North America News

US Major Indices Rebound, Nasdaq Leads with 0.65% Gain

U.S. stocks closed higher on Wednesday, recovering some of the sharp losses from the previous session. The Nasdaq Composite led the rebound, gaining 0.65%, while the S&P 500 and Dow Jones Industrial Average rose 0.37% and 0.48%, respectively.

The bounce came as the Nasdaq found support at its 100-hour moving average, helping lift sentiment after Tuesday’s selloff, when the Nasdaq tumbled 2.04% and the S&P fell 1.17%.

Closing levels:

- Dow Jones: +228.57 points (+0.48%) at 47,311.00

- S&P 500: +24.74 points (+0.37%) at 6,796.29

- Nasdaq Composite: +151.16 points (+0.65%) at 23,499.80

Sector Performance

Seven of the S&P 500’s eleven sectors closed in positive territory, led by Consumer Discretionary, which rebounded 1.12% amid optimism that the Supreme Court may limit the president’s tariff powers — a positive for retail importers.

| Sector | % Change |

|---|---|

| Consumer Discretionary | +1.12% |

| Materials | +0.54% |

| Health Care | +0.44% |

| Industrials | +0.40% |

| Financials | +0.28% |

| Energy | +0.19% |

| Utilities | +0.04% |

| Real Estate | −0.06% |

| Information Technology | −0.08% |

| Consumer Staples | −0.20% |

| Communication Services | −0.36% |

Top Gainers

Airlines, chipmakers, and clean energy stocks led the day’s winners.

- Micron +8.93%

- Southwest Airlines +6.56%

- United Airlines Holdings +6.47%

- American Airlines +6.13%

- Lam Research +5.95%

- Nebius NV +5.82%

- First Solar +5.59%

- iShares Global Clean Energy ETF +5.42%

- Western Digital +5.16%

- Delta Air Lines +5.15%

- Stellantis NV +4.33%

- Robinhood Markets +4.15%

- Tesla +4.03%

Notable Decliners

High-growth tech and defense names lagged:

- Super Micro Computer −11.34%

- Live Nation Entertainment −10.42%

- Papa John’s −5.08%

- Emerson Electric −3.84%

- Home Depot −2.42%

- Lockheed Martin −2.40%

- Chewy −2.13%

- Bank of America −2.05%

- Uber Technologies −2.02%

- ProShares UltraPro Short QQQ −1.99%

- Roblox −1.86%

- Synopsys −1.81%

- NVIDIA −1.77%

Earnings Highlights

$SNAP | Snap Inc. (Q3 2025)

- Revenue: $1.51B (vs. $1.49B est)

- Adjusted EBITDA: $182M (vs. $124.2M est)

- Daily Active Users: 477M (vs. 476.3M est)

- Q4 Revenue Guidance: $1.68B–$1.71B (vs. $1.69B est)

- Q4 Adjusted EBITDA: $280M–$310M (vs. $254.6M est)

- Revenue Growth Outlook: +8% to +10%

Snap topped expectations across key metrics and guided for continued growth into Q4, signaling improved ad demand and user engagement.

$QCOM | Qualcomm (Q4 2025)

- Adjusted Revenue: $11.27B (vs. $10.77B est)

- Adjusted EPS: $3.00 (vs. $2.88 est)

- FY CapEx: $1.19B (vs. $1.18B est)

- Q1 Revenue Guidance: $11.8B–$12.6B (vs. $11.59B est)

- Q1 Adjusted EPS: $3.30–$3.50 (vs. $3.26 est)

Qualcomm delivered a strong beat and issued upbeat guidance, underscoring robust chip demand across mobile and AI-driven segments.

$DUOL | Duolingo (Q3 2025)

- Revenue: $271.7M (vs. $260.3M est)

- Daily Active Users: 50.5M

- Monthly Active Users: 135.3M

- Adjusted EBITDA: $80M

- FY Revenue Guidance: $1.027B–$1.032B (raised from $1.02B est)

- FY Adjusted EBITDA: $296.9M–$300.2M

Duolingo posted strong top-line growth and profitability, lifted by user engagement and AI-driven personalization, prompting a full-year guidance raise.

$HOOD | Robinhood Markets (Q3 2025)

- Revenue: $1.27B (vs. $1.19B est)

- EPS: $0.61 (vs. $0.53 est)

- Transaction-Based Revenue: $730M, +129% YoY

- Net Deposits: $20.4B

- Platform Assets: $333B, +119% YoY

- Gold Subscribers: 3.9M, +77% YoY

- FY25 Operating Expenses + SBC: ~$2.28B

- Leadership Update: CFO Jason Warnick to retire; Shiv Verma to succeed

Robinhood crushed expectations, driven by record trading activity, surging deposits, and growing premium subscriptions. The company reaffirmed its cost discipline while signaling investment in new areas such as prediction markets.

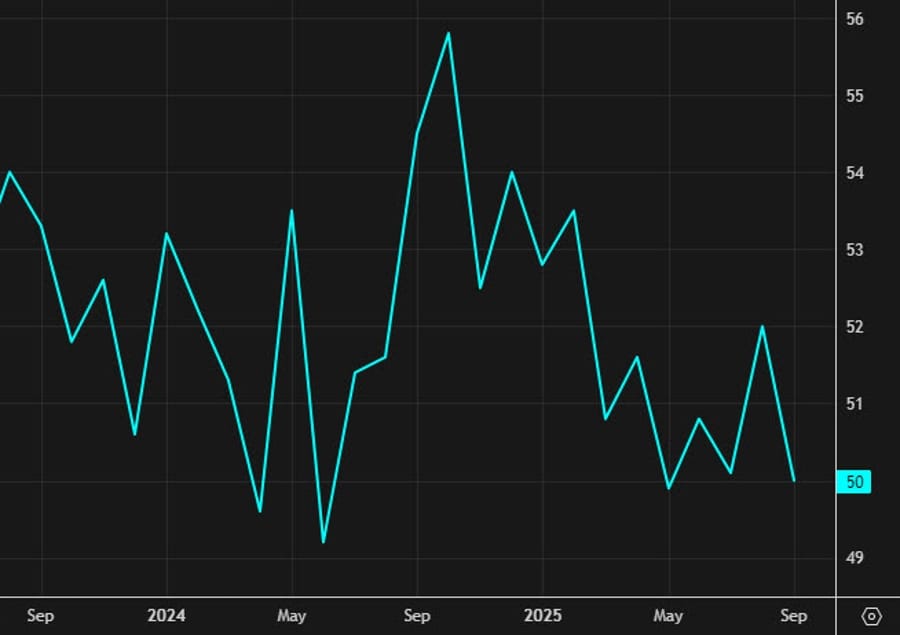

ISM U.S. October Services PMI 52.4 vs 50.8 Expected — 8-Month High

The ISM services index rose to 52.4 in October, its highest in eight months, beating expectations for 50.8 and up sharply from September’s 50.0.

Key components:

- Business activity: 54.3 (prior 49.9)

- New orders: 56.2 (prior 50.4) — highest since Oct 2024

- Employment: 48.2 (prior 47.2)

- Prices paid: 70.0 (prior 69.4) — 3-year high

- Supplier deliveries: 50.8 (prior 52.6)

- Inventories: 49.5 (prior 47.8)

- Backlogs: 40.8 (prior 47.3)

- Exports: 46.5 (unchanged)

- Imports: 49.2 (unchanged)

The data point to renewed strength in demand but persistent cost pressures.

Comments in the report:

- “Activity is generally flat month-over-month; we are closely monitoring effects of the new tariff announcement.” [Finance & Insurance]

- “Uncertainty due to the federal government shutdown has shuttered many non-essential functions. This will lead to project delays and likely hurt our overall fiscal year 2026 expectations. Our sites are funded through the next couple of months, but if the shutdown continues beyond that time, we will expect mass furloughs of our employees.” [Management of Companies & Support Services]

- “Relatively flat activity levels for oil and gas.” [Mining]

- “Client demand for advisory and compliance services remains solid, particularly as businesses navigate evolving tax legislation and increased regulatory scrutiny. However, we are seeing extended approval cycles on discretionary projects and tighter controls on consulting spend, which is putting pressure on procurement to be more agile and cost-efficient.” [Professional, Scientific & Technical Services]

- “Heightened business activity due to new fiscal year budget. Items made with or utilizing precious metals are up, basic labor is down — though maintaining employees has been more difficult since a return-to-office order was implemented.” [Public Administration]

- “The overall economy continues to provide mixed signals, which makes it difficult to determine how to move forward as a business given the uncertainty.” [Real Estate, Rental & Leasing]

- “Business very strong, no supply chain or logistical issues.” [Retail Trade]

- “General business has been steady, with minimum fluctuation.” [Transportation & Warehousing]

- “Tariffs continue to cause disruption in contracts and contracting, driving up pricing on goods, particularly engineered and manufactured equipment. The backlog of existing orders with delays continues to persist for equipment and manufactured equipment.” [Utilities]

- “Business seems to be picking up. Multifamily is a big driver. I think most projects that have been postponed are finally coming to fruition as lumber prices have found a bottom. The outlook is better with the Fed’s plan to continue with rate cuts. Home prices coupled with elevated interest rates continue to keep a lid on sales. Home affordability is still a bit out of reach for a large portion of potential buyers. [Wholesale Trade]

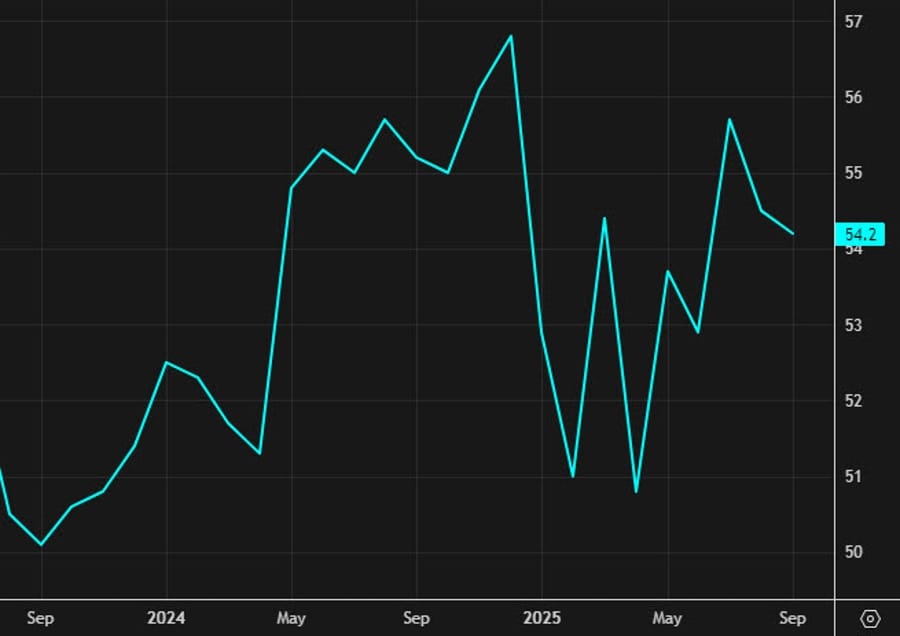

U.S. October Final S&P Global Services PMI 54.8 vs 55.2 Prelim

The final S&P Global U.S. services PMI for October came in at 54.8, slightly below the preliminary estimate of 55.2 but up from September’s 54.2.

The composite PMI printed at 54.6 versus 54.8 prelim. The readings indicate solid service-sector growth heading into Q4 despite a mild moderation from early estimates.

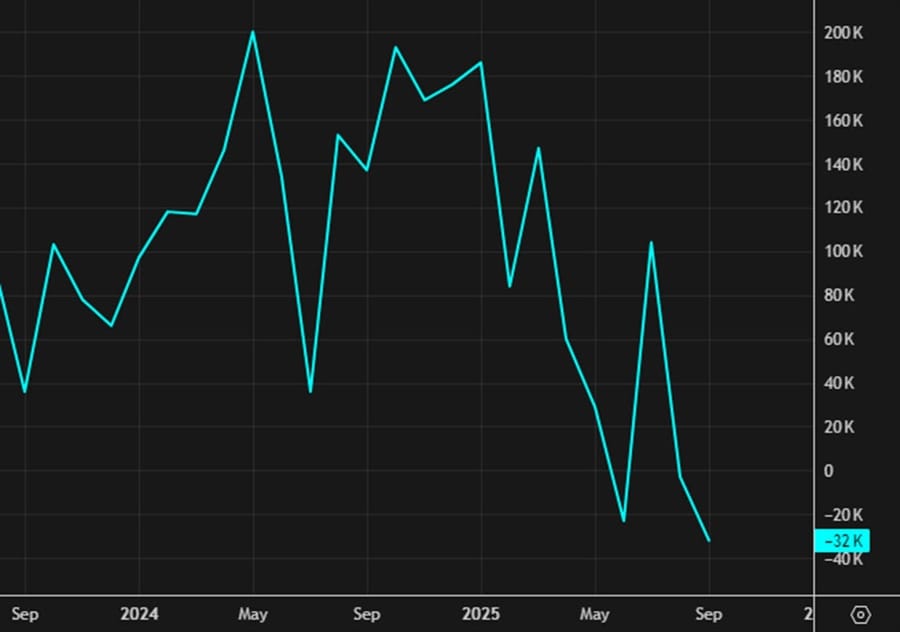

ADP October U.S. Employment +42K vs +28K Expected

Private payrolls rose by 42,000 in October, above the 28,000 expected, according to ADP data. The prior month’s decline of 32,000 was revised to -29,000.

Sector breakdown:

- Goods-producing: +9K (prior -3K)

- Service-providing: +33K (prior -28K)

- Trade/transportation/utilities: +47K (prior -7K)

- Leisure/hospitality: -6K (prior -19K)

Median pay for job stayers was unchanged at 4.5%, while pay for job changers ticked up to 6.7% from 6.6%. The stronger print suggests ongoing resilience in hiring momentum ahead of Friday’s nonfarm payrolls report.

“Private employers added jobs in October for the first time since July, but hiring was modest relative to what we reported earlier this year,” said Nela Richardson, chief economist, ADP. “Meanwhile, pay growth has been largely flat for more than a year, indicating that shifts in supply and demand are balanced.”

Treasury to Keep Coupon Auction Sizes Steady “for Several Quarters”

The U.S. Treasury said it plans to keep coupon auction sizes unchanged “for at least the next several quarters” in its quarterly refunding announcement — a signal that any expansion in borrowing is likely to come later.

Despite deficits running near 6% of GDP, Treasury officials opted for stability, with a modest bump in inflation-protected securities (TIPS) announced.

Details:

- 3-year notes: $58 billion

- 10-year notes: $42 billion

- 30-year bonds: $25 billion

- TIPS reopening for December: $24 billion

Treasury yields rose after the release, with the 10-year up 1.9 bps to 4.11%, a level that has capped yields since early October.

U.S. Mortgage Applications Fall 1.9% as Rates Edge Higher

U.S. mortgage applications declined 1.9% in the week ending October 31, following a 7.1% rise the previous week, according to the Mortgage Bankers Association.

The market index fell to 332.3 from 338.7. The purchase index slipped to 163.3, and refinancing activity dropped to 1,290.8 from 1,327.8. The average 30-year fixed mortgage rate ticked up to 6.31% from 6.30%.

While the data rarely moves markets, the figures reaffirm the inverse relationship between mortgage rates and borrower demand.

Fed’s Miran: ADP Data “A Welcome Surprise,” But Tariffs Pose Risk

Federal Reserve official Miran said the latest ADP report was “a welcome surprise,” showing ongoing labor-market resilience.

He added that job trends remain consistent with pre-shutdown patterns and that current data could justify lower interest rates over time. However, Miran cautioned that growing uncertainty around tariffs could weigh on economic momentum.

U.S. Shutdown Hits 35 Days, Poised to Break Record

The U.S. government shutdown has tied the 35-day record set in 2018–19 after the Senate again failed to pass a funding bill. The impasse is set to become the longest in history on Wednesday.

The Congressional Budget Office estimates an eight-week shutdown could shave $14 billion off GDP. Key economic data releases remain delayed as agencies stay closed.

Goldman, Morgan Stanley CEOs Warn of 10–15% Market Correction

Goldman Sachs and Morgan Stanley CEOs warned that U.S. equities could face a correction of 10–15% as stretched valuations leave markets vulnerable to sentiment shifts.

Speaking in Hong Kong, Morgan Stanley’s Ted Pick called such a pullback “healthy,” citing complacency and record-high valuations. Goldman’s David Solomon added that technology stocks look “fully valued” and said markets often run ahead of fundamentals late in the cycle.

Canada October Services PMI Rises to 50.5, First Expansion Since November

Canada’s services sector returned to growth in October, with the S&P Global PMI jumping to 50.5 from 46.3 in September — the first reading above 50 in nearly a year.

However, the report’s tone remained cautious: operating costs continued to rise sharply, competitive pressures limited price pass-through, and staffing levels declined as firms chose not to replace departing employees.

New business fell for an 11th straight month, backlogs dropped steeply, and business confidence stayed below trend.

Paul Smith, Economics Director at S&P Global Market Intelligence, said:

“October’s survey data signalled a return to (admittedly marginal) growth of Canada’s service sector amid some evidence of a stabilisation in the business environment. However, whilst welcome, growth realistically failed to make up for the sustained period of contraction seen through much of 2025 and should be viewed in the context of the continued uncertainty and client hesitancy that still plagues market demand.

“Political and economic uncertainty, especially in relation to trade policies, also continues to dominate the outlook with confidence amongst firms remaining sub-par in October. That helped to explain why companies were again reluctant to replace any leavers, especially given evidence of continued spare capacity in the sector.

“Against this backdrop of soft employment and economic activity trends, and with selling price inflation remaining below trend, the latest PMI data once again provide a timely reminder of why the Bank of Canada loosened monetary policy again last week.”

Commodities News

Gold Steadies in Tight Range as Traders Await Fresh Catalysts

Gold is consolidating between $3,900 and $4,000 per ounce as investors await new triggers following last week’s selloff.

Despite hawkish Fed commentary, the metal’s recent stability suggests exhaustion after an 11% decline. Analysts see the short-term bias as neutral to bearish, with resistance near $4,000 and downside targets around $3,820.

Broader uptrend prospects hinge on falling real yields and dovish policy momentum later this year.

Crude Oil Trapped in Narrow Range; Traders Eye Breakout

Crude oil prices remain confined to a tight range between $59.64 and $61.45 over the past seven sessions, reflecting indecision between buyers and sellers.

The price continues to oscillate between established swing levels on both ends, providing short-term trading opportunities.

Trading strategy highlights:

- Traders can lean against the range extremes for low-risk entries, or

- Wait for a breakout to confirm directional bias.

Prices moved toward the lower end of the range today, putting pressure on buyers to step in and defend support. A break below $59.64 or above $61.45 could set up the next directional move.

U.S. Weekly Crude Stocks +5.2M Barrels vs +0.6M Expected

EIA data showed U.S. crude inventories rose by 5.20 million barrels in the week ending October 31, far above expectations for a 0.6M increase. The prior week saw a draw of 6.86M barrels.

Product details:

- Gasoline: -4.73M (expected -1.14M)

- Distillates: -0.64M (expected -1.97M)

The larger-than-expected crude build is viewed as bearish for oil markets.

Silver Recovery Stalls Below $48.00 as Dollar Strengthens

Silver’s rebound is losing traction ahead of the $48.00 resistance zone, weighed by firm U.S. Treasury yields and a strong dollar.

The metal trades sideways between $45.85 and $49.35, after bouncing from $46.90 lows on Tuesday. The USD Index holds near three-month highs above 100.00, limiting precious metals’ upside.

Traders await further direction from upcoming U.S. economic data — including the ADP and ISM reports — for clues on Fed policy.

U.S. Crude Inventories Rise, Refining Margins Stay Supported — ING

Oil markets came under pressure as risk sentiment weakened and inventories rose, ING analysts Manthey and Patterson said.

API data showed crude stocks rose by 6.5M barrels last week, with Cushing inventories up 400K. Gasoline and distillate stocks fell by 5.7M and 2.5M barrels, respectively — a supportive sign for refining margins.

“While the crude build is bearish, refined products remain supported,” ING noted. “Reports that Ukraine struck Lukoil’s Norsi refinery added to strength in middle distillates, with ICE gasoil cracks near $30/bbl.”

European Gas Prices Rise as Cold Weather Risks Build — ING

European natural gas prices extended gains as colder weather forecasts and lower wind output boosted demand expectations, ING analysts Ewa Manthey and Warren Patterson said.

TTF futures rose 2.55% on Tuesday. EU gas storage stands around 83%, below the five-year average of 92%.

“The EU gas balance remains vulnerable this winter,” ING noted, though speculative participation remains subdued. “Prospects for colder-than-usual December weather and weaker wind generation are supporting prices.”

New Zealand Commodity Prices Fall 0.3% in October as Dairy Weakens

New Zealand’s ANZ World Commodity Price Index slipped 0.3% in October, extending recent declines as lower dairy prices outweighed gains in other exports.

Dairy dropped 2.5%, offsetting increases in meat and wool (+3.0%), forestry (+1.1%), and aluminium (+5.1%). In local-currency terms, the index rose 1.5% thanks to a weaker NZD.

Despite the monthly dip, the index is up 4.4% y/y in USD terms and 12% y/y in NZD terms.

API Survey Shows Sharp Crude Oil Build, Gasoline and Distillates Fall

Private oil inventory data showed a major headline crude build, according to the latest API survey.

Crude stocks rose by 6.5 million barrels, while gasoline inventories dropped 5.653 million and distillates fell 2.459 million. Cushing hub stocks increased by 364,000 barrels. The figures point to strong crude supply but continued drawdowns in refined products.

Europe News

European Stocks Close Higher, FTSE 100 Leads Gains

European equities finished higher on Wednesday, led by the UK’s FTSE 100, which rose 0.64%.

France’s CAC 40 lagged with a modest 0.08% gain, while Germany’s DAX added 0.42%. Spain’s Ibex 35 and Italy’s FTSE MIB gained 0.39% and 0.41%, respectively.

Closing snapshot:

- Germany DAX: +0.42%

- France CAC 40: +0.08%

- UK FTSE 100: +0.64%

- Spain Ibex 35: +0.39%

- Italy FTSE MIB: +0.41%

Broadly positive sentiment in global markets helped lift European stocks, even as gains were capped by caution ahead of upcoming U.S. data releases.

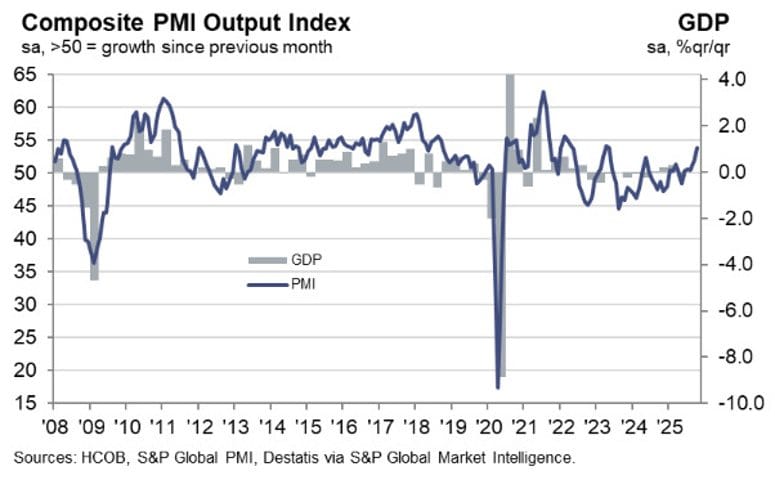

Eurozone October Services PMI at 53.0, Highest in 17 Months

The euro area’s services economy gathered pace in October, with the HCOB final services PMI rising to 53.0, up from 52.6 in the preliminary estimate and the strongest reading in 17 months.

The composite PMI improved to 52.5 from 52.2, reaching a 29-month high. Growth was led by Germany, Spain, and Italy, while France remained the lone drag.

Employment growth accelerated to its fastest pace since June 2024, supported by stronger demand. Input cost inflation cooled to a three-month low, yet selling prices climbed at the quickest rate since March — suggesting profit margins are holding firm.

“Finally, there’s something positive to report about the eurozone economy again. The services sector saw a solid upswing in October. When it comes to new business, you’d have to go back to May of last year to find a similarly strong increase. In this environment, service providers also hired more staff than in the previous month, which sparks hope for sustained growth.

“A key driver of growth in the services sector this October was Germany. The jump in the index there — up more than three “points to 54.6 — is striking and more than offsets the decline in France, where political tensions are dampening people’s willingness to spend. Keeping up this relatively strong growth momentum in the services sector over the coming months won’t be easy. In France, political stability would help — passing the 2026 budget would be a step in that direction. In Germany, much will depend on whether the government’s stimulus package actually motivates businesses and households to invest and spend more.

“Cost inflation in the services sector has eased a bit, but selling price inflation ticked up. For now, though, there’s no sign of broader inflationary pressure. This is because economic growth remains moderate, and the tariff dispute with the U.S. is creating disinflationary effects in the eurozone — partly due to increased imports from China. These PMI figures are unlikely to give the European Central Bank much of a headache.

“France is clearly putting the brakes on eurozone economic growth. On the bright side, it’s not just Germany where the expansion rate has picked up significantly. Even when excluding Germany and France, the composite PMIs for the rest of the eurozone show the strongest growth in two-and-a-half years. In this sense, the recovery is gaining broader traction.”

Eurozone Producer Prices Slip 0.1% in September, Energy Weighs

Eurozone producer prices declined 0.1% month-on-month in September, slightly weaker than expectations for no change, according to Eurostat data. August’s drop was revised to -0.4% from -0.3%.

Excluding energy — which fell 0.2% — producer prices were stable overall. Durable consumer goods prices rose 0.2%, non-durables gained 0.1%, while intermediate goods fell 0.1%. Prices for capital goods were unchanged.

The figures point to subdued pipeline inflation pressures across the bloc.

Germany October Services PMI Final at 54.6, Employment Rises Again

Germany’s services sector continued to expand solidly in October, with the final HCOB services PMI coming in at 54.6, slightly above the 54.5 preliminary reading and sharply higher than September’s 51.5.

The composite PMI was confirmed at 53.9, versus 53.8 initially and 52.0 previously. The report highlighted that employment rose for the first time in three months, marking a return of hiring momentum as new business volumes improved.

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Germany’s services sector started the fourth quarter with renewed momentum, as the HCOB Services PMI surged to 54.6 in October, marking its highest reading in nearly two-and-a-half years. The acceleration in business activity was accompanied by a solid rise in new work, which recorded only its second increase in over a year.

“Employment rebounded after two months of decline, with service providers returning to hiring mode amid rising backlogs of work – the first such increase in 18 months. The accumulation of outstanding business, albeit modest, signals growing capacity pressures, which surveyed firms attributed to stronger demand, supply shortages, and a lack of qualified staff. However, optimism about future activity ticked down slightly from September’s recent high, suggesting some caution remains despite the overall upbeat tone.

“Inflationary pressures intensified, with input costs rising at the fastest pace since April, which was largely driven by wage increases, as firms reported. Output prices followed suit, climbing at the quickest rate in eight months. These developments point to a sector regaining pricing strength amid improving demand conditions.

“Taken together, the October PMI data suggest that Germany’s services economy is regaining its footing after a subdued period. The combination of rising demand, renewed hiring, and stronger pricing power bodes well for the broader economy, even as firms remain watchful of external risks and cost pressures.”

Germany Industrial Orders Rise 1.1% in September, Beat Forecasts

Germany’s factory orders rose 1.1% in September, topping expectations for a 1.0% gain. August’s decline was revised to -0.4% from -0.8%.

The rise was driven by automotive (+3.2%) and electrical equipment (+9.5%) orders, offsetting a sharp 19% drop in metal products following large August contracts. Excluding big-ticket items, orders increased 1.9%.

France October Services PMI Revised Up to 48.0, Still Signals Contraction

France’s services activity shrank further in October despite a modest upward revision in final data. The HCOB final services PMI rose to 48.0 from a preliminary 47.1, but remained below the 50 threshold that separates growth from contraction.

The composite PMI was revised up to 47.7 from 46.8, compared with 48.1 previously. The report points to the steepest drop in service-sector output since April.

Still, job creation persisted, and input price inflation eased to its slowest pace in more than four and a half years. Business sentiment for the year ahead remained generally positive despite the softer backdrop.

HCOB notes that:

“The downward trend in France’s private sector economy continues unabated at the start of the fourth quarter. After the HCOB manufacturing PMI already signalled weakness in October, conditions in the service sector also deteriorated. As a result, the HCOB Composite PMI Business Activity Index has declined once again, marking the fourteenth consecutive month in which the French private economy has failed to register growth.

“The French service sector is under pressure, with weak demand emerging as the central issue. This is reflected in declining business activity and a disappointing level of new orders. Key drivers include customer caution and restraint, intense competitive pressures and ongoing political uncertainty. Business expectations for the coming 12 months have further deteriorated in October and remain well below the historical average. Several companies with a pessimistic outlook explicitly cited the political situation as a contributing factor.

“On a more positive note, hiring activity in the service sector has so far remained resilient. The corresponding index has stayed in expansion territory for three consecutive months, suggesting that the sluggish overall performance has yet to deter hiring. However, caution is warranted: if demand remains subdued, employment dynamics are likely to weaken over time. Declining backlogs of work serve as an additional warning sign, indicating that current hiring intentions may be built on shaky ground.”

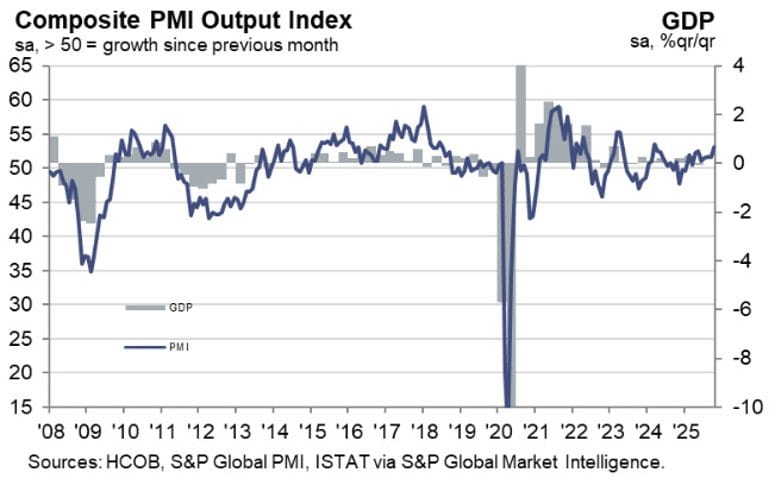

Italy Services PMI Rises to 54.0, Best in Six Months

Italy’s services sector expanded at its fastest pace since April, with the HCOB PMI jumping to 54.0 from 52.5, beating expectations. The composite index climbed to 53.1 from 51.7.

Growth was driven by stronger new business and exports, while input cost inflation eased to a 4½-year low. Employment gains were modest despite rising output.

Commenting on the PMI data, Nils Müller, Junior Economist at Hamburg Commercial Bank, said:

“Italy’s services sector entered the fourth quarter on a strong footing, as the HCOB Italy Services PMI rose to 54.0 in October. The acceleration in activity growth was accompanied by a robust rise in new business, fresh customer wins, and a renewed rise in export orders. The improvement in services fed through to the broader economy, lifting the HCOB Italy Composite PMI to 53.1, marking the strongest reading since March 2024. While manufacturing output also returned to growth, the momentum was clearly concentrated in the service sector.

“Price dynamics in the Italian service sector were mixed. Input cost inflation eased to a four-and-a-half year low, offering some relief to firms. However, operating expenses continued to be elevated, with higher energy, insurance and consultancy costs cited. In response, service providers raised their charges at a faster pace, aiming to protect margins amid improved demand conditions.

“Employment growth remained subdued, with firms adding staff only fractionally, often through temporary hires. Despite the stronger rise in workloads, backlogs continued to fall, pointing to persistent spare capacity. Business confidence stayed positive but was below historical norms, reflecting a cautious outlook in the face of persistent global headwinds.

“Overall, October’s PMI data highlight the resilience of the service sector, which remains the main engine of growth within Italy’s private economy. With overall demand firming and export orders showing early signs of recovery, the outlook has brightened – even if hiring and sentiment remain restrained.”

Italy September Retail Sales Drop 0.5%, Below Forecasts

Italian retail sales fell 0.5% in September, missing expectations for a 0.1% gain, according to data from ISTAT. The prior month’s decline was revised to -0.1%.

On a yearly basis, sales rose 0.5%, matching the previous reading. Large-scale distribution was up 0.4% y/y, non-store sales gained 1.9%, and online sales jumped 7.3%. Small retailers saw a 0.4% fall.

Among non-food items, cosmetics rose 4.0%, while footwear and travel goods slid 5.7% and clothing dropped 5.2%. The figures suggest household spending remains uneven as consumers tighten budgets.

Spain’s Services PMI Hits 10-Month High at 56.6

Spain’s services sector accelerated in October, with the HCOB PMI climbing to 56.6 from 54.3, well above expectations. The composite index rose to 56.0 from 53.8.

Stronger demand and export growth lifted activity, while business confidence reached a seven-month high. Input costs eased to a three-month low, though firms continued to raise selling prices.

HCOB notes that:

“Spain’s private sector is entering the fourth quarter with noticeable momentum. The HCOB Composite PMI recorded a solid increase, reaching 56.0 points, which is the highest level so far this year. This improvement is driven by accelerated growth in both manufacturing and services. Following the robust GDP expansion in the third quarter, the October PMI figures fuel optimism that Spain’s GDP could grow by nearly 3.0 percent in 2025, thereby maintaining its exceptional position among the four major euro area economies.

“Business activity in Spain’s services sector picked up significantly in October. This development is underpinned by a solid inflow of new orders, which firms attribute directly to stronger market demand. Only foreign orders showed signs of weakening growth, reflecting the uncertain international business environment.

“Spanish service providers are expanding their workforce to keep pace with sustained business momentum. This is also evident in rising backlog of work, which has now increased for four consecutive months. Against this backdrop, firms remain confident about their business outlook for the coming year. Their optimism is reflected in ambitious growth plans, the expansion of commercial activities, and expectations of continued strong demand in 2026. “Price developments remain a point of concern. Both input and output price indices are significantly above the levels seen between 2009 and 2020. Panellists report rising personnel and energy costs, which have compelled many firms to adjust their prices accordingly.”

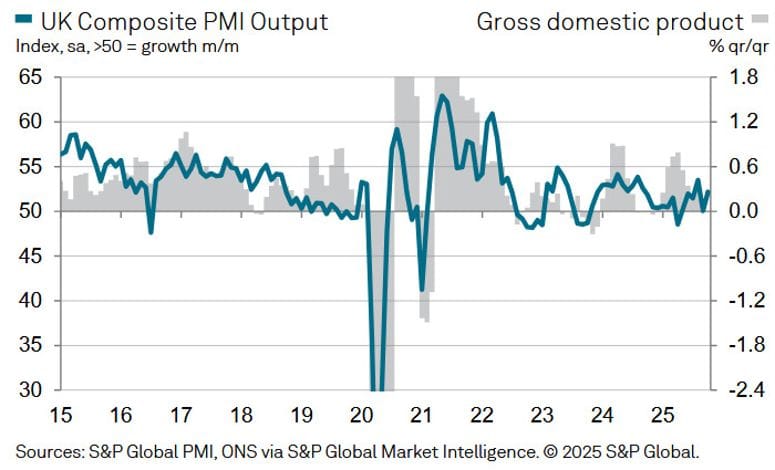

UK Services PMI Rises to 52.3 in October, Activity Picks Up

The UK’s services sector gained further traction in October, with the final S&P Global PMI climbing to 52.3 from a preliminary 51.1 and up from 50.8 in September.

The composite index was confirmed at 52.2 versus 51.1 initially. The report signaled faster growth in business activity and new orders, while employment moved close to stabilization.

Input price inflation slowed to its lowest in 11 months, offering some relief to firms facing cost pressures.

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“The latest survey offered some positive signals for the UK service economy, with output growth stronger than the earlier ‘flash’ estimate for October, and therefore confirming a notable improvement from September’s five- month low. Similarly, the rate of new business expansion gained momentum, with the latest upturn among the strongest seen over the past year.

“Service providers typically commented on a turnaround in new client wins and better-than-expected sales performances in October. A number of firms noted resilient customer demand, especially in domestic markets, despite elevated business uncertainty and delayed decision-making on major spending ahead of the Budget.

“Labour market conditions finally showed some signs of stabilisation, with the pace of job cuts in the service economy slowing considerably since September. This was helped by improved confidence towards the business outlook. Output growth expectations rebounded to a 12-month high in October. Lower borrowing costs and planned investments in new technologies were cited as factors supporting positive sentiment.

“Higher wages were again widely reported as pushing up input prices. However, the overall pace of cost inflation was the lowest since November 2024. Adding to signs of easing inflationary pressure, latest data indicated that service providers increased their prices charged to the least marked extent since June.”

ECB’s Nagel and Villeroy Call for Vigilance, Stress Policy Flexibility

European Central Bank policymakers struck a cautious tone on inflation and future policy direction.

Germany’s Joachim Nagel said the ECB must stay alert to inflation risks but avoid complacency, noting that any further rate cuts would require significant justification.

Separately, France’s Francois Villeroy de Galhau said the ECB should maintain “full optionality,” emphasizing that the bank is not locked into a fixed stance. He said improving data give policymakers flexibility, with the next move possibly being either a cut or a hike depending on incoming information.

Asia-Pacific & World News

China’s Top Trade Envoy Urges U.S. to Foster Cooperative Environment

China’s lead trade negotiator has called on the United States to create conditions conducive to stronger cooperation following talks with a U.S. agriculture delegation.

The official noted that China and the U.S. remain important partners in agricultural trade. Beijing recently pledged to purchase 12 million metric tons of U.S. soybeans by the end of January, after briefly halting imports ahead of the Xi–Trump summit in South Korea.

Despite easing some tariffs earlier in the day, China has maintained its 13% duty on soybeans — a move that could allow flexibility to shift purchases back to Brazil in the coming months.

Beijing Orders State-Funded Data Centers to Use Only Domestic AI Chips

China has reportedly ordered all state-funded data centers to deploy only locally made AI chips, tightening controls on foreign technology, according to Reuters sources.

The guidance applies even to projects less than 30% complete, forcing removals of previously installed foreign chips. Most data centers in China receive some form of state funding, meaning the rule will have broad impact.

The ban covers Nvidia’s H20, B200, and H2000 processors, which had circulated through unofficial channels despite prior restrictions.

Chinese Equities Open Lower; Hang Seng and Shanghai Down Nearly 1%

Chinese stocks opened lower on Wednesday, tracking regional weakness. The Shanghai Composite fell 0.95%, while Hong Kong’s Hang Seng slipped 0.97%. Japan and South Korea markets also traded sharply lower.

China’s Services Growth Slows in October, PMI at 52.6

China’s private services sector expanded at a slower pace in October, with the RatingDog/S&P Global Services PMI easing to 52.6 from 52.9. The composite index slipped to 51.8 from 52.5.

Stronger domestic demand partly offset falling export orders, which declined for the first time in four months. Employment contracted further, while input costs rose at the fastest rate in a year.

Business sentiment stayed positive but weakened amid global uncertainty and tighter margins.

Premier Li Calls for Fairer Trade Rules, Warns Against Protectionism

Chinese Premier Li Qiang urged nations to resist protectionism, warning that unilateral trade barriers are undermining the global economy.

Speaking at an economic forum, Li said China will continue to open its markets, expand imports, and reform trade governance to promote fairness and transparency.

Li projected China’s economy to exceed 170 trillion yuan within five years and pledged further liberalization in telecoms and healthcare sectors to attract foreign investment.

China to Suspend 24% U.S. Tariffs for One Year, Maintain 10% Levy

China’s Finance Ministry said it will suspend 24% tariffs on certain U.S. goods for one year starting November 10 while maintaining a 10% duty.

The move, confirmed by the Commerce Ministry, includes plans to remove tariffs on select U.S. agricultural imports, easing trade tensions at least temporarily.

Trump Halves Tariff on Chinese Fentanyl Imports to 10% Under Trade Pact

President Donald Trump has signed an executive order reducing the tariff on Chinese imports linked to fentanyl production from 20% to 10%, fulfilling a key element of the new U.S.-China trade accord.

The order, effective November 10, follows Xi Jinping’s pledge to curb exports of precursor chemicals used in fentanyl production. Trump said progress justified the rollback but warned the U.S. will “monitor compliance closely.”

The one-year agreement aims to stabilize trade ties after months of tariff escalation, though questions remain about enforcement and long-term durability.

PBOC sets USD/ CNY mid-point today at 7.0901 (vs. estimate at 7.1336)

- PBOC CNY reference rate setting for the trading session ahead.

- People’s Bank of China injects 65.5bn yuan via 7 day reverse repos in open market operations

TD Securities: RBA Neutral Stance Pressures AUD, Dip Buying Still Favored

The Australian dollar slipped after the Reserve Bank of Australia’s latest policy statement struck a neutral tone, disappointing traders hoping for a hawkish pivot.

TD Securities said the RBA’s balanced messaging “dampened AUD sentiment” as investors unwound long positions. Still, the bank remains bullish on AUD/USD around 0.6440, seeing dips as buying opportunities near the 200-day moving average.

TD maintains forecasts for RBA rate cuts in May and August 2026, expecting higher unemployment to open room for gradual easing. The firm also noted near-term U.S. dollar strength could persist if upcoming U.S. jobs data beats forecasts.

RBNZ’s Hawkesby: Housing and Credit Growth Remain Stable

Reserve Bank of New Zealand Governor Hawkesby said housing prices and credit growth are showing no signs of stress, indicating the central bank can maintain its current loan-to-value ratio settings.

New Zealand Unemployment Rises to 5.3% in Q3 as Labour Market Cools

New Zealand’s job market showed further signs of fatigue in the September quarter, with unemployment inching up to 5.3%, matching forecasts and slightly above the prior 5.2%.

Employment growth was flat during the quarter (0.0% q/q), falling short of expectations for a small increase. The participation rate eased to 70.3% from 70.5%, suggesting softer labour force engagement as economic momentum slows.

Private-sector hourly earnings excluding overtime rose 0.5% q/q and 2.1% y/y, consistent with projections. The data reinforces the view that the labour market remains soft but stable, keeping the Reserve Bank of New Zealand on course to maintain its gradual policy easing stance.

BOJ Minutes Show Readiness to Raise Rates Gradually if Data Holds Up

The Bank of Japan’s September meeting minutes show policymakers largely aligned on keeping real interest rates low but open to gradual rate hikes if economic and inflation forecasts hold.

Members highlighted high global uncertainty, particularly around tariffs and trade policy, arguing for cautious policy moves. Some saw room to wait for clearer U.S. data, while others warned of the risks of delaying normalization.

The board also discussed inflation dynamics, noting that while price gains are broadening, the 2% target has not been firmly achieved. Several officials stressed maintaining support until inflation expectations become more anchored.

South Korea Halts KOSPI Futures After 5% Drop

The Korea Exchange triggered its “sidecar” mechanism after KOSPI futures plunged 5%, halting program trading for five minutes amid regional market turmoil.

The circuit breaker was activated as Asian equities followed Wall Street’s selloff. The KOSDAQ also hit a 6% decline, prompting a similar trading pause.

Crypto Market Pulse

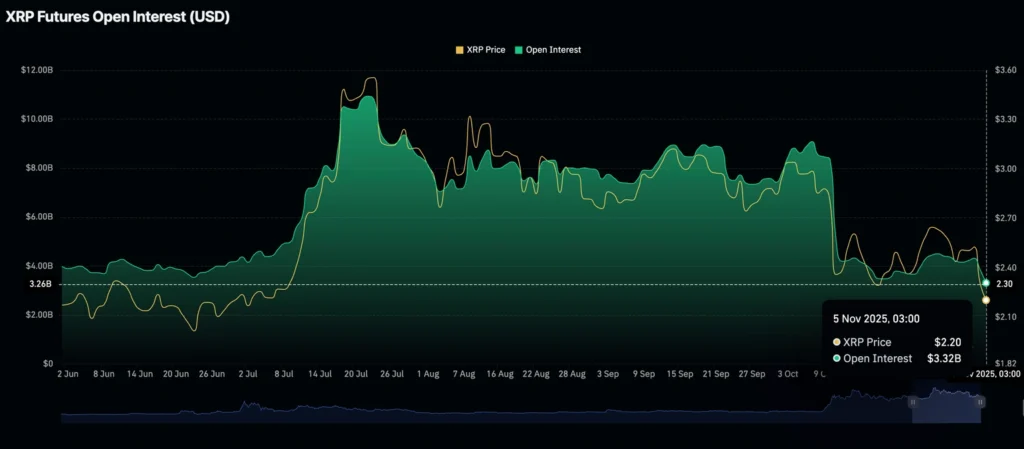

XRP Eyes Recovery but Faces Weak Retail Demand, Heavy Shorts

Ripple’s XRP held near $2.22 on Wednesday, attempting a mild rebound after two days of declines. Despite the stabilization, recovery remains fragile amid low retail demand and increased short positioning.

The token has struggled to maintain momentum since peaking at $3.66 in mid-July.

Derivatives data (CoinGlass):

- Monday: $29M longs, $3M shorts liquidated

- Tuesday: $36M longs, $6M shorts liquidated

- Wednesday: $2M longs, $1.5M shorts liquidated

- Futures Open Interest fell to $3.32B (from $4.33B Monday, $9.09B Oct 7)

Funding rates remain near zero (0.0001%), indicating traders are cautious and short-biased. The sharp drop in open interest highlights a risk-off sentiment as traders avoid leverage exposure, keeping XRP vulnerable to another 10–15% correction if momentum fails to recover.

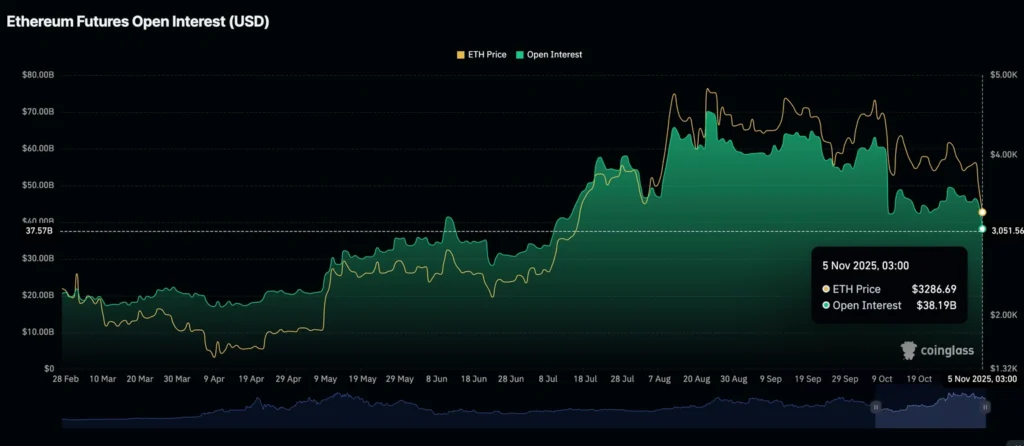

Ethereum Holds Above $3,300 as SOPR Reset Signals Possible Bottom

Ethereum (ETH) is regaining ground above $3,350, supported by a potential shift back toward risk-on sentiment after recent losses.

The SOPR (Spent Output Profit Ratio) fell below 1.00, implying that holders are realizing losses — often a sign of market capitulation that can precede recovery.

Still, on-chain and derivatives data suggest the rally remains tentative:

- Futures Open Interest: $38B, down 19% from $47B last weekend and nearly 47% below the August peak of $70B.

- Supply in profit down 32% from the October high of 78M ETH.

ETH’s short-term structure remains fragile, but the SOPR reset hints at bottoming potential if $3,300 support continues to hold.

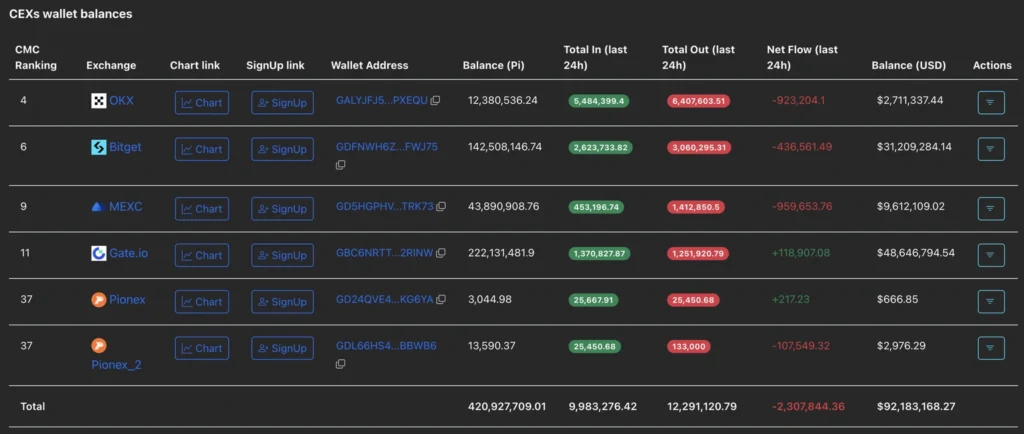

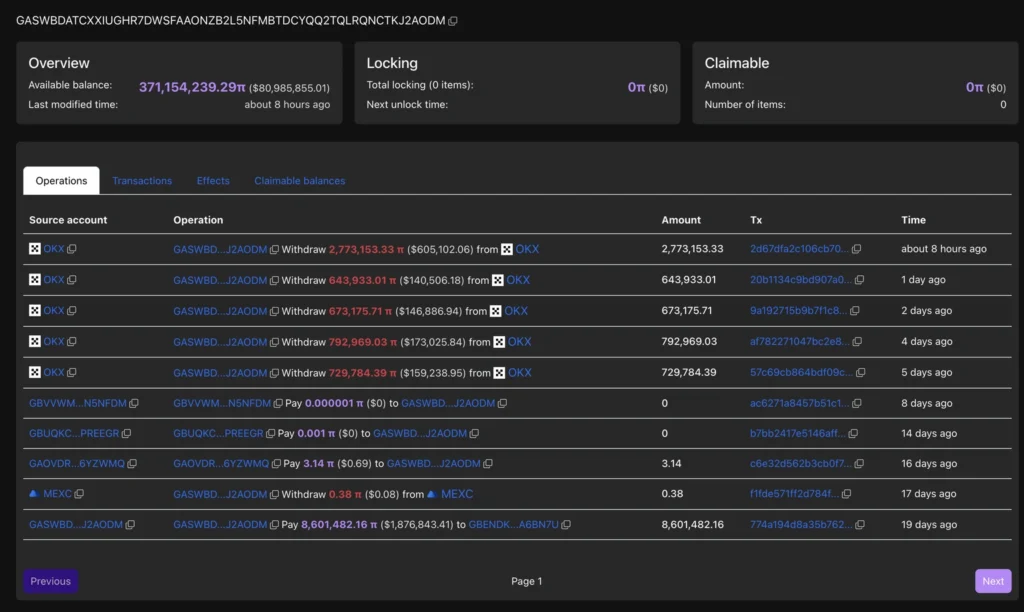

Pi Network (PI) Stabilizes as Exchange Outflows Ease Selling Pressure

Pi Network (PI) traded around $0.2100 on Wednesday, recovering modestly after a 5.49% decline on Tuesday. On-chain activity shows signs of accumulation from large holders, reducing near-term selling pressure.

Key metrics (PiScan):

- 2.3M PI tokens left centralized exchange (CEX) wallets in the past 24 hours — a 0.55% drop in exchange balances.

- The sixth-largest wallet purchased 2.77M PI tokens, lifting holdings to 371.15M tokens — the largest transaction in 24 hours.

The consistent buying from whales over the past five sessions and declining on-exchange supply support the view that selling pressure is easing. However, the technical setup still leans bearish, suggesting that PI needs sustained accumulation to confirm a rebound.

Crypto Today: Bitcoin Back Above $100K as China Suspends Tariffs

Bitcoin reclaimed the $100,000 level on Wednesday after China suspended a 24% retaliatory tariff on select U.S. imports, including agricultural goods.

Ethereum and XRP also steadied, with ETH above $3,300 and XRP near $2.23. XRP continues to hold the $2.00 support but faces limited short-term upside.

China’s Ministry of Finance said it will remove tariffs on soybeans, wheat, corn, and chicken from November 11, following the U.S. decision to reduce fentanyl-related levies.

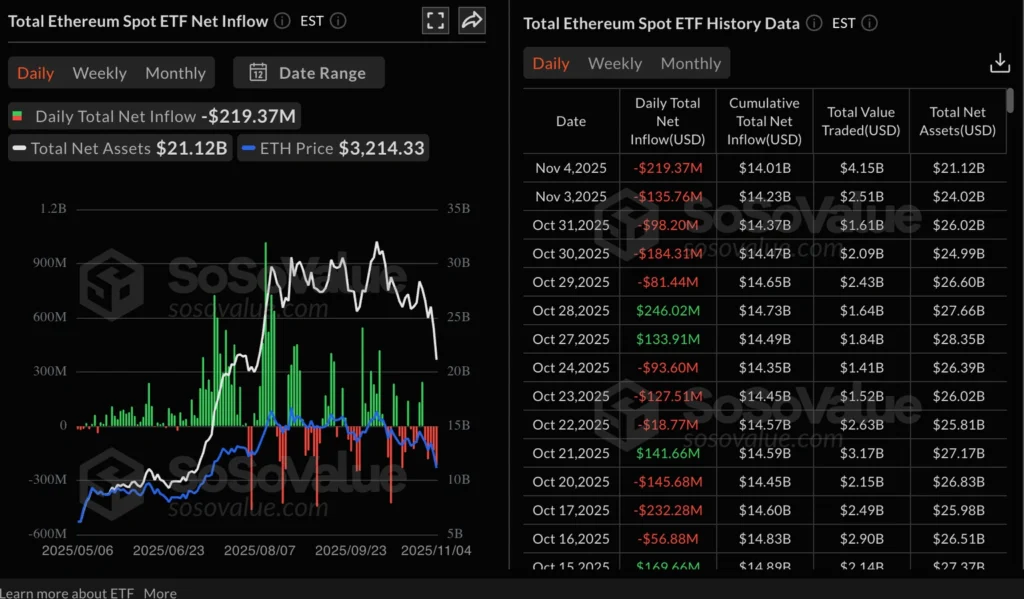

ETH ETF outflows:

U.S.-listed spot ETH ETFs recorded $219M in outflows on Tuesday, marking five straight days of redemptions. Total inflows stand at $14.01B with net assets of $21.12B, according to SoSoValue.

A close above $102,000 could signal renewed bullish momentum for BTC in the near term.

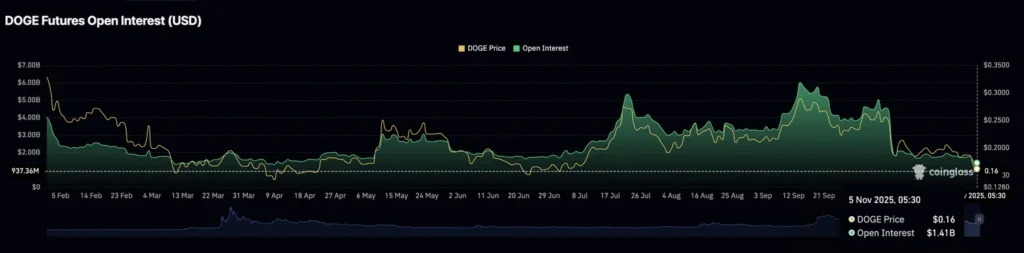

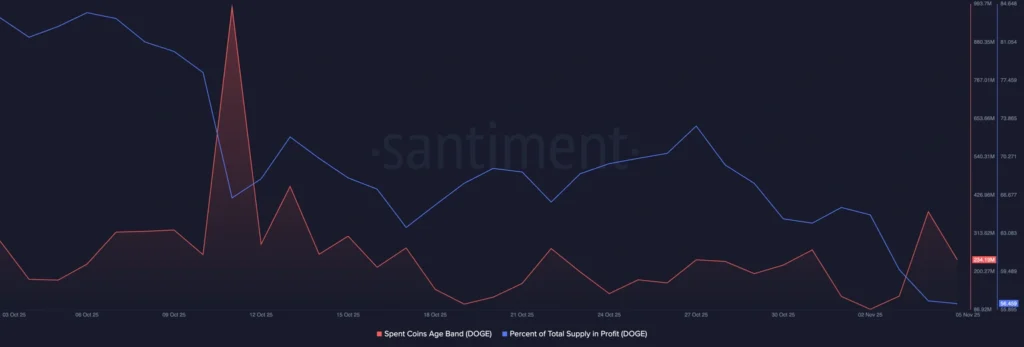

Dogecoin Stabilizes as Retail Interest Fades, On-Chain Signals Bearish

Dogecoin rose just over 1% on Wednesday, hovering above $0.1570 after rebounding from intraday lows near $0.1545.

Despite the minor uptick, retail participation has fallen to early April levels, while on-chain data suggests long-term holders are taking profits.

Key data points:

- DOGE futures open interest dropped to $1.41B — a 7-month low (CoinGlass)

- Spent Coins Age Band spiked to 377M on Tuesday vs 126M Monday, indicating older coins are being sold

- Supply in profit fell to 56.46%, down from 83.81% a month ago (Santiment)

The drop in active traders and holder confidence increases the risk of further downside if momentum fails to recover.

Bitcoin Holds $100,000 as Bulls Defend Key Level

Bitcoin is struggling to maintain the $100,000 mark, rebounding after briefly dipping below the level earlier this week.

The cryptocurrency remains under pressure, trading below both the 100- and 200-day moving averages. Analysts warn a firm break could trigger stop-loss selling.

Traders see the six-figure threshold as a key psychological line amid broader market volatility.

The Day’s Takeaway

North America

U.S. Markets

U.S. equities rebounded modestly after Tuesday’s sharp selloff, led by a 0.65% Nasdaq gain. The S&P 500 rose 0.37% and the Dow added 0.48%, buoyed by strength in consumer discretionary and airline stocks. The Nasdaq found support at its 100-hour moving average, helping stabilize sentiment.

S&P 500 Sector Performance:

Consumer Discretionary +1.12% | Materials +0.54% | Health Care +0.44% | Industrials +0.40% | Financials +0.28% | Energy +0.19% | Utilities +0.04% | Real Estate −0.06% | Info Tech −0.08% | Consumer Staples −0.20% | Comm Services −0.36%

Top Gainers: Micron +8.93%, Southwest +6.56%, Lam Research +5.95%, Robinhood +4.15%, Tesla +4.03%

Notable Decliners: Super Micro −11.34%, Live Nation −10.42%, Home Depot −2.42%, Lockheed Martin −2.40%, NVIDIA −1.77%

Macro & Policy Developments

- ADP Employment (Oct): +42K vs. +28K expected — showing resilience in private hiring, with strength in trade and transportation.

- ISM Services PMI (Oct): 52.4, an 8-month high, signaling firm demand despite rising input costs.

- Treasury Borrowing: Coupon auction sizes to remain steady “for several quarters,” anchoring long-term yield expectations (10-yr yield at 4.11%).

- Fed’s Miran: Called the ADP data “a welcome surprise” but warned tariffs could cap growth.

- Mortgage Applications: −1.9% week-on-week as rates edged up to 6.31%.

Earnings Highlights

- Snap ($SNAP): Revenue $1.51B vs. $1.49B est; upbeat Q4 guide (+8–10% revenue growth).

- Qualcomm ($QCOM): Revenue $11.27B vs. $10.77B est; strong AI-chip outlook.

- Duolingo ($DUOL): Revenue $271.7M vs. $260.3M est; raised full-year guidance.

- Robinhood ($HOOD): Revenue $1.27B vs. $1.19B est; EPS $0.61; trading and premium growth surging.

Canada

- Services PMI: Rose to 50.5 in October, the first expansion in nearly a year. Cost pressures remain high, but stabilization hints at early recovery signs.

Commodities

Crude Oil

- EIA Inventories: +5.2M barrels (vs. +0.6M est); gasoline −4.73M, distillates −0.64M — bearish for crude, but refining margins remain firm.

- Range Action: WTI remains trapped between $59.64–$61.45, with traders awaiting a breakout trigger.

- ING Commentary: Despite crude builds, refined products are supported by strong margins and refinery disruptions in Russia.

Metals

- Gold: Flat between $3,900–$4,000 as traders await fresh catalysts; bias remains neutral to slightly bearish.

- Silver: Rebound stalled below $48 amid strong USD and higher yields.

Energy (Europe)

- European Natural Gas: +2.55% on colder weather forecasts and reduced wind output. Storage levels at ~83% (below five-year average), keeping markets cautious.

Agriculture

- China Tariff Shift: Beijing suspended 24% tariffs on U.S. farm goods — soybeans, wheat, corn, and chicken — potentially lifting U.S. agricultural exports.

Europe

Equities

European stocks closed higher: FTSE 100 +0.64%, DAX +0.42%, CAC 40 +0.08%, Ibex 35 +0.39%, FTSE MIB +0.41%. Gains reflected improved services data and global risk recovery.

Economic Data

- Eurozone Services PMI: 53.0 — 17-month high, led by Germany, Spain, and Italy.

- Germany: Factory orders +1.1% (Sep); Services PMI 54.6.

- France: Services PMI 48.0 — still contracting.

- Italy: Services PMI 54.0, 6-month high; Retail sales −0.5% (Sep).

- Spain: Services PMI 56.6, best in 10 months.

- UK: Services PMI 52.3 — momentum improving; inflation pressures easing.

- Eurozone Producer Prices: −0.1% m/m, led by energy declines.

Policy Commentary

- ECB’s Nagel & Villeroy: Urged vigilance on inflation but stressed flexibility — signaling no preset path for rate cuts.

Asia

Japan

- BOJ Minutes: Officials open to gradual rate hikes if inflation trends persist, but remain cautious amid global trade uncertainty.

China

- Services PMI: 52.6 (vs. 52.9 prior), showing slower but steady expansion.

- Trade Developments:

- China suspended 24% tariffs on certain U.S. imports for one year, retaining a 10% duty.

- Premier Li Qiang called for fairer global trade and warned against protectionism.

- Beijing ordered all state-funded data centers to use domestic AI chips — affecting Nvidia H-series processors.

- Market Performance: Shanghai −0.95%, Hang Seng −0.97% amid caution.

South Korea

- KOSPI Futures: Trading temporarily halted after a 5% drop; KOSDAQ −6%, triggering circuit breakers.

Australia & New Zealand

- RBA: Neutral tone dampened AUD sentiment; TD Securities still favors dip buying near 0.6440 USD.

- NZ Unemployment: 5.3% (Q3, as forecast); soft labor market supports gradual RBNZ easing outlook.

- NZ Commodity Prices: −0.3% m/m in October, led by a 2.5% fall in dairy.

- RBNZ’s Hawkesby: Said housing and credit growth remain stable.

Crypto

Bitcoin (BTC)

Back above $100,000 following China’s tariff suspension news. Technical sentiment improves, but price remains capped below key resistance; a close above $102,000 could reignite upside momentum.

Ethereum (ETH)

Holding above $3,300 as SOPR reset indicates potential bottom formation. Futures open interest down 19%, suggesting reduced leverage exposure.

XRP (Ripple)

Stable near $2.22 but faces weak retail demand and declining open interest (−63% since October peak), signaling fragile sentiment.

Dogecoin (DOGE)

+1% to $0.1570; retail activity near 7-month lows, with on-chain data showing older holders taking profits.

Pi Network (PI)

Recovered to $0.2100 as exchange outflows eased and whales accumulated. Still technically bearish but selling pressure is subsiding.

ETH ETF Flows

U.S. spot ETH ETFs saw $219M in outflows (five straight sessions). Total inflows stand at $14.01B; net assets $21.12B (SoSoValue).