North America News

US Stocks End Mixed; Yields Push Higher Despite Weak Sentiment Data

US equities finished Friday little changed, with the S&P 500 slipping modestly after briefly touching an intraday record high. The Nasdaq outperformed, lifted by a sharp rebound in Tesla shares, while the Dow and Russell 2000 closed lower.

Index performance:

- Dow Jones Industrial Average: -273.78 pts (-0.59%) to 45,834.22

- S&P 500: -3.18 pts (-0.05%) to 6,584.29

- Nasdaq Composite: +98.03 pts (+0.44%) to 22,141.10 (new record close)

- Russell 2000: -24.46 pts (-1.01%) to 2,397.06

For the week, all major benchmarks advanced:

- Dow +0.95%

- S&P 500 +1.59%

- Nasdaq +2.03%

- Russell 2000 +0.25%

Sentiment Data Disappoints

The University of Michigan’s preliminary September consumer sentiment index fell to 55.4 (vs 58.0 expected, 58.2 prior).

- Current conditions: 61.2 (vs 61.3 expected, 61.7 prior)

- Expectations: 51.8 (vs 54.9 expected, 55.9 prior)

Inflation expectations were mixed:

- 1-year outlook: unchanged at 4.8%

- 5-year outlook: up to 3.9% (from 3.5%)

Although the survey has lost influence since the pandemic, the Fed continues to monitor inflation expectations as part of its policy framework.

Treasury Yields and Auctions

Bond yields rose despite weaker sentiment, reflecting concerns about sticky inflation expectations.

- 2-year: +3.3 bps to 3.561%

- 5-year: +5.5 bps to 3.633%

- 10-year: +5.5 bps to 4.066% (hit intraday low of 3.996%, lowest since April 7, 2025)

- 30-year: +3.0 bps to 4.61%

For the week, the yield curve flattened:

- 2-year: +5.3 bps

- 5-year: +5.3 bps

- 10-year: -0.8 bps

- 30-year: -7.9 bps

Treasury auctions of 3-year, 10-year, and 30-year notes were completed. Demand was strong in the 3- and 10-year sectors, while the 30-year sale drew average interest.

Looking Ahead

Next week will be dominated by central bank policy decisions, with at least four major rate announcements scheduled.

UMich Sentiment Weakens in September

The University of Michigan’s preliminary September survey showed U.S. consumer confidence softening:

- Headline sentiment: 55.4 (expected 58.0, prior 58.2)

- Current conditions: 61.2 (expected 61.3, prior 61.7)

- Expectations: 51.8 (expected 54.9, prior 55.9)

Inflation expectations:

- 1-year: 4.8% (unchanged)

- 5-year: 3.9% (up from 3.5%)

The higher long-term inflation reading will not go unnoticed at the Fed.

CBO Cuts 2025 GDP Forecast, Sees Higher Inflation

The Congressional Budget Office (CBO) released updated forecasts compared to January 2025:

- Real GDP growth:

- 2025: 1.4% (down 0.5 pp, tariffs + weak immigration weigh on growth)

- 2026: 2.2% (boost from reconciliation act)

- 2027–28: 1.8% (steady as stimulus fades, labor supply weakens)

- Inflation (PCE):

- 2025: 3.1% (tariff spike)

- 2026: 2.4%

- 2027–28: 2.0% (Fed target)

- Unemployment:

- 2025: 4.5% (higher vs Jan)

- 2026: 4.2% (lower vs Jan)

- 2027–28: ~4.4% (steady)

- Rates:

- Fed funds: 4.5% end-2025, easing to 3.3% by 2027–28

- 10-year Treasury: 4.3% (2025) → 3.9% (2028)

Overall: Slower 2025 growth, higher near-term inflation, but Fed easing expected to resume beyond 2025.

Trump Criticizes Fed Over Rate Policy

U.S. President Donald Trump, speaking to Fox News, once again pressed the Federal Reserve on rates:

“The Fed is always late. We have the best stock market ever. Inflation is down, the stock market is up, and we should have lower interest rates.”

While Trump will get a cut at next week’s FOMC meeting, the outlook for longer-term yields remains less certain.

Morgan Stanley Now Expects Fed Cuts in September, October, and December

Morgan Stanley has revised its Fed call, now projecting three rate cuts in the remaining 2025 FOMC meetings — September, October, and December.

Previously, the bank expected only two cuts (September and December). Looking into 2026, they forecast additional 25 bps cuts in January, April, and July.

Weak U.S. Jobs Data and Sticky Inflation Complicate Fed Outlook

The U.S. economy added just 22,000 jobs in August, with prior months revised lower by 21,000, bringing the three-month average down to 29,000 compared to 168,000 in 2024. Unemployment rose to 4.3% from 4.2%, while participation ticked higher.

An annual benchmark revision cut payrolls by 911,000 as of March 2025, halving earlier job creation estimates.

Inflation remained firm:

- CPI: +0.4% m/m, +2.9% y/y

- Core CPI: +3.1% y/y, +3.6% annualized

- Tariff costs have doubled since August, raising goods inflation risk

- Services inflation ex-energy: +3.6% y/y

The Fed is expected to deliver a 25bp rate cut next week, though officials remain wary of sticky inflation even as labor market weakness builds. Markets want reassurance the Fed prioritizes downside risks to jobs.

Ex-Goldman CEO Blankfein Sees Crisis Brewing, But Stays Fully Invested

Former Goldman Sachs chief Lloyd Blankfein cautioned that the U.S. is likely “due” for another crisis, pointing to risks in credit markets such as narrow spreads and rising private credit leverage.

Key points:

- U.S. historically faces crises every 4–5 years

- Credit spreads (ICE BofA HY OAS at ~2.84%) at historic lows

- Private credit AUM up 14.5% year-on-year, with insurers adding leverage

- Some assets may be mispriced or overstated in value

Despite the warning, Blankfein said he remains 100% invested in equities, citing likely Fed rate cuts and the long-term transformative effect of AI. His stance aligns with Goldman’s bullish call for a new secular bull market, especially in tech, services, manufacturing, and global exposure.

U.S. and Japan Reaffirm FX Commitments After Tariff Order

The U.S. and Japan’s finance ministers issued a joint statement reaffirming G7 currency policy principles: exchange rates should be market-driven, interventions only in disorderly conditions, and operations disclosed monthly.

Japanese Finance Minister Kato highlighted the timing of the statement, saying it was significant following Washington’s new tariff order. He emphasized that no talks occurred with Treasury Secretary Bessent on specific exchange-rate levels but noted the importance of sustained dialogue.

Canada July Building Permits Slip, Capacity Utilization Steady

Canada’s July 2025 building permits edged down -0.1% m/m (expected +4.0%), following a steep -9.0% drop in June.

- Permits were -8.2% y/y.

- Residential intentions rose by $268.3 million to $7.3 billion.

- Non-residential permits fell $279.2 million to $4.6 billion.

In a separate release, Q2 capacity utilization came in at 79.3% (expected 78.8%), down from 80.1% in Q1.

- Manufacturing utilization slipped to 79.3% vs 79.9% prior.

Commodities News

Gold Climbs $15, Approaches Weekly Highs

Gold rose $15 to $3,649, nearing the weekly high at $3,675, as weak UMich sentiment data bolstered demand.

- The metal is consolidating ahead of the FOMC meeting. A dovish tone from Chair Powell could pave the way toward $3,750 and even $4,000.

- Technicals: Tuesday’s spike left overbought conditions, but dips are well supported.

- Geopolitics: U.S. efforts to pressure Russia into Ukraine peace talks add mixed risks. Tougher sanctions would lift gold, but any peace breakthrough would weaken demand.

Oil Prices Rise on U.S. Push for Sanctions on India, China

Crude oil gained $1.19 to $63.57 after reports that the U.S. will seek 100% tariffs on China and India to deter purchases of Russian oil.

Bloomberg reports

- Washington hopes to secure backing from G7 nations, though unity is uncertain.

- Some EU states, notably Hungary, have blocked tougher energy sanctions, and new measures would require unanimous EU approval.

Despite doubts over implementation, the headlines helped support oil prices.

U.S. Gas Inventories Rise More Than Expected

EIA data showed U.S. natural gas stocks increased by 71 Bcf last week, above the 68 Bcf forecast and well above the 5-year average build of 56 Bcf.

- Total inventories reached 3.34 Tcf as of September 5, about 6% above the 5-year norm.

- Warmer weather muted demand, contributing to the build.

- Henry Hub front-month contract slipped almost 1% to around $2.90/MMBtu in early trading.

Commerzbank: IEA Supply Forecast Too Ambitious

Commerzbank analysts caution that the IEA’s outlook for a large oil surplus may be unrealistic.

- OPEC+ output has risen 1 million bpd less than pledged since Q1 2025, as some producers (notably Russia) hit capacity limits.

- Another strong expansion in 2026 supply, as the IEA assumes, appears “ambitious.”

- If oversupply emerges, oil prices could face pressure similar to 2020, unless geopolitical disruptions tighten supply.

OPEC Still Sees Oil Market Deficit

According to Commerzbank’s Carsten Fritsch, OPEC’s latest report leaves forecasts unchanged:

- OPEC+ supply expansion continues, but OPEC still projects a market undersupply when compared with demand.

- IEA vs OPEC: IEA expects softer demand and more supply, while OPEC assumes stronger demand and tighter balances.

- Commerzbank warns OPEC’s demand assumptions look too optimistic.

Gold Eyes New Highs Ahead of Fed Decision

Gold prices stayed supported after the U.S. CPI print matched expectations and initial jobless claims rose sharply to the highest since 2021, largely due to a spike in Texas. The softer labor signal reinforced expectations of a dovish Fed, keeping bullion’s bullish momentum alive.

- Macro view: Falling real yields remain supportive; however, intermittent hawkish repricing in rates may cause corrections.

Technical outlook:

1-hour chart: Price rejected at 3,657 swing high. Buyers may lean on the trendline for upside breakout attempts; sellers target a pullback toward 3,590.

Daily chart: Buyers see better risk/reward near the 3,400 trendline; sellers eye downside break toward 3,120.

4-hour chart: Bullish momentum intact with a minor trendline support; pullbacks expected to attract dip-buyers.

UBS Raises Gold Forecast to $3,800 by Year-End

UBS lifted its year-end gold price target to $3,800, up $300 from its earlier projection. For mid-2026, the bank now sees gold at $3,900 (previously $3,700).

UBS notes:

- Maintains an “Attractive” view on gold, with a recommended mid-single-digit portfolio allocation.

- Central bank demand expected at 900–950 tons this year (just below 2024’s ~1,000 tons).

Key risk: If the Fed is forced into renewed rate hikes due to upside inflation surprises, the bullish outlook for gold could face headwinds.

IEA Warns of Massive 2026 Oil Oversupply

The IEA now projects a 3.33 million bpd surplus for next year, one of the largest since the COVID-19 pandemic.

- The revision (+360k bpd from last month) is due entirely to higher supply.

- Demand was revised slightly higher, but not enough to offset supply gains.

- Supply expected to rise >1 million bpd for both OPEC+ and non-OPEC+ in 2026.

Markets reacted with oil prices falling nearly 2% on Thursday, erasing early-week gains.

Switzerland Weighs U.S. Gold Refinery and Pharma Expansion to Offset Tariffs

Switzerland is drafting measures to reduce U.S. tariffs imposed by the Trump administration, which reached 39% on Swiss goods in August. The tariffs target a deficit driven largely by Swiss pharma and gold exports.

Planned responses include:

- Establishing or expanding gold refining capacity in the U.S.

- Boosting domestic pharma output to cover U.S. demand

- Increasing purchases of U.S. defense equipment and LNG

Economy Minister Guy Parmelin described negotiations with Washington as “constructive.”

Platinum Market Faces Third Year of Deficit – WPIC

The World Platinum Investment Council (WPIC) expects a 2025 deficit of 850,000 ounces, still large but lower than last year’s 968,000 shortfall.

- Downward revision reflects higher recycling and weaker industrial demand, with the latter at an 8-year low.

- Jewelry demand is rising strongly, especially in China, but not enough to offset industrial weakness.

- Automotive demand revised down slightly; investment demand revised up on strong bar/coin demand despite ETF outflows.

Mine supply remains constrained, projected to fall ~6% y/y to a 5-year low. Above-ground stocks are expected to decline to under 3 million ounces.

Price forecasts (Commerzbank):

- Platinum: $1,400 end-2025 (raised from $1,350), $1,500 end-2026.

- Palladium: unchanged at $1,200 (2025) and $1,300 (2026).

Japan Cuts Price Cap on Russian Oil

Japan will lower its price cap on Russian crude to US$47.6 per barrel from $60, effective Friday, according to Chief Cabinet Secretary Hayashi.

The move, part of a new sanctions package, also adds asset freezes and export restrictions on entities in Russia and other countries. The EU made a similar adjustment in July.

Canada Weighs Scrapping Oil Cap in Favor of New Climate Strategy

Ottawa is in talks with Alberta and energy producers on potentially dropping its planned federal cap on oil and gas emissions. In exchange, the government would push for alternative emissions-reduction projects such as carbon capture.

The cap, a proposal dating back to Justin Trudeau, was designed to cut oil and gas sector emissions by 37% below 2022 levels by 2030. Producers have opposed it, warning it could limit output.

Prime Minister Mark Carney is exploring a replacement: a “climate competitiveness strategy” emphasizing investment and practical emissions measures. Any shift would depend on industry-backed projects like the Pathways carbon capture initiative.

Critics caution Canada could drift further from its 2030 climate commitments as oil sands emissions climb.

U.S. to Push G7 for High Tariffs on China, India Over Russian Oil Purchases

At the upcoming G7 finance ministers’ meeting on Friday, Washington will urge partners to impose steep tariffs on China and India as a response to their continued buying of Russian crude. The Financial Times reports this is part of a new U.S. push to tighten measures on Moscow’s revenue streams.

Europe News

European Stocks Flat but End Week Higher

European equity markets closed marginally lower on 12 September 2025, but capped a strong week overall:

- Day performance: Stoxx 600 -0.1%, DAX -0.1%, CAC -0.1%, FTSE 100 -0.1%, IBEX -0.1%, FTSE MIB -0.1%

- Weekly performance: Stoxx 600 +1.0%, DAX +0.4%, CAC +1.9%, FTSE 100 +0.9%, IBEX +2.2%

The flat finish rounded off a solid week of gains across the region.

Germany August CPI Confirmed at 2.2%

Germany’s final August CPI stood at +2.2% year-on-year, unchanged from the preliminary estimate and higher than July’s +2.0%.

- HICP: +2.1% y/y (prelim 2.1%), prior +1.8%

- Core inflation: 2.7% y/y

The stickiness in core prices supports the ECB’s cautious stance, keeping policymakers hesitant to resume rate cuts for now.

France Inflation Slows Further in August

France’s final August CPI came in at +0.9% y/y, unchanged from the preliminary estimate and slightly softer than July’s +1.0%.

- HICP: +0.8% y/y (prelim 0.8%), prior +0.9%

- Core inflation: 1.2% (down from 1.5% in July)

- Services inflation: 2.1% (down from 2.5%)

- Food prices: 1.6% (unchanged)

The moderation in services inflation drove the decline, offering France some relief as underlying price pressures continue to ease.

UK Economy Stalls in July as Industry and Manufacturing Drag

The UK’s GDP for July 2025 was flat at 0.0% month-on-month, in line with forecasts, according to ONS data. This followed a +0.4% rise in June.

Breakdown of key sectors:

- Services: +0.1% (expected 0.0%), prior +0.3%

- Industrial production: -0.9% (expected 0.0%), prior +0.7%

- Manufacturing: -1.3% (expected 0.0%), prior +0.5%

- Construction: +0.2% (expected -0.2%), prior +0.3%

Services offered a small lift at the start of Q3, but declines in industry and manufacturing offset that. With growth stagnating, concerns over fiscal pressures and stubborn inflation remain high, leaving the BOE facing mounting stagflation risks into year-end.

UK Public Inflation Expectations Climb Higher

The BOE/Ipsos inflation survey for August 2025 shows public expectations are rising:

- 1-year outlook: 3.6% (up from 3.2%)

- 2-year outlook: 3.4% (up from 3.2%)

- 5-year outlook: 3.8% (up from 3.6%)

The 1-year figure marks the highest since 2023. The data adds to concerns that stagflation risks are becoming more entrenched in the UK economy.

ECB’s Patsalides: Interest rates could go either way next

- Comments from the ECB policymaker

- The present interest rates are appropriate if inflation develops as projected

- Unless there’s any other significant development, there’s no need to take action soon

- Risks to inflation are balanced

- In this context, interest rates can go either way next

- I wouldn’t like to exclude a rise in interest rates if the need arises

- No reasons to be too worried about a more permanent undershoot of inflation

ECB’s Villeroy: Another rate cut is possible in coming meetings

- Villeroy remains one of the most dovish members

- Several of us underlined downside inflation risks

- Upward risks to inflation are lower than downward

ECB’s Kazaks: There cannot be a pre-determined path for ECB

- Comments from the ECB policymaker to CNBC

- ECB forecast very similar to where it was in June

- Risk still remains elevated

- Meeting-by-meeting approach is still right

- We are in good place on inflation

- Lagarde was clear that we don’t see France stress

- December meeting is rich, projections will show if there is deviation from 2% target and how persistent and large it may be

- If ETS 2 carbon-pricing system doesn’t happen, that would have quite a sizeable downside impact on inflation

- Exchange rate and Chinese trade flows are key risks

- We should stick to a meeting by meeting approach and remain data dependent

ECB’s Šimkus: Inflation risks are significantly high

- Remarks by ECB policymaker, Gediminas Šimkus

- Inflation has stabilised at the targeted level, but the risks remain high

- Economic activity is picking up faster than previously observed

- Labour market conditions are in good shape

Morgan Stanley: Sterling Liquidity More Fragile Than Expected

Research from Morgan Stanley suggests the British pound behaves more like smaller currencies such as the Swiss franc or New Zealand dollar than the euro or yen when facing large capital flows.

While trades of $1 billion barely move the euro or yen, sterling can swing noticeably despite being the fourth most-traded currency globally. Analysts argue this reflects the dominance of capital flows over trade in FX markets.

Liquidity differences also vary by timing and location, with late London trading having outsized price effects. The findings, based on simulated client orders, suggest that global investors are the key force driving sterling.

JP Morgan Now Sees ECB Rate Cut Pushed to December

The European Central Bank struck a less dovish tone in its latest policy meeting. Following this, JP Morgan revised its forecast for the next rate cut, now expecting it in December, compared with its earlier call for October.

Asia-Pacific & World News

China August Credit Data Falls Short

China’s M2 money supply grew 8.8% y/y in August, matching July but slightly above the expected 8.7%.

- New yuan loans: ¥590 billion (forecast ¥800 billion)

- Prior: -¥50 billion

The continued weakness in new lending is raising concerns. However, Beijing is preparing a round of subsidy-driven stimulus programs that could trigger trillions in new loans to revive demand and boost consumption in coming months.

China’s Q3 GDP Expected Below 5%

Societe Generale’s Michelle Lam forecasts China’s third-quarter GDP growth will come in under 5%, raising expectations of further stimulus into year-end.

Recent targeted measures have offered some support, but the weaker momentum suggests markets are looking for more significant intervention to stabilize growth through the winter.

China Plans $35 Billion Battery Storage Expansion to 180 GW by 2027

Beijing has announced a plan to nearly double its new energy storage capacity to 180 GW by 2027, up from 95 GW in June. The roadmap foresees 250 billion yuan (US$35 billion) in investment, led by major players like BYD and CATL.

China has a track record of exceeding targets, already reaching its 2025 goal of 30 GW two years early. For comparison, the U.S. expects just over 46 GW of utility-scale storage by 2025.

China Warns Mexico Over 50% Auto Tariff Plan

Beijing’s Commerce Ministry criticized Mexico’s decision to hike tariffs on Chinese cars, saying the move will:

- Seriously harm Mexico’s business environment

- Undermine investor confidence

- Trigger “necessary measures” from China to defend its trade interests

The tariffs, set at 50%, come amid U.S. pressure and are part of a wider Mexican trade policy overhaul.

Beijing Considers $1 Trillion Program to Clear Local Government Debt

China is weighing a plan worth over $1 trillion to help local governments settle overdue payments to private-sector companies. The idea involves state-owned banks and policy lenders extending short-term credit to regional authorities so they can reduce arrears, which total more than US$1 trillion.

The first stage targets at least 1 trillion yuan of liabilities, with efforts continuing through 2027. President Xi Jinping has flagged delayed payments as a risk to business confidence and private-sector health. While the move would provide relief to companies, it could add strain on banks already battling higher loan losses.

PBOC sets USD/ CNY central rate at 7.1019 (vs. estimate at 7.1081)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 230bn yuan via 7-day reverse repos at 1.40%

- net injection of 41.7bn yuan

New Zealand Manufacturing PMI Falls Back Into Contraction

New Zealand’s BNZ–BusinessNZ Performance of Manufacturing Index dropped to 49.9 in August, sliding from 52.8 in July and dipping below the long-term average of 52.5.

Details:

- New Orders: 55.2 (highest since August 2022, still expanding)

- Raw Materials Deliveries: 50.5 (expansion, but softer than July)

- Production: 46.6 (down 6.7 points)

- Employment: 49.1 (contraction)

- Finished Stocks: 47.1 (contraction)

BusinessNZ’s Catherine Beard noted strength in new orders, while BNZ economist Doug Steel stressed manufacturers still face tough conditions, with the economy showing uneven signs of recovery.

New Zealand Card Spending Rises 0.7% in August

Retail card transactions in New Zealand climbed 0.7% month-on-month in August, after a 0.2% gain previously. Year-on-year growth slowed to +0.9% compared with +1.7% in July.

Card spending covers around 68% of core retail sales in the country.

Former FX Chief Warns BOJ on Inflation From Weak Yen

Ex-top FX official Toyoo Gyoten argued the BOJ needs to pay closer attention to the inflationary risks created by the weak yen.

Key remarks:

- Japan’s interest rates have been “too low,” fueling yen depreciation.

- Persistent weakness could accelerate inflation further.

- The yen remains historically undervalued and “should strengthen significantly from here.”

U.S. Tariffs Threaten Japan’s Corporate Earnings

Japan’s chief trade negotiator Ryosei Akazawa said that new U.S. tariffs of 15% could reduce Japanese corporate earnings by as much as 3%.

The duties — already scaled down for autos and auto parts — risk undermining profits ahead of next year’s spring wage negotiations. Analysts warn this could complicate the BOJ’s rate hike path in 2026 if wage growth weakens.

Japan Expands Export Restrictions to China, Turkey, and UAE

Japan’s Trade Ministry announced new restrictions covering entities linked to Russia’s war in Ukraine: six in China, two in Turkey, and one in the UAE. The move adds to Tokyo’s existing sanctions against Moscow.

Crypto Market Pulse

Crypto Today: Bitcoin Holds $115K, Ethereum and XRP Stay Firm

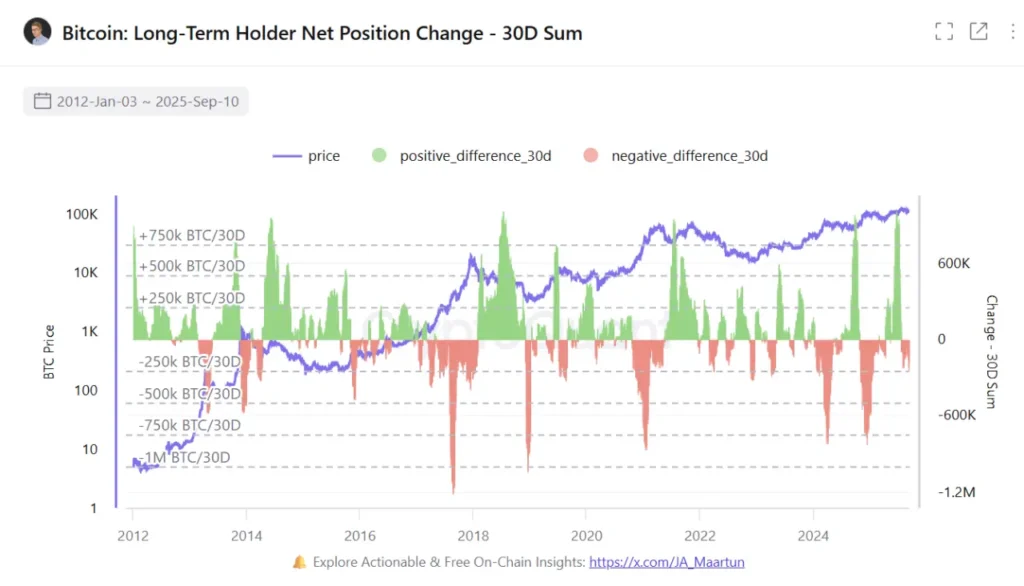

Bitcoin (BTC) traded around $115,000 on Wednesday, briefly spiking above $116,000, supported by whale accumulation and ETF inflows.

- BTC whales (100–1,000 BTC wallets) added 65,000 BTC in 7 days, now holding 3.65M BTC.

- Exchange flows show consistent net outflows, a bullish sign of long-term holding.

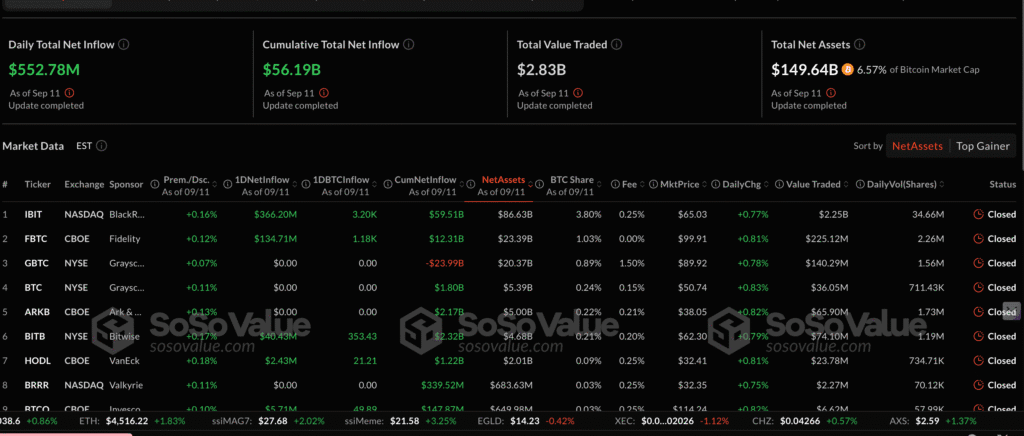

- BTC ETFs saw $553M inflows Thursday, bringing YTD inflows to $1.7B (SoSoValue).

Ethereum (ETH):

- Recovered above $4,500, targeting the $4,956 ATH (Aug 24).

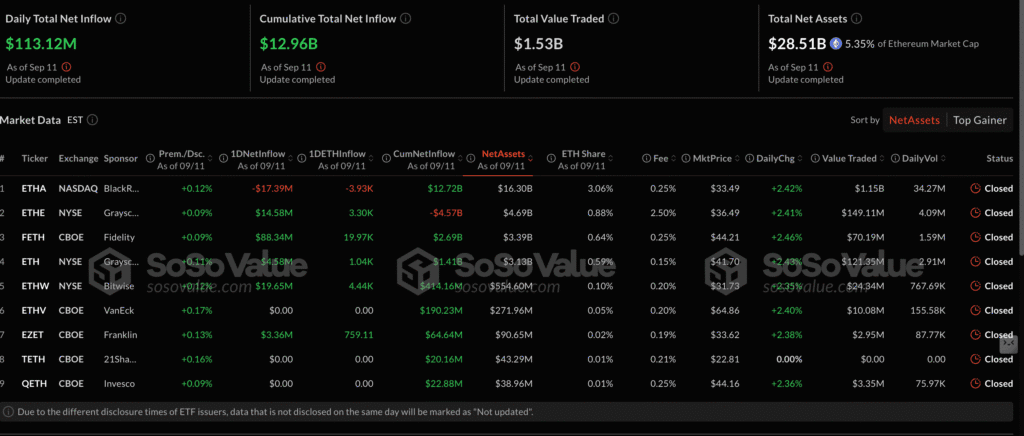

- ETH ETFs posted $113M inflows Thursday, the third straight day of gains after a losing streak, with total net inflows at $12.96B.

XRP:

- Cleared a 3-month descending trendline, reinforcing momentum toward the $3.66 July high.

Overall sentiment is improving as investors prepare for next week’s Fed decision, with Bitcoin eyeing the $120,000 psychological level.

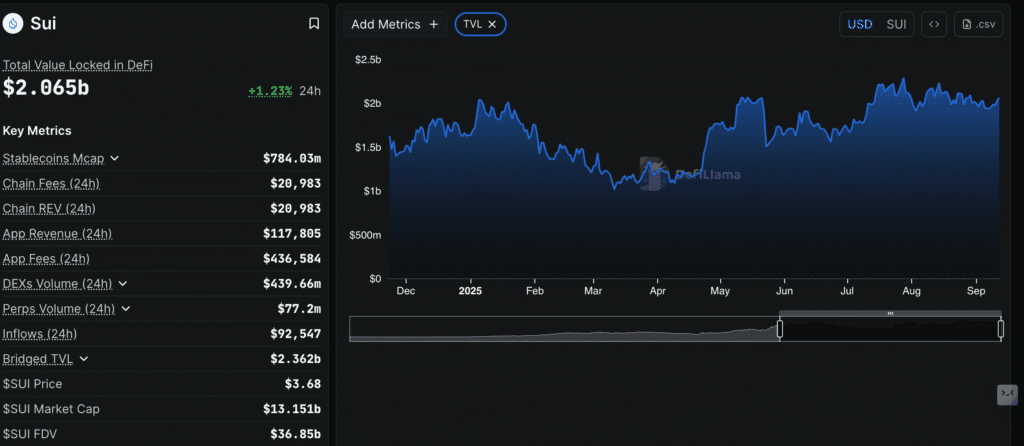

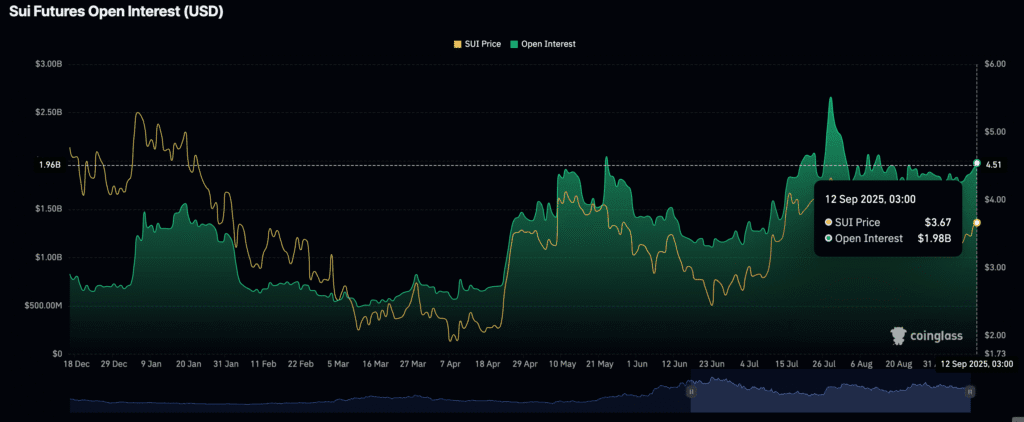

SUI Targets 22% Rally as DeFi TVL Tops $2B

Sui (SUI) traded around $3.62 Friday after briefly topping $3.70 earlier in the week, with bulls eyeing a breakout to $4.43 (+22%).

Ecosystem growth:

- TVL: Climbed back above $2B, rebounding from $1.91B in early August after peaking at $2.29B in late July.

- Rising TVL reflects stronger confidence in staking protocols, which reduce circulating supply and ease sell pressure.

Derivatives support:

- OI: Averaged $1.98B Friday, up from $1.78B (Aug 22).

- Rising OI indicates stronger conviction that SUI can break above descending trendline resistance.

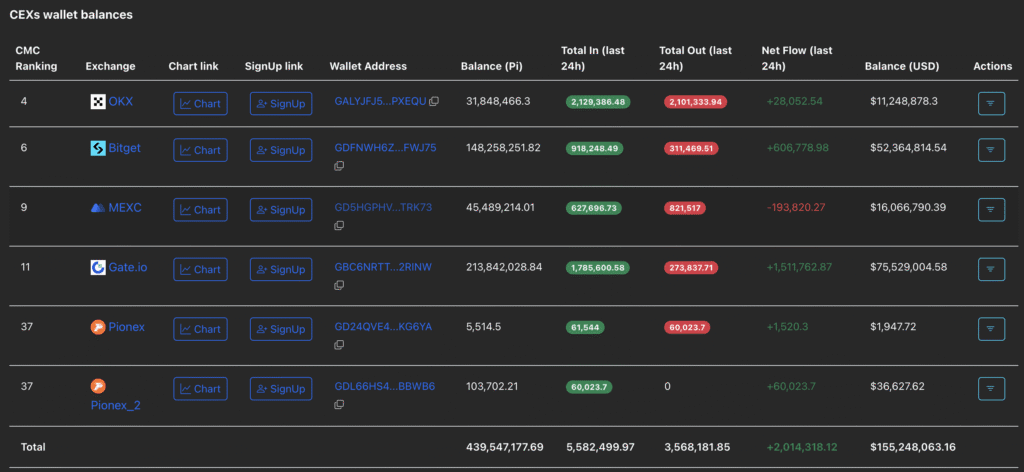

PI Rebounds After Consolidation, Faces Breakout Test

Pi Network’s PI token rose over 3% on Friday, ending a week-long consolidation and testing resistance at the top of its channel.

- A confirmed breakout could unlock more gains, but signals remain mixed.

- CEX wallet balances rose by 2.01M PI in the last 24 hours (PiScan), reflecting increased deposits and softer retail demand.

Rising exchange reserves suggest some holders are preparing to sell, limiting upside momentum unless fresh demand steps in.

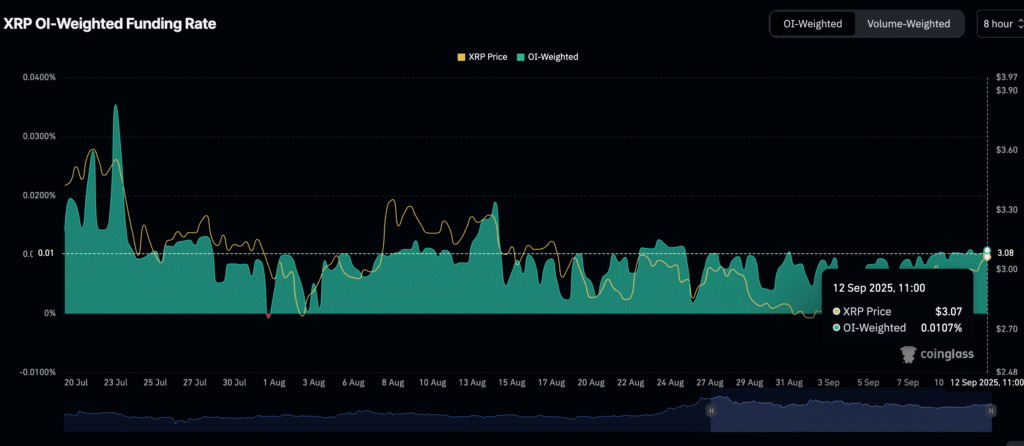

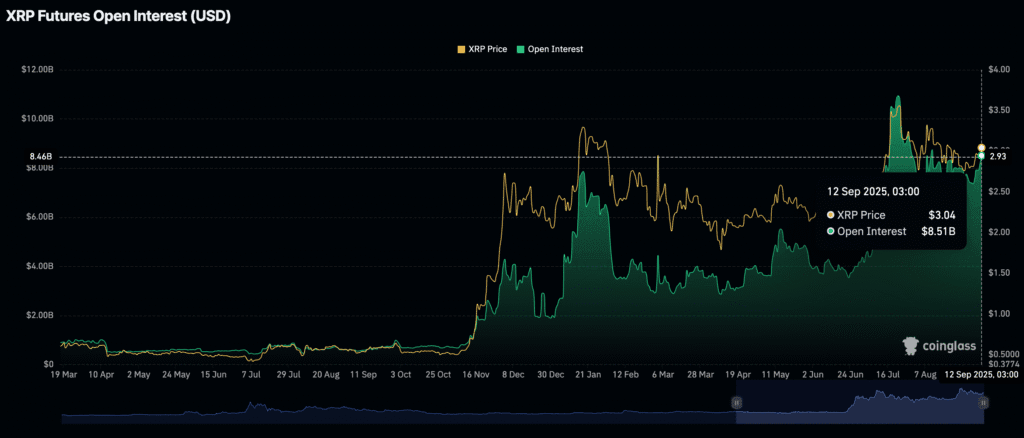

XRP Momentum Builds as Open Interest Rebounds

Ripple’s XRP continues to test the $3.00 level with bulls aiming for a retest of the $3.66 record high (July 18).

Market drivers:

- Futures OI: Averaged $8.51B this week, up from $7.37B last Sunday, though still below the July peak of $10.94B.

- Funding rates: Rising to 0.0107%, reinforcing bullish sentiment.

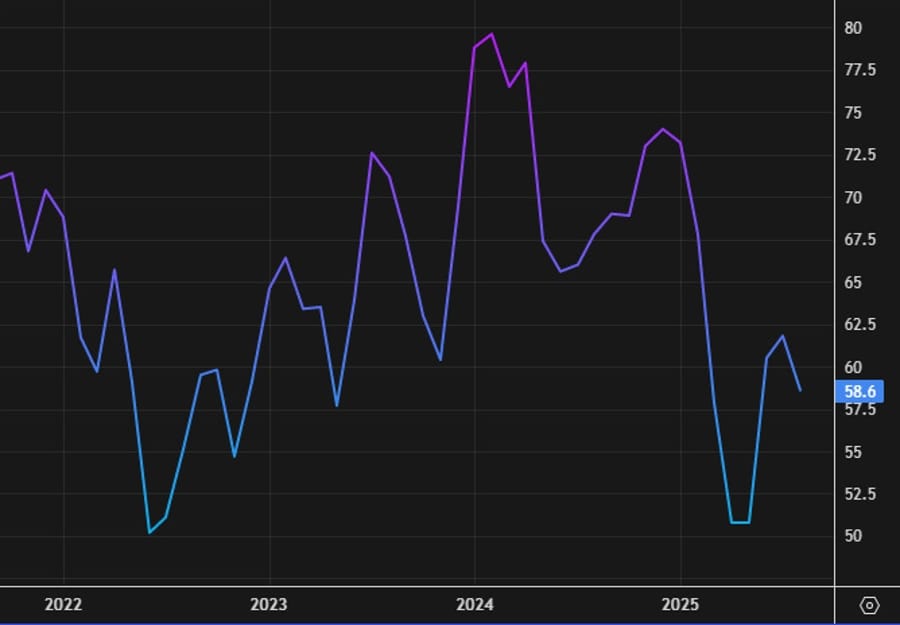

- Altcoin Season Index: Climbed to 78, suggesting broader altcoin momentum.

Risk watch:

- Exchange reserves on Binance rose to 3.66B XRP (+23% since Aug 31), signaling potential supply pressure.

- Rising reserves often precede sell pressure, but corrections may not be immediate. Traders should monitor closely.

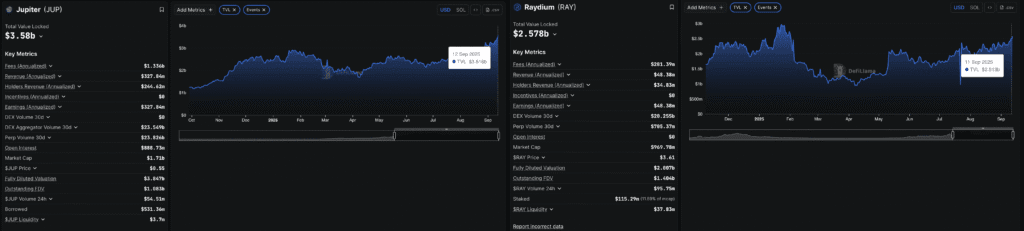

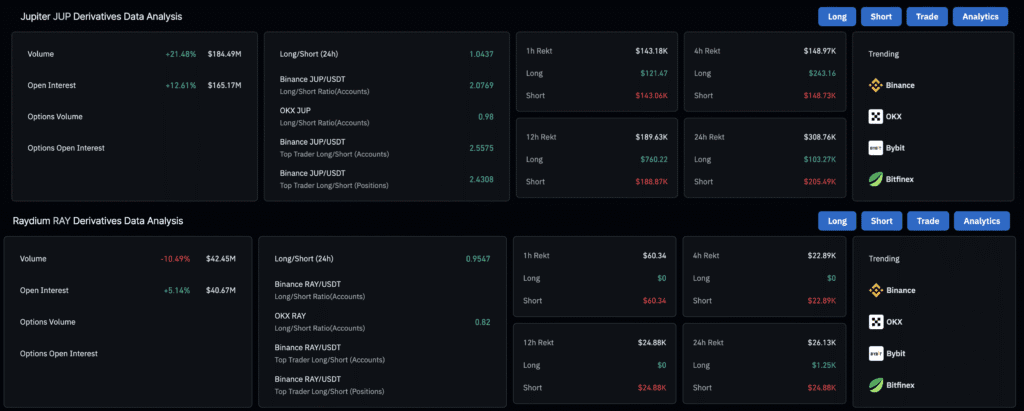

Raydium and Jupiter Extend Gains as TVL and Open Interest Surge

Solana-based DeFi protocols Raydium (RAY) and Jupiter (JUP) were among Friday’s top performers, extending their rallies in line with Solana’s broader uptrend.

- Raydium gained for the third straight day after bouncing off a key support trendline.

- Jupiter cleared its 200-day EMA, with bulls now targeting $0.65.

On-chain data backs the move:

- TVL on Raydium rose to $2.578 billion, while Jupiter’s TVL climbed to $3.580 billion (DeFiLlama).

- Open Interest jumped 5% for Raydium ($40.67M) and 12% for Jupiter ($165.17M) (CoinGlass), signaling rising trader conviction.

The combination of growing liquidity and higher derivatives positioning highlights stronger retail and speculative demand.

S&P Blocks Strategy From Index Inclusion, JPMorgan Flags Crypto Risks

S&P Dow Jones Indices has declined to add Strategy (formerly MicroStrategy) to the S&P 500, despite it meeting eligibility and size thresholds.

JPMorgan analysts say the decision underscores reluctance to include companies functioning as de facto bitcoin funds, given Strategy’s valuation is tied more to bitcoin holdings than its IT operations.

The move may prompt other index providers to rethink listings of crypto-heavy firms. Nasdaq has already required shareholder approval for stock issuance tied to crypto purchases.

JPMorgan argues investor focus may shift toward crypto firms with operating businesses (exchanges, miners) rather than balance-sheet holders. Strategy’s premium over bitcoin has narrowed sharply, echoing volatility seen in peers like EightCo, CaliberCos, and Mogu.

The Day’s Takeaway

United States

- Stocks & Yields: US equities ended mixed. The S&P 500 (-0.05%) slipped after briefly touching a record high, while the Nasdaq (+0.44%) closed at a new peak, boosted by a 7% jump in Tesla. The Dow (-0.59%) and Russell 2000 (-1.01%) fell. For the week, all major indices advanced (Dow +0.95%, S&P +1.59%, Nasdaq +2.03%, Russell +0.25%).

- Bonds: Treasury yields rose despite weaker sentiment data, with the 10-year up 5.5 bps to 4.066% (weekly low of 3.996%, lowest since April). The curve flattened: short-term yields rose while the long end fell on the week. Treasury auctions drew strong demand in 3- and 10-years, while the 30-year was average.

- Data: The University of Michigan sentiment index fell to 55.4 (vs 58.0 expected, 58.2 prior). Inflation expectations diverged: 1-year steady at 4.8%, 5-year up to 3.9% from 3.5%.

- Outlook: The Fed is expected to deliver a 25 bps rate cut next week, but officials remain wary of sticky inflation. The CBO cut its 2025 GDP forecast to 1.4% (down 0.5 pp) and raised its inflation projection to 3.1% (from tariffs). Former Goldman CEO Blankfein warned of crisis risks in credit markets but remains fully invested in equities.

- Politics: President Trump again criticized the Fed, calling for faster rate cuts.

- Geopolitics: The US will push G7 partners to impose tariffs on China and India over Russian oil purchases. Separately, the US and Japan reaffirmed FX commitments in a joint statement after Washington’s new tariffs.

Canada

- Economy: July building permits slipped -0.1% m/m (expected +4.0%), after June’s -9.0%. Residential rose, but non-residential fell. Q2 capacity utilization eased to 79.3% from 80.1%.

- Policy: Ottawa is in talks to potentially scrap its oil and gas emissions cap, shifting toward a “climate competitiveness strategy” focused on carbon capture.

Mexico

- Trade Policy: Mexico will raise tariffs on Chinese autos to 50% (from 20%) as part of a $52B overhaul targeting steel, textiles, motorcycles, and toys. Analysts view this as aligned with US efforts to counter Beijing. China condemned the move, warning of retaliation.

Europe

- ECB Outlook: JP Morgan now expects the next ECB rate cut in December (vs October previously) after the bank struck a less dovish tone.

- Inflation:

- Germany’s CPI confirmed at +2.2% y/y, with core at 2.7%, showing sticky inflation.

- France CPI slowed to +0.9% y/y, with services inflation easing to 2.1%.

- UK July GDP flat (0.0% m/m) as industry and manufacturing weakened, raising stagflation concerns. Public inflation expectations rose: 1-year 3.6%, 5-year 3.8%.

- FX & Markets: Morgan Stanley flagged sterling liquidity fragility, behaving more like small currencies in large flow scenarios. European equities ended Friday flat (Stoxx 600 -0.1%), but gained on the week (Stoxx 600 +1.0%).

- Switzerland: Drafting measures to offset US tariffs (39%), including building gold refining and pharma capacity in the US.

Asia

- China:

- Considering a $1T plan to clear local government arrears, starting with ¥1T liabilities and continuing through 2027.

- Credit growth stayed weak in August: ¥590B new loans vs ¥800B expected. M2 growth 8.8% y/y. More subsidy-driven stimulus likely.

- Plans $35B expansion of energy storage to 180 GW by 2027.

- Q3 GDP expected below 5% (SocGen).

- Criticized Mexico’s 50% auto tariff and warned of countermeasures.

- Japan:

- Cut its price cap on Russian oil to $47.6/bbl (from $60).

- Expanded export restrictions to China, Turkey, UAE.

- Analysts warn US tariffs could cut corporate earnings by 3%.

- Ex-FX chief Gyoten urged BOJ to consider weak yen’s inflation risks.

- Other Asia-Pacific:

- New Zealand manufacturing PMI slipped back into contraction at 49.9. Card spending rose 0.7% m/m in August.

Commodities

- Oil:

- Crude rose $1.19 to $63.57 on US tariff push vs China/India.

- OPEC still sees a market deficit; IEA warns of 2026 oversupply (+3.33M bpd surplus, one of the largest since COVID).

- Commerzbank doubts IEA supply assumptions, citing capacity limits.

- Baker Hughes rig count: US +2 w/w, Canada +5 w/w, but both down y/y.

- Natural Gas: US inventories rose 71 Bcf, above forecast, leaving stocks 6% above 5-year average. Henry Hub slipped to $2.90/MMBtu.

- Gold & Platinum:

- Gold rose $15 to $3,649, approaching $3,675 weekly highs, supported by weaker sentiment data. UBS lifted its gold forecast to $3,800 by year-end.

- WPIC projects a 2025 platinum deficit of 850k oz, the third straight year, though narrower than 2024. Commerzbank sees platinum at $1,400 end-2025, palladium at $1,200.

Crypto

- Bitcoin & Ethereum: BTC held ~$115K, with whale accumulation (+65k BTC in 7 days) and ETF inflows ($553M Thursday). ETH recovered above $4,500 with ETF inflows of $113M.

- Altcoins:

- XRP tested $3.00 with OI rising to $8.5B; funding rates positive, but rising exchange reserves may cap gains.

- SUI rebounded above $3.60, eyeing $4.43 as DeFi TVL topped $2B.

- Raydium and Jupiter extended gains with surging TVL and OI, highlighting Solana DeFi strength.

- PI token gained 3% but faces selling pressure as exchange reserves rose.

- Corporate: S&P Dow Jones declined to add Strategy (ex-MicroStrategy) to the S&P 500, citing its bitcoin-heavy balance sheet. JPMorgan flagged risks for crypto-heavy firms.