📊 GDP Jumps, Fed Holds — Meta & Microsoft Soar Post-Earnings

• U.S. Q2 GDP rose 3.0%, but real demand showed weakness; Fed held rates, signaling no immediate cuts

• Stocks were mixed, with the NASDAQ up +0.15%, while the S&P 500 and Dow slipped; markets digest Powell’s cautious tone

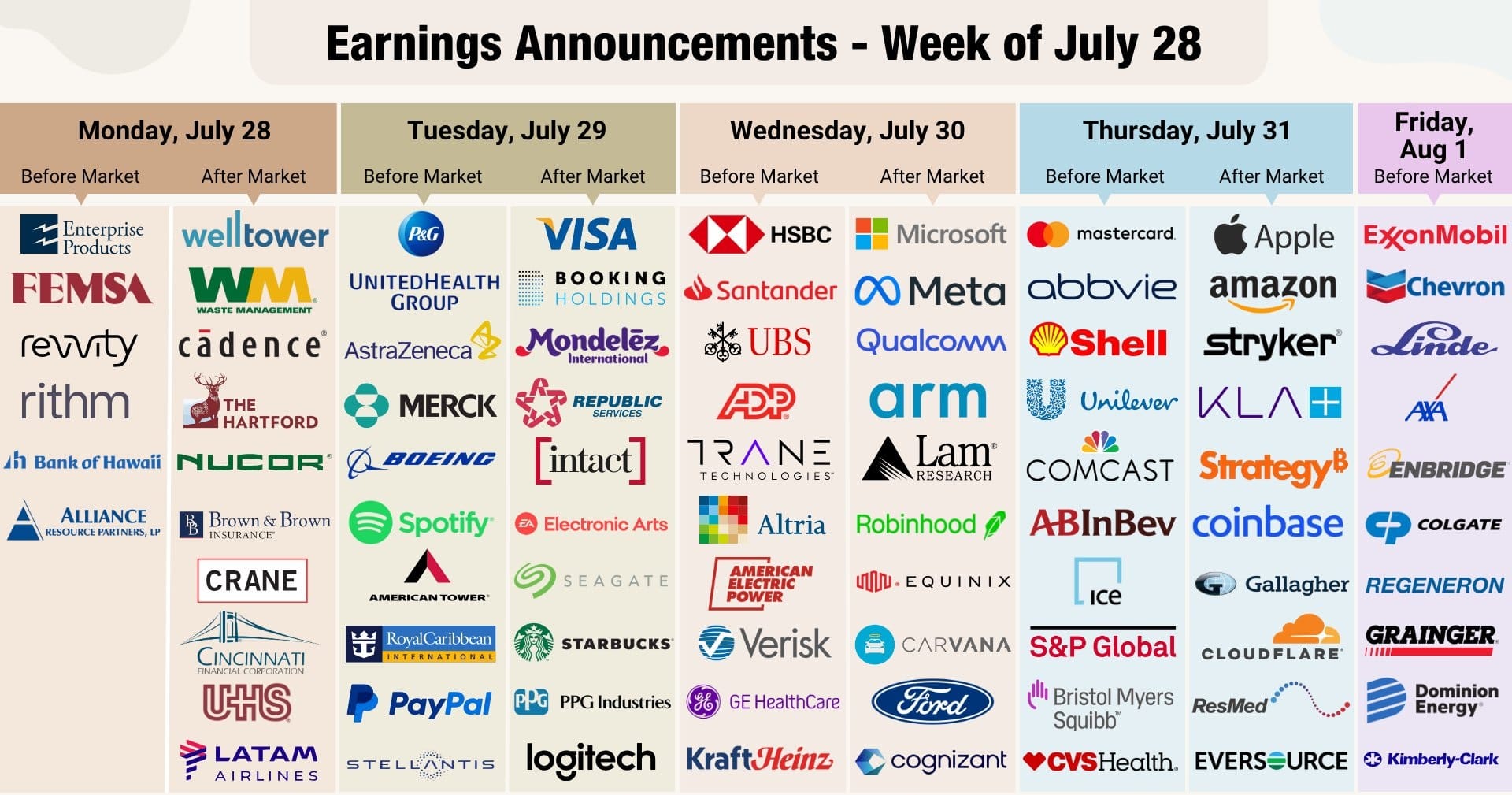

• Meta crushed earnings (EPS $7.14 vs. $5.85), surging +9% post-close; Microsoft also beat and jumped +6.5%

• Alphabet dipped after a revenue miss, while AMD soared on raised guidance and strong AI chip demand

• Crude oil fell as U.S. inventories surged and China demand worries lingered; gold attempted a bounce but stayed below resistance

• XRP held $3.00, but on-chain data suggests weakening conviction; Ethereum steadied above $3,730 as it turns 10