North America News

U.S. Stocks Sink as Trump Tariff Threat Reignites Trade War Fears

New York — U.S. equities tumbled Friday after President Donald Trump reignited trade tensions with China, announcing potential new tariffs in response to Beijing’s rare earth export controls.

Markets had been trading higher through the morning until 10:30 a.m. ET, when Trump’s post hit social media, triggering a sharp and sustained selloff. Investors rushed to take profits after months of strong gains, unwilling to risk further exposure amid renewed uncertainty.

The Nasdaq Composite led losses, plunging 3.5%, while the S&P 500 fell 2.7%, the Dow Jones Industrial Average lost 1.9%, and the Russell 2000 dropped 2.6%. All four major indices finished at session lows, signaling strong downside momentum into the close.

Weekly performance:

- Nasdaq: −2.4%

- S&P 500: −2.5%

- Dow: −2.7%

- Russell 2000: −2.9%

Notable decliners:

- Tesla (TSLA) −5.0%

- Baidu ADR (BIDU) −8.0%

- Qualcomm (QCOM) −7.3%

- Amazon (AMZN) −4.95%

- Meta Platforms (META) −3.9%

- Occidental Petroleum (OXY) −5.1%

- FedEx (FDX) −5.0%

- AMD (AMD) −7.8%

- Nvidia (NVDA) −4.7%

The risk-off move extended to bonds and commodities. Treasury yields fell sharply, while WTI crude dropped below $59 per barrel in a worsening energy selloff.

Traders now price in 109 basis points of rate cuts over the next year, up from 100 bps at the start of the week, reflecting expectations that renewed trade uncertainty could pressure growth and prompt a more aggressive Federal Reserve response.

U.S. Consumer Sentiment Edges Up to 55.0 in October

Ann Arbor — The University of Michigan’s consumer sentiment index rose slightly to 55.0 in October from 55.1 previously, roughly matching expectations.

- Current conditions: 61.0 (vs. 60.4 prior)

- Expectations: 51.2 (vs. 51.7 prior)

- 1-year inflation outlook: 4.6% (vs. 4.7%)

- 5-year inflation: 3.7% (unchanged)

The data suggest steady but subdued sentiment as households balance persistent inflation with cautious optimism over incomes and jobs.

From survey director Joanne Hsu:

“Improvements this month in current personal finances and year-ahead business conditions were offset by declines in expectations for future personal finances as well as current buying conditions for durables. Overall, consumers perceive very few changes in the outlook for the economy from last month. Pocketbook issues like high prices and weakening job prospects remain at the forefront of consumers’ minds. At this time, consumers do not expect meaningful improvement in these factors. Meanwhile, interviews reveal little evidence that the ongoing federal government shutdown has moved consumers’ views of the economy thus far.”

BLS Confirms October 24 CPI Release Despite Shutdown

Washington — The Bureau of Labor Statistics said it will release September CPI data on Friday, October 24 at 8:30 AM ET, even as most federal agencies remain closed due to the government shutdown.

No other economic reports will be published until normal operations resume. The CPI release will provide the only major inflation gauge available to markets in the near term.

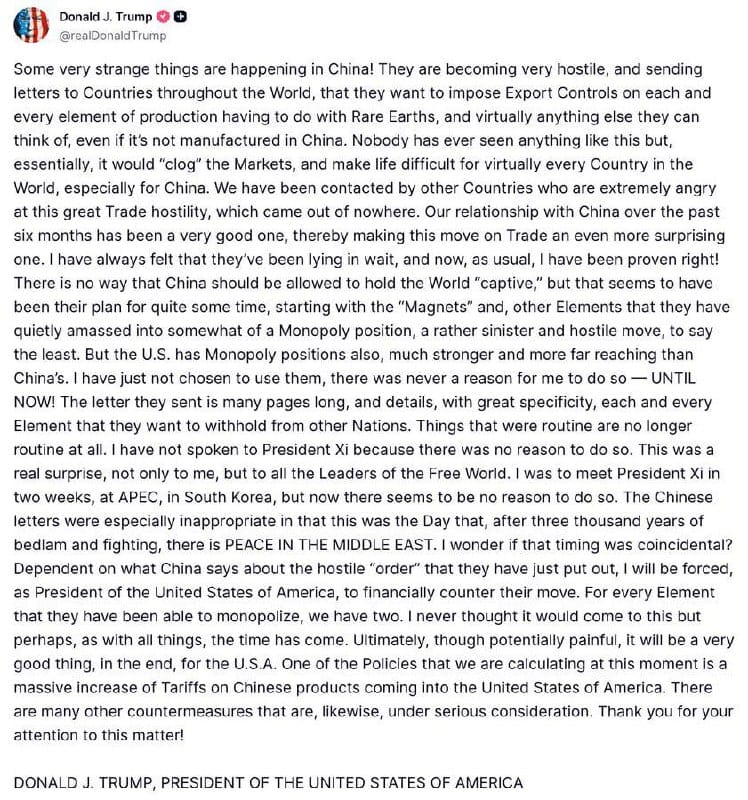

Trump Vows Higher Tariffs on China After Rare Earth Move

Washington — Former President Donald Trump said the U.S. will raise tariffs on Chinese imports after Beijing announced export controls on rare earth elements.

In a Truth Social post, Trump accused China of attempting to “monopolize global supply chains” and described the move as “hostile.”

The U.S. canceled a planned meeting between Trump and President Xi Jinping at APEC in South Korea. Officials said additional “financial countermeasures” were under review.

Trump described the response as “painful but necessary,” framing it as a long-term benefit for the U.S. economy.

Fed’s Waller: “Interview for Chair Was All Economics”

Washington — Federal Reserve Governor Christopher Waller said his interview for the Fed Chair role focused purely on economic issues, not politics.

“There was nothing political about the interview — it was all serious economics,” Waller told reporters.

He said labor market data across sources point to weakness, noting that ADP and BLS figures are consistent with negative jobs growth. CPI data, he added, would be critical for the next policy decision.

Waller reiterated that the Fed must continue cutting rates “cautiously,” moving in quarter-point steps, and dismissed tariff-related inflation as a “one-time change.”

“The labor market is not tight in any way,” he said, emphasizing that monetary policy adjustments would remain gradual.

Fed’s Musalem: Inflation and Jobs Goals in “Tension”

St. Louis — St. Louis Fed President Alberto Musalem said the Federal Reserve’s dual mandate is under strain as high inflation and a softening labor market pull policy in opposite directions.

“Inflation is still materially above target while the labor market is showing signs of weakness — the Fed’s goals are in tension,” Musalem said Friday.

He warned that a balanced policy stance “only works if inflation expectations remain anchored.” Short-term expectations, he noted, remain “a little elevated,” while long-term expectations are stable.

Musalem said only about 10% of current inflation stems from tariffs, with the effect expected to fade by mid-2026.

He described monetary policy as between modestly restrictive and neutral, adding that financial conditions remain accommodative. Musalem supported the September rate cut as “insurance” against a labor market downturn but cautioned that the Fed has limited room to ease further without overstimulating demand.

“Policy should continue to lean against inflation,” he said, forecasting healthy Q4 GDP growth and noting that spending remains steady, though low-income and Hispanic households are showing strain.

The St. Louis Fed will conduct a labor market survey this month to assess conditions.

U.S. Layoffs Begin Amid Shutdown, OMB Director Confirms

Washington — U.S. Office of Management and Budget Director Russ Vought said Friday that layoffs across federal agencies have begun, citing the ongoing government shutdown.

Vought described the cuts as “firings,” emphasizing that the process had officially started. He did not specify how many workers were affected or which agencies were most impacted.

The comments come as the shutdown enters its second week, disrupting government services and delaying several key data releases.

JP Morgan’s Dimon Warns of Possible Market Correction

JP Morgan Chase CEO Jamie Dimon warned that U.S. stocks could face a significant correction within two years, citing excessive optimism over AI, mounting fiscal risks, and geopolitical uncertainty.

Speaking to the BBC, Dimon said investors appear complacent. “I’m far more worried than others,” he said, adding that AI enthusiasm resembles the dot-com era.

He expects many AI investments to “probably be lost” despite long-term potential and urged caution over inflation and U.S. fiscal policy.

Dimon described the U.S. as “a little less reliable” internationally, pointing to rearmament and defense readiness as priorities.

He also signaled progress in talks to ease U.S. tariffs on India, saying administration officials aim to deepen ties and roll back restrictions tied to Russian oil trade.

Citigroup Expects Softer U.S. CPI, Disinflation Trend Intact

Citigroup expects the U.S. core Consumer Price Index to rise 0.28% in September, down from 0.35% in August, signaling continued easing in inflation pressures.

The bank said weaker housing inflation should offset tariff-related goods price increases, while softer labor and property markets reduce the risk of persistent inflation.

Even if official releases are delayed by the government shutdown, Citigroup said underlying disinflation remains clear and should allow the Fed more room to cut rates later this year.

Fed’s Daly Says Inflation “Much Lower Than Feared,” Urges Balance

San Francisco Fed President Mary Daly said U.S. inflation has eased far more than expected and warned that further labor-market softening could become a concern if policy remains too tight.

Speaking after the Fed’s September rate cut, Daly said monetary policy is still “modestly restrictive” and that additional cuts remain part of a cautious risk-management approach.

She also cautioned against taking extreme positions on artificial intelligence, saying both excessive pessimism and over-optimism risk missing reality. “AI could be transformational,” Daly said, “but we shouldn’t jump to conclusions.”

She added that the slowing economy is accelerating AI adoption, which could translate into faster productivity growth over time.

U.S. BLS Recalls Staff to Complete CPI Report Despite Shutdown

The U.S. Bureau of Labor Statistics is recalling a small number of employees to finish work on the September Consumer Price Index, ensuring key inflation data are released despite the government shutdown, the New York Times reported.

Although the CPI was initially due on October 15, the BLS is prioritizing completion to meet deadlines for the Social Security cost-of-living adjustment, which depends on third-quarter inflation figures.

Former BLS commissioner Erica Groshen said data collection was completed before the October 1 shutdown, allowing analysts to focus on processing and publication.

Economists said the move reduces uncertainty for the Federal Reserve and markets ahead of the October 28–29 policy meeting, when the CPI will be a key input.

The government’s decision to “un-pause” CPI work underscores efforts to maintain critical economic continuity even as other major releases, including the September jobs report, remain delayed.

Canada Adds 60,400 Jobs in September, Beating Expectations

Ottawa — Canada’s labor market rebounded strongly in September, adding 60,400 jobs compared to forecasts of +5,000, according to Statistics Canada.

The unemployment rate held at 7.1%, slightly better than expected, while participation rose to 65.2%.

- Full-time employment: +106,100

- Part-time employment: −45,600

- Wages for permanent employees: +3.6% YoY (unchanged)

The data mark a sharp recovery from August’s 65,500-job decline, suggesting continued resilience despite elevated joblessness.

Commodities News

Gold Technical View: Profit Taking Tests Bullish Momentum

Gold prices fell on Thursday as traders locked in profits following a steep rally. The move was not driven by new fundamentals but reflected exhaustion after record highs.

Fundamentals: The market remains driven by momentum and expectations of a dovish Fed. A delayed CPI report due to the U.S. government shutdown could still pose a short-term risk, as hotter data might trigger a hawkish repricing.

Daily Chart: Gold remains in an extended uptrend despite Thursday’s pullback. Momentum support sits near $3,819, while the primary trendline continues to guide buyers higher.

4-Hour Chart: Buyers are expected to defend the ascending trendline. A clean break lower could extend the correction toward $3,819.

1-Hour Chart: Resistance stands around $4,000, where sellers may look to fade strength. A breakout above that level could reinvigorate bullish momentum toward new highs.

U.S. Rig Count Falls by Two; Canada Adds Three — Baker Hughes

Houston — The U.S. rig count declined for a second straight week, falling by two rigs to 547, while Canada added three rigs to 193, according to data from Baker Hughes.

In the U.S., oil rigs fell by four to 418, while gas rigs rose by two to 120 and miscellaneous rigs were unchanged at nine. The total count is 39 rigs below the same period last year, with oil rigs down 63, gas rigs up 19, and miscellaneous rigs up five.

The U.S. offshore rig count held steady at 15, down three year-on-year.

In Canada, oil rigs were unchanged at 129, while gas rigs rose by three to 63 and miscellaneous rigs remained at one. The Canadian count is 26 rigs lower than a year ago, reflecting a drop of 25 oil rigs and two gas rigs, offset by one additional miscellaneous unit.

U.S. Gas Inventories Rise 80 Bcf, Prices Fall to $3.24

Houston — U.S. natural gas inventories rose by 80 billion cubic feet last week, above expectations of +77 Bcf, according to EIA data cited by ING.

Total storage now stands at 3.64 trillion cubic feet, 4.5% above the five-year average.

Henry Hub futures fell for a third straight session to $3.24/MMBtu, the lowest in over a week.

In Europe, ARA refined product stocks rose slightly to 5.98 million tons, while Singapore inventories fell by 2.5 million barrels, led by sharp declines in light distillates and residuals.

WTI Crude Extends Slide, Tests $60 Support

New York — U.S. crude futures fell sharply Friday, with WTI down $1.22 to $60.28, its lowest since June, as oversupply fears intensified.

The drop threatens a break below key support at $60.00, a level traders view as critical for near-term stability.

Despite OPEC+ raising November output by only 137,000 bpd, inventories remain heavy. Tanker data point to large volumes of crude at sea with limited storage options.

Goldman Sachs now projects a 2.0 million bpd surplus from Q4 2025 through 2026 and sees WTI averaging $52 next year, warning that sustained weakness could force U.S. shale cutbacks.

Technically, a move below $59.74 would expose $55.12, the June low.

Silver Hits New Record Highs Amid Supply Strain — ING

London — Silver prices extended gains to fresh record highs Thursday, fueled by safe-haven demand and tightening physical supply, ING said.

ETF holdings climbed for a third session to 822.6 million oz, while total inflows reached 621.7koz.

The Silver Institute projects a fifth consecutive annual deficit, while tariffs and logistical shifts have tightened availability in the London market.

Silver is up 73% year-to-date, making it one of 2025’s best-performing assets.

Commerzbank: Copper Tightens as Nickel Faces Oversupply

Frankfurt — Global base metals markets continue to diverge, with Copper supported by tightening supply and Nickel under pressure from a widening surplus, Commerzbank said Friday.

The International Nickel Study Group (INSG) projects 8% output growth this year and 7% next year, outpacing demand growth of 5–6%, keeping the market oversupplied.

In contrast, the International Copper Study Group (ICSG) now expects a 2025 deficit of 150,000 tons, reversing earlier surplus estimates, as production growth slows to just 1%.

Commerzbank said the Copper market’s rapid shift “underscores how quickly disruptions can alter fundamentals,” particularly given Indonesia’s dominance in Nickel production.

Gold ETFs Log Heavy Inflows, Driven by U.S. Demand

Frankfurt — Gold ETF holdings surged in September, led by strong North American buying, according to Commerzbank’s Barbara Lambrecht.

Global inflows topped 145 tons, the 11th strongest month since ETFs were launched in 2004. The U.S. accounted for roughly 90 tons, over 60% of the total.

Total holdings stood near 3,840 tons at month-end — just 70 tons below the 2020 record. In dollar terms, assets are now nearly double their 2020 peak, boosted by record spot prices and a weaker U.S. dollar.

LME Copper Breaks Out, Targets 2024 Highs — Société Générale

London — LME Copper surged past resistance, confirming a bullish breakout toward its 2024 peak near $11,100, Société Générale analysts said Friday.

Prices are holding above $10,590, the new support zone. Sustained strength could open the way to $11,470 and $11,920.

Momentum indicators remain positive, showing “no clear signs of reversal,” the bank said, adding that only a break below $10,590 would threaten the uptrend.

EIA: Global Oil Oversupply Set to Widen Into 2026

Washington — The U.S. Energy Information Administration (EIA) warned Friday that global oil oversupply is likely to persist through Q1 2026, according to Commerzbank analysis.

Despite capacity constraints, Russia’s output rose 200,000 bpd in September to 9.4 million bpd, still below its quota.

U.S. production hit a record 13.6 million bpd in July, and forecasts have been revised up to an annual average of 13.5 million bpd in 2026.

Commerzbank said the EIA’s projections confirm that “the market remains significantly oversupplied,” reinforcing downward pressure on prices.

Copper Jumps Nearly 2% as Mine Disruptions Deepen — ING

London — Copper prices rose nearly 2% Thursday, briefly touching $11,000/t, as supply disruptions at major mines tightened the market, ING reported.

Chile’s Codelco posted its weakest output in 21 years — just 93.4kt in August, down 25% YoY — following a deadly collapse at its El Teniente mine.

Output from Tech Resources, Freeport-McMoRan, and Hudbay Minerals also declined, prompting downward revisions to 2025 production.

With expectations of Fed rate cuts later this year, ING said sentiment toward industrial metals remains “constructively bullish.”

U.S. Treasury’s Bessent Sees India Cutting Russian Oil Purchases

U.S. Treasury Secretary Bessent said he expects India to start reducing imports of Russian oil “over the next few weeks and months” in favor of U.S. supplies.

Speaking to reporters, Bessent said Argentina’s president will visit the White House next Tuesday, emphasizing that any assistance extended to Buenos Aires is “not a bailout” and that the U.S. Exchange Stabilization Fund will not incur losses.

He described Argentina’s peso as undervalued and praised its openness to U.S. investment in mining and minerals.

Bessent also said China is expected to resume soybean purchases later in the season and that an announcement of farmer support would have already been made if not for the shutdown.

Saudi Oil Exports to China Fall as Refiners Seek Cheaper Cargoes

Saudi Arabia’s crude exports to China are set to drop to about 40 million barrels in November from around 51 million in October as refiners pivot to lower-priced spot barrels from other Middle East producers, according to traders cited by Reuters.

The pullback follows a surge in Saudi shipments last month and reflects greater price sensitivity among Chinese refiners amid stable refining margins and broad regional supply.

Sources said the shift likely won’t disrupt long-term Saudi–China energy ties but highlights how buyers are optimizing costs as price spreads widen.

The reduced flows may pressure official selling prices in the region and boost demand for alternative grades. Traders said the trend underscores China’s leverage in global crude markets as it continues to diversify sourcing strategies.

ANZ Projects Oil to Hold at $60–$65 Until Mid-2026, May Climb to $70

ANZ expects global crude prices to trade between $60 and $65 a barrel through the first half of 2026, before potentially rebounding to around $70 by year-end if demand improves or OPEC intervenes.

The bank said the market has entered a phase of relative balance, with supply surpluses largely priced in and traders adjusting to slower demand growth and stable output.

“Near-term oversupply is rarely a surprise,” ANZ noted, adding that this limits downside risk.

While the outlook is more muted than earlier forecasts, the bank said producers’ willingness to manage output will likely prevent deeper declines and provide a foundation for gradual recovery.

Europe News

European Stocks Close Lower, Led by Italy’s FTSE MIB

London — Major European markets ended lower Friday, led by Italy’s FTSE MIB with a 1.74% decline, as investors reduced risk ahead of U.S. inflation data.

| Index | Close | Change | % |

|---|---|---|---|

| Euro Stoxx 50 | 5,537.50 | −88.10 | (−1.57%) |

| DAX 40 | 24,241.47 | −369.79 | (−1.50%) |

| CAC 40 | 7,918.01 | −123.35 | (−1.53%) |

| FTSE 100 | 9,427.46 | −81.93 | (−0.86%) |

| IBEX 35 | 15,476.49 | −108.32 | (−0.70%) |

| FTSE MIB | 42,047.49 | −744.11 | (−1.74%) |

For the week, the Euro Stoxx 50 fell 2.1%, while Italy’s MIB dropped 2.8%, marking its worst week since June.

ECB’s Villeroy says that French economy is holding up

- Villeroy is speaking more in his capacity as Bank of France governor here

- Confirms France GDP growth forecast of 0.7% for 2025

- French sentiment is not very good because of political situation, economic wise remains fine

- Political uncertainty could affect up to 0.5% GDP growth

- France must keep 2029 deficit goal of 3% of GDP

- For next year, deficit should be within 4.8% of GDP

ECB’s Kazaks: ECB rate at 2% is appropriate

- Comments from the ECB policymaker, Martins Kazaks

- We have delivered on the inflation target

- We are about neutral on ECB rates

- Not seeing anything extraordinary in French situation

Asia-Pacific & World News

China’s New Export Curbs Expand Beyond Chips, Threaten U.S. Supply Chains

China has imposed sweeping export controls that now cover not only semiconductors but also rare earths and industrial equipment, tightening its grip on key global supply chains.

Analysts said the move escalates the technology confrontation with Washington and could disrupt U.S. chip and AI production.

Policy analyst Dean W. Ball said Beijing now wields “de facto control” over the global semiconductor chain and that strict enforcement could temporarily halt the U.S. AI boom.

Bill Bishop described the measures as Beijing “calling Washington’s bluff” ahead of the APEC summit, warning that retaliation could quickly spiral.

Both analysts said the step marks a sharp escalation in the trade conflict and will accelerate diversification away from China’s dominance in critical materials.

Trump Administration Plans to Bar Chinese Airlines from Overflying Russia

The Trump administration plans to prohibit Chinese airlines from flying over Russian airspace on all U.S.-bound routes, according to reports on the news wires.

The proposal, which surfaced Thursday, would mark a new escalation in U.S.–China aviation tensions. Details on implementation and timing remain unclear.

UBS: AI Expansion Driven by Real Investment, Not Speculation

UBS said investors should remain positioned in artificial intelligence plays, arguing that the boom is underpinned by tangible capital expenditure and rapid adoption rather than hype.

The bank expects global AI revenues to reach $2.6 trillion by 2030, growing 41% annually, supported by infrastructure buildouts and deepening industry integration.

UBS cited data showing 26% of Americans now use AI tools daily, compared with 59% in markets like Singapore and the UAE.

It estimated AI-related capex will rise 67% this year to $375 billion and another 33% in 2026 to $500 billion, driven by demand for computing capacity from players such as OpenAI, AMD, and NVIDIA.

Valuations remain reasonable relative to earnings growth, UBS said, urging investors to maintain diversified exposure across software, hardware, and semiconductor sectors and to use market pullbacks to build positions.

PBOC sets USD/ CNY reference rate for today at 7.1048 (vs. estimate at 7.1329)

- PBOC CNY reference rate setting for the trading session ahead.

In Open market operations (OMOs) the PBOC inject 409bn yuan at an unchanged rate of 1.4%

- net drain of 191bn yuan after maturites today

RBA’s Bullock Says Services Inflation Still “a Bit Sticky”

Reserve Bank of Australia Governor Michele Bullock told lawmakers that services inflation remains “a little sticky,” even as the labor market edges closer to balance.

Testifying before a Senate committee in Canberra, Bullock said consumption is beginning to recover and inflation, while higher than expected in Q2, is trending lower overall.

She noted that dwelling and service costs are still elevated but described overall inflation risks as “broadly balanced.”

Bullock reiterated that policy decisions remain data-driven and cautioned against overreacting to volatile monthly CPI readings.

New Zealand Manufacturing PMI Stays at 49.9, Output Weak

New Zealand’s Performance of Manufacturing Index was unchanged at 49.9 in September, signaling ongoing contraction.

The PMI averaged 50.9 in Q3, barely above Q2’s 49.9, showing limited momentum despite expectations for recovery.

Production rose slightly to 50.1 while new orders slipped to 50.3. Employment remained soft at 47.5, consistent with further job losses.

Four of five sub-indices hovered around the neutral 50 mark.

Business sentiment improved modestly, with firms more optimistic about future output.

The Reserve Bank of New Zealand’s recent 50bp rate cut to 2.5%, and an expected final 25bp cut in November, could offer some relief, though near-term growth remains subdued.

ANZ Sees One More RBNZ Cut in November After Front-Loaded Easing

ANZ expects the Reserve Bank of New Zealand to deliver one final rate cut in November, lowering the Official Cash Rate to 2.25%, following this week’s front-loaded 50-basis-point move.

The bank said the RBNZ’s latest decision represents a tactical acceleration of easing plans, not a pivot toward more aggressive policy.

In a note, ANZ said the central bank’s neutral tone keeps options open for either a pause or further cuts of 25–50 basis points next month, depending on how data unfold.

It sees November’s expected 25bp move as the end of the cycle, though weaker activity could justify deeper easing. “Risks remain two-sided,” ANZ said, adding that the threshold for positive surprises is low, meaning a modest pickup in demand could shift sentiment quickly.

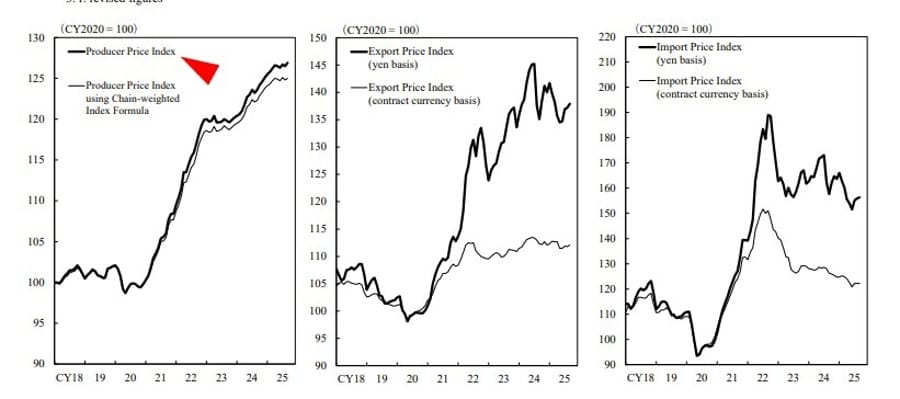

Japan September PPI Rises 2.7% Y/Y, Above Expectations

Japan’s producer prices rose 2.7% in September from a year earlier, exceeding forecasts of 2.5% and matching August’s pace, Bank of Japan data showed Friday.

On a monthly basis, the Corporate Goods Price Index rose 0.3%, ahead of the 0.1% consensus and reversing August’s 0.2% drop.

The data suggest ongoing cost pressures across wholesale industries despite the yen’s weakness and modest energy relief.

Japan’s Komeito Leader Signals Break from LDP Coalition

Tokyo — Japan’s ruling coalition faces upheaval after Komeito leader Tetsuo Saito informed LDP President Sanae Takaichi of his intention to withdraw from the long-standing alliance.

Saito cited irreconcilable differences over “money and politics” issues, calling the LDP’s proposed solutions “inadequate” and announcing Komeito would “reset” its cooperation with the LDP “for the time being.”

Komeito said it would not support Takaichi’s bid for prime minister in parliament. The split marks the most serious rift since 2009 and threatens to end a partnership that has lasted since 1999.

Komeito has struggled to maintain influence in recent elections, and Saito has warned that the party would not align with an LDP leadership that diverges from its moderate stance — a reference to Takaichi’s harder conservative views.

Japan’s Kato Warns of “One-Sided” Yen Moves, Pledges Vigilance

Japan’s Finance Minister Shunichi Kato said authorities have recently observed “one-sided, rapid” moves in the yen and will closely monitor markets for signs of disorderly trading.

Speaking to reporters, Kato declined to comment on specific levels but said currency stability is vital and exchange rates should reflect fundamentals.

He noted that a weak yen has both advantages and drawbacks and stressed the need for balanced moves.

Kato added that he has yet to decide whether he will attend next week’s G20 and IMF meetings, saying he would like to meet with key financial counterparts if he does.

Japan’s Takaichi Sparks Concern Over BOJ Independence

Japan’s incoming leader Sanae Takaichi pledged immediate stimulus and a gasoline-tax cut, raising renewed questions about the Bank of Japan’s autonomy.

Takaichi said she will move “immediately” on a fiscal package and argued that monetary and fiscal policy must align — language reminiscent of early Abenomics.

She said the weak yen benefits exporters but hurts households and called for coordination to stabilize prices.

Analysts warned her stance could pressure BOJ Governor Kazuo Ueda to delay rate hikes, though inflation and voter anger over prices may restrain interference.

The yen has fallen to an eight-month low as markets weigh whether Takaichi’s leadership signals more political influence over central-bank policy or pragmatic adjustment driven by economic realities.

Japan May Step In if Yen Falls Toward 160, Ex-BOJ Official Warns

Japan could intervene in currency markets if the yen weakens sharply toward 160 per dollar, former Bank of Japan official Atsushi Takeuchi said, warning that excessive moves could force Tokyo’s hand.

Takeuchi, who previously oversaw FX operations at the BOJ, told Reuters that authorities are likely comfortable with a gradual decline, but “alarm bells will start ringing” if markets begin pricing a plunge to 160 or 170. “If the yen falls that much, authorities could and must step in,” he said.

While he noted that intervention would not reverse the broader downtrend, it could slow the pace of depreciation.

The yen traded around 153 per dollar on Friday, heading for its steepest weekly drop in a year after Sanae Takaichi won the ruling party leadership race. Her pro-stimulus stance has dampened expectations for near-term BOJ tightening.

Takeuchi said the yen should eventually stabilize as the U.S.–Japan rate gap narrows — with the Fed likely to cut rates as the BOJ tightens modestly — but warned losses could accelerate if Takaichi appears tolerant of further weakness.

Crypto Market Pulse

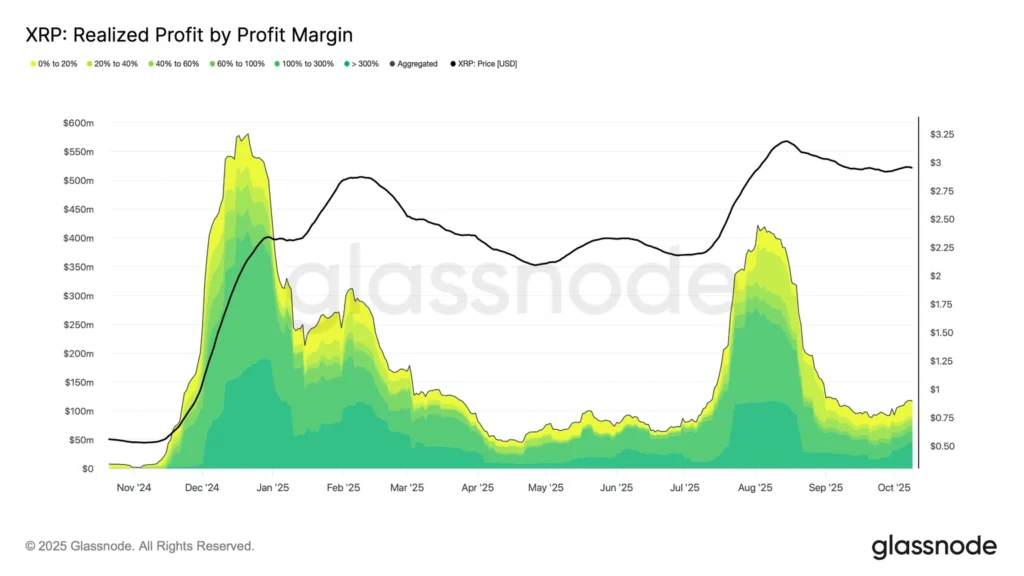

XRP Sinks Below 100-Day EMA as Profit-Taking Deepens

New York — XRP extended its decline Friday, dropping below the 100-day exponential moving average as investors booked profits following months of gains.

The token traded around $2.70, down for a second consecutive session, with selling pressure intensifying as early buyers — particularly those who entered below $1.00 — realized profits, according to Glassnode.

The broader crypto market remains subdued despite Bitcoin’s new all-time high of $126,199 earlier this week. Traders expect a 25 bp Fed rate cut later this month, which could help stabilize sentiment.

Technical support lies at $2.70, with resistance at $3.00. A sustained move below support could open losses toward $2.50, while a recovery above $3.00 may signal renewed bullish momentum.

Glassnode noted that “two major profit-taking waves” in December 2024 and July 2025 have exhausted much of XRP’s bullish energy, underscoring waning retail demand.

Ethereum Falls to $4,100 as Kerrisdale Shorts BitMine

New York — Ethereum (ETH) fell 6% to around $4,100 on Friday after Kerrisdale Capital disclosed a short position in BitMine Immersion (BMNR), criticizing the firm’s Ethereum treasury strategy as “a playbook that no longer works.”

Kerrisdale said BitMine’s repeated equity issuances have diluted investors and eroded its net asset value premium, which has narrowed sharply in recent months.

The report contrasted BitMine’s model with MicroStrategy’s Bitcoin strategy, arguing that BitMine lacks the investor enthusiasm that supported MicroStrategy’s fundraising cycle.

Kerrisdale further warned that the rise of competing crypto treasury vehicles and upcoming ETFs had erased scarcity — a key driver of prior valuation premiums.

BitMine shares dropped over 7% Friday, while Ethereum retreated amid broader weakness across digital assets. Analysts said a loss of 100-day SMA support could push ETH toward $3,500 in the near term.

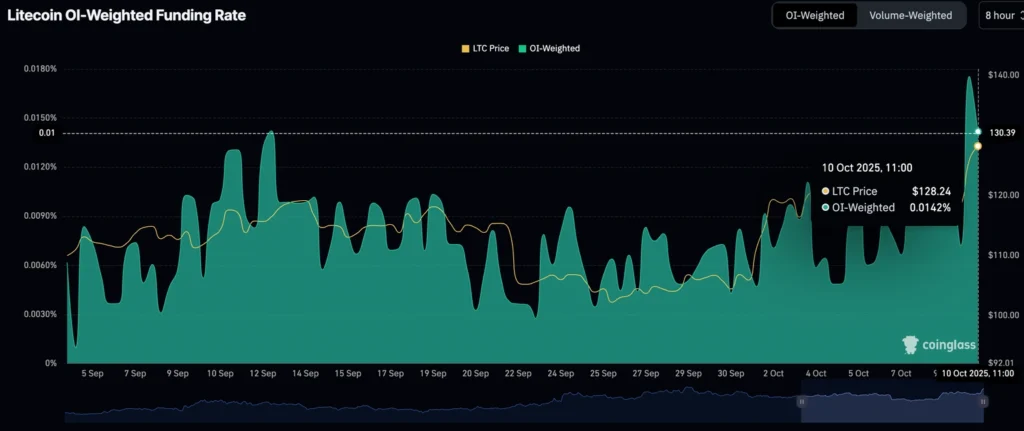

Litecoin Rebounds Above $130 as Retail Interest Rises

New York — Litecoin (LTC) climbed above $130 on Friday, extending a two-day recovery supported by a rebound in retail demand.

Open interest in Litecoin futures rose to $1.11 billion, up from $795 million at the start of October, signaling stronger speculative participation.

Despite the pickup, the OI-weighted funding rate slipped to 0.0142% from 0.0175%, indicating that some traders are hedging gains with fresh short positions.

Technical analysts noted a double top pattern forming on the daily chart, warning that a failure to hold above $130 could expose downside toward $122.

Still, sentiment remains constructive as derivatives positioning suggests confidence in further upside amid improving market tone.

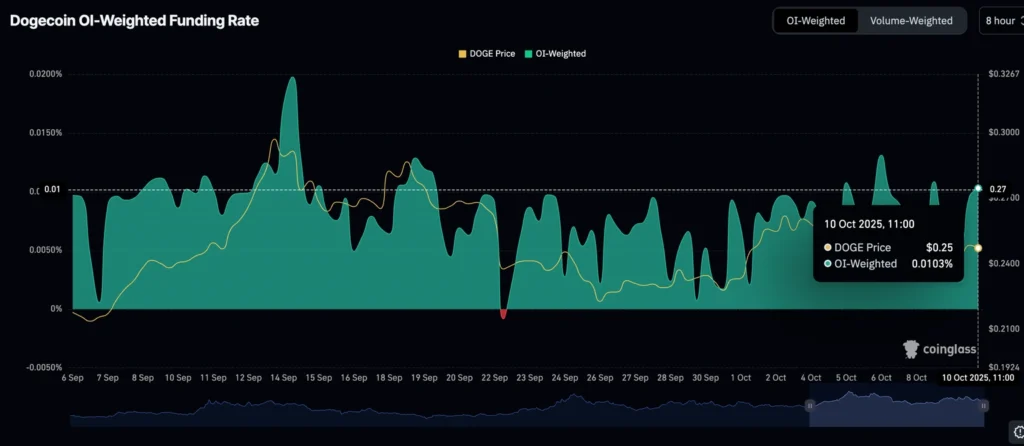

Dogecoin Holds $0.25 as Funding Rates Stay Positive

New York — Dogecoin (DOGE) traded above $0.25 on Friday, recovering from early-week losses even as retail participation showed signs of fatigue.

The meme token rebounded from $0.24 support, tracking a modest improvement in risk sentiment across the crypto market.

However, futures open interest slipped to about $4.4 billion, down from $5.0 billion earlier in the week, reflecting weaker retail conviction.

Despite the drop, OI-weighted funding rates turned more positive, climbing to 0.0103% from 0.0057%, indicating bullish positioning by leveraged traders.

Analysts said DOGE remains on track to test $0.28, but warned that low participation could limit upside momentum if new buyers fail to enter the market.

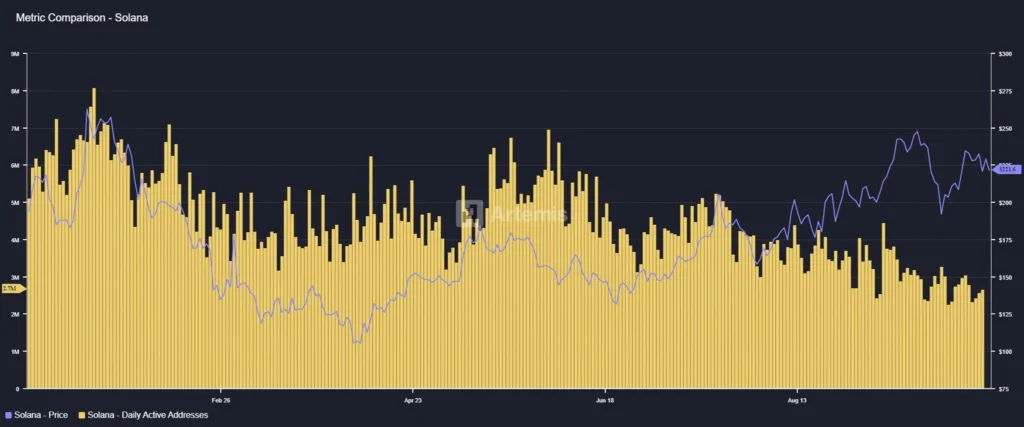

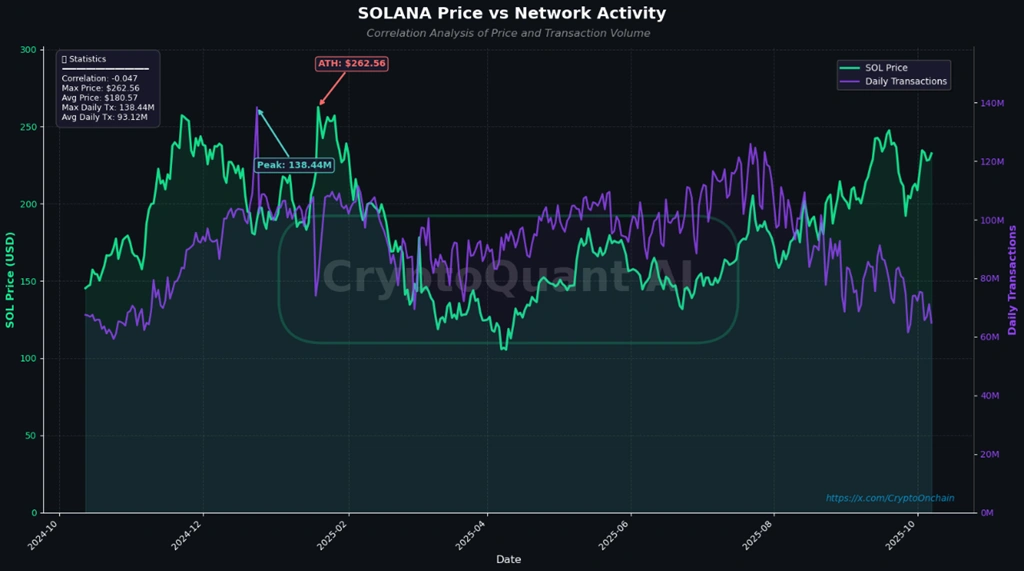

Solana Rally Faces Reality Check as On-Chain Activity Weakens

Singapore — Solana (SOL) extended its three-month rally into October but faces questions over sustainability as on-chain activity declines.

Data from Artemis show a widening divergence between price and network usage since mid-August: SOL’s price has surged from $175 to above $220, while daily active addresses have fallen from 4 million to around 2.7 million.

Analysts said the trend suggests speculation rather than organic demand is driving prices. CryptoQuant’s CryptoOnchain also reported that Solana’s daily transaction count has halved to about 64 million, down from 125 million in July.

He added that 80–90% of Solana transactions are “vote transactions” tied to network consensus, not user activity.

“If the decline stems from reduced real usage, the credibility of this price rally weakens, increasing the risk of a sharp correction,” CryptoOnchain warned.

The Day’s Takeaway

North America

- U.S. Equities Tumble on Trade War Fears: U.S. stocks plunged as President Trump reignited trade tensions with China, announcing potential tariffs in response to rare earth export controls. The Nasdaq led losses, falling 3.5%, while the S&P 500 dropped 2.7%. Treasury yields fell sharply, and WTI crude sank below $59/barrel.

- Fed Signals Cautious Easing: Fed officials, including Christopher Waller and Alberto Musalem, emphasized a cautious approach to rate cuts amid labor market softness and sticky inflation. The CPI release is delayed due to the ongoing government shutdown.

- Canada Adds Jobs, Beating Expectations: Canada’s labor market rebounded strongly in September, adding 60,400 jobs, far exceeding forecasts of +5,000. The unemployment rate held steady at 7.1%, with wages for permanent employees rising 3.6% YoY.

- U.S. Rig Count Declines: The U.S. rig count fell by two rigs to 547, with oil rigs dropping by four to 418. Canada added three rigs, bringing its total to 193.

Commodities

- Gold Hits Record Highs: Gold surged past $4,000/oz amid U.S. fiscal concerns and safe-haven demand. ETF inflows remain strong, with global holdings nearing 3,840 tons.

- Crude Oil Weakens: WTI crude fell below $60/barrel as oversupply fears persisted. The EIA warned of a widening global oil surplus through Q1 2026, pressuring prices further.

- Copper and Silver Rally: Copper jumped nearly 2% amid mine disruptions, while silver hit new record highs driven by tight physical supply and safe-haven flows.

Europe

- Stocks Close Lower Amid Risk-Off Sentiment: European equities ended lower, led by Italy’s FTSE MIB, which fell 1.74%. The Euro Stoxx 50 dropped 1.57% as investors reduced risk ahead of U.S. inflation data.

- French Bonds Remain “Uninvestable”: Analysts warn French government bonds are still uninvestable amid political instability and fiscal challenges.

Asia

- Japan’s Political and Economic Challenges: Komeito signaled a break from the LDP coalition, threatening Japan’s ruling alliance. The yen weakened toward 153 per dollar as incoming leader Sanae Takaichi pledged immediate stimulus.

- China Tightens Rare Earth Controls: China imposed sweeping export curbs on rare earths and industrial equipment, escalating tensions with the U.S. Analysts warn the move could disrupt global supply chains.

Rest of World

- New Zealand Manufacturing Contracts: New Zealand’s manufacturing PMI remained at 49.9, signaling ongoing contraction. Production and employment remain weak, though business sentiment improved modestly.

- Argentina’s Peso Undervalued: U.S. Treasury Secretary Bessent praised Argentina’s openness to U.S. investment, describing the peso as undervalued and signaling progress in talks to ease U.S. tariffs on India.

Crypto Markets

- Bitcoin Holds Above $122K: Bitcoin traded above $122,000, with Ethereum pulling back to $4,100 after Kerrisdale Capital shorted BitMine Immersion.

- XRP and Solana Under Pressure: XRP fell below its 100-day EMA amid profit-taking, while Solana’s rally faces skepticism due to declining on-chain activity. Dogecoin held $0.25 as funding rates turned positive.