North America News

US Stocks End Mixed as Tech Slide Caps Volatile Week

US equities finished Friday mixed, clawing back from steep intraday losses but still closing the week sharply lower, led by another heavy selloff in the tech sector.

- Dow Jones Industrial Average: +74.80 points (+0.16%) to 46,987.10

- Session low: -416 points

- S&P 500: +8.48 points (+0.13%) to 6,728.80

- Session low: -88.88 points

- Nasdaq Composite: -49.46 points (-0.21%) to 23,004.54

- Session low: -490 points

Weekly performance:

- Dow: -1.21%

- S&P 500: -1.63%

- Nasdaq: -3.04% — worst week since late March

The Nasdaq’s drop capped a punishing week for mega-cap tech names, with semiconductors and EV stocks hit hardest. NVIDIA (-7.04%) led declines, deepening its ongoing correction, while Tesla (-5.92%), Meta (-4.11%), and Microsoft (-4.03%) also retreated. Amazon (+0.08%) was the only major tech stock to end the week in positive territory.

Selling pressure spread across high-beta names as elevated yields and cautious risk sentiment weighed on growth and speculative assets.

Notable weekly laggards included:

- Celsius (-31.06%) — earnings miss and margin concerns

- Super Micro Computer (-23.42%) — AI-server slowdown

- DoorDash (-19.67%) — weak outlook and slowing growth

- Papa John’s (-19.17%) — disappointing post-earnings trend

- Raytheon (-17.17%) — mixed defense outlook

- Block (-13.81%), Shopify (-12.34%), and Palantir (-11.24%) — broad tech and fintech weakness

- ARK Innovation ETF (-9.25%), Moderna (-9.57%), and Dell (-9.45%) — further evidence of investors exiting high-valuation growth

The tone remained risk-off heading into the weekend as traders weighed rising yields and a slowing global demand backdrop against still-firm US growth data.

NY Fed Survey: Inflation Fears Ease, Job Concerns Rise

A New York Fed survey showed Americans’ short-term inflation expectations fell modestly while worries about job security increased.

Respondents see inflation at 3.2% over one year, down from 3.4%, with three-year expectations steady at 3.0% and five-year at 5.0%.

Households reported a more negative view of the labor market and their financial outlook, with perceptions of current and future finances both deteriorating.

The results suggest sentiment is softening even as inflation pressures cool—an overall dovish signal for policymakers.

U.S. Consumer Sentiment Weakens Sharply in November

The University of Michigan’s consumer sentiment index dropped to 50.3 in November, below the preliminary reading of 53.2 and October’s 53.6.

The current conditions gauge fell to 52.3 versus 59.2 expected, while expectations declined to 49.0 against 50.3 forecast.

Inflation expectations edged higher in the short term, with one-year outlook rising to 4.7% from 4.6%, while five-year expectations eased slightly to 3.6%.

The data reflect growing consumer anxiety over economic prospects and personal finances heading into year-end.

Fed Vice Chair Jefferson Urges Caution on Future Rate Cuts

Federal Reserve Vice Chair Philip Jefferson said policymakers should move “slowly” with additional rate cuts as the stance of monetary policy remains “somewhat restrictive.”

Speaking Thursday, Jefferson noted that available data suggest the economy has changed little in recent months, though some official reports remain delayed by the government shutdown.

He reiterated that decisions will continue to be made “meeting by meeting,” based on data, outlook, and risk balance. December remains a “live meeting,” he added, acknowledging diverging views within the Fed.

Jefferson said the Fed retains enough private and market data to guide decisions but reaffirmed that “official data remain the gold standard.”

JPMorgan Sees S&P 500 Breaking 7,000 as Bull Market Extends

JPMorgan analysts remain bullish on U.S. equities through 2026, advising clients to “buy the dip” as growth and earnings stay solid.

Led by Andrew Tyler, the team said the S&P 500 could surpass 7,000 soon, citing resilient macro data and easing headwinds.

Key drivers:

- Private payrolls rose 42,000 in October, signaling labor stabilization.

- Services PMI at 52.4 implies 2.5% GDP growth; the Atlanta Fed sees ~4% Q3 expansion.

- 83% of S&P 500 firms beat earnings forecasts in Q3, the strongest since 2021.

- Tariff and shutdown uncertainties are fading, while fiscal clarity should lift risk assets.

The analysts expect continued upside as robust earnings offset valuation concerns tied to AI optimism.

Fed’s Musalem Flags Inflation Risks, Warns on Deficits

St. Louis Fed President Alberto Musalem said the U.S. economy remains resilient but faces headwinds from tariffs, fiscal deficits, and sticky inflation.

Speaking Thursday, Musalem noted that while the labor market has “softened,” it remains near full employment. He expects growth to slow in late 2025 before rebounding in 2026 as price pressures ease.

He cautioned that existing tariffs are adding to inflation but should fade by 2026, while uncertainty over trade policy continues to weigh on corporate sentiment.

Musalem said the Fed’s dual mandate remains in tension, with “upside risks to inflation” and “downside risks to jobs.” He also described deficits as “unsustainable,” posing longer-term threats to stability.

He added that the Fed’s balance sheet strategy is being handled separately from rate policy and confirmed ongoing internal debate about the future target rate structure.

U.S. Airlines Ordered to Cut Flights at 40 Major Airports by Friday

The U.S. Federal Aviation Administration is requiring airlines to trim flight operations by 4% across 40 of the nation’s busiest airports by 6 a.m. Eastern Time Friday, according to a draft order seen by Reuters.

The same document outlines deeper cuts—a 10% reduction—beginning November 14. The FAA will also impose new restrictions on space launches starting November 10.

The directive follows a spike in flight cancellations and comes as Washington’s government shutdown shows no sign of ending. The disruptions threaten to upend Thanksgiving travel and weigh on broader U.S. economic activity.

Tesla Shareholders Approve Musk’s Massive Pay Package

Tesla Inc. investors have voted overwhelmingly to reinstate CEO Elon Musk’s ten-year compensation plan, potentially worth as much as $878 billion, in a move viewed as a vote of confidence in his long-term leadership.

The decision, announced after Tesla’s legal reincorporation from Delaware to Texas, ensures Musk retains full voting influence from his 15% stake—helping override opposition from large investors including Norway’s sovereign wealth fund.

The package is entirely performance-based, tied to aggressive production and valuation targets: 20 million vehicles delivered, 1 million robotaxis and humanoid robots deployed, and a stock market capitalization climbing toward $8.5 trillion.

Tesla’s board warned Musk could step back from the company if the plan were rejected. The approval reinforces investor belief that Tesla’s value depends heavily on Musk’s push into artificial intelligence and robotics, despite controversy surrounding his political commentary.

Canada Adds 66,600 Jobs in October, Unemployment Falls

Canada’s labor market surprised to the upside in October, adding 66,600 jobs versus expectations for a 2,500 loss, according to Statistics Canada.

The unemployment rate fell to 6.9% from 7.1%, while the participation rate ticked up to 65.3%.

However, the quality of job gains was mixed: full-time employment fell by 18,500, while part-time positions surged 85,100.

Wage growth for permanent employees slowed slightly, signaling that while demand for labor remains firm, underlying momentum may be cooling.

Commodities News

Gold Technical Outlook: Consolidation Persists Around $4,000

Gold prices remain trapped in a tight consolidation band near $4,000 per ounce, with traders awaiting new catalysts to define direction.

Despite hawkish comments from Fed Chair Jerome Powell, the metal has shown little momentum since last week’s session, hinting at either a short-term bottom or simple exhaustion after an 11% pullback.

Fundamentals: Strong U.S. labor data continue to weigh on the market, as steady employment reduces expectations for near-term rate cuts. Weak economic readings, however, could revive demand for gold.

Daily Chart: Price action remains rangebound between $3,900 and $4,000, offering little clarity.

4-Hour Chart: Resistance around $4,020 has repeatedly capped rallies. Sellers are expected to defend that zone, targeting declines toward $3,820. A sustained breakout above resistance could open the path toward $4,150.

1-Hour Chart: Minor support lies near $3,960, where buyers may attempt rebounds. A break below that level would likely invite renewed bearish pressure.

Overall, the short-term bias remains neutral to slightly bearish pending a decisive catalyst.

Crude Oil Ends Week Lower, Settles at $59.75

Crude oil futures closed slightly higher on Friday, recovering from midweek losses but still posting a weekly decline as global demand concerns lingered.

- Settlement: $59.75 per barrel

- Change: +$0.32 on the day

- Weekly move: -$1.06 (-1.74%)

From a technical standpoint, WTI futures briefly traded above the 200-bar moving average on the 4-hour chart early in the week, topping out near $61.45, before sellers regained control.

Prices later slipped below the 100-bar moving average and undercut support in the $59.64–$60.17 zone, but downside momentum faded before the close.

Heading into next week, traders will continue watching the two established swing areas:

- Resistance: $61.45–$61.94

- Support: $59.64–$60.17

A sustained break beyond either range is likely to define near-term bias as markets weigh ongoing geopolitical risks against subdued refinery demand and rising inventories.

Baker Hughes Rig Count: U.S. Up 2, Canada Up 4

U.S. oil and gas rigs rose by two to 548, Baker Hughes reported Friday.

Oil rigs were unchanged at 414, gas rigs increased by three to 128, and miscellaneous rigs fell by one to six.

Year-on-year, the U.S. count is down 37 rigs, with oil rigs 65 lower and gas rigs up 26. Offshore rigs held steady at 19, five more than a year ago.

Canada’s rig count increased by four to 191, including two additional oil and two gas rigs.

Compared with last year, Canada’s total is down 16 rigs, as weaker crude prices continue to limit drilling activity.

China Extends Gold Buying Spree for Twelfth Straight Month

China’s central bank expanded its gold holdings for a twelfth consecutive month in October, reinforcing its push to diversify reserves amid global market volatility.

The People’s Bank of China said it raised its gold reserves to 74.09 million fine troy ounces, up from 74.06 million in September. The value of the holdings climbed to $297.21 billion from $283.29 billion a month earlier, reflecting higher prices.

The steady accumulation highlights Beijing’s continued move to hedge against U.S. dollar dominance and bolster financial resilience as geopolitical tensions persist.

Libya Targets Higher Oil Output, Eyes 1.8 Million Barrels a Day

Libya plans to increase oil production to 1.6 million barrels per day next year and 1.8 million barrels by 2027, said Oil Minister Mohamed Oun, according to Commerzbank.

Output currently stands near 1.4 million barrels per day, marking steady recovery after years of civil unrest.

A new bidding round for 22 exploration and development blocks, the first in more than 17 years, has attracted interest from around 40 companies, the state oil firm NOC said.

Libya is exempt from OPEC+ production caps, giving it room to expand independently — though Commerzbank warned that its special status could face scrutiny if global supply cuts resume.

China Data Supports Copper Price Correction, Says Commerzbank

Copper has pulled back sharply from its late-October record of just above $11,000 per ton, and Commerzbank says the move represents a healthy correction.

According to Thu Lan Nguyen, Head of FX and Commodity Research, “supply concerns had run too far ahead of fundamentals,” with no clear evidence of shortages.

Chinese customs data showed copper ore imports fell for a second straight month in October, though they remain at elevated levels — roughly 7% higher year-on-year.

Commerzbank said the figures indicate stable production but soft downstream demand, with unwrought copper and product imports still subdued.

China Confirms Suspension of Some Rare Earth Export Controls

Beijing confirmed it will suspend parts of the rare earth export restrictions announced on October 9, extending the suspension through November 10, 2026, the Ministry of Commerce said Friday.

Officials said the move is part of a recently agreed trade truce with Washington, signaling a temporary easing in the two countries’ technology and resource standoff.

The announcement underscores both sides’ efforts to stabilize relations even as competition over strategic minerals remains intense.

Russian Oil Exports Fall Sharply as U.S. Sanctions Bite

U.S. sanctions on Russia’s two largest oil firms are beginning to weigh on exports, with seaborne crude shipments down 20% to just over 3 million barrels per day last week — the lowest in 10 weeks, Commerzbank reported, citing Bloomberg data.

The biggest declines came from Pacific and Arctic ports, while flows from the Baltic and Black Sea regions held firmer.

The four-week average fell to 3.58 million barrels per day, still relatively high.

Russia has also been storing more oil at sea, with tanker inventories rising to 380 million barrels.

Commerzbank said that while sanctions are having an effect, “past experience shows Moscow is likely to find ways to keep crude moving.”

Gold ETFs See Continued Inflows in October, Led by North America and China

Global gold-backed exchange-traded funds (ETFs) recorded another month of inflows in October, pushing holdings to a five-year high of 3,892 tons, Commerzbank noted, citing World Gold Council (WGC) data.

This marks the fifth consecutive monthly inflow and the ninth this year, totaling nearly 674 tons year-to-date.

ETF demand was strongest in North America and Asia, while Europe saw its first outflows in five months, mainly from the UK and Germany.

Chinese ETFs alone added 34 tons, nearly offsetting Europe’s decline. Four of the six top-performing ETFs by inflows were Chinese, underscoring a geographic shift in investor demand.

According to WGC data, the U.S. remains the largest source of inflows, followed by China and then Europe.

China Begins Easing Rare Earth Export Curbs but U.S. Hopes May Fall Short

China has started adjusting its rare earth export licensing system in a limited effort to streamline shipments, though a full rollback of April’s restrictions remains unlikely, industry sources told Reuters.

The move involves a new, faster licensing regime designed to facilitate exports, but insiders cautioned that implementation could take months. The updated permits—valid for only a year—would expand export volumes without dismantling existing controls.

Some producers said they had yet to receive notice of any procedural changes. Analysts view the shift as a calibrated signal from Beijing, keeping leverage over Washington ahead of future trade talks while maintaining political control over strategic resources.

Gunvor Drops Lukoil Asset Bid After U.S. Calls Firm “Kremlin Puppet”

Swiss commodity trader Gunvor Group has withdrawn its proposal to buy Lukoil’s overseas assets after the U.S. Treasury said it would not approve the deal, accusing the firm of being a “Kremlin puppet.”

The Treasury’s post on X cited President Donald Trump’s insistence that Russia’s war in Ukraine end “immediately,” saying Washington would not allow Gunvor to benefit while the conflict continues.

Gunvor dismissed the accusation as “false,” stressing it has cut ties with Russia since co-founder Gennady Timchenko sold his 43.6% stake in 2014, just before sanctions over Crimea.

The firm had been negotiating to buy Lukoil’s refining and retail assets in Europe, including plants in Bulgaria and Romania and around 2,000 fuel stations. Lukoil had accepted the offer pending U.S. approval, but with sanctions expansion expected November 21, Gunvor’s exit effectively kills the transaction.

Europe News

European Stocks End Week Lower After Friday Selloff

European equities closed the week on a weak note, erasing earlier gains as risk appetite faded into the weekend.

Friday close:

- Stoxx 600 -0.6%

- German DAX -0.75%

- France CAC 40 -0.3%

- UK FTSE 100 -0.6%

- Spain IBEX -1.45%

- Italy FTSE MIB -0.4%

Weekly performance: - Stoxx 600 -1.3%

- DAX -1.3%

- CAC 40 -2.2%

- FTSE 100 -0.4%

- IBEX -0.9%

Profit-taking and weak sentiment data weighed on the region’s markets, capping an otherwise steady week for European equities.

Germany Trade Surplus Narrows on Stronger Imports

Germany’s trade surplus shrank to €15.3 billion in September, missing expectations for €16.8 billion, as import growth outpaced exports, data from Destatis showed.

Exports rose 1.4% on the month, while imports climbed 3.1%.

Shipments to the U.S. rose 11.9% after four months of declines but remain 14% below levels from a year earlier.

France Trade Deficit Widens as Imports Climb

France’s trade deficit expanded to €6.58 billion in September from a revised €5.19 billion in August, the finance ministry reported.

Exports were flat, rising just 0.1% month-on-month, while imports increased 2.5%, driven by higher energy and equipment purchases.

UK House Prices Hit Record High in October

UK house prices climbed 0.6% in October, the fastest pace since January and above expectations for a 0.1% rise, according to Halifax.

The average property price reached a record £299,862.

Halifax said demand remains steady despite affordability challenges, with more buyers turning to longer mortgage terms and smaller deposits.

The lender expects gradual improvement in affordability as wage growth continues to outpace home prices.

Morgan Stanley Moves Up BoE Cut Forecast to December

Morgan Stanley now expects the Bank of England to deliver its first rate cut in December, bringing forward its previous forecast of February 2026.

The bank cited weakening growth, rising unemployment, and receding fiscal risks as reasons for earlier action.

The move follows the BoE’s narrow decision to hold rates steady this month, underscoring the growing divide within the Monetary Policy Committee.

Nomura Sees Final BoE Rate Cut in April

Nomura now expects the Bank of England’s final rate cut for this cycle in April 2026, pushing back earlier forecasts that anticipated one in February.

The firm maintains a 3.50% terminal rate outlook. Other banks’ projections vary widely:

Barclays and BNP Paribas also see 3.50%, Citi and SocGen 3.00%, Deutsche Bank 3.25%, Goldman Sachs 3.00%, ING 3.25%, Morgan Stanley 2.75%, and UBS 3.25%.

The divergence reflects uncertainty around the BoE’s endgame as inflation trends evolve.

J.P. Morgan Backs BoE Decision to Hold Rates

J.P. Morgan Asset Management’s Zara Nokes said the Bank of England’s 5–4 decision to leave rates unchanged at 4% was the “right call,” citing persistently high inflation.

While labor market conditions are softening, she said consumer demand and confidence remain firm. Nokes warned that expectations for future price increases are edging up, complicating the inflation fight.

She said a fiscal tightening push in 2026 could shift risks, but until inflation shows “clear progress” toward 2%, rate cuts would be premature.

Asia-Pacific & World News

Trump Pushes Central Asia Rare Earths to Curb China Reliance

President Donald Trump said the U.S. will deepen partnerships with Central Asian nations to diversify sources of rare earths and critical minerals, reducing dependence on China.

Speaking at a White House summit with leaders from Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, and Turkmenistan, Trump said the talks focused on minerals vital to defense and high-tech manufacturing.

Cove Capital LLC recently took a 70% stake in two Kazakh deposits alongside Kazakhstan’s sovereign fund. Tajikistan’s President Emomali Rahmon expressed interest in expanding exports of rare earths to the U.S.

The summit marks Washington’s latest move to rewire strategic supply chains for clean energy and advanced manufacturing.

U.S. Blocks Nvidia AI Chip Sales to China Despite Trump Signals

The U.S. government has decided to block Nvidia Corp. from selling its newest scaled-down artificial intelligence chips to China, reversing earlier hints from President Donald Trump that such exports might proceed.

Sources said federal agencies have been told not to grant licenses for the modified products, which were designed to comply with existing export rules.

The move underscores Washington’s commitment to limiting Beijing’s AI capabilities. Nvidia had already shared samples of its B30A chip with Chinese clients; the company is now redesigning the chip to seek future approval.

Nvidia said it currently has “zero share” of China’s data-center market, and the country is excluded from its outlook. The White House declined comment.

Warburg Pincus Sees Opportunity in China After Valuation Reset

Private equity firm Warburg Pincus is turning positive on China, citing cheaper valuations and the retreat of global rivals as reasons to re-enter the market.

CEO Jeffrey Perlman said in Tokyo that Chinese firms growing at 20% annually can now be bought at just five to six times EBITDA, calling it “an attractive entry point.”

Perlman said Asia overall offers compelling value relative to the U.S., following a decade in which China’s economic growth outpaced its market returns.

China Trade Surplus Narrows as Exports Drop

China’s October trade data showed yuan-denominated exports fell 0.8% from a year earlier, while imports rose 1.4%.

In dollar terms, exports declined 1.1%, missing forecasts for a 3% increase, while imports rose 1.0%, also below expectations.

The trade surplus reached $90.07 billion, slightly below September’s $90.45 billion. China’s surplus with the U.S. widened to $24.76 billion from $22.82 billion a month earlier.

China Inflation Data Due Sunday: Deflation Likely to Persist

China’s October consumer and producer price data are scheduled for release Sunday, November 9 at 01:30 GMT (Saturday, November 8 at 8:30 p.m. U.S. Eastern).

Both CPI and PPI are expected to remain in deflationary territory, underscoring persistent weakness in domestic demand and industrial pricing pressures.

PBOC sets USD/ CNY reference rate for today at 7.0836 (vs. estimate at 7.1131)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 141.7bn yuan via 7-day reverse repos at an unchanged rate of 1.40%.

- PBOC drains a net 1.5722 trillion yuan for the week via open market operations, the biggest fund withdrawal since Jan 2024.

Morgan Stanley Turns Bullish on India as Growth Strengthens

Morgan Stanley raised its outlook on Indian equities, saying the economy’s next growth cycle is underway, supported by monetary easing, tax reductions, and fiscal stimulus.

The bank is overweight financial, consumer, and industrial sectors, expecting stronger foreign portfolio inflows.

Key supports include RBI rate cuts, liquidity injections, and GST reductions worth roughly ₹15 trillion, aimed at boosting consumption.

Analysts also point to improved India–U.S. trade ties, easing China tensions, and reform momentum in privatization and banking as catalysts for a sustained rally.

Japan’s Takaichi Revives Abenomics-Style Stimulus

Prime Minister Sanae Takaichi has filled top economic panels with pro-stimulus advocates, signaling a return to Abenomics-era policy.

Former BOJ deputy governor Masazumi Wakatabe joins the Council on Economic and Fiscal Policy, reinforcing the government’s push for sustained fiscal and monetary expansion.

Takaichi also appointed economists Toshihiro Nagahama and Takuji Aida, both known for backing aggressive demand-side measures.

The reshuffle marks a shift from the prior administration’s fiscal conservatism and points to continued easy policy until Japan’s inflation goal is securely met.

Japan Household Spending Misses Forecasts

Japan’s household spending rose 1.8% year-on-year in September, short of the expected 2.5% gain, while month-on-month spending fell 0.47% versus a 0.1% drop forecast.

The data point to ongoing consumer restraint and suggest the Bank of Japan will stick to a slow, cautious approach on rate hikes as it assesses inflation sustainability.

Crypto Market Pulse

XRP Slips Below $2.18 as Retail Activity Weakens

Ripple’s XRP fell below $2.18 Friday, underperforming major peers as retail activity remained muted.

The broader crypto market remains cautious amid the U.S. government shutdown and subdued risk appetite, keeping traders on the sidelines.

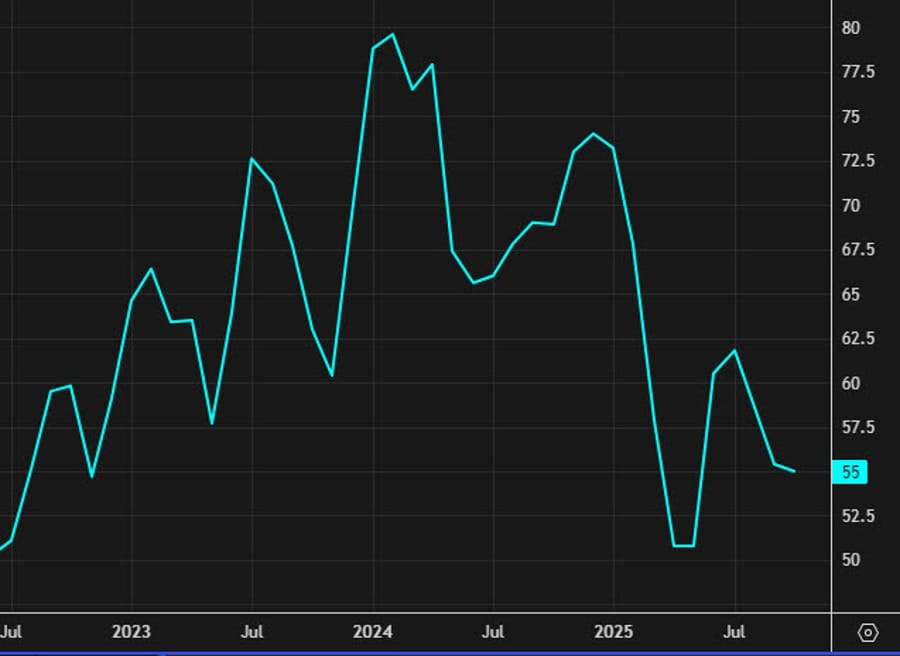

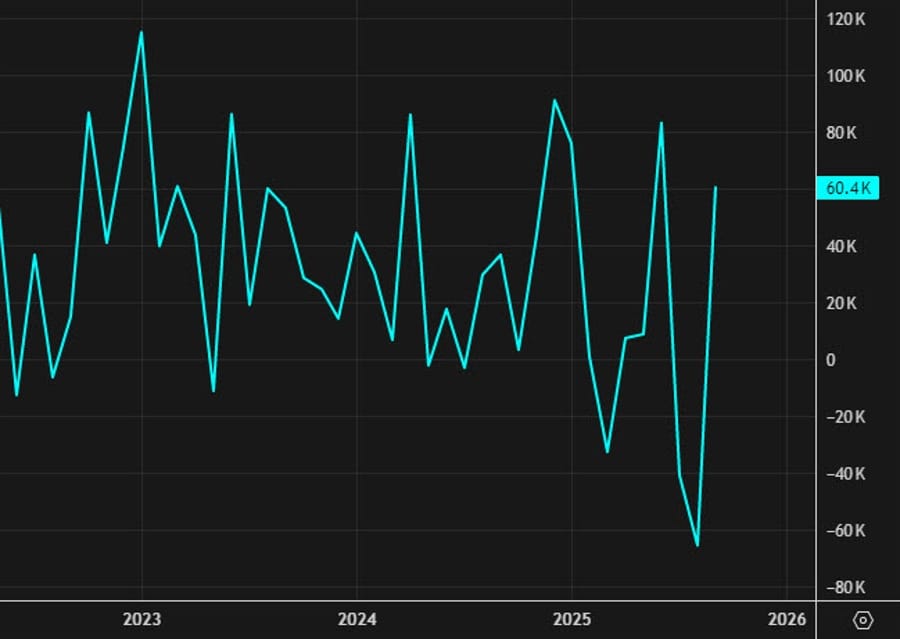

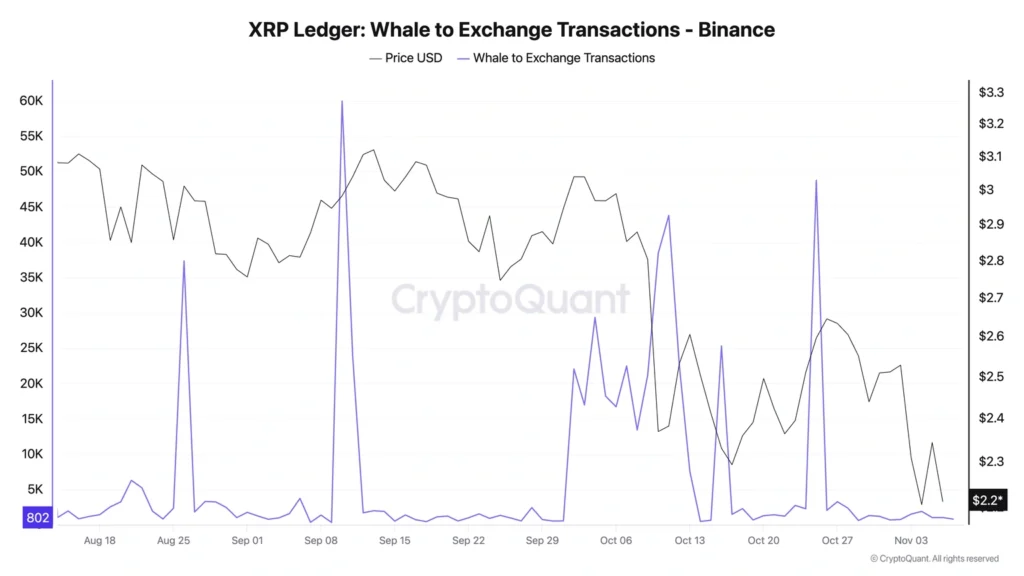

On-chain data show retail participation flat since October’s $19 billion market-wide liquidation, while whale-to-exchange transfers dropped sharply — to around 800 on Friday, down from 49,000 on Oct. 25.

Analysts say fewer large transfers to exchanges reduce immediate selling pressure, potentially setting the stage for a gradual stabilization if sentiment improves.

Elixir’s deUSD Stablecoin Collapses After $93 Million Stream Finance Default

Elixir Finance halted redemptions for its deUSD stablecoin after borrower Stream Finance defaulted on $68 million in debt following $93 million in trading losses.

The collapse triggered a sharp depeg, sending deUSD to $0.015 within hours as reserves fell short of collateral requirements.

Stream had used deUSD for leveraged bets on Elixir’s lending platform; subsequent liquidations wiped out liquidity buffers.

Elixir’s Total Value Locked (TVL) plunged over $200 million, sparking broader concerns about stablecoin confidence in decentralized finance (DeFi).

The project said it is “coordinating with affected parties” but gave no timeline for recovery.

HYPE Faces Pressure as Staking Balance Drops 2%

Hyperliquid (HYPE) hovered near $37.00 Friday, holding above its 200-day EMA but showing signs of fatigue after failing to break $40.00.

DefiLlama data show staked assets fell 2.32% in the past 24 hours to $2 billion, reflecting cooling investor confidence.

Futures open interest slid to $1.62 billion, down from $2 billion a week ago and well below September’s record $2.59 billion.

Analysts warn that if risk-off sentiment persists, HYPE could struggle to reclaim higher levels in the near term, despite its underlying decentralized exchange fundamentals.

Crypto Today: Bitcoin, Ethereum, XRP Hold Steady as ETF Inflows Resume

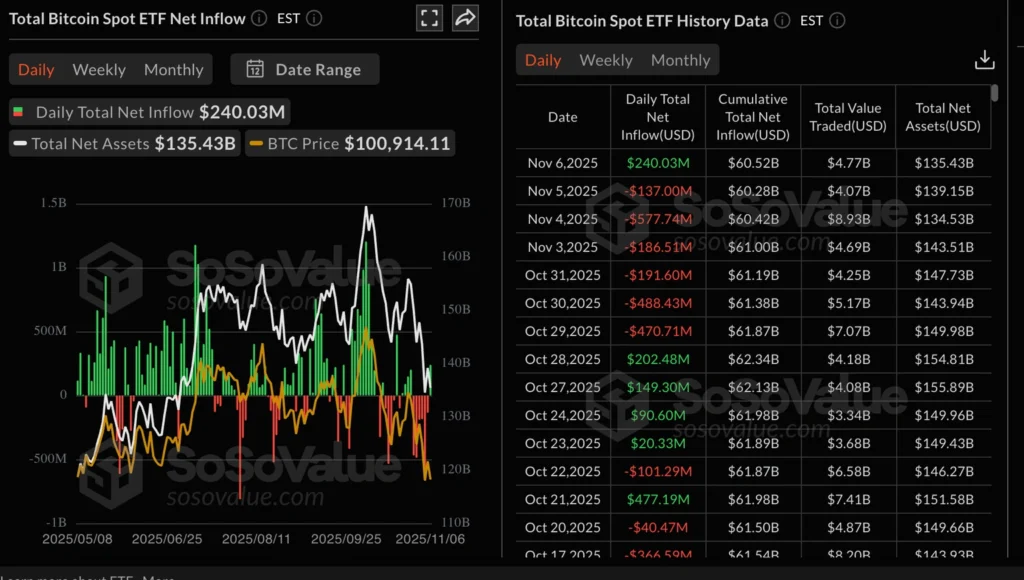

Bitcoin (BTC) traded above $101,000 on Friday as spot ETF inflows returned after six days of outflows, signaling improving sentiment.

U.S.-listed BTC ETFs drew $240 million in new inflows Thursday, bringing total assets to $135.43 billion, according to SoSoValue data. BlackRock’s IBIT led with $112 million, followed by Fidelity’s FBTC and 21Shares’ ARKB.

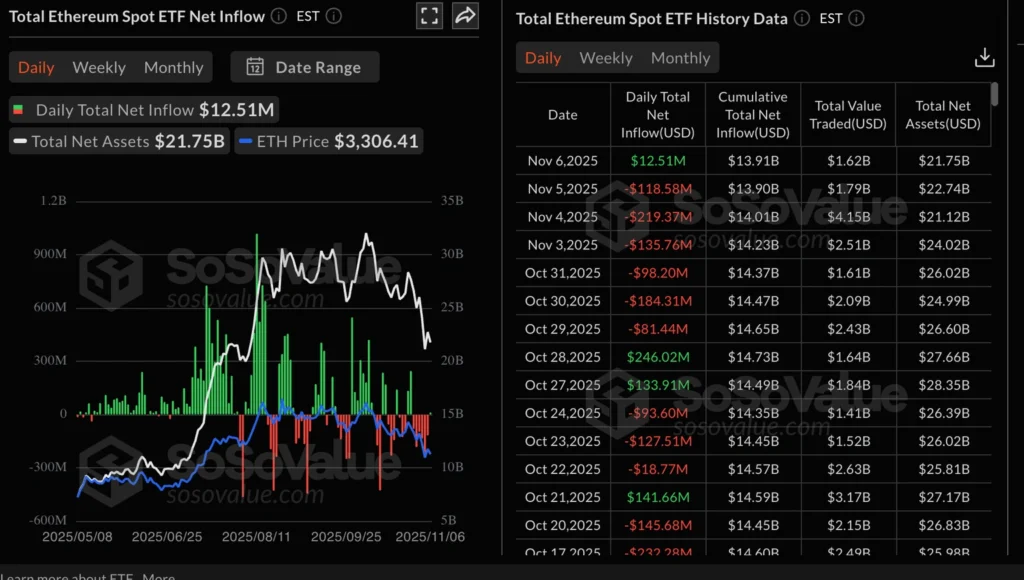

Ethereum (ETH) stayed above $3,300, supported by $12.5 million in ETF inflows and stable retail participation, while XRP held the $2.18 support amid weaker momentum.

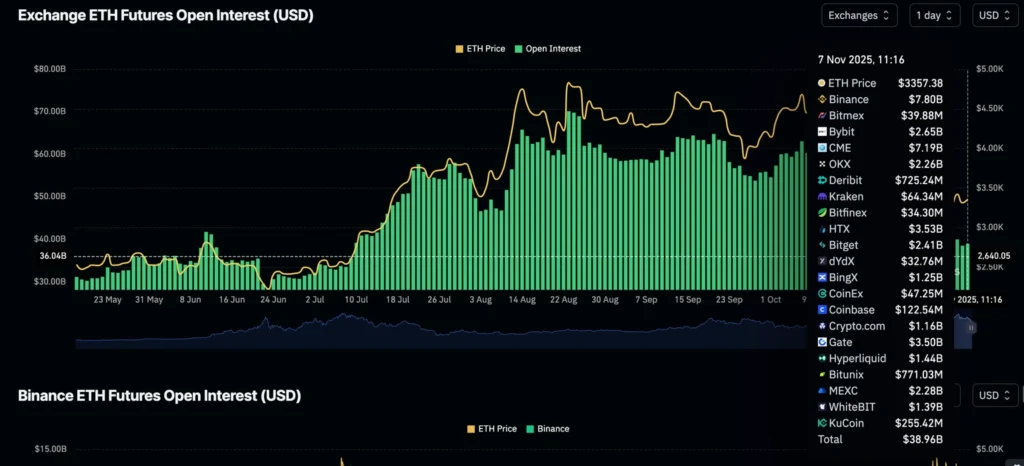

Futures open interest in ETH rose to $38.96 billion, hinting at tentative recovery in investor appetite. Analysts say consistent ETF inflows would confirm a shift in institutional positioning after October’s risk-off liquidation.

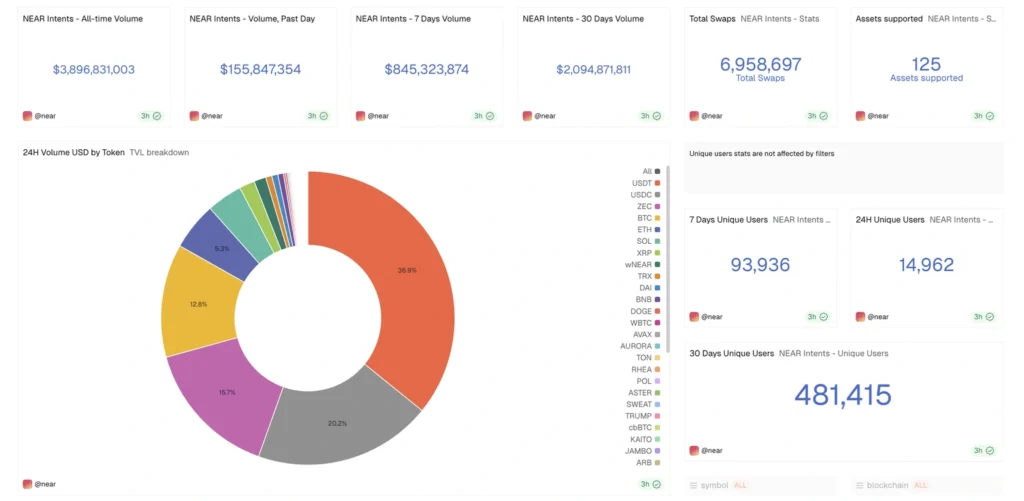

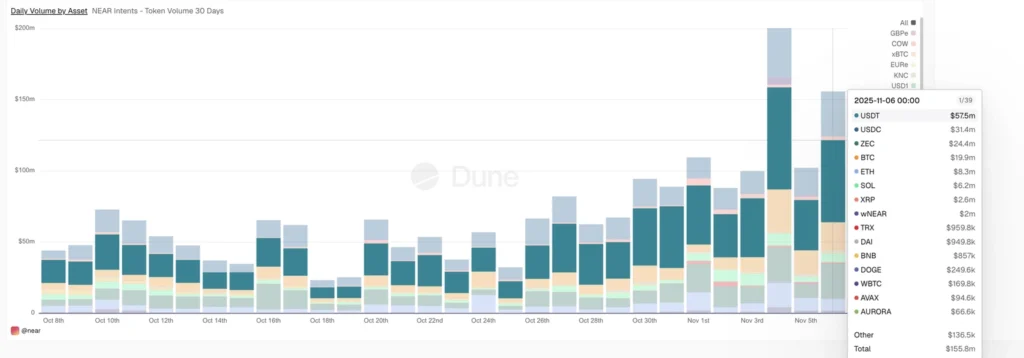

NEAR Rallies as Intent Layer Trading Volume Surges

Near Protocol (NEAR) gained 10% Friday, breaking out of a short-term downtrend amid surging activity on its Intent layer, where cumulative trading volume is nearing $4 billion.

The Intent layer automates cross-chain swaps via solver networks, with $200 million and $155 million in trading volume recorded on Tuesday and Thursday respectively.

Futures open interest in NEAR jumped 65% within 24 hours, reflecting strong retail participation.

While the layer enables gas abstraction — allowing transaction fees to be paid in USDT or USDC — analysts note this limits direct demand for the NEAR token. Still, the data highlight growing adoption of the ecosystem’s infrastructure.

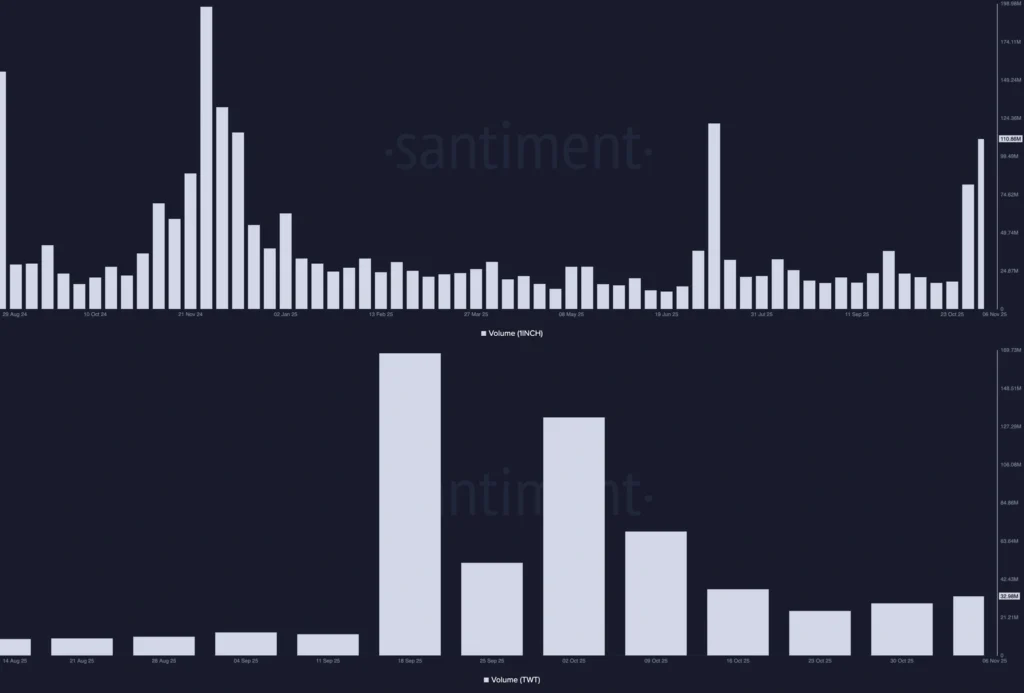

Trust Wallet Token and 1inch See Bullish Momentum on Rising User Activity

Trust Wallet Token (TWT) and 1inch (1INCH) extended gains Friday as on-chain activity and trading volumes climbed following early-week losses.

1inch’s weekly trading volume rose to $110.86 million, up from $81.21 million the prior week, while TWT reached $32.98 million, marking a second weekly rise.

Integration of 1inch’s aggregator within Trust Wallet has strengthened correlations between the two tokens, analysts said.

Network growth for 1inch — a key user adoption metric — climbed to 160 active addresses, the highest since mid-July, according to Santiment.

Trust Wallet also reported a rebound in daily active users after October’s adoption surge, supporting a constructive short-term outlook for both assets.

The Day’s Takeaway

North America

U.S. equities ended mixed after a volatile session, with the Dow up 0.16%, the S&P 500 up 0.13%, and the Nasdaq down 0.21%, capping the index’s worst week since March as mega-cap tech names led declines. NVIDIA, Tesla, Meta, and Microsoft fell sharply, while Amazon managed slight gains. Risk sentiment remained defensive amid rising yields and slower global demand signals.

The FAA ordered airlines to cut 4% of flights at 40 major airports by Friday, with deeper 10% cuts to follow mid-November, citing cancellations and shutdown-related disruption. The move risks complicating holiday travel and broader economic momentum.

Tesla shareholders approved Elon Musk’s reinstated $878 billion pay package, reinforcing his strategic influence after the company’s legal reincorporation to Texas.

Fed officials struck a cautious tone: Vice Chair Jefferson urged patience on rate cuts, while St. Louis Fed’s Musalem warned of inflation risks from tariffs and unsustainable deficits.

Consumer sentiment weakened sharply, with the Michigan index dropping to 50.3 as inflation expectations ticked higher.

The New York Fed’s survey showed easing inflation expectations but growing job insecurity, highlighting economic unease.

JPMorgan maintained a bullish long-term view on U.S. equities, projecting the S&P 500 could top 7,000 amid resilient growth and strong corporate earnings.

Nvidia’s AI chip sales to China remain blocked despite Trump administration signals to ease export rules, reinforcing Washington’s tech control stance.

Canada’s labor market surprised to the upside, adding 66,600 jobs in October, cutting unemployment to 6.9%, though full-time work fell.

Commodities

Crude oil settled at $59.75 per barrel, up $0.32 on the day but down 1.74% for the week, weighed by global demand concerns. Technicals show tight range-bound trade between $59.64 and $61.94.

Baker Hughes reported U.S. rigs +2 to 548 and Canada +4 to 191, showing slight recovery despite weaker year-on-year totals.

Commerzbank said copper’s pullback from $11,000 per ton reflects a healthy correction as China data show steady imports but soft demand.

Gold ETFs recorded a fifth consecutive month of inflows, lifting global holdings to a five-year high of 3,892 tons, led by North America and China.

China’s central bank extended its gold-buying streak to a twelfth month, boosting reserves to 74.09 million troy ounces.

China also began easing rare-earth export curbs, aligning with a temporary U.S. trade truce, though full rollback remains unlikely.

Libya aims to raise oil production to 1.6 million bpd in 2025 and 1.8 million by 2027, aided by a new licensing round.

Russian oil exports fell 20% to just over 3 million bpd as new U.S. sanctions took effect, though Commerzbank expects Moscow to maintain flows through alternative channels.

Gold prices remain rangebound near $4,000 per ounce, with neutral-to-bearish bias amid firm labor data and limited new catalysts.

Europe

European stocks ended the week lower after Friday’s selloff: Stoxx 600 -0.6%, DAX -0.75%, CAC 40 -0.3%, FTSE 100 -0.6%. Weekly losses averaged 1–2%, reflecting risk-off sentiment and weak confidence data.

Germany’s trade surplus narrowed to €15.3 billion as imports outpaced exports; France’s deficit widened to €6.58 billion on stronger energy and equipment imports.

The UK housing market showed resilience — prices rose 0.6% to a record £299,862, supported by longer mortgage terms and real wage gains.

J.P. Morgan Asset Management backed the BoE’s decision to hold rates at 4%, citing persistent inflation. Nomura sees the final BoE rate cut in April 2026, while Morgan Stanley moved up its forecast to December 2025, underscoring policy divergence.

Asia

China’s inflation and trade data confirmed ongoing deflationary pressure and weaker export momentum. October exports fell 1.1% in USD terms, while imports rose 1.0%. The trade surplus narrowed to $90.07 billion.

Warburg Pincus turned bullish on China after valuation resets, while Beijing confirmed partial suspension of rare-earth export curbs under a temporary truce with Washington.

Japan’s household spending rose 1.8% y/y, missing forecasts, keeping the BoJ on a cautious tightening path. Prime Minister Takaichi re-embraced Abenomics-style stimulus, appointing pro-expansion economists to key advisory roles.

Rest of World

Trump pledged expanded cooperation with Central Asia to secure rare earths and critical minerals, partnering with Kazakhstan and Tajikistan to reduce China reliance.

Morgan Stanley turned bullish on India, citing fiscal stimulus, RBI easing, and privatization reforms as catalysts for the next growth cycle.

Crypto

Bitcoin traded above $101,000 as ETF inflows resumed, adding $240 million Thursday, reversing six days of outflows. Ethereum held $3,300 with $12.5 million in ETF inflows; XRP stabilized near $2.18.

Near Protocol rallied 10% as Intent Layer activity surged past $4 billion, driving renewed investor interest. Trust Wallet Token and 1inch extended gains on rising network usage and integrated trading volume.

XRP later slipped below $2.18 on muted retail activity, though reduced whale-to-exchange transfers suggest easing sell pressure.

Elixir’s deUSD stablecoin collapsed after Stream Finance’s $93 million default, plunging to $0.015 and eroding $200 million in TVL.

Hyperliquid (HYPE) eased 2% as staking balances fell, reflecting cooling investor sentiment across DeFi markets.