North America News

Dow Tops 48,000 as Rotation Out of Tech Deepens

U.S. stocks ended mixed on Wednesday as the rotation out of high-growth tech and into blue-chip names gained momentum. The Dow Jones Industrial Average notched its first-ever close above 48,000, while the Nasdaq fell and the S&P 500 ended little changed.

- Dow Jones Industrial Average: +326.86 points (+0.68%) to 48,254.82

- S&P 500: +4.31 points (+0.06%) to 6,850.92

- Nasdaq Composite: -61.84 points (-0.26%) to 23,406.46

The shift in leadership was evident, with five of the seven “Magnificent 7” stocks posting losses. Meta led the declines, down 2.90%, while Nvidia and Microsoft bucked the trend with modest gains.

Magnificent 7 Performance

- Meta Platforms: -2.90%

- Tesla: -2.04%

- Amazon.com: -1.95%

- Alphabet A: -1.56%

- Apple: -0.65%

- NVIDIA: +0.33%

- Microsoft: +0.48%

Meta shares have now dropped nearly 23% from their 2025 peak of $790, closing at $609.01. AMD surged 9% to $258.89 after upbeat commentary from its investor day.

Dow Leaders and Laggards

UnitedHealth (+3.55%), Goldman Sachs (+3.54%), and Cisco (+3.14%) led the Dow’s advance, with 21 of 30 components closing higher. The weakest performers included Amazon (-1.95%) and Chevron (-1.87%).

US 10-Year Note Auction Tails; Demand Soft

The US Treasury’s $42 billion sale of 10-year notes on Wednesday met with soft demand. The high yield was 4.074%, tailing the when-issued level by 0.6 basis points.

The bid-to-cover ratio came in at 2.43, down from 2.48 previously. Indirect bidders took 67%, directs 22.55%, and primary dealers the remaining 10.45%.

Analysts characterized the sale as weak, with tepid investor participation suggesting ongoing caution amid rate uncertainty.

US MBA Mortgage Applications Rise 0.6% After Prior Drop

Mortgage applications in the US increased 0.6% in the week ending November 7, rebounding from a 1.9% decline the previous week, data from the Mortgage Bankers Association showed.

The market index rose to 334.2 from 332.3, the purchase index climbed to 172.7 from 163.3, while refinancing activity slipped to 1,247.5 from 1,290.8. The average 30-year fixed mortgage rate ticked higher to 6.34% from 6.31%.

The release is typically low-impact for markets but continues to highlight a sluggish housing sector adjusting to higher rates.

Fed’s Bostic: Price Stability Risks Growing More Urgent

Atlanta Fed President Raphael Bostic said risks to price stability have become “clearer and more urgent,” even as the labor market shows some moderation.

Bostic, who is not a voter this year, said he favors holding the Fed funds rate steady until there is “clear evidence” of inflation returning to the 2% target. He cited Fed surveys showing persistent upward pressure on prices and costs, noting inflation is not confined to import channels.

Bostic added that while policy is “restrictive,” particularly in housing and other rate-sensitive sectors, there are few signs of an imminent cyclical labor downturn. He sees little likelihood that inflation pressures will fully dissipate before mid-to-late 2026.

Separately, Fed’s Miran remarked that monetary policy is currently “too restrictive.”

Fed’s Williams: Balance Sheet Expansion to Resume Once Reserves Ample

New York Fed President John Williams said it will not be long before the Federal Reserve needs to expand reserves again through gradual bond purchases.

Williams stressed that such renewed balance sheet expansion would be a technical measure, not a change in monetary policy stance. He added that the Fed continues to monitor market liquidity closely and reminded that the standing repo facility can be accessed “without stigma” if needed.

Fed Policymakers Split as Inflation–Jobs Debate Deepens

Divisions inside the Federal Reserve are widening as officials weigh inflation risks against a softening labor market, complicating the outlook for further rate cuts.

While markets still see a December reduction as likely, several hawkish policymakers argue that resilient spending and tariff-driven price pressures warrant caution. Doves counter that job-market weakness is mounting, though the government shutdown has delayed key data releases.

Chair Jerome Powell has sought to maintain unity, but the debate remains finely balanced ahead of the December 9–10 meeting.

McDonald’s Warns SNAP Freeze Hitting Low-Income Consumers

McDonald’s CEO Chris Kempczinski said the freeze in U.S. food-assistance payments amid the government shutdown is hurting low-income diners, who make up a key customer base.

He told investors the disruption to SNAP benefits is adding financial strain at the lower end of the income spectrum. Tyson Foods echoed the concern, noting consumers are reallocating budgets toward essential food purchases.

Roughly 40 million Americans rely on SNAP, representing about 12% of national food and beverage spending. A short-term funding bill is moving through Congress but may take days to restore full benefits.

Nomura Expects Fed to Pause in December, Bucking Market Consensus

Nomura expects the Federal Reserve to hold interest rates steady in December, citing still-solid labor conditions and Chair Jerome Powell’s hawkish tone.

The call diverges from market expectations for another quarter-point cut. Nomura warned that a pause could draw political backlash from President Trump, who has pressed for faster easing ahead of the election year.

Goldman Expects First U.S. Job Loss Since 2020 as Labor Market Softens

Goldman Sachs projects a 50,000 decline in U.S. nonfarm payrolls for October — the first monthly job loss since 2020 — citing weaker labor demand, layoffs, and the end of a deferred-resignation program that kept thousands of federal employees on payrolls through September.

Private hiring has slowed sharply, and Goldman’s job-growth tracker shows momentum fading. With official data delayed by the government shutdown, investors are relying on private estimates to gauge the pace of labor-market cooling.

UBS Sees S&P 500 Hitting 7,300 as Fed Cuts and AI Investment Extend Rally

UBS has lifted its S&P 500 target to 7,300 by mid-2026, betting that a combination of Federal Reserve rate cuts, resilient corporate earnings, and soaring AI investment will keep U.S. equities climbing.

The bank expects two additional rate cuts by early 2026, arguing that a softening labor market and easing inflation will justify continued policy support. Roughly 80% of S&P 500 firms have posted stronger-than-expected third-quarter results, and UBS anticipates a post-shutdown rebound in activity to boost fourth-quarter growth.

AI-related spending remains a central pillar of the bank’s bullish view. Tech companies are expanding data-center capacity and chip orders, with NVIDIA signaling strong demand. UBS says rising capex in AI will continue to propel the market well into next year.

Institutional Investors Turn Defensive as State Street Risk Gauge Slips

State Street’s Risk Appetite Index fell back to neutral in October, signaling a shift toward defensive positioning even as global equities hover near record highs.

The firm said institutional investors have not abandoned risk assets but are rotating within portfolios, favoring safer sectors. Equity allocations remain at their highest in nearly two decades, underscoring continued optimism tempered by valuation concerns — particularly in AI-linked tech giants.

State Street noted that while overall sentiment is constructive, investors are increasingly cautious about overstretched valuations and potential macro shocks.

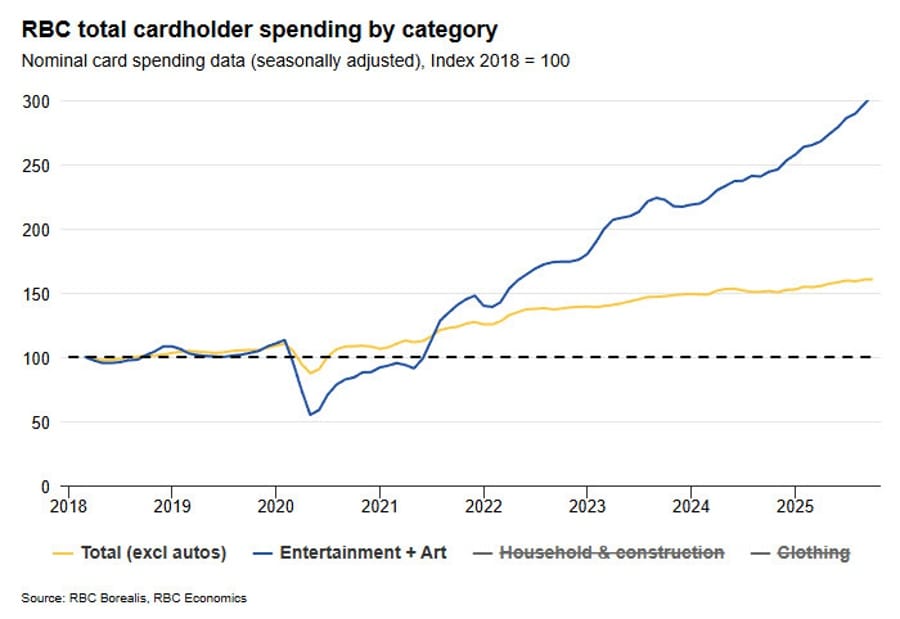

Canadian Consumer Spending Tracker Shows October Strength

RBC’s latest consumer spending tracker signaled continued resilience in Canadian consumption, posting a second consecutive month of robust growth in October.

The three-month average of core retail sales rose 0.5% month-over-month, following a 0.7% gain in September. Most of the October strength came from entertainment and arts, driven by activity in Ontario — host of the World Series.

Dining-related card spending also remained near record highs, again led by Ontario. Meanwhile, household and construction-related spending remained among the weakest categories but reached an 18-month high.

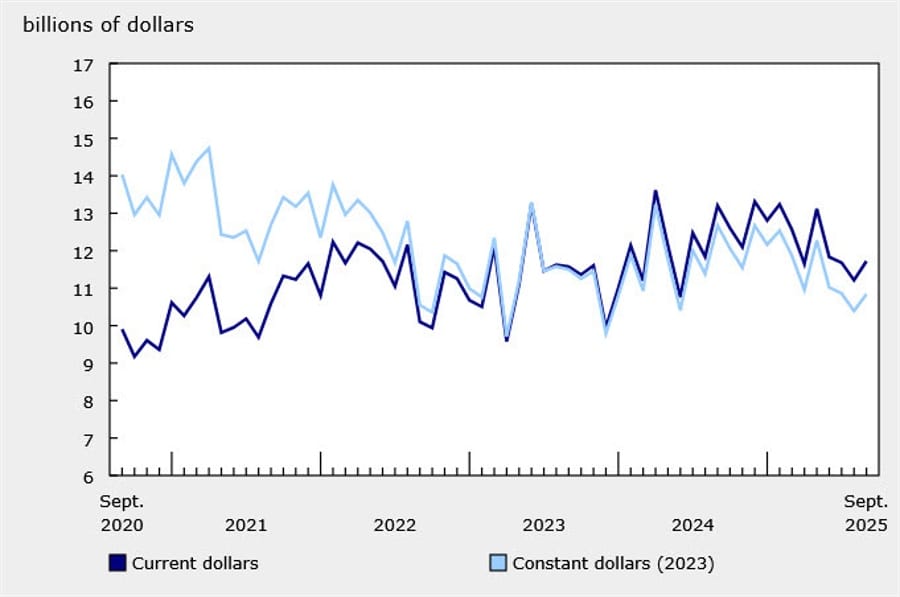

Canada September Building Permits Jump 4.5%, Beating Forecasts

Canadian building permits rose 4.5% in September, well above expectations for a 1% increase, after a revised 1.2% decline in August, according to Statistics Canada data.

The total permit value reached C$11.7 billion, with residential projects up 4.8% and non-residential up 4.0%. Permits for the third quarter as a whole fell 5.4%.

While Ottawa’s latest budget includes significant capital-spending commitments, analysts note that approval bottlenecks mean new project activity will take time to materialize.

Commodities News

Gold Breaks Above $4,200 as Dollar and Yields Slide Ahead of Shutdown Vote

Gold surged nearly 2% on Wednesday, reclaiming the $4,200 mark as U.S. Treasury yields and the Dollar retreated. The rally comes ahead of a crucial House vote to end the 43-day government shutdown.

The yellow metal has now recovered sharply from its late-October low of $3,886, with traders betting on weaker economic data and a more dovish Federal Reserve stance.

Soft readings from ADP and Challenger reports this week signaled growing strain in the labor market, reinforcing market expectations for earlier Fed rate cuts.

House Republican leader Steve Scalise confirmed that the vote to reopen the government is scheduled for 7:00 PM ET. The White House said that if the measure passes, upcoming inflation and payroll data could be delayed due to the shutdown’s data disruptions.

Despite rising equity markets, bullion extended gains — an unusual move that underscores the market’s broader uncertainty.

Crude Oil Slides 4% to $58.49 as OPEC Flips Forecast to Surplus

Oil prices dropped sharply on Wednesday, with WTI crude settling down $2.55, or 4.18%, at $58.49 a barrel — the lowest close in over a month.

The decline came after OPEC revised its Q3 outlook from a projected 400,000 barrels-per-day deficit to a 500,000 bpd surplus, signaling that global supply may be outpacing demand.

The bearish tone deepened as Saudi Arabia cut its benchmark crude price to Asia to an 11-month low, hinting at weakening regional demand. Meanwhile, strong U.S. output and a firmer dollar added to downside pressure.

Technically, crude broke below key support levels. After holding near $61.45 on Tuesday, prices fell under a key moving average cluster at $60.30 and breached the lower swing area near $59.58, leaving sellers firmly in control.

OPEC Sees Near-Balanced Oil Market in 2026, Pauses Output Hikes

OPEC expects the global oil market to be almost balanced next year, projecting a marginal surplus of about 20,000 barrels per day, assuming current production levels hold.

The latest monthly report marks a shift from the group’s prior forecast of a 50,000-bpd deficit and a deeper shortfall in September. Despite earlier quota increases of 137,000 bpd, official data show OPEC output actually fell by 73,000 bpd in October, led by lower supply from Kazakhstan.

The cartel plans to pause production hikes in the first quarter of 2026 amid weak prices, softer seasonal demand, and concerns about oversupply. WTI crude traded down 87 cents at $60.16 a barrel.

Oil Rises on Refined-Product Strength, ING Says

Oil prices extended gains Tuesday, with ICE Brent settling more than 1.4% higher to reclaim levels above $65 a barrel, supported by firming refined-product margins, ING analysts Ewa Manthey and Warren Patterson said.

The rally has been driven by surging gasoline and gasoil cracks amid tightening supplies and heightened uncertainty over Russian crude exports. Ongoing Ukrainian drone strikes on Russian refineries, along with fresh US sanctions on Lukoil and Rosneft, have intensified market concerns over middle-distillate availability.

Ship-tracking data show Russian seaborne exports have slowed in recent weeks, with the four-week average at its lowest since mid-September. Volumes to China and India have dropped, though a sizable portion of shipments remain listed as “unknown destinations.”

Traders await OPEC’s monthly report, the US Energy Information Administration’s short-term outlook, and API inventory data — all due later Wednesday.

Gold Finds Dip Buyers Near $4,100 as Market Draws New Floor

Gold pared early losses to trade near flat at $4,129 per ounce Wednesday after briefly slipping below $4,100 in late-Asia hours. The quick rebound marks the second straight session in which dip buyers emerged around the $4,100 level, forming what traders describe as a tentative short-term floor.

While near-term support is firming, broader market focus remains on the macro backdrop — dollar strength, real yields, and geopolitical flows — that continue to drive gold’s medium-term direction.

Trump Administration to Expand Offshore Drilling in Major Policy Reversal

The Trump administration is preparing to lift restrictions on offshore oil drilling, paving the way for new projects near California, Alaska, and the Gulf of Mexico — a sharp reversal of Biden-era limits.

The plan, expected this week, aligns with President Trump’s pledge to boost domestic energy output and reduce costs. While producers remain cautious about costly offshore investments, officials say the expansion could spur jobs and growth.

Interior Secretary Doug Burgum has already directed agencies to begin drafting lease schedules, citing the need for “responsible energy development.”

Europe News

European Stocks Extend Gains; Italy’s MIB Hits 25-Year High

European equities closed higher Wednesday, with major indices logging another day of broad gains. Italy’s FTSE MIB ended at its highest level since 2000, while the UK’s FTSE 100 and Spain’s Ibex reached fresh record highs.

Closing levels:

- Germany’s DAX: +1.22%

- France’s CAC 40: +1.04%

- UK’s FTSE 100: +0.12%

- Spain’s Ibex: +1.39%

- Italy’s FTSE MIB: +0.80%

Investors extended risk appetite as earnings momentum and resilient economic data supported European market sentiment.

Germany October CPI Final Confirms 2.3% Y/Y; Core Stays Elevated

Germany’s final October inflation data confirmed consumer prices rose 2.3% from a year earlier, unchanged from the preliminary estimate, data from Destatis showed Wednesday. That’s down from 2.4% in September.

The EU-harmonized HICP measure also matched the flash print at 2.3% year-on-year, easing from 2.4% prior. Core inflation held steady at 2.8%, underscoring lingering price pressures even as headline momentum cools.

The persistence of elevated core prices keeps the European Central Bank cautious about the timing and pace of policy normalization.

ECB Officials Play Down Risks, Highlight Economic Resilience

Bank of France Governor François Villeroy de Galhau said France’s economy remains resilient despite political uncertainty, noting that high household savings reflect concerns over fiscal deficits.

Separately, ECB policymaker Isabel Schnabel said eurozone growth has been stronger than expected, though inflation pressures persist in services and food. She described rates as “in a good place,” while warning that inflation risks remain tilted slightly upward.

Asia-Pacific & World News

China’s He Lifeng: Ample Scope for US-China Economic Cooperation

Chinese Vice Premier He Lifeng said there is “vast room for cooperation” between China and the United States in trade and economic affairs, according to comments published by Xinhua.

He, who was appointed in May to lead China’s trade negotiations with Washington, signaled an intent to stabilize bilateral relations following a period of tension. His remarks suggest Beijing aims for a more predictable phase in US relations — though future policy direction under President Trump remains uncertain.

China Directs SMIC to Prioritize Huawei as U.S. Curbs Tighten

Beijing has instructed Semiconductor Manufacturing International Corp. to allocate scarce advanced chip capacity to Huawei, intensifying shortages caused by U.S. export controls.

The order underscores China’s determination to sustain domestic AI development despite Washington’s restrictions. Analysts estimate Huawei could produce over 800,000 Ascend processors this year, doubling output in 2026, even as yields remain poor at SMIC.

In the U.S., officials are divided on whether to further tighten chip-export rules. Nvidia has lobbied for limited approvals, citing China’s role as a key AI hub.

Beijing Condemns Japan PM Takaichi Over Taiwan Defense Remarks

China’s state media unleashed fierce criticism of Japanese Prime Minister Sanae Takaichi after she suggested Japan could deploy its Self-Defense Forces if China attacked Taiwan, invoking the 2015 security law’s “survival-threatening” clause.

Beijing’s foreign ministry called her comments “egregious,” warning Japan could face consequences. Xinhua used unusually harsh language in its response, accusing the new prime minister of “reckless provocation.”

Xi and Spain’s King Pledge Stronger Ties in Beijing Meeting

Chinese President Xi Jinping and Spain’s King Felipe VI agreed to deepen their strategic partnership during a signing ceremony in Beijing, reaffirming cooperation in trade, investment, and cultural exchange.

Xi said China seeks a “steady and trusted” relationship with Spain, while King Felipe described the ties as built on mutual trust. The meeting comes as Beijing looks to strengthen bilateral relations with individual EU members amid broader tensions with Brussels.

Chinese Banks Inflate Loan Data With Short-Term “Phantom” Lending

Chinese banks are using short-term “phantom” loans to meet official lending quotas amid weak credit demand, according to industry sources.

The practice — issuing and recalling loans within weeks — temporarily inflates lending data but fails to support real economic activity. Regulators have pledged tighter oversight after identifying widespread circular flows of funds within the banking system.

Credit growth remains at historic lows, investment has fallen for the first time since 2020, and lending to local-government vehicles is increasingly constrained by stricter scrutiny from the Ministry of Finance.

Goldman Pushes China “Dual Cut” Forecast to 2026, Sees Gradual Yuan Rise

Goldman Sachs now expects China’s next policy rate and reserve-ratio cuts to occur in 2026, reflecting the People’s Bank of China’s preference for currency stability and structural reforms over aggressive easing.

The bank forecasts a 10bp rate cut and 50bp RRR reduction in early 2026, followed by another small cut later that year. Goldman says Beijing’s latest monetary policy report highlights “cross-cyclical adjustments” and a focus on RMB internationalization, suggesting limited appetite for stimulus.

Goldman expects the yuan’s appreciation against the dollar to remain “gradual and choppy,” dependent on exporter inflows and broader dollar trends.

Central Banks Gradually Diversify Away from the Dollar, Standard Chartered Says

Reserve managers are quietly cutting exposure to the U.S. dollar, yet they are not shifting heavily into the euro, sterling, or yen. According to Standard Chartered’s analysis of IMF data, allocations are instead spreading into smaller G-10 and emerging-market currencies such as the Canadian and Australian dollars, the Swiss franc, and select liquid EM units.

The trend suggests a slow erosion of dollar dominance, but without a clear alternative emerging. Rather than a coordinated move toward another major currency bloc, diversification reflects a search for better returns, geopolitical neutrality, and portfolio balance. Official investors are adapting to a fragmented currency landscape — one where many small bets replace a few large ones.

PBOC sets USD/ CNY mid-rate at 7.0833 (vs. estimate at 7.1141)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injects 195.5bn yuan at 1.40% via 7-day reverse repos

- after maturities today the net injections is 130bn yuan

RBA’s Hauser Says Policy Still Restrictive but Under Review

Reserve Bank of Australia Deputy Governor Andrew Hauser said monetary policy is likely still restrictive but under active review, as board members debate how tight current settings remain.

Hauser described consumption data as mixed and dismissed a sharp rebound in consumer sentiment as “probably erratic.” He said policymakers will wait for more consistent signs of recovery before shifting stance.

Hauser added that the RBA’s goal remains to return inflation to target without triggering higher unemployment and emphasized that the board’s new governance structure encourages open debate.

Australia Home Loans Jump 9.6% in Q3, Fastest Rise Since 2021

Australian housing finance surged in the third quarter, with total home loans rising 9.6% quarter-on-quarter — the sharpest increase since early 2021 and well above expectations of 2.6%.

Owner-occupier loans climbed 4.7%, while investor lending soared 17.6%, signaling a broad rebound in housing demand despite high borrowing costs.

RBA’s Brad Jones Warns Markets Are Mispricing Geopolitical Risk

Reserve Bank of Australia Assistant Governor Brad Jones said global markets appear complacent about geopolitical risks, warning that asset valuations remain elevated despite rising uncertainty.

Speaking at the ASFA Conference in Broadbeach, Jones also noted early signs of fragmentation in central-bank gold reserves — a potential signal of shifting confidence in global financial stability.

Japan PM Takaichi: Japan Has Not Yet Escaped Deflation

Prime Minister Sanae Takaichi said Japan cannot yet declare victory over deflation, warning that recent price increases driven by food costs could hurt growth.

She pledged close coordination with the Bank of Japan to ensure inflation is supported by rising wages and sustainable demand. Takaichi emphasized that policy missteps could push the economy back into deflation, undermining consumption and capital spending.

Finance Minister Satsuki Katayama separately said the government is monitoring rapid yen movements “with a high sense of urgency,” adding that stable currency conditions are essential for economic fundamentals.

Japan’s Factory Mood Hits Four-Year High; Services Hold Steady

Japan’s manufacturing sentiment surged in November to its strongest level since early 2022, driven by a weaker yen and recovering demand for autos and electronics, according to the Reuters Tankan survey.

The manufacturers’ index jumped to +17 from +8, while the electronics sub-index leapt to +25 from +5 amid stronger chip orders and export gains. Automakers also posted sharp improvements, with transport machinery rising to +27 from +9.

Non-manufacturing sentiment was unchanged at +27, supported by robust tourism and domestic demand. However, companies remain cautious about supply disruptions and potential fallout from new U.S. trade tariffs on China. The manufacturing index is expected to ease slightly to +15 by February.

Japan’s Bond Yields Surge to Crisis-Era Highs as Market Regime Shifts

Japanese government bond yields have climbed to their highest levels since the 2008 financial crisis, signaling a decisive break from decades of ultra-loose monetary policy. The 10-year yield reached 1.69%, while the 40-year neared record highs, reflecting investor expectations of higher inflation and tighter financial conditions ahead.

The move raises fiscal risks for Japan’s heavily indebted government and pressures domestic banks and insurers reliant on low-yielding debt. It also reverberates globally, prompting investors to reassess yen-funded carry trades that have underpinned asset flows worldwide.

For years, the Bank of Japan’s yield-curve control policy and negative rates anchored borrowing costs near zero. With the BoJ now stepping back, yields are rising fast — a sign that markets see the end of Japan’s long experiment with deflation and near-free money.

Crypto Market Pulse

Bitcoin Slips to Weekly Lows, Erasing Early Gains

Bitcoin fell sharply on Wednesday, sliding to its lowest level since November 7 after erasing early-session gains. The cryptocurrency peaked near $105,600 during early New York trading but has since dropped nearly 1% on the day.

The $99,000 zone — which held multiple times last week — remains a key support level, though charts now show a potential head-and-shoulders formation that traders warn could signal further downside for Bitcoin and the broader risk complex.

William Blair Reaffirms Outperform on Circle After Strong Q3

William Blair reiterated its outperform rating on Circle (CRCL) following stronger-than-expected third-quarter results. The firm said Circle continues to lead the stablecoin market through its USDC token and remains best positioned to define the “programmable money” standard.

Circle shares were down 3.9% in premarket trading Wednesday at around $94.50.

Analyst Andrew Jeffrey said short-term catalysts are limited but recommended buying on weakness given Circle’s scale advantage over rivals. He cited progress in infrastructure initiatives — notably the CPN orchestration layer and Arc layer-1 blockchain, which now counts 100 participants ahead of a planned 2026 mainnet launch and potential native token.

Transaction volume rose sharply, with 12-month total payment volume up 101x to an annualized $3.4 billion. Circle raised its 2025 revenue forecast to $90–$100 million, from $75–$85 million previously.

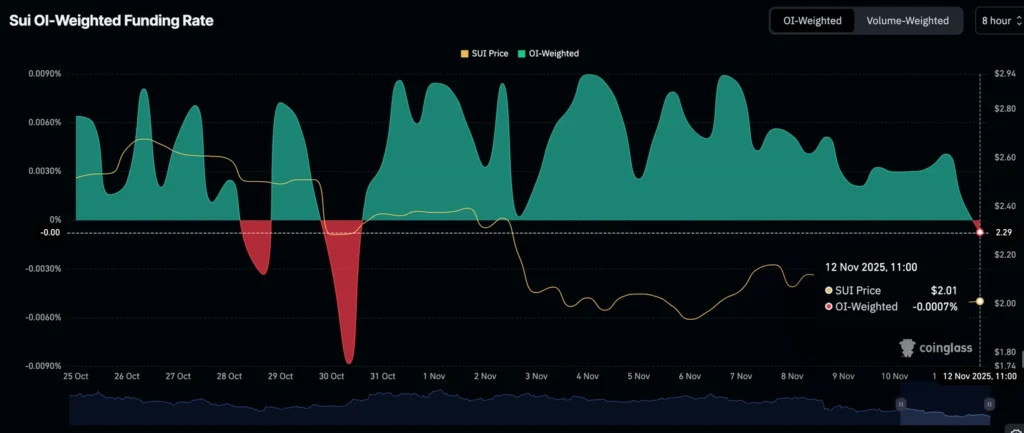

Sui Reclaims $2.00 as DeFi TVL Slides 15%

Sui (SUI) rebounded above $2.00 on Wednesday, up 3.5% on the day, though its DeFi ecosystem continues to contract amid broad risk-off sentiment.

DefiLlama data show total value locked (TVL) fell 15% to $1.35 billion over the past 24 hours — extending a steady decline from the record $2.63 billion reached on October 9. The retracement reflects waning confidence as traders pull assets from staking protocols.

Futures open interest has also dropped to $781 million, down from $835 million Tuesday and $1.84 billion at the start of October, underscoring light participation. Funding rates have turned negative (-0.007%), signaling increased short positioning.

Analysts say sustained OI growth is needed to confirm a durable price recovery; otherwise, a move back below $2 remains likely.

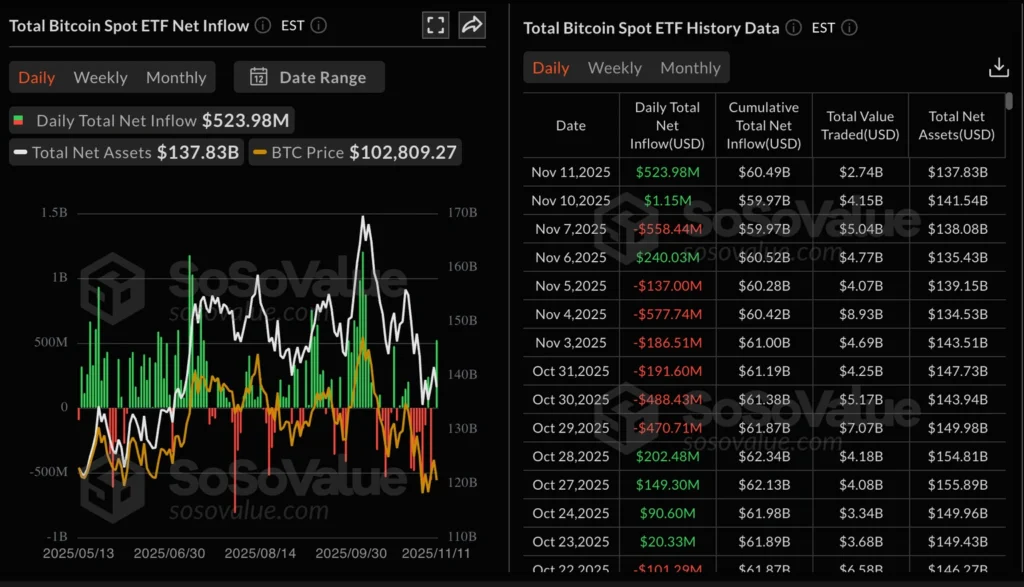

Crypto Market Regains Momentum as Bitcoin ETF Inflows Return

Bitcoin rebounded above $104,000 on Wednesday, rising alongside major cryptocurrencies as renewed inflows into US-listed Bitcoin ETFs signaled a revival of institutional demand.

ETF data from SoSoValue showed $523 million in inflows Tuesday, following $1.15 million Monday. The return of demand has boosted sentiment after October’s $19 billion crypto liquidation event.

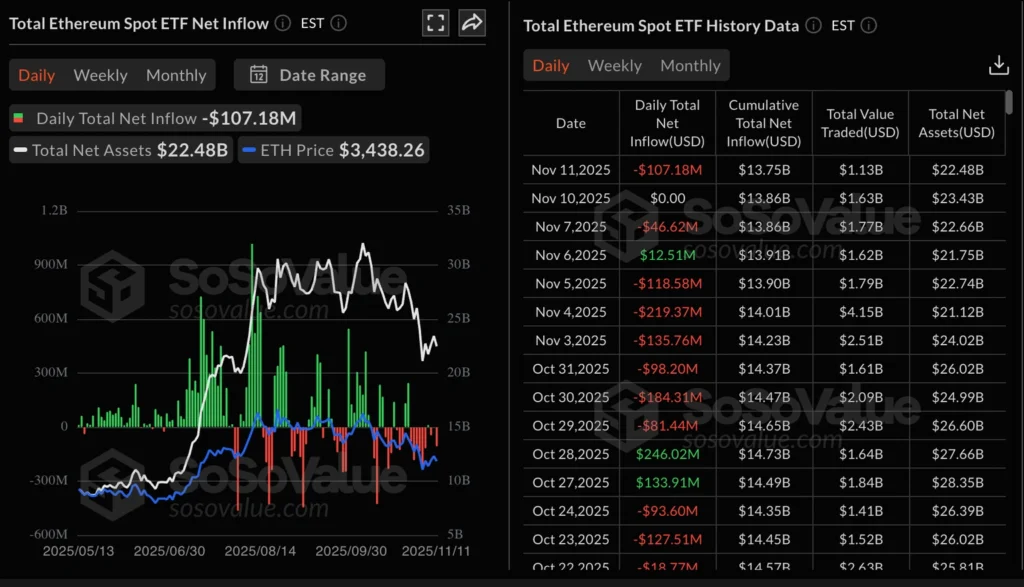

Ethereum remained subdued near $3,400 amid $107 million of outflows from US-listed ETH ETFs, which hold about $22.5 billion in assets. Ripple’s XRP also trimmed losses, trading above $2.40 as derivatives open interest stabilized around $3.95 billion.

Market participants view ETF flows as a key gauge of appetite for risk assets amid ongoing macro uncertainty.

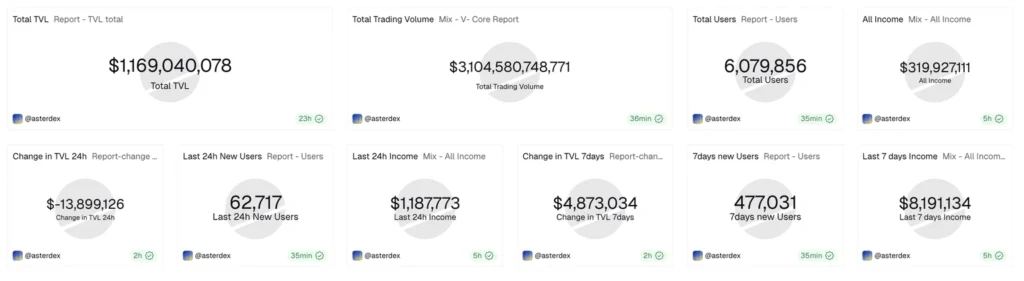

Aster Bulls Eye Breakout as Trading Volume Tops $3 Trillion

Aster (ASTER) extended gains of more than 8% Wednesday, approaching resistance near $1.21 as buying interest strengthened on the Binance-backed decentralized exchange. Total trading volume has surpassed $3 trillion for the first time, placing Aster just behind Hyperliquid’s $3.2 trillion milestone.

Despite the volume record, on-chain indicators remain mixed. Protocol fees have trended below $20 million since mid-October — $15.8 million last week — reflecting slower user growth. Open interest across perpetual contracts has dropped to $2.67 billion from $5.01 billion in early October, suggesting softer speculative demand.

Weekly perpetual trading volume totaled $72.0 billion last week, down from $76.7 billion in mid-October, with $20.6 billion recorded so far this week. Analysts see potential for a short-term breakout but note broader caution as liquidity and participation decline.

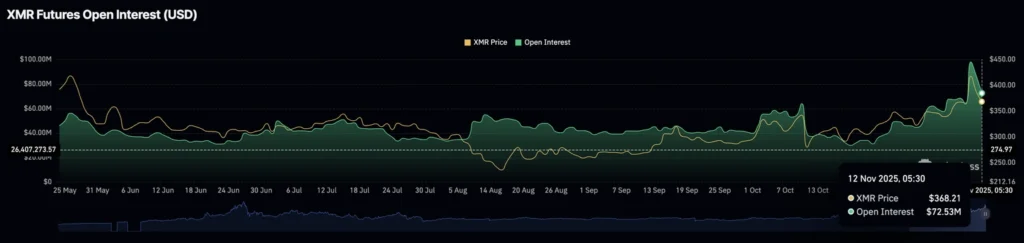

Monero Recovers Midweek Despite Declining Retail Interest

Monero (XMR) climbed more than 4% Wednesday, marking its first positive session of the week after two straight declines. The privacy-focused cryptocurrency remains under mixed technical signals, with MACD momentum near a bearish crossover but RSI holding above the midline.

Derivatives data show retail participation waning: CoinGlass reported XMR futures open interest (OI) fell to $72.53 million from $97.98 million on Monday, reflecting reduced speculative appetite.

Despite softer derivatives activity, spot trading volume has remained firm above $200 million since Sunday, indicating that longer-term holders are maintaining positions even as leveraged traders step back.

The Day’s Takeaway

North America: Rotation Defines Wall Street; Fed Voices Caution

U.S. equities ended mixed as investors continued rotating out of tech and into blue-chip names. The Dow Jones Industrial Average closed above 48,000 for the first time, supported by strong gains in healthcare and financials, while the Nasdaq fell 0.26% as five of seven “Magnificent 7” stocks declined. Meta (-2.9%) led the tech retreat, while Nvidia (+0.33%) and Microsoft (+0.48%) edged higher. AMD jumped 9% following upbeat investor commentary.

In the bond market, the U.S. 10-year Treasury auction drew soft demand, tailing by 0.6 basis points, reinforcing investor caution amid rate uncertainty.

Fed officials struck a cautious tone: New York Fed President John Williams signaled upcoming technical balance sheet expansion, while Atlanta’s Raphael Bostic warned that inflation risks remain pressing and that policy should stay restrictive until clear disinflation emerges.

Canadian data from RBC showed consumer spending staying firm in October, with entertainment and dining leading gains, particularly in Ontario.

Canada’s consumer spending held up through October, underscoring economic resilience even as housing and construction lagged. Entertainment and dining outperformed, with Ontario again leading on event-driven demand.

Commodities: Gold Shines, Oil Slumps

Gold surged past $4,200, climbing nearly 2% as the Dollar and Treasury yields slipped ahead of a U.S. government shutdown vote. Weak ADP and Challenger job data added to dovish Fed expectations, helping bullion extend its recovery from October’s $3,886 low despite risk-on equity markets.

In contrast, WTI crude oil tumbled 4.18% to $58.49, its lowest close in over a month. OPEC’s surprise shift from a projected supply deficit to a surplus and Saudi Arabia’s price cut to Asia fueled bearish sentiment. Technical breakdowns below $60 intensified selling pressure.

Europe: Momentum Builds as Indices Extend Gains

European markets extended their winning streak, buoyed by resilient earnings and steady macro data. Italy’s FTSE MIB hit its highest since 2000, while the UK’s FTSE 100 and Spain’s Ibex closed at record highs.

Closing snapshot: DAX +1.22%, CAC 40 +1.04%, FTSE 100 +0.12%, Ibex +1.39%, FTSE MIB +0.80%.

Asia: China Signals Stability

Chinese Vice Premier He Lifeng struck a conciliatory tone, saying there is “vast room for cooperation” between Beijing and Washington in trade and economic matters. His remarks, published by Xinhua, indicate an intent to stabilize relations and focus on predictability, though U.S. policy under Trump remains a wildcard.

Crypto: Mixed Signals Across Majors

Bitcoin fell nearly 1%, touching its lowest level since November 7, as traders warned of a potential head-and-shoulders pattern near $99,000 support.

Monero (XMR) rebounded 4% midweek despite a sharp drop in futures open interest, signaling waning retail participation but steady spot demand.

Sui (SUI) climbed back above $2.00 amid a 15% DeFi TVL drop to $1.35 billion, highlighting fragile sentiment and increased short positioning.

Circle (CRCL) received a reaffirmed outperform rating from William Blair after strong Q3 results and 101x TPV growth, keeping USDC at the forefront of the stablecoin race.