North America News

Major US Indices Close Higher for Fourth Straight Session

The major US stock indices advanced for a fourth consecutive day on Wednesday, led by the NASDAQ’s 0.82% gain. Markets continued to benefit from a sharp shift in Federal Reserve rate expectations following comments from New York Fed President Williams. Rate-cut odds for December have risen from roughly 35% last week to nearly 85% this week. The Fed enters its blackout period after Friday, with the policy decision due December 10.

Closing Levels:

- Dow Jones Industrial Average: +314.67 (+0.67%) at 47,427.12

- S&P 500: +46.73 (+0.69%) at 6,812.61

- NASDAQ Composite: +189.10 (+0.82%) at 23,214.69

J.P. Morgan now expects the Fed to deliver a December rate cut, adding momentum to the rally.

US Treasury sells 44 billion dollars in 7 year notes

The auction cleared at a high yield of 3.781 percent, slightly above the 3.775 percent when issued level. Demand leaned soft overall. The bid to cover came in at 2.46, below the six month average of 2.56.

Dealers took 9.44 percent, in line with norms. Direct bidders were strong at 30.27 percent, while indirect bidders, a proxy for foreign demand, were light at 56.65 percent. A quiet auction with weaker international interest and a high yield relative to WI levels.

Atlanta Fed GDPNow estimate dips

The Atlanta Fed GDPNow tracker slipped to 3.9 percent from 4.0 percent the day before.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 3.9 percent on November 26, down from 4.0 percent on November 25. After this morning’s advance durable manufacturing report from the US Census Bureau, the nowcast of third-quarter real gross private domestic investment growth decreased from 4.4 percent to 3.5 percent.

US mortgage rates slip again

Freddie Mac reports the average 30 year fixed mortgage rate at 6.23 percent, down from 6.26 percent a week ago. The recent cycle low is 6.19 percent, with the lowest reading since October 2022 at 6.09 percent.

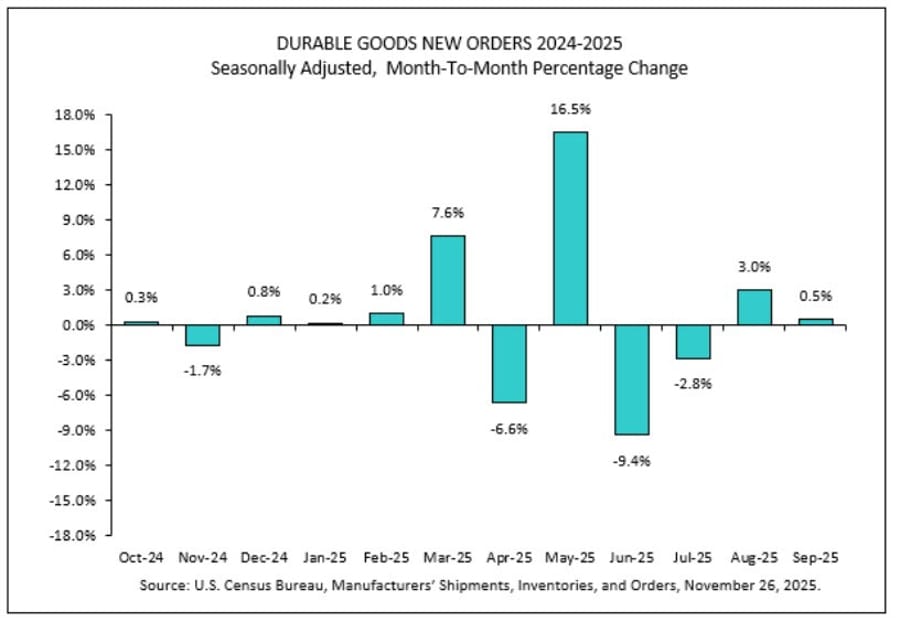

US durable goods orders beat expectations

Durable goods orders rose 0.5 percent in September, topping the 0.3 percent estimate. August was revised up to 3.0 percent. Orders excluding transport climbed 0.6 percent, also beating expectations.

Non-defense capital goods excluding aircraft, a key investment gauge, rose 0.9 percent. This adds to signs of steady business spending.

US jobless claims come in lower than expected

Initial jobless claims fell to 216,000, beating the 225,000 estimate. Continuing claims landed at 1.96 million, slightly below expectations. The trend still points to a labor market with low firing and low hiring.

The data does not shift the outlook for the Fed. Markets place the odds of a December rate cut near 79 percent.

US MBA mortgage applications edge higher

Mortgage applications rose 0.2 percent in the week ending 21 November. The market index ticked up to 317.6. Purchases climbed to 181.6 from 168.7, while refinancing slipped to 1090.4 from 1156.8. The 30-year mortgage rate moved up to 6.40 percent from 6.37 percent.

This release rarely moves markets.

HP Tops Q4 Estimates but Delivers Soft 2026 EPS Outlook

HP Inc. posted stronger fourth-quarter revenue but tempered expectations for fiscal 2026, while detailing a significant workforce overhaul. The company reported US$14.64 billion in revenue for the quarter ending October 31, beating expectations of roughly US$14.53 billion. Adjusted earnings were US$0.93 per share, slightly above forecasts.

HP now projects non-GAAP earnings of US$2.90 to US$3.20 for FY2026, below consensus of around US$3.32, and anticipates US$2.8 billion to US$3.0 billion in free cash flow. As part of a restructuring plan, HP will trim between 4,000 and 6,000 roles globally by FY2028, aiming for a gross run-rate savings target of US$1 billion. The plan carries expected charges of about US$650 million. Management highlighted persistent cost pressure in print and personal systems and reiterated its focus on AI PCs, workflow automation tools and sharpening its manufacturing footprint.

Federal Reserve November Minutes: Activity Little Changed

The Federal Reserve’s November Beige Book reported that overall US economic activity was little changed across most districts. Two districts noted modest declines, while one reported modest growth. Several contacts flagged rising risks of slower activity in the months ahead.

Key Themes:

- Employment: Slight decline; firms relying on hiring freezes and hour reductions rather than layoffs. AI adoption replaced some entry-level positions.

- Wages: Grew modestly; pressures firmer in manufacturing, construction, and healthcare.

- Prices: Rose moderately; tariffs contributed to higher input costs across manufacturing and retail. Some firms faced margin strain.

Regional Highlights:

- Boston: Mild expansion; housing stronger; modest wages and prices.

- New York: Slight activity decline; slow consumer spending.

- Philadelphia: Modest decline; government shutdown weighed on conditions.

- Cleveland: Mixed; AI-related manufacturing demand helped.

- Richmond: Slight growth; manufacturing contracted.

- Atlanta: Flat; home sales weaker; energy demand up.

- Chicago: Slight growth across most sectors.

- St. Louis: Softening demand; outlook slightly pessimistic.

- Minneapolis: Flat; consumer spending fell.

- Kansas City: Growth slowed; modest price inflation.

- Dallas: Slight decline; manufacturing a relative bright spot.

- San Francisco: Mixed; slight improvement in lending.

Fed rate-cut expectations for December remain steady near 84%.

Alphabet Approaches US$4 Trillion as Nvidia Falls on Chip Competition

Alphabet extended its rally on Tuesday, edging closer to a US$4 trillion valuation, while Nvidia slid as investors reassessed the dominance of its AI chips. Reports that Meta is exploring large-scale purchases of Google’s AI processors weighed on Nvidia, which dropped 2.6 percent and remains well below the US$5 trillion valuation touched weeks ago. Alphabet is up about 15 percent this month, while Nvidia is down roughly 12 percent. Investors are evaluating whether hyperscalers will diversify chip sourcing, a trend that could pressure Nvidia’s valuation while benefiting Alphabet and its cloud division.

Dollar Slips as Markets Weigh “Hassett Effect”

The US dollar eased after traders raised the probability that Kevin Hassett could become the next Federal Reserve chair. Mizuho Securities said the nomination risk has triggered concerns about potential politicisation of the Fed, adding uncertainty to the policy outlook even as senior officials continue to signal support for another rate cut next month.

Analysts said this “Hassett effect” is prompting markets to factor in a higher risk of future policy shifts influenced by political pressure.

Deutsche Bank Sees S&P 500 Hitting 8,000 by End-2026

Deutsche Bank set one of Wall Street’s most bullish equity targets, projecting the S&P 500 to reach 8,000 by the end of 2026. The bank said positioning has slipped back to underweight levels after reversing earlier in the year, providing room for renewed inflows. It argued that rate volatility, rather than rate levels, is driving equities. As volatility eases, Deutsche Bank expects stronger inflows, firmer valuations and sustained appetite for risk.

HP Plans Deeper Job Cuts as AI Overhaul Reshapes Workforce

HP will eliminate 4,000 to 6,000 roles as it moves to embed artificial intelligence across product development, customer support and internal operations. CEO Enrique Lores said many tasks will be handled more effectively by AI systems, calling the shift unavoidable for the sector. The restructuring is tied to a US$1 billion annual savings target by fiscal 2028 and will cost roughly US$650 million, including about US$250 million in FY2026. Lores said HP is transitioning from AI pilots to broad deployment, including AI agents that manage workflows and accelerate engineering cycles. Investors will watch whether long-run margin gains offset execution risks and slower revenue growth.

Dovish Daly Supports SGD as USD Softens

The Singapore dollar tracked higher as traders increased bets on Federal Reserve rate cuts. MUFG said sentiment has shifted risk-on, helped by comments from San Francisco Fed President Mary Daly, who signalled support for lower rates and warned about labour-market risks. Daly’s views often align with Chair Jerome Powell, reinforcing expectations of policy easing that have pressured the US dollar.

Canada PM Carney: Brief Talk With Trump, Washington Visit Planned

Canadian Prime Minister Mark Carney stated he had a short conversation with US President Trump on Tuesday. He plans to travel to Washington next week for the World Cup draw.

Carney noted that trade discussions with the US have not yet restarted, signaling that formal negotiations remain on hold for now.

Commodities News

Gold Rises as USD Weakens and Yields Fall

Gold climbed more than 0.80% on Wednesday, rising from $4,127 to trade near $4,165, supported by lower US Treasury yields and a softer US Dollar. Despite firm US economic data, expectations for a Fed rate cut in December remain anchored around 84%.

Data Highlights:

- Jobless claims hit the lowest since mid-April.

- Durable goods orders exceeded expectations, though eased from August.

Geopolitical Landscape:

- China–Taiwan tensions ticked higher after comments on shifting PLA flight patterns.

- Russia signaled partial openness to elements of the US Ukraine peace plan.

A successful Russia-Ukraine peace deal would be a headwind for gold, but dovish Fed expectations continue to underpin price support.

Crude Oil Futures Settle at $58.65

Crude oil futures rose $0.70 (+1.21%) to settle at $58.65. The session ranged between $57.66 and $58.69 as prices remained choppy but generally constructive.

Technically, crude reclaimed the 100-hour moving average at $58.24, stabilizing downside pressure. However, the price continues to trade below the 200-hour moving average at $59.01, leaving buyers unable to establish full control.

Resistance also remains at the broken trendline near $59.30. A break above both the 200-hour MA and this trendline would signal a more decisive bullish shift.

Baker Hughes Rig Count: U.S. -10, Canada -7

North American drilling activity declined this week, according to the latest Baker Hughes rig count.

United States:

- Total rigs: 544 (-10 w/w)

- Oil rigs: 407 (-12)

- Gas rigs: 130 (+3)

- Miscellaneous: 7 (-1)

- Year-on-year: -38 rigs (oil -70, gas +30)

Offshore rigs fell to 18, though still up 5 from a year earlier.

Canada:

- Total rigs: 188 (-7 w/w)

- Oil rigs: 121 (-7)

- Gas rigs: 67 (unch.)

- Year-on-year: -17 rigs

Crude oil inventories rise more than expected

Crude stocks rose by 2.774 million barrels, far above the 55 thousand estimate. Distillates increased by 1.147 million barrels and gasoline jumped by 2.513 million. Refining activity picked up, with utilization rising 2.3 percent compared with an expected 0.8 percent.

US crude production slipped to 13.814 million barrels a day from 13.834 million. WTI trades at 57.98 dollars, up 3 cents on the day.

Copper market still well supplied, says Commerzbank

ICSG data shows a 57 thousand ton deficit for September. After seasonal adjustment, the figure flips to a 17 thousand ton surplus, nearly unchanged from the previous month. For the first nine months of the year, the market recorded a 94 thousand ton surplus.

While the surplus is smaller than last year’s 310 thousand tons, the market remains adequately supplied. Commerzbank advises caution, noting that prices may have rallied ahead of confirmed deficits.

TDS says gold is no longer under owned

TDS strategist Daniel Ghali says the under owned phase in gold has passed. Recent 13F filings show a sharp increase in institutional ETF ownership. ETF options now carry a premium to Comex contracts, reversing a trend that began after the pandemic.

Funds linked to retail flows and hedge funds drove recent inflows. Ghali notes that gold benefited from the broad debasement trade throughout 2025, but positioning is now crowded and could be nearing an inflection point.

LME Copper nears 11,000 dollars per ton

Industrial metals extended gains as the weaker US dollar and stronger Fed rate cut expectations lifted sentiment. Markets now price an 80 percent chance of a December cut, up sharply from last week.

Supply issues added support. Codelco is pushing for a steep jump in premiums for refined copper deliveries to China, with offers near 335 to 350 dollars a ton over LME prices for 2026. That compares with 89 dollars for 2025.

Positioning shows caution. Net longs in aluminum fell to early July levels and copper net longs dropped to their lowest since late September.

Deutsche Bank raises 2026 gold forecast

Deutsche Bank lifted its 2026 gold forecast to 4,450 dollars from 4,000. The expected trading range sits between 3,950 and 4,950. The bank sees continued central bank buying as the key driver. The latest supply and demand data shows strong official sector demand diverting metal away from the jewelry market, while overall demand continues to outpace supply.

The bank adds a few risks. A deeper equity correction would hurt gold, and less Fed easing than markets expect would also weigh on it. A negotiated end to the Russia-Ukraine conflict could bring a temporary dip. Reserve managers could also slow their purchases, and sharp rallies in real gold prices often lead to heavy corrections.

They expect the stronger gold outlook to spill over into silver, platinum, and palladium. Tight supply has left silver and platinum in deficit, and elevated lease rates point to scarce physical metal. Palladium looks more balanced.

Oil slips as peace talks pressure energy markets

Oil prices pulled back as hopes for progress in Russia Ukraine talks grew. Reports suggest the US and Ukraine are signaling openness to a deal, while Moscow remains firm on positions discussed during the Alaska meeting. More clarity is expected as US envoy Steve Witkoff heads to Moscow.

API data shows crude inventories fell by 1.9 million barrels, less than the expected 2.4 million. Gasoline and distillate stocks rose. Gasoil cracks and time spreads continue to weaken. A peace deal would reduce a major supply risk tied to sanctions and drone strikes on Russian refineries.

European gas prices fall to 18 month low

TTF prices slipped another 1.2 percent as peace talks and mild weather expectations weighed on the market. The widening JKM to TTF spread raises the risk that LNG flows into Europe could begin to slow.

US Private Survey Shows Crude Draw as Gasoline and Distillates Rise

Private-sector oil data showed a larger-than-expected crude draw, with the American Petroleum Institute reporting a 1.9 million-barrel decline. Gasoline inventories rose 500,000 barrels, distillates increased 800,000 barrels and Cushing stocks slipped 300,000 barrels.

Europe News

European equity markets close higher

Major European indices finished the day in the green, led by Spain’s Ibex with a gain of 1.36 percent.

The closing snapshot:

• DAX up 0.98 percent

• CAC up 0.88 percent

• FTSE 100 up 0.5 percent

• Ibex up 1.36 percent

• FTSE MIB up 1.01 percent

UK OBR releases fiscal outlook early

The OBR published its fiscal outlook ahead of the budget. It now projects the current budget to reach a surplus of 21.7 billion pounds in 2029–30, up from a 9.9 billion buffer in March.

Key measures include a three-year extension of personal tax threshold freezes, higher dividend, property, and savings tax rates, and NICs on salary-sacrifice pensions. Together, the changes lift personal tax receipts by 14.9 billion. New taxes target property valued above 2 million pounds and electric and plug-in hybrid cars starting April 2028. Gambling tax reforms add another 1.1 billion.

Spending rises in every year and by 11 billion in 2029–30. As a share of GDP, the budget marks the third-largest medium-term tax increase since 2010.

Forecasts show GDP growth of 1.5 percent in 2025, 1.4 percent in 2026, and 1.5 percent in 2027. CPI inflation is projected at 3.5 percent in 2025 and 2.0 percent in 2027. Debt sits at 95 percent of GDP this year and ends the decade near 96 percent. The chance of meeting the fiscal target sits at 59 percent.

Switzerland November UBS investor sentiment improves

UBS and CFA Society Switzerland reported November sentiment at 12.2, up from minus 7.7 in October. The lift comes even as the current conditions index slipped to minus 4.9 from zero.

UBS notes that expectations for export momentum brightened after Switzerland and the US announced a joint declaration of intent on a trade agreement.

ECB commentary: rates appropriate, risks balanced

ECB Vice President Luis de Guindos said current interest rates remain appropriate. He is comfortable with the near-term inflation path and does not see inflation expectations slipping. Services and wage dynamics look constructive, and he is slightly more upbeat on growth. Overall, he sees balanced risks.

ECB’s Boris Vujcic added that climate change is making food inflation harder to predict, increasing the risk of surprises.

UK Chancellor Lifts Minimum Wage Ahead of Tax-Heavy Budget

UK Chancellor Rachel Reeves raised statutory pay levels across key age groups as she prepares to hand down a Budget focused on fiscal repair and growth. The national living wage for workers aged 21 and above will rise 4.1 percent, while pay for those aged 18 to 20 will jump 8.5 percent. Reeves will present the Budget on Thursday, aiming to stabilise the public finances, strengthen essential services, ease cost pressures and support productivity gains.

Asia-Pacific & World News

China issues plan to further boost consumption

Beijing rolled out another push to lift domestic demand. The plan calls for upgrades to consumer goods in rural areas, broader use of policies tied to equipment upgrades, and a full rollout of trade-in programs for household items. Officials expect consumption to take up a steadily larger share of economic growth by 2030.

The roadmap also highlights AI adoption across consumer sectors, stronger R&D for elderly-friendly products, and support for pet-related and trendy toy markets.

China Escalates Rhetoric Against Japan and Taiwan’s Ruling Party

China accused Japan and Taiwan’s Democratic Progressive Party of stoking tensions in the Taiwan Strait and warned against any external interference. Beijing criticised remarks by Taiwan’s “external affairs” chief Lin Chia-lung encouraging tourism and support for Japanese goods.

The Taiwan Affairs Office said it would respond firmly to any outside attempts to influence cross-Strait matters. The comments added to geopolitical unease, contributing to firmer gold prices alongside softer US yields and a weaker dollar.

Taiwan Says China Accelerating Military Preparations and Grey-Zone Pressure

Taiwan’s president warned that China is ramping up military, political and information pressure and accelerating preparations to seize the island by force. The president said Beijing is intensifying drills, grey-zone tactics and influence campaigns aimed at weakening Taiwan’s autonomy.

Taipei said it will strengthen defence capabilities and deepen partnerships with democratic nations to deter escalation and maintain regional stability.

China Accelerates AI-Driven Factory Overhaul to Protect Manufacturing Base

China is fast-tracking the integration of artificial intelligence across its industrial economy as it seeks to defend its position as the world’s dominant manufacturing hub. The push spans textiles, electronics, steel, cement and home appliances, with fully automated “dark factories” and AI-managed ports becoming more common.

The country installed 295,000 industrial robots last year—almost nine times the US total and more than the rest of the world combined. Forty-five of the 131 World Economic Forum-recognised advanced factories are in mainland China.

Beijing sees AI-enabled production as essential to offset rising labour costs, shortages and external pressure from tariffs. The political environment allows rapid deployment of automation, while China’s manufacturing ecosystems give it a scale advantage even as it lags in cutting-edge AI chips.

Wall Street Journal (gated)

The People’s Bank of China has set the onshore yuan at its strongest since 14 October 2024

- PBOC sets USD/ CNY reference rate for today at 7.0796 (vs. estimate at 7.0825)

- PBOC injects 213.3bn yuan at 1.40% via 7-day reverse repos

Australia CPI Overshoots, Undercutting Case for RBA Cuts

Australia’s October CPI surprised on the upside, coming in at zero percent month on month against expectations for a 0.2 percent decline. Annual inflation printed at 3.8 percent versus the 3.6 percent forecast, well above the Reserve Bank of Australia’s 2 to 3 percent target.

Core readings were also hotter: trimmed mean inflation rose 3.3 percent year on year and 0.3 percent on the month. The weighted median index climbed 3.4 percent year on year. The data signals sticky price pressures and dims prospects for near-term RBA easing.

RBNZ Governor Hawkseby Says Baseline Assumes Rates Hold Through 2026

Following the RBNZ’s 25-basis-point cut, Governor Paul Hawkseby said the central projection assumes the cash rate stays unchanged through 2026. Hawkseby said the committee sees balanced risks, improving high-frequency data and a stabilising labour market. He reiterated that all options remain open and noted lingering concerns about global inflation pressures.

RBNZ Cuts Rates Another 25 bps, Signals Pause Ahead

The Reserve Bank of New Zealand delivered a third consecutive 25-basis-point cut, taking the Official Cash Rate to 2.25 percent. The committee debated holding at 2.50 percent but voted 5–1 to lower the rate. Updated projections show the OCR at 2.25 percent in March 2026 and 2.28 percent in December 2026, down from prior forecasts.

The board said inflation is expected to fall to around 2 percent by mid-2026, although annual CPI rose to 3 percent in the September quarter. Policymakers noted spare capacity in the economy and a stabilising labour market. They said future moves depend on medium-term inflation dynamics and overall economic momentum.

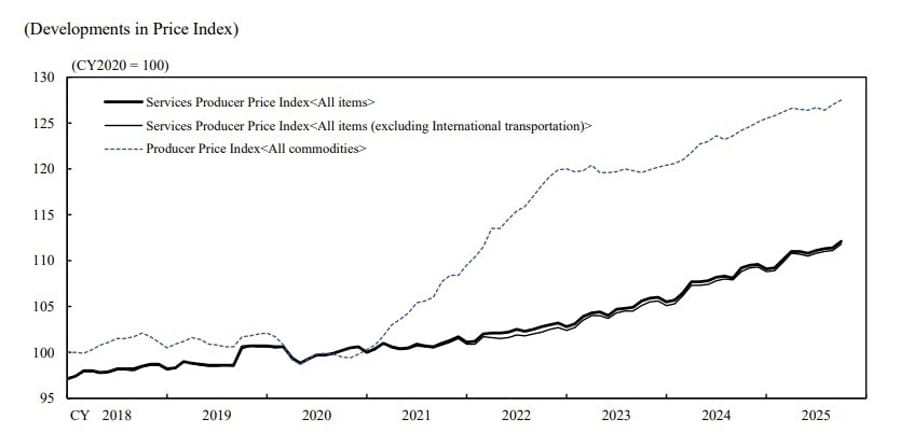

Japan’s October Services PPI Rises 2.7 Percent

Japan’s October Services Producer Price Index increased 2.7 percent year on year, matching expectations but below the previous 3.0 percent reading. The data shows continued price gains in labour-intensive industries, including hotels and construction, supporting the BOJ’s view that tight labour conditions are feeding service-sector inflation.

BOJ Signals Near-Term Hike as Yen Slide and Politics Shift

The Bank of Japan has intensified hawkish messaging as the yen weakens and political objections to tightening ease. Officials familiar with internal discussions told Reuters that the BOJ is intentionally highlighting inflation risks tied to currency weakness, keeping a December hike in play.

Governor Ueda and Prime Minister Sanae Takaichi recently met, reducing political hesitation over further tightening. Several board members, including Junko Koeda and Kazuyuki Masu, are now seen as open to a move to 0.75 percent.

Markets remain split on whether the BOJ acts in December or waits until January, with the US Federal Reserve’s decision likely to influence the timing.

BOJ Board Turns More Hawkish as Ueda Keeps Timing Flexible

Support for near-term tightening is widening inside the Bank of Japan, raising the probability of a hike either in December or January. Kazuyuki Masu, who had been cautious earlier this year, said the moment for a move is “approaching.” Junko Koeda voiced support for continued policy normalisation without committing to December. Asahi Noguchi, typically among the most dovish, will speak Thursday after signalling a more hawkish stance in September.

Former BOJ official Hideo Momma said the latest comments remain within Governor Kazuo Ueda’s own guidance. Momma noted that Ueda has left both December and January open, and the board is expected to follow the month the governor ultimately selects.

South Korea Warns of Tough Measures as Won Faces Speculative Pressure

South Korea’s finance minister signalled a firmer stance against rapid won moves, warning traders against speculative behaviour. Minister Koo Yun-cheol said the currency has been reacting more sharply than peers due to domestic structural factors and expectations of further weakness.

Authorities have held talks with brokerages and remain in contact with the National Pension Service, though the NPS will not be instructed to support the won. Koo said all policy tools remain available should volatility intensify.

Crypto Market Pulse

Bitcoin Rallies After Break Above 200-Hour Moving Average

Bitcoin surged after decisively breaking above its 200-hour moving average at $87,691—a level that had capped gains throughout the week.

BTC has been rebounding from its November 21 low of $80,533 but remains well below the late-October peak near $116,381. The latest upside move pushed the price above Monday’s high and to a fresh intraday peak of $89,698.

With buyers back in control, the next major resistance sits at the 38.2% Fibonacci retracement of the October–November decline at $94,229.

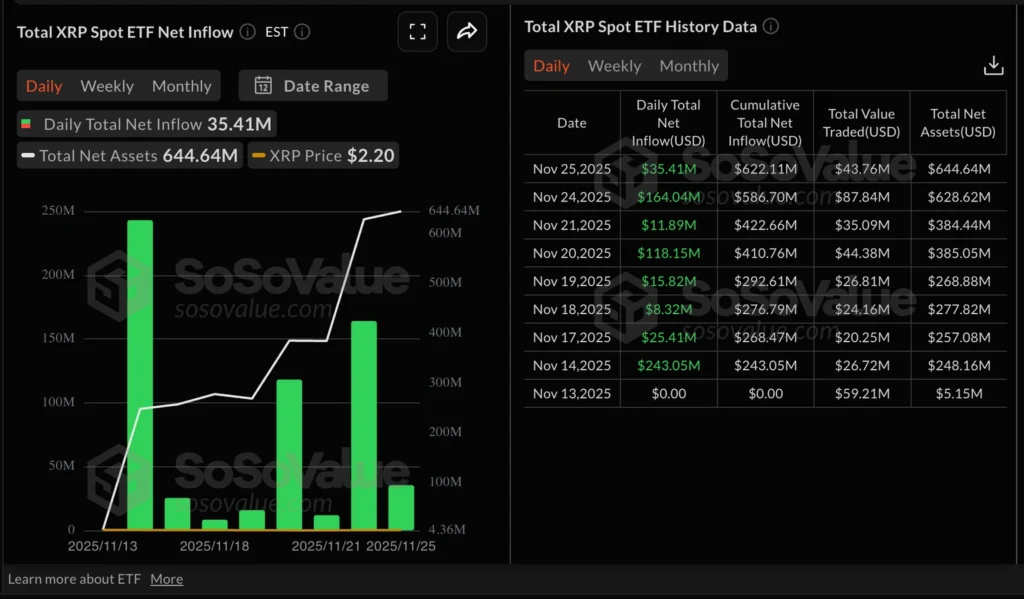

XRP extends losses despite ETF inflows

XRP trades at 2.17 dollars after two days of declines. The token failed to break above 2.30 on Monday and sentiment remains weak even as ETFs continue to attract capital.

Four US listed XRP ETFs have gathered 622 million dollars in cumulative flows. Tuesday alone saw 35 million in inflows.

Retail activity remains soft. Open interest sits below 4 billion dollars, well off its July peak near 11 billion. Without stronger participation, upside momentum may stay limited.

Monero, SPX6900 and Jito push higher

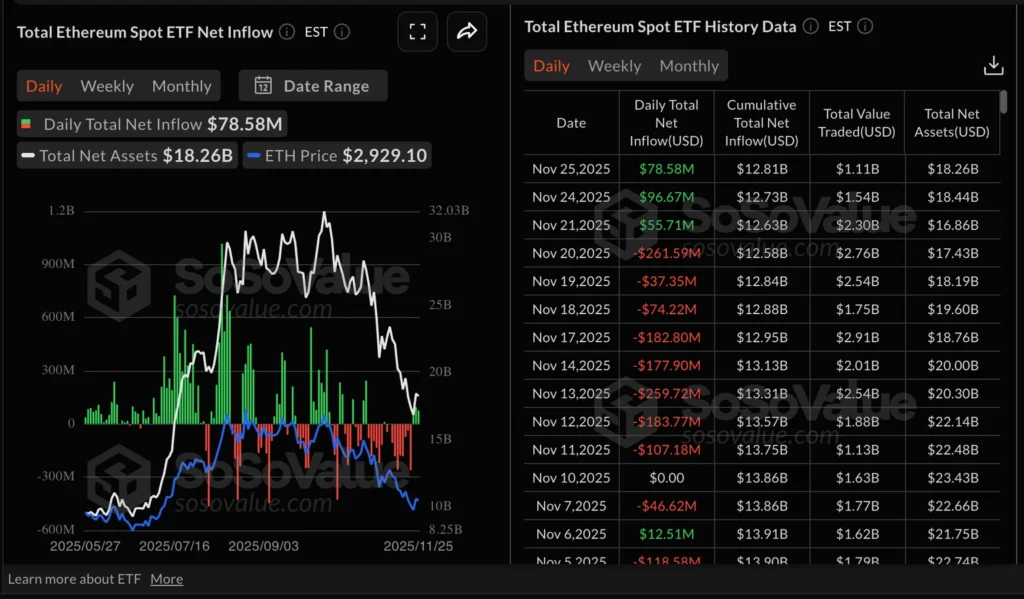

Monero, SPX6900 and Jito gained on Wednesday while the broader crypto market struggled to maintain momentum. Bitcoin trades above 87,000 dollars and Ethereum trades near 2,900.

Monero sits at 398 dollars, holding above key moving averages. MACD and RSI point to steady buying, though resistance at 420 remains firm.

SPX6900 trades at 0.66 dollars with a four day rally supported by a MACD buy signal. The 50 day EMA near 0.79 may cap gains.

Jito reclaimed the 50 EMA on the four hour chart and continues to recover from a 0.44 dollar low. Bulls target the 100 EMA near 0.59 and the 200 EMA near 0.74.

Crypto rebound remains weak

The global crypto market cap edged up 0.6 percent to 3.02 trillion, but price action stays sluggish. Bitcoin has hovered around 87,000 for three days. Risk appetite in equities and a softer dollar helped, yet crypto has not responded with meaningful strength.

Analysts point to year end profit taking, institutional caution and reduced appetite after October’s sharp drop. Some metrics still hint at long term upside. CryptoQuant says Bitcoin’s risk return ratio is the most attractive since mid 2023. Citigroup expects Bitcoin to stay in an 82,000 to 90,000 range through the first quarter of 2026.

Data also shows large Binance traders holding a long to short ratio above 3.8, the highest in more than three years. At the same time, many public companies holding Bitcoin face liquidity pressure, according to Cointab.

Bitcoin Steadies Above US$87,000 as ETF Inflows Return

Bitcoin stayed above US$87,000 on Wednesday, supported by renewed ETF inflows following weeks of volatility. US-listed Bitcoin ETFs saw US$128 million of inflows on Tuesday, indicating tentative institutional interest returning after the October 10 flash crash.

Ethereum ETFs recorded a third straight day of inflows—US$79 million Tuesday, US$97 million Monday and US$56 million Friday. Fidelity’s FETH led with nearly US$48 million, followed by BlackRock’s ETHA at US$46 million.

XRP remains below its 50-day moving average despite steady institutional participation. ETF flows will help determine whether crypto can sustain a move toward US$90,000 as macro uncertainty lingers.

Ark Invest Adds US$9.1 Million in Circle and Bullish as Crypto Stocks Slide

Ark Invest purchased US$7.6 million in Circle shares and US$1.5 million in Bullish stock on November 25, extending its buying streak even as crypto-linked names continue to fall. Bitcoin was trading near US$87,500 at the time. Bullish, parent of CoinDesk, closed at US$40.50, down 2.41 percent, while Circle finished 3.62 percent lower at US$70.11.

Ark also bought 15,197 shares of Coinbase worth about US$3.86 million. COIN is down around 30 percent over the month.

Ark holds US$151.8 million of Bullish across its funds, while Coinbase and Circle remain the firm’s largest crypto-exposed positions at 4 percent and 2 percent of total holdings respectively.

South Africa Flags Rising Crypto Risks as Users Hit 7.8 Million

South Africa’s Reserve Bank warned of growing vulnerabilities as the country’s crypto user base reached 7.8 million by July 2025. Luno, VALR and Ovex held US$1.5 billion in customer assets at the end of 2024, according to SARB’s latest Financial Stability Review. Account numbers have nearly doubled since early 2022, driven by inflation, rand weakness and demand for digital savings and remittances.

USD-pegged stablecoins overtook Bitcoin as the most-traded pairs in 2022, with stablecoin volume climbing from under 4 billion rand in 2022 to nearly 80 billion rand by October 2025. Regulators warn the instruments remain untested during stress events.

South Africa’s framework remains incomplete, with the Financial Stability Board rating the regime only “partially adequate.” Crypto’s cross-border nature allows users to bypass capital controls, raising concerns about hidden outflows in a high-debt economy.

The FSCA began licensing exchanges in 2022, with more than 300 applications submitted. Authorities are drafting rules for stablecoin issuers, though reforms lag rapid adoption. SARB warned that without tighter oversight, crypto could amplify shocks to liquidity and exchange rates. Broader risks from AI and quantum technologies were noted, but crypto remains the most immediate structural concern.

The Day’s Takeaway

North America

US equities extended their rally. All major indices closed higher for a fourth straight session, lifted by surging rate-cut expectations. The NASDAQ led with a gain of 0.82 percent. Odds of a December Fed cut now sit near 85 percent after comments from NY Fed President Williams and confirmation that the Fed enters blackout after Friday. J.P. Morgan expects a December cut.

US jobless claims landed below expectations at 216,000, with continuing claims at 1.96 million. Durable goods orders beat forecasts at 0.5 percent, and core capital goods rose 0.9 percent. Mortgage applications edged up 0.2 percent, while Freddie Mac reported the 30-year mortgage rate at 6.23 percent, down slightly on the week.

The November Beige Book showed little change in overall activity. Labor markets softened through hiring freezes and hour reductions, while wage growth stayed modest. Firms continued to report higher input costs tied to tariffs.

HP beat Q4 expectations but warned on FY2026 earnings and confirmed a major reduction of 4,000 to 6,000 jobs as part of its AI-driven restructuring. Alphabet advanced toward a 4 trillion dollar valuation as investors reassessed chip competition between Nvidia and hyperscalers. Deutsche Bank set an aggressive S&P 500 target of 8,000 by end-2026.

The dollar slipped as markets weighed the potential “Hassett effect” on Fed policy. Canada’s Prime Minister Carney confirmed a brief call with President Trump and noted that trade talks remain on hold until further notice. The Atlanta Fed’s GDPNow estimate eased to 3.9 percent.

Commodities

Crude inventories rose sharply, with US crude stocks up 2.774 million barrels. Distillates and gasoline increased as refinery utilization jumped 2.3 percent. US crude production edged down to 13.814 million barrels. WTI traded near 58 dollars. A separate API survey showed a crude draw, while gasoline and distillates rose in both sets of data.

Oil futures settled at 58.65 dollars, supported early in the session but pressured by progress in Russia-Ukraine peace discussions. Time spreads weakened, and a potential peace agreement would reduce a major geopolitical supply premium.

Baker Hughes reported a notable drop in North American drilling. US rigs fell by 10 and Canada’s by 7 for the week.

Gold continued to climb, supported by lower yields and a softer dollar. TDS said gold is no longer under owned as ETF allocations rise. Deutsche Bank increased its 2026 gold forecast to 4,450 dollars. They flagged crowded positioning as a near-term risk. The firmer gold outlook extended to silver, platinum and palladium.

LME copper pushed toward 11,000 dollars per ton as supply concerns and stronger Fed cut expectations boosted sentiment. Codelco sought sharply higher premiums for 2026 deliveries to China. Meanwhile, ICSG data showed the copper market remains adequately supplied on a seasonally adjusted basis. European gas fell to an 18-month low.

Europe

European equity markets closed firmly higher. Spain’s Ibex led with a 1.36 percent gain, followed by broad advances across the DAX, CAC, FTSE 100 and FTSE MIB.

The UK’s Chancellor raised the national living wage ahead of a tax-heavy Budget. The OBR released its fiscal outlook early, projecting a larger medium-term surplus driven by extended threshold freezes and higher taxes across dividends, property and savings. Inflation is expected to reach 2 percent in 2027.

ECB officials said current rates remain appropriate. Vice President de Guindos sees balanced risks and stable inflation expectations. Vujcic highlighted weather-driven volatility in food inflation. Switzerland’s UBS investor sentiment improved sharply into November.

Switzerland’s trade expectations improved following a joint declaration with the US. UBS/CFA data showed sentiment moving notably higher despite weaker current conditions.

Asia

The BOJ continued to lean more hawkish. Multiple board members signaled openness to a December or January hike, while Governor Ueda maintained optionality. Japan’s services PPI rose 2.7 percent. A Reuters report said the BOJ is intentionally stressing inflation risks to manage yen expectations.

China rolled out a new plan to boost consumption, focusing on rural upgrades, trade-in programs, AI adoption and market expansion in elderly-friendly and pet-related products. Beijing continued to accelerate AI-driven industrial automation to protect its manufacturing base.

Tensions rose as China escalated criticism toward Japan and Taiwan’s ruling party. Taiwan said China is accelerating military and grey-zone pressure.

Australia’s CPI overshot expectations, dimming prospects for near-term RBA easing. Core readings remained sticky. The RBNZ cut rates another 25 basis points to 2.25 percent but signaled a likely pause. Governor Hawkseby said the baseline outlook assumes rates hold through 2026. South Korea warned of speculative pressure on the won.

Crypto

Bitcoin held above 87,000 dollars with renewed ETF inflows, including 128 million dollars into US BTC products. Ethereum ETFs posted a third day of positive flows. Analysts expect a range between 82,000 and 90,000 into early 2026. Binance trader positioning showed long-to-short ratios at multi-year highs.

BTC broke back above its 200-hour moving average and reached an intraday high near 89,700. Key resistance sits near 94,229.

Altcoins showed mixed action. Monero, SPX6900 and Jito gained, with several reclaiming short-term moving averages. XRP extended losses despite steady ETF inflows and sits near 2.17 dollars. Broader crypto momentum remains soft as institutions show caution and year-end profit taking continues.

Ark Invest added more than 9 million dollars in Circle and Bullish, plus additional Coinbase. South Africa warned that crypto adoption is outpacing regulation, raising systemic risks.

South Africa’s Reserve Bank flagged rising crypto-linked risks as domestic users reached 7.8 million. Regulators warned that stablecoin flows could complicate capital-flow monitoring and amplify liquidity shocks in a high-debt environment.