North America News

U.S. Stocks End Mixed as Dow Slips, S&P and Nasdaq Hit Records

U.S. equities closed mixed on Wednesday, with the Dow Jones Industrial Average falling while the S&P 500 and Nasdaq Composite notched fresh record highs.

The Dow was weighed down by sharp losses in several mega-cap names:

- Salesforce −3.77%

- Amazon −3.31%

- Apple −3.23%

- McDonald’s −2.10%

- Walmart −1.84%

- Visa −1.67%

In total, 21 of 30 Dow components ended lower.

Tech stood out as the driver of gains:

- Oracle surged +35.95% to $328.33 after upbeat forward guidance, despite missing on both EPS ($1.47 vs $1.48 est.) and revenue ($14.93B vs $15.04B est.).

- Nvidia climbed +3.81%.

- Broadcom jumped nearly 10%, up $32.90.

- AMD rose +2.39%.

Closing levels:

- Dow: 45,490.92 (−220.42, −0.48%)

- S&P 500: 6,532.04 (+19.43, +0.30%)

- Nasdaq: 21,886.06 (+6.57, +0.03%)

U.S. 10-Year Auction Clears at 4.033%

The Treasury sold $39 billion in 10-year notes with a high yield of 4.033%, clearing through the when-issued level of 4.046% by 1.3 bps.

- Bid-to-cover: 2.65

- Indirect bidders: 83.13%

- Direct bidders: 12.66%

- Primary dealers: 4.21%

The strong demand points to ongoing appetite for longer-dated Treasuries despite market volatility.

Atlanta Fed GDPNow Sees Q3 Growth at 3.1%

The Atlanta Fed’s GDPNow model ticked higher for Q3, raising its estimate to 3.1% from 3.0% previously. The update highlights resilience in U.S. growth, complicating the case for aggressive Fed rate cuts.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 3.1 percent on September 10, up from 3.0 percent on September 4. After recent releases from the US Bureau of Labor Statistics and the US Census Bureau, increases in the nowcasts of real personal consumption expenditures growth and real gross private domestic investment growth from 2.1 percent and 6.0 percent, respectively, to 2.3 percent and 6.2 percent, were partly offset by a decline in the nowcast of the contribution of net exports to GDP growth from 0.28 percentage points to 0.23 percentage points.

U.S. Producer Prices Fall Short in August

The U.S. August PPI undershot expectations, coming in at +2.6% y/y versus forecasts of 3.3% (prior 3.3%).

Details:

- Headline m/m: -0.1% (exp. +0.3%, prior +0.9%)

- Ex-food & energy y/y: +2.8% (exp. +3.5%, prior +3.7%)

- Ex-food & energy m/m: -0.1% (exp. +0.3%, prior +0.9%)

- Ex-food, energy & trade y/y: +2.8% (unchanged)

- Ex-food, energy & trade m/m: +0.3% (prior +0.6%)

U.S. Wholesale Sales Beat Forecasts in July

Wholesale sales jumped +1.4% m/m in July, well above expectations for +0.2% and the prior +0.3%.

Inventories were up +0.1% m/m, compared to +0.2% expected and a prior +0.2%. While not a headline release, these numbers feed into GDP and reflect stockpiling swings tied to tariffs.

U.S. Mortgage Applications Surge 9.2%

Mortgage Bankers Association data for the week ending September 5, 2025 showed a sharp rebound:

- Market index: 297.7 vs. 272.5 prior

- Purchase index: 169.1 vs. 158.7 prior

- Refinance index: 1012.4 vs. 902.5 prior

- 30-year mortgage rate: 6.49% vs. 6.64% prior

This follows a prior week decline of -1.2%.

Klarna IPO Opens Hot, Then Fades

Klarna priced its IPO at $40 per share, opened at $52, briefly spiked to $57.20, then slid to $47.05 in early trading.

- IPO raised: $1.37B

- Implied valuation: ~$14B

Founded in 2005, Klarna is best known for its “buy now, pay later” services but has since expanded into digital banking and financial tools.

Trump Appeals Ruling Blocking Fed Governor’s Removal

President Trump has appealed a court ruling that temporarily blocked his attempt to remove Fed Governor Lisa Cook over allegations of mortgage fraud.

The judge not only allowed Cook to remain in her role for now but also noted that Trump’s move would likely be deemed unlawful.

Barclays Ups S&P 500 Targets for 2025 and 2026

Barclays raised its S&P 500 forecast, now seeing the index finish 2025 at 6,450, up from 6,050 previously. That shift pulls them closer to the Street’s median forecast of around 6,500.

Among other calls:

- Oppenheimer and Wells Fargo: above 7,000

- BMO Capital: 6,700

- Citi, Goldman Sachs, Fundstrat: 6,600

- Deutsche Bank: 6,550

- Morgan Stanley, HSBC, Yardeni: 6,500

- JPMorgan: 6,000 (forecast issued in June)

For 2026, Barclays lifted its year-end target to 7,000, up from 6,700. Sector changes include a positive view on U.S. tech, a neutral upgrade for materials, and a downgrade of healthcare to neutral.

Goldman Sachs Sees Hotter U.S. CPI in August

Goldman Sachs expects U.S. core CPI to rise 0.36% month-on-month in August, above the 0.30% consensus, pushing the annual rate to 3.13%.

Headline CPI is forecast at +0.37% m/m, driven by food (+0.35%) and energy (+0.60%). Tariffs under President Trump are expected to add inflation pressure across several categories.

Goldman said while tariff effects keep monthly core inflation near 0.3%, the broader trend should cool as housing and labor pressures ease.

Oracle Could Post Biggest-Ever Single-Day Gain for $500bn+ Stock

Despite quarterly revenue and earnings missing estimates, Oracle stock surged 26% in after-hours trading, potentially marking the largest single-day gain ever for a U.S. company with a market cap above $500 billion.

CEO Safra Catz said four multi-billion-dollar deals signed in Q1 boosted remaining performance obligations to $455 billion, up 359% year-on-year.

Oracle sees RPO surpassing $500 billion soon, and projects cloud revenue could reach $18 billion this year and as much as $144 billion in five years.

Court Rules Fed Governor Lisa Cook Stays in Role

A U.S. court ruled that Federal Reserve Governor Lisa Cook cannot be removed from her post while litigation with former President Trump proceeds.

The court said “for cause” removal applies only to misconduct while in office, and that Cook’s due process rights were violated. As a result, she will participate in the upcoming September FOMC meeting on monetary policy.

Deutsche Bank Lifts S&P 500 Target to 7,000

Deutsche Bank raised its year-end 2025 S&P 500 target to 7,000, up from earlier forecasts, following a stronger-than-expected second-quarter earnings season.

The bank also boosted its EPS estimate for 2025 to $277 per share from $267, noting that corporate resilience is offsetting tariff headwinds.

Oracle Cloud Orders Surge Past $500 Billion, Shares Jump 27%

Oracle announced it expects booked revenue for its cloud business to exceed half a trillion dollars, sending shares soaring 27% after hours.

Executives said several multi-billion-dollar contracts are set to be signed in the coming months. Oracle highlighted its cloud platform’s integration with leading AI models — including ChatGPT, Gemini, and Grok — as a key driver of demand.

NAB Forecasts Fed to Start Cutting Rates in September

National Australia Bank expects the Federal Reserve to deliver its first 25bp rate cut in September, beginning a gradual easing cycle that could total 125bps by the end of 2026.

- NAB sees 50bps of cuts in 2025, followed by 75bps in 2026.

- That would leave the Fed funds rate at 3.00–3.25%, near neutral levels.

- Economists pointed to elevated inflation pressures on one hand, and rising unemployment risks on the other, with political considerations adding to the uncertainty.

NAB also warned that tariff-related inflation could complicate the Fed’s path.

Jamie Dimon: U.S. Economy Losing Steam After Jobs Revision

JPMorgan CEO Jamie Dimon warned the U.S. economy is showing clear signs of slowing after the Labor Department revised payroll growth lower by 911,000 jobs for the year through March 2025 — the steepest cut in more than two decades.

Dimon noted that while consumers are still spending, confidence appears weaker. He described the economy as “mixed,” with household activity softening but corporate earnings holding up. He expects the Federal Reserve to cut rates soon, though he doubts it will significantly change the overall trajectory.

Bessent: Plan to Protect U.S. Dollar Supremacy, Confident on Tariffs

U.S. Treasury Secretary Bessent said he is preparing a detailed proposal aimed at preserving the global dominance of the U.S. dollar. At the same time, he expressed confidence that the Supreme Court will uphold President Donald Trump’s tariffs. According to Bessent, maintaining the dollar’s reserve currency status remains a priority for Washington, and he intends to put forward written guidance on how the U.S. can safeguard that position.

Trump Urges EU to Match U.S. With 100% Tariffs on China and India

President Donald Trump has called on the European Union to impose tariffs of up to 100% on imports from China and India, officials told the Financial Times. The move is designed to cut into two of Russia’s largest crude oil customers and apply further pressure on President Vladimir Putin.

Washington has indicated it will “mirror” any tariffs the EU imposes, effectively doubling the impact. The EU has traditionally leaned on sanctions instead of tariffs, so this request would mark a sharp change in approach. Trump has long accused Beijing and New Delhi of supporting Russia’s economy through energy purchases. While raising duties on India earlier this year, he also highlighted closer cooperation with Prime Minister Narendra Modi on trade barriers.

Supreme Court to Fast-Track Trump Tariff Case

The U.S. Supreme Court will hear arguments in November on whether President Donald Trump overstepped his authority with his tariff measures. The case follows a federal court ruling against him, which Trump has appealed.

For now, the tariffs remain in force while the high court reviews the issue.

Commodities News

Gold Rally Stalls Ahead of U.S. Inflation Data

Gold’s record-breaking surge has paused as traders turn their attention to U.S. inflation figures. A weak jobs report last Friday strengthened bets on Federal Reserve rate cuts, keeping real yields lower and boosting bullion.

- Near term: U.S. PPI arrives today, with CPI due tomorrow ahead of next week’s FOMC. Markets are certain of a 25 bps cut, while soft inflation could raise odds of a 50 bps move.

- Bigger picture: Gold remains in an uptrend as Fed easing pushes real yields down. But any hawkish repricing of rates risks sparking corrections.

Technical outlook:

- Daily chart: Shooting star candle signals momentum cooling. Buyers have better risk/reward near the 3,400 trendline; sellers eye a drop toward 3,120.

- 4H chart: Minor upward trendline still guiding bullish momentum. Buyers defend it; a break lower exposes 3,400.

- 1H chart: Another minor trendline supports gains. Sellers need a breakdown to target the next support.

WTI Jumps Despite Bearish EIA Data as Geopolitical Risks Mount

WTI crude climbed to $63.50, its highest this week, as traders looked past bearish inventory data and refocused on geopolitical tensions.

- EIA reported: +3.9M crude, +1.5M gasoline, +4.7M distillates

- Poland said Russian drones violated its airspace, prompting NATO consultations under Article IV

- Trump reacted on Truth Social, calling the move “an act of aggression” and hinting at potential energy sanctions

Added pressure from Middle East tensions is also bolstering crude’s risk premium, helping extend WTI’s 3-day winning streak.

U.S. Crude Inventories Post Surprise Build, Headwind for Oil

EIA data for the week ending September 5 showed U.S. crude oil inventories rising +3.94M barrels, against expectations for a -1.04M draw.

- Prior week: +2.42M

- Gasoline: +1.46M vs -0.24M expected

- Distillates: +4.72M vs +0.04M expected

- Refinery utilization: +0.6% vs -0.6% expected

WTI crude was up $0.68 at $63.32 ahead of the release, but the surprise build presents a short-term headwind.

Silver Rebounds, Bulls Eye $41.50

Silver regained ground, trading near $41.10 in early European hours Wednesday and holding a bullish bias within an ascending channel.

- Resistance levels: $41.50 (psychological), $41.67 (Sept 2011 high), $42.80 (channel top), $43.00 (major barrier).

- Support levels: $41.00, $40.65 (9-day EMA), $40.20 (channel base), $38.49 (50-day EMA).

RSI sits just below 70, signaling strong momentum though near overbought territory.

Barclays Lowers Brent 2026 Forecast to $66

Barclays trimmed its 2026 Brent crude price forecast by $4 to $66 per barrel, citing expectations that OPEC+ will fully reverse voluntary supply cuts by September 2026.

The bank highlighted OPEC+’s decision to increase October quotas by 137,000 barrels per day as the first step in rolling back the 1.66 million bpd in cuts introduced in May 2023. At the current pace, the full unwind could finish within a year.

Markets took comfort that the pace was slower than earlier feared, with October’s increase well below August and September’s four-times-larger hikes. Despite the adjustment, Barclays remains constructive on oil due to resilient spot fundamentals and valuation support.

API Survey: Surprise Crude Build Reported

Private API inventory data showed an unexpected increase in crude oil stockpiles:

- Crude oil: +1.25 million barrels

- Gasoline: +329,000 barrels

- Distillates: +1.5 million barrels

Analysts had expected a draw in headline crude, making this build a surprise to markets.

Europe News

European Stocks End Mixed, Spain Outperforms

Major European indices finished the day mixed:

- DAX: -0.39%

- CAC 40: +0.15%

- FTSE 100: -0.19%

- Ibex: +1.29%

- FTSE MIB: +0.12%

Spain’s Ibex led the gains, while Germany and the UK closed in the red.

ECB Meeting: BofA Sees Slightly Negative Risk for Euro

Bank of America expects the European Central Bank to hold rates steady at tomorrow’s meeting, with only modest tweaks in the statement and Christine Lagarde’s press conference.

- Lagarde is likely to note the U.S.-EU trade deal but warn that risks to the eurozone outlook have risen since summer.

- BofA expects her tone to lean slightly dovish, though still emphasizing flexibility.

- Market pricing: only ~7 bps of cuts by year-end, ~17 bps by June 2026.

BofA sees euro downside risk as limited but tilts bearish versus the pound and the Australian dollar.

SNB’s Chairman Schlegel: US dollar is still absolutely the dominant currency

- Remarks from the Swiss National Bank Chairman, Martin Schlegel

- US dollar is still absolutely the dominant currency.

- The Fed is central to international financial system; there is currently no alternative.

- Effect of tariffs on Switzerland is difficult to determine.

- Bar is high to go into negative interest rate territory, but will do it if really necessary.

- Absolutely crucial to preserve central bank independence.

EU foreign affairs and security chief Kallas says must strengthen support for Ukraine

- Remarks by Kaja Kallas, the high representative for foreign affairs and security policy for the EU

- EU stands in full solidarity with Poland

- We must raise the cost on Moscow

- Need to strengthen support for Ukraine and invest in Europe’s defence

- EU plays a major role and we will support initiatives like ‘The Eastern Shield’

EU’s von der Leyen: We need more sanctions on Russia

- European Commission president, Ursula von der Leyen, remarks

- Europe stands in full solidarity with Poland after violation of airspace

- In sanction talks, we are looking at phasing out Russian fossil fuels faster

- Also looking at sanctions on the third party countries

- Need to work on a new solution to finance Ukraine using frozen Russian assets

- Will launch an ‘Eastern flank watch’ programme to improve surveillance of countries bordering Russia

- We will build a drone wall

- We ensured that Europe got the best possible deal out there

- We have put our companies at a relative advantage

- Our direct competitors are facing much higher US tariffs

- The deal provides crucial stability for our relations with the US at a time of global insecurity

Asia-Pacific & World News

China Inflation Slips Deeper Into Deflation

China’s August CPI fell 0.4% year-on-year, the sharpest drop in six months, compared with expectations for a 0.2% decline. CPI was flat month-on-month after a 0.4% rise in July.

Producer prices also remained weak, with PPI down 2.9% year-on-year, matching forecasts but showing the smallest decline in four months.

Chinese Insurers Ramp Up Equity Holdings

Chinese insurers have raised their equity holdings to 3.1 trillion yuan ($90 billion increase in H1 2025), the highest in more than three years, according to Bloomberg.

- Equity holdings now represent 8.5% of total assets.

- Morgan Stanley projects more than 1 trillion yuan of additional inflows this year.

- Regulators have supported the trend by loosening restrictions and reducing capital charges.

Analysts expect insurers to remain key liquidity providers through 2026, though they warn volatility risks could rise in downturns.

Markets Hold Steady as NATO First Engages Russian Drones

Markets stayed calm overnight despite a new escalation in the Russia-Ukraine war. For the first time since the conflict began in 2022, Poland confirmed it used weapons to down Russian drones that crossed into its airspace.

Warsaw described it as “an unprecedented violation of Polish airspace by drone-type objects”, saying the drones repeatedly breached the border before being shot down. Operations are now underway to locate the debris.

Russian drones have strayed near the Polish border before, often prompting fighter jets to scramble, but this marks the first direct engagement by a NATO country against Russian assets since the war started.

PBOC sets USD/ CNY mid-point today at 7.1062 (vs. estimate at 7.1359)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 304bn yuan via 7-day reverse repos at 1.40%

- net 74.9bn injection yuan

Chile’s Central Bank Keeps Rate at 4.75%

Chile’s central bank voted unanimously to hold its benchmark rate at 4.75%, unchanged from the prior level.

- Policymakers said the outlook for core inflation over the next year is now higher than projected in June.

- Officials also pointed to persistent uncertainty stemming from global trade tensions and their impact on growth.

- The bank said it requires more data before moving rates closer to the neutral range.

Japan Manufacturers Hit Three-Year Confidence High

The latest Reuters Tankan survey showed Japanese manufacturing sentiment rising to +13 in September, its strongest reading in more than three years, up from +9 in August.

- The auto and transport machinery sector surged to 33, the best since late 2023, thanks to robust export orders.

- Other sectors, including textiles, refining, and precision machinery, reported weaker demand.

- The services index improved to +27, supported by real estate, retail, and transport.

Japan’s economy continues to be supported by solid consumption, with Q2 GDP expanding at an annualized 2.2%.

Crypto Market Pulse

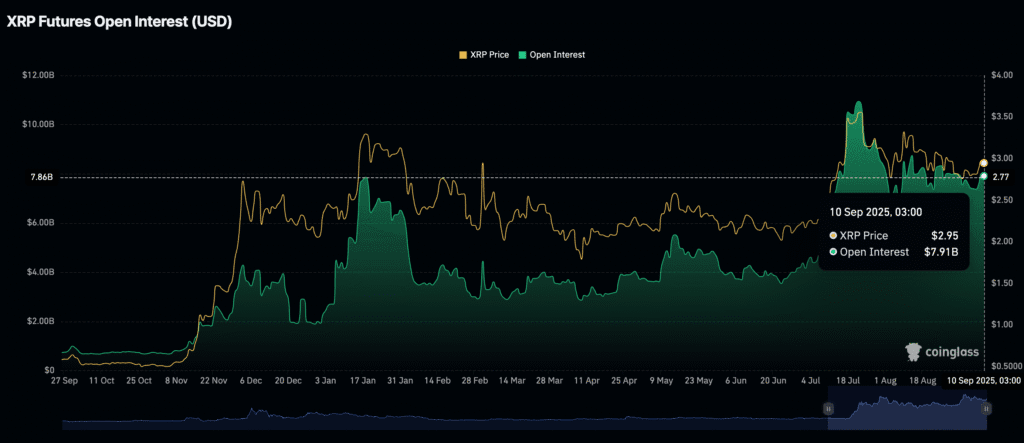

XRP Climbs Above $3, Bulls Eye $3.35 Next

XRP crossed back above $3.00 on Wednesday, signaling bullish momentum toward the $3.35 level, with the all-time high of $3.66 in view.

- Futures open interest: near $8B (up from $7.37B on Sunday)

- Funding rate: steady at 0.0103%

- Catalysts: Fed rate cut expectations, rising retail demand

Traders see a daily close above $3 as confirmation of renewed upside strength.

SEC Chief: Most Tokens Not Securities, Supports Crypto Super-Apps

SEC Chair Paul Atkins declared that “most crypto tokens are not securities” and outlined a new regulatory approach during a keynote at the OECD Roundtable in Paris.

Key points:

- Project Crypto initiative: SEC aims for a unified framework for trading, lending, and staking.

- Platforms will be able to operate as “super-apps” with multiple custody solutions.

- Atkins pledged clear rules instead of enforcement-by-litigation, saying regulation should be the “minimum effective dose.”

- He praised the EU’s MiCA rules as a strong template.

Meanwhile, the European Banking Authority finalized rules forcing banks to hold far more capital against unbacked crypto, assigning a 1,250% risk weight to assets like Bitcoin. This contrasts with more flexible stances in the U.S. and Switzerland.

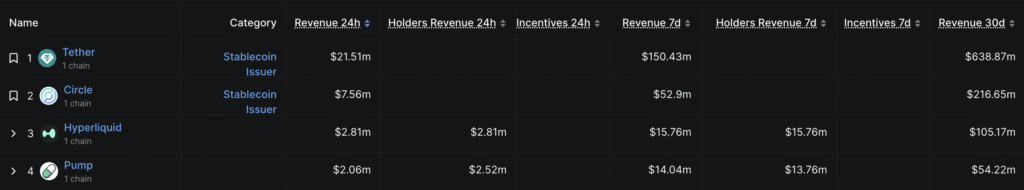

Pump.fun Surges 15% Ahead of Binance Listing

Pump.fun’s native token PUMP rallied over 15% on Wednesday, reclaiming the $0.005000 level after Binance.US confirmed deposits and announced PUMP/USDT trading at 11:00 GMT.

DeFiLlama data shows Pump.fun ranked second by revenue among DeFi protocols in the past 24 hours, generating $2.52 million, just behind Hyperliquid’s $2.81 million. The platform has consistently held the #2 spot over the past month, signaling sustained demand.

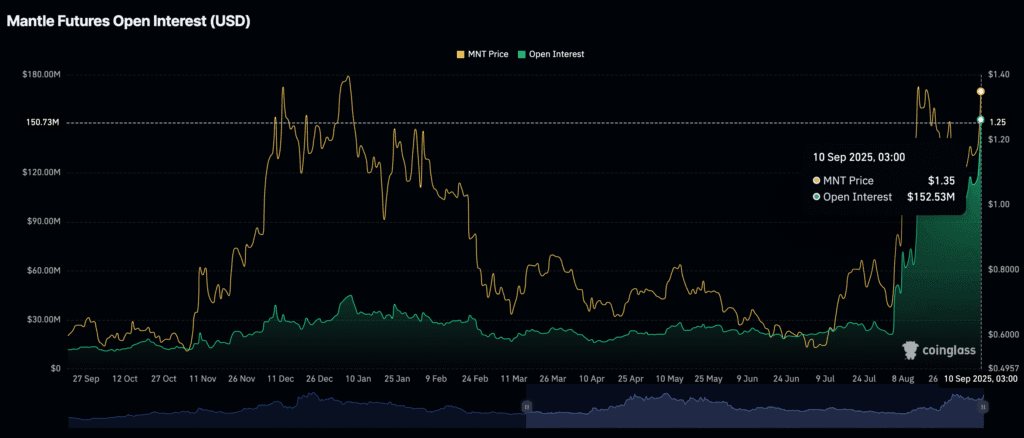

Mantle Surges 16% After Bybit Listing

Mantle (MNT) rallied to $1.47, up 16% in 24 hours, nearing its record high of $1.54.

- Bybit listed 21 MNT trading pairs and launched a HODL & Earn program backed by XUSD stablecoin with a $60K prize pool.

- Market cap: ~$4.7B

- 24h trading volume: $573M

- Futures open interest: $153M, up sharply from $99M last week and $21M in early August.

While adoption momentum is strong, RSI readings suggest the market may be overheating.

Dogecoin ETF “DOJE” Launching This Week

Dogecoin broke higher from a symmetrical triangle, trading around $0.240 on Wednesday, with analysts targeting $0.311 in the days ahead.

Bloomberg’s Eric Balchunas confirmed the first-ever Dogecoin ETF, ticker DOJE, is set to launch Thursday under Rex-Osprey. He called it the start of the “meme coin ETF era.”

On-chain data shows heavy whale accumulation, with addresses holding between 100k and 100m DOGE adding 280 million tokens from Sunday to Wednesday. If approved, DOJE would make DOGE more accessible for traditional investors, adding legitimacy and liquidity to the meme coin.

Ethereum Futures: Bullish Bias Above 4,310

Ethereum futures traded at 4,328.5, up 0.52% on the session, holding above today’s VWAP at 4,319.5.

- Bullish bias holds above 4,310, with targets at 4,352, 4,369, 4,398.5, 4,413, 4,425, 4,486, 4,505, 4,590, and 4,910.

- Bearish bias below 4,240, exposing downside to 4,204, 4,180, 4,154, and 4,032.

The broader picture shows Ethereum consolidating between 4,100 and 4,850 since August 10. Option markets suggest easing volatility, with call premiums collapsing but put premiums holding steady — signaling stabilization rather than bearish conviction.

The Day’s Takeaway

North America

- Dollar Strategy & Tariffs: Treasury Secretary Bessent said he will publish a proposal to safeguard the U.S. dollar’s global reserve status. He also expressed confidence the Supreme Court will uphold Trump’s tariffs.

- Trump Trade Push: President Trump urged the EU to match U.S. tariffs of up to 100% on Chinese and Indian imports, aiming to pressure two of Russia’s biggest crude customers.

- Supreme Court & Tariffs: The U.S. Supreme Court agreed to fast-track arguments on Trump’s tariff authority in November.

- Fed Policy Outlook: NAB forecast the Fed’s first rate cut in September, totaling 125 bps by end-2026. Goldman Sachs expects hotter August CPI (+0.36% m/m core), while the Atlanta Fed GDPNow raised Q3 growth to 3.1%.

- Labor Market Revision: JPMorgan’s Jamie Dimon warned of slowing U.S. momentum after a historic jobs revision cut payroll growth by 911k.

- Mortgage & Inflation Data: Mortgage applications rose 9.2% in early September, while PPI undershot forecasts (+2.6% y/y vs 3.3% expected). Wholesale sales beat at +1.4% m/m.

- Treasury Auction: The U.S. sold $39B in 10-year notes at 4.033%, clearing 1.3 bps through WI, with strong indirect demand (83.1%).

- Equities:

- The Dow slipped −220.42 (−0.48%) to 45,490.92, weighed by losses in Salesforce, Amazon, Apple, McDonald’s, Walmart, and Visa.

- The S&P 500 (+0.30%) and Nasdaq (+0.03%) closed at record highs, powered by Oracle (+35.9%), Broadcom (+9.8%), Nvidia (+3.8%), and AMD (+2.4%).

- Deutsche Bank lifted its S&P 500 target to 7,000, while Barclays now sees 6,450 in 2025 and 7,000 in 2026.

- Oracle Surge: Oracle projected cloud revenue bookings above $500B, sending shares up 27% after hours — potentially the largest single-day gain for a $500B+ company.

Commodities

- Oil Inventories: EIA reported a surprise build: crude +3.94M, gasoline +1.46M, distillates +4.72M. WTI was up $0.68 pre-release at $63.32, then extended gains to $63.50 as geopolitical risks overshadowed bearish data.

- API Data: Private survey also showed builds in crude (+1.25M), gasoline (+0.33M), and distillates (+1.5M).

- Geopolitics: Poland said Russian drones violated its airspace, prompting NATO consultations under Article IV. Trump hinted at possible Russian energy sanctions, while Middle East tensions added further risk premium.

- Forecasts: Barclays cut its Brent 2026 forecast to $66, citing OPEC+ supply unwinds.

- Gold & Silver: Gold stalled ahead of CPI after a record run, with traders eyeing U.S. inflation data for rate-cut signals. Silver rebounded to $41.10, with bulls targeting $41.50–43.00.

Europe

- Equities: European markets ended mixed — DAX −0.39%, FTSE 100 −0.19%, CAC +0.15%, Ibex +1.29%, FTSE MIB +0.12%.

- ECB Outlook: BofA expects the ECB to hold rates steady, with Lagarde striking a slightly dovish tone.

- Crypto Regulation: The EBA finalized rules requiring banks to hold heavy capital buffers (1,250% risk weight) against unbacked crypto.

Asia

- Japan: Reuters Tankan survey showed manufacturing sentiment at a three-year high (+13), led by autos. Services index rose to +27, reflecting strong consumption and a 2.2% annualized Q2 GDP.

- China: August CPI fell −0.4% y/y, deeper into deflation. PPI dropped −2.9% y/y, its smallest decline in four months. Chinese insurers boosted equity holdings by 90B yuan in H1, hitting a 3-year high.

Rest of the World

- Chile: Central bank held its benchmark rate at 4.75%, citing higher core inflation risks and global trade uncertainty.

- NATO: Markets held steady despite Poland downing Russian drones — the first direct NATO engagement with Russian assets since 2022.

Crypto

- Ethereum: Futures held at 4,328.5 (+0.52%), maintaining bullish bias above 4,310, with consolidation between 4,100–4,850.

- XRP: Climbed back above $3.00, with futures OI near $8B and targets at $3.35.

- Mantle (MNT): Surged 16% to $1.47 after Bybit listed 21 trading pairs and launched a HODL & Earn program. OI rose to $153M.

- Pump.fun (PUMP): Rallied 15% ahead of Binance.US listing. Revenue ranked #2 among DeFi protocols.

- Dogecoin: Broke higher to $0.24; first DOGE ETF (“DOJE”) launches Thursday. Whale accumulation added 280M tokens this week.

- Regulation: SEC Chair Atkins said most tokens aren’t securities, backing “crypto super-apps” with clearer rules, in contrast to Europe’s stricter stance.