North America News

Tech Leads Market Higher as S&P Turns Positive for 2025

Tuesday saw a strong session for U.S. equities, particularly tech stocks, as softer inflation data revived investor confidence. The S&P 500 closed at 5,886.55, a 0.72% gain, pushing the index to +0.08% year-to-date, finally back in the green for 2025.

The NASDAQ outperformed, jumping 1.61% to 19,010.08, while the Dow slid -269.67 points (-0.64%) to 42,140.43, hit by a 17.83% drop in UnitedHealth following the CEO’s resignation and lack of forward guidance.

The Russell 2000 rose 0.49%, ending the day at 2,102.34.

Among standout gainers:

- First Solar +22.63%

- Super Micro Computer +15.99%

- Robinhood +8.93%

- Palantir +8.10%

- ETH/USD +7.44%

- NVIDIA +5.59%

- Block +5.74%

- United Airlines +5.06%

April U.S. Inflation Data: Headline CPI Dips, Core Holds Steady

The April 2025 U.S. CPI report shows further disinflation, with the headline number falling to +2.3% YoY, the lowest since February 2021, and below the 2.4% forecast.

Key figures:

- Headline CPI MoM: +0.2% (vs +0.3% expected)

- Unrounded headline MoM: +0.221%

- Core CPI YoY: +2.8% (in line with expectations)

- Core CPI MoM: +0.2% (vs +0.3% expected)

- Unrounded core MoM: +0.237%

Deeper inflation metrics:

- Core goods: +0.06%

- Core services: +0.317%

- Core services ex-shelter: +0.287%

- Core services ex-rent/OER: +0.373%

- Services ex-energy: +0.317%

Real weekly earnings fell 0.1% after being revised up to +0.6% in March. While inflation is cooling, persistent core service pressures may delay Fed easing.

NFIB: Small Business Optimism Beats Forecasts Despite Drop

The NFIB Small Business Optimism Index came in at 95.8 for April, beating expectations of 94.5 but down from March’s 97.4 reading.

- The Uncertainty Index fell 4 points to 92, still well above the long-term average of 68

- 34% of business owners reported unfilled job openings, down 6 points MoM

- This is the lowest hiring pressure seen since January 2021

While headline sentiment remains subdued, the report signals gradual normalization in small business labor markets as conditions adjust post-trade deal.

U.S. Student Loan Delinquencies Surge

Following the end of pandemic-era relief programs, student loan delinquencies have risen sharply. In Q1 2025, 7.74% of student debt was over 90 days delinquent, up from less than 1% in the previous quarter. Approximately 6 million borrowers are now past due or in default.

U.S.-China Tariff Reduction

The U.S. and China agreed to reduce tariffs for 90 days, with U.S. duties on Chinese goods dropping from 145% to 30%, and China’s tariffs on U.S. products decreasing from 125% to 10%. This temporary truce aims to ease trade tensions and has positively impacted global markets.

BofA Survey: Fund Managers Dump Dollars, Embrace Soft Landing View

Bank of America’s latest Fund Manager Survey revealed the largest underweight position in the U.S. dollar since 2006.

Highlights:

- Pre-Geneva, fund managers priced U.S. tariffs on Chinese goods at 37%

- Post-truce, 61% now anticipate a soft landing, up from 37% in April

- Hard landing views fell to 26%, down from 49% the prior month

BofA analysts note that the trade ceasefire has lowered perceived risk of recession or a credit event, prompting reallocations across major asset classes.

Goldman Sachs Scales Back Fed Cuts, Sees Lower Recession Odds

Following the U.S.-China tariff deal, Goldman Sachs revised its recession probability for the U.S. over the next 12 months down to 35%, from a prior 45%.

Goldman now expects only one Fed rate cut in 2025, compared to its earlier forecast of three. The firm sees trade relief reducing supply-side inflation risk, but believes persistent price pressures will limit how much easing the Fed can justify.

US Bessent: Talks in Geneva with China resulted in a mechanism to avoid escalation

- US Treasury Secretary Scott Bessent speaking

- Talks in Geneva with China resulted in a mechanism to avoid escalation.

- President Trump wants to rebalance the US economy.

- China needs to rebalance towards consumption economy.

- We do not want a generalised decoupling between the two largest economies in the world.

- United States will bring medicine, semiconductor and other strategic industries home.

- Very productive discussions with Japan.

- Focused on Asia deals, Indonesia has been very forthcoming, Taiwan presented very good proposals.

BofA: “Trump Put” in Play as Markets Cheer Trade Ceasefire

Bank of America analysts say the market rebound following the U.S.-China tariff truce reflects the return of the “Trump Put”—the idea that Trump will act to prevent a market collapse.

BofA commentary:

- “De-escalation looks set to continue.”

- “The Trump Put is alive and well.”

- “Further trade deals are likely as the administration seeks to avoid recession.”

Despite the ceasefire, the 10% baseline tariff introduced in April is likely to remain, according to Commerce Secretary Lutnick, who said it’s expected to be in place indefinitely.

Deutsche: Fed Rate Cuts Still Unlikely Before December

Deutsche Bank maintains its forecast that the Fed’s first rate cut won’t come until December, even after the easing of U.S.-China trade restrictions.

Why?

- Tariff relief may reduce supply-side inflation risks

- But core inflation pressures remain elevated

- Fed is likely to proceed cautiously despite trade peace

Analysts concluded: “We don’t see near-term disinflation strong enough to prompt early easing.”

Citi: July Now the Expected Start of Fed Rate Cuts

Citigroup has pushed its forecast for the first Fed rate cut to July, moving it from June after analyzing the latest U.S.-China tariff developments.

Citi now expects:

- A cut at every FOMC meeting from July to January

- Total of 125 basis points in easing over that period

This is based on expectations that tariff de-escalation, coupled with softening inflation, will give the Fed room to start a steady path of reductions.

Trump’s Hassett says there are 24 countries lined up for trade talks over the next weeks

- Hassett is Trump’s director of the National Economic Council, a senior economic adviser:

- Rebooting the relationship with China

- Greer, Bessent will continue talks with China

- Markets could expect ‘normalization’ of things

- 24 trade talks lined up over the next weeks

U.S. Trade Representative Greer: If things don’t work out, China tariffs can go back up

- Greer speaking on Fox

U.S. Trade Representative Greer:

- China has agreed to remove countermeasures

- Outcome of China tariff talks ‘pragmatic’

- If things don’t work out, China tariffs can go back up

Canada: Carney’s Cabinet Reshuffle

Prime Minister Mark Carney unveiled a streamlined 29-member cabinet, aiming to reset U.S.-Canada relations and revitalize the economy. François-Philippe Champagne remains as Finance Minister, while Anita Anand steps in as Foreign Minister, replacing Mélanie Joly, who moves to Industry. Chrystia Freeland continues as Minister of Transport and Internal Trade. The reshuffle reflects Carney’s strategy to reduce U.S. dependence and implement significant investments and tax reforms.

Reuters has more here.

Commodities News

Gold Bounces on Inflation Miss, but Upside Capped by Risk-On Sentiment

Gold prices moved modestly higher on Tuesday, ending the session around $3,250, up 0.42%, as investors reacted to softer U.S. CPI data. However, risk appetite driven by the U.S.–China trade ceasefire kept the metal from regaining Monday’s steep 2.70% loss.

April CPI came in lighter than projected: 0.2% m/m for both headline and core, with 2.3% y/y and 2.8% y/y readings, respectively. Despite the weaker data, traders remain cautious, anticipating that tariffs will begin filtering into price levels over the coming months.

Traders are now looking ahead to the PPI and retail sales reports, which could further steer expectations on interest rate moves. Fed funds futures now price in 52 basis points of cuts by year-end — two cuts in total, in line with the Fed’s December 2024 projections.

Gold still faces technical resistance near $3,300. Even though geopolitical risks are down for now, the trend could shift quickly. Central banks continue to buy: the People’s Bank of China added 2 tonnes, Poland added 12 tonnes, and the Czech Republic increased reserves by 2.5 tonnes in April.

Private Oil Inventory Data Shows Unexpected Crude Build

Private oil inventory figures released ahead of official EIA data showed a surprise crude oil build, running counter to market expectations:

- Crude oil stocks: +4.287 million barrels

- Gasoline: -1.374 million barrels

- Distillates: -3.675 million barrels

- Cushing: -850,000 barrels

- Strategic Petroleum Reserve (SPR): +0.5 million barrels

The headline crude build surprised traders who had expected a draw, and it could challenge the recent bullish momentum in crude futures — particularly if confirmed by official numbers on Wednesday.

Crude Oil Pushes to Highest Close Since Mid-April

Crude oil futures closed Tuesday at $63.67, climbing $1.72 or 2.78% on the day. The rally marks the fourth consecutive daily gain and the fifth in the last six sessions. Since May 5, when oil settled at $57.15, prices have surged 11.38%.

This is the strongest close since April 17, when the market ended at $63.68. Traders are now eyeing the $64.71 level, which represents the 50% retracement of oil’s range from its April 2020 pandemic low.

Fundamentals have provided support: easing tensions in the U.S.–China trade standoff, a new trade agreement with the UK, and growing optimism ahead of the summer driving season in the U.S. However, some of the upward pressure is being checked by supply-side developments. OPEC+ is continuing its phased rollback of 2.2 million barrels per day in production cuts, while the EIA anticipates that inventories will continue to build in the coming months.

Commerzbank: China’s Copper Imports Hitting Saturation Point

China’s Copper imports reached a record in April, with 2.92 million tons of ore and concentrate shipped in—a massive peak that appears to signal a slowdown in future growth, according to Commerzbank’s Volkmar Baur.

Key data:

- 12-month total: 28.8 million tons (record high)

- Since 2010:

- Ore/concentrate imports: +300%

- Unwrought Copper/products: +30%

- Ratio of ore to finished Copper imports now exceeds 5:1

Baur notes that while April showed a strong +24.6% YoY jump, the broader trend shows momentum weakening:

- 12-month import growth has dropped to 2.4%, down from 9% a year ago

This may reflect tight global supply more than waning Chinese demand. In 2023, China accounted for 65% of global Copper ore and concentrate imports, while total global supply rose just 1.8%, per the U.S. Geological Survey.

Chinese Gold ETFs See Record Inflows in April

Chinese Gold ETFs saw a surge in demand during April, with net inflows of nearly 65 tons, marking the largest monthly increase in over three years, according to Commerzbank and World Gold Council data.

Breakdown of WGC data:

- Global ETF inflows: 115 tons in April

- China’s share: ~65 tons

- April inflows exceeded all of Q1 2025 and surpassed total 2024 inflows

This marks a shift in investor behavior in China:

- Previously favored physical gold (bars and coins)

- Now showing increased interest in ETFs

Despite the surge, China’s total Gold ETF holdings remain modest at 203 tons—well below the U.S. (1,750+ tons) and Europe (1,340+ tons). If this trend holds, it could drive sustained institutional gold buying out of China in the years ahead.

Silver, Platinum, Palladium Lag Gold in Post-Tariff Price Reaction

Silver, Platinum, and Palladium briefly rallied after the U.S.-China tariff truce but later followed Gold into decline, says Commerzbank’s Carsten Fritsch.

Fritsch observes that, although losses were less severe than Gold’s, the overall price action was underwhelming:

- Silver and Palladium remain below early April levels

- Platinum has only just returned to those levels

- Gold, despite the pullback, is still well above its early April mark

The Gold/Silver ratio remains near 100, and Gold continues to trade at more than three times the price of both Platinum and Palladium. This skew reflects lingering market doubts that the tariff ceasefire will hold or evolve into a broader resolution.

Citi Cuts Near-Term Gold Outlook, Eyes Consolidation Zone

Citigroup has revised its 0–3 month gold price target to $3,150/oz, citing expectations of range-bound consolidation after the metal’s recent rally.

Analysts forecast gold will trade between $3,000 and $3,300 per ounce in the near term, as markets digest the effects of tariff shifts, central bank actions, and changing inflation forecasts.

Europe News

German ZEW Expectations Surge, But Conditions Still Grim

The May ZEW survey revealed a stark contrast in Germany’s economic outlook:

- Current conditions: -82.0 (worse than -77.0 forecast)

- Economic sentiment: +25.2 (well above +11.9 expected)

While present conditions remain deeply negative, expectations surged, reflecting optimism tied to political stabilization and progress on global trade negotiations. The ZEW institute credited the sentiment boost to “a more cooperative global backdrop.”

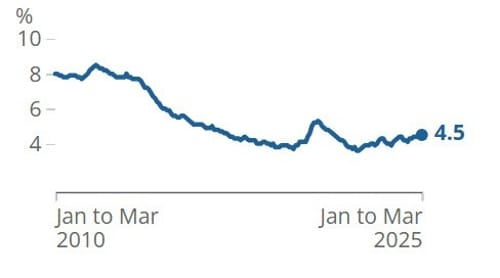

UK March Jobless Rate Steady at 4.5%, Wages Stay Elevated

Latest ONS data shows that the UK’s ILO unemployment rate held steady at 4.5% in March, matching forecasts but edging up from 4.4% the previous month.

- Employment change: +112K (vs +115K expected)

- Average weekly earnings (3m/y): +5.5% (vs +5.2% expected)

- Ex-bonus wages: +5.6% (vs +5.7%)

- April payrolls: -33K (prior revised to -47K from -78K)

Despite stable joblessness, the labor market shows signs of cooling momentum, particularly on payroll growth and hiring demand.

UK Retail Sales Soar in April, Posting Strongest Growth Since 2023

UK retail spending jumped 7.0% YoY in April, marking the largest increase since the pandemic era, according to the British Retail Consortium.

Highlights:

- March’s growth was just 1.1%

- Like-for-like sales climbed 6.8% (vs 0.9% in March)

- Clothing led the way thanks to sunny weather and Easter timing

- 2-month average (March + April): +4.3% YoY

Barclaycard data showed consumer card spending rose 4.5%, the first time in two years growth exceeded inflation. 70% of households said their financial situation felt stable.

Goldman Sachs Revises ECB Outlook, Now Sees Terminal Rate at 1.75% by July

Goldman Sachs has changed its forecast for the European Central Bank, now expecting the policy rate to hit a terminal level of 1.75% in July 2025. This is a shift from their earlier projection that anticipated a deeper cut to 1.50% by September.

The firm now forecasts:

- A 25 basis point cut in June

- Another 25 bps cut in July, bringing rates to 1.75%

Goldman’s view is now more aligned with market pricing, although traders still see only an 80% chance of a June cut and lower odds for July. One potential disruptor: the July 9 expiration of the EU-U.S. reciprocal tariff exemption, which could complicate the ECB’s path if no deal is reached.

In tandem, Goldman also nudged its Eurozone GDP forecasts upward, now projecting +0.1% growth in both Q3 and Q4, compared to flat growth in prior forecasts.

ECB Strategy Review to Reaffirm Past Stimulus Policy

According to Reuters, the European Central Bank is expected to stand by its past aggressive monetary policy during the upcoming strategy review, despite internal and external criticism.

Sources say the ECB will continue to justify quantitative easing, negative rates, and forward guidance as necessary responses to historic economic conditions. The review, launched in March, will likely emphasize the importance of “forceful and persistent” actions during crisis periods.

BoE’s Pill: I do worry about upside risks to inflation in upside inflation scenario

- Comments from BoE’s policymaker, Huw Pill

- Should not assume that latest MPR forecast is a direct endorsement of market interest rate curve.

- I see risk of second round effects (for inflation).

- I remain concerned we have seen a structural change in price and wage setting in UK.

- Response of monetary policy to ensure we get CPI back to target may need to be more persistent.

- MPR inflation forecast has become less relevant to MPC policy debate.

ECB’s Makhlouf: Uncertainty is weighing on investment

- Comments from the ECB policymaker, Gabriel Makhlouf

- Uncertainty is weighing on investment.

- Soft data pointing to a significant cooling in business and consumer sentiment.

- Global economic integretion is now stalled, if not reversing; last few weeks have seen an acceleration in pace and scale of change.

- Even if a full-blown trade war turns out to be short-lived, uncertainty effects will persist for some time.

- Monetary policy must adapt to the new nature of supply shocks generated by geoeconomic fragmentation.

- Given effects of size, scale and more persistent nature of fragmentation-induced shocks, and their impact on prices, monetary policy responses will need careful calibration.

- Threats of inflation de-anchoring, from both above and below, warrant forceful and persistent responses.

- Interest rates remains default policy lever in our toolbox; when constrained by lower bound, other tools such as targeted lending and balance sheet operations have their uses.

ECB’s Nagel: It’s important to be cautious and not overreact

- Comments from the ECB policymaker, Joachim Nagel

- In monetary policy, it’s important to be cautious and not overreact, giving undue weight to specific announcements that could change shortly afterwards.

- We will continue to apply a data-driven approach.

- Decisions to be taken at each meeting.

Asia-Pacific & World News

UBS Lifts China Growth Outlook as Tariff Relief Takes Hold

Analysts at UBS have upgraded their 2025 GDP forecast for China to a range of 3.7% to 4.0%, up from their previous projection of 3.4%.

They now believe that the worst of the trade war fallout is behind, citing reduced friction between the U.S. and China and improving sentiment around Chinese exports and industrial recovery. UBS flagged easing external pressure as a key factor supporting stronger near-term performance.

U.S. Drops China De Minimis Tariff to 54%, Flat Fee Still Applies

The U.S. will lower its de minimis tariff rate on Chinese shipments from 120% to 54%, though the $100 flat minimum fee remains in place.

That flat fee will rise to $200 starting June 1, as part of an earlier policy move. The $800 duty-free threshold, previously scrapped, has not been reinstated. While the new rate offers partial relief, consumer groups warn the remaining charges are still a burden for lower-value imports.

China Clears Boeing Aircraft Deliveries Following Trade Deal

China has lifted its ban on aircraft deliveries from Boeing, per a Bloomberg headline, as part of the easing trade tensions between Beijing and Washington.

While this removes a hurdle for the U.S. aerospace giant, Airbus is expected to retain its dominant market share in China, given recent momentum and diversification efforts by Chinese airlines amid geopolitical uncertainty.

China Says Fentanyl Problem Isn’t Theirs to Solve

Asked whether fentanyl would feature in upcoming trade talks, China’s Foreign Ministry said the issue is a domestic U.S. matter, not China’s responsibility.

Beijing labeled the 20% U.S. tariff imposed over fentanyl-related concerns as “unreasonable.” The remarks, made just a day after the tariff truce began, reveal early fault lines in what remains a fragile diplomatic reset.

China and Brazil Vow to Defend Global South’s Interests

China’s Foreign Minister met with his Brazilian counterpart in Beijing, where both sides affirmed support for:

- Multilateralism

- Rules-based global order

- The interests of the Global South

They discussed the Ukraine conflict, calling for direct negotiations and a diplomatic resolution.

The meeting signals Beijing’s intention to leverage the 90-day U.S. tariff pause by strengthening strategic alliances across the southern hemisphere.

China Builds Mega Ports in South America to Feed Agricultural Needs

According to the Wall Street Journal, China is expanding its infrastructure presence in South America to reduce dependency on U.S. crops. The centerpiece is a mega export terminal in Brazil planned by state grain trader Cofco.

The project aims to:

- Facilitate soybean and foodstuff imports from Latin America

- Alleviate capacity issues at Santos, Brazil’s main export hub

- Work around fertilizer shortages and soil degradation

Beijing is positioning South America as a long-term food security partner, ensuring stable supply lines amid rising global tensions.

Wall Street Journal is gated, link here if you can access.

SASAC Orders State Firms to Double Down on Innovation, National Goals

China’s SASAC (State-owned Assets Supervision and Administration Commission) has directed central SOEs to align their efforts with long-term strategic goals under the 14th and upcoming 15th Five-Year Plans.

At an expanded Party Committee meeting, the commission urged firms to:

- Fast-track innovation

- Strengthen tech self-reliance

- Focus on frontier and emerging industries

- Enhance localization in key sectors

SOEs are also being pushed to play a more active role in national security, economic resilience, and core technology breakthroughs, while driving forward large-scale strategic projects that reinforce the state-owned economy’s leadership role.

Xi: Trade Wars Have No Winners, Isolation Follows Domination

President Xi Jinping criticized tariff-driven trade strategies, warning that such conflicts benefit no one. He emphasized that bullying and power politics lead only to isolation, and reaffirmed China’s support for global cooperation as a foundation for peace and growth.

Xi also pledged China’s continued backing for Latin America and the Caribbean, including a 66 billion yuan credit line to enhance ties. Areas of focus include infrastructure, food security, energy, agriculture, and critical minerals. He stressed mutual support on key policy issues and stronger regional representation in multilateral institutions.

PBOC sets USD/ CNY central rate at 7.1991 (vs. estimate at 7.2180)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 180bn yuan via 7-day reverse repos at 1.40%

- 405bn yuan mature today

- net drains 225bn yuan

Australia’s Business Confidence Dips as Firms Shy Away from Investment

The NAB business survey for April showed a business confidence index of -1, up from -4, but still cautious. Business conditions ticked down to +2, with all components showing mild weakness:

- Sales index: steady at +5

- Employment index: stable at +4

- Profitability: dropped to -4

- Capex index: fell 6 points to +1, below the historical average

NAB attributes the decline in capital investment to uncertainty around U.S. trade policies, pressuring forward-looking decisions.

Westpac Consumer Sentiment Up, But Confidence Still Subdued

Westpac’s consumer sentiment index rose 2.2% in May to 92.1, bouncing back from a 6% drop in April. Despite the lift, sentiment remains firmly pessimistic (sub-100).

Year-over-year, sentiment is up 12%.

The improvement was driven by:

- A decisive federal election result

- Increased optimism about future rate cuts

Nonetheless, sentiment remains fragile, reflecting broader economic caution.

BoJ’s Uchida: U.S. Tariffs Could Impact Japanese Prices in Both Directions

BoJ Deputy Governor Uchida noted that new U.S. tariffs could have mixed effects on Japan’s economy and inflation outlook.

Key points:

- Tariffs may weigh on growth in the near term

- Upside/downside risks exist for Japanese inflation

- Japan’s economy is expected to slow to potential before picking up as global growth rebounds

- Inflation expectations may pause temporarily, but wage growth should continue due to tight labor conditions

Uchida also warned about rapid FX movements, saying they complicate corporate planning and heighten macro uncertainty.

BoJ April Summary shows uncertainty a high priority discussion item

- Bank of Japan Summary of Opinions at the Monetary Policy Meeting on April 30 and May 1, 2025

Headlines via Reuters:

- One member said: BOJ likely to keep raising interest rates in accordance with improvements in economy, prices

- One member said: No change to BOJ’s rate-hike stance as real interest rates deeply negative but must scrutinise risks

- One member said: Uncertainty surrounding economy, price outlook high, likelihood of achieving price goal not as high as in past

- One member said: BoJ has little choice but to take wait-and-see stance until developments surrounding U.S. trade policy stabilise to some extent

- One member said: BoJ will enter temporary pause in rate hikes but shouldn’t slide into excessive pessimism, must guide policy nimbly and flexibly

- One member said: Chance of Japan’s underlying inflation faltering is small

- One member said: U.S. trade policy development could turn positive or negative any time, which means BOJ’s policy path could change any time as well

- One member said: Our projections have been severely jolted by US trade policy with higher US tariffs likely to weigh on Japan’s economy, prices

- One member said: Must be mindful of upside risks to prices if global supply chains are disrupted

- One member said: From long-term perspective, U.S. tariff policy and ensuing uncertainty likely won’t affect Japan’s underlying inflation, potential growth rate

Japan finance minister Kato wants to discuss FX with Bessent

- A transparent attempt here from Kato to verbally intervene in the slumping yen

Japan finance minister Kato

- Making preparations to join G7 meetings in Banff

- If have a chance, hope to have a meeting with U.S. Treasury Secretary Bessent to discuss forex

- Possible to discuss tariff deal if meeting with Bessent is realised

- Will closely monitor U.S.-China tariff deal

- Won’t comment on forex levels

- Will closely watch out markets developments caused by U.S.-China tariff deal

Crypto Market Pulse

Ethereum Surges 9% Following Soft US Inflation Data

Ethereum (ETH) saw a significant uptick on Tuesday, climbing 9% to reach $2,700. This rally was spurred by the release of the U.S. Consumer Price Index (CPI) data for April, which came in lower than anticipated. The softer inflation figures have reignited bullish sentiment in the cryptocurrency market, particularly for Ethereum.

CPI Data Sparks Renewed Interest in Ethereum

The U.S. Bureau of Labor Statistics reported that the headline CPI rose by 0.2% in April, below the expected 0.3%. On an annual basis, inflation slowed to 2.3%, marking its lowest rate since February 2021. Core CPI, which excludes food and energy prices, also increased by 0.2%, under the forecasted 0.3%, and remained steady at 2.8% year-over-year.

These figures have led to increased speculation that the Federal Reserve may consider lowering interest rates, with the CME FedWatch Tool indicating a growing probability of a 25 basis point cut in September. Such expectations have bolstered investor confidence in risk assets, including cryptocurrencies.

Institutional Activity and Market Dynamics

Institutional interest in Ethereum has been on the rise. Notably, digital asset investment firm Abraxas Capital withdrew 33,482 ETH from Binance after borrowing $240 million in USDT from the lending platform Aave. Since last Wednesday, the firm has accumulated a total of 211,030 ETH, according to on-chain data from Lookonchain.

Despite the surge in buying activity, Ethereum’s funding rates remain moderately elevated, and options markets show a partial skew towards puts. Analysts from QCP note that this suggests the rally is not driven by speculative excess. They also observe a resurgence in longer-dated option flows, indicating that Ethereum may be positioning itself as a significant allocation in investment portfolios.

ETH/BTC Ratio and Market Sentiment

Ethereum’s performance has outpaced Bitcoin’s over the past week, with the ETH/BTC ratio increasing by over 30%, from 0.018 to 0.025. This shift suggests a rotation of capital from Bitcoin to Ethereum. However, analysts caution that historically, such bullish movements in the ETH/BTC ratio have often been followed by sell-offs.

Investor sentiment remains optimistic, with a growing number of market participants betting on Ethereum surpassing $2,800 and even $3,000 by the end of May. Data from crypto options exchange Derive indicates that the probability of ETH reaching these levels has risen significantly over the past week.

Technical Outlook: Potential Bullish Flag Formation

From a technical perspective, Ethereum has reclaimed the $2,544 level and is testing resistance at the 200-day Simple Moving Average (SMA). The price action suggests the formation of a bullish flag pattern. If ETH can flip the 200-day SMA into support, it may validate this pattern and target the $2,850 resistance level.

The Relative Strength Index (RSI) and Stochastic Oscillator have remained in overbought territory since May 8, indicating strong bullish momentum. However, a daily close below $2,100 would invalidate the bullish thesis and could see ETH retrace towards $1,688.

Ethereum’s Current Market Position

As of the latest data, Ethereum is trading at $2,688.29, with an intraday high of $2,705.16 and a low of $2,425.28. The price has increased by $203.24, or approximately 8.18%, from the previous close.

Conclusion

Ethereum’s recent price surge is attributed to favorable macroeconomic data and increased institutional interest. While technical indicators point towards a potential continuation of the uptrend, investors should remain cautious of historical patterns that have seen similar rallies followed by corrections. Monitoring key support and resistance levels, as well as broader market sentiment, will be crucial in assessing Ethereum’s short-term trajectory.

Conclusion

Ethereum’s recent price surge is attributed to favorable macroeconomic data and increased institutional interest. While technical indicators point towards a potential continuation of the uptrend, investors should remain cautious of historical patterns that have seen similar rallies followed by corrections. Monitoring key support and resistance levels, as well as broader market sentiment, will be crucial in assessing Ethereum’s short-term trajectory.

XRP Rally Runs Into Resistance as Traders Cash Out, SEC Chair Vows Regulatory Clarity

XRP touched $2.65 on Monday before retreating to $2.44 by Tuesday morning, as the broader crypto rally faded and investors booked profits. The move follows a week of upbeat sentiment triggered by the U.S.-China trade thaw and dovish regulatory signals from the U.S. Securities and Exchange Commission (SEC).

At the Crypto Task Force roundtable on Monday, SEC Chair Paul Atkins said the Commission plans to modernize how it regulates crypto assets — moving away from “ad hoc enforcement” and instead developing clear, purpose-built rules. He stressed that the U.S. must lead on crypto innovation, echoing the administration’s ambition to become the world’s digital asset hub.

This comes shortly after Ripple and the SEC reached a settlement, with Ripple agreeing to pay $50 million — less than half of the prior $125 million penalty. Both parties have also dropped their respective appeals, putting the long-running lawsuit to rest.

On the charts, XRP still trades above major EMAs — the 50-, 100-, and 200-day — with a support confluence around $2.23. However, the RSI on the 12-hour chart has dropped to 63.17, reversing from overbought territory. If momentum continues to fade, XRP may test support at $2.40, with further downside potential to $2.23 and $2.20.

CoinGlass data also shows that $35 million in XRP positions were liquidated in the past day, with $22.82 million of those being long positions — a strong sign that many are cashing out after the recent spike.

Bitcoin Volatility Drops Below S&P 500 and Nasdaq as Institutional Demand Rises

Bitcoin’s price action has become surprisingly calm. According to analysts at Galaxy Digital, BTC’s realized 10-day volatility fell to 43.86, slipping below the S&P 500’s 47.29 and Nasdaq 100’s 51.26 — a rare dynamic for an asset known for its sharp moves.

The drop in volatility comes despite heightened macro uncertainty. Since President Trump’s “Liberation Day” tariff announcement on April 2, traditional markets have fluctuated, with gold reaching $3,500 before settling lower, and the U.S. dollar index retreating nearly 4%. Yet Bitcoin surged 11% in that same period.

Galaxy’s report also highlights that Bitcoin’s correlation with equities remains elevated — around 0.62 with the S&P and 0.64 with the Nasdaq — but its beta has fallen, suggesting traders now see BTC less as a risk-on bet and more as a hedge.

“Bitcoin doesn’t need the backing of any nation-state to retain its integrity,” said Chris Rhine, head of Galaxy’s liquid active strategies. He likened the shift to the 2018–2019 period when Bitcoin rallied during the U.S.-China trade war.

Other voices echoed that sentiment. Kronos Research CEO Hank Huang noted that as ETF inflows rise and funds like Strategy keep stacking BTC, volatility naturally drops. “Institutions are treating Bitcoin as digital gold,” he said.

Galaxy’s OTC desk described the market tone as “cautiously bullish,” with low leverage and mild hedging activity. With 95% of BTC supply already mined and government-level interest rising, Galaxy analysts argue that Bitcoin is stepping firmly into its role as a “mature digital store of value.”

BlackRock’s Jay Jacobs also weighed in recently, saying that geopolitical fragmentation is driving a global pivot away from the U.S. dollar and toward alternatives like gold — and increasingly, Bitcoin.

Cardano Cools Off After Sharp Run-Up, Eyes $0.71 Support as Holders Take Profits

Cardano (ADA) is seeing a pullback on Tuesday, shedding 3.59% after a 19% rally last week. The token is now trading around $0.78 as investors appear to be taking profits, evidenced by notable activity from long-dormant wallets. On-chain analytics platform Santiment reports that ADA wallets untouched for extended periods have suddenly sprung into action — a possible sign of increased selling intentions.

The “Network Realized Profit/Loss” (NPL) metric from Santiment showed a strong upward spike on Monday, indicating that many addresses sold at significant gains. This uptick implies that investors are capitalizing on recent highs, potentially adding to near-term selling pressure.

The “Age Consumed” metric, which tracks the movement of older coins, also flashed bearish signals. A major surge — the largest since mid-April — was recorded Monday, often a precursor to local price tops as long-term holders shift assets to exchanges.

ADA had surged 25.16% between Thursday and Saturday after pushing through its 200-day EMA at $0.71. However, it faced stiff resistance around $0.84, which also aligns with the 50% Fibonacci retracement drawn from the March 3 high of $1.17 to the April 7 low of $0.51. That level has now acted as a ceiling for two straight days.

The Relative Strength Index (RSI) on the daily chart now reads 61 and is pointing lower after hitting overbought territory over the weekend. A further dip below the neutral line of 50 could accelerate losses. If the decline continues, ADA may test key support back at the 200-day EMA near $0.71.

Overleveraged Crypto Bulls Get Burned as Market Liquidations Top $730M

The crypto market was rocked by a steep selloff over the past 24 hours, wiping out more than $730 million in leveraged positions. The majority — roughly 73% — were long bets, according to Coinglass data. The biggest single liquidation came from a $11 million BTCUSD position on Bybit.

Bitcoin tumbled below the $102,000 mark, hitting an intraday low of $100,700 during the New York session. Earlier optimism during the Asian session on Monday — driven by the U.S.-China 90-day tariff truce — had lifted prices, but those gains quickly evaporated.

Market participants are now bracing for further swings as the U.S. CPI report is due soon, potentially injecting even more volatility into an already nervous market.

The scale of liquidations signals how heavily skewed traders were toward the bullish side. With sentiment already rattled and major economic data on deck, conditions remain unstable for risk assets across the crypto space.

The Day’s Takeaway

United States

- CPI Comes in Soft: April headline CPI rose +0.2% (vs +0.3% expected), bringing annual inflation to 2.3%, the lowest since February 2021. Core CPI held at +2.8% y/y.

- Markets React: S&P +0.72% to 5,886.55, Nasdaq +1.61% to 19,010.08. The S&P turned slightly positive for the year at +0.08%.

- Dow Dragged by UnitedHealth: Dow -0.64% after UnitedHealth dropped nearly 18% on a surprise CEO exit and lack of forward guidance.

- Private Oil Data: API data showed a +4.287M bbl crude build, contrasting with expectations for a draw.

Canada

- Carney Cabinet Finalized: PM Mark Carney confirmed 30 ministers and 10 secretaries. Francois-Philippe Champagne will serve as Finance Minister. Chrystia Freeland stays on as Minister for Transport and Internal Trade.

- Market Focus: All eyes on May 27 for Parliament’s return and the throne speech. Potential shifts in housing, infrastructure, and climate portfolios may weigh on CAD.

Commodities

- Crude Rallies Again: WTI settled at $63.67, up $1.72 or 2.78%, climbing for the fourth consecutive session. Since May 5, crude is up 11.38%.

- Gold Rebounds on CPI Miss: Gold bounced to $3,250 (+0.42%) after falling 2.7% Monday. Softer inflation and steady Fed expectations are offering support, though gains remain capped under $3,300.

- Silver, Platinum, Palladium Lag: Despite easing trade fears, industrial metals remain under pressure, with Commerzbank noting skepticism around a long-term tariff resolution.

- China Dominates Gold ETF Flows: Chinese ETFs saw nearly 65 tons of net inflows in April — more than the entire Q1 total. Total global ETF inflows hit 115 tons.

Europe

- ECB Rate Outlook Shifts: Goldman Sachs now sees the ECB pausing at a 1.75% terminal rate in July. Markets are still pricing in a 25 bps cut for June with uncertainty around July.

- German ZEW Survey Pops: Economic expectations soared to 25.2 (vs 11.9 expected), but current conditions dipped further to -82.0. Optimism is tied to easing trade tensions.

- UK Wage Growth Stays High: ILO unemployment rate held at 4.5%, while wage growth remained firm at 5.5% y/y. April payrolls fell by 33K, less than March’s -78K.

Asia

- China Confirms Tariff Rollback: Beijing confirmed a 90-day pause on 24% tariffs and reset rates on U.S. goods to 10%. Officials signaled openness to further reductions.

- Xi Warns Against Trade Wars: President Xi reiterated that no one wins in trade conflicts and urged global cooperation.

- BOJ Sees Mixed Impact: BoJ Deputy Gov. Uchida flagged both inflationary and deflationary risks from U.S. tariffs on Japan. BOJ policy outlook remains cautious.

Rest of the World

- German Copper Imports Hit Ceiling: China imported a record 2.92M tons of copper ore in April, but year-over-year growth has slowed to 2.4%, suggesting a plateau.

- ECB Strategy Review Leans Defensive: Leaks suggest the ECB will reaffirm past aggressive policy choices rather than critique QE or negative rates.

Crypto

- Ethereum Jumps on CPI Miss: ETH rose 9% to $2,700 as soft U.S. inflation fueled bullish rotation. ETH/BTC ratio is up over 30% in a week, but historical patterns suggest a potential pullback.

- Cardano Cools Off: ADA slipped 3.59% to $0.78 after a 19% rally. On-chain metrics show profit-taking and increased activity from dormant wallets.

- Bitcoin Below $102K Sparks Liquidations: Over $730M in leveraged crypto positions were wiped out in 24 hours—73% were long. BTC dropped to an intraday low of $100,700.

- XRP Retreats After Hitting $2.65: XRP pulled back to $2.44 amid market-wide profit-taking. SEC Chair Paul Atkins emphasized clear, proactive regulation for crypto markets.

- Bitcoin Volatility Dips Below Nasdaq: Galaxy Digital reports BTC’s 10-day realized volatility dropped to 43.86, lower than both the S&P 500 and Nasdaq — an unusual shift. Analysts say institutional flows are driving a structural evolution in BTC’s market behavior.