North America News

Stocks sink as buyers at the open turn into heavy sellers by the close

A strong open turned into a brutal close as major indices gave up big early gains and finished deep in the red. Hopes that Nvidia’s blowout earnings would revive risk appetite faded fast once buyers lost control of the tape.

The NASDAQ swung more than one thousand points from high to low. It was up 583 at the peak and closed down 486, a drop of 2.15 percent.

The S&P 500 was up 128 at the highs and ended down 103, a loss of 1.55 percent.

The Dow rose 718 at its best level and finished down 386, a decline of 0.84 percent.

Nvidia set the tone. The stock opened strong after beating estimates and jumped more than 5 percent at the session high. Once it slipped back under key hourly moving averages, selling accelerated. Nvidia closed at 180.98 dollars, down 2.97 percent, and only a touch above its 100 day moving average at 180.08. The day’s top tick hit 196.

The selloff hit a wide range of names. Notable losses included:

Nebius NV down 11.01 percent

Micron down 10.87 percent

Robinhood down 10.11 percent

Western Digital down 8.92 percent

AMD down 7.84 percent

Moderna down 7.53 percent

Palo Alto Networks down 7.47 percent

DoorDash down 7.21 percent

Uber down 6.88 percent

SoFi down 6.77 percent

Oracle down 6.59 percent

Super Micro Computer down 6.34 percent

Lam Research down 6.18 percent

Roblox down 5.82 percent

Palantir down 5.81 percent

ASML ADR down 5.57 percent

MicroStrategy down 5.02 percent

Stellantis down 4.85 percent

Celsius down 4.83 percent

Corning down 4.64 percent

Intel down 4.24 percent

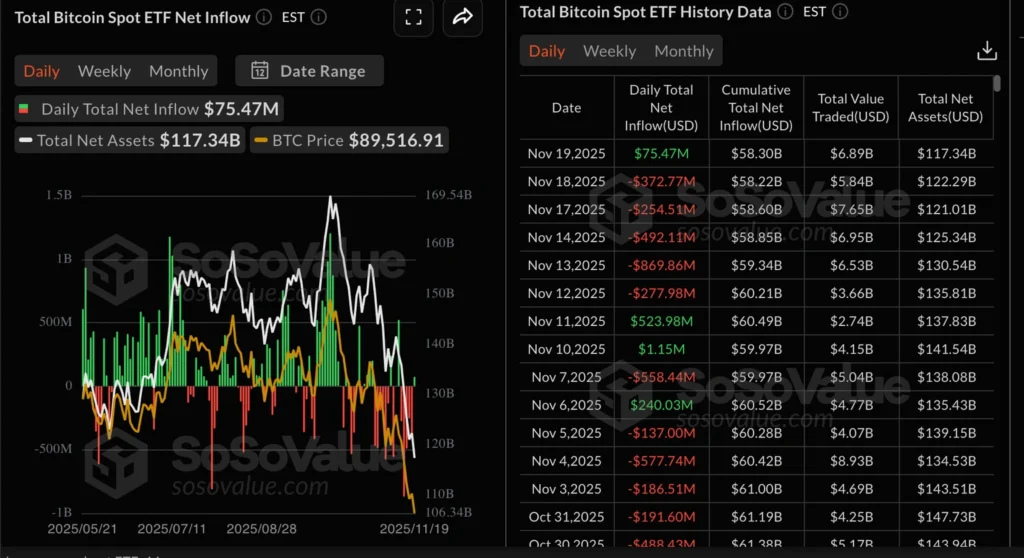

Bitcoin joined the risk off move and dropped to 86,538 dollars, its lowest level since April.

A day that started with confidence ended with investors shell shocked. It was a clear case of the market snatching defeat from the jaws of victory.

US September jobs report: Better headline, mixed picture

The first NFP release since the government shutdown came in at +119K, stronger than the +50K expected. Prior data was revised down to -4K.

Private payrolls rose 97K. Manufacturing lost 6K jobs, slightly better than expected. Government hiring added 22K after a negative reading last month.

Unemployment ticked up to 4.4 percent. Earnings slowed to 0.2 percent month over month. Participation rose to 62.4 percent. The two month net revision came in at -33K.

This is the final jobs print before the December 10 FOMC decision. Markets price only a 21 percent chance of a rate cut, and this report does not offer a strong reason to shift that view.

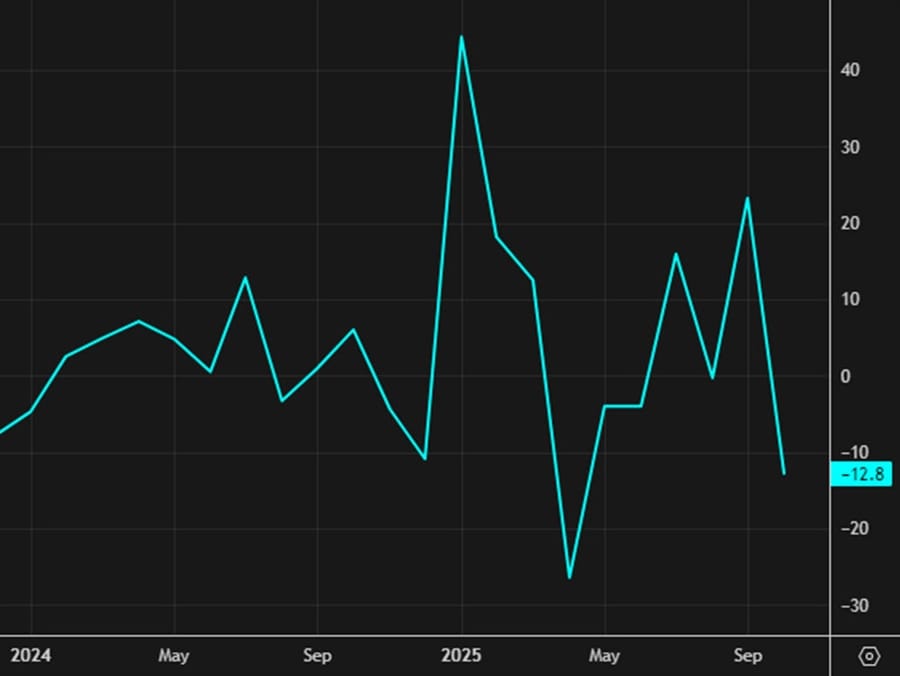

Philly Fed index falls back into negative territory

The November Philly Fed index came in at -1.7, below the +2.0 expected. Last month’s reading was -12.8.

Employment improved slightly. Prices paid jumped to 56.1, an unwelcome sign for inflation watchers. New orders slipped back into negative after two positive months. Shipments fell. Unfilled orders declined again.

Six month expectations improved to 49.8, which leans hawkish. A special survey question showed firms expect their own prices to rise 3.0 percent over the next year, down from 4.1 percent in August. Expected compensation costs eased slightly.

The report offers no clean narrative. Some indicators hint at cooling. Others point to sticky pricing pressure.

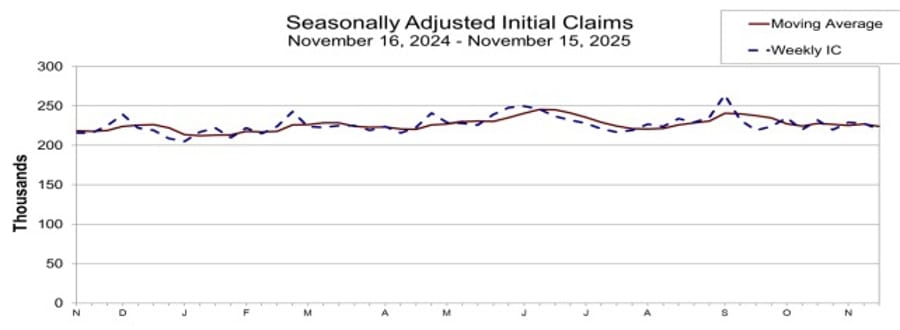

US jobless claims stay firm

Initial jobless claims came in at 220K versus the 230K estimate. The four week moving average declined to 224.25K. Continuing claims ticked higher to 1.974 million.

Like the September jobs report, this data shows no clear sign of weakening in the labor market.

US existing home sales edge higher

Existing home sales for October came in at 4.10 million, slightly above expectations. This is a 1.2 percent monthly gain. Inventory stands at 4.4 months. Median home prices rose 2.1 percent from a year earlier.

Fed officials highlight concerns on inflation and market risks

Chicago Fed President Goolsbee said inflation appears stuck around 3 percent and remains too high compared with the Fed’s 2 percent target. He believes rates can fall in the long run but is uneasy about the current inflation backdrop.

Governor Cook noted that not all market volatility is harmful, but pointed to vulnerabilities in hedge fund Treasury strategies. She retains her position for now after the Supreme Court declined to fast track a removal request.

Fed’s Hammack warns against cutting rates

Fed member Hammack, who votes in 2026, delivered a clear message. Cutting rates now risks keeping inflation high. Easing could also fuel financial risk taking and distort asset pricing. She noted that banks remain well capitalized and household finances look healthy.

Her remarks suggest no support for near term rate cuts.

Barclays Lifts 2026 S&P 500 Target to 7,400 on Mega-Cap Tech Momentum

Barclays has raised its S&P 500 target for end-2026 to 7,400, up from 7,000, citing the sustained strength of mega-cap technology and support from expected Federal Reserve rate cuts. Reuters reported the bank also boosted its earnings forecast for the index to $305 from $295, predicting that AI-linked tech leaders will outperform even in a subdued growth environment.

Despite its optimistic view on tech, Barclays highlighted risks beyond the sector. Rising unemployment, persistent inflation and weakening consumer sentiment could curb earnings elsewhere. The bank also flagged that while tariff escalation appears unlikely, some price pressures have yet to reach consumers, adding downside risk as the U.S. approaches midterm elections.

U.S. Set to Approve Major AI-Chip Exports to UAE and Saudi Arabia Under Strict Curbs

The U.S. Commerce Department is preparing to authorise exports of up to 70,000 advanced Nvidia AI-chip servers to state-aligned technology firms in the UAE and Saudi Arabia, the Wall Street Journal reported. The move represents a reversal of earlier hesitation inside the administration, where security concerns had delayed sales.

Under the plan, each country could obtain as many as 35,000 Nvidia GB300 systems, built around the Blackwell B300 processor. The approved buyers are G42 in Abu Dhabi and Humain in Saudi Arabia. AMD, which has already secured a multibillion-dollar partnership with Humain, is also expected to benefit.

Officials say the licences will include stringent safeguards designed to block any diversion of technology to China or Huawei, reflecting Washington’s dual priorities of controlling China’s access to frontier AI hardware while strengthening ties with Gulf partners.

Trump Considers Executive Order Challenging State-Level AI Rules

President Trump is weighing an executive order that would confront state efforts to regulate artificial intelligence, according to a draft viewed by Reuters. The proposal would instruct Attorney General Pam Bondi to create an “AI Litigation Task Force” charged with challenging state laws deemed to infringe on interstate commerce or conflict with federal authority.

The order would also direct the Commerce Department to examine state AI legislation and potentially withhold federal broadband funding from states whose rules diverge from national priorities. The move would set up a direct confrontation over regulatory control as states draft their own AI guardrails.

Canada producer prices run hot

Canada’s October producer price index rose 1.5 percent, far above the 0.3 percent estimate. Year over year prices increased 6.0 percent. The raw materials price index gained 1.6 percent.

Pipeline inflation remains firm, which may complicate the outlook for rate cuts.

Commodities News

Gold slips as strong jobs data and hawkish Fed comments drive traders out of havens

Gold fell on Thursday as a stronger than expected US jobs report and firm Fed rhetoric pushed traders toward the dollar and away from safe assets. Prices were down 0.38 percent and trading near 4,061 dollars after an early rally faded.

The September payrolls report came in mixed but still stronger than forecasts. Nonfarm Payrolls rose by 119,000, more than double the estimate of 50,000. Unemployment rose from 4.3 to 4.4 percent, which stays within the Fed’s outlook.

Gold initially spiked to 4,110 dollars after the release. The move reversed once Fed officials signaled they remain uneasy about inflation. Cleveland Fed President Beth Hammack warned that progress has stalled. Fed Governor Michael Barr said he is concerned that inflation is still sitting near 3 percent.

Rate cut expectations shifted but remain uncertain. Odds of a quarter point cut in December rose to about 39 percent from 30 percent the day before, based on CME FedWatch data.

However, Wednesday’s FOMC minutes showed that many policymakers prefer to hold off on easing at the December meeting.

The push and pull between mixed data, hawkish signals and shifting rate expectations kept gold under pressure through the session.

WTI steadies but the bearish trend still dominates

WTI crude inched higher on Thursday, recovering part of Wednesday’s sharp drop, as traders showed caution ahead of the US sanction deadline on two major Russian oil firms. Prices were up about 0.70 percent and trading near 59.70 dollars.

The sanctions deadline is seen as a short term supply risk, but the broader backdrop still weighs on crude. Concerns about oversupply, uneven demand and soft global growth continue to cap rallies.

The technical setup remains weak. WTI trades below the 50 day and 100 day moving averages, and sellers continue to defend the 61.50 to 62.00 zone.

Momentum indicators have improved slightly. RSI is holding steady and MACD is turning a bit higher, which hints at stabilization but not a trend change.

For now, crude is catching its breath, but the upside remains limited unless supply risks materialize or demand shows real signs of life.

Hedge funds and retail drive the latest Gold rally

TDS says the recent strength in Gold has been powered by hedge funds and retail traders, whose inflows have far exceeded central bank purchases. Official sector buying still provides a floor, but it is not strong enough to fuel another explosive rally on its own.

TDS Strategist Daniel Ghali notes that retail flows tend to react quickly to shifts in the Fed outlook. A prolonged pause could be the trigger that cools demand.

Chile raises Copper price forecasts

Chile, the world’s biggest Copper producer, lifted its price forecasts for this year and 2026. Cochilco now expects prices to average 4.45 dollars this year and 4.55 dollars next year, helped by global supply disruptions, lower rates, a softer dollar and resilient demand.

Disruptions remain a major factor. Chile now sees no production growth for 2025 after an accident at the El Teniente mine. Growth in 2026 depends on that mine returning to normal operations, which Codelco says is unlikely.

Oil slips as peace discussions ease supply concerns

Brent settled about 2.1 percent lower after reports surfaced that the US and Russia are working on a Ukraine peace plan. Even if the plan is unlikely to gain Ukraine’s support, the effort reduces fears of tougher sanctions on Russia.

US crude inventories fell by 3.43 million barrels due to stronger exports and increased refinery activity. Gasoline stocks rose and demand softened, pressuring gasoline cracks.

European Gas prices retreat on peace talk reports

European natural Gas prices fell about 2.4 percent, weighed down by reports of US Russia peace discussions even as colder weather increased storage withdrawals. EU storage is now 81 percent full, down from mid October peaks.

Funds cut their net long positions and added fresh shorts, pushing gross shorts to a record high. The market now faces the risk of a sharp squeeze if supply surprises hit or cold conditions persist.

Gold consolidates ahead of key US data

Gold wiped out last week’s short squeeze and is now sitting near key levels ahead of the September NFP and Jobless Claims reports. Strong data should keep pressure on gold because it supports the idea that the Fed could pause rate cuts. Weak data should help the metal since it gives the Fed more room to ease.

The bigger trend still leans higher because real yields are likely to keep falling if the Fed maintains a dovish stance. In the short term, hawkish repricing in rates is a headwind.

On the 4 hour chart, support sits near 4020 with trendline confluence. If price hits that area, buyers are likely to step in with defined risk. A bounce could target the 4150 resistance. Sellers want a clean break below support, which would open the door toward 3820.

On the 1 hour chart, a counter trendline caps the current pullback. Sellers will likely lean on it with stops above. Buyers want to see a breakout before increasing long exposure toward resistance.

Europe News

Eurozone consumer confidence holds weak levels

Eurozone flash consumer confidence for November came in at minus 14.2, matching the prior reading and slightly below expectations of minus 14.0. Sentiment remains stuck in pessimistic territory as households continue to face tight financial conditions.

Eurozone Construction Output Slips 0.5 Percent in September

Eurostat data showed a 0.5 percent month-on-month decline in Eurozone construction output for September, following a 0.1 percent fall previously. The report rarely affects markets and is viewed primarily as a backward-looking indicator.

Germany’s October Producer Prices Rise 0.1 Percent; Year-on-Year Decline Driven by Energy

German producer prices edged up 0.1 percent in October, slightly above expectations, while falling 1.8 percent from a year earlier. Destatis said lower energy costs remained the key driver of the annual decline, while intermediate goods were also cheaper. Excluding energy, producer prices were up 0.8 percent year-on-year and down 0.1 percent month-on-month. The data is not expected to influence ECB policy.

UK Factory Orders Remain Weak According to CBI Survey

The CBI’s November trends survey reported total orders at minus 37, slightly better than the prior minus 38 but below expectations for minus 33. The index, which tracks order flows across domestic and export markets, has hovered between minus 18 and minus 36 for several years. The release is not considered market-moving.

UK Consumer Confidence Sees Steep Drop as Households Brace for Tax and Cost Pressures

UK consumer sentiment posted its sharpest decline since April, according to a survey by Opinium for the British Retail Consortium. Expectations for the broader economy fell to minus 44 percent, from minus 35 percent in October, while personal-finance expectations slid to minus 16 percent.

The BRC said the deterioration reflects rising concern about household budgets, cost pressures and speculation over possible income-tax increases. With spending intentions weakening ahead of Christmas, attention turns to Finance Minister Rachel Reeves’s budget on 26 November.

ECB’s Makhlouf: I’m comfortable with where monetary policy is

- Comments from the ECB policymaker, Gabriel Makhlouf

- Need compelling evidence to change my view

- We should be very cautious in reacting to small deviations in the projections

- New projections unlikely to show significant change

- Completely relaxed about undershooting next year, inflation will come back

- Risks around the inflation outlook are balanced

Asia-Pacific & World News

China raises concerns in talks with the US

China’s commerce minister met with the US ambassador to discuss trade ties. China raised concerns about tariffs, export controls and investment restrictions. Both sides called for better management of uncertainty. China also restated its position on Nexperia.

China Keeps LPRs Unchanged for Sixth Month as Policymakers Tread Carefully

China kept its one-year and five-year loan prime rates steady at 3.0 percent and 3.5 percent in November, matching forecasts from a Reuters poll. With credit demand still weak and the property sector under pressure, authorities are reluctant to cut rates further due to strain on bank margins and the risk of capital outflows.

Although the LPR remains the key reference rate for lending and mortgages, China’s main policy lever is now the seven-day repo rate, currently at 1.4 percent.

Beijing Examines New Real-Estate Support Measures; Developer Shares Rise

Chinese policymakers are reviewing a package of nation-wide housing support options aimed at stabilising the deteriorating property market, according to people familiar with the discussions. Proposals include mortgage subsidies for first-time buyers, larger income-tax rebates for homeowners and lower transaction costs.

The measures have been under review since at least the third quarter as sales and prices continue to slide. While no final decisions have been made, the deliberations signal growing concern about stress spreading to banks and local-government finances. Property-sector stocks rose on the report.

White House Opposes Congressional Push for Tighter Nvidia Export Controls

The White House is urging lawmakers to reject proposed legislation that would impose stricter limits on shipments of advanced AI chips to China and other overseas buyers, Bloomberg reported. The bill, part of the GAIN AI initiative, would require chipmakers to serve U.S. demand before exporting, potentially restricting Nvidia’s global business.

Administration officials argue that sweeping controls would undermine U.S. leadership in AI hardware, drive customers to foreign alternatives and weaken the domestic industry. Some major U.S. cloud providers support the bill, saying it would help secure chip supply for domestic buyers. With the measure tied to defence legislation, the final outcome will depend on negotiations between Congress and the White House.

China’s Loan Prime Rates Steady as PBOC Leans on Repo Benchmark

Asia’s economic calendar opened quietly, with China’s central bank keeping its benchmark lending rates unchanged as its policy focus continues to shift toward the seven-day reverse repo rate. The People’s Bank of China has relied on the repo rate as its primary instrument since mid-2024, aligning its framework more closely with major central banks that steer markets through a single short-term rate.

China’s one-year LPR remains at 3.0 percent, and the five-year rate sits at 3.5 percent, both unchanged since May’s 10-basis-point reduction. The shorter tenor guides most corporate and household loans, while the five-year rate anchors mortgage pricing.

Washington Slows Push Toward Chip Tariffs as Officials Warn of China Blowback

The White House is recalibrating its approach to semiconductor tariffs, easing away from expectations of imminent duties as officials weigh the risk of economic fallout and renewed tension with Beijing. According to Reuters, several U.S. officials have privately told lawmakers and industry groups that tariff plans remain under review and may not roll out on the timeline previously signaled.

Senior figures fear steep levies could raise consumer prices and spark another cycle of retaliatory trade measures. The administration also faces concerns about supply chains tied to rare earth materials critical for chip fabrication. While Washington publicly insists its tariff posture is unchanged, the internal debate reflects anxiety about inflation, political sensitivities heading into the holiday season, and the delicate calm reached during President Trump’s recent meeting with China’s Xi Jinping in Busan.

National security investigations launched in April opened the door to tariffs near 100 percent on foreign-produced chips, excluding firms investing in U.S. production. But the scope and timing remain unsettled as policymakers gauge geopolitical and economic risk.

Nvidia Projects $500 Billion Chip Pipeline Through 2026, Flags Ongoing China Weakness

Nvidia executives delivered a notably bullish long-range outlook, saying demand for next-generation Blackwell and Rubin chips now provides visibility on roughly $500 billion in revenue from early 2024 through 2026. CFO Colette Kress told analysts that Nvidia expects to be the preferred supplier for what it sees as $3 trillion to $4 trillion in annual global AI-infrastructure spending by decade’s end.

Yet geopolitical headwinds continue to weigh on China. Management said several expected large-scale deals in the country failed to materialise, citing U.S. export curbs and softer domestic appetite. Even so, the company stressed that demand from hyperscalers, sovereign AI buyers and multinational enterprises far outweighs the shortfall, giving Nvidia its strongest multiyear pipeline to date.

PBOC sets USD/ CNY reference rate for today at 7.0905 (vs. estimate at 7.1201)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 300bn yuan via 7-day reverse repos at an unchanged rate of 1.40%

- after today’s maturities the net injection is 110bn yuan

IMF Calls for Major Overhaul of Australia’s Tax System as Debt Surges Past $1 Trillion

The IMF has called on Australia to undertake sweeping tax reform as federal and state debt climb sharply. In its annual review, the Fund urged reintroducing a mining tax, lifting the GST rate, cutting tax exemptions and shifting state revenues from stamp duties to broad-based property levies.

The IMF also pushed for tighter spending control, especially in the NDIS and aged-care sectors, and called for coordinated fiscal planning across states. While it expects economic growth to improve from 1.8 percent in 2025 to 2.1 percent in 2026, it warned that global uncertainty, including U.S. tariff policy, could weigh on demand and employment.

RBA’s Hunter Cautions Against Reacting to Volatile Inflation as Structural Shifts Reviewed

RBA Assistant Governor Sarah Hunter warned that monthly inflation readings are too volatile to anchor policy decisions, saying the central bank will not respond to isolated data points as it assesses whether the current 3.6 percent cash rate is sufficiently restrictive.

Hunter said the Bank is examining structural changes in price-setting behaviour, supply-capacity measurement and monetary-policy transmission, noting that stronger-than-expected housing activity after recent cuts complicates the traditional framework. She added that recent inflation surprises have forced a reassessment of the easing outlook. The labour market, she said, remains tighter than is consistent with a return to target inflation.

APRA Warns Australian Banks Against Easing Mortgage Standards

Australia’s banking watchdog has cautioned lenders against loosening mortgage criteria as competition intensifies. The Australian Prudential Regulation Authority said new system-wide stress tests show banks and super funds can withstand severe shocks driven by geopolitical tensions, inflation swings, climate events or cyber disruptions.

But APRA emphasised that resilience depends on maintaining tight housing-loan standards, given the system’s heavy exposure to household debt. Any decision to chase market share by relaxing credit checks, the regulator warned, could heighten vulnerability if the economy were hit by a downturn.

BOJ’s Koeda Backs More Tightening as Inflation Holds Near Target

Bank of Japan board member Toyoaki Koeda signalled support for continued rate increases, saying Japan must avoid policy settings that distort economic behaviour. She noted underlying inflation near 2 percent, supported by firmer economic indicators and labour-market tightness.

Koeda said temporary food-price pressures, including elevated rice costs, should ease in the first half of the next fiscal year, but she warned that second-round effects remain a risk. She also outlined the need for predictable balance-sheet reduction and said the BOJ must remain alert to wage dynamics, currency movements and import-price trends as it evaluates further tightening.

Tokyo Warns Against Disorderly Yen Moves as Officials Note One-Sided Trading

Japan’s top government spokesman, Chief Cabinet Secretary Kihara, said recent yen fluctuations are “sharp” and “one-sided,” adding that authorities remain on high alert for excessive or speculative market activity. He said foreign-exchange markets should reflect underlying fundamentals and reiterated that officials are watching developments with a high degree of urgency.

Reuters Poll: BOJ Expected to Hike to 0.75 Percent in December as Yen Slide Lifts Inflation Risk

A majority of economists in a Reuters poll now expect the Bank of Japan to raise interest rates to 0.75 percent at its December meeting. Of the 81 respondents, 43 forecast a move next month, while all forecasters expect the rate to reach at least 0.75 percent by the end of the first quarter of 2026.

The yen’s renewed weakness, including a 10-month low against the dollar and a record trough against the euro, has intensified concerns about imported inflation. Economists also expect wage growth to remain robust, though slightly below this year’s pace. They attributed Japan’s recent GDP contraction to temporary factors and said underlying demand remains solid.

Japan Signals Heightened Market Vigilance as Yen Weakens

Japan’s senior economic officials struck a coordinated tone on Wednesday, with Finance Minister Satsuki Katayama and Bank of Japan Governor Kazuo Ueda agreeing to monitor market developments with “a strong sense of urgency.” The yen’s weakness and expectations of large-scale stimulus have sharpened scrutiny across currency and bond markets.

Crypto Market Pulse

Bitcoin breaks below 87,000 as risk off accelerates

Bitcoin dropped nearly 5 percent to trade around 86,960 dollars, marking its lowest level since April. Selling pressure increased as the price broke below the 50 percent retracement of the August rally.

Bitcoin is still well above its April low of 74,434 dollars but far from the year’s peak at 126,272 dollars. The market remains vulnerable if liquidation pressure continues.

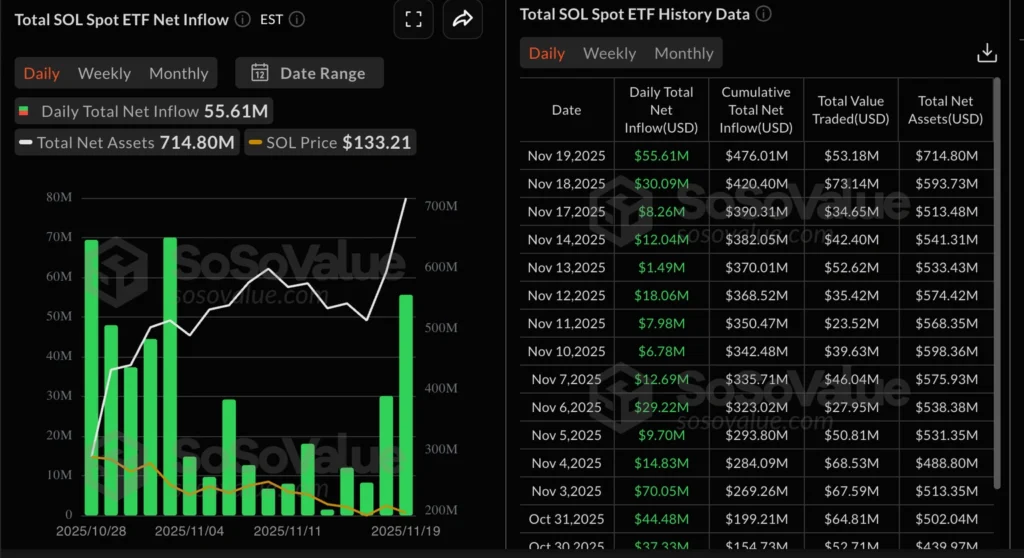

Solana builds recovery momentum with steady ETF inflows

Solana is trading above 141 dollars after bouncing off 130. Despite the broader market’s risk off tone, SOL ETFs attracted almost 56 million dollars in inflows on Wednesday, pushing cumulative inflows to 476 million dollars.

Retail demand remains soft, and futures Open Interest has fallen from November highs. If OI continues to slip, the risk of Solana dropping back toward 130 increases.

Cardano risks a slide toward 30 cents as whales sell

Cardano fell 2 percent on Thursday as large holders offloaded more than 370 million ADA over the past week. Selling pressure intensified Wednesday, driven by older tokens returning to the market.

Open Interest offers a small positive sign, rising 30 percent to 1.64 billion ADA over seven days. Long positions on Binance outnumber shorts, but funding rates remain moderate.

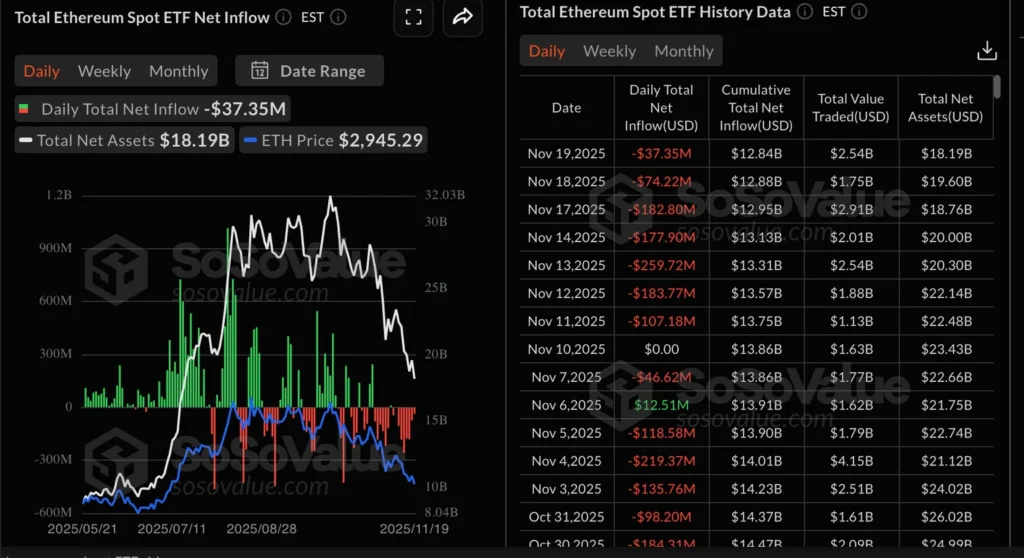

Crypto holds key levels as selling pressure persists

Bitcoin is steady above 92,000 dollars with mild ETF inflows offering support. Ethereum is struggling to stay above 3,000 dollars as ETF outflows continue. XRP holds the 2 dollar support, though a strong recovery remains unlikely without retail demand.

Bitcoin ETFs recorded about 74 million dollars in inflows after a long stretch of outflows, while Ethereum ETFs shed 37 million dollars.

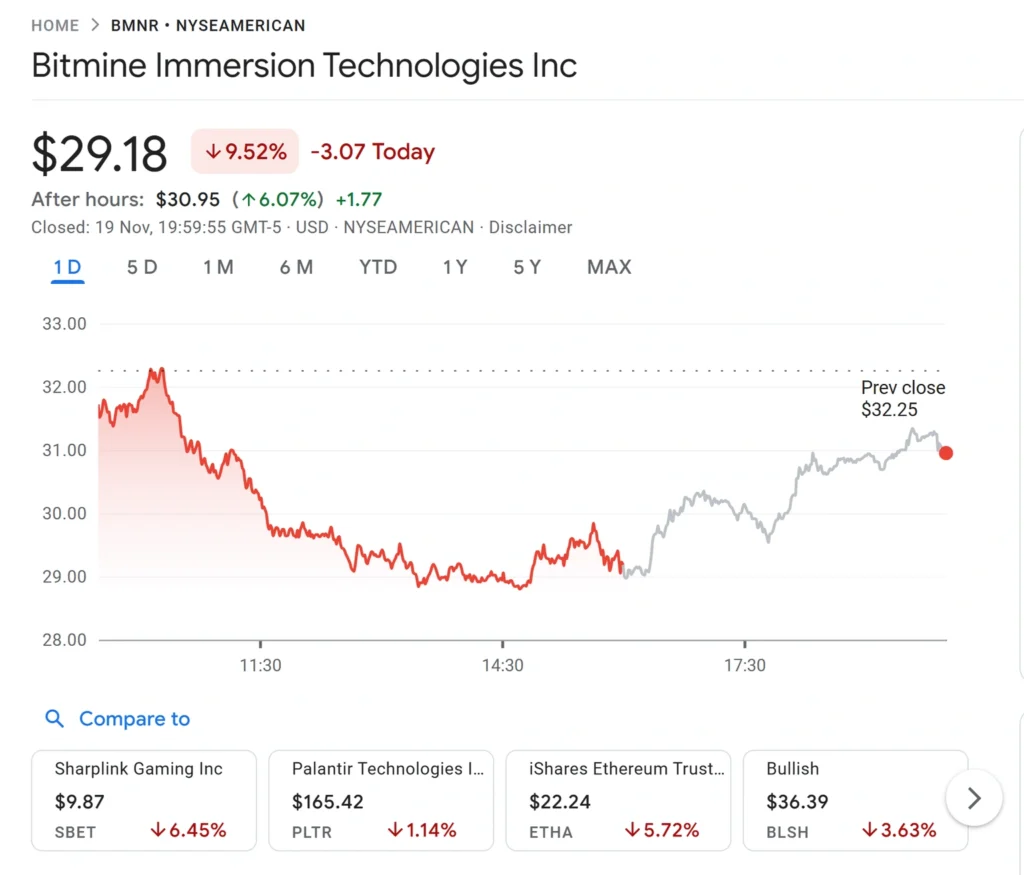

ARK ramps up crypto stock buying during market weakness

Cathie Wood’s ARK Invest added exposure to Bullish, Circle and BitMine as crypto related stocks sold off. ARK bought millions worth of shares across ARKF, ARKW and ARKK, continuing a buying streak that started earlier in the week.

The move comes as crypto stocks slide deeper into red territory. Bullish fell more than 3 percent, Circle lost nearly 9 percent and BitMine dropped about 9.5 percent before recovering in after hours trading.

Fartcoin extends its recovery with strong whale support

Fartcoin gained 12 percent on Thursday and is testing the upper trendline of a falling channel. Open Interest is up 30 percent to more than 220 million dollars, signaling aggressive long positioning.

On chain data shows whales increasing their holdings to nearly 48 percent of supply, lifting confidence and improving the chances of a breakout.

The Day’s Takeaway

North America

US Stocks Reverse Hard as Early Buyers Turn Into Heavy Sellers

A big open collapsed into a bruising close as major indices swung from strong gains to heavy losses. Nvidia’s early surge failed to hold the tape together, and sellers crushed the rally by midday.

The NASDAQ swung more than one thousand points. It was up 583 at the highs and closed down 486 for a drop of 2.15 percent.

The S&P 500 added 128 early and ended down 103 for a loss of 1.55 percent.

The Dow climbed 718 at the peak and finished down 386 for a decline of 0.84 percent.

Nvidia set the tempo. The stock opened strong after beating earnings, jumped more than 5 percent, then rolled over once it slipped below key hourly moving averages. It closed at 180.98, down 2.97 percent, and only slightly above its 100 day average at 180.08. The session high hit 196.

Selling was broad. Notable losses included Nebius NV down 11.01 percent, Micron down 10.87 percent, Robinhood down 10.11 percent, Western Digital down 8.92 percent, AMD down 7.84 percent, Moderna down 7.53 percent, Palo Alto Networks down 7.47 percent, DoorDash down 7.21 percent, Uber down 6.88 percent, SoFi down 6.77 percent, Oracle down 6.59 percent, Super Micro down 6.34 percent, Lam Research down 6.18 percent, Roblox down 5.82 percent, Palantir down 5.81 percent, ASML ADR down 5.57 percent, MicroStrategy down 5.02 percent, Stellantis down 4.85 percent, Celsius down 4.83 percent, Corning down 4.64 percent and Intel down 4.24 percent.

Bitcoin followed the risk off tone and dropped to 86,538, its lowest level since April.

What started as a confidence play in tech ended with a full scale retreat.

US Labor and Fed Outlook

The September NFP report came in mixed but still stronger than forecasts. Payrolls rose 119,000 against expectations of 50,000. Unemployment ticked up to 4.4 percent. Wage growth slowed to 0.2 percent.

Markets hold about a 21 percent chance of a December rate cut. The report does not change the Fed’s stance that inflation progress remains uneven.

Europe

Eurozone Consumer Confidence Stays Stuck in Red Territory

Eurozone flash consumer confidence held at minus 14.2 in November. Expectations were minus 14.0. High borrowing costs and tight budgets are keeping households cautious.

European Gas Slips on Peace Talk Reports

European natural Gas fell about 2.4 percent as reports of US Russia peace discussions eased supply concerns even with colder weather lifting withdrawals. EU storage is 81 percent full. Funds cut net longs and added shorts, driving gross shorts to a record high. A sharp squeeze becomes more likely if cold weather deepens or if supply surprises hit.

Commodities

Gold Slips as Jobs Strength and Fed Comments Support the Dollar

Gold fell 0.38 percent to trade near 4,061 after an early jump faded. NFP showed a stronger than expected 119,000 increase in jobs. Unemployment rose to 4.4 percent.

Gold spiked toward 4,110 but reversed as Fed officials warned that inflation progress is stalling. Cleveland Fed President Hammack said inflation remains sticky. Governor Barr said he is uneasy with inflation hovering near 3 percent.

Rate cut odds for December rose to about 39 percent, but FOMC minutes showed many officials prefer no move this year.

Hedge Funds and Retail Are Driving the Latest Gold Rally

TDS notes hedge funds and retail traders have powered recent gold strength, with inflows well above central bank buying. The official sector still creates a floor, but another explosive rally needs sustained retail support.

TDS strategist Daniel Ghali says retail flows move quickly when the Fed outlook shifts. A long pause could cool the demand spike.

Oil Holds Steady but the Trend Stays Bearish

WTI traded near 59.70, up about 0.70 percent as traders watched the US sanction deadline on two major Russian oil firms.

The broader backdrop still weighs on crude. Oversupply worries and weak demand keep the upside capped. WTI remains below the 50 day and 100 day averages. Sellers continue to defend the 61.50 to 62.00 region.

Momentum shows mild improvement with steady RSI and a firmer MACD, but the trend has not flipped.

Brent Slips on Peace Talk Headlines

Brent fell about 2.1 percent after reports that the US and Russia are discussing a Ukraine peace plan. Even if Ukraine does not back the proposal, the talks reduce fears of tighter sanctions.

US crude inventories fell 3.43 million barrels. Exports rose and refiners boosted runs. Gasoline stocks increased and demand softened, pressuring gasoline cracks.

Chile Lifts Copper Forecasts as Supply Disruptions Bite

Chile raised its copper price forecasts to 4.45 dollars for this year and 4.55 for next year.

Disruptions remain the key driver. The country no longer expects production growth in 2025 after an accident at El Teniente. Growth in 2026 depends on recovery at that site, which Codelco says is unlikely.

Crypto

Bitcoin Holds Key Support but Pressure Stays Heavy

Bitcoin is steady above 92,000 with mild ETF inflows offering support, though sellers remain active. Ethereum struggles to stay above 3,000 as ETFs see outflows. XRP is holding 2 dollars, but upside traction is thin.

Bitcoin ETFs brought in 74 million dollars after persistent outflows. Ethereum ETFs shed 37 million.

ARK Buys Into Crypto Weakness

Cathie Wood’s ARK funds ramped up buying in Bullish, Circle and BitMine as crypto stocks sold off. Purchases spread across ARKF, ARKW and ARKK.

Bullish dropped more than 3 percent, Circle almost 9 percent and BitMine about 9.5 percent before bouncing in after hours trade.

Fartcoin Extends Its Recovery

Fartcoin gained 12 percent and is testing the upper trendline of its falling channel. Open Interest climbed 30 percent to more than 220 million dollars. Whale holdings rose to almost 48 percent of supply, improving breakout odds.

Solana Builds Momentum but Needs Retail Support

Solana trades above 141 after bouncing off 130. SOL ETFs drew 56 million dollars in inflows on Wednesday, lifting total inflows to 476 million.

Futures Open Interest continues to slip from November highs. A deeper OI decline could drag prices back toward 130.

Cardano Faces Pressure as Whales Sell

Cardano dropped 2 percent as large holders unloaded more than 370 million ADA over the week. Older tokens returned to circulation, adding stress.

Open Interest rose 30 percent to 1.64 billion ADA. Longs outnumber shorts on Binance. Funding rates remain moderate. Downside risk toward 30 cents still stands.

Bitcoin Breaks Below 87,000 as Risk Off Accelerates

Bitcoin fell almost 5 percent to 86,960, its lowest point since April. The break below the 50 percent retracement of the August rally accelerated liquidations.

The coin remains well above the April low of 74,434 but is far removed from the 126,272 peak. The market stays vulnerable if forced selling continues.

Global Macro

Fed Officials Flag Ongoing Inflation Risks and Market Vulnerabilities

Chicago Fed President Goolsbee said inflation is stuck near 3 percent and still too high relative to the 2 percent goal. He expects rates to fall over time but is uneasy with current progress.

Governor Cook warned that not all market volatility is benign. She cited risks tied to hedge fund Treasury strategies. She remains in her role after the Supreme Court declined to fast track a removal request.