North America News

Market Recap: Stocks Reverse Losses, Led by Nasdaq & Russell 2000

After a rough trading day yesterday, U.S. stocks bounced back strongly as investors piled into risk assets. The Nasdaq and Russell 2000 led the charge, erasing previous losses.

Major Indices:

- Dow Jones: +134.13 pts (+0.30%) → 44,556.04

- S&P 500: +43.30 pts (+0.72%) → 6,037.87

- Nasdaq: +262.06 pts (+1.35%) → 19,654.02

- Russell 2000: +31.7 pts (+1.41%) → 2,290.20

Tech and growth stocks outperformed, with investors shrugging off macroeconomic concerns for now.

Big Gainers:

- Palantir (+23.99%) – Surged after strong earnings, signaling rising demand for AI-driven solutions.

- Super Micro Computer (+8.60%) – Continued rally as investors remain bullish on AI and server demand.

- Arm Holdings (+4.21%) – Advanced on optimism surrounding chip sector growth.

Alphabet (GOOGL) Earnings Breakdown

Google’s parent company missed revenue expectations, dragging its stock down 6% after hours despite an earnings beat.

Key Financials:

- Revenue: 🟥 $96.46B (Miss, est. $96.65B)

- EPS: 🟩 $2.15 (Beat, est. $2.13)

- Operating Income: 🟩 $30.97B (Beat)

- Cloud Revenue: 🟥 $11.96B (Miss, est. $12.19B)

- Free Cash Flow: 🟥 $24.84B (Miss, est. $26.75B)

Takeaways:

- YouTube Ads and Search Revenue beat estimates, but Cloud and Network segments disappointed.

- Operating Margins improved, but free cash flow decline raised investor concerns.

- Stock dropped 6% after hours due to concerns over growth trajectory.

Chipotle (CMG) Q4 Earnings:

- Revenue: ✅ $2.85B (Met expectations)

- Operating Income: 🟩 $415.7M

- EPS: 🟩 $0.24

- Operating Margin: 14.6%

Chipotle’s Guidance:

- Flat Q1 comparable sales expected.

- Tariff impact: If U.S. tariffs on Mexico/Canada/China take effect, it could add 60 bps to costs.

- Wage inflation expected to ease in Q2.

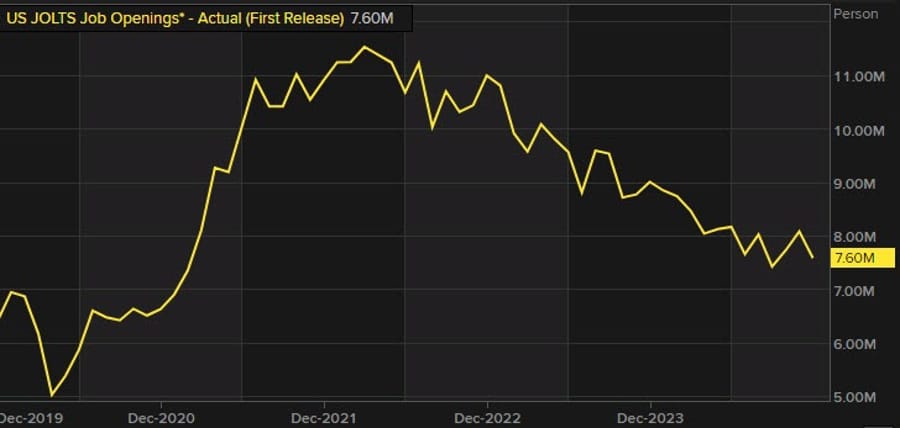

JOLTS job openings 7.600M vs 8.000M estimate

- The JOLTs job opening data for December 2024

- Prior month 8.098M (higher than the 7.770M estimate) revised to 8.156M.

- JOLTs job openings for December 7.600M vs 8.000M estimate.

Details:

- Vacancy rate 4.5% vs 4.9% (revised from 4.8% ) last month

- Quits rate 2.0% vs 2.0% (revised from 1.9%) last month. Total quits last month were little changed at 3.2 million but declined by 242,000 over the year.

- Hires rate 3.4% vs 3.4% (revised from 3.3%) last month. Hires in December were little changed at 5.5 million, but down 325,000 over a year. Hires last month were revised up 104,000 to 5.4 million

- Separations 3.3 % vs 3.3% (revised from 3.2%) last month. Total separations were little changed at 5.3 million

US December factory orders -0.9% vs -0.7% expected

- US December factory orders for December 2025 along with revisions to durable goods orders

- Prior was -0.4% (revised to -0.8%)

- Factory goods orders ex transportation +0.3% vs +0.2% prior

- Durable goods orders -2.2% vs -2.2% preliminary. Prior month was -2.0%

- Durable goods ex transportation +0.3% vs +0.3% preliminary. Prior month -0.2%

- Durable goods ex defense -2.4% versus -2.4% preliminary

- Durable goods nondefense capital goods orders ex-air +0.4% versus +0.5% preliminary. Prior was +0.9%

Fed’s Daly: The economy is in a very good place

- Comments from the San Francisco Fed President

- There is continued momentum in the economy though there is uncertainty

- Fed can take its time to look at data and policy changes

- Business contacts are optimistic

- The Fed has not finished the job on inflation yet

- The Fed has promised 2% inflation and will dedicate itself to that

- The Fed is in a good position to wait and see

Fed’s Goolsbee sees risks that inflation could tick back up

- Tariffs are not the only thing on pause

Federal Reserve Bank of Chicago President Austan Goolsbee spoke in a radio interview, Headlines via Reuters:

- Uncertainties likely mean Fed needs to be a little more careful, prudent on cutting rates

- There are risks that inflation could tick back up

- If fiscal choices affect prices or employment, we have to think it through

- We’ve seen strong growth, strong consumer

- There are concerns about inflation

- Would be hard to tell difference if rising prices is a sign of overheating, or a one-time effect of tariffs

- Might have to slow pace of rate cuts amid uncertainty

Trump is planning a US sovereign wealth fund

In brief:

- Trump signed an executive order to begin developing a U.S. government-owned investment fund.

- The fund could be used to profit from TikTok if an American buyer is found.

- TikTok has until early April to secure an approved partner or buyer.

- Trump wants the U.S. to take a 50% stake in TikTok.

- TikTok is cited as an example of potential assets for the new sovereign wealth fund.

- Treasury Secretary Scott Bessent and Commerce Secretary nominee Howard Lutnick will lead efforts to establish the fund, which may need congressional approval.

Bullard – inflation will slow markedly this year, allowing lower Fed interest rates

- Former St. Louis Federal President James Bullard

- Bullard predicts core PCE inflation will drop to 2.3% by the end of 2025, down from 2.8% at the end of last year.

- Inflation is expected to continue declining toward the 2% target but remain slightly above it.

- The Fed has managed to reduce post-pandemic inflation without causing a recession.

- Monetary policy is now in a fine-tuning phase.

- As markets recognised the Fed’s success, they adjusted bond prices and helped un-invert the Treasury yield curve.

- The Fed appears on track for two more 0.25% rate cuts in 2025.

- A rate cut in March seems unlikely, with a cut more probable later in the spring.

Trump will pause tariffs on Canada for 30 days

- Trudeau and Trump spoke, have put off tariffs for at least 30 days

Canada’s PM Trudeau:

- Delay in US tariffs for at least 30 days.

- Nearly 10,000 troops to protect border, will we keep an eye on the border 24/7

- I had good call with Trump.

- will appoint a fentanyl czar

- will add Mexican cartels to the list of terrorist entities

- will launch, with the US, a joint strike force on organized crime, fentanyl trafficking and money laundering

Commodities News

Oil – private survey of inventory shows a headline crude oil build larger than expected

- This is from the privately surveyed oil stock data ahead of official government data tomorrow morning out of the US.

- Crude +5.025 million (exp. +3.17 million)

- Gasoline +5.426

- Distillates -6.979

- Cushing +110,000

- SPR +0.3 million

Trump expected to sign executive order restoring ‘maximum pressure’ on Iran

- Bloomberg cites a US official

This should be bullish for oil, which was down 3% today before the report.

The official cited said the order is aimed at denying Iran all paths to a nuclear weapon and countering Iran’s ‘malign influence’. The official said the pressure includes sanctions and enforcement mechanisms for those violating existing sanctions.

The order says the Secretary of State will modify or rescind existing sanctions waivers and cooperate with the Treasury to implement a campaign “aimed at driving Iran’s oil exports to zero”.

WTI has bounced about $1.20 in very short order on this.

ICYMI on Oil – U.S. shale industry and Saudi Arabia tell Trump they won’t boost output

- Wall Street Journal with the info

The Wall Street Journal is gated, but if you can access it, the story is here:

U.S. Frackers and Saudi Officials Tell Trump They Won’t Drill More

- President says lower prices will solve many of the country’s problems but finds early resistance in the oil market

In brief:

- U.S. shale industry is now focused on keeping costs down and returning cash to investors, not more drilling

- Saudi Arabia says it is unwilling to augment global oil supplies, say people familiar with the matter

Europe News

European equity close: Spain, Italy and France lead with strong gains

- Closing changes in Europe

- Stoxx 600 +0.3%

- German DAX +0.4%

- France CAC +0.7%

- UK FTSE 100 -0.1%

- Spain IBEX +1.5%

- Italy’s FTSE MIB +1.2%

Asia-Pacific & World News

China anti-monopoly regulator launches investigation into Google

- This comes alongside the the counter-tariff measures after Trump’s 10% tariffs officially take effect

There’s no details on the investigation as China’s anti-monopoly regulator just issues a statement that they will be launching a probe into Google “for suspected violation of the country’s anti-monopoly law”.

China announces counter-tariffs against Trump’s trade moves

- China slaps 15% tariffs on US coal, liquified natural gas

- Additional 10% tariffs will be imposed on crude oil, farm equipment, and some autos

- New tariffs to go into effect on 10 February

At the same time, they’re also announcing that export controls will be implemented on tungsten, tellurium, bismuth, molybdenum, and indium-related materials. These ones will go into effect starting from today.

Financial Times: China’s exporters to step up offshoring to beat Trump’s tariffs

- A report in the Financial Times as new tariffs loom

The Financial Times is gated, but here is the link if you can access it

https://www.ft.com/content/71950f26-8272-4710-b3cc-72ad1007d77f

In brief:

- Chinese manufacturers say they will speed up efforts to move production to other countries to circumvent US tariffs

- locations including the Middle East

Other strategies include:

- passing the cost to US customers

- seeking alternative markets

Australian consumer confidence hit a 32-month high at 88.5 (prior 86.0)

- Consumer sentiment still net pessimistic while its below the 100 threshold

ANZ-Roy Morgan Consumer Confidence weekly survey.

Consumer confidence rose 2.5 points last week to 88.5 points

- four-week moving average +0.3 points to 86.9 points

- Weekly inflation expectations -0.4 to 4.6%

ANZ comment:

- Consumer Confidence highest level since May 2022

- Households are feeling more confident about the economic outlook, with short-term economic confidence rising to its highest level since April 2022 (before the first rate hike in May 2022), while economic confidence over the next five years reached a 12-month high.

- The decline in weekly inflation expectations and the broad-based lift across the subindices may have been influenced by discussion that the Reserve Bank of Australia (RBA) could cut rates at its February meeting. This comes after the quarterly CPI indicator showed that the RBA’s preferred measure of inflation, the trimmed mean, printed below RBA forecasts in Q4

Forecast for 100bp of Reserve Bank of Australia interest rate cuts in 2025

- Westpac forecast

A note from Westpac argues that confidence that the RBA will start cutting rates at its February 18 Board meeting is expected to remain steady this week. Westpac still predicts 100 basis points of cuts in 2025, with market expectations slightly less aggressive, pricing in just over 3.5 cuts.

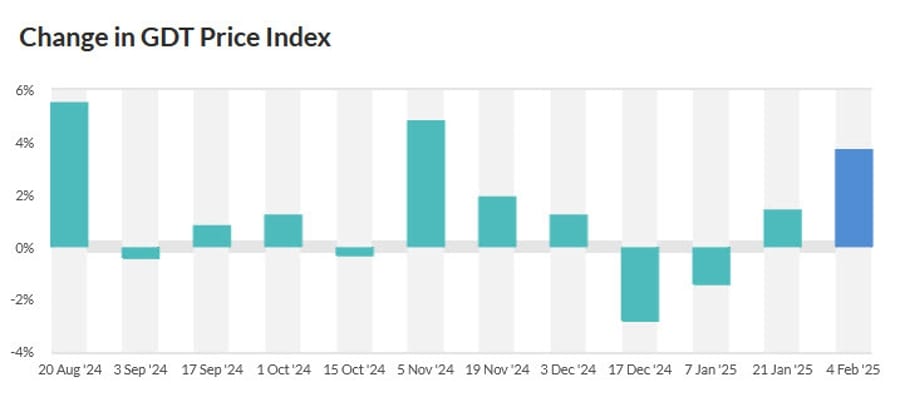

New Zealand GDT Price Index +3.7%

- The latest dairy auction results

- Prior was +1.4%

- Whole milk powder +4.1%

Bank of Japan Governor Ueda says aiming for 2% inflation on a sustainable basis

- Bank of Japan Governor Ueda is answering questions in the Japanese parliament

- BoJ is aiming to achieve 2% inflation, as measured by overall CPI, on a sustainable basis

- trend inflation refers to price moves excluding one-off factors

Crypto Market Pulse

David Sacks: The feasibility of a bitcoin reserve is being studied

- Says he will evaluate a bitcoin reserve, doesn’t mention other cryptos

Shiba Inu Shows Signs of Rally After UAE Blockchain Partnership

Shiba Inu (SHIB) saw a modest uptick on Tuesday following the announcement of a landmark partnership with the United Arab Emirates (UAE) Ministry of Energy and Infrastructure (MOEI). The collaboration aims to integrate blockchain into energy and infrastructure operations, marking what the Shiba Inu team claims is the first time a world government has adopted blockchain at a federal level.

Key Highlights of the UAE Partnership

- Shiba Inu’s Web3 technology will be used to power next-generation digital transformation efforts.

- ShibOS (Shiba Inu’s Operating System) will unify blockchain development within UAE’s energy and infrastructure sectors.

- Sharif Al Olama, UAE’s Undersecretary for Energy and Petroleum Affairs, hailed the partnership as a “pivotal moment” in the evolution of government services.

- Shytoshi Kusama, Shiba Inu’s lead developer, described it as one of the “most powerful partnerships in Web3.”

SHIB Market Reaction: Signs of a Potential Rebound

- SHIB gained 1% following the announcement, reversing some losses after a month-long decline.

- The token has been in a downtrend since the start of the year, losing over 30% in the past month (CoinGecko data).

- Previous partnerships, such as collaborations with Chainlink and Zama, have historically boosted SHIB’s price, signaling potential upside with the UAE deal.

Growing Government Interest in Blockchain

This partnership underscores the increasing government adoption of digital assets and blockchain technology. As more nations explore decentralized technology, projects like Shiba Inu could see greater real-world utility and adoption, providing a long-term bullish catalyst.

While SHIB remains in a downtrend, its strategic expansion into government-backed Web3 initiatives could position it for a stronger recovery in the coming months.

The Day’s Takeaway

Day’s Takeaways: Key Market Insights

The markets bounced back strongly today, led by the Nasdaq and Russell 2000, as investors reversed yesterday’s losses and piled into tech and growth stocks. Despite Alphabet’s post-earnings drop, sentiment remained bullish across sectors.

Big Picture:

✔️ Tech Stocks Led the Rally: Nasdaq jumped 1.35%, driven by AI, chips, and cloud stocks.

✔️ Alphabet Earnings Disappointed: Revenue miss dragged GOOGL down 6% after hours.

✔️ Bitcoin and Ethereum Show Volatility: BTC rebounded past $100K, while ETH faces downside risks.

✔️ Gold Hits All-Time High: Trade war concerns pushed gold to $2,845.

✔️ Shiba Inu Gains on UAE Partnership: Blockchain adoption fuels SHIB optimism.

Macro & Crypto Shift:

- David Sacks: “The feasibility of a Bitcoin reserve is being studied.”

- This suggests growing institutional & sovereign interest in BTC as a reserve asset.

- More nations and companies may follow suit, further driving Bitcoin’s adoption.

Final Word:

Markets remain bullish but macro risks loom, with tariffs, interest rates, and crypto regulation being key factors to watch. Big tech earnings, crypto trends, and institutional moves on Bitcoin will shape the next leg of market action.