North America News

Dow Stocks Lead the Winners as Nasdaq Lags — Rotation Drives Market Close

Rotation. Rotation. Rotation.

That’s the theme as Wall Street closes the day with a clear shift in momentum. Investors rotated out of tech and into blue-chip names, sending the Dow Jones Industrial Average higher while the Nasdaq slipped and the S&P 500 ended modestly positive.

Dow Outperforms on Defensive Strength

Traditional, “bricks-and-mortar” Dow 30 components attracted steady inflows as traders sought relative safety amid tech weakness. The session’s biggest gainers included:

- Merck & Co. (MRK) +4.84%

- Amgen (AMGN) +4.57%

- Nike (NKE) +3.87%

- Johnson & Johnson (JNJ) +2.88%

- McDonald’s (MCD) +2.61%

- Walt Disney (DIS) +2.34%

- Honeywell (HON) +2.21%

- Verizon (VZ) +2.18%

- Apple (AAPL) +2.16%

- Procter & Gamble (PG) +2.09%

Tech Stocks Drag Nasdaq Lower

Chipmakers bore the brunt of selling pressure after SoftBank announced it had divested its entire Nvidia (NVDA) stake in favor of expanding its investment in OpenAI. Semiconductor names sold off sharply:

- Nvidia (NVDA) −2.96%

- AMD (AMD) −2.65%

- Intel (INTC) −1.48%

- Broadcom (AVGO) −1.79%

- Micron (MU) −4.81%

Other notable laggards included Nebius NV (NBIS) −7.07%, Lam Research (LRCX) −4.29%, Trump Media & Technology (DJT) −4.02%, and Papa John’s (PZZA) −3.91%.

Retail, discretionary, and AI-adjacent names also struggled, with Tapestry (TPR) −3.81%, Super Micro Computer (SMCI) −3.40%, Arm (ARM) −3.29%, First Solar (FSLR) −3.20%, and MicroStrategy (MSTR) −3.14% all lower.

Grayscale Bitcoin Trust (GBTC) dropped −3.09%, while Alibaba (BABA) slid −3.07%, rounding out a tough day for growth and momentum stocks.

ADP Weekly US Employment

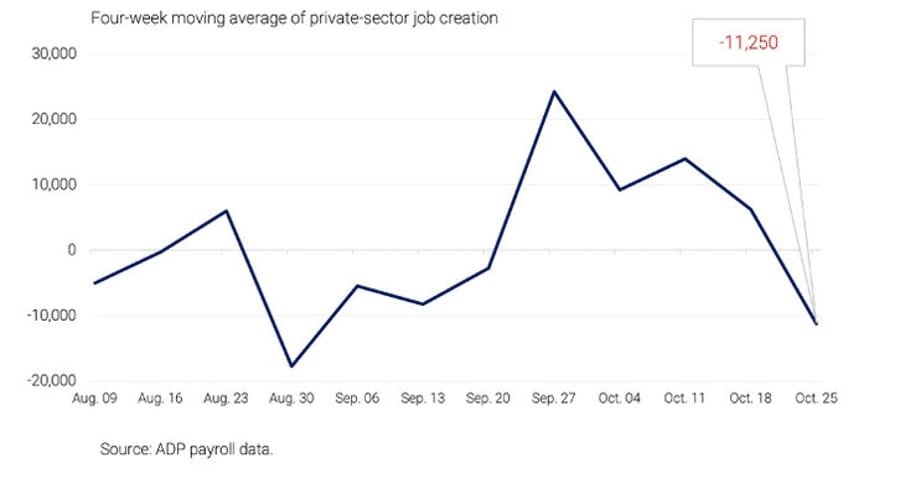

The US shed an average of 11,250 jobs per week in the four weeks ending October 25.

Initially, the data showed a gain of +14,250, but revisions now reveal a steady decline. Despite ADP’s official October report showing a +42K increase in private-sector jobs, the weekly breakdown suggests inconsistent hiring momentum.

ADP noted that October’s gains were concentrated in education and healthcare and trade, transportation, and utilities, while professional services, information, and leisure and hospitality continued to lose jobs.

US October NFIB Small Business Optimism Index

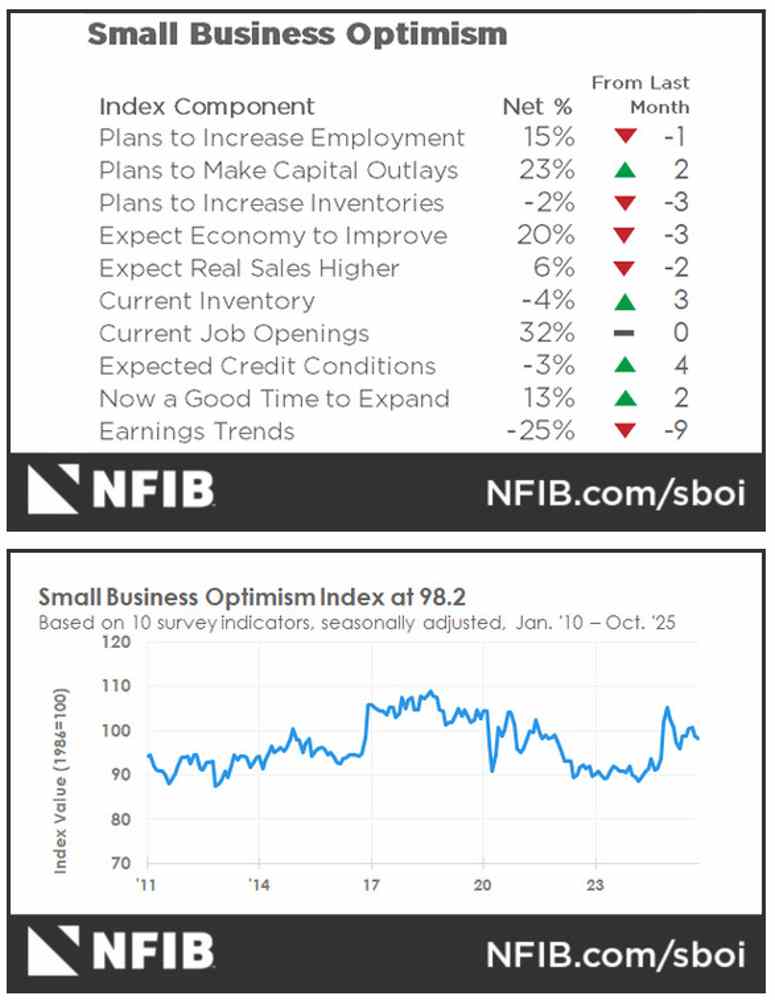

Actual: 98.2 (vs. 98.3 expected)

Prior: 98.8

The report was broadly in line with expectations and is not a market mover.

According to the NFIB, optimism declined slightly due to softer sales and reduced profits. The Uncertainty Index dropped to 88, the lowest this year.

NFIB Chief Economist Bill Dunkelberg commented that while optimism dipped, small businesses continue to face labor shortages and quality concerns remain the top issue on Main Street.

JPMorgan Stays Bullish, Cites U.S. Reopening and Nvidia Earnings

JPMorgan strategists reaffirmed a bullish stance on equities, seeing near-term upside from a potential U.S. government reopening and Nvidia’s upcoming earnings.

The bank said resolving the shutdown could release liquidity and boost GDP forecasts. It expects the Fed to cut rates by 25 bps in December, with corporate buybacks adding further market support.

Risks include a weak Nvidia report, extended shutdown, or bond volatility. Still, JPMorgan noted light positioning could amplify gains if sentiment improves.

Opendoor Strikes Back at Short Sellers with Warrant Dividend

Opendoor Technologies shares erased a 20% intraday drop Friday to close flat after the company unveiled a warrant dividend aimed at squeezing short sellers.

Investors of record on November 18 will receive three tradable warrants per 30 shares held, with strike prices of $9, $13, and $17 expiring in November 2026.

Short sellers must compensate lenders for these warrants, increasing their costs and prompting some to cover positions. About 28% of Opendoor shares were shorted as of mid-October. CEO Kaz Nejatian said the move “might ruin the night of a few short sellers.”

UBS Targets S&P 500 at 7,500 by 2026, Driven by Earnings

UBS projects the S&P 500 will climb to 7,500 by 2026, fueled by 14% earnings growth rather than higher valuations. Nearly half of that expansion is expected from technology firms.

The bank outlined a two-phase global outlook: a short-term slowdown followed by stronger growth in 2026 as fiscal support gains traction.

UBS anticipates roughly 10% U.S. equity returns next year, outpacing Europe and emerging markets, which it expects to rise about 8%. It added that broader participation beyond large-cap tech could emerge in mid-2026, particularly in cyclicals.

Veterans Day: U.S. Stock Markets Open, Bond Trading Closed

Tuesday, November 11, 2025, marks Veterans Day — a federal holiday in the United States. While the New York Stock Exchange and Nasdaq remain open, U.S. bond markets will be closed in observance.

The Securities Industry and Financial Markets Association follows the Federal Reserve Bank of New York’s holiday calendar, which lists Veterans Day as a non-trading day for fixed income.

Foreign exchange desks at major banks will operate but are expected to see lighter liquidity. Futures on the CME’s Globex platform will trade on a normal schedule, though activity may be thinner than usual.

Commodities News

Gold Holds Near $4,110 as Markets Await House Vote on US Funding Bill

Gold prices are holding steady near $4,110 on Tuesday, consolidating after touching a three-week high of $4,148. Traders are closely watching developments in Washington as the Senate-approved stopgap funding bill moves to the House of Representatives for a vote.

Funding Bill Eases Shutdown Risks

The Senate passed the measure with a 60–40 vote. If approved by the House, the bill would fund the US government through January 30, with certain agencies secured through September 30. Bipartisan support, including from moderate Democrats, has helped calm market fears over an extended shutdown.

The compromise drops the earlier demand to renew expiring Affordable Care Act subsidies, signaling a pragmatic effort to keep the government operating.

Economic Data and Rate Cut Bets in Focus

While the economic calendar remains thin due to the shutdown, ADP data showed private companies cut an average of 11,250 jobs per week in the four weeks ending October 25.

The weaker data reinforced expectations for a December Fed rate cut, with CME FedWatch showing 67% odds, up from 62% a day earlier. Still, Fed Chair Jerome Powell has emphasized that another cut this year is “far from certain.”

Gold remains supported by dovish expectations, though profit-taking above $4,140 has capped near-term upside.

Crude Oil Settles at $61.04 as Prices Rebound from Early Lows

Crude oil finished the session higher, with WTI futures settling at $61.04 per barrel, up $0.91 (1.51%).

The market found support early in the session near $59.66, before rebounding toward intraday highs at $61.28.

Technical View

On the hourly chart, prices initially dipped into a swing support zone between $59.58 and $60.17, which attracted fresh buying. The rebound carried crude back above both the 100-hour and 200-hour moving averages, signaling improving short-term momentum.

The day’s high, however, stalled just below the next resistance zone between $61.45 and $61.94, leaving traders eyeing that range as the next key target for continuation.

Gold Technical Analysis: Short Squeeze or Prelude to Another All-Time High?

Gold rallied more than 3% on Monday as optimism grows over the end of the US government shutdown. The question now: is this just a short squeeze or the start of another leg higher?

Fundamental Overview

Gold broke free from its recent consolidation phase, pushing toward the 4,150 level — the previous swing high. The move looks more technical than fundamental, likely driven by a short squeeze as traders were caught off-guard.

With the US government reopening, key macro data such as Non-Farm Payrolls (NFP) and CPI will return to the spotlight. These reports will likely set the tone for gold’s next major move.

This week’s key release is the US ADP employment data. The Fed’s stance remains cautious, and markets are pricing about a 63% chance of a December rate cut.

- Strong US data — especially in the labor market — could weigh on gold, reinforcing a “higher for longer” rate narrative.

- Weak data, on the other hand, would bolster gold as expectations of policy easing firm up.

Longer term, gold’s outlook stays constructive. Falling real yields and a dovish Fed bias continue to support the metal. But near-term, any hawkish repricing could trigger another pullback.

Gold Technical Analysis – Daily Timeframe

On the daily chart, gold has retraced to test resistance at 4,150 — the previous swing high. Sellers are likely to defend this level, setting short positions with stops just above. If resistance holds, downside momentum could aim toward 3,800.

Buyers will need a clear break above 4,150 to confirm continuation toward fresh record highs.

Gold Technical Analysis – 4-Hour Timeframe

The 4-hour chart reinforces the same resistance zone near 4,150. Sellers are expected to engage around these levels, while bulls await a breakout to validate renewed upside momentum. A close above 4,150 could open the way toward a new all-time high.

Gold Technical Analysis – 1-Hour Timeframe

The short-term structure remains straightforward. Sellers will likely enter around the 4,150 resistance with tight risk management, while buyers will stand aside until price confirms a breakout above the level.

China’s Lower LNG Imports Ease Market Pressure – Commerzbank

European gas prices hover just above €31/MWh, about 25% lower than a year ago. Despite lower storage levels (currently 82.6%, vs. 93.3% last November), improved LNG supply is keeping the market calm.

Commerzbank’s Barbara Lambrecht attributed this to:

- Expanded import terminals and stronger US LNG exports.

- A notable decline in Chinese demand — down 6.2% y/y in the first ten months, with LNG imports nearly 17% lower.

Mild weather and ample pipeline supply continue to cap European gas prices, reducing near-term risks of shortages.

Gold Regaining Momentum – OCBC

Gold’s sharp rebound reflects renewed optimism as the US government shutdown nears resolution. OCBC analysts Frances Cheung and Christopher Wong describe gold’s performance as that of an “alpha proxy,” outperforming risk assets.

The corrective pullback earlier restored healthier market positioning. Medium-term fundamentals remain supportive:

- The Fed is expected to ease policy through 2026,

- Central bank and institutional demand continues,

- Gold’s hedge role against policy and fiscal uncertainty remains intact.

Technically, fading bearish momentum and a rising RSI suggest improving sentiment.

- Resistance: 4,250

- Support: 4,064 (21-DMA), 3,970 (38.2% Fib).

If consolidation between 3,920–4,020 holds, it could form a base for another push higher.

China’s Diverging Gold Demand – Commerzbank

According to data from the China Gold Association, gold demand totaled 683 tons in the first three quarters of 2025, down 8% year-on-year.

- Jewelry demand: Fell 32.5% to 270 tons, hurt by higher prices and new purchase taxes starting November 1.

- Investment demand (bars & coins): Rose 24.5% to 352 tons, now making up over half of total demand.

- PBoC purchases: Continued for the 12th straight month, though modest — just 1 ton in October and 40 tons over the past year.

Commerzbank’s Carsten Fritsch noted that while central bank demand persists, other buyers (Poland, Kazakhstan) have been more aggressive this year.

Gold Price Surge – Commerzbank

Gold prices jumped 3.7% (around $150) to $4,150 per ounce since Monday’s open. Silver outperformed, gaining over 5%, with platinum and palladium also posting strong advances.

Commerzbank highlighted that the rally was counterintuitive, given improved risk appetite following hopes of a US government resolution. However, weaker US data — particularly the slide in consumer confidence to a 3½-year low — reinforced expectations for more Fed rate cuts.

The bank expects gold to reach $4,200 in 2026, supported by continued monetary easing and slower US growth. Their forecasts for next year:

- Gold: $4,200

- Silver: $50

- Platinum: $1,700

- Palladium: $1,400

Europe News

European Stocks Close Higher — Spain, Italy, and France Lead Gains

European equities advanced broadly on Tuesday, with major indices closing in positive territory. Spain’s Ibex, Italy’s FTSE MIB, and France’s CAC 40 led the region’s gains, while the FTSE 100 and Ibex both closed at record highs.

Italy’s FTSE MIB finished at its strongest level since 2000, underscoring the strength of Southern European markets.

Closing Snapshot

- Germany’s DAX: +0.57%

- France’s CAC 40: +1.25%

- UK’s FTSE 100: +1.15%

- Spain’s Ibex: +1.27%

- Italy’s FTSE MIB: +1.24%

Investor sentiment across Europe improved amid optimism over a resolution to the US government funding standoff and stabilizing bond yields.

Germany November ZEW Economic Sentiment

Headline: 38.5 (vs. 41.0 expected)

Previous: 39.3

Current conditions: -78.7 (vs. -78.0 expected; prior -80.0)

The latest ZEW survey disappointed across all components. However, the data is unlikely to sway ECB policy or market sentiment.

ZEW noted that “the overall mood is characterised by a fall in confidence in the capacity of Germany’s economic policy to tackle pressing issues. Although the investment programme may provide stimulus, structural challenges persist.”

UK Jobless Rate Rises to 5.0%, Weakest Labor Reading Since 2021

The UK unemployment rate rose to 5.0% in September, exceeding forecasts of 4.9% and marking the highest since March 2021.

Employment fell by 22,000, and October payrolls declined 32,000. Wage growth eased slightly, with total pay up 4.8% versus 5.0% expected, and ex-bonus pay up 4.6%.

Real pay growth slipped to 0.7%. The weak report could push the Bank of England closer to considering rate cuts amid mounting labor market softness.

UK Spending Slows Ahead of Budget, Black Friday

British consumer spending eased in October as households delayed purchases before the November 26 budget and Black Friday sales.

Barclays reported a 0.8% annual decline in card spending, driven by weaker fuel and grocery outlays. Retail sales rose just 1.6% year-on-year, the weakest since May, according to the BRC.

Barclays’ Julien Lafargue said consumers are adopting a “wait and see” approach amid expected tax hikes. Retailers, said BRC’s Helen Dickinson, are counting on Black Friday to offset weak demand. Confidence indicators all fell for the first time since August 2022.

ECB Officials Signal Rates Appropriate, Risks Balanced

ECB policymakers said inflation risks are now balanced and the current rate setting remains suitable.

Frank Elderson and Martin Kocher both described the policy stance as “appropriate,” while Boris Vujcic noted growth and inflation have slightly exceeded forecasts.

Vujcic added that retail participation in equity markets is rising faster than among hedge funds, calling valuations “stretched” and consumer caution “hard to explain.”

BoE’s Greene Warns Inflation Risk Still High, Policy Must Stay Restrictive

Bank of England policymaker Megan Greene said inflation risks remain elevated, and monetary policy must stay tighter for longer.

Greene highlighted precautionary saving, high wage settlements, and persistent inflation expectations. She said current policy may not be “meaningfully restrictive” yet and warned that wages remain too high relative to weak growth.

She called the latest wage data encouraging but said forward-looking indicators suggest disinflation may stall.

U.S., Switzerland Near Tariff Reduction Deal, Trump Confirms

The U.S. and Switzerland are close to lowering tariffs on Swiss goods from 39% to around 15%, President Donald Trump said Monday. Talks are ongoing, with Trump describing Switzerland as “a good ally.”

Swiss officials declined comment, though sources indicated a deal could be finalized within two weeks.

The 39% levy, imposed in August, has hit Swiss exporters of luxury goods, precision machinery, and chocolate particularly hard. A reduction would ease pressure on these sectors and mark a notable softening in the Trump administration’s trade stance.

Asia-Pacific & World News

PBOC Reaffirms Loose Policy to Support Growth

China’s central bank reiterated its pledge to maintain an “appropriately loose” monetary stance, saying liquidity will remain ample amid global uncertainty and domestic challenges.

In its Q3 monetary policy report, the PBOC said it will support consumption, technology investment, and employment while keeping prices stable and the yuan flexible.

The statement aligns with Beijing’s ongoing effort to prop up growth amid weak demand, even as sentiment improves and trade tensions ease.

Tesla’s China Sales Plunge 36%, Lowest in Three Years

Tesla’s China sales dropped 35.8% in October to 26,006 vehicles — the weakest since 2022 — as competition from domestic EV makers intensified.

Exports from its Shanghai plant rose to 35,491 units, a two-year high, partially offsetting domestic softness. Tesla’s market share slid to 3.2% from 8.7% in September.

Xiaomi sold roughly 49,000 units of its new EVs in the same month. The broader market slowed amid fading subsidies and cautious consumers.

China Plans Rare Earth Export Controls Targeting U.S. Military Links

Beijing is developing a new export system that would fast-track rare earth shipments for approved buyers but block firms tied to the U.S. military, the Wall Street Journal reported.

Dubbed the “validated end-user” system, the plan would make it harder for dual-use firms in aerospace and defense to access Chinese rare earth magnets — key materials for jets, submarines, and drones.

The system could evolve before implementation, but the move appears aimed at restricting U.S. defense access while maintaining trade with civilian industries.

Nomura: China’s Reforms Unlikely to Lift Economy as Demand Weakens

Nomura says China’s efforts to curb “involution” — excessive workplace competition — won’t be enough to restore growth, citing ongoing demand weakness and fragile inflation.

October’s CPI rose 0.2% year-on-year after a 0.3% decline in September, slightly above forecasts. Producer prices fell 2.1%, narrowing from -2.3%. Nomura said food and gold prices supported the CPI uptick, while metals helped PPI, but durable goods stayed weak.

The bank kept its 2025 outlook unchanged, expecting flat CPI and a -2.5% PPI, warning that policy reforms alone cannot offset sluggish spending or structural headwinds.

PBOC sets USD/ CNY central rate at 7.0866 (vs. estimate at 7.1204)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injects 403.8bn yuan at 1.40% via 7-day reverse repos

Australian Business Confidence Dips, Conditions Improve

Australia’s NAB Business Confidence Index edged down to 6 in October from 7, while business conditions rose to 9, their best since March 2024.

Sales jumped five points to +19, profitability rose to +9, and employment held steady at +3. Cost pressures eased, with input costs up just 1% and labor costs 1.5%. Capacity utilization climbed to 83.4%.

NAB’s Sally Auld said momentum from late 2024 has persisted, though capacity strain and wage pressures weigh on sentiment. The results reinforce expectations that the RBA will keep rates steady at 3.6% for now.

Australia’s Consumer Confidence Jumps to 103.8, First Optimism Since 2022

Australia’s Westpac-Melbourne Institute Consumer Confidence Index surged 12.8% in November to 103.8, signaling net optimism for the first time in nearly four years.

The survey recorded a seven-year high outside the pandemic period, with sharp gains across all sub-indices:

- Family finances outlook up 12.3% to 109.1

- 12-month economic outlook up 16.6%

- Five-year outlook up 15.3%

- “Good time to buy major items” up 15% to 111.6

Westpac called the rise “extraordinary,” suggesting that easing rate expectations and resilient employment have boosted sentiment.

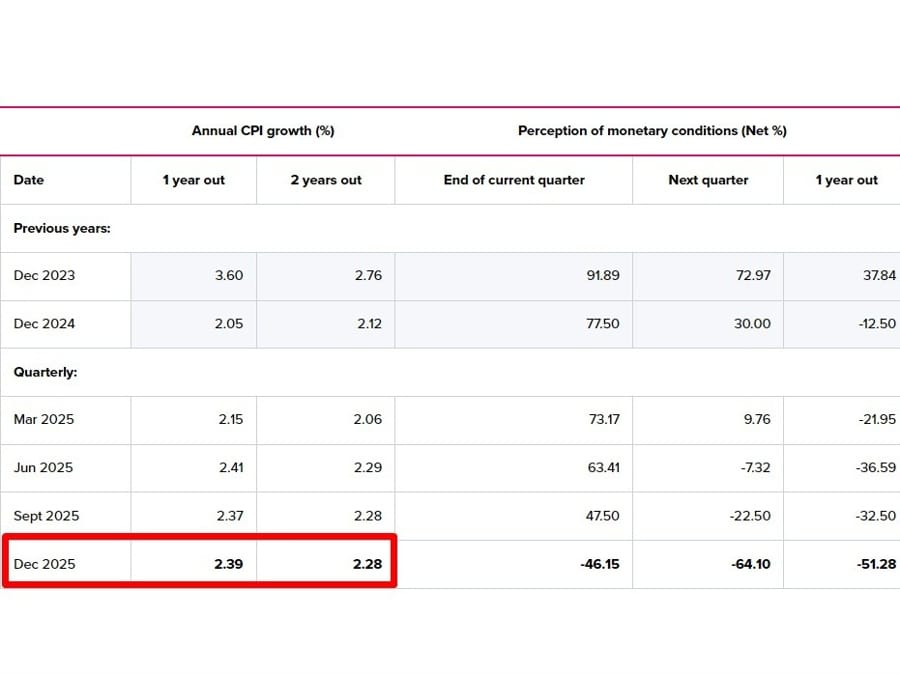

RBNZ Inflation Expectations Steady, No Policy Shift Expected

New Zealand’s one-year inflation expectations rose slightly to 2.39% from 2.37%, while the two-year gauge held at 2.28%, the Reserve Bank of New Zealand said.

Both remain within the central bank’s 1–3% target range. The data are unlikely to affect the RBNZ’s easing trajectory aimed at supporting growth.

Japan’s Kiuchi Says Weak Yen Lifting Prices, Hurting Households

Japan’s Economy Minister Yoshitaka Kiuchi said the weak yen is pushing up import costs and consumer prices, eroding household purchasing power.

He said Tokyo will expand targeted support for lower-income families and energy users while pursuing wage growth that outpaces inflation to sustain real income gains and consumption.

South Korea’s Early-November Trade Shows Modest Deficit

South Korea’s exports rose 6.4% year-on-year in the first 10 days of November, while imports climbed 8.2%, customs data showed Monday.

The trade balance posted a $1.22 billion deficit for the period, as import growth slightly outpaced exports. The figures indicate continued external demand momentum despite a minor short-term imbalance.

Crypto Market Pulse

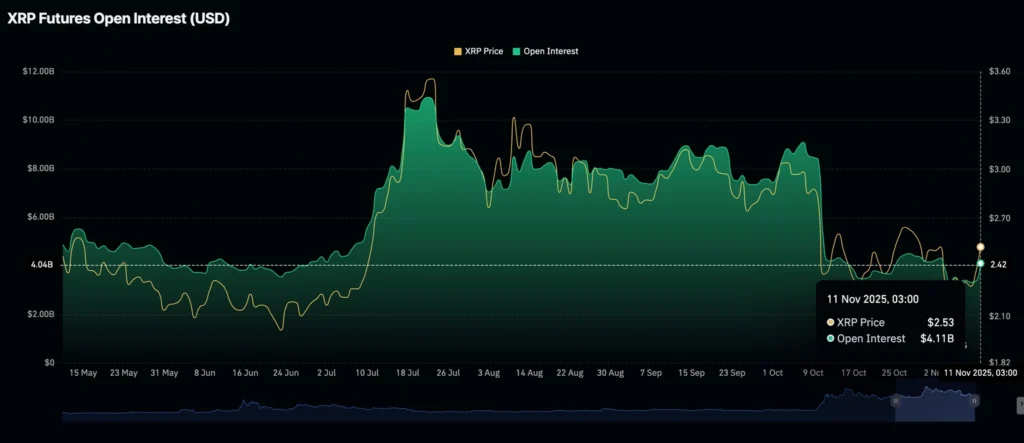

XRP Recovery Slows Amid Rising Derivatives Activity

XRP pulled back to $2.43 on Tuesday after two days of gains, retreating from an intraday high of $2.57 — where the token tested the confluence of the 50-day and 200-day EMAs.

The pullback aligns with the broader market’s profit-taking mood as traders respond to ongoing macroeconomic uncertainty and lack of strong sector catalysts.

Derivatives Market Rebounds Despite Price Consolidation

XRP’s derivatives market shows renewed retail activity. Open Interest (OI) climbed to $4.11 billion on Tuesday from $3.36 billion the previous day — a sharp increase coinciding with the rally to $2.58.

The trading volume also rose to $10.58 billion, indicating fresh capital inflows and elevated participation.

While OI and volume expansion support short-term bullish sentiment, price confirmation remains key. The MACD continues to flash a buy signal, suggesting the potential for another push toward the $3.00 resistance level if momentum holds.

BNB Risks Over 15% Correction as On-Chain and Retail Demand Plunge

BNB extended its decline below $1,000 on Tuesday as bulls failed to reclaim a key resistance trendline. Both derivatives and on-chain metrics indicate waning interest, with futures Open Interest and network activity trending lower.

The technical setup remains bearish, reinforcing the late-October breakdown from a bearish flag formation.

On-Chain and Derivatives Data Confirm Weakness

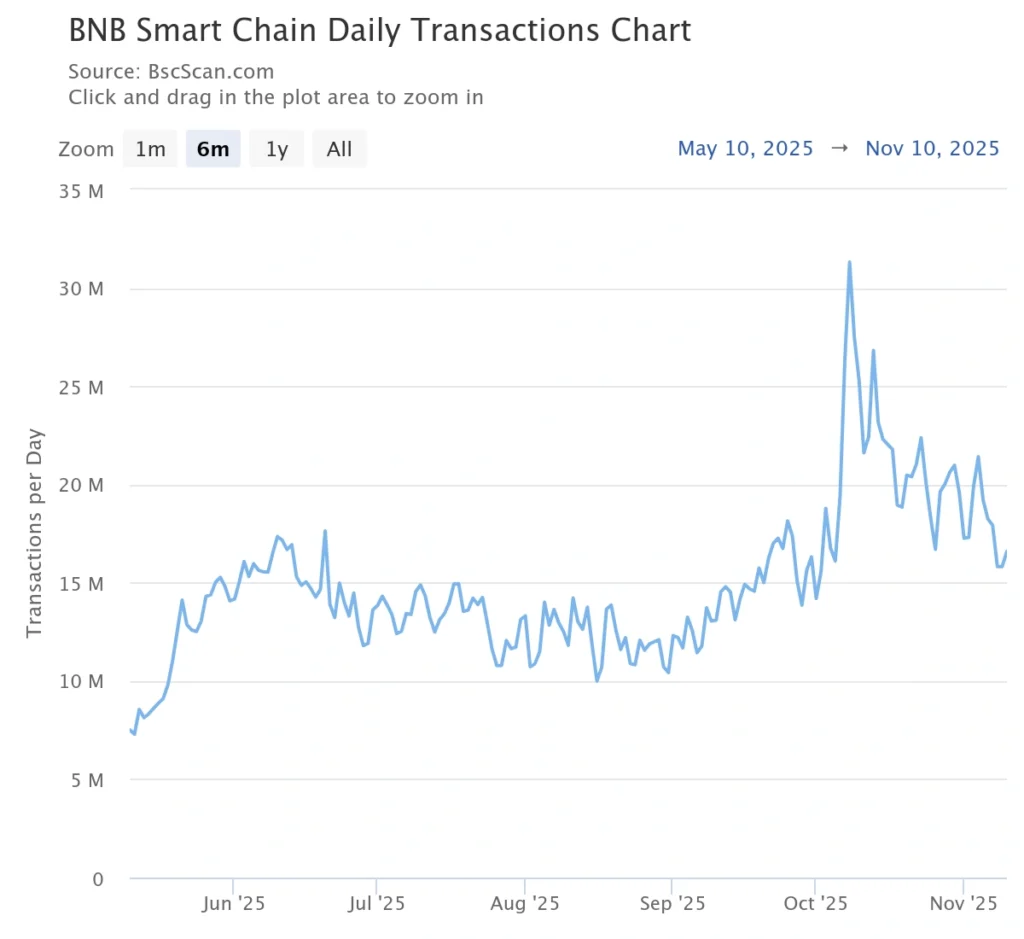

BNB Chain is seeing reduced user activity. BscScan data show daily transactions fell to 16.59 million on Monday, down from 31.30 million on October 8 — a clear indication of slowing network usage.

CoinGlass data reveal a 2.39% decline in BNB futures Open Interest over the past 24 hours to $1.41 billion, reflecting traders’ growing risk aversion.

Adding to the bearish pressure, the OI-weighted funding rate flipped negative at -0.0100%, compared with 0.0051% earlier in the day. This suggests sellers are paying a premium to maintain short exposure — a strong indication of sell-side dominance.

Unless BNB reclaims the $1,000 psychological level soon, the token risks a deeper 15% pullback, potentially toward the $850 area.

Solana (SOL): Falling Wedge Pattern Hints at 22% Upside Breakout

Solana (SOL) slipped to around $164 on Tuesday as broad market weakness continued to dampen enthusiasm. Despite the short-term cooling, the daily chart shows a falling wedge pattern, typically a bullish formation, projecting a potential 22% breakout toward $200 if confirmed.

Muted Derivatives Market Signals Limited Speculative Momentum

Solana’s derivatives activity remains subdued since the October 10 deleveraging event, which triggered more than $19 billion in liquidations.

CoinGlass data show that SOL futures Open Interest sits at $7.72 billion, down from $10 billion on November 1 and $14.83 billion on October 1.

This decline signals a lack of speculative buildup, as traders stay on the sidelines amid a broader shift toward capital preservation.

A sustained recovery in Open Interest would be needed to validate a bullish reversal. Until then, SOL’s recovery potential appears limited despite the encouraging wedge setup.

Crypto Today: Bitcoin, Ethereum, XRP Recovery Stalls Amid Weak Institutional and Retail Demand

Bitcoin trades above $105,000 but faces overhead pressure as low ETF inflows and weak retail participation weigh on sentiment. Ethereum remains below its 200-day EMA as traders build short exposure, while XRP’s derivatives market gains traction with Open Interest surpassing $4 billion.

Bitcoin, Ethereum, and XRP Struggle for Direction

Bitcoin (BTC) hovers above $105,000 after giving back a portion of Monday’s gains. Ethereum (ETH) and Ripple (XRP) are also cooling off, as investors appear to be taking profits amid a broader risk-off tone.

Both institutional and retail demand remain subdued, suggesting skepticism that the market has truly turned bullish. Technical indicators lean bearish, reinforcing caution in the short term.

Institutional and Retail Demand Stay Muted

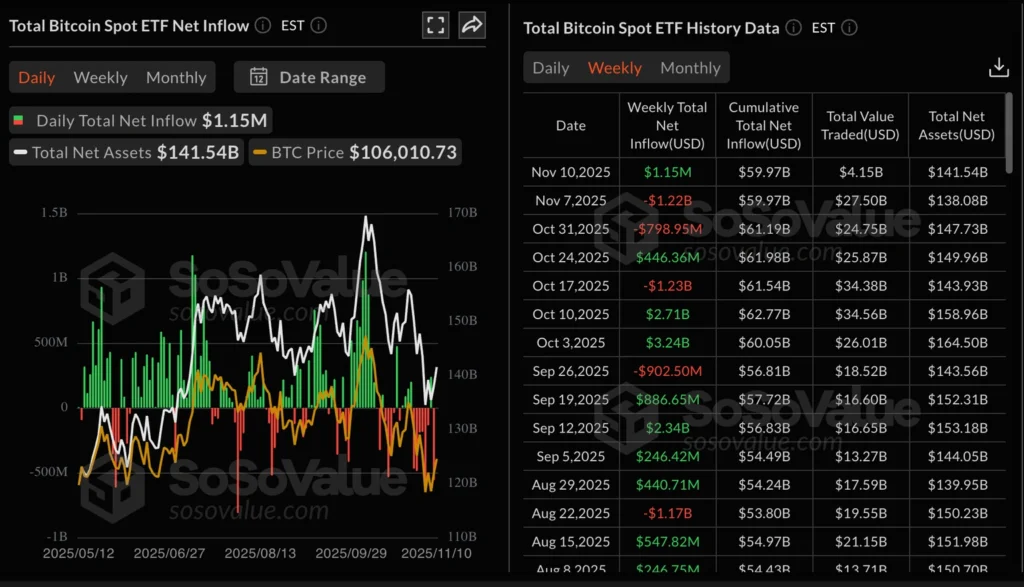

Institutional appetite for Bitcoin has weakened over the past two weeks as macroeconomic uncertainty deepens, driven by the prolonged US government shutdown. Persistent outflows from Bitcoin spot ETFs underscore this trend.

According to SoSo Value, ETF inflows stood at $1.15 million on Monday. In contrast, the previous two weeks saw outflows of $1.22 billion and $799 million. Total net inflows stand at $59.97 billion, with net assets at $141.54 billion as of November 10.

Retail participation also remains sluggish following the October 10 deleveraging event, which wiped out more than $19 billion in crypto assets in a single day. Bitcoin futures Open Interest has slipped to $68.37 billion, down from $71 billion on November 1 and a peak of $94.12 billion in October.

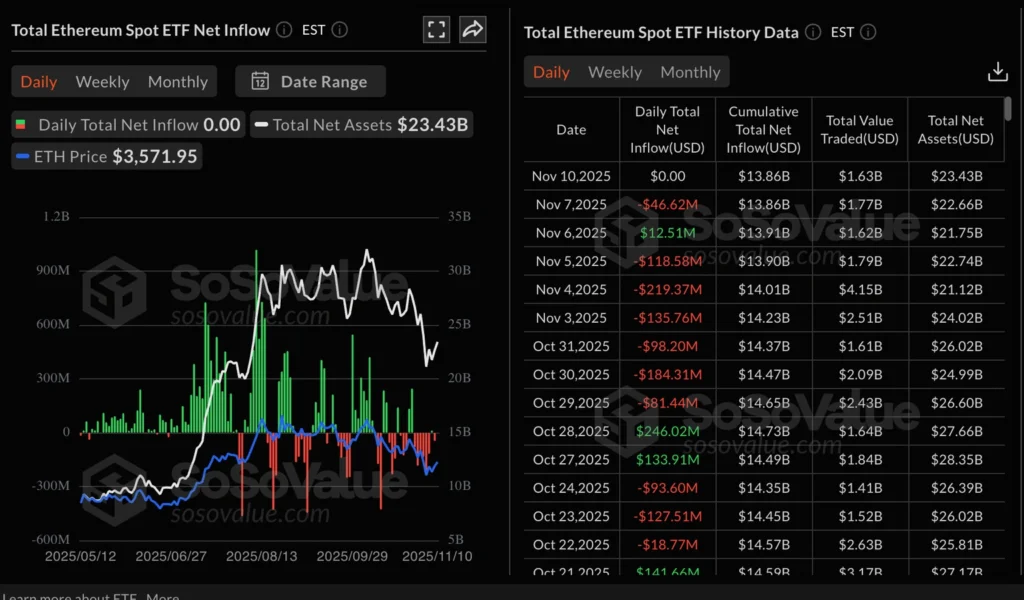

Ethereum ETFs recorded zero net flows on Monday, with cumulative net inflows at $13.86 billion and net assets at $23.43 billion.

Short positioning continues to build. The OI-weighted funding rate dropped sharply to 0.0007% on Tuesday from 0.0067% the previous day, signaling growing bearish conviction.

Senate Bill Seeks to Move Crypto Oversight from SEC to CFTC

A bipartisan Senate proposal would hand primary crypto regulation to the Commodity Futures Trading Commission, shifting authority from the SEC — a change long sought by the industry.

Introduced by Senators John Boozman and Cory Booker, the draft would classify most tokens as digital commodities, require registration for certain firms, and impose transaction fees.

The Trump administration supports the move, though some Democrats question the CFTC’s limited resources. The bill must pass multiple committees and win at least seven Democratic votes to overcome a filibuster.

MicroStrategy Expands Bitcoin Holdings to $68 Billion

MicroStrategy added 487 BTC last week for $49.9 million, lifting total holdings to 641,692 BTC valued above $68 billion.

The purchases, funded through at-the-market stock sales under tickers STRF, STRC, STRK, and STRD, keep the Virginia-based firm’s accumulation pace steady. Its average purchase price sits near $74,100 per coin versus bitcoin’s current $105,700.

MicroStrategy remains the largest corporate bitcoin holder, effectively operating as a public bitcoin vehicle. The company continues to fund acquisitions via equity issuance rather than debt, avoiding leverage while maintaining steady buying momentum.

The Day’s Takeaway

Rotation Drives Divergence Across US Equity Markets

Wall Street closed mixed on Tuesday, defined by a decisive rotation from growth to value. The Dow Jones Industrial Average outperformed as investors shifted into defensive and dividend-heavy names, while the Nasdaq lagged under renewed pressure in the semiconductor sector. The S&P 500 finished modestly higher, balancing strength in consumer staples and healthcare against weakness in tech.

Dow Leaders:

Merck & Co. (+4.84%), Amgen (+4.57%), Nike (+3.87%), Johnson & Johnson (+2.88%), and McDonald’s (+2.61%) topped the list as money flowed toward stable cash generators.

Tech Under Pressure:

Chip stocks fell after SoftBank disclosed it had fully exited its Nvidia stake to increase exposure to OpenAI. Nvidia declined 2.96%, AMD 2.65%, Micron 4.81%, and Broadcom 1.79%. Additional underperformers included Nebius NV (−7.07%), Lam Research (−4.29%), and Super Micro Computer (−3.40%), as AI-linked equities extended their retreat.

The pattern underscored a broad rotation theme — defensive strength amid cyclical fatigue and waning enthusiasm for high-valuation growth.

Macro Watch: Gold Steady, Oil Rebounds, Europe Firm

Gold:

Bullion hovered around $4,110 after reaching a three-week high of $4,148. Investors stayed cautious ahead of the House vote on the Senate-approved US funding bill, which would avert a shutdown through January 30. The 60–40 Senate passage and signs of bipartisan support helped temper volatility.

ADP data showing persistent private-sector job losses fueled bets for a December Fed rate cut — now priced at 67% odds — though Chair Jerome Powell maintained a cautious tone. Gold’s upside remains capped by near-term profit-taking above $4,140.

Crude Oil:

WTI settled at $61.04 per barrel, up $0.91 (1.51%), after recovering from session lows near $59.66. Technical support at $59.58–$60.17 held firm, triggering a rebound above both the 100- and 200-hour moving averages. Traders now watch the $61.45–$61.94 resistance zone for continuation signals.

Europe:

Major European indices closed higher, buoyed by easing global risk concerns. Spain’s Ibex (+1.27%) and the UK’s FTSE 100 (+1.15%) both hit record highs, while Italy’s FTSE MIB (+1.24%) marked its strongest close since 2000. France’s CAC 40 rose 1.25%, and Germany’s DAX added 0.57%. Broad gains reflected renewed stability in sovereign bond markets and optimism over US fiscal developments.

Crypto Roundup: Momentum Fades Across Majors

Bitcoin, Ethereum, XRP:

Bitcoin traded just above $105,000 but failed to extend its recovery as weak ETF inflows and fading retail demand capped upside. Spot Bitcoin ETF inflows totaled only $1.15 million Monday, while cumulative net assets stood at $141.54 billion. The short-term tone remains cautious, with the OI-weighted funding rate falling to 0.0007% — a sign of rising bearish bets.

Ethereum stayed below its 200-day EMA amid heavy short positioning and zero ETF inflows, while XRP’s derivatives market saw a sharp OI rebound to $4.11 billion, suggesting speculative interest even as spot prices retreated to $2.43.

BNB:

BNB extended losses below $1,000, with on-chain data confirming reduced network activity. Daily BNB Chain transactions fell to 16.59 million from 31.30 million a month earlier. Open Interest declined to $1.41 billion, and the funding rate turned negative (−0.0100%), underscoring sell-side dominance. The token risks a deeper 15% pullback unless it reclaims $1,000 soon.

Solana:

SOL hovered near $164, consolidating after recent strength. The daily chart forms a falling wedge pattern projecting a potential 22% upside breakout to $200, but muted derivatives activity — OI at $7.72 billion, down sharply from October — signals limited speculative momentum.

The Bottom Line

Global markets are rotating rather than rallying. Investors are pivoting to defensive equity plays, trimming exposure to growth and crypto assets amid policy uncertainty and subdued liquidity.

Gold’s stability and oil’s rebound reflect controlled risk appetite, but conviction remains low. Until institutional inflows return and macro clarity improves, market direction across both traditional and digital assets will likely remain range-bound and selective rather than broad-based.