North America News

Stocks Post Sharpest Drop Since May on Mideast War Fears, Yields Rise Counter to Trend

Wall Street ended the week with a broad selloff, triggered by escalating hostilities between Israel and Iran. Friday saw the worst day for U.S. equities since May 21, with all major indices closing lower by at least 1.13%.

Closing numbers:

- Dow Jones: -769.83 pts (-1.79%) to 42,197.79, closing below its 200-day and 100-day moving averages.

- S&P 500: -68.29 pts (-1.13%) to 5,976.97, holding just above its 100-hour MA.

- Nasdaq: -255.66 pts (-1.30%) to 19,406.83, bouncing after testing its 100-hour MA intraday.

Weekly performance:

- Dow: -1.32%

- S&P 500: -0.39%

- Nasdaq: -0.63%

Unusually, Treasury yields rose despite the risk-off tone:

- 2-year: +4.6 bps to 3.952%

- 5-year: +4.9 bps to 4.008%

- 10-year: +5.2 bps to 4.408%

- 30-year: +5.9 bps to 4.901%

This divergence from the usual “buy bonds during crisis” playbook may reflect concerns about rising oil prices rekindling inflation, or simply a technical bounce after a sharp drop in yields earlier in the week.

Looking ahead, investors face a packed central bank calendar:

- Fed policy meeting on Wednesday (rate hold expected, focus on dot plot and projections).

- Bank of Japan on Tuesday (status quo expected).

- Bank of England on Thursday (likely no change).

- Swiss National Bank may cut rates by 25 basis points, potentially to 0.00%.

Key data releases include U.S. retail sales, UK GDP, and Australia’s jobs report, all of which could inject further volatility into already anxious markets.

University of Michigan Sentiment Jumps in June; Inflation Expectations Drop

The University of Michigan’s preliminary consumer sentiment reading for June surged to 60.5, beating expectations of 53.5 and up sharply from May’s 52.5. The report shows improving consumer outlook across the board.

- Breakdown:

- Current conditions: 63.7 (vs. 59.4 est., 58.9 prior)

- Expectations: 58.4 (vs. 49.0 est., 47.9 prior)

- Inflation expectations:

- 1-year outlook: 5.1%, down from 6.6%

- 5-year outlook: 4.1%, down from 4.2%

The improvement suggests early signs of confidence returning to consumers, likely supported by easing inflation pressures and optimism around policy shifts.

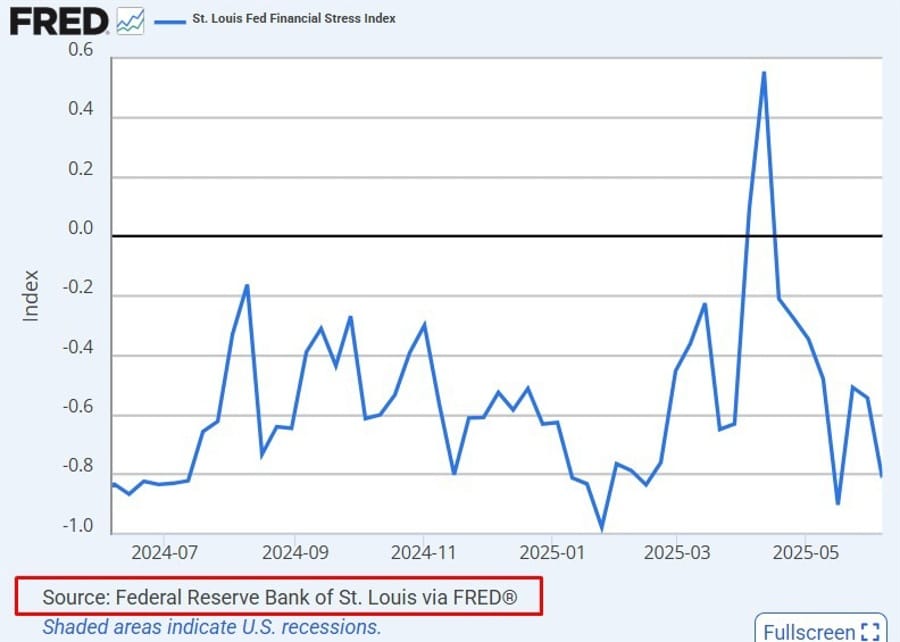

Fed’s Financial Stress Index Drops Sharply in Early June

The St. Louis Fed’s latest data shows a significant easing in financial stress. For the week ending June 6, the Financial Stress Index fell to -0.81 from the previous week’s -0.54. The index—built from 18 indicators including interest rates, yield spreads, and market-based volatility measures—suggests broad market calm. As policymakers shy away from more aggressive actions, market confidence appears to be firming.

Musk’s SpaceX May Be Sidelined from Golden Dome Missile Shield

Reuters reports that Elon Musk’s SpaceX may have a reduced role in the Golden Dome missile defense system, a project it was previously expected to help build alongside Palantir and Anduril. The shift follows a falling-out between Musk and President Trump. New plans being considered could focus more on upgrading existing ground infrastructure instead of relying on SpaceX’s satellite tech in the initial rollout.

Trump Expands 50% Steel Tariffs to Home Appliances

A new round of tariffs on imported appliances is set to begin June 23. President Trump’s administration announced that fridges, washers, ovens, and more will now fall under the 50% tariff regime. The duties—initially introduced at 25% and expanded—will now target eight new product categories based on their steel content. This is the second expansion of affected items since the policy launched, raising concerns over broader inflationary impacts on consumer goods.

Goldman Sachs Cuts Recession Odds to 30%, Sees Smoother Growth

Goldman Sachs has revised down its 12-month U.S. recession forecast to 30% from 35%, citing a thaw in U.S.-China trade tensions. The recent agreement on tariff structures and Chinese student visas, along with eased restrictions on rare earth exports, contributed to a more stable outlook. Financial conditions have improved, and the bank has bumped its 2025 GDP growth forecast from 1% to 1.25%. Peak unemployment is now expected to hit 4.4%.

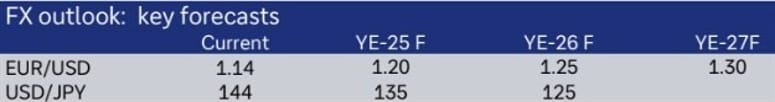

Deutsche Bank Flags Risk to USD as Trade Policy Clouds Outlook

Deutsche Bank warns that prolonged trade friction could undermine the U.S. dollar’s structural advantages. While a full-blown recession isn’t their base case, strategists believe the dollar is losing ground as capital, hedging, and valuation flows outweigh rate differentials. The U.S.’s large current account deficit and net international investment gap leave it vulnerable. Deutsche sees potential rotation into surplus currencies like the euro, yen, and yuan, though that depends on the policy path Trump’s administration ultimately takes.

Trump to Host Emergency Security Council Meeting Amid War Talk

President Trump is scheduled to convene the National Security Council on Friday, June 13 at 11:00 a.m. ET to address escalating conflict between Israel and Iran. Iranian state media has floated claims that Tehran may declare war on Israel and retaliate “soon.” The situation follows strikes on multiple high-value Iranian targets, including Natanz, with confirmed fatalities among senior Revolutionary Guard and nuclear officials. Netanyahu has vowed that the Israeli campaign will not stop until Iran’s threat is “neutralized.”

Canadian Wholesale Sales Fall 2.3% in April, Broad-Based Decline

Canada’s wholesale trade dropped 2.3% in April 2025, far below the forecasted -0.9%. This follows a modest 0.2% rise in March. Six of seven subsectors saw sales declines, together making up over 80% of the total.

- Biggest decline: Motor vehicles and parts, down 6.5% to $14.3 billion.

- Year-over-year: Wholesale sales rose 0.1%.

- Volume basis: Down 2.2%.

- Provincial breakdown: Seven provinces reported decreases, with Ontario seeing the sharpest pullback.

- Inventories: Adjusted for exclusions, inventories dropped 0.2% to $129.4 billion.

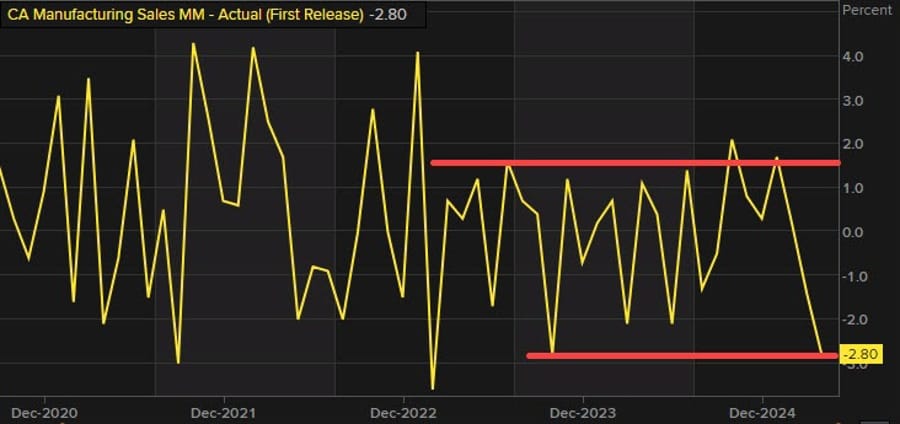

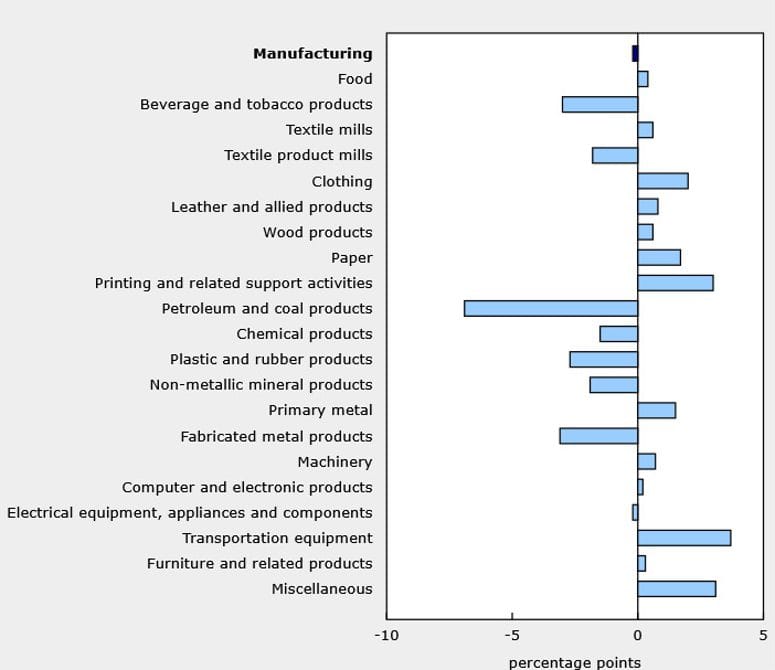

Canadian Manufacturing Sales Slide 2.8% in April, Biggest Drop Since 2023

Manufacturing sales in Canada fell 2.8% in April 2025, a steeper decline than the -2.0% expected and the most severe monthly drop since October 2023. The current level is the lowest since January 2022.

- Key sectors driving the downturn:

- Petroleum and coal: -10.9%

- Motor vehicles: -8.3%

- Primary metals: -4.4%

- Excluding petroleum/coal: -1.8%

- Year-over-year: Total sales declined 2.7%.

- In constant dollars: Sales fell 1.8%.

- Industrial Product Price Index: Dropped 0.8% in April.

Manufacturer feedback revealed significant strain from U.S. tariffs:

- Half reported tariff impacts.

- One-third faced price hikes.

- One-quarter cited cost spikes in shipping, labor, or materials.

- One-fifth saw demand shifts.

Ontario manufacturers were hit hardest, especially in transportation equipment and metals.

Canada Q1 Capacity Utilization Rises to 80.1%, Driven by Energy and Utilities

Canada’s industrial capacity utilization rate rose to 80.1% in Q1 2025, surpassing the consensus estimate of 79.8%. The prior quarter’s reading was revised slightly lower from 79.8% to 79.7%. This improvement, while not typically a market mover, reflects continued economic normalization—often seen when central banks shift into easing mode.

- Mining, Quarrying, Oil & Gas: Utilization in this sector jumped 0.7 points to 76.7%, driven by increased activity in the oil sands and related support services.

- Electric Power: Utilization rose from 83.2% to 86.1%, supported by elevated electricity demand due to colder-than-average weather in some regions.

- Manufacturing: Capacity use declined by 0.2 points to 77.9%, with major drag from:

- Petroleum and coal products: -6.9 points

- Fabricated metal products: -3.1 points

Commodities News

Gold Spikes to $3,446 Before Settling Near $3,422 as War Risk and Fed Bets Collide

Gold jumped to a five-week high of $3,446 per ounce Friday following Israeli airstrikes on Iran, before pulling back slightly to settle around $3,422, still up more than 1% on the session.

The move marked the third straight daily gain for bullion and was fueled by:

- Escalating geopolitical risk after Israel targeted Iranian nuclear sites and senior officials.

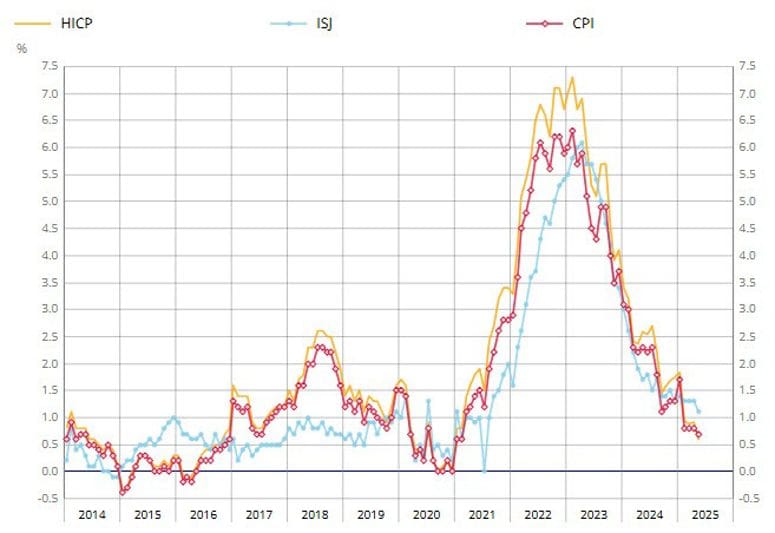

- Soft U.S. inflation data, with both CPI and PPI coming in below forecasts, reinforcing expectations of a September Fed rate cut.

- Falling U.S. real yields and a weaker U.S. dollar—though the Dollar Index (DXY) has bounced off its lows, now trading at 98.15.

President Trump blamed Iran for provoking the conflict, but also hinted the attack could be used as leverage for negotiations. Traders now turn their attention to next week’s FOMC meeting, along with U.S. data on retail sales, housing, and industrial production—all of which could steer gold’s next leg.

Analysts at Goldman Sachs forecast gold to hit $3,700 by year-end, with a potential move to $4,000 by mid-2026. Bank of America shares a similar outlook. With money markets now pricing in 47 basis points of Fed easing by year-end, gold’s bullish thesis remains intact—even as inflationary risks from rising oil prices complicate the backdrop.

Crude Oil Futures Surge Over 7%, Settle Just Below $73

Crude oil prices exploded higher on Friday as geopolitical concerns continued to dominate the energy landscape. July crude futures settled at $72.98, marking a $4.94 gain, or +7.26% on the day.

The sharp rally came as tensions between Israel and Iran rattled markets, driving a broad risk-off move and prompting increased demand for energy commodities amid fears of supply disruptions. The price surge pushed crude well above key technical levels, reinforcing bullish momentum heading into next week.

EU Gas Storage Progress Uneven, Germany Lags Behind

The European gas market remains jittery as the TTF contract rebounded 5% off Tuesday’s low. While EU-wide storage has filled faster than usual, reaching 52%, the picture is more concerning in Germany, where reserves sit at just 44%, according to GIE.

Breitbrunn, Germany’s third-largest gas facility, failed to find a bidder for extra capacity—raising alarms. The operator now believes the mandated 80% fill target by November 1 will not be met, citing technical constraints and slow injection rates.

This situation underscores the structural vulnerabilities in the bloc’s energy planning heading into winter.

Commerzbank Lifts Outlook for Silver, Platinum, and Palladium

Commerzbank has raised its year-end forecasts across the precious metals complex:

- Silver: $37/oz (up from $34)

- Platinum: $1,250/oz (was $1,000)

- Palladium: $1,100/oz (was $1,000)

For 2026, the targets are even higher: Silver at $40, Platinum at $1,400, and Palladium at $1,200. Analyst Carsten Fritsch notes that while Silver and Platinum remain undervalued relative to Gold and face supply constraints, Palladium’s upside is limited due to declining demand from automakers and increased recycling.

Investors may begin favoring Silver and Platinum as cheaper inflation hedges, though momentum could remain Gold-centric in the near term.

OPEC Stands Pat as Oil Surges Above Key Resistance Levels

The Secretary-General of OPEC stated that the organization sees no need for policy action at this time, citing no new shifts in either supply or broader market conditions. Despite that, oil prices are soaring amid fears of disruptions tied to the Middle East.

- Technical breakout:

- WTI crude climbed to $72.91, up $4.09 or 5.94% on the day.

- Hit a session high of $77.57—highest since January 20.

- Currently trades above:

- 200-day moving average ($68.47)

- 61.8% Fibonacci retracement level ($70.96)

- Support zones:

- Closest is $72.22 (April 2 high).

- A break below this reopens $70.96 as a downside target.

The year-to-date high remains $80.73, set on January 15.

Iraq Says Iranian Gas Flows Remain Steady Despite Strikes

Iraq’s state-run media reports that natural gas deliveries from Iran have not been impacted by Israel’s recent military actions. While oil markets briefly eased, crude prices resumed their upward trajectory in late trading. WTI crude was last seen at $72.96 per barrel, up 6% on the day, as traders factor in broader supply concerns linked to the regional conflict.

Gold Climbs to $3,445 as Inflation Softens and Risks Rise

Gold surged to $3,445 per ounce overnight—the highest since April’s record peak—boosted by soft U.S. inflation data and rising geopolitical tensions.

Commerzbank notes that PPI data from May was cooler than forecast, strengthening the case for a Fed rate cut by September. President Trump’s renewed attacks on Fed Chair Powell and the weakening U.S. dollar have further bolstered Gold’s appeal.

Analysts believe mounting concerns over the Fed’s independence and doubts about the U.S. dollar’s safe-haven status are driving sustained demand for Gold. Central banks and retail investors are expected to continue adding to their holdings, though upward momentum may begin to taper.

U.S. Oil Output May Have Peaked as Drilling Slows, Says Commerzbank

U.S. oil production appears to have peaked earlier than expected, according to Commerzbank’s analysis of the EIA’s latest monthly forecast. Production hit 13.59 million barrels per day in April—earlier than the previous projection of a December 2025 peak.

The EIA has now revised its end-of-year forecast downward by 250K bpd. Drilling activity has been falling since mid-March, with the Baker Hughes rig count hitting a post-2021 low of 442 rigs.

Even with relaxed permitting under the Trump administration, producers are hesitant. Lower oil prices have blunted the incentive to expand output. This shift could allow OPEC+ to regain market share, with Saudi Arabia reportedly preparing to ramp up production.

JPMorgan Warns Oil Could Spike to $130 in Escalation Scenario

JPMorgan kept its base-case oil forecast at $60–$70 per barrel but warned that a worst-case geopolitical scenario could propel prices to $120–$130. The report cited the risk of a supply shock if Iranian exports—currently 2.1 million barrels per day—are disrupted or if the Strait of Hormuz is closed. Current Brent prices, sitting near $69, already reflect a $4 risk premium, the bank noted. Tensions in the Gulf and further conflict could easily inflate that margin.

Oil Prices Price in Risk Premium as Middle East Tensions Flare

Geopolitical risk is quickly being baked into crude oil prices, ING reports, following Israel’s military action against Iran. With daily output from Iran near 3.3 million barrels and 1.7 million of that exported, markets are bracing for potential supply disruptions if the conflict escalates. Volatility has spiked sharply as uncertainty over oil flow from the region intensifies.

Natanz Nuclear Facility Reportedly Destroyed, Says Iran Atomic Chief

Iran’s top nuclear official has reportedly told domestic media that the Natanz facility—one of the country’s primary uranium enrichment sites—has been hit. Alternate reports describe the damage as “severe,” though no official statement has clarified the full extent. Meanwhile, Iran’s National Oil Refining and Distribution Company stated that no damage has occurred to the nation’s refineries or storage tanks. With Iran playing a significant role in global oil supply despite sanctions, markets are watching closely for spillover effects.

Europe News

European Markets Close Lower Across the Board on Geopolitical Fears

Major European indices ended the day in the red as geopolitical uncertainty dragged on sentiment. Italy and Spain led the declines, while the UK’s FTSE 100 was the only index to eke out a weekly gain.

Closing figures:

- DAX: 23,516.24 (-1.07%)

- CAC 40: 7,684.69 (-1.04%)

- FTSE 100: 8,850.62 (-0.39%)

- Ibex 35: 13,910.59 (-1.27%)

- FTSE MIB: 39,438.74 (-1.28%)

Weekly performance:

- DAX: -3.24%

- CAC 40: -1.54%

- FTSE 100: +0.14%

- Ibex 35: -2.37%

- FTSE MIB: -2.86%

Markets remain volatile as investors weigh military risks in the Middle East and their impact on global energy, currency, and inflation dynamics.

Eurozone Trade Surplus Shrinks Sharply in April

The Eurozone’s trade balance fell to €9.9 billion in April, down from €36.8 billion in March. The sharp drop highlights slowing export momentum amid a complex backdrop of weakening global demand and ongoing geopolitical tensions affecting European trade channels.

Eurozone Industrial Output Drops 2.4% in April

Industrial production across the Eurozone fell 2.4% month-on-month in April, missing the -1.7% forecast and reversing from March’s upwardly revised 2.4% gain. Sector breakdowns show broad-based weakness: intermediate goods (-0.7%), energy (-1.6%), capital goods (-1.1%), durable consumer goods (-0.2%), and non-durables (-3.0%). The data suggests that any Q1 strength may have been short-lived.

Germany Confirms May CPI at 2.1% Year-on-Year

Germany’s final consumer price index (CPI) for May came in at +2.1% year-on-year, matching the preliminary estimate and holding steady from April’s reading. The Harmonized Index of Consumer Prices (HICP) also held at 2.1%. However, core inflation remains uncomfortably high at 2.8%, which complicates the European Central Bank’s decision to stay on hold through the summer.

German Wholesale Prices Fall Again in May, But Still Up on Year

Germany’s wholesale price index declined 0.3% in May, marking the third straight monthly drop. Despite that, prices remain up 0.4% year-over-year, mainly driven by gains in food, beverages, and tobacco. The May decline followed April’s -0.1% print and shows continued monthly pressure, even as year-on-year comparisons still reflect earlier price spikes.

France’s May CPI Holds at 0.7% Annually; Core Inflation Eases

Final data from INSEE confirms France’s consumer prices rose 0.7% in May, unchanged from the initial estimate but down from April’s 0.8%. The harmonized index rose 0.6%, matching preliminary figures. Notably, core inflation declined to 1.1%, down from April’s 1.3%, with services inflation falling from 2.4% to 2.1%, providing some relief for policymakers.

Spain’s Final CPI for May Edges Up to 2.0%

Spain’s final CPI for May rose to 2.0% year-on-year, slightly above the 1.9% preliminary reading but still a step down from April’s 2.2%. The HICP also confirmed at 2.0%. Core inflation cooled to 2.2% from 2.4%, indicating ongoing disinflation across much of the eurozone.

Asia-Pacific & World News

China’s Credit Growth Slows in May as Loan Activity Cools

China’s money supply (M2) rose 7.9% year-over-year in May, just shy of the 8.1% expected and slightly below April’s 8.0%. New yuan loans totaled ¥620 billion, missing the forecast of ¥850 billion, though well above April’s ¥280 billion. The numbers reflect a pullback in bank lending following aggressive stimulus measures in Q1 as Beijing prepared for heightened trade tensions.

Iran Confirms Deaths of Senior Commanders, Warns of Escalation

Iran’s military confirmed the deaths of several top figures—including Revolutionary Guards chief Hossein Salami, Armed Forces Chief Mohammad Bagheri, and Gholam Ali Rashid, head of the Khatam al-Anbiya Central Command—following Israeli strikes. Tehran has declared that Israel has “crossed all red lines” and said there will be no limits on its response to what it now refers to as an act of war.

IAEA: No Radiation Spike Detected at Natanz Facility

The International Atomic Energy Agency (IAEA) said it has not observed any rise in radiation at Iran’s Natanz nuclear site following Israeli airstrikes. While the facility was reportedly struck multiple times, radiation levels remain stable. Iran also confirmed that its Bushehr nuclear power station—its first operational commercial reactor—was not hit during the attack.

Commerce Secretary Says China Tariff Pause Likely Short-Lived

U.S. Commerce Secretary Howard Lutnick suggested the current pause in China tariffs likely won’t be extended, though he noted that final decisions rest with President Trump. Despite recent diplomatic progress, policy direction remains highly contingent on the White House’s mood. Market participants should be prepared for sudden shifts, as no clear signal on long-term trade policy has been issued.

Iran Promises Retaliation Against U.S. and Israel

Iran’s military command, via state media, issued a stern warning stating both Israel and the U.S. would “pay a very heavy price” for recent strikes. The Armed Forces warned of a coming retaliatory attack, calling it inevitable and “by God’s will.” The rhetoric has escalated sharply, with promises of a “harsh blow” aimed directly at both nations.

PBOC sets USD/ CNY reference rate for today at 7.1772 (vs. estimate at 7.1685)

- PBOC CNY reference rate setting for the trading session ahead.

- Injects 202.5bn yuan via 7-day reverse repos At 1.40%

- 135bn yuan mature today

- injects net 67.5bn yuan

New Zealand PM Heads to China, Europe for Diplomatic Push

Prime Minister Christopher Luxon will embark on a diplomatic tour this month, visiting China, the EU, and the NATO summit. It will be his first official trip to China since taking office. Discussions with President Xi will likely center on the $23 billion bilateral trade relationship, while the European leg will focus on expanding Indo-Pacific security ties and reinforcing support for multilateral frameworks in an increasingly fractured world.

New Zealand Manufacturing PMI Falls Back Into Contraction

New Zealand’s May Manufacturing PMI slid to 47.5, down sharply from April’s 53.3, according to BusinessNZ. That puts the index back in contraction after four months of modest expansion. Catherine Beard, BusinessNZ’s Director of Advocacy, described the report as disappointing, especially given early-year optimism. The reading is well below the long-term average of 52.5.

BNZ’s Senior Economist Doug Steel:

- “the New Zealand economy can claw its way forward over the course of 2025, but the PMI is yet another indicator that suggests an increased risk that the bounce in GDP reported for Q4, 2024 and Q1, 2025 could come to a grinding halt”

Japan Eyes Auto Tariff Exemption in U.S. Trade Deal

Japan’s chief trade negotiator Ryosei Akazawa told Bloomberg that Tokyo is working toward securing an exemption from the U.S.’s 25% tariff on automobiles and parts. The Japanese government expects that a bilateral agreement will grant the country special status. The auto industry is one of Japan’s largest exporters and a key interest in trade talks.

Japan Sets July 20 for Upper House Elections

According to Japanese media outlets including Asahi, the country’s Upper House elections will take place on July 20, 2025. Out of 248 seats, 124 will be contested. The ruling LDP-Komeito coalition must retain at least 125 seats to hold its majority. Prime Minister Ishiba, who took power after the LDP lost its Lower House majority last year, now leads a minority government entering a critical political test.

Bank of Japan Likely to Hold Rates, But Inflation Sparks Debate

BOJ officials are expected to keep the policy rate at 0.5% during their June 16–17 meeting. Sources suggest inflation is running slightly above what the Bank had projected earlier this year, raising the possibility of policy tightening later—if global trade frictions ease. A notable factor has been a surge in rice prices, which may be reinforcing inflation expectations among households. Markets will be closely focused on signals regarding future bond purchase reductions, especially for 2026.

Crypto Market Pulse

Ethereum Slides Despite $463M Buy from SharpLink, Risk-Off Mood Weighs Heavy

Ethereum (ETH) lost ground on Friday, falling over 6% to trade around $2,460 despite a major announcement from SharpLink Gaming (NASDAQ: SBET). The company disclosed it had acquired 176,270.69 ETH for approximately $462.9 million, becoming the largest publicly listed firm holding Ethereum.

The purchase, executed at an average price of $2,626 per ETH, was funded through private placements and at-the-market (ATM) equity offerings. SharpLink noted it has already staked 95% of its ETH reserves, positioning the asset as a yield-generating, long-term treasury strategy.

Despite the bullish fundamental signal, market sentiment remains under pressure. Ongoing conflict in the Middle East, especially after Israel’s strike on Iran, has pushed crypto markets lower. SharpLink’s stock fell 66% on Friday, and Ethereum’s chart shows price flirting with breakdown levels near the 50-day moving average. A failure to hold support could trigger a deeper drop toward $2,260.

SharpLink Chairman Joseph Lubin described Ethereum as “foundational infrastructure” for financial systems, aligning the strategy with institutional DeFi trends. Still, Friday’s selloff overshadowed the bullish narrative.

Walmart and Amazon Explore Stablecoin Plans Amid Legislative Shift

Walmart and Amazon are in early-stage discussions about launching stablecoins pegged to the U.S. dollar, The Wall Street Journal reports. The move could dramatically cut transaction fees, streamline digital payments, and create new customer loyalty mechanisms. With Amazon’s $638 billion in 2024 global revenue and Walmart posting $122 billion in U.S. net sales for the fiscal year ending January 2025, stablecoin integration could shift billions of dollars from traditional payment processors like Visa and Mastercard.

The backdrop for this development is the U.S. Senate’s progress on the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins). After a substitute amendment passed by a 68–30 margin, the final vote is expected early next week. Backed by Senators Lummis, Gillibrand, Hagerty, and Scott, the bill could modernize U.S. payments and secure its role in global financial innovation.

Notably, major banks including JPMorgan, Citigroup, Wells Fargo, and Bank of America are also in the early stages of developing a joint stablecoin product—highlighting rapid institutional adoption of blockchain-based assets.

Ripple and SEC Seek Release of $125M in XRP Escrow as Price Slumps

Ripple and the SEC filed a joint motion to release $125 million held in escrow, with $50 million earmarked for settlement payment to the SEC and the remaining $75 million returned to Ripple. The filing comes amid mounting geopolitical turmoil, which has dragged XRP down to $2.14 at press time—just above key support at $2.09.

The crypto market saw over $23 million in XRP liquidations over the past 24 hours, largely triggered by Israel’s targeted strikes on Iranian nuclear and military infrastructure. Iran has since responded with drone attacks, escalating the conflict and prompting Israel to declare a state of emergency.

In parallel, institutional interest in XRP remains strong. Companies including Trident Digital Tech Holdings and Hyperscale Data Inc. have announced new XRP-backed treasury products. Ondo Finance also recently launched OUSG, its tokenized U.S. Treasuries product, on the XRP Ledger, aiming to bridge DeFi with traditional finance.

Bitcoin Craters Below $104K as Middle East Crisis Deepens

Bitcoin plunged to $103,162 following Israel’s surprise strikes on Iranian nuclear facilities, including military installations in Tehran. While the crypto asset saw a slight recovery, it remains 2% down on the day.

Prime Minister Netanyahu confirmed the attacks, signaling further action if necessary. The escalation follows an IAEA report accusing Iran of breaching uranium enrichment limits—raising concerns of broader conflict. President Trump acknowledged the potential for “massive conflict” but still voiced hope for diplomacy.

Sui Slides Below $3 as Derivatives Signal Bearish Momentum

Sui (SUI) fell below $3 again on Friday, marking its third consecutive day of losses. The broader crypto downturn—driven by conflict in the Middle East—has wiped out market confidence. At press time, SUI was down over 5%.

According to CoinGlass, SUI’s Open Interest dropped 14% in the past 24 hours to $1.20 billion, its lowest point since April. Long liquidations totaled $12.63 million versus just $766K in shorts, pushing the long/short ratio to 0.9369.

Technical signals also show a potential breakdown from a triangle pattern, suggesting further downside. Funding rates fluctuated sharply but currently hover at 0.0024%, indicating some lingering bullish activity, possibly linked to short-term price recovery efforts.

The Day’s Takeaway

United States

- Markets Suffer Sharp Losses: The S&P 500 (-1.13%), Dow (-1.79%), and Nasdaq (-1.30%) posted their steepest one-day drops since May 21, driven by fears of broader conflict following Israel’s airstrikes on Iran and subsequent retaliation.

- Yields Defy Risk-Off Trend: Treasury yields rose despite geopolitical tension, with the 10-year at 4.408% and the 30-year nearing 4.90%, likely reflecting inflation concerns tied to spiking oil prices.

- University of Michigan Sentiment Improves: June’s preliminary reading rose to 60.5, while one-year and five-year inflation expectations eased to 5.1% and 4.1%, respectively.

- Federal Reserve in Focus: The FOMC meets next week. A rate hold is expected, but the market will scrutinize updated projections and the dot plot, especially as softer CPI and PPI data support potential rate cuts by September.

Canada

- Capacity Utilization Rises to 80.1%: Canada’s industrial sectors showed signs of momentum, led by strength in energy and utilities. However, manufacturing utilization dipped slightly due to weakness in petroleum and metals.

- Manufacturing Sales Drop Sharply: April’s sales fell 2.8%, the largest decline since October 2023. Petroleum (-10.9%) and motor vehicles (-8.3%) led the fall. Feedback links part of the weakness to recent U.S. tariffs.

- Wholesale Trade Contracts: April wholesale sales declined 2.3%, well below expectations. Seven provinces saw declines, with Ontario the weakest. Motor vehicle sales dropped 6.5%, dragging the headline figure.

Commodities

- Oil Soars on Mideast Conflict: July crude futures jumped $4.94 or +7.26%, closing at $72.98. Intraday highs neared $77.57, the strongest level since January, as traders priced in supply disruption risk.

- Gold Breaks Higher: Spot gold hit $3,446, its highest in five weeks, before settling near $3,422. Geopolitical stress, a weaker dollar, and dovish Fed bets all fueled the rally. Goldman Sachs sees $3,700 by year-end, with potential for $4,000 in 2026.

- Commerzbank Lifts Metals Outlook:

- Silver year-end forecast raised to $37/oz, $40 in 2026.

- Platinum now seen at $1,250/oz this year.

- Palladium forecast modestly raised to $1,100/oz, with limited upside due to declining auto demand and rising recycling.

- U.S. Oil Output May Have Peaked: EIA data revised peak output to April’s 13.59M bpd, earlier than expected. Production forecasts for year-end and 2026 have been downgraded, with drilling activity at its lowest since fall 2021.

Europe

- Markets End Deep in Red: European indices closed lower as war fears drove risk aversion:

- DAX: -1.07% (weekly -3.24%)

- CAC 40: -1.04% (weekly -1.54%)

- FTSE MIB: -1.28% (weekly -2.86%)

- Ibex 35: -1.27% (weekly -2.37%)

- Only FTSE 100 ended the week higher: +0.14%

- Gas Storage Worries Resurface: Germany’s gas fill rate lags at 44%, compared to the EU average of 52%. Failure to auction more capacity at Breitbrunn raises concern about hitting the 80% November target.

Asia

- SharpLink Bets Big on Ethereum: The U.S.-listed company bought 176,270.69 ETH (~$463 million), becoming the largest public ETH holder. Still, ETH prices dropped 6% Friday, as Middle East conflict triggered liquidations.

- Japan’s BOJ Decision Looms: Policymakers meet Tuesday. No rate change expected, but inflation tracking slightly above earlier projections could renew discussion of future tightening if global conditions stabilize.

Crypto

- Bitcoin Drops Below $104K: BTC tumbled as Israel’s military strikes sparked global volatility. While it partially rebounded, the asset remains under pressure. Safe-haven flows moved instead toward gold and the yen.

- Ethereum Underperforms Despite SharpLink Buy: ETH remains weak, closing down 6% despite SharpLink Gaming’s high-profile $463 million purchase and staking strategy. Analysts warn that breaking key support could send ETH toward $2,260.

- Sui Slips Below $3: The altcoin logged its third straight daily loss. Open interest plunged 14% to $1.2B, with long liquidations totaling over $12.6M, signaling heightened bearish momentum amid market-wide derisking.