North America News

Stocks decline as tariff ruling clouds outlook

U.S. equities opened September on the back foot, weighed down by uncertainty over tariffs and stretched valuations. The S&P 500 fell 44.72 points (-0.7%) to 6415.54, the Nasdaq Composite dropped 175.92 points (-0.8%) to 21279.63, and the Dow Jones Industrial Average lost 249.07 points (-0.6%) to 45295.81.

A U.S. Court of Appeals ruling that most of President Trump’s tariffs are illegal stoked investor caution. Existing levies will remain in place until October 14, pending a likely appeal to the Supreme Court, which the administration is seeking to expedite.

All 11 S&P 500 sectors traded in negative territory during the session, though a late rebound pared losses. Real estate (-1.7%), industrials (-1.1%), and technology (-1.0%) were the weakest performers. Large-cap tech dragged on early trade, with NVIDIA (NVDA -1.97%) notably volatile before closing just below its 50-day moving average. The PHLX Semiconductor Index ended down 1.1%.

Smaller-cap indices held up slightly better: the S&P Mid Cap 400 slipped 0.5%, and the Russell 2000 lost 0.6%. Defensive groups, including health care (+0.1%) and consumer staples (+0.1%), eked out modest gains. Energy stocks (+0.2%) led on the back of firmer oil prices, with WTI crude settling +2.5% higher at $65.60 per barrel.

Notable individual movers included Kraft Heinz (-6.9%), after announcing plans to split into two companies, and Constellation Brands (-6.6%), which cut FY26 earnings guidance.

Treasury yields climbed as bonds sold off: the 2-year yield rose 4 bps to 3.66%, while the 10-year yield gained 5 bps to 4.28%. The CBOE Volatility Index (VIX) jumped 14% to 17.51, reflecting a rise in investor unease.

Year-to-date gains remain intact: Nasdaq +10.2%, S&P 500 +9.1%, Dow +6.5%, Russell 2000 +5.5%, and S&P Mid Cap 400 +3.8%.

Key economic data:

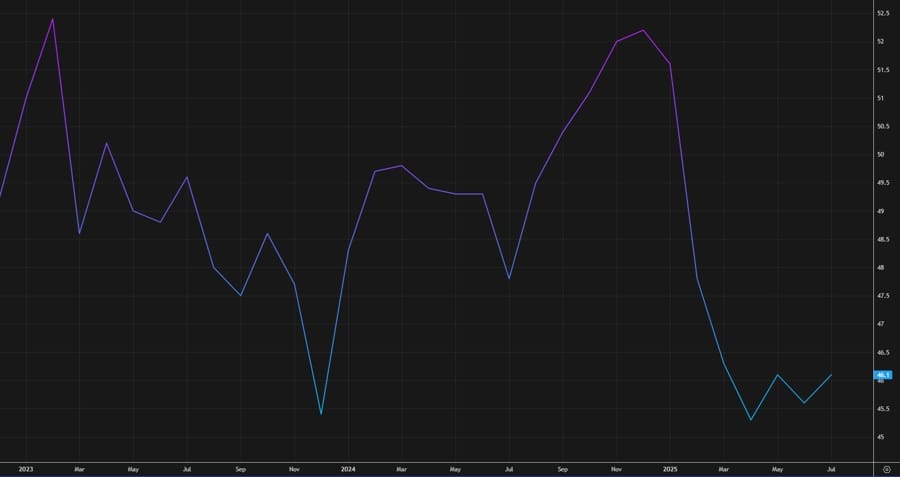

- August ISM Manufacturing Index: 48.7% (prev. 48.0%) – still in contraction, though new orders returned to expansion.

- July Construction Spending: -0.1% (prev. -0.4%) – softness led by nonresidential categories.

- August S&P Global U.S. Manufacturing PMI (final): 53.0 (prev. 53.3).

Atlanta Fed GDPNow slips to 3.0% for Q3

The Atlanta Fed’s GDPNow tracker eased to 3.0% from 3.5% after new data from the Census Bureau and ISM. Consumption and private investment growth estimates were revised lower, to 1.7% and 5.3% respectively, from 2.3% and 6.1%. A stronger inventory contribution offset part of the drag, rising to 0.69pp from 0.59pp.

U.S. ISM Manufacturing Weakens in August

The U.S. ISM manufacturing index for August printed at 48.7, below expectations of 49.0 but above July’s 48.0.

Breakdown of key components:

- Prices paid: 63.7 (expected 65.3, prior 64.8)

- Employment: 43.8 (expected 44.5, prior 43.4)

- New orders: 51.4 (prior 47.1)

- Imports: 46.0 (prior 47.6)

- Production: 47.8 (prior 51.4)

Comments in the report:

- “A 50-percent tariff on imports from Brazil, combined with the U.S. Department of Agriculture’s elimination of the specialty sugar quota, means certified organic cane sugar — and everything made with it — is about to get significantly more expensive.” (Food, Beverage & Tobacco Products)

- “Orders across most product lines have decreased. Financial expectations for the rest of 2025 have been reduced. Too much uncertainty for us and our customers regarding tariffs and the U.S./global economy.” (Chemical Products)

- “Tariffs continue to be unstable, with suppliers adding surcharges ranging between 2.6 percent to 50 percent.” (Petroleum & Coal Products)

- “Tariffs continue to wreak havoc on planning/scheduling activities. New product development costs continue to increase as unexpected tariff increases are announced — for example, 50-percent duties on imports from India, and increases to all countries up from original 10 percent. Our materials/supplies are now rising in price, so our sell pricing is again being reviewed to ensure we keep a sustainable margin. Plans to bring production back into U.S. are impacted by higher material costs, making it more difficult to justify the return.” (Computer & Electronic Products)

- “The construction industry, especially home building, is still at a lower level. With new construction at a low level, our new sales are impacted. We are mainly now relying on replacement business. Cost of goods sold is higher due to tariff-impacted goods.” (Machinery)

- “Domestic sales remain flat but are down four percent from plan by unit volume [tariff pricing]. Export demand is falling as customers do not accept tariff impacts, which likely will require some production transfers out of the U.S. Supplier deliveries remain consistent with ocean shipping costs dropping significantly. Tariff costs have biggest financial impact but also costs of copper and of steel products.” (Fabricated Metal Products)

- “The trucking industry continues to contract. Our backlog continues to shrink as customers continue to hold off on buying new equipment. This current environment is much worse than the Great Recession of 2008-09. There is absolutely no activity in the transportation equipment industry. This is 100 percent attributable to current tariff policy and the uncertainty it has created. We are also in stagflation: Prices are up due to material tariffs, but volume is way off.” (Transportation Equipment)

- “Very tentative domestic market, with home building and remodeling not very active at all. Inflation, among other factors, is starting to impact consumer buying power, leading to negative signs for our order files. International markets are upended due to the unpredictability of on-again, off-again tariff activity.” (Wood Products)

- “We’ve implemented our second price increase. ‘Made in the USA’ has become even more difficult due to tariffs on many components. Total price increases so far: 24 percent; that will only offset tariffs. No influence on margin percentage, which will actually drop. In two rounds of layoffs, we have let go of about 15 percent of our U.S. workforce. These are high-paying and high-skilled roles: engineers, marketing, design teams, finance, IT and operations. The administration wants manufacturing jobs in the U.S., but we are losing higher-skilled and higher-paying roles. With no stability in trade and economics, capital expenditures spending and hiring are frozen. It’s survival.” (Electrical Equipment, Appliances & Components)

- “There is still uncertainty in the construction market. Large expansions or investment are hampered by the unknown of costing and the economy. The markets we operate in can be strong short term, but there is an underlying feeling that has you questioning for how long.” (Nonmetallic Mineral Products)

U.S. Final Manufacturing PMI Hits 53.0

The U.S. S&P Global final manufacturing PMI for August stood at 53.0, slightly below the 53.3 preliminary reading but still the highest in three years.

- July’s final figure was 49.8.

- Input cost inflation accelerated, the second-fastest pace in the last three years.

- Attention now shifts to the ISM manufacturing survey and construction spending, due later today.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“Purchasing managers reported that the US manufacturing was running hot over the summer.

“The past three months have seen the strongest expansion of production since the first half of 2022, with the upturn gathering pace in August amid rising sales. Hiring also picked up again in August as factories took on more staff to meet an influx of new orders and an accumulation of uncompleted work for waiting customers.

“The manufacturing sector is therefore on course to provide a boost to the US economy in the third quarter.

“The upturn is in part being fueled by inventory building, with factories reporting a further jump in warehouse holdings in August due to concerns over future price rises and potential supply constraints. These concerns are being stoked by uncertainty over the impact of tariffs, fears which were underpinned by a further jump in prices paid for inputs by factories, linked overwhelmingly by purchasing managers to these tariffs.

“Cost increases are being passed on to customers via widespread hikes to factory gate prices. The big question is the degree to which these price rises will then feed through to higher consumer price inflation in the coming months.”

U.S. July Construction Spending Contracts

U.S. construction spending in July fell -0.1%, matching expectations.

- June’s figure was revised at -0.4%.

- Weakness in construction activity continues to weigh on economic momentum.

Goldman Sachs edges Q3 growth forecast up to 1.7%

Goldman Sachs lifted its Q3 GDP tracker to 1.7% from 1.6%. The bank cited mixed August ISM manufacturing data—stronger new orders and jobs, but weaker output—and a downward revision to the S&P Global PMI. Construction spending fell 0.5% in real terms, but details were firmer than Goldman’s prior assumptions, prompting the modest upgrade.

Goldman: Trump May Switch Tariff Tools if Courts Block IEEPA

Goldman Sachs warned that tariff uncertainty could unsettle markets and drive safe-haven demand if courts strike down measures imposed under the International Emergency Economic Powers Act (IEEPA).

- IEEPA-based tariffs account for 8 of the 11 percentage-point rise in effective U.S. tariffs this year.

- If overturned, Goldman expects the administration to pivot to Section 122 (temporary tariffs up to 15% for seven months) or Section 301 (previously used against China).

- However, Section 301 would be cumbersome to apply broadly across trading partners.

Goldman predicts future tariff hikes will rely more on sectoral measures, ultimately lifting the effective tariff rate about 17pp from the year’s start.

UBS Calls for Fed “Four-Peat” in Rate Cuts

UBS expects the Federal Reserve to slash rates at each of its next four policy meetings, totaling 100 basis points, starting in September.

The forecast rests on cooling inflation, weakening labor demand, and increasingly dovish Fed rhetoric.

- July’s PCE inflation data — the Fed’s preferred gauge — showed core inflation at 2.9% y/y and headline steady at 2.6%, matching expectations and pointing to stable price pressures.

- Energy and goods costs are cooling, shelter inflation is easing, though services inflation remains sticky.

- UBS warns the bigger risk lies in the labor market. While unemployment is still low, indicators show softer job demand, and Fed officials expect the rate to climb above its natural level by year-end.

- July’s meeting revealed two dissents favoring an immediate cut — a rare event not seen in over 30 years. Powell, Williams, and Waller have all adopted softer tones, with Waller explicitly backing a September move.

UBS projects rate cuts at the following meetings:

- September 16–17, 2025

- October 28–29, 2025

- December 9–10, 2025

- January 27–28, 2026

Morgan Stanley: Fed Could Deliver More Aggressive Cuts

Morgan Stanley believes the Federal Reserve may reduce rates faster than markets anticipate, with the fed funds rate potentially dropping to 2.25% in 2025 before stabilizing near 2.75%.

- Their baseline assumes 25-bp cuts at each meeting through December 2026.

- Powell’s Jackson Hole remarks emphasized labor risks over inflation, strengthening the dovish outlook.

The bank outlined three scenarios:

- A demand boost from fiscal stimulus (10% chance).

- Higher Fed tolerance of inflation (10%).

- A mild recession triggered by trade or supply shocks (30%).

Morgan Stanley argues markets are underpricing these risks, with bonds assigning only 20% probability compared to their more bearish view.

Bessent Confident Supreme Court Won’t Overturn Trump’s Tariffs

U.S. Treasury Secretary Bessent told Reuters he believes the Supreme Court will uphold the tariffs imposed under former President Trump.

- He argued that while other legal frameworks exist to support tariffs, none are as strong or efficient as the current approach.

- Bessent also said Washington is making progress in pressing Europe to take action against India’s purchases of Russian oil.

- He dismissed a recent Shanghai meeting of non-Western leaders as little more than “performative theater.”

- India and China, he added, are undermining Ukraine by helping sustain Russia’s war economy.

Canada’s Manufacturing PMI Improves but Still Below 50

Canada’s S&P Global manufacturing PMI rose to 48.3 in August, an improvement from July’s 46.1 but still below the expansion threshold.

- The softer decline reflected slower falls in output and new orders.

- However, firms continued to cut labor capacity amid weak demand and an unusually uncertain outlook.

- Sales performance remains underwhelming, weighing on confidence.

Commenting on the latest survey results, Paul Smith, Economics Director at S&P Global Market Intelligence said:

“Canada’s manufacturing economy continued to struggle in the face of tariffs and uncertainty in August although, somewhat positively, to a noticeably lesser degree than earlier in the year. Although continuing to decline, output, new orders and employment all recorded slower falls compared to July.

“Hopefully, the manufacturing economy will continue this broad underlying path towards stabilisation, but the outlook remains extremely uncertain, with confidence remaining way below its typical trend level – resulting in a significant downside risk to sector performance going forward. Moreover, adapting to the new international trading environment remains a challenge, with costs continuing to rise sharply, and customs and logistical challenges leading to further supply-side constraints.”

Commodities News

Gold Hits Fresh Record at $3,512

Gold climbed above $3,508 in Asian trading, reaching a new all-time high of $3,512.

- The breakout is notable after months of consolidation below $3,500.

- Fundamentals remain supportive as Trump reshapes the Fed, undermines the dollar, and sparks uncertainty by firing the BLS chief.

- Seasonal patterns are less favorable — September is historically weak for gold — but strength usually resumes in November through February.

- Risks remain if Trump’s tariff strategy collapses in the courts and Congress refuses support, which could reduce turmoil and undercut gold’s rally.

Oil prices rebound, hit 4-week highs

Crude oil rallied after a volatile US session, with WTI gaining $1.65 to $65.66—the highest since August 6. A sharp $1 intraday selloff was quickly reversed as time spreads widened, underscoring tighter supply-demand dynamics. Geopolitical risk remains elevated: Washington is pressing Europe to cut Russian crude imports entirely, while India deepens ties with Moscow. In the Middle East, further sanctions hit tankers moving Iranian oil. Looking ahead, Sunday’s OPEC+ meeting could mark the first in months without fresh supply additions. A clean break above today’s highs leaves little resistance before $70.

Commerzbank: Metal Rally May Fade

Commerzbank analyst Barbara Lambrecht said recent gains in industrial metals are likely to run out of steam.

- Copper rose 3% in August and attempted to break above $10,000 per ton, but the move stalled.

- Earlier momentum came from U.S. rate-cut prospects and a weaker dollar.

- With no new catalysts, Commerzbank expects the upswing to subside in the short term.

Silver Jumps to 14-Year High

Silver prices climbed above $40 per ounce this week, the first time since 2011, according to Commerzbank’s Carsten Fritsch.

- Silver’s rally has outpaced gold, driving the gold/silver ratio down to 85, its lowest of the year.

- Earlier in 2025, the ratio climbed above 100 amid tariff-driven recession fears, but prices recovered after many of those tariffs were suspended.

- Industrial demand accounts for nearly 60% of silver use, and supply is projected to remain tight for a fifth straight year.

- Silver ETFs have added almost 2,100 tons since late May.

- Platinum rose above $1,400/oz, still below July’s 11-year high. Palladium traded around $1,130/oz, lagging behind both gold and platinum.

ING: Gold and Silver Continue to Rally

ING analysts Ewa Manthey and Warren Patterson said gold and silver are both advancing on expectations of Fed rate cuts.

- Silver surged past $40/oz for the first time since 2011.

- Gold is closing in on April’s record high of $3,500.

- Markets anticipate the Fed will resume cutting rates in three weeks, with this Friday’s jobs report likely to reinforce the case.

- Tariff uncertainty, Fed independence concerns, and a softer dollar are providing additional support.

- Silver has risen more than 40% this year, with ETF inflows now running seven months straight, totaling 806moz by August.

- The gold/silver ratio has narrowed to 85 from April’s high of 104.7, bringing it closer to its historical average.

Gold Technical Outlook: All Eyes on U.S. Data

Gold broke to a new all-time high after a multi-month consolidation, fueled by falling real yields and technical momentum.

Fundamentals:

- The rally began late last week without a clear catalyst, suggesting a short squeeze.

- Declining real yields since Powell’s dovish pivot have provided steady support.

- Traders are now awaiting U.S. labor data, with Friday’s NFP report the key risk event. Strong numbers could dampen rate-cut bets, while soft data would boost expectations for a September move.

Daily Chart:

- Gold has broken out of a four-month range into record highs.

- Sellers may attempt to fade the move with risk capped above the new peak, eyeing a return toward 3,245 support.

- Buyers will look for fresh highs to add to bullish positions.

4-Hour Chart:

- The uptrend is intact, guided by a rising trendline.

- A pullback into the line could see buyers re-enter with stops below.

- A break lower, however, would give sellers a chance to drive toward the 3,245 support.

1-Hour Chart:

- A minor upward trendline is offering near-term support.

- Bulls will lean on it to press higher, while bears await a breakdown to target 3,438 as the next level.

European gas rises as Norwegian flows shrink

TTF benchmark gas prices climbed 1.4% as extended maintenance at Norway’s Troll field squeezed supply. Flows to Europe have slumped below 240mcm/day, down from 340mcm/day in early August. EU storage is 78% full, lagging last year’s 92% and the five-year average of 85%, according to ING.

OPEC+ in focus as supply risks loom

Brent crude climbed back above $68 in thin US holiday trading, with ING noting attention is turning to this weekend’s OPEC+ meeting. Analysts expect no change in October output, but warn of a potential return to cuts if surplus concerns intensify. Meanwhile, US officials are weighing new trade curbs on Brazil over its Russian diesel imports, which have averaged nearly 600kt per month this year.

OPEC+ Unlikely to Adjust Output, Says Commerzbank

OPEC+ members are set to meet virtually this weekend, but no change to quotas is expected, Commerzbank’s Carsten Fritsch noted.

- Voluntary cuts of 2.2m bpd have already been reversed with this month’s production hike.

- Remaining restrictions of 3.66m bpd (including 1.66m voluntary) are in place until the end of 2026.

- Fritsch said it is improbable quotas will be changed outside a regular meeting, especially with oversupply risks looming later this year.

Oil Prices Edge Higher, India Defies U.S. Pressure

Brent crude rose above $68 per barrel as September trading opened, with Commerzbank’s Carsten Fritsch pointing to concerns over supply disruptions from Russia.

- Russian seaborne exports recently hit a four-week low, with shipments to India at their weakest in nearly three years.

- India continues buying Russian oil despite U.S. pressure. The energy minister defended the purchases, arguing they helped stabilize markets and prevented prices from reaching $200.

- Russian Urals crude is offered at $3–4 below Brent for September/October cargoes, while U.S. crude recently carried a $3 premium.

- An Indian refinery under EU sanctions has lost supplies from Saudi Arabia and Iraq, leaving it reliant on Russian oil. Utilization has fallen to 70–80% due to payment and sanction-related constraints.

UBS Sticks to Gold $3,700 Forecast, ANZ Eyes Jobs Report

UBS maintains its 12-month gold target at $3,700/oz by end-June 2026, citing lower real rates and geopolitical risks.

ANZ, meanwhile, says the U.S. jobs report will be critical in determining whether bullion’s current rally continues, with Fed cuts expected at the September meeting providing near-term support.

Europe News

European equities log steepest fall in a month

Europe’s major stock markets dropped sharply, with the Stoxx 600 off 1.5% for its worst day in a month. The DAX led declines, falling 2.2%, followed by Spain’s IBEX (-1.5%) and Italy’s FTSE MIB (-1.6%). France’s CAC shed 0.7% and the UK’s FTSE 100 fell 0.8%.

Eurozone CPI Rises to 2.1% in August

Eurostat’s preliminary data showed Eurozone headline inflation at +2.1% y/y in August, just above expectations of 2.0% and the prior 2.0%.

- Core CPI came in at +2.3%, exactly in line with forecasts, but slightly lower than July’s 2.4%.

- Services inflation remained sticky at 3.1%, underscoring persistent underlying pressures.

- The figures give the ECB reason to maintain its current stance ahead of next week’s policy meeting.

ECB’s Muller: It makes sense to hold rates and watch the economy

- Comments from the ECB’s Muller

- Looking at recent data, we are more-or-less on the projected path from the last round of ECB projections

- In light of all the recent turmoil, the economy has held up quite well in Europe (cites US trade policy and Ukraine war)

ECB’s Šimkus: No reason to adjust rates now

- Remarks by ECB policymaker, Gediminas Šimkus

- But it is more true than not that another rate cut is coming

- Some risks to the economy are materialising

ECB’s Schnabel: I do not see a reason for a further rate cut

- Remarks by ECB executive board member, Isabel Schnabel

- Rates are already mildly accommodative

- Inflation risks are tilted to the upside

- Tariffs are on balance inflationary

- Less worried about exchange rate

- Global rate hikes may come earlier than people think

ECB Has Likely Ended Rate Cuts, Dolenc Says

Slovenia’s acting central bank chief Primoz Dolenc signaled the European Central Bank has wrapped up its easing cycle. Speaking with Delo, he noted the Governing Council’s July meeting confirmed no further cuts were warranted, and nothing has changed since to alter that stance.

- Current monetary settings are considered adequate for hitting the inflation target.

- Dolenc highlighted that uncertainty has eased after the EU secured a trade deal with the U.S., fixing a 15% tariff on most exports.

- While tariffs came in slightly higher than June’s projections, he downplayed any significant impact on growth or inflation.

Asia-Pacific & World News

Xi and Putin Present a United Front at SCO Summit

Chinese President Xi Jinping and Russian President Vladimir Putin appeared together in Tianjin during the Shanghai Cooperation Organisation summit, projecting solidarity on the global stage.

- Xi used his speech to denounce “hegemonism” and “bullying practices” in global affairs — a thinly veiled reference to the United States.

- Images and video from the summit showed the two leaders in unusually warm spirits, smiling and conversing, signaling intentional optics.

- The summit served as a showcase for Beijing and Moscow’s continued partnership, underscoring their willingness to push back against U.S. influence.

China’s CSI 300 Jumps 25% on Reform Hopes

China’s CSI 300 Index has surged about 25% since February, even as fundamentals remain weak.

- Consumer sentiment is fragile, deflationary pressures persist, and property markets continue to struggle.

- The rally is being framed by Beijing as the outcome of reforms launched 18 months ago.

Authorities have:

- Encouraged dividend payouts and share buybacks.

- Reduced fees and incentivized long-term investors like insurers and pension funds.

- Tightened oversight, cracking down on fraud to restore trust.

Beijing aims to foster a “slow bull market” — gradual, sustainable gains that can substitute for a faltering property sector and help strengthen pensions. Whether the rally lasts remains to be seen, but for now, reforms and limited alternatives are funneling savings into equities.

Foxconn Raises Pay Ahead of iPhone 17 Launch

With Apple’s iPhone 17 due for release on September 9, Foxconn is boosting wages at its Zhengzhou plant to secure staff and meet production targets.

- Since late July, Foxconn has offered heavy incentives and ramped up overtime.

- Regular workers received bonuses of RMB 5,400.

- Dispatched workers were given a record rebate of RMB 8,000.

- Workers staying three months may see even higher payouts.

PBOC sets USD/ CNY central rate at 7.1089 (vs. estimate at 7.1325)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 255.7bn yuan via 7-day reverse repos at 1.40%

- 405.8bn yuan mature today

- net drain is 150.1bn yuan

Australia’s Net Exports Add to Q2 GDP

Australia’s external sector contributed +0.1% to Q2 GDP, above expectations for 0.0% and reversing Q1’s -0.1%.

- Current account deficit came in at AUD -13.7bn (expected -16.0bn, prior -14.7bn).

- Export volumes improved after Q1 weather disruptions, though softer commodity prices weighed on overall value.

- Student arrivals remained subdued, limiting services exports.

New Zealand dairy prices slide 4.3%

Global Dairy Trade (GDT) auction prices fell 4.3%, with the average price at $4,043. Whole milk powder, the key benchmark, dropped 5.3%.

New Zealand Terms of Trade Jumps in Q2

New Zealand’s Q2 2025 terms of trade surged 4.1% q/q, beating expectations of 1.9% and marking a sharp improvement from Q1’s 1.9%.

- Export prices rose just 0.2% q/q (forecast 1.5%, prior 7.1%).

- Import prices dropped 3.7% q/q (forecast -1.5%, prior +5.1%).

At the margin, the stronger terms of trade support the New Zealand dollar.

Japan to Draft Economic Measures Targeting Inflation and Tariffs

According to the Sankei Shimbun, Prime Minister Shigeru Ishiba is preparing to instruct ministers to compile a package of economic steps to address inflation and the fallout from U.S. tariffs. The directive could come as early as this week.

- Ishiba remains in office despite mounting calls for his resignation, with many lawmakers urging him to step down.

- The measures are seen as part of an effort to repair trust and mitigate political damage.

- The ruling LDP is also set to finalize a report today reviewing its defeat in July’s upper house elections.

- Public support for Ishiba has shown some recovery, giving him temporary breathing space.

BOJ’s Himino: Inflation Still Too High, Rates Too Low

Bank of Japan Deputy Governor Himino said real interest rates remain very low, backing the case for more hikes.

- BOJ plans to continue rate increases as the economy and prices improve.

- Inflation is near but not yet at 2%, with risks on both sides.

- Himino stressed policy should be guided mainly by short-term rates, not bond purchases.

On markets and policy:

- BOJ wants to gradually reduce JGB buying to restore bond market function.

- The central bank may eventually need to taper its balance sheet, including ETF and J-REIT holdings.

- A recent Japan-U.S. trade deal reduced some uncertainty, but global trade risks remain high.

Japan Trade Negotiator: No U.S. Visit Date Yet

Japan’s chief trade negotiator Akazawa said no date has been fixed for his next trip to Washington.

- He emphasized there are no misunderstandings with the U.S. in trade talks.

- Japan will seek a Trump executive order to cut auto tariffs.

- He denied reports that Tokyo agreed to reduce agricultural tariffs, calling such claims incorrect.

South Korea Sees Weakest Inflation Since 2021

South Korea’s August CPI recorded the slowest annual increase since November 2024, undershooting expectations.

- Headline CPI +1.7% y/y (poll +2.0%).

- Headline CPI -0.1% m/m (poll +0.2%).

- Core CPI +1.3% y/y, down from July’s +2.0%, the weakest since August 2021.

A one-off plunge in telecom prices dragged inflation lower. SK Telecom cut monthly fees by 50% for all 24 million subscribers after a data leak, leading to a 13.3% fall in telecommunications costs.

Crypto Market Pulse

SEC may fast-track XRP ETF approvals

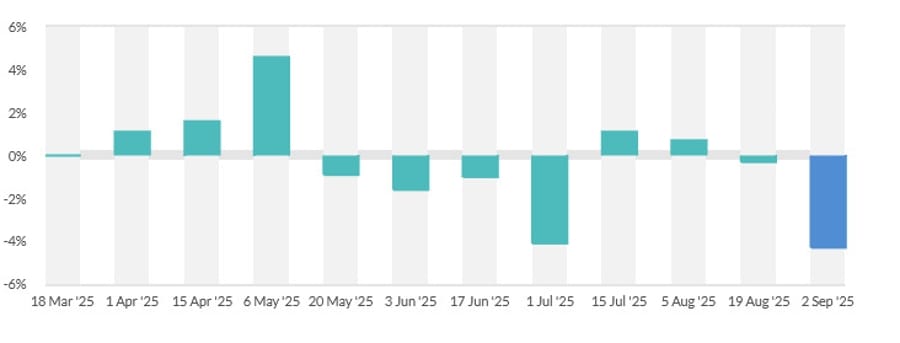

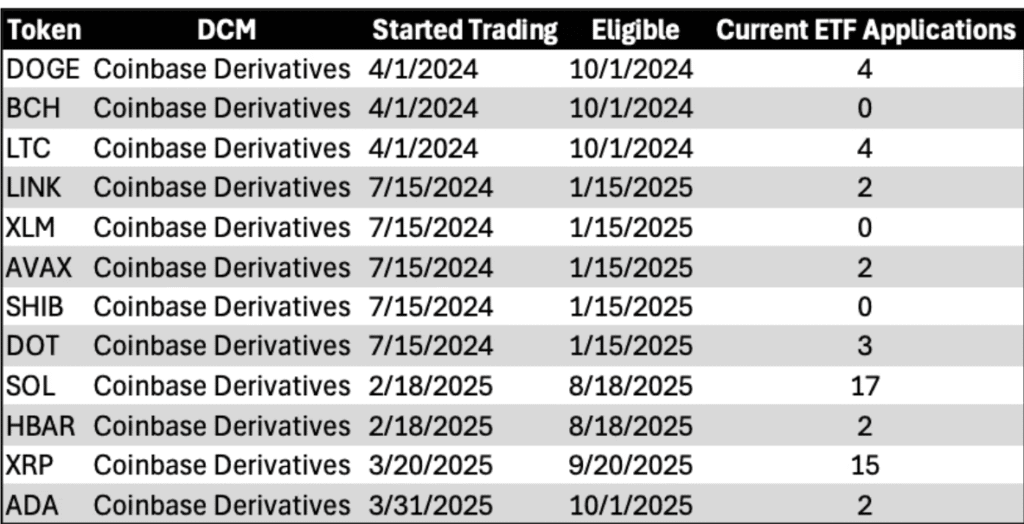

XRP traded steadily above its 100-day EMA on Tuesday, with bulls eyeing a breakout above the key $3.00 resistance. Optimism is being fueled by proposals that could allow the U.S. Securities and Exchange Commission (SEC) to fast-track approvals for crypto exchange-traded funds (ETFs).

The Cboe BZX Exchange, NASDAQ, and NYSE Arca submitted amendments (19b-4 filings) seeking streamlined listing standards. Traditionally, the SEC has stretched decisions to the 240-day limit, but the rule change would create an expedited pathway for tokens meeting specific criteria.

Under the proposal, ETFs could qualify if:

- The underlying commodity trades on a market that is an Intermarket Surveillance Group (ISG) member.

- It underlies a futures contract traded on a designated contract market (DCM) for at least six months.

- The ETF provides at least 40% net asset value exposure to the commodity upon initial listing.

According to Galaxy Research, 10 tokens already qualify, including Bitcoin Cash, Litecoin, Chainlink, Solana, Stellar, Avalanche, Dogecoin, Shiba Inu, Polkadot, and Hedera. XRP and Cardano (ADA) are expected to meet the six-month DCM requirement by September 20 and October 1, respectively.

Industry groups such as the Digital Chamber and Multicoin Capital Management have supported the proposal, calling for additional safeguards like a $500 million minimum market cap and $50 million in six-month trading volume.

Approval of an XRP ETF would mark a significant milestone, potentially driving institutional adoption and reinforcing XRP’s position as a legitimate asset class. Traders are eyeing a push toward $3.66, the token’s all-time high, should regulatory momentum align with bullish market sentiment.

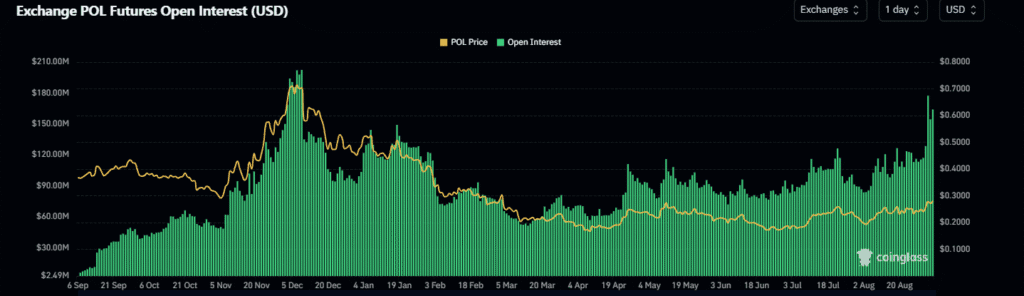

Polygon (POL) strengthens on bullish flows

Polygon’s POL token gained above $0.28, supported by rising futures open interest, stronger stablecoin activity, and network usage.

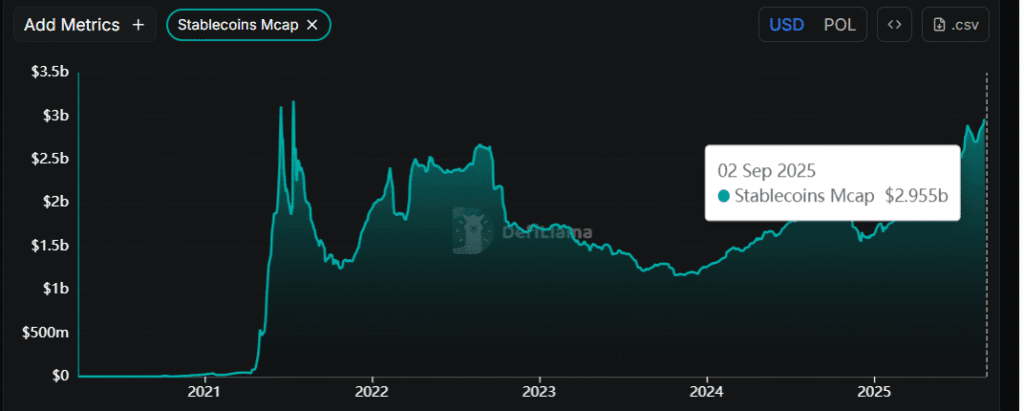

Futures OI has surged from $115M to $177M since Friday—the highest since December. Stablecoin market cap on the network has jumped to $2.95B, its strongest since mid-2021, bolstering a bullish outlook. A breakout above $0.33 remains in view.

Gemini files for NASDAQ IPO under ticker GEMI

Crypto exchange Gemini filed with the SEC to list 16 million Class A shares on NASDAQ under the ticker GEMI, priced between $17–$19. Lead bookrunners include Goldman Sachs, Citigroup, Morgan Stanley and Cantor Fitzgerald. The Winklevoss-founded firm joins a wave of US crypto IPOs, following SEC leadership changes and withdrawal of enforcement threats.

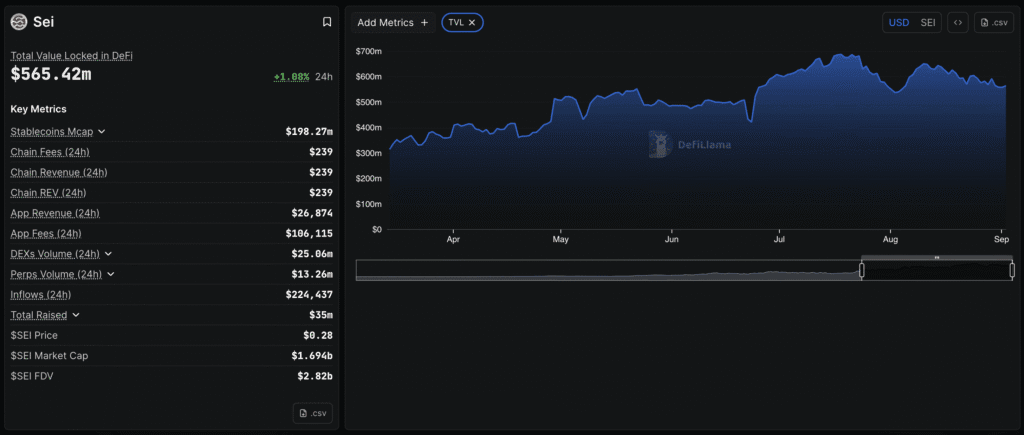

SEI recovers amid ETF filing, rising adoption

Sei (SEI) rose over 2% Tuesday after a recent pullback, supported by network growth and a new ETF filing. 21Shares submitted an S-1 for a SEI ETF with the SEC, joining Canary Capital. Sei reported a 500% jump in active weekly addresses over six months, with totals exceeding 5M for two straight weeks. TVL reached $565.4M, up slightly from Monday.

Ondo eyes breakout as tokenized stocks launch

Ondo Finance’s token (ONDO) gained over 4% to $0.91 as the platform prepared to launch more than 100 tokenized stocks and ETFs on Wednesday. The initiative aligns with the SEC’s push to unify securities and crypto under a single license. Ondo already leads in tokenized Treasuries, with over $1B issued on Ethereum and sector volumes surpassing $7B.

Japan Post Bank to Launch Digital Yen by 2026

Japan Post Bank plans to introduce a blockchain-based digital yen, dubbed DCJPY, by fiscal 2026.

- The bank manages about ¥190 trillion ($1.29 trillion) in deposits and is partly state-owned.

- Customers will be able to convert deposits into DCJPY for instant settlement of securities and other blockchain-based assets.

- The digital currency will be fully backed 1:1 by fiat yen, making it distinct from stablecoins not directly tied to deposits.

The Day’s Takeaway

North America

- Equities slide on tariff ruling: The S&P 500 (-0.7%), Nasdaq (-0.8%), and Dow (-0.6%) opened September weaker as a U.S. Court of Appeals declared most Trump-era tariffs illegal. Levies remain until Oct. 14 pending a Supreme Court appeal. All 11 S&P sectors saw losses at some point; real estate (-1.7%), industrials (-1.1%), and technology (-1.0%) lagged most. Defensive groups — health care and consumer staples (+0.1% each) — eked out gains. Energy (+0.2%) led on stronger oil.

- Mega-cap pressure: NVIDIA (-1.97%) was volatile, closing just under its 50-day MA, while the PHLX Semiconductor Index lost 1.1%.

- Corporate movers: Kraft Heinz (-6.9%) announced a split into two companies. Constellation Brands (-6.6%) cut FY26 guidance.

- Rates and volatility: Treasury yields rose (2Y +4 bps to 3.66%, 10Y +5 bps to 4.28%). The VIX spiked 14% to 17.51.

- Growth outlook:

- Atlanta Fed GDPNow cut to 3.0% for Q3 (from 3.5%), citing weaker consumption and investment.

- Goldman Sachs nudged Q3 GDP forecast up to 1.7% (from 1.6%) on firmer construction details and ISM orders.

- Economic data:

- ISM Manufacturing Index: 48.7 (prev. 48.0) – still contracting, but new orders rebounded.

- Construction Spending: -0.1% (prev. -0.4%).

- S&P Global U.S. Manufacturing PMI (final): 53.0 (prev. 53.3).

YTD performance: Nasdaq +10.2%, S&P 500 +9.1%, Dow +6.5%, Russell 2000 +5.5%, S&P Mid Cap 400 +3.8%.

Commodities

- Oil rallies: WTI settled +$1.65 at $65.66, a 4-week high, reversing an intraday selloff. Tight spreads, U.S. pressure on Europe to cut Russian imports, and Iranian tanker sanctions lifted sentiment. Brent reclaimed $68. Traders eye Sunday’s OPEC+ meeting, with no fresh supply expected but risk of future cuts.

- Gas: TTF benchmark rose 1.4% as Norwegian Troll field maintenance cut flows to <240mcm/day (vs. 340mcm in early Aug). EU storage stands at 78%, well below last year (92%).

Europe

- Equities tumble: The Stoxx 600 fell 1.5%, its steepest drop in a month. Germany’s DAX led losses (-2.2%), followed by Italy (-1.6%) and Spain (-1.5%). France (-0.7%) and the UK (-0.8%) also slipped.

Asia-Pacific

- New Zealand dairy: GDT auction prices fell 4.3% to $4,043, with whole milk powder down 5.3%.

Rest of World

- Brazil in focus: U.S. officials weigh new trade curbs over Russian diesel imports, averaging ~600kt/month in 2024.

Crypto

- XRP ETF prospects: XRP trades above its 100-day EMA as the SEC reviews fast-track ETF proposals. Criteria require ISG trading, six months of futures trading, and 40% NAV exposure. XRP should qualify by Sept. 20; Cardano by Oct. 1. Approval could drive XRP toward its $3.66 record high.

- Gemini IPO: Filed for NASDAQ listing (ticker GEMI), aiming to sell 16M Class A shares at $17–$19. Banks: Goldman, Citi, Morgan Stanley, Cantor.

- Ondo Finance (ONDO): +4% to $0.91 ahead of launching >100 tokenized stocks/ETFs. Already leads tokenized Treasuries ($1B+ issued).

- Sei (SEI): +2%, supported by ETF filings (21Shares, Canary Capital). Network users up 500% in 6 months; TVL $565.4M.

- Polygon (POL): Broke $0.28 with rising futures OI ($177M, highest since Dec) and stablecoin flows ($2.95B cap, strongest since mid-2021). Traders eye $0.33 breakout.