North America News

U.S. Stocks Slide as AI Boom Faces Investor Reality Check

Equities retreat amid renewed scrutiny of tech valuations; post-close earnings show mixed results across major names

U.S. equities closed sharply lower on Thursday, with major indexes weighed by renewed investor caution toward the AI investment boom and softer corporate sentiment. The S&P 500 fell 1.1%, the Nasdaq Composite dropped 1.9%, and the Dow Jones Industrial Average slipped 0.8%, while the Russell 2000 lost 1.6%.

The pullback reflects growing investor unease over stretched valuations in the technology sector, as companies tied to artificial intelligence spending show signs of moderation.

Earnings Roundup

The Trade Desk (TTD)

The ad-tech firm beat revenue and earnings expectations for the third quarter.

- Adjusted EPS: $0.45 vs. $0.44 expected

- Revenue: $739 million vs. $718.3 million estimated

- Net Income: $116 million

- Pretax Profit: $179.5 million

- EBIT: $161.2 million

- Adjusted EBITDA Margin: 43%

Despite the beat, management struck a cautious tone on digital ad demand amid rising competition in connected TV.

Airbnb (ABNB)

The travel platform reported slightly softer profitability even as bookings grew.

- Revenue: $4.10 billion vs. $4.08 billion expected

- EPS: $2.21 vs. $2.34 expected

- Gross Booking Value (GBV): $22.9 billion vs. $21.69 billion expected

- Q4 Revenue Outlook: $2.66–$2.72 billion (in line with estimates)

- Q4 GBV Growth: Low double digits YoY

- Q4 Nights & Seats Growth: Mid-single digits

- Long-Term Tax Rate: To decline to mid-to-high teens starting 2026

Investors focused on guidance indicating steady but slowing growth momentum into the holiday season.

Wynn Resorts (WYNN)

Wynn exceeded revenue estimates but missed on profit.

- Revenue: $1.83 billion vs. $1.75 billion expected

- Adjusted EPS: $0.86 vs. $1.10 expected

- EPS: $0.85

- Adjusted Net Income: $88.7 million vs. $115.6 million estimated

Despite stronger Macau performance, profitability lagged amid higher operating costs.

Take-Two Interactive (TTWO)

The game publisher’s results topped expectations but showed a quarterly loss as it prepares for a major release.

- Revenue: $1.77 billion vs. $1.72 billion expected

- Net Bookings: $1.96 billion

- EPS: –$0.73; Net Income: –$133.9 million

- Q3 Outlook: Revenue $1.57–$1.62 billion; EPS –$0.49 to –$0.35; Bookings $1.55–$1.60 billion

- FY 2025 Guidance: Revenue $6.38–$6.48 billion; EPS –$2.25 to –$1.90

- Grand Theft Auto VI to launch November 19, 2026

Investors viewed the near-term losses as investment-heavy quarters ahead of the blockbuster release.

Block Inc. (SQ)

The payments company reported strong top-line and profit growth driven by both Cash App and Square ecosystems.

- Gross Profit: $2.66 billion (+18% YoY)

- Net Income: $462 million (+63% YoY)

- Operating Income: $409 million (15% margin); Adjusted: $480 million (18% margin)

- Adjusted EBITDA: $833 million (31% margin)

- Cash App Gross Profit: $1.62 billion (+24% YoY), $94 per active (+25% YoY), 58M monthly actives (+2% YoY)

- Square Gross Profit: $1.02 billion (+9% YoY); GPV $67.2 billion (+12% YoY; U.S. +9%, International +26%)

- FY 2025 Outlook: Gross Profit $10.24 billion (+15% YoY); Adjusted Operating Income $2.06 billion (20% margin)

- Q4 2025 Guidance: Gross Profit $2.76 billion (+19% YoY); Adjusted Operating Income $560 million (20% margin)

The company’s upbeat results underscored continued strength in digital payments despite broader risk-off sentiment.

U.S. October Layoffs Surge 175% Year-on-Year, Highest October Since 2003

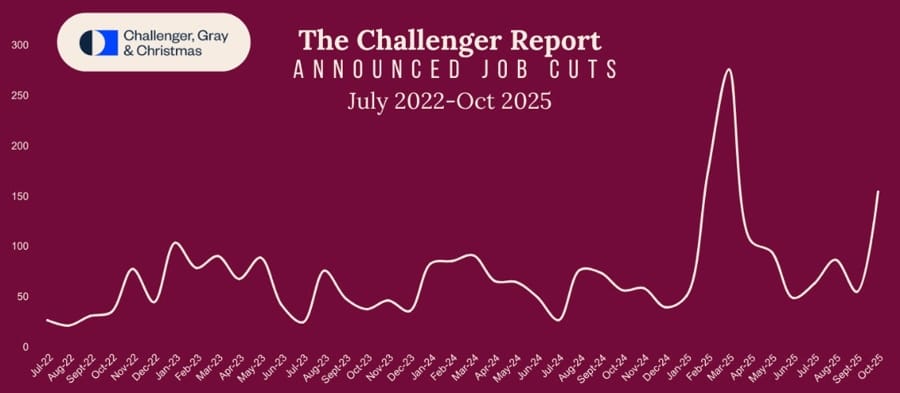

U.S. employers announced 153,074 job cuts in October, according to Challenger, Gray & Christmas — nearly triple the 55,597 recorded a year earlier and up 183% from September. It marks the highest October total since 2003.

The firm said the spike reflects a combination of post-pandemic corrections, AI-driven restructuring, and slower consumer and corporate spending. “Some industries are correcting after the hiring boom of the pandemic,” the report said, adding that those laid off are finding it harder to secure new roles.

Technology firms led the surge, with 33,281 job cuts in October compared with 5,639 in September. Retail layoffs totaled 2,431 for the month, while year-to-date retailer cuts reached 88,664 — up 145% from last year’s 36,136.

Fed’s Williams: Natural Rate of Interest “Hard to Pin Down”

Barr, Hammack, and Miran offer contrasting policy tones as Fed debates December move

New York Fed President John Williams said Thursday that the natural rate of interest remains difficult to determine, underscoring the central bank’s cautious stance after two consecutive 25-basis-point cuts this year.

“The natural rate of interest is hard to pin down,” Williams told reporters, adding that while AI-driven investment is lifting U.S. capital demand, policymakers must remain vigilant about inflation.

Williams emphasized the Fed’s commitment to restoring price stability: “Getting inflation back to 2% as soon as we can is the right thing. People don’t like high inflation, and our 2% target serves us well.” He also reiterated the importance of the Fed’s independence, calling it “incredibly important” to maintain credibility and global economic stability.

Williams’ remarks follow mixed economic signals — including softer Challenger job cuts data and steady ISM activity — suggesting a mildly cooling but resilient labor market.

Elsewhere, Fed Vice Chair Michael Barr said “progress has been made on inflation, but there is still work to do,” pointing to a two-speed economy where wealthier households are thriving while lower-income Americans struggle to save. He added that AI adoption may be contributing to a “low-hire, low-fire” labor dynamic in some sectors.

By contrast, Fed Governor Christopher Waller Hammack struck a hawkish tone, saying policy should remain “modestly restrictive” to bring inflation down. He warned that price growth could overshoot the target by one percentage point, and said it may take “two to three years” to return to 2%. “It’s not obvious the Fed should cut again,” he said, adding that the economy remains “robust and healthy.”

Meanwhile, Fed Governor Adriana Miran took a dovish stance, saying she expects another rate cut in December, and prefers 50-basis-point increments to reach a neutral stance more quickly. “We don’t need a 75-basis-point move,” she said, noting that labor market deterioration remains gradual.

Fed’s Goolsbee Says He May Be Reluctant to Continue Rate Cuts

Federal Reserve policymaker Austan Goolsbee said he may be hesitant to support further rate cuts, citing uncertainty in inflation data and continued strength in consumer spending.

Speaking to CNBC, Goolsbee noted that most labor market indicators still show stability, even as headline payroll figures fluctuate. “The unemployment rate is basically unchanged — we’re seeing mild cooling, not collapse,” he said.

Goolsbee cautioned against reading too much into a single payroll drop, suggesting the unemployment rate is now a better gauge of labor conditions. “Low hiring and low firing suggest uncertainty, not recession,” he added.

On inflation, Goolsbee said, “There’s very little private sector information about inflation right now; it’ll take time before we see any problems.” He reiterated that inflation cannot be assumed to be transitory, saying he’s “more uneasy about rate cuts without clear inflation data.”

He described the current situation as “foggy,” suggesting a slower and more cautious approach. “When it’s foggy, let’s be careful and slow down,” Goolsbee said, noting that the lack of inflation data makes him more cautious about further easing.

JPMorgan’s Dimon Warns of Market Downside, Stresses Fed Independence

JPMorgan Chase CEO Jamie Dimon cautioned investors that markets remain vulnerable to downside risks, urging restraint amid high valuations and potential credit stress. Speaking on the U.S. economic outlook, Dimon said that while no administration welcomes elevated interest rates, the Federal Reserve must retain full independence in setting policy.

He warned that the possibility of a recession with credit implications cannot be ruled out, even as growth signals remain steady. Dimon also noted that while tariffs attract political attention, they are just one of several factors shaping the broader economy.

Goldman Sachs: Supreme Court Likely to Limit Presidential Tariff Powers

Goldman Sachs said the U.S. Supreme Court appears poised to curtail the president’s ability to impose tariffs under the International Emergency Economic Powers Act (IEEPA), with a ruling expected by early 2026.

Prediction markets now assign roughly 10 percentage points less probability that the Court will uphold current tariffs.

If struck down, the government may need to refund $115–145 billion in collected duties, though Goldman expects officials to rely on other authorities to reimpose similar measures.

The overall trade impact is likely to be modest, with any relief focused on smaller partners rather than major economies such as China or the EU.

Snap Shares Jump on $400 Million Perplexity AI Deal, AR Spin-Off

Snap Inc. shares rose after the company unveiled a $400 million partnership with AI startup Perplexity to integrate conversational search into Snapchat starting in 2026. The deal, funded through cash and equity, coincided with stronger third-quarter earnings.

Snap also announced plans to spin off its augmented reality Spectacles division into a new subsidiary called “Specs,” modeled after Alphabet’s Waymo. The company said Specs is fully funded for launch next year.

The twin moves highlight Snap’s push into AI-driven engagement tools and independent AR hardware development.

OpenAI Seeks U.S. Loan Guarantees to Fund $1 Trillion AI Infrastructure Push

OpenAI is seeking U.S. government loan guarantees to help finance what could become a $1 trillion AI infrastructure expansion, CFO Sarah Friar said at a Wall Street Journal conference. The company aims to build an ecosystem involving banks, private equity, and potentially government partners to support massive computing investments.

Federal guarantees would reduce borrowing costs and expand credit access by shielding lenders from default risk — a model rarely used in the tech sector.

The request comes alongside a $300 billion Oracle deal and a $500 billion “Stargate” data-center venture with Oracle and SoftBank. Despite projected multibillion-dollar revenues, OpenAI’s spending far exceeds income. Friar said an IPO is not planned, emphasizing focus on scaling and long-term funding stability.

U.S. Transport Secretary Flags Rising Air-Safety Risks Amid FAA Capacity Cuts

Transportation Secretary Sean Duffy warned that the nation’s air system is becoming increasingly risky as air traffic controllers face mounting pressure, in some cases working unpaid or taking second jobs. The comments follow a fatal air crash that killed 11 people on Tuesday.

The Federal Aviation Administration announced it will cut scheduled flight capacity by 10% at 40 major hubs starting Friday to ease strain on the system. Duffy’s remarks underscore growing safety concerns as staffing challenges and financial stress weigh on U.S. air traffic operations.

Canada’s Ivey PMI Drops Sharply to 51.7 From 59.8

Canada’s Ivey Purchasing Managers Index fell to 51.7 in October from 59.8 in September, signaling a slowdown in business activity.

The non-seasonally adjusted index also dropped sharply to 51.7 from 61.6. While the Ivey PMI is not considered a key indicator compared to other surveys, the steep decline suggests cooling momentum in Canada’s manufacturing and service sectors amid broader global uncertainty.

Bank of Canada’s Macklem Says Monetary Policy Can’t Fix Tariff-Driven Structural Shifts

Bank of Canada Governor Tiff Macklem told lawmakers that monetary policy has limited ability to address the structural economic disruptions caused by U.S. tariffs. In opening testimony before the House of Commons, Macklem reiterated that while rate tools can influence demand, they cannot offset trade and industrial shifts driven by geopolitical measures.

Banxico Cuts Key Rate by 25 bps to 7.25%, as Expected

The Bank of Mexico (Banxico) lowered its benchmark interest rate by 25 basis points to 7.25% on Thursday, marking a continuation of its gradual easing cycle. The move was widely expected by economists.

The decision passed by a 4–1 vote, with Deputy Governor Jonathan Heath dissenting in favor of holding rates steady.

In its statement, Banxico said it expects inflation to converge toward its 3% target by the third quarter of 2026, though policymakers remain cautious amid resilient domestic demand and exchange rate volatility.

Analysts said the cut underscores the central bank’s confidence that price pressures are easing while leaving room for further reductions if economic growth slows in 2026.

Commodities News

Gold Holds Below $4,000 as U.S. Shutdown Threat and Job Cuts Lift Haven Demand

Weaker dollar and falling yields support bullion; market eyes December Fed meeting

Gold prices steadied below the $4,000 mark on Thursday after briefly touching an intraday high of $4,019, buoyed by a weaker U.S. dollar, declining Treasury yields, and renewed political uncertainty in Washington. At the time of writing, spot gold traded around $3,985, up roughly 0.1% on the day.

Safe-haven demand strengthened after Republican House Speaker Mike Johnson warned that prospects for averting a U.S. government shutdown were dimming, raising fears of prolonged fiscal instability.

Adding to the cautious tone, the Challenger, Gray & Christmas report showed that U.S. employers cut over 150,000 jobs in October, the steepest monthly decline in more than two decades. The data revived expectations for a potential Fed rate cut in December, especially as recent economic releases signal a cooling but still resilient labor market.

Meanwhile, investors digested a mixed set of comments from Federal Reserve officials. Cleveland Fed’s Beth Hammack reiterated that inflation risks remain elevated, suggesting policy should stay “modestly restrictive,” while Governor Michael Barr sounded more balanced, and New York Fed’s John Williams noted that the neutral rate likely sits around 1%.

In parallel, the U.S. Supreme Court appeared skeptical of former President Donald Trump’s tariff powers, according to Bloomberg, casting uncertainty over trade policy continuity — another factor reinforcing gold’s defensive appeal.

Overall, analysts said the confluence of softer jobs data, political gridlock, and cautious Fed rhetoric has reinforced bullion’s appeal as a hedge against both economic and policy risk.

Nikkei: U.S.–China Rare Earth Deal Faces Confusion Over Export Controls

Discrepancies have emerged between Washington and Beijing over the details of a rare earth agreement, Nikkei reported Thursday, highlighting potential friction in the recent U.S.–China trade détente.

According to the U.S. Federal Register, the executive agreement commits China to “postpone and effectively eliminate coercive export controls” on rare earth elements and other critical minerals, while also easing retaliatory measures against American semiconductor and agricultural exports.

The U.S. said Beijing agreed to suspend tariffs on a wide range of U.S. farm goods, including soybeans, sorghum, and logs, until December 31, 2026, while Washington pledged to maintain its suspension of reciprocal tariffs through November 10, 2026.

However, Chinese officials have not confirmed those details publicly, raising doubts over whether Beijing agreed to eliminate all export restrictions. “There seems to be a disconnect,” Nikkei said, noting that China’s silence could complicate implementation.

The deal, signed under Executive Order 14257, lowers tariffs on Chinese imports to an additional 10% ad valorem rate, replacing higher duties imposed during the earlier trade dispute.

WTI Crude Rebounds Above $60 as Risk Sentiment Improves

West Texas Intermediate crude climbed back above $60.00 a barrel Thursday, recovering from two-week lows as broader risk sentiment improved and geopolitical tensions resurfaced.

Reports of Ukrainian drone strikes on Russia’s Volgograd and Saratov refineries renewed concerns over supply risks. Despite that, U.S. Energy Information Administration data showed crude inventories rose by 5.2 million barrels last week — far exceeding expectations of a 1.8 million increase.

Gasoline stocks fell by 4.7 million barrels, their lowest since November 2022, while distillate inventories remain 8% below seasonal norms. Still, worries about oversupply persist as OPEC+ continues its gradual production increases into 2026.

ING: Oil Market Turns Bearish as TTF Shorts Hit Record

Oil prices fell on Wednesday after a bearish U.S. inventory report showed a sharp 5.2 million barrel build in crude stocks, according to ING’s Ewa Manthey and Warren Patterson.

The rise was driven by an 873,000 b/d increase in imports. Gasoline inventories dropped by 4.73 million barrels, bringing stocks to their lowest level since November 2022, while distillate inventories fell by 643,000 barrels — about 8% below the five-year seasonal average.

Brent crude closed down 1.4% as market sentiment soured amid expectations of a large surplus in 2026. Saudi Aramco also cut December selling prices to Asia, lowering the Arab Light premium by $1.20/bbl to $1.00 over the benchmark — the lowest since January.

OPEC+ recently approved a 137,000 b/d output hike for December but plans to pause further increases in early 2026 amid growing supply risks.

ING: EU Gas Market Faces Winter Risk Amid Record Fund Short Positions

Investment funds have sharply reduced their net long exposure in European gas, heightening risks of a squeeze if cold weather hits, according to ING analysts Ewa Manthey and Warren Patterson.

Funds cut their net long in Dutch TTF gas by 24.8 TWh last week to just 21.4 TWh — the smallest since March 2024 — while gross short positions hit a record 393 TWh.

Storage levels are 83% full, below the five-year average of 92%, leaving the market vulnerable if winter demand surprises to the upside.

At the same time, funds boosted their exposure to EU carbon allowances, adding 2,600 contracts to reach a net long of 96,500 — the largest since May 2021. ING said the EUA outlook remains constructive, with supply expected to tighten significantly in 2026.

Trump Administration Expands Critical Minerals List to Include Copper, Coal

The Trump administration has expanded the U.S. list of critical minerals to include copper, uranium, silver, metallurgical coal, potash, silicon, and lead — a move framed under “national security” priorities.

The update, guided by the Energy Act of 2020, directs the U.S. Geological Survey (USGS) to revise the list every three years and incorporate public and interagency feedback. The new list will influence how Bipartisan Infrastructure Law funds are allocated for domestic resource development.

The timing is politically significant as the Supreme Court reviews arguments over the extent of executive power in applying tariffs under “national security” grounds. Expanding the list could strengthen the administration’s defense that such powers allow retaliation if countries like China restrict exports of key materials.

TDS: Copper Poised for Upside as Macro and Micro Forces Align

Copper markets may be set for an upside breakout as macroeconomic and microstructural dynamics finally move in sync, according to TD Securities Senior Commodity Strategist Daniel Ghali.

“Tight inventories and chronic underinvestment are supporting copper,” Ghali said, adding that an “epic AI capex boom” could add around 550,000 tons to annual demand by 2027.

China’s latest Five-Year Plan prioritizes AI development, potentially increasing copper-intensive infrastructure investment. Meanwhile, lingering U.S. tariff risks are keeping inventories constrained.

“An unraveling of the debasement trade would create an ideal setup for copper upside,” Ghali noted, citing a convergence between long-term demand growth and short-term supply constraints.

Japan, U.S. to Explore Joint Rare Earth Mining Near Minamitori Island

Japan and the United States will jointly study rare earth mining near Minamitori Island to secure critical mineral supplies and reduce reliance on China, Prime Minister Sanae Takaichi said Thursday.

The initiative follows talks with U.S. President Donald Trump and will begin with seabed test extraction in January, about 1,900 kilometers southeast of Tokyo.

The project underscores deepening U.S.–Japan resource cooperation and could pave the way for commercial-scale production in the years ahead.

Morgan Stanley Raises 2026 Oil Forecast to $60 After OPEC+ Output Pause

Morgan Stanley has lifted its 2026 Brent crude forecast to $60 a barrel from $57.50 after OPEC+ halted production hikes earlier than planned. The bank said limited output growth — about 500,000 barrels per day added between March and October versus a pledged 2.6 million — should prevent a supply glut.

The forecast reflects confidence that producer restraint will stabilize prices despite uncertain global demand heading into 2026.

Europe News

Eurozone Retail Sales Slip 0.1% in September as Non-Food Demand Weakens

Eurozone retail sales fell 0.1% in September, missing expectations for a 0.2% gain, according to Eurostat data released Wednesday. August figures were revised down to a 0.1% decline from an initial 0.1% increase.

The drop was driven by weaker non-food sales, which fell 0.2%, while food sales were unchanged. The data, viewed as lagging, are unlikely to influence the European Central Bank’s policy stance, with officials focused on forward indicators of consumer spending and inflation.

Germany Industrial Output Rebounds 1.3% in September, Below Expectations

German industrial production rose 1.3% in September, missing forecasts for a 3% rebound, data from Destatis showed Wednesday. August output was revised upward to a 3.7% decline from an initial 4.3% drop.

The modest gain was driven largely by a recovery in the automotive sector, where output surged 12.3% following a 16.7% fall in August caused by factory shutdowns and model changeovers.

On a quarterly basis, total industrial output fell 0.8% in the third quarter compared with the prior three months, highlighting continued weakness in Europe’s largest economy despite signs of stabilization.

German Construction PMI Drops to 42.8, Deepest Slump in Seven Months

Germany’s construction sector contracted at a faster pace in October, with the HCOB Construction PMI falling to 42.8 from 46.2 a month earlier, marking the steepest decline in seven months.

The latest survey showed further deterioration in housing activity, which remains the weakest segment, while commercial and civil engineering work also slipped back into contraction. Persistent high borrowing costs and weak demand continue to weigh heavily on the industry.

HCOB notes that:

“This is a heavy blow for the construction sector, which was already under pressure. Across the sector as a whole, activity dropped in October at the fastest rate since March this year. The most striking result was the decline in civil engineering, where we had seen moderate growth over the previous two months. The situation in residential construction is even more dramatic, with the deep recession worsening further. Commercial construction also took a hit, though the drop was less forceful than the decline in housing activity. Overall, the numbers reflect a climate of uncertainty, high building costs, and relatively high long-term interest rates, which have hovered well above the levels of the previous decade for the past two years.

“The slump in civil engineering activity shows that the large-scale infrastructure investments the government has already started are clearly subject to bigger fluctuations. We expect growth in this sector to stabilize over the course of next year, once a broader range of public projects gets approved and rolled out.

“In residential construction, activity is falling faster than at any other point this year. It’s pretty clear that the so-called “building turbo” from the federal government – which mainly aims to ease zoning regulations and speed up approval processes – isn’t working at all. It looks like we’ll need additional measures, like direct subsidies and more social housing, to really tackle the housing shortage.

“Incoming orders are shrinking a bit less than the month before, but they still signal that the construction sector isn’t heading for a turnaround just yet. Confidence in higher construction activity a year from now remains low, and demand for subcontractors has dropped sharply. On the bright side, cost inflation has come down significantly and is now well below the long-term average. That could help improve profitability for construction firms.”

Bank of England Holds Rate at 4.00%, Split Vote Reflects Growing Dovish Tilt

The Bank of England left its benchmark rate unchanged at 4.00% at its November meeting, with a closer-than-expected 5–4 vote split. Deputy Governors Breeden and Ramsden, along with Dhingra and Taylor, voted for a 25-basis-point cut.

The decision marks a shift from the previous 7–2 vote and reflects growing confidence that inflation has peaked. The BoE noted that underlying disinflation is progressing, though more evidence is needed before easing further.

Officials said the balance of risks has become more even, with inflation persistence less of a concern and weaker demand posing a larger threat. Dissenting members argued that monetary policy is already overly restrictive and that elevated household savings could further curb consumption.

UK Construction PMI Falls to 44.1, Sharpest Drop in Over Five Years

UK construction activity shrank at its fastest pace in more than five years in October, with the S&P Global PMI falling to 44.1 from 46.2 in September and below expectations for 46.7.

The decline was broad-based, led by sharp reductions in housing and civil engineering projects. Firms cited a lack of new work to replace completed contracts and subdued client demand amid tighter financial conditions.

S&P Global notes that:

“UK construction companies reported another challenging month in October as the prolonged weakening of order books so far in 2025 resulted in the fastest decline in business activity for over five years. Civil engineering and residential activity saw the fastest rates of contraction, while commercial building showed some resilience.

“Reduced workloads were again widely attributed to risk aversion and delayed decision-making among clients, which contributed to a slower-than-expected release of new projects. Subdued demand in the wake of heightened political and economic uncertainty also led to the steepest drop in input buying since May 2020.

“Meanwhile, some positive signals for the construction sector in October included a slowdown in cost inflation to its lowest for one year, rising subcontractor availability, and a sustained improvement in supplier performance.

“Looking ahead, business activity expectations for the coming 12 months remained much weaker than the long-run survey average, largely due to worries about fragile investment sentiment and weak sales pipelines. However, overall optimism levels edged up to the highest since July as the prospect of lower borrowing costs reportedly helped to boost demand projections.”

BoE’s Bailey Signals Gradual Path Lower for Bank Rate

Bank of England Governor Andrew Bailey said the central bank is likely to continue a “gradual downward path” for the policy rate but emphasized that further cuts depend on clearer evidence of sustained disinflation.

Speaking at a press conference after the November policy decision, Bailey said the committee’s judgment rests on two main factors: easing domestic price and wage pressures, and reduced risks of inflation persistence. “The latest inflation data were encouraging, but it’s only one data point,” he said.

Bailey added that future moves would also depend on fiscal policy outcomes but declined to speculate on the upcoming budget. He noted that policy remains restrictive and that the UK is at a “critical moment” for incoming economic data.

Goldman Sachs Now Expects BoE Rate Cut in December

Goldman Sachs expects the Bank of England to lower its policy rate by 25 basis points in December, reversing its prior forecast for no change.

The shift follows the BoE’s latest 5–4 vote to keep rates steady at 4.00%, with four members already backing a cut. Governor Andrew Bailey signaled that the central bank may pursue a gradual downward path if inflation continues to ease.

Bailey warned, however, that inflation remains “a long way above” the 2% target, and the BoE must remain vigilant about persistent price and wage pressures. He added that while inflation risks are easing, economic activity remains weak, with signs of softening in the labor market.

The BoE meets again on December 18, where Bailey could once again hold the deciding vote.

ECB’s de Guindos: Inflation news is positive

- Comments from the ECB Vice President, Luis de Guindos

- Marginally more optimistic on growth

- Much more optimistic on services inflation

- Evolution of wages fully alignes with projections

- Level of uncertainty is huge

- Our intention is to give a gently growing dividendm we will say more in February

- Comfortable with current level of interest rates

- We believe that undershooting will be temporary

- Convergence to 2% is now the baseline

- No discussion on modifying QT

Asia-Pacific & World News

China Buys First U.S. Wheat Cargoes in Over a Year

China has purchased two cargoes of U.S. wheat for December shipment, marking its first such deals in more than a year, according to trade reports. The combined volume totals around 120,000 tons, split between U.S. soft white wheat and spring wheat.

The purchases are the first since October 2024 and come shortly after the latest U.S.–China “deal,” suggesting Beijing may be signaling goodwill following recent trade discussions. However, analysts note that China has a history of easing into commitments before later pulling back.

China’s overall grain imports have declined sharply in recent years as domestic output expanded. The country imported roughly 60 million tons of grain in the 2021–22 season, compared with about 20 million tons last year.

China Defends Yuan to Bolster Investor Confidence

China is prioritizing currency stability over export competitiveness as the People’s Bank of China reinforces support for the yuan. The central bank raised its counter-cyclical adjustment factor this week when setting the daily USD/CNY midpoint, effectively limiting depreciation.

The yuan’s trade-weighted index has climbed to pre-tariff levels, signaling Beijing’s preference for a firm currency to attract foreign inflows.

Analysts see continued gradual appreciation as China seeks to finalize trade deals and strengthen investor sentiment. A Reuters poll showed long-yuan positions at their highest since mid-September.

China Bans Foreign AI Chips in State-Funded Data Centers

China has barred the use of foreign-made AI chips in all state-funded data centers, Reuters reported, dealing a blow to U.S. suppliers such as Nvidia, AMD, and Intel. Projects less than 30% complete must remove or cancel foreign chip purchases, while others will face review.

The ban aims to accelerate domestic semiconductor development and reduce reliance on U.S. technology, benefiting local firms including Huawei and Cambricon.

The move further entrenches the U.S.–China tech divide, with Nvidia’s share of China’s AI chip market — once near 95% — now effectively zero. Analysts say the policy could reshape China’s $100 billion data center industry and solidify state support for domestic AI growth.

Nvidia’s Huang Warns U.S. Could Lose AI Race to China

Nvidia CEO Jensen Huang warned that the United States risks ceding AI leadership to China amid regulatory gridlock, Axios reported. Speaking to the Financial Times in London, Huang said Beijing’s subsidies and energy policies are advancing AI faster than Washington’s fragmented rules.

He noted that while U.S. states debate dozens of new regulations, China is cutting energy costs to accelerate AI computing. “China is going to win the AI race,” Huang said, citing China’s vast researcher base and open-source ecosystem. Nvidia’s China market once worth $50 billion remains critical despite export bans on its advanced chips.

Huang urged the U.S. to expand energy output and invest in infrastructure to maintain global AI competitiveness.

PBOC sets USD/ CNY reference rate for today at 7.0865 (vs. estimate at 7.1222)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 92.8bn yuan via 7-day reverse repos at 1.40%.

- That injection still results in a net drain on the day, of 249.8bn yuan.

Australia’s September Trade Surplus Slightly Misses Forecasts at $3.94 Billion

Australia’s trade surplus came in at A$3.94 billion for September, slightly below expectations of A$4.0 billion but well above August’s A$1.83 billion. Exports surged 7.9% month-on-month, the fastest since April 2022, while imports rose 1.1%, slowing from a 3.2% increase in the prior month. Both exports and imports improved on stronger commodity flows and steady domestic demand.

RBNZ’s Hawkesby Sees Jobless Rise as Expected, Warns on Trade Frictions

Reserve Bank of New Zealand Governor Christian Hawkesby said the recent increase in unemployment aligns with the bank’s expectations and reflects the economy’s current stage in the cycle.

Speaking to parliament following the Financial Stability Report, Hawkesby said conditions remain “hard out there,” but the financial system is resilient even under adverse scenarios.

He flagged global trade fragmentation as a key risk and warned of possible renewed trade wars. The governor added that regional disparities persist, with some sectors faring better than others amid the slowdown, signaling the RBNZ’s cautious stance on further easing.

Japan to Tighten Foreign Investment Law, Narrow IT Reviews

Japan plans to revise its Foreign Exchange and Foreign Trade Act in 2026 to strengthen national security screening and close regulatory gaps. The overhaul will streamline procedures after a surge in filings since 2019 and may narrow IT-sector reviews to critical cybersecurity areas.

Officials are also weighing a U.S.-style investment review body to coordinate oversight across ministries. The reform aligns Japan’s security screening more closely with U.S. standards while preserving investor access.

Japan Services PMI Eases to 53.1 in October as Demand Softens

Japan’s services sector expanded for a seventh month in October, though momentum cooled, according to S&P Global. The final Services PMI came in at 53.1, slightly below September’s 53.3 but above the flash estimate of 52.4.

New business growth slowed to its weakest in 16 months, while overseas demand fell for a fourth month.

Price pressures intensified, driven by higher labour, food, and fuel costs. Business confidence dipped from September’s eight-month high, and hiring grew at a slower pace.

The composite PMI rose to 51.5 from 50.9, as resilient services helped offset a deeper manufacturing contraction.

Japan Coalition Partner Cautions Against Early BoJ Rate Hike

Hidetaka Fujita, co-leader of the Japan Innovation Party, warned that an early Bank of Japan rate hike would send confusing signals to businesses and undermine stability. Fujita said “now is not the time” for major policy shifts, stressing the need for steady conditions amid higher costs.

He also confirmed the government will not raise taxes to finance accelerated defence spending, as Tokyo frontloads its multi-year security budget.

Fujita’s comments underscore coalition caution over premature tightening and reinforce expectations of gradual monetary normalization under Prime Minister Sanae Takaichi’s government.

Toyota, Honda Step Up Investment to Make India Key Auto Hub

Japanese automakers are deepening investment in India as they pivot away from China, positioning the country as a major manufacturing and export base. Toyota, Honda, and Suzuki are committing billions to expand local operations in what is now the world’s third-largest car market, Reuters reported.

Toyota and Suzuki have pledged $11 billion in new facilities, while Honda plans to base next-generation EV production in India by 2027.

Japan’s transport-sector investment in India has surged more than sevenfold since 2021 as direct flows to China have plunged.

Favorable costs, government incentives, and curbs on Chinese EV makers are drawing Japanese firms toward India’s rapidly growing market.

Japan Real Wages Fall 1.4% in September, Ninth Consecutive Decline

Japan’s inflation-adjusted real wages fell 1.4% in September from a year earlier, marking a ninth straight monthly decline and highlighting ongoing pressure on households. Nominal pay rose 1.9% to an average of ¥297,145 ($1,971), but inflation jumped 3.4%, outpacing earnings growth.

Base pay rose 1.9%, overtime pay increased 0.6%, and bonuses rebounded 4.5% after an August drop.

The data complicate the Bank of Japan’s path to policy tightening. Governor Kazuo Ueda has said the 2026 wage outlook will be pivotal. Labor federation Rengo is targeting another 5% hike next spring after this year’s 5.25% increase — the largest in 34 years. Prime Minister Sanae Takaichi reiterated Japan has yet to achieve sustainable inflation supported by wage growth.

Crypto Market Pulse

XRP Slide Deepens as Network Activity Fades

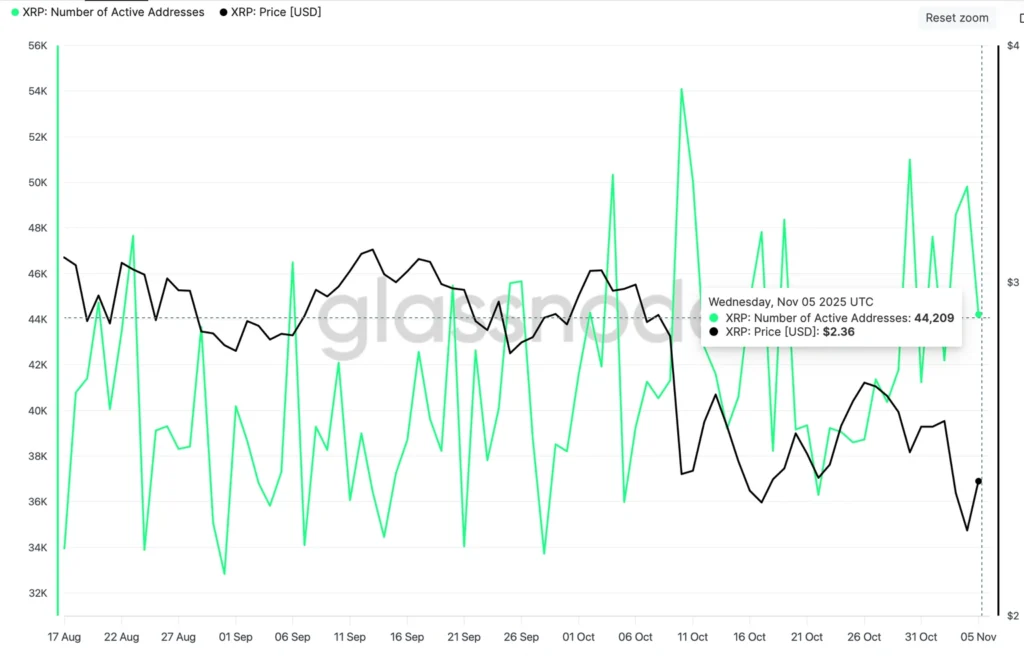

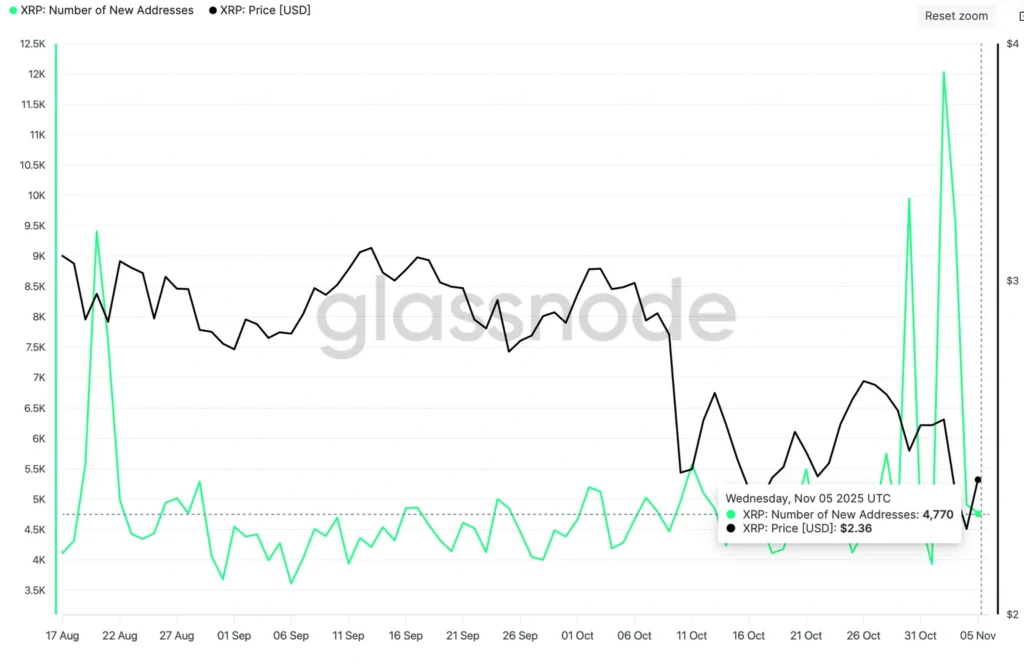

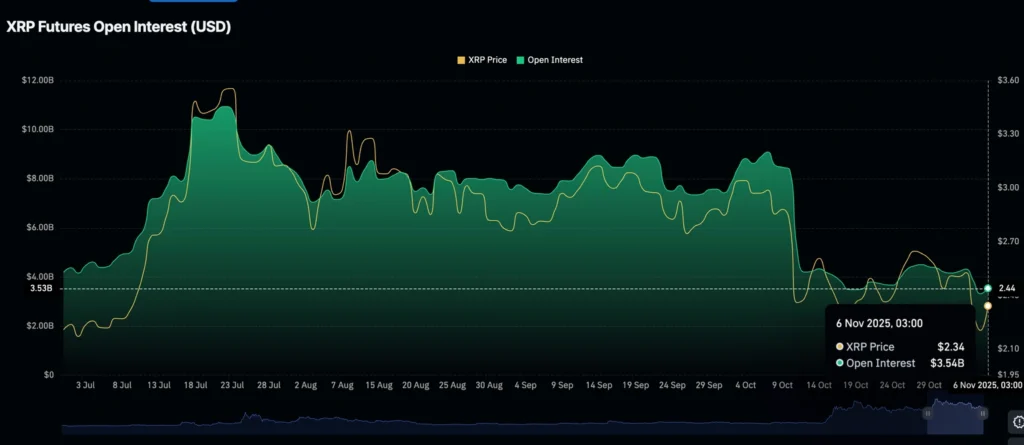

Ripple’s XRP extended losses Thursday, trading near $2.30, as weakening on-chain metrics and tepid investor demand weigh on sentiment.

Data from Glassnode show that active XRP Ledger addresses fell to roughly 44,000, down from 54,000 in mid-October — an 18.5% decline that coincides with a slide in price from $2.84.

Meanwhile, new wallet creation has dropped 60% since Sunday to 4,770, signaling shrinking adoption.

The slowdown has also hit derivatives markets: XRP futures open interest has fallen to $3.54 billion from $4.33 billion on Monday and a peak of $9.09 billion earlier in October. Analysts say the data reflect an ongoing risk-off mood, with traders reluctant to re-enter long positions.

The weakness mirrors broader crypto sentiment, with major assets like Bitcoin and Ethereum also under pressure amid persistent ETF outflows and subdued retail participation.

Bank of England to Match U.S. Timeline on Stablecoin Regulation

The Bank of England (BoE) plans to synchronize its stablecoin regulatory framework with the United States, aiming for full implementation by 2026, Deputy Governor Sir Jon Cunliffe said Thursday.

Cunliffe emphasized that the U.K. must “move at comparable speed to our U.S. counterparts to protect competitiveness and financial stability,” as global digital asset oversight rapidly evolves.

The stablecoin market now exceeds $160 billion in circulation and accounts for roughly 40% of decentralized finance (DeFi) transaction volume. Regulators warn that without parallel standards, capital could shift across borders, undermining policy control.

In the U.S., the SEC classifies some stablecoins as securities, while the CFTC treats them as commodities — a dual oversight model that has accelerated rulemaking. The BoE’s move also aligns with the EU’s Markets in Crypto-Assets (MiCA) framework, which caps issuance and mandates strict reserve requirements.

Under the BoE’s roadmap, draft rules will be released in early 2026, with industry consultations running through Q1 2026. Issuers will face reserve audits and redemption mandates, though analysts warn differing technical requirements between jurisdictions could fragment global liquidity pools.

Aster Rebounds Toward Key Resistance as Sentiment Improves

Aster (ASTER) rose 4% Thursday, marking a third straight session of gains as it approaches a key resistance trendline. The rebound follows a decline in bearish sentiment and the token’s expanded use as collateral on its native derivatives exchange.

The new 80% margin ratio for ASTER collateral has boosted trader confidence. CoinGlass data shows a 5.87% jump in futures open interest over 24 hours, with the funding rate turning less negative — a sign of reduced demand for short positions.

If bullish momentum holds, Aster could break above its trendline resistance, setting up for a potential short-term rally.

Crypto Market: Bitcoin, Ethereum, XRP Recovery Stalls as Risk-Off Sentiment Returns

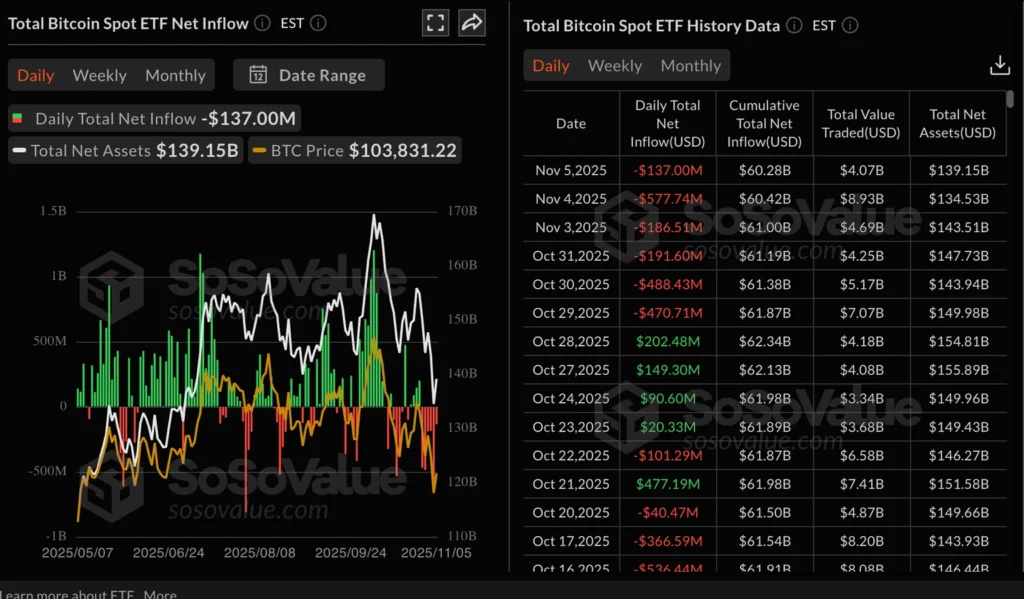

Bitcoin (BTC) traded below $103,000 on Thursday as ETF outflows and risk aversion weighed on crypto sentiment. Institutional interest in crypto ETFs continues to decline, with U.S.-listed Bitcoin funds seeing $137 million in outflows on Wednesday — the sixth straight day of withdrawals, per SoSoValue data.

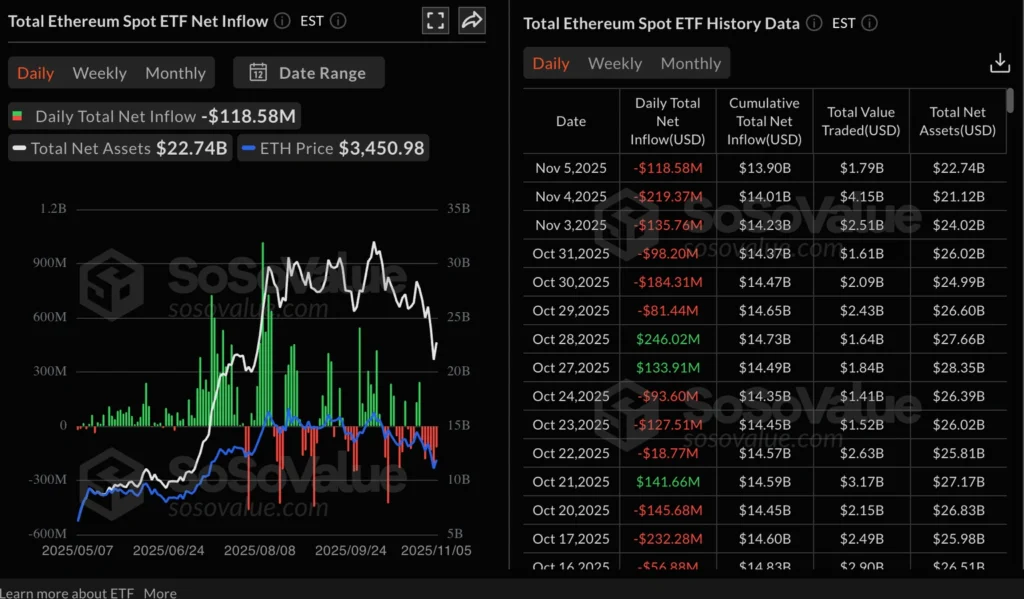

Ethereum (ETH) saw $119 million in outflows, while net inflows across all ETH ETFs stood at $13.9 billion. BlackRock’s ETHA fund led the outflows with $147 million, while Grayscale’s ETH fund saw $24 million in inflows.

Retail participation in Ethereum futures also weakened, with open interest down to $40 billion from an October peak of $63 billion, suggesting traders are closing longs and increasing short exposure. XRP remains volatile ahead of a potential “Death Cross” pattern confirmation.

Crypto Market Gains 1% but Bulls Struggle to Regain Control

The global crypto market rose about 1% over the past 24 hours to $3.4 trillion, snapping a four-day losing streak. Still, analysts warn the rebound looks more like consolidation than a true reversal, with broader risk-off sentiment and a stronger dollar keeping pressure on digital assets.

Bitcoin is hovering near $103,000, above the 50-week moving average but still vulnerable to renewed selling. Analysts note that short-term holders continue to sell at a loss, while long-term “accumulator” wallets added a record 375,000 BTC over the past month.

Ripple announced $500 million in new strategic investments, while French firm Sequans Communications sold 970 BTC to reduce debt. In contrast, Japan’s Metaplanet secured a $100 million loan to buy more Bitcoin.

Zcash (ZEC) has gained traction as a privacy-focused alternative to Bitcoin, with Galaxy Digital calling it “encrypted Bitcoin” for those wary of institutional centralization.

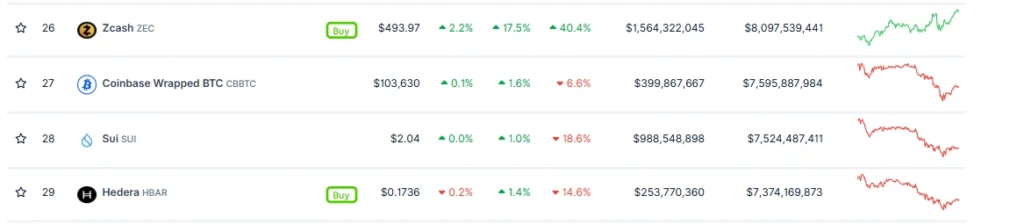

Zcash Rally Pushes Market Cap Past $8 Billion; Bulls Target $580

Zcash (ZEC) extended its rally Thursday, climbing above $490 and up more than 17% for the week. The token’s market capitalization topped $8 billion, surpassing Sui (SUI) and Hedera (HBAR).

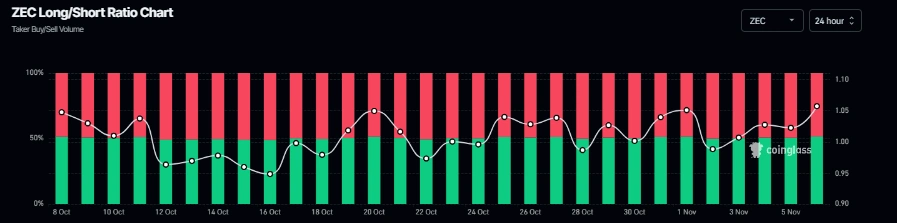

According to CoinGlass, ZEC futures open interest hit a record $773.8 million, indicating strong buying momentum.

The long-to-short ratio stood at 1.05, suggesting bullish positioning among traders.

Analysts see potential for ZEC to test resistance around $578, though CryptoQuant data warned of overheating in retail activity. Elevated leverage and growing spot trading volumes suggest speculative risk could rise if momentum fades.

The Day’s Takeaway

North America

U.S. Stocks Slide as AI Boom Faces Investor Reality Check

U.S. equities retreated Thursday as enthusiasm for AI-linked names cooled. The S&P 500 fell 1.1%, the Nasdaq Composite dropped 1.9%, the Dow slipped 0.8%, and the Russell 2000 lost 1.6%. Investors rotated out of stretched tech valuations ahead of mixed corporate earnings.

Earnings Roundup

- The Trade Desk (TTD): Q3 revenue $739M vs. $718M est.; adj. EPS $0.45 vs. $0.44 est.; margin 43%. Executives flagged tougher digital ad competition.

- Airbnb (ABNB): Revenue $4.10B vs. $4.08B est.; EPS $2.21 vs. $2.34 est. Q4 guidance steady, with slowing growth into holidays.

- Wynn Resorts (WYNN): Revenue $1.83B vs. $1.75B est.; adj. EPS $0.86 vs. $1.10 est. Macau strong, costs high.

- Take-Two Interactive (TTWO): Revenue $1.77B vs. $1.72B est.; net bookings $1.96B; EPS –$0.73. Eyes on GTA VI release, Nov. 2026.

- Block (SQ): Gross profit $2.66B (+18% YoY); net income $462M (+63%). Q4 guide strong; digital payments remain resilient.

Fed Officials Signal Unease Over Further Rate Cuts

Chicago Fed’s Austan Goolsbee said policy should proceed cautiously given “foggy” inflation data and stable labor markets. He warned against overreacting to one soft payroll report, noting “low hiring and low firing suggest uncertainty, not recession.”

New York Fed’s John Williams echoed caution, saying the natural rate of interest is “hard to pin down,” while Vice Chair Michael Barr emphasized uneven household recovery. Governor Beth Hammack stayed hawkish, urging a “modestly restrictive” stance, while Governor Adriana Miran leaned dovish, favoring another December cut.

Canada’s Ivey PMI Slumps to 51.7

Canada’s Ivey PMI fell sharply to 51.7 in October from 59.8, hinting at cooling in both manufacturing and services amid softer global demand.

Banxico Cuts Key Rate to 7.25%

The Bank of Mexico lowered its benchmark rate by 25 bps to 7.25%, a widely expected move that extends its gradual easing cycle. The 4–1 vote reflected confidence that inflation is moderating toward the 3% target by late 2026.

Commodities

Gold Holds Below $4,000 as Shutdown Fears Boost Safe-Haven Demand

Gold peaked at $4,019 before settling near $3,985 as weaker yields and a softer dollar supported bullion. Job cuts data showing 150,000 layoffs in October and renewed U.S. shutdown threats spurred safe-haven buying. Mixed Fed commentary reinforced expectations for a December rate cut.

Oil Rebounds Above $60 as Risk Appetite Improves

WTI crude climbed back above $60 after falling earlier in the week. Reports of Ukrainian drone strikes on Russian refineries revived supply concerns, though U.S. inventories rose by 5.2M barrels, tempering gains. Gasoline stocks fell 4.7M barrels to the lowest since 2022, and distillates remain 8% below norms.

ING: Oil Market Turns Bearish as Inventories Build

ING analysts flagged a 5.2M-barrel U.S. crude build and record TTF short positioning as signs of a bearish setup. Brent fell 1.4%, while Saudi Aramco cut December selling prices to Asia — the weakest since January.

Copper Poised for Upside as AI Demand Meets Tight Supply

TD Securities’ Daniel Ghali sees copper positioned for gains as tight inventories, underinvestment, and AI-driven demand converge. China’s new AI-heavy Five-Year Plan could lift consumption by 550,000 tons by 2027.

ING: EU Gas Market Faces Winter Risk

Funds slashed net longs in Dutch TTF gas to 21.4 TWh — the lowest since March 2024 — while gross shorts hit a record 393 TWh. Storage is 83% full, below the five-year 92% average, leaving Europe exposed if winter demand spikes.

Nikkei: Rare Earth Deal Between U.S. and China Sparks Confusion

Confusion surrounds a new rare earth trade pact after Washington said Beijing agreed to “eliminate coercive export controls,” while China has not confirmed those terms. The deal, under Executive Order 14257, eases tariffs on both sides through late 2026 but may face implementation hurdles.

Europe

Goldman Sachs Sees BoE Rate Cut in December

Goldman now expects the Bank of England to lower rates by 25 bps next month after a narrow 5–4 hold vote. Governor Andrew Bailey signaled room to ease if inflation continues to fall, though price pressures remain above target.

Bank of England to Align Stablecoin Rules with U.S. by 2026

BoE Deputy Governor Jon Cunliffe said the U.K. will synchronize its stablecoin regulation timeline with the U.S. by 2026 to prevent capital flight and regulatory arbitrage. Draft rules and consultations are due early that year.

Asia

U.S.–China Rare Earth Agreement Faces Clarity Gap

Reports indicate differing interpretations of the recent U.S.–China deal on rare earth exports. While U.S. officials say Beijing will lift restrictions and suspend tariffs on key farm goods, Chinese authorities have not confirmed — raising doubts about enforcement.

Crypto

Market Rebounds Slightly but Remains Fragile

The global crypto market added 1% to $3.4T, pausing a four-day slide. Bitcoin hovered near $103,000, with long-term holders adding 375,000 BTC in the past month even as short-term traders took losses.

Bitcoin, Ethereum, XRP Weaken as ETF Outflows Continue

Risk aversion weighed on digital assets, with $137M of Bitcoin ETF outflows and $119M from Ethereum funds. BlackRock’s ETHA led redemptions; open interest in ETH futures fell to $40B from $63B in October.

XRP Extends Decline on Weak Network Activity

Active XRP addresses dropped 18% to 44,000, while new wallets fell 60%. Open interest shrank to $3.5B from $9B in October, signaling retreating investor interest.

Zcash Rally Pushes Market Cap Past $8B

ZEC rose above $490, up 17% for the week, with open interest at a record $774M. Analysts see resistance near $578 but warn of overheating and rising leverage.

Aster Extends Rebound Toward Key Resistance

Aster (ASTER) gained 4% as sentiment improved. Open interest rose 5.9% and funding rates turned less negative, suggesting fading short pressure. A breakout above its trendline could signal short-term upside.