North America News

US Stocks End Lower After Weak ISM Data; Eyes on AMD, Super Micro Earnings

Major U.S. equity indices closed in the red Tuesday after disappointing ISM Services PMI data, which fell to its lowest reading since May.

Here’s how the key indices finished:

- Dow Jones: -61.90 pts (-0.14%) at 44,111.74

- S&P 500: -30.77 pts (-0.49%) at 6,299.17

- NASDAQ: -137.03 pts (-0.65%) at 20,916.55

- Russell 2000: +13.36 pts (+0.60%) at 2,225.67

Chip stocks were hit after President Trump hinted at sooner-than-expected tariffs, prompting declines across the sector:

- Broadcom: -1.61%

- Nvidia: -0.97%

- AMD: -1.40% ahead of earnings

- Super Micro Computer: announced a miss on both earnings and revenue but guided higher for the year

Super Micro Misses, Guides Up — Shares Drop in After-Hours

- EPS: $0.41 vs. $0.45 expected

- Revenue: $5.2B vs. $6.0B expected

- Forward Guidance: FY revenue at $33B vs. $30.3B expected

- After-Hours Trading: Shares down -12%

Earnings Highlights – After the Bell

SNAP

- Revenue: $1.34B (in line)

- EPS: -$0.16 vs. +$0.01 expected

- Net Loss: $262.6M

- Free Cash Flow: $23.8M

- DAUs: 469M vs. 467.9M est.

- Q3 Revenue Guidance: $1.48B–$1.51B (in line)

- Q3 DAU Outlook: ~476M

AMD

- Q2 Revenue: $7.69B vs. $7.42B est.

- GAAP EPS: $0.54

- Adj. EPS: $0.48 vs. $0.49 est.

- Net Income: $872M

- Operating Loss: -$134M

- Gross Margin: 40%

- Took $800M charge tied to U.S. export controls

- Q3 Outlook: Revenue $8.7B; Non-GAAP GM ~54%

MATCH GROUP (MTCH)

- Q2 Revenue: $863.7M vs. $853.6M est.

- Adj. Operating Income: $290M

- Payers: 14.1M

- Q3 Revenue: $910M–$920M vs. $890.3M est.

- FY revenue expected near high end of guidance

RIVIAN (RIVN)

- Adj. EPS: -$0.80 vs. -$0.65 est.

- Revenue: $1.30B vs. $1.28B est.

- OpEx: $908M

- FY25 Deliveries: 40K–46K units

- FY25 Adj. EBITDA Loss: $2.0B–$2.25B

- Q3 expected to be strongest delivery quarter of 2025

Opendoor (OPEN)

- Q2 Revenue: $1.6B vs. $1.5B est.

- Net Loss: $29M

- Gross Profit: $128M

- Gross Margin: 8.2%

- Q3 Revenue Guidance: $800M–$875M

Treasury Sells $58 Billion in 3-Year Notes at 3.669% High Yield

The U.S. Treasury auctioned off $58 billion in 3-year notes at a high yield of 3.669%, slightly above the 3.662% WI level at the time of the sale.

The auction produced a tail of 0.7 basis points, larger than the six-month average of 0.4 bps, signaling weaker-than-expected demand.

Bid-to-cover came in at 2.53x, below the six-month average of 2.59x, reflecting less aggressive participation.

Breakdown by buyer type:

- Direct bidders took 28.13% (six-month average: 19.9%)

- Indirect bidders absorbed 54% (six-month average: 65.5%)

- Dealers ended up with 17.9% (above average of 14.7%)

Foreign participation was notably soft, pushing more burden onto primary dealers and weakening the auction result overall.

US ISM Non-Manufacturing PMI Slips to 50.1 in July

The ISM non-manufacturing index for July dipped to 50.1, missing the 51.5 forecast and down from 50.8 in June. Most components lost ground, and trade-related disruptions were a key theme.

Component breakdown:

- Business Activity: 52.6 (↓ 1.6 pts)

- New Orders: 50.3 (↓ 1.0 pts)

- Employment: 46.4 (↓ 0.8 pts, contraction deepens)

- Supplier Deliveries: 51.0 (↑ 0.7 pts)

- Inventories: 51.8 (↓ 0.9 pts)

- Prices: 69.9 (↑ 2.4 pts, strong inflation pressure)

- Backlog of Orders: 44.3 (↑ 1.9 pts, still weak)

- New Export Orders: 47.9 (↓ 3.2 pts, fell into contraction)

- Imports: 45.9 (↓ 5.8 pts, sharpest drop)

- Inventory Sentiment: 53.2 (↓ 3.9 pts)

Trade pressures were clearly felt. Respondents pointed to tariffs delaying purchase decisions, cost spikes, and project cancellations—especially in agriculture, construction, and healthcare. Some respondents noted that while tariff rhetoric remains loud, the real economic impact is just beginning to register.

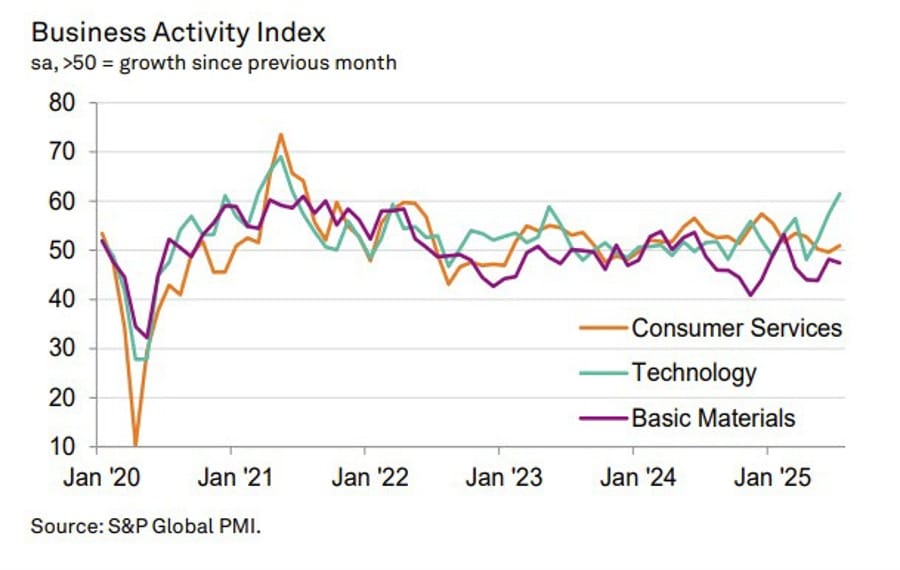

US S&P Global Services PMI Revised Up to 55.7 for July

The final S&P Global Services PMI for July rose to 55.7, up from the preliminary 55.2 and sharply above June’s 52.9. The Composite PMI came in at 55.1, also an improvement from the previous 52.9.

Sector highlights:

- Technology led with its fastest expansion since June 2021.

- Financials recorded its strongest growth pace since December 2024.

- Industrials extended its growth streak to 18 months.

- Consumer Goods and Services saw marginal growth, but below H1 2025 averages.

- Healthcare experienced a mild contraction—the worst since May 2024.

- Basic Materials fell further into contraction, now declining for five straight months.

Business activity broadened, with 5 of 7 sectors reporting gains—up from four sectors in June.

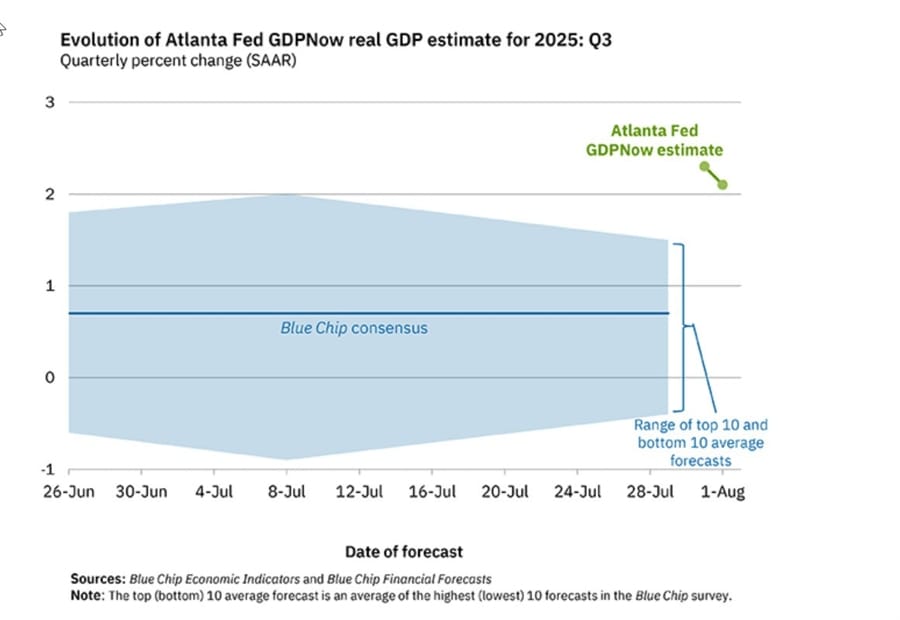

Atlanta Fed Ups Q3 GDPNow Estimate to 2.5%

The Atlanta Fed’s GDPNow model revised its Q3 2025 U.S. growth forecast upward to 2.5%, from 2.1% as of August 1. The Fed cautioned that early-quarter estimates can carry more volatility, but its track record of accuracy near final GDP releases adds weight to the adjustment.

The boost reflects a slight improvement in real-time data inputs but comes with a warning that this figure may shift as more information rolls in during the quarter.

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 2.5 percent on August 5, up from 2.1 percent on August 1. After recent releases from the US Bureau of Economic Analysis, the US Census Bureau, and the Institute for Supply Management, increases in the nowcasts of real personal consumption expenditures growth and real gross private domestic investment growth from 1.6 percent and 6.3 percent, respectively, to 2.0 percent and 6.9 percent, more than offset a decline in the nowcast in the contribution on net exports to GDP growth from -0.30 percentage points to -0.36 percentage points.

U.S. Trade Deficit Narrows to -$60.2B in June

The U.S. June trade deficit narrowed to $60.2 billion, better than the expected $61.3 billion, and a significant improvement from May’s -71.7 billion. Exports came in at $277.3 billion, down from $279.9 billion, while imports fell more steeply to $337.5 billion from $350.5 billion.

President Trump: Survey data is very antiquated and also political

- Pres. Trump on CNBC

- Survey data is antiquated and very political

- The numbers were rigged the numbers or rate

- Before the election there was a massive outflow of beauty for Biden

- Powell is highly political.

- Kevin Warsh is a very good.

- The two Kevin’s are doing well and have two other candidates

- The decision will be very soon

- I will announce a replacement for Kuglers announcement

- He is taking Bessent off the list as Fed Governor

- Prices are down since I have come in

- The price of stocks are way up

- Energy is way down with Gasoline to $2.40.

- There is tremendous energy

- OPEC+ is drilling more because want to make me happy

- If energy prices do go down Putin will stop killing people.

- Japan will be opening up the country, and the investment promises are like a “signing bonus”

- Indonesia, Vietnam and Korea has opened up their country.

- If EU does not make those investments they will pay tariffs

- If they make the investment their tariffs will be decreased to 15%

- EU deal is that they will give Trump $600B in anything he wants.

Stocks dip as he gets into tariffs.

- Will be announcing tariffs on chips soon

- We will be putting a small tariff on Pharma . Will go up to 150-250% in one year

- Not worried about oil prices

- The inflation was the highest during the Biden administration

- He will be raising India tariffs soon on the Russia oil

- The sticking point with India are that tariffs are too high.

On China:

- Xi called for a meeting with Trump

- We will meet with China before the end of year if there is a trade deal.

- China is very reliant on the US

- Has a good relation with China

- We are getting very close to a deal.

- China did not respect Biden. They respect us.

On banks:

- They discriminated against me

- Both BofA and JPM discriminated against me conservatives.

On immigration:

- We are getting criminals out of our country

- Am working with the farmers though. The farmers are great. Not doing anything to hurt the farmers

- We are looking for the criminals

- 50% of the murderers, murdered more than 1 person.

On running again:

- I am probably not going to run again

- I have the best poll numbers I have ever had

- The Democrats are lost

- Schumer is finished.

BofA Maintains No‑Cut Outlook Despite Market Pricing In

Despite expectations of a Fed rate cut by mid‑September (90%+ chance via CME FedWatch Tool), Bank of America insists it’s keeping its call that rates remain at 4.25–4.50% through 2025. BofA analysts argue that weak labor revisions don’t justify a rate cut unless unemployment clearly deteriorates. They also stress that inflation remains the Fed’s primary concern.

UBS Flags Complacency in U.S. Credit Markets

UBS warns that U.S. high‑yield bond spreads are near decade‑low levels, indicating excessive optimism and underpricing of slowdown risk. Markets are pricing in global growth of over 5%—well above UBS’s 2.7% forecast—while credit investors appear less conservative than equity holders. With inflation still high, UBS cautions that a downturn could sharply widen risk premiums.

Société Générale Warns of Equity Bubble Risk if S&P 500 Tops 7,500

Société Générale projects the S&P 500 could climb to 6,900 by end‑2025, and reach 6,500–7,250 under a re‑rating scenario driven by Fed rate cuts. They caution that if a Fed easing cycle pushes the index past 7,500 in 2026, it may enter bubble territory. Factors cited include lower oil, inflation relief (“One Big Beautiful Bill”), looser regulation, fiscal stimulus, supply‑chain duplication, and continued EPS growth amid a weakening USD potentially pushing EUR/USD toward 1.20.

Concerns Grow Over Trump Firing U.S. Bureau of Labor Statistics Head

Reports indicate that after President Trump fired the BLS head over poor data, some investors fear erosion of trust in U.S. economic data—raising comparisons to Latin America or Turkey, where poor numbers sometimes lead to outright data suppression. Clients of investment banks reportedly worry they may need to rethink U.S.‑based investments if trust in inflation and employment figures fades.

The Wall Street Journal (gated) with the report

Goldman Sachs Sees Fed Rate Cuts Starting September

Goldman Sachs analysts anticipate that the Federal Open Market Committee (FOMC) will begin cutting interest rates in September, likely in three consecutive steps of 25 basis points. If the upcoming jobs report shows a notable uptick in unemployment, they suggest a possible 50 bp cut instead.

Canada Offers $700M in Loan Guarantees to Support Lumber Sector

Canadian Prime Minister Mark Carney has unveiled a C$700 million loan guarantee program for the softwood lumber industry, aimed at helping producers navigate escalating U.S. tariffs.

In addition, C$500 million is being allocated to fund product development and market diversification. Carney emphasized the need for Canada to broaden its export footprint beyond the U.S. as trade negotiations drag on.

Key points from Carney’s remarks:

- Canada is exploring options to remove other tariffs across industries

- He will speak with President Trump “when it makes sense”

- Ongoing U.S.–Canada talks include efforts to support the U.S. auto sector’s competitiveness

The funding is part of a broader strategy to shield the lumber sector while laying the groundwork for long-term market shifts.

Canada’s Trade Deficit Shrinks Slightly in June

Canada reported a trade deficit of C$5.86 billion in June, less than the C$6.3 billion forecast. Exports rose to C$61.74 billion, while imports increased to C$67.6 billion. Exports to the U.S. rose 3.1% m/m but remained 12.5% lower y/y. Imports from the U.S. rose 2.6%, ending a three-month slide.

Meanwhile, exports to non-U.S. countries dropped 4.1%, weighed by declines to the UK (gold) and Japan (iron ore), partly offset by increased shipments to China. The non-U.S. trade gap widened to C$9.8 billion.

Q2 saw a sharp decline in Canadian exports, down 12.8% q/q, with energy and automotive products leading the slump. Imports fell 3.9%, though mineral imports surged. Overall, the merchandise trade balance posted a record C$19.0B deficit, swinging from a C$388M surplus in Q1. Real exports fell 9.0%, while imports declined 1.5%.

Commodities News

Gold Nears $3,400 as Fed Cut Bets Rise and Trump Eyes New Fed Pick

Gold prices continued to push higher Tuesday, trading at $3,381, up 0.20%, as investors ramp up expectations for a Fed rate cut in September.

Key drivers include:

- Last week’s disappointing NFP report with revisions to May and June

- ISM Services PMI slipped to 50.1 in July, down from 50.8, missing forecasts for 51.5

- US trade deficit narrowed sharply to -$60.2B, lowest in nearly two years

- China trade gap fell to its lowest in 21 years, according to BEA

On the policy front, Fed Governor Adriana Kugler’s resignation has opened the door for a Trump-appointed replacement. Treasury Secretary Scott Bessent has declined consideration for Fed Chair.

Meanwhile, U.S. tariffs will rise again on August 7, with effective rates between 10% and 41%, averaging 18.3%—the highest since 1934, per Yale’s Budget Lab.

Citi this week updated its gold price target to $3,500/oz, projecting record highs over the next three months. The bank cited deteriorating U.S. growth, heightened inflation risks from tariffs, and weakened confidence in data credibility following the removal of the BLS chief.

Despite a potential ceiling from recovering Treasury yields and a stronger dollar, gold is poised to test resistance at $3,400, especially if the Fed confirms a shift toward easing.

Upcoming U.S. events this week include Jobless Claims, Consumer Sentiment, and multiple Fed speakers—all of which could reinforce gold’s bullish momentum.

Crude Oil Drops 1.7%, Settles at $65.16

Crude oil futures closed down $1.13, or -1.7%, at $65.16 per barrel on Tuesday. The move came amid broader market caution and fading momentum after recent supply and demand shifts.

The pullback reflects a cooling in energy market sentiment as traders weigh future output decisions from OPEC+ and potential disruptions tied to geopolitical developments and tariff impacts.

Citi Raises Gold Forecast to $3,500 Amid U.S. Macro Risks

Gold rose $8 to $3,380/oz on Tuesday, after Citi lifted its 3-month price target to $3,500, up from $3,300. The bank now expects gold to trade in the $3,300–$3,600/oz range in the near term.

Driving factors behind the bullish call:

- Higher tariffs are fueling inflation more than expected

- Labor market data is showing clear signs of weakening

- Concerns over Fed independence and questionable reliability of U.S. economic data are adding further uncertainty

Citi previously oscillated between $3,150 and $3,500 price targets, but now expects a bullish breakout. The metal is increasingly being viewed as a hedge against not just inflation but also policy instability and geopolitical volatility.

Copper Market Looks for Direction Post-Tariff Shock – Commerzbank

Copper is still searching for stability after the U.S. tariff shift. Prices on the LME saw a small uptick yesterday following a selloff triggered by Trump’s announcement that only semi-finished copper products—not refined ones—would face new U.S. tariffs. This fueled speculation that copper stockpiles at COMEX might now be re-exported. At the same time, tariffs make additional copper supply outside the U.S. less likely, supporting prices, according to Commerzbank’s Thu Lan Nguyen.

Market fundamentals may also push prices higher. Chilean output has been disrupted after an earthquake hit one of its largest mines, responsible for 356,000 tons of copper last year—7% of the nation’s total. With treatment and refining charges already near record lows, any further output hits could tighten global supply. Shanghai Metal Markets expects a 0.5% drop in Chinese copper processing this month and a deeper cut in September due to planned smelter maintenance. A tight market and potential demand rebound could fuel a copper rally in the medium term.

China-India Gold Demand Diverges Sharply – Commerzbank

The World Gold Council’s latest data shows starkly split gold demand in Asia’s biggest markets, according to Commerzbank’s Carsten Fritsch. High prices dragged jewelry demand down 28% in China to 194 tons, the weakest first-half showing since 2009 (excluding pandemic years). India saw a 20% decline to 160 tons, its second-lowest in at least 25 years.

In value terms, however, Chinese jewelry demand held steady, while India’s rose. Meanwhile, bar and coin demand surged. Chinese investors bought 239 tons, a 12-year high, far outpacing jewelry. In India, bar and coin demand hit 93 tons, softening the jewelry pullback. Overall, gold demand from Chinese households dropped only 6% y/y, while India fell 12%. The data reflects gold’s dual identity: both a luxury item and a hedge against volatility.

OPEC+ Confirms 547k b/d Supply Hike for September – Commerzbank

OPEC+ members sticking to voluntary cuts agreed to ramp up output by 547,000 b/d in September. This fully unwinds the 2.2 million b/d of voluntary curbs imposed in H2 2023 and early 2024—one year earlier than planned, Commerzbank’s Carsten Fritsch notes.

The remaining cuts—3.66 million b/d—stay in place through 2026 unless market conditions change. A further policy shift could come at the group’s September 7 meeting, though the next major decision point is expected in November.

However, boosting production beyond September is risky. U.S. secondary tariffs targeting Russian oil could shuffle global supply chains. If large portions of Russia’s oil exports to India and China are blocked, that supply gap could soak up surplus. But replacing Russia’s share may fracture OPEC+ unity.

Trump’s Tariff Exemption Sends Copper Prices Tumbling – ING

LME copper dropped 1.4%, and Comex copper crashed over 20% last week after Trump spared refined copper forms from new U.S. tariffs. ING analysts Ewa Manthey and Warren Patterson say New York futures had previously surged to all-time highs, with a 30% premium over London. That gap has now vanished.

Copper inventories at Comex hit a 21-year high, and re-exporting those stockpiles could weigh on LME prices. Tariffs still apply to semi-finished copper—pipes, rods, tubes, cables, connectors—but exclude ores, cathodes, and anodes, which will keep the raw material market from tightening.

ING: OPEC+ Wraps Up Cuts With Final 547k b/d Increase

OPEC+ confirmed its final supply increase of 547k b/d for September, ending the unwind of 2.2 million b/d in voluntary cuts. ING sees this as the group’s last hike for now, especially with rising inventories and weaker post-summer demand.

WTI prices for 2026 sit below $64/bbl, and Trump’s threats of penalties on Indian purchases of Russian oil could put 1.7 million b/d at risk. If redirected, that oil might absorb Q4 surpluses, and open space for further OPEC+ cuts. Meanwhile, ICE Brent net longs rose by 33,959 lots, and Gasoil net longs hit their highest since March 2022 at 100,644 lots.

Despite a stronger market, U.S. rig activity keeps falling—down five last week to 410 rigs, marking 14 straight weeks of decline, even with prompt WTI near $67/bbl.

Europe News

European Stocks Close Slightly Higher; DAX Leads, CAC Lags

European equities posted modest gains on Tuesday, with Germany’s DAX rising 0.42%, making it the day’s best performer among the major indices. France’s CAC 40 dipped 0.14%, marking the only decline among the group.

Here’s where the key indices landed:

- DAX (Germany): +0.42%

- CAC 40 (France): -0.14%

- FTSE 100 (UK): +0.16%

- Ibex (Spain): +0.15%

- FTSE MIB (Italy): +0.11%

Most regional markets posted narrow gains, reflecting a cautious but positive trading tone across the continent.

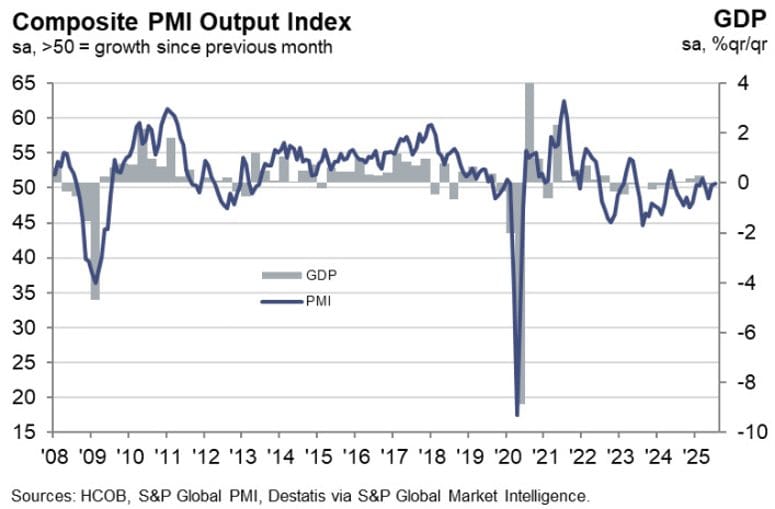

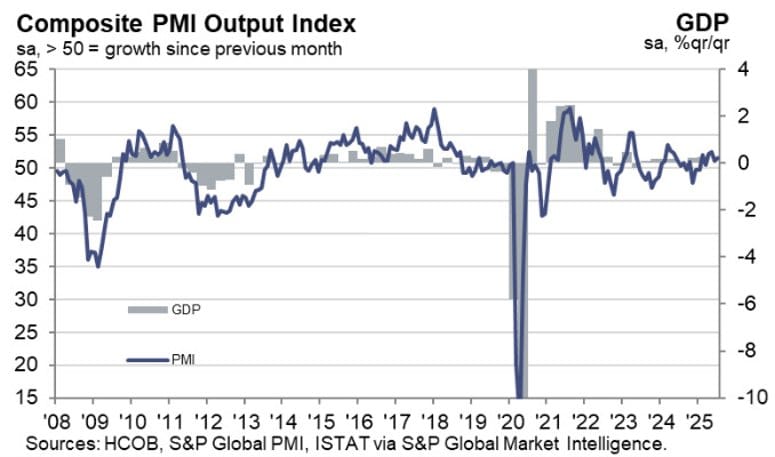

Eurozone Services PMI Shows Tepid Growth

The Eurozone’s final July Services PMI landed at 51.0, slightly below the 51.2 flash but better than June’s 50.5. The Composite PMI registered 50.9, a marginal improvement from the 50.6 prior. Business activity improved modestly across the bloc, but the pace remained below the long-run average, with weak demand still capping growth. France stood out as the region’s major weak link.

HCOB notes that:

“This could turn out to be a good summer for service providers. In Italy and Spain, business activity rose more sharply in July than in the previous month, while Germany, after several challenging months, has clawed its way back into growth territory. The standout performer is Spain, where the Purchasing Managers’ Index jumped by more than three points—pointing to a third quarter that’s off to an exceptionally strong start.

“France, by contrast, is the only one of the four major eurozone economies where the private services sector is contracting. Worse still, the downturn deepened. One key factor is the government’s plan for sweeping budget cuts, which could weigh heavily on economic growth. Speculation is mounting that the administration may face a vote of no confidence, adding to the already high level of uncertainty. While Spain is stepping on the gas, France is firmly on the brakes.

“Employment in the eurozone’s services sector has been expanding uninterruptedly since February 2021. At first glance, this might suggest a sector in robust health, but productivity – as measured by separate S&P Global PMI data – has been declining since mid-2022, with only a brief pause around the turn of the year. This points to a troubling disconnect: even in the age of digital business models, growth in the services sector is not translating into meaningful productivity gains. Given that more than half of gross value added in the eurozone comes from services, this is a disquieting diagnosis.

“Inflation is easing in the eurozone’s services sector, increasing the likelihood of one further interest rate cut by the European Central Bank in the second half of the year. Costs are rising at a pace that is the slowest in nine months and below the long-term average. This dovetails with recent data from the ECB’s Wage Tracker, which shows a deceleration in wage growth—an essential cost component for service providers—over the past several months.”

Eurozone June PPI Up 0.8%, Driven by Energy

Producer prices across the Eurozone rose 0.8% m/m in June, matching expectations and reversing the -0.6% dip in May. The gain was largely attributed to a 3.2% jump in energy prices. Excluding energy, PPI edged down 0.1%. Intermediate goods fell 0.2%, while capital, durable, and non-durable consumer goods each saw minor monthly gains.

Germany’s Services Sector Expands to 50.6 in July

Germany’s final Services PMI reached 50.6, topping the flash reading of 50.1 and climbing from 49.7 in June. The Composite PMI also finished at 50.6, up slightly from both the prior 50.4 and preliminary 50.3. A key highlight was the steep easing in inflation pressures—now at their lowest since early 2021.

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Germany is entering the second half of the year with growth that, while modest, is evident across the board – both in services and manufacturing. Slightly rising order intakes and moderately improved export business across manufacturing and services combined paint the picture of an economy that is slowly but visibly emerging from a prolonged period of weakness. Following the GDP contraction in the second quarter, we anticipate a return to modest growth in the third.

“In the services sector, business activity picked up again after a three-month dry spell. Particularly encouraging is the increase in new business – the first since August 2024. Companies are also looking to the future with renewed optimism. However, there is no sign of euphoria, and the recovery in the service sector is somewhat fragile, as backlogged orders have shrunk and the employment growth seen since the beginning of the year has almost come to a standstill.

“Costs in the services sector rose at their slowest pace since February 2021. This aligns with the European Central Bank’s Wage Tracker, which has shown a decline in annual wage growth since the beginning of the year – wages being a key cost driver for service providers. In this environment, companies raised their selling prices at the weakest rate since April 2021. For the ECB, this is welcome news, especially given Germany’s outsized influence on the Eurozone’s overall inflation rate.”

France’s Services PMI Falls Sharply to 48.5

France’s final Services PMI for July was revised down to 48.5, missing the preliminary reading of 49.7 and falling from June’s 49.6. Composite PMI followed suit at 48.6, below the initial estimate of 49.6. The data reflects worsening conditions in the services sector, with soft demand, labor constraints, and sluggish client activity dragging output lower.

HCOB notes that:

“France’s Composite PMI has declined to a three-month low, marking a subdued start to the second half of the year. Although GDP growth came in stronger than expected at 0.3% quarter-on-quarter, this expansion was largely driven by changes in inventories. This raises concerns about the sustainability of the current growth path. The muted private sector sentiment suggests limited momentum in the near term.

“Activity in the French service sector had approached the expansion threshold in recent months, but the HCOB Services PMI registered a moderate decline in July. This reflects persistently weak demand conditions. Notably, some survey respondents pointed to delayed decision-making as a factor weighing on demand. These delays likely stem from political uncertainty within France and ongoing geopolitical tensions in global trade. As a result, business expectations for the next 12 months have deteriorated.

“The slowdown in business activity is increasingly reflected in capacity utilization. In July, backlogs of work declined, and forward-looking expectations worsened significantly. This is translating into a more challenging environment for workers in the services sector: temporary contracts are less frequently renewed, and voluntary departures are often not followed by new hires, leading to a net reduction in employment.

“On the price side, conditions remain broadly unchanged from the previous month. Input prices continue to rise moderately, driven by higher wages and increased costs for intermediate goods. Given firms’ limited pricing power, output price inflation remains contained. The modest increase in prices charged reflects both cost pressures and efforts to support revenue growth.”

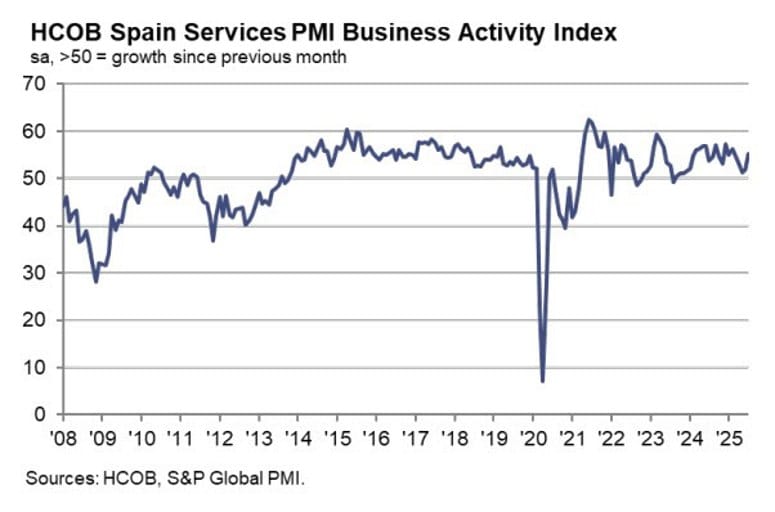

Spain’s Services PMI Surges to 55.1 in July

Spain’s services sector roared ahead in July, with the HCOB Services PMI climbing to 55.1, beating the 52.5 forecast and rising from June’s 51.9. The Composite PMI also improved to 54.7, up from 52.1. Domestic demand was the main driver, and new business recorded its strongest growth since February as the summer season boosted economic activity.

HCOB notes that:

“The latest HCOB PMI data is likely to be met with optimism in Spain’s private sector. Following the robust quarterly GDP growth of 0.7%, the July reading of the HCOB PMI Composite Output Index reinforces expectations that the current growth trajectory could persist in the coming quarters. As the second half of the year begins, the Spanish economy is exhibiting broad-based expansion, supported by both the services and manufacturing sectors.

“The service sector, in particular, is experiencing a notable upswing in activity and new business. Firms attributed the increase in domestic demand to targeted marketing efforts and improvements in service quality. While foreign demand has also picked up, it remains less dynamic than domestic demand; a divergence that reflects ongoing global trade policy uncertainties. In the short term, the new US–EU trade agreement may help reduce some of this uncertainty. In the short term, the new trade agreement between the US and the EU could have a stabilising effect, but in the medium term there remains a risk that the US government will once again resort to threatening higher tariffs as an economic policy lever.

“Rising activity levels have led to increased capacity utilisation in the services sector, as evidenced by a rise in backlogs of work. This already had a positive impact on employment dynamics in July. The robust level of business confidence suggests that hiring momentum is likely to continue in the coming months. In accommodation and food services, sectors traditionally facing structural labour shortages, migration inflows in recent years have played a key role in alleviating bottlenecks.

“Price pressures in the services sector remain elevated. Although the pace of input cost inflation has moderated over the course of the year, input price inflation continues to trend above pre-pandemic levels. Wage growth remains a primary cost driver, which is also reflected in continued increases in output prices.”

Italy’s Services Sector Grows, But Momentum Slows

Italy’s July Services PMI came in slightly below expectations at 52.3 (vs. 52.6 forecast), though still up from 52.1 in June. The Composite PMI rose to 51.5, improving from 51.1. While overall activity rose modestly and domestic demand held firm, job creation lost momentum despite businesses showing more optimism about the outlook.

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Italy’s services sector extended its growth streak into July, with the headline HCOB Services PMI inching up to 52.3 from 52.1 in June. This modest acceleration reflects a sector that remains resilient, underpinned by steady domestic demand and a cautiously improving outlook. Business activity rose for the eighth consecutive month, with surveyed firms reporting new client wins and the launch of fresh projects. However, the pace of new business growth softened to its weakest in six months, suggesting that while the recovery continues, it is becoming more measured.

“The divergence between domestic and international demand persisted. While local sales held firm, new export business declined for the twelfth straight month, reflecting ongoing fragility in global demand. Nonetheless, the rate of contraction in foreign orders eased slightly, hinting at a possible bottoming out. Employment growth, though still above the historical average, lost some momentum as firms focused on filling existing vacancies rather than expanding headcount aggressively.

“On the price front, input cost inflation cooled to its lowest level since November 2024, despite continued upward pressure from wages, fuel and services. This easing in cost pressures gave firms some breathing room. Meanwhile, output prices rose at the fastest pace in over a year. The move suggests a renewed effort to defend margins, even as consumer price sensitivity remains a concern.

“The July PMI data arrives alongside a disappointing Q2 GDP print, with Italy’s economy contracting by 0.1% quarter-on- quarter, against expectations of a modest expansion. While services remain a source of relative strength, the manufacturing PMI stayed in contraction territory. Taken together, the data point to a fragile growth environment heading into the second half of the year.”

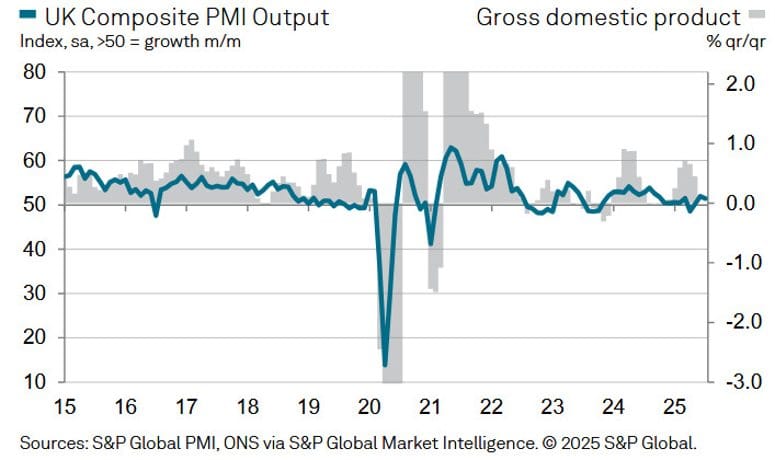

UK Services PMI Softens to 51.8 in July

The UK’s final Services PMI for July came in at 51.8, slightly above the 51.2 preliminary figure but well down from June’s 52.8. Composite PMI stood at 51.5, up from the 51.0 flash but still below the 52.0 prior. Growth in services activity remained modest, with new work declining and employment falling at its fastest pace since February.

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“UK service providers recorded a third consecutive monthly rise in business activity, but they were unable to maintain the growth rate achieved in June.

“Moreover, new business intakes swung back into contraction during July, with the downturn in order books the fastest for just over two-and-a-half years. Risk aversion and low confidence among clients were the main reasons provided for sluggish sales pipelines, alongside an unfavourable global economic backdrop.

“Hiring trends were especially subdued, with total workforce numbers decreasing to the greatest extent since February. Worries about rising payroll costs were cited as the main factor holding back recruitment.

“Suppliers again sought to pass on rising employment costs, although the latest increase in input prices across the service economy was the slowest since December 2024.

“Despite headwinds from strong cost pressures and lacklustre domestic economic conditions, service providers remain upbeat overall regarding the year ahead business outlook. Optimism improved since June, helped by receding concerns about US tariffs and hopes of a boost to business and consumer spending from interest rate cuts in the second half of 2025.”

EU Confirms Broad 15% Tariff Scope, Including Autos

The European Union confirmed that a 15% tariff rate will broadly apply to products under the Section 232 framework—this includes cars, car parts, and, pending further review, pharmaceuticals. Steel and aluminum remain excluded. EU officials emphasized that this is a non-binding framework deal, awaiting a U.S. response to finalize a joint statement. The deal is seen as a temporary relief while permanent arrangements are negotiated—similar to setups with China, the UK, and Japan.

EU says to expect some ‘turbulence’ in trade talks with the US moving forward

- EU trade commissioner Sefcovic says he is in contact with Lutnick and Greer to put the framework agreement into practice

- Trying to get as many products as possible into list of zero tariffs i.e. exemption list

- We are not here to say we have fundamentally solved everything in one go with regards to tariffs

- There will be some ‘turbulence’ in talks moving forward

- But we have set up a good basis for ourselves

- The work will continue in a constructive spirit

EU Delays Tariff Retaliation Versus U.S. by Six Months

Following fresh trade talks between the EU and U.S., the EU has agreed to postpone retaliatory tariffs originally scheduled for launch on July 27. Instead, implementation is delayed by six months, to foster stability and ease trade uncertainty as both sides draft a final Joint Statement.

Asia-Pacific & World News

China Services PMI Surges in July

The S&P China Services PMI climbed to 52.6 in July 2025, its highest level since May 2024, beating consensus (50.2) and up from June’s 50.6. The Composite PMI edged down to 50.8 from 51.3. This uptick was led by rising domestic demand and stronger tourism‑linked export orders, particularly among smaller, export‑oriented firms along the coast. Meanwhile, the official state‑sector PMI held steady at 50.0. Job growth in services reached its fastest rate since July 2024, while raw material, fuel, and wage pressures pushed firms to lift selling prices for the first time in half a year. Business confidence was buoyed by renewed trade stability amid a U.S.–China tariff truce agreement.

Hong Kong Central Bank Steps In to Support HKD

The Hong Kong Monetary Authority intervened again in currency markets, selling just under HKD 6.4 billion to support the dollar–HK dollar peg. The HKD had been approaching the weak end of its allowed trading band.

PBOC sets USD/ CNY central rate at 7.1366 (vs. estimate at 7.1667)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 160.7bn yuan via 7-day reverse repos at 1.40%

- 449.2bn yuan mature today

- net 288.5bn yuan drain

Australian Household Spending Gains in June

Australia’s household outlays rose 0.5% month‑on‑month in June (down from May’s +1.0%), while year‑on‑year growth accelerated to +4.8%, up from the prior +4.4%.

ANZ Job Ads Survey – July

Job advertisements fell 1.0% m/m (after +1.8% in June) but were up 0.1% y/y, registering 14.4% above pre‑pandemic levels. ANZ noted that these elevated levels suggest the labor market is unlikely to loosen significantly in the near term.

Australia’s S&P Global Services PMI Strengthens in July

Australia’s final S&P Global Services PMI in July came in at 54.1 (vs. June’s 51.8). The Composite PMI climbed to 53.8 (June: 51.6). Services growth was driven by sharp increases in new business and stabilizing export demand. Employment accelerated, though future‑activity sentiment dipped—suggesting caution about coming months. Inflationary pressures intensified, with both input and output prices rising, yet S&P Global still expects further rate reductions before year‑end.

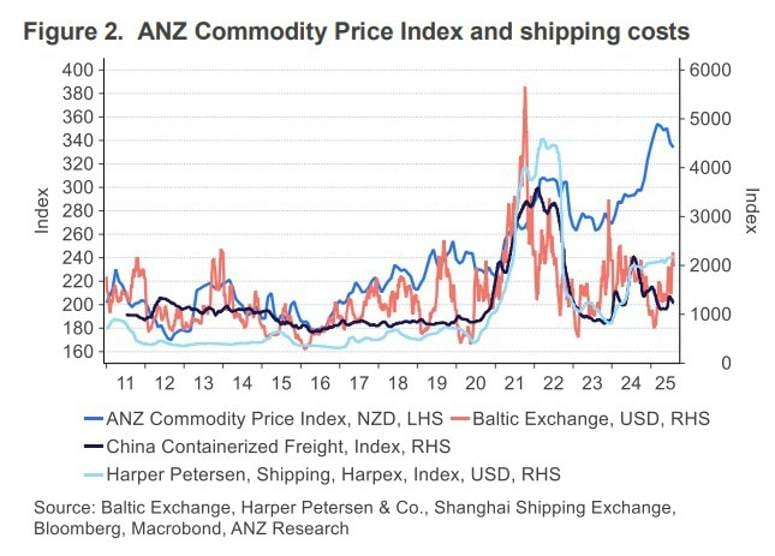

New Zealand Commodity Prices Fall in July

The ANZ World Commodity Price Index dropped 1.8% month‑on‑month in July, an improvement compared to June’s -2.4%. On a yearly basis, the index was up 10.7%, supported by stronger dairy and red meat prices. A stronger NZD contributed to a 1.2% m/m dip in commodity prices. The report also pointed out that while global shipping prices remained elevated in July, exporters expect cost relief soon as global demand softens.

Japan–U.S. Trade Negotiations Intensify

Japan’s chief trade negotiator, Akazawa, is returning to the U.S. for follow‑up talks, aiming to finalize details and prompt implementation of a new auto tariff agreement. One goal is to secure swift U.S. approval to move the tariff live.

Japan Services PMI Hits Five‑Month High in July

Final Jibun Bank Services PMI for Japan reached 53.6 in July (flash: 53.5; prior: 51.7), the strongest pace in five months. Growth was supported by robust domestic demand, offsetting a sharp decline in export orders and weaker tourism—a slump partly attributed to earthquake fears. New domestic business momentum was strongest in three months. However, services employment turned flat, ending a 21‑month streak of expansion, as labor constraints and budget limits weighed. Input‑cost inflation eased to a 17‑month low and output price increases slowed to their weakest in nine months. The Composite PMI ticked up to 51.6, the highest since February, but manufacturing slipped back into contraction.

BoJ June minutes: Will continue raising policy rate if the economy moves in line with forecast’s

- Bank of Japan June 2025 meeting minutes

The June meeting minutes have been dated by the July meeting. Headlines via Reuters:

- Many members said inflation somewhat overshooting forecast but must scrutinise economic developments due to downside risk to growth from US tariff policy

- One member said must support economy with current rate level as underlying inflation likely to stagnate temporarily

- Another member said now is period where we must scrutinise impact of BOJ’s January rate hike on economy, prices

- Members shared view BOJ expected to continue raising policy rate if economy, prices move in line with its forecast

- A few members said BOJ will likely consider resuming rate hikes once there are prospects trade woes stabilise

- One member said rate hike phase may be on pause for time being, but BOJ must respond nimbly, resume rate hike depending on U.S. policy development

- One member said BOJ may need to ‘decisively’ adjust degree of monetary support even during period of uncertainty as inflation is moving above expectations

- One member said appropriate to keep policy rate at current level for time being as it will take more time to have more clarity on corporate profits, Japan-US trade talks outcome

- MOF representative said hopes BOJ takes appropriate, flexible response as needed with due consideration to bond market stability, in tapering its bond buying

- One member said the recent sharp rises in super-long yields in major economies warrants attention

- A few members said expansionary fiscal policies, loose-monetary policies sought by some countries could moderate pace of slowdown in global economy

- A few members said uncertainty remains high but downward pressure on Japan’s economy from US tariff policy may not be as strong as projected in BOJ’s previous meeting

- Some members said recent inflation overshooting projections made in April quarterly report due largely to rising rice, food costs

- One member said changes in price-setting behaviour becoming embedded in food makers, restaurants so must scrutinise whether this will spread to other sectors

- Members shared view impact of past rises in import costs, recent food price rises on inflation likely to dissipate

- One member said wage momentum likely to be sustained even as tariffs weigh on corporate profits

- One member said paying attention to fact Japan seeing home-made inflation emerge such as from wage hikes driven by labour shortage

- Several members said rising prices of rice and other food products frequently purchased by households could affect households’ inflation expectations so must watch carefully

Crypto Market Pulse

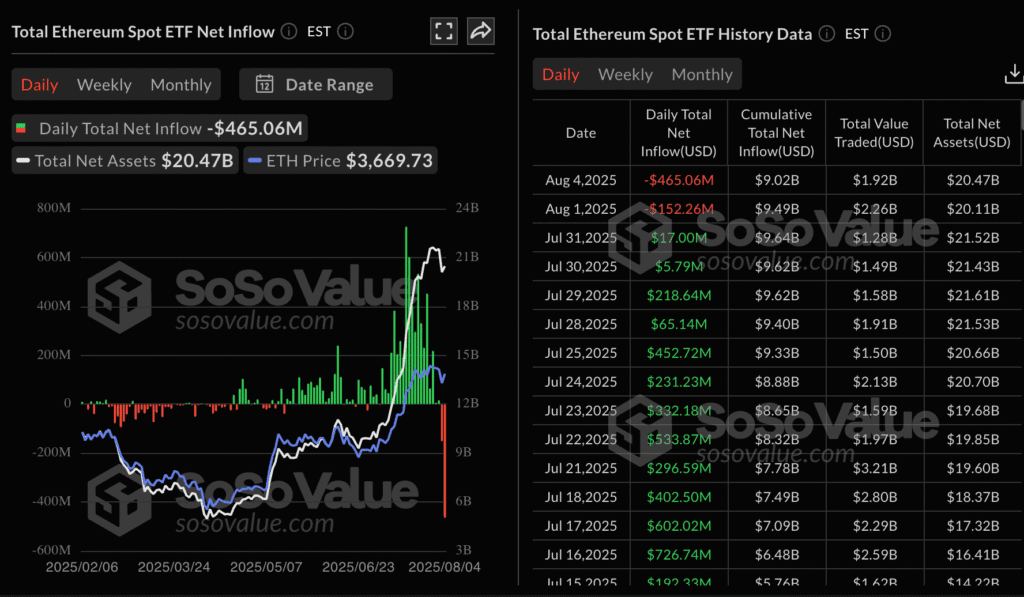

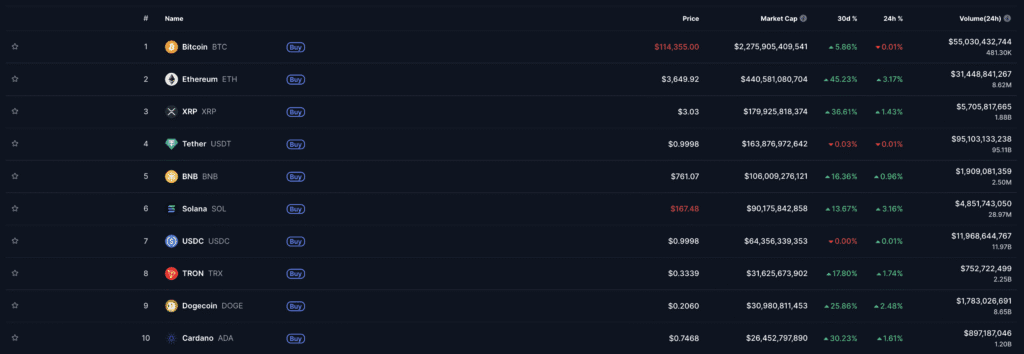

Crypto Market on Edge: XRP Holds Support, ETH and BTC See ETF Outflows

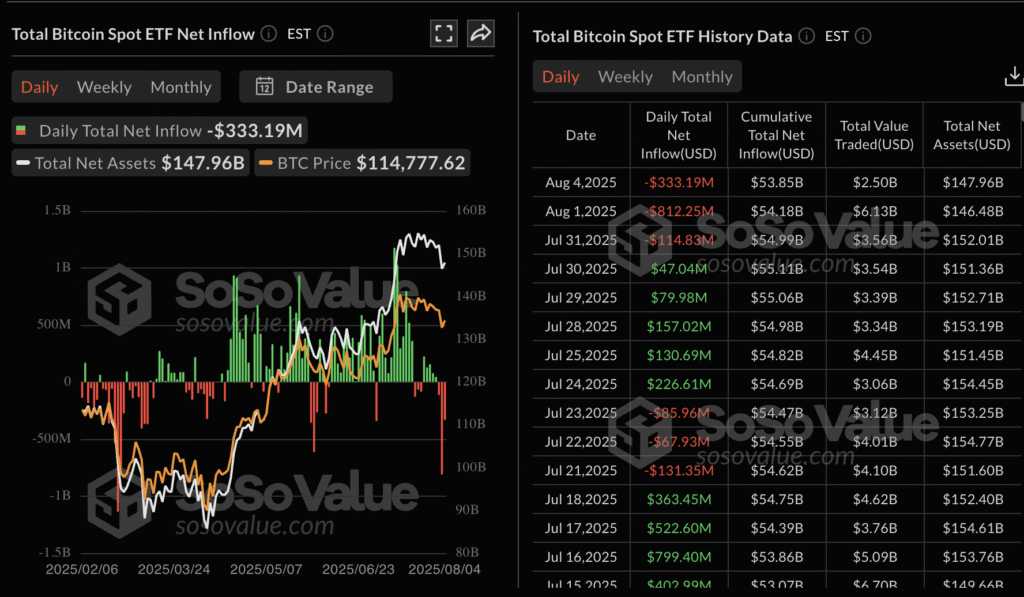

Bitcoin and Ethereum remain under pressure as a wave of spot ETF outflows signals waning institutional confidence.

BTC fell below $115,000, while ETH is stuck under $3,700 resistance. XRP is faring better, holding strong above $3.00 despite flashing a SuperTrend sell signal.

Key developments:

- ETH spot ETFs saw $465M in outflows Monday — the largest single-day withdrawal since launch.

- BTC spot ETFs also dropped $333M, marking three straight days of outflows.

- XRP remains above $3.00, eyeing $3.30 short-term resistance and $3.66 all-time high.

According to SoSoValue and Glassnode:

- ETH spot ETFs still boast $9B in net inflows.

- Net assets total about $20.5B with BlackRock’s ETHA leading at $10.7B, followed by Grayscale’s ETHE at $4.1B, and Fidelity’s FETH at $2.44B.

Technical outlook:

- ETH’s MACD shows a bearish crossover from July 30.

- ETH has support from its 50-day EMA ($3,195), 100-day EMA ($2,882), and 200-day EMA ($2,725).

- XRP staying above $3.00 boosts odds of a rally to $3.30, and possibly a retest of $3.66 from July 18.

The market remains cautious as macro uncertainty—especially U.S. tariff implementation—keeps risk-on sentiment in check.

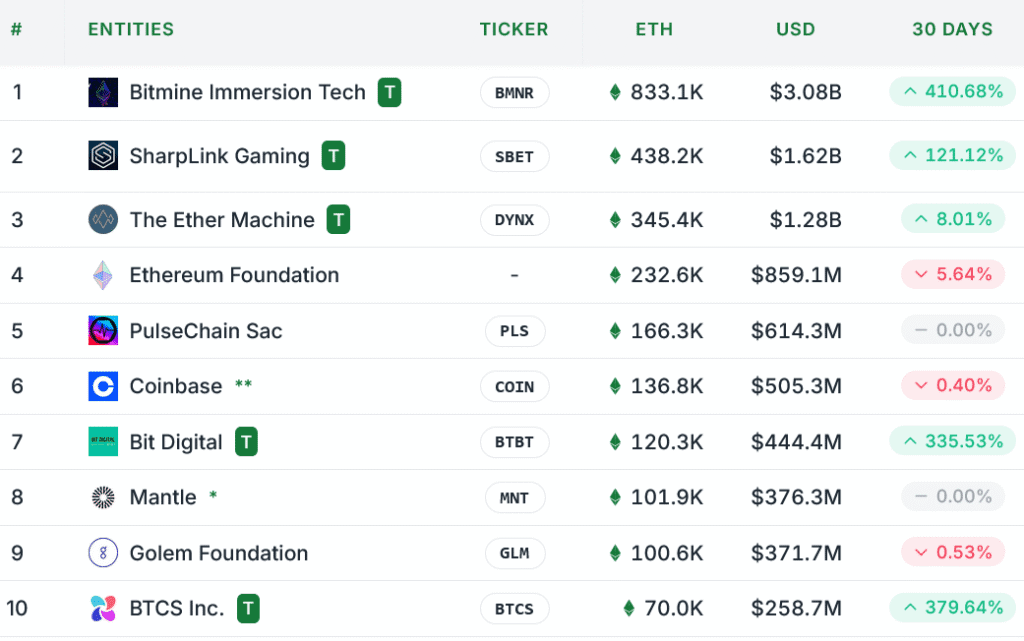

BitMine’s ETH Stack Tops $3B After New 208K Buy

Tom Lee’s BitMine Immersion Technologies bought 208,137 ETH last week, pushing its total holdings to 833,137 ETH—now worth over $3 billion. That cements BitMine’s position as the fourth-largest crypto treasury firm, trailing only Strategy, MARA, and Twenty One Capital.

ETH hit $3,730 Monday before sliding to $3,654, per CoinGecko. BitMine’s rapid growth—going from zero to over 800k ETH in just 35 days—has put it ahead of rivals like SharpLink (438k ETH) and The Ether Machine (345k ETH).

Tom Lee called the growth a pursuit of the “alchemy of 5%” ETH market share, adding that BitMine has outpaced peers in both NAV growth and liquidity.

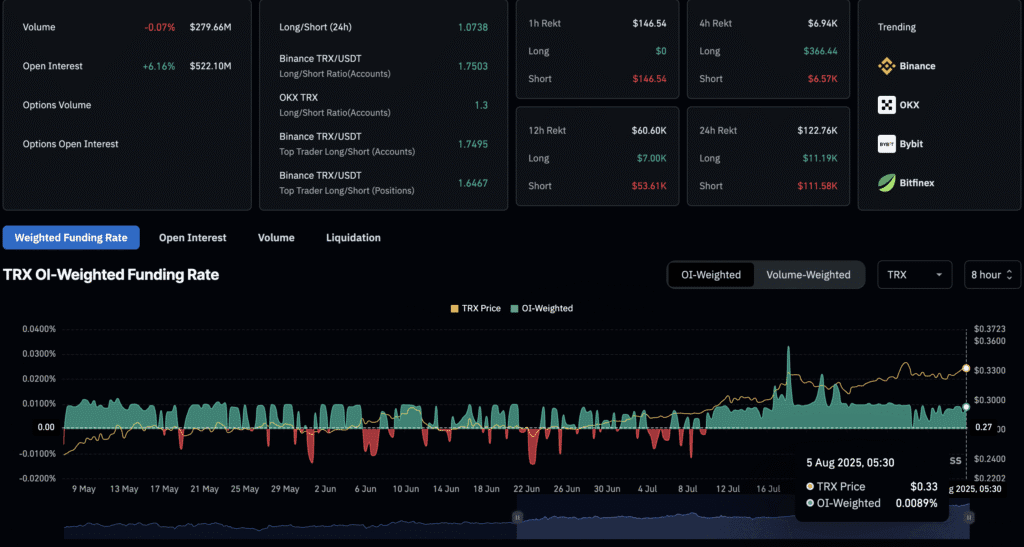

TRX Momentum Builds as Tron Network Hits Record Activity

TRON (TRX) has extended its recovery for a third straight day, rising nearly 1% as on-chain and derivatives metrics point to rising confidence.

Open interest rose over 6% in 24 hours, reaching $522.1 million. Total Value Locked (TVL) on the TRON network is now $27.14 billion, up 1.41% in a day. TRON now hosts 323 million accounts, with total transfer volume surpassing $20.28 trillion. Weekly average stablecoin transfers came in at $160 billion, signaling massive ongoing usage.

TRX traders are eyeing continued gains with market indicators suggesting growing capital inflows.

Litecoin Pops 11% on ETF Buzz and Merchant Surge

Litecoin (LTC) jumped over 11%, briefly crossing $123, leading large-cap altcoin gains this week. The move follows growing ETF chatter and rising on-chain merchant activity. In July, Litecoin accounted for 14.5% of CoinGate payments—trailing only Bitcoin and beating stablecoins like USDT.

Grayscale’s ETF application is delayed until October, but Bloomberg estimates a 90% approval chance, thanks to LTC’s classification as a commodity by the CFTC.

MEI Pharma’s $100 million Litecoin buy adds a treasury angle. On-chain metrics show LTC above its 7-day SMA, with RSI at 69.5 and MACD showing early divergence. Traders are eyeing the $124–$131 resistance band for a breakout.

Mantle (MNT) Climbs Toward $0.90 Amid Stablecoin Surge

Mantle (MNT) rallied 20% Monday and steadied at $0.87 Tuesday as stablecoin market cap on its network jumped 23% to $654 million. MNT’s DeFi growth has driven market cap to $2.9 billion, with institutions and retail investors piling in.

The ETH-based network contributed 101,867 ETH (~$369M) to the Strategic ETH Reserve. On-chain data shows open interest spiked 92% to $46 million, and derivatives volume ballooned to $139 million. Tether dominates Mantle’s stablecoin mix, accounting for 66% of the cap.

A long/short ratio of 1.0648 suggests traders remain bullish in the near term.

Ethereum, XRP See $170M Whale Accumulation

Institutional interest in Ethereum (ETH) and Ripple (XRP) is heating up. Over $110M in ETH and $60M in XRP were scooped up this week by whales. Two massive ETH buys—14,575 and 15,000 tokens—came from FalconX, while XRP saw a 20 million token buy from Upbit.

ETH and XRP have gained 45% and 36% over the last 30 days, respectively. ETH climbed 3% in the past 24 hours, and XRP rose 1%, outperforming most of the top 10 cryptos. Analysts see this as a setup for a broader altcoin run.

CFTC Launches Initiative to Allow Spot Crypto Trading

The U.S. Commodity Futures Trading Commission, led by Acting Chair Caroline Pham, has launched a new push to allow spot crypto contracts to trade on registered futures exchanges. This initiative, part of a broader “crypto sprint” following recommendations from the President’s Digital Assets Working Group, is seeking public input on how to list these contracts under existing DCM rules.

Saylor’s Strategy Acquires US $2.46 B of Bitcoin

Between July 28 and August 3, the Strategy team added 21,021 BTC to their holdings at a total cost of approximately US $2.46 billion, averaging US $117,256 per coin. As of August 3, their cumulative Bitcoin stash reached 628,791 BTC.

The Day’s Takeaway

North America

US stocks slipped after weaker-than-expected ISM Services data triggered fresh concerns over the health of the U.S. economy. The July ISM Non-Manufacturing PMI fell to 50.1, its lowest since May, with seven of ten components declining. Notably, imports and export orders dropped sharply, as trade disruptions and tariff effects filter through the services sector.

Major indices closed lower:

- Dow: -0.14%

- S&P 500: -0.49%

- NASDAQ: -0.65%

- Russell 2000: +0.60%

Treasury auction demand weakened. The U.S. sold $58B in 3-year notes at a 3.669% high yield, with lower foreign participation and a positive 0.7 basis point tail.

Earnings action:

- Palantir rose 7.85% on revenue topping $1B.

- Super Micro Computer missed on earnings and revenue; shares fell -12% after hours despite strong forward guidance.

- AMD beat on revenue ($7.69B) but missed on adjusted EPS; it absorbed $800M in export-related charges.

- Snap posted in-line revenue but a wider loss; forward guidance was mixed.

- Match Group topped expectations and guided higher.

- Rivian missed on EPS and raised its expected FY25 EBITDA loss to $2.25B.

- Opendoor beat revenue estimates, guiding to a Q3 slowdown.

The Atlanta Fed’s GDPNow estimate for Q3 was revised up to 2.5% from 2.1%, though volatility in early-quarter readings remains high.

Canada announced a C$700M loan guarantee program for the softwood lumber sector and C$500M in development funds to help the industry cope with U.S. duties. PM Carney signaled a push to diversify export markets and is in talks with Trump over broader tariff issues.

Canada’s trade deficit came in at C$5.86B, slightly better than expected. Exports rose, especially to the U.S., while non-U.S. exports dipped. Q2 saw a major fall in total exports and a record C$19B merchandise trade deficit.

Commodities

Gold extended gains, trading up 0.20% to $3,381, following last week’s soft jobs data and Tuesday’s ISM miss. Expectations are now building for a September Fed rate cut. Citi raised its 3-month gold price forecast to $3,500/oz, citing tariff-related inflation and weakening U.S. data credibility.

Crude oil fell by $1.13 to settle at $65.16, down 1.7% on the day, amid broader risk-off sentiment and rising inventories.

Copper markets remain unsettled after Trump’s selective tariffs. Prices found modest support on supply risks tied to a Chilean mine disruption. Shanghai Metal Markets expects a production dip in China due to ore shortages and scheduled smelter maintenance.

Europe

European equities posted small gains, led by Germany’s DAX (+0.42%), while France’s CAC (-0.14%) lagged. The FTSE 100, Ibex, and FTSE MIB all posted fractional increases.

The Eurozone Services PMI was mixed:

- Spain: 55.1 (beat)

- Italy: 52.3 (slight miss)

- France: 48.5 (downgraded, contraction deepens)

- Germany: 50.6 (revised up)

- Eurozone composite: 50.9 (flat overall, sluggish growth)

The Eurozone June PPI rose 0.8% m/m, driven by energy prices (+3.2%). Core PPI dipped when energy was excluded.

The EU confirmed 15% tariffs will apply to auto imports and car parts under the updated Section 232 framework, while still in negotiations with the U.S.

Asia

China’s S&P Services PMI jumped to 52.6 in July, its best reading since May 2024, driven by domestic demand and a rebound in export orders. The composite index fell to 50.8 due to weakness in manufacturing.

Japan’s Jibun Bank Services PMI reached 53.6, the fastest pace in five months, despite weaker tourism and flat employment. The composite PMI inched up to 51.6, even as manufacturing slipped.

Australia’s services sector showed strength in July with an S&P Global Services PMI of 54.1, while composite PMI hit 53.8. Job creation accelerated, though future expectations softened.

Hong Kong’s central bank intervened again in FX markets, buying 6.4B HKD to support the currency near the top end of its USD/HKD trading band.

Crypto

Crypto markets remained tense amid growing ETF outflows and macro uncertainty.

- Bitcoin (BTC) is hovering just below $115,000 after a rebound from $113,725

- Ethereum (ETH) struggles under $3,700, with ETF outflows hitting $465M, the largest since launch

- XRP is holding key support at $3.00, with short-term upside toward $3.30

SoSoValue reported $333M in BTC ETF outflows, the third straight daily decline. Ethereum ETFs saw their worst day on record. BlackRock’s ETHA holds the largest stake at $10.7B, followed by Grayscale ($4.1B) and Fidelity ($2.44B).

Market sentiment has turned defensive as traders weigh U.S. tariffs, Fed policy shifts, and economic data reliability following recent leadership changes at the BLS.