North America News

U.S. Stocks Swing Wildly but Finish the Day Flat

U.S. equities opened to heavy selling before staging a sharp turnaround that erased the early losses within 90 minutes. Tech names fueled the rebound as investors piled in, but momentum faded late in the day, leaving the major indexes mostly unchanged. Weekly performance was similarly muted.

Daily moves:

- S&P 500: flat

- Nasdaq Composite: +0.1%

- Dow Jones Industrial Average: –0.6%

- Russell 2000: +0.3%

Weekly moves:

- S&P 500: +0.1%

- Nasdaq Composite: –0.5%

- DJIA: +0.3%

- Russell 2000: –1.8%

Delayed September Jobs Report Set for Nov. 20 Release

The BLS confirmed it will finally publish the September 2025 non-farm payrolls report on Thursday, Nov. 20 at 8:30 a.m. ET.

The data is stale after the prolonged disruption, but its release marks progress toward normalizing the reporting schedule.

Fed’s Logan: October Cut Was a Mistake, December Cut Hard to Justify

Dallas Fed President Lorie Logan reiterated that she would have preferred keeping rates unchanged in October. Looking ahead, she said a December cut would require clear evidence of cooling inflation or a weakening labor market.

Logan becomes a voting member next year, making her stance more consequential.

Fed’s Schmid Warns Rate Cuts Won’t Solve Labour-Market Weakness

Kansas City Fed President Jeffrey Schmid said inflation concerns extend well beyond tariff effects and reiterated the reasoning behind his October dissent. He argued that inflation remains too firm while the labour market, though cooling, is still broadly balanced. Schmid added that additional rate cuts would not address deeper structural issues in employment.

U.S. Labour Secretary Says October CPI Release Uncertain

U.S. Labour Secretary Lori Chavez-DeRemer said the BLS was unable to fully collect data for October’s CPI report, casting doubt on whether the release can be completed. She added that September jobs figures, which were collected but not processed, might be ready next week.

The White House has already signalled the possibility that October CPI and NFP may not be published at all due to earlier disruptions. With the next FOMC meeting approaching, officials are prioritising the availability of November data, though it remains unclear if November CPI can be compiled in time.

Walmart Shares Drop After CEO Doug McMillon Announces Retirement

Walmart CEO Doug McMillon will retire on January 31, 2026, prompting a 2.8% drop in the retailer’s shares after the announcement. McMillon, 59, is widely credited for strengthening Walmart’s position against Amazon and overseeing a doubling of the company’s share price over the past two years.

He will be succeeded by John Furner, a 30-year company veteran who started as an hourly employee and currently leads Walmart U.S. Chairman Greg Penner said Furner’s experience across the business and record of execution make him the right leader for the company’s next phase. McMillon will remain on the board until June.

Report Says Trump Administration Prepares Tariff Exemptions to Ease Food Prices

The New York Times reported the administration is preparing tariff exemptions to lower food costs after signalling a focus on price relief earlier in the week. The shift marks another retreat from the “no exceptions” approach that characterised earlier tariff policy.

Citi Sees September Payrolls Soon, October Data Likely Delayed

Citi economists say the U.S. data calendar remains disrupted by the government shutdown. September payrolls could be released as early as Friday or early next week, while October payrolls may slip into December due to incomplete surveys.

The bank expects October CPI and payrolls to be published but with less reliability. It sees labour-market data continuing to soften and expects the Fed to cut rates in December, January and March.

U.S.–Swiss Trade Talks Show Momentum Toward Tariff Relief

A senior U.S. official said talks with Switzerland were “very positive,” with a proposal ready for presidential approval that would reduce tariffs on Swiss imports and ease certain non-tariff barriers. The discussions have been intermittent for months but appear to be nearing a decision phase.

Canada September Manufacturing Rebounds More Than Expected

Canada’s manufacturing sales rose 3.3% in September, beating expectations of 2.8%, reversing a revised 1.1% drop in August. Wholesale trade climbed 0.6%, compared with forecasts of flat growth, following a revised 1.0% decline in the prior month. The data offers a firmer signal that Canada’s industrial sector regained momentum at the tail end of Q3.

Commodities News

Oil Ends a Turbulent Week With a Slim Gain

Crude prices were thrown around this week by shifting sentiment on Russian supply and broader market risk. Oil sold off sharply midweek, then rebounded Thursday and Friday even as equities wobbled. The action hinted at hedging flows and heavy short-covering as traders reduced exposure.

Despite the noise, crude ended the week just 35 cents higher. Futures flipped into contango—though the curve remains nearly flat—and 3-2-1 crack spreads widened to $31.89, the highest of the year. Volatility remains contained within the price range established in late October, signaling continued consolidation.

Central Bank Gold Buying Remains a Black Box

A new report highlights how little visibility the market has into central bank gold purchases. Because reporting is voluntary, analysts estimate that only about a quarter of buying is disclosed.

China reports purchases of roughly two tonnes per month, but Société Générale believes true demand could reach 250 tonnes this year. Analysts have been watching order patterns for 400-ounce bars, one of the few indirect clues available. The World Gold Council says only one-third of official buying is publicly recorded, meaning China’s reserves could be far larger than its official figures suggest.

The core message: large buyers are accumulating gold, and the market doesn’t know how much—though odds are high that China is leading the charge.

Baker Hughes Rig Count: U.S. Ticks Up, Canada Slips

The latest rig count showed a small uptick in U.S. activity and a pullback in Canada.

United States:

- Total rigs: +1 to 549

- Oil rigs: +3 to 417

- Gas rigs: –3 to 125

- Miscellaneous: +1 to 7

- Down 35 rigs from a year ago

- Offshore rigs unchanged at 19, up from 14 last year

Canada:

- Total rigs: –3 to 188

- Oil rigs: –5 to 124

- Gas rigs: +2 to 64

- Down 12 rigs from last year

Copper Market Softens as Supply Signals Improve – Commerzbank

Copper briefly pushed above USD 11,000 per ton before pulling back, with Commerzbank’s Thu Lan Nguyen noting that weak Chinese data and the partial restart of Indonesia’s Grasberg mine removed upward pressure.

China’s industrial output remains higher than a year ago, but its pace has slowed, reflecting subdued domestic demand—particularly in real estate. Stronger metal production combined with weak consumption implies increased Chinese exports, with industry sources estimating October shipments exceeded 100,000 tons, putting full-year exports on track for a record.

High LME prices have incentivized additional exports, though inventory data shows only slight increases so far this month. If stock builds continue, Commerzbank sees room for further downward correction in prices.

Oil Market Still Appears Well Supplied – ING

Oil closed about 0.5% higher despite a bearish U.S. inventory report and an IEA update again highlighting expectations for a substantial 2026 surplus.

U.S. crude inventories rose 6.4 million barrels last week, surpassing forecasts and reaching the highest level since June. Exports fell sharply, driving the build. Gasoline and distillate stocks declined even as refinery utilization climbed to 89.4%.

The IEA continues to expect strong supply growth—3.1 million bpd in 2025 and 2.5 million bpd in 2026—while demand increases remain modest. September saw a 77.7-million-barrel surge in global observed stocks, with floating storage again dominating. Preliminary October data indicates further increases.

Middle distillates remain supported by low inventory levels, unplanned outages, maintenance, Russian sanctions uncertainty, and winter demand.

Agencies Diverge, but Oversupply Expected for 2026 – Commerzbank

The IEA’s latest monthly report maintains expectations for a record supply surplus above 4 million bpd next year, driven by a 2.5 million bpd supply increase against just 770,000 bpd demand growth. Commerzbank views the supply forecast as overly optimistic and expects such an imbalance would push prices sharply lower—forcing producers to adjust.

Non-OPEC supply was revised up significantly for Q3 2025, contributing to a surge in global inventories, now at four-year highs. Floating storage accounts for most of the increase, while OECD inventories also climbed back to their five-year average.

OPEC’s report projects a broadly balanced 2026, with oversupply in the first half offset by a deficit later in the year, assuming OPEC+ output stays unchanged.

The EIA, meanwhile, forecasts a 2.2 million bpd surplus next year and expects Brent to average USD 55. It sees U.S. crude production reaching a record this month before gradually declining in 2026—though still at slightly higher levels than previously estimated.

Silver Nears Record Before Pullback – Commerzbank

Silver approached its four-week-old record high of USD 54.5/oz before reversing nearly 2%. Analyst Carsten Fritsch attributes the move to gold’s simultaneous decline and an overextended prior rally, reflected in the Gold/Silver ratio falling below 78, near its mid-October low.

Despite Thursday’s drop, silver remains on pace for its strongest week in five months and could log a record weekly close if it finishes at USD 52 or above. The IEA’s projection of surging electricity demand over the next decade has supported sentiment, as silver is critical in power generation, transmission, and electric mobility. Electrical and electronic uses now account for nearly 70% of industrial silver demand.

China’s Crude Processing Remains Strong in October – Commerzbank

China processed nearly 15 million barrels per day of crude in October—slightly below September but 6.5% higher than a year earlier. Through the first ten months, refinery throughput rose 4% compared with last year, pointing to annual growth.

Based on production and import data, crude inventories rose by about 690,000 bpd in October. While the build was smaller than earlier this year, China continues to expand its reserves, raising questions about how long such buying can absorb excess global supply.

IEA Pushes Oil Demand Peak to Much Later – Commerzbank

The IEA’s new World Energy Outlook extends the expected peak in oil demand significantly. Under its Current Policies Scenario, demand rises until 2050 and ends the period 13% higher than in 2024, reflecting a slower transition to electric vehicles.

The Stated Policies Scenario still shows a 2030 peak, but the revision brings the IEA closer to OPEC’s long-standing view that demand will increase through 2050. Even so, OPEC’s projected end-period demand remains about 10 million bpd higher than the IEA’s.

Uncertainty Over U.S. Data Timing Pressures Gold – Commerzbank

Gold eased again as markets awaited clarity on when data delayed by the U.S. government shutdown will be released. Nguyen noted that the BLS expects to announce new dates soon, though meaningful economic assessment may remain difficult due to disrupted data collection.

Kevin Hassett has already warned that October’s labor report will lack unemployment-rate data. Several FOMC members have signaled discomfort with further rate cuts without reliable labor and inflation figures, creating a real risk that policymakers hold off on a December move.

Oil Gains After Drone Strike Hits Russian Novorossiysk Hub

Crude prices jumped more than 2% on Friday after a Ukrainian drone attack struck an oil facility in Novorossiysk, one of Russia’s key export terminals. Brent rose 2.1% and WTI climbed 2.4%. Local authorities reported that drone debris hit residential buildings, a trans-shipment depot and nearby coastal infrastructure.

The strike adds to supply-side risk as U.S. sanctions tighten on Russian producers, with new measures against Lukoil and Rosneft taking effect on November 21. JPMorgan estimates roughly 1.4 million bpd of Russian crude is now sitting on tankers amid rising discharge delays. The bank warned cargo unloading after the cut-off could become “significantly more challenging.”

Europe News

Eurozone Q3 GDP Holds Steady, but Stagflation Fears Linger

Eurozone quarterly growth held at 0.2% in the second estimate for Q3, matching the preliminary release, according to Eurostat. Year-on-year GDP was revised up slightly to 1.4% from the initial 1.3%, with the prior quarter adjusted to 1.5%.

The region’s resilience masks growing concern over Germany’s deteriorating backdrop. Investors are increasingly focused on whether weak German output and sticky inflation risks could tilt the bloc toward a stagflationary setting heading into year-end.

France Final October CPI Revised to 0.9%

France’s final CPI for October was revised to 0.9% year-on-year, down from 1.0% in the preliminary reading. HICP was revised to 0.8%. Core inflation eased to 1.2%. The ECB continues to face constraints from persistent price pressures in Germany.

Spain Final October CPI Holds at 3.1%

Spain’s final CPI for October matched the preliminary 3.1% reading, up from 3.0% in September. HICP was unchanged at 3.2%. Core inflation ticked up to 2.5%, supporting expectations that the ECB will remain on hold through year-end.

ECB’s Kazaks Says Current Rate Level Matches Inflation Outlook

ECB policymaker Martins Kazaks said the current policy rate aligns with inflation conditions and that adjustments will be made if warranted. He said the ECB has achieved its inflation target and described U.S. tariff policy as less damaging than initially feared.

Asia-Pacific & World News

UBS: China’s AI Power Build-Out Modest Compared With U.S., No Signs of Bubble

UBS upgraded its outlook for China’s late-2020s power demand, projecting annual growth of about 8% from 2028 to 2030 — well above consensus. The bank attributes the surge to AI-driven data-centre use, industrial exports and electrification. AI alone could add 2.3 percentage points to annual demand growth.

China’s AI-power build-out is estimated at 5–6GW, far below the 40–45GW underway in the U.S., which UBS says suggests no bubble. The bank expects a sharp pickup in energy-sector investment during the 15th Five-Year Plan and strong gains in nuclear, wind and storage technologies.

Evergrande Property Services Invites Updated Bids as Liquidation Advances

Liquidators for Evergrande Property Services have invited selected bidders to review additional materials ahead of submitting updated non-binding offers by late November 2025. They stressed the process remains preliminary.

Evergrande, once China’s most valuable developer, collapsed under more than US$300 billion in liabilities and was ordered into liquidation in early 2024. Its Hong Kong listing was cancelled in August 2025.

China’s October Activity Snapshot

October activity data showed:

- Retail Sales +2.9% YoY (expected +2.7%)

- Industrial Production +4.9% YoY (expected +5.5%)

- Industrial Production YTD +6.1%

- Fixed-Asset Investment YTD –1.7% (expected –0.8%)

- Unemployment 5.1%

Property indicators continued deteriorating: investment –14.7% YTD, new construction starts –19.8%, sales –6.8%, funding –9.7%.

The NBS said operations were “generally stable” but acknowledged significant structural pressures.

China New-Home Prices Fall Again in October

New-home prices in China fell 2.2% year-on-year in October, matching the previous month’s drop. Prices declined 0.5% from September, extending the sector’s persistent downturn.

Beijing Emphasises Stabilisation Despite Weak October Investment and Industrial Data

China’s October figures showed firmer consumption but weaker factory activity and investment. Retail sales rose 2.9% year-on-year, supported by holiday spending. Industrial production cooled to 4.9%, while fixed-asset investment fell 1.7% in the year to date, reflecting deepening distress in the property sector. Real estate investment dropped 14.7% in the first ten months, with new starts and developer funding plunging.

The unemployment rate edged down to 5.1%. The NBS said consumption gained from holiday travel but acknowledged slowing investment amid a difficult external environment and rising domestic competition. Officials maintained that China retains “huge” investment potential and said efforts to revive private investment will intensify.

Amazon and Microsoft Back U.S. Bill That Could Curb Nvidia’s China Chip Exports

Amazon and Microsoft have endorsed the Gain AI Act, a U.S. proposal that would curb exports of advanced chips to China until domestic demand is met. The measure marks a notable split with Nvidia, their key supplier, which opposes the legislation.

The bill aims to safeguard U.S. access to AI-grade semiconductors and includes provisions allowing “trusted entities” to receive export exemptions without full licensing. Nvidia, which holds roughly 80% of the AI-chip market, argues the law would distort supply chains and risk triggering more restrictions from Washington.

The proposal has backing from Senate Majority Leader Chuck Schumer and may be folded into the year-end National Defense Authorization Act, though it still requires bipartisan approval.

China Housing Slide Deepens as Industrial and Investment Indicators Soften

China’s property downturn intensified in October, with new-home prices dropping 0.45% from the prior month — the sharpest decline in a year. Industrial output rose 4.9% from a year earlier, undershooting forecasts and easing from September’s pace. Retail sales advanced 2.9%, while fixed-asset investment contracted 1.7% in the year to date, a significantly weaker showing than anticipated.

NBS spokesperson Fu Linghui said the economy is operating “relatively smoothly” but acknowledged mounting domestic and external pressures. Economists said the housing sector remains the main drag, pointing to sluggish investment, oversupply in the secondary market and subdued sentiment. Analysts expect policymakers to lean further on infrastructure and strategic manufacturing to steady growth.

PBOC sets USD/ CNY reference rate for today at 7.0825 (vs. estimate at 7.0964)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 212.8bn yuan via 7-day reverse repos at an unchanged rate of 1.40%.

New Zealand Manufacturing PMI Back in Expansion at 51.4

New Zealand’s October PMI rose to 51.4 from a revised 50.1, marking four straight months above 50 for the first time in three years. Four of five sub-indices expanded, though employment remained in contraction. BNZ’s Doug Steel said the improvement is modest but moving in the right direction.

BOJ Says Deputy Governor Uchida Still Expected at December Meeting

The BOJ said Deputy Governor Shinichi Uchida is expected to attend the December 18–19 policy meeting despite being hospitalised for leukemia treatment. The central bank said he will work remotely for several weeks.

Japan’s Economy Minister Kiuchi Notes Weak Yen’s Role in Lifting CPI

Economy Minister Kiuchi said a soft yen adds to inflation through higher import costs, assuming those costs are passed through. The remarks come as officials issue sporadic comments attempting to support the currency.

Finance Minister Katayama said forthcoming stimulus will align with the administration’s proactive fiscal stance.

Japan’s Takaichi Eases Away From Nationwide Minimum-Wage Target

Prime Minister Sanae Takaichi said the government will not pursue a new numerical target for the minimum wage, noting resistance from smaller regional firms facing tight margins. Her comments point to a more flexible approach where wage growth is expected to occur organically rather than through mandated benchmarks.

U.S.–South Korea Deal Expands Investment, Lowers Tariffs and Strengthens Defence Ties

Washington and Seoul announced a broad agreement covering investment, trade and defence. The U.S. approved US$150 billion in Korean shipbuilding investment and an additional US$200 billion in strategic commitments.

The U.S. also authorised South Korea to build nuclear-powered attack submarines. Seoul pledged US$25 billion in U.S. equipment purchases by 2030 and support worth US$33 billion for U.S. Forces Korea.

The U.S. will reduce Section 232 tariffs on Korean autos, parts, timber and certain pharmaceuticals to a 15% ceiling. South Korea will remove its 50,000-unit cap on U.S. vehicle imports and address non-tariff barriers on food and agriculture.

South Korea Signals Readiness to Stabilise Won After Sharp Slide

Seoul said it stands ready to act after the won weakened to seven-month lows. Market participants suspected authorities had already sold dollars following warnings from the finance ministry.

Officials cited a structural imbalance in dollar supply and demand, heightened by rising overseas investment by Korean residents. The currency briefly touched 1,475.4 per dollar — its weakest level since April — before rebounding on speculation of intervention. Authorities plan discussions with the National Pension Service and major exporters on stabilisation tools.

Crypto Market Pulse

Bitcoin Hits Lowest Level Since May in Late-Friday Slide

Bitcoin’s rebound didn’t hold. The cryptocurrency slipped to a fresh low not seen since May and is now close to breaking below its spring trough. It’s flat year-over-year and far below the early-October record near USD 126,000.

Zooming out, the long-term uptrend from the 2023 low at USD 15,556 is still intact, but price action is testing the bottom of that channel.

Sentiment has shifted: enthusiasm has moved toward AI and quantum computing, while crypto attention has rotated into memecoins and options trading rather than ecosystem development or blockchain utility.

Bitcoin may be struggling for relevance, at least in the current macro narrative.

XRP Extends Decline as Supply in Profit Hits One-Year Low

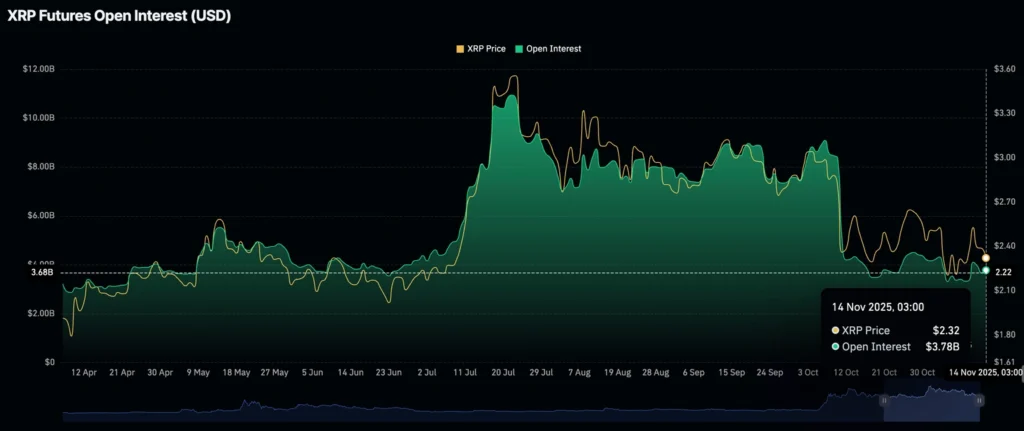

XRP trades above USD 2.25 after four days of losses, reflecting persistent risk-off sentiment despite the launch of the first U.S. XRP spot ETF, which recorded USD 59 million in debut-day volume.

Glassnode data shows supply in profit has fallen to around 44 million XRP—its lowest level since early November 2024—down from 64 million in mid-July. The decline indicates growing unrealized losses but also suggests lower potential sell-side pressure if sentiment stabilizes.

Retail demand remains tepid. Futures open interest is slightly higher at USD 3.78 billion but remains well below early-month levels. A sustained rise in OI is needed to support a short-term recovery.

VeChain Mainnet Upgrade Moves to DPoS as Market Pressure Continues

VeChain trades near USD 0.0156, with broader crypto volatility and weak sentiment keeping investors cautious.

The network will shift from Proof of Authority to Delegated Proof of Stake during the upcoming Hayabusa upgrade, aimed at expanding participation and improving security while maintaining predictable fees.

DPoS enables all VET holders to stake or delegate to validators, giving them a direct role in governance, rewards, and network security. VeChain highlights enterprise-grade reliability and guaranteed uptime as key benefits.

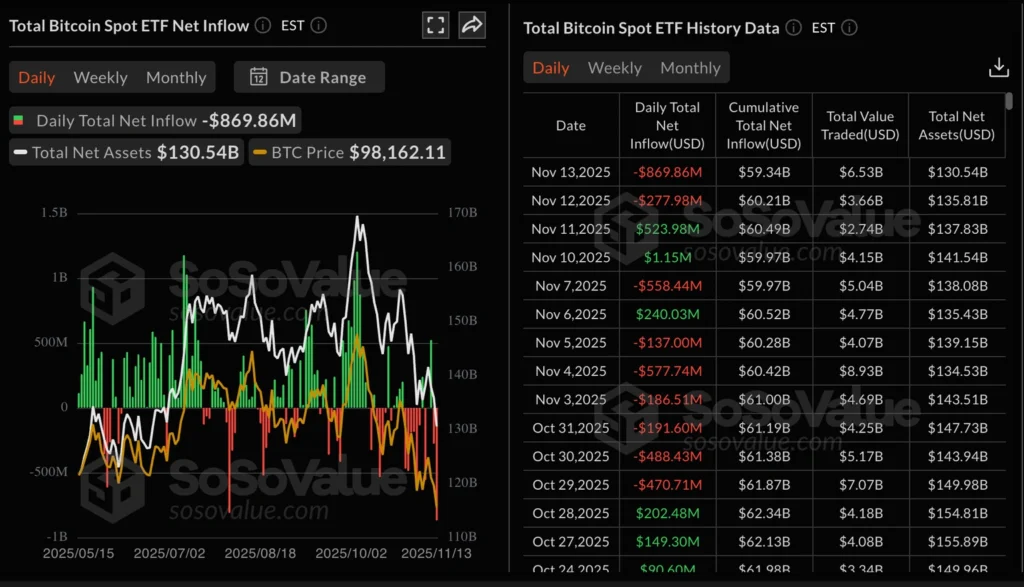

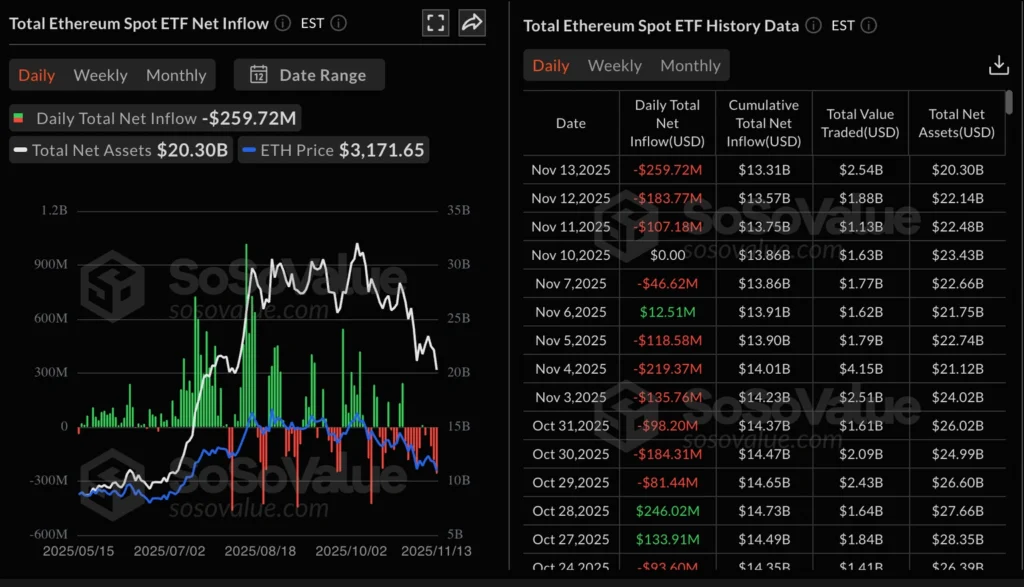

Crypto Market Slumps as Bitcoin, Ethereum, XRP Face Persistent Outflows

Bitcoin hovered above US$97,000 on Friday as a broad sell-off swept the crypto market, driven by weak institutional and retail demand. Ethereum extended its five-day losing streak, and XRP slid below US$2.30, with market cap dropping 5.4% to US$3.36 trillion.

Spot ETF outflows intensified: U.S.-listed bitcoin ETFs saw roughly US$870 million in redemptions on Thursday, the largest since October 7. GBTC led withdrawals with US$318 million, followed by BlackRock’s IBIT (US$257 million) and Fidelity’s FBTC (about US$200 million).

Ethereum ETFs also posted nearly US$260 million in outflows, with no inflow day since November 6. The overall tone highlights fading institutional interest across major digital assets.

Michael Saylor Says More Bitcoin Purchases Coming

MicroStrategy co-founder Michael Saylor said the firm has accelerated its bitcoin buying and will report details on Monday. He reiterated that investors must be prepared for high volatility and said significant leverage remains in the market.

Saylor noted heavy selling from long-term holders around the US$100,000 level but said he believes Bitcoin is forming a base. He added that the company remains over-collateralised even in the event of an 80% price drop and currently holds an average purchase price around US$74,000.

Crypto Market Loses US$1 Trillion Since October Peak, Further Slide Possible

Total crypto market value has fallen more than 6% in the past day to US$3.26 trillion, its lowest level since early July. The market has now shed over US$1 trillion, or 24%, since its October 7 peak — a decline that meets the technical definition of a bear market. Another drop of roughly 20% is possible if traditional market patterns hold.

Bitcoin slipped below US$97,000, down nearly 6% in 24 hours and 11% since November 11. A “death cross” signal is emerging, though recent cycles have seen similar patterns give way to rebounds.

Long-term holders have accelerated selling, offloading roughly 815,000 BTC in the past month, the most since early 2024, according to Glassnode and CryptoQuant.

Elsewhere, Taiwan is studying a strategic crypto reserve, Canary Capital launched the first U.S. spot XRP ETF, and the SEC drafted new asset-classification guidance under the Howey test. Tracking services 99Bitcoins and BitBo noted that, for the first time, no major source has declared Bitcoin “dead” over the past year.

The Day’s Takeaway

North America

U.S. equities swung sharply but closed flat, with early selling fully erased within 90 minutes before momentum faded. Daily results: S&P 500 flat, Nasdaq +0.1%, Dow –0.6%, Russell 2000 +0.3%. Weekly moves were similarly muted.

The delayed September U.S. jobs report is set for Nov. 20, marking the first step toward restoring normal data flow after the shutdown.

Fed’s Lorie Logan called the October rate cut a mistake, saying a December cut requires clear evidence of softer inflation or labor markets.

Walmart shares fell 2.8% after announcing CEO Doug McMillon will step down January 31, 2026. John Furner will take over, and McMillon will remain on the board until June.

U.S.–Swiss trade negotiations are nearing tariff-relief decisions, with a proposal ready for presidential sign-off.

Canada’s September data firmed, with manufacturing sales up 3.3% and wholesale trade up 0.6%, reversing previous declines.

Citi expects continued U.S. data delays, with October payrolls likely slipping into December and CPI arriving with reduced reliability.

Commodities

Oil ended the week with a modest gain, supported by late-week short covering despite a bearish U.S. inventory build of 6.4 million barrels. Crack spreads widened to the strongest level of the year, and the curve shifted into shallow contango.

Copper softened as China’s slowing demand and the partial restart of the Grasberg mine eased upward pressure. China’s metal exports appear on track for a record year as weak domestic consumption meets high LME prices.

Silver retreated nearly 2% after nearing its recent record, with the Gold/Silver ratio falling below 78. Industrial demand remains robust, particularly in power and electronics.

Gold softened as markets waited for clarity on U.S. data timing, complicating FOMC decision-making and reducing the odds of a December rate cut.

Central-bank gold buying remains opaque, with analysts estimating only one-quarter of official purchases are reported. China may be accumulating far more than disclosed, according to industry proxies such as 400-oz bar flows.

China’s crude processing stayed strong, averaging nearly 15 million bpd in October, up 6.5% from last year. Inventories continued to rise, though at a slower pace than earlier this year.

Global supply agencies diverged, but all signal oversupply in 2026. The IEA projects a record surplus above 4 million bpd; the EIA sees a 2.2 million bpd surplus with Brent averaging $55; OPEC expects early-year surplus followed by late-year tightening.

The IEA pushed the oil-demand peak much later, projecting rising demand through 2050 under current policies, moving it closer to OPEC’s long-held view.

Baker Hughes rig counts showed U.S. rigs up 1 to 549, while Canada slipped by 3 to 188. U.S. oil rigs rose, gas rigs fell, and offshore activity held steady.

Europe

Eurozone Q3 GDP remained unchanged, with Germany flat and France showing slight improvement.

Eurozone auto sales slipped 8.9%, continuing their post-summer cooling trend.

UK retail sales rose modestly, supported by prior-year base effects rather than a genuine acceleration.

Asia

China’s slowdown continued, with industrial activity still above last year but losing momentum, especially in real estate. Weak consumption and strong production are pushing metal exports sharply higher.

Japan saw weaker industrial orders, and South Korea posted steady semiconductor-led exports, keeping its recovery intact.

Crypto

VeChain hovered near USD 0.0156 as the network prepares to shift from Proof of Authority to Delegated Proof of Stake in the Hayabusa upgrade, broadening validator participation and enhancing governance.

XRP extended its decline, trading above USD 2.25 despite the launch of the first U.S. XRP spot ETF. Supply in profit fell to a one-year low, reducing near-term selling pressure if sentiment stabilizes.

Bitcoin fell to its lowest level since May, testing the bottom of its long-term channel. Attention has rotated toward AI and quantum-themed trades, while crypto activity has shifted toward memecoins and options.