North America News

Major US Stock Indices Close Higher as Tech Leads, Nvidia Earnings Fuel Momentum

US equities ended the day higher on Wednesday, with the Nasdaq out front as chip stocks outperformed. The index rose 0.59 percent, lifted by a 2.85 percent gain in Nvidia ahead of its earnings release.

The closing snapshot:

• Dow Jones Industrial Average rose 47.10 points, or 0.10 percent, to 46,138.77

• S&P 500 gained 24.84 points, or 0.30 percent, to 6,642.16

• Nasdaq Composite rose 131.38 points, or 0.59 percent, to 22,564.23

Chip stocks posted mixed results. Broadcom rose 4.09 percent and Intel climbed 2.27 percent, while AMD fell 2.93 percent and Micron slipped 1.13 percent.

Notable gainers included Block up 7.56 percent, Nebius NV up 5.00 percent, Shopify up 4.00 percent, Lam Research up 3.90 percent, ASML up 3.52 percent, Robinhood up 3.39 percent, Intuitive Surgical up 3.27 percent, Alphabet A up 3.00 percent and Oracle up 2.33 percent.

Nvidia’s results landed after the close and delivered another blowout quarter. Adjusted EPS came in at 1.30 dollars versus estimates of 1.24 dollars. Revenue reached 57.01 billion dollars, well above expectations. Gross margin held at 73.6 percent.

Data centre revenue surged to 51.2 billion dollars, powered by demand for H100 systems and early Blackwell orders. CEO Jensen Huang said cloud GPU supply is sold out and that Blackwell demand is running ahead of 2026 visibility.

The company guided fourth quarter revenue to a range of 63.7 to 66.3 billion dollars, above consensus. Nvidia said Blackwell volume shipments begin early next year, with demand exceeding supply through the forecast horizon.

U.S. Sells 20-Year Bonds at 4.706 Percent

The Treasury sold 16 billion dollars in 20-year bonds at a high yield of 4.706 percent, a tail of 0.2 basis points versus the when-issued level of 4.704 percent. The bid-to-cover ratio was 2.41.

Indirect bidders took 59.47 percent. Direct bidders took 29.15 percent. Primary dealers took the remaining 11.38 percent. The auction awarded 62.39 percent of accepted bids at the high yield.

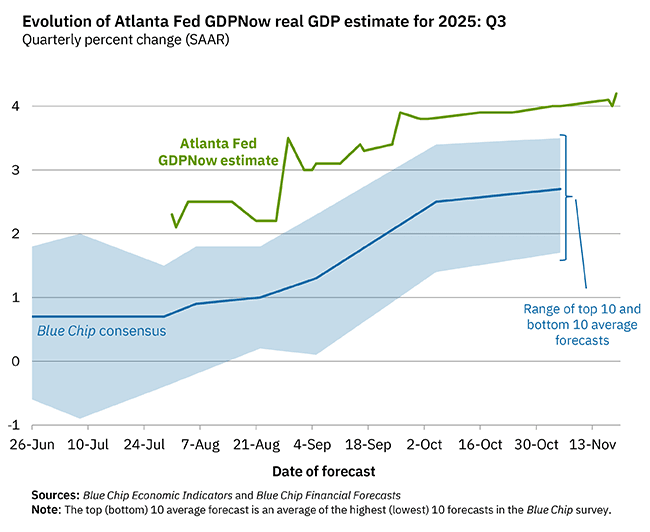

GDPNow Lifts Q3 Growth Estimate to 4.2 Percent

The Atlanta Fed’s GDPNow model increased its estimate for third-quarter U.S. real GDP growth to 4.2 percent as of November 19, up from 4.1 percent on November 17.

U.S. Mortgage Applications Drop 5.2 Percent as Activity Slows

U.S. mortgage applications fell 5.2 percent in the week ending November 14, according to the Mortgage Bankers Association. The market index dropped to 316.9 from 334.2. The purchase index slipped to 168.7 from 172.7, and the refinance index fell to 1,156.8 from 1,247.5. The average 30-year mortgage rate edged up to 6.37 percent from 6.34 percent. The release is typically not market moving.

U.S. August Trade Deficit Narrows to $59.6 Billion

The U.S. trade deficit narrowed to $59.6 billion in August, better than expectations for a $61.0 billion gap and marking the smallest deficit of the year. The prior figure was revised to $78.2 billion from $78.3 billion.

Target Cuts Full-Year Outlook as Shoppers Turn More Selective

Target lowered its full-year earnings guidance to a range of $7.70 to $8.70, warning that consumers remain “choiceful” and focused on essentials. Shares fell 3.2 percent in pre-market trading after the retailer reported soft revenue and another drop in same-store sales.

Q3 SSS fell 2.7 percent, marking a fifth straight decline, with household essentials down 3.7 percent. Executives reiterated that shoppers are stretching budgets and prioritising food, essentials and beauty. Target maintained expectations for a low single-digit sales decline in Q4. The results follow a weak report from Home Depot, though that retailer blamed a lack of storms and the slump in housing.

Foreign Demand for Treasuries Pulls Back in September; Japan Adds to Holdings

Foreign investors trimmed U.S. Treasury holdings in September for the first time in six months, Treasury Department data showed after a delay caused by the 43-day federal shutdown. Total foreign holdings slipped to $9.249 trillion, though they remain 5.5 percent higher than a year earlier.

Japan increased its position to $1.189 trillion, the highest since August 2022 and a ninth straight month of buying. China continued its long decline, edging down to $700.5 billion as it manages yuan pressure and diversifies reserves. The U.K. cut its holdings to $865 billion from just over $904 billion in August.

On a transactions basis, foreigners bought $25.5 billion in Treasuries, less than half of August’s total and well below May’s $147 billion surge. Equity flows were robust, with overseas investors purchasing $132.9 billion in U.S. stocks. Total net capital inflows reached $190.1 billion, slightly above August.

FOMC Minutes Show Support for Holding Rates Steady Through Year-End

Minutes from the latest Federal Open Market Committee meeting showed many participants believe keeping the target range unchanged for the rest of the year is appropriate under their economic outlooks.

Most participants expect additional downward adjustments over time as the committee moves toward a neutral stance. Several said a December cut would be appropriate if the economy evolves as they expect.

The minutes noted rising downside risks to employment as job gains slow. Inflation has moved up since earlier in the year and remains “somewhat elevated,” with upside risks still present.

Members agreed to end quantitative tightening on December 1 as reserves near ample levels. The minutes also pointed to a split in consumer behavior, with high-income households supported by equity gains while lower-income households are tightening spending.

Staff projections show tariffs adding upward pressure to inflation in 2025 and 2026. The outlook expects GDP growth to stay above potential through 2028, though uncertainty remains high. Some participants flagged stretched asset valuations and warned of the risk of a disorderly drop in equity prices.

BLS Confirms October Jobs Report Canceled

The Bureau of Labor Statistics will not publish the October jobs report due to the government shutdown. The gap will remain on official charts as a missing data point.

The establishment survey for October will be folded into the December 16 release alongside November’s numbers. The household survey could not be conducted, leaving the October page blank.

The October JOLTS report has been rescheduled to December 9.

Tesla Secures Arizona Ride-Hailing Permit, Clearing Way for Robotaxi Launch

Tesla received a ride-hailing permit from Arizona regulators, completing the final regulatory step needed to operate a robotaxi service in the state. The company applied on November 13 and was approved on November 17 after meeting all Transportation Network Company requirements.

White House Unveils Major Defense and Technology Deals With Saudi Arabia

The White House announced a broad package of agreements with Saudi Arabia following President Trump’s meeting with Crown Prince Mohammed bin Salman. Riyadh will purchase nearly 300 U.S.-made tanks as part of a larger defense bundle that also includes future F-35 deliveries. Officials framed the deals as reinforcing industrial capacity and deepening security ties.

Beyond defense, both governments advanced several strategic initiatives, including a civil nuclear cooperation agreement, progress on critical minerals collaboration, and a new memorandum of understanding on artificial intelligence aimed at driving joint research and commercial deployment. The deals highlight widening U.S.–Saudi cooperation across military, economic and technology sectors.

Trump Pushes for Federal Authority Over AI Investment Rules

Donald Trump used social media to tout artificial intelligence investment as a key driver of what he called the world’s “hottest” economy, warning that state-level regulation could blunt momentum. He argued states are imposing rules that risk producing what he labelled “woke AI,” urging a single federal standard to avoid a patchwork of 50 regulatory regimes. He said such a framework could protect children while avoiding censorship.

Commodities News

Gold Turns Lower as Dollar Strength and Peace Rumors Weigh on Safe-Haven Flows

Gold trimmed a sharp early advance on Wednesday, giving back gains as the US Dollar strengthened and traders monitored reports of progress around a possible US–Russia peace framework for Ukraine. At the time of writing, spot gold traded around 4,081 dollars, up 0.31 percent but below session highs.

The metal initially benefited from renewed caution following a string of weak equity sessions tied to AI-bubble fears. Softer Treasury yields also offered support. The move faded as the Dollar pushed higher ahead of delayed US labor data and the release of Federal Reserve meeting minutes.

Traders are watching the December 16 jobs release, which will combine October and November payrolls after the BLS canceled the October report. Money markets now assign a 42 percent chance of a December rate cut following Chair Jerome Powell’s warning that a move next month is not guaranteed.

News reports suggesting US and Russian officials have discussed a new peace proposal also pressured gold, trimming safe-haven demand.

WTI Slides Toward 59 Dollars as Inventory Signals Diverge and Sanctions Limit Downside

WTI crude fell 2.80 percent on Wednesday, trading near 59 dollars as traders weighed conflicting US inventory data and the impact of looming sanctions on major Russian oil exporters.

API figures showed a 4.4 million barrel crude build for the week ending November 14, the second consecutive weekly increase. The data added early pressure, reinforcing the view that US supply has been running above seasonal norms.

EIA data later told a different story. Government figures showed a 3.426 million barrel draw, far larger than expected and in sharp contrast to the prior week’s heavy build. The divergence helped stabilise prices and prevented a deeper selloff.

Markets are also tracking US sanctions on Rosneft and Lukoil that take effect Friday. The US Treasury says the measures are already squeezing Russia’s oil revenue and are expected to reduce export volumes in coming months.

WTI remains caught between rising supplies and a cautious demand outlook on one side, and geopolitical risks and tighter official inventory data on the other.

Silver Rallies Past $51.50 as Risk-Off Mood Lifts Safe Havens

Silver climbed above $51.50 on Wednesday, extending a rebound from the $49.35 area as risk-off sentiment and weak U.S. jobs data pushed investors toward safe assets. Fears of an AI-driven equity bubble and expectations for a potential Fed rate cut in December added to the metal’s momentum. Traders are watching resistance near $52.10 as bullish pressure builds.

EIA Shows 3.4 Million-Barrel U.S. Crude Draw, Product Stocks Jump

U.S. crude inventories fell 3.426 million barrels last week, beating expectations for a 603,000-barrel draw, according to EIA data. The prior week saw a 6.413 million-barrel build.

Product stocks moved the other way. Gasoline inventories rose 2.327 million barrels against expectations for a 227,000-barrel decline. Distillates increased 171,000 barrels, compared with forecasts for a 1.215 million-barrel drop.

WTI traded lower, down $1.66 at $59.10, as hopes for progress toward a Ukraine–Russia peace deal and comments from Russian producers about the limited impact of sanctions on exports weighed on prices.

Freeport Targets 2026 Grasberg Restart, Lifting Copper Prices

Freeport-McMoRan plans to restore full copper output at Indonesia’s Grasberg mine in 2026 after a September mudslide forced a force majeure. Two zones restarted in late October, including the Deep Mill Level Zone and Big Gossan. The Grasberg Block Cave underground mine is slated to ramp up in Q2 2026, ING analysts Ewa Manthey and Warren Patterson said.

The company expects Grasberg to produce about one billion pounds of copper and nearly one million ounces of gold next year, roughly 10 percent below estimates made before the incident. The partial restart alleviates pressure on smelters facing tight feedstock conditions. Grasberg is the world’s second-largest copper mine and accounts for roughly 4 percent of global supply.

Copper output disruptions have been widespread this year, including flooding at the Kamoa-Kakula mine in the DRC in May and an accident at Chile’s El Teniente mine in July.

Chinese NBS data for October showed refined copper output rising 8.9 percent year-on-year to 1.204 million tonnes. Zinc production hit a record 665,000 tonnes, up 15.7 percent, while lead output fell 2.4 percent to 645,000 tonnes.

Goldman Sees Oil Sliding Through 2026 Before Rebounding in 2027

Goldman Sachs expects oil prices to drift lower through 2026 as delayed pre-pandemic projects and unwinding OPEC+ cuts create a roughly 2 million-barrel-per-day surplus. The bank now forecasts Brent at $56 and WTI at $52 in 2026, below current forward curves. The IEA has warned the 2025 glut could exceed 4 million barrels per day.

Goldman sees the market tightening again from 2027 as underinvestment curbs new supply, with Brent returning toward $80 by 2028 and WTI toward $76. Risks remain wide: Brent could fall into the $40s if non-OPEC output holds up or global growth softens; a steeper Russian decline could push prices back above $70.

Diesel Market Tightens as Russian Supply Concerns Drive Gasoil Crack

Brent settled more than 1 percent higher, moving closer to $65 per barrel as supply risks overshadow surplus concerns, according to ING’s Manthey and Patterson. The ICE gasoil crack surged above $38 per barrel, up from around $23 in mid-October, driven by worries over Russian diesel availability amid sanctions and Ukrainian attacks on refineries.

The prompt ICE gasoil time spread jumped into a backwardation above $43 per tonne. Strong distillate margins should push refiners to maximise middle-barrel yields. Broader margin strength also supports refinery runs and tempers the bearish case for crude.

From January, ICE Futures Europe will ban deliveries of diesel made from Russian oil refined in third countries, aligning with the EU’s refined product restrictions.

API data overnight showed U.S. crude inventories up 4.4 million barrels, gasoline up 1.5 million and distillates up 600,000, a broadly bearish set of figures ahead of the EIA report.

Deutsche Bank Sees Gold Supported by Central-Bank Buying Into 2026

Deutsche Bank says gold continues to benefit from steady central-bank accumulation, which remains the dominant force shaping prices as ETF demand stays muted. Analysts argue official-sector purchases will keep cushioning the market during bouts of weakness, creating a structural floor. Volatile conditions have kept ETF investors on the sidelines, reducing responsiveness to price dips. The bank maintains a bullish stance and sees upside risks to its 2026 average price forecast of $4,000 per ounce.

Private Survey Shows Larger-than-Expected U.S. Crude Build

A private inventory survey signalled a heavier crude stock increase than markets anticipated. The latest American Petroleum Institute figures showed crude holdings up 4.4 million barrels. Gasoline rose 1.5 million barrels and distillates added 600,000 barrels. Cushing stocks fell 800,000 barrels. The Strategic Petroleum Reserve logged a 500,000-barrel increase.

Europe News

Eurozone September Final CPI Confirmed at 2.1 Percent

Eurozone inflation for September was confirmed at 2.1 percent year-on-year, matching the preliminary estimate, Eurostat said. The reading eased slightly from August’s 2.2 percent. Core CPI also matched the flash figure at 2.4 percent, unchanged from the prior month. The final release offered no surprises.

UK October CPI Matches Expectations at 3.6 Percent

UK inflation slowed to 3.6 percent year-on-year in October, in line with expectations and down from 3.8 percent. Core CPI also matched forecasts at 3.4 percent. Services inflation eased to 4.5 percent, slightly below the expected 4.6 percent. Markets had already priced an eighty-percent chance of a December rate cut, and the data reinforced rather than changed that outlook.

Investors Expect Stable Euro Through 2026, BoA Survey Shows

Bank of America’s November global fund manager survey points to a stable medium-term outlook for the euro. Nearly half of respondents see EUR/USD ending 2026 in the 1.10 to 1.20 range, close to the current 1.1587 level. Another 30 percent expect a move into the 1.20 to 1.30 band. Tail risks remain minimal, with only 2 percent anticipating a break below parity and 2 percent seeing a run above 1.30. Views on valuation have moderated: 45 percent now call the dollar overvalued, down from 50 percent last month, and just 13 percent view the euro as undervalued compared with 17 percent in October.

Asia-Pacific & World News

China Says Takaichi’s Taiwan Remarks Have Damaged Bilateral Ties

China’s Foreign Ministry escalated its criticism of Prime Minister Takaichi’s comments on Taiwan, saying the remarks “fundamentally damaged” the political foundation of Sino-Japanese relations. Beijing urged Japan to retract the statements and warned that refusal to do so would trigger “stern and resolute countermeasures,” with Japan bearing full responsibility.

China Plans to Renew Ban on Japanese Seafood Imports

China intends to reinstate a ban on Japanese seafood imports as tensions with Tokyo escalate. Relations have soured following comments from Prime Minister Takaichi on Taiwan, which Beijing condemned sharply. Chinese authorities have warned that even if shipments were allowed in, there would be “no market.”

PBOC sets USD/ CNY central rate at 7.0872 (vs. estimate at 7.1121)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injects 310.5bn yuan at 1.40% via 7-day reverse repos

- net injections is 115bn yuan (after maturities today)

Australia’s Leading Index Turns Positive as Growth Signals Improve

The Westpac-Melbourne Institute Leading Index rose 0.11 percent month-on-month in October, pushing the six-month annualised growth rate to 0.35 percent from 0.10 percent. Westpac said the move marks a shift into slightly positive territory after months of around-trend readings, with a sharp rise in consumer expectations playing a major role.

Australia Q3 Wage Price Index Matches Expectations

Australia’s Wage Price Index rose 0.8 percent in the September quarter, in line with forecasts and matching the prior quarter’s pace. Annual growth held at 3.4 percent. Q3 is typically a key period for wage adjustments, as Australia’s Fair Work Commission implements its annual minimum and award wage increases. This year’s ruling delivered a 3.5 percent lift.

New Zealand Q3 PPI Slows, Undershooting Forecasts

New Zealand’s third-quarter producer prices rose at a softer pace than projected, according to Stats NZ. PPI outputs increased 0.6 percent quarter-on-quarter, shy of the expected 0.7 percent and matching the prior reading. Inputs rose only 0.2 percent, well below expectations of 0.9 percent and down from the prior 0.6 percent. The weaker wholesale inflation backdrop offers support for the Reserve Bank of New Zealand as it continues its easing cycle to shore up growth.

Japan’s Finance Minister Signals Close Coordination With BOJ

Finance Minister Satsuki Katayama said she met BOJ Governor Kazuo Ueda to reaffirm tight coordination between the government and central bank. She said the meeting reviewed cooperation under the new administration and maintained the technical tweak to the BOJ-government joint statement without altering its substance.

She reiterated the focus on achieving wage-supported inflation and sustainable growth while monitoring markets closely. There was no discussion of FX intervention or details on the size of the upcoming stimulus package. Katayama also declined to comment on potential new JGB issuance.

BOJ May Delay Rate Hike Until March as Advisers Flag Weak Economy

Goushi Kataoka, a key adviser to Prime Minister Takaichi and a former BOJ board member, said the central bank is unlikely to raise rates before March. He expects a supplementary budget of about ¥20 trillion and argues policymakers must first see evidence that stimulus is bolstering demand.

Kataoka pointed to the Q3 GDP contraction and core inflation still below 2 percent, saying a January hike is “not highly likely.” His caution mirrors comments from former Deputy Governor Masazumi Wakatabe. Kataoka said he does not expect political pressure on the BOJ when it meets on December 19.

Yen Outlook Splits Investors: BoA Sees 2026 Strength, MUFG Warns of Short-Term Slide

The yen remains a point of contention in markets. Bank of America’s latest survey shows 30 percent of fund managers expect the currency to outperform in 2026, making it the top pick among surveyed assets. The view reflects expectations that Japan’s policy stance could ultimately normalise.

Near-term pressure tells a different story. The yen sits at a nine-and-a-half-month low against the dollar as investors anticipate looser fiscal and monetary policy under Prime Minister Sanae Takaichi. MUFG strategist Lee Hardman says weak data, including the Q3 contraction, is fuelling expectations of policy easing. Concerns over Japan’s public finances have added to the pressure. Finance Minister Satsuki Katayama’s discomfort with the yen’s drop has stirred talk of intervention, but MUFG says rhetoric alone is unlikely to halt the slide.

Japan’s New Stimulus Package Expected to Exceed ¥20 Trillion

Kyodo reports that Japan’s upcoming economic stimulus package will exceed ¥20 trillion, supported by a supplementary budget of roughly ¥17 trillion. The plan marks one of the largest fiscal efforts undertaken in recent years.

Japan’s September Core Machinery Orders Jump Past Expectations

Japan’s September core machinery orders delivered a stronger-than-expected performance. Orders rose 11.6 percent year-on-year, beating expectations of 5.4 percent and accelerating from the prior 1.6 percent. On a monthly basis, orders rose 4.2 percent, outpacing the 2.0 percent forecast and rebounding from a 0.9 percent contraction. The figures offer a positive signal for Japan’s investment outlook.

Crypto Market Pulse

XRP Drops Toward 2.00 Dollars as Retail Demand Stays Weak and Staking Debate Emerges

XRP traded under pressure on Wednesday, changing hands at 2.12 dollars as the market’s risk-off tone kept the token on a downward path. Since hitting a record 3.66 dollars in July, XRP has struggled to hold momentum amid macro uncertainty and a lack of strong catalysts.

If selling persists, the token could test the 2.00 dollar level. Retail participation remains weak following the October 10 deleveraging event that wiped out 19 billion dollars in crypto positions.

Developers are exploring potential native staking features for the XRP Ledger. XRP Ledger researcher J. Ayo Akinyele said the network has matured across payments, real-world asset settlement and global liquidity flows but needs to determine how staking rewards would be created and distributed. Ripple CTO David Schwartz added that the ongoing work on programmability and smart contracts makes this an appropriate time to discuss native DeFi capabilities.

In derivatives, futures open interest averaged 3.85 billion dollars on Wednesday, up from 3.6 billion dollars on Tuesday but below the 4.17 billion dollars recorded on November 1.

The OI-weighted funding rate climbed to 0.0090 percent as long positioning increased.

XRP needs to hold the 2.07 to 2.10 dollar support area to improve risk appetite and avoid a deeper slide.

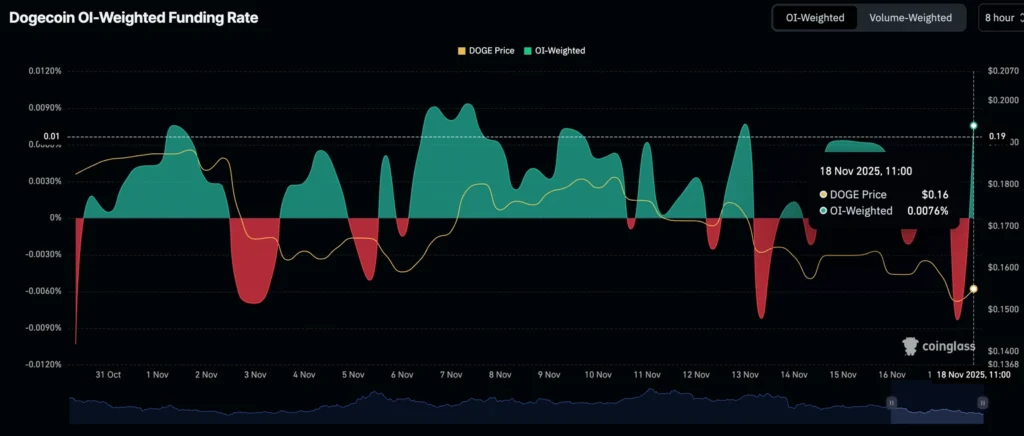

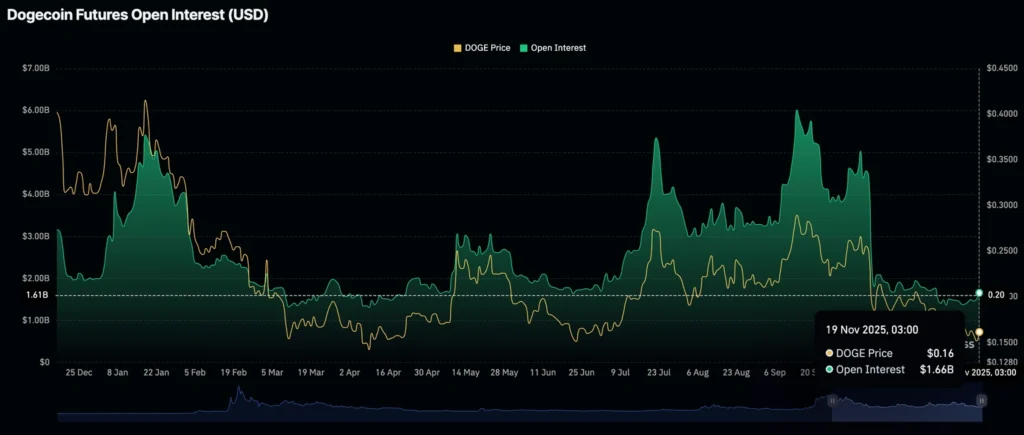

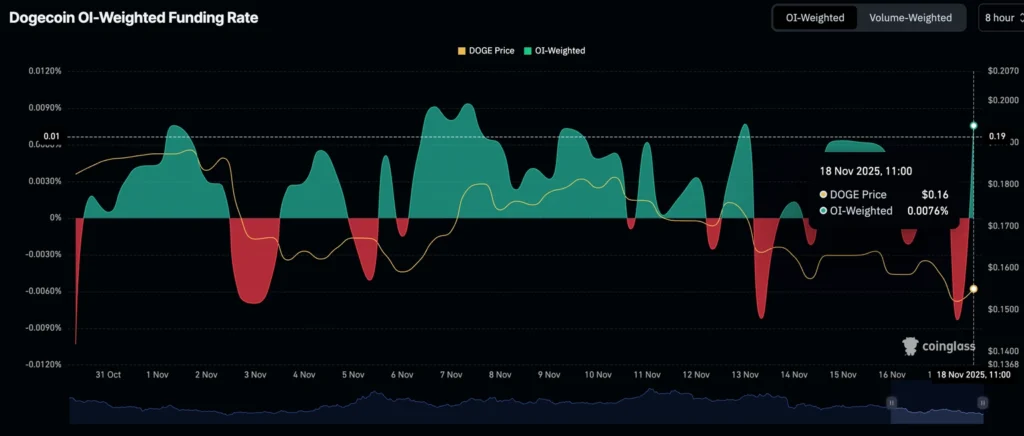

Dogecoin Under Pressure as Traders Look for Direction

Dogecoin traded around 0.1587 dollars on Wednesday, extending a slide that began after the October 10 flash crash. The coin has lost 37 percent of its value since that event, weighed down by caution across the crypto market and the lack of a clear catalyst ahead of the December Federal Reserve meeting.

Futures open interest for DOGE rose to 1.66 billion dollars on Wednesday, showing early signs of stabilizing. After the deleveraging in October, OI fell to 1.37 billion dollars on November 7. The steady rebuild suggests traders are slowly returning.

The OI-weighted funding rate climbed to 0.0076 percent on Wednesday from negative 0.0083 percent on Tuesday as traders added long positions. DOGE needs to hold above the 0.1500 support level to keep sentiment from slipping back into a deeper bearish trend.

Arbitrum Holds 0.22 Dollars as Development Framework Expands

Arbitrum traded near 0.22 dollars on Wednesday as volatility rose across crypto markets. The token has struggled to recover since reaching 0.62 dollars in August.

A recent Messari report highlighted continued progress across the Arbitrum ecosystem. The platform is moving beyond its identity as an Ethereum Layer 2 and is evolving into a broader infrastructure layer aimed at developers and enterprise-grade applications.

The “Arbitrum Everywhere” framework supports builders through the full application cycle. Projects begin on Arbitrum One, the shared liquidity layer, and can later migrate to custom Arbitrum Chains built with Nitro technology. The framework operates through four pillars: Builder Freedom, Enterprise Ready, DeFi Unchained and the Digital Sovereign Nation. Together, they shape a flexible system designed for long-term growth.

Crypto Market Weakens as Bitcoin, Ethereum and XRP Face Heavy Outflows

Bitcoin traded above 91,000 dollars on Tuesday but continued to edge lower as institutional demand softened. Ethereum slipped after failing to hold above 3,100 dollars, and XRP extended its decline toward 2.00 dollars.

Risk appetite has faded since mid-October after Federal Reserve Chair Jerome Powell warned that a December rate cut is not assured. The October 10 flash crash set the tone, and sentiment has stayed bearish as spot ETF outflows continue and retail interest remains low.

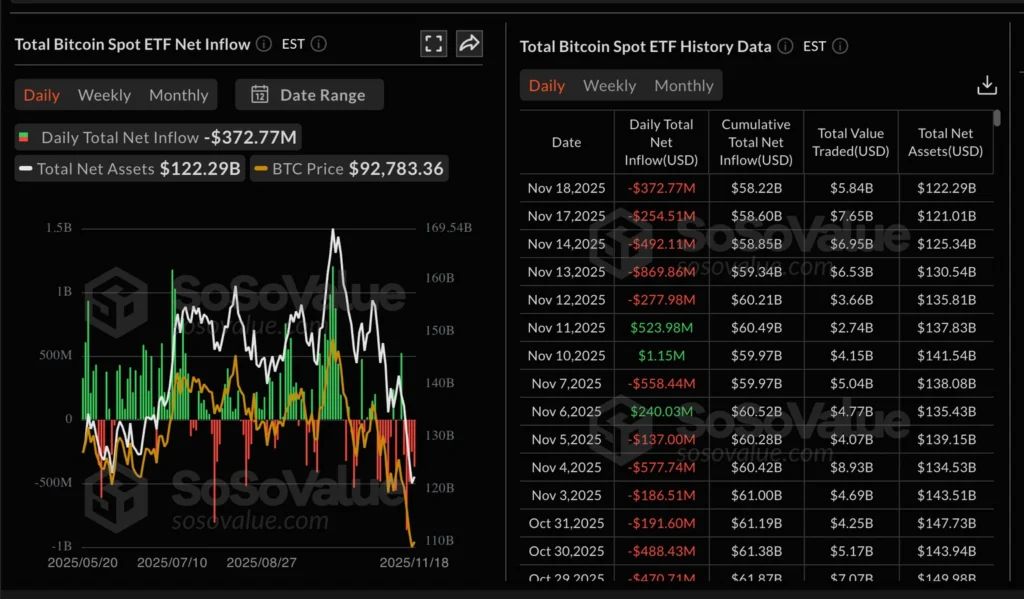

Bitcoin ETFs saw 373 million dollars in outflows on Tuesday. Net assets have dropped to 122.29 billion dollars from about 170 billion dollars on October 6. Cumulative net inflows average 58.22 billion dollars.

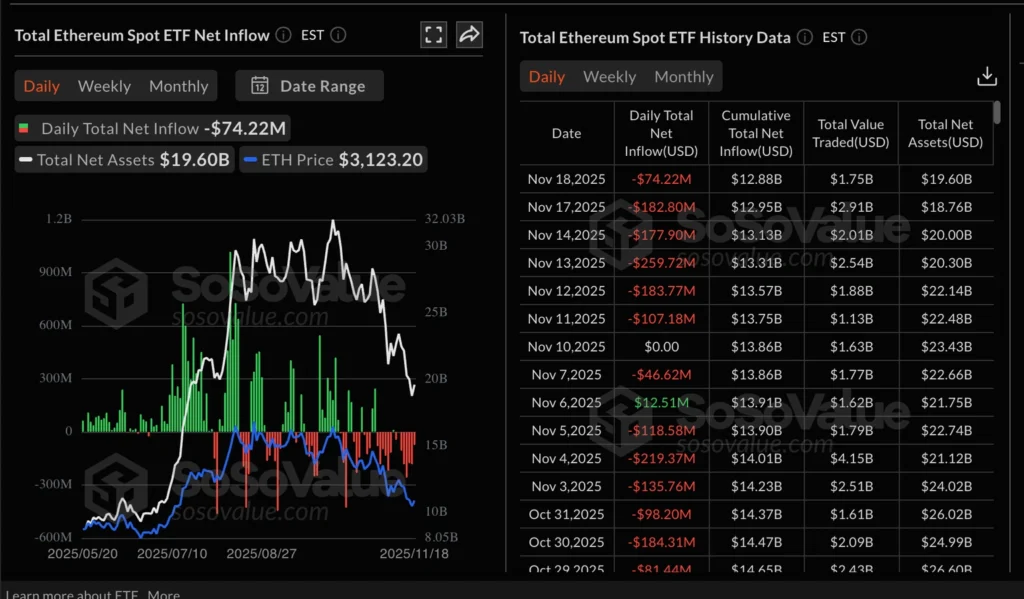

Ethereum ETFs recorded 74 million dollars in outflows on Tuesday, with cumulative inflows of 12.88 billion dollars and net assets at 19.6 billion dollars. If withdrawals continue, short-term recovery will stay difficult.

Hyperliquid Launches HIP-3 Growth Mode With Ultra-Low Fees for New Markets

Decentralized exchange Hyperliquid introduced HIP-3 growth mode, a feature that allows anyone to deploy new markets with sharply reduced fees to encourage liquidity and market development.

The upgrade cuts taker fees by more than 90 percent for new markets, dropping the usual 0.045 percent level to a range of 0.0045 to 0.009 percent. Top staking and volume tiers may see fees as low as 0.00144 to 0.00288 percent.

Growth mode can be activated on a per-asset basis without central approval. Markets must avoid overlap with existing validator-run perpetuals and must represent distinct assets. The fee scale set by deployers can range from 0 to 1. Once enabled, growth mode locks for 30 days to maintain stability.

The feature is designed to expand liquidity, lower entry barriers and widen Hyperliquid’s asset list. Reaction on social media framed the move as a strong catalyst for new derivatives markets. HYPE, the platform’s token, traded below 40 dollars, down 6 percent.

BoE Outlines Framework for Regulating Sterling Stablecoins

The Bank of England is preparing new guardrails for systemic sterling-denominated stablecoins as it moves toward a regulated multi-currency environment. Deputy Governor Sarah Breeden said a consultation paper will outline oversight expectations for digital tokens used in retail payments and settlement.

The BoE plans temporary holding caps to ease the transition. Individuals would be limited to £20,000 per stablecoin, businesses to £10 million, with exemptions for major firms. Balances would be held directly with the central bank during the interim period. The Bank plans to lift the limits once it judges the system stable.

The Day’s Takeaway

North America

Equities

US equities closed higher with tech in control. The Nasdaq led with a 0.59 percent gain as chip names strengthened ahead of Nvidia’s results. Broadcom climbed more than four percent, Intel added over two percent, and several large cap tech stocks followed.

Nvidia delivered again after the close. Adjusted EPS came in at 1.30 dollars versus 1.24 expected. Revenue hit 57.01 billion dollars with data centre sales soaring to 51.2 billion dollars. Management said cloud GPU supply is sold out and Blackwell demand is running ahead of 2026 visibility. The company guided fourth quarter revenue to 63.7 to 66.3 billion dollars and confirmed Blackwell volume shipments begin early next year.

At the close, the Dow added 47.10 points, or 0.10 percent, the S&P 500 rose 0.30 percent, and the Nasdaq gained 131.38 points, or 0.59 percent. Block, Shopify, Lam Research, ASML, Robinhood, Intuitive Surgical, Alphabet A and Oracle were among the session’s strongest movers.

Rates and Policy

The Bureau of Labor Statistics confirmed it will not publish the October jobs report after shutdown disruptions. October and November establishment data will be released together on December 16, and the October household survey will remain blank.

FOMC minutes showed support for keeping rates unchanged through year end. Several members said a December cut could make sense if growth slows as expected. The minutes pointed to softer job gains, ongoing inflation risks and uneven consumer behavior. Members also agreed to end quantitative tightening on December 1.

Treasuries were active after the sale of 16 billion dollars in 20 year bonds at 4.706 percent with a 2.41 bid to cover. Indirect bidders took almost sixty percent.

Commodities

WTI crude slid 2.80 percent toward 59 dollars. API data showed a 4.4 million barrel build, but EIA numbers later revealed a 3.426 million barrel draw, which helped steady prices after early pressure. Traders are also watching US sanctions on Rosneft and Lukoil that take effect Friday. Treasury officials say the measures are already squeezing Russian revenues.

Gold pulled back from early highs as the Dollar strengthened and reports hinted at progress on a potential US Russia peace framework for Ukraine. Spot gold held near 4,081 dollars, up modestly but well off session peaks. Safe haven positioning was mixed as markets waited for the December 16 combined jobs release and tracked shifting rate expectations.

Europe

European markets reflected the cautious tone in global trading. Investors focused on delayed US labor numbers, Nvidia’s results and the Fed’s signal that policy may stay tight a bit longer unless data softens. Energy shares lagged after the break lower in WTI.

Asia and Rest of the World

Asian markets were mixed. US tech strength helped but broader caution kept gains limited. Concerns about global demand, currency pressure against a firmer Dollar and central bank uncertainty held risk appetite in check. Several emerging market currencies softened as the Dollar moved higher.

Crypto

Crypto remained under pressure as outflows continued across major assets.

Bitcoin traded above 91,000 dollars early Tuesday but drifted lower as institutional appetite remained weak. Spot Bitcoin ETFs saw 373 million dollars in outflows. Net assets are now 122.29 billion dollars, down from roughly 170 billion on October 6.

Ethereum slipped after losing the 3,100 dollar level. Its ETFs recorded 74 million dollars in outflows with net assets at 19.6 billion dollars. Weak flows make near term recovery difficult.

XRP traded around 2.12 dollars and could retest 2.00 dollars if selling persists. Open interest climbed to 3.85 billion dollars as long positioning increased. Developers continued debate on potential native staking features for the XRP Ledger, raising questions about reward creation and distribution.

Dogecoin held near 0.1587 dollars. The token has lost 37 percent since the October 10 flash crash, but open interest is climbing again, rising from 1.37 billion dollars on November 7 to 1.66 billion. The 0.1500 level remains key support.

Arbitrum traded near 0.22 dollars. A new Messari report said the network is shifting into a broader infrastructure layer with the “Arbitrum Everywhere” framework guiding projects from Arbitrum One to custom chains.

Hyperliquid launched HIP 3 growth mode, slashing taker fees for new markets by more than ninety percent to encourage liquidity. HYPE traded below 40 dollars, down six percent.