 6,466.58.

- NASDAQ Composite: +31.24 points (+0.14%) to 21,713.14.

- Russell 2000: +45.27 points (+1.98%) to 2,328.05 (adding to Tuesday’s 2.99% jump).

The NASDAQ climbed as much as 121.84 points at its peak before dropping 36.76 points into the red, then rebounding before the close. The S&P hit session highs of +34.52 points, briefly fell by -0.74 points, and recovered to finish higher.

New intraday records:

- S&P 500: 6,480.28

- NASDAQ Composite: 21,801.75

US Mortgage Applications Jump as Rates Ease

US MBA mortgage applications rose 10.9% in the week ending August 8, accelerating from the prior 3.1% gain. The market index climbed to 281.1 from 253.4. The purchase index rose to 160.2 (from 158.0), while the refinance index surged to 956.2 (from 777.4). The average 30-year mortgage rate slipped to 6.67% from 6.77%, helping boost activity.

Fed’s Bostic: No Urgency for Policy Shift as Labor Market Holds

Atlanta Federal Reserve President Raphael Bostic said there is no immediate need to adjust monetary policy given the labor market’s resilience. Key points:

- Low-to-moderate-income households are under increasing financial pressure.

- Stress is starting to reach higher-income households.

- Small businesses are facing more difficulties than large firms.

- Credit card usage is climbing, signaling potential strain on consumer spending.

Trump Urges EU and Ukraine to Consider Territorial Concessions

Axios reports that former U.S. President Donald Trump has told European Union leaders and Ukrainian President Volodymyr Zelenskiy that giving up some territory will be necessary to resolve the ongoing conflict with Russia. Whether this actually happens remains uncertain.

Fed’s Goolsbee Economists unanimous that Fed must be independent

- Fed’s Goolsbee:

- Independence of the Fed is important because we don’t want inflation to come back.

- Economists unanimous that Fed must be independent from political interference.

- Tariffs are a stagflation area shock

- He is uneasy about view of tariffs as a one-time shot that creates only transitory inflation

- I don’t like pre-committing on rates.

- Will still get inflation readings before the next Fed meeting.

- Sharply lower job gains may reflect transition period on immigration.

- Lower job gains may just be a sign of drop in population growth.

- The danger from tariffs is that they reduce productivity growth.

- A major determinant of mortgages is long rates, which reflect in part long-run inflation expectations.

- If Inflation goes the wrong way, the Fed will have to act.

- There are some warning signs in the labor market, need to keep an eye on that as well

US Bessent: Trump came up with the Nvidia agreement, it is a unique solution

- Comments from the US Treasury Secretary, Scott Bessent

- I could see an Nvidia arrangement in other cases over time.

- I don’t want Huawei to have a digital belt and road.

- Taxpayer gets a benefit from NVIDIA China sales.

- A lot of Chinese tech is piggybacking from the US.

- We can discuss with China the use of Nvidia chips.

- We don’t want to sell everything to everybody.

- Will use revenue from semiconductors to pay down US debt.

More:

US Bessent: There’s good chance of 50 basis point rate cut for the Fed

- We should be 150-175 bps lower on Fed’s rate now.

- If data has been accurate, possible the Fed would have cut earlier.

- I think we could go into a series of rate cuts.

- Rate cut would signal an adjustment.

- On Fed Chair names: goint to cast a wide net of 10-11 people.

- Would not support halting jobs reports.

- What we want is good data.

- I called for a shadow Fed Chair, but I don’t think so now.

- On 30 year bonds: we are committed to keeping inflation expectations low.

- Yields show there is credibility.

- Don’t think the Fed needs to go back into large scale asset purchase (QE).

UBS Sees 100bps in Fed Cuts Starting September Despite Price Pressures

UBS forecasts the Federal Reserve will start an easing cycle in September, delivering a total of 100 basis points in rate reductions even though it expects price pressures to persist into 2026.

The bank sees moderating core inflation and a slowing U.S. economy creating space for the Fed to prioritize growth support over maintaining restrictive rates for an extended period.

Goldman Sachs: CPI Data Supports Case for September “Insurance” Rate Cut

Goldman Sachs says the latest U.S. inflation figures suggest tariff-driven price effects will be short-lived and limited in scale. The bank expects the Fed’s focus to shift toward labor market conditions, where recent weakness could strengthen the case for a September “insurance” cut to guard against economic downside risks.

Morgan Stanley Lists Three Risks That Could Stall Stock Rally

In a client note, Morgan Stanley identified three potential threats to the current equity rally:

- Weakening job market — softer hiring trends, downward revisions, and reduced job openings

- Concentrated Q2 earnings — gains centered in a few sectors and mega-cap stocks, with most firms showing little profit growth

- Stagflation risk — tariffs and sticky inflation could slow economic momentum later in the year

Nomura Brings Forward Fed Rate Cut Forecast to September, With More Easing Ahead

Nomura Holdings now expects the U.S. Federal Reserve to begin lowering interest rates in September with a 25 basis point cut, followed by additional quarter-point reductions in December and March.

The firm pointed to a weakening U.S. labor market and easing inflation risks as the primary reasons for accelerating its forecast. This marks a shift from its earlier projection, which had the first rate cut happening later in the year. While many analysts already anticipated action in the coming months, Nomura’s revised outlook reflects growing conviction that the Fed will move sooner rather than later.

Bank of Canada July Meeting Minutes Highlight Wait-and-See Approach

Minutes from the Bank of Canada’s July rate decision show split views among Governing Council members:

- Some felt current policy is sufficient to support the economy.

- Others argued more stimulus could be necessary.

- All agreed more clarity is needed before making firm decisions.

The Council noted inflation expectations remain anchored, though global trade disruptions could keep upward pressure on prices. Spillover effects from lower exports into domestic investment and spending have so far been limited.

Commodities News

Gold Gains as Rate-Cut Speculation and Geopolitical Events Drive Demand

Gold prices edged higher during the North American session, supported by growing expectations for a Federal Reserve rate cut next month and renewed geopolitical focus. Spot gold rose 0.30% to $3,357, holding above a key support level at $3,350.

Treasury Secretary Scott Bessent urged the Fed to cut its benchmark rate by 50 basis points in September and target a total reduction of 150–175 bps over time. Traders appear confident the central bank will resume easing, despite July CPI showing flat headline inflation but a rise in core prices.

On the geopolitical front:

- Trump is meeting European and Ukrainian leaders before Friday’s Alaska summit with Putin on a potential Ukraine cease-fire.

- Washington and Beijing have extended their tariff truce for 90 days.

With few major data releases on Wednesday, attention turned to Fed officials Austan Goolsbee and Raphael Bostic, who both made public remarks. Looking ahead, markets await U.S. PPI, weekly jobless claims, retail sales, and the University of Michigan consumer sentiment report.

WTI Crude Falls to Lowest Level Since June 1

U.S. crude oil futures settled at $62.65, down $0.52 (-0.82%) on the day, marking the lowest price since June 1. On the daily chart, WTI has slipped further below its 100-day moving average ($64.77) and is now trading beneath a key swing area of $63.61–$65.27. Sellers maintain the advantage unless buyers reclaim those levels.

U.S. Oil Inventory Data Shows Unexpected Build

Latest weekly crude oil inventory figures:

- Crude oil: +3.036M barrels (vs. -0.275M expected)

- Distillates: +0.714M barrels (vs. +0.725M expected)

- Gasoline: -0.792M barrels (vs. -0.693M expected)

- Cushing, OK: +0.045M barrels (previous week +0.453M)

The numbers point to a larger-than-anticipated crude oil build, reinforcing a downside bias in prices. WTI crude is now trading lower by $0.23 at $62.90, remaining below the 100-day moving average of $64.77.

Silver Tests Key Resistance at $38.20

Silver extended gains for a second day, trading near $38.20 in the Asian session — up 0.7% and testing a descending trendline from July’s multi-year peak. Technical momentum suggests a potential breakout above this barrier, which could open the way to $38.70, then $39.00, and potentially $39.50 — the highest level since February 2012.

Support sits at $38.00, with a drop below $37.85 likely to reassert the trendline resistance and target mid-$37.00s, $37.10, and possibly $36.20.

E3 Warn Iran of Possible Sanctions Snapback Without Nuclear Talks Progress

France, Germany, and the UK have warned they will trigger the UN “snapback” mechanism to reimpose sanctions on Iran if it does not return to nuclear negotiations by the end of August 2025.

In a letter to the UN, the foreign ministers said:

“If Iran is not willing to reach a diplomatic solution before the end of August 2025, or does not seize the opportunity of an extension, the E3 are prepared to trigger the snapback mechanism.”

The warning comes after “serious, frank and detailed” discussions in Istanbul last month — the first in-person talks since Israeli and U.S. strikes on Iranian nuclear facilities.

Europe News

European Markets Climb on Peace Hopes and Tariff Relief

Major European indices ended higher as optimism grew over potential peace talks between Trump and Putin and a reduced impact from tariffs. Closing figures:

- Germany’s DAX: +0.67%

- France’s CAC 40: +0.66%

- UK’s FTSE 100: +0.19%

- Spain’s Ibex: +1.08%

- Italy’s FTSE MIB: +0.60%

Trump rated his earlier meeting with European leaders and Zelenskiy a “10” ahead of Friday’s Alaska summit.

Germany Inflation Holds Steady in July

Germany’s final July CPI confirmed the preliminary reading, with prices up 2.0% y/y, matching June’s pace. The EU-harmonized HICP also came in at +1.8% y/y, unchanged from the earlier estimate. Core inflation remains at 2.7%, a level still uncomfortably high for the ECB. Policymakers are not expected to cut rates in September, and the data reinforces the stance to hold policy steady through summer.

Spain Inflation Matches Preliminary Reading

Spain’s July CPI rose 2.7% y/y, in line with the preliminary estimate and up from 2.3% in June. The HICP also registered +2.7% y/y, matching forecasts. Core inflation ticked slightly higher to 2.3% from 2.2% in June. The report supports expectations that the ECB will keep rates unchanged for now.

Macron: Trump Expressed Intent for Ukraine Cease-Fire in Talks with Putin

Following meetings between Trump, Zelenskiy, and European leaders, French President Emmanuel Macron said Trump intends to push for a cease-fire in upcoming discussions with Russian President Vladimir Putin. Macron noted:

- Territorial disputes should only be negotiated directly with Ukraine.

- A cease-fire must be the starting point for any agreement.

- No recognition of Russian territorial claims.

German Chancellor Friedrich Merz expressed hope for Trump’s success at Friday’s meeting in Anchorage, while Zelenskiy emphasized Ukraine must be directly involved in talks and called for more sanctions on Russia.

UK PM Starmer: Have military plans ready that could be used if there is a cease-fire

- PM Starmer speaking on peace/ceasefire plans

- They have a military plan ready that could be used if there is a ceasefire

- Have to combine active diplomacy with military support to Ukraine and pressure Russia

- Talks about cease-fire have to sit alongside credible security guarantees.

- Have made progress on security guarantees and call with Trump earlier today.

- Stand ready to increase pressure on Russian sanctions and other measures as needed.

Trump to Confer with European Leaders, Zelenskyy Ahead of Putin Meeting

US President Trump said he will speak with European leaders and Ukrainian President Zelenskyy before his scheduled meeting with Russian President Putin in Alaska in two days. Zelenskyy arrived in Berlin for talks with German Chancellor Merz before joining other European officials to coordinate positions. Washington has downplayed expectations of a ceasefire, calling the Trump-Putin meeting a “listening exercise.”

Asia-Pacific & World News

China Posts Rare Negative Bank Lending in July

China’s July M2 money supply grew 8.8% y/y, topping expectations of 8.2%. However, new yuan loans fell ¥50 billion, far below forecasts for a ¥300 billion increase — and potentially the first negative monthly reading since July 2005. Year-to-date, new lending totals ¥12.87 trillion, slightly under the estimated ¥13.22 trillion. The unusual contraction raises questions about demand for credit amid ongoing economic softness.

Hong Kong Monetary Authority Intervenes Again to Support HKD

The Hong Kong Monetary Authority purchased just over HK$7 billion to bolster the local currency, which has been trading near the weaker end of its permitted band against the U.S. dollar.

U.S. and China Plan Trade Talks Within 3 Months; Tariffs Linked to Fentanyl Progress

U.S. Treasury Secretary Scott Bessent announced that trade negotiators from Washington and Beijing will meet again within two to three months to discuss economic ties. The statement follows Monday’s agreement to prolong the existing tariff truce by 90 days, avoiding steep new duties.

Bessent also said Chinese President Xi Jinping has invited U.S. President Donald Trump to meet, though no date has been confirmed. Trump has indicated willingness to meet before year-end if a trade deal is secured.

However, Bessent made clear that U.S. tariffs — currently a 20% levy plus an additional 10% base rate — would remain until China demonstrates sustained progress in curbing fentanyl exports, which could take months or even a year. Beijing denies Washington’s allegations of lax controls on fentanyl precursor shipments.

PBOC and Commerce Ministry Outline Measures to Boost Service Consumption

Chinese authorities signaled fresh support for the nation’s service consumption sector.

The Ministry of Commerce said the sector holds “significant growth potential” and that bolstering it will help lift domestic demand and employment.

A People’s Bank of China representative said financial institutions will be guided to:

- Expand credit issuance targeting service consumption

- Streamline consumer loan approval processes

Meanwhile, regulatory officials emphasized that lenders must closely monitor how subsidy funds are used and prevent them from being diverted to non-consumption activities.

China Imposes 75.8% Tariff on Canadian Canola; Australia to Benefit but Supply Gap Remains

China has introduced a provisional anti-dumping duty of 75.8% on Canadian canola imports, starting Thursday, in an escalation of the trade conflict that began after Ottawa levied tariffs on Chinese electric vehicles last year. The decision effectively shuts Canadian exporters out of a market worth nearly C$5 billion in 2024, according to figures from the Canola Council of Canada.

Replacing the millions of tonnes Canada typically supplies will be challenging in the short term. Australia — the world’s second-largest exporter — is poised to gain from its recent re-entry into the Chinese market after a years-long ban. However, analysts note it will be unable to fully meet demand unless China’s import needs decline significantly.

Canadian officials expressed being “deeply disappointed” by the move, but said they remain open to dialogue to ease tensions. Canola is Canada’s largest cash crop and a key ingredient in Chinese cooking oil production and livestock feed.

PBOC sets USD/ CNY mid-point today at 7.1350 (vs. estimate at 7.1759)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 118.5bn yuan via 7-day reverse repos at 1.40%

- 138.5bn yuan mature today

- net 20bn yuan drain

Australia’s Q2 Housing Finance Data Shows Rebound in Lending

Australia’s housing finance figures for the second quarter showed gains across both investor and owner-occupier segments:

- Investor loan value: +1.4% q/q (prev -0.3%)

- Owner-occupier loan value: +2.4% q/q (prev -2.5%)

- Total home loans value: +2.0% q/q (est +2.0%, prev -1.6%)

The data points to a recovery in mortgage demand after prior declines. While the improvement could slightly temper expectations for aggressive Reserve Bank of Australia rate cuts, analysts doubt it will significantly alter policy direction.

Australia Q2 Wage Price Index Beats RBA Forecast on Annual Basis

Australia’s Q2 Wage Price Index results:

- YoY: 3.4% (exp 3.3%, prior 3.4%) — above RBA forecast of 3.3%

- QoQ: 0.8% (exp 0.8%, prior 0.9%) — matching expectations but slightly softer than Q1

The annual growth beat expectations, suggesting ongoing wage-driven inflation pressures. While the quarterly pace slowed, the stronger year-on-year figure could reduce the urgency for deeper rate cuts.

New Zealand Electronic Card Retail Sales Rise 0.2% in July

New Zealand’s July Electronic Card Retail Sales:

- MoM: +0.2% (prior +0.5%)

- YoY: +1.7% (prior -0.4%)

The data covers about 68% of core retail sales and serves as the main monthly gauge of consumer spending.

Reuters Tankan: Japan Manufacturing Sentiment Improves in August

August Reuters Tankan survey results:

- Manufacturing index: +9 (Jul: +7) — second straight month of improvement

- Transport machinery sector surged to +25 from +9 but is expected to ease ahead

- Non-manufacturing index: +24 (Jul: +30) — first drop in five months

- Food industry sentiment collapsed to -25 from 0 on higher input costs

Three-month outlook:

- Manufacturing expected to fall back to +4 in November

- Non-manufacturing projected at +25

Nikkei and Topix Hit All-Time Highs

Japan’s Nikkei and Topix stock indices both reached record highs in today’s session, reflecting continued bullish sentiment in Japanese equities.

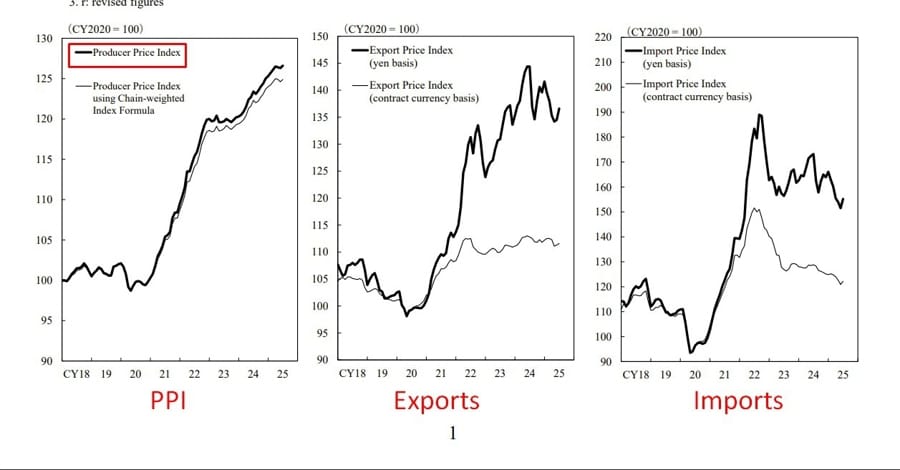

Japan July PPI Meets Monthly Forecast, Beats Yearly Expectation

Japan’s July Producer Price Index (PPI):

- YoY: +2.6% (exp 2.5%, prior 2.9%)

- MoM: +0.2% (exp 0.2%, prior -0.2%)

While this is a measure of wholesale prices rather than consumer inflation, it contributes to downstream pricing pressures in the economy.

Crypto Market Pulse

Bitcoin’s Market Share Drops Below 60% as Ether Rallies

Bitcoin’s market cap sits at $2.39 trillion, while total cryptocurrency value has topped $4 trillion for the first time. BTC’s share of the crypto market has dipped below 60%, its lowest since February 1, as Ethereum’s rally above $4,700 drives gains.

- BTC/USD: Broke May 22 high of $112,000; new record $123,231.07 (July 14). Currently testing resistance at $120,990–$123,231.

- Bear case: Drop to $116,500–$115,000.

- Bull case: Break above $123,231 for new highs.

- ETH/USD: Broke March 2024 high of $4,410; now eyeing $4,867 record from Nov. 2021.

- Bear case: Pullback toward $4,110–$3,750.

- Bull case: Hold above $4,867 for fresh highs.

U.S. stocks are also rallying, with the S&P 500 and Nasdaq 100 at record levels, as the dollar index falls below 98 and traders price in a likely September 17 Fed rate cut to 4.00%–4.25%.

XRP Targets Return to Record High as Market Sentiment Improves

Ripple’s XRP is trading at about $3.25, up for the second straight day and aiming for its record $3.66 high from July 18. The XRP Ledger stablecoin market cap jumped 46% in a week to $166 million, while payment network Mesh added support for Ripple’s RLUSD.

Open interest in XRP derivatives rose 9% to $8 billion, and trading volume climbed 20% to $12.5 million, indicating strong speculative demand amid a broader crypto rally sparked by lower-than-expected U.S. July inflation and growing expectations for a September Fed rate cut.

OKB Surges Over 150% on Major Token Burn and Migration to X Layer

OKB, the native token of OKX’s X layer, has soared more than 150% after the exchange announced a 65.25 million token burn, reducing total supply to 21 million. The move accompanies the shutdown of OKTChain and full migration to the X layer — a zkEVM-based public chain launched with Polygon in 2023.

The X layer now processes 5,000 TPS at negligible cost and will integrate OKX Wallet, Exchange, and Pay. The ecosystem will see new developer incentives, cross-chain functions, and zero-gas withdrawals. The one-time burn aims to tighten supply and increase long-term token value. Ethereum-based OKB holders are urged to migrate via the “Withdrawal to X Layer” feature as future ERC-20 withdrawals will be discontinued.

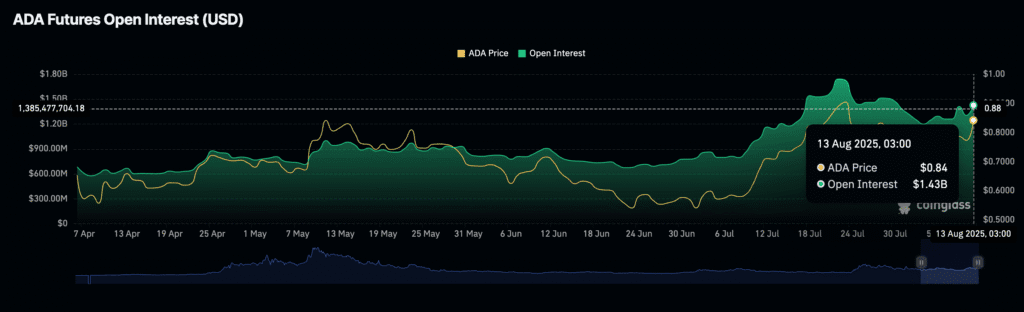

Cardano Targets $1.00 as Open Interest Climbs

Cardano (ADA) is trading around $0.87, up over 4%, with a bullish technical setup backed by strong market sentiment. The token is challenging a descending trendline that has capped gains since December.

Open interest in Cardano futures jumped to $1.43 billion from $1.2 billion on August 3, reflecting growing investor participation. The increase mirrors a July rally when ADA reached $0.93 and OI peaked at $1.74 billion before easing. A breakout above resistance could clear the path toward $1.00.

Ethereum Pushes Back Above $4,600 on Strong Fundamentals

Ethereum’s rally has been powered by a combination of regulatory clarity, institutional participation, technical upgrades, and its expanding role in DeFi and stablecoins. Key drivers include:

- Nearly half of all stablecoins run on Ethereum, with U.S. legislation such as the GENIUS Act boosting confidence in the ecosystem

- Increasing adoption by banks, asset managers, and public companies shifting toward ETH-based infrastructure

- Approval of nine U.S. spot ETH ETFs since May 2024, drawing significant inflows

- Recent upgrades (Pectra and Dencun) improving scalability, staking efficiency, and lowering transaction costs

- Strong yield opportunities through staking and DeFi protocols

Cathie Wood: Ethereum Solidifying Role as Institutional Blockchain

Ark Invest CEO Cathie Wood believes Ethereum is firmly establishing itself as the preferred blockchain for institutional use. In an interview with CoinDesk on Monday (U.S. time), she highlighted adoption by major trading platforms — including Coinbase and Robinhood — that are building their Layer 2 networks on Ethereum.

Wood noted that the protocol underpins much of the stablecoin market, contrasting its versatility with Bitcoin. She emphasized that ETH holdings can be staked to generate yield, offering utility beyond being a store of value.

Ark ETFs have recently taken their first significant position in ETH, and Wood also disclosed an investment in Tom Lee’s $BMNR, which she described as the largest Ethereum treasury globally. Despite acknowledging Ethereum’s higher costs and slower speeds at times, she stressed its security and decentralization advantages.

The Day’s Takeaway

North America

U.S. Stock Indexes Close at Records Despite Volatile Session

Major U.S. indices posted fresh closing and intraday highs after a session that swung between gains and losses:

- Dow Jones Industrial Average: +463.66 (+1.04%) to 44,922.27.

- S&P 500: +20.82 (+0.32%) to 6,466.58 — new intraday high at 6,480.28.

- NASDAQ Composite: +31.24 (+0.14%) to 21,713.14 — intraday high at 21,801.75.

- Russell 2000: +45.27 (+1.98%) to 2,328.05, adding to Tuesday’s 2.99% gain.

Fed Policy Outlook – Bostic and Goolsbee Remarks

Atlanta Fed President Raphael Bostic said the central bank can afford to wait before adjusting rates, citing a still-strong labor market but noting financial stress among lower- and middle-income households. Chicago Fed President Austan Goolsbee also made public remarks, though markets are focusing on broader rate-cut expectations.

Nomura Brings Forward Fed Rate Cut Forecast

Nomura now projects a September rate cut of 25 bps, followed by reductions in December and March, citing a weakening labor market and easing inflation risks.

UBS Sees Aggressive Fed Easing Cycle

UBS expects the Fed to cut rates by a total of 100 bps starting in September, even with price pressures likely to persist into 2026.

Goldman Sachs Supports September “Insurance” Cut

Goldman Sachs says recent inflation data shows tariff-related price impacts will be temporary, reinforcing the case for a September rate cut to guard against economic risks.

U.S. Mortgage Applications Jump

MBA mortgage applications rose 10.9% for the week ending August 8, aided by a drop in the average 30-year rate to 6.67%.

Commodities

Gold Rises on Rate-Cut Bets and Geopolitical Tensions

Gold climbed 0.30% to $3,357, holding above $3,350, as traders bet on a September Fed rate cut and eyed geopolitical developments, including Trump’s upcoming Alaska meeting with Putin on Ukraine.

WTI Crude Oil Declines to Lowest Level Since June 1

U.S. crude futures settled at $62.65 (-$0.52, -0.82%), extending losses and remaining below the 100-day moving average of $64.77.

Weekly U.S. Oil Inventory Data Shows Large Build

- Crude oil: +3.036M barrels (vs. -0.275M est.)

- Distillates: +0.714M barrels (vs. 0.725M est.)

- Gasoline: -0.792M barrels (vs. -0.693M est.)

- Cushing: +0.045M barrels (prior +0.453M)

Europe

Trump Pushes for Ukraine Cease-Fire Talks

French President Macron said Trump intends to seek a Ukraine cease-fire in talks with Putin, with any territorial disputes to be negotiated directly with Ukraine. German Chancellor Merz echoed support for a cease-fire as the first step, while Zelenskiy demanded no talks without Ukraine and called for more sanctions on Russia.

European Markets End Higher on Peace Hopes

- DAX: +0.67%

- CAC 40: +0.66%

- FTSE 100: +0.19%

- Ibex: +1.08%

- FTSE MIB: +0.60%

Germany Inflation Steady in July

Final CPI rose 2.0% y/y; HICP +1.8% y/y. Core inflation at 2.7% keeps ECB policy on hold.

Spain Inflation Matches Preliminary Reading

CPI +2.7% y/y; HICP +2.7% y/y. Core inflation ticked up to 2.3% from 2.2%.

Asia

China Imposes 75.8% Tariff on Canadian Canola

Move effectively shuts Canada out of a nearly C$5B market; Australia to benefit but unable to fully replace supply.

U.S.-China Plan Trade Talks Within 3 Months

Tariff truce extended 90 days; U.S. ties tariff removal to progress on fentanyl control.

PBOC and Commerce Ministry Outline Service-Sector Boost

Measures include expanded credit for service consumption and streamlined loan approvals.

Japan’s Nikkei and Topix Hit Record Highs

Both indices closed at all-time highs as investor sentiment toward Japanese equities remains bullish.

Japan July PPI Meets Monthly Forecast, Beats Yearly Estimate

PPI +2.6% y/y (exp. 2.5%); +0.2% m/m (exp. 0.2%).

Reuters Tankan Shows Improved Japan Manufacturing Sentiment

Manufacturing index rose to +9 in August (from +7), while non-manufacturing slipped to +24 (from +30).

China Posts Rare Negative Bank Lending in July

New yuan loans fell ¥50B (exp. +¥300B) — potentially the first negative monthly reading since 2005 — despite M2 growth of 8.8% y/y.

Rest of the World

E3 Warn Iran of Possible Sanctions Snapback

France, Germany, and the UK said they will reimpose UN sanctions if Iran fails to return to nuclear talks by end-August 2025.

Australia Q2 Housing Finance Rebounds

Investor lending +1.4% q/q; owner-occupier +2.4% q/q; total +2.0% q/q, signaling improved mortgage demand.

Australia Q2 Wage Price Index Beats RBA Forecast

WPI +3.4% y/y (exp. 3.3%), matching prior quarter; +0.8% q/q in line with forecasts.

New Zealand July Card Retail Sales Rise

Electronic card sales +0.2% m/m, +1.7% y/y, covering ~68% of core retail sales.

Crypto

Bitcoin’s Market Share Falls Below 60%

BTC market cap: $2.39T; total crypto market: $4T+. Ethereum’s rally above $4,700 driving gains.

- BTC: Resistance at $120,990–$123,231; break higher could trigger fresh highs.

- ETH: Testing $4,650–$4,867 zone; breakout could extend rally.

Ethereum Pushes Above $4,600

Driven by ETF inflows, DeFi adoption, and upgrades improving scalability and staking efficiency.

XRP Maintains Bullish Momentum

Trading near $3.25, eyeing $3.66 record high; derivatives OI +9% to $8B, volume +20% to $12.5M.

Cardano Approaches $1.00 Target

Trading around $0.87; OI up to $1.43B, testing key trendline resistance.

OKB Surges Over 150% After Token Burn

65.25M tokens destroyed as part of migration to X Layer, reducing supply to 21M.