North America News

Wall Street Rallies to Record Highs as Investors Eye Fed Cut, US–China Thaw, and AI Boom

U.S. stocks surged to new record highs Tuesday, powered by optimism ahead of the Federal Reserve’s policy decision, renewed signs of a U.S.–China trade truce, and unrelenting enthusiasm around artificial intelligence.

The NASDAQ led major indexes with a 0.80% gain, as heavyweight tech names dominated the advance. Nvidia, Apple, Broadcom, Microsoft, CrowdStrike, Micron, and Palantir each closed at new all-time highs.

Nvidia was the standout. Shares jumped 4.98% to $201.03, adding roughly $230 billion in market value after CEO Jensen Huang’s keynote at the GTC Conference in Washington, D.C., showcased the company’s deepening AI footprint across industries. The rally pushed Nvidia’s market capitalization to $4.89 trillion, just shy of the $5 trillion milestone.

Investors are also bracing for a critical wave of earnings. Microsoft, Meta, and Alphabet report results after Wednesday’s close, followed by Amazon and Apple on Thursday. Meanwhile, the Federal Reserve is widely expected to deliver a 25 basis point rate cut tomorrow — with markets pricing in another move in December.

Closing levels:

- Dow Jones Industrial Average: +161.70 points (+0.34%) at 47,706.37

- S&P 500: +15.73 points (+0.23%) at 6,890.89

- NASDAQ Composite: +190.04 points (+0.80%) at 23,827.49

- Russell 2000: −13.70 points (−0.55%) at 2,506.65

After hours, corporate earnings brought more headlines:

- Visa (V): Q4 EPS $2.98 on revenue of $10.7B (beats estimates); payments volume +9%, cross-border +12%; dividend raised 14% to $0.67 after $899M litigation provision.

- Electronic Arts (EA): Q2 EPS $0.54, revenue $1.84B (misses estimates); net income $137M; company withdraws forward guidance.

- Booking Holdings (BKNG): Q3 EPS $99.50 vs. $95.40 forecast; revenue $9B; net income $2.7B.

U.S. 7-Year Treasury Auction Tails Slightly at 3.790%

The U.S. Treasury’s $44 billion auction of seven-year notes stopped at 3.790%, slightly above the 3.782% when-issued yield, producing a small tail of 0.8 basis points.

The bid-to-cover ratio came in at 2.46, up from 2.40 at the previous sale, while the prior auction cleared at 3.956%. The result follows a week of smooth 2-year and 5-year auctions, suggesting continued steady demand across the curve despite modest upward yield pressure.

ADP to Begin Weekly U.S. Employment Updates, First Estimate at 14,250 Jobs

ADP will begin publishing weekly updates on U.S. private-sector employment, the firm said, with the first preliminary reading showing a 14,250-job gain for the four weeks ending October 11.

The report, released each Tuesday, will present a four-week moving average designed to capture short-term labor market shifts. ADP described the new data as a complement to its monthly employment survey.

While the firm did not clarify whether the 14,250 figure represents a total or average gain, the result signals weak hiring momentum. Recent corporate job cuts — including Amazon’s plan to reduce up to 30,000 positions, Nestlé’s global two-year reduction of 16,000 jobs, and layoffs at GM, Target, and Applied Materials — highlight a cooling private-sector outlook.

U.S. Home Prices Rise 1.6% in August, Beating Expectations

U.S. home prices rose 1.6% year-on-year in August, outpacing forecasts for a 1.3% gain, according to the S&P CoreLogic Case-Shiller index.

On a monthly basis, prices climbed 0.2%, reversing expectations for a 0.1% decline. The Federal Housing Finance Agency (FHFA) index showed similar strength, with a 0.4% monthly increase and a 2.3% annual rise.

Economists cautioned that seasonal adjustments may be flattering the data, as unadjusted Case-Shiller figures show a 0.6% monthly decline typical for August.

U.S. Consumer Confidence Edges Up in October

U.S. consumer confidence improved modestly in October, with the Conference Board index rising to 94.6 from 93.2, above expectations for 93.2.

The present situation index advanced to 129.3 from 125.4, while expectations slipped to 71.5 from 73.4. The share of respondents saying jobs were “hard to get” increased slightly to 18.4%.

Although confidence remains subdued after September’s seven-month low, the improvement suggests consumers are stabilizing after a period of weak sentiment.

“Consumer confidence moved sideways in October, only declining slightly from its upwardly revised September level,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “Changes to the individual subcomponents were also limited and largely cancelled each other out. The Present Situation Index regained some strength after September’s drop. Consumers’ view of current business conditions inched upward, while their appraisal of current job availability improved for the first time since December 2024. On the other hand, all three components of the Expectations Index weakened somewhat. Consumers were a bit more pessimistic about future job availability and future business conditions while optimism about future income retreated slightly.”

Richmond Fed Index Improves to -4 in October, Still Negative

The Richmond Federal Reserve’s composite manufacturing and services index climbed to -4 in October from -17, signaling a slower pace of contraction across the Fifth District.

Key measures improved across shipments, new orders, and local business conditions, though most remained below zero. Employment indicators strengthened slightly, with the number of employees index rising to -10 from -15 and wages up to 15 from 13.

Price pressures eased, with prices paid and received both declining. Six-month expectations turned more optimistic, led by higher forecasts for shipments and new orders. Still, manufacturers continue to report limited capacity use and skill shortages.

U.S. Launches $80 Billion Nuclear Reactor Program With Westinghouse

The U.S. government has signed an $80 billion partnership with Westinghouse Electric Company to build 10 large nuclear reactors nationwide, marking one of the most ambitious nuclear energy investments in decades.

The reactors, based on Westinghouse’s AP1000 design, are slated to be under construction by 2030. The project is described as a cornerstone of Washington’s industrial strategy, aimed at securing reliable clean energy for industries such as defense, artificial intelligence, and critical minerals.

Westinghouse is majority-owned by Brookfield Renewable Partners and Cameco. The agreement also gives the U.S. government the option to take a 20% stake in Westinghouse once private shareholders have received $17.5 billion in distributions.

Commerce Secretary Howard Lutnick said the initiative reflects President Trump’s vision to “rebuild America’s energy sovereignty” and create high-skilled jobs as part of a broader nuclear resurgence.

Nvidia’s Jensen Huang to Deliver Keynote at GTC 2025 as Shares Hit Record

Nvidia CEO Jensen Huang will deliver the keynote address at the company’s 2025 GTC conference in Washington, D.C., as shares hover near record highs.

Nvidia stock rose 0.9% to $193.23, surpassing its previous closing high of $192.57 from earlier this month. The stock hit an intraday peak of $195.47, just shy of its all-time high of $195.62.

Earlier, Nvidia announced a $1 billion equity investment in Nokia as part of a strategic partnership. Nokia will issue about 166 million new shares at $6.01 apiece to Nvidia, with proceeds supporting next-generation connectivity infrastructure for the AI era. The collaboration aligns Nvidia’s AI leadership with Nokia’s telecommunications networks.

Trump, Xi to Discuss Tariff Cuts Tied to Fentanyl Crackdown, WSJ Reports

The Wall Street Journal reports that President Donald Trump and Chinese President Xi Jinping plan to discuss a potential reduction in U.S. tariffs on Chinese goods in exchange for stronger Chinese enforcement on fentanyl-related chemical exports.

Under the proposal, the U.S. would lower its 20% tariff on fentanyl-linked products to 10%, reducing the average tariff on Chinese goods from roughly 55% to about 45%. The change would narrow the gap with tariffs imposed on other trading partners, such as India and Brazil.

In return, China is expected to resume large-scale U.S. soybean purchases and delay new rare-earth export restrictions. The framework aims to stabilize trade relations and pause the escalation of additional tariff measures between the world’s two largest economies.

Trump Confirms Thursday Meeting With China’s Xi

U.S. President Donald Trump confirmed he will meet Chinese President Xi Jinping on Thursday, saying he expects “a good outcome.”

Markets showed little reaction, as the meeting had been anticipated following last weekend’s preliminary trade agreement reached in Malaysia. Investors are positioning for a positive signal from the talks.

Trump also noted that U.S. Treasury Secretary Scott Bessent “helped calm the markets,” adding that while he considered Bessent for a Federal Reserve position, “he doesn’t want it.”

BofA Sees Fed Cutting Rates This Week, Then Pausing

Bank of America expects the Fed to deliver a 25 basis point rate cut this week, followed by a pause in December before resuming easing next year.

The bank anticipates potential dissent within the committee, with one member possibly favoring a larger cut and another pushing back. BofA said Chair Powell will likely avoid clear forward guidance due to limited data availability amid the government shutdown.

The firm expects rate cuts to resume in mid-2026 as consumption remains firm but inflation moderates.

Morgan Stanley Expects Fed to Cut Rates Again This Week

Morgan Stanley expects the U.S. Federal Reserve to deliver another 25 basis point rate cut this week, lowering the federal funds rate to a 3.75%–4.00% range.

The firm anticipates the Fed will maintain an easing bias while offering limited guidance on future moves due to a lack of new data amid the government shutdown. Chair Jerome Powell is expected to emphasize data dependence and risk management in his remarks.

Most analysts expect this week’s reduction, though forecasts diverge on whether another cut will follow in December.

Commodities News

Gold Slips Below $4,000 as US–China Thaw Shifts Flows Toward Risk Assets

Gold fell for a second day Tuesday, slipping 0.63% to $3,955/oz, as renewed optimism over U.S.–China trade relations drew investors toward equities and away from safe havens. The yellow metal briefly rebounded from three-week lows under $3,900, but the risk-on tone kept its upside capped.

Trade optimism erodes safe-haven demand

The latest boost to sentiment came after last week’s high-level talks in Malaysia, where U.S. and Chinese officials advanced discussions on tariffs, shipping fees, fentanyl regulation, and rare-earth exports — paving the way for a potential breakthrough when Presidents Trump and Xi meet Thursday.

However, geopolitical risks in the Middle East continue to offer a floor for bullion. The Jerusalem Post reported that Israeli officials plan a stronger response to renewed Hamas activity, raising the prospect of regional escalation.

Gold remains up 51% year-to-date, supported by strong central bank demand and falling real yields. Yet, traders expect further near-term softness as rate-cut optimism lifts equities and dampens the non-yielding metal’s appeal.

Fed rate outlook

According to Prime Market Terminal’s probability model, the Federal Reserve is expected to cut rates by 25 bps on Wednesday and again in December. Such easing could later revive gold’s appeal if yields continue to compress.

Europe’s Gas Market Calm Despite Lower Storage Levels – Commerzbank

European gas inventories entered the heating season at 83% full — 10 percentage points below the five-year average — yet prices remain stable near €31 per MWh, down more than 25% year-on-year, Commerzbank’s Barbara Lambrecht noted.

“The EU relaxed its 90% storage target due to more flexible LNG supply,” she said. “That explains the market’s composure despite lower filling levels.”

The IEA expects record LNG capacity growth by 2030, suggesting longer-term downward pressure on prices, though Lambrecht cautioned that a cold start to winter could quickly reverse sentiment.

Copper Nears All-Time High on Trade Progress, Tight Supply – Commerzbank

Copper prices climbed toward $11,000 per ton Monday as reports of a U.S.-China trade breakthrough lifted sentiment, Commerzbank’s Thu Lan Nguyen said.

“Concerns about a new escalation have eased, supporting base metals,” Nguyen noted, adding that concrete details will emerge after the Trump-Xi meeting Thursday.

LME inventories continue to decline, although Nguyen said this likely reflects shipments redirected to the U.S., where COMEX prices have risen above LME levels. A recovery in LME stockpiles is expected once price differentials normalize.

Gold and Silver Extend Correction as ETF Outflows Accelerate – Commerzbank

Gold dropped below $3,900 per ounce Tuesday, deepening a sharp correction that began last week. Silver fell nearly 5% to $45.6, its lowest since late September, Commerzbank’s Carsten Fritsch reported.

The selloff follows rising optimism around a U.S.-China trade deal and heavy ETF outflows totaling 37 tons in four sessions, indicating broad profit-taking.

From their peaks, gold is down about 11% and silver 16%, though both had surged 60–90% earlier in the year. Fritsch said much of the correction may already have played out.

OPEC+ Likely to Approve Another Modest Output Increase – Commerzbank

OPEC+ is expected to approve a moderate output increase at its virtual meeting next Sunday, according to Reuters sources cited by Commerzbank’s Carsten Fritsch.

Four sources said a hike of roughly 137,000 barrels per day — in line with the adjustments made for October and November — is under discussion, while a fifth suggested a pause due to weaker seasonal demand.

Fritsch said markets have likely priced in a small increase, and prices could rise if the final decision is smaller than expected, especially with Russian supply under pressure.

Gold Drops Below $4,000 as Trade Optimism Reduces Safe-Haven Demand – ING

Gold fell more than 3% to below $4,000 an ounce on Monday, extending its correction from last week’s record highs amid progress in U.S.-China trade negotiations.

“Gold hit a record above $4,380 just last week,” said ING’s Chris Turner. “A trade deal reduces geopolitical tension, weakening safe-haven demand.”

ETF outflows accelerated, with last Friday marking the largest withdrawal since May. Despite the pullback, gold remains up over 50% this year on sustained central bank buying, which Turner said could resume at lower price levels.

Copper Approaches Record High on Trade Hopes, Softer Inflation – ING

Copper prices are nearing the May 2024 record of $11,104.50 per ton, supported by easing U.S.-China tensions, ongoing supply disruptions, and expectations of a Federal Reserve rate cut after softer U.S. inflation data, ING’s Manthey and Patterson said.

“With trade optimism growing and supply risks building, copper’s outlook is turning brighter,” they noted. “Another Fed rate cut could further boost industrial metals.”

A U.S.-China trade agreement would remove a major downside risk that has weighed on the copper market for over a year.

China’s Gold Imports from Hong Kong Drop Sharply – Commerzbank

China’s net gold imports from Hong Kong fell to 22 tons in September, down sharply from last year, Commerzbank’s Carsten Fritsch reported, citing Hong Kong trade data.

Year-to-date net imports are 45% lower versus 2024, mainly due to strong Chinese gold exports early in the year. Gross imports are down only 7%, but exports have nearly tripled, signaling weaker domestic demand.

Fritsch said high prices are deterring buyers, with Swiss gold exports to China also down more than 50% from last year.

Oil Steady, Middle Distillates Strengthen on Supply Risks – ING

Crude prices were little changed as optimism over U.S.-China trade talks faded, with ICE Brent settling about 0.5% lower. ING analysts Ewa Manthey and Warren Patterson said the market remains supported by a comfortable overall supply outlook but warned that middle distillates are tightening.

“The ICE gasoil crack surged above $31 per barrel from around $23 mid-month,” they said. “New U.S. sanctions threaten roughly 1 million barrels per day of Russian diesel exports, while India may curb refinery runs if Russian crude imports slow.”

Ukrainian strikes on Russian refineries also pose further supply risks, they added, reinforcing the tightness in diesel and jet fuel markets.

Trump, Takaichi Sign Framework on Critical Mineral Supply

U.S. President Donald Trump and Japanese Prime Minister Sanae Takaichi have signed a framework to strengthen cooperation on securing supplies of critical minerals and rare earths.

According to a White House statement, the pact aims to use joint investment and economic policy coordination to build diversified and transparent markets for critical materials essential to modern industry and defense production.

Iraq Seeks Higher OPEC Production Quota Amid Rising Exports – Commerzbank

Iraq is negotiating for a higher OPEC production quota, currently capped at 4.4 million barrels per day, according to Oil Minister statements cited by Commerzbank’s Carsten Fritsch.

“Iraq’s available capacity is 5.5 million barrels per day,” the minister said. Exports have risen to 3.6 million barrels daily — about 200,000 bpd higher than last month — helped by the resumption of pipeline exports from Kurdistan to Turkey’s Ceyhan port.

Baghdad may argue for an increase similar to the UAE’s recent 300,000 bpd hike when OPEC+ meets in late November.

Europe News

ECB Survey Shows Slight Dip in Short-Term Inflation Expectations

Eurozone inflation expectations for the year ahead fell to 2.7% from 2.8%, according to the European Central Bank’s latest survey.

Expectations for three and five years ahead held steady at 2.5% and 2.2%, respectively. The ECB noted a modest tightening in credit standards among banks, contrary to earlier forecasts of stability.

While the data is unlikely to shift ECB policy, officials will welcome signs of easing inflation expectations across the bloc.

German Consumer Sentiment Weakens Further in November

Germany’s GfK consumer climate index fell to -24.1 for November, below expectations of -22.0 and down from a revised -22.5 in October.

Income expectations plunged from 15.1 to 2.3, offset partly by modest improvement in economic expectations, which rose to 0.8. GfK said renewed inflation fears, job insecurity, and geopolitical tensions continue to dampen household sentiment.

Italy Confidence Indicators Improve in October

Italy’s business confidence rose to 88.3 in October, up from 87.3 and slightly above expectations, according to Istat. Consumer confidence also improved to 97.6 from 96.8.

Istat said confidence strengthened across all components—personal, economic, current, and future outlooks—while businesses reported improved order books and production expectations.

The data signals steady sentiment but is not expected to influence European Central Bank policy.

U.K. Shop Prices Fall for First Time Since March as Food Costs Drop

U.K. shop prices declined in October for the first time in seven months, driven by the sharpest fall in food costs since 2020, the British Retail Consortium (BRC) said.

Overall prices dropped 0.3% from September, while food prices fell 0.4%, marking the biggest monthly decrease in nearly five years. Annual shop price inflation eased to 1.0% from 1.4%, while food inflation slowed to 3.7% from 4.2%.

BRC Chief Executive Helen Dickinson attributed the decline to intense retail competition, discounting, and lower global sugar prices. She urged the government not to raise sector taxes in the upcoming budget, warning that doing so could prolong inflationary pressures.

The data supports the case for a potential Bank of England rate cut in December as price pressures continue to ease.

Sterling Seen at Risk if BOE Cuts Rates in December, MUFG Says

MUFG Bank warns the British pound could weaken if the Bank of England cuts rates in December, as markets have not fully priced in such a move.

Currently, only about 16 basis points of easing are reflected in market pricing, short of a full 25 basis point cut, according to LSEG data. A rate reduction could therefore drive front-end gilt yields and the pound lower.

MUFG said the decision will depend on incoming inflation data, with steady September inflation at 3.8% potentially supporting the case for policy easing. Traders will focus on inflation and wage releases in the coming weeks for confirmation.

Asia-Pacific & World News

China’s New Five-Year Plan Doubles Down on Manufacturing, Tech Self-Reliance

China’s next five-year plan for 2026–2030 reaffirms the country’s commitment to manufacturing strength and technological independence, signaling little shift toward a consumption-driven model.

According to excerpts released after the Communist Party’s Fourth Plenum, the plan prioritizes “scientific and technological self-reliance” and “new quality productive forces.” Despite calls from some policymakers to rebalance toward household spending, Beijing appears intent on defending its manufacturing dominance.

Analysts cited by the Wall Street Journal said the leadership is prepared to sacrifice some living standards to win the technology race with the U.S. Political consolidation under President Xi Jinping remains strong, with the anti-corruption campaign continuing as a tool to ensure internal alignment.

China Pledges “Reasonable” Economic Growth Over Next Five Years

Beijing has released the full text of its Fourth Plenum resolution, outlining plans to sustain economic growth “within a reasonable range” over the next five years while deepening reforms and driving technological independence.

The resolution calls for coordinated economic and social development, stronger domestic demand, and greater self-reliance in key technologies. Authorities pledged to balance efficient markets with proactive government policies, enhance fiscal sustainability, and maintain an active fiscal stance.

The plan also emphasizes consumption-led growth, with measures aimed at raising the household consumption rate and fully unlocking the economy’s long-term potential.

China, Germany Seek to Calm Diplomatic Tensions After Trip Canceled

China and Germany moved to downplay tensions after German Foreign Minister Johann Wadephul postponed a planned visit to Beijing amid disputes over export controls and Germany’s criticism of China’s links to Russia.

A German government spokesperson said Berlin remains committed to “respectful and constructive dialogue,” while China’s foreign ministry urged both sides to strengthen ties from a “strategic and long-term perspective.”

Business leaders warned that worsening tensions could weigh on Germany’s fragile economy and trade relationship with China, which reached over $200 billion last year.

Nomura Sees “Tension–Truce Cycle” as New Normal in U.S.–China Relations

Nomura’s Chief China Economist, Lu Ting, says the U.S. and China appear locked in a repetitive “tension–escalation–truce” cycle that is likely to define bilateral relations going forward.

Recent trade discussions in Kuala Lumpur suggested a temporary easing, with both sides considering small-scale concessions such as tariff pauses and renewed U.S. soybean purchases. But disputes over rare earth exports, trade compliance, and geopolitical issues persist.

Lu warned that while near-term cooperation remains possible, strategic competition will continue to intensify. Markets tied to U.S.–China trade—especially commodities and tech—should expect ongoing volatility as phases of optimism repeatedly give way to renewed strain.

PBOC sets USD/ CNY central rate at 7.0856 (vs. estimate at 7.1029)

- PBOC CNY reference rate setting for the trading session ahead.

PBoC injects CNY 475.3bln via 7-day reverse repos, rate at unchanged 1.40%

Australian Authorities Raid WiseTech in Insider Trading Probe

Australian Federal Police and the corporate regulator ASIC executed a search warrant at logistics software firm WiseTech Global as part of an insider trading investigation.

The warrant sought documents related to trades by company co-founder Richard White and three employees between late 2024 and early 2025.

WiseTech said no charges have been filed and that the company itself is not under direct allegation. The firm pledged full cooperation with authorities.

U.S. Treasury, Japan Discuss “Sound” Policy and Market Stability

U.S. Treasury Secretary Scott Bessent met Japan’s Finance Minister Satsuki Katayama to discuss economic and financial issues, emphasizing the need for “sound” monetary policy and clear communication to prevent excess currency volatility.

The Treasury said conditions today differ markedly from those during the launch of Abenomics, and Bessent welcomed Japan’s latest fiscal initiatives.

Katayama later clarified there were no direct talks about monetary policy direction or foreign exchange intervention, noting that the U.S.–Japan stance on FX stability remains unchanged.

Japan’s Takaichi Pledges “New Golden Age” in U.S. Alliance

Japanese Prime Minister Sanae Takaichi praised U.S. President Donald Trump’s leadership and pledged to usher in a “new golden age” of the Japan–U.S. alliance during a bilateral meeting.

Takaichi thanked Trump for his enduring friendship with the late former Prime Minister Shinzo Abe and credited him with contributing to peace across Asia and the Middle East. She expressed commitment to further cooperation in realizing a “free and open Indo-Pacific” and strengthening Japan’s defense capabilities.

Trump, in turn, recalled Abe as a “great friend” and said the new partnership with Takaichi would make U.S.–Japan ties “stronger than ever.” Both leaders are expected to formalize a joint document on securing rare earths and critical mineral supply chains later in the day.

Japan, U.S. to Issue Fact Sheet on Potential U.S. Investment Projects

Japan and the United States are preparing to release a joint fact sheet highlighting possible investment projects in the U.S., according to a senior Japanese government official.

The document is expected to cover sectors such as power generation and automotive products, and will include major corporate participants, including Mitsubishi Heavy Industries. The initiative underscores deepening bilateral cooperation aimed at advancing industrial and energy collaboration between the two allies.

South Korea’s GDP Grows 1.2% in Q3, Beating Forecasts

South Korea’s economy expanded 1.2% in the third quarter from the previous quarter, the fastest pace in 18 months and stronger than the expected 0.9%, according to preliminary data from the Bank of Korea.

Year-on-year growth reached 1.7%, exceeding expectations of 1.5%. Exports rose 1.5% from the prior quarter, while private consumption climbed 1.3% helped by government stimulus. Facility investment increased 2.4%, though construction activity slipped 0.1%.

The data highlights resilient domestic demand and steady export performance despite global headwinds.

South Korea Consumer Sentiment Edges Down in October

South Korea’s consumer sentiment index dipped slightly to 109.8 in October from 110.1 in September, according to the Bank of Korea.

Despite the decline, the index remains in net optimistic territory. Inflation expectations for the next 12 months rose to 2.6% from 2.5%, suggesting households anticipate mild price pressure ahead.

Crypto Market Pulse

XRP Extends Rally Toward $2.70 as Risk Appetite Returns

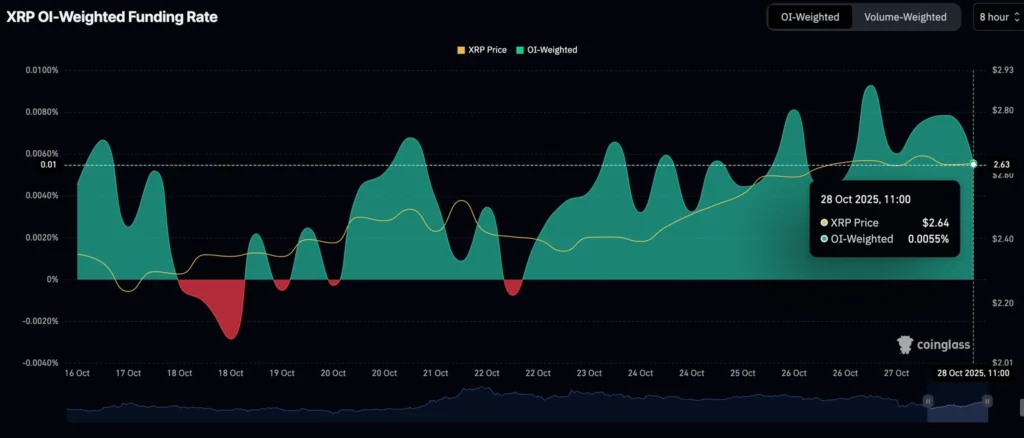

XRP traded around $2.65 Tuesday, extending gains for a fourth straight day alongside broader crypto strength.

Open interest in XRP derivatives climbed above $4.5 billion, up from $3.5 billion earlier this month, signaling renewed speculative demand.

Retail traders are returning after October’s deleveraging event, though funding rates suggest cautious positioning.

The Federal Reserve’s expected 25-basis-point rate cut this week could further support risk-on sentiment across crypto assets.

Securitize to Go Public on Nasdaq in $1.25 Billion SPAC Deal With Cantor Equity Partners

Tokenization firm Securitize announced plans to go public through a merger with Cantor Equity Partners II, valuing the company at $1.25 billion pre-money.

The transaction is expected to raise up to $469 million, including a $225 million PIPE led by investors such as Arche, Hanwha, ParaFi, and Borderless Capital.

Following completion, the company will be renamed Securitize Corp. and listed under ticker SECZ. CEO Carlos Domingo said the firm will tokenize its own equity to demonstrate on-chain ownership.

Backed by investors including BlackRock, ARK Invest, and Hamilton Lane, Securitize manages over $4 billion in assets and previously acted as transfer agent for BlackRock’s BUIDL fund.

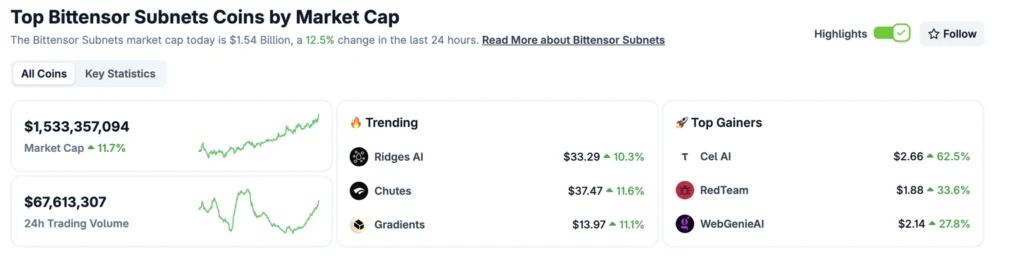

Bittensor (TAO) Rally Targets $500 as Subnet Demand Surges

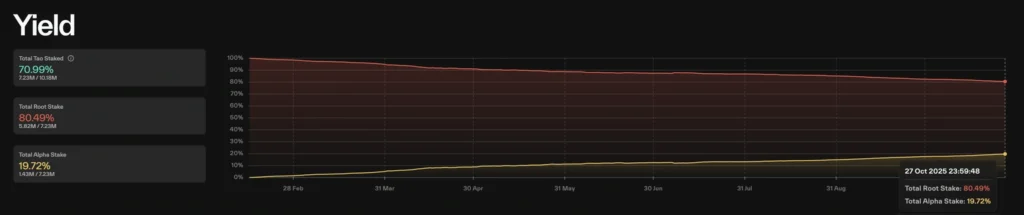

Bittensor’s TAO token climbed 7% to around $450 Tuesday, marking a fourth day of gains amid rising demand for its AI subnets.

Subnet market capitalization jumped 11.7% in 24 hours, while TAO futures open interest rose nearly 20%, reflecting growing investor enthusiasm.

Of 7.23 million TAO tokens staked, about 1.43 million have been swapped for “alpha tokens,” signaling increased exposure to subnet projects. Analysts said the technical breakout points to continued upside if momentum persists.

Crypto Market Holds Gains as ETF Inflows Rebound

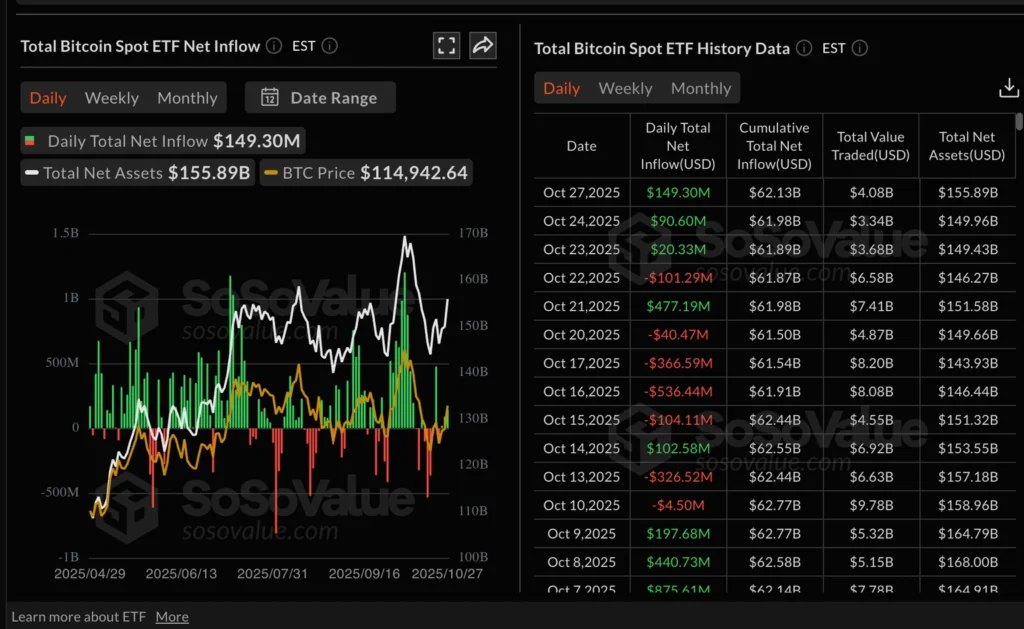

Bitcoin (BTC) traded above $114,000 Tuesday, supported by renewed inflows into spot ETFs. U.S.-listed BTC funds attracted $149 million in net inflows Monday, following $446 million last week.

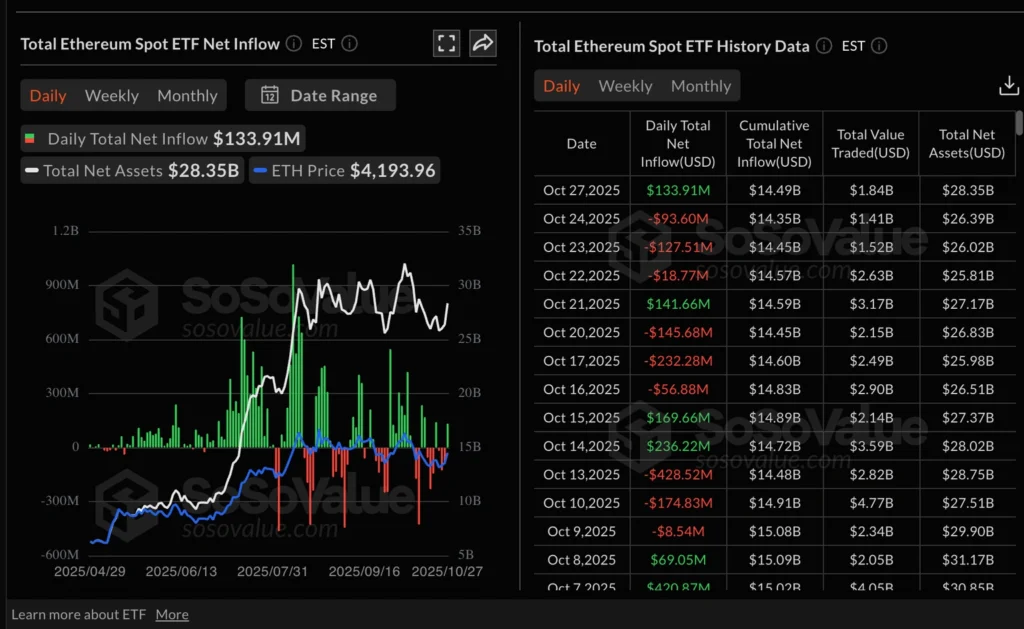

Ethereum (ETH) climbed back above its 50-day moving average, with $134 million in ETF inflows — the first positive reading after three days of outflows.

XRP also stabilized above $2.61, benefiting from firmer derivatives activity. Analysts said improving institutional flows and expectations of a Fed rate cut are underpinning risk sentiment across the crypto market.

PBOC Reaffirms Crypto Ban, Expands Digital Yuan Push

China’s central bank reaffirmed its ban on cryptocurrency trading while accelerating the rollout of its state-backed digital currency, the digital yuan, according to Caixin.

PBOC Governor Pan Gongsheng said at the Financial Street Forum that restrictions on virtual assets will remain in force and warned that offshore stablecoins pose systemic risks. He pointed to growing international concern over money laundering and financial stability.

Pan announced new operational centers in Beijing and Shanghai to manage and expand the digital yuan ecosystem. The move underscores Beijing’s drive to maintain control over digital finance while advancing its influence in central bank digital currency development.

S&P Assigns “B-” Junk Rating to Saylor’s Bitcoin Firm

S&P Global Ratings has issued its first-ever credit assessment of a Bitcoin treasury-focused company, assigning a speculative “B-” rating to Michael Saylor’s firm, Strategy.

The agency cited the company’s heavy Bitcoin exposure, limited U.S. dollar liquidity, and concentrated business model as key credit risks. Strategy’s $640,808-Bitcoin reserve, built largely through equity and debt issuance, leaves it highly exposed to crypto market volatility.

S&P maintained a stable outlook, assuming the firm will prudently manage its convertible debt maturities and maintain preferred stock dividends, potentially through additional borrowing. The agency also flagged a currency mismatch between the company’s Bitcoin assets and dollar-denominated liabilities.

The move marks a milestone in the convergence of traditional credit markets with crypto-financed corporate structures.

The Day’s Takeaway

North America

U.S. equities & tech leadership — Major U.S. indices closed at fresh records again, led by the Nasdaq (+0.80%). Big-tech winners included Nvidia, Apple, Broadcom, Microsoft, CrowdStrike, Micron and Palantir. Nvidia stole the spotlight after Jensen Huang’s GTC keynote: shares rallied ~5% to $201.03, lifting market cap toward $4.9 trillion. Investors are positioned for a heavy earnings cadence this week (Microsoft, Meta, Alphabet after close; Amazon and Apple to follow) and a widely priced 25 bps Fed cut tomorrow.

Fixed income & bills — The Treasury’s $44bn 7-year auction stopped at 3.790% (WI 3.782%), a tiny tail (0.8 bp). Demand was steady: bid-to-cover 2.46 vs 2.40 prior. Smooth auctions earlier in the week point to orderly Treasury demand despite slightly firmer yields.

Macro & labour signals — ADP will now publish weekly private-payroll estimates; its first four-week reading showed 14,250 jobs (weak tone). Conference Board consumer confidence edged up to 94.6 (Oct). The Richmond Fed composite improved to -4 from -17, showing softer contraction but still negative activity. Case-Shiller house prices beat expectations (+1.6% y/y in Aug), though seasonal adjustments cloud the monthly picture.

Corporate headlines — After-hours movers: Visa beat and hiked its dividend; Electronic Arts missed and withdrew guidance; Booking beat estimates. The U.S.–Japan economic dialogue continued at official levels (Treasury–Finance readouts), plus a separate U.S.–Japan fact-sheet is in the works on potential U.S. investment projects (power, autos; Mitsubishi Heavy Industries flagged).

Policy outlook — Banks and major houses (Morgan Stanley, BofA) largely expect a 25 bps Fed cut this week with varied views on further easing into December — the consensus is an easing bias but limited forward guidance.

U.S. industrial strategy (global impact) — U.S. announced an $80bn partnership with Westinghouse to build 10 AP1000 nuclear reactors (targeting construction by 2030). The program is framed as a strategic industrial build-out to secure power for critical industries (AI, defense, critical-minerals processing) and signals a major tilt toward advanced nuclear in national policy.

Commodities

Crude & middle distillates — Oil opened steady; ICE Brent eased ~0.5% as early trade-talk optimism faded. Middle distillates strengthened sharply: ICE gasoil crack jumped above ~$31/bbl from ~$23 mid-month, and Nov/Dec gasoil spreads moved deep into backwardation. U.S. sanctions and Ukrainian strikes threaten ~1m b/d of Russian diesel flows; Indian run cuts would further tighten exports. OPEC+ appears set for a modest December production increase (reports point to ~137k b/d), while Iraq is lobbying for a quota uplift after Kurdistan exports resumed.

European gas — Storage at the start of the heating season is ~83% full (≈10 pts below five-year average) but prices are calm (~€31/MWh) thanks to flexible LNG flows. IEA expects a large wave of new LNG capacity by 2030 — a medium-term bearish force — but a cold winter could quickly tighten the market.

Precious metals — Gold plunged from record highs and slipped below $4,000/oz, trading around $3,955 as US–China thawing reduced safe-haven bids and ETF outflows accelerated. Silver fell ~5% to near $45.6/oz. China’s net gold imports from Hong Kong weakened (September ~22t; YTD net imports down ~45% vs prior year), reflecting price sensitivity and softer domestic demand.

Base metals — Copper is racing back toward its record (~$11,000+/t) on U.S.–China optimism, supply disruptions and hopes for lower U.S. rates. LME stocks are falling while COMEX prices trade richer, suggesting transient regional flows and tightness.

Europe

Prices & retail — U.K. shop prices fell 0.3% in October — first monthly drop since March — driven by the largest monthly fall in food prices since 2020. Annual shop inflation eased to 1.0%. Retail discounting and lower sugar costs were cited; the print bolsters talk of a possible BoE move later in the year.

Sentiment & surveys — Germany’s GfK consumer climate worsened to -24.1 for November (income expectations collapsed). Italy’s business and consumer confidence improved modestly in October (business 88.3; consumer 97.6). ECB survey: one-year inflation expectations edged down to 2.7% (from 2.8%); 3- and 5-year outlooks steady.

Diplomacy & trade — Berlin and Beijing sought to tamp down tensions after a German minister postponed a China trip amid disputes over export controls and geopolitical criticisms; both sides emphasized continued dialogue to protect a €200bn+ trade relationship.

Asia

China macro & strategy — Beijing published its Fourth Plenum resolution and previewed the 2026–2030 five-year plan emphasizing “reasonable” growth, deeper reforms, stronger domestic demand and a heavy push for tech self-reliance and manufacturing strength. The plan prioritizes markets-plus-active-government coordination and aims to boost consumption rates over time, while keeping fiscal sustainability in view.

U.S.–China diplomacy — President Trump confirmed a Thursday meeting with Xi Jinping; markets are positioned for a constructive outcome after recent Kuala Lumpur talks. Reports suggest possible tariff and trade trade-off elements (including controversial fentanyl-linked tariff talks flagged in press reports).

Japan — Tokyo and Washington are preparing a fact sheet on potential U.S. investment projects (power generation, auto-related) and Trump and PM Takaichi signed a framework on critical minerals/rare earths — part of a broader push to secure diversified, resilient supply chains.

South Korea — Q3 GDP surprised on the upside at +1.2% q/q (y/y +1.7%), strongest pace in 18 months, driven by exports and consumption stimulus. Consumer sentiment eased slightly to 109.8 in October; 12-month inflation expectations ticked to 2.6%.

China financial policy — PBOC reiterated its crypto ban and accelerated digital-yuan rollout with new operational centers in Beijing and Shanghai, underscoring tighter control over digital finance.

Australia — Australian Federal Police and ASIC executed a search warrant at WiseTech Global in an insider-trading probe tied to trades by executives and employees (late-2024 to early-2025). The company says no charges yet and it is not itself currently accused.

Crypto

Credit markets meet crypto — S&P Global assigned a speculative “B-” rating to Michael Saylor’s Strategy, citing concentrated Bitcoin exposure, limited USD liquidity and currency mismatches between BTC assets and dollar liabilities. The stable outlook assumes prudent debt and dividend management. This is a landmark credit assessment framework for Bitcoin-treasury firms.

Market flows & prices — Bitcoin sits north of $114k, supported by renewed ETF inflows (US-listed BTC ETFs netted ~$149m Monday, building on ~$446m last week). Ethereum ETF inflows returned (~$134m) and ETH reclaimed its 50-day EMA. XRP rallied toward $2.65–$2.70 with open interest rising past $4.5bn, signalling returning retail/derivatives appetite.

Listings & tokenization — Tokenization platform Securitize filed a SPAC merger with Cantor Equity Partners II to list on Nasdaq at a $1.25bn pre-money valuation, planning to tokenize its own equity — a high-profile push to demonstrate real-world asset tokenization at scale.

Alts & momentum names — TAO (Bittensor) surged ~7% toward ~$450 as subnet demand and futures open interest climbed, reflecting niche AI-token speculation. Overall crypto risk appetite is buoyed by macro easing expectations and stronger institutional flows — but funding-rate and OI dynamics suggest positions are still cautious.