North America News

US Stocks Surge as Nasdaq Leads, Meta Extends Winning Streak to 19 Days

The major US stock indices closed higher on Thursday, with the Nasdaq leading gains at +1.50%, followed by the S&P 500 (+1.04%) and Dow Jones (+0.77%). The S&P closed just three points short of its record high of 6,118.71, as strong earnings and momentum in tech stocks fueled optimism.

📈 Final Market Performance:

- Dow Jones: +344.75 points (+0.77%) at 44,711.31

- S&P 500: +63.09 points (+1.04%) at 6,115.07

- Nasdaq Composite: +295.69 points (+1.50%) at 19,945.64

- Russell 2000: +26.29 points (+1.17%) at 2,282.18

Stock-Specific Highlights:

- Meta (+19-day winning streak, +0.76%) recovered from session lows, bringing its year-to-date gains to 24%.

- AppLovin (+24%) soared on strong earnings, extending its 2024 gains to 45.65%.

- Wynn Resorts (WYNN) beat Q4 earnings estimates, with EPS of $2.42 vs. $1.22 expected, while revenue topped $1.84 billion.

- Applied Materials (AMAT) posted strong Q1 results, exceeding sales and EPS estimates, with gross margins at 48.9%.

- Airbnb (ABNB) beat Q4 estimates, reporting $2.48B revenue vs. $2.42B expected, though Q1 guidance came in slightly below estimates.

Twilio Achieves First-Ever GAAP Operating Profitability in Q4

Twilio ($TWLO) reported Q4 revenue of $1.19 billion (+11% YoY), marking its first quarter of GAAP operating profitability.

Key Financial Highlights:

- Q4 GAAP Operating Income: $14 million profit

- Q4 Non-GAAP Net Income Per Share: $1.00

- Full-Year Free Cash Flow: $657.5 million

- Share Repurchase Program: Authorized up to $2 billion in new buybacks

📊 2025 Outlook:

- Q1 Revenue Guidance: $1.13B-$1.14B (+8%-9% YoY)

- FY25 Organic Revenue Growth: 7%-8%

- FY25 Non-GAAP Income From Operations: $825M-$850M

With strong revenue growth, improved cost management, and a new share buyback program, Twilio’s bullish momentum could continue into 2025.

Coinbase Delivers Blowout Q4 Earnings as Crypto Trading Surges

Coinbase ($COIN) reported Q4 revenue of $2.27 billion, far exceeding estimates of $1.87 billion, as crypto trading activity surged.

📊 Key Financial Metrics:

- Full Year 2024 Revenue: $6.6B (+111% YoY)

- Q4 Transaction Revenue: $1.6B (+172% QoQ)

- Q4 Net Income: $1.3B (boosted by crypto investment gains)

- Q4 Adjusted EBITDA: $1.3B

- EPS: $5.13 (Basic), $4.68 (Diluted)

📈 Business Performance:

- Consumer Trading Volume: +176% QoQ

- Institutional Trading Volume: +128% QoQ

- Coinbase One Subscriber Base: 600,000+ (50% increase since Q1)

- International Expansion: 19% of total revenue, up from 16% YoY

- Derivatives Market Growth: Perpetual futures listings up 20%

🔎 Market Outlook:

- Q1 Subscription & Services Revenue Guidance: $685M-$765M

- Q1 Transaction Revenue Through Mid-February: ~$750M

- Positive Regulatory Developments: SEC litigation progress, new crypto regulations, and global expansion could further boost sentiment.

With record-breaking trading volumes, improving regulatory clarity, and strong financial execution, Coinbase is well-positioned for continued momentum into 2025.

US treasury sells $25 billion of 30 year bonds at a high yield of 4.748%

- WI level at the time of the auction 4.736%

- High yield 4.748%

- WI at the time of the auction 4.736%

- Tail 1.2 basis points versus 6-month average of 0.2 basis points

- Bid to cover 2.33X versus 6-month average of 2.46X

- Directs (domestic demand) 18.6% versus 6-month average of 17.6%

- Indirects (international demand) 65.1% versus 6-month average of 68.4%

- Dealers 16.3% versus 6-month average of 14.0%

NY Fed: Q4 total household debt rose 0.5% to $18.04 trillion

- Household debt data from the NY Fed

- Household debt up $3.9 trillion since 2019

- Overall consumers ‘in pretty good shape’ in terms of debt

- Aggregate delinquencies up slightly in Q4 to 3.6% from 3.5%

- Credit card balances rose $45 billion to $1.21 trillion

US January PPI +3.5% vs +3.2% y/y expected

- January PPI data from the Census Bureau

- Prior was +3.3%

- PPI m/m +0.4% vs +0.3% expected (prior +0.2%, revised to +0.5%)

- PPI ex food and energy +3.6% y/y vs +3.3% expected (3.5% prior)

- PPI ex food and energy +0.3% m/m vs +0.3% expected (+0.0% prior, revised to +0.4%)

- Ex food, energy and trade +3.4% y/y vs +3.3% prior

There were some big upward revisions to the December numbers but it doesn’t really matter. The headline numbers are +0.5% and +0.4% back-to-back which is an unpleasant acceleration.

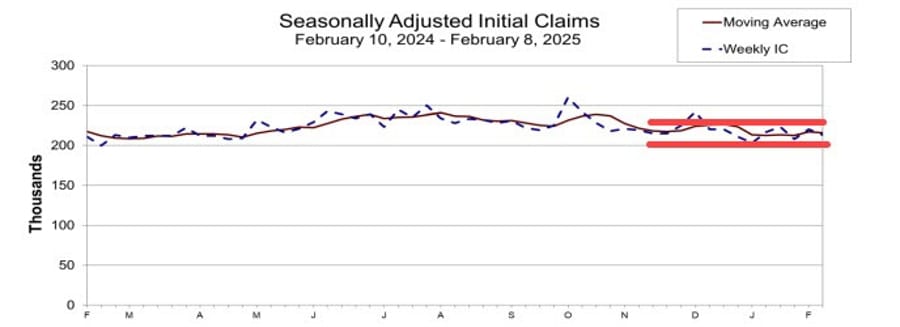

US initial jobless claims 213K versus 215K estimate

- Initial and continuing jobless claims

- Prior week 219K revised to 217K

- Initial jobless claims 213K vs 215K estimate

- 4-week moving average of initial jobless claims 216K vs 217K last week

- Prior week continuing claims 1.880M

- Continuing claims 1.850M vs 1.880M estimate

- 4-week moving average of continuing claims 1.872M vs 1.872M last week

Trump announces reciprocal tariffs: Could begin to impose some tariffs “within weeks”

- Trump speaks on reciprocal tariffs and the White House releases the Presidential Memorandum

- Sending merchandise through another country to avoid tariffs will not be accepted

- Says he’s decided to charge reciprocal tariffs

- Provisions will be made for non-monetary tariffs, such as tests on cars

- Provisions for non-monetary tariffs will include limitations on trade

- Lutnick will be coming up with numbers equivalent to limitations and other non-tariff barriers

- Other countries can reduce or eliminate tariffs

- Says EU lowered tariffs on cars to 2.5%, so that’s a big win (I don’t believe the EU has announced this)

- We want a level playing field

- Reciprocal tariffs will bring fairness back

- Lutnick: we are going to address each country one-by-one

- Greer: We will look at everything including ‘fake anti-trust regimes’

- Car tariffs are coming soon

- This tariff will be over-and-above steel tariffs, also cars and pharmaceuticals

- Trump: India has more tariffs than nearly any other country

- Prices could go up somewhat in the short term

- Interest rates are going to be going down

- Lutnick: Studies should be done by April 1 and ‘will be ready to go’

- Trump: Canada has been tough on military, not paying enough

- Canada does not have enough military protection

- The EU does not treat the US right on trade

- Expects a lot of countries tariffs to stay the same

- Says he doesn’t expect any exemptions or waivers

- War in Ukraine has to end

- The TikTok deadline could be extended, hopes to make a deal

- Does not want US Steel to make a deal with Japan

- Taiwan took our chip business away, we want that business back

- Says he does trust Putin on Ukraine war, believes he wants peace

- I want to tell Xi and Putin “let’s cut the military budget in half”

- We want to talk about de-nuclearization, there’s no reason to build nuclear weapons

Statement from the White House:

- Commerce Dept and USTR will “quickly submit” a report detailing proposed remedies on a country-by-country basis

- Could begin to impose some tariffs “within weeks”

- Will examine most-egregious issues and countries with biggest US trade surpluses first

- Not ruling out a global flat tariff

- Annual trade deficit threatens US economic and national security

- Hoping to have discussions with other countries, Trump more than happy to lower tariffs if others want to lower tariffs

- Tariffs will use statutory authorities including Section 232, 301 or emergency economic powers act

Senior Trump official: Hope to have bilateral trade deal with India this year

- Comments from an unnamed US official on the wires

- We are moving towards signing a new India-US defense framework

- Tariffs on China give India an opportunity to strengthen supply chains and expand relations with the US

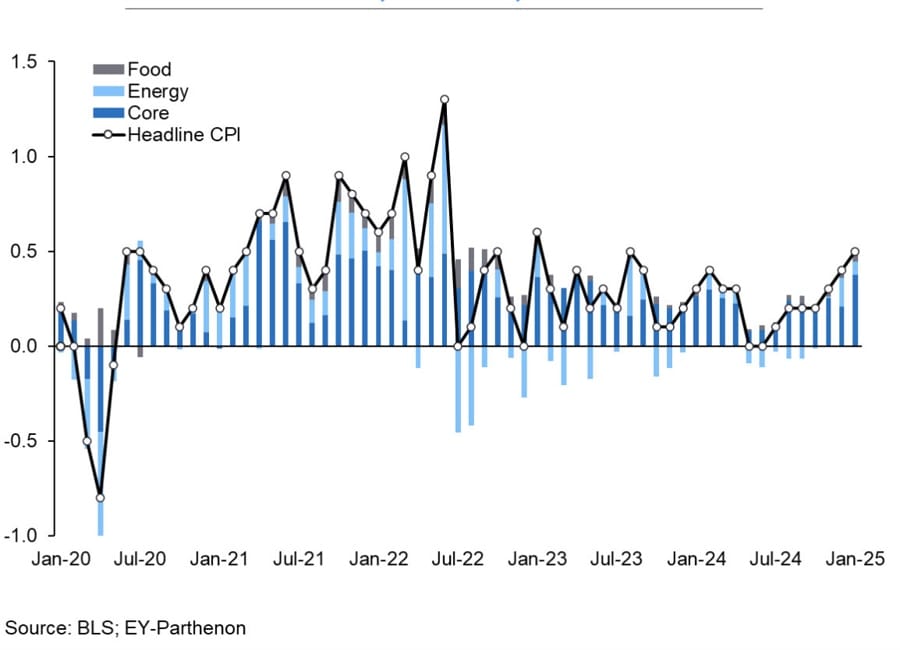

Goldman Sachs revises core PCE inflation forecast higher after CPI report

- Goldman Sachs already moving ahead considering the next consumer inflation data

Goldman Sachs has adjusted its inflation outlook following the latest Consumer Price Index (CPI) report, now estimating that the core Personal Consumption Expenditures (PCE) price index rose 0.35% in January, slightly above its previous 0.32% forecast. This would place the year-over-year core PCE inflation rate at 2.64%.

The investment bank also expects headline PCE inflation to have increased 0.38% month-over-month, translating to an annual rise of 2.51%. Additionally, they note that residual seasonality effects in core PCE components will likely shift from a 5 basis point drag in December to a 4 basis point boost in January.

Meanwhile, Goldman estimates that market-based core PCE, a measure that excludes imputed and volatile components, rose 0.26% in January.

Bank of America: Strong CPI underscores Fed’s caution, rate hikes back in discussion

- “The bottom line is clear: the Fed has no reason to cut further”

Bank of America analysts say the latest Consumer Price Index (CPI) report delivered another upside surprise, reinforcing the case for the Federal Reserve to keep rates on hold.

The headline CPI rose 0.5% in January (0.467% unrounded), pushing the annual rate to 3.0%, while core CPI—which strips out food and energy—increased 0.4% (0.446% unrounded), bringing the year-over-year figure to 3.3%.

“The bottom line is clear: the Fed has no reason to cut further,” the analysts wrote, noting that inflation remains stuck above the central bank’s 2% target and the unemployment rate nearly dipped into the 3% range in January.

While they still see the threshold for additional rate hikes as high, Bank of America argues that tightening should now be back in the conversation following the stronger-than-expected inflation data.

Barclays says a Fed rate cut still expected in 2025, but the risks of no cut is rising

- Response to the high CPI report

Barclays analysts maintain their expectation of a single Federal Reserve rate cut this year, but warn that the risks of no cuts at all are increasing. In their latest assessment, they highlight growing market focus on the possibility of rate hikes, reflecting persistent inflation concerns and a resilient U.S. economy.

While Barclays still sees monetary easing on the horizon, they acknowledge that stronger-than-expected economic data could delay or even eliminate the need for cuts in 2025. With the Fed keeping a data-dependent approach, market participants are closely watching upcoming inflation reports and labor market trends for further policy signals.

Fed likely to stay on hold despite strong CPI, rate cuts expected in Q3

- TD after the sticky high US CPI data on Wednesday

TD economists suggest that while the latest Consumer Price Index (CPI) report is not encouraging from the Federal Reserve’s perspective, it should not be viewed as a signal of sustained inflationary pressures. The firm cautions against extrapolating January’s strength into the medium-term inflation outlook, emphasizing that the key takeaway is that the data will likely keep the Fed on the sidelines for now—aligning with TD’s long-standing view.

Despite the inflation surprise, TD maintains that the Fed will preserve its easing bias, remaining in a wait-and-see mode as it looks for further clarity from upcoming economic data. The firm continues to expect the Federal Open Market Committee (FOMC) to begin cutting rates in the third quarter of 2025. While the bar for rate hikes remains high, TD acknowledges that policymakers will need more confidence that inflation is sustainably cooling before committing to any easing.

Morgan Stanley hasn’t changed its Federal Reserve forecast despite strong US CPI report

- The January US inflation data came in way hotter than forecast

In response to the data Morgan Stanley have maintained their call for just one Federal Open Market Committee (FOMC) rate cut this year, in June.

Morgan Stanley analysts suggest that the latest Consumer Price Index (CPI) data signals a firm reading for core Personal Consumption Expenditures (PCE) inflation, though likely softer than the January 24 print.

- As a result, they anticipate a gradual decline in year-over-year core PCE inflation throughout Q1 2025.

- Despite this moderation, the firm maintains its view that the Federal Reserve will extend its policy pause, expecting just one rate cut in 2025, which they forecast will occur in June.

The Wall Street Journal says Trump’s call for rate cuts defies inflation reality

- The Wall Street Journal editorial board with an opinion piece

The Wall Street Journal editorial board questions Donald Trump’s understanding of monetary policy, arguing that his recent call for lower interest rates contradicts economic fundamentals. Trump’s demand came on the same day inflation rose for the third straight month, with CPI up 0.5% in January, pushing the 12-month rate back to 3%.

The Journal is gated, but here is the link if you can access it:

- Trumponomics and Rising Inflation

- The President calls for easier money even though consumer prices keep rising. Does he want even higher prices?

The editorial notes that higher tariffs, which Trump also advocates, typically fuel inflation, making rate cuts even less appropriate. Markets reacted accordingly, with the 10-year Treasury yield jumping to 4.63%, reflecting concerns that persistent inflation will keep the Federal Reserve cautious on easing.

While Trump isn’t to blame for inflation after just three weeks in office, the real policy error, according to WSJ, was the Fed’s premature rate cuts in late 2024, which drove long-term yields higher and failed to contain price pressures. Fed Chair Jerome Powell has since signaled patience in further cuts, and the editorial suggests Trump’s push for easier money could risk another inflation surge, undermining his own political standing.

About 75,000 workers have accepted Trump’s buyout program

- Reuters info

There is some debate on how many will need to be hired back, perhaps as private sector employees, to perform necessary government jobs.

Signs of Consumer Softness Emerging in Canada

Canadian consumers are showing signs of strain, as Canadian Tire’s latest earnings report highlighted weaker-than-expected retail performance, particularly in discretionary spending.

Key Earnings Highlights:

- Same-store sales at Canadian Tire’s flagship store rose just 1.1% (vs. 2.9% expected), reflecting softer consumer demand.

- Essential item sales climbed 4.2%, but discretionary spending fell 2% in Q4 and 5% for the full year.

- Mark’s and Sport Chek both underperformed expectations, with same-store sales up 1.8% (vs. 2.6% expected) and 0.4% (vs. 2.3% expected), respectively.

- A December sales bump was noted, likely coinciding with the GST holiday.

Despite these challenges, Canadian Tire CEO Greg Hicks expressed cautious optimism, stating that the company is “observing economic green shoots”, though consumer demand remains constrained in discretionary categories.

Trade & Economic Pressures Weigh on Outlook

Beyond retail, Canada’s freight and logistics sector is also facing headwinds. Trucking giant Mullen Group warned of “very challenging market conditions,” with weak demand and intensifying pricing pressures.

Chair and CEO Murray Mullen was particularly cautious about Canada’s economic trajectory, citing a lack of capital investment and potential trade disruptions with the US as major risks. He stated that “2025 will be no better than last year” for freight demand.

Upcoming Data & Tariff Concerns

- The Canadian December retail sales report is set for release on February 21, along with January advance numbers.

- US tariff uncertainty remains a growing concern among Canadian businesses, which could impact sentiment and consumer behavior in the coming months.

With both retail and freight sectors showing signs of strain, the Canadian economy may face increasing pressure as trade tensions and weak investment trends persist.

Commodities News

Gold Rallies as Trump Signs Reciprocal Tariffs Order, USD Weakens

Gold surged to $2,925 on Thursday, nearing its all-time high of $2,942, as US President Donald Trump signed a reciprocal tariffs order, vowing to impose matching duties on imports from trading partners.

Key Market Drivers:

- Trump’s tariff announcement fueled safe-haven demand for gold, as uncertainty over US trade policies increased.

- The US Dollar Index (DXY) dropped 0.61% to 107.32, making gold more attractive to investors.

- US Treasury yields declined, despite a stronger-than-expected Producer Price Index (PPI), which showed inflation pressures lingering.

- Central bank gold purchases surged 54% YoY, with over 1,000 tons purchased for the third consecutive year, according to the World Gold Council (WGC).

With inflation concerns rising and the Fed signaling a longer period of restrictive policy, gold’s near-term outlook remains bullish.

Copper Extends Gains as Technical Breakout Targets Higher Levels

LME Copper has broken out of an Inverse Head and Shoulders pattern, pushing toward 9530, with BBH analysts forecasting further upside.

Key Technical Levels:

- Copper successfully defended support at 9290, reinforcing the bullish structure.

- Daily MACD remains positive, confirming sustained upward momentum.

- Next upside targets:

- 9780/9830 (pattern target)

- 10150 (September 2024 high)

With momentum indicators supporting further gains, copper could see continued strength in the near term, barring macroeconomic disruptions.

IEA: Russian Oil Exports Remain Largely Unaffected by US Sanctions

In its latest monthly oil market report, the International Energy Agency (IEA) raised its 2025 global oil demand growth forecast to 1.1 million barrels per day (bpd) from 1.05 million bpd.

Key Takeaways:

- Despite recent US sanctions, Russian oil flows remain largely unaffected.

- Workarounds to sustain Russian export volumes are expected to emerge in the coming weeks.

- China’s fuel consumption has plateaued, with gasoline, jet fuel, and gasoil demand slightly declining in 2024.

While sanctions and geopolitical factors remain in focus, the IEA suggests that Russian oil exports are likely to persist, limiting the impact of policy-driven supply restrictions.

Oil Traders Expected to Continue Selling Amid Russia-Ukraine Deal Prospects

Crude oil markets are seeing continued selling pressure, with the potential for a Russia-Ukraine peace deal reducing energy supply risk premiums, according to TDS Senior Commodity Strategist Daniel Ghali.

Key Market Trends:

- Energy supply risks have reversed, negating the impact of Biden’s recent sanctions on Russia.

- Concerns over OPEC+ spare capacity and surplus expectations are weighing on prices more than geopolitical risks.

- CTA (Commodity Trading Advisor) algorithms have accelerated selling in Brent crude, with up to -20% of their max size expected to be liquidated in the current session.

- While signs of algo selling exhaustion are emerging, models indicate there is still room for further downside pressure.

Overall, the outlook for significantly higher oil prices remains narrow, with most scenarios pointing toward a range-bound market for 2025.

Europe News

Eurozone December industrial production -1.1% vs -0.6% m/m expected

- Latest data released by Eurostat – 13 February 2025

- Prior +0.2%

That’s a miss on estimates as euro area industrial output slumped by more than expected at the end of last year. The breakdown shows a drop in most categories, with declines seen in the production of intermediate goods (-1.9%), capital goods (-2.6%), and durable consumer goods (-0.7%). That if offset slightly by increases in output for energy (+0.5%) and non-durable consumer goods (+5.1%).

Germany January final CPI +2.3% vs +2.3% y/y prelim

- Latest data released by Destatis – 13 February 2025

- Prior +2.6%

- HICP +2.8% vs +2.8% y/y prelim

- Prior +2.8%

Switzerland January CPI +0.4% vs +0.4% y/y expected

- Latest data released by the SNB – 13 February 2025

- Prior +0.6%

- Core CPI +1.2% y/y

- Prior +0.7%

UK December monthly GDP +0.4% vs +0.1% m/m expected

- Latest data released by ONS – 13 February 2025

- Prior +0.1%

- Services +0.4% vs +0.1% m/m expected

- Prior +0.1%; revised to +0.2%

- Industrial output +0.5% vs +0.2% m/m expected

- Prior -0.4%; revised to -0.5%

- Manufacturing output +0.7% vs -0.1% m/m expected

- Prior -0.3%

- Construction output +1.5% vs +0.2% m/m expected

- Prior +0.4%; revised to +1.0%

UK Q4 preliminary GDP +0.1% vs -0.1% q/q expected

- Latest data released by ONS – 13 February 2025

- Prior 0.0%

UK Housing Market Cools Despite Upbeat Surveyors; Positive Outlook Ahead

- UK housing market shows cooling trend in January, but a positive outlook is supported by easing mortgage pressures.

Data for the UK housing market from the Royal Institution of Chartered Surveyors (RICS):

January house price balance comes in at +22

- December was +26 (which was the highest reading since September 2022)

- survey’s measures of growth in new buyer enquiries and agreed sales both weakened

RICS comment:

- “Growth in buyer demand lost a bit of momentum through the early part of the year, with this flatter picture likely linked to the turbulence seen across money markets in the first half of January,”

- “Moving forward, respondents continue to envisage a slightly positive near-term outlook for sales activity. This should be further supported by the unwinding of some of the pressures around mortgage interest rates over the past couple of weeks.”

German economy ministry warns that there is no noticeable economic recovery yet

- The ministry says that there is still no sign of a turnaround in the industrial sector

The manufacturing recession in Germany is carrying over to this year and the outlook isn’t that bright still. The German economy ministry warns that there is no material rebound in economic conditions to start the new year and says that the German industry remains in a troubling spot.

ECB’s Vujčić: Market expectation for three more rate cuts this year is not unreasonable

- Remarks by ECB policymaker, Boris Vujčić

- ECB could remove reference to “restrictive policy” in March

- Recent FX movements are not something we need to be worried about

BOE’s Pill: I do expect we can cut rates further

- Remarks by BOE chief economist, Huw Pill

- But urges caution of further rate cuts

- Disinflation process is not yet complete

- US tariffs could have “quite substantial effects”

Asia-Pacific & World News

PBOC says will implement appropriately loose monetary policy

- Remarks by the Chinese central bank as they release their Q4 monetary policy implementation report

- To keep liquidity ample

- To adjust and optimise policy strength and pace at appropriate time

- Will promote reasonable rebound of prices, maintain prices at a reasonable level

China has proposed holding a Trump / Putin summit

- Wall Street Journal report

Chinese officials in recent weeks have floated a proposal to the Trump team through intermediaries to hold a summit between the two leaders and to facilitate peacekeeping efforts after an eventual truce, according to people in Beijing and Washington familiar with the matter.

That’s according to the Wall Street Journal report (gated):

- China Tries to Play the Role of Peacemaker in Ukraine

- U.S. and Europe would view Beijing’s proposal skeptically given its close ties to Moscow

More:

- The Chinese offer, notably, envisions a U.S.-Russian summit without the involvement of Ukrainian President Volodymyr Zelensky, according to the people in Beijing and Washington. The prospect of the U.S. negotiating the future of Ukraine and of European security with Russia and China is contrary to the West’s longstanding pledge to include Ukraine in any talks to decide its future. The White House declined to confirm whether it had received China’s offer, but still rejected it. “Not viable at all,” a White House official said.

Hong Kong’s ‘central bank’ says the PBOC will issue yuan sovereign bonds in HK

- The Hong Kong Monetary Authority functions as HK’s central bank.

The Hong Kong Monetary Authority (HKMA) functions as HK’s central bank.

Says the People’s Bank of China will issue yuan sovereign bonds in HK.

PBOC sets USD/ CNY mid-point today at 7.1719 (vs. estimate at 7.3000)

- PBOC CNY reference rate setting for the trading session ahead.

The PBOC has injected 125.8bn yuan in reverse repos via Open Market Operations

- 7 days at an unchanged rate of 1.5%

- 275.5bn yuan mature today

- the net impact is a drain of 149.7bn yuan

Taiwan’s Foxconn says it is open to buying a stake in Nissan

- Foxconn eyeing a closer relationship with Renault, Nissan’s biggest shareholder

Reuters with the report.

In brief:

- Taiwan’s Foxconn would consider taking a stake in Nissan

- “But purchasing its shares is not our aim; our aim is cooperation,” he said, adding it was talking about cooperation with Nissan’s biggest shareholder Renault

Link to the Reuters piece here for more.

Australian Inflation Expectations survey for February 2025 4.6% (prior was 4.0%)

- Melbourne Institute Survey of Consumer Inflation Expectations in Australia

Melbourne Institute Survey of Consumer Inflation Expectations in Australia, February 2025.

Quite the surge, jumping back up to 4.6% y/y

January was 4.0%

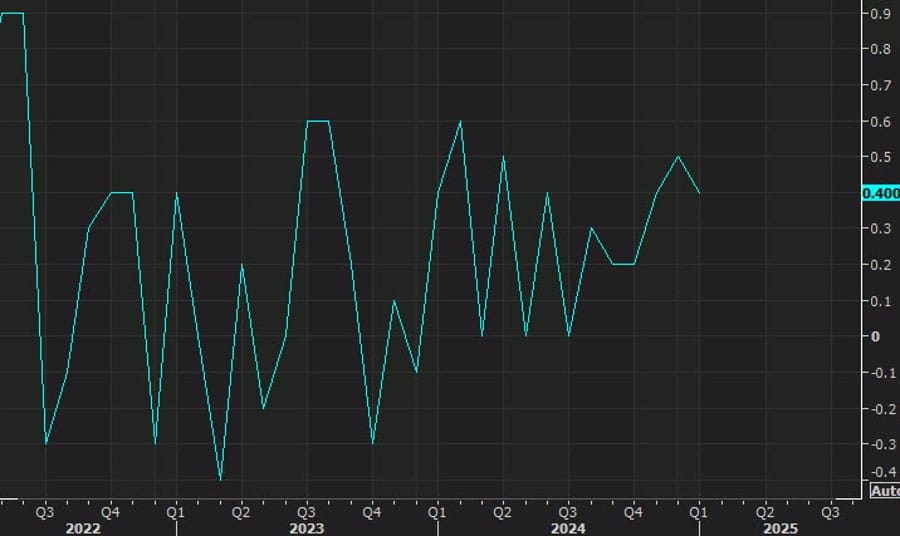

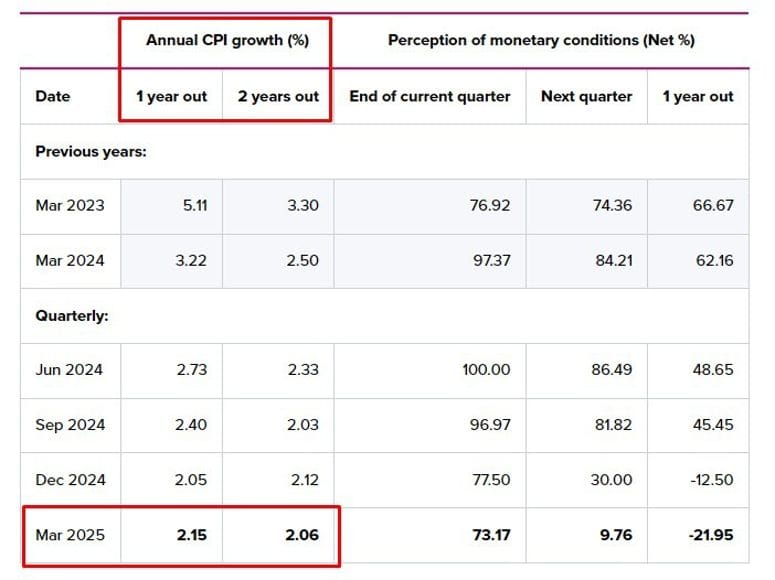

Reserve Bank of New Zealand inflation expectations: 1yr 2.15% (prior 2.05) 2yr 2.06 (2.12)

- Mixed results, the 2 year dropped a touch, which is probably the more important of these two numbers

Reserve Bank of New Zealand Inflation Expectations 1 and 2 years out

The RBNZ view 2 years as a reasonable time frame for monetary policy changes to impact the economy, hence it’s the 2 year figure that policy makers pay the most attention to. Still, that jump for the 1 year won’t go unnoticed.

New Zealand inflation expectations remained subdued in Q1 2025

- Everyone all set for a 50bp interest rate cut from the Reserve Bank of New Zealand next week?

The survey showed that two-year inflation expectations, a key measure for assessing the impact of monetary policy, edged down to 2.06% from 2.12% in the previous quarter.

- one-year inflation expectations rose slightly to 2.15% from 2.05%

The bigger picture shows the sharp fall:

New Zealand data: January Card retail sales -1.6% m/m (prior +2.4) & -0.5% y/y (prior -1)

- Data for purchases made in New Zealand on debit, credit and store cards.

Card spending data covers around 68% of core retail sales in NZ. Its used as the main retail sales indicator for the country.

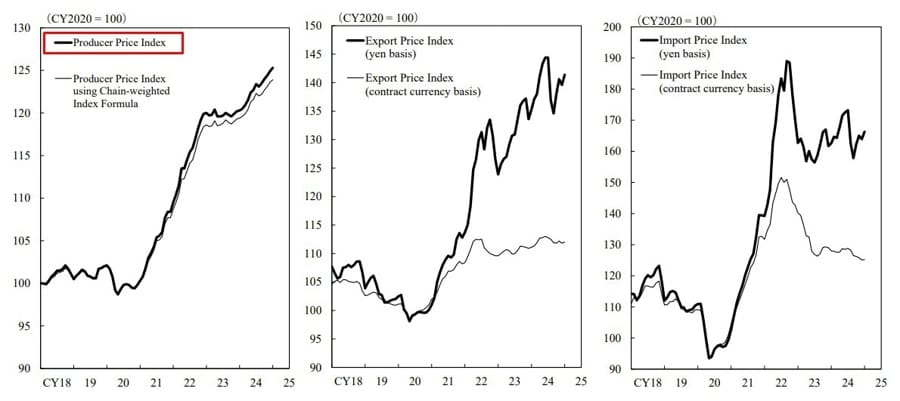

More sticky high inflation data, this time from Japan

- Japan’s January wholesale inflation data was much higher than expected and higher than in December and November.

- January 4.2%, December 3.9%, November 3.8% is the latest quarter’s trend

Japan PPI for January is +4.2%y/y (expected +4.0% prior +3.8%)

- For the m/m, comes in at +0.3% (vs. expected +0.3% and prior of +0.3%)

This’ll fuel further speculation of Bank of Japan rate hikes to come.

Japan PPI for January is +4.2%y/y (expected +4.0% prior +3.8%)

- For the m/m, comes in at +0.3% (vs. expected +0.3% and prior of +0.3%)

Also known as the Corporate Goods Price Index, a monthly report from the Bank of Japan:

Crypto Market Pulse

Bitcoin ETFs Face Three Days of Outflows Amid Market Stagnation

US spot-listed Bitcoin ETFs have seen three consecutive days of outflows, totaling $494 million, as Bitcoin struggles to break out of its trading range near $96,000. The largest single-day outflow occurred on Wednesday, with $251 million exiting these funds.

Key ETF Flow Data:

- BlackRock’s iShares Trust (IBIT) recorded a $22.1 million outflow, a rare dip for the dominant ETF.

- Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw the largest outflow of $102 million.

- Trading volumes have dropped, with total ETF volume at $2.58 billion on Wednesday, significantly lower than when Bitcoin gains momentum.

The lackluster demand mirrors broader market sentiment, as Bitcoin remains stuck between $90,000 and its all-time high of $109,000, a range that has held since mid-November.

Ethereum Could See Demand Boost as Cboe Files for Staking in ETH ETF

Ethereum (ETH) may experience a fresh wave of demand, as Cboe BZX Exchange submitted a filing to allow staking within 21Shares’ Ethereum ETF.

Why This Matters:

- Staking would enable ETF holders to earn passive rewards, making Ethereum ETFs more attractive to investors.

- The SEC under previous leadership opposed staking in ETFs, but regulatory sentiment is shifting following President Trump’s election.

- SEC Commissioner Hester Peirce recently advocated for Ethereum staking within ETFs, hinting at policy changes under the new administration.

Potential Market Impact:

- If approved, Ethereum ETFs could see a surge in inflows, reinforcing ETH’s “internet bond” narrative.

- Standard Chartered’s 2025 crypto outlook suggests ETH could hit $14,000 if staking is implemented within ETFs.

With regulatory winds shifting in favor of crypto, Ethereum could see increased institutional demand, further solidifying its position in the digital asset landscape.

PancakeSwap (CAKE) Rallies 96% in Seven Days, Nears $3

PancakeSwap’s native token, CAKE, extended its seven-day rally to 96%, climbing 8% on Thursday, driven by record trading activity and renewed optimism in the Binance ecosystem.

Key Catalysts for CAKE’s Surge:

- PancakeSwap ranked #1 in 7-day trading volume, with $99.8 billion in activity over the last 30 days.

- Binance’s former CEO Changpeng Zhao (CZ) highlighted Binance Chain’s 2025 roadmap, which includes features like gasless transactions, AI, and sub-second block finality, boosting sentiment for BNB ecosystem tokens.

- CAKE’s market share surged to 21.87%, making it the leading decentralized exchange (DEX) by trade volume.

As Binance’s broader ecosystem continues to evolve, CAKE’s momentum could sustain further upside, though profit-taking remains a risk.

US States Push for Bitcoin Reserves, Could Fuel $23B in BTC Demand

A growing number of US states are proposing Bitcoin Reserve bills, with 20 states advancing legislation that, if passed, could require $23 billion in Bitcoin purchases.

Potential Market Impact:

- If enacted, these bills could mandate the purchase of 247,000 BTC, tightening supply further.

- State pension funds may also invest in BTC, increasing institutional adoption.

- Utah, Oklahoma, Arizona, and North Carolina have advanced their proposals, bringing them closer to becoming law.

Since President Trump’s call for a national Bitcoin Reserve, several states have taken independent steps to secure BTC holdings. While the federal initiative is still in early stages, state-level reserves could drive significant price action, especially given Bitcoin’s existing supply constraints.

XRP Eyes Recovery as Accumulation Rises, But Derivatives Market Lags

XRP is showing signs of recovery, gaining 2% in early Thursday trading, as on-chain data reveals increased accumulation among investors.

Key Metrics Indicating Accumulation:

- Mean Coin Age metric is trending upward, suggesting holders are keeping their XRP instead of selling.

- The 30-day MVRV ratio hit -17%, a level historically followed by strong rallies—previous dips to this level have resulted in 60%+ gains.

Derivatives Market Caution:

- Open interest in XRP futures has declined by 30% in the past week, from 2.05 billion XRP to 1.42 billion XRP.

- Funding rates have remained negative, signaling traders are still hesitant to go long.

The SEC acknowledged Grayscale’s XRP ETF filing on Tuesday, boosting speculation that an XRP ETF could be approved, with Bloomberg analysts placing a 65% probability on approval. If sentiment in XRP’s derivatives market improves, the token could see renewed momentum toward $2.55. However, a drop to $2.26 could trigger liquidations worth over $80 million.

With ETF speculation, accumulation trends, and a stabilizing market, XRP’s next move hinges on derivatives activity and broader crypto sentiment.

The Day’s Takeaway

Day’s Takeaway: Markets Rally as Tech Leads, Earnings Shine, and Crypto Booms

US stocks continued their bullish momentum, with the Nasdaq gaining 1.50%, as Meta notched its 19th straight winning session and AppLovin soared 24% post-earnings. The S&P 500 closed just shy of a record high, fueled by strong corporate earnings and easing regulatory concerns.

Coinbase posted a blowout quarter, crushing estimates with $2.27B in Q4 revenue, thanks to surging consumer and institutional trading volumes. The crypto exchange also benefited from favorable regulatory shifts, with Q1 projections signaling continued strength.

Gold surged to $2,925, nearing its all-time high of $2,942, after Trump signed a reciprocal tariff order and the US Dollar weakened (-0.61%). Central banks continued buying aggressively, with gold purchases rising 54% YoY.

In the commodity space, oil traders continued selling as geopolitical risks eased, with Russia’s oil flows largely unaffected by US sanctions, according to the IEA. Meanwhile, LME Copper extended its rally toward 9,530, with momentum targeting 9,780-9,830.

The crypto industry also saw a major regulatory shift, as Cboe filed for Ethereum ETF staking approval. This could drive a surge in institutional demand, potentially pushing ETH toward Standard Chartered’s $14,000 target for 2025.

With earnings season driving optimism, crypto gaining regulatory clarity, and inflation still in focus, markets remain positioned for volatility as investors assess the Fed’s next moves.