North America News

Stocks Climb as Traders Bet on Rate Cuts Despite Trade Risks

U.S. markets closed higher Thursday as cooling inflation and rising jobless claims reinforced expectations of Federal Reserve rate cuts—even as geopolitical and trade risks re-emerged. The Dow rose 101.85 points to 42,967.62, the S&P 500 added 23.02 points to reach 6,045.26, and the Nasdaq gained 46.61 points to settle at 19,662.48.

Traders shrugged off early jitters tied to President Trump’s aggressive trade rhetoric and reports of U.S.-Israeli military coordination on potential action against Iran. The White House confirmed embassy staff were authorized to leave Baghdad, heightening geopolitical concerns.

On the economic front, the May Producer Price Index rose just 0.1% month-over-month, while April’s figure was revised up from -0.5% to -0.2%. Core PPI also rose just 0.1%, with the year-over-year core rate slowing to 3.0% from 3.2%. Meanwhile, jobless claims rose to 248,000 for the second week running, and continuing claims surged by 54,000 to 1.956 million—the highest since 2021.

Technology stocks led the way, fueled by a 13.3% surge in Oracle shares following strong Q3 earnings. Utilities also outperformed. Communication services and industrials lagged, with Boeing dragging the latter down after a fatal Air India crash.

The bond market rallied, particularly at the long end, thanks to the strong 30-year auction. The 10-year Treasury yield dropped to 4.36%, undercutting its 50-day moving average. Traders are now pricing in a potential rate cut as soon as September.

Strong Demand at 30-Year Bond Auction Pushes Yield Below Expectations

The U.S. Treasury auctioned off $22 billion in 30-year bonds on Thursday, drawing in stronger-than-expected demand. The bonds were sold at a high yield of 4.844%, coming in 1.5 basis points below the 4.859% when-issued (WI) level—a notable tail, especially compared to the six-month average of a 0.1 basis point tail in the opposite direction.

The bid-to-cover ratio was solid at 2.43x, above the six-month average of 2.39x, indicating broad interest. Direct bidders, largely domestic institutions, took 23.4% of the offering (up from the 22.3% average), while indirect buyers—primarily foreign accounts—snapped up a robust 65.2%, beating their six-month average of 63.2%. Dealers were left with just 11.4%, well below their usual 14.4% allocation.

Solid demand, especially from overseas, underscores sustained appetite for long-term U.S. debt.

U.S. Household Net Worth Slips to $169.3 Trillion in Q1

The Federal Reserve reports a dip in household net worth to $169.3 trillion in Q1 2025. Stock market losses shaved off $2.3 trillion, while real estate values declined by $0.2 trillion. Household debt rose at an annualized rate of 1.9%, and nonfinancial debt grew by 2.8%. The data reflects early-year financial tightening among U.S. households.

U.S. Jobless Claims Hit Highest Level Since 2021

Initial jobless claims rose to 248,000 last week, topping the 240,000 forecast and marking the highest level since October 2024. The four-week moving average climbed to 240,250. Continuing claims also increased, reaching 1.956 million—well above the 1.910 million estimate and the highest since November 2021. This marks the third consecutive weekly increase in continuing claims, suggesting rising stress in the labor market.

U.S. PPI Rises 2.6% Annually in May, Monthly Pace Slows

Producer prices in the U.S. increased 2.6% year-over-year in May, matching forecasts and ticking up from a revised 2.5% in April. On a monthly basis, PPI rose just 0.1%, falling short of the 0.2% estimate. Core PPI (excluding food and energy) also rose 0.1% month-on-month and 3.0% year-over-year. The figures reflect cooling price momentum, despite lingering inflationary pressures in core categories.

Goldman Sachs Expects Core PCE Inflation to Climb

Despite a cooler CPI print, Goldman Sachs expects May’s core PCE inflation—the Fed’s preferred measure—to edge up 0.2%, lifting the annual rate to 2.6% from 2.5%. The firm attributes the expected rise to new Trump-era tariffs, which they say could drive core PCE inflation up to 3.5% by the end of 2025. While the impact may fade over time, Goldman warns that the peak could come between May and August.

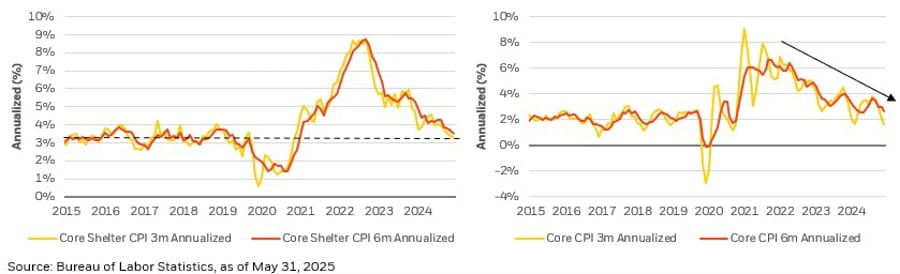

Softer CPI Raises Chances of Fed Rate Cuts

U.S. inflation eased more than anticipated for a fourth consecutive month, reinforcing the case for rate cuts. BlackRock’s Rick Rieder notes that subdued CPI figures, especially in core services and housing, raise the odds that the Federal Reserve will cut rates later this year—particularly if the job market weakens further. While tariffs remain a concern, current inflation trends are pointing downward.

U.S.-China Trade Deal Fails to Resolve Core Issues

Despite a new agreement between the U.S. and China, economists at Capital Economics say little real progress has been made. The deal mainly touches on non-tariff measures like rare earths but leaves broader trade tensions—and tariffs—unchanged. Mark Williams, the firm’s Chief Asia Economist, argues that the bilateral relationship remains fragile and far from a meaningful reset.

Commodities News

Gold Nears $3,400 on Fed Cut Bets, Middle East Jitters

Gold surged to $3,386, just shy of the $3,400 mark, as weaker U.S. data and Middle East tensions drive demand. Jobless claims have stayed above 240K for two weeks, and inflation continues to soften, adding pressure on the Fed to ease rates. Meanwhile, rising tensions between Israel and Iran are adding a geopolitical bid to gold. Traders are now pricing in more than 50 basis points of cuts by year-end, as the U.S. Dollar tumbles to multi-year lows.

Silver Rebounds Above $36.00 as Dollar Dips

Silver prices climbed back above $36.00 after briefly dipping to a five-day low of $35.46, helped by a sharp decline in the U.S. Dollar. The formation of a bullish hammer candlestick indicates renewed upside momentum, with targets at $36.88 and $37.49—levels not seen in 13 years. RSI remains stable, hinting that buyers still have the upper hand. Key support lies at $35.40 and $35.00, with further downside risks below those levels.

Brent Crude Eyes $72 and $75.40 After Bullish Breakout

Société Générale analysts say Brent crude is gaining momentum following a breakout from its consolidation range. A double-bottom near $58.40 and a MACD crossover in positive territory suggest more upside ahead. Short-term support is pegged around $66.60, while resistance levels are identified at the 200-day moving average near $72 and the April peak of $75.40.

Allies May Lower Russian Oil Price Cap Without U.S.

Reports suggest that Europe, Canada, and the UK are prepared to revise the cap on Russian oil prices without U.S. coordination. Analysts question the effectiveness of such a move in the absence of U.S. enforcement power, particularly over global banking systems. WTI crude retreated by $1.06 to $67.02, unwinding yesterday’s rally.

Trump: I would love to avoid a conflict with Iran

- Geopolitical news on Iran is heating up

On Iran, Trump says:

- Iran’s going to have to negotiate tougher

- I would love to avoid a conflict with Iran.

- I want to have an agreement with Iran

- Fairly close to an agreement with Iran

- I’d prefer a more friendly path to an agreement

- There is a chance of a massive conflict.

- Something could happen soon…

Fitch Cuts 2025 Oil Forecast to $65 on Oversupply

Fitch Ratings has downgraded its outlook for global oil prices, citing an oversupply issue driven by OPEC+ production increases, rising non-OPEC output, and demand pressures from U.S. tariffs. The agency now sees Brent crude averaging $65 per barrel in 2025, down from $70. While geopolitical risks could offer some price support, a persistent glut in supply is likely to weigh on markets. Nevertheless, energy companies remain financially solid, thanks to conservative spending and healthy balance sheets.

Central Banks Boost Gold Reserves at Record Pace

The European Central Bank reports that global central banks have continued aggressively accumulating gold. While the euro’s international use remains stable around 19%, ECB President Christine Lagarde emphasized that rule of law and strong institutions underpin confidence in the euro. The bank also notes that currency usage patterns are increasingly influenced by geopolitical alliances—especially following Russia’s invasion of Ukraine.

TD Securities Targets $3,650 Gold Price Amid Middle East Tensions

TD Securities has taken a tactical long position on gold, citing rising geopolitical risks in the Middle East. The firm views gold as a safe-haven asset with minimal downside risk under current conditions. Their one-month target is $3,650 per ounce, reflecting expectations that regional instability could push demand for the precious metal higher.

Europe News

Ifo Lifts German Growth Forecast to 0.3% for 2025

Germany’s economy is now expected to expand by 0.3% in 2025, up slightly from the previous 0.2% forecast, per the latest Ifo Institute projections. The 2026 outlook also received a major upgrade—from 0.8% to 1.5%. Inflation estimates stand at 2.1% for 2025 and 2.0% for 2026. Ifo credits new government measures for the revised projections, suggesting a modest short-term boost and stronger gains next year.

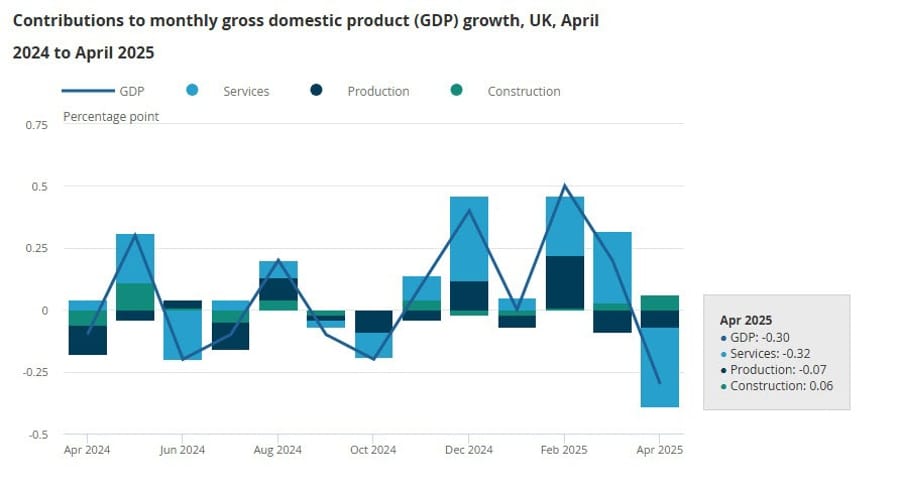

UK GDP Falls 0.3% in April, Services Slump Leads the Decline

UK economic output contracted by 0.3% in April, according to the latest ONS figures—sharply underperforming the expected -0.1% and reversing from March’s +0.2%. The main drag came from a 0.4% drop in the services sector, the first monthly decline since October. Out of 14 tracked subsectors, nine posted declines. Industrial output fell 0.6%, while manufacturing slipped 0.9%. The only bright spot was construction, which rose 0.9%. It’s a shaky start to Q2 for the UK economy.

UK House Price Growth Weakest in Nearly a Year

UK housing data from the Royal Institution of Chartered Surveyors shows May’s price balance dropped to -8, the weakest reading since July 2024. That’s down from -3 in April and below expectations of -4. Analysts cite uncertainty over trade policies and the aftermath of March’s Stamp Duty rush as key factors weighing on the market.

ECB’s de Guindos: Recent developments may well have a dampening impact on growth

- Comments from the ECB policymaker

- Recent developments may well have a dampening impact on growth in the Euro Area.

- The Euro Area economy has proved fairly resilient to date, supported by a strong labour market.

- The use of the US dollar in international funding, payment and trade transactions, or as a reserve currency, will not be challenged in the short term.

- But the role of the Euro can gradually expand, especially if we deliver on “more Europe”.

- The ECB concern has shifted from inflation to slow growth.

ECB’s Schnabel: Monetary policy cycle is coming to an end

- Comments from the ECB policymaker

- Monetary policy cycle is coming to an end.

- Growth outlook broadly stable despite trade conflict.

- Medium-term inflation stabilizes at target.

- Financing conditions are no longer restrictive.

- Private consumption is supporting growth.

- Defence and infrastructure spending counteract tariffs.

- Energy prices and the Euro could change in either direction.

- I expect only limited trade diversion from China to EU.

- The Euro’s global role is strong, could strengthen further.

- Eurozone core inflation still elevated, but on a good path.

- Eurozone headline inflation will ease further in Q1 2026 due to energy price base effect, will return to 2% over medium term.

- ECB is in a good place in terms of monetary policy.

- We are very far from de-anchoring of inflation expectations to the downside.

- Strong euro exchange rate is driven by a positive confidence shock in EU, not interest rate differential.

ECB’s Villeroy: No fixed position on future rate decisions

- Comments from the ECB policymaker to Fanceinfo radio

- No fixed position on future rate decisions.

- Decisions will depend on data.

- Believe in pragmatism and agility on monetary policy.

ECB’s Simkus: The ECB has arrived at neutral level of rates

- Comments from the ECB policymaker

- The ECB has arrived at neutral level of rates.

- Important ECB doesn’t commit to one direction or another.

- Rates may still have to come down as risk has increased that inflation will be below projections.

- Important to take a pause on rates.

- I don’t reject possibility of another rate cut in 2025.

- Inflation may be lower than the target in medium term.

Asia-Pacific & World News

China Signals Deal Compliance Amid Trump Claims

China’s Foreign Ministry reaffirmed its intention to follow through on commitments made with the U.S., responding to Trump’s statement that a trade deal is “done.” While no specifics were disclosed, China’s Commerce Ministry noted the issuance of rare earth export licenses as a concrete step. The limited follow-up and muted communication from Beijing raise questions about the depth and timing of the deal’s implementation.

ECB and PBOC Renew Commitment to Cooperation

ECB President Christine Lagarde and PBOC Governor Pan Gongsheng have signed a renewed Memorandum of Understanding focused on central bank cooperation. The updated MoU, first signed in 2008, sets a framework for ongoing dialogue, technical collaboration, and information sharing between the European and Chinese central banks. Lagarde underscored the importance of global coordination amid an uncertain economic landscape.

China Extends 10-Day Visa-Free Transit to 55 Countries

China’s National Immigration Administration is expanding its 240-hour (10-day) visa-free transit policy. Starting June 12, Indonesian travelers will join citizens from 54 other nations eligible for the program. The policy allows visitors to enter through 60 key entry points in 24 regions—including Beijing and Shanghai—with onward tickets and valid documentation. State media highlighted the move, likely aiming to contrast China’s openness with tightened restrictions in the U.S.

PBOC sets USD/ CNY mid-point today at 7.1803 (vs. estimate at 7.1703)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 119.3bn yuan via 7-day reverse repos at 1.40%

- 126.5bn yuan mature today

- net drain is 7.2bn yuan

Australian Inflation Expectations Jump to 5%

The latest Melbourne Institute survey shows Australian consumers now expect inflation to hit 5% in June 2025. That’s a significant rise from the 4.1% level reported in May, suggesting public concern about persistent price pressures is growing again.

Westpac Sees RBA Rate Cuts Starting August

Westpac expects the Reserve Bank of Australia to begin cutting rates in August and again in November 2025, followed by additional cuts in February and May 2026. The bank’s forecast sees the cash rate eventually landing at 2.85%, down from the current 3.85%. However, if inflation and labor conditions deteriorate faster than expected, the timing of cuts could be pulled forward to December 2025 or early 2026.

New Zealand Retail Card Spending Rebounds

New Zealand’s April retail sales, based on card transactions, rose 0.9% year-on-year—up from a -0.3% decline previously. On a month-over-month basis, sales dipped slightly by 0.2%. These figures, covering about two-thirds of core retail activity, suggest a modest but uneven recovery in consumer spending.

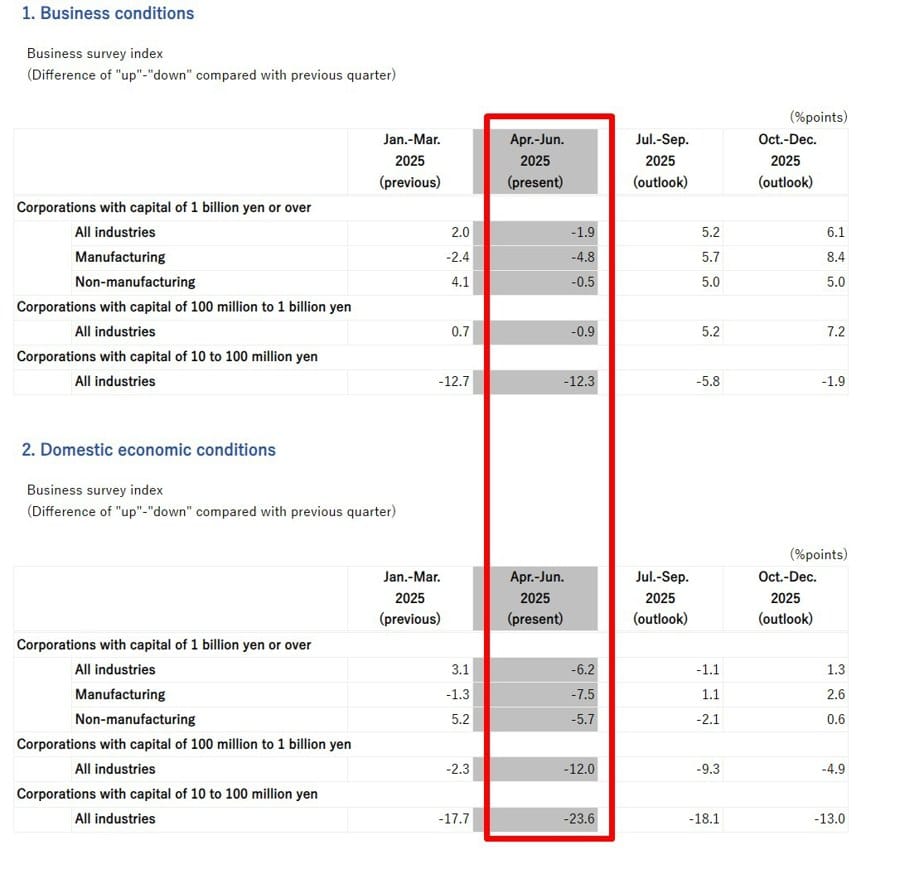

Japan’s Business Sentiment Slumps in Q2

Japan’s latest Business Outlook Survey shows a sharp decline in large manufacturers’ sentiment. The Q2 index fell to -4.8, missing forecasts of +0.8 and falling from -2.4 in Q1. The report, released by Japan’s Ministry of Finance, signals growing pessimism in the industrial sector.

Here is the breakdown:

Crypto Market Pulse

Crypto Market Loses Momentum as Bitcoin Falls Below $108K

Bitcoin is once again under pressure, trading near $107,399 after failing to hold the $110,000 level reached earlier in the week. The rally sparked by earlier optimism over U.S.-China trade talks has faded, with volumes thinning and open interest dropping across crypto futures.

Ethereum is also on the back foot, struggling to hold above $2,700 despite sustained inflows into spot ETFs. XRP is testing support at its 200-day moving average, with bears eyeing a break below $2.09.

Institutional appetite remains intact—particularly for Ethereum ETFs, which posted $240 million in inflows on Wednesday alone, outpacing Tuesday’s $125 million. Bitcoin ETFs saw a daily total of $165 million, down from $431 million the day before, led by BlackRock’s IBIT and VanEck’s HODL.

But that institutional support hasn’t translated into price strength. With risk sentiment still fragile and retail interest fading, the broader crypto market may struggle to find its footing without a fresh catalyst.

XRP Slips Below Key Averages Despite Institutional Activity

XRP continues to face selling pressure, trading around $2.25—down 15% from its May 12 peak of $2.65. The token has broken below both its 50-day and 100-day EMAs, reinforcing a bearish technical structure.

Despite the decline, institutional interest in XRP remains strong. Singapore-based Trident recently announced a $500 million XRP treasury fund. And Ripple CEO Brad Garlinghouse told attendees at the XRP Ledger Apex 2025 summit that he believes the XRP Ledger could command up to 14% of global liquidity currently dominated by SWIFT within the next five years.

Still, the reality is mixed. While RippleNet has partnered with banks worldwide, XRP’s use in On-Demand Liquidity (ODL) transactions remains limited. Moreover, SWIFT is moving ahead with its own blockchain upgrades via the ISO 20022 protocol scheduled for November—casting doubt on XRP’s path to mainstream adoption in legacy finance.

Whale Selloff Pressures Shiba Inu as Profit Supply Shrinks

Shiba Inu (SHIB) continues its slide, falling for a second straight session and dipping below its 50-day EMA. The memecoin is currently down over 3%, with technicals suggesting more downside ahead.

On-chain data shows whales are steadily unloading SHIB. Wallets holding between 10 million and 100 million tokens have reduced holdings by 9 billion SHIB since January 1. Larger accounts, with 100 million to 1 billion tokens, trimmed 720 billion SHIB during the same period.

At the same time, the percentage of SHIB supply held in profit has collapsed to 23%—a dramatic drop from 75% at the start of the year. The combination of shrinking whale confidence and underwater holders signals a potentially deeper correction for the token in the near term.

TRUMP Meme Coin Struggles as USD1 Stablecoin Expands

The TRUMP meme coin is holding the $10.00 support but shows little sign of recovering. Open interest and trading volumes are falling fast, pointing to fading investor interest. Meanwhile, World Liberty Financial—linked to the Trump family—has rolled out updates for the USD1 stablecoin, including a bridge module and upcoming lending features. USD1 is fully backed by USD and treasuries, designed for multi-chain use, but its rollout hasn’t boosted sentiment around the TRUMP token, which continues to lose steam.

Tether Acquires 32% of Canadian Gold Firm Elemental

Tether has taken a major step into commodities, acquiring a 32% stake in Elemental Altus Royalties, a Canadian gold royalty company. The purchase, made through Tether Investments, aligns with the company’s long-term strategy to integrate real-world assets like gold and Bitcoin into its ecosystem. Tether has also secured an option to purchase additional shares through a deal with Alpha 1 SPV, potentially boosting its stake beyond the current 31.9%. CEO Paolo Ardoino said the move aims to build out the next-generation financial infrastructure.

Tron Dominates USDT Supply as Whale Activity Ramps Up

The Tron blockchain now holds the largest supply of USDT in circulation, eclipsing even Ethereum. On-chain data for May shows over $694 billion worth of USDT moved in nearly 90 million transactions. Whale activity is intense, with transactions above $1 million accounting for 65% of total volume. Tron’s dominance is fueled by low fees and recent minting activity, pushing USDT’s market cap on Tron to $77.7 billion—surpassing Ethereum’s $73.2 billion. Meanwhile, USDC lags behind with a $60.9 billion cap.

The Day’s Takeaway

United States

- Rate Cut Bets Firm Up: Softer-than-expected May PPI (+0.1% m/m, 2.6% y/y) and a jump in continuing jobless claims to 1.956 million—highest since 2021—have strengthened expectations for a Fed rate cut by September.

- 30-Year Bond Auction Shows Strong Demand: The Treasury’s $22B 30-year auction cleared at a yield of 4.844%, 1.5 bps below the WI level. Indirect bidders (mostly foreign) took a hefty 65.2%, pushing dealer allocation down to 11.4%. Grade: A-.

- Equities Grind Higher: The S&P 500 rose 0.4%, while the Nasdaq and Dow each gained 0.2%. Oracle jumped 13.3% after beating Q3 estimates, leading tech higher. Communication services and industrials lagged.

- Geopolitical Tensions in Focus: President Trump confirmed U.S. embassy personnel in Baghdad were authorized to evacuate. Reports of potential Israeli military action against Iran added to global risk concerns.

Commodities

- Gold Pushes Toward $3,400: Gold reached $3,386 as falling U.S. yields, weak labor data, and Middle East tensions drove demand. Traders are now pricing in over 50 basis points of rate cuts by year-end.

- Silver Rebounds on Dollar Weakness: Silver reclaimed $36.00 after a five-day low, supported by a bullish hammer formation and RSI holding firm. Resistance now lies at $36.88 and $37.49.

- Brent Crude Technical Breakout: Brent eyes $72 and $75.40 as resistance, after breaking out of a consolidation zone near $66.60. Momentum is supported by MACD strength and a confirmed double bottom pattern.

- Fitch Cuts Oil Outlook: Fitch downgraded its 2025 oil price forecast to $65/barrel (from $70) citing oversupply from OPEC+ and weak demand tied to U.S. tariffs.

Europe

- Germany Outlook Improves Slightly: The Ifo Institute raised its 2025 growth forecast for Germany to 0.3% (from 0.2%) and 2026 to 1.5% (from 0.8%), citing new fiscal measures.

- UK GDP Shrinks in April: Monthly GDP dropped 0.3%, driven by a 0.4% fall in services—the first decline since October 2024. Industrial output fell 0.6%, while construction grew 0.9%.

- UK Housing Cools Further: The RICS house price balance fell to -8 in May, the weakest level in nearly a year, with sentiment dampened by trade policy uncertainty and recent Stamp Duty changes.

- ECB Notes Record Central Bank Gold Buying: Despite stable euro usage globally (~19%), the ECB highlighted continued gold accumulation by global central banks and emphasized the role of the rule of law in maintaining confidence in the euro.

- ECB & PBOC Sign MoU: Christine Lagarde and Pan Gongsheng signed an updated memorandum of understanding to deepen central banking cooperation between Europe and China.

- Russia Oil Price Cap Faces Split Enforcement: Europe, Canada, and the UK are considering lowering the cap on Russian oil prices even without U.S. backing. Skepticism remains on enforcement feasibility.

Asia

- China Expands Visa-Free Transit: China added Indonesia to its 240-hour visa-free transit program, expanding access to travelers from 55 countries, covering 60 entry points in 24 regions.

- Japan Business Sentiment Deteriorates Sharply: Japan’s Q2 Business Outlook Survey showed large manufacturers’ sentiment falling to -4.8, far worse than expectations (+0.8).

- Ripple CEO Eyes 14% of SWIFT’s Liquidity: At a conference in Asia, Ripple CEO Brad Garlinghouse projected that the XRP Ledger could absorb 14% of SWIFT’s global liquidity within five years, highlighting XRP’s role in cross-border transactions.

Crypto

- Bitcoin & Ethereum Pull Back: Bitcoin dipped below $108,000, losing momentum after recent gains. Ethereum is approaching $2,700 support despite strong ETF inflows ($240M on Wednesday).

- XRP Weakens Despite Institutional Moves: XRP continues to decline, now trading around $2.25, even as Trident announced a $500M XRP treasury and Ripple’s CEO highlighted long-term liquidity goals.

- Shiba Inu Faces Whale Dump: Whale wallets are offloading SHIB, reducing holdings significantly since January. Supply in profit is now just 23%, down from 75%, signaling pressure on retail investors.

- TRUMP Token Slumps: The TRUMP meme coin hovers near $10 support as volumes and open interest collapse. Meanwhile, World Liberty Financial launched new features for its USD1 stablecoin, but sentiment around the token remains weak.

- Tether Buys Into Gold: Tether acquired a 32% stake in Canadian royalty firm Elemental Altus, reinforcing its pivot into asset-backed investments and diversifying the USDT backing.

- Tron Dominates USDT Circulation: Tron now holds over $77.7 billion in USDT, surpassing Ethereum. Whale transfers drove over $455 billion in volume last month, supported by Tron’s low fees and rapid growth.