North America News

US stocks close lower as midday rebound fades

US equities finished in the red on Tuesday after a midday rebound failed to gain traction, leaving all three major indices stuck in negative territory from open to close.

At the closing bell, the Dow Jones Industrial Average fell 498.50 points, or 1.07 percent, to 46091.74. The index briefly trimmed losses at the session high but remained down 207.32 points at best.

The S&P 500 slipped 55.09 points, or 0.83 percent, to 6617.32. Even at its strongest level of the day, the index was still down 5.70 points.

The Nasdaq Composite dropped 275.23 points, or 1.21 percent, to 22432.85. At its session high, it was still off 65.06 points.

The closing levels were well above the lows, where selling had accelerated earlier in the session. The Dow had been down 676 points at its worst levels. The S&P had fallen 98.09 points, and the Nasdaq had dropped 476.93 points at the trough.

Nvidia, which reports earnings after the close on Wednesday, ended the day down 2.81 percent at 181.37, a decline of 5.24.

Other notable laggards included:

Home Depot: −6.00%

Western Digital: −5.94%

Micron: −5.56%

Amazon.com: −4.43%

AMD: −4.31%

Box Inc: −3.71%

CrowdStrike Holdings: −3.04%

Arm: −2.97%

SoFi Technologies: −2.96%

Deutsche Bank AG: −2.95%

Lam Research: −2.87%

NVIDIA: −2.80%

Microsoft: −2.70%

Cadence Design: −2.60%

Boston Scientific: −2.50%

IBM: −2.42%

Palantir: −2.29%

Fortinet: −2.17%

Block: −2.12%

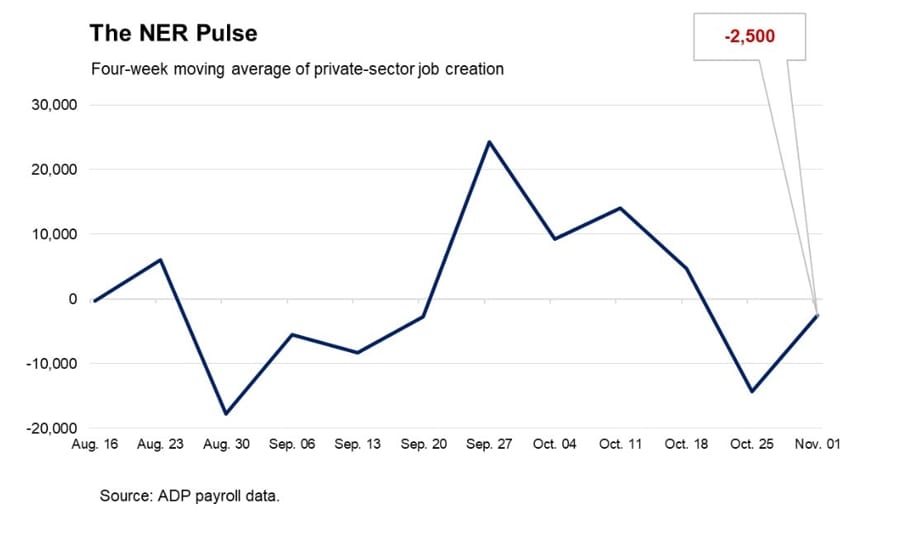

ADP Weekly Employment Shows Loss of 2,500 Jobs; Claims Remain Elevated

Private employers shed an average of 2,500 jobs a week in the four weeks ending November 1, softer than the prior week’s pace of minus 11,250. An initial weekly reading had shown a gain of 14,250. ADP will continue publishing weekly except during the week of its monthly release.

Jobless claims data for the week of October 18 showed 232,000 initial claims and 1.957 million continuing claims. The most recent pre-shutdown release was for the week of September 20, when initial claims were 219,000 and continuing claims for the week of October 11 were 1.947 million. Both readings have since moved higher.

Oxford Economics, using unadjusted state-level figures, projected claims at 231,000, nearly matching the actual outcome. The firm expects claims for the week of October 25 to fall by 12,000 to 219,000, but flagged potential risks to that estimate.

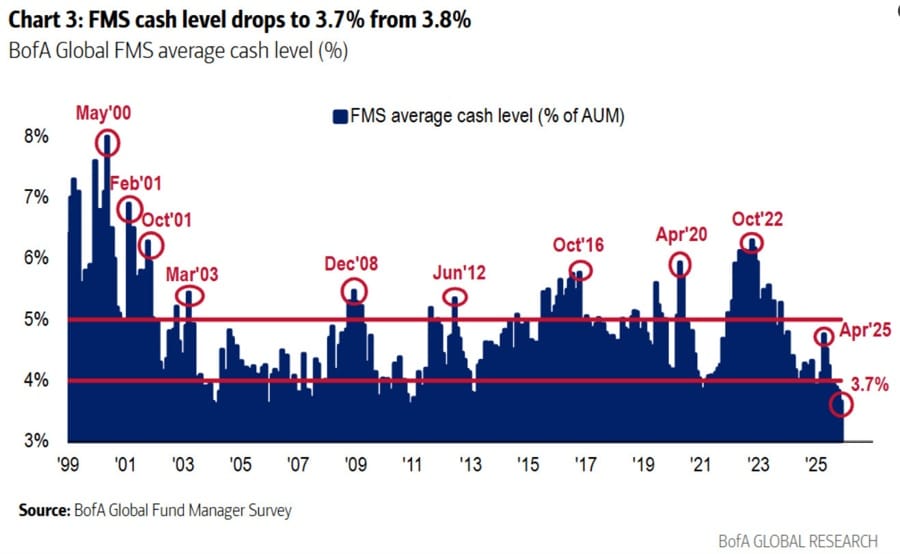

Bank of America Flags Fund Managers’ Low Cash Levels

Bank of America’s latest fund manager survey points to cash positions at levels the bank considers risky. Cash balances of 3.7 percent or lower have occurred 20 times since 2002, and in each case stocks fell while Treasuries outperformed over the following one to three months.

Investors are also reassessing the strength of the artificial intelligence trade. The setup is tight heading into key events this week, including Nvidia earnings on Wednesday and Google’s release of Gemini 3. Both could lift sentiment, but the margin for disappointment is narrow.

US Homebuilder Sentiment Rises to 38 in November

The National Association of Home Builders housing market index for November rose to 38, slightly above expectations of 37 and up from 37 in October. Current single-family home sales increased to 41 from 38. Prospective buyer traffic improved to 26 from 25. The sector continues to struggle with 30-year mortgage rates above 6 percent. Lumber futures for January have also fallen sharply.

US Factory Orders for August Rise 1.4 Percent, Matching Forecasts

US factory orders for August increased 1.4 percent, meeting expectations. The prior month had shown a decline of 1.3 percent. Durable goods orders were unchanged at a previously reported 2.9 percent gain. The data remain delayed due to the government shutdown, leaving August figures still filtering through months later.

US Initial Claims Rise to 232K; Continuing Claims Reach 1.957 Million

US jobless claims for the week ending October 18 came in at 232,000, according to data now being released after the shutdown delay. Continuing claims rose to 1.957 million. The numbers show little change in the labor market compared with earlier readings, even if the figures are dated. The Department of Labor appears to be catching up on the backlog, with current data expected on Thursday.

Cloudflare Drops More Than 3 Percent in Pre-Market as Outage Hits Global Sites

Cloudflare shares traded more than 3 percent lower in pre-market after a widespread outage affected multiple websites including X. The company acknowledged an internal server error on its network and said the issue is under investigation. Cloudflare provides infrastructure for thousands of websites worldwide.

Barkin Says Upcoming Data Will Shape Fed’s December Decision

Richmond Fed President Thomas Barkin said he hopes incoming economic data will bring more clarity ahead of the December 10 policy meeting, signaling uncertainty about the path forward. Barkin, viewed as a representative voice for the center of the Federal Reserve, said inflation remains above target but is unlikely to accelerate further because consumers are pushing back on rising prices and productivity has improved.

He added that job growth has slowed, although labor supply has also softened, leaving the overall picture mixed. Markets now place the odds of a December move near fifty-fifty, up from thirty-eight percent yesterday. That shift came after Governor Christopher Waller argued forcefully for a rate cut and said there was no data between now and the meeting that would change his view.

BofA Fund Manager Survey Shows AI Bubble Now Top Tail Risk

Bank of America’s latest Fund Manager Survey shows investors increasingly view an AI bubble as the biggest tail risk, with 45 percent of respondents highlighting the threat. Key findings include:

- First signs in 20 years that investors believe companies are overinvesting.

- Long Mag 7 ranked as the most crowded trade for 54 percent of respondents.

- Emerging markets and banks seen as most vulnerable to a proper fourth quarter risk off move.

- Froth expected to correct further if the Fed skips a December rate cut.

- Bullish positioning viewed as a headwind, not a tailwind, for risk assets.

- Cash levels at a very low 3.7 percent, flagged as a sell signal.

- Global investors the most overweight equities since February 2025.

- Most overweight commodities since September 2022.

Concerns about an AI bubble have grown sharply in recent weeks, coinciding with Chair Powell’s more hawkish tone and the lack of commitment to a December rate cut.

Morgan Stanley Lifts S and P 500 Target to 7,800 as Earnings and Policy Drive Bull Case

Morgan Stanley raised its 12 month S and P 500 target to 7,800 from 7,200, with chief United States equity strategist Mike Wilson saying a new bull market began in April. Wilson said solid earnings growth, improving operating leverage, firmer pricing power, and efficiency gains tied to AI will support profits through 2026. The bank projects S and P 500 EPS at 272 dollars in 2025, 317 dollars in 2026, and 356 dollars in 2027. Valuations may compress slightly but should stay elevated given strong profit momentum.

Wilson said a supportive Federal Reserve is the second key pillar. He expects rate cuts and a balance sheet stance aimed at running the economy hot. He added that markets are underestimating how dovish the Fed may turn.

Morgan Stanley expects market leadership to broaden as earnings recover. The bank upgraded small caps to overweight as revisions improve and also raised consumer discretionary goods to overweight based on relative improvement versus services. Financials and healthcare remain overweight, with healthcare called the preferred quality growth exposure.

JP Morgan Says Long iPhone 17 Wait Times Show Demand Still Outpacing Supply

JP Morgan said global wait times for Apple’s iPhone 17 lineup remain far longer than normal, indicating demand continues to run ahead of supply deep into the cycle. In its Week 10 tracker, the bank said average lead times are around seven days compared with two days at the same stage last year.

The base iPhone 17 remains the most supply constrained model for the second straight week. The mid range iPhone Air saw a small uptick in delays, while the Pro and Pro Max models held steady. That differs from last year when wait times for premium models were already easing, suggesting firmer high end demand this cycle.

Deutsche Bank Says Hawkish Fed Sparked Multi Asset Pullback but Broader Backdrop Remains Firm

Deutsche Bank said markets have been under pressure across nearly all major asset classes since mid October, with both risk assets and traditional havens caught in a synchronized retreat. Bitcoin is down 24 percent from its recent peak, the S and P 500 is enduring its longest stretch without a record since the Liberation Day volatility earlier this year, gold is down about 6 percent from its October high, and the United States 10 year yield has climbed 18 basis points since late October.

The bank said two factors explain the selloff. First, a more hawkish Federal Reserve has revived a familiar pattern seen in 2015 and 2016, 2018, and 2022, when a firmer policy stance triggered broad drawdowns. Second, markets had rallied at a pace rarely sustained historically, with six month S and P 500 gains into late October the strongest since the post Covid rebound. Concerns about public finance have also unsettled several asset classes.

Even so, Deutsche Bank said the underlying environment remains resilient. The S and P 500 is only about 2 percent off its high, the United States has delivered the fastest stretch of rate cuts outside a recession since the 1980s, the United States China trade truce has eased geopolitical tension, and financial stress indicators including the VIX and high yield spreads remain well below October levels. The bank said the usual warning signs of larger corrections are not yet in place.

HSBC Says Odds Favor Year End Equity Melt Up as Bubble Fears Overstated

HSBC says concerns about an AI driven market bubble are exaggerated and that conditions favor a year end melt up in equities rather than a correction. Chief multi asset strategist Max Kettner wrote that many investor objections focus on supposed early warning signs, the so called canaries in the coal mine, but HSBC sees far fewer threats than the broader narrative implies.

Kettner noted that despite headlines about soaring AI related capital spending, most corporate capex plans remain subdued. He added that talk of widespread layoffs has also cooled, with references to job cuts easing on recent earnings calls and little evidence that AI adoption is causing large scale displacement.

HSBC said strong money market inflows now function as a contrarian buy signal, while aggregate sentiment gauges sit in neutral territory. Positioning does not appear stretched. Kettner said the backdrop supports staying risk on into year end.

Waller Signals Support for December Rate Cut as Labor Market Slows

Federal Reserve Governor Christopher Waller said he favors a 25 basis point rate cut at the December 9 and 10 FOMC meeting, arguing that incoming data points to a clear loss of momentum in the United States labor market. Speaking in London, Waller said the combination of private and public indicators gathered during the 43 day government shutdown shows hiring running at what he described as near stall speed, with jobless claims rising, layoffs becoming more frequent, and little evidence of wage pressure.

Waller said that when one removes the temporary influence of tariffs, underlying inflation now sits close to the Fed’s 2 percent target. Inflation expectations, he added, remain anchored. With growth cooling and household sentiment weakening, Waller warned that restrictive policy is hitting lower and middle income families hardest, especially given ongoing affordability strains in housing and autos.

Some officials have urged waiting for clearer information, but Waller pushed back, saying policymakers are not operating in a fog and that current indicators provide enough clarity for action. He added that even the delayed September jobs report is unlikely to shift his view that more easing is appropriate.

He said a December cut would serve as insurance against further labor market deterioration and move policy closer to neutral.

Waller Q&A

During a Q&A session, Waller repeated that labor market fragility remains the central risk. He said that if hiring showed a convincing rebound, the case for additional insurance cuts would weaken, but current trends continue to move the other way. Soft survey data shows rising layoff intentions, while companies report that spending cutbacks among lower and middle income consumers are weighing on hiring plans. Some firms, he added, are funding AI investments by freezing recruitment.

Waller said the balance sheet looks appropriate for now, but noted that rising market rates hint that reserve levels are nearing scarcity. He expects natural reserve demand to rise and said the Fed might be one or two months away from needing to expand the balance sheet again.

Waller said policymakers should focus primarily on labor market weakness rather than the mild overshoot in inflation. He reiterated that a single 25 basis point move would not be enough to restore the pace of job growth seen earlier in the cycle. He declined to comment on President Trump’s public rate commentary.

Canada October Housing Starts Slow to 232.8K vs 265.0K Expected

Canadian housing starts fell sharply in October to 232,800 units, well below expectations of 265,000. The prior reading was 279,200. The October data signal a notable cooling in homebuilding activity compared with September.

Commodities News

Gold rises above 4050 as investors position for a dovish Fed

Gold advanced on Tuesday during the North American session, supported by weaker risk appetite and renewed expectations that the Federal Reserve will lean toward easing in December. Spot prices traded near 4058, up 0.36 percent.

Initial US data offered little pushback against the move. Initial Jobless Claims for the week ending October 18 came in at 232K. Factory Orders for August were slightly better than expected but did little to shift sentiment. Bullion buyers pushed the metal above the 4050 level as investors continued to build positions tied to possible Fed action.

Despite recent hawkish comments from Fed officials, futures markets added to expectations of a December rate cut. Traders will look to the FOMC Minutes for more insight into how divided policymakers are ahead of the next decision. Nonfarm Payrolls on Thursday remain the key release for the week.

Goldman Sachs added a further catalyst after confirming that China’s central bank resumed gold purchases. Analysts said China may continue buying through November, a trend that would support near-term upside given the scale and consistency of official sector demand.

WTI firms above 60 as traders weigh surplus forecasts and Russia sanctions

WTI crude moved higher on Tuesday, trading near 60.50 and up roughly 1.35 percent despite growing concerns that the market is heading into a period of oversupply.

Recent projections from both the International Energy Agency and the US Energy Information Administration point to a widening surplus as non-OPEC supply increases and consumption trends soften into early 2026. The shift continues to pressure sentiment even as short-lived geopolitical support fades.

Russia’s export operations through Novorossiysk have resumed, reducing part of the risk premium that had lifted crude after last week’s disruption.

Markets are now watching the next round of US sanctions on Russian oil majors Rosneft and Lukoil, due to take effect on November 21. President Donald Trump said he is prepared to approve broader sanctions as long as he retains final authority over decisions tied to Russia. He added that he is comfortable with Republican lawmakers drafting legislation aimed at countries that continue to do business with Moscow, citing Russia’s lack of progress on a Ukraine peace agreement.

From a technical view, WTI remains locked inside a descending channel on the daily chart, which keeps the broader trend skewed lower. Prices have pushed above the 21-day Simple Moving Average near 59.97, offering a slight improvement in short-term momentum.

The first key resistance zone sits between 61.00 and 61.50. The area aligns with the channel’s upper boundary and a former support that has repeatedly acted as resistance since late October. A daily close above this zone would hint at a shift in structure and open the path toward the 100-day Simple Moving Average near 62.80.

Support rests at Monday’s low near 59.22 and then last week’s trough at 58.12. A break below these levels would strengthen the bearish bias and expose the October 22 low at 57.31, with further downside risk toward the broader October swing low near 56.00.

Deutsche Bank Says Demand Inelasticity Supports Gold’s Strategic Appeal

Gold continues to play an important role in portfolio diversification even though its correlation with risk assets has increased, Deutsche Bank analyst Michael Hsueh wrote in a new report. Hsueh noted that gold’s positive correlation with risk is not a new phenomenon.

He added that reserve managers are likely to buy during periods of weakness, while ETF investors may be less active as long as realized volatility stays high. Elevated official sector demand remains the primary driver behind gold’s strength relative to financial fair value, and Deutsche Bank expects that dynamic to persist. The bank maintains a bullish long term bias and sees upside to its 4,000 dollar average price forecast for next year.

Hsueh also said a period of softer price performance could help revive jewelry demand, which is on track to fall by about 300 tonnes this year, or roughly 18 percent. Recycled gold supply, which has been subdued as consumers held back in anticipation of further gains, could also rise. The World Gold Council has noted similar trends.

Gold Gains $25 in Early New York Trading

Gold climbed $25 in early US trade to reach 4,069 dollars an ounce, reversing the late-day decline seen during yesterday’s risk-driven selloff. Gold has shown a habit of sharp early New York moves, though the direction varies.

A broader view suggests the metal may settle into a consolidation range between 3,900 and 4,350 dollars after its strong rally. Bulls see potential for higher levels if a Trump-led Federal Reserve pushes for looser policy, combined with renewed fiscal stimulus and tariff uncertainty. Bears argue that tighter policy, stronger judicial oversight, and more restraint from Congress could cap further gains.

Barclays Says Brent Could Climb Above 85 Dollars if Russian Exports Drop Sharply

Barclays warned that Brent crude could jump above 85 dollars a barrel if Russian oil exports fall significantly, arguing that markets are underpricing supply side risks. The bank said most 2026 forecasts that cluster in the mid 50 to mid 60 dollar range assume smooth rebalancing of supply and demand.

Barclays said the market faces asymmetric risk. Demand uncertainty is well known, but potential supply shocks, especially a decline in Russian shipments due to sanctions or logistical constraints, are not fully reflected in prices. A meaningful reduction in Russian flows would quickly tighten inventories and drive a sharp rally in Brent, the bank said.

Barclays acknowledged uncertainty around the probability and timing of such an event but said the scenario is credible enough to warrant careful monitoring, particularly given the inflation implications of a prolonged price spike.

Gold Briefly Breaks 4,000 Dollars Before Buyers Step In

Gold slipped below the 4,000 dollar mark before bouncing as dip buyers stepped in to defend the level. Market tone remains weak with broad deleveraging underway and investors selling across most assets, but buyers signaled that the round number remains an important support area.

If heavier selling pushes gold below that threshold again, traders expect a sharper and more rapid decline.

Goldman Sachs Sees Oil Slump in 2026 Before Recovery Sets In

Goldman Sachs extended its oil outlook to 2035 and warned of a difficult year ahead for producers. The bank projects Brent and WTI prices will fall to averages of 56 and 52 dollars in 2026, compared with forward prices near 63 and 60 dollars, as the final stage of a large supply wave creates a surplus.

Goldman expects a roughly 2 million barrels per day surplus next year, driven by stronger non OPEC output outside Russia. That dynamic could pull Brent into the mid 50 dollar range. Prices today sit near 63.84 dollars. The bank sees the market remaining heavy through mid 2026 before low prices start to curb non OPEC supply.

The bank forecasts a shift in 2027 as demand continues to rise and supply tightens, creating a deficit in the second half of that year. Prices would then need to increase enough to encourage long cycle investment. Goldman projects Brent at 80 dollars by late 2028. They argue that this level is necessary to compensate for declining legacy fields, years of under investment, ongoing structural declines in Russia, and persistent demand growth into the 2030s.

Goldman sees no repeat of past US shale surges, and notes that refined product margins already point to a market that needs higher crude prices to balance supply. Risks remain two sided. Brent could slide into the 40 dollar range if non OPEC supply exceeds expectations or if the economy weakens. Prices could also spike above 70 dollars if Russian production drops sharply.

The recommended strategy is to position for the downturn before the rebound. Goldman advises shorting the 2026 third quarter to December 2028 Brent timespread to capture the surplus. Producers should hedge against 2026 downside, while consumers should consider hedging upside risk for 2028 and beyond.

Chinese Buying Pushes United States Soybean Futures to Highest Level Since Mid 2024

United States soybean futures climbed to their strongest level in more than a year after China’s state owned trader COFCO returned to the American market following the latest United States China trade agreement. Traders told Reuters that COFCO booked at least 14 cargoes, roughly 840,000 tonnes, for December and January shipment. It marks China’s largest United States soybean purchase since the Trump Xi summit in October.

Corn also firmed and wheat futures reached their highest point since July. China, the world’s biggest soybean importer, had leaned heavily on South American supplies during trade tensions with Washington. Months of record imports created a domestic glut, and renewed United States buying is now giving futures markets another lift.

Goldman Expects Strong Central Bank Buying and Reaffirms Gold Target of 4,900 Dollars

Goldman Sachs said official sector gold buying accelerated sharply in November, reinforcing its bullish long term call for spot prices to reach 4,900 dollars by the end of 2026. The bank estimates that central banks purchased about 64 tonnes of gold in September, and early signals suggest November demand may have been similarly strong.

Goldman said the renewed accumulation fits a multi year pattern as central banks diversify away from the United States dollar and build strategic reserves in response to geopolitical tension, fiscal uncertainty in major economies, and concerns about long run inflation dynamics. The firm said official sector flows have become one of the most reliable structural supports for the gold market.

With financial conditions expected to ease through 2026, Goldman said persistent reserve diversification, ongoing ETF inflows tied to softer rate expectations, and firm physical demand from Asia should continue to drive the market. Temporary macro driven volatility is likely to be overshadowed by steady central bank accumulation and tightening supply.

Europe News

Morgan Stanley Sees Euro Rising to 1.23 Dollars in Early 2026 Before Sliding to 1.16

Morgan Stanley expects the euro to strengthen against a softer USD in the first half of 2026 but said those gains are unlikely to persist. The bank said the European Central Bank may face pressure to deliver more rate cuts, taking the deposit rate to 1.5 percent from 2.0 percent, which would weigh on the currency later in the year.

The firm said tariff tension impacts will continue to filter through the eurozone economy, but the bigger drag will be fiscal policy. Morgan Stanley said Germany is likely to fall far short of its fiscal easing plans, offering less support than investors expect and creating another headwind for the currency.

The bank forecasts the euro rising to 1.23 dollars in the first half of 2026, then sliding to 1.16 dollars by year end as policy divergence and weaker European fundamentals return to focus.

BOE’s Pill Says Underlying UK Inflation Running Lower Than Headline

Bank of England Chief Economist Huw Pill said underlying inflation in the United Kingdom appears weaker than headline numbers suggest, raising the question of when inflation will finally reach target after nearly five years above it. Pill cautioned against reading too much into recent data shifts. He noted that wage growth remains significantly higher than what fits a 2 percent inflation environment, especially given weak productivity.

Asia-Pacific & World News

China Sets Price Guidance for 4 Billion Euro Bond as It Diversifies Offshore Funding

China issued initial price guidance for a new euro denominated sovereign bond, with documents reviewed by Reuters showing plans to raise 4 billion euros across two maturities. Investors were guided to a four year tranche at mid swaps plus 28 basis points and a seven year tranche at mid swaps plus 38 basis points.

Beijing has steadily tapped euro markets in recent years as part of a strategy to diversify its investor base, strengthen ties with Europe, and reduce reliance on USD funding at a time of geopolitical and currency sensitivity. Euro issuance also gives European investors access to high grade sovereign paper with modest yield pickup relative to core benchmarks.

The deal continues a pattern of regular euro issuance that has become a fixture in China’s annual funding plan.

China and Russia Pledge Deeper Cooperation in Investment, Energy, and Agriculture

China’s Premier Li Qiang met Russia’s Prime Minister Mikhail Mishustin in Moscow on Monday, with both governments signaling plans to broaden economic and cultural cooperation. Xinhua reported that Li said China is prepared to expand collaboration with Russia in investment, energy, and agriculture and invited more high quality Russian agricultural and food products into China.

Li encouraged Moscow to provide greater support and operational clarity for Chinese companies investing and operating in Russia. Both sides also agreed to widen cooperation in culture, education, and film to strengthen the social dimension of bilateral ties.

PBOC sets USD/ CNY mid-rate at 7.0856 (vs. estimate at 7.1096)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injects 407.5bn yuan at 1.40% via 7-day reverse repos

- after maturities today the net injection is 3.5bn yuan

RBA Minutes Signal Rates May Stay on Hold Longer but Easing Still Possible if Growth Slows

The Reserve Bank of Australia said in the minutes of its November 3 and 4 meeting that it may keep the cash rate unchanged for longer if demand and employment continue to outperform expectations, even as it still sees scenarios where further easing might be required. The board called the current 3.6 percent rate slightly restrictive, though that assessment may be shifting given stronger housing credit and firmer consumer spending.

The RBA has cut rates three times this year but held them steady in November due to higher inflation, resilient demand, and a revived housing market. Policymakers said they can take time to evaluate new information on spare capacity, the labor market, and the degree of restrictiveness in policy. Members noted a little more underlying inflation pressure than previously assessed and now expect inflation to remain above the 2 to 3 percent band until mid 2026.

Markets have reduced expectations for further near term cuts after October employment surged and unemployment fell back to 4.3 percent. Even so, the RBA said additional easing will be considered if growth disappoints or if the labor market softens materially. The bank also said the Australian dollar is near fair value and that global downside risks have eased even as global growth is expected to cool in the second half of 2025.

BOJ Governor Ueda Says Discussed Economy and Policy with Prime Minister Takaichi

Bank of Japan Governor Kazuo Ueda said he discussed the economy and monetary policy with Prime Minister Sanae Takaichi and told her the BOJ is adjusting the degree of support needed to achieve stable 2 percent inflation. Ueda said the BOJ will decide policy while studying a wide set of data. He confirmed that foreign exchange was discussed but declined to give details. He said stable currency moves that reflect fundamentals are desirable and that the BOJ is monitoring the economic impact of FX swings.

Separately, Chief Cabinet Secretary Minoru Kihara said Takaichi’s comments on Taiwan are consistent with Japan’s long held views. When asked whether the government planned to retract the remarks, Kihara said no, a response that is unlikely to sit well with Beijing and suggests political tensions will persist.

Japan Maintains Moderate Recovery View as Long Term JGB Yields Edge Higher

Economy Minister Kiuchi said the government still believes the economy is improving moderately and said the latest third quarter GDP results do not change that assessment. He said long term interest rates are determined by markets and that authorities are monitoring financial conditions closely, including recent moves in long dated JGB yields.

His remarks came as the 30 year JGB yield rose 2.5 basis points to 3.28 percent, extending recent upward pressure on the long end of the curve. Officials continue to express confidence in the recovery narrative but acknowledge the need to track bond market dynamics as yields drift higher.

Japan Finance Minister Says Stimulus Package Has Grown Sizable but Offers No Figures

Japan’s Finance Minister Katayama said the upcoming economic stimulus package has grown sizable, but he declined to provide a specific number. His comments imply that ministries have expanded the package as they coordinate measures aimed at supporting households and keeping growth on track.

Katayama signaled the government is not yet ready to announce the overall cost, reflecting ongoing negotiations over funding, fiscal discipline, and political sensitivities tied to Japan’s high public debt.

Goldman Forecasts 7.7 Percent Annual Global Equity Returns and Urges Investors to Look Beyond United States Markets

Goldman Sachs expects global equities to deliver 7.7 percent annualized USD returns over the next decade, supported by earnings growth and steady shareholder payouts. Chief global equity strategist Peter Oppenheimer said expected gains will be driven largely by nominal GDP growth, profitability, and distributions.

The firm broke out ten year regional return forecasts as follows:

- United States expected at 6.5 percent per year, driven mainly by earnings and modest dividends, with buybacks offsetting some valuation drag.

- Europe seen returning 7.1 percent, with contributions split between earnings growth and payouts.

- Japan projected at 8.2 percent, supported by 6 percent EPS growth and policy backed improvements to shareholder returns.

- Asia excluding Japan expected to post 10.3 percent, driven by about 9 percent EPS growth and a 2.7 percent dividend yield, though with some valuation compression.

- Broader emerging markets forecast at 10.9 percent, powered by strong earnings growth in China and India.

Oppenheimer said investors should diversify internationally given stronger nominal GDP in emerging markets, the global breadth of AI benefits, and the potential lift from a softer USD.

Nikkei Says Japan’s Takaichi Eyes Fuel Tax Cuts and New Investment Incentives

Prime Minister Sanae Takaichi will open tax reform talks this week aimed at cutting fuel taxes to support household budgets while identifying offsetting revenue measures to safeguard fiscal discipline, according to the Nikkei. The ruling Liberal Democratic Party and its coalition partner will begin shaping the 2025 tax package, including the already agreed removal of gasoline and diesel surcharges that will leave a revenue gap of about 1.5 trillion yen.

To fill the shortfall, the government is considering scaling back major corporate tax incentives, especially for R and D and wage boosting programs, and is reviewing higher taxes on wealthy households including reforms to the so called 100 million yen barrier. Ministries are divided over shrinking the R and D credit, which cost nearly 1 trillion yen last fiscal year.

Officials are also weighing fresh investment incentives such as first year full depreciation for domestic capex, tax breaks for startup investment, and benefits for firms relocating out of central Tokyo. Personal income tax adjustments are also under discussion, including a larger standard deduction and expanded mortgage tax relief by lowering minimum home size requirements.

Long end JGB yields have moved higher as markets assess the fiscal implications of Takaichi’s stimulus agenda, raising pressure on the government to secure credible offsets before fuel tax cuts take effect.

Crypto Market Pulse

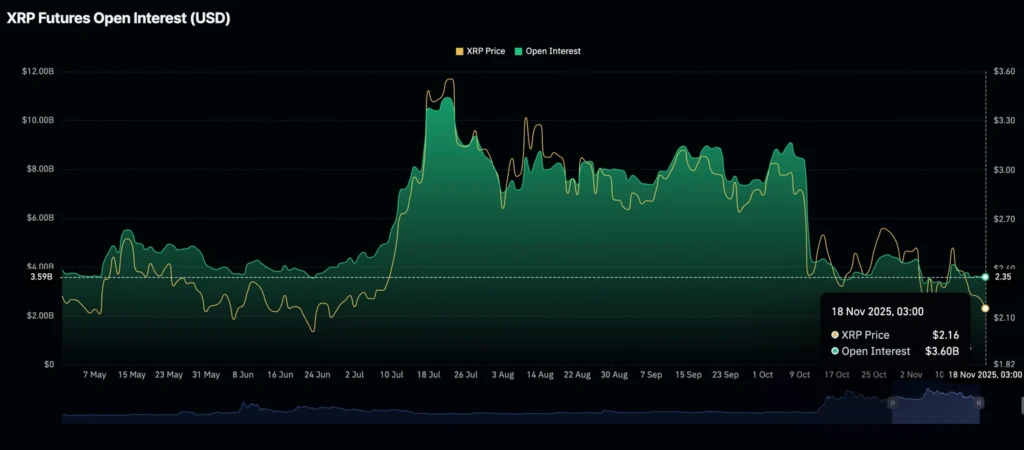

XRP holds near 2.10 as weak retail interest caps recovery attempts

XRP spent Tuesday trading just above support near 2.10 as risk-off sentiment and a lack of strong demand continued to weigh on performance across the cryptocurrency market.

Retail and institutional appetite remains low. The futures Open Interest for XRP averaged 3.6 to 3.78 billion on Tuesday, reflecting subdued positioning. Sideways movement in OI highlights hesitation among traders who are reluctant to commit to fresh exposure until clearer catalysts emerge.

The backdrop has been weak since the Federal Reserve cut rates in October. Investors have become cautious about the policy path heading into the December 10 meeting. Chair Jerome Powell said after November’s 25 basis point cut to a range of 3.75 to 4.00 percent that further reductions were not guaranteed.

CME FedWatch data shows the market split between another 25 basis point cut and a pause. Current probabilities sit near 50.6 percent for a cut and 49.4 percent for a hold.

Technical readings remain soft. The RSI continues to trend lower and the MACD sits on a sell signal, reinforcing the view that bearish sentiment is firmly in place.

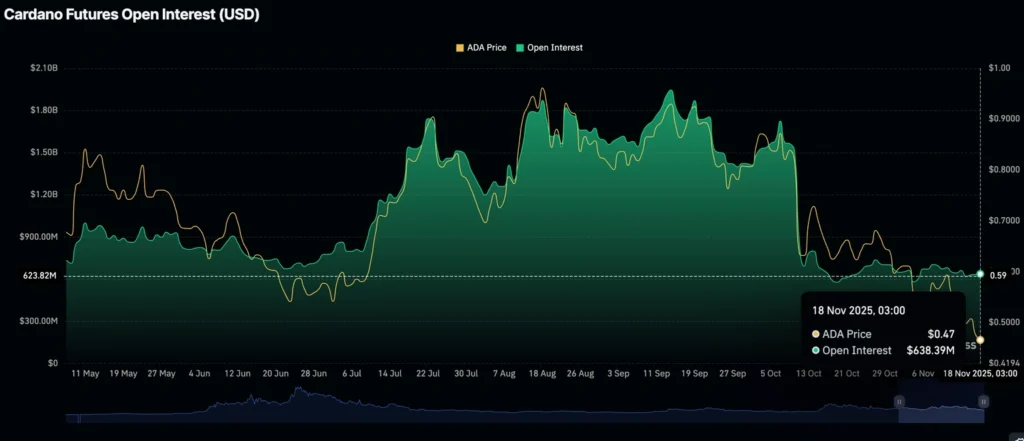

Cardano Falls Back to 2024 Levels as Retail Interest Thins

Cardano traded near 0.45 dollars on Tuesday, erasing its one year gains as selling pressure persists. The token has been in a steady downtrend since reaching 1.02 dollars in July.

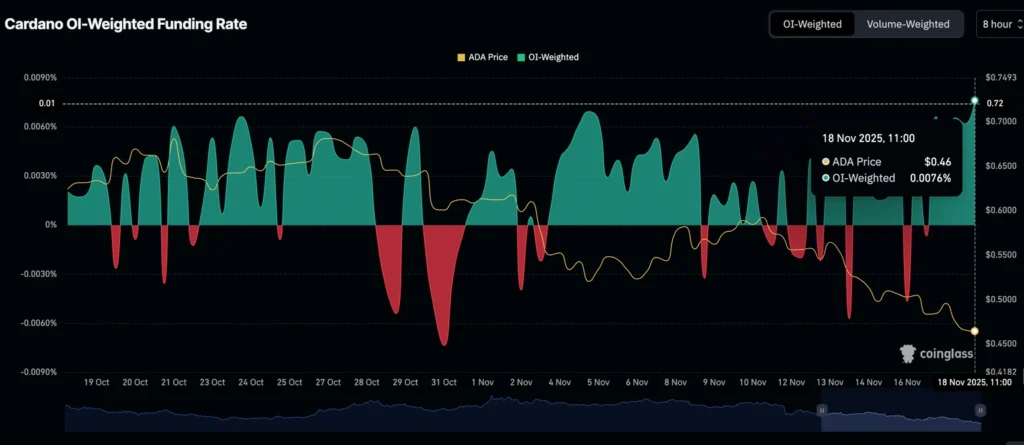

Cardano’s derivatives market has weakened sharply since the October 10 flash crash, which wiped out more than 19 billion dollars in crypto positions. CoinGlass data show futures open interest averaging 638 million dollars, down from 1.51 billion dollars on October 10. Open interest had reached a record of 1.95 billion dollars on September 14 before the deleveraging event.

Open interest trends serve as a gauge of market participation. The persistent decline signals lower confidence in ADA and its ecosystem. Funding rates, however, show some stabilization. The OI weighted funding rate has risen to 0.0076 percent, reflecting increased demand for long exposure. Higher readings typically support gradual recovery if broader conditions improve.

Tron Extends Losses as TVL Slides and Funding Turns Negative

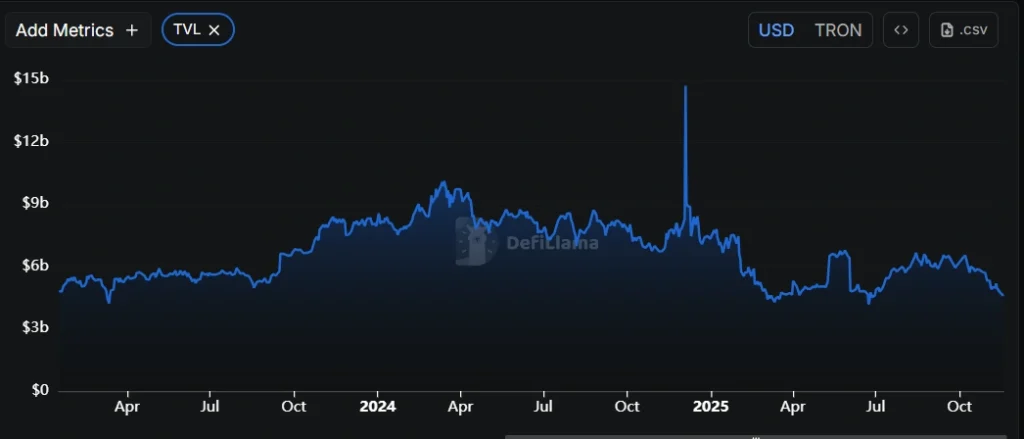

Tron traded below 0.288 dollars on Tuesday, extending its decline after last week’s rejection at a key resistance level. Weakness in the token’s on chain and derivatives indicators is reinforcing the bearish tone.

DefiLlama data show Tron’s total value locked fell to 4.58 billion dollars and has been declining since early October. Lower TVL signals slowing activity and reduced user engagement across the Tron ecosystem. Derivatives markets reflect similar caution.

According to Coinglass, the OI weighted funding rate dropped to minus 0.0044 percent, indicating that short sellers are paying longs. Negative funding rates generally suggest that bearish positioning is building.

The technical view points to the possibility of further downside, with traders watching the 0.276 dollar level as the next support.

Crypto Market Weakens as Bitcoin Holds Near 91,000 Dollars

Bitcoin traded above 91,000 dollars on Tuesday, slightly lower on the day but off earlier lows, as risk aversion weighed on the broader digital asset market. Ethereum hovered above 3,000 dollars and XRP traded near 2.18 dollars, showing modest stabilization, though the wider trend remains bearish.

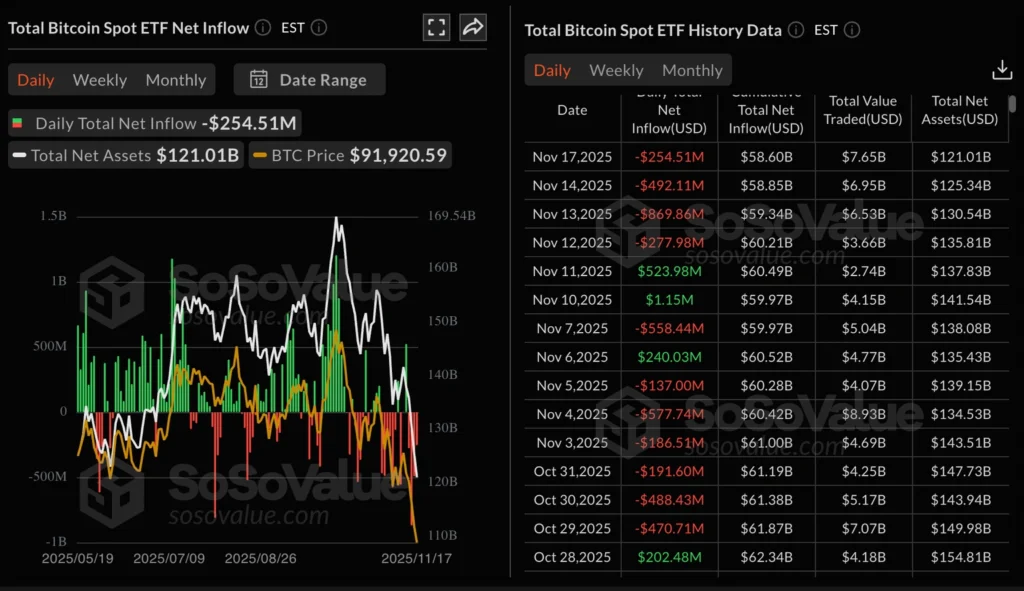

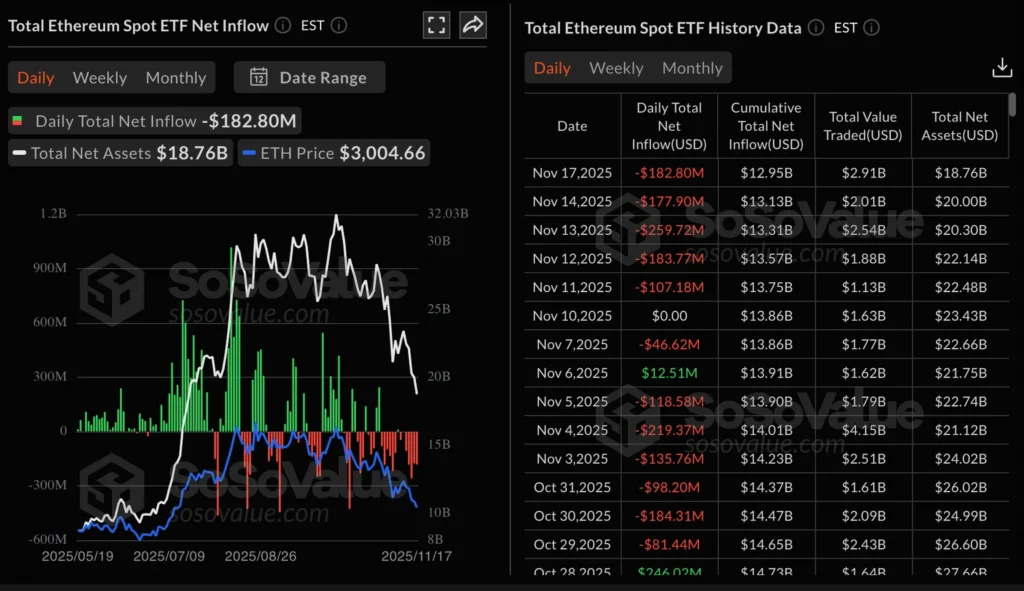

Institutional demand continues to soften. US listed Bitcoin spot ETFs recorded roughly 255 million dollars in outflows on Monday, adding to last week’s withdrawals. Total net inflows now stand at 58.6 billion dollars, with net assets at 121 billion dollars.

Ethereum ETFs also saw notable outflows of nearly 183 million dollars on Monday. The last inflow day for ETH ETFs was November 6. According to SoSoValue, cumulative inflows total 12.95 billion dollars, with net assets at 18.76 billion dollars.

Persistent ETF outflows have kept sentiment subdued. Without a shift in institutional flows, sustaining a recovery over the near term may remain challenging for Bitcoin, Ethereum, and XRP.

Aster Rallies 16 Percent as Derivatives Data Show Renewed Bullish Interest

Aster rose about 16 percent on Tuesday, recovering from an 8 percent drop the day before. The Binance backed perpetuals focused DEX token climbed toward a one month high and pushed through the 1.2900 dollar supply zone. Rising demand helped fuel higher futures activity and a stronger funding rate.

CoinGlass data show Aster’s futures open interest increased nearly 5 percent in the past 24 hours to reach 615.78 million dollars, suggesting traders are adding long positions. The OI weighted funding rate rose to 0.0144 percent, which signals traders are paying a premium to maintain long exposure. Rates above 0.010 percent usually reflect strong demand and expectations for further gains.

With Aster trading above major moving averages and nearing a potential golden cross, the broader technical backdrop remains constructive.

Bitcoin Drops Below 91,000 Dollars for First Time in Six Months

Bitcoin extended its decline in Asian trading on Tuesday, falling below 91,000 dollars for the first time in six months. The move reflects a broader risk off shift as expectations for a December Federal Reserve rate cut fade and concerns about AI developments weigh on sentiment.

Other assets have also come under pressure as investors continue reducing exposure across risk categories.

The Day’s Takeaway

North America

US equities finish lower as midday rebound fizzles

All three major US indices spent the entire session in negative territory on Tuesday.

- Dow fell 498.50 points, or 1.07 percent, to 46091.74.

- S&P 500 lost 55.09 points, or 0.83 percent, to 6617.32.

- Nasdaq dropped 275.23 points, or 1.21 percent, to 22432.85.

All three closed well above their lowest levels of the day, but weak tech sentiment dragged on performance. Nvidia slid 2.81 percent ahead of earnings. Other heavy movers included Home Depot, Western Digital, Micron, Amazon, AMD and Microsoft, all posting losses between 2 and 6 percent.

Commodities

Oil: Goldman warns of a painful 2026 before a stronger rebound

Goldman Sachs extended its oil outlook through 2035 and expects Brent and WTI to fall to averages of 56 and 52 dollars in 2026. The bank said the final stage of a supply wave will create a 2 million barrels per day surplus next year, driven by stronger non OPEC output outside Russia. Brent could sink into the mid 50s as a result.

Goldman expects 2027 to mark the start of a tightening phase as low prices choke non OPEC output and demand keeps rising. The bank projects Brent at 80 dollars by late 2028. It argues this price is needed to offset years of under investment, declines in legacy fields, and Russia’s structural drop in production.

Risks run in both directions. Brent could slide into the 40s if supply remains resilient or the economy weakens. Prices could spike above 70 if Russian output drops sharply. Goldman advises shorting the 2026 to 2028 Brent timespread to capture the surplus and suggests producers hedge downside while consumers hedge upside beyond 2028.

WTI edges above 60 as traders monitor supply and sanctions

WTI traded near 60.50 on Tuesday, up about 1.35 percent. The move comes despite rising expectations that the oil market is heading into a surplus through 2026 because of non OPEC growth and softer demand forecasts.

Russia’s resumption of Novorossiysk exports trimmed last week’s risk premium.

Traders are now tracking the next round of US sanctions on Rosneft and Lukoil, set to take effect November 21. President Trump signaled he is willing to approve broader sanctions as long as he keeps final authority on actions tied to Russia.

WTI remains inside a descending channel. Resistance sits in the 61.00 to 61.50 zone. Support is at 59.22 and then 58.12.

Gold holds above 4050 as Fed expectations tilt dovish

Gold traded near 4058 on Tuesday, up 0.36 percent, supported by weaker risk appetite and a growing belief that the Fed may ease in December. Initial Jobless Claims came in at 232K and Factory Orders were slightly better than expected, but neither shifted sentiment.

Traders are waiting for the FOMC Minutes and Thursday’s Nonfarm Payrolls. Goldman Sachs reported that China’s central bank has resumed gold buying, a trend that could continue into November and boost near-term prices.

Deutsche Bank says demand inelasticity keeps gold attractive

Deutsche Bank analyst Michael Hsueh said gold still plays a key role in diversification even though it has shown more frequent positive correlations with risk assets. He said reserve managers are likely to buy on weakness, while ETF flows may stay muted while volatility remains high.

He added that official sector demand remains the main reason gold trades above fair value. The bank sees upside to its 4000 dollar average price forecast for next year. Softer prices could revive jewelry demand, which is expected to fall 300 tonnes this year. Recycled supply could rise if consumers stop holding out for further gains.

Crypto

Market softens as Bitcoin holds near 91000

Bitcoin traded slightly lower on Tuesday but stayed above 91000. Ethereum hovered just above 3000 and XRP traded near 2.18. The broader trend remains bearish as institutional flows continue to weaken.

US listed Bitcoin ETFs saw about 255 million dollars in outflows on Monday. Total net inflows stand at 58.6 billion, with 121 billion in net assets. Ethereum ETFs recorded roughly 183 million dollars in outflows, with no inflow days since November 6.

Persistent ETF outflows are keeping sentiment fragile. Without a reversal in institutional flows, a sustained recovery may be difficult.

Aster jumps 16 percent as derivatives data turn bullish

Aster rallied 16 percent on Tuesday after an 8 percent decline the day before. The Binance backed token moved through the 1.2900 supply zone. CoinGlass data show futures open interest up 5 percent to 615.78 million dollars. The funding rate rose to 0.0144 percent, signaling traders are paying a premium to stay long.

Aster now trades above major moving averages and is nearing a golden cross, which keeps the technical tone bullish.

Tron weakens as TVL and funding rates fall

Tron traded below 0.288 on Tuesday. TVL has slipped to 4.58 billion dollars and has been falling since early October, signaling weaker engagement across the Tron ecosystem.

Funding rates have turned negative at minus 0.0044 percent, showing shorts are paying longs and that bearish positioning is strengthening. Traders are watching 0.276 as the next support.

Cardano drops to 2024 levels as retail demand fades

Cardano traded near 0.45 on Tuesday, wiping out its one year gain. The token has been sliding since reaching 1.02 in July.

Open interest has dropped to an average of 638 million dollars, down from 1.51 billion on October 10. The flash crash on that day liquidated more than 19 billion dollars in crypto positions and triggered a steep drop in ADA participation.

The funding rate has risen to 0.0076 percent, showing some long interest returning. That could help stabilization if conditions improve.

XRP holds near 2.10 as retail demand stays muted

XRP struggled to lift above 2.10 on Tuesday. Futures open interest remains soft, hovering around 3.6 to 3.78 billion dollars. Weak demand and sticky risk-off sentiment continue to limit recovery attempts.

The RSI trends lower and the MACD remains on a sell signal. With the Fed meeting approaching and rate expectations split between a cut and a pause, traders remain cautious.