North America News

Stocks Slip as S&P Snaps Streak, Focus Turns to Fed

U.S. stocks closed lower Monday despite solid services data, as Trump’s tariff escalation and Fed uncertainty dragged sentiment.

Major Moves:

- S&P 500: -0.64% to 5650.55 (ends 9-day win streak)

- NASDAQ: -0.74% to 17,844.24

- Dow: -0.24% to 41,219.14

Growth in the ISM Services PMI (51.6 vs. 50.6 est.) and higher Prices Paid (65.1) suggested inflation could reheat. Still, Trump’s tariff push and entertainment sector targeting raised new trade war fears. Netflix and Paramount both fell.

Attention now shifts to Wednesday’s Fed meeting. Markets expect no change in rates, but Powell’s tone may influence risk sentiment going forward.

Ford, Palantir Earnings: Solid Revenue, Cautious Guidance

Palantir (PLTR) Q1 Results

- EPS: $0.13 (in line)

- Revenue: $884M (beat est. $861M)

- Q2 guidance: $934–$938M (above est. $898M)

- FY revenue outlook: $3.89–$3.90B (above est. $3.75B)

- Shares down 1.5% after-hours

Ford (F) Q1 Results

- EPS: $0.14 (vs. est. $0.00)

- Revenue: $40.66B (beat est. $36.20B)

- Suspended 2025 guidance due to tariff uncertainty

Ford highlighted an expected $1.5B EBIT hit from potential tariffs. Model E losses narrowed to $849M vs. expected $1.4B. Blue segment surprised with a $96M profit.

US Treasury’s $58B 3-Year Note Auction Sees Strong Domestic Demand

The US Treasury sold $58 billion in 3-year notes at a high yield of 3.824%, slightly better than the 3.826% when-issued level. The auction tailed by -0.2 basis points, better than the six-month average.

Auction details:

- Bid-to-Cover Ratio: 2.56x (vs. 2.63x average).

- Direct Bidders: 23.7% (above average).

- Indirect Bidders: 62.4% (below average).

- Dealers: Took 13.9% (below average).

Strong domestic interest, weaker international participation, but overall solid results.

US April ISM Services Beats Expectations at 51.6

The ISM Services Index for April rose to 51.6, beating expectations of 50.2 and improving from March’s 50.8. Though modest, it signals continued growth in the services sector.

Breakdown:

- Prices Paid surged to 65.1 from 60.9 — inflation risk persists.

- New Orders improved to 52.3 from 50.4.

- Employment rose to 49.0 from 46.2, but still shows contraction.

- Business Activity fell to 53.7 from 55.9.

- Inventories and supplier deliveries both strengthened.

- Imports slumped to 44.3 from 52.6.

Comments in the report:

- “Sales and traffic have improved on track with year-over-year seasonal trends. We seem to be outperforming some of the publicly traded restaurants reporting results.” [Accommodation & Food Services]

- “Tariffs are negatively impacting small business customers. Many small business customers source their products from China. They cannot afford to compete in the marketplace sourcing from other countries. We could not move products fast enough to beat the tariff starting dates.” [Agriculture, Forestry, Fishing & Hunting]

- “Business is steady.” [Construction]

- “There is great concern at my institution (medical school with a research institute and hospital) that changes from the current administration will severely and adversely affect many of the populations we are trying to help live healthier lives.” [Educational Services]

- “We are actively reviewing the impact of tariffs. We are seeing some vendors increasing their prices, and we are actively pushing back on those increases. We expect our vendors to honor our contracted pricing.” [Health Care & Social Assistance]

- “Generally, pricing is lower, but there is some uncertainty of actual, final costs due to tariffs.” [Other Services]

- “Our business is in a state of crises with uncertainty caused by both the ongoing trade war and the threats to federal funding of programs.” [Public Administration]

- “Uncertainty remains the dominating theme as the U.S. government has been maddeningly inconsistent with tariff implementation.” [Real Estate, Rental & Leasing]

- “Tariffs and concerns about government grants still impacting our procurement operations. Some projects are slowing or being held off to ensure we have funds to complete the current work.” [Transportation & Warehousing]

- “The tariff uncertainty is causing a lot of consumption of human capital. We are starting to see some tariff charges, some are significant given the price of the highly specialized units that were ordered over two years ago. Based on our spend over the last couple of years, we will have to adjust our capital and operations and maintenance plans.” [Utilities]

Conclusion: A mixed bag, but broadly supportive of moderate growth, though pricing pressures remain elevated.

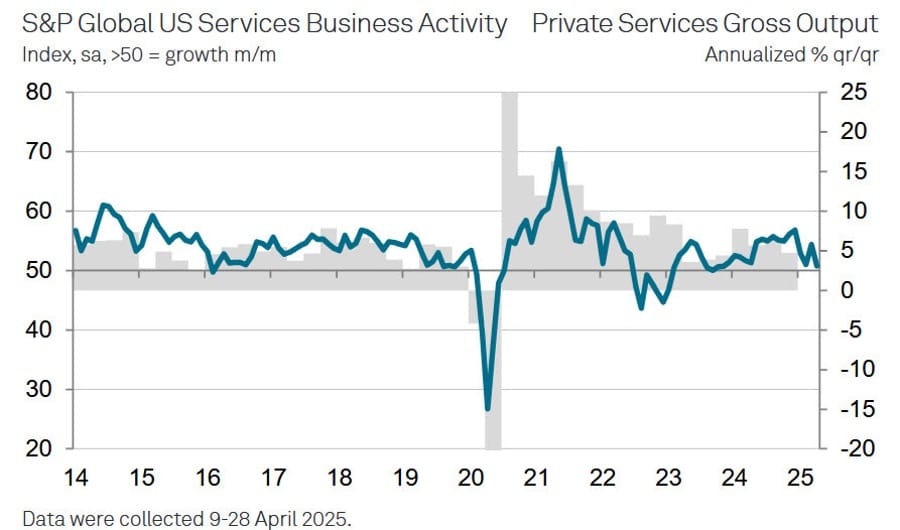

US April Final S&P Global Services PMI Revised Down to 50.8

The final April reading for US S&P Global Services PMI came in at 50.8, down from the preliminary 51.4 and significantly lower than March’s 54.4. The composite PMI was also revised down to 50.6 from the 51.2 prelim.

Details:

- Business activity slowed amid weaker gains in new work.

- Hiring was minimal.

- Inflation pressures eased notably from March’s recent high.

- Business sentiment hit a 2.5-year low, one of the weakest since the pandemic’s early phase.

Takeaway: While the index still signals expansion, momentum is clearly fading.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“While tariff announcements mean manufacturing dominates the news, a worrying backstory is developing in the vastly larger services economy, where business activity and hiring have come closer to stalling in April amid plunging business confidence.

“Business and consumer facing service providers alike, and especially financial services firms, are reporting markedly weaker growth prospects, citing intensifying uncertainty over the economic outlook amid recent tariff announcements and ongoing federal spending cuts.

“A key area of weakness is slumping exports of services, which is now falling at rate not seen since 2022, but domestic demand is also reportedly waning as confidence slides lower. “

Higher prices paid for imports due to tariffs are also driving up service sector firms’ costs, feeding though to higher prices, notably in consumer-facing industries such as restaurants and hotels.

“The resulting bottom line from the services sector is a heightened risk of stalling growth and rising inflation, or stagflation.”

Bessent: Tariffs, tax cuts and deregulation are keys to drive long-term investment

- Comments from Bessent at Milken conference

- Tax legislation will prevent main street tax hike by making small business deduction permanent

- Legislation will restore 100% expensing for equipment, expand full expensing to factory construction, provide tax credits and deductions for R&D

- US markets are ‘antifragile’ over a long-term horizon, it’s never a bad time to invest in America

- Trading deals maybe as early as this week

- I’m highly confident that 17 trading partners excluding China have presented with very good trade proposals

- We could see more frictionless trade from these negotiations

- Could see substantial progress with China in the coming weeks

- The market is not pricing in inflation, hard data is still resilient

Buffett Confirms Greg Abel as Berkshire Successor

Warren Buffett confirmed Greg Abel will become CEO of Berkshire Hathaway at the end of 2025.

Buffett will stay on in an advisory role and won’t sell any shares. Abel said the firm’s value-investing philosophy will remain unchanged and that he’s ready to deploy Berkshire’s $347 billion in cash.

It’s unclear if Abel will also take on the chairman role; Buffett’s son Howie is expected to become nonexecutive chairman.

Bessent’s WSJ Op-Ed: Big Promises, Little Substance

U.S. Treasury Secretary Bessent used a WSJ op-ed to pitch Trump’s economic vision as a revival of the American working class.

Key pillars: tariffs, permanent tax cuts, and deregulation

Critics note the plan lacks credible data, underplays the downsides of tariffs and tax cuts, and leans on slogans like “economic security is national security.” The piece reads more like campaign material than a serious policy proposal.

The Journal is gated, here is the link if you can access it.

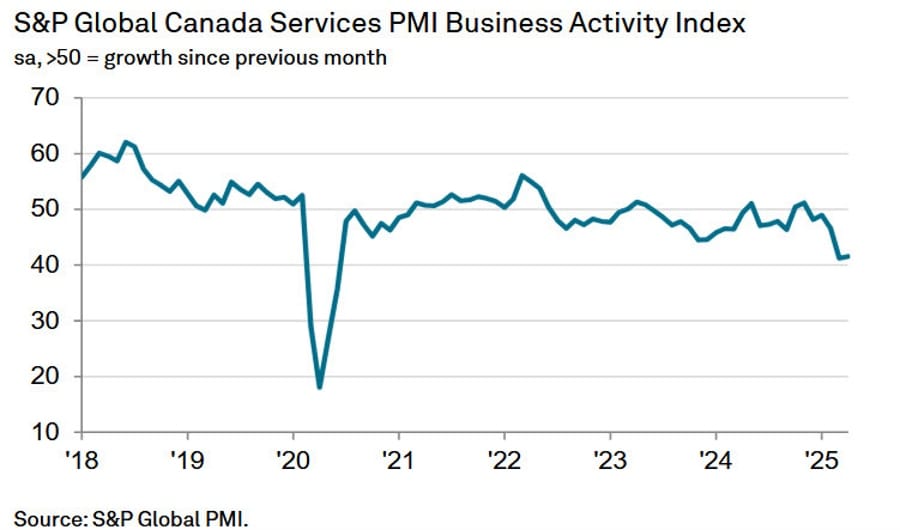

Canada April S&P Global Services PMI Rises Slightly, Still Signals Recession Risk

Canada’s services sector showed a small uptick in April, with the S&P Global Services PMI rising to 41.5 from 41.2 in March. Despite the improvement, the reading remains deep in contraction territory and just above March’s low, the worst since June 2020. The composite index slipped slightly to 41.7 from 42.0.

Key details:

- Job losses persisted for a fourth straight month.

- Firms are not replacing departing staff due to weak demand.

- Selling prices were cut for the first time in nearly four years.

- Sales volumes and new work continue to decline.

- Backlogs are falling as companies easily handle current workloads.

Paul Smith, Economics Director at S&P Global Market Intelligence, said:

“Canada’s service sector economy faced another challenging month, with activity declining steeply and new business volumes again down sharply. Firms again linked these weak trends to widespread economic and political uncertainty, in turn linked to trade policies and, at the time of survey data collection, the general election.

“Service providers are hopeful that a more stable business environment will have emerged in a year’s time, but presently, given the lack of new work and excess capacity at units, job losses were again reported. Moreover, adding to the woes of service providers, firms felt compelled to reduce their output charges for the first time in over four years – despite input price inflation remaining elevated as suppliers were again reported to be reevaluating their list prices.”

Bottom line: This is recessionary data. The Bank of Canada may need to move faster to address economic weakness.

Commodities News

Gold Breaks $3,300 as Dollar Weakens Ahead of Fed

Gold surged more than 2% on Monday, rising over $70 to settle at $3,321. A falling U.S. dollar and renewed inflation concerns helped drive demand for safe-haven assets.

Key Drivers:

- ISM Services PMI beat: 51.6 vs. 50.6 expected

- Prices Paid spiked: 65.1, highest since Feb 2023

- Trump’s tariffs: Sparked inflation fears

- DXY: Dollar index fell 0.2%

Trump confirmed he won’t remove Fed Chair Powell early but pushed for rate cuts. Markets are pricing in a Fed hold this week. Traders will watch Powell’s Wednesday press conference for any shift in policy outlook.

Oil Falls Nearly 2% as OPEC+ Boosts Output

Crude oil prices dropped sharply Monday after OPEC+ announced a major production increase.

- WTI Crude: Settled at $57.13, down $1.16 or 1.99%

- Session low: $55.39 — close to the April 9 low of $55.15

- Lowest close since: February 10, 2021

Traders are eyeing $49.44 — the 61.8% Fibonacci retracement from 2020 lows — as the next major technical support.

With oil demand under pressure and supply rising, market participants are bracing for further downside unless macro conditions shift.

Silver Surges Near $32.60 on Weaker Dollar, Fed Caution

Silver jumped to nearly $32.60 as the US Dollar fell and traders braced for the Fed’s rate decision. With rates likely on hold and uncertainty over US-China trade, silver is drawing safe-haven interest.

Market dynamics:

- USD Index fell to 99.50, down 0.5%.

- Fed rate cuts in June now seen as unlikely (odds drop to 32%).

- Trump’s comment on possible tariff cuts keeps trade tensions in focus.

Technical setup:

- Silver below 20-day EMA at $32.65.

- RSI under 50, suggesting fading momentum.

- Resistance: $34.60 (March high).

- Support: $30.90 (April low).

Outlook: Price action remains volatile but supported by macro uncertainty and Fed indecision.

Palladium and Platinum Start Mixed

- Palladium trades at $960.28/oz, up slightly.

- Platinum flat at $966.75/oz.

- PGMs show little direction in early European trading.

Gold Climbs Past $3,300 as Risk-Off Mood Returns

- Rebounds 2%, taking out 100- and 200-hour MAs at $3,270 and $3,294.

- Bounce off 50% Fib level from last week’s drop.

- Persistent uncertainty around US tariffs and China supports gold’s safe-haven appeal.

Barclays Cuts Brent Crude Forecast

Barclays has lowered its Brent crude outlook, citing faster-than-expected OPEC+ output hikes. It now sees Brent averaging $66 in 2025 (down $4) and $60 in 2026 (down $2).

Key drivers: OPEC+ raised output by 411,000 bpd in June—its second straight increase. Saudi Arabia is pressuring under-compliant members like Iraq and Kazakhstan. Barclays now expects voluntary cuts to be fully rolled back by October 2025, a year earlier than forecast.

Separately, U.S. crude output was revised lower by 100,000 bpd in 2025 and 150,000 bpd in 2026. Brent fell over $2 early Monday to $59.20.

Oil Opens Sharply Lower on OPEC+ Supply News

Oil futures gapped down as trading opened this week, with Brent sliding over 3%. The move followed weekend news of a planned OPEC+ production hike, signaling weaker price support going forward.

OPEC+ Signals Full Exit From Voluntary Cuts

Reuters reports that OPEC+ may fully phase out its 2.2 million bpd in voluntary cuts by November if member compliance doesn’t improve.

April’s surprise hike led by Saudi Arabia was followed by another 411,000 bpd boost approved for June, with more expected through October. Saudi Arabia has warned non-compliant nations—Kazakhstan in particular—could face pressure if they don’t meet targets. UBS’s Giovanni Staunovo said the market will take this as bearish unless exports reflect better compliance.

Europe News

Europe Markets Mixed as Global Volatility Builds

European equity markets closed with mixed results Monday as U.S. protectionist rhetoric and economic crosswinds weighed on investor sentiment.

Final Index Moves:

- Germany DAX: +1.12%

- France CAC 40: -0.55%

- UK FTSE 100: +1.17%

- Spain Ibex 35: +0.53%

- Italy FTSE MIB: +0.39%

Eurozone Sentix Confidence Rebounds to -8.1

- Beats expectations of -12.5, prior was -19.5.

- Expectations index surges to 19.6 (from 3.8).

- Investors less worried about recession, despite lingering tariff fears.

Swiss Inflation Hits 0% in April, Below Forecast

- Headline CPI: 0.0% YoY (vs. +0.2% expected), prior: +0.3%.

- Core CPI: +0.6% YoY (prior: +0.9%).

- Marks first flat inflation print since March 2021.

- Swiss franc strength and falling inflation could pressure SNB.

SNB Sight Deposits Edge Higher

- Total sight deposits: CHF 454.1B (prior: CHF 451.1B).

- Domestic sight deposits: CHF 443.1B (vs. CHF 442.6B prior).

- Modest increase signals cautious liquidity shifts.

London Markets Shut for May Day

- UK markets are closed for the May Day holiday.

- European markets open but flows are light due to recent Asian holidays.

- Data releases are limited to start the week.

ECB’s Panetta: Protectionism threatens to weaken prosperity

- Remark by ECB executive board member, Fabio Panetta

- Protectionism threatens to weaken prosperity.

Asia-Pacific & World News

Asian Markets Closed for Holidays

Markets in Japan, South Korea, Hong Kong, and mainland China are closed due to holidays. All will reopen Tuesday.

PBoC: Uncertainty Rising, Asia Must Cooperate

- Governor Pan warns of growing global economic risks.

- Calls for regional cooperation on tariffs.

- Remarks signal concern over persistent trade tensions.

Goldman Sachs: China Exports to Fall Through 2026

Goldman Sachs expects China’s exports to contract 5% in both 2025 and 2026, citing rising U.S. tariffs and worsening trade relations.

Some trade re-routing through Southeast Asia may soften the blow, but Goldman sees China’s trade surplus falling to 3.7% of GDP in 2025 (from 4.0% in 2024).

FT: Chinese Firms Re-Routing Exports to Dodge Tariffs

The Financial Times reports that Chinese exporters are routing goods through third countries to hide their origin and evade Trump-era tariffs. The long-known practice is gaining renewed visibility amid rising U.S.-China tensions.

Trump: No Plans to Talk With Xi This Week

Trump said he has no scheduled talks with Chinese President Xi this week, though he left the door open to a trade deal by stating one “could” happen.

Trump Backs Off China Tariffs — Again

Trump signaled another pullback on China tariffs, telling reporters he might lower them:

“Otherwise, you could never do business with them… and they want to do business very much.”

This shift may force U.S. firms reconsidering reshoring strategies to reevaluate.

Taiwan Central Bank Confirms FX Intervention

- Governor Yang confirms market intervention today.

- Describes intervention as “appropriate” but less aggressive than usual.

- Exporters and firms ramp up USD selling.

Taiwan Dollar Posts Historic Surge

MUFG labeled the Taiwan dollar’s 3.8% daily surge on May 2 as a “19-standard-deviation event”—the largest since 1983. The move capped a 5.5% gain for the week.

Driving factors: renewed optimism over U.S.-China trade, strong U.S. tech earnings, resilient Taiwanese GDP, $1.2B in equity inflows, and hedging activity.

Thin holiday trading may have amplified the jump. The government confirmed it concluded its first round of tariff talks with the U.S. on May 1.

Australia’s PM Albanese Re-Elected, Talks with Trump

PM Anthony Albanese confirmed his weekend re-election victory and said he spoke with Trump post-win. Topics included tariffs and the AUKUS defense pact. The conversation was described as “warm and positive.”

Australia and Singapore Election Round-Up

- Australia: Labor Party secured an expanded majority—85 seats (up from 77), while the opposition lost 18 seats. Labor also becomes the largest Senate party with at least 28 seats. The Greens likely hold the balance of power.

- Singapore: The ruling People’s Action Party won its fourth straight term, securing 87 out of 97 contested seats.

Australia Job Ads Continue to Rise

ANZ-Indeed job ads rose 0.5% m/m in April, after a 0.4% rise in March. The report signals continued strength in Australia’s labor market.

Australia Inflation Gauge Jumps

The Melbourne Institute’s April CPI gauge showed inflation rose 0.6% m/m and 3.3% y/y—its highest in 13 months. The core (trimmed mean) measure hit 0.4% m/m and 3.3% y/y, up from 2.9% in March.

Australia Services PMI Softens

The final S&P Global Services PMI for April came in at 51.0, down from the prior 51.6 and the preliminary reading of 51.4. The composite index also printed at 51.0. Manufacturing PMI last week was 51.7.

RBNZ Flags Risks from AI in Finance

New Zealand’s central bank warned rapid AI adoption poses financial stability risks. These include model errors, data privacy lapses, market distortions, and heavy reliance on a few tech firms.

Despite the risks, the RBNZ acknowledged AI’s benefits and said it will continue monitoring developments closely.

US Rejects Japan’s Request for Full Tariff Exemption

The US has denied Japan’s request for full exemption from upcoming reciprocal tariffs but is open to reducing the planned 14% tariff if negotiations progress.

Key points:

- The 14% tariff is scheduled to resume on July 9.

- The US may consider keeping tariffs at 10% or cutting the 14% rate based on the outcome of ongoing trade talks.

Implication: Trade tensions remain, but there’s room for compromise if discussions advance.

Vietnam-US Tariff Talks Set for May 7

- Vietnam among six countries prioritized by the US for trade negotiations.

- Talks are part of broader effort to de-escalate tariff tensions.

- Other countries on the list: India, Japan, South Korea, Indonesia, UK.

Crypto Market Pulse

Crypto Today: BTC Slips Below $94K, SUI Defies Market as Trump Targets Hollywood Imports

Market Overview

Global cryptocurrency market cap fell 3% to $3.03 trillion on Monday, with over $100 billion in outflows in 24 hours. The drop came after U.S. President Donald Trump proposed 100% tariffs on foreign-produced films, unsettling global risk assets.

Bitcoin Update

Bitcoin dropped 5% to $93,400, falling from Friday’s peak of $98,200. The downturn followed bearish sentiment and rising derivatives volumes, which surged 74% in the past day.

MicroStrategy revealed it acquired 1,895 BTC between April 28 and May 4 for $180 million, funded via equity sales. The firm now holds 555,450 BTC — about 2.6% of total circulating supply.

Altcoin Watch

While major altcoins like ETH, SOL, and XRP saw 1% losses, SUI was the outlier — gaining 5.1% to $3.44 amid high network activity and increased investor demand. SUI led top-10 token performance with $1.5 billion in daily volume.

AI and PolitiFi tokens, including the Trump Coin, saw a mixed session. Short-term capital rotated into meme-adjacent plays such as Pump.fun and VICE, reflecting speculative sentiment.

OKX Relaunches Web3 DEX After Lazarus-Linked Pause

OKX has relaunched its decentralized exchange aggregator, OKX Web3, after halting it due to suspicious activity linked to North Korea’s Lazarus Group.

The updated platform now includes:

- Real-time abuse detection

- On-chain wallet risk tracking

- A suspicious wallet database

Security audits were completed by CertiK, Hacken, and SlowMist to strengthen infrastructure and prevent future attacks.

Saylor Praises Buffett as “Bitcoin of the 20th Century” Amid Retirement News

Michael Saylor called Warren Buffett’s Berkshire Hathaway the “Bitcoin of the 20th century” at MicroStrategy’s shareholder meeting.

Buffett, 94, announced he will retire as CEO by year-end. Vice Chairman Greg Abel will take over in 2026. Buffett will remain involved and continue to hold his shares.

During his 60-year tenure, Berkshire delivered a 20% annualized return from 1965 through 2024.

Bitcoin Briefly Falls Below $94K Amid $2B ETF Inflows

Bitcoin (BTC) briefly dipped below $94,000 on Monday despite $1.8 billion in ETF inflows last week, suggesting profit-taking as investor gains accumulate.

Highlights:

- Strategy bought 1,895 BTC at $95,167 each, bringing its total to 555,450 BTC.

- Semler Scientific added 167 BTC, now holding 3,634.

- Thumzup Media filed to raise $200 million for BTC purchases.

- BTC’s Realized Profit/Loss Ratio rose above 1.0, indicating increased selling.

- MVRV Ratio reset to 1.74, a typical consolidation zone.

Bottom line: Despite short-term selling, institutional interest remains strong, supporting the long-term bullish outlook.

TRUMP Meme Coin Falls 32% as President Denies Involvement

The TRUMP meme coin has plunged 32% from its April high of $16.44, trading near $11.12. The drop follows President Trump’s public denial of any involvement or profits from the token.

Developments:

- Trump said in an NBC interview: “I’m not profiting from anything.”

- Top 220 token holders invited to a May 22 dinner at Trump National Club.

- Top 25 get VIP access and a White House tour.

- RSI dropped to 42.01, pointing to rising bearish momentum.

- Support at $10 remains critical.

Watch for: A break below $10 could trigger further declines, while reclaiming the $11.40–$11.83 range might revive bullish momentum ahead of the dinner event.

Bitcoin Holds $95K Amid Mixed Economic Signals

- BTC down ~3% over weekend, stabilizes near $95,000.

- Trump hints at recession, but promises a trade deal announcement this week.

- On-chain profit-taking pressures BTC, but ETF inflows still strong ($1.81B last week).

XRP Struggles as Activity Slows, Despite Whale Accumulation

- XRP at $2.17, clings to $2.10 support.

- Daily active addresses fall from 612K in Q1 to ~40K now.

- Whales increasing holdings, hinting at long-term optimism.

- Still trades below key EMAs; RSI near oversold.

$58M in Token Unlocks May Shake ENA and MOVE

- Ethena to unlock 171.88M tokens (~3.1% supply); Movement to release 50M (~2%).

- Unlocks could lead to volatility and price pressure if demand doesn’t match.

- Past large unlocks caused double-digit drops, especially for ENA.

- Broader crypto market cautious amid US-China uncertainty.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

U.S. equities fell Monday, ending a multi-session rally as traders reacted to President Trump’s latest 100% tariff proposal on foreign-made films. The move revived protectionist fears and weighed on risk sentiment.

- S&P 500: -0.64% to 5,650.55

- Nasdaq: -0.74% to 17,844.24

- Dow Jones: -0.24% to 41,219.14

The S&P snapped a nine-day win streak, and markets now await Wednesday’s Fed decision. Treasury yields climbed, with the 10-year note at 4.34%, while the dollar slipped 0.2%.

Despite strong April ISM Services PMI data (51.6 vs. 50.6 est), rising input prices (Prices Paid: 65.1) stirred inflation concerns. Trump reaffirmed support for Powell through 2026 but urged rate cuts.

Earnings Highlights:

- Palantir (PLTR):

- EPS: $0.13 (inline)

- Revenue: $884M (beat est. $861M)

- Q2 Guidance: $934M–$938M (above est. $898M)

- FY Guidance: $3.89B–$3.90B (above est. $3.75B)

- Shares: -1.5% after-hours

- Ford (F):

- Adjusted EPS: $0.14 (vs. est. $0.00)

- Revenue: $40.66B (vs. est. $36.2B)

- Model E losses narrowed vs. expectations

- Tariff impact: Estimated $1.5B hit to FY EBIT

- FY guidance suspended due to tariff uncertainty

Investors are now focused on Powell’s press conference, with the Fed widely expected to hold rates steady.

Canada

Canada’s economy remains under pressure, with April’s S&P Global Services PMI ticking up slightly to 41.5 from 41.2 — still deep in contraction territory. The composite PMI fell to 41.7, near June 2020 lows.

Key takeaways:

- Job losses persisted for a fourth month

- Companies are cutting prices for the first time in nearly four years

- New business volumes and backlogs continue to decline

- Firms are reluctant to rehire due to weak demand

Bottom line: The data confirms recession risks. Pressure is building on the Bank of Canada to act sooner to support the economy.

Equities tracked U.S. markets lower, while the loonie weakened slightly amid falling oil prices and soft domestic data.

Commodities

Oil:

WTI crude dropped 1.99% to settle at $57.13, its lowest close since February 2021. Prices briefly hit $55.39, nearing April’s low of $55.15. OPEC+’s decision to raise output surprised markets and added downside pressure. Technical support sits at $49.44, the 61.8% retracement from the 2020 low.

Gold:

Gold surged more than $70 to $3,321 (+2.2%), driven by dollar weakness and inflation hedging. Trump’s tariff announcement spurred safe-haven flows despite resilient economic data, with traders hedging against potential supply shocks and Fed inaction.

Europe

European equities ended mixed as investors assessed U.S. trade rhetoric and awaited central bank moves.

- Germany (DAX): +1.12%

- France (CAC 40): -0.55%

- UK (FTSE 100): +1.17%

- Spain (Ibex): +0.53%

- Italy (FTSE MIB): +0.39%

Media and multinational consumer stocks lagged amid tariff concerns. Economic sentiment remains cautious, with limited signs of recovery across the bloc.

Asia

Asian markets posted cautious gains as investors balanced Trump’s latest tariff threats with China trade speculation and upcoming Fed policy. Export-heavy markets like South Korea and Taiwan lagged.

Japan’s Nikkei held steady as yen weakness supported exporters, while Chinese equities traded flat. Beijing’s silence on the movie tariffs stoked uncertainty. Traders await more clarity on China’s potential response.

Crypto

The total crypto market cap dropped 3% to $3.03 trillion amid a broader risk-off move and renewed macro jitters. Over $100B in capital flowed out in 24 hours.

Bitcoin (BTC) fell 5% to $93,400 — down from Friday’s $98,200 high. ETH, XRP, and SOL posted 1–2% declines. Traders responded to Trump’s economic nationalism by reducing crypto exposure.

SUI stood out, gaining 5.1% to $3.44 on strong network growth and $1.5B in volume. It was the only top-10 asset to post gains.

MicroStrategy bought 1,895 BTC last week for $180M, lifting its total holdings to 555,450 BTC (2.6% of total supply), funded by share sales.

AI and political meme tokens, including Trump-linked coins, showed mixed performance. Derivatives volumes spiked 74% on rising volatility expectations.