North America News

U.S. Stocks End Sharply Lower as Meta Drags; Amazon, Apple Beat After the Close

Major U.S. stock indexes closed at session lows Thursday as a late-session tech selloff weighed heavily on sentiment. The Nasdaq Composite tumbled 1.57%, the S&P 500 fell 0.99%, and the Dow Jones Industrial Average slipped 0.22%.

- S&P 500: 6,822.36 (-68.23)

- Dow Jones: 47,522.12 (-109.88)

- Nasdaq Composite: 23,581.14 (-377.33)

Meta shares plunged 11.3% (-$85.20) after the company flagged higher AI spending, erasing earlier gains in the broader tech sector.

After the close, Amazon and Apple reported results that beat expectations, helping futures stabilize modestly.

Apple’s results:

- EPS: $1.85 vs. $1.77 expected

- Revenue: $102.47B vs. $102.19B expected

- iPhone: $49.03B (+6.1% YoY)

- Services: $28.75B (vs. $28.18B est.)

- China sales: $14.49B (below $16.43B est.)

Apple’s results underscored strong iPhone and Services growth but highlighted ongoing weakness in China.

Amazon’s results:

- EPS: $1.95 vs. $1.58 expected

- Revenue: $180.17B vs. $177.82B expected

- AWS: $33.01B (+20% YoY, vs. $32.39B est.)

- Q4 outlook: $206–$213B revenue (street: $208.45B); operating income $21–$26B

Amazon’s stock jumped ~10% after hours on upbeat Q4 guidance and continued cloud momentum.

In other corporate news, Netflix announced a 10-for-1 stock split, closing at $1,089, while Coinbase and Reddit both topped Q3 expectations, with Coinbase reporting $1.79B revenue and $433M profit, and Reddit posting $585M revenue and $0.80 EPS, alongside a 19% surge in daily users.

Meta Draws $125 Billion in Orders for $25 Billion Bond Deal

Meta Platforms Inc. received more than $125 billion in investor orders for its planned $25 billion bond sale, underscoring robust demand for top-tier corporate debt.

The deal, expected to be issued in six tranches with maturities ranging from 5 to 40 years, could be one of 2025’s largest corporate offerings.

Proceeds will fund Meta’s AI infrastructure and data center expansion. Despite strong demand, Meta’s shares fell about 10–12% amid investor concern over rising leverage and capital spending.

U.S. 30-Year Mortgage Rate Falls to 6.17%, Lowest in a Year

The average U.S. 30-year fixed mortgage rate fell to 6.17% for the week ending October 30, down from 6.19% the prior week, Freddie Mac said.

It marks the lowest level since October 2024, providing modest relief for homebuyers after months of elevated borrowing costs.

Nomura Withdraws Call for December Fed Rate Cut

Nomura Holdings no longer expects the Federal Reserve to cut interest rates in December, citing a shift in tone from Chair Jerome Powell following this week’s policy meeting.

Powell told reporters that a December cut is “not a foregone conclusion,” signaling a more cautious stance amid the ongoing U.S. government shutdown, which has disrupted several key economic data releases.

Nomura had previously forecast a 25-basis-point reduction before year-end. Futures markets still price roughly 72% odds of another cut, down from 91% before the Fed decision.

The firm now anticipates the Fed will hold rates steady through December, awaiting clearer data before making its next move.

Trump: Meeting With Xi “Amazing,” Says Soybean Purchases to Resume

U.S. President Donald Trump described his meeting with Chinese President Xi Jinping as “amazing,” saying both sides agreed on several key trade and security matters.

Speaking after talks concluded, Trump said China will immediately resume soybean purchases and intensify efforts to curb fentanyl exports, including lowering related tariffs. He added that tariffs on Chinese goods will be reduced from 57% to 47%.

Trump also claimed discussions touched on semiconductor cooperation — with China set to engage Nvidia and other U.S. firms — though he said “Blackwell chips” were not part of the talks.

On rare earths, Trump said the issue was “fully settled,” with China agreeing to maintain exports to the United States, removing a potential supply bottleneck.

Calpers to Oppose Elon Musk’s $1 Trillion Tesla Pay Plan

Calpers, the largest U.S. public pension fund, said it will vote against Elon Musk’s $1 trillion pay package at Tesla, citing excessive concentration of power.

The fund, holding about five million Tesla shares, called the proposal “disproportionate” and warned it would consolidate too much control in one individual.

Musk is pushing for investor approval ahead of a Nov. 6 shareholder vote in Austin. If passed, the 10-year incentive plan could raise his stake above 25%.

Calpers’ opposition could sway other large investors weighing corporate governance risks.

Trump Orders U.S. to Resume Nuclear Weapons Testing

Donald Trump said he has instructed the Department of War to restart U.S. nuclear weapons testing, citing rival nations’ recent programs.

“The process will begin immediately,” he wrote. The U.S. has not conducted a nuclear test since 1992.

Axios noted the move follows Russia’s claim of testing a “tsunami-making” nuclear device and could reignite a global arms race if implemented.

OpenAI Targets $1 Trillion IPO by 2027

OpenAI is preparing for an IPO that could value the company near $1 trillion, making it one of the largest market debuts in history, Reuters reported.

The San Francisco-based AI firm aims to file in late 2026 with a potential 2027 listing, and could raise at least $60 billion, depending on market conditions.

CFO Sarah Friar has discussed the timeline internally, while CEO Sam Altman is said to view the listing as critical for funding long-term AI infrastructure and development.

If completed, it would cement OpenAI’s place among the world’s most valuable tech companies.

Goldman Sachs: Tech Rally Elevated but Not a Bubble

Goldman Sachs strategist Peter Oppenheimer says the global tech rally shows stretched valuations but remains grounded in fundamentals, not speculation.

Oppenheimer noted that most gains are driven by strong corporate earnings rather than leverage or debt-fueled startups. He compared the current dominance of tech to past leadership cycles in finance and energy that lasted decades without triggering crises.

While valuations are “increasingly stretched,” he said they have yet to reach bubble levels. The main risk, he warned, would be if earnings disappoint and investors start questioning the sustainability of returns.

BlackRock’s Rieder Sees Fed on Hold as December Cut Doubt Rises

BlackRock’s head of fixed income Rick Rieder, seen as a contender to succeed Jerome Powell as Fed Chair in 2026, said the Federal Reserve may hold off on a December rate cut.

Speaking to CNBC, Rieder noted that despite access to broad data sources, the Fed may “skip a cut” next meeting and delay additional easing into next year — potentially under a new Chair.

Rieder is among five finalists reportedly under consideration for the top job, alongside Waller, Bowman, Hassett, and Warsh.

Trump Diverts Pentagon Funds to Cover Troop Pay During Shutdown

As the government shutdown nears its fourth week, the White House redirected $5.3 billion from Pentagon accounts to ensure U.S. troops receive paychecks on Friday, Axios reported.

The Office of Management and Budget sourced the funds from a military housing program ($2.5B), Army and Air Force research accounts ($1.4B), and Navy shipbuilding procurement ($1.4B).

Officials said Trump remains firm on continuing the shutdown, prioritizing uninterrupted military pay even as 42 million Americans risk losing access to food stamp benefits by Saturday.

Trump Claims South Korea to Pay $350 Billion for Tariff Relief

Donald Trump said on his social media platform that South Korea agreed to pay $350 billion to the U.S. in exchange for lower tariffs.

He added that Seoul also committed to buying “vast quantities” of American oil and gas and that South Korean companies plan $600 billion in U.S. investments. Trump further claimed he approved South Korea’s request to build a nuclear-powered submarine, strengthening the alliance.

However, Trump has previously announced deals that were later disputed or unconfirmed, so his latest statement warrants caution.

US Commerce Secretary Lutnick – semiconductor tariffs are not part of US-South Korea deal

- Also on Alaska natural gas project

U.S. Commerce Secretary Lutnick announces South Korea $200M investment in Alaska’s natural gas project.

- says semiconductor tariffs are not part of U.S.-South Korea deal

Senate Democrats warn Trump: Don’t trade away national security secrets for China deal

- Senate Democrats led by Chuck Schumer urged President Trump not to loosen U.S. national security restrictions as he meets Xi Jinping, warning against concessions on export controls or outbound investment limits in pursuit of a trade deal.

As President Donald Trump meets Chinese President Xi Jinping in Asia on Thursday, a group of Senate Democrats has warned against trading away U.S. national security protections for the sake of a deal.

In a letter led by Senate Majority Leader Chuck Schumer, Democrats urged Trump to maintain strict export controls, investment curbs, and security partnerships with allies, saying these must not be on the negotiating table. The lawmakers also cautioned against weakening the Treasury Department’s new Outbound Investment Security Program, which restricts U.S. firms from aiding the development of advanced technologies in China and other rival nations.

The warning underscores mounting concern in Washington that Trump may seek to strike a politically symbolic accord with Beijing by softening long-standing restrictions on sensitive technology transfers, even as tensions remain high over trade, defense, and critical minerals supply chains.

The warning highlights political resistance in Washington to any easing of U.S.-China tech restrictions. Markets will watch for signs Trump might temper export controls or investment rules as part of a broader trade framework with Xi.

Canada Faces Productivity Crisis Despite Rate Cuts

Canada’s economy is struggling with a “structural productivity crisis”, according to Warren Lovely of National Bank Financial.

Speaking to Bloomberg, Lovely said the Bank of Canada’s rate cuts are a response to economic strain rather than strength. “We’ve been a hamster in a wheel,” he said, referring to weak output growth per worker hour.

He urged policymakers to focus on long-term productivity measures to prevent further stagnation.

Commodities News

Gold Reclaims $4,000 as Rally Accelerates

Gold surged $95 (+2.4%) on Thursday to $4,024 per ounce, reclaiming the $4,000 mark and breaking above key technical resistance at its 100-hour moving average ($3,999.85).

The next test for bulls lies near the 200-hour MA at $4,083.62 — a sustained move above could strengthen the broader bullish setup.

For now, momentum remains on buyers’ side, with attention on whether gold can maintain traction amid renewed geopolitical and macro volatility.

Crude Oil Ends Slightly Higher; Traders Eye Technical Levels

Crude oil futures settled modestly higher at $60.57, up $0.09 (0.15%), after a choppy session defined by tight technical ranges.

- High: $60.79 (tested 100-hour MA)

- Low: $59.64 (tested 200-hour MA at $59.82)

The $60.79 level remains near-term resistance, while $59.80 serves as support. A break above the 100-hour MA could invite more buying, while a drop below the 200-hour MA risks renewed selling pressure.

Copper Hits Record High as Supply Tightens, Dollar Falls

Copper surged to a new record on the London Metal Exchange, surpassing $11,104.50 per tonne, driven by a weaker U.S. dollar, rate cuts, and tightening supply.

ING analysts Ewa Manthey and Warren Patterson said prices are up more than 25% year-to-date, boosted by disruptions at Freeport’s Grasberg mine in Indonesia and a global risk-on mood.

However, they cautioned that Chinese buyers show signs of price sensitivity, with the Yangshan premium down over 20% since September, limiting further upside.

Silver Market Balances After “Squeeze” Era, Says TDS

TD Securities said fears of another “silver squeeze” appear overdone, noting that inventories have rebounded sharply since last year’s supply crunch.

Senior strategist Daniel Ghali said London Bullion Market inventories have increased by over 50 million ounces, helped by outflows from ETFs and exchanges in Shanghai and Comex.

He added that without prices reclaiming the $50/oz mark, ETF holders’ behavior remains unstable — and liquidations could reinforce a bearish cycle in the short term.

Funds Cut TTF Gas Longs as Shorts Rise, Says ING

Investment funds reduced their net long positions in TTF natural gas by 14.3 TWh to 46.2 TWh last week, largely due to fresh short entries, according to ING.

European gas storage levels have slipped to just under 83%, below the five-year average of 92%, though prices remain range-bound ahead of winter.

Funds also cut holdings of EU carbon allowances by 821 contracts, marking their first weekly reduction in a month.

China Pauses Rare Earth Export Controls for One Year

China’s Commerce Ministry said it will suspend rare earth export restrictions for 12 months, part of a broader easing of trade tensions with the United States.

The ministry said both sides agreed to extend tariff exemptions, expand agricultural imports, and cooperate on fentanyl enforcement.

Beijing will also pause countermeasures related to U.S. shipbuilding and Section 301 investigations for one year, and pledged to handle TikTok-related issues with Washington “appropriately.”

The move follows trade discussions between Presidents Xi and Trump and signals a temporary thaw in bilateral economic relations.

Lynas Revenue Surges 66% as Western Demand for Rare Earths Climbs

Lynas Rare Earths, the largest producer outside China, reported a 66% rise in quarterly revenue to A$200.2 million, supported by strong Western demand for strategic minerals.

The result, though below the A$230 million forecast from Visible Alpha, highlights robust appetite for non-Chinese supply despite price softness.

Lynas operates in Australia and Malaysia, providing key inputs for EVs, wind turbines, and defense systems.

Its results reinforce Australia’s critical role in reshaping global supply chains for rare earths, though geopolitical sensitivities with China remain a potential risk.

Oil Rises After Bullish U.S. Inventory Draw, Eyes on OPEC+

Crude oil prices climbed after EIA data showed U.S. crude inventories fell by 6.86 million barrels last week, with large draws on the Gulf Coast.

ING’s Ewa Manthey and Warren Patterson said lower imports — down 867,000 b/d week-on-week — and rising domestic demand lifted prices, with Brent closing 0.8% higher.

Gasoline stocks dropped 5.9 million barrels and distillates fell 3.4 million, even as refiners cut utilization to 86.6%.

Traders are now focused on OPEC+ talks and the Trump–Xi meeting, which could set the tone for near-term supply and trade sentiment.

Gundlach Cuts Gold Exposure, Sees 50-50 Odds of Fed Rate Cut

Jeffrey Gundlach has pared gold exposure to 10%, warning that the metal’s surge has entered “nosebleed” territory. The DoubleLine Capital chief said he retains a 5% allocation to a broad commodities index and is increasing exposure to non-U.S. and emerging-market equities.

Gundlach expects inflation to stay above 3%, suggesting a potential steepening of the yield curve as disinflation slows. He estimates a roughly even chance that the Federal Reserve will cut rates again in December, following two 25-basis-point reductions earlier this year.

He urged investors to rebalance portfolios as U.S. policy shifts from restrictive toward neutral, stressing diversification and disciplined risk management as key to navigating the next phase of monetary easing.

Europe News

European Stocks Close Flat to Lower; DAX, FTSE Little Changed

Major European indexes ended mixed to slightly lower on Wednesday.

- Germany’s DAX: +0.06%

- France’s CAC 40: −0.53%

- UK’s FTSE 100: +0.04%

- Spain’s IBEX: −0.68%

- Italy’s FTSE MIB: −0.09%

Traders cited a cautious tone following the ECB meeting and mixed earnings reports across sectors.

ECB Keeps Rates Unchanged, Says Inflation Near Target

The European Central Bank left interest rates unchanged, maintaining the refinancing rate at 2.15% and the deposit rate at 2.00%, as expected.

The ECB said inflation remains “close to the 2% medium-term target,” with its assessment of the outlook “broadly unchanged.” It described the eurozone economy as continuing to grow “despite global challenges.”

Officials reiterated that decisions will remain data-dependent, taken meeting by meeting, and that the ECB is not pre-committing to any particular rate path.

The bank also confirmed that its APP and PEPP portfolios are declining at a measured pace as reinvestments have ceased.

Eurozone GDP Grows 0.2% in Q3, Slightly Above Forecasts

The euro area economy expanded 0.2% quarter-on-quarter in Q3, beating expectations of 0.1%, Eurostat reported. That follows a 0.1% increase in Q2.

While overall growth remains modest, the bloc continues to outperform its more fragile members, particularly Germany, which remains a drag on regional momentum.

The reading supports expectations that the ECB will keep policy unchanged through year-end, with inflation and activity both stabilizing but still uneven across the region.

Eurozone Unemployment Holds at 6.3% in September

The euro area unemployment rate was unchanged at 6.3% in September, matching forecasts and holding steady for the sixth straight month, Eurostat data showed.

The rate has fluctuated narrowly between 6.2% and 6.4% since early 2024, reflecting continued labor market resilience despite sluggish economic growth across the bloc.

Eurozone Confidence Improves in October but Outlook Still Fragile

The European Commission’s October sentiment survey showed a modest rise in confidence, with the final consumer confidence index unchanged at -14.2, matching the preliminary estimate.

The economic sentiment index climbed to 96.8 from a revised 95.6, while industrial confidence improved to -8.2 from -10.1, and services confidence rose to 4.0.

Despite the gains, the Commission said conditions remain fragile, particularly in Germany, where sticky inflation and weak output continue to weigh on sentiment.

Germany Inflation Eases to 2.3% in October, Core Stays Firm

Germany’s headline CPI rose 2.3% year-on-year in October, slightly above expectations of 2.2% but down from 2.4% in September, Destatis reported.

The HICP measure also came in at 2.3%, while core inflation held steady at 2.8%.

The small downside move in headline prices supports expectations that the ECB will maintain its policy stance, with inflation still near target but underlying pressures persistent.

Germany Unemployment Unexpectedly Falls by 1,000 in October

Germany’s jobless count unexpectedly fell by 1,000 in October, compared with expectations for an 8,000 increase, according to data from the Federal Employment Agency.

The unemployment rate held steady at 6.3%, in line with forecasts and unchanged from September.

Officials said the “autumn recovery has been sluggish”, with hiring momentum still weak despite seasonal demand. Overall, the data suggest limited improvement in Europe’s largest labor market as growth pressures persist.

German State CPI Data Signal Slightly Softer National Print

Inflation across key German states eased slightly in October, suggesting a marginal decline in the upcoming national reading.

Bavaria’s CPI rose 2.2% year-on-year, down from 2.4%; Saxony registered 2.2% versus 2.3%, and North Rhine-Westphalia held steady at 2.3%. Baden-Württemberg’s reading was roughly in line with prior trends.

The combined data point to national headline inflation likely cooling to around 2.3%, from 2.4% in September — though analysts note the core inflation figure remains the key gauge for the ECB.

German Economy Flatlines in Q3, Avoids Technical Recession

Germany’s economy stagnated in Q3, posting 0.0% quarter-on-quarter growth, in line with forecasts, after a 0.3% contraction in Q2, according to Destatis.

Year-on-year growth reached 0.3%, signaling sluggish momentum as high inflation and weak external demand weigh on activity.

The data highlight stagflation risks — with prices elevated and output stagnant — as the eurozone’s largest economy struggles to regain traction entering the final quarter of 2025.

France GDP Surprises to Upside in Q3, Expands 0.5%

France’s economy expanded 0.5% in the third quarter, outpacing expectations of 0.2%, according to preliminary data from INSEE. The prior quarter’s growth was revised to 0.3%.

On an annual basis, GDP grew 0.6%, below the 0.8% pace seen previously. Domestic demand contributed +0.3 percentage points to quarterly growth, while net exports added 0.9 points, offsetting a -0.6 point drag from inventories.

Household consumption rose 0.1%, while total production increased 0.8% on the quarter — a sharp improvement from 0.3% in Q2.

The data suggest France’s economy remains resilient despite headwinds from slowing eurozone activity and tighter financial conditions.

Italy GDP Stalls in Q3 as Industry Slips, Services Flat

Italy’s economy showed no growth in Q3, matching prior quarter performance and missing expectations for a 0.1% rise, according to preliminary figures from Istat.

GDP was 0.4% higher year-on-year, short of forecasts for 0.6%. Istat said modest gains in agriculture and forestry offset a slight industrial decline and stagnant services output.

From a demand perspective, a negative contribution from domestic demand was offset by a positive trade balance, leaving overall growth flat.

Spain Inflation Rises to 3.1% in October, Slightly Above Forecasts

Spain’s consumer prices rose 3.1% year-on-year in October, slightly above expectations of 2.9%, data from the national statistics agency INE showed. That’s up marginally from 3.0% in September.

The EU-harmonized CPI (HICP) increased 3.2%, topping estimates of 3.0%, while core inflation edged up from 2.4% to 2.5%.

The uptick reinforces expectations that the European Central Bank (ECB) will keep interest rates unchanged for the rest of the year, as inflation remains sticky despite broader signs of economic cooling.

Switzerland’s KOF Indicator Jumps to 101.3, Beats Forecasts

Switzerland’s KOF Economic Barometer rose to 101.3 in October, topping expectations of 98.3 and up from 98.0 in September, signaling improving momentum as Q4 begins.

It marks the highest reading since March and suggests the Swiss economy is regaining modest strength. However, analysts note that the Swiss National Bank’s greater challenge remains managing the strong franc, which continues to pressure exports and inflation expectations.

Lagarde: Inflation Stable, Consumption to Support Growth

At a press conference in Florence, ECB President Christine Lagarde said eurozone inflation is unchanged and the economy should benefit from stronger household consumption despite a cooling labor market.

She noted that digital services are driving growth while manufacturing remains constrained by tariffs. Lagarde added that wage growth is moderating, long-term inflation expectations are around 2%, and risks are now “more balanced.”

She also pointed to AI-related investment as a positive development, while warning that defense spending and geopolitical tensions could alter inflation dynamics.

Lagarde reiterated the ECB’s data-dependent stance, saying, “We are in a good place — and we will do whatever is needed to stay there.”

SNB Tschudin: They are in a situation where policy is appropriate at present

The SNB Tschudin says:

- We are in a situation where we have appropriate monetary policy at present

- policy is expected at the moment.

- If inflation would 0% for a short time, that is okay.

- Management is the interest rate, will do interventions when necessary

Goldman Sachs Expects BoE to Cut Rates in November

Goldman Sachs now expects the Bank of England to cut rates next month, citing soft economic data and an upcoming contractionary budget.

The bank pointed to weakening wage growth, a slowing labor market, and GDP undershooting central bank projections. The November 26 budget, expected to include higher taxes and spending restraint, could deepen the slowdown.

Goldman forecasts the BoE will lower the policy rate to about 3% by mid-2026, a faster easing path than previously assumed.

Asia-Pacific & World News

Xi Jinping: U.S.-China Relations Remain Stable, Consensus Reached

Chinese President Xi Jinping said U.S.-China relations have maintained “overall stability,” following his meeting with President Trump in Washington.

Xi said both sides’ economic and trade teams held “in-depth” discussions and reached consensus on resolving key issues, adding that relations should focus on cooperation rather than retaliation.

He emphasized that the two countries should “shorten the list of problems and lengthen the list of cooperation,” describing trade as a “ballast stone” for the broader relationship.

Xi added that China “has never sought to challenge or replace anyone,” and pledged to maintain communication and coordination with the U.S. on trade, energy, and implementation of the new agreements.

China’s Premier Li Calls for Stronger Domestic Demand

Premier Li Qiang emphasized the need to expand domestic demand and deepen supply-side reforms while balancing growth with security.

State media quoted Li as saying that China must integrate innovation with industrial development, promote high-quality growth, and strengthen long-term risk-prevention mechanisms.

He urged policy preparedness to prevent systemic risks, improve livelihoods, and cultivate new growth drivers through the “internal stability of the domestic cycle.”

China Expands Forests by Area the Size of Texas

China has increased forest cover by 173 million acres since 1990 — an area roughly the size of Texas — marking the largest national reforestation effort in modern history.

The gains stem from decades of tree-planting and desert-control projects, including a 2,000-mile green belt around the Taklamakan Desert. The expansion has curbed desertification and added to global tree cover, particularly across Asia.

China’s model could reshape global carbon markets, influence timber supply, and guide other nations’ climate strategies.

Hong Kong Cuts Base Rate in Line With Fed

The Hong Kong Monetary Authority (HKMA) reduced its base rate by 25 basis points to 4.25%, mirroring the U.S. Federal Reserve’s latest move.

Under the Linked Exchange Rate System, the Hong Kong dollar’s peg to the U.S. dollar requires the city’s monetary policy to track Fed actions closely.

When U.S. rates change, the HKMA adjusts its own to maintain the peg within the HK$7.75–7.85 trading band. The approach ensures monetary stability, though it can diverge from local economic conditions.

PBOC sets USD/ CNY mid-point today at 7.0864 (vs. estimate at 7.1056)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injects 342.6bn yuan at 1.40% via 7-day reverse repos

Australia Export, Import Prices Fall in Q3

Australia’s export and import prices declined in the third quarter but at a slower pace than earlier in the year.

The Import Price Index fell 0.4% q/q (expected -0.3%, prior -0.8%), while the Export Price Index dropped 0.9%, following a steep -4.5% in Q2, as weaker commodity prices weighed on returns.

The data suggest continued price moderation but some stabilization after midyear declines.

New Zealand Business Confidence Hits 20-Month High

New Zealand’s business confidence surged to 58.1% in October from 49.6%, reaching the highest level since February, according to the ANZ Business Outlook Survey.

The share of firms expecting their own activity to improve rose to 44.6%, up from 43.4%.

The bank attributed the rise to aggressive monetary easing, with the RBNZ cutting rates by 300 basis points since August 2024. ANZ said retail sentiment shows “the economy warming as monetary stimulus flows through.”

BOJ’s Ueda: Monetary Easing to Stay as Growth Moderates

Bank of Japan Governor Kazuo Ueda said the central bank will maintain easy monetary conditions to support the economy, which is recovering “moderately” but faces weakness due to slowing overseas growth.

Speaking after the policy meeting, Ueda said external trade frictions and softer corporate profits have weighed on Japan’s outlook, but risks to the U.S. economy have eased since July.

Board members Toyoki Takata and Naoki Tamura dissented from the BOJ’s quarterly report, proposing stronger language on inflation nearing the 2% stability target.

Ueda said food inflation has risen due to temporary factors but should ease, and wage gains next year are expected to match this year’s pace.

He added the BOJ will “take a little longer” to assess the impact of U.S. tariffs on Japan and is prepared to adjust policy “irrespective of political timing,” even before final spring wage negotiations conclude.

Toyota Sees No Immediate Chip Impact From Nexperia Export Curbs

Toyota Motor Corp. said it faces no immediate semiconductor shortage following China’s export restrictions on Dutch chipmaker Nexperia, though it remains on alert for possible supply disruptions.

Speaking at the Japan Mobility Show in Tokyo, CEO Koji Sato said, “There’s some risk, but it’s not like we’re facing shortages tomorrow,” adding that the company continues to closely monitor its supply chain.

The comments follow the Dutch government’s move to seize control of Nexperia, citing national security concerns tied to its Chinese parent, Wingtech Technology. Beijing’s retaliation through export curbs has added uncertainty for automakers reliant on older-generation chips.

Sato said Japanese manufacturers are now working to standardize legacy semiconductors to avoid a repeat of the pandemic-era shortages that crippled global auto production.

Bank of Japan Holds Rates Steady, Two Members Dissent

The Bank of Japan left its short-term policy rate at 0.5% by a 7–2 vote, with dissenting members Toyoki Takata and Naoki Tamura advocating a hike to 0.75%.

Both cited rising inflation expectations and progress toward the 2% price goal. The majority, however, maintained patience, citing uncertainty over global demand.

The BOJ’s forecasts remain unchanged: core CPI at 2.7% (2025), 1.8% (2026), and 2.0% (2027); GDP growth around 0.7–1.0%.

The bank said inflation risks are balanced but economic risks skew downside. It reaffirmed its data-dependent stance and noted the yen’s growing impact on price dynamics.

Foreign Investors Pour ¥1.3 Trillion Into Japan Stocks

Foreign investors bought a net ¥1.34 trillion in Japanese equities last week — the strongest inflow in over a month — while domestic investors continued to sell foreign assets, Ministry of Finance data show.

Japanese investors sold ¥351.4 billion in foreign bonds and ¥62.1 billion in overseas equities, marking slower outflows from the prior week. Foreign holdings of Japanese bonds fell ¥253.5 billion.

The data underscore renewed foreign optimism toward Japan’s market amid a weaker yen and corporate reform momentum.

Samsung Profit Doubles on AI Chip Boom

Samsung Electronics posted Q3 net income of KRW 12.0 trillion, more than double analyst forecasts, driven by soaring AI chip demand and resilient smartphone sales.

Revenue reached KRW 86 trillion, with operating profit at KRW 12.2 trillion. The semiconductor unit earned KRW 7 trillion, reflecting strong demand for HBM3E chips used in AI servers.

Samsung said it’s selling to all major customers and plans to launch HBM4 in 2026. The mobile division earned KRW 3.6 trillion, and displays contributed KRW 1.2 trillion.

The company expects the chip market to stay strong through Q4, signaling ongoing momentum in AI-related hardware.

Crypto Market Pulse

XRP Extends Decline After Fed Rate Cut and Trump–Xi Trade Deal

XRP slid below $2.50 on Thursday, extending its correction amid a “sell the news” reaction to both the Fed’s rate cut and the Trump–Xi meeting outcome.

The Fed cut rates by 25 bps to a 3.75%–4.00% range. However, Chair Jerome Powell warned that another cut in December is “not a foregone conclusion,” cooling market optimism.

The broader crypto market weakened despite progress in U.S.–China trade talks, where both sides agreed to reduce tariffs, resume soybean exports, and ease rare-earth restrictions.

XRP’s derivatives backdrop remains soft:

- Open Interest: $4.37B (down 41% since October 1)

- RSI: Bearish zone, signaling extended profit-taking

XRP trades around $2.45, with fading retail momentum suggesting more downside risk near-term.

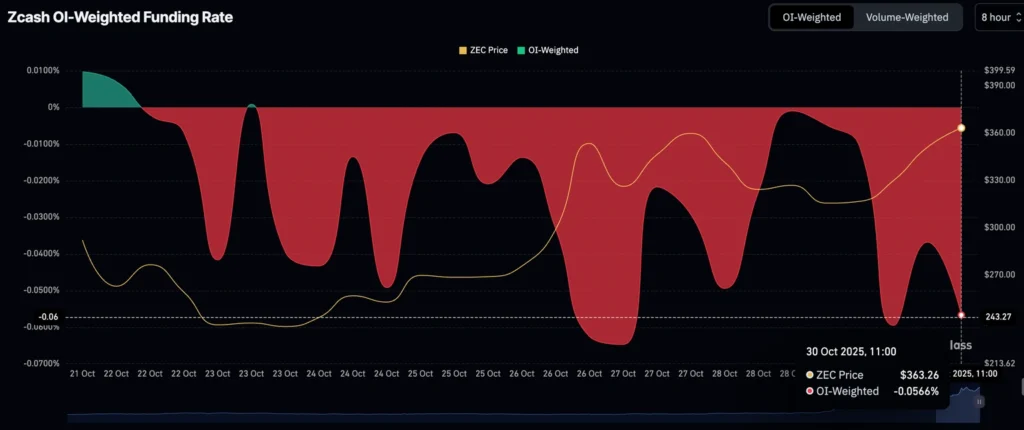

Zcash (ZEC) Extends Rally, Eyes $400

Zcash (ZEC) remains one of the few bright spots in crypto, trading above $360 on Thursday as privacy-focused tokens gain traction.

Retail interest has surged:

- Futures Open Interest: $518M (near record highs)

- Funding Rate: -0.0566% (mild profit-taking pressure)

While technical indicators (MACD, RSI) show mixed signals, the strong derivatives activity suggests confidence in ZEC’s bullish trend. Still, sustained negative funding could trigger short-term profit-taking before a potential test of the $375–$400 resistance zone.

Ondo Finance and Chainlink Partner to Advance On-Chain Tokenization

Ondo Finance has partnered with Chainlink to bring financial institutions on-chain through the tokenization of real-world assets (RWA).

The collaboration names Chainlink as Ondo’s official oracle provider for tokenized securities, enabling accurate and secure on-chain data flow.

The partnership builds on prior initiatives with global institutions including SWIFT and Euroclear, focusing on scalable RWA infrastructure for tokenized stocks, ETFs, and structured products.

Chainlink co-founder Sergey Nazarov said,

“By securing its tokenized stocks with Chainlink, Ondo is redefining how traditional financial instruments can operate on-chain — programmable, composable, and globally accessible.”

Despite the announcement, both ONDO and LINK traded slightly lower, mirroring broader crypto market softness.

Crypto Today: Bitcoin, Ethereum, XRP Rebound After Trump–Xi Meeting

The crypto market staged a mild rebound Thursday following the Trump–Xi summit in South Korea, which saw new agreements to ease trade tensions.

Bitcoin (BTC) reclaimed $110,000, while Ethereum (ETH) oscillated between $3,680 support and $4,250 resistance. XRP edged back toward $2.50, facing resistance at its 200-day EMA.

Market drivers:

- Trump confirmed tariffs on Chinese goods would drop to 47%, with new deals on soybeans and rare earth exports.

- The leaders signed a one-year trade agreement, with reciprocal visits planned for 2026.

Meanwhile, Wednesday’s Fed rate cut initially pressured crypto, as Powell’s cautious tone dashed hopes for multiple cuts this year.

Traders remain divided over whether crypto’s latest uptick marks the start of a recovery or merely a short-term bounce in a choppy post-FOMC environment.

Japan’s JPYC Debuts First Yen-Backed Stablecoin

Tokyo-based JPYC has launched Japan’s first yen-backed stablecoin, backed one-to-one by bank deposits and government bonds, signaling the nation’s entry into the $300 billion global stablecoin race.

Alongside the launch, JPYC introduced JPYC EX, a licensed issuance and redemption platform operating under Japan’s anti–money laundering regulations. President Noriyoshi Okabe called the development “a historic step for Japanese currency,” adding that seven companies plan to integrate the token.

Japan’s stablecoin market has gained momentum this year, following Circle’s USDC rollout. MUFG, SMBC, and Mizuho are each developing yen-linked digital currencies, while Monex Group is preparing its own entry.

The JPYC launch positions Japan as a credible player in global stablecoin innovation and could accelerate fintech adoption and yen digitalization.

Michael Saylor Forecasts Bitcoin at $150,000 by End-2025

MicroStrategy co-founder Michael Saylor predicts Bitcoin will reach $150,000 by the end of 2025, pointing to a major policy shift in Washington toward digital assets.

Speaking at the Money 20/20 conference in Las Vegas, Saylor told CNBC that the past year marked “the best in industry history,” highlighting the SEC’s acceptance of tokenized securities and Treasury Secretary Scott Bessent’s support for stablecoins.

He said these developments, combined with broader regulatory normalization, have bolstered institutional confidence. The $150,000 target, he added, aligns with consensus projections from analysts covering both MicroStrategy and the broader Bitcoin ecosystem.

Saylor’s view underscores growing optimism as U.S. regulators move toward clearer frameworks for crypto assets.

The Day’s Takeaway

North America

Fed Stays Cautious, Nomura Walks Back December Cut Call

The Federal Reserve’s latest decision prompted Nomura to withdraw its forecast for a December rate cut, now expecting no change through year-end. Chair Jerome Powell said December is “not a foregone conclusion,” keeping flexibility amid a month-long government data blackout. Fed funds futures now price roughly 72% odds of a December cut, down from 91% before the meeting.

Wall Street Sinks as Meta Drags; Amazon, Apple Rescue Futures

U.S. equities closed sharply lower Thursday.

- S&P 500: −0.99% to 6,822.36

- Dow Jones: −0.22% to 47,522.12

- Nasdaq: −1.57% to 23,581.14

Meta’s stock tumbled 11.3% after warning of higher AI spending despite record bond-sale demand. After the bell, Amazon and Apple both beat estimates, lifting futures modestly.

- Apple: EPS $1.85 (vs. $1.77 est.), Revenue $102.47B

- Amazon: EPS $1.95 (vs. $1.58 est.), Revenue $180.17B, upbeat Q4 outlook

Meta’s $25B Bond Deal Oversubscribed 5x

Meta drew $125B in orders for its $25B multi-tranche bond, underscoring demand for high-grade corporate paper even as investors question the firm’s rising leverage. Proceeds will fund AI infrastructure and data centers.

U.S. Housing Gets Some Relief

The average 30-year fixed mortgage rate fell to 6.17%, the lowest since October 2024, offering a small boost to buyer sentiment after months of high borrowing costs.

Europe

ECB Holds Rates; Lagarde Confident Inflation Is Anchored

The ECB kept its key rates unchanged (Refi 2.15%, Deposit 2.00%), saying inflation is “close to target.” President Christine Lagarde stressed that consumption and digital activity should support growth while manufacturing stays under pressure from tariffs. She reaffirmed that decisions remain data-dependent, describing the eurozone as “in a good place.”

Eurozone GDP +0.2%, Unemployment Steady at 6.3%

Eurostat data showed Q3 GDP rose 0.2% QoQ, slightly ahead of expectations, with unemployment steady for a sixth straight month at 6.3%. Confidence improved modestly, but officials warned the outlook remains fragile.

France Outperforms Peers

French GDP expanded 0.5% QoQ, more than double forecasts, driven by trade strength even as inventories dragged. Household consumption was flat but production rose sharply (+0.8%).

Germany Avoids Recession, Inflation Cools

Germany’s Q3 GDP stagnated at 0.0%, avoiding a technical recession after a 0.3% Q2 contraction. Inflation eased to 2.3%, with core at 2.8%, while unemployment unexpectedly fell by 1,000. Regional CPI prints suggest price pressures continue to moderate.

Italy Stalls Again

Italy posted flat growth for a second straight quarter, missing modest expectations for +0.1%. Industrial softness offset gains in agriculture.

Spain Inflation Tops Forecasts

Spain’s CPI accelerated to 3.1% YoY, slightly above projections, reinforcing expectations that the ECB will hold steady for the rest of the year.

Stocks End Mixed

- DAX: +0.06%

- CAC 40: −0.53%

- FTSE 100: +0.04%

- IBEX: −0.68%

- FTSE MIB: −0.09%

Caution prevailed after the ECB decision and a flurry of mixed earnings.

Asia

Toyota: No Immediate Chip Shortage from Nexperia Curbs

CEO Koji Sato said Toyota faces no immediate chip supply issues following China’s restrictions on Dutch semiconductor maker Nexperia. He warned, however, that prolonged curbs could pose risks and said Japanese automakers are working to standardize older chip designs to prevent future shocks.

BOJ’s Ueda: Easy Policy to Continue

Governor Kazuo Ueda said Japan’s recovery remains “moderate,” with food inflation driven by temporary factors. He expects wage hikes next year to match 2025 levels and reiterated that the BOJ will maintain accommodative policy until inflation stability is firmly secured.

China–U.S. Summit: Trade Truce and Export Pauses

Presidents Trump and Xi Jinping struck a broad trade deal:

- U.S. tariffs on China cut from 57% → 47%

- China to resume soybean imports and ease fentanyl exports

- Agreement to pause rare-earth export controls for one year

- Both sides to discuss chip cooperation and maintain dialogue on energy and technology

Beijing also confirmed it will suspend countermeasures linked to shipbuilding and 301 investigations for a year.

China’s Xi: “Relations Maintain Overall Stability”

Xi emphasized that both sides should “shorten the list of problems, lengthen the list of cooperation,” framing trade as the stabilizing force in U.S.–China relations.

Switzerland (Note: Non-EU, but regional)

KOF leading indicator rose to 101.3, the best since March, signaling improving Q4 prospects despite SNB’s ongoing franc concerns.

Commodities

Gold Reclaims $4,000 as Rally Accelerates

Gold surged 2.4% to $4,024/oz, clearing key resistance at $3,999.85. The next test lies near $4,083.62. Momentum favors bulls amid heightened geopolitical and macro volatility.

Crude Oil Edges Higher on U.S. Draws

Oil rose modestly to $60.57 (+0.15%) after U.S. crude inventories fell 6.86 M bbl last week. Gasoline and distillate stocks also declined sharply. Analysts see technical support near $59.80 and resistance around $60.80.

Copper Hits Record High

LME copper touched an all-time high at $11,104.50/tonne, up 25% YTD, boosted by a weaker dollar and tight supply. ING analysts cautioned that Chinese demand shows price sensitivity, with Yangshan premiums down 20% since September.

Silver Market Stabilizes

TD Securities said the “silver squeeze” era has faded as inventories rebuilt by over 50 M oz. Analysts warned ETF liquidations could pressure prices if they stay below $50/oz.

Natural Gas Positioning Shifts Bearish

Funds cut TTF gas longs by 14.3 TWh and added shorts as storage dipped below 83% — under the five-year average — keeping prices range-bound ahead of winter.

Oil Traders Eye OPEC+ and Trade Talks

Focus now shifts to upcoming OPEC+ meetings and possible fallout from the Trump–Xi trade agreement, which could shape near-term demand expectations.

Crypto

Market Sells the News After Fed Cut, Then Rebounds

The Fed’s 25 bps rate cut to 3.75–4.00% initially hit crypto as Powell tempered expectations for more easing. After the Trump–Xi trade deal, digital assets rebounded:

- Bitcoin: ≈ $110,000

- Ethereum: $3,680–$4,250 range

- XRP: around $2.45, struggling to hold its 200-day EMA

XRP Slides on Profit-Taking

XRP fell below $2.50 amid weak derivatives sentiment (Open Interest $4.37B, −41% MoM). RSI remains bearish.

Zcash Outperforms

ZEC trades above $360, eyeing $400 resistance. Open Interest near records ($518M) reflects strong bullish momentum despite mild profit-taking.

Ondo Finance–Chainlink Partnership

Ondo named Chainlink its oracle provider for tokenized securities, enabling secure on-chain data for RWAs. Both tokens slipped slightly with the broader market.