North America News

U.S. Stocks End Flat; Russell 2000 Leads Rebound as Copper Skyrockets

U.S. equity markets closed mostly unchanged on Tuesday, with a notable bounce in small caps.

Closing snapshot:

- S&P 500: –0.1%

- Nasdaq Composite: flat

- Dow Jones Industrial Average: –0.4%

- Russell 2000: +0.7%

The Russell 2000 recovered after a sharp drop on Monday driven by tariff headlines. Broader market action stayed range-bound, but a surge in meme stocks suggests speculative excess is creeping back in — a sign some investors see as a late-cycle warning, even though these stocks can often stay elevated for a while.

On the trade front, President Trump indicated that the U.S. will issue additional tariff letters to another 15–20 countries in the coming days, outlining new duty levels. Sector-specific hikes were also announced, including pharmaceutical tariffs set to rise up to 100% or more in phases. The administration also confirmed a 50% tariff on copper imports — a move that dramatically altered supply dynamics.

Copper staged its biggest intraday gain since 1989, soaring 13.3% to finish at $5.645 per pound, marking a record high for the front-month futures contract and surpassing the March peak. This single-day move is now the largest percentage gain ever recorded for copper.

In bond markets, yields showed a mixed close:

- 2-year: 3.898% (–0.4 bps)

- 5-year: 3.977% (+1.2 bps)

- 10-year: 4.403% (+0.8 bps)

- 30-year: 4.925% (–0.5 bps)

Treasury Sells $58B in 3-Year Notes at 3.891% High Yield

The U.S. Treasury auctioned $58 billion of three-year notes at a high yield of 3.891%, slightly above the 3.887% when-issued level at the time of the auction.

Key auction stats:

- Bid-to-cover ratio: 2.51× (below the six-month average of 2.61×)

- Tail: 0.4 basis points, close to the six-month average

- Direct bidders (domestic): 29.4%, much higher than the 15.1% average

- Indirect bidders (international): 54.1%, below the 66.6% average

- Dealers: 16.5%, lower than the 18.2% average

While domestic demand was stronger, foreign interest came in weaker than usual, suggesting some caution among international buyers amid ongoing fiscal policy shifts and geopolitical tensions.

U.S. May Consumer Credit Rises $5.1B, Below Forecast

Consumer credit in the U.S. rose by $5.1 billion in May, falling short of the $11.0 billion increase that economists had expected.

The modest gain suggests that while consumers are still borrowing, they are doing so cautiously. There are no immediate signs of stress in household credit markets, but the softer-than-expected figure could point to more conservative spending or credit usage amid persistent economic uncertainty.

U.S. Year-Ahead Inflation Expectations Ease to 3.0%

The New York Fed’s latest consumer survey showed year-ahead inflation expectations falling to 3.0% in June, down from 3.2% in May.

Longer-term inflation projections remained stable: three-year expectations stayed at 3.0%, and five-year expectations held at 2.6%.

Households maintained their home price growth outlook at 3%, but they expected faster price rises in rent, gas, medical care, and college expenses.

Respondents felt more confident about their finances and access to credit in June. Labor market expectations also improved, painting a slightly more optimistic picture for U.S. consumers going forward.

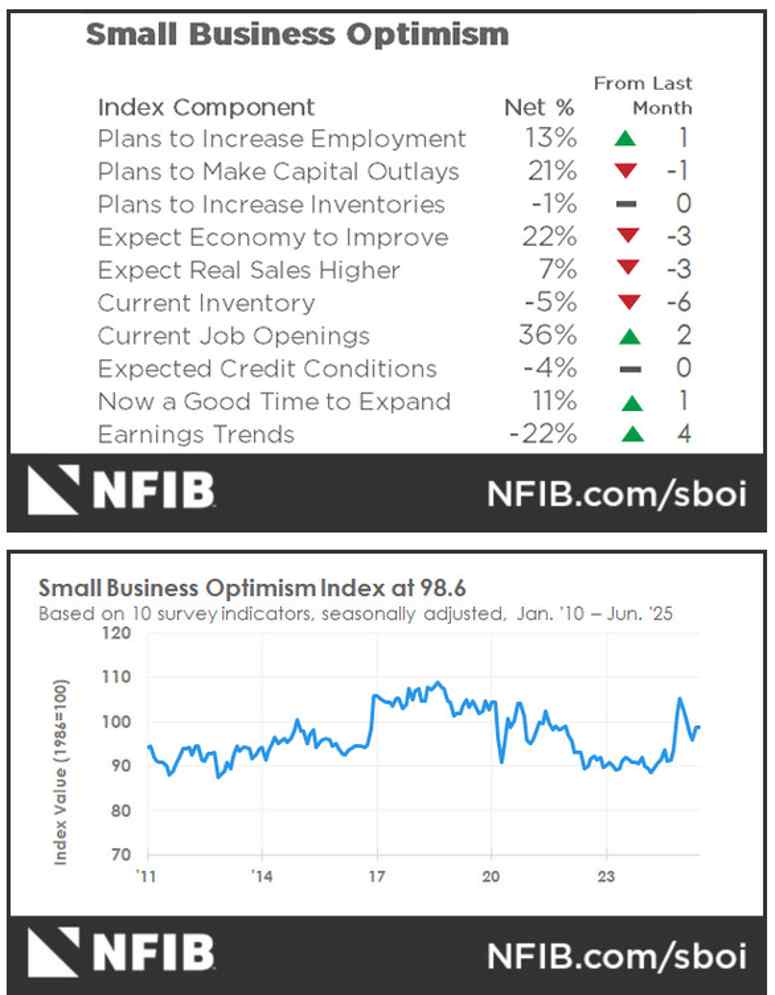

U.S. NFIB Small Business Optimism Index Dips to 98.6

The NFIB small business optimism index fell slightly to 98.6 in June, just below the 98.7 forecast and down from 98.8 in May.

A notable driver of the decline was a rise in the number of respondents citing excessive inventories. Meanwhile, the Uncertainty Index dropped five points to 89, signaling reduced near-term uncertainty.

Taxes re-emerged as the top concern for small business owners, with 19% listing them as their main issue — the highest since July 2021. This suggests that tax policy remains a major sticking point for U.S. entrepreneurs even as other economic pressures evolve.

NFIB Chief Economist Bill Dunkelberg said: “Small business optimism remained steady in June while uncertainty fell. Taxes remain the top issue on Main Street, but many others are still concerned about labor quality and high labor costs.”

U.S. Treasury Boosts T-Bill Issuance Across Multiple Tenors

The U.S. Treasury announced an increase in T-bill issuance, expanding supply across four-, six-, and eight-week bills.

Officials confirmed no plans for cash management bills. Following the recent debt ceiling resolution, Treasury aims to lift its cash balance to $500 billion by the end of July.

On July 9, Treasury will auction $65 billion in 17-week bills. The next day, it will sell $70 billion of eight-week bills (up from $45 billion) and $80 billion of four-week bills (up from $55 billion).

Trump Speaking: Not happy with Russian Pres. Putin

- We will step up contractors to make military equipment

- Not happy with Putin

- Looking at Russian sanctions

- Chair Powell should resign immediately.

- Should get someone in there to lower rates immediately.

- Everyone pays on August 1

- If they don’t want to pay, they don’t sell in the US

- The deals are mostly my deal to them.

- We are picking a number that is low and fair.

- BRICs are getting 10% pretty soon.

- The US dollar is king. We will look to keep it that way

- The EU is treating us very nicely

- Probably two days off from sending EU letter. A letter is a deal.

- Prices are down in this country.

- Gasoline prices are lower.

- I have a great relationship with Xi

- We will be announcing semi conductor tariffs soon.

- Believer copper tariffs will be 50%

HSBC: No Convincing Case Yet for a Sustained U.S. Dollar Rebound

HSBC’s FX strategists believe conditions aren’t yet right for a strong U.S. dollar recovery. A return to dollar strength would typically require the currency to respond to interest rate differentials — but that correlation has broken down in 2025.

Despite the U.S. maintaining a rate advantage, the dollar index (DXY) hasn’t tracked yields as closely. HSBC points to a mix of uncertainties: political risk, structural market shifts, and continued investor caution as factors weighing on the greenback.

Goldman Sachs Moves Up Fed Rate Cut Timeline to September

Goldman Sachs now expects the U.S. Federal Reserve to start cutting interest rates in September — three months earlier than previously forecast. The firm cites weaker-than-expected inflation, fading wage pressures, and signs of demand softening.

Chief economist David Mericle assigns slightly better than 50% odds to a September rate cut, with follow-up 25 bps cuts likely in October and December, and two more in early 2026. Goldman has also trimmed its terminal rate forecast to 3–3.25%, down from 3.5–3.75%.

While the labor market appears solid, job openings are falling, and hiring is becoming more difficult. Tariff-driven inflation impacts are proving modest, and inflation expectations are easing, giving the Fed flexibility ahead of Powell’s term end.

Goldman Sachs Raises S&P 500 Forecasts on Rate Cut Expectations

Goldman Sachs now projects higher short-term returns for the S&P 500, revising their 3-, 6-, and 12-month targets to +3% (6400), +6% (6600), and +11% (6900) respectively.

The forecast revision is based on two key factors: growing expectations of earlier and more substantial U.S. interest rate cuts, and the enduring strength of large-cap stocks leading the market.

U.S. Tariff Hike Threatens Japan’s Economic Outlook, Warns Morgan Stanley MUFG

Japan may face fresh economic challenges as the U.S. signals a new 25% tariff on Japanese imports starting August 1, up from the previous 24% set in April. Morgan Stanley MUFG economists caution that if these duties persist without a trade agreement, Japan’s economy could take a significant hit.

The financial firm notes that prolonged tariff pressure would damage export performance and weigh on corporate investment. However, they also anticipate a potential fiscal stimulus response later this year, possibly unveiled in a special autumn session of Japan’s Diet after the Upper House elections.

Former Fed Reserve Governor Warsh says tariffs not inflationary, has sympathy for Trump

- Sycophantic comments from Warsh, he is jockeying to become next Federal Reserve System Chair

- I have sympathy for Trump’s frustration over Fed policy.

- Tariffs are not inflationary

- ‘Plenty of deadwood’ at Federal Reserve

- what the Fed needs is regime change.

- Regime change means new sets of policies, new way of thinking about economic growth, a new understanding of what really drives inflation and also means new personnel.

- This isn’t 1978 economics anymore, where we think that inflation is caused by high wages. Inflation’s caused by this growth of money

- to underscore the point, back in the ’08 crisis, we cut rates to zero. We decided because the economy was racing away from us, we’d create this new instrument called quantitative easing. And about every trillion dollars we grew the balance sheet, we thought roughly was worth about 50 basis points of cuts. If you look right now, and you could take down that balance sheet, a couple trillion dollars over time in concert with the Treasury secretary, that’s a big rate cut that could come. And what you would do then is turbocharge the real economy where things are somewhat tougher and ultimately the financial markets would be fine.

- Why is it that financial market conditions are so loose? The IPO markets are booming. You got all that money racing around, it’s not helping the real economy as much as an interest rate cut would.

Trump says August 1 tariff deadline is firm, but he is open to other ideas

- The translation is, of course, August 1 is not firm

Trump also addressing other matters:

- we have scheduled Iran talks

- Iran will not be a nuclear state

- I hope we don’t have to do another strike on Iran

Trump says may adjust tariffs for some countries

- Trump says also that close to making a trade deal with India

- Trump says may adjust tariffs for some countries.

On Ukraine:

- We are going to have to send more weapons to Ukraine. Defensive weapons. They have to defend themselves”

- “I’m not happy with President Putin at all,”

- “If I can stop a war, you know, because I have an ability to do so…I’m disappointed, frankly, that President Putin hasn’t stopped. I’m not happy about it either.”

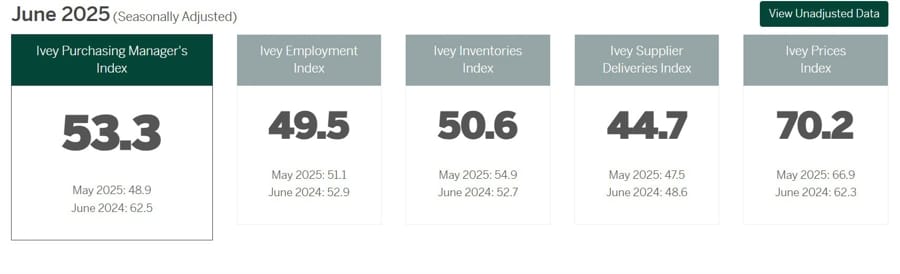

Canada’s Ivey PMI Climbs Back Above 50 in June

Canada’s Ivey Purchasing Managers Index rebounded to 53.3 in June (seasonally adjusted), up from 48.9 in May. The non-seasonally adjusted measure also rose to 54.6 from 53.8.

This move back above the 50 mark indicates expansion in economic activity, despite the index’s typical volatility.

Component details showed employment easing to 49.5 (from 51.1), inventories dropping to 50.6 (from 54.9), and supplier deliveries slowing further to 44.7 (from 47.5).

The price index, however, surged to 70.2 from 66.9, signaling growing input cost pressures.

Canada’s Finance Minister Orders Deep Budget Cuts

Canada is heading for fiscal tightening, with Finance Minister François-Philippe Champagne instructing cabinet colleagues to identify tens of billions of dollars in spending reductions.

Details are limited so far, but the move signals a shift toward budget discipline amid rising debt and inflationary concerns.

Commodities News

Gold Slides Below $3,300 as Trade Optimism Dampens Safe-Haven Appeal

Gold prices fell on Tuesday, weighed down by improving risk appetite following news that reciprocal U.S. tariffs will now take effect on August 1 rather than July 9.

The yellow metal dipped 1.2% intraday, trading below $3,300 and heading toward key support around $3,280. Traders are reacting to President Trump’s new tariff measures, which include a 25% duty on Japanese goods and a 30% rate on imports from South Korea. The delay in implementation has fueled hopes for more trade deals and reduced immediate demand for safe havens like gold.

Technically, gold has been coiling into a triangle pattern, marked by lower highs and higher lows. This setup often precedes a breakout, but for now, traders remain hesitant as they await a clear directional signal.

Hawkish Federal Reserve expectations, along with stronger-than-expected U.S. labor data, have capped gold’s upside momentum. Meanwhile, stable Treasury yields have limited flight-to-safety flows.

Key events on deck:

- FOMC Meeting Minutes will be released Wednesday, offering clues on the Fed’s June decision to keep rates at 4.25%–4.50%.

- German industrial production rose 1.2% in May, easing European recession concerns and adding slight pressure to gold.

- The BRICS summit wrapped up in Rio de Janeiro on Monday, with member nations advancing de-dollarization efforts. In response, Trump declared on Truth Social that any country supporting “Anti-American policies” under BRICS would face an extra 10% tariff — no exceptions.

Despite these crosswinds, gold’s near-term technical posture suggests that any break below $3,280 could trigger further declines, while a rebound above $3,300 might stabilize the metal short term.

Crude Oil Settles at $68.33, Eyes Bullish Technical Shift

Crude oil futures closed at $68.33 on Tuesday, up $0.40 on the day. Prices briefly pushed above the 200-day moving average ($68.37) for the first time since June 23, peaking at $68.87 before slipping back.

A sustained break above the 200-day MA would mark a bullish technical signal, while support remains strong above the 100-day MA at $65.31.

The latest rally came despite unexpected OPEC+ production hikes announced over the weekend, suggesting that traders are more focused on signs of demand recovery and geopolitical risks than short-term supply increases.

If prices can firmly hold above the 200-day level, further gains may follow. However, a reversal below the 100-day MA would flip sentiment back to bearish.

Silver Consolidates Near $36.70 as Tariff Risks Support Safe-Haven Demand

Silver is holding steady near $36.70, consolidating in a tight range just below 13-year highs. The metal has been oscillating between $35.50 and $37.30 for the past four weeks, with the 20-day SMA at $36.42 acting as a key support level.

President Trump’s new tariffs on 14 countries — including Japan and South Korea, both facing 25% duties — have fueled safe-haven demand. Additionally, an executive order extended the tariff deadline to August 1, maintaining trade tensions.

Despite geopolitical support, stronger-than-expected U.S. jobs data last week has reduced hopes for near-term Fed rate cuts, limiting silver’s upside.

Technical signals show a consolidating market with Bollinger Bands narrowing, indicating a potential breakout ahead. The RSI is hovering around 60, signaling mild bullish momentum without being overbought. The Rate of Change (ROC) sits at +1.21, suggesting a gradual upward bias.

A decisive move above $37.30 could open the door to $38 and beyond. On the downside, a break below $36.42 would likely send prices toward $35.72, and if that fails, possibly down to $34.50.

Copper Surges 11% as Trump Announces 50% Import Tariff

U.S. copper prices jumped 11% to $5.59 on Tuesday after President Trump confirmed a hefty 50% tariff on copper imports during a Cabinet meeting.

“Today we’re doing copper,” Trump declared, revealing a strategy that raises eyebrows given America’s heavy reliance on imported copper for grid upgrades, electric vehicles, and other infrastructure.

The move is likely to increase costs for U.S. manufacturers and further strain domestic supply chains. Copper mining and smelting capacity in the U.S. is limited, and new projects typically take years or even decades to ramp up.

The immediate market impact favors domestic producers like Freeport-McMoRan, which could benefit from a price premium driven by reduced competition from imports. However, analysts argue that this policy may do little to boost local mining or smelting capacity in the short term and will mostly raise costs for end users.

Morgan Stanley Sees Oil as Key Risk to USD Weakness

Morgan Stanley remains bearish on the U.S. dollar but warns that a sharp oil price spike could disrupt this view in the short term.

A supply-driven surge in oil could trigger a USD short squeeze, potentially lifting the dollar by 2% or more. This risk echoes market reactions seen after Russia’s invasion of Ukraine in early 2022, when geopolitical shocks fueled sudden FX moves.

Analysts note that strong USD-equity correlations could limit any prolonged dollar strength. While the bank expects a weaker dollar medium term — driven by converging interest rates, hedging flows, and relative growth dynamics — a temporary oil shock could offer opportunities to re-enter dollar shorts at better levels.

Morgan Stanley suggests viewing any oil-induced USD rally as transitory and a chance for bearish traders to reposition.

HSBC Flags Downside Risk to $65 Brent Oil Forecast

HSBC analysts warn that Brent crude may not hold at the $65 per barrel level in Q4 2025 due to growing oversupply. The bank now anticipates an additional 550,000 barrels per day increase in output this September.

Although summer demand in the Northern Hemisphere and Middle East is currently absorbing the excess, the projected surplus in later months could drive prices lower than previously forecast.

Europe News

European Stocks Close Higher, Led by Italy

Major European equity indices ended Tuesday in positive territory, with Italy’s FTSE MIB taking the lead.

Final results:

- German DAX: +0.55%

- France’s CAC 40: +0.56%

- UK’s FTSE 100: +0.54%

- Spain’s Ibex: +0.03% (largely flat)

- Italy’s FTSE MIB: +0.67%

The gains highlight cautious optimism among investors despite ongoing global economic uncertainties.

Germany Posts €18.4 Billion Trade Surplus in May, Above Forecast

Germany’s trade surplus grew to €18.4 billion in May, beating market expectations of €15.5 billion, according to Destatis data released on July 8.

This stronger surplus comes despite a 1.4% drop in exports for the month. The key driver was an even sharper decline in imports, which fell 3.8% in real terms.

The prior trade balance was €14.6 billion, reflecting a continuing adjustment in Germany’s external trade dynamics amid global demand and supply chain shifts.

France’s Trade Deficit Narrows to €7.76 Billion in May

France reported a narrower trade deficit of €7.76 billion in May, better than the anticipated €8.25 billion shortfall, data from the Ministry of Finance showed on July 8.

Exports dipped slightly by 0.3% month-over-month, while imports stayed nearly flat during May. The April deficit was initially reported at €7.97 billion but was later revised to €7.6 billion.

This modest improvement suggests some stabilization in France’s trade balance as external demand and domestic spending patterns evolve.

German Finance Minister Warns EU Ready to Retaliate Against U.S.

Germany’s finance minister reiterated that the EU is prepared to retaliate if it cannot secure a fair trade deal with the U.S.

Although no concrete countermeasures have been detailed yet, the EU has maintained this tough stance throughout negotiations. Talks between the two sides remain stuck, and Brussels continues to signal readiness to act if discussions fail to deliver equitable terms.

Report – “US offers EU 10 percent tariff deal — with caveats”

- Politico says “Negotiations are still fluid, with any trade agreement subject to final approval by Donald Trump.”

- U.S. has offered the European Union a trade proposal that would apply a 10% baseline tariff on EU goods, while granting exceptions for certain sensitive sectors like aircraft and spirits, according to EU officials.

- EU Trade Commissioner Maroš Šefčovič has been in contact with U.S. officials following a call between Trump and European Commission President Ursula von der Leyen.

- diplomats say no firm deal has been secured, and uncertainty remains high.

- The U.S. has not agreed to EU requests for exemptions on politically sensitive sectors like automobiles, steel, aluminium, or pharmaceuticals

- The European Commission declined to comment, saying only that negotiations are ongoing

Asia-Pacific & World News

UN trade agency warns of further instability caused by new trade war deadline

- A couple of comments by the director of the UN trade agency

- Reciprocal tariffs delay extends period of uncertainty and causes further instability

- Developing countries still most hit by tariffs

- Deep cuts in development aid and unpredictable trade sees a perfect storm brewing

- It will create a dual shock for developing countries with tariffs and aid shrinking

- Tariffs will have an impact on the US economy in the long run

Taiwan says haven’t received notice from US regarding tariffs yet

- Bloomberg with the headline

For some context, Taiwan was hit with 32% tariffs initially back in April. The rollout of the tariffs seems like it will take a couple of days at least. Of note, Japan and South Korea were slapped with 25% tariffs

PBoC Gauges Market Sentiment on Dollar Drop and Yuan Strength

The People’s Bank of China is reportedly polling financial institutions on their outlook for the yuan after a steep drop in the U.S. dollar. Sources say the central bank conducted the survey last week, asking about the causes of dollar weakness and expectations for future yuan performance.

The U.S. dollar has fallen 11% in 2025 — its worst first-half showing since 1973. By contrast, the yuan has appreciated modestly, up 1.3% since Trump’s tariff announcement in April, prompting speculation that Chinese authorities are wary of an overly strong yuan just as trade talks intensify.

China May Double Southbound Bond Connect Quota in Market Reform Push

Chinese regulators are considering a proposal to double the Southbound Bond Connect quota to 1 trillion yuan. The plan includes setting aside 500 billion yuan specifically for non-bank institutions like insurers and mutual funds — currently barred from the program.

If approved, the expansion would give Chinese investors greater access to overseas bonds, especially those traded in Hong Kong and denominated in U.S. dollars. It would also help address long-standing capital control concerns, and potentially boost demand for offshore yuan bonds.

The move complements Beijing’s broader agenda to modernize its financial system and support internationalization of the yuan, although the system remains largely closed-loop — with strict limits on capital outflows.

China Expands Offshore Bond Access for Local Investors

China’s central bank is widening access to offshore bond investments, aiming to further open its capital markets. The People’s Bank of China (PBoC) announced that the Bond Connect program will now include more domestic institutions, such as mutual funds, brokers, insurers, and wealth managers.

Additionally, the PBoC will raise the quota for Swap Connect, improving access to interest rate hedging tools. These measures follow earlier plans to double the Southbound Bond Connect limit to $139 billion, aligning with Beijing’s push to elevate the yuan’s global role and give domestic investors more options abroad.

PBOC sets USD/ CNY central rate at 7.1534 (vs. estimate at 7.1772)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 69bn yuan via 7-day reverse repos at 1.40%

- 131bn yuan mature today

- net drain 62bn yuan

RBA Surprises by Keeping Cash Rate at 3.85%

The Reserve Bank of Australia defied expectations today by leaving its cash rate unchanged at 3.85%, rather than cutting it by 25 basis points as widely anticipated.

The decision passed with a 6–3 vote among policymakers. While inflation continues to ease and the cash rate now stands 50 basis points lower than five months ago, the board decided to wait for further confirmation that inflation is moving sustainably toward the 2.5% target.

The RBA noted that domestic demand remains uncertain, and the labor market is still tight. Officials stressed the importance of balancing price stability and full employment. While inflation risks have become more balanced, the bank signaled that it will closely monitor economic data and risks before making further adjustments.

Interestingly, aside from the unexpected rate hold, the policy language largely mirrors the May statement, emphasizing their commitment to maintaining stability and jobs.

RBA’s Bullock: It is appropriate to have a cautious, gradual stance on easing

- Remarks by RBA governor, Michele Bullock, at her press conference

- Communication has been going pretty well

- Different people can have different interpretations of data

- Our interpretation of inflation data was a bit different to the market

- By the next meeting, we will have more data and news developments

- Monthly inflation data is a bit too volatile

- The quarterly CPI report is the more comprehensive read, could be higher

- Looking for confirmation that we’re still on the right path with inflation

- There was a good active debate among policymakers

- The difference in vote was very little, more towards the downside risks from international concerns

- The difference in vote is not about direction, more so about timing

- Before August meeting, we will get the next quarterly CPI report

- The difference today is not direction, it’s all about timing

- If quarterly CPI report reaffirms our expectations, that will validate our easing path

- And “that’s what we are waiting for”

- 50 bps rate cut was considered in May

- But it was quickly dismissed

- We considered 50 bps just for the sake as an alternative

- But the firm decision was a 25 bps rate cut

- We’re not swinging around at all

- Being cautious has paid off well for us

- We put out plenty of information in a timely manner

- The narrative now is much easier to follow, there’s so much information available

- I’m trying to talk to the public to help them understand

- Markets have many other things they can look at to decide for themselves

Australian Business Confidence Hits +5, Business Conditions Surge

Business sentiment in Australia improved again in June 2025, according to the National Australia Bank survey. Confidence rose to +5, up from +2 in May — the third consecutive monthly increase.

Business conditions soared to +9, the highest reading since March 2024. Sales surged 10 points to +15, while profitability climbed 9 points to +4. Employment also rose, reaching +3. The rebound was particularly strong in manufacturing and retail, sectors that had lagged in the previous month.

NAB analysts caution against over-interpreting one month’s data, but welcome the upward trend in both conditions and sentiment, especially in a challenging global backdrop.

US and Japan agreed to continue vigorous talks on tariffs

- Akazawa says he spoke to Lutnick and relayed the outcome of the call to Japan prime minister Ishiba

- Spoke with Lutnick for 40 minutes

- Agreed to actively engage in trade negotiations

- Japan is not looking for easy compromises

- Will not set a deadline in negotiating with US on trade

- And that includes the 1 August date set currently

- There is no point in striking a deal with the US without agreement on tariffs on autos

- Japan has already put all the necessary issues on the table

- Autos are a key sector that is core to Japan’s economy

- Will not sacrifice agriculture sector for sake of trade deal with the US

- Japan continues to seek mutually beneficial agreement with US

- The Japan trade negotiator spoke with US Treasury Secretary Bessent for about 30 minutes today.

Japan PM Ishiba: No tariff deal because Japan kept defending what needs to be defended

- Japanese Prime Minister Ishiba says he is not backing down

- Will continue dialogue with U.S., seek chance of agreeing on deal that benefits both countries

- As a result of past negotiations with U.S., we were able to avert hike in tariffs to 30–35%

- US has proposed to continue talks until new aug 1 deadline

- Deeply regrettable that US announced tariff hike

- We were unable to agree on deal with us so far is because we engaged in tough negotiation on view Japan should not make easy concessions

Japan Finance Minister Kato: no current plans for specific foreign-exchange discussions with Bessent

- Have deepened understanding with Bessent on forex, will continue close coordination

- Will work on negotiations with us on tariffs

- Not decided whether to attend G20 meetings in South Africa

- Expect us stance to change as we continue trade negotiations

- Will take necessary steps to help industries cope with US tariffs while communicating with other agencies

- Have deepened understanding with Bessent on forex, will continue close coordination

- no current plans for specific foreign-exchange discussions with U.S. Treasury Secretary Scott Bessent.

Crypto Market Pulse

Trump’s $3.3 Trillion Tax Package Could Propel Bitcoin to $120K by Month-End

Bitcoin is hovering around $108,000 after briefly spiking above $110,000 last week. Analysts suggest President Trump’s newly signed One Big Beautiful Bill Act (OBBBA) could send BTC surging to $120,000 before July wraps up.

The OBBBA introduces sweeping tax reforms projected to expand the federal deficit by $3–4 trillion. According to K33 Research, this will flood the economy with liquidity, potentially fueling risk assets like Bitcoin.

Bitget’s Chief Analyst Ryan Lee points to the bill, alongside record U.S. stock performance and expected monetary expansion, as major tailwinds. Lee predicts that Bitcoin could smash past its all-time highs and target $120,000, bolstered by institutional buying and continuous ETF inflows.

CoinShares data shows Bitcoin investment products received $790 million last week, although inflows have moderated from prior weeks. The bulk of these came from U.S. investors, while Canada and Brazil saw outflows.

Bitget COO Vugar Usi Zade highlighted that U.S. debt — now at $36.21 trillion — could push investors to hedge into Bitcoin and Ethereum. The OBBBA’s added fiscal burden is likely to weaken the dollar further, strengthening the case for crypto.

Meanwhile, Trump is urging Congress to fast-track the GENIUS Act (focused on stablecoin regulation) before the August recess. If passed, the bill could open the door for more institutional capital to flow into crypto via stablecoins, acting as a liquidity bridge.

XRP Eyes 18% Breakout as Futures Interest Climbs Amid Tariff Jitters

XRP is gaining ground despite broader macro tensions tied to U.S. tariff policy. On Tuesday, the token climbed over 1%, trading near $2.28, and is setting up for an 18% breakout if it confirms an inverse head-and-shoulders pattern.

The looming August 1 deadline for new U.S. tariffs — including steep rates on Japan and South Korea — is rattling global markets. QCP Capital notes that only one trade deal has been completed out of 195 potential partners, while 14 new tariff letters have been issued with rates ranging from 25% to 40%.

Despite these risks, XRP remains firm. Open Interest (OI) in XRP futures has surged to $4.93 billion, up from $3.53 billion on June 23, reflecting renewed trader conviction. Futures trading volume jumped 120% to $10 billion, hinting at a buildup in speculative momentum.

In the past 24 hours, long and short liquidations have been nearly equal at around $5 million each, showing an indecisive market that might consolidate before making a decisive move. A clean break above the neckline of the H&S pattern could propel XRP toward higher targets quickly.

PI Network Faces Sell Pressure Despite Whale Activity

PI Network’s token slipped below $0.50, hitting $0.45 as of Tuesday, extending a multi-day decline. The downward move comes despite significant whale buying activity — two major purchases totaling over 2 million PI tokens in the past 24 hours.

At the same time, CEX wallet balances rose by 2.41 million PI tokens, bringing the total to 373.6 million. This increase suggests more supply is hitting exchanges, which may signal growing sell-side pressure. Technically, PI is showing bearish momentum with a potential retest of the $0.40 level ahead.

Dogecoin Breakout Targets $0.20 as Addresses Hit Record High

Dogecoin is gaining traction again after breaking out of a technical pattern, with bulls eyeing the $0.20 resistance level. As of Tuesday, DOGE traded around $0.1701, showing a 20% move from its prior base.

On-chain data highlights strong network growth — total addresses reached 108 million on July 4, a 5% rise from January levels. This trend points to a surge in adoption and retail interest.

However, speculative interest remains muted. Futures Open Interest (OI) has dropped to $2 billion from the January peak of $5.42 billion. Despite this, DOGE is supported by steady fundamentals and modest long liquidation activity, totaling $3 million in the past day.

FLOKI Rockets Higher as Whales Scoop Up Over 1.2 Billion Tokens

FLOKI is riding a bullish wave after breaking out of a falling wedge, currently trading near $0.0000827. Whale wallets accumulated 1.23 billion tokens from Friday to Tuesday, underscoring confidence in the meme coin.

Open Interest (OI) also surged to $49.92 million on Monday — the highest of 2025 and nearly double Sunday’s figure. This suggests new capital is flowing into FLOKI’s futures market, reinforcing the momentum.

Santiment data shows large wallets holding between 10M and 100M tokens contributed to this accumulation, signaling that bigger players are betting on further upside.

The Day’s Takeaway

United States

- Equities ended flat overall, with the S&P 500 down 0.1%, Nasdaq unchanged, Dow down 0.4%, and the Russell 2000 up 0.7% after a steep selloff the day before. Meme stocks saw strong speculative moves, suggesting late-stage risk appetite.

- President Trump announced new tariffs, including letters to 15–20 more countries and a 50% tariff on copper imports. Additional sector-specific tariffs (e.g., pharmaceuticals up to 100%) were outlined, potentially raising costs and fueling volatility.

- U.S. Treasury auctioned $58 billion in three-year notes at 3.891% high yield. Domestic demand was strong (direct bidders at 29.4%), while foreign demand fell short.

- Consumer credit outstanding rose by $5.1 billion in May, well below expectations of $11 billion, indicating cautious borrowing trends.

- NFIB small business optimism index slipped to 98.6, slightly below forecast. Taxes resurfaced as the top concern among owners.

- Year-ahead inflation expectations fell to 3.0%, according to the New York Fed survey. Longer-term inflation expectations stayed steady, while optimism around household finances and labor market prospects improved.

Canada

- Ivey PMI rebounded to 53.3 in June, back above the 50 threshold, signaling renewed expansion. Employment and inventories weakened, but price pressures rose sharply.

- Finance Minister François-Philippe Champagne asked cabinet members to identify tens of billions in spending cuts, signaling fiscal tightening ahead.

Commodities

- Copper surged 13.3% to $5.645/lb, its largest one-day gain ever, following Trump’s announcement of a 50% tariff on imports. Prices hit an all-time high for front-month contracts.

- Crude oil settled at $68.33, up $0.40 on the day. Briefly broke above the 200-day moving average, signaling possible bullish momentum despite OPEC+ production increases.

- Gold fell 1.2%, sliding below $3,300 and heading toward $3,280 support. Trade optimism reduced safe-haven demand, while Fed hawkishness and stronger U.S. data capped gains.

- Silver held near $36.70, consolidating below 13-year highs in a tight range amid tariff tensions. Technical indicators show potential for breakout, but markets remain in wait-and-see mode.

Europe

- German trade surplus rose to €18.4 billion in May, beating expectations, as exports dropped 1.4% and imports fell more sharply by 3.8%.

- France’s trade deficit narrowed to €7.76 billion, better than forecast, with slight export decline and flat imports.

- Major European stock indices closed higher, led by Italy’s FTSE MIB (+0.67%). German DAX +0.55%, France CAC +0.56%, UK FTSE +0.54%, Spain Ibex nearly flat (+0.03%).

- Germany’s finance minister reaffirmed that the EU is ready to retaliate if a fair trade agreement with the U.S. cannot be reached.

Asia – Pacific

- RBA kept rates steady at 3.85%, defying expectations for a 25 bp cut. The board voted 6-3, citing moderating inflation and the need for more data to confirm its trajectory toward the 2.5% target.

- The People’s Bank of China (PBoC) expanded offshore bond access for domestic institutions via Bond Connect and Swap Connect, aiming to liberalize capital flows further.

- PBoC surveyed banks on yuan strength as the dollar weakened sharply YTD, signaling possible concerns about excessive appreciation.

- China is also weighing a plan to double the Southbound Bond Connect quota, potentially unlocking more overseas bond investments for non-bank financial institutions.

Crypto

- Bitcoin held above $108,000, consolidating after last week’s surge past $110,000. Analysts expect Trump’s $3.3 trillion “One Big Beautiful Bill” to boost liquidity and potentially propel BTC to $120,000 by July-end.

- XRP traded near $2.28, setting up for an 18% breakout above an inverse head-and-shoulders pattern. Futures Open Interest climbed to $4.93 billion, with strong derivatives market momentum.

- Dogecoin hovered around $0.17, targeting $0.20 resistance, backed by record address growth and consistent network expansion.

- FLOKI rallied, breaking above a falling wedge pattern, with whales accumulating over 1.2 billion tokens and open interest surging to its yearly high.