North America News

S&P and Nasdaq Set New Records as Tesla and Apple Lead Gains

After a brief pullback on Tuesday, both the S&P 500 and Nasdaq notched fresh record highs, marking the third record close in the last four sessions.

Optimism around U.S. trade agreements — notably the new Vietnam deal — helped offset earlier market jitters caused by the weak ADP employment data.

Apple shares advanced 2.22%, continuing their rebound. Tesla surged 4.97% on upbeat delivery results, lifting broader sentiment. The small-cap Russell 2000 also outperformed with a 1.31% gain, while the Dow Jones Industrial Average ended almost flat.

Final index closes:

- Dow: down 10.52 points (–0.02%) at 44,484.42.

- S&P 500: up 29.41 points (+0.47%) at 6,227.42.

- Nasdaq: up 190.24 points (+0.94%) at 20,393.13.

- Russell 2000: up 28.82 points (+1.31%) at 2,226.39.

Top individual movers with gains above 3%:

- MicroStrategy (MSTR): +7.74%

- Robinhood (HOOD): +6.15%

- Moderna (MRNA): +5.54%

- Whirlpool (WHR): +5.03%

- Tesla (TSLA): +4.96%

- First Solar (FSLR): +4.59%

- Grayscale Bitcoin Trust (GBTC): +4.21%

- ARK Genomic Revolution ETF (ARKG): +4.12%

- Nike (NKE): +4.11%

Tesla Beats Low Expectations With 384K Q2 Deliveries

Tesla announced second-quarter deliveries of 384,122 vehicles, just below the 389,407 expected but well above whispered estimates of around 350,000.

Shares jumped 5% premarket after falling 7% yesterday on delivery fears and Musk-related headlines.

Production details:

- Total production: 410,244 (expected: 400,083)

- Model 3/Y production: 396,835 (expected: 383,567)

- Other models: 13,409 (expected: 13,616)

Delivery breakdown:

- Model 3/Y deliveries: 373,728 (expected: 377,295)

- Other models: 10,394 (expected: 14,644)

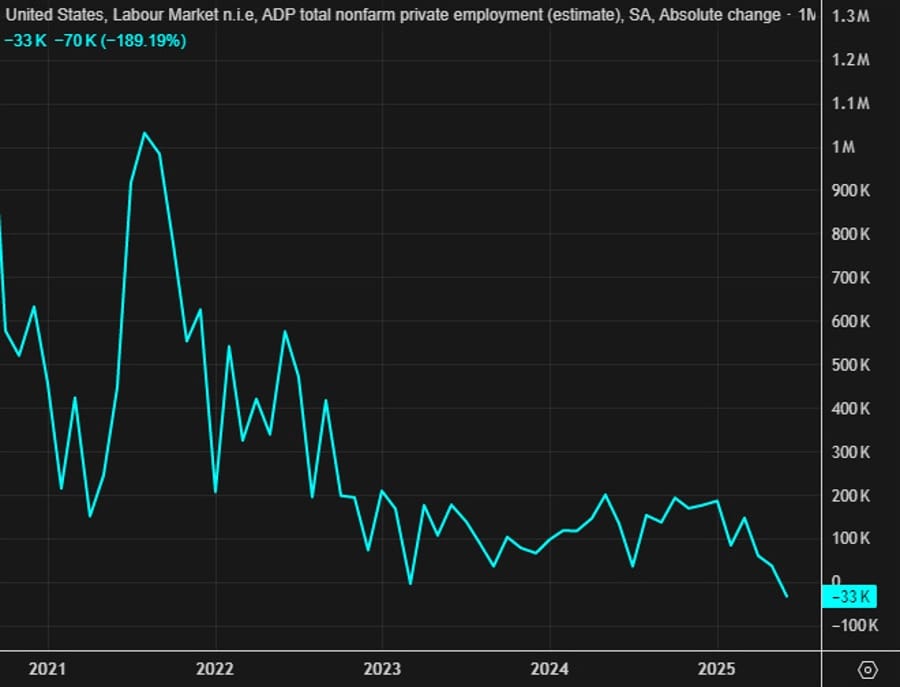

U.S. June ADP Employment Misses Badly at –33K

ADP reported a surprising contraction in private employment for June, with payrolls dropping by 33,000 versus expectations for a 95,000 gain.

May’s figure was revised up to +37K.

Breakdown by sector:

- Goods-producing: +32K (prior: –2K)

- Services: –66K (prior: +36K)

Industry-specific details:

- Professional/business services: –56K

- Education/health: –52K

- Financial activities: –14K

- Manufacturing: +15K

- Leisure/hospitality: +32K

Wage trends:

- Pay growth for job stayers: +4.4% (prior: +4.5%)

- Pay growth for job changers: +6.8% (prior: +7.0%)

This was the weakest result since March 2023, when payrolls dropped by 102,000.

Microsoft Tones Down AI Chip Strategy, Nvidia Cheers

Microsoft is reportedly scaling back its AI chip ambitions as it works to overcome delays, according to The Information.

The company has sought to reduce its dependence on Nvidia for AI workloads but has found the transition more challenging than expected.

On Wednesday:

- Nvidia shares climbed $3.66 (+2.37%) to $156.96, with a session high at $157.60.

- Nvidia’s all-time high: $158.71 (June 28).

- Nvidia’s April low: $86.62; up around 83% since.

- Microsoft shares were steady at $492.06.

The move is seen as a win for Nvidia as it strengthens its position as the dominant AI chip supplier.

U.S. June Challenger Layoffs Fall to 48K, But Q2 Cuts Hit Four-Year High

Employers in the U.S. announced 47,999 job cuts in June, a sharp drop from May’s 93,816, according to Challenger, Gray & Christmas.

Year-over-year, June layoffs were 2% lower.

However, Q2 totals tell a different story: 247,256 job cuts this quarter, up 39% from 177,391 in Q2 2024, and the highest second-quarter figure since 2020.

U.S. Mortgage Applications Rise 2.7% as Refinancing Leads the Bump

Mortgage applications in the U.S. increased by 2.7% for the week ending June 27, according to the Mortgage Bankers Association.

In detail:

- Prior week: +1.1%

- Market index: 256.5 (previous: 250.8)

- Purchase index: 165.3 (previous: 165.2)

- Refinance index: 759.4 (previous: 713.4)

The average 30-year mortgage rate dipped to 6.79% from 6.88%, encouraging more homeowners to refinance. Despite rates still sitting at elevated levels, the recent cooling has provided a slight tailwind for activity.

Goldman Sachs Predicts Weak June Payrolls at Just 85K

Goldman Sachs expects U.S. nonfarm payroll growth to come in sharply below consensus, forecasting an increase of only 85,000 jobs for June — well under the median market estimate of 113,000.

Key factors weighing on the outlook:

- Big data signals showing softening trends.

- The expiration of Temporary Protected Status for 350,000 Venezuelans, potentially reducing the headline figure by around 25,000.

- A projected 15,000 decline in federal government payrolls.

Unemployment rate:

- Expected to rise slightly to 4.3%, up from an unrounded 4.24% last month.

Wage growth:

- Average hourly earnings projected to increase by 0.3% month-over-month.

- Wage survey data suggest the annualized pace is dropping below 3%, hinting at further moderation.

Impact of strikes:

- Ending labor strikes might add around 6,000 jobs back into the headline, but not enough to offset other drags.

Conclusion: Goldman says the data would reinforce a narrative of a cooling labor market and help push the Federal Reserve further toward a dovish stance. If wage trends continue to slow, it could also sustain downward pressure on the U.S. dollar.

Fed’s Barkin: Will be looking at change in the unemployment rate

- Comments from Barkin

- Will factor in slowing immigration

- We have a lot to learn before the next meeting including jobs, inflation and trade policy

- Business contract say consumer demand remains solid but consumers are shopping for lower prices

- Business contacts say they are still on pause in terms of investment, want to see trade policy settled

Politico: U.S.-Vietnam Trade Pact Near, May Serve as Model for Asia

Politico reports that the final details of the U.S.-Vietnam trade agreement are expected “within weeks,” with a major tariff reduction for Vietnamese imports on the table.

Key elements include:

- Vietnam agreeing to buy 50 Boeing aircraft ($8 billion).

- A $2.9 billion U.S. agriculture purchase (poultry, pork, beef, other goods).

- Preferential market access for U.S. agricultural and industrial products.

- Addressing non-tariff barriers, including IP protections.

The agreement sets rules of origin aimed at limiting transshipment of Chinese-made goods through Vietnam, pushing Vietnam to cut reliance on Chinese imports (currently about 40% of its total).

Analysts suggest this could become a blueprint for future regional trade deals.

Trump Strikes Controversial Trade Deal With Vietnam, Imposes 20% Tariff

Trump announced via Truth Social a new trade deal with Vietnam, introducing a 20% tariff on all imports from Vietnam and a 40% tariff on transshipped goods.

In return, Vietnam agreed to completely open its markets to U.S. goods at zero tariffs, a concession Trump described as unprecedented.

He highlighted potential opportunities for large-engine vehicles like SUVs in Vietnam.

The announcement rattled some consumer names; Nike shares slipped as Vietnam is a major manufacturing base for footwear and apparel.

Trump emphasized that this is a win for his “reciprocal” trade strategy, though critics point out the deal appears heavily one-sided.

Microsoft Plans to Cut 9,000 Jobs Following May Layoffs

Microsoft revealed plans to lay off another 9,000 workers, adding to the 6,000 jobs cut in May.

The new wave represents about 4% of its workforce, with deep cuts expected in the Xbox division.

These layoffs arrive alongside a weak ADP employment report, underscoring a shift among major firms toward aggressive margin improvements through headcount reductions.

The contrast to the hiring frenzy of 2021 is stark, and analysts suggest this move could embolden other tech giants to follow suit.

BoA: Fed Cuts Unlikely Without Labor Market Weakness

Bank of America analysts say the Fed is unlikely to cut rates soon, as inflation remains stubbornly above target and tariff effects could push prices even higher.

Chair Jerome Powell recently noted that without stronger evidence of labor market deterioration, the Fed will remain on hold.

BoA points out that while goods inflation may reflect preemptive pricing ahead of tariffs, further upward price pressure is likely to follow.

They conclude that although a rate cut is still possible this year, it would require clear and convincing labor market softness to overcome inflation risks.

Deutsche Bank: Dollar Faces Pressure as Foreign Demand Fades

The U.S. dollar is under renewed selling pressure as foreign investors reduce purchases of dollar-denominated assets, according to Deutsche Bank.

ETF flow data reveal overseas buyers are no longer absorbing enough U.S. assets to cover the large current account deficit.

The U.S. net international investment position (NIIP) improved slightly in Q1 to –$24.61 trillion (from –$26.54 trillion), largely due to weaker asset performance and dollar depreciation.

DB estimates that the dollar would need to weaken by 30–35% to restore historical GDP-to-NIIP balance, underscoring the severity of America’s external funding challenge.

Goldman: S&P 500 Rally Still Has Legs—But Only Through July

Goldman Sachs flow strategists say the S&P 500 can extend its climb into mid-July, helped by strong seasonal trends, lower volatility, and improving sentiment.

However, they caution the move could run out of steam by August.

July has historically been the strongest month for the index, particularly in the first half.

Tailwinds include excess capital from systematic strategies, easing geopolitical fears, and optimism around trade deals and possible rate cuts.

Yet, risks persist: the rally has been driven by narrow leadership and weaker-quality stocks, with bullish positioning now climbing sharply.

Goldman: U.S. Jobs Data Could Accelerate Dollar Weakness

Goldman Sachs warned that Thursday’s June U.S. jobs report could trigger further dollar losses, especially against the euro and yen.

They note that recent declines in U.S. front-end rates and easing geopolitical tensions have eroded the dollar’s safe-haven appeal.

A weaker-than-expected Nonfarm Payroll (NFP) figure or clear labor market softness would reinforce expectations of a dovish Fed pivot, accelerating USD downside.

While a major miss would spark renewed selling, Goldman still expects a gradual grind lower as macro drivers—rather than fiscal or geopolitical noise—take center stage.

Bessent says he is certain the Federal Reserve will cut rates by September

- Bessent admits he doesn’t understand the impact on tariffs on inflation

Bessent was speaking in an interview with Fox:

- says ‘a little bewildering’ that tariffs wouldn’t push Fed towards a cut

- Asked if he thinks Powell will lower rates by fall, Bessent: I think they could do it sooner than then but certainly by September

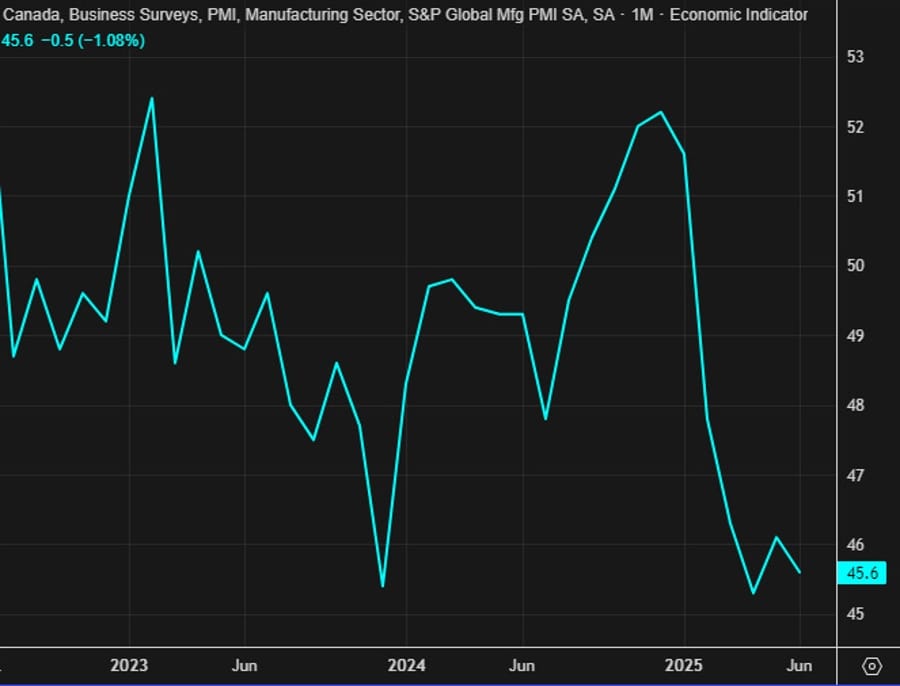

Canada’s June Manufacturing PMI Slides Further to 45.6

Canada’s manufacturing PMI slipped to 45.6 in June from 46.1 in May, according to S&P Global.

The drop was fueled by sharply weaker international sales, especially from the U.S., and one of the steepest declines in new export orders in survey history.

Production volumes were cut at the fastest pace in over five years, reflecting a severe slowdown in new work.

Some respondents remain hopeful that trade tensions, including tariff uncertainty, will ease in the coming year, but for now, the sector remains stuck at the bottom.

Commenting on the latest survey results, Paul Smith, Economics Director at S&P Global Market Intelligence said:

“Canada’s manufacturing economy continued to struggle in the face of tariffs and the ongoing uncertainty related to future trade policies. A lack of new orders underpinned the latest downturn and helped to explain the steepest reduction in production since the height of the pandemic in the spring of 2020. International sales unsurprisingly were especially subdued, and, against this backdrop, firms chose to make further cuts to their employment and purchasing activity.

“Although sentiment improved on hopes of some stability in the year ahead, confidence in the outlook remains subdued and uncertain. And firms continued to face pressure on their operating margins as, despite easing since May, inflationary pressures were again evident. Tariffs again drove steep rises in prices and also exacerbated supply-side delays, which intensified during June.”

Canada Pushes to Scrap All Trump-Era Tariffs in New U.S. Deal

Canada’s ambassador to Washington confirmed that the government is determined to eliminate every Trump-era tariff as part of an upcoming deal with the White House.

The ambassador expressed confidence that Canada can secure this outcome as part of a wider economic and security agreement expected by July 21, a deadline set by Prime Minister Mark Carney himself.

Info via Canadian media, Globe and Mail, link here (may be gated).

Commodities News

Gold Edges Higher Ahead of Key U.S. Jobs Report

Gold prices rose modestly on Wednesday, with traders positioning for Thursday’s critical U.S. Nonfarm Payrolls data. At last check, spot gold was trading at $3,348, up 0.29% for the session.

The ADP report earlier this week pointed to a significant slowdown, with private firms cutting 33,000 jobs instead of the 95,000 gain expected. Microsoft’s announcement of 9,000 job cuts further fueled concerns over labor market softness.

Forecasts suggest the June payroll report will show 110,000 new jobs, down from May’s 139,000. The jobless rate is predicted to rise from 4.2% to 4.3%, remaining close to the Federal Reserve’s recent 4.4% projection.

Geopolitical backdrop:

- Tensions eased following reports of a potential 60-day ceasefire in Gaza and a truce between Israel and Iran, limiting safe-haven inflows to gold and capping its rally below $3,400.

Additional drivers:

- Central banks added 20 tonnes to global reserves in May. Kazakhstan led with 7 tonnes, followed by Turkey (6 tonnes) and Poland.

- Uncertainty persists around Trump’s trade policies, especially with the July 9 tariff deadline approaching.

- Debate in Congress over Trump’s “One Big Beautiful Bill,” which may face pushback from House conservatives.

Federal Reserve signals:

- Chair Jerome Powell reiterated that policy remains moderately restrictive and said rate cuts aren’t off the table, though July may be too soon.

- Without the inflationary pressure from Trump’s tariffs, Powell suggested the Fed might have already cut rates.

Markets currently price in around 63.5 basis points of easing by year-end.

Oil Surges to $67.45, Breaks Above Key Technical Levels

Crude oil futures jumped $2 to settle at $67.45 on Wednesday, defying bearish fundamentals such as surprise inventory builds and rising OPEC+ supply.

EIA data showed:

- Crude stocks: +3.8 million barrels (expected: –1.8 million).

- OPEC+ added 411,000 barrels per day on July 1, with another increase likely to be approved for August.

A sharp drop in ADP employment (–33K vs. expected +95K) added to economic uncertainty, but the weaker U.S. dollar provided support.

Technically, oil broke above the April 24 top-end range, the 50% retracement level at $66.33 (from the April 9 low), and the 200-hour moving average at $67.06.

These moves triggered buying momentum, giving bulls a green light to push higher.

U.S. Weekly Oil Inventories Show Surprise Build

EIA data revealed a crude oil inventory build of +3.845 million barrels last week, defying expectations for a 1.809 million-barrel draw.

Other components:

- Gasoline: +4.188 million barrels (expected: –236K)

- Distillates: –1.710 million barrels (expected: –960K)

This report ends a streak of large draws; prior week saw a draw of –5.836 million barrels.

API numbers from late Tuesday showed:

- Crude: +680K

- Gasoline: +1.920 million

- Distillates: –3.458 million

Silver Stalls Near $36 Awaiting U.S. Jobs Clarity

Silver prices are hovering around $36.00, trading in a tight range as traders hold back ahead of key U.S. labor market data releases.

Key levels:

- Support: $35.40

- Resistance: $37.35

Earlier in the week, strong U.S. job openings data and a stronger-than-expected ISM manufacturing reading bolstered the U.S. dollar and added uncertainty to silver’s short-term direction.

Fed Chair Jerome Powell’s cautious messaging also tempered immediate expectations for rate cuts.

Goldman Sachs: No Major Oil Shock Expected if OPEC+ Lifts Output

Goldman Sachs strategists believe any decision by OPEC+ to raise oil production this coming Sunday won’t spark a big market reaction.

According to the bank, most traders already anticipate an increase, so the market has largely priced in the move ahead of the July 6 meeting.

Europe News

ECB’s Rehn: should be mindful of risk that inflation stays persistently below 2% target

- Comments from the ECB policymaker

- ECB should be mindful of the risk that inflation stays persistently below 2% target.

- Joint European borrowing to finance defence could bolster euro’s role by creating new safe asset.

- ECB is in a good place, but no reason for complacency.

- Can’t allow inflation undershoot to shift expectations.

- Concerned about inflation being below target for an extended time.

- Exchange rate is not a policy target.

- Risks to inflation are two-sided.

- The Euro has real chance to become more important.

ECB’s Centeno: I’m still cautious, following all data available

- Comments from the ECB policymaker

- I’m still cautious, following all data available.

- I’m worried about investment in the Euro Area.

- Strong Euro will bring more investors to Europe.

- Euro strength reflection of global developments.

- I’m in no rush to lower interest rates.

- A weak Q2 could raise the risk of too low inflation.

- The risk of inflation undershoot is greater than overshoot.

BOE’s Taylor says don’t think bigger rate cuts are necessarily needed or desirable

- Remarks by BOE policymaker, Alan Taylor

- Soft landing is at risk, UK economy is slowing down

- Starting to see cracks in the labour market

- Worried that inflation could undershoot target

- Everything has to be taken into consideration, we are not on a pre-set path on rates

- Confident that energy shocks are going to fall off in 2026

- Sees greater probability of a downside scenario in 2026 on demand weakness and trade disruptions

UK Wage Growth Rises, Challenging BoE’s Inflation Outlook

Median pay awards in the UK rose to 3.4% during the three months to May, up from 3.2%, driven in part by April’s hike to the National Living Wage.

Private-sector median deals climbed to 3.5%, with nearly 19% of firms awarding increases above 6% (versus 12% in April).

Public-sector pay averaged 3.6%.

The Bank of England is closely watching wage trends as a persistent inflationary threat. Stronger pay growth could undermine the central bank’s forecasts for slowing price pressures.

Asia-Pacific & World News

PBOC sets USD/ CNY mid-point today at 7.1546 (vs. estimate at 7.1623)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 98.5bn yuan via 7-day reverse repos at 1.40%

- 365.3bn yuan mature today

- net drain is 266.8bn yuan

Australia’s May Retail Sales Miss Again, Up Only 0.2%

Australia’s retail sales grew just 0.2% month-over-month in May, missing the 0.4% forecast and extending a streak of underwhelming data.

April sales were revised down to –0.1% (from +0.3%).

Annual growth eased to 3.3%, the slowest since November last year, with food sales unexpectedly dropping while clothing and department stores saw modest gains.

Australian Building Permits Edge Up 3.2% in May

Building permits in Australia rose 3.2% month-over-month in May, falling short of expectations for a 4.8% rise.

This follows a sharp 5.7% decline in April.

Year-over-year, permits increased 6.5%, down from 7.5% previously.

Building approvals remain volatile, reflecting the lumpy nature of this data series.

Japan’s Akazawa says will not sacrifice national interests by rushing into a trade deal

- Remarks by Japan trade negotiator, Ryosei Akazawa

- Any agreement that would hurt our national interests for the sake of timing should not be made

- There is possibility of travelling to the US but no specific schedule is decided yet

- Japan and US are continuing vigorous trade negotiations

Japan trade negotiator Akazawa reportedly set for another US visit this weekend

- This will be the 8th time that Akazawa is heading to the US for trade talks

And despite the many visits, the situation remains somewhat the same as per the first time he went. The running theatrics at least make it seem like they’re holding a tough position. But only time will tell I guess. We’re a week away from the 9 July deadline and Trump is seemingly losing his patience.

Crypto Market Pulse

Crypto Market: Bitcoin Eyes Highs, ETH and XRP Signal Strength

Bitcoin (BTC) is gaining ground again, pushing past $107,000 and trading at $107,665 on Wednesday after dipping to $105,100.

Ethereum (ETH) is showing fresh bullish signals, trading at $2,449 after rebounding from its 100-day EMA support at $2,381. The ETH Community Conference in France is adding to optimism, drawing over 6,400 attendees and more than 500 speakers.

XRP is consolidating near $2.18, aiming to break its 50-day EMA at $2.20. Bulls are eyeing a push toward $2.34 (June peak) and potentially $2.65 (May high).

On technicals, Ethereum’s MFI indicator is approaching its midline, suggesting rising demand. The RSI also points higher, reinforcing a potential rally toward $2,882 if $2,468 (200-day EMA) is cleared.

Market backdrop:

- SEC approved Grayscale’s plan to convert its Digital Large-Cap Fund (holding BTC, ETH, XRP, SOL, ADA) into an ETF.

- Bloomberg analysts raised approval odds for spot ETFs (XRP, SOL, LTC) to 95% by year-end.

Spot ETF flows:

- Bitcoin ETFs saw $342 million in outflows on Tuesday, ending a 15-day net inflow streak. Fidelity’s FBTC led with $173 million in redemptions.

- Ethereum ETFs marked $41 million in net inflows, continuing a three-day streak.

XRP Holds Below $2.20 as Ripple Taps OpenPayd for New Stablecoin Corridors

XRP is hovering just under its 50-day EMA resistance at $2.20, reflecting ongoing market indecision despite Ripple’s recent partnership push.

Ripple announced a major deal with OpenPayd to integrate Ripple Payments across the euro and pound sterling. This move will allow Ripple to tap into OpenPayd’s global infrastructure, aiming for compliant, scalable, and efficient institutional transfers.

On Wednesday, XRP was trading around $2.18, stuck in sideways action despite the stablecoin corridor expansion and XRPL EVM Sidechain integration earlier this week.

Open Interest (OI) in XRP futures has ticked up to $4.16 billion from $3.54 billion on June 23, according to CoinGlass. Even so, it remains well below previous highs of $5.52 billion (May 14) and $7.86 billion (January 18).

Avalanche and Toncoin Active Users Double, Hint at Breakouts

Avalanche (AVAX) and Toncoin (TON) have both seen their active addresses more than double over the past month, signaling renewed network engagement.

On Wednesday:

- AVAX rose over 3% to $17.59.

- TON gained more than 1% to $2.82.

Avalanche’s active addresses surged to roughly 392,000 on Friday from 192,000 on May 27, a 51% jump in 30 days.

Toncoin also doubled its active addresses to around 750,000, up from 365,000 on June 2. New address creation on TON climbed to 241,000 (from 133,000).

Technical momentum for AVAX is reinforced by MACD and MFI indicators, while funding data for both tokens support a bullish bias.

Celestia (TIA) Builds Momentum for Breakout

Celestia (TIA) saw a sharp 5% rebound on Wednesday, signaling a potential breakout from its downward channel.

A bullish RSI divergence and rising Open Interest support this move, with CoinGlass data showing OI up 4.51% to $169.79 million in 24 hours.

Funding rates flipped positive (+0.0050% vs. –0.0042%), reflecting increased long positioning.

Despite a higher rate of long liquidations ($333.57K vs. $50.72K in shorts), traders appear more optimistic.

The long/short ratio dropped to 0.9113, indicating caution, but momentum is building for a possible technical reversal.

Bonk Ends Solana Saga Token Redemption as Claims Wind Down

Bonk (BONK) rebounded nearly 4% on Wednesday after two days of losses, supported by renewed optimism and rising Open Interest.

On Wednesday, Bonk announced it will end its token redemption program for Solana Saga phone owners on July 31.

Of 20,000 available redemptions, 17,599 were claimed. Remaining tokens will be moved to Bonk’s DAO.

The end of the redemption window coincides with the rollout of Solana’s new Seeker mobile device, marking a new chapter for the ecosystem.

Pi Network Faces Bearish Risk Ahead of 19.2 Million Token Unlock

Pi Network (PI) managed a 1% bounce on Wednesday after six consecutive days of losses but remains under bearish pressure.

The network’s largest token unlock this year—19.2 million PI tokens—is scheduled for July 4, raising concerns of a potential supply-driven sell-off.

Despite the rollout of the AI-powered Pi App Studio and ecosystem staking initiatives on Pi2Day, the announcements failed to spark sustained buying interest.

Pi trades below $0.50, with traders bracing for further volatility as the additional supply hits the market.

The Day’s Takeaway

United States

- Equities surge to record highs: The S&P 500 and Nasdaq closed at all-time highs again, each marking their third record in four sessions. Apple (+2.22%) and Tesla (+4.97%) led gains, helped by optimism over new trade deals such as the Vietnam agreement. The Russell 2000 rose 1.31%, while the Dow closed nearly unchanged at –0.02%.

- Job market signals softness:

- ADP employment: Private payrolls dropped by 33K in June, far below the +95K expected — the weakest since March 2023.

- Challenger layoffs: June cuts fell to 48K from 93.8K prior, but Q2 layoffs surged to 247K, the highest since 2020.

- MBA mortgage applications: Rose 2.7% last week, mainly from a jump in refinancing activity as mortgage rates dipped to 6.79%.

- Nonfarm payroll outlook: Goldman Sachs forecasts a soft June jobs report (+85K vs. 113K consensus), expecting the unemployment rate to rise to 4.3% and wage growth to slow further.

- Construction spending: Fell 0.3% in May (vs. expected –0.2%).

- Manufacturing PMI signals mixed trends:

- ISM manufacturing PMI rose to 49.0 (above 48.8 expected).

- S&P Global final manufacturing PMI jumped to 52.9 from 52.0 prelim.

- JOLTs job openings: May job openings rose to 7.77 million, beating expectations (7.3M).

- White House trade optimism: The administration expressed confidence in securing an EU trade deal soon, citing strong progress.

- Senate passes major tax/spending bill: The bill, which included $4.5T in tax cuts and $1.2T in spending cuts, now returns to the House.

- GDP outlook: Atlanta Fed’s Q2 GDPNow estimate lowered to 2.5% (from 2.9%).

- Microsoft job cuts: Plans to lay off 9,000 workers, adding to 6,000 in May.

- Tesla deliveries: Delivered 384K vehicles in Q2, topping low-end whispers but missing official estimates (389K).

- Tech rotation: Heavy selling in mega-cap tech (e.g., Nvidia, Broadcom), while Dow and small caps outperformed.

Canada

- Manufacturing PMI weakens: June PMI dropped to 45.6 from 46.1. Export orders fell at one of the sharpest rates in survey history, particularly from the U.S. Producers slashed volumes at the steepest pace in five years.

Commodities

- Crude oil: Futures rose $2 to settle at $67.45, breaking above the 50% retracement and 200-hour moving average. EIA data showed an unexpected crude inventory build of +3.8M barrels (vs. expected –1.8M). Gasoline stocks also rose sharply.

- Gold: Rose 0.29% to $3,348 as traders braced for Friday’s NFP report. Central bank purchases in May (20 tonnes) added some support.

- Silver: Hovering near $36, consolidating as markets await more U.S. labor data to gauge Fed policy path.

Rest of the World

- Australia:

- May retail sales rose 0.2% m/m (below +0.4% expected).

- May building permits up 3.2% m/m (below expected 4.8%).

- Vietnam:

- Trump announced a trade deal imposing 20% tariff on imports from Vietnam, with 0% tariffs on U.S. exports into Vietnam. Vietnam to buy $8B in Boeing aircraft and $2.9B in U.S. agricultural goods.

- Politico reports deal to be finalized in coming weeks; framework could shape future Asia deals.

Crypto

- Bitcoin: Rebounded to $107,665 (+2%), pushing toward all-time highs despite ETF outflows. ETFs saw $342M net outflows Tuesday, breaking a 15-day inflow streak.

- Ethereum: Up to $2,449, rebounding from its 100-day EMA. Positive signals from ETH Community Conference in France (6,400 attendees).

- XRP: Trading around $2.18, consolidating below the 50-day EMA at $2.20. Futures Open Interest recovered to $4.16B but remains lower than earlier peaks.

- Avalanche & Toncoin: Active addresses more than doubled over the last month. AVAX up over 3%, TON up over 1%.

- Celestia (TIA): Active bullish signals from RSI divergence, Open Interest rising, potential channel breakout.

- Bonk (BONK): Up nearly 4% after announcing end of token redemption for Solana Saga owners as of July 31.

- Pi Network (PI): Slight rebound after six days of declines. 19.2M token unlock scheduled for July 4 could weigh on prices.