North America News

Nasdaq Erases All Post-Election Gains in Brutal Selloff

U.S. stock markets suffered sharp losses, with tech stocks and small caps hit hardest.

- S&P 500: -1.75%

- Nasdaq Composite: -2.6%

- Russell 2000: -2.8%

- Dow Jones Industrial Average: -1.4%

The tariff escalation weighed on sentiment, though last-minute buying emerged after Trump delayed signing the Canada tariffs. However, China tariff hikes to 20% remain on track, adding further pressure to global markets.

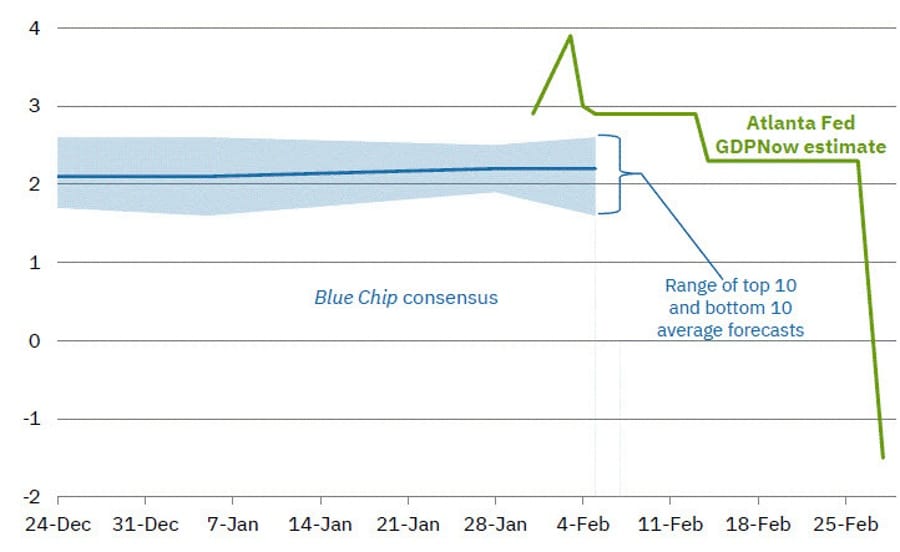

GDPNow U.S. Growth Tracker Plummets to -2.8%

The Atlanta Fed’s GDPNow forecast for Q1 2025 plunged to -2.8% (prior: -1.5%, Friday’s revision: +2.3%).

- This marks a stunning 5-percentage-point swing in just two business days.

- The downturn reflects weaker economic momentum and rising concerns over tariffs.

Atlanta Fed:

After this morning’s releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3 percent and 3.5 percent, respectively, to 0.0 percent and 0.1 percent.

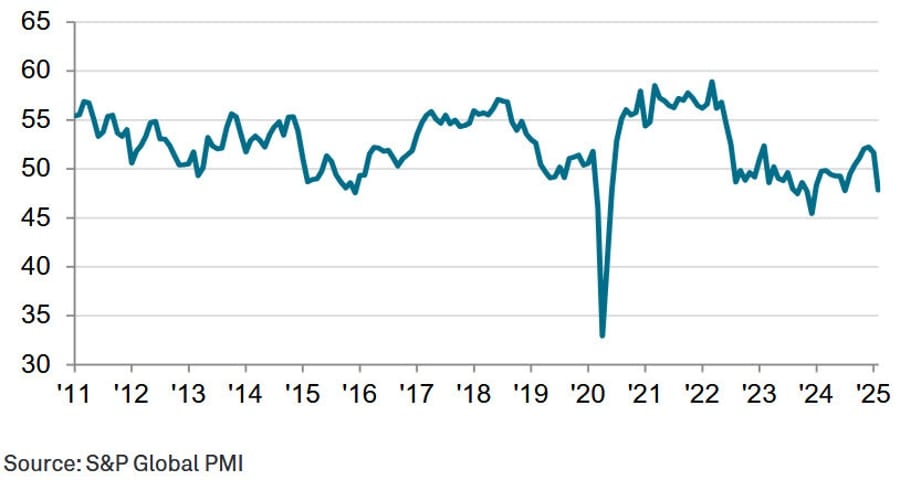

ISM U.S. Manufacturing PMI Falls to 50.3, Price Pressures Surge

The ISM Manufacturing PMI declined to 50.3 (expected: 50.8, prior: 50.9).

Key details:

- Prices paid surged to 62.4, the highest level since June 2022.

- Employment index dropped to 47.6, reflecting a soft labor market.

- New orders fell sharply to 48.6 (prior: 55.1), the worst decline since 2022.

- Production weakened to 50.7, while imports increased to 52.6.

Despite staying above the 50 mark for the second straight month, the report suggests rising price pressures and slowing demand.

- “The tariff environment regarding products from Mexico and Canada has created uncertainty and volatility among our customers and increased our exposure to retaliatory measures from these countries.” [Chemical Products]

- “Customers are pausing on new orders as a result of uncertainty regarding tariffs. There is no clear direction from the administration on how they will be implemented, so it’s harder to project how they will affect business.” [Transportation Equipment]

- “Tariff impact has been minimal to overall manufacturing and raw material supply. Limits on U.S. government spending in key organizations like the Food and Drug Administration, Environmental Protection Agency and National Institutes of Health are delaying some orders.” [Computer & Electronic Products]

- “Inflation and pricing pressure continue to drive uncertainty in our 2025 outlook. We are seeing volume impacts due to pricing, with customers buying less and looking for substitution options.” [Food, Beverage & Tobacco Products]

- “The incoming tariffs are causing our products to increase in price. Sweeping price increases are incoming from suppliers. Most are noting increases in labor costs. Vendors are indicating open capacity. Inflationary pressures are a concern. Our company is working diligently to see how the new tariffs will affect our business.” [Machinery]

- “Business is still slow, but some indications of improved demand are six to nine months out. Steel and scrap costs are increasing, and it’s too early to tell how high they will go.” [Fabricated Metal Products]

- “New orders continue to be strong after picking up in December. The uncertainty about tariffs keeps us cautious on spending, despite the strong sales right now.” [Electrical Equipment, Appliances & Components]

- “Management now has us running scenarios to project tariff impacts to our business. They want numbers in 24 hours on variables that equate to a wild guess. Interesting times we live in.” [Nonmetallic Mineral Products]

- “Internal analysis ongoing about impact of tariffs, but nothing concrete yet. General business conditions remain tepid; outlook on the durables side growing more pessimistic with growing domestic inventories of automobiles.” [Plastics & Rubber Products]

- “Customer volumes seem to be better than 2024. However, customers are still very hesitant to commit to long-term volumes due to the market uncertainty caused by proposed tariffs on steel/aluminum imports.” [Primary Metals]

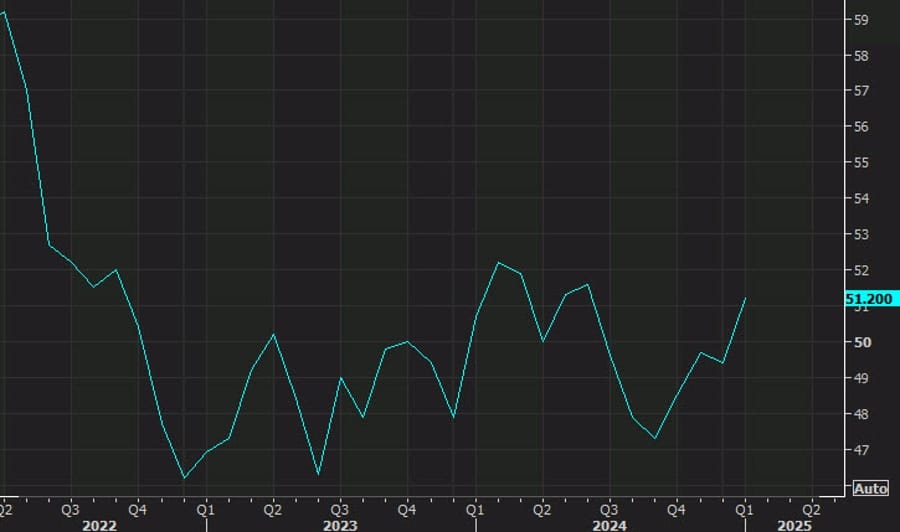

U.S. February Manufacturing PMI Rises to 52.7

The S&P Global U.S. Manufacturing PMI increased to 52.7 (preliminary: 51.6, January final: 51.2).

- Optimism hit a three-year high, continuing momentum from January.

- Inventory-building ahead of tariffs may have driven the gains.

- Despite tariff-related uncertainties, manufacturing output remains resilient.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“A rise in the PMI to a 32-month high signals an improvement in the health of the manufacturing sector which may only be skin deep.

“Although manufacturing production grew at the strongest rates since May 2022 and new orders increased at the best pace in a year, there’s much to suggest that this improvement could be short lived. Production and purchasing were often buoyed by companies and their customers building inventory to beat price hikes and supply issues caused by tariffs. Exports have meanwhile slumped and supplier delivery delays were the most common since October 2022 amid disruptions to trade caused by tariff worries.

“Business optimism about the year ahead has consequently fallen compared to the buoyant mood evident in January, with February seeing an increase in the number of companies citing concerns over tariffs and other policies introduced by the new Trump administration.

“Worries have noticeably swelled in relation to the inflationary impact of tariffs, which were widely reported as having caused factory input costs to spike higher in February. These higher costs are being passed on to customers, resulting in the strongest factory gate price inflation recorded for two years, which manufacturers fear may in turn not only damage sales in the coming months but also encourage the Fed to take a more hawkish view of inflation.”

US January construction spending -0.2% vs 0.0% expected

- US construction spending for January 2025

- Prior was +0.5%

Trump Confirms 25% Tariffs on Canada & Mexico Effective Tuesday

Trump officially confirmed the 25% tariffs on Canada and Mexico, stating:

“There’s no room left for a deal on tariffs with Mexico and Canada.”

Key Announcements:

- U.S. agricultural products will now be prioritized for domestic sales.

- TSMC’s total U.S. investment reaches $165 billion, adding five new chip factories in Arizona.

- Trump signals a potential update on the Ukraine minerals deal Tuesday night.

- China tariffs to double to 20% from 10%.

- Tariff penalties planned for countries devaluing their currencies—mentioning Japan’s yen specifically.

Trump signed action to increase China tariffs to 20% – White House

The White House says that Trump signed the order to raise China tariffs to 20%.

Trump Confirms April 2 Tariffs on Foreign Goods, Markets Focus on Canada & Mexico Tariffs

President Donald Trump reaffirmed that reciprocal tariffs on external goods will take effect on April 2, urging U.S. farmers to prepare for a domestic-oriented agricultural market.

“To the Great Farmers of the United States: Get ready to start making a lot of agricultural product to be sold INSIDE of the United States. Tariffs will go on external product on April 2nd. Have fun!” – Trump on Truth Social

However, markets remain more concerned about 25% tariffs on Canada and Mexico, which are set to take effect on Tuesday.

Trump says TSMC will build five additional factories in the United States

- Today’s infrastructure announcement as billed

- TSMC to build five additional chip factories in the US

- Total investment will be at least $165 billion

- $100 billion in addition to $65 billion already pledged

- Will also build an R&D center

Fed’s Musalem: Recent consumer and housing data pose some downside risk

- Comments from the St Louis Fed President

- Outlook is for continued solid growth but recent data pose some downside risks

- Patient approach to policy will help achieve the Fed’s goals

- Says he would look closely at behavior of inflation expectations if dual goals come into conflict

- So far, longer-term inflation expectations remain broadly anchored

- Expects economy to continue to grow but would be concerned about signs of future weakening of consumption or dampening of business confidence

Trump Could Freeze Ukraine Aid Today

According to an Axios report, Trump’s cabinet will discuss suspending military aid to Ukraine during a meeting today.

- The discussion comes alongside expected decisions on tariffs for Mexico and Canada.

- The potential move signals a shift in U.S. foreign policy and defense priorities.

Trump to Announce $100 Billion TSMC Investment in U.S. Chip Manufacturing

According to a WSJ report, Taiwan Semiconductor Manufacturing Co. (TSMC) plans to invest $100 billion in U.S. chip plants over the next four years.

- President Trump is expected to announce the investment later today.

- The move underscores U.S. efforts to strengthen domestic semiconductor production amid geopolitical tensions with China.

Trump’s Tariff Decision Expected This Afternoon

Commerce Secretary Howard Lutnick confirmed that Trump will decide on tariffs today.

“He knows they’ve done a good job on the border, but they haven’t done enough on fentanyl.”

- A formal tariff announcement is expected tomorrow.

Navarro Justifies Canada Tariffs, Cites Trade Deficits and Drug Policy

Former White House trade advisor Peter Navarro defended tariffs on Canada in a CNBC interview, emphasizing trade deficits and drug policy concerns:

- “If you continue to run trade deficits, foreign countries will have everything you own.”

- Claimed exporting nations absorb a large portion of tariffs.

- Asserted that during Trump’s first term, inflation was not an issue.

- Highlighted timber and lumber executive orders over the weekend.

- Deregulation, DOGE, and ‘drill, baby, drill’ remain key pillars of Trump’s economic strategy, with tariffs being “second-order small.”

Warren Buffett: Trump’s Tariffs Are “An Act of War”

Billionaire investor Warren Buffett criticized Trump’s tariff policies in a recent CBS interview, warning of inflationary effects and consumer costs:

“Tariffs are actually, we’ve had a lot of experience with them. They’re an act of war, to some degree.”

“Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!”

Buffett’s remarks highlight growing concerns that protectionist policies could have unintended economic consequences, particularly for American consumers and global trade relations.

Moody’s Analytics: U.S. Economy Struggles Amid Policy Uncertainty

Mark Zandi, Chief Economist at Moody’s Analytics, has warned that the U.S. economy is experiencing significant difficulties due to erratic economic policymaking in Washington, D.C. Zandi highlighted key economic indicators showing signs of weakness, including declines in retail sales, manufacturing production, real consumer spending, home sales, and consumer confidence. The sharp downturn in these metrics over the past two months suggests growing economic instability, with uncertainty surrounding policy decisions contributing to the overall economic malaise.

Canada’s Manufacturing PMI Falls to 47.8 Amid Tariff Fears

Canada’s S&P Global Manufacturing PMI dropped to 47.8 (prior: 51.6), signaling contraction.

- Input cost inflation surged to its highest level since April 2023.

- Tariff and annexation concerns are impacting consumer and business confidence.

- Investment and spending are slowing, reflecting broader economic uncertainty.

Commenting on the latest survey results, Paul Smith, Economics Director at S&P Global Market Intelligence said:

“The considerable uncertainty related to tariffs being applied on all goods passing across the Canada-United States border weighed heavily on the manufacturing economy during February. Output fell noticeably, driven lower by a steeper decline in new orders as product markets, both at home and abroad, were paralysed by concerns over the applicability and size of tariffs in the coming months.

“Understandably, manufacturers grew increasingly downbeat about the future, with confidence at its lowest level since a series record low was registered in April 2020. This meant firms also adopted an increasingly cautious approach to purchasing and employment, with cuts made in each case since January.

“Adding to the general woes was an acceleration in input price inflation to its highest in nearly two years, with costs rising on the back of a stronger US dollar and, in some cases, vendors raising prices ahead of possible changes to tariffs in the months ahead.”

Sheinbaum: Mexico Waiting on U.S. Tariff Decision

Mexican President Claudia Sheinbaum responded cautiously to the possibility of U.S. tariffs:

“We have a Plan B, C, and D.”

- Stated Mexico will announce its own response tomorrow.

- Emphasized that Mexico will make independent economic decisions regardless of U.S. policy.

Commodities News

Gold Rallies to $2,888 Amid Geopolitical Tensions and Trade Uncertainty

Gold snapped a two-day losing streak, rising over 1% to $2,888, fueled by:

- Trump’s tariff threats on Mexico, Canada, and China.

- Escalating tensions with Ukraine, following a clash between Trump and Zelenskyy.

- A sharp drop in U.S. growth forecasts, with the Atlanta Fed’s GDPNow estimate plunging to -2.8%.

Market Movers: Gold Gains as U.S. Economic Outlook Weakens

- ISM Manufacturing PMI dipped to 50.3, signaling a mild slowdown.

- S&P Global Manufacturing PMI improved to 52.7, pointing to continued sector expansion.

- Markets now expect 71 basis points (bps) of Fed rate cuts, up from 58 bps last week.

OPEC Confirms April Oil Output Increase, Oil Prices Drop

OPEC+ has officially confirmed that it will proceed with its planned April oil output increase, reversing earlier expectations of a delay.

- Production will rise by 138,000 barrels per day (bpd) starting in April.

- The decision signals OPEC’s intent to continue supply increases, possibly under U.S. pressure.

- Total planned hikes will gradually add 2.2 million bpd by December 2026.

This move has pushed oil prices lower, as markets now expect further supply growth in the coming years.

Here is the statement, which confirms the earlier reports but also highlights flexibility based on market conditions.

The eight OPEC+ countries, which previously announced additional voluntary adjustments in April and November 2023, namely Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman met virtually on March 3, 2025, to review global market conditions and the future outlook.

Taking into account the healthy market fundamentals and the positive market outlook, they re-affirmed their decision agreed upon on December 5, 2024, to proceed with a gradual and flexible return of the 2.2 mbd voluntary adjustments starting on 1st April, 2025, while remaining adaptable to evolving conditions. Accordingly, this gradual increase may be paused or reversed subject to market conditions. This flexibility will allow the group to continue to support oil market stability. Furthermore, the eight countries reiterated their collective commitment to full conformity with the additional voluntary production adjustments as agreed under the 53rd JMMC meeting on April 3, 2024. They also confirmed their intention to fully compensate for any overproduced volumes since January 2024, in accordance with the compensation plans submitted to the OPEC Secretariat, ensuring that all compensations are completed by June 2026.

The countries with overproduced volumes have also agreed to frontload their compensation plans, so that more of the overproduced volumes are compensated in the earlier months of the compensation period, and will submit their updated compensation schedules to the OPEC Secretariat by the 17th of March 2025 which will be posted on the Secretariat’s website.

Silver Surges as Fed Rate Cut Bets Weigh on U.S. Dollar

Silver climbed nearly 1% to $31.50, benefiting from:

- Weaker U.S. Dollar amid rising expectations of a Fed rate cut in June.

- Falling U.S. Personal Spending, raising concerns over economic growth.

- Safe-haven demand, as Trump prepares to impose tariffs on Canada, Mexico, and China on March 4.

Fed Rate Cut Expectations Increase

- CME FedWatch tool now shows a 77% probability of a rate cut in June (previously 63%).

- March and May Fed meetings are expected to maintain rates at 4.25%-4.50%.

- Investors await U.S. Nonfarm Payrolls (NFP) data this week for further economic signals.

Oil Prices Rise as Hopes for a Peace Deal Fade

Oil markets reacted negatively to uncertainty around a U.S.-Ukraine standoff, leading to increased fears over sanctions and trade restrictions.

- Brent crude rose over 1%, reflecting reduced optimism for a Russia-Ukraine peace deal.

- Speculators continue reducing their exposure to oil, with net long positions in ICE Brent dropping by 44,677 lots.

Potential Impact of Tariffs on Canada & Mexico

- The U.S. relies on Canada and Mexico for 69% of its crude imports.

- Canadian oil producers face greater risks, as most pipelines are U.S.-dependent.

- Mexico has more flexibility, potentially redirecting crude exports elsewhere.

Additionally, China’s Two Sessions meeting this week could impact oil demand forecasts, with Beijing likely to maintain its 5% growth target.

Europe News

German and UK Stocks Close at Record Highs

European markets surged to new highs, driven by strong investor inflows and defense sector gains.

- STOXX 600: +1.2% (record high)

- DAX (Germany): +2.6% (record high)

- FTSE 100 (UK): +0.7% (record high)

- CAC 40 (France): +1.2%

- IBEX 35 (Spain): +0.3%

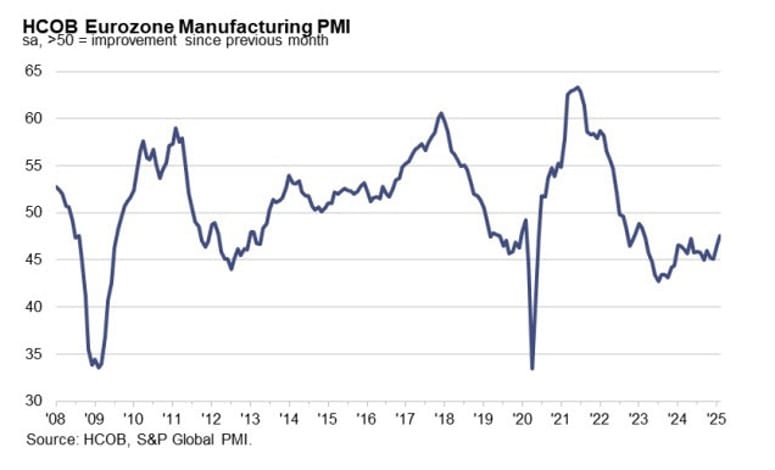

Eurozone Manufacturing PMI Strengthens to 47.6

The HCOB Eurozone Manufacturing PMI increased to 47.6 (preliminary: 47.3, prior: 46.6).

- Despite Spain’s drop, other regions improved, with Germany seeing a two-year high.

- The sector remains in contraction, but production appears to be stabilizing.

HCOB notes that:

“It’s still too early to call it a recovery, but the PMI hints that the manufacturing sector might be finding its footing. New orders are falling at the slowest pace since May 2022, and production is edging closer to stabilising. So, after almost three years of recession, we could see a bit of growth in the coming months. A quick formation of a government in Germany, political stability in France, and a deal with the US on key tariff issues would definitely help.

“Job cuts sped up in February, but it’s not uncommon for layoffs to continue even after a recession ends. So, this doesn’t necessarily mean a recovery is far off. “As for the four big eurozone countries, Spain is still showing growth in production, but its Manufacturing PMI, which has been doing rather well for the past three years, dipped below the 50 mark due to declining new orders.

“Most companies are staying optimistic about the future. The confidence index is just above the long-term average. This is surprising considering the tariff threats from the US, but companies know that a recession is usually followed by a recovery. There are also signs that Russia’s war against Ukraine might end this year, and the expected political stabilisation in Germany is certainly a positive element, too.”

Eurozone February CPI Edges Higher at +2.4% Y/Y

The Eurozone preliminary CPI rose 2.4% year-over-year (expected: 2.3%, **prior: 2.5%*).

- Core CPI came in at +2.6%, unchanged from expectations but down from 2.7% in January.

- While inflation remains above 2%, the data supports the ECB’s case for a rate cut this week. However, policymakers may pause further easing if price pressures persist.

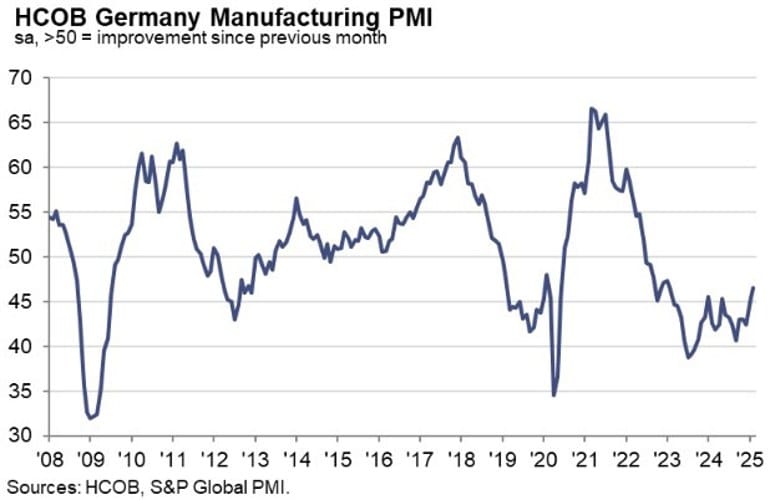

Germany’s Manufacturing PMI Reaches 25-Month High at 46.5

Germany’s HCOB Manufacturing PMI improved to 46.5 (preliminary: 46.1, prior: 45.0), marking a 25-month high.

Key findings:

- Output Index rose to 48.9, a 9-month high.

- Employment declined sharply, reflecting ongoing structural challenges.

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“The recession in German industry may come to an end in the coming months. In particular, incoming orders, which have fallen again but more slowly than at any time since April 2022, are a source of hope. The same applies to the order backlog. The recession in production has weakened significantly within two months. In the intermediate goods sector output even grew again, while in the other key sector of capital goods, production has come close to stabilizing. This points to the possibility of an early recovery overall. At this point in time, however, a great deal of caution is still called for, as it is still unclear whether the upward trend in global industrial activity will continue.

“Job cuts have accelerated sharply of late. Companies have been reducing their headcount month after month since mid- 2023. However, with the stabilization of production that is becoming apparent, it is possible that companies will gradually change tack and that the downsizing measures will come to an end in the coming months.

“Demand remains weak. Although there are signs of a stabilization in the order situation, the fact that supplier delivery times shortened in February is an indication of the spare production and transport capacity in the economy. Furthermore, the inventory cycle hasn’t turned around yet – both finished products and purchased inputs are still seeing reductions.

“The outlook for the future is looking positive, though not as bright as at the beginning of the year. A lot will depend on how quickly a new government is formed and how bold their economic plans will be. To truly turn things around, we’ll need a solid investment plan to modernize public infrastructure and sustainably improve conditions in Germany.”

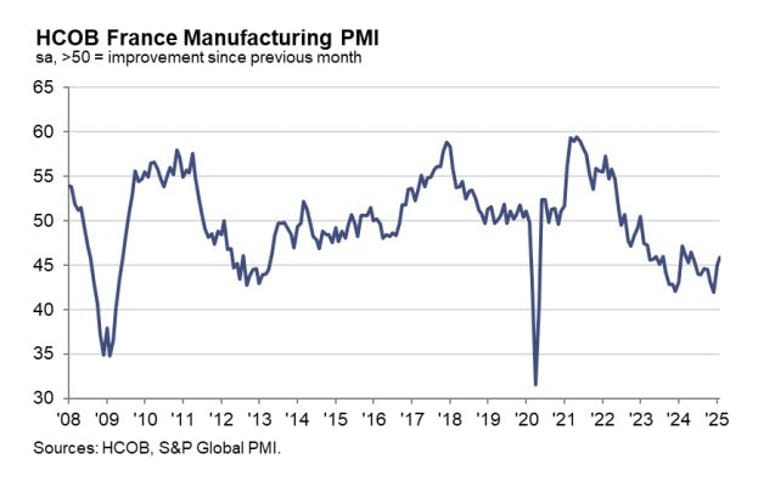

France’s February Manufacturing PMI at 45.8, Slightly Improved

France’s final Manufacturing PMI rose to 45.8 (preliminary: 45.5, prior: 45.0), but remains in deep contraction.

- Both output and new orders declined sharply, despite a slight improvement in February.

- Demand remains weak, continuing to weigh on the industry.

- Price pressures intensified slightly, raising concerns for the months ahead.

HCOB notes that:

“The decline is slowing. The state of the French manufacturing industry is so weak that a slower contraction signalled by the HCOB PMI in February is a small consolation. Flash PMI figures had already suggested that service providers are faring even worse, with their contraction intensifying. France’s current crisis is arguably due to political reasons. Repeated no confidence votes and deep ideological divisions in Paris have gripped the economy. The recently concluded “Artificial Intelligence Action Summit” in Paris vividly demonstrated that France remains an attractive destination for investment compared to its European neighbours. The country should not squander its solid position through political infighting.

“Price pressures plagued industrial companies in February as input price inflation gained significant momentum. Surveyed companies cited energy, fuels, precious metals, wood, and plastics as the main causes of cost increases. The growth in output prices is not keeping pace, indicating weak pricing power among French industrial firms. Some companies have reportedly lowered their prices due to competitive pressures.

“There are better, but by no means reassuring prospects. Domestic and foreign order intakes continue to shrink significantly, but downturns slowed. The construction sector was identified as a drag by surveyed French industrial companies. Nevertheless, there are reports of increased sales to customers in Europe, the USA, Africa, and the Asia-Pacific region. However, a large-scale recovery is not in sight. Future output expectations have just managed to surpass stagnation, overcoming half a year of pessimistic sentiment. Nonetheless, it appears that surveyed companies are broadly divided in their outlook between hope and concern.”

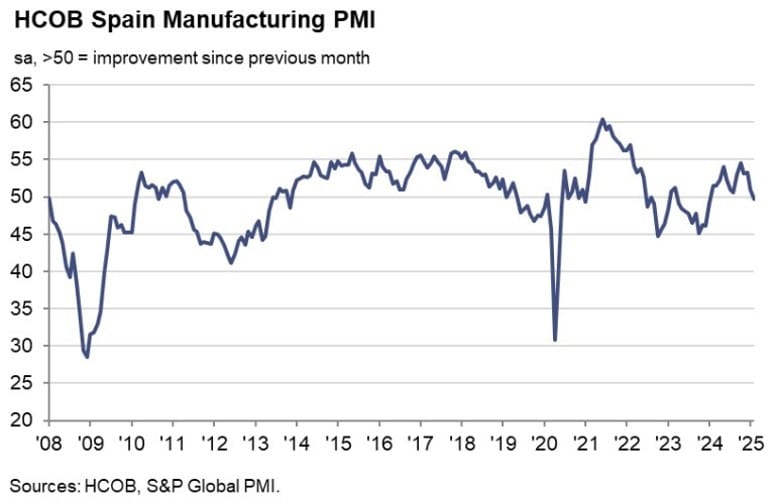

Spain’s February Manufacturing PMI Falls to 49.7, Below Expectations

The HCOB Spain Manufacturing PMI declined to 49.7 (expected: 51.4, prior: 50.9), slipping back into contraction.

Key findings:

- New orders dropped for the first time since July 2024.

- Production growth helped clear backlogs.

- Job losses recorded, but confidence in the outlook strengthened.

Comment:

Commenting on the PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“The performance of Spain’s manufacturing industry took a hit in February. According to the HCOB PMI headline index, Spain’s manufacturing sector managed to avoid decline over the past 12 months, unlike many of its European counterparts. This resilience was mirrored in the hard data, with industrial production rising in three out of four quarters last year. However, that positive trend has now come to a halt. February marked the first, albeit marginal, decline in the manufacturing sector since the start of 2024

“The first deterioration in over a year is attributed to both stagnating output and falling orders. While production saw a slight uptick, this was largely due to clearing existing backlogs, as reported by panellists. The order situation is particularly worrisome. Geopolitical uncertainties are casting a shadow over business, leading to cancelled or postponed investments in manufacturing and reduced activity. The weakness of key trade partners in the Eurozone exacerbates this issue. Additionally, the prospect of various US tariffs, though probably not as impactful on Spain as on Germany and Italy for example, still create a level of uncertainty that affects business decisions.

“On a brighter note, price developments are somewhat encouraging. After months of building input price pressure, February saw a slight easing. Nonetheless, raw materials and supplier costs continue to drive input prices up. Some companies have passed these higher costs onto customers, but the overall price pressure remains within a normal range and is not overly concerning.

“A closer look at sub-sectors reveals some disparities. The consumer goods category continues to expand, in contrast to investment goods, which has been in contraction territory for two successive months. This is likely to be the result of investment uncertainty. The intermediate goods sector remains in growth territory but has only seen marginal improvement.

“Finally, while large-scale layoffs are unlikely to hit Spanish workers, the employment index has dipped back into contraction territory for the first time in six months. Despite these challenges, the outlook among manufacturers remains cautiously optimistic.”

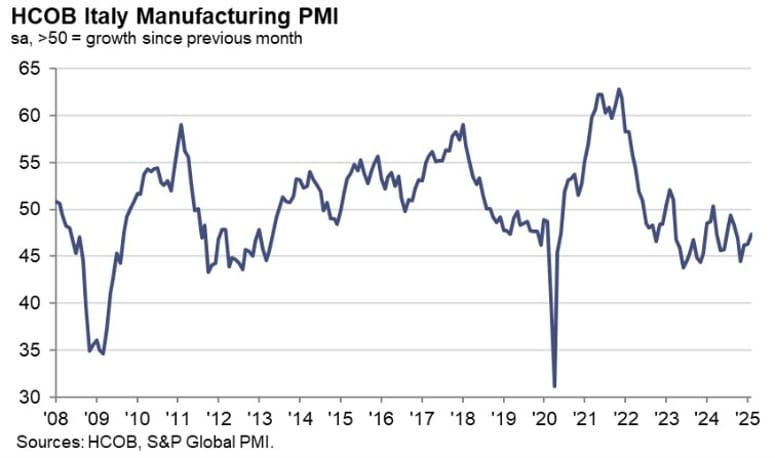

Italy’s Manufacturing PMI Rises to 47.4, Beating Expectations

Italy’s HCOB Manufacturing PMI climbed to 47.4 (expected: 46.8, prior: 46.3), though the sector remains in contraction.

Key findings:

- Softer decline in production volumes compared to prior months.

- Output prices lowered again due to weak demand.

- Employment and purchasing activity fell, as firms continued cost-cutting.

Commenting on the PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“The situation in Italy’s manufacturing sector remains bad. The headline HCOB PMI for February showed a slight improvement, but it’s still stuck in contraction territory. Meanwhile, Istat’s latest production figures underscore the ongoing trend of deindustrialization, and neither the HCOB PMI nor the current geopolitical climate offer much hope for a turnaround in the short-term.

“Italy’s manufacturing sector is closely tied to Germany’s, and both are in deep trouble. The latest Flash PMI data from Germany showed signs of the downturn easing, which could have provided a boost to Italian manufacturing, but this should not be overestimated and is just a faint glimmer of hope in an otherwise bleak landscape. General market demand remains weak, as evidenced by persistently subdued order levels.

“The economic malaise is taking its toll on workers, too. For the past five months, there’s been a noticeable trend of staff reductions, corroborated by anecdotal evidence and media reports. With dwindling backlogs and empty order books, companies are relying upon stocks of finished products rather than ramping up production. As a result, output continued to decline.

“Given the current crisis in Italy’s manufacturing sector, one might be surprised to observe such a high level of future confidence. This sentiment might seem unexpected against the backdrop of US tariffs. However, the prospect of a more stable political environment in Germany following the recent elections, as one of Italy’s most important trade partners, along with anticipated further rate cuts and a potential political shift towards more manufacturing-friendly policies from Brussels, likely contribute to this optimistic outlook.”

UK Manufacturing PMI Falls to 14-Month Low at 46.9

The S&P Global UK Manufacturing PMI dropped to 46.9 (preliminary: 46.4, prior: 48.3), marking its lowest level in 14 months.

Key findings:

- Steepest job losses since mid-2020.

- Output and new orders declined at faster rates.

Rob Dobson, Director at S&P Global Market Intelligence:

“February PMI data show UK manufacturers facing an increasingly difficult trading environment. Weak demand, low client confidence and rising cost pressures are accelerating the downturns in output and new orders, while the Autumn Budget’s changes to the national minimum wage and employer NICs are driving up inflation fears and intensifying the downward trend in staff headcounts. The pace of manufacturing job losses is currently running at a rate not seen since the pandemic months of mid-2020.

“Cost and demand considerations also encouraged cutbacks to purchasing activity and stocks, as the tough economic backdrop placed manufacturers on an increasingly defensive footing. Input costs are rising at the fastest pace for over two years, as suppliers front load expected increases in their own wage and NIC costs. Factory gate selling price inflation has also hit a 22-month high. This combination of absent growth and rising prices will contribute to a growing dilemma for the Bank of England over the coming months.”

UK Mortgage Approvals Beat Expectations in January

The Bank of England (BoE) reported that January mortgage approvals rose to 66.19k (expected: 65.65k, *prior: 66.51k).

- Net consumer credit rose to £1.7 billion (prior: £1.1 billion).

- Mortgage debt net borrowing increased to £4.2 billion, up from £3.3 billion in December.

- The annual growth rate of mortgage lending rose to 1.8%, continuing its upward trend since April 2024.

Switzerland’s Manufacturing PMI Improves to 49.6

The Procure Manufacturing PMI for Switzerland increased to 49.6 (expected: 48.0, prior: 47.5).

- Both output and new orders rose, indicating improving conditions.

- Though still in contraction, the sector is moving closer to expansion after a prolonged slowdown.

Here’s the breakdown:

Swiss National Bank (SNB) Sight Deposits Fall Slightly

SNB total sight deposits for the week ending February 28 stood at CHF 437.4 billion, down from CHF 438.1 billion the prior week.

Asia-Pacific & World News

China Prepares Countermeasures Against Trump’s March 4 Tariffs

In response to Trump’s new 10% tariffs on Chinese imports—citing concerns over China’s role in fentanyl exports—China is evaluating countermeasures, including both tariffs and regulatory restrictions. According to the Global Times:

- U.S. agricultural and food products are expected to be prime targets.

- Non-tariff measures may include customs delays and stricter regulatory scrutiny.

- The timing aligns with China’s annual parliamentary meeting, where economic strategies for 2025 will be discussed.

While analysts believe China may still seek negotiations, no trade talks are currently scheduled. Some experts warn that Trump’s move could backfire, prompting a stronger Chinese response rather than concessions.

Caixin China Manufacturing PMI Beats Expectations at 50.8

China’s Caixin Manufacturing PMI for February 2025 came in at 50.8, exceeding forecasts of 50.3 and marking a three-month high.

- New export orders rebounded after two months of decline.

- Workforce reductions continued for the sixth consecutive month as firms focused on cost efficiency.

- Input costs rose, particularly for copper and chemicals, while output prices declined due to discounts and promotions.

- Supply chains improved post-Chinese New Year, but raw material inventories dipped.

While optimism about future growth remains, concerns persist over employment and domestic demand. March is seen as a critical policy window for economic adjustments.

PBOC sets USD/ CNY reference rate for today at 7.1745 (vs. estimate at 7.2857)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injects 97bn yuan via 7-day RR, sets rate at 1.5%

- 292.5bn yuan mature today

- net drain is 195.5bn yuan

Weekend News from China’s February PMI Data Signals Economic Expansion

China’s National Bureau of Statistics (NBS) has released official Purchasing Managers’ Index (PMI) data for February, indicating steady economic recovery:

- Manufacturing PMI: 50.2 (forecast: 50.0, previous: 49.1)

- Services PMI: 50.4 (forecast: 50.3, previous: 50.2)

- Composite PMI: 51.1 (previous: 50.1)

Notably, the employment sub-index remained below the 50 threshold but reached a 22-month high, suggesting improving labor market conditions. The data points to a stabilizing Chinese economy, with both manufacturing and services sectors showing expansion, albeit at a moderate pace.

Australian Q4 2024 Business Inventories & Profits Beat Expectations

The Australian Bureau of Statistics reported mixed business indicators for Q4 2024:

- Business inventories rose 0.1% q/q (expected: 0.0%), a minor but positive input for upcoming GDP data.

- Company operating profits surged 5.9% q/q, far exceeding expectations of 1.8% and rebounding sharply from a -4.6% decline in Q3.

These results suggest stronger-than-expected business performance heading into 2025.

Australian Private Inflation Survey: First Monthly Drop Since 2021

The Melbourne Institute Inflation Gauge showed a -0.2% m/m decline in February, the first monthly drop in inflation since August 2021.

- Annual inflation slowed to 2.2%, below the RBA’s 2-3% target range (prior: 2.3%).

- Trimmed mean inflation (core indicator) fell -0.1% m/m, signaling continued easing price pressures.

This data could influence the Reserve Bank of Australia’s policy stance, potentially delaying future rate hikes.

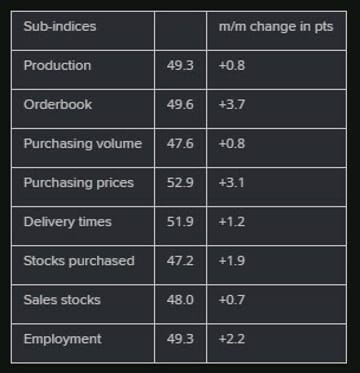

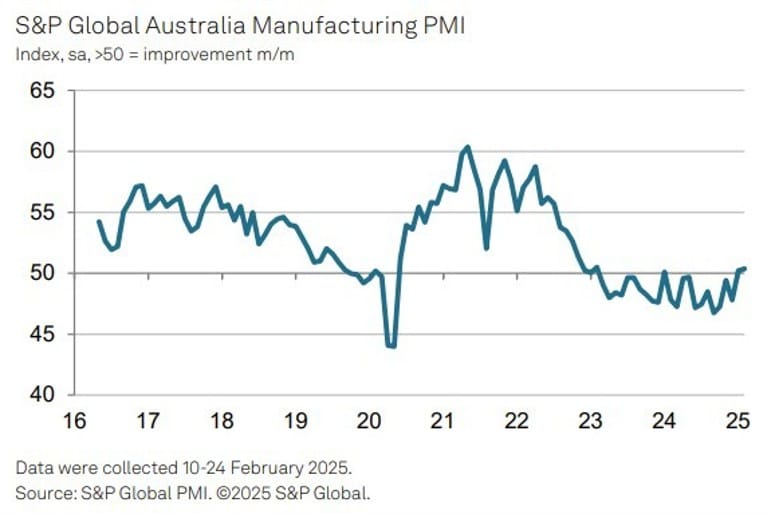

Australian Manufacturing PMI Reaches 50.4 in February, Highest in Two Years

S&P Global Australian Final Manufacturing PMI – February 2025

Australia’s manufacturing sector continued its path to recovery, with the S&P Global Australian Final Manufacturing PMI rising to 50.4 in February, marking its highest level in two years. While this is slightly below the preliminary reading of 50.6, it still reflects an improvement from January’s 50.2.

Key Highlights:

- Final PMI for February: 50.4 (highest in two years)

- Preliminary estimate: 50.6

- January’s PMI: 50.2

Report Insights & Analysis

According to the latest survey, business conditions in Australia’s manufacturing sector continue to improve, offering a positive outlook for future growth.

Encouraging Signs for Future Output

- A renewed rise in new orders signals strengthening demand, providing optimism for future production.

- The future output index hit its highest level in nearly three years, suggesting manufacturers are increasingly confident about upcoming business activity.

Short-Term Weakness in Production & Employment

- Current production fell in February, but analysts attribute this to excess capacity as demand recovery is still in its early stages.

- Employment levels saw a slight decline, alongside a sustained downturn in purchasing activity, reflecting cautious business sentiment.

- Going forward, continued sales growth will be crucial to drive sustained output and employment recovery.

Easing Price Pressures & Inflation Trends

- Input price increases slowed, rising at a rate below the long-run average in February.

- Output price inflation softened, a welcome development that could support demand recovery in the coming months.

Outlook

While challenges remain, particularly in current production and employment, the renewed rise in new orders and improving future output expectations suggest the Australian manufacturing sector is gradually regaining momentum. Further demand recovery will be essential to sustain this upward trend.

Japan’s Manufacturing PMI Rises to 49.0 but Remains in Contraction

Japan’s Jibun Manufacturing PMI for February 2025 improved to 49.0 (prior: 48.7), but the sector remains in contraction.

- Global demand remains weak, with firms citing reduced confidence in the U.S., Europe, and China.

- Output declined for the sixth consecutive month, though at a slower rate.

- New orders remained subdued, reflecting an extended downturn since mid-2023.

- Business confidence fell to its lowest level since June 2020, driven by concerns over U.S. trade protectionism and tariffs.

Despite these challenges, Japanese manufacturers maintain a cautiously optimistic long-term outlook.

Japan’s Top FX Diplomat Highlights Wage Growth Prospects for SMEs

Japan’s top foreign exchange diplomat, Atsushi Mimura, noted that small and medium-sized enterprises (SMEs) also have strong prospects for wage hikes, not just large corporations.

- Real private consumption remains below pre-COVID levels.

- Bright spots in Japan’s economy include strong corporate investment and inbound tourism.

Japanese Media Reports Potential U.S. Pressure on Bank of Japan to Hike Rates

According to a report from Nikkei, Japan’s central bank, the Bank of Japan (BoJ), may face mounting pressure from the United States to accelerate interest rate hikes. The potential scrutiny arises as President Donald Trump’s administration continues to refine its approach to reciprocal tariffs, signaling that currency manipulation could be considered a non-tariff trade barrier. If Japan becomes a focus of U.S. investigations regarding reciprocal tariffs, and if the White House determines that the yen’s depreciation is influenced by BoJ’s monetary policy, the Japanese central bank could be urged to tighten its policy sooner than planned.

The Nikkei article is gated

Crypto Market Pulse

Bitcoin Drops Below $90,000 as Institutional Positioning Remains Unclear

Bitcoin (BTC) briefly surged to $94,416 on Monday before erasing gains and falling below $90,000.

- Institutional demand remains unclear, with arbitrage-driven flows adding complexity.

- BlackRock’s Bitcoin ETF integration and the U.S. crypto strategic reserve announcement initially fueled optimism.

- The Crypto Fear & Greed Index indicates traders remain fearful, despite bullish news.

Why Bitcoin Fell Below $90,000

- Market participants reacted to Trump’s crypto strategic reserve announcement and the upcoming White House crypto summit.

- Volatility remains high, leading to profit-taking.

- On-chain data suggests that between $88,118 and $92,035, traders hold $34.83 billion worth of BTC—a crucial support level.

If BTC drops further, these traders could face unrealized losses, potentially triggering more downside. However, a rebound above $90,000 could support a rally toward $100,000.

2.9 Million XRP Deposited on Binance as XRP Price Retreats

XRP price retraced 9% to $2.70 on Monday after a 40% rally fueled by Trump’s crypto strategic reserve announcement.

- Bitcoin maximalist Peter Schiff questioned XRP’s inclusion, sparking debate.

- Cardano CEO Charles Hoskinson defended Ripple, highlighting XRP’s strong community and resilience.

XRP Faces Resistance at $3

- Trump’s executive order established the U.S. crypto strategic reserve, including XRP, Bitcoin, Ethereum, Solana, and Cardano.

- All five assets saw double-digit gains, but XRP’s rally faded due to profit-taking.

- Binance reserves of XRP surpassed 2.9 million, signaling increased short-term volatility.

With U.S. Treasury funds flowing into multiple altcoins, Bitcoin’s dominance could face pressure as XRP, ADA, SOL, and ETH gain institutional recognition.

Arthur Hayes Dismisses Trump’s Bitcoin Reserve Plans: “Just Words”

Arthur Hayes, co-founder of BitMEX, has dismissed former U.S. President Donald Trump’s proposed Bitcoin reserve strategy as “just words,” arguing that the initiative lacks real substance. Hayes pointed out that for the U.S. government to actually purchase Bitcoin or other cryptocurrencies, it would need congressional approval, a means to borrow funds, or a revaluation of gold reserves—none of which are currently in place.

“Nothing new here,” Hayes scoffed, downplaying any immediate impact of Trump’s announcement.

Trump Proposes U.S. Crypto Strategic Reserve to Strengthen Digital Asset Industry

Former President Donald Trump has announced plans to establish a U.S. Crypto Reserve, emphasizing the importance of digital assets in the future of finance. Posting on his social media platform, Trump stated:

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration. My Executive Order on Digital Assets directs the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!”

In a follow-up statement, Trump confirmed the inclusion of Bitcoin (BTC) and Ethereum (ETH) as key components of the reserve, reaffirming his strong support for the crypto industry.

Massive $195 Million Buy Order on BTC and ETH Executed Prior to Trump’s Announcement

A substantial cryptocurrency purchase was executed just before former President Donald Trump’s recent announcement on digital assets. The details of the buy order are as follows:

- Bitcoin (BTC): $123 million worth of BTC was acquired at an approximate price of $85,908 per unit. The liquidation level for this position is set at $84,752.

- Ethereum (ETH): $75 million worth of ETH was purchased at around $2,197 per unit, with its liquidation level also set at $2,197.

This significant movement in the cryptocurrency market suggests anticipation of a policy shift, likely linked to Trump’s statement on a Crypto Strategic Reserve.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

U.S. Markets: Stocks Sell Off as Tariff Uncertainty Weighs on Sentiment

U.S. equities had a bruising session, with major indices tumbling as investors digested Trump’s escalating trade policies and a worsening economic outlook:

- S&P 500: -1.75%

- Nasdaq Composite: -2.6% (erasing all gains since the election)

- Russell 2000: -2.8%

- Dow Jones Industrial Average: -1.4%

Key Drivers:

- Trump confirmed 25% tariffs on Canada & Mexico starting Tuesday, with China tariffs doubling to 20% on April 2.

- The Atlanta Fed’s GDPNow forecast plunged to -2.8%, raising fears of an economic slowdown.

- The ISM Manufacturing PMI dipped to 50.3, while the S&P Global PMI improved to 52.7, reflecting mixed economic signals.

Despite last-minute buying interest after Trump delayed signing the Canada tariffs, the overall mood remains risk-off, with investors flocking to safe-haven assets.

Commodities: Gold Surges, Oil Drops as OPEC Confirms Output Increase

Gold Climbs to $2,888 on Safe-Haven Demand

Gold prices rallied over 1%, reversing recent losses as geopolitical and trade tensions fueled risk aversion.

- Trump’s tariff threats and clash with Ukraine’s Zelenskyy boosted demand for bullion.

- Fed rate cut expectations increased, with markets pricing in 71 basis points of easing.

- Falling Treasury yields and a weaker U.S. dollar further supported gold.

Oil Prices Fall as OPEC Confirms April Output Hike

OPEC+ confirmed its planned 138,000 bpd production increase for April, pushing oil prices lower.

- This decision reverses expectations of a delay, signaling OPEC’s willingness to increase supply despite demand concerns.

- The market now expects a gradual increase of 2.2 million bpd by December 2026.

- Canada and Mexico—two of the U.S.’s biggest crude suppliers—face trade disruptions, which could add volatility to energy markets.

Europe: Stocks Hit Record Highs Despite Global Trade Concerns

Unlike Wall Street, European equities rallied to fresh record highs, led by defense and energy stocks:

- STOXX 600: +1.2% (record high)

- DAX (Germany): +2.6% (record high)

- FTSE 100 (UK): +0.7% (record high)

- CAC 40 (France): +1.2%

- IBEX 35 (Spain): +0.3%

What’s Driving Europe’s Outperformance?

- Investors rotated into European stocks as uncertainty in U.S. markets grew.

- Germany’s manufacturing PMI hit a 25-month high at 46.5, supporting optimism.

- Safe-haven flows boosted European assets, particularly in defense stocks amid global tensions.

Global Markets: Economic & Trade Tensions Dominate Headlines

Asia-Pacific:

- Japan’s Manufacturing PMI improved to 49.0, but remains in contraction.

- China’s Two Sessions meeting is in focus, with Beijing expected to maintain its 5% GDP growth target amid growing trade tensions.

- OPEC’s output increase could weigh on Asia’s energy import costs, adding another layer of volatility.

Emerging Markets:

- Canada’s Manufacturing PMI plunged to 47.8, signaling a sharp contraction amid tariff fears and inflation pressures.

- Mexico’s response to U.S. tariffs is pending, but retaliation could disrupt North American trade flows.

- Eurozone’s final CPI at +2.4% raises questions about the ECB’s rate path, though a rate cut remains on the table.

Crypto Markets: Bitcoin Slides Below $90,000, XRP Faces Volatility

Bitcoin Drops Under $90,000 Amid Market Jitters

Bitcoin surged to $94,416 earlier in the session but failed to hold gains, correcting below $90,000.

- Institutional demand remains unclear, with arbitrage-driven flows distorting the long-term picture.

- Trump’s crypto strategic reserve announcement and BlackRock’s Bitcoin ETF integration initially fueled optimism.

- However, the Crypto Fear & Greed Index remains in “fear” territory, reflecting uncertainty despite bullish news.

XRP Sees 9% Pullback After 40% Rally

Ripple (XRP) initially surged 40% after Trump included it in the U.S. crypto strategic reserve, alongside Bitcoin, Ethereum, Solana, and Cardano.

- Bitcoin maximalists, led by Peter Schiff, criticized XRP’s inclusion, questioning its legitimacy.

- Cardano CEO Charles Hoskinson defended Ripple, emphasizing XRP’s resilience and strong community.

- Binance reserves of XRP surpassed 2.9 million, suggesting potential short-term volatility.

Looking Ahead:

- Bitcoin’s $90,000 support is crucial—on-chain data suggests traders hold $34.83 billion in BTC between $88,118 and $92,035.

- The upcoming White House crypto summit on Friday could drive fresh institutional interest.

- U.S. Treasury’s crypto fund diversification into XRP, ADA, SOL, and ETH may challenge Bitcoin’s dominance.

Final Takeaway

The global financial landscape is shifting rapidly, driven by Trump’s aggressive trade policies, geopolitical uncertainty, and shifting economic conditions.

Key Market Themes to Watch:

✅ U.S. equities under pressure, while European stocks shine

✅ Gold rallies, while oil declines on OPEC’s decision

✅ Tariffs set to hit Canada, Mexico, and China, increasing economic uncertainty

✅ Crypto markets remain volatile, with Bitcoin struggling to hold $90,000

Markets remain on high alert, and traders will be watching Trump’s next moves closely—especially as he prepares to finalize his China tariff increase and trade strategy in the coming days.