North America News

NASDAQ Closes at Record High, Marks New Intraday Peak

The NASDAQ closed Friday at another all-time high, gaining 207.32 points (+0.98%) to 21,450.02 and setting a new intraday record of 21,464.53, edging past the July 31 peak of 21,457.48.

The S&P 500 also advanced, finishing at 6,389.45 — just $0.32 shy of its record close of 6,389.77. The Dow Jones Industrial Average rose 206.97 points (+0.47%) to 44,175.61, while the Russell 2000 added 3.70 points (+0.17%) to 2,218.41.

Weekly Performance:

- Dow Jones: +1.35%

- S&P 500: +2.43% (biggest weekly gain since June 23)

- NASDAQ: +3.87% (biggest weekly gain since June 23)

Big Movers This Week:

- Apple: +13.33% — top performer in the large-cap space

- Tesla: +8.93%

- Nvidia: +5.17%

- Alphabet: +6.50%

- Amazon: +3.70%

- Meta: +2.57%

- Microsoft: -0.39%

Tech strength drove the market, with mega-cap names — especially Apple — providing most of the upside momentum.

Feds Musalem: Economic activity appears stable, not increasing or decreasing

- Favors maintaining the policy where it is

- Economic activity appears stable, not now increasing or decreasing

- Bankers report that funding pressures have diminished, credit quality is good

- Companies continue to report a shortage of skilled labor

- Firms remain cautious on capital spending and hiring

- Companies are using different strategies to adapt to tariffs, including cost-cutting and negotiating with suppliers

- Companies are not yet resorting to layoffs to reduce costs

- Companies that are most dependent on imports are passing along costs; those closer to consumers are less likely to raise prices so far

- The Fed is now missing on its inflation target but not missing on its employment mandate; labor market around full employment

- Looking ahead there is a risk that the Fed may miss on both inflation and employment, with downside risk to jobs

- Likely that most of the impact of tariffs on inflation will fade

- There is a reasonable probability that there may be some inflation persistence

- Labor market is in balance, but economic activity has been weaker and that poses risks to jobs

- The Fed is balancing risks to both sides of its mandate right now

JP Morgan Sees Fed Delivering Three Straight Cuts Starting September

JP Morgan now expects the Federal Reserve to deliver three consecutive 25 bp rate cuts from September through year-end — a sharp shift from its earlier forecast of just one December cut.

The change reflects worsening labor market conditions and aligns with a broader market view that policy easing will need to accelerate.

Currently, Fed funds futures price in roughly 59 bp of cuts for 2025, but JP Morgan’s call leans more dovish and could be reinforced if job data remains weak in Q3.

UBS Stays Bullish on Equities Despite Tariff Headwinds

UBS says market fundamentals — not trade headlines — remain the primary driver of equities. The bank notes:

- Corporate earnings are still growing.

- Consumer spending is holding up.

- Recession risk in the near term remains low.

UBS expects the U.S. effective tariff rate to settle near 15%, which could slow growth and lift inflation but is unlikely to derail the economy or end the rally.

With Fed rate cuts on the horizon, the bank sees volatility as a buying opportunity and recommends staying diversified, keeping defensive capital preservation strategies, and adding on dips.

Canada’s Carney: Wages Outpacing Inflation; Criticizes Israel Gaza Plan

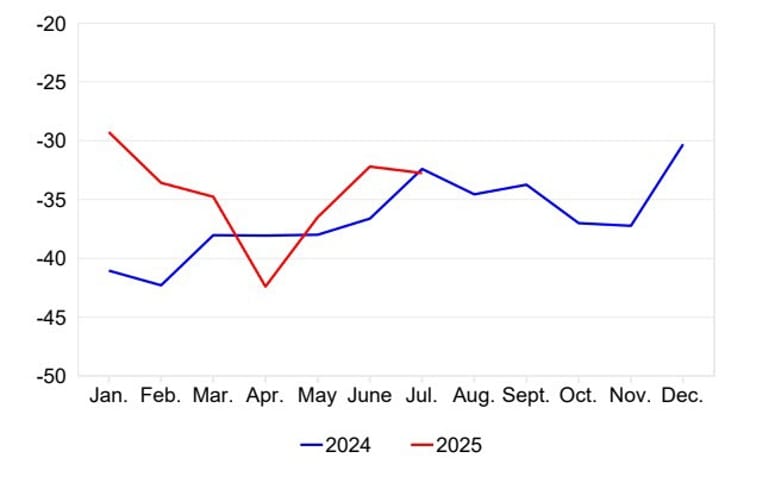

Canadian PM Mark Carney said Friday that wage growth is now running ahead of inflation, with average hourly earnings up 3.5% in July versus 3.2% the prior month. He noted, however, that real wages remain near post-pandemic lows.

On foreign policy, Carney condemned Israel’s reported plan to occupy all of Gaza, warning it would endanger hostages and escalate tensions.

Canada’s July Jobs Report Misses Expectations

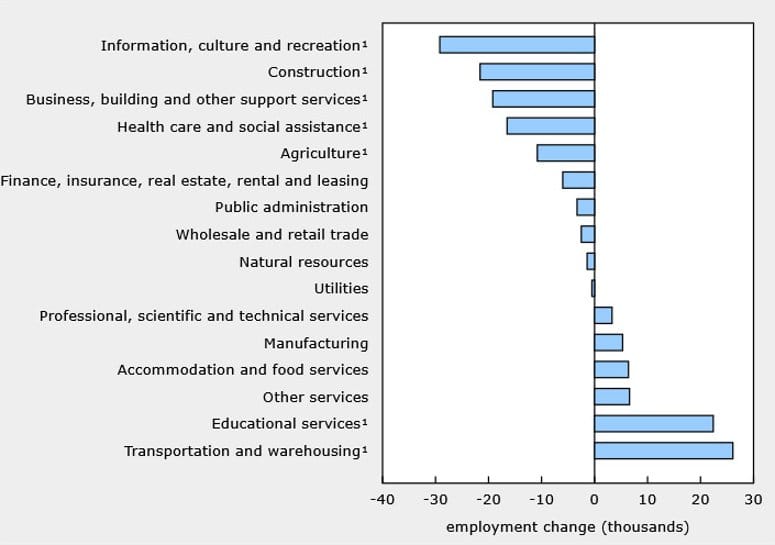

Canada lost 40,800 jobs in July, far worse than the expected gain of 13,500. Full-time employment fell by 51,000, partially offset by a 10,300 gain in part-time work. The unemployment rate held at 6.9%, just below expectations, while wage growth rose slightly to 3.3% year-on-year.

Markets reacted by increasing bets on a September Bank of Canada rate cut to 38%, though policymakers may need more evidence given persistent inflation pressures.

Commodities News

Baker Hughes Rig Count: US Down, Canada Up

The US rig count fell by 1 to 539 this week, with oil rigs up 1 to 411, gas rigs down 1 to 123, and miscellaneous rigs down 1 to 5. Year-over-year, the total is down 49 rigs. Offshore rigs held steady at 13.

In Canada, the rig count rose by 3 to 180, driven by a 4-rig gain in gas drilling. Oil rigs fell by 2 to 122. Compared to last year, Canada’s total is down 37 rigs.

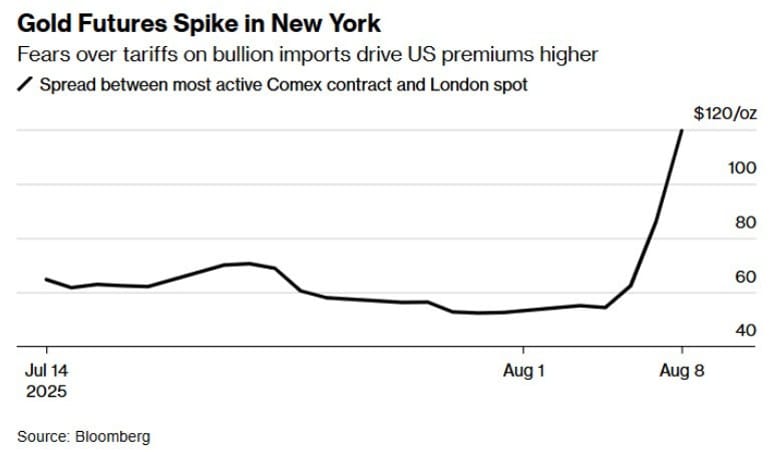

Gold Spot Prices Hold Steady as COMEX Futures Surge — Tariffs Create Price Gap

Gold spot prices are holding steady despite COMEX futures hitting elevated levels after surprise US tariffs on certain gold imports. The tariffs mean gold will be more expensive in the US compared to overseas markets, creating an unusual price discrepancy between COMEX and London Metal Exchange (LME) contracts.

Normally, price differences are limited to contract specifications, but gold shipped from London to the US must be recast in Switzerland to meet COMEX bar-size requirements. With Switzerland refining roughly 90% of gold from industrial mines, tariffs at this stage sharply raise US delivery costs. The market, unprepared for this announcement, is now reassessing demand, especially after the gold-buying surge seen in early 2025 failed to continue.

Oil Prices Slip on Hopes of Trump–Putin Meeting

Brent crude fell 0.7% on reports that Presidents Trump and Putin may meet as soon as next week. Ukrainian President Zelenskyy’s participation remains uncertain, which could affect secondary US tariffs on India. Indian refiners are already scaling back Russian crude purchases amid tariff uncertainty, likely shifting demand toward Middle Eastern grades.

China’s July crude imports averaged 11.2m bpd, down 8% from June but still up 11.5% year-on-year.

China Extends Gold-Buying Streak

The People’s Bank of China added 60,000 troy ounces to reserves in July, marking a ninth straight month of buying and bringing holdings to 73.96 million ounces. Gold prices are up more than 25% this year, supported by central bank purchases, trade tensions, and geopolitical risks.

UBS Warns Tariffs on Large Gold Bars Could Disrupt Funding Markets

UBS is cautioning that U.S. tariffs on 1 kg and 100 oz gold bars — key formats in wholesale bullion and EFP trades — could trigger significant market dislocation.

The bank sees a risk that higher costs will drive a mass unwinding of short EFP positions, which are typically settled in London. Such a move would increase the demand for cash and liquidity in the city’s bullion market, tightening funding conditions and potentially straining the system.

These bars, now more expensive to move into the U.S., sit at the heart of the global gold trade and are vital to the mechanics of futures settlement.

US Tariffs on Gold Bars Drive Record COMEX Prices

Gold futures on COMEX hit a record $3,534/oz after US Customs classified 1kg and 100oz gold bars from Switzerland as subject to a 39% tariff. Switzerland, a top gold refiner, exported 450 tons of gold to the US in Q1 amid earlier uncertainty over tariffs.

The decision has reopened doubts over import rules, widening the COMEX–London spot price gap to over $100 — the largest since spring market disruptions.

Higher Tariffs Slash 2025 Oil Demand Growth Forecasts

S&P Global Commodity Insights has slashed its forecast for 2025 global oil demand growth to 635,000 barrels per day, less than half the 1.3 million b/d expected before U.S. tariff announcements in April.

The downgrade reflects weaker consumption in the U.S., China, the Middle East, and Eurasia. The IEA has also trimmed its projections, warning that Brazil, India, and Singapore could slip into contraction if conditions worsen.

Major traders are already feeling the slowdown: Glencore’s energy and steelmaking coal trades plunged 88% year-on-year in H1, while Trafigura cautioned demand could weaken further after preemptive buying ahead of tariff hikes.

India Cuts Russian Oil Imports Amid Tariff Threats

Russian seaborne oil shipments to India dropped to 460,000 barrels per day last week, the lowest since April 2022, after US tariff threats. This marks the third consecutive weekly decline from mid-July’s average of 1.6 million bpd. Sources say Indian state refiners are halting Russian purchases as a 25% US tariff is set to take effect in three weeks, rising to 50% after reciprocal measures.

China remains Russia’s top oil buyer, importing over 11 million bpd in July, up 11.5% from a year earlier despite a month-on-month decline.

Tariffs on Strategic Gold Bars Threaten Market Stability

The U.S. decision to hit 1 kg and 100 oz Swiss gold bars with tariffs is sending shockwaves through the bullion trade. These sizes are the preferred deliverable units for COMEX contracts and play a key role in the “Exchange for Physical” (EFP) mechanism linking London’s unallocated gold market to New York’s deliverable futures.

By making delivery more expensive, the tariffs are disrupting that link, pushing short sellers to close or roll contracts and risking a funding squeeze in London’s bullion banking system. This comes on top of Basel III rules that already pressure banks to hold more physical gold and limit rehypothecation.

Strategically, the tariffs erode Switzerland’s refining edge, squeeze London’s trading desks, and bolster COMEX’s influence in global price setting.

US Slaps Tariffs on Large Gold Bars, Hitting Switzerland’s Refining Industry

The United States has officially imposed tariffs on imports of one-kilogram and 100-ounce gold bars, a move that could shake the world’s biggest gold refining hub in Switzerland.

According to a July 31 letter from U.S. Customs and Border Protection, these bars will now fall under a customs classification that makes them subject to import duties. These formats are common in wholesale gold trading and are accepted for delivery on COMEX futures contracts.

The decision directly threatens Switzerland’s refining dominance, as the country processes much of the world’s gold supply into these exact specifications. Market players are warning the change could rattle gold’s global supply chain.

Europe News

European Stocks End Mixed; Weekly Gains Strong Outside UK

European equities closed Friday mixed. The German DAX finished flat, France’s CAC 40 rose 0.44%, Spain’s Ibex 35 gained 0.91%, and Italy’s FTSE MIB added 0.56%, while the UK’s FTSE 100 dipped 0.06%.

For the week, major indices posted strong gains with the exception of the UK:

- DAX: +3.28%, best week since late April

- CAC 40: +2.61%, best since late April

- FTSE 100: +0.30% as BOE’s dovish cut weighed

- Ibex 35: +4.94%, best since mid-April

- FTSE MIB: +4.21%, best since mid-April

Swiss Consumer Sentiment Improves, But Tariff Risks Loom

Switzerland’s consumer sentiment index was -32.8 in July, little changed from June’s -32.2, according to SECO data. However, Q3 sentiment has improved to -28 from -39 in Q2. The outlook could darken if US tariffs on Swiss gold — and possibly pharmaceuticals — weigh on exports in the coming months.

BoE’s Pill: There is some shift in the balance of risks on inflation

- Remarks from the BoE policymaker

- A clear decision was made to cut interest rates

- Disinflation is showing ongoing progress

- At the margin, there has been an upward shift in inflation risks for 2-3 years time

- Inflation is being driven by one-off effects

- There is a risk of spillover into more persistent inflation

- Weaker labor market is acting as an offsetting factor

- If price and wage-setting behaviour is changing, we need to question if the recent pace of rate cuts is sustainable

- MPC overall believes UK monetary policy is still restrictive

- When inflation is high due to external forces, we need to be aware of the risk that they might affect domestic price-setting

- Scope to lower rates is limited by weak supply growth

- We are approaching 2% to 4% neutral rate range

- There is a little bit further to go on rates

- It is too early to offer precise guidance on neutral rate

- Rate-cutting pace is less clear than over the past year

Asia-Pacific & World News

SMIC Chief Says Demand Still Outpacing Supply, Rush Orders to Ease in Q4

The CEO of Semiconductor Manufacturing International Corporation (SMIC) said Friday that demand for its chips continues to exceed available supply.

He noted that the recent wave of urgent orders and accelerated shipments, fueled partly by shifting trade and tariff policies, should begin to slow in the fourth quarter.

While the industry braced for a “hard landing” from new tariffs, the company has so far avoided any major downturn, maintaining strong customer demand across sectors.

PBOC sets USD/ CNY reference rate for today at 7.1382 (vs. estimate at 7.1742)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 122bn yuan via 7-day reverse repos at 1.40%

- 126bn yuan mature today

- net 4bn yuan drain

RBA Expected to Cut Rates to 3.60% in August, More Easing Likely by Year-End

All 40 economists surveyed by Reuters expect the Reserve Bank of Australia to trim its cash rate by 25 basis points to 3.60% at its August 12 meeting.

The move follows a softer inflation print — headline CPI dropped to 2.1% last quarter, near the bottom of the RBA’s target range — and an uptick in unemployment to 4.3% in June, the highest in three-and-a-half years.

Most analysts (35 of 38) predict another 25 bp cut in Q4, taking the rate to 3.35% by year-end. Forecasts suggest one more cut to 3.10% by March 2026, with rates holding steady through the rest of that year.

BOJ July Policy Summary Flags High Uncertainty on Outlook

The Bank of Japan’s July policy meeting summary shows deep caution among policymakers, despite leaving the short-term rate unchanged at 0.5%.

Key points from board members:

- Rates could continue rising if the economy and inflation track forecasts.

- Significant uncertainty remains around trade policy and its economic impact.

- Japan’s underlying inflation is seen accelerating toward 2%, with second-round effects emerging from higher food and fuel costs.

- Some members want to keep policy loose for now, others argue for timely hikes to avoid disruptive rapid increases later.

- The recent Japan-U.S. trade agreement is seen as a major positive for reducing uncertainty.

Officials also stressed the need to monitor U.S. inflation and labor data before deciding future moves.

Japan Household Spending Misses Expectations in June

Japan’s June household spending rose 1.3% year-on-year, missing forecasts for a 2.6% increase and slowing sharply from the prior month’s 4.7% gain.

On a month-to-month basis, spending fell 5.2%, deeper than the expected -3.0% drop, reversing a 4.6% rise in May.

Japan’s Nikkei Jumps on Positive Tariff Talks with the US

Japan’s benchmark Nikkei 225 rose 2% on Friday, shrugging off Wall Street’s overnight decline, after trade envoy Ryosei Akazawa announced progress in tariff negotiations with the United States.

Following talks in Washington with Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent, Akazawa said the U.S. had agreed to correct a presidential tariff order and refund duties collected in error. Under the revised agreement:

- Items taxed above 15% will be capped at 15%

- Items below 15% will now be charged exactly 15%, including existing duties

The upcoming formal order will also cut U.S. auto tariffs from 27.5% to 15%. Akazawa criticized the original oversight as “extremely regrettable” but said both U.S. officials acknowledged the mistake and promised swift action.

Crypto Market Pulse

XRP Nears Record High as Ripple–SEC Case Nears Resolution

XRP traded at $3.38 Friday after Ripple and the US SEC jointly moved to dismiss their appeals in the Second Circuit Court, signaling an end to a five-year legal battle. The filing states each side will cover its own costs.

The case began in 2020 when the SEC accused Ripple of selling unregistered securities. A 2023 ruling cleared programmatic exchange sales but upheld violations for institutional deals. Earlier this year, the parties agreed to a $50M settlement, though the district court rejected the motion to close the case.

With the latest filing and an SEC status update due August 15, traders are eyeing a potential push toward XRP’s July all-time high of $3.66. Technicals remain bullish, with MACD showing a buy signal.

Dogecoin Rally Faces Profit-Taking Risks

Dogecoin rose nearly 19% from $0.1881 to $0.2232 this week, supported by speculative demand and broader crypto gains. Open Interest climbed 6.6% to $3.4B, with trading volume hitting $6.5B. However, a rise in supply held in profit raises the risk of early profit-taking that could slow the uptrend.

Ethereum Hits 2024 Highs, Faces Key Resistance

Ethereum broke above $3,900, its highest since December, but faces heavy resistance at the $3,900–$4,000 range — a historical turning point. A short squeeze could push prices toward $4,800 if shorts are forced to cover.

Standard Chartered says public companies holding ETH may be more attractive than ETFs due to staking yields and DeFi integration. Fundstrat’s Tom Lee sees growing Wall Street interest in Ethereum as tokenization gains traction.

Meanwhile, new US tariffs on Southeast Asian mining equipment are expected to slow Bitcoin mining growth.

Pi Network Eyes Bullish Reversal After AI Investment

Pi Network (PI) rose about 1% Friday, extending a 4.6% rally, as charts formed a bullish Adam and Eve pattern. The move followed news that Pi invested in AI robotics startup OpenMind, part of a $20 million raise led by Pantera Capital.

The community remains cautious after Pi requested volunteer moderation against misinformation, without compensation. The investment aligns with Pi’s earlier $100 million venture commitment.

Bitcoin Rises on Fed Dovish Signals, Trump Executive Order

Bitcoin climbed this week as dovish Federal Reserve comments and President Trump’s executive order allowing cryptocurrencies in retirement plans boosted risk sentiment. Fed officials Williams, Daly, and Kashkari all pointed toward a possible September rate cut, citing softening labor data.

The market focus now turns to next week’s US CPI report, which could solidify or undermine rate-cut expectations ahead of Powell’s speech at Jackson Hole. Technically, BTC bounced from the $112,000 trendline to test a downward resistance zone. Bulls are eyeing a breakout to all-time highs, while bears are watching for a rejection toward the major upward trendline.

The Day’s Takeaway

North America

US Equities Extend Gains, NASDAQ Hits New Records

The NASDAQ closed at a record 21,450.02, rising 0.98% and setting a fresh intraday high of 21,464.53, surpassing the previous peak from July 31. The S&P 500 advanced to 6,389.45, narrowly missing a record close by $0.32, while the Dow gained 206.97 points (+0.47%) to 44,175.61. The Russell 2000 rose 0.17% to 2,218.41.

- Weekly performance: Dow +1.35%, S&P +2.43% (largest gain since June 23), NASDAQ +3.87% (largest since June 23).

- Key movers: Apple +13.33%, Tesla +8.93%, Alphabet +6.50%, Nvidia +5.17%, Amazon +3.70%, Meta +2.57%, Microsoft -0.39%.

Canada’s Carney: Wages Outpacing Inflation

Prime Minister Mark Carney said average hourly wages rose 3.5% in July versus 3.2% in June, outpacing CPI growth, but remain near post-pandemic lows. Carney also condemned Israel’s reported plan to occupy all of Gaza, warning it would endanger hostages.

Canada Jobs Report Misses Expectations

Canada lost 40,800 jobs in July versus expectations for a 13,500 gain. Full-time employment fell by 51,000, part-time jobs rose by 10,300. The unemployment rate held at 6.9%. Wage growth rose to 3.3% y/y. Markets increased the probability of a September Bank of Canada rate cut to 38% from 33%.

Baker Hughes Rig Count

US rig count fell by 1 to 539, down 49 from a year ago. Offshore rigs held steady at 13. Canada’s rig count rose by 3 to 180, but remains 37 below last year’s level.

Commodities

Gold Tariffs Drive COMEX–London Price Gap

Surprise US tariffs on 1kg and 100oz gold bars from Switzerland sent COMEX futures to record highs, with prices closing at $3,534/oz and widening the gap with London spot prices to over $100. Switzerland refines about 90% of gold from industrial mines, and these bar sizes are standard for COMEX delivery, making US gold more expensive than in overseas markets.

UBS and Market Warnings

UBS warned tariffs could disrupt the “Exchange for Physical” mechanism linking London’s unallocated gold market to COMEX deliverable contracts, risking funding squeezes in London bullion markets.

Oil Market Developments

- India: Russian oil shipments to India fell to 460,000 bpd, the lowest since April 2022, amid US tariff threats.

- China: July crude imports averaged 11.2m bpd, up 11.5% y/y but down 8% m/m.

- Brent crude: Fell 0.7% on hopes of a Trump–Putin meeting that could influence sanctions policy.

- S&P Global: Cut 2025 global oil demand growth forecast to 635,000 bpd from 1.3m bpd, citing weaker demand in multiple regions.

China Central Bank Continues Gold Buying

The PBoC added 60,000 troy ounces in July, marking a ninth consecutive month of reserve increases, bringing total holdings to 73.96 million ounces.

Europe

European Stocks End Mixed; Weekly Gains Strong Outside UK

Friday’s close saw the DAX flat, CAC 40 +0.44%, FTSE 100 -0.06%, Ibex 35 +0.91%, FTSE MIB +0.56%. Weekly gains: DAX +3.28%, CAC 40 +2.61%, Ibex 35 +4.94%, FTSE MIB +4.21%, FTSE 100 +0.30%.

Swiss Consumer Sentiment Improves

July SECO index was -32.8 versus -32.2 in June. Q3 sentiment improved to -28 from -39 in Q2. Risks remain from new US tariffs on Swiss gold and potential future tariffs on pharmaceuticals.

BOJ July Summary (Japan–Europe tie-in for policy watch)

While technically Asia-focused, European policymakers are watching Japan’s policy as the BOJ flagged high uncertainty from trade disputes and signaled rates could rise if inflation meets forecasts.

Asia

Japan’s Nikkei Rises on Tariff Negotiation Progress

Nikkei 225 jumped 2% after Japanese and US trade officials agreed to cap tariffs at 15% and cut US auto tariffs from 27.5% to 15%. Refunds will be issued for duties collected above the cap.

Japan Household Spending Misses Forecasts

June household spending rose 1.3% y/y (forecast 2.6%), slowing from May’s 4.7% gain. Month-on-month, spending fell 5.2% versus an expected 3.0% drop.

SMIC CEO: Demand Still Outpacing Supply

China’s largest chipmaker says rush orders driven by trade and tariff shifts should ease in Q4, but overall demand remains strong.

Crypto

Bitcoin

BTC rose this week on dovish Fed commentary and Trump’s executive order allowing cryptocurrencies in retirement plans. Price rebounded from $112,000 to test a downward trendline. A breakout could open new all-time highs; a rejection could send it back toward its major upward trendline.

Ethereum

ETH hit $3,900 — highest since December — testing heavy resistance. Analysts see potential for a short squeeze toward $4,800. Standard Chartered says companies holding ETH may be more attractive than ETFs due to staking yields and DeFi use.

XRP

XRP traded at $3.38 after Ripple and the SEC jointly moved to dismiss appeals in their five-year legal fight, suggesting a settlement could be near. Technicals remain bullish, with traders watching the $3.66 all-time high.

Dogecoin

DOGE gained nearly 19% from $0.1881 to $0.2232 this week on rising speculative demand. Open Interest rose 6.6% to $3.4B, but a large share of supply in profit could trigger profit-taking.

Pi Network

PI rose about 1%, extending a 4.6% rally, as charts formed a bullish Adam and Eve pattern. Gains followed news of investment in AI robotics startup OpenMind.