North America News

U.S. Stocks Edge Higher After Moody’s Downgrade, S&P Logs Sixth Straight Gain

U.S. equity markets closed slightly higher on Monday, overcoming early-session losses triggered by Moody’s credit downgrade of the U.S. government late Friday. After a choppy day, the S&P 500 extended its winning streak to six sessions, while the Dow posted its third consecutive gain.

At its lowest point, the Dow Jones Industrial Average had shed 317 points but rebounded to finish up 137.33 points, or 0.32%, at 42,792.07.

The S&P 500 fell as much as 62.69 points intraday before closing in positive territory, gaining 5.22 points, or 0.09%, to reach 5,963.60.

The Nasdaq also turned green by the bell after dropping 273.68 points earlier in the session. It ended the day up 4.36 points, or 0.02%, at 19,215.46.

Traders appeared to digest the downgrade and shift focus back to broader economic signals and upcoming Fed commentary.

U.S. Leading Index Sinks 1.0% in April, Deepest Drop Since March 2023

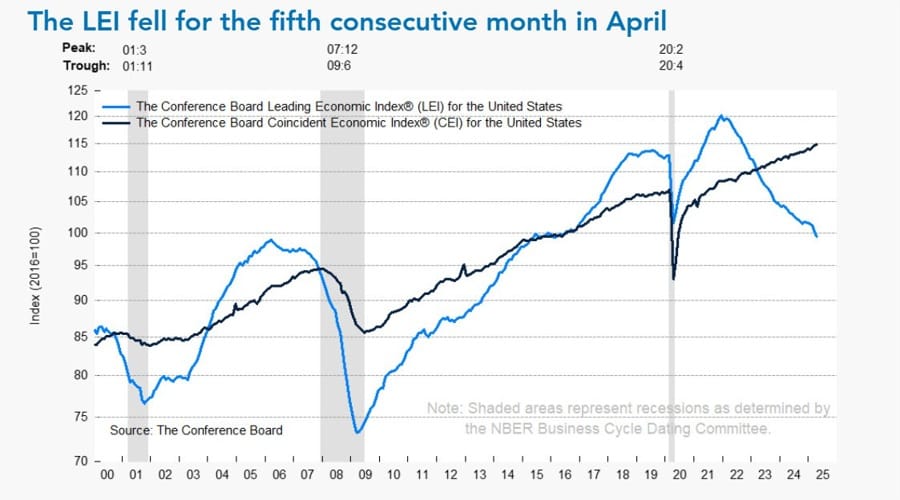

The Conference Board’s Leading Economic Index fell 1.0% in April to 99.4 (2016=100), the largest monthly decline since March 2023. March’s drop was revised to -0.8%. Over the past six months, the index has fallen 2.0%, matching the previous half-year’s pace.

The LEI has posted negative readings in 38 of the last 41 months. Key drags in April included consumer sentiment, building permits, and reduced manufacturing hours.

Despite the slump, the decline isn’t deep enough to confirm a recession. The Conference Board is now forecasting 1.6% U.S. GDP growth in 2025, down sharply from 2.8% in 2024. Tariff-related economic strain is expected to peak in the third quarter.

Additional data:

- Coincident Economic Index (CEI): +0.1% in April to 114.8, up 1.1% over six months

- Lagging Economic Index (LAG): +0.3% to 119.3, reversing March’s 0.1% drop; six-month rate now +0.8%, turning positive after a prior -0.8%

The components for the month show:

Feds Kashkari: There is big uncertainty now in the economy

- Minneapolis Fed Pres. Kashkari is now speaking

- Coming into the year, economic conditions were good.

- There is big uncertainty now in the economy.

- Doesn’t know when tariff landscape will settle out.

- Businesses are holding off on investment amid uncertainty.

US treasury does not anticipate any trade deal announcements at G7 meeting this week

- According to a source briefed on US preparations

According to a source briefed on US preparations for G7 finance meeting in Canada:

- US treasury does not anticipate any trade deal announcements at G7 finance meeting in Canada.

Fed’s Bostic: Moody’s Downgrade Will Reverberate Through Economy and Markets

Speaking with CNBC, Atlanta Fed President Raphael Bostic said Moody’s downgrade of the U.S. credit rating will have a broad impact across the financial system and real economy. He warned that borrowing costs could rise, and uncertainty may affect investment decisions and demand for U.S. debt.

Bostic emphasized that the downgrade adds a layer of unpredictability to an already complex economic outlook. He said it’s too early to know how this will affect U.S. debt demand, and that the Fed will monitor evolving conditions over the next 3–6 months.

On tariffs, Bostic noted that with household finances still under pressure from inflation, it’s unclear if consumers can absorb additional costs. He currently favors only one rate cut this year, cautioning that it will take time to assess how tariffs play out.

He added that if the implementation of tariffs drags on, it could reshape consumer behavior. Despite recent volatility, Bostic said Treasury markets remain healthy. Inflation remains the bigger concern for him, with expectations heading in a “worrisome” direction.

While employment remains stable and companies aren’t planning mass layoffs, inflation risks appear more pressing than labor market concerns. He noted that sentiment is declining, but hasn’t yet impacted the real economy—though that disconnect might soon close as inventories are drawn down.

As for market volatility in April, Bostic downplayed it, attributing it to investors adjusting to new expectations around tariffs. Still, he stressed that even reduced tariffs on Chinese goods carry significant economic implications.

FOMC Gov. Jefferson: The impact of tariffs on the Fed’s mandates is top of mind

- FOMC Governor Jefferson is speaking

- The impact of tariffs on the Fed’s mandate is top of mind.

- The risks to the Fed’s mandates depends on policy choices by the administration that have not been made.

- There are risks to both jobs and inflation, but given uncertainty it is appropriate to wait and see on right decisions

- The US could face a one-time increase in the price level tariffs, need to be sure that does not become a sustained increase in inflation.

- Will keep policy in place to be sure inflation expectations remain anchored

- So far the labor market has been very resilient.

- It is too early to tell how the labor market will be affected by administration policies

- There are no active conversations about changing the ample reserve operations framework

- Asked about the Moody’s downgrade, says that is trying to fulfill its price and jobs mandate.

- The downgrade will be treated the same as other incoming data, with focus on implications for jobs and inflation.

Fed’s Williams speaking to reporters:

- Uncertainty has led the Fed to keep interest rates steady so far this year.

- The path forward might not become clearer for months

- It’s not going to be that in June, we’re going to understand what’s happening more in July

- It’s going to be a process of collecting data, getting a better picture, and watching those things develop

Feds Williams: Recent economic data has been very good

- New York Fed President Williams is a voting member

New York Fed president John Williams is speaking to the Mortgage Bankers Association in New York City. Williams is a permanent voting member on the Federal Reserve Board:

- Recent economic data has been very good.

- Labor market is pretty much in balance

- First quarter growth was unusual trade issues

- Inflation has been coming down slowly and gradually.

- Keyword for economy is uncertainty.

- Monetary policy is in a good place.

- Fed rate policy is well-positioned. It is slightly restrictive.

- Some forward-looking indicators are signaling concern.

- Trade is particular point of uncertainty.

- Many firms and households are in a wait-and-see mode

- Fed has a ways to go in shrinking its balance sheet

- Balance sheet drawdown not affecting market prices.

- Dollar remains the world’s reserve currency.

- Global investors associate USS place to invest.

- We are not seeing major changes in investor interest in treasury bonds.

- Core fixed income markets have been functioning really well.

- Consumers are still in good shape.

- Seeing some signs and data of rising consumer caution

- The economy is likely to slow this year.

- It is going to take some time to get read on economy

- Fed can take it time on monetary policy decision.

- Tariffs potentially raise inflation and unemployment.

US-EU trade discussion are being complicated by internal EU disagreement

- Meanwhile WH Hassett says would not be surprised more trade deals announced this week

- US-EU trade talks are being delayed by internal EU disagreements on how to approach a deal.

- The process still appears far from completion, according to White House sources.

- The situation remains fluid, and developments could change quickly.

- While the China deal happened faster than expected, this case looks more complex.

WH Hassett: Would not be surprised if there are more trade deals this week

WH Hassett is saying:

- Would not be surprised if there are more trade deals this week

- We’ll keep a close eye on what Chinese have agreed to

- The Debt ceiling will go up with a beautiful bill

- US debt is the safest bet on earth.

- Moody’s downgrade should not be a surprise to the markets.

- Says that 15 countries are close to a trade deal

Moody’s Strips US of Last AAA Rating, Citing Fiscal Mismanagement

Moody’s has downgraded the United States’ credit rating to Aa1 from Aaa, citing failure by Congress and successive administrations to address rising deficits and ballooning interest costs. The move comes just as lawmakers are debating major tax reforms.

The agency warned that U.S. fiscal health is deteriorating compared to peers, projecting debt-to-GDP to reach 134% by 2035—up from 98% last year. While Moody’s still sees the rating as stable, it stressed that America’s strong economic base is no longer enough to offset its worsening debt metrics.

Goldman Sachs Predicts Continued Dollar Weakness Amid Trade Tensions

Goldman Sachs Research says the U.S. dollar will likely stay under pressure as trade tensions escalate and GDP growth slows. They forecast a 10% drop versus the euro and 9% losses against the yen and pound.

The firm points to eroding investor confidence, fewer foreign purchases of U.S. assets, and even signs of consumer backlash—such as boycotts and declining tourism. Goldman also flagged a broader shift as foreign central banks reduce dollar reliance, warning that private investors might soon do the same.

Tariffs could shift economic strain inward, with U.S. companies and consumers absorbing higher costs. A potential 10% universal tariff, while uncertain, is no longer off the table and may reshape global economic dynamics.

Canadian Markets Closed for Victoria Day

Canada is observing Victoria Day today. All financial markets in the country are shut for the public holiday.

Commodities News

Gold Reclaims $3,200 as Moody’s Downgrade Spurs Flight to Safety

Gold prices bounced higher on Monday, driven by safe-haven demand following Moody’s downgrade of U.S. government debt. The precious metal crossed back above the $3,200 level, rebounding from session lows of $3,202.

Spot gold is benefiting from a weaker U.S. dollar, with the Dollar Index (DXY) falling 0.47% to 100.50. That came as investors reacted to Moody’s decision to cut the U.S. credit rating from AAA to Aa1, citing over a decade of fiscal neglect by U.S. policymakers.

U.S. Treasury yields remain elevated, with the 10-year note sitting around 4.481%, up nearly 4 basis points. Real yields are also higher at 2.147%.

Geopolitics also played a role: a two-hour phone call between Putin and Trump reportedly concluded with signs of progress on Ukraine ceasefire talks, adding to global risk sentiment.

Federal Reserve officials spoke throughout the day, offering mixed signals:

- Fed’s Bostic said the central bank may only cut rates once this year, noting uncertainty over tariff impacts.

- New York Fed’s Williams remarked that current policy remains “on track.”

- Vice Chair Jefferson warned that while tariffs might cause a short-term inflation spike, the Fed must guard against longer-term effects.

Major institutions remain bullish on gold’s outlook. Goldman Sachs forecasts average prices to hit $3,700 by the end of 2025 and climb to $4,000 by mid-2026, citing strong structural demand and global fiscal risks.

Oil Settles Slightly Higher as Trump-Putin Call Calms Markets

Crude oil futures ended modestly in the green on Monday, rising $0.20 to settle at $62.69 per barrel, a 0.32% gain on the day.

Early losses were driven by renewed investor caution after Moody’s downgraded U.S. sovereign credit. However, sentiment improved after reports of a constructive call between former President Donald Trump and Russian President Vladimir Putin.

Trump described the discussion as “very informative” and hinted at possible ceasefire negotiations between Russia and Ukraine. This added a note of optimism to markets already navigating geopolitical tension and macro uncertainty.

Both WTI and Brent opened lower, but the news helped contain downside pressure, leaving oil prices relatively stable to start the week.

Silver Climbs Modestly on Moody’s Downgrade, Dollar Weakness

Silver is trading slightly higher at $32.30 on Monday as investors shift into alternative safe-haven assets. The uptick follows Friday’s credit downgrade of the U.S. by Moody’s, which has weighed on the dollar and lifted metals like silver.

Silver is testing the 50-day Simple Moving Average (SMA) at $32.75, with resistance ahead at the $33.00–$33.23 range. On the downside, support levels include $32.07 (61.8% Fibonacci retracement) and $31.96 (100-day SMA). A breach of $31.29 would mark a deeper retracement.

The RSI is neutral at 47.57, indicating indecision. While market momentum is muted, continued weakness in the dollar and geopolitical tensions—especially with U.S. tariff threats and Fed policy shifts—could boost silver further.

WTI Drops Toward $61 as Moody’s Downgrade Fuels Bond Yield Spike

West Texas Intermediate (WTI) oil prices plunged toward $61.00 on Monday as soaring U.S. bond yields added to bearish sentiment. Moody’s downgrade of the U.S. sovereign credit rating sent 10-year Treasury yields climbing to 4.54%, raising concerns about future fiscal spending and energy demand.

Moody’s cited ballooning debt levels and high interest costs as reasons for stripping the U.S. of its Aaa rating. The downgrade also dragged down the U.S. dollar, with the Dollar Index falling to around 100.20.

Adding to oil’s weakness, new data from China showed only moderate growth in April. Industrial production rose 6.1% year-over-year, slowing from March’s 7.7%, while retail sales increased 5.1%, under expectations and down from the previous 5.9% print.

With both U.S. fiscal stress and softening Chinese demand in focus, oil traders are bracing for more volatility this week.

Oil Sees Speculative Buying as Markets Watch Trump-Putin Call

Oil prices logged a second straight week of gains, helped by easing tariff tensions. However, the market paused Monday, awaiting clarity on the fallout from Moody’s U.S. credit downgrade and ongoing geopolitical developments.

According to ING analysts Ewa Manthey and Warren Patterson, attention is focused on an expected phone call between Donald Trump and Vladimir Putin regarding the Russia-Ukraine conflict. Any hints at de-escalation could shift oil market sentiment, though sanctions have already been largely sidestepped by Russia via exports to India and China.

Speculative traders have ramped up long positions in Brent. ICE Brent net longs increased by 53,586 contracts to 151,144, with the gains primarily driven by fresh buying. Meanwhile, U.S. drilling continues to slow. Baker Hughes data shows the U.S. oil rig count fell for a third week, down by one rig to 473—its lowest since January.

If prices remain under pressure, expect further pullback in domestic drilling activity.

Europe News

European Markets Mixed; Italy Slips from 15-Year High, Germany Hits Record

European equities ended the day with mixed results. Italy’s FTSE MIB dropped 1.20% to 40,166.76, retreating from its highest levels since 2008. In contrast, Germany’s DAX climbed 0.71% to finish at a new all-time high of 23,935.09.

Other key index moves:

- France’s CAC 40 dipped slightly by 3.07 points (-0.04%) to 7,883.63

- UK’s FTSE 100 added 14.74 points (+0.17%) to close at 8,699.31

- Spain’s Ibex 35 gained 34.50 points (+0.25%) to reach 14,099.00

Eurozone Inflation Holds Steady in April; ECB Rate Cut Odds Remain High

Eurostat confirmed final April CPI at +2.2% year-on-year, matching preliminary estimates. Core inflation also held at +2.7%, up from 2.5% in March.

The data hasn’t changed expectations for a European Central Bank rate cut in June. Markets currently assign a 91% probability to a 25-basis-point move, and pricing implies a total of 51 bps in cuts by year-end. However, signs suggest June’s cut could be the final move of 2025, pending further economic signals.

Swiss Sight Deposits Fall Sharply as SNB Adjusts Liquidity

Swiss National Bank data for the week ending May 16 shows total sight deposits fell to CHF 443.18 billion, down from CHF 453.24 billion the previous week.

Domestic deposits dropped to CHF 434.8 billion from CHF 444.8 billion. These weekly figures can hint at whether the SNB is intervening in currency markets or tweaking financial system liquidity.

UK House Prices Hit Record, But Spring Growth Slowest in Nearly a Decade

UK housing data for May 2025 shows a monthly rise of 0.6%, bringing prices to a new all-time high. Yet this is the weakest springtime increase since 2016. Year-over-year growth sits at 1.2%, barely changed from April’s 1.3%.

A major factor in the slowdown is reduced demand: transactions in April dropped 4% from a year earlier, following the expiration of tax incentives for lower-priced homes and first-time buyers.

SNB Schlegal: SNB tolerates negative inflation rate in the short term

- SNB Chairman Schlegal speaking

- SNB will tolerate negative inflation rate in the short term

- Uncertainty is currently very high.

- Swiss franc is often sought as a safe haven in times of uncertainty

- Policy rate is our main instrument, but when necessary we can intervene in the forex market.

- The outlook for Swiss inflation is currently very unclear

- There is no alternative to US treasuries.

- SNB is not a currency manipulator.

- It only intervened to pursue our mandate

- We have only intervened to slow overvaluation of the franc, not to gain a competitive advantage for Switzerland.

BOE Dhingra: Her vote for 50 bp cut was partly to make a statement on direction of economy

- BOE Dhingra speaking

- Her vote for 50 basis point cut was partly to make a statement on direction of the economy

- might see some cost pass-through from US tariffs

- Argue that numbers would be quite small.

- Won’t rule out scenario where global trade breaks and UK suffers inflation, but don’t think that’s where we’re headed

- My working hypothesis is that dollar depreciation is not going to put immense pressure on UK import prices

- If dollar starts to really go up we have to worry about what exchange-rate dynamics do for UK inflation

EU and UK said to reach outline deal to strengthen ties

- This looks like a breakthrough in the new EU-UK deal

- EU and UK said to reach outline deal to strengthen ties.

- EU-UK deal agreed by negotiators, needs political sign off.

The EU and UK will meet today in London for the first official summit since Brexit. The meeting is to pave the way for closer ties between both sides.

UK Government releases further details of EU reset deal

- Discussion on details of each commitment will continue

- UK and EU also agree security and defence partnership.

- The partnership paves way for UK firms to access EU’s 150bln pound defence fund.

- Sanitary and phytosanitary deal has no time limit.

- Closer co-operation on emissions trading systems will mean UK businesses not hit by EU carbon tax.

- UK economy to add nearly 9 bln pounds by 2040 as a result of deals on food and drink, emissions trading.

- Deal will protect British steel exports from new EU rules and tariffs.

- UK and EU to discuss access to EU facial image databases.

- Britsh holidaymakers will be able to use more passport e-gates in Europe.

- UK and EU agree to co-operate on youth mobility scheme, scheme will be capped and time-limited.

More details here

ECB’s Lagarde: Euro Strength Makes Sense Amid US Policy Uncertainty

ECB President Christine Lagarde said the euro’s rise—even during uncertain times—makes sense due to declining confidence in U.S. governance. In a weekend interview with La Tribune Dimanche, she noted that financial markets increasingly view Europe as a haven of stability.

Lagarde contrasted the EU’s institutional strength and legal consistency with mounting unpredictability in the U.S. She also called for deeper integration and the creation of a unified European capital market, arguing there is growing political will to make it happen.

Barclays expects the ECB to cut rates by 25bp in June, September and December

- Depo rate to reach 1.5%

Market expectations suggest a high probability of another 25 basis point cut, potentially bringing the deposit rate down to 2.00%.

This outlook is influenced by concerns over global trade tensions and their impact on eurozone inflation and growth.

Barclays suggest the June cut is on, with another 25bp cut at each of the September and December meetings.

European Central Bank Board Member Schnabel cautious on a June ECB rate cut

- On a June cut, Schnabel was coy: “It’s to be seen what will happen,”

European Central Bank Board Member Schnabel spoke on Saturday, expressing a cautious approach to further rate cuts. Schnabel cited lingering uncertainties from global trade tensions and inflation dynamics.

- “We need to maintain a steady hand for now”

- warned that falling energy prices and slowing global growth may lower inflation in the short term but could reverse in the medium term.

- “We can leave rates broadly at the level they are at now and are confident that we can also maintain price stability in this way.”

- “It’s to be seen what will happen”

Schnabel remarked also on the euro’s recent appreciation:

- “We now have a historic opportunity to further strengthen the international role of the euro”. To support that goal she reiterated the need for a unified European bond market and revisiting the idea of joint debt issuance. “I do think that it’s not fundamentally wrong to also think about joint debt to finance public goods in Europe”

ECB’s Kazaks: Rate cuts may be nearing end, but outlook still uncertain

- Governing Council member of the European Central Bank, Martins Kazaks

Latvian central bank governor, and therefore a Governing Council member of the European Central Bank, Martins Kazaks spoke on Friday with CNBC, ICYMI:

In brief, he said on Friday that interest rates may be close to their terminal level, though uncertainty remains high and further changes to the policy outlook are possible:

- “We are, by and large, within the baseline scenario” (the ECB inflation target is 2%)

- “And if the baseline scenario holds, then I think we are relatively close to the terminal rate already”

- “a couple of more cuts may be possible”

Kazaks said the outlook will depend on incoming data on developments in the economy

“The important thing is to see where the trade talk and the trade story take us, and then of course we’ll act”

Asia-Pacific & World News

China Slams U.S. Over Chip Export Rules, Accuses Washington of Breaking Geneva Deal

China has condemned the United States’ recent move to revise chip export controls, accusing Washington of violating agreements made during the Geneva talks. Beijing called on the U.S. to reverse its decision and warned that it would take retaliatory steps if necessary.

Major Chinese Banks to Cut Deposit Rates After PBoC Easing

According to Reuters, state-owned banks in China will cut deposit rates starting Tuesday. The move follows recent action by the People’s Bank of China, which earlier this month lowered the reserve requirement ratio by 50 basis points and cut both the main policy rate and the standing lending facility rate by 10 basis points each.

April 2025 Industrial Output Beats Forecasts, Retail Sales Slightly Miss

China’s industrial sector posted a 6.1% year-over-year gain in April 2025, surpassing expectations of 5.5%. While down from March’s 7.7% surge—which was likely driven by pre-tariff stockpiling—the performance still reflects healthy production momentum.

Retail sales rose 5.1% in the same month, just under the 5.5% forecast and below March’s 5.9%. Analysts noted that although industrial figures were encouraging, consumer activity appeared slightly restrained.

China’s Housing Market Stalls: Prices Flat Month-on-Month, Still Down Year-on-Year

April 2025 saw no change in new home prices compared to March, marking a second consecutive flat month. However, prices remain 4.0% lower than the same period a year ago, according to Reuters data. While the pace of annual decline has slightly eased from March’s -4.5%, the property market continues to show signs of prolonged softness.

China Sees Stable Economic Momentum Despite Headwinds, NBS Says

China’s economy is holding its ground despite mounting challenges, according to a recent statement from the National Bureau of Statistics (NBS). Officials highlighted solid gains in productivity and a largely stable job market, reinforcing the country’s gradual but consistent growth trajectory.

Beijing continues to push diversification through stronger trade ties with Belt and Road nations. However, internal investment is still lagging. Authorities acknowledge that the current engine for investment growth lacks sufficient force. Improving investment efficiency and upgrading structural composition remains a key focus.

Foreign trade in April showed resilience, withstanding pressure and demonstrating China’s capacity to adjust during international turbulence. Chinese trade firms are reportedly more capable of navigating market shifts and have adapted well to friction in global commerce.

Tariff reductions between China and the U.S. are anticipated to support bilateral trade expansion and could help revive global economic activity. Despite soft pricing putting pressure on businesses and households, and structural labor market issues—especially among younger job seekers—officials remain confident in China’s ability to manage adversity.

Real estate will see renewed government coordination aimed at increasing affordable housing and revitalizing urban centers.

China Stats spokesman: contribution of consumption to eco growth will continue to increase

- China National Bureau of Statistics (NBS) spokesman

International environment now still complex and severe, domestic cyclical and structural contradictions are intertwined

- But there are many favorable conditions for sustained economic recovery

- Although external impact increased in April, the trend of economic recovery did not change

- Gradual implementation of policies will be conducive to the sustained recovery and improvement of the economy

- As the effect of policies continues to show, contribution from consumption to economic growth will continue to increase

PBOC sets USD/ CNY reference rate for today at 7.1916 (vs. estimate at 7.2057)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 135bn yuan via 7-day reverse repos at 1.40%

- 43bn yuan mature today

- net injection 92bn yuan

Australian PM Open to Fair Trade Deal with EU

Prime Minister Anthony Albanese confirmed he’ll meet with European Commission President Ursula von der Leyen during his visit to Rome. He reiterated Australia’s readiness to negotiate a trade deal with the EU—provided it serves national interests.

Albanese pointed to the Australia-UK agreement as a model but made it clear: “We won’t sign just any deal.” His trip also includes attending the inauguration mass of Pope Leo XIV.

the Australian Financial Review (gated)

New Zealand’s Q1 PPI Shows Broad Cost Increases Across Sectors

New Zealand’s Producer Price Index rose sharply in Q1 2025. Inputs were up 2.9% quarter-on-quarter, while outputs climbed 2.1%, reversing previous declines.

The largest contributors on the output side were utilities (+26.2%), manufacturing (+2.3%), and real estate services (+1.4%). Input costs were driven primarily by a staggering 49.4% spike in utilities, with manufacturing and construction also contributing modestly.

NZ Services Sector Contracts Further in April, PMI Falls to 48.5

New Zealand’s services sector shrank more sharply in April, with the BusinessNZ Services PMI dropping to 48.5 from 49.1. This marks a deeper move into contraction territory and lags far behind the long-term average of 53.0.

BusinessNZ CEO Katherine Rich noted the sector remains stuck in a cycle of mild decline. BNZ economist Doug Steel added that despite optimism elsewhere, the PSI paints a sobering picture of economic weakness, particularly when compared to New Zealand’s key trade partners.

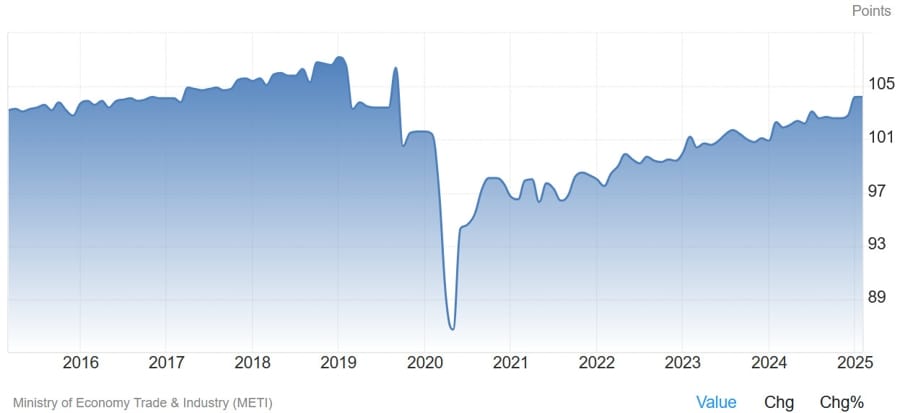

Japan’s Service Sector Rebounds in March, Tertiary Industry Index Jumps 15.8%

Japan’s Tertiary Industry Index surged 15.8% in March 2025, bouncing back sharply from a revised -0.3% in February. The index tracks output in the country’s service sector, and while it’s not considered a market mover, the swing reflects a notable rebound in services activity.

Japan’s Prime Minister Firmly Rejects U.S. Auto Tariffs

Prime Minister Ishiba took a firm stance in parliament against U.S. tariffs on Japanese vehicles. He emphasized that Japan is aiming for a mutually beneficial agreement with Washington but will not accept unilateral tariffs, highlighting the importance of strong investment relationships in reaching a deal.

Japan’s Agriculture Ministry suspended imports of poultry from parts of Brazil – bird flu

- Japan’s Agriculture Ministry:

- has suspended imports of poultry meat from Brazil’s Montenegro City following bird flu outbreak

- has suspended imports of live poultry from state of Rio Grande do Sul in Brazil following bird flu outbreak+

BOJ DepGov Uchida Will keep raising interest rates if economy, prices improve as forecast

- Bank of Japan Deputy Governor Uchida:

- will keep raising interestt rates if economy, prices improve in line with our forecast

- uncertainty surrounding each country’s trade policy extremely high

- Japan’s underlying inflation likely to re-accelerate after period of slowdown in growth

- mindful that recent rise in prices have negative impact on consumption

Japan finance minister Kato says Japan not facing problem getting funds via debt issuance

- Kato remark addressing rising yields for Japanese Government Bonds

Japan finance minister Kato:

- Japan not facing problem procuring funds from market via debt issuance

- If Japan loses market trust in its finances, it may face rise in interest rates that could affect debt redemption

- Losing market trust in Japan’s finances could trigger weak yen, excessive inflation that would have severe impact on economy

Japan Prime Minister Ishiba: Japan financial situation worse than Greece

- Against funding tax cuts with JGBs

- Japan financial situation worse than Greece

- Against funding tax cuts with JGBs

Crypto Market Pulse

Crypto Inflows Top $785 Million as Strategy Adds 7,390 BTC Despite Lawsuit

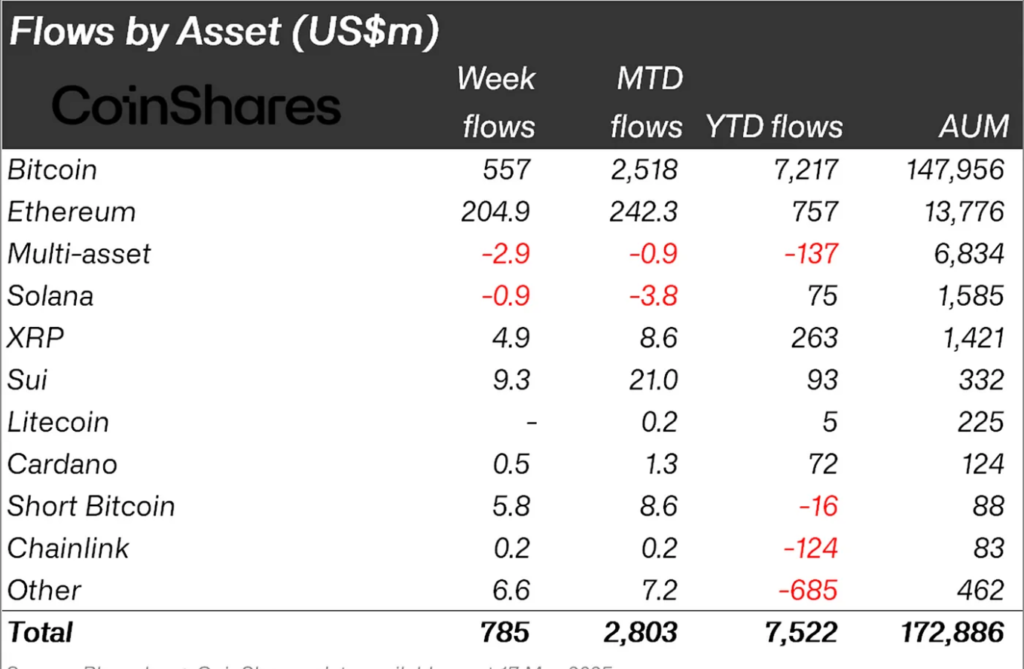

Digital asset investment products saw another strong week, recording $785 million in net inflows, bringing 2025’s year-to-date total to $7.5 billion, according to CoinShares’ latest report. Bitcoin led the gains with $557 million in inflows.

The headline-grabbing move came from Strategy, which added 7,390 BTC to its treasury between May 12 and 14 at an average price of $103,498—amounting to a $764.9 million investment. This brings Strategy’s total holdings to 576,230 BTC valued at over $40.1 billion.

The inflows mark the fifth consecutive week of gains for crypto products, following a rebound from nearly $7 billion in outflows earlier this year during heightened tariff-related volatility.

Despite the bullish investment activity, Strategy is facing legal pressure. A new class-action lawsuit filed by Pomerantz LLP alleges that the firm and its executives, including CEO Michael Saylor, misled investors by failing to properly disclose risks tied to its Bitcoin exposure.

In a statement, Strategy pledged to “vigorously defend against these claims.”

Meanwhile, Japanese firm Metaplanet disclosed a fresh Bitcoin buy of 1,004 BTC for $104 million, raising its holdings to 7,800 BTC—the firm’s second-largest crypto purchase to date.

Bitcoin traded above $106,000 on Monday before slipping slightly, and remains a key asset amid mounting institutional demand.

Solana Risks Double-Digit Drop as Key Support Nears

Solana (SOL) slipped to $165.40 on Monday, with technical signals turning bearish. A test of the 200-day EMA near $162.42 is underway, and a close below could open the door to a deeper slide toward $141.

SOL was rejected at the $184.13 resistance on May 14 and has dropped nearly 10% since. The 200-day EMA and support at $160 are aligned with a long-term trendline; a daily close below this confluence may accelerate losses.

Indicators are flashing warnings: the RSI has cooled to 54 and could drop below the 50 neutral mark, while the MACD is on the verge of a bearish crossover. According to Coinglass, SOL’s long-to-short ratio is just 0.85—the lowest in over a month—highlighting increased bearish sentiment among traders.

If price breaks below $160, the next downside target lies at $141.41, Solana’s low from May 6.

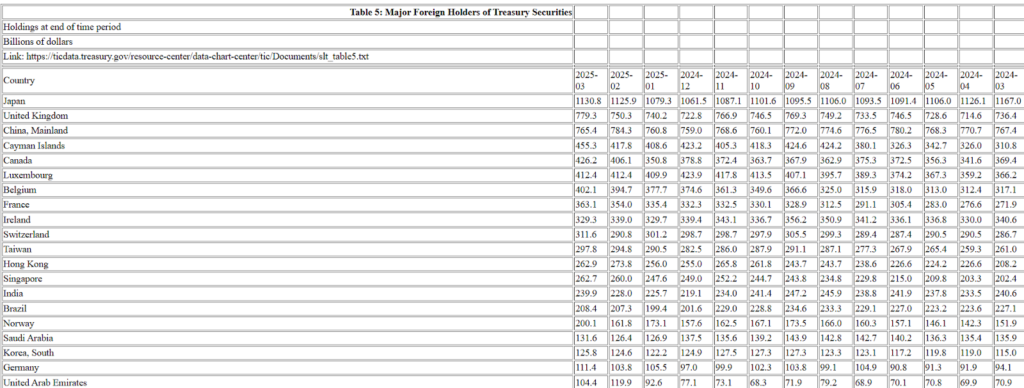

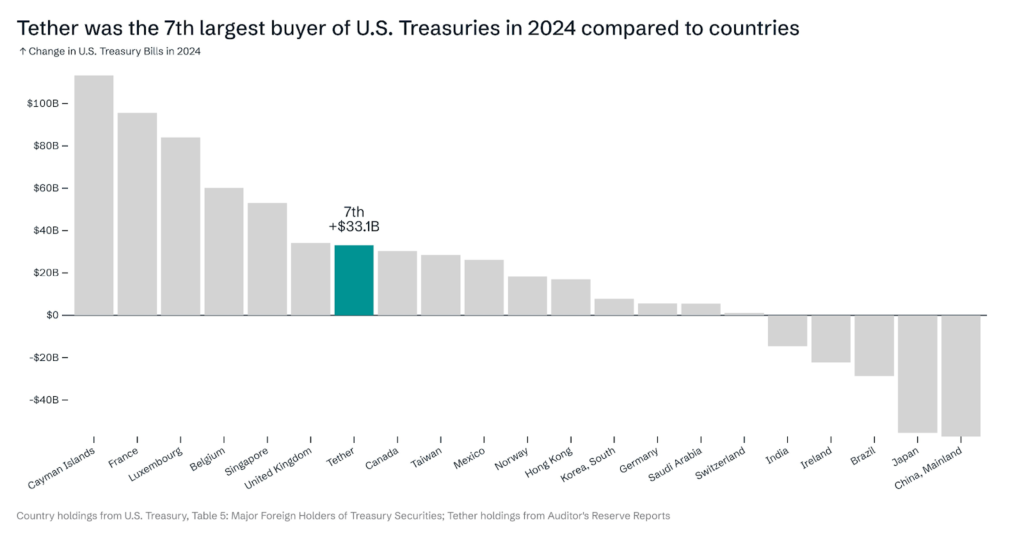

Tether Surpasses Germany in U.S. Treasury Holdings, Hits $120B

Tether has eclipsed Germany in U.S. Treasury bill ownership, with more than $120 billion in holdings—making it the 19th largest global holder, according to Tether’s Q1 2025 attestation and U.S. Treasury data.

Tether’s reserve strategy, heavily reliant on short-term Treasuries, helped the company post over $1 billion in operating profits in Q1. These traditional assets, including gold, have helped the firm offset losses from crypto market volatility.

In 2024, Tether ranked as the seventh-largest global buyer of U.S. Treasurys—surpassing countries like Canada and Taiwan. This reflects the company’s growing importance in managing dollar-denominated liquidity across digital finance.

Meanwhile, regulatory clarity around U.S. stablecoins is slowly taking shape. The STABLE Act, which promotes transparency and reserve backing, has passed committee and awaits a floor vote in the House. The GENIUS Act—focused on full AML compliance and collateral requirements—stalled after pushback over perceived political conflicts.

Still, with over $151 billion in stablecoin issuance and a growing role in global markets, Tether’s influence continues to expand.

Sui Rally Stalls Despite $9.3M Inflows and Strong DeFi Growth

Sui’s recent price momentum lost steam on Monday, falling back to $3.71 after peaking at $4.30 on May 12. The pullback suggests profit-taking may be kicking in, even as investment flows into Sui products remain strong.

Last week, Sui saw $9.3 million in fresh inflows, according to CoinShares, reflecting broader optimism in crypto markets. Despite the dip, Sui’s decentralized finance (DeFi) ecosystem holds over $2 billion in total value locked (TVL), indicating sustained investor confidence.

The TVL has climbed from roughly $1.78 billion on May 1, reflecting growing user engagement. A rising TVL typically signals belief in the protocol’s long-term potential. Additionally, stablecoin market cap on Sui surged 23.5% to $1.09 billion last week, with USDC leading. DEX trading volume jumped 10.47% to $4.14 billion.

Despite positive on-chain metrics, SUI’s price remains capped below $4.00. Monday’s low touched $3.59 before recovering to $3.71. The RSI has declined from an overbought 75.53 on May 8 to near 50, suggesting a weakening trend.

Key price levels include support at $3.50, a demand zone near $3.26 aligned with the 50-day EMA, and a broader trendline around $2.96 where the 200-day EMA sits. A decisive move through any of these levels could set SUI’s next direction.

XRP Under Pressure as Price Slips Below $2.31 Despite UAE Partnerships

Ripple’s XRP is trading at $2.31 on Monday, pulling back from last week’s $2.65 high. While Ripple has made strategic moves in the UAE, including partnerships with Zand Bank and fintech firm Mamo, XRP faces technical risks if it loses support at its 50-day EMA.

These new deals follow Ripple’s receipt of a license from the Dubai Financial Services Authority (DFSA). Zand and Mamo will use Ripple’s blockchain-based payment systems to improve cross-border transactions, including development of an AED-backed stablecoin.

Ripple now operates in more than 90 global markets and has processed $70 million in volume through its Ripple Payments platform. The UAE, a $400 billion trade hub, is a key expansion point.

Technically, XRP’s 50-day EMA near $2.28 provides immediate support. If that breaks, the 100-day EMA around $2.25 is next. A further breakdown could trigger a retest of the $2.00 level, especially if the RSI—currently around the neutral 50 line—continues to fall. Resistance toward a return to $3.00 remains contingent on holding these key support zones.

Binance and Kraken Reportedly Targeted in Weekend Cyberattacks

According to Bloomberg, Binance and Kraken were recent targets of cyberattacks similar to those that hit Coinbase. There are conflicting accounts: while some reports claim limited data was compromised, others suggest both platforms successfully fended off the attacks and protected customer data.

Bitcoin Surges Past $106,400 as Dollar Slips

Bitcoin surged to levels not seen since late January, breaking above $106,400. The spike follows a weaker U.S. dollar after the weekend, giving cryptocurrencies a lift amid renewed investor appetite.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

- Wall Street ends mixed but positive: The S&P 500 closed higher for the sixth straight session, shrugging off early losses tied to Moody’s U.S. debt downgrade. The Dow gained 137 points, while the Nasdaq barely eked out a gain after falling over 270 points intraday.

- Moody’s downgrade reverberates: Despite rattling markets at the open, the downgrade to Aa1 didn’t cause a panic sell-off. Instead, traders recalibrated expectations for fiscal policy, interest rates, and risk premiums.

- Fed officials hold the line: Bostic, Williams, and Jefferson offered a steady-but-cautious tone, acknowledging tariff risks and inflationary pressures, while signaling no rush to cut rates aggressively.

Canada

- Victoria Day holiday: Canadian markets were closed Monday for the national holiday, resulting in no trading activity across TSX or other local exchanges. Investors will return Tuesday digesting global developments, especially from the U.S. and China.

Commodities

- Oil settles slightly higher: WTI crude closed at $62.69, up $0.20, after recouping early losses triggered by Moody’s downgrade. Support came from signs of potential ceasefire talks between Russia and Ukraine, as reported from a Trump-Putin phone call.

- Gold breaks above $3,200: Investors moved into safe-haven assets, sending gold prices up as the U.S. dollar weakened and real yields climbed. Goldman Sachs reaffirmed a bullish gold trajectory, forecasting $4,000/oz by mid-2026.

- Silver remains range-bound: Hovering near $32.30, silver struggled to break through resistance but stayed supported by macro uncertainty and USD softness.

Europe

- Stock markets mixed: Italy’s FTSE MIB dropped 1.20%, reversing from 15-year highs, while Germany’s DAX set a new record, up 0.71%. France and the UK saw minor moves, as investors weighed the U.S. downgrade and Fed outlook.

- Eurozone inflation steady: Final April CPI and Core CPI both confirmed at +2.2% and +2.7% y/y, keeping pressure on the ECB ahead of its June meeting. Markets are still pricing in a 91% chance of a rate cut next month.

Asia

- Japan services rebound: The Tertiary Industry Index jumped 15.8% in March, reversing a previous contraction and hinting at a strong comeback in the country’s service sector.

- China growth slows: April industrial output rose 6.1%, while retail sales missed at 5.1%, both down from March figures. Combined with renewed chip export tension with the U.S., this is adding strain to investor confidence.

- Chinese banks to cut rates: State-owned banks are expected to lower deposit rates, following the PBoC’s recent monetary easing measures aimed at stabilizing growth.

Crypto

- $785M inflows power fifth week of gains: Digital asset funds continued attracting capital, led by $557 million in Bitcoin inflows. Cumulative 2025 inflows now total $7.5 billion.

- Strategy buys 7,390 BTC: Despite facing a lawsuit for alleged misstatements, the firm purchased $764.9 million worth of Bitcoin, increasing holdings to 576,230 BTC.

- Bitcoin flirts with $106K: BTC touched highs not seen since January 22, even as broader crypto markets showed a mild 1.2% pullback.

- Tether surpasses Germany in U.S. Treasurys: With $120B in holdings, Tether is now the 19th largest global holder, outpacing major sovereigns like Canada and Taiwan.

- Metaplanet adds 1,004 BTC: The Japanese firm expanded its treasury to 7,800 BTC, reflecting sustained institutional demand.