North America News

S&P 500 Surges on Weak Jobs Data, Fed Cut Bets Firm

US stocks flipped early losses into a powerful late-session rally Thursday, with the S&P 500 closing at an all-time high and the Dow Jones Industrial Average surging more than 350 points. A softer ADP jobs report boosted confidence that the Federal Reserve will cut rates this month.

The S&P 500 finished at 6,502 — its strongest daily close ever and just shy of the intraday record of 6,207 set on August 25. Buying pressure accelerated into the close for a third straight day.

Index performance:

- S&P 500 +0.8%

- Nasdaq +1.0%

- Russell 2000 +1.3%

- Dow Jones +0.8% (+350 points)

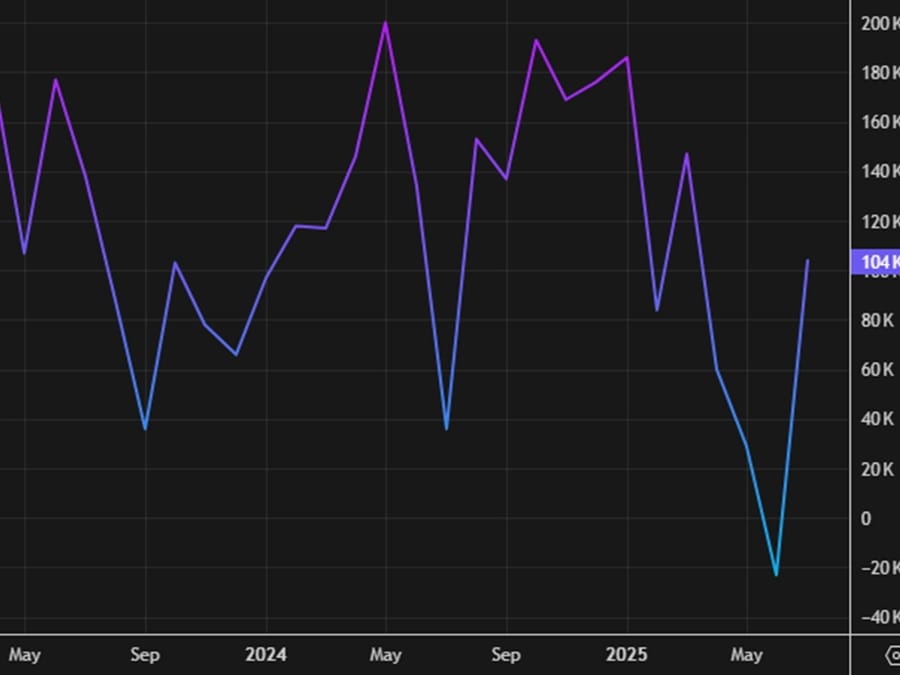

The spark came from ADP payroll data showing private-sector job growth of just 54K in August, well below the 65K forecast and sharply lower than July’s revised 106K. Weekly jobless claims also rose to 237K, slightly above expectations.

The disappointing figures reinforced expectations that the Fed will cut rates on September 17. Markets now price the odds at nearly 100%.

The Dow, while still modestly down for the week, is within striking distance of record territory above 45,760. Friday’s Nonfarm Payrolls report is now seen as a potential catalyst for new highs.

ISM August services PMI beats expectations

The ISM services index rose to 52.0 in August, above forecasts of 51.0 and up from 50.1 in July. Business activity surged to 55.0, while new orders climbed to 56.0.

Employment slipped slightly to 46.5, highlighting labor market weakness, while prices paid eased to 69.2 from 69.9.

US September S&P Global final services PMI revised lower

The final US services PMI for September was revised to 54.5, down from the 55.4 flash estimate and August’s 55.7. The composite PMI came in at 54.6 versus 55.1 prior.

While the headline remains in solid expansion territory, business optimism declined, reflecting uncertainty around US policy.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“Although weaker than signaled by the preliminary ‘flash’ PMI reading, and below that seen in July, the expansion of the service sector in August was still the second strongest recorded so far this year. Together with a robust manufacturing PMI reading, the surveys are consistent with the US economy growing at a solid 2.4% annualized rate in the third quarter.

“Fuller order books, reflecting a summer upturn in customer demand, has meanwhile encouraged service providers to take on additional staff in increasing numbers, accompanied by a return to hiring in the manufacturing sector. While low household confidence is reportedly keeping spending on consumer services relatively subdued, demand for financial services is showing especially strong growth amid improving financial market conditions.

“However, the brighter news on current economic growth and hiring is marred by concerns over future growth prospects and inflation. Business optimism regarding the year ahead outlook has dropped to one of the lowest levels seen over the past three years amid escalating worries over the uncertainty and drop in demand caused by federal government policy, most notably tariffs, as well as the associated rise in price pressures. Inflation concerns have been fanned by a further steep rise in input costs which have fed through to another marked increase in average charges for services.

“The survey data therefore point to some downside risks to growth in the coming months while signaling upside risks to inflation, as import tariffs feed through to prices charged for both goods and services.”

U.S. Jobless Claims Rise to 237K

Initial claims rose to 237K for the week ending August 30, above expectations of 230K and up from the prior 229K.

- Four-week average: 231K (vs 228.5K prior)

- Continuing claims: 1.940M (vs 1.962M prior)

ADP: U.S. Private Payrolls Rose 54K in August

ADP data showed +54K jobs created in August, short of the +65K forecast and well below July’s +106K (revised).

Breakdown by sector:

- Goods-producing: +13K

- Services: +42K

- Trade/transport/utilities: -17K

- Leisure/hospitality: +50K

Wage data:

- Job stayers: +4.4% y/y

- Job changers: +7.1% y/y

ADP’s chief economist Nela Richardson said hiring momentum has been “whipsawed by uncertainty,” citing labor shortages, cautious consumers, and AI-related disruption.

U.S. July Trade Deficit Widens to $78.3B

The U.S. trade balance showed a -78.3B deficit in July, wider than the expected -75.7B and up from June’s -60.2B.

Goods trade was reported at -102.84B, a slight improvement from the preliminary -103.6B estimate.

U.S. Q2 Unit Labor Costs Revised Lower

U.S. unit labor costs rose 1.0% in Q2, below expectations of 1.2% and down from the preliminary 1.6% reading.

The revision reflects updated productivity data.

U.S. Layoffs Hit 85,979 in August

Challenger, Gray & Christmas reported 85,979 job cuts in August, up from 62,075 in July and about 13% higher than a year earlier.

This marks the worst August for layoffs since 2020. Employers cited economic factors, government-related disruptions, and a surge in closures and bankruptcies as key drivers.

The report adds to evidence of a labor market slowdown.

Fed’s Williams signals gradual rate path, tariff risks

NY Fed President John Williams said interest rates are likely to come down gradually over time, with policy currently “modestly restrictive” and appropriate.

He sees GDP growth at 1.25–1.5% this year, unemployment rising to ~4.5% next year, and inflation trending toward target by 2027.

Williams warned tariffs could add 1–1.5% to inflation this year but said so far they haven’t caused persistent price pressures. He declined to comment on market odds for a September rate cut.

Goldman Sachs Expects Another Weak U.S. Jobs Print

Goldman Sachs forecasts non-farm payrolls to rise just +60K this Friday, missing consensus of +75K. The bank highlights seasonal August distortions as a downside risk, which often drag initial estimates lower.

The unemployment rate is seen climbing to 4.3%, pointing to further labor market cooling. Meanwhile, average hourly earnings are expected to rise 0.3% m/m, with calendar quirks helping lift the figure modestly.

Goldman argues the data will support a September Fed rate cut, though the exact timing could still be debated depending on broader developments.

Morgan Stanley: Antitrust Case Won’t Dent Google’s Power

Morgan Stanley says Google’s dominance in search remains secure despite this week’s antitrust ruling.

The bank argues the remedies are mild and will not disrupt Google’s market position. Google retains Chrome, Android, and likely its Apple Safari deal (though contract terms may change).

Sharing some data with competitors was ordered, but Morgan Stanley views this as a limited risk given Google’s scale, reach, and ongoing investment in generative AI.

HSBC Ups S&P 500 Forecast, Bull Case at 7,000

HSBC has raised its year-end S&P 500 target to 6,500, citing stronger Q2 earnings and minimal tariff impact.

The new forecast suggests a 1.3% upside from the index’s last close at 6,415.

HSBC also maintains a bull-case scenario of 7,000 and a bear case of 5,700. Momentum is strongest in tech and financials, while company guidance shows only limited tariff headwinds.

The bank still expects the Fed to cut rates in September but sees a more modest easing path than markets currently price in.

Tesla Opens Robotaxi App to the Public

Tesla has unlocked access to its robotaxi app for everyone, signaling the company’s move beyond the limited circle of early users in Austin, Texas.

The official Tesla Robotaxi account on X posted late Wednesday that the rideshare platform is “now available to all.” Until now, access was mostly confined to investors and select social media personalities.

Analysts expect broader availability to act as a supportive factor for Tesla’s stock.

Canada July trade deficit narrows slightly

Canada posted a trade deficit of C$4.94B in July, modestly wider than the C$4.75B forecast but improving from June’s -C$5.86B.

Commodities News

Gold dips under $3,550 as dollar rebounds ahead of NFP

Gold prices slipped on Thursday as the US dollar staged a recovery, with traders locking in profits ahead of Friday’s pivotal Nonfarm Payrolls release. Spot gold fell 0.5% to $3,542 despite markets assigning a 98% probability to a Fed rate cut later this month.

Economic data painted a mixed picture. Initial jobless claims rose more than expected, while the July trade deficit widened. Meanwhile, ISM services PMI came in at 52.0 — the strongest expansion in six months — highlighting resilience in parts of the economy.

The soft labor data has kept Fed policy in focus. At Jackson Hole, Fed Chair Jerome Powell acknowledged that the job market is losing momentum, strengthening expectations for a 25bp rate cut in September.

However, political uncertainty adds another layer of support for bullion. Traders are weighing tariff disputes, a court ruling against some US levies, and tensions between the Trump administration and Fed Governor Lisa Cook — accused of mortgage fraud — which have raised fresh concerns about Fed independence.

For now, gold is consolidating as traders position for Friday’s NFP report, expected to show 75K new jobs and unemployment ticking up to 4.3%.

US crude stocks rise unexpectedly

EIA data showed a 2.4M barrel build in crude inventories last week, against expectations for a 2M draw.

Distillates rose 1.68M (vs. -598K expected), while gasoline stocks fell by 3.8M (vs. -1.1M forecast). The mixed report left crude prices little changed in early trading.

Silver Holds Support at $40.50

Silver bounced off support near $40.50 after pulling back from highs at $41.45. The metal is now trading just under $41.00.

Precious metals corrected lower this week as dovish Fed comments eased debt-related concerns. Still, risk appetite remains muted, keeping silver’s downside contained.

Technically, silver remains in a short-term bearish correction within a broader bullish trend.

Citi Forecasts: Silver Up, Brent Oil Down

Citi has revised its commodity outlook, projecting higher silver prices but weaker oil.

- Silver: Expected to rise toward $43 per ounce in the coming months.

- Brent crude oil: Average 2026 price forecast cut to $62 per barrel from $65.

- Natural gas (Henry Hub): Short-term bullish target of $3.8/MMBtu, with a more constructive medium-term view—projecting over 11,000 by end-2026.

- Aluminium: Outlook lifted, with the 2027 average forecast raised to $3,500 per ton from $3,000, making it at least as bullish as copper.

(Reuters reporting.)

Europe News

Eurozone Retail Sales Fall in July

Eurozone retail sales fell 0.5% m/m in July, worse than the -0.2% forecast, Eurostat reported.

June’s figure was revised sharply higher from +0.3% to +0.6%, softening the blow.

Breakdown:

- Food, drinks, tobacco: -1.1%

- Automotive fuel: -1.7%

- Non-food items: +0.2%

German Construction PMI Slips to 46.0

Germany’s construction PMI eased to 46.0 in August from 46.3 in July, HCOB reported.

Despite the dip, civil engineering returned to growth, and job losses slowed significantly. However, new orders continued to contract sharply, showing the sector remains under pressure.

HCOB notes that:

“Germany’s construction sector is still struggling to gain traction. Residential construction continues to shrink at a relatively steep pace, and commercial building activity has taken a sharp hit after a surprise uptick in the previous month. The only bright spot is civil engineering, which showed solid growth in August – likely benefiting from the federal government’s infrastructure program. That dip in the previous month now looks more like a one-off.

“The cautious optimism seen a few months ago has given way to growing pessimism. The index tracking future activity has dropped significantly. Persistently high long-term interest rates and the perception that the new government is also having trouble turning its promises into actual legislation seem to be weighing on sentiment.

“Input price inflation has eased slightly and is now well below the average of recent years. But after the price surge in 2021/22, levels have only partially normalized. Production costs remain high, which continues to hold back momentum in the construction sector.

“There are a few faint signs of a recovery in demand. For instance, supplier delivery times have improved very little, with the index now at its lowest level since February. Also, while the availability of subcontractors is still rising, it’s doing so at a slower pace than the month before. Subcontractors have also raised their prices a bit more than in previous months, which fits the picture. Still, overall conditions remain tough, and any recovery is likely to be slow and gradual.”

IfW Sees German Economy Growing Just 0.1% in 2025

The Kiel Institute for the World Economy projects Germany’s economy will expand a mere 0.1% in 2025 after two straight years of contraction.

Improved sentiment and higher government spending provide some lift, but U.S. tariff policy remains the main headwind.

Looking ahead:

- 2026 GDP growth: 1.3%

- 2027 GDP growth: 1.2%

- Budget deficit: widening from 2% of GDP (2024) to roughly 3.5% by 2027

Ifo Downgrades German Growth Forecasts

Germany’s Ifo Institute now expects the economy to grow just 0.2% in 2025, trimming its prior estimate of 0.3%.

Further out, Ifo projects:

- 2026 GDP: 1.3% (from 1.5% previously)

- 2027 GDP: 1.6%

The think tank warns U.S. tariffs remain a significant drag and cautions that continued policy stagnation risks “years of economic paralysis” and weakening business prospects.

UK Construction PMI Rises to 45.5

The U.K.’s August construction PMI ticked up to 45.5, above expectations of 45.0, after July’s 44.3—its worst in over five years.

The reading still sits firmly below 50, showing another month of contraction. Residential and civil engineering activity fell sharply, though commercial construction declines slowed.

HCOB notes that:

“Construction activity has decreased throughout the yearto-date, which is the longest continuous downturn since early-2020. August data signalled only a partial easing in the speed of decline after output fell at the fastest pace for over five years in July.

“Sharply reduced levels of housing and civil engineering activity were again the main reasons for a weak overall construction sector performance. Commercial work showed some resilience in August, with the downturn the least marked for three months.

“There were some positive signals on the supply side as vendors’ delivery times shortened, subcontractor availability improved and purchasing price inflation hit a ten-month low. However, easing supply conditions mostly reflected subdued demand and a lack of new projects.

“Elevated business uncertainty and worries about broader prospects for the UK economy meant that construction sector optimism weakened in August. The proportion of panel members expecting a rise in output over the year ahead was 34%, down from 37% in July and lower than at any time since December 2022.”

Switzerland August CPI In Line at +0.2% y/y

Swiss consumer prices rose 0.2% y/y in August, matching forecasts and unchanged from July.

Core CPI slowed slightly to +0.7% y/y versus +0.8% prior. The Federal Statistical Office figures suggest little change for the Swiss National Bank’s near-term outlook.

Swiss Jobless Rate Holds Steady at 2.9%

Switzerland’s seasonally adjusted unemployment rate stayed at 2.9% in August, matching expectations, according to SECO.

The number of registered unemployed edged up to 132,105, compared to 111,354 a year ago when the jobless rate was 2.5%.

France Fines Google €325 Million Over Cookie Practices

France’s CNIL data protection authority has fined Google a record €325 million ($380 million) for violating cookie consent rules.

The regulator found Google placed cookies without proper approval during account sign-ups and displayed ads between Gmail messages without valid consent.

The same action also included a penalty against Chinese fashion giant Shein, AFP reported.

Asia-Pacific & World News

BYD Cuts 2025 Sales Target

China’s EV giant BYD has trimmed its 2025 sales goal to 4.6 million vehicles, down from the earlier 5.5 million target.

The revised target was communicated internally and to key suppliers last month, according to sources. One source said the adjustment reflects intensifying competition in the EV market. The target could still be revised depending on demand conditions.

Cambricon Shares Slide Over 7%

Shares of Chinese AI chipmaker Cambricon plunged more than 7%, dragging broader indexes lower.

The selloff followed reports that regulators are considering new restrictions on stock speculation.

China Mulls Curbing Stock Speculation

Reports suggest Chinese regulators are weighing new measures to limit speculative trading after a $1.2 trillion rally since August.

The Shanghai Composite is at a 10-year high, while the CSI 300 is up more than 20% from this year’s low.

Proposed steps include:

- Removing some short-selling restrictions.

- Expanding options to cool speculation.

- Directing banks to check for illicit lending into equities.

- Telling brokerages not to aggressively market 24-hour account openings (which jumped 166% year-on-year in August).

- Warning social media against hyping bullish milestones.

Officials have pledged strict enforcement, though the CSRC has not issued public comment.

Nasdaq Plans Stricter Listing Rules

Nasdaq is moving to raise the bar for new listings, with tougher minimum thresholds in the pipeline.

- Minimum public float: $15 million for all new listings.

- Higher threshold for Chinese companies: at least $25 million offering size.

Firms already in the listing process would have 30 days to finalize under current rules before new standards take effect.

China Slaps U.S. Fiber Optics With Anti-Dumping Duties

China’s Ministry of Commerce has imposed new anti-dumping duties of 33.3% to 78.2% on U.S. fiber optic cable imports, escalating trade tensions.

Companies hit include:

- Corning (37.9%)

- OFS Fitel (33.3%)

- Draka Communications Americas (78.2%)

The decision follows a six-month investigation, with the duties set to last until April 21, 2028, in line with tariffs first applied in 2023.

Beijing accused U.S. exporters of evading prior levies by altering trading practices. Analysts view the move as retaliation against Washington’s restrictions on China’s semiconductor sector.

Chinese Brokerage Pushes Back on Reported Market Curbs

Guotai Haitong Securities disputed recent reports suggesting regulators are weighing measures to cool down China’s rallying stock market.

The firm said the draft rules submitted last Friday are designed to stabilize the market and reinforce sustainable growth. The brokerage emphasized the importance of long-term, rational investment, warning that volatility and misleading commentary damage market confidence.

They noted securities lending and short-selling will still be possible under quota controls, even as regulators review adjustments. According to Guotai Haitong, recent fluctuations stem mainly from profit-taking after rapid gains and from false rumors, but the medium-term outlook remains positive with strong upward momentum.

PBOC sets USD/ CNY mid-point today at 7.1052 (vs. estimate at 7.1405)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 212.6bn yuan via 7-day reverse repos at 1.40%

- net 203.5bn yuan drain

Australia’s July Trade Surplus Surges to $7.31 Billion

Australia posted a July trade surplus of $7.31 billion, smashing expectations of $4.92 billion and topping June’s $5.37 billion.

Breakdown of the data:

- Exports: +3.3% MoM (prior +2.6%).

- Imports: -1.3% MoM (prior -3.1%).

The Australian Bureau of Statistics also reported household spending rose 0.5% month-on-month, in line with forecasts. Year-over-year spending was up 5.1%, the strongest since late 2023.

- Services spending: +1.6% MoM, +8% YoY.

- Goods spending: -0.3% MoM, +2.7% YoY.

RBA Governor Bullock: Interest Rate Cuts May Not Be Coming

Reserve Bank of Australia Governor Michele Bullock signaled that rate reductions may not be on the horizon.

Speaking Wednesday, she said household spending is slowly improving, and private sector growth is picking up:

“For some time we have been predicting that the Australian consumer will start to spend a bit more, and they are—slowly. We’re seeing it come back, and that’s welcome.”

Bullock added the economy appears stronger than previously thought, which could delay interest rate cuts if momentum continues.

U.S. and Japan Nearing Auto Tariff Deal

According to Reuters, Washington and Tokyo are close to an agreement to slash U.S. tariffs on Japanese cars.

The current 27.5% tariff would drop to 15%, potentially taking effect by late September after a presidential executive order. The final date remains pending, with President Trump holding the decision.

If confirmed, the move could ease pressure on the Bank of Japan by boosting the yen, though uncertainty lingers due to ongoing tariff litigation at the Supreme Court and parallel talks on agriculture.

Japan’s Akazawa Heads to Washington for Trade Talks

Japan’s top trade negotiator, Hiroshi Akazawa, is visiting the U.S. after resolving domestic administrative issues.

He said the visit aims to secure presidential approval of tariff agreements already reached. Akazawa stressed the Ishiba administration should prioritize ongoing tasks and sees no need for an early LDP leadership contest.

RBC: Higher Japan Yields to Trigger Yen Surge by 2026

RBC analysts say rising Japanese bond yields are about to reshape global financial flows, strengthening the yen as domestic investors redirect capital back home.

Key points from the bank’s outlook:

- Japanese yields now offer competitive returns compared to overseas markets.

- Investors could earn 30–120 basis points of excess yield domestically, depending on bond maturity.

- RBC expects Japan’s overnight rates to climb about 50 basis points by end-2026, while U.S. rates may fall 130 basis points.

- If insurers boost hedge ratios from 45% to 60%, an estimated $173 billion could flow back into yen assets.

RBC calls the trend a structural shift that will drive long-term JPY strength.

Crypto Market Pulse

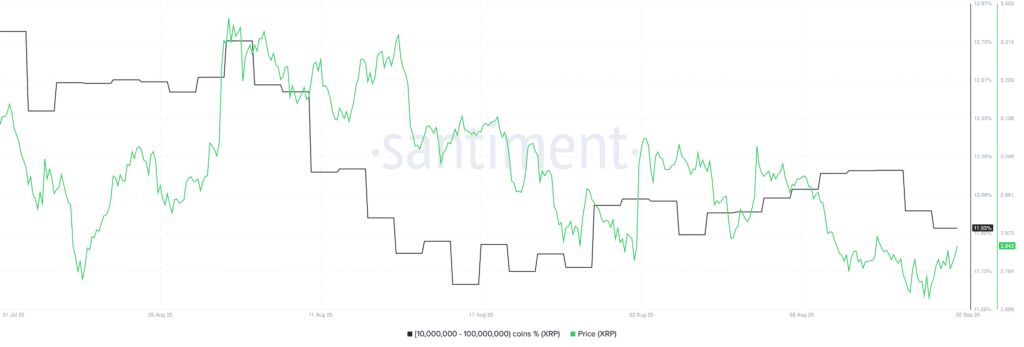

XRP bearish bias extends as whales de-risk

XRP is sliding toward fresh monthly lows, with price action gravitating toward the 200-day EMA. The token trades in a tight band between $2.77 support and $3.00 resistance, but Wednesday’s failed breakout attempt left it exposed to renewed selling.

Large holders appear to be cashing out. Wallets with 10M–100M XRP trimmed exposure, cutting their share of supply to 11.88% from 13.12% in late July. This suggests whales are taking profits amid weak technicals.

On-chain activity is also fading. Active addresses dropped 54% since mid-July, down to ~23,000, reflecting declining engagement on the XRP Ledger. Futures open interest has slid to $7.56B from nearly $11B in late July, signaling cooling demand.

Unless activity rebounds, XRP risks further downside before any sustainable recovery.

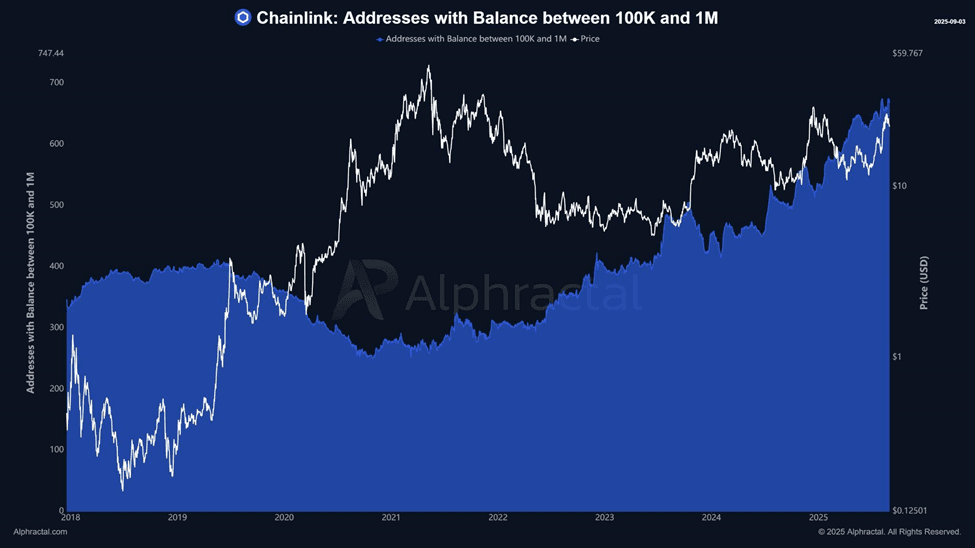

Chainlink whale addresses hit all-time high in September

Chainlink (LINK) is gaining strength as whale wallets hit record levels this month. Addresses holding 100K–1M and 1M+ LINK have now surpassed 600, according to Alphractal. In just the first two days of September, whales accumulated 1.25M LINK.

Santiment data suggests whales and “sharks” remain confident, with LINK increasingly viewed as critical cross-chain infrastructure for the next bull cycle.

Trading volume supports the trend, holding between $1B–$2B daily over the past month — double July’s average. LINK trades near $23, while its realized price sits at ~$15, offering a strong support base during pullbacks.

Near Protocol partners with Aptos for cross-chain swaps

NEAR is consolidating above $2.40, with bulls eyeing a breakout from a falling wedge that could push toward $3.00. Despite risk-off sentiment across crypto, derivatives data shows stability: NEAR futures OI rebounded to $265M this week.

In a key network development, Near Protocol partnered with Aptos to enable one-click cross-chain swaps via Near Intents, an open-source chain-abstraction protocol. The integration removes the need for bridges, relying instead on Near’s Chain Signatures and MPC nodes for security.

Aptos becomes the 20th network to join Near Intents, alongside Ethereum, Bitcoin, and Solana.

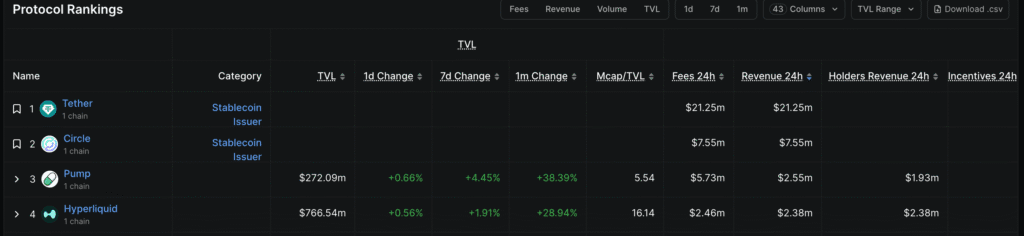

Pump.fun’s new model revives Solana meme coin culture

Pump.fun is fueling a resurgence in Solana’s meme coin scene. The platform rolled out a new dynamic fee structure, slashing creator fees to 0.05% (from 0.95%) once a project hits ~98K SOL in market cap.

The change sparked activity: creators earned $2.4M in just 24 hours, while Pump.fun became the top non-stablecoin revenue generator in crypto, pulling in $2.55M — surpassing Hyperliquid.

SPL token launches spiked to their highest since mid-August, while Solana liquidity got an extra boost from Circle minting 250M USDC on-chain. Together, these factors point to renewed speculative demand for Solana-based meme tokens.

Etherealize raises $40M as firms add $1.2B in ETH

Ethereum-focused advocacy firm Etherealize closed a $40M round led by Electric Capital and Paradigm. The funding will go toward building institutional tools, including platforms for tokenized assets and fixed-income products.

The firm, founded with support from Vitalik Buterin and the Ethereum Foundation, aims to accelerate Wall Street adoption of ETH — which still lags Bitcoin in institutional inflows and ETF traction.

The raise comes as public firms added $1.26B worth of ETH this week. BitMine Immersion Technologies, Sharplink Gaming, and Yunfeng Financial were among the buyers, while The Ether Machine raised 150,000 ETH ($654M) ahead of a planned listing.

ETH currently trades at $4,427.

MicroStrategy Tipped for S&P 500 Inclusion

Crypto-focused company MicroStrategy (MSTR), led by Michael Saylor, could be added to the S&P 500 as soon as Friday, according to speculation across digital asset media outlets.

The index rebalances quarterly; July’s additions included Block, founded by Jack Dorsey. Other candidates this time are Robinhood and AppLovin.

MicroStrategy, which holds 636,505 BTC worth nearly $71 billion, has a market cap just under $98 billion and has been one of 2024’s top-performing stocks.

The firm meets all entry requirements: U.S. domicile, market cap above $22.7 billion, liquidity, and listed shares. If included, institutional portfolios such as 401Ks and pension funds would gain indirect Bitcoin exposure. Advocates call it “paradigm-shifting.”

The Day’s Takeaway

North America

United States

- Stocks: The S&P 500 closed at a record high of 6,502, just shy of its all-time intraday record, as weak ADP payrolls (+54K vs. +65K forecast) cemented expectations of a September Fed cut. Dow +350pts (+0.8%), Nasdaq +1.0%, Russell 2000 +1.3%.

- Labor Market:

- Challenger layoffs hit 85,979 in August, the worst August since 2020.

- Jobless claims rose to 237K; 4-week avg 231K.

- Goldman Sachs expects Friday’s NFP at +60K (vs. +75K consensus), unemployment at 4.3%.

- Economic Data:

- ISM services PMI: 52.0 (strongest in 6 months).

- S&P Global services PMI revised to 54.5 from 55.4.

- July trade deficit widened to -$78.3B.

- Q2 unit labor costs revised lower to +1.0%.

- Fed Commentary: NY Fed’s Williams said rates will fall gradually but warned tariffs could add up to 1.5% to inflation.

- Energy: EIA showed a surprise 2.4M crude build (expected -2M), gasoline -3.8M.

Canada

- July trade deficit narrowed to C$4.94B, improving from June’s -C$5.86B though slightly wider than forecast.

Commodities

- Gold: Down 0.5% to $3,542 as dollar rebound outweighed Fed cut bets; traders booking profits ahead of NFP.

- Silver: Holding $40.50 support after correction. Citi lifted forecast to $43/oz.

- Oil: Citi cut Brent 2026 average forecast to $62/bbl. EIA data mixed with crude build and gasoline draw.

- Natural Gas: Citi short-term bullish, targeting $3.8/MMBtu.

- Aluminium: Citi raised 2027 forecast to $3,500/ton, matching copper’s outlook.

Europe

- France: CNIL fined Google €325M for cookie consent violations.

- Germany:

- Construction PMI dipped to 46.0, but job losses slowed.

- IfW sees just 0.1% GDP growth in 2025.

- Ifo also cut forecasts: 0.2% growth in 2025.

- UK: Construction PMI rose to 45.5 from 44.3 but remains in contraction.

- Eurozone: Retail sales fell -0.5% m/m in July (vs. -0.2% expected).

- Switzerland:

- CPI +0.2% y/y in August, in line with forecasts.

- Jobless rate steady at 2.9%.

Asia

- China:

- Commerce Ministry slapped 33–78% anti-dumping duties on U.S. fiber optics.

- Regulators weighing new curbs on speculative trading after $1.2T rally.

- Guotai Haitong rebutted reports, saying measures aim for stability.

- Cambricon shares fell 7% on speculation curbs.

- BYD cut 2025 sales target to 4.6M (from 5.5M).

- Japan:

- RBC sees rising JGB yields drawing $173B back into yen assets by 2026, supporting long-term JPY strength.

- Trade negotiator Akazawa visiting Washington to finalize auto tariff deals.

- U.S. and Japan near deal to cut U.S. auto tariffs from 27.5% to 15%, pending executive order.

- Australia:

- RBA’s Bullock signaled rate cuts not imminent as spending/growth improve.

- July trade surplus surged to A$7.31B (vs. A$4.92B expected).

Crypto

- Ethereum: Etherealize raised $40M for institutional ETH tools. Public firms added $1.26B in ETH. ETH trades $4,427.

- XRP: Bearish bias deepens as whales trimmed holdings (11.9% from 13.1%). On-chain activity -54%.

- Chainlink (LINK): Whale addresses at record highs, adding 1.25M LINK in early September. LINK near $23.

- Near Protocol: Partnered with Aptos for cross-chain swaps via Near Intents.

- Solana/Pump.fun: New fee model reignited meme coin launches, $2.4M earned by creators in 24h. Circle minted 250M USDC on Solana.

- MicroStrategy: Tipped for S&P 500 inclusion, potentially adding indirect Bitcoin exposure to index funds.