North America News

U.S. Stocks Surge on Tariff Relief; S&P and Nasdaq Post 2nd-Best Day Since 2022

Wall Street rallied hard on Monday after the U.S. announced it would slash tariffs on Chinese goods from 145% to 30% for the next 90 days, including a 20% fentanyl-specific tariff. The agreement, reached over the weekend, sparked aggressive buying across all major indices and pushed the S&P and Nasdaq to their second-best single-day performances since 2022.

Major Index Performance

- Dow Jones Industrial Average:

Closed up +1,160.70 points (+2.81%) at 42,410.10

2nd-strongest day since November 6, 2024 - S&P 500:

Gained +184.28 points (+3.26%) to finish at 5,844.19

Best day since November 10, 2022, excluding one - Nasdaq Composite:

Jumped +779.43 points (+4.35%) to 18,708.34

2nd-best day since November 30, 2022 - Russell 2000:

Rose +16.12 points (+3.42%) to 2,092.19

Second-best day since November 6, 2024

Top Performers on the Day

Big-name tech, energy, and retail stocks all rallied strongly:

- Shopify +13.71%

- First Solar +11.07%

- Block (Square) +9.29%

- Lam Research +9.18%

- Amazon +8.09%

- Meta Platforms +7.92%

- Arm Holdings +7.77%

- Micron Technology +7.49%

- Papa John’s +7.26%

- Gilead Sciences +7.12%

- FedEx +6.94%

- Tesla +6.82%

Noteworthy gainers among mega-cap and chip stocks included:

- Alphabet (Google) +3.74%

- Microsoft +2.40%

- Nvidia +5.44%

- Nike +7.34%

Corporate Earnings Highlights

- ZoomInfo (ZI):

- Q1 Revenue: $305.7M vs $295.3M expected

- Adj. EPS: $0.23 vs $0.22 expected

- Adj. Operating Income: $100.9M

- Q2 Outlook: Revenue $295M–$298M, Adj. EPS $0.22–$0.24

- Full-Year Guidance: Revenue $1.195B–$1.205B, Adj. EPS $0.96–$0.98

- Topgolf Callaway (MODG):

- Q1 EPS: $0.01 vs -$0.06 expected

- Revenue: $1.09B vs $1.07B expected

- Adj. EBITDA: $167.3M vs $129.3M expected

- Reaffirmed full-year revenue and EBITDA guidance

April U.S. Budget Surplus Hits $258 Billion

The U.S. federal budget posted a $258 billion surplus in April, slightly above forecasts of $256 billion. That compares to a $161 billion deficit in March and a $210 billion surplus in April 2025.

This strong surplus aligns with April’s typical revenue surge due to the tax season. It also reflects rising receipts and flat-to-moderate expenditure levels in the month.

Fed Survey: Lending Standards Tighten Sharply, Credit Demand Slumps

The Federal Reserve’s Senior Loan Officer Opinion Survey for Q2 shows that banks are tightening credit standards across the board as borrower demand weakens, especially in business and commercial real estate lending.

Business Lending

Commercial and Industrial (C&I) Loans:

- Standards tightened for firms of all sizes

- Highest share of banks tightening in over a year

- Tighter terms: smaller credit lines, higher spreads, stricter covenants, more collateral required

- Demand fell significantly across the board

- Key drivers: uncertain economic outlook, regulatory pressure, industry concerns, and reduced risk appetite

Commercial Real Estate (CRE) Loans:

- Standards tightened for construction, land development, and nonfarm nonresidential loans

- Multifamily lending remained broadly unchanged

- Demand was mixed: softer at most banks, but some large and foreign banks noted stronger interest

- Over the past year, lenders reduced loan-to-value ratios, increased debt service coverage, and shortened interest-only periods

- Office property loans saw the broadest tightening across all CRE categories

Household Lending

Residential Real Estate (RRE):

- Standards mostly unchanged; slight tightening for non-QM jumbo mortgages

- Demand weakened for most mortgage types

- HELOCs: lending terms stable, but demand saw modest improvement

Consumer Loans:

- Credit card lending saw modest tightening, mainly via lower credit limits

- Standards for auto and other consumer loans unchanged

- Demand fell for credit cards and other consumer loans, while auto loan demand was stable

House Tax Bill: Exempt workers from tips, with exceptions

US House Republicans tax bill:

- Would exempt workers from tips from income and tax with exceptions (through 2028

- Includes exemption on workers overtime pay with exceptions

- Enhanced deduction for senior citizens by $4000 with exceptions

- Raising cap on state and local tax deduction (SALT deductions) to $30,000 from current $10,000 with exceptions

- does not include millionaire tax bracket

- Republican tax bill raises debt limit by $4 trillion

Fed’s Goolbee: Tariffs on China would still have a stagflationary impulse

- Goolsbee: Fed could afford to take its time before making any policy decisions

- Tariffs and the uncertainty around President Trump’s policies still risked a combination of higher consumer prices and slower growth.

- On China, it is definitely less impactful stagflationarily than the path they were on. Yet it’s three to five times higher than what it was before,

- It is going to have a stagflationary impulse on the economy. It’s going to make growth slower and make prices rise.

- The way that we’re doing this is not free for the economy,

- Businesses he has spoken to want to make big investments and hire people, but the prospects that any of these negotiated tariff truces could lapse have made decisions like that much more difficult.

- US/China statements are coming with explicit recognition that this isn’t permanent and that it’s going to be revisited in the near future.

- Part of those announcements are explicitly putting off into the future major decisions, so that’s why it feels like there is in corporate America a lot of sitting on the hands. If they’re sitting on their hands, that backs into the wait-and-see posture of the Fed

- Fed could afford to take its time before making any policy decisions. The labor market is still in solid shape, and there are not yet acute signs of strain. But the risks to inflation are not negligible, and it is still possible that tariffs of the nature that Mr. Trump is willing to keep in place could lead to a much more persistent problem

- what would concern him was if either the labor market started to deteriorate notably or expectations about inflation over a longer time horizon started to rise significantly

- Stagflation is a very uncomfortable situation for a central bank

Bessent: We want a decoupling with China for strategic necessities

- Bessent comments to CNBC in an interview

- We are going to protect our steel, semiconductor industries, selected medicines

- Believe China is now serious about halting fentanyl flows into the US

- We have a mechanism in place to avoid upwards tariffs pressure

- We want American businesses to be able to sell to China

- I imagine we will meet (with China) again in the next few weeks

- We got a lot done over two days

- Will see what we can do on non-tariff barriers

- I think we’ll have a deal

- China tariffs will go up without a deal, won’t go all the way to 145%

On Iran/Russia:

- So far Iran is acting intelligently

- Iran is being reasonable

- Believes Russia will agree to a 30-day ceasefire

Trump: We achieved a total reset with China

- Comments from Trump in today’s press conference

- We’re negotiating with India right now (on trade)

- US helped a lot of with India-Pakistan ceasefire

- Agreement doesn’t cover steel, aluminum, cars or pharma

- Says he spoke to Tim Cook this morning; Cook will built a lot in the USA

- Talks in Geneva were friendly

- We’re not looking to hurt China

- Will speak to Xi at the end of the week maybe

- China was honoring the ‘phase 1’ deal until Biden came in

- There is a big incentive for China to stop sending fentanyl, I take them at their word they will make it stop

- We will no longer tolerate profiteering from big pharma

- Drug policy change will pay for ‘golden dome’ missile defense

Trump: I just called the Speaker of the House and I just called the leader, our leader in the Senate, John Thune..spoke to both of them. I said, when “You’re going to have to score two things. You’re going to have to number one, score that hundreds of billions of dollars of tariff money is coming in. But even bigger than that, you’re going to have to score that year. Your cost for Medicaid and Medicare and just basically pharmaceuticals and drugs is going down at a level that nobody has ever seen before. It’ll pay for the Golden Dome.” I see the Golden dome is there. See? That’ll easily pay for the Golden Dome. And we’ll have a lot of money left over.

Fed’s Kugler: Trade policy shifting but still likely to lead to higher prices and less GDP

- Kugler on the wires

- It has become hard to judge the underlying growth of the economy

- Labor market conditions mostly stable

- Supported keeping rates stable at current restrictive level, Fed in a good position to deal with change in macro outlook

Trump Doubles Down: Drug Prices Slashed by 59% “Plus!”

In a fiery Truth Social post, Donald Trump declared:

“DRUG PRICES TO BE CUT BY 59%, PLUS! Gasoline, Energy, Groceries, and all other costs, DOWN. NO INFLATION!!! LOVE, DJT”

Though Trump’s post lacked specifics beyond his earlier executive order, he reinforced his stance that major cost-of-living components will be addressed. However, analysts note he’s unlikely to secure rate cuts from the Fed under current inflation metrics.

Trump to Slash Prescription Drug Prices by Up to 80%

Former President Donald Trump announced that prescription drug and pharmaceutical prices in the U.S. will be cut by 30% to 80%, nearly immediately. He plans to sign the executive order at 9:00 a.m. Monday at the White House.

He stated the U.S. will match the lowest drug prices paid by any country in the world. Unlike vague outcomes from the weekend’s China talks, this policy carries direct consumer impact, especially for those dependent on long-term medication.

Bessent: We have reached agreement with China on a 90-day pause, moving down tariff levels

- Bessent speaks in Geneva

- Both sides will move reciprocal/retaliatory tariffs down by 115%

- Throughout the trade process, we have had a plan in place

- And now, we have a mechanism for continued talks

- The consensus this weekend is that neither side wants a decoupling

- We do want more balanced trade, would like to see China open to more US goods

- As negotiations move forward, think there is a possibility to see purchase agreements

- Look forward to very good discussions now that there is the mechanism in place for talks

Commodities News

Gold Suffers Worst Selloff Since November 2024

Gold prices plummeted more than 3% Monday as easing U.S.-China trade tensions triggered a broad risk-on rotation, sapping demand for safe-haven assets.

- Gold last traded at $3,224.21, down $101 or -3.06%

- Intraday high: $3,326

- Intraday low: $3,207.95 (just above May 1’s low at $3,202.03)

- Worst single-day loss since November 25, when gold fell 3.35%

The sharp move comes after the U.S. and China mutually agreed to reduce tariffs for 90 days:

- U.S. duties dropped from 145% to 30%

- China cut tariffs from 125% to 10%

Market Outlook

- If gold breaks below $3,202, it may fall toward the 38.2% Fibonacci retracement of the November rally at $3,132.16

- Further downside could test the long-term trendline near $3,082, and then the 100-day MA at $2,953.80

Despite the daily loss, gold remains up 22.83% year-to-date, after rising 27.22% in 2024 and 13.16% in 2023.

Macro Influences

- April US CPI is projected to remain at 2.4% YoY, with core CPI holding at 2.8% YoY

- Central bank demand remains strong:

- PBoC added 2 tonnes in April (sixth straight month)

- Poland’s NBP added 12 tonnes, total holdings at 509 tonnes

- Czech National Bank added 2.5 tonnes

Swap markets continue to price in a Fed rate cut of 25bps in July, with a second cut expected before year-end.

Crude Oil Rises for Third Straight Day, Settles at $61.95

Crude oil futures rose again Monday, with WTI closing at $61.95, up $0.93 or +1.52%.

- Daily high: $63.57

- Daily low: $61.04

- Since May 5 low, oil is up 11.48%

This marks the third consecutive day of gains, as markets respond positively to the temporary easing of trade tensions between the U.S. and China. Traders are also watching for possible shifts in OPEC+ output policy and broader global demand recovery indicators.

Oil Prices Strengthen on Trade Talks, Supply Cuts

Oil prices saw gains on optimism over U.S.-China trade progress and reduced U.S. drilling activity. As of the latest trade:

- WTI is trading above $63/bbl

- Brent is nearing $66/bbl

Key developments:

- U.S. oil rigs fell by 5 to 474, the lowest count since January 24

- Frac spread count dropped by 6 to 195, indicating lower completion activity

- Net long positions in Brent fell by over 12,000 lots, while shorts increased

- WTI also saw net longs decrease by more than 10,000 lots

This shift in trader positioning suggests cautious optimism, but markets are watching for further impact from evolving tariff policy.

U.S. Natural Gas Prices Slide on Inventory Surge

ING reports that U.S. natural gas futures opened lower on Thursday amid signs that supply is outpacing demand.

Key points:

- EIA data shows total U.S. gas storage at 2.15 trillion cubic feet, now 1.4% above the five-year average

- Last week marked the second straight week of a triple-digit build

- The market shifted from a 230Bcf deficit in March to a surplus

- Weather models now suggest warming conditions in northern and southern regions, possibly lifting demand marginally

The price slide comes despite mild support from seasonal consumption expectations.

Palladium Inches Higher; Platinum Holds Steady

Trading opened mixed for Platinum Group Metals (PGMs):

- Palladium (XPD) rose to $985.03 per troy ounce, up from $979.55

- Platinum (XPT) remained flat at $1002.60, matching Friday’s close

Both metals have been relatively range-bound to start the week, as investors digest broader commodity market movements and assess global demand prospects.

Goldman Sachs Cuts Brent/WTI Price Forecasts Through 2026

Goldman Sachs is dialing back its outlook for oil prices, citing strong supply growth beyond U.S. shale:

- Brent forecast:

- Avg. $60/barrel in H2 2025

- $56 in 2026

- WTI forecast:

- Avg. $56/barrel in H2 2025

- $52 in 2026

The firm notes that steady non-U.S. supply growth will likely keep a lid on prices over the medium term.

Europe News

European Markets Close Higher; German DAX Hits New Record

European equity markets closed solidly higher on Monday, with Germany’s DAX index hitting a new all-time high.

Closing Levels:

- DAX (Germany): +52.21 pts (+0.22%) to 23,551.54 (new record)

- CAC 40 (France): +106.35 pts (+1.37%) to 7,850.11

- FTSE 100 (UK): +50.18 pts (+0.59%) to 8,604.99

- Ibex 35 (Spain): +101.22 pts (+0.75%) to 13,655.31 (highest since 2008)

- FTSE MIB (Italy): +551.60 pts (+1.40%) to 39,921.60

The rally follows improving global sentiment as investors welcomed tariff reductions between the U.S. and China, alongside better-than-expected economic data and strong corporate earnings across the eurozone.

Swiss Sight Deposits See Slight Shift as SNB Watches Developments

As of the week ending 9 May, the Swiss National Bank (SNB) reported:

- Total sight deposits: CHF 453.2 billion, slightly down from CHF 454.1 billion

- Domestic sight deposits: CHF 444.8 billion, up from CHF 443.1 billion

The weekly changes were modest, but with progress in global trade talks, the SNB may take some comfort in renewed signs of market stability.

BOE Taylor: We are a long way from neutral level of interest rates

- BE Taylor:

- We are a long way from the neutral level of interest rates

- Neutral rate for me is 2.75 – 3% in the UK.

- Erosion of business confidence in the UK has continued in REC and PMI surveys..

- There is a sense of precaution and concernt

- Tariff shock was bigger than anyone expected.

- Although there are signs of a pause, we don’t know where it will go.

- Wage settlement data is coming in line with expectations for slower wage growth.

- Central forecast of BOE had quite mild treatment of global trade situation

- The UK/US trade deal is quite slender.

ECBs Nagel: We shouldn’t overreact to individual announcements

- ECB Nagel is on the wires saying:

- We shouldn’t overreact to individual announcements.

Bessent: UK, Switzerland Now Top U.S. Trade Priorities

Bessent, commenting on the current U.S. trade landscape, said the UK and Switzerland have leapfrogged other regions, including the EU, in line for trade deals with the U.S.

He emphasized that progress with the EU remains sluggish and suggested that opening trade further with China could improve fairness for U.S. businesses. He also pointed out that China has yet to shift toward a consumer-driven economy—still relying heavily on production and exports.

BOE’s Greene: Wage, inflation measures are moving in the right course but still too high

- Remarks by BOE policymaker, Megan Greene

- Inflation persistence indicators are still too high

- Slightly worried that medium-term inflation expectations are starting to tick up

- Disinflation process in underway.

- Some slack opened up in the labour market.

- Risks to UK productivity are to the downside.

- FX rates could be disinflationary if the trend persists.

- On net, I think tariffs will be disinflationary for the UK, this was a factor in my rate decision.

BOE’s Lombardelli: Caution remains appropriate

- Remarks by BOE policymaker, Clare Lombardelli

- Evidence suggests that policy is still restrictive

- Wage growth is still too high for on target inflation

- Wages is my main focus when looking for disinflation

- Further gradual disinflation progress and trade developments made 25 bps rate cut appropriate

- Latest US-China discussions are good news, if reports are accurate.

- Progress on domestic inflation, not US tariffs, was the main factor behind my rate vote.

- Trade policy uncertainty will continue until there’s a permanent solution.

- UK GDP data is volatile, makes it hard to gauge if weakness is due to demand or supply.

UK Hiring Sentiment Drops to Lowest Level Since COVID Era

The CIPD employment intentions gauge fell from +13 to +8, marking the weakest hiring outlook since the pandemic—excluding the COVID lockdown period.

Large firms in the private sector drove the drop, as inflation, global uncertainty, and rising operational costs weigh on business confidence.

Additional data from the KPMG/REC survey showed another month of falling job placements, although the decline was slightly less severe than in March.

Key points:

- Median pay settlements holding at 3%

- Official wage growth figures due Tuesday, expected at nearly 6% y/y

- BDO’s employment index also fell to a 12-year low in April

Asia-Pacific & World News

US-China Trade Deal Leaves Out $800 E-Commerce Exemption

According to Reuters, the recently announced U.S.-China deal does not cover the de minimis exemption—a key rule that allows imports valued under $800 to enter the U.S. duty-free.

This loophole has been especially beneficial to Chinese e-commerce firms selling small-ticket items to U.S. consumers. The absence of this provision means higher costs for American online shoppers, particularly those buying from overseas. On platforms like Reddit’s DHL community, users have reported duty fees exceeding the value of the items ordered.

New Deal Imposes 10% Base Tariff, 20% Levy on Fentanyl-Linked Products

Per the joint U.S.-China statement, a modified tariff structure will apply:

- 10% base tariff on Chinese goods

- Additional 20% levy on items linked to fentanyl supply chains

Both countries will pause their respective tariffs for 90 days, with room for continued dialogue. Meetings may rotate between China, the U.S., or neutral locations. A new working-level mechanism has been created to keep communication flowing on trade and economic topics.

US-China Tariff Cuts May Exceed Expectations, Report Claims

Phoenix TV, a Hong Kong-based outlet, claims U.S.-China tariff reductions could exceed 100%. The report—still unconfirmed by major global media—cites an anonymous source close to the negotiations.

Initial expectations pegged cuts at 50–60%, which would already have been meaningful. If Phoenix TV’s claim holds, it signals a more aggressive move toward trade de-escalation than many had forecast. Skepticism remains high until corroborated by more reliable channels.

Xi Jinping Scheduled to Speak Publicly on May 13

China’s President Xi Jinping is set to deliver a speech on May 13 at the opening ceremony of the fourth ministerial meeting of the China-CELAC Forum in Beijing, according to a Sunday announcement from the Foreign Ministry.

Public speeches by Xi are relatively rare compared to counterparts like former President Trump, making this an event to watch, especially given the context of rising trade and geopolitical tensions.

Goldman Sachs Predicts Stronger Yuan Over Next 12 Months

Goldman Sachs now expects the USD/CNY to trend downward, reaching:

- 7.20 in 3 months

- 7.10 in 6 months

- 7.00 within 12 months

The note, cited by Bloomberg, highlights China’s strong export performance and argues that the yuan is undervalued, especially on a trade-weighted basis. GS sees potential appreciation of the yuan as one lever to offset tariff-related costs.

Chinese Firms Speed Up Push to Ditch Foreign Components

According to the Financial Times, over two dozen publicly listed companies in Shanghai and Shenzhen have disclosed to investors that they are stepping up efforts to eliminate foreign components from their supply chains.

Financial filings reviewed by the FT show a deliberate and growing shift toward domestic sourcing, as firms aim to strengthen supply chain resilience and reduce dependence on imported parts.

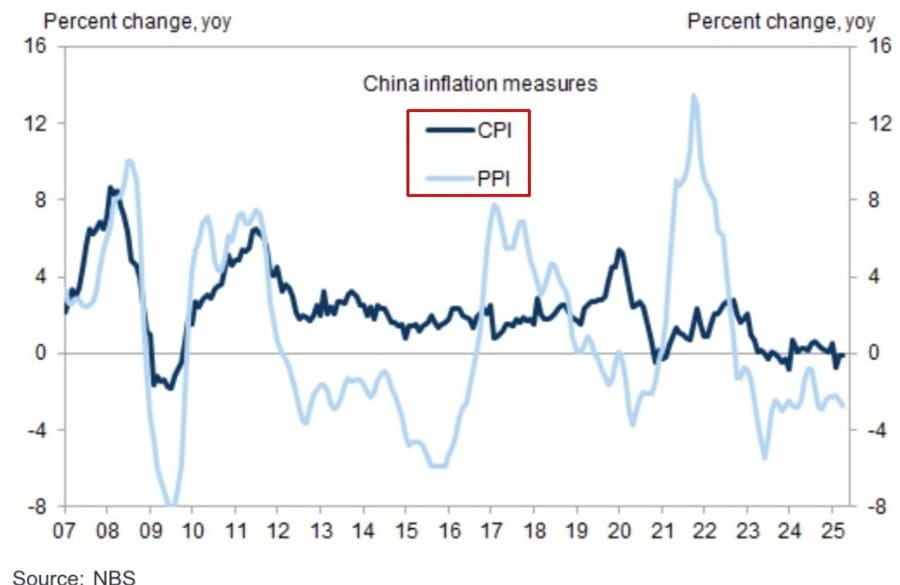

China’s April CPI, PPI Numbers Show Persistent Deflation Risk

China’s April inflation figures came in soft once again, pointing to ongoing deflationary pressures.

- CPI: -0.1% y/y (same as forecast and prior)

+0.1% m/m (prior -0.4%)

Core CPI (ex-food & energy): +0.5% y/y (unchanged) - PPI: -2.7% y/y (slightly better than -2.8% expected, but worse than March’s -2.5%)

This marks more than two consecutive years of factory-gate deflation.

The data was released quietly over the weekend while global attention was fixed on Geneva trade developments.

China Calls Geneva Meeting a First Step; Talks Not Without Tension

Vice Premier He Lifeng characterized the weekend’s Geneva meeting with U.S. trade officials as a “first step” toward repairing bilateral trade ties, though he acknowledged ongoing differences and frictions.

He reiterated that the trade relationship is fundamentally “win-win”, rejecting zero-sum thinking. China is prepared to manage disagreements constructively and expand areas of cooperation, aiming to bring greater stability and predictability to global trade.

Both sides confirmed the creation of a new economic and trade consultation mechanism, and a joint statement is expected Monday.

Awaiting China-U.S. Joint Statement Following Geneva Talks

Chinese Vice-Premier He Lifeng announced that a joint statement will be released in Geneva on Monday, following the latest round of trade negotiations with the United States. Vice-Commerce Minister Li Chenggang hinted that the statement would contain “good news for the world.”

So far, no official release time has been published.

From China’s side, officials said both countries have agreed to create a China-U.S. trade consultation mechanism to facilitate ongoing dialogue. The U.S. delegation added that “substantial progress” had been made, with Greer noting that the perceived differences between the two countries “may not be as large” as once thought.

PBOC sets USD/ CNY reference rate for today at 7.2066 (vs. estimate at 7.2429)

- PBOC CNY reference rate setting for the trading session ahead.

BOC injects 43bn yuan via 7-day RR, sets rate at 1.4%

- there are no maturities today, hence the net injection is that 43bn yuan

South Korea’s Early May Trade Numbers Drop Sharply

Preliminary data from South Korea’s Customs Agency showed a major drop in export activity during the first 10 days of May:

- Exports: -23.8% y/y

- Imports: -15.9% y/y

- Trade Balance: -$1.74 billion (provisional)

The figures point to a sharp contraction in trade activity, raising concerns about global demand and regional economic momentum.

Japan PM: Autos, Agriculture, Airplane Parts Off Limits in Security Talks

Japanese Prime Minister Ishiba clarified that sectors like autos, agriculture, and aircraft parts are not part of national security negotiations.

Economy Minister Akazawa supported this position, adding that security concerns and currency matters are not being discussed within the trade framework.

Japan April Bank Loans Slowed; March Current Account Surplus in Line

Japan’s latest financial indicators:

- April Bank Lending: +2.4% y/y (down from March’s 2.8%)

- March Current Account (non-seasonally adjusted): ¥3.678 trillion (matched expectations, down from ¥4.061T prior)

- Adjusted Current Account (March): ¥2.72T (down from ¥2.91T)

The numbers arrived with little fanfare, as attention remains on U.S.-China relations and Washington’s push to lower domestic drug prices.

Crypto Market Pulse

Dogecoin Surges 40% But Stalls Below Key Resistance Amid Trade Deal Optimism

Dogecoin rallied as high as $0.25 on Monday, climbing over 40% since the April 7 tariff-driven market crash, but remains capped by a descending trendline near $0.26—a critical resistance level that has been in place since December.

Trade Talks Spark Risk-On Shift

Risk appetite surged after U.S.-China trade negotiations in Geneva produced an agreement to slash tariffs for 90 days. The U.S. lowered duties from 145% to 30%, while China dropped its own from 125% to 10%. Treasury Secretary Scott Bessent emphasized that both countries are aiming for “balanced trade” without triggering decoupling.

This trade breakthrough—paired with a separate UK-U.S. deal last week—boosted global markets and reignited interest in speculative crypto assets, especially meme coins.

Whales Increase Exposure to DOGE

According to Santiment, wallets holding between 100M and 1B DOGE now control 17.1% of the total supply, up from 15.69% in March and 16.68% in mid-April. This steady accumulation suggests large investors are positioning for further gains.

Technical Picture: Momentum Strong, But Resistance Still in Play

- DOGE is up 7% today, trading at $0.25

- Price remains above the 50-, 100-, and 200-day EMAs

- The MACD shows growing divergence between the MACD line and the signal line, with expanding green histograms above zero

- RSI has entered the overbought zone (>70), reflecting strong momentum but also flashing caution

If DOGE breaks the trendline, upside targets include $0.30 and $0.40, with support seen at the 200-day EMA ($0.21), 100-day EMA ($0.20), and 50-day EMA ($0.18) in case of rejection.

Memecoins WIF, BOME, FLOKI Extend Rallies on Trade-Driven Risk Appetite

Dogwifhat (WIF), Book of Meme (BOME), and FLOKI continued their explosive runs on Monday as investors flooded into meme coins following the U.S.-China tariff reduction deal.

Trade Pact Sparks Speculation

Markets responded to news that the U.S. and China would cut tariffs significantly for 90 days—dropping U.S. tariffs to 30% and Chinese tariffs to 10%. This sparked a renewed wave of speculative buying across the crypto sector, with meme tokens leading.

Dogwifhat (WIF)

- WIF surged 26% on Saturday, breaking the $0.76 100-day EMA

- On Monday, price climbed another 36%, hitting $1.24

- Resistance: $1.44

- Support: $1.00

- RSI remains above 70, signaling caution as the rally enters overbought territory

Book of Meme (BOME)

- BOME broke past resistance at $0.0016 and hit $0.0026

- Briefly tested 100-day EMA at $0.0022

- Resistance: January 31 high at $0.0036

- Support: Sunday low at $0.0020

- RSI over 70 and still climbing—momentum remains strong but overextended

FLOKI

- FLOKI broke above a long-term trendline Thursday and surged 44% in two days

- Now trading at $0.00011, just above the 200-day EMA

- Resistance: $0.00015

- RSI pulled back slightly from overbought zone but still bullish

All three tokens show strong upside momentum, but traders should be cautious. Elevated RSI readings point to high likelihood of volatility and short-term pullbacks.

Crypto Market Slows Slightly, But Momentum Holds Near Highs

The total crypto market cap rose to $3.35 trillion over the weekend, extending recent gains but showing signs of cooling. Ethereum and Dogecoin led the advance, both posting near-40% gains in the past seven days.

Sentiment Settles in Greed Zone

The Crypto Fear & Greed Index has held steady at 70 for three straight days—bullish, but not euphoric. This balance could provide room for continued upside.

Bitcoin briefly crossed $105,500 Monday morning, entering a price zone where it has twice failed to hold in the last six months. Analysts see the late January–April correction as having reset market conditions, creating space for a new rally.

Notable Developments

- Cointelegraph suggests BTC’s breakout from a “bull flag” pattern points to a target as high as $182,000

- Net inflows to spot BTC ETFs hit $921M last week, bringing cumulative flows to $41.16B since Jan 2024

- Ethereum ETF flows reversed with a $38.2M outflow, reducing cumulative inflows to $2.47B

- Strategy firms are buying BTC faster than miners can produce, creating an implied 2.23% annual deflation

- Miners sold ~70% of newly mined coins in April as profitability fell

- Coinbase CEO Brian Armstrong confirmed the exchange considered but ultimately rejected a BTC treasury strategy

Bitcoin Approaches All-Time High as Trade Deals Boost Risk Sentiment

Bitcoin stabilized around $104,000 on Monday, holding most of its 10.44% weekly gain. The crypto market cheered the de-escalation of trade tensions, following significant tariff reductions by both the U.S. and China.

Tariff Rollbacks Fuel Crypto Rally

After a weekend of negotiations in Geneva, the U.S. agreed to lower tariffs from 145% to 30%, while China cut duties from 125% to 10%. The deal is effective for 90 days. U.S. Trade Representative Jamieson Greer and Vice Premier He Lifeng led the talks.

Separately, the UK-U.S. trade agreement reduced UK import tariffs on American goods from 5.1% to 1.8%, reinforcing the global shift toward cooperation.

Institutional Buying Adds to Momentum

Japanese investment firm Metaplanet added 1,241 BTC worth $125.3M on Monday, bringing its holdings to 6,796 BTC. Meanwhile, U.S. spot Bitcoin ETFs attracted $920.9M in inflows last week, according to Coinglass—extending a four-week streak of institutional buying.

Price Outlook: $105K Resistance Under Pressure

- Bitcoin faces resistance at $105,000

- The all-time high is $109,588, last hit on January 20

- RSI is at 74, suggesting overbought conditions

- A close above $105K could trigger a move to retest all-time highs

- Failure to break may see a pullback to $100,000 psychological support

If institutional flows continue and macro sentiment holds, BTC could break out decisively. However, overbought indicators point to a short-term consolidation risk.

BlackRock’s IBIT Logs Longest Inflow Streak of the Year

BlackRock’s IBIT spot Bitcoin ETF has now recorded net inflows for 20 consecutive trading days—the longest such run for any spot Bitcoin ETF in 2025.

Over $5 billion flowed into IBIT during the streak. Meanwhile, Goldman Sachs became IBIT’s largest shareholder after increasing its holdings by 28% in Q1. The sustained inflows highlight growing institutional demand despite recent crypto market volatility.

The Day’s Takeaway

United States

- Stocks Soar on Tariff Deal:

Major U.S. indices posted their second-best days since 2022 after the U.S. announced it would slash tariffs on Chinese goods from 145% to 30% for 90 days.- Dow: +2.81% at 42,410.10

- S&P 500: +3.26% at 5,844.19

- Nasdaq: +4.35% at 18,708.34

- Russell 2000: +3.42% at 2,092.19

- Biggest Gainers: Shopify (+13.71%), First Solar (+11.07%), Block (+9.29%), Amazon (+8.09%), Meta (+7.92%), Tesla (+6.82%)

- ZoomInfo (ZI) and Topgolf Callaway (MODG) both beat earnings and raised/reaffirmed full-year guidance.

- Fed Loan Survey Signals Tightening Credit Conditions:

The Fed’s Senior Loan Officer Survey showed tighter lending standards for both business and household loans, with declining demand, particularly in C&I, CRE, and credit card segments. - April Federal Budget Surplus Hits $258B:

Surpassing expectations of $256B, April’s surplus reflects typical tax-season inflows. March showed a $161B deficit.

Commodities

- Gold Suffers Sharpest Drop Since November:

Gold fell 3.06% to $3,224.21 as risk appetite surged following the U.S.-China tariff deal.- Intraday high: $3,326

- Low: $3,207.95

- A break below $3,202 could send it toward $3,132 (38.2% Fib level)

- Central Bank Buying Continues:

- PBoC added 2 tonnes

- Poland’s NBP added 12 tonnes

- Czech National Bank added 2.5 tonnes

- Crude Oil Extends Rally:

WTI settled at $61.95, up 1.52%, marking the third consecutive day of gains. Since May 5, oil is up 11.48%.

Europe

- Equities Close Higher Across the Board:

European markets ended the day in the green, led by strong performance in France and Italy.- DAX (Germany): +0.22% to 23,551.54 (new record high)

- CAC 40 (France): +1.37% at 7,850.11

- FTSE 100 (UK): +0.59% at 8,604.99

- Ibex 35 (Spain): +0.75% at 13,655.31 (highest since 2008)

- FTSE MIB (Italy): +1.40% at 39,921.60

Asia

- Lending Conditions Tighten in Japan:

Japan’s latest data shows lending growth slowing. Bank loans in April rose 2.4% YoY, down from 2.8% in March.- March current account surplus met expectations at ¥3.678T, down from ¥4.061T

- Adjusted current account surplus at ¥2.72T

- South Korea’s Export Slump:

Exports for May 1–10 fell 23.8% YoY, while imports dropped 15.9%. Trade deficit stood at $1.74B. - China’s Inflation Flatlines:

April CPI held at -0.1% YoY, unchanged from March. PPI declined 2.7% YoY, its 25th consecutive negative print. Demand signals remain weak.

Crypto

- Bitcoin Tests Resistance as Risk Appetite Climbs:

BTC stabilized at $104,000, up 10.44% from last week.- Key resistance: $105,000

- All-time high: $109,588

- RSI at 74, signaling overbought conditions

- Metaplanet added 1,241 BTC ($125.3M), total holdings now at 6,796 BTC

- U.S. spot Bitcoin ETFs took in $920.9M last week

- Dogecoin Hits $0.25, Up 40% Since April Low:

DOGE tests descending trendline at $0.26. Whale wallets (100M–1B DOGE) now hold 17.1% of supply, up from 15.69% in March. - Meme Coins Surge with WIF, BOME, FLOKI Leading:

- Dogwifhat (WIF): +36% to $1.24, targeting $1.44

- Book of Meme (BOME): +34% to $0.0026, eyes $0.0036

- FLOKI: +12% to $0.00011, aiming for $0.00015

- All three show overbought RSI, increasing risk of near-term pullbacks

- Gold’s Drop Confirms Rotation Out of Safe Havens and Into Risk Assets

Crypto, especially meme tokens and Bitcoin, benefited directly from the risk-on move triggered by trade de-escalation.